The Enabling Effect of Intellectual Property Strategy on Total Factor Productivity of Enterprises: Evidence from China’s Intellectual Property Model Cities

Abstract

1. Introduction

2. Theory and Hypothesis

2.1. IPMC and TFP

2.2. Moderating Mechanism

2.3. Mediating Mechanism

3. Study Design

3.1. Model

3.2. Samples and Data

3.3. Variables

4. Empirical Analysis

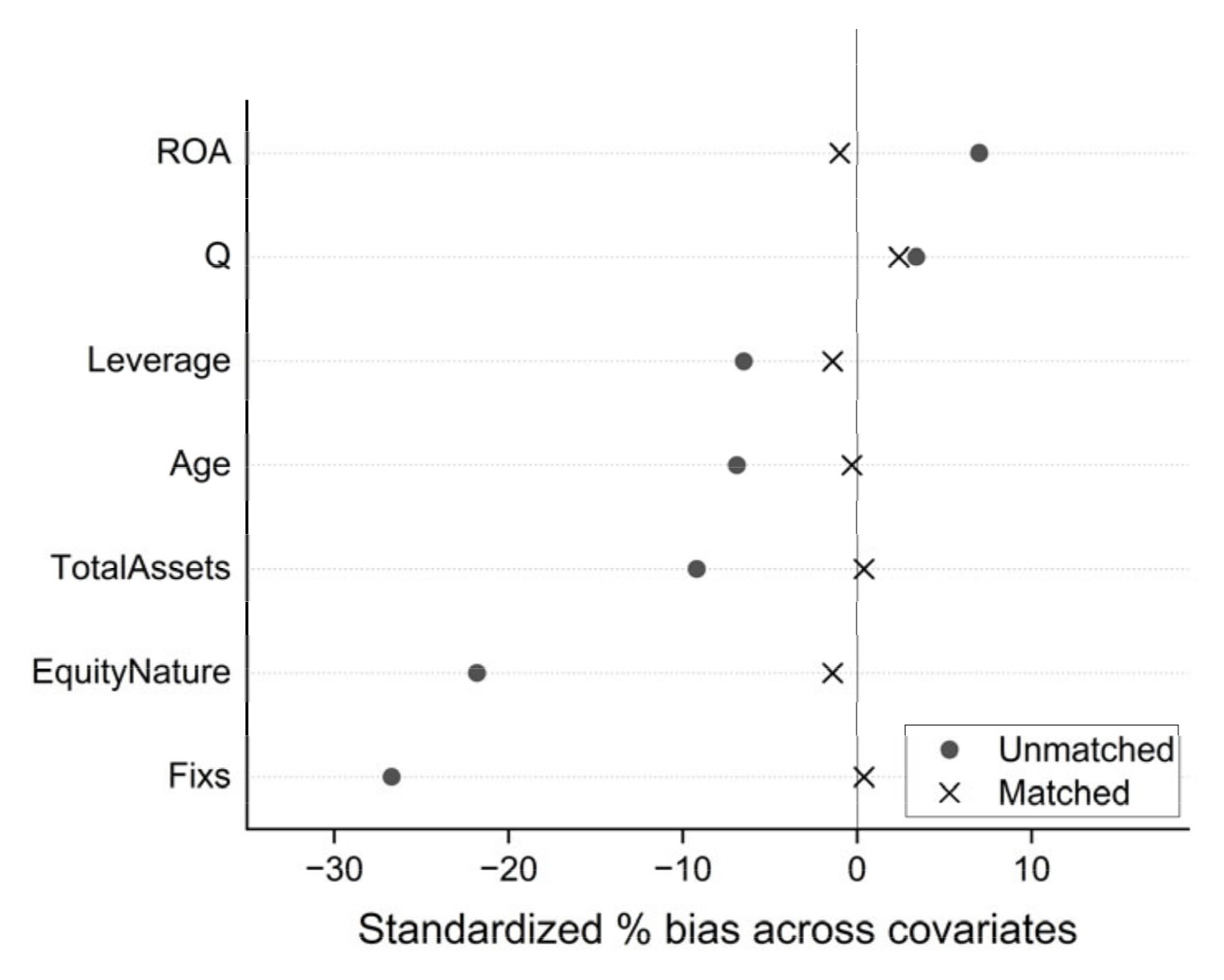

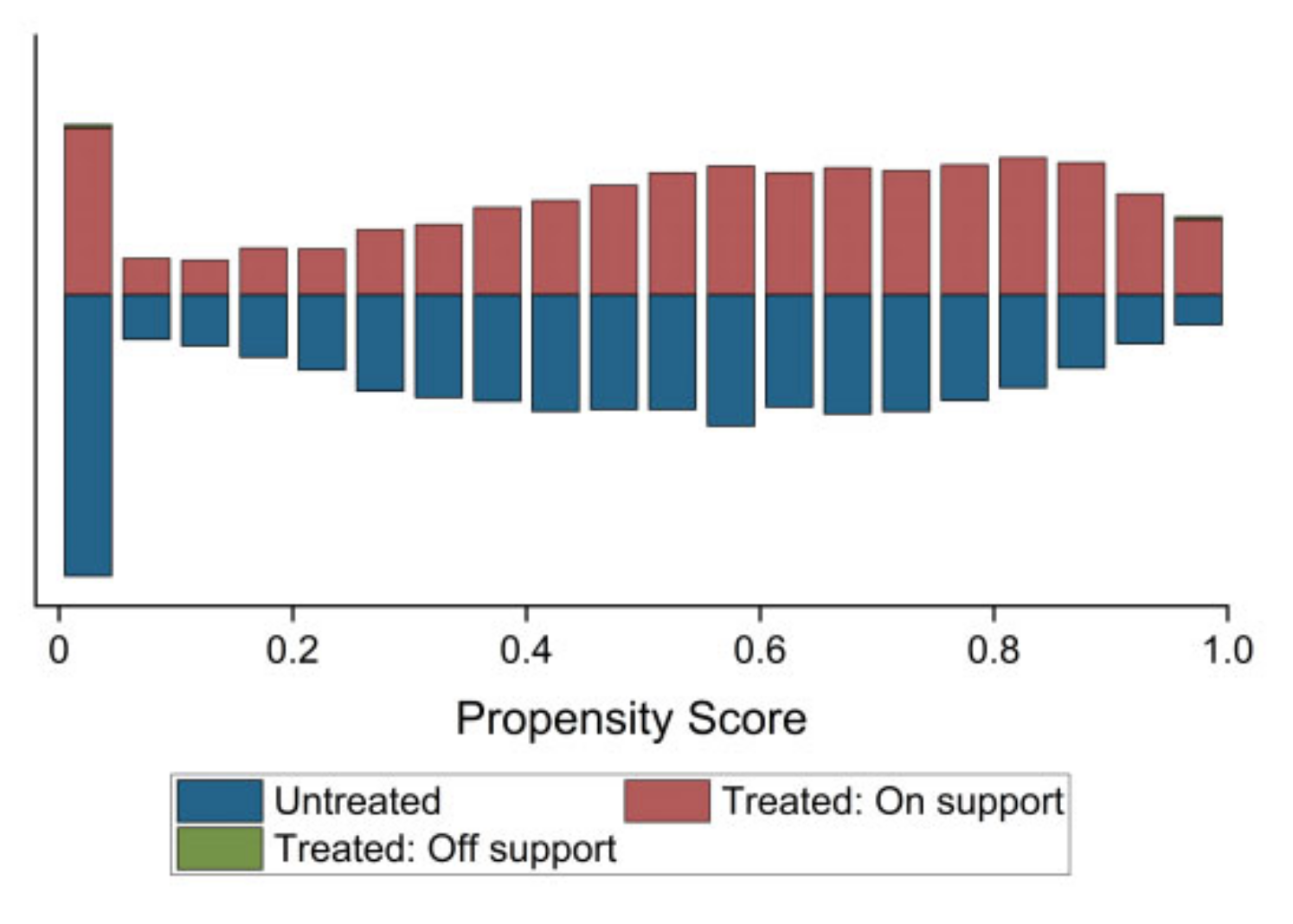

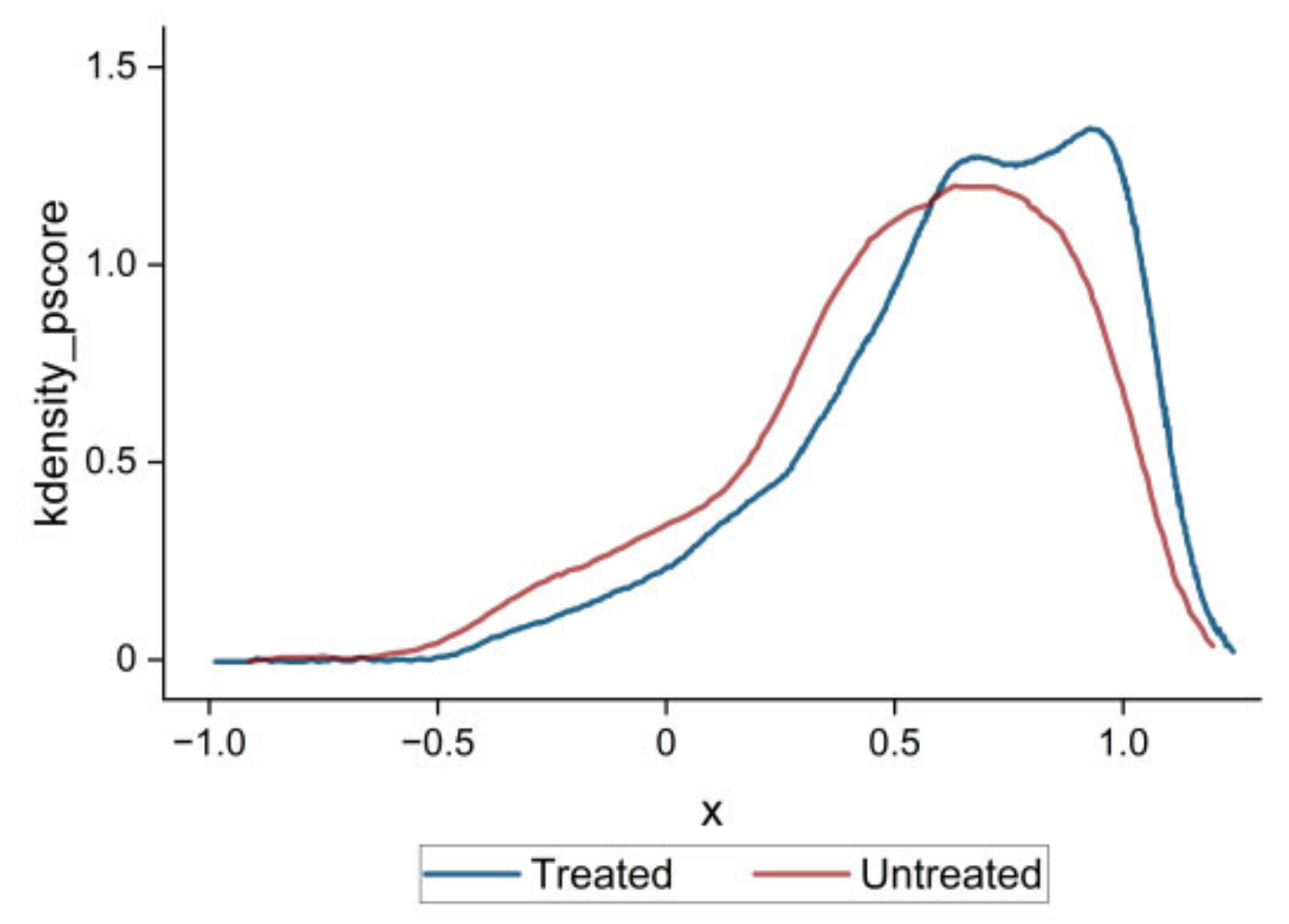

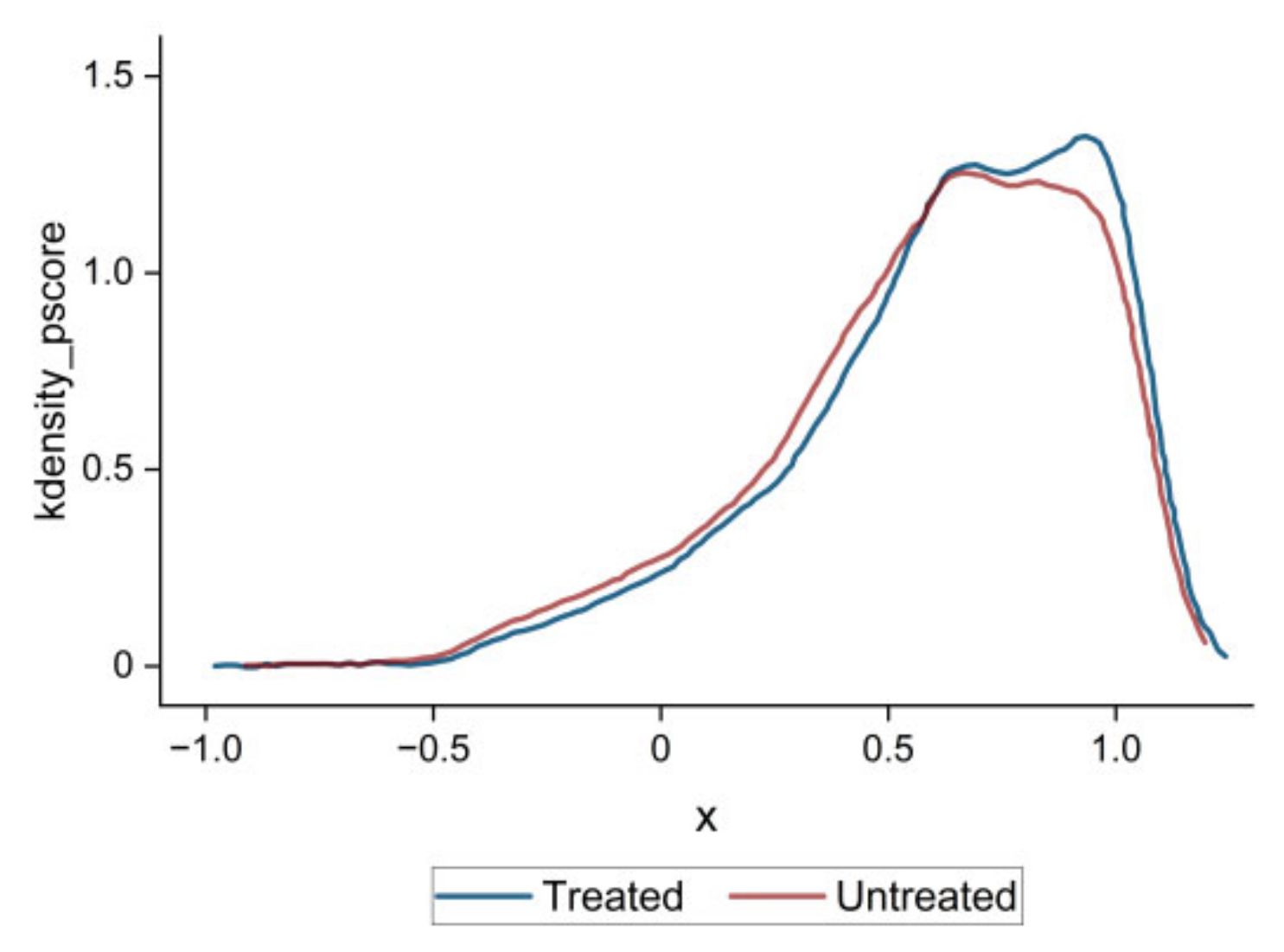

4.1. Propensity Score Matching (PSM) Results

4.2. Benchmark Regression Results

4.3. Robustness Test

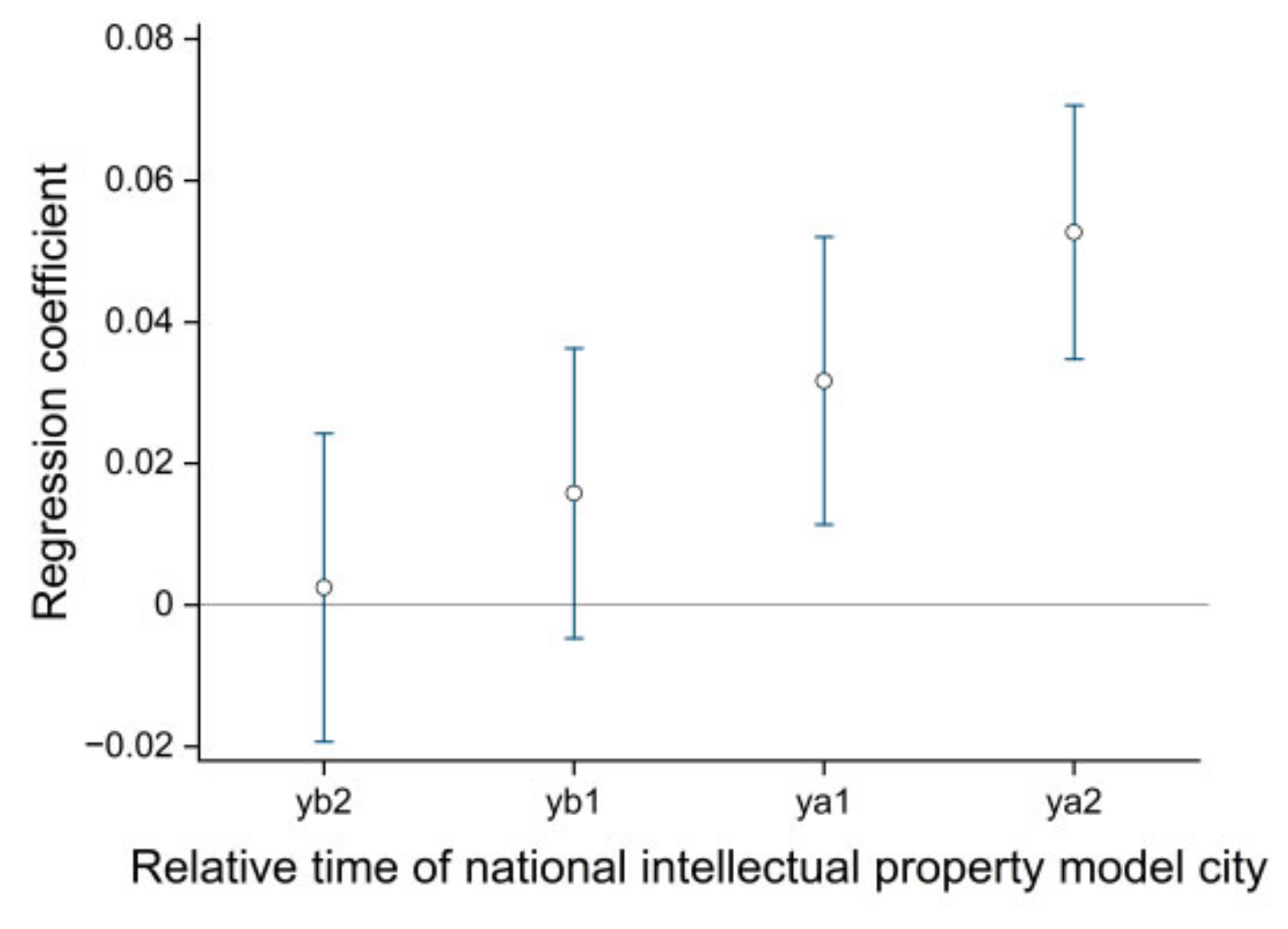

4.3.1. Parallel Trend Test

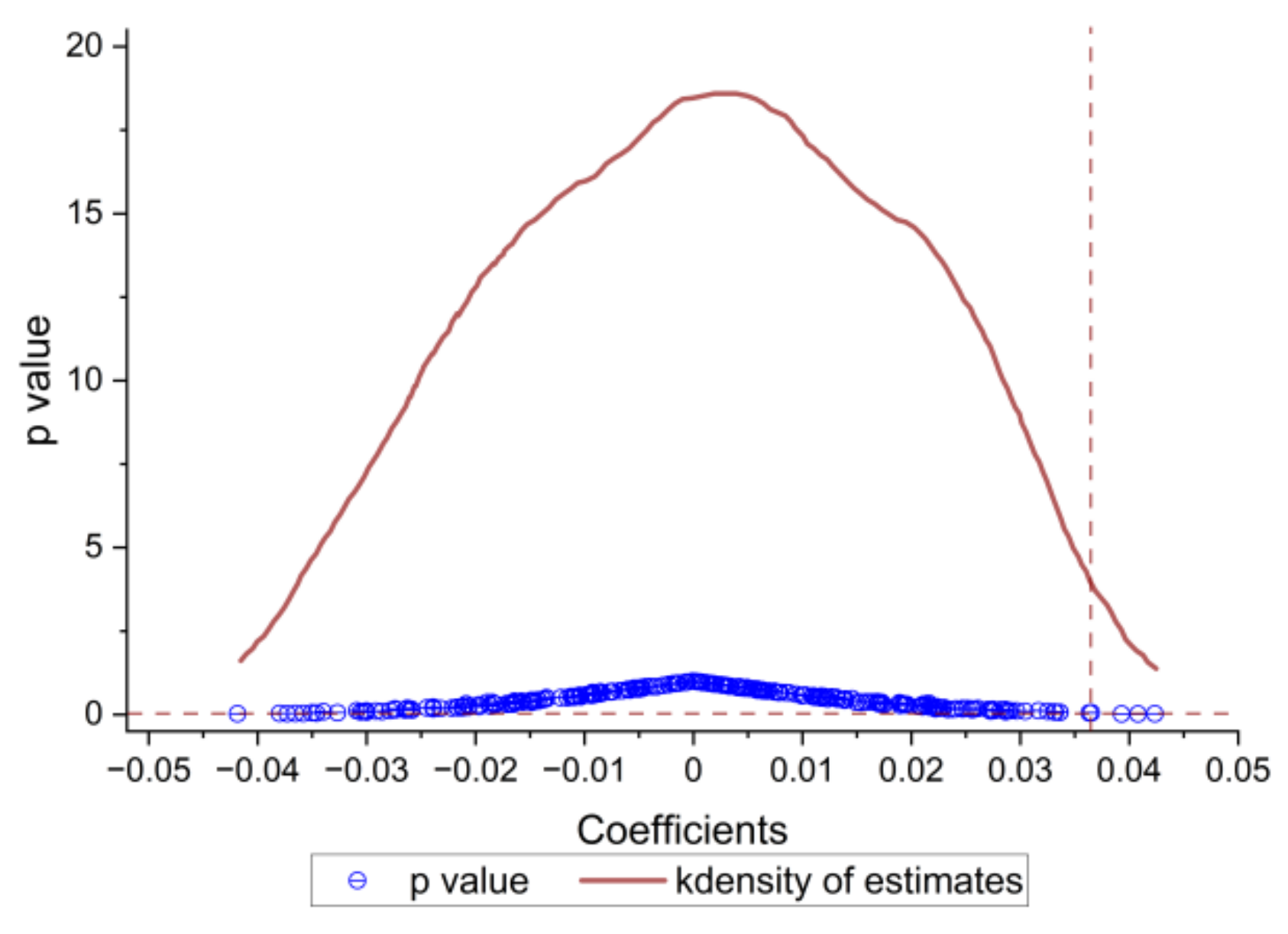

4.3.2. Placebo Test

4.3.3. Other Robustness Tests

5. Heterogeneity, Moderating Effect and Mediating Effect Tests

5.1. Period Heterogeneity

5.2. Enterprise Ownership Heterogeneity

5.3. Organizational Political Strategy Heterogeneity

5.4. Moderating Effect Test

5.5. Mediating Effect Test

6. Conclusions and Implications

6.1. Theoretical Contributions

6.2. Implications

- (1)

- IPMC has a significant positive effect on TFP. The government should deepen the construction of IPMC, expand the scale of IPMC and the scope of influence of policy effects, stimulate TFP, and help China achieve high-quality IP rights and high-quality economic development.

- (2)

- The government should continuously optimize the IPMC policies for the period heterogeneity and enterprise heterogeneity of IPMC impact on TFP. First, the government should further establish and improve the selection, dynamic supervision, incentive, and exit mechanism of IPMC. It will form a variety of measures to promote TFP, alleviate the lagging effect, and play long-term effects. Second, the government should stabilize the status of state-owned enterprises in economic development. Give full play to the positive response and demonstration effect of state-owned enterprises to IPMC policies, and promote TFP. Third, the government should encourage enterprises to implement organizational political strategies and let more entrepreneurs participate in policy formulation and implementation. It helps to improve the practicability of the policy and the accuracy of the enterprise’s interpretation of the policy. It will expand the policy benefit effect of IPMC on TFP.

- (3)

- The government should accelerate the establishment of a new type of government-business relationship and optimize the urban business environment. First, the government should deepen the reform of administrative examination and approval, simplify the examination and approval process, improve the efficiency and quality of government services, and reduce institutional transaction costs. And improve the close government-business relationship, and promote the role of IPMC in TFP. Second, the government must improve the long-term mechanism for preventing corruption and eradicate the negative impact of rent-seeking and rent-setting on enterprises. At the same time, disclose financial information to improve the information transparency of enterprises and reduce government interference. It will promote fair competition in the market and fair allocation of resources, improve the clean government-business relationship, and promote the role of IPMC in TFP.

- (4)

- The TFP should be promoted by increasing urban fiscal expenditure on science and technology and improving enterprise technological innovation. The government should effectively increase the fiscal expenditure on science and technology to increase investment in R&D subsidies, talent introduction policies, and knowledge-sharing platforms and create a business environment that encourages innovation. It will provide multi-faceted guarantees and incentives for enterprises to carry out innovation activities and promote TFP. Enterprises should fully strive for and use the policy and financial support of IPMC, pay attention to the innovative talents introduction, establishment of R&D teams, and the investment of R&D funds. Adhere to the innovation-driven development strategy, actively carry out technological innovation, and give full play to the role of IPMC in promoting TFP.

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wei, S.J.; Xie, Z.; Zhang, X.B. From “made in China” to “innovated in China”: Necessity, prospect, and challenges. J. Econ. Perspect. 2017, 31, 49–70. [Google Scholar] [CrossRef]

- Shaikh, I.A.; Randhawa, K. Industrial R&D and national innovation policy: An institutional reappraisal of the US national innovation system. Ind. Corp. Chang. 2022, 31, 1152–1176. [Google Scholar] [CrossRef]

- Jiang, N.; Li, P.Y.; Ou, Z.H. Intellectual property protection, digital economy and regional entrepreneurial activity. China Soft Sci. 2021, 36, 171–181. [Google Scholar] [CrossRef]

- Fang, L.H.; Lerner, J.; Wu, C.P. Intellectual property rights protection, ownership, and innovation: Evidence from China. Rev. Financ. Stud. 2017, 30, 2446–2477. [Google Scholar] [CrossRef]

- Amin, M.R.; Chung, C.Y.; Kang, S. Does information quality matter in corporate innovation? Evidence from the Korean market. Econ. Innov. New Technol. 2021, 1871271. [Google Scholar] [CrossRef]

- Van Der Wouden, F. Are Chinese cities getting smarter in terms of knowledge and technology they produce? World Dev. 2022, 150, 105729. [Google Scholar] [CrossRef]

- Qin, B.; Gao, A.K. The impact of intellectual property city pilots on industrial structure upgrading: Empirical evidence based on DID. Ind. Econ. Res. 2020, 19, 45–57. [Google Scholar] [CrossRef]

- Ji, X.Y.; Gu, N.H. Does the establishment of intellectual property model cities affect innovation quality? J. Financ. Econ. 2021, 47, 49–63. [Google Scholar] [CrossRef]

- Zhao, F.S.; Li, L. Research on the entrepreneurial effect of intellectual property regimes: Empirical evidence based on the construction of intellectual property city pilots in China. Ind. Econ. Res. 2021, 20, 44–57. [Google Scholar] [CrossRef]

- Xu, Y.; Wei, D.M. Urban intellectual property strategy and enterprise innovation: A quasi-natural experiment from national intellectual property model city. Ind. Econ. Res. 2021, 20, 99–114. [Google Scholar] [CrossRef]

- Qiu, W.; Zhang, J.; Wu, H. The role of innovation investment and institutional quality on green total factor productivity: Evidence from 46 countries along the “Belt and Road”. Environ. Sci. Pollut. Res. 2022, 29, 16597–16611. [Google Scholar] [CrossRef] [PubMed]

- Hu, X.T.; Yin, X.P. Do stronger intellectual property rights protections raise productivity within the context of trade liberalization? Evidence from China. Econ. Model. 2022, 110, 105791. [Google Scholar] [CrossRef]

- Su, Z.F.; Wang, C.F.; Peng, M.W. Intellectual property rights protection and total factor productivity. Int. Bus. Rev. 2022, 31, 101956. [Google Scholar] [CrossRef]

- Chen, Z.Y.; Zhang, J.; Zi, Y. A cost-benefit analysis of R&D and patents: Firm-level evidence from China. Eur. Econ. Rev. 2020, 133, 103633. [Google Scholar] [CrossRef]

- Dai, X.Y.; Chapman, G. R&D tax incentives and innovation: Examining the role of programme design in China. Technovation 2022, 113, 102419. [Google Scholar] [CrossRef]

- Contractor, F.J. Can a firm find the balance between openness and secrecy? Towards a theory of an optimum level of disclosure. J. Int. Bus. Stud. 2019, 50, 261–274. [Google Scholar] [CrossRef]

- Kale, S.; Rath, B.N. Does innovation matter for total factor productivity growth in India? Evidence from ARDL bound testing approach. Int. J. Emerg. Mark. 2018, 13, 1311–1329. [Google Scholar] [CrossRef]

- Mao, K.; Failler, P. Does Stronger Protection of Intellectual Property Improve Sustainable Development? Evidence from City Data in China. Sustainability 2022, 4, 14369. [Google Scholar] [CrossRef]

- Clo, S.; Florio, M.; Rentocchini, F. Firm ownership, quality of government and innovation: Evidence from patenting in the telecommunication industry. Res. Policy 2020, 49, 103960. [Google Scholar] [CrossRef]

- Rong, Z.; Wu, X.K.; Boeing, P. The effect of institutional ownership on firm innovation: Evidence from Chinese listed firms. Res. Policy 2017, 46, 1533–1551. [Google Scholar] [CrossRef]

- Huang, M.; Liao, Z.H.; Lin, H. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2020, 278, 123634. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, Q.Y.; Liu, Y. The new type of government-business relationship and corporate performance stability: Evidence from Chinese listed companies. J. Ind. Eng. Manag. 2021, 35, 1–13. [Google Scholar] [CrossRef]

- Li, J.H.; Huang, J.H. Network embeddness, innovation legitimacy and radical innovation resource acquisition. Sci. Res. Manag. 2017, 38, 10–18. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, M.G. How to improve the government-enterprise relationships to retain enterprise? Econ. Res.-Ekon. Istraživanja 2022, 35, 6345–6363. [Google Scholar] [CrossRef]

- Li, S.Y.; Shahzadi, A.; Zheng, M.B.; Chang, C.P. The impacts of executives’ political connections on interactions between firm’s mergers, acquisitions, and performance. Econ. Chang. Restruct. 2021, 55, 653–679. [Google Scholar] [CrossRef]

- Zhao, X.Y.; Yi, C.J. Can state-owned capital intervention prohibit real enterprises shifting from real to virtual economy: On the regulating role of the intimate and clean relationship between politics and business relations. Bus. Manag. J. 2021, 43, 61–74. [Google Scholar] [CrossRef]

- Liu, S.Y.; Du, J.; Zhang, W.K.; Tian, X.L.; Kou, G. Innovation quantity or quality? The role of political connections. Emerg. Mark. Rev. 2021, 48, 100819. [Google Scholar] [CrossRef]

- Díaz-Díaz, N.L.; López-Iturriaga, F.J.; Santana-Martín, D.J. The role of political ties and political uncertainty in corporate innovation. Long Range Plan. 2022, 55, 102111. [Google Scholar] [CrossRef]

- Wang, G.H.; Wang, Y.Q.; Rui, X.Q. Effects of political networking capability and strategic capability on exploratory and exploitative innovation: Evidence from traditional manufacturing firms in China. J. Manuf. Technol. Manag. 2022, 33, 618–642. [Google Scholar] [CrossRef]

- Chen, C.; Gu, J.J.; Luo, R.X. Corporate innovation and R&D expenditure disclosures. Technol. Forecast. Soc. Chang. 2022, 174, 121230. [Google Scholar] [CrossRef]

- Lu, F.F.; Zhu, Z.; Gao, H. Political tie hot potato: The contingent effect of China's anti-corruption policy on cash and innovation. Res. Policy 2022, 51, 104476. [Google Scholar] [CrossRef]

- Sweet, C.; Eterovic, D. Do patent rights matter? 40 years of innovation, complexity and productivity. World Dev. 2019, 115, 78–93. [Google Scholar] [CrossRef]

- Pedro, C.N.; Oscar, A.; Diana, S.; Elena, S. The link between intellectual property rights, innovation, and growth: A meta-analysis. Econ. Model. 2021, 97, 196–209. [Google Scholar] [CrossRef]

- Männasoo, K.; Hein, H.; Ruubel, R. The contributions of human capital, R&D spending and convergence to total factor productivity growth. Reg. Stud. 2018, 52, 1598–1611. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Z.K.; Xu, D.Y. Notching R&D investment with corporate income tax cuts in China. Am. Econ. Rev. 2021, 111, 2065–2100. [Google Scholar] [CrossRef]

- Liu, S.Y.; Du, J.; Zhang, W.K.; Tian, X.L. Opening the box of subsidies: Which is more effective for innovation? Eurasian Bus. Rev. 2021, 25, 813–837. [Google Scholar] [CrossRef]

- Lin, J.; Wu, H.M.; Wu, H. Could government lead the way? Evaluation of China’s patent subsidy policy on patent quality. China Econ. Rev. 2021, 69, 101663. [Google Scholar] [CrossRef]

- Hou, Q.S.; Chen, Z.H.; Teng, M. Today’s baton and tomorrow’s vision: The effect of strengthening patent examination system on corporate innovation strategies. J. Bus. Res. 2022, 144, 614–626. [Google Scholar] [CrossRef]

- Tian, B.B.; Yu, B.X.; Chen, S.; Ye, J.J. Tax incentive, R&D and firm innovation: Evidence from China. J. Asian Econ. 2020, 71, 101245. [Google Scholar] [CrossRef]

- Chen, T.Y.; Wang, Y.; Zhao, X.S. Business Environment, Enterprises Confidence and high-quality development: Empirical evidence from the 2018 China Enterprise General Survey (CEGS). J. Macro-Qual. Res. 2020, 8, 110–128. [Google Scholar] [CrossRef]

- Chen, Z.Y.; Zhang, J. Types of patents and driving forces behind the patent growth in China. Econ. Model. 2018, 80, 294–302. [Google Scholar] [CrossRef]

- Dai, X.Y.; Sun, Z. Does firm innovation improve aggregate industry productivity? Evidence from Chinese manufacturing firms. Struct. Chang. Econ. Dyn. 2021, 56, 1–9. [Google Scholar] [CrossRef]

- Wong, K.K.G.; Fleisher, B.M.; McGuire, W.H. Technical progress and induced innovation in China: A variable profit function approach. J. Product. Anal. 2022, 57, 177–191. [Google Scholar] [CrossRef]

- Fang, J.; He, H.; Li, N. China's rising IQ (Innovation Quotient) and growth: Firm-level evidence. J. Dev. Econ. 2020, 147, 102561. [Google Scholar] [CrossRef]

- Dong, B.; Guo, Y.; Hu, X. Intellectual property rights protection and export product quality: Evidence from China. Int. Rev. Econ. Financ. 2022, 77, 143–158. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–342. [Google Scholar] [CrossRef]

- Qian, X.S.; Kang, J.; Tang, Y.L.; Cao, X.P. Industrial policy, efficiency of capital allocation and firm’s total factor productivity: Evidence from a natural experiment in China. China Ind. Econ. 2018, 36, 42–59. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

| Type | Variables | Definition |

|---|---|---|

| Dependent variable | TFP | LP method is used to measure total factor productivity, OP method and OLS method are used for robustness test |

| Independent variable | TREAT_POST | Intellectual property model city. The interaction terms of grouping dummy variables and policy enforcement dummy variables |

| Control variable | ROA | Profitability. Return on Assets |

| Q | Tobin’s Q | |

| Leverage | Leverage ratio. Total liabilities/Total assets | |

| Age | Enterprise age | |

| TotalAssets | Total assets | |

| EquityNature | Ownership attributes. For state-owned enterprises, take 1; otherwise, take 0 | |

| Fixs | Fixed assets ratio. Fixed assets/Total assets |

| Variables | Mean | SD | Min | Max |

|---|---|---|---|---|

| TFP | 9.1 | 1.001 | 6.872 | 12.1 |

| TREAT_POST | 0.471 | 0.499 | 0 | 1 |

| ROA | 0.0402 | 0.0494 | −0.251 | 0.191 |

| Q | 1.968 | 1.075 | 0.865 | 8.264 |

| TotalAssets | 98.81 | 214 | 4.721 | 2502 |

| Age | 17.1 | 5.759 | 1 | 62 |

| EquityNature | 0.369 | 0.482 | 0 | 1 |

| Leverage | 0.424 | 0.194 | 0.0546 | 0.885 |

| Fixs | 0.215 | 0.15 | 0.00207 | 0.694 |

| Variables | Sample | Mean | %Bias | %Reduct | t-test | ||

|---|---|---|---|---|---|---|---|

| Treated | Untreated | |Bias| | t | p > |t| | |||

| ROA | Unmatched | 0.02671 | −0.04341 | 7 | 5.05 | 0.000 | |

| Matched | 0.02601 | 0.03594 | −1 | 85.8 | −0.83 | 0.407 | |

| Q | Unmatched | 0.013 | −0.02112 | 3.4 | 2.45 | 0.014 | |

| Matched | 0.01373 | −0.01004 | 2.4 | 30.3 | 1.95 | 0.051 | |

| Leverage | Unmatched | −0.02461 | 0.03998 | −6.5 | −4.65 | 0.000 | |

| Matched | −0.02583 | −0.01208 | −1.4 | 78.7 | −1.13 | 0.259 | |

| Age | Unmatched | −0.02624 | 0.04263 | −6.9 | −4.95 | 0.000 | |

| Matched | −0.02434 | −0.0217 | −0.3 | 96.2 | −0.22 | 0.829 | |

| TotalAssets | Unmatched | −0.03559 | 0.05783 | −9.2 | −6.73 | 0.000 | |

| Matched | −0.03712 | −0.04077 | 0.4 | 96.1 | 0.34 | 0.732 | |

| EquityNature | Unmatched | 0.3284 | 0.43387 | −21.8 | −15.81 | 0.000 | |

| Matched | 0.32869 | 0.33525 | −1.4 | 93.8 | −1.15 | 0.251 | |

| Fixs | Unmatched | −0.10199 | 0.16571 | −26.7 | −19.42 | 0.000 | |

| Matched | −0.10095 | −0.10501 | 0.4 | 98.5 | 0.35 | 0.727 | |

| Variables | (1) TFP | (2) TFP | (3) TFP | (4) TFP |

|---|---|---|---|---|

| TREAT_POST | 0.0412 *** | 0.0346 *** | 0.0423 *** | 0.0357 *** |

| (0.011) | (0.00952) | (0.011) | (0.00953) | |

| ROA | 0.144 *** | 0.144 *** | ||

| (0.00316) | (0.00316) | |||

| Q | −0.0377 *** | −0.0377 *** | ||

| (0.00352) | (0.00352) | |||

| Leverage | 0.247 *** | 0.247 *** | ||

| (0.00502) | (0.00502) | |||

| Age | 0.325 *** | 0.325 *** | ||

| (0.00787) | (0.00788) | |||

| TotalAssets | 0.174 *** | 0.175 *** | ||

| (0.00573) | (0.00575) | |||

| EquityNature | 0.0238 | 0.0245 | ||

| (0.0192) | (0.0192) | |||

| Fixs | −0.175 *** | −0.175 *** | ||

| (0.0052) | (0.0052) | |||

| Year FE | Yes | Yes | Yes | Yes |

| Enterprise FE | Yes | Yes | Yes | Yes |

| Constant | 8.689 *** | 9.065 *** | 8.687 *** | 9.063 *** |

| (0.0112) | (0.0098) | (−0.0112) | (0.00981) | |

| Observations | 21,930 | 21,930 | 21,912 | 21,912 |

| Enterprises | 3268 | 3268 | 3268 | 3268 |

| R-squared | 0.284 | 0.467 | 0.285 | 0.468 |

| Variables | (1) TFP_OP | (2) TFP_OLS | (3) TFP | (4) TFP | (5) TFP | (6) TFP |

|---|---|---|---|---|---|---|

| TREAT_POST | 0.0283 *** | 0.0370 *** | 0.0195 * | 0.0237 ** | 0.0181 * | 0.0310 *** |

| (0.0088) | (0.0103) | (0.0109) | (0.011) | (0.0094) | (0.0107) | |

| ROA | 0.131 *** | 0.153 *** | 0.143 *** | 0.142 *** | 0.137 *** | 0.105 *** |

| (0.00288) | (0.00342) | (0.00347) | (0.00319) | (0.00313) | (0.00409) | |

| Q | −0.0207 *** | −0.0522 *** | −0.0335 *** | −0.0394 *** | −0.0426 *** | −0.00769 * |

| (0.00324) | (0.0038) | (0.0039) | (0.00354) | (0.00353) | (0.00437) | |

| Leverage | 0.186 *** | 0.290 *** | 0.247 *** | 0.244 *** | 0.224 *** | 0.226 *** |

| (0.00458) | (0.00544) | (0.00547) | (0.00507) | (0.00497) | (0.00601) | |

| Age | 0.268 *** | 0.409 *** | 0.326 *** | 1.179 *** | −0.0121 | 0.288 *** |

| (0.0072) | (0.00852) | (0.00881) | (0.248) | (0.108) | (0.0096) | |

| TotalAssets | 0.112 *** | 0.223 *** | 0.212 *** | 0.175 *** | 0.186 *** | 0.157 *** |

| (0.00531) | (0.00617) | (0.00665) | (0.0058) | (0.00592) | (0.00786) | |

| EquityNature | −0.0196 | 0.0251 | 0.0132 | 0.025 | −0.00906 | 0.0216 |

| (0.0174) | (0.0207) | (0.0208) | (0.0195) | (0.0186) | (0.0227) | |

| Fixs | −0.149 *** | −0.0743 *** | −0.167 *** | −0.174 *** | −0.167 *** | −0.109 *** |

| (0.00479) | (0.00562) | (0.0056) | (0.00523) | (0.00517) | (0.00616) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Enterprise FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 6.652 *** | 10.97 *** | 9.057 *** | 9.874 *** | 9.025 *** | 9.179 *** |

| (0.00886) | (0.0106) | (0.0106) | (0.213) | (0.0906) | (0.0114) | |

| Observations | 23,264 | 21,972 | 17,903 | 21,912 | 21,912 | 17,714 |

| Enterprises | 3377 | 3272 | 2656 | 3268 | 3268 | 3033 |

| R-squared | 0.383 | 0.503 | 0.479 | 0.485 | 0.548 | 0.379 |

| Variables | (1) TFP | (2) TFP | (3) TFP | (4) TFP | (5) TFP |

|---|---|---|---|---|---|

| TREAT_POST | 0.0421 *** | 0.00965 | 0.0382 ** | 0.0242 * | |

| (0.0147) | (0.0123) | (0.0181) | (0.0128) | ||

| TREAT_POST0 | 0.0173 | ||||

| (0.0124) | |||||

| TREAT_POST1 | 0.0373 *** | ||||

| (0.0127) | |||||

| TREAT_POST2 | 0.0225 * | ||||

| (0.0136) | |||||

| TREAT_POST3 | 0.0636 *** | ||||

| (0.0143) | |||||

| TREAT_POST4 | 0.0815 *** | ||||

| (0.0144) | |||||

| TREAT_POST5 | 0.0697 *** | ||||

| (0.0152) | |||||

| TREAT_POST6 | 0.0651 *** | ||||

| (0.0161) | |||||

| TREAT_POST7 | 0.0711 *** | ||||

| (0.0167) | |||||

| TREAT_POST8 | 0.0872 *** | ||||

| (0.0191) | |||||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Enterprise FE | Yes | Yes | Yes | Yes | Yes |

| Constant | 9.049 *** | 9.279 *** | 8.971 *** | 9.238 *** | 9.185 *** |

| (0.0105) | (0.00993) | (0.00887) | (0.0226) | (0.0159) | |

| Observations | 21,912 | 8081 | 13,831 | 4227 | 11,589 |

| Enterprises | 3268 | 1091 | 2368 | 1036 | 2134 |

| R-squared | 0.469 | 0.403 | 0.522 | 0.467 | 0.441 |

| Variables | (1) TFP | (2) TFP |

|---|---|---|

| TREAT_POST | 0.0251 ** | 0.0365 *** |

| (0.0124) | (0.0120) | |

| GBRelationship1 | ||

| TREAT_POST*GBRelationship | ||

| Close | −0.0522 ** | |

| (0.0228) | ||

| TREAT_POST*Close | 0.0520 *** | |

| (0.0157) | ||

| Clean | 0.00901 | |

| (0.0229) | ||

| TREAT_POST*Clean | 0.0299 * | |

| (0.0156) | ||

| Controls | Yes | Yes |

| Year FE | Yes | Yes |

| Enterprise FE | Yes | Yes |

| Constant | 8.976 *** | 8.946 *** |

| (0.0179) | (0.0177) | |

| Observations | 20,661 | 20,661 |

| Enterprises | 3059 | 3059 |

| R-squared | 0.451 | 0.450 |

| Variables | (1) TFP | (2) FiscalExp | (3) TFP | (4) TFP | (5) Innovation | (6) TFP |

|---|---|---|---|---|---|---|

| TREAT_POST | 0.0333 *** | 0.0253 *** | 0.0327 *** | 0.0341 *** | 0.0349 ** | 0.0311 *** |

| (0.0103) | (0.00887) | (0.0103) | (0.0107) | (0.0173) | (0.0106) | |

| FiscalExp | 0.0209 ** | |||||

| (0.00935) | ||||||

| Innovation | 0.0851 *** | |||||

| (0.00548) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Enterprise FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 9.065 *** | −0.031 *** | 9.065 *** | 9.093 *** | −0.0596 ** | 9.098 *** |

| (0.0108) | (0.00926) | (0.0108) | (0.0173) | (0.0280) | (0.0172) | |

| Observations | 18,484 | 18,484 | 18,484 | 15,390 | 15,390 | 15,390 |

| Enterprises | 3039 | 3039 | 3039 | 2802 | 2802 | 2802 |

| R-squared | 0.476 | 0.091 | 0.476 | 0.525 | 0.066 | 0.534 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, Y.; Sun, M. The Enabling Effect of Intellectual Property Strategy on Total Factor Productivity of Enterprises: Evidence from China’s Intellectual Property Model Cities. Sustainability 2023, 15, 549. https://doi.org/10.3390/su15010549

Zhu Y, Sun M. The Enabling Effect of Intellectual Property Strategy on Total Factor Productivity of Enterprises: Evidence from China’s Intellectual Property Model Cities. Sustainability. 2023; 15(1):549. https://doi.org/10.3390/su15010549

Chicago/Turabian StyleZhu, Ye, and Minggui Sun. 2023. "The Enabling Effect of Intellectual Property Strategy on Total Factor Productivity of Enterprises: Evidence from China’s Intellectual Property Model Cities" Sustainability 15, no. 1: 549. https://doi.org/10.3390/su15010549

APA StyleZhu, Y., & Sun, M. (2023). The Enabling Effect of Intellectual Property Strategy on Total Factor Productivity of Enterprises: Evidence from China’s Intellectual Property Model Cities. Sustainability, 15(1), 549. https://doi.org/10.3390/su15010549