Abstract

This study analyses whether country-level innovation performance and firm-level innovation commitment are associated to adopting the integrated reporting in Europe. The empirical analysis relies on a logistic regression model applied to 388 firm-year observations regarding firms located in Europe and data between 2016–2019. The results show a positive and significant association between country-level innovation performance and integrated reporting uptake. Moreover, at a firm level, the data partially support that the influence of innovation commitment on the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance. This research contributes to the literature by focusing simultaneously on the impact of country-level innovation performance and firm-level innovation commitment on integrated reporting acceptance in the European setting. In addition, the adopted country-level conceptual support is based on the institutional theory combined with the framework of the national innovation systems. The latter, to the best of our knowledge, has not yet been applied in this line of research.

1. Introduction

Disclosure policies are a crucial element of the overall corporate strategy since they can affect both stakeholders’ perceptions and internal decision-making [1,2]. The way each firm communicates with its stakeholders the value creation process, and the way it relates with the environment, its past and future policies and performance may positively influence how the firm is perceived, but may also entail additional costs from loss of competitiveness and increased litigation risks [3]. Historically, there has been an accountability deficit. This fact, along with significant financial reporting scandals and ecological concerns propelled disclosure research focused on these issues as well as the development of new guidelines on sustainability reporting such as the Global Reporting Initiative, the United Nations Global Compact, the reporting standards published by the Sustainability Accounting Standards Board (Value Report Foundation), the IFRS sustainability disclosure standards and the non-financial (2014/95/EU) European Union directive [4,5,6,7,8,9,10,11,12,13,14,15,16,17]. Sustainability reporting emerges as a means of enhancing the firms’ communication regarding its impact on the environment and human resources. Nonetheless, there are still criticisms regarding a lack of connectivity between this information and the firms’ long-term business success [10]. In traditional reporting, often, it is difficult for stakeholders to evaluate whether the companies’ strategy is sustainable [11]. This fact led to the idea of integrating into one document the mainstream financial reporting with environmental reporting [12]. This document would communicate the firms’ strategy, performance, prospects and how value is created over the short, medium and long-term and, thus, designated the following: integrated report (hereafter IR) [15,18,19]. Also, sustainability and financial reports are viewed as lengthy. The IR framework addresses this issue by highlighting the importance of concision [15,18,19]. Thus, IR intends to improve the communication with the firms’ stakeholders providing a broader view of the firms’ strategy and performance. In this regard, it underlines the importance of connecting the several units of the firm and its capitals, including resources not owned by the company (e.g., natural), when reporting the firms’ outlook, performance, policies and value creation process [13,14,15]. Finally, environmental reports’ focus encompasses all stakeholders whereas the IR framework is primarily directed to investors [10,15,20].

IR has gained prominence in academia [16,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35] and within practitioners [10]. Some view it as a tool that surmounts some of the critics that traditional reporting has received to fulfil some of the unmet needs of information of its stakeholders [10]. These informative needs are embedded in the IR framework and are related to a management report that is more concise, holistic and that has an integrated view of the firms’ units [36,37]. As a result, some authors argue that IR is important as it can enhance the firms’ decision-making process and positively affect the firms’ value [1,2,3,10].

As a consequence of its relevance and novelty, there were new opportunities for research in the accounting field. This study contributes to this new body of knowledge and analyses whether country-level innovation performance and firm-level innovation commitment are associated to adopting the integrated reporting in Europe. It follows a new line of research that includes the study of the factors associated with IR adoption. Even though previous studies results indicated several IR drivers at a country, industry and firm-levels [25,26,27,28,29,30,31,32,33,34,35], to the best of our knowledge, the influence of innovation as a possible driver of IR uptake, concurrently, at a country-level and firm-level, was not examined. Former studies focusing on the impact of innovation on voluntary disclosure are rare and mainly focused on the firm-level. Research focusing on the impact of firm-level environmental innovation on environmental disclosures level and adoption suggested, predominantly, a positive impact [38,39,40]. In addition, previous quantitative research focusing on innovation performance at a country-level, to the best of our knowledge, are related to other areas, such as operational research [41,42]: environmental issues [43,44,45] as well as economics, finance and innovation [46,47,48,49,50]. The adopted conceptual support of the national innovation systems framework and institutional theory emphasize the relevance of considering innovation performance at a country-level and the impact that it may have on firms’ innovative practices. Firstly, the national innovation systems framework [51,52] highlights the uniqueness and, thus, the relevance of the innovation system of each country and the importance of the institutions comprising that system. Secondly, the institutional theory [53] shows that there are mechanisms that lead to firms adopting innovative practices (coercive, normative and mimetic isomorphism), including new reporting frameworks such as integrated reporting. These mechanisms will be described in more detail subsequently in the literature review section. In brief, the aforementioned country-level conceptual support of the national innovation systems and institutional theory support that country-level innovation performance may positively influence the propensity to adopt IR (H1).

Therefore, this research has the purpose of filling this void by studying the incentives of IR adoption by considering, (i) the impact of innovation performance at a country-level and (ii) the influence of innovation commitment, at a firm-level, considering the influence of innovation commitment on IR adoption when firm-level sustainability performance acts as a moderator.

Conceptually, it was mentioned that this study is grounded, at a country-level, on the institutional theory and the national innovation systems framework. The latter conceptual framework, to the best of our knowledge, has not yet been contemplated in this stream of research.

At a firm-level, this research is supported on the perspectives of the signaling and proprietary costs theories. Signaling theory shows that managers may have information about the performance of the investments that investors do not have. Also, as managers want to increase their bonuses and maintain their job they have interest in signalizing investors their performance, as it cannot be fully observed. Managers want to be perceived as legitime. Thus, if they communicate their performance in an incomplete or inefficient way, their performance assessment could be negatively impacted. This is especially relevant when there is significant evidence indicating the high uncertainty regarding research and development investments capability to increase firms’ value [54,55]. Therefore, it is anticipated that firms with a higher level of innovation commitment are associated to a higher likelihood of publishing integrated reports (H2).

However, the IR framework highlights other aspects that may affect the managers’ decision-making process. Firstly, it explicitly highlights the positive impact that IR-related processes may have on the environment [15,56]. Secondly, the IIRC has considered the need to disclose environmental information in several parts of the IR framework such as a definition of capital that includes the natural capital [15]. Thirdly, the IR framework recommends the inclusion of not only economic and technological issues as part of the firms’ value creation description, but also societal and environmental issues [15]. Finally, the IR framework mentions the inclusion of ecological issues in the strategy and business outcomes elements regarding how firms have integrated these issues in their strategic analysis to foster their competitiveness [15]. Consequently, the IR framework requires the disclosure of both non-financial and financial information [56]. In addition, previous research that suggest a positive impact of sustainability performance on IR adoption [34] is in line with the view that organizations will publish information that may positively affect it and avoid publishing information that may negatively impact their value [40,57]. Therefore, it is anticipated that firms’ innovation commitment influence on IR uptake is higher for firms with a higher sustainability performance (H3).

The empirical analysis was based on a logistic regression analysis. The sample is composed by 388 firm-year observations for the years 2016–2019 of listed firms in Europe.

The results of the binary logistic regression model provided support for the hypothesis predicting an association between country-level innovation performance and IR acceptance. At a firm-level, the results partially support that the influence of innovation commitment on the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance.

This study extends previous literature findings by showing evidence of two new determinants that drive IR acceptance, namely country-level innovation performance and firm-level innovation commitment.

Also, one of the adopted country-level conceptual frameworks was the national innovation systems that, to the best of our knowledge, has not been applied to this strand of research. Moreover, it was provided a combined view of this framework with the institutional theory.

This research provides evidence that countries with different innovation performance levels and, thus, different innovation-inducive settings may impact IR adoption differently. Even though this framework was published in 2013 and a significant amount of research has been published, some researchers question IIRC’s objectives and framework [58]. Although IR diffusion is increasing, it is still limited [59]. In this context, it is essential for IR practice that regulators and professional bodies analyze the results of independent empirical research to assess further developments and foster acceptance. In their effort towards harmonization and diffusion of a higher level of integrated information, European institutions and professional bodies may gauge the need to tailor the legislation and guidelines in light of these differences. In addition, in less innovative environments regulators and professional bodies may consider, for example, offering additional support related to the IR implementation process. Some firms report a lack of implementation guidance and view IR as a complex endeavor. This assistance could consist, for example, of implementation guidelines adapted to the needs of each industry or in formal training [60,61]. Also, this study suggests that the association between the level of innovation commitment and the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance. Accordingly, regulators and professional bodies may consider prioritizing their support to firms with lower sustainability performance.

Finally, the results of this study point out the relevance that innovative-oriented cultures may have on business practices and, more particularly, on the decision to adopt IR. These conclusions may lead stakeholders to view innovation as a signal of the firms’ predisposition to communicate in a transparent way and, therefore, support better-informed decisions. In addition, firms being perceived as more transparent may positively impact the firms’ relations with its stakeholders which is key, according to the stakeholder theory [62], for the firms’ survival.

Overall, this study contributes to a better understanding regarding the role that country and firm-level innovation may have on business practices.

2. Background and Hypotheses

2.1. Previous Literature

The following literature review is based on studies in voluntary adoption settings, written in English and published in the Web of Science and Scopus databases.

Most previous related research adopted a quantitative approach and are in line with this study’s methodology. Nonetheless, there were a small number of studies that adopted a qualitative approach and that also contributed to a better understanding of this topic.

These authors based their conclusions on interviews with senior executives and on the content analysis of integrated reports of firms in the UK [11,60,61] and Sri Lanka [63] between 2012 and 2016. They found that internal and external factors were associated to IR uptake. Incentives such as the existence of management support, the possibility of synergies with the firms’ information systems and industry membership. Some firms also reported that they wanted to be aligned with their stakeholders’ expectations and, thus, strengthen their bond. Finally, it was also mentioned the positive influence of the legislation, standard setters and schools. Nonetheless, these firms also mentioned the existence of barriers regarding a lack of IR implementation guidance along with its complexity [11,60,63].

In line with the previously mentioned qualitative research, former studies focusing on the determinants of IR adoption also found country, industry and firm-level predictors. Concerning country-level determinants, there was a prominence of topics related to the institutional-legal [25,33,64] economic-financial system [25,33] as well as the influence of culture [29]. At an industry-level, the focus was on industry membership and industry concentration [27]. Finally, at a firm-level, there was an emphasis on predictors related to governance [26,30,65,66,67], sustainability [34,67] and firms’ performance and size [27].

Even though these studies confirmed the existence of country, industry and firm-level incentives, there are still important gaps that need to be examined. To the best of our knowledge, previous research has not considered the influence of innovation as a possible predictor of IR adoption, simultaneously, at a country-level and firm-level.

Within the broad spectrum of research of voluntary disclosure incentives, previous research on the influence of innovation is, to the best of our knowledge, scarce and directed to the firm-level with a focus on environmental reporting adoption and disclosure level. For example, Radu and Francoeur [40] based their sample on US listed firms in 2011. They posited that firms that were environmentally more innovative had a higher level of environmental disclosure. Gallego-Álvarez [38] obtained similar results. Based on 2014 data and with most continents represented in the sample, the author contends that firm-level innovation had a positive impact on the level of environmental disclosure. By contrast, Hsueh [39] designed a sample based on Fortune Global 500 in 2015 and posited that firms pertaining to the group that invested in environmental R&D did not increase the likelihood of carbon disclosure voluntary adoption. Nonetheless, the results supported a positive influence on the voluntary carbon disclosure level. Finally, Busco et al. [68] based their study on firms pertaining to the STOXX Europe 600 index between 2002 and 2015 and analyzed the factors that explained the ability to integrate environmental, social and economic factors in the firms’ decision-making. They posited that firms with a higher level of R&D investments had a higher ability to incorporate sustainability issues in their decision-making process.

At a country-level quantitative studies that address innovation performance, to the best of our knowledge, pertain to other areas of knowledge, such as operational research [41,42]: sustainability [43,44,45] as well as economics, finance and innovation [46,47,48,49,50].

Accordingly, this study addresses these gaps by re-examining the drivers of IR uptake. It assesses the impact of country-level innovation performance and firm-level innovation commitment on the propensity of publishing an IR.

Regarding the conceptual support, previous archival studies focusing on the drivers of IR adoption were grounded on several frameworks commonly used in the voluntary disclosure literature, such as the proprietary costs theory [27]: the stakeholders theory [29]; the institutional theory [64,69]; the legitimacy theory [34] and the agency theory [26,27]. The theoretical approach of this study is described in Section 2.2 and Section 2.3.

2.2. Country-Level Innovation Performance

For countries to be at the forefront of the competitive landscape, the need to rely on their national innovation systems has grown [48]. The national innovation system is a conceptual framework [70] that views this system as comprised by the countries’ organizations (e.g., firms, universities, research institutes) and institutions that have the role of establishing laws and rules [51,52,71]. Technology advance and adoption will be influenced by the decisions of these intertwined institutions [72]. This conceptual framework has been widely used (i) in academia by researchers, ii) by policymakers [73] and iii) by organizations such as the World Bank, the OECD and the International Monetary Fund [52,72]. The national innovation systems framework assumes that each country has a specific innovation system that is, to some extent, different from other countries [51,74]. This uniqueness stems, partially, from the idea that each element of the system cannot be seen as being independent of each other but rather as interacting in a particular way with the others [52]. Thus, it can be argued that it is relevant to study the impact of innovation at a country-level on organizational practice. For a positive cycle of innovation and adoption to occur, the role of each countries’ institutions is paramount [48,52,72]. If we complement the national innovation systems view of the importance and influence that institutions have on organizational innovation practices with the institutional theory perspective, we can understand how these institutions influence organizational behavior [75,76]. This conceptual framework is frequently used to study the adoption of practices in organizations [33,77,78]. Firms that are in a similar institutional setting will tend to adopt similar patterns regarding their practices in a quest to obtain legitimacy, because they want to guarantee resources that are pivotal to their existence [53,79,80]. The reasoning for choosing institutional theory as the conceptual approach for this research was twofold. Firstly, IR adoption represents a disclosure decision. Prior research also includes studies focusing on IR adoption [25,33] on the grounds of the institutional theory, thus showing evidence of its relevance in explaining IR adoption. Secondly, DiMaggio–Powell [53] emphasize that institutional theory may explain why some organizations implement innovative practices.

One important aspect of this perspective is the idea that institutionalized practices, mostly, do not stem from a rational analysis. It considers the influence of other processes that lead to the homogenization of organizational behavior under a similar environment to guarantee their continuity [53]. These authors consider mechanisms that can lead to change and institutionalization, such as formal or informal institutional pressures when there is a dependency relation with another institution, e.g., in the form of law or guidelines that can be mandatory or not. For example, financial institutions in countries with higher levels of innovation performance will tend to expect a higher level of innovative organizational practices, including the type of management reports that the firm publishes, when evaluating credit proposals, thus, exerting coercive pressure, although informal, on their clients. Also, universities in countries with a higher innovation performance may instill an innovative mindset that may increase the firms’ predisposition to innovate and embrace new ways of reporting their business activities and performance (normative isomorphism). Their influence may result from formal training or R&D synergic activities, creating links between the firms and the universities research and development centers. Lastly, as often firms need loans to survive and thrive, the power of these institutions can be substantial. In addition, in countries with higher levels of innovation performance, firms may endure fierce competition. To deal with this uncertain environment, they may model their peers’ reporting practices to improve their competitive position and assure legitimacy (mimetic isomorphism) [53]. Therefore, it is hypothesized that companies located in an environment that favors innovation will face a similar stimulus towards innovation that will increase their propensity for publishing integrated reports. It follows that:

H1.

Firms from countries with a higher level of innovation performance are associated to a higher likelihood of publishing integrated reports.

2.3. Firm-Level Innovation Commitment

2.3.1. Firm-Level Innovation Commitment: Hypothesis 2

In the context of information asymmetry between two entities, signaling theory can be helpful explaining behavior [81]. This theory was initially applied in the labor market and subsequently extended to accounting as a result of Ross’s [82] ground-breaking work regarding the role of the financial structure as a signal to the market. Its application in research has reached other fields of knowledge such as strategy, entrepreneurship and human resource management [83]. It assumes that there is an entity that sends a signal (signaler) that is directed to another entity. This entity will interpret that signal (the receiver). It reasons that there is information that the outsiders do not have, but want, and thus the need to communicate (signalize) to the receiver [83]. Frías–Aceituno et al. [27] studied several potential drivers of IR. They structured their study, among others, with the assumptions of signaling theory as their conceptual guide. They posited that the disclosure of high returns could function as a signal of the firms’ investment quality. The results of García–Sánchez and Noguera–Gámez [31] and Girella et al. [32] also confirmed this hypothesis. The disclosure of an IR might also be viewed as a signal to investors of management’s unobserved quality [84]. Managers may have information about the performance of the investments that investors (outsiders) do not have. In addition, managers want to maximize their bonuses and keep their job. Hence, they may decide to signal investors (receivers of the signal) their performance, since it cannot be fully observed, thus reducing this information gap. An incomplete or misinterpretation by investors of management’s performance could negatively affect their performance appraisal and management’s legitimacy could be questioned. This is even more pertinent in a context where there is significant evidence supporting the high uncertainty surrounding research and development (hereafter R & D) investments regarding its capacity to create value [54,55].

Additionally, in the environmental disclosure strand of research most of the evidence suggests a positive effect of firm-level innovation on both environmental reporting adoption and disclosure level. Although Hsueh’s [39] findings support a lack of statistical significance between firm-level innovation and carbon disclosure adoption, Busco et al. [68] contended that firms with a higher level of R & D investments have a higher performance regarding their ability to integrate environmental, social and economic factors in their decision-making. In the same vein, Gallego—Álvarez [38] as well as Radu and Francoeur [40] found evidence of a positive and significant association between firm-level innovation and the extent of environmental disclosure. In brief, both the signaling theory and the empirical evidence anticipate an influence of innovation commitment on the propensity for IR uptake.

H2.

Firms with a higher level of innovation commitment are associated to a higher likelihood of publishing integrated reports.

2.3.2. Firm-Level Innovation Commitment: Hypothesis 3

Nonetheless, other factors may influence the managers’ decisions. Although some question the importance of the IR framework as an environmental communication tool [58], there are several allusions in the IR framework to sustainability issues. Firstly, it explicitly highlights the positive impact that IR-related processes may have on sustainability: “The cycle of integrated thinking and reporting, resulting in efficient and productive capital allocation, will act as a force for financial stability and sustainable development” [15] (p. 2). Secondly, the IIRC has considered the need to disclose environmental information in several parts of the IR framework such as a definition of capital that includes “(…) financial, manufactured, intellectual, human, social and relationship, and natural capital (…)” [15] (p. 6). This definition reflects a comprehensive view of the firms’ resources that incorporates an ecological dimension, thus encouraging firms to adopt this integrated view in their decisions and policies [56,61]. Also, the IR framework recommends the inclusion of not only economic and technological issues as part of the firms’ value creation description, but also “(…) societal issues and environmental challenges, sets the context within which the organization operates” [15] (p. 21). Moreover, the IR framework recommends the inclusion of sustainability topics in the strategy and business outcomes elements regarding “(…) The extent to which environmental and social considerations have been embedded into the organization’s strategy to give it a competitive advantage” [15] (p. 45). Hence, the IR framework emphasizes the need to integrate non-financial with financial information [56].

Theoretically, it could be contended that the propensity to publish an IR is higher at lower levels of sustainability performance to align the firms’ behavior with societal expectations and, thus, the disclosure of an IR would result from a legitimization strategy [85]. Nonetheless, there is evidence of a significant and positive impact of sustainability performance on IR adoption [34]. These results are congruent with the conceptual perspective that firms will avoid the disclosure of information that may erode their value but will publish information that may positively affect it [40,57].

Thus, it can be also argued that the influence of the firms’ innovation commitment level on IR acceptance will be higher when the firms’ sustainability performance is higher. Managers’ incentives to enhance the way they communicate the firms’ performance through IR will increase when they can, simultaneously disclosing favorable news concerning the firms’ sustainability performance. Organizations with a weaker sustainability performance will avoid the additional costs [40,57] that may arise from disclosing a below-par performance.

Hence, the following is hypothesized:

H3.

The association between the level of innovation commitment and the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance.

3. Research Design

3.1. Sample and Data

The initial analysis was focused on non-financial public firms of the ten European countries with the highest gross domestic product (GDP) in 2019 (International Monetary Fund), namely Germany, France, the UK, Netherlands, Sweden, Poland, Belgium, Romania, Spain and Italy. All the companies of these countries with positive R & D expenses and environmental sustainability scores, as well as financial information, available at the Thomson Reuters database for all the four years of analysis (2016, 2017, 2018 and 2019) were examined. For these firms, the integrated or annual reports and corporate social responsibility reports for these fiscal years available in English on the website of all these firms were collected. A total of 5542 documents were downloaded. A content analysis was performed on all these reports using the built-in search engine of the document reader software. Firms that explicitly acknowledged in the report as being an integrated report were selected for the treatment group. The remaining firms, not selected for the treatment group, were screened for the control group. For each firm in the treatment group, a control firm was selected from the same country, industry (when available) and with the closest size. The final sample was comprised by 388 firm-year observations in both groups, composed by 194 observations in the treatment group and 194 observations in the control group. The financial data for all years were collected from the Thomson Worldscope database and refer to the consolidated financial statements. For other variables, the primary data sources are Cornell et al. [86], the World Bank, Hofstede and will be described in more detail in the next section.

Table 1 presents the sample distribution per country and Table 2 shows the sample distribution per industry. France (31%) and the UK (16%) are the countries with the highest representativity. Regarding the sample industries’ composition, the manufacturing sector is the most representative (73%).

Table 1.

Sample composition per country.

Table 2.

Sample composition per industry.

3.2. Research Model

Having in mind that (i) the research hypotheses are centered on the association between innovation performance at a country-level and innovation commitment moderated by sustainability performance at a firm-level, with the propensity of adopting IR and (ii) the model includes continuous and binary explanatory variables with a binary dependent variable, a pooled binary logistic regression model was adopted with year, country and industry fixed effects with the following Equation (1).

where e represents the exponential and

Y = IR

X1 = GI

X2 = RD

X3 = ESG

X4 = RD*ESG

X5 = LAW

X6 = GDP

X7 = INDIV

X8 = INDC

X9 = SIZE

X10 = LEV

X11 = ROA

X12 = CF

X13k = Country dummy variables with k = 1, 2, …, 8.

X14j = Industry dummy variables with j = 1, …, 4.

X15t = Year dummy variables with t = 1, …, 4.

The dependent variable (IR) is a binary variable with a value of 1 the firm adopts IR and a value of 0, otherwise.

GI is an interest variable that depicts each country’s innovation performance level. It is measured by the innovation output score divided by the innovation input score and depicts the countries’ innovation performance regarding how efficiently the used resources lead to innovation outputs [86]. A higher ratio depicts a higher performance. This indicator was chosen, firstly, because it is a multi-dimensional metric and compatibility with the institutional and national systems of innovation conceptual frameworks [46]. In this regard, this index considers the influence of the institutions pertaining to each country’s innovation system on firms’ practices and includes key elements of the national innovation systems framework such as the educational system (learning), the support of the financial sector and the level of linkages between companies and institutions [46,48,51]. Secondly, this indicator has been frequently adopted on research and published in scientific journals, such as statistics, operational research [41,42], economics and innovation [46,48,49]. Thirdly, although other entities such as the European Commission, the World Economic Forum, the World Bank and OECD developed several innovation performance indicators, these alternatives did not fit the requirements of this research. Regarding the indicator produced by the European Commission, as it does not measure the relation between the inputs and outputs, it was not adopted [87]. The indicator published by the World Economic Forum relies, mainly, on surveys. Since “self-reported innovations can be subjective and difficult to calibrate” [88] (p. 3), this data source was also excluded. The World Bank and OECD also have indicators related to innovation. However, a composite overarching indicator is not available.

RD is an interest variable that measures firm-level innovation commitment. It is measured by the research and development expenses to net sales ratio centered on the mean. It captures an essential part of firms’ innovativeness [89] and are viewed by some researchers as “the organization’s effort or commitment towards innovation” [90]. Although input indicators indirectly measure innovation and, thus, do not guarantee that the innovation process will be successful, they are commonly used in research and have been frequently used in research as a proxy for innovation [91]. Regarding indicators for innovation output, the use of patent-based proxies is also common, but they also have limitations as previously referred for the input indicators [92]. For example, the number of claims associated with each patent may vary within countries, hindering comparisons [93] and some innovations cannot be protected by patents [94]. In this study, the use of a measure of output such as patents for the sampled companies was not feasible due to time constraints and reliability issues. Therefore, this study measures innovation commitment at a firm-level as the R & D expenses to net sales ratio.

ESG is an interest variable that measures the firms’ the environmental social governance score provided by the Thomson Reuters Asset4 database and is centered on the mean. The ESG score ranges from a minimum of zero to a maximum of 100 and its final score is influenced by a comprehensive set of indicators grouped in the environmental, governance and social pillars (Thomson Reuters Asset4). The fact that this indicator is based on information produced by the companies conveys reliability to the data. Moreover, this data provider has a specialized team in sustainability and a verification process that includes, e.g., independent audits and automated checks integrated in their data collection procedure [95] and is commonly adopted by researchers [13,96]. The variables RD and ESG were centered on the mean for interpretation purposes. RD*ESG is an interaction term of the variable RD and the variable ESG.

The regression model also includes control variables that resulted from the review of previous literature. At a country-level the model considers the following predictors related to the legal system, economic development and culture.

LAW (World Bank) reflects the quality of the country legal system. A value of one for countries with a score above the median and zero otherwise. It is anticipated a positive impact of this predictor on IR acceptance [25,31,64].

GDP (World Bank) is the natural logarithm of the GDP per capita (parity purchasing power) and controls for the level of economic development. It expected a positive influence of this variable on IR adoption [33,64,97].

INDIV [98] represents the level of individualism of a country. Captures the level of independence within the members of a society. A higher score translates into a more self-centered society. It is predicted a negative association between the level of individualism of a country and the propensity to publish an IR [28,29,32].

INDC is the level of concentration of an industry measured by the Herfindahl index. It anticipates a negative impact of this driver [27,28,31].

At a firm-level, the model includes the following independent variables related to the firms’ size, performance (profit and cash-flow) and financial structure.

SIZE (Thomson Reuters Datastream) is the natural logarithm of total assets. It is anticipated a positive influence of this variable on the likelihood of adopting IR [25,26,27,29,66,99,100].

LEV (Thomson Reuters Datastream) represents the firms’ total debt to total equity ratio. It is anticipated a negative influence of this driver on the probability of IR adoption [28,30,32,34].

ROA (Thomson Reuters Datastream) represents the earnings before interest and taxes (n) divided by the total assets (n − 1). A positive association between this determinant and IR acceptance [25,27,29,66] is expected.

Finally, CF (Thomson Reuters Datastream) represents the free cash-flow to total sales ratio. It is expected that the higher the cash-flow (CF), the higher the incentive to publish an IR [25,27,29]. The research model also includes country, industry and year fixed effects.

4. Results and Discussion

4.1. Descriptive Statistics

Table 3 depicts descriptive statistics related to all firms (Panel A), the treatment group (Panel B) and the control group (Panel C). Finally, Panel D outlines the results of the comparison tests.

Table 3.

Descriptive statistics and bivariate tests.

The mean of the variable RD is lower in the treatment group when compared to the control group and not statistically significant. The variables RD and ESG have the same absolute mean values in the treatment and control groups, but with opposite signs. This is expected as these variables were centered on the mean and both groups have the same number of firms. Mean centering was deemed as necessary for interpretation purposes as the sample does not include observations with a value of zero for RD or ESG. Thus, if these variables were left uncentred, the value of the coefficients of each one of these variables would be meaningless. Also, the conclusions remain the same if these variables are not centered.

The variables ESG, SIZE, ROA and CF are statistically significant (5% for ROA and 1% for the others) and present mean values in the treatment group that are superior to the mean values of the control group. The variables INDC and LEV mean values are higher in the IR adopters’ group, although not econometrically significant.

This bivariate analysis has the limitation of not presenting the results in a multivariate setting and, thus, is useful as a preliminary exploratory analysis. The binary logistic regression model presented in the next section will extend this analysis by, simultaneously, considering several predictors and, thus, overcome this limitation.

Table 4 shows that the correlations between all the continuous variables fall below an absolute value of 0.6 and, thus, under the threshold of 0.8. Moreover, untabulated results indicate that the values of all the variance inflation factors fall below 10. Therefore, the data suggest that the model does not present multicollinearity problems [101].

Table 4.

Spearman’s correlations for the continuous variables.

4.2. Logistic Regression Results

Table 5 summarizes the outputs of the logistic regression model. Model C4 departs from Equation (1) previously stated and includes all the explanatory variables. Model C1 includes all the predictors of model C4 except for the firm-level interest variables, namely RD (focal variable), ESG (moderator) and the product term of both. Model C2 drops the country-level interest variable GI from model C4 and includes all the other variables of this model. Finally, model C3 includes all the variables of model C4 but does not consider the interaction between the firm-level interest variables RD and ESG.

Table 5.

Logistic regression results 1.

4.2.1. Country-Level Innovation Performance: Hypothesis 1

Table 5 presents the logistic regression results and shows that the coefficients for country-level innovation performance (GI) are positive and significant at a 1% level (C1 = 1.846; C3 = 2.132; C4 = 2.875). These results suggest that firms from countries with a higher level of innovation performance are associated to a higher likelihood of publishing integrated reports, hence, supporting H1. At a conceptual level, the rational supporting this hypothesis stemmed from a conjoint view of the national innovation systems framework with the institutional theory. Firstly, it was emphasized the importance of analyzing the impact of innovation at a country-level on companies’ practices due to the uniqueness of each country as underlined in the national innovation systems framework [51,52,74]. It was also highlighted the major role played by each country’s institutions in the innovation cycle [48,52,72]. The national innovation systems framework emphasizes the importance of institutions as catalysts for innovation. Subsequently, this view was complemented with the lens of the institutional theory. It was explained the influence that each country institutional setting has on the adoption of these new practices. For example, it was stated that companies may adopt similar behavior to promote their continuity [53,79]. The literature review along with this conceptual analysis supported the hypothesis that companies that are in an environment that favors innovation have a higher propensity to adopt IR. These results support this reasoning.

4.2.2. Firm-Level Innovation Commitment: Hypothesis 2 and 3

Table 5 shows that in model C3, the coefficient of the variable RD is negative and significant at a 1% level (C3 = −2.254). This output suggests that a higher level of innovation commitment is associated to a lower likelihood of publishing an integrated report. Therefore, the evidence does not support H2 predicting that firms with a higher level of innovation commitment are associated to a higher likelihood of publishing integrated reports.

This output contrasts with Gallego-Álvarez [38] and Radu and Francoeur [40] evidence indicating a positive and significant influence of firm-level innovation on the level of environmental disclosures and with Hsueh [39] results of a non-significant impact of this variable. This comparative analysis has limitations as these studies address disclosure quality rather than adoption and belong to a parallel line of investigation.

In addition, the conceptual support for H2 circumscribed to the signaling theory was not confirmed. It was contended that managers of firms that were more committed to innovation could benefit in their performance appraisal from signaling their performance to investors adopting a reporting framework that reflected a more holistic, concise and intertwined view of the firm [54,55,84].

A possible explanation for this result is that the influence of firm-level innovation commitment (RD) on IR uptake may be conditional on the firms’ sustainability performance (ESG). This possibility is considered on hypothesis 3 and is analyzed in the next paragraphs.

Table 5 also shows that model C4 has a higher pseudo square than model C3 (C3 = 0.0874 and C4 = 0.1061). In addition, the interaction terms (ESG*RD) coefficients are positive and significant at a 1% level in models C2 and C4. These results indicate that ESG moderates the influence of RD on the dependent variable (C2 = 0.502; C4 = 0.507).

The moderator variable ESG is positive and statistically significant at a 1% level (C2 = 0.036; C4 = 0.037). The focal variable (RD) has coefficients that are negative and significant in models C2 and C4 (C2 = −5.339; C4 = −5.424) at a 1% significance level. Nonetheless, further analysis is required to assess whether the association between the firm-level innovation commitment and the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance as predicted on hypothesis 3.

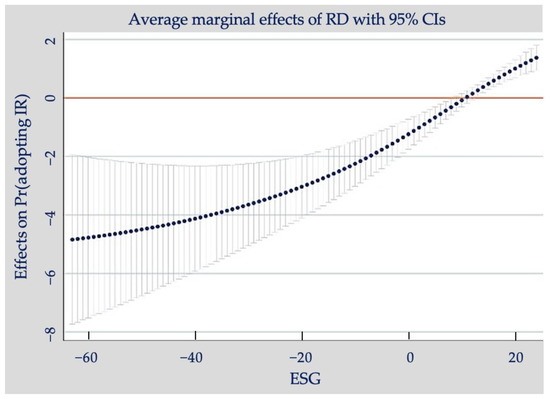

Since both the product term (RD*ESG) and the individual coefficients (RD and ESG) do not depict in a meaningful and complete way the impact that the interest (focal) variable (RD) has on the dependent variable, an average marginal effects analysis was carried out in the next paragraphs.

To understand how the variable RD influences the dependent variable, it was computed the average marginal effect for different levels of sustainability performance (the moderator variable).

Figure 1 depicts the average marginal effects of firm-level innovation commitment on IR adoption (Y axis) for different levels of ESG performance (X axis) ranging from a minimum of −63 to a maximum of 24. When the sustainability performance level is below 8, the innovation commitment influence on the probability of adoption of IR is negative and statistically significant at 1% and 5% levels (64% of the observations fall within this range). Hence, the expected benefits of an enhanced communication are inferior to the expected costs that arise from a loss of competitiveness and increased litigation risks [3,57,102]. This figure also shows that this negative impact is consistently reduced as the moderator (ESG) variable increases.

Figure 1.

Average Marginal Effects of R&D commitment (RD) on IR adoption for different levels of firm-level ESG performance (ESG).

The right side of Figure 1 shows that when the sustainability performance (ESG) level is above 13, there is a positive impact of innovation commitment (RD) on the probability of adopting an IR that increases consistently as the moderator variable increases (statistically significant at a 1% level within this range and represented by 25% of the observations). These results support hypothesis 3 predicting that the association between the level of innovation commitment and the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance. Thus, for some firms the benefits may be superior to the expected costs. In other words, the expected improvement in the way it communicates how it creates value, how it perceives its external environment, its strategy along with its past and future performance exceeds the expected total costs [3,57,102].

Overall, there is a steady increase in the average marginal effects from a minimum of −4.84 to a maximum of 1.38 in the entire range of observations. However, the 95% confidence interval in Figure 1 also shows that there are 11% of the observations that have average marginal effects with no statistical significance that fall between 8 and 13 of sustainability performance (ESG). As a result, these data present partial support for hypothesis 3 where it was anticipated that the association between the level of innovation commitment and the likelihood of publishing an integrated report is higher for firms with a higher-level of sustainability performance.

These results are similar to Gallego–Álvarez and Radu–Francoeur findings suggesting a positive and significant impact of firm-level innovation commitment on the extent of environmental disclosures, but contrast with Hsueh’s results of a non-significant influence of this factor [38,39,40]. These studies, albeit carried out in a parallel line of investigation, are focused on disclosure quality rather than adoption restricting a meaningful comparison.

In addition, the data partially confirm the conceptual support. Firstly, regarding the signaling theory reasoning concerning the influence of firm-level innovation commitment on the propensity for IR adoption. Also, it was argued the existence of a link between the IR framework and sustainability that supports an expected positive impact of higher sustainability performance levels on the influence of firm-level innovation commitment on IR adoption [15,18,34]. Managers have additional incentives to disclose an IR when they can communicate a positive sustainability performance [40,57].

The control variables of GDP, INDC, LAW, SIZE, ROA and CF are statistically significant and are in line with the majority of previous studies [25,26,27,28,29,30,31,32,33,35,66,97]. INDIV is positive and statistically significant in contrast to Fuhrmann [28], García-Sánchez et al. [29] and Girella et al. [32] results of a positive association between a higher level of collectivism and IR uptake. The sample composition of these studies included a significant proportion of firms from regions other than Europe (Asia, Africa, Australia, North and South America), which may explain this difference. Finally, the variable LEV depicts a positive and econometrically significant influence in line with the legitimacy theory principles. Firms may need to explain how these resources were used [34,68,85] and, thus, provide creditors additional information to be perceived as legitimate. Conversely, Lai et al. [34] and Girella et al. [32,66] obtained non-significant results. García-Sánchez et al. [30] and Fuhrmann [28] evidence suggest that this relation is negative and statistically significant as the financial institutions may opt to use covenants to protect their investments [28].

In summary, the results support hypothesis 1, suggesting that firms from countries with a higher level of innovation performance are associated to a higher likelihood of publishing integrated reports. Additionally, at a firm-level, the data partially suggest an association between the level of innovation commitment and the likelihood of publishing integrated reports that is higher for firms with a higher-level of sustainability performance (H3).

5. Conclusions

The integrated reporting framework has gained importance and notoriety as a more efficient and complete way of communication with the firms’ stakeholders. Some authors argue that its adoption can improve firms’ decision-making process and positively impact firms’ value [1,2,10]. It has specific attributes that support this expected influence. For example, it emphasizes the relevance of communicating the firm’s strategy, performance, how andhow it creates value and its outlook in an all-inclusive, integrated and concise way. It aims at answering criticisms [10], such as the excessive number of reports that firms publish and the lack of connectivity between them [15,16,18,19].

Firms’ decisions on how to communicate with the stakeholders their strategic options and performance may be beneficial but may also lead to additional costs and risks [3,57,103]. Thus, it is essential that the decision to adopt and develop a new reporting framework be also supported, when available, in scientific evidence. In this regard, this research investigated two drivers of IR adoption that, to the best of our knowledge, have not yet been analyzed previously, namely, the effect that country-level innovation performance and firm-level innovation commitment have on the propensity to publish an integrated report. The collected sample included 388 firm-year observations for the years 2016–2019 of firms located in Europe. The primary data sources were the firms’ websites and the Thomson Reuters database.

The results were based on a logistic regression and suggest that country-level innovation performance has a positive influence on the likelihood of IR uptake on the grounds of the national innovation systems framework [48,51,52,74] combined with the institutional theory [53,79]. At a firm-level, the data partially support that association between the level of innovation commitment and the likelihood of publishing integrated reports is higher for firms with a higher-level of sustainability performance on the grounds of the signaling [81] and proprietary costs [57] theoretical predictions.

Regarding the contributions of this study, firstly, this investigation extends former literature findings by analyzing two new drivers of IR, namely, country-level innovation performance and firm-level innovation commitment.

Secondly, one of the conceptual frameworks adopted was grounded on the national innovation systems framework. To the best of our knowledge this framework has not yet been applied to this line of research.

Thirdly, the results of this investigation suggest that different innovation-inducive settings may have a distinct impact on IR adoption. In their path towards harmonization and diffusion of integrated information, European institutions and professional bodies may contemplate the need to adapt the legislation considering these differences. Some firms view IR as complex and report a lack of implementation guidance [60,61]. As a result, in settings with weaker innovation systems, European institutions and professional bodies could have a key role assisting firms in the IR implementation process. These institutions, for example, could publish additional implementation guidelines or provide training [60,61]. Also, this study suggests that firm-level innovation commitment influence on IR adoption will increase when the level of sustainability performance increases. Therefore, regulators and professional bodies may consider providing more assistance to organizations that need to improve their sustainability performance.

Lastly, the results of this study contribute to an enhanced understanding regarding the impact that pro-innovative cultures may have on business decisions and, more specifically, on the decision to adopt IR. These findings may lead stakeholders to view innovation as a signal of the firms’ willingness to communicate in a transparent way and, thus, contribute to better-informed decisions. Also, through the lens of the stakeholder theory, firms may increase their longevity as a consequence of improved relations with its stakeholders. Hence, being perceived as more transparent may increase the firm’s lifespan [62]. In short, this research raises stakeholders’ awareness regarding the importance that both country and firm-level innovation may have on organizational practice.

This study has associated some limitations that may contribute to future research opportunities. Although a significant amount of care was taken in the selection of the variables, the proxy for country-level innovation performance could mirror other specific country-level variables, not included in this study, thus, restricting the results interpretation. The conclusions of this research are restricted to the European setting and, thus, cannot be extrapolated to other regions. Future studies could assess the impact of these drivers on explaining IR adoption either focusing on a non-European country or on a non-European region (e.g., Asia, Africa, Australia and America) where firms face different regulatory and cultural environments. Also, these findings were based on a quantitative methodological approach. Future research could shed light on the rationale behind the managers’ decision to adopt IR by conducting, e.g., surveys and interviews. Although there are some published studies with this focus, the amount of available evidence is still restricted [60,61]. The availability of data obtained adopting different methodological approaches would allow a more robust and comprehensive understanding surrounding IR adoption.

Author Contributions

R.P. was responsible for the construction of the research ideas and writing the first draft; I.L. and A.S. were responsible for the revision of the content and language. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The financial data for all years were collected from the Thomson Worldscope database and refer to the consolidated financial statements.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Blomme, H. Core & More: Making Reporting Smarter, IFAC. 2017. Available online: https://www.ifac.org/knowledge-gateway/preparing-future-ready-professionals/discussion/core-more-making-reporting-smarter (accessed on 18 May 2022).

- Carraher, S.; Auken, H.V. The use of financial statements for decision making by small firms. J. Small Bus. Entrep. 2013, 26, 323–336. [Google Scholar] [CrossRef]

- Perego, P.; Kennedy, S.; Whiteman, G. A lot of icing but little cake? Taking integrated reporting forward. J. Clean. Prod. 2016, 136A, 53–64. [Google Scholar] [CrossRef]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Baumüller, J.; Sopp, K. Double materiality and the shift from non-financial to European sustainability reporting: Review, outlook and implications. J. Appl. Account. Res. 2022, 23, 8–28. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Branco, M.C. Determinants of corporate sustainability performance in emerging markets: The Brazilian case. J. Clean. Prod. 2013, 57, 134–141. [Google Scholar] [CrossRef]

- Noti, K.; Mucciarelli, F.M.; Angelici, C.; dalla Pozza, V.; Pillinini, M. Corporate Social Responsibility (CSR) and Its Implementation into EU Company Law. 2020. Available online: https://www.europarl.europa.eu/thinktank/en/document/IPOL_STU(2020)658541 (accessed on 25 April 2022).

- White, A.L. New Wine, New Bottles: The Rise of Non-Financial Reporting. A Business Brief by Business for Social Responsibility. 2005. Available online: http://www.bsr.org/reports/200506_BSR_Allen-White_Essay.pdf (accessed on 22 May 2022).

- Siew, R.Y.J. A review of corporate sustainability reporting tools (SRTs). J. Environ. Manag. 2015, 164, 180–195. [Google Scholar] [CrossRef]

- Eccles, R.; Kruzs, M. The Integrated Reporting Movement: Meaning, Momentum, Motives and Materiality; Wiley: Hoboken, NJ, USA, 2015. [Google Scholar]

- Eccles, R.G.; Krzus, M.P. One Report—Integrated Reporting for a Sustainable Strategy, Financial Executive; Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- King, M.; Roberts, L. Integrate Doing Business in the 21st Century; Juta Company Ltd.: Cape Town, South Africa, 2013. [Google Scholar]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Howit, R. IIRC Newsletter-Highlights from 2016: Breakthrough Year, International Integrated Reporting Council Newsletter. 2016. Available online: https://integratedreporting.org/news/we-have-made-history-together-thank-you/ (accessed on 18 February 2022).

- IIRC. The International IR Framework, International Integrated Reporting Council. 2021. Available online: https://www.integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf (accessed on 24 February 2022).

- Manes-Rossi, F.; Tiron-Tudor, A.; Nicolò, G.; Zanellato, G. Ensuring more sustainable reporting in Europe using non-financial disclosure-de facto and de jure evidence. Sustainability 2018, 10, 1162. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- IIRC. The International IR Framework, International Integrated Reporting Council. 2013. Available online: http://integratedreporting.org/wp-content/uploads/2013/12/13-12-08-THE-INTERNATIONAL-IR-FRAMEWORK-2-1.pdf (accessed on 5 January 2022).

- IIRC. The International IR Framework, International Integrated Reporting Council. Towards Integrated Reporting. Communicating Value in the 21st Century. 2011. Available online: https://integratedreporting.org/wp-content/uploads/2011/09/IR-Discussion-Paper-2011_spreads.pdf (accessed on 4 March 2019).

- Milne, M.J.; Gray, R. W(h)ither Ecology? The Triple Bottom Line, the Global Reporting Initiative, and Corporate Sustainability Reporting. J. Bus. Ethics 2013, 118, 13–29. [Google Scholar] [CrossRef]

- Adams, C.A.; Potter, B.; Singh, P.J.; York, J. Exploring the implications of integrated reporting for social investment (disclosures). Br. Account. Rev. 2016, 48, 283–296. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The Consequences of Mandatory Corporate Sustainability Reporting. In The Oxford Handbook of Corporate Social Responsibility: Psychological and Organizational Perspectives; McWilliams, A., Rupp, D.E., Siegel, D.S., Stahl, G.K., Waldman, D.A., Eds.; Oxford University Press: Oxford, UK, 2019; pp. 452–489. [Google Scholar]

- Rinaldi, L.; Unerman, J.; de Villiers, C. Evaluating the Integrated Reporting journey: Insights, gaps and agendas for future research. Account. J. 2018, 31, 1294–1318. [Google Scholar] [CrossRef]

- de Villiers, C.; Venter, E.R.; Hsiao, P.C.K. Integrated reporting: Background, measurement issues, approaches and an agenda for future research. Account. Financ. 2017, 57, 937–959. [Google Scholar] [CrossRef]

- Frías-Aceituno, J.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. Is integrated reporting determined by a country’s legal system? An exploratory study. J. Clean. Prod. 2013, 44, 45–55. [Google Scholar] [CrossRef]

- Frías-Aceituno, J.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. The role of the board in the dissemination of integrated corporate social reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- Frías-Aceituno, J.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. Explanatory Factors of Integrated Sustainability and Financial Reporting. Bus. Strategy Environ. 2014, 23, 56–72. [Google Scholar] [CrossRef]

- Fuhrmann, S. A multi-theoretical approach on drivers of integrated reporting—Uniting firm-level and country-level associations. Meditari Account. Res. 2020, 28, 168–205. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Rodríguez-Ariza, L.; Frías-Aceituno, J. The cultural system and integrated reporting. Int. Bus. Rev. 2013, 23, 828–838. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Martínez-Ferrero, J.; Garcia-Benau, M.A. Integrated reporting: The mediating role of the board of directors and investor protection on managerial discretion in munificent environments. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 29–45. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Noguera-Gámez, L. Institutional Investor Protection Pressures versus Firm Incentives in the Disclosure of Integrated Reporting. Aust. Account. Rev. 2018, 28, 199–219. [Google Scholar] [CrossRef]

- Girella, L.; Rossi, P.; Zambon, S. Exploring the firm and country determinants of the voluntary adoption of integrated reporting. Bus. Strategy Environ. 2019, 28, 1323–1340. [Google Scholar] [CrossRef]

- Jensen, J.C.; Berg, N. Determinants of Traditional Sustainability Reporting Versus Integrated Reporting. An Institutionalist Approach. Bus. Strategy Environ. 2012, 21, 299–316. [Google Scholar] [CrossRef]

- Lai, A.; Melloni, G.; Stacchezzini, R. Corporate Sustainable Development: Is ‘Integrated Reporting’ a Legitimation Strategy? Bus. Strategy Environ. 2016, 25, 165–177. [Google Scholar] [CrossRef]

- Sierra-García, L.; Zorio-Grima, A.; García-Benau, M.A. Stakeholder Engagement, Corporate Social Responsibility and Integrated Reporting: An Exploratory Study. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 286–304. [Google Scholar] [CrossRef]

- Dumay, J.; la Torre, M.; Farneti, F. Developing trust through stewardship: Implications for intellectual capital, integrated reporting, and the EU Directive 2014/95/EU. J. Intellect. Cap. 2019, 20, 11–39. [Google Scholar] [CrossRef]

- la Torre, M.; Sabelfeld, S.; Blomkvist, M.; Dumay, J. Rebuilding trust: Sustainability and non-financial reporting and the European Union regulation. Meditari Account. Res. 2020, 28, 701–725. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I. Assessing corporate environmental issues in international companies: A study of explanatory factors. Bus. Strategy Environ. 2018, 27, 1284–1294. [Google Scholar] [CrossRef]

- Hsueh, L. Opening up the firm: What explains participation and effort in voluntary carbon disclosure by global businesses? An analysis of internal firm factors and dynamics. Bus. Strategy Environ. 2019, 28, 1302–1322. [Google Scholar] [CrossRef]

- Radu, C.; Francoeur, C. Does Innovation Drive Environmental Disclosure? A New Insight into Sustainable Development. Bus. Strategy Environ. 2017, 26, 893–911. [Google Scholar] [CrossRef]

- Saisse, R.D.L.G.; Lima, G.B.A. Similarity modelling with ideal solution for comparative analysis of projects in the context of the additional brics proposal. Braz. J. Oper. Prod. Manag. 2019, 16, 659–671. [Google Scholar] [CrossRef]

- Tziogkidis, P.; Philippas, D.; Leontitsis, A.; Sickles, R.C. A data envelopment analysis and local partial least squares approach for identifying the optimal innovation policy direction. Eur. J. Oper. Res. 2020, 285, 1011–1024. [Google Scholar] [CrossRef]

- Chaminade, C. Innovation for what? Unpacking the role of innovation for weak and strong sustainability. J. Sustain. Res. 2020, 2, e200007. [Google Scholar]

- Fernandes, A.J.C.; Rodrigues, R.G.; Ferreira, J.J. National innovation systems and sustainability: What is the role of the environmental dimension? J. Clean. Prod. 2022, 347, 131164. [Google Scholar] [CrossRef]

- Gonçalves Montenegro, R.L.; Ribeiro, L.C.; Britto, G. The effects of environmental technologies: Evidence of different national innovation systems. J. Clean. Prod. 2021, 284, 124742. [Google Scholar] [CrossRef]

- Crespo, N.F.; Crespo, C.F. Global innovation index: Moving beyond the absolute value of ranking with a fuzzy-set analysis. J. Bus. Res. 2016, 69, 5265–5271. [Google Scholar] [CrossRef]

- Farooq, M.; Noor, A. The impact of corporate social responsibility on financial distress: Evidence from developing economy. Pac. Account. Rev. 2021, 33, 376–396. [Google Scholar] [CrossRef]

- Gogodze, J. Mechanisms and Functions within a National Innovation System. J. Technol. Manag. Innov. 2016, 11, 12–21. [Google Scholar] [CrossRef]

- Jankowska, B.; Matysek-Jȩdrych, A.; Mroczek-Dabrowska, K. Efficiency of National Innovation Systems—Poland and Bulgaria in the Context of the Global Innovation Index. Comp. Econ. Res. 2017, 20, 77–94. [Google Scholar] [CrossRef]

- Tang, D.; Li, Y.; Zheng, H.; Yuan, X. Government R&D spending, fiscal instruments and corporate technological innovation. China J. Account. Res. 2022, 15, 100250. [Google Scholar]

- Lundvall, B.-A. National Systems of Innovation: Towards a Theory of Innovation and Interactive Learning; Pinter: London, UK, 1992. [Google Scholar]

- Lundvall, B.-A. National innovation systems—Analytical concept and development tool. Ind. Innov. 2007, 14, 95–119. [Google Scholar] [CrossRef]

- DiMaggio, P.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields (translated by G. Yudin). Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Kothari, S.P.; Laguerre, T.E.; Leone, A.J.; Simon, W.E. Capitalization versus Expensing: Evidence on the Uncertainty of Future Earnings from Capital Expenditures versus R&D Outlays. Rev. Account. Stud. 2002, 7, 355–382. [Google Scholar]

- Rosenberg, N. Exploring the Black Box: Technology, Economics, and History, Technology and Culture, Technology and Culture; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Eccles, R.G.; Serafeim, G. Corporate and integrated reporting: A functional perspective. In Corporate Stewardship: Achieving Sustainable Effectiveness; Mohrman, S., O’Toole, J., Sheffield, E., Eds.; Greenleaf Publishing: Sheffield, UK, 2015. [Google Scholar]

- Verrecchia, R.E. Discretionary Disclosure. J. Account. Econ. 1983, 5, 179–194. [Google Scholar] [CrossRef]

- Flower, J. The international integrated reporting council: A story of failure. Crit. Perspect. Account. 2015, 27, 1–17. [Google Scholar] [CrossRef]

- WBCSD. Reporting Matters, World Business Council for Sustainable Development. 2020. Available online: https://www.wbcsd.org/contentwbc/download/10460/156310/1 (accessed on 22 March 2022).

- Robertson, F.A.; Samy, M. Factors affecting the diffusion of integrated reporting—A UK FTSE 100 perspective. Sustain. Account. Manag. Policy J. 2015, 6, 190–223. [Google Scholar] [CrossRef]

- Robertson, F.A.; Samy, M. Rationales for integrated reporting adoption and factors impacting on the extent of adoption: A UK perspective. Sustain. Account. Manag. Policy J. 2020, 11, 351–382. [Google Scholar] [CrossRef]

- Freeman, E.R. Strategic Management: A Stakeholder Approach; Pitman Publishing: Boston, MA, USA, 1984. [Google Scholar]

- Gunarathne, N.; Senaratne, S. Diffusion of integrated reporting in an emerging South Asian (SAARC) nation. Manag. Audit. J. 2017, 32, 524–548. [Google Scholar] [CrossRef]

- Kılıç, M.; Uyar, A.; Kuzey, C.; Karaman, A.S. Does institutional theory explain integrated reporting adoption of Fortune 500 companies? J. Appl. Account. Res. 2021, 22, 114–137. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Raimo, N.; Vitolla, F. CEO power and integrated reporting. Meditari Account. Res. 2021, 29, 908–942. [Google Scholar] [CrossRef]

- Girella, L.; Zambon, S.; Rossi, P. Board characteristics and the choice between sustainability and integrated reporting: A European analysis. Meditari Account. Res. 2022, 30, 562–596. [Google Scholar] [CrossRef]

- Hsiao, P.C.K.; de Villiers, C.; Scott, T. Is voluntary International Integrated Reporting Framework adoption a step on the sustainability road and does adoption matter to capital markets? Meditari Account. Res. 2022, 30, 786–818. [Google Scholar] [CrossRef]

- Busco, C.; Malafronte, I.; Pereira, J.; Starita, M.G. The determinants of companies’ levels of integration: Does one size fit all? Br. Account. Rev. 2019, 51, 277–298. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M. Appreciations, criticisms, determinants, and effects of integrated reporting: A systematic literature review. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 518–528. [Google Scholar] [CrossRef]

- Edquist, C. Systems of Innovation Approaches—Their Emergence and Characteristics. In Systems of Innovation: Technologies, Institutions and Organisations; Edquist, C., Ed.; Pinter: London, UK, 1997. [Google Scholar]

- Edquist, C.; Johnson, B. Institutions and Organisations in Systems of Innovation. In Systems of Innovation: Technologies, Institutions and Organisations; Edquist, C., Ed.; Pinter: London, UK, 1997. [Google Scholar]

- Sharif, N. Emergence and development of the National Innovation Systems concept. Res. Policy 2006, 35, 745–766. [Google Scholar] [CrossRef]

- Balzat, M.; Hanusch, H. Recent trends in the research on national innovation systems. J. Evol. Econ. 2004, 14, 197–210. [Google Scholar] [CrossRef]

- Watkins, A.; Papaioannou, T.; Mugwagwa, J.; Kale, D. National innovation systems and the intermediary role of industry associations in building institutional capacities for innovation in developing countries: A critical review of the literature. Res. Policy 2015, 44, 1407–1418. [Google Scholar] [CrossRef]

- Campbell, J.L. Institutional Analysis and the Paradox of Corporate Social Responsibility. Am. Behav. Sci. 2006, 49, 925–938. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. ‘Implicit’ and ‘Explicit’ CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- Oliver, C. Strategic responses to institutional processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations: Ideas, Interests and Identities; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Spence, M. Job Market Signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Ross, S.A. The Determination of Financial Structure: The Incentive-Signalling Approach, Source. Bell J. Econ. 1997, 8, 23–40. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signalling theory: A review and assessment. J. Manag. 2011, 37, 39–67. [Google Scholar]

- Sun, Y.; Davey, H.; Arunachalam, M.; Cao, Y. Towards a theoretical framework for the innovation in sustainability reporting: An integrated reporting perspective. Front. Environ. Sci. 2022, 10, 1584. [Google Scholar] [CrossRef]

- Dowling, J.; Pfeffer, J. Organizational Legitimacy: Social Values and Organizational Behavior. Pac. Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

- Cornell, INSEAD and WIPO, The Global Innovation Index 2019: Creating Healthy Lives—The Future of Medical Innovation. World Intellectual Property Organization. 2019. Available online: https://www.wipo.int/publications/en/details.jsp?id=4434 (accessed on 5 June 2022).

- Edquist, C.; Zabala-Iturriagagoitia, J.M.; Barbero, J.; Zofío, J.L. On the meaning of innovation performance: Is the synthetic indicator of the Innovation Union Scoreboard flawed? Res. Eval. 2018, 27, 196–211. [Google Scholar] [CrossRef]

- Gann, D.; Dogson, M. We Need to Measure Innovation Better. Here’s How. World Economic Forum. 2019. Available online: https://www.weforum.org/agenda/2019/05/we-need-to-measure-innovation-better-heres-how-to-do-it/ (accessed on 5 February 2022).

- Romijn, H.; Albaladejo, M. Determinants of innovation capability in small electronics and software firms in southeast England. Res. Policy 2002, 31, 1053–1067. [Google Scholar] [CrossRef]

- Ferreira, A.; Moulang, C.; Hendro, B. Environmental management accounting and innovation: An exploratory analysis, Accounting. Audit. Account. J. 2010, 23, 920–948. [Google Scholar] [CrossRef]

- Dziallas, M.; Blind, K. Innovation indicators throughout the innovation process: An extensive literature analysis. Technovation 2019, 80–81, 3–29. [Google Scholar] [CrossRef]

- Flor, M.L.; Oltra, M.J. Identification of innovating firms through technological innovation indicators: An application to the Spanish ceramic tile industry. Res. Policy 2004, 33, 323–336. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levin, R.C. Empirical studies of innovation and market structure. In Handbook of Industrial Organization; Elsevier: Amsterdam, The Netherlands, 1989; Volume 2, pp. 1059–1107. [Google Scholar]

- Coombs, R.; Narandren, P.; Richards, A. A literature-based innovation output indicator. Res. Policy 1996, 25, 403–413. [Google Scholar] [CrossRef]

- Thomson Reuters. Thomson Reuters ESG Scores; Thomson Reuters: Toronto, ON, Canada, 2019. [Google Scholar]

- Ioannou, I.; Serafeim, G. What Drives Corporate Social Performance? The Role of Nation-level Institutions. J. Int. Bus. Stud. 2012, 43, 834–864. [Google Scholar] [CrossRef]

- Belal, A.R. Environmental reporting in developing countries: Empirical evidence from Bangladesh. Eco-Manag. Audit. 2000, 7, 114–121. [Google Scholar] [CrossRef]

- Hofstede, G. Dimension Data Matrix. 2015. Available online: https://geerthofstede.com/research-and-vsm/dimension-data-matrix/ (accessed on 18 May 2022).

- Buzby, S.L. Company Size, Listed Versus Unlisted Stocks, and the Extent of Financial Disclosure. J. Account. Res. 1975, 13, 16–37. [Google Scholar] [CrossRef]

- Singhvi, S.S.; Desai, H.B. An empirical analysis of the quality of corporate financial disclosure. Account. Rev. 1971, 46, 120–138. [Google Scholar]

- Gujarati, D. Basic Econometrics, 3rd ed.; Mc-Graw Hill International Editions: New York, NY, USA, 1995. [Google Scholar]

- Steyn, M. Organisational benefits and implementation challenges of mandatory integrated reporting: Perspectives of senior executives at South African listed companies. Sustain. Account. Manag. Policy J. 2014, 5, 476–503. [Google Scholar] [CrossRef]

- Birshan, M.; Seth, I.; Sternfels, B. Strategic Courage in an Age of Volatility. 2022. Available online: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/strategic-courage-in-an-age-of-volatility (accessed on 25 May 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).