The Influence of Government Subsidies on the Efficiency of Technological Innovation: A Panel Threshold Regression Approach

Abstract

1. Introduction

2. Literature Review

- Most literature uses the data at provincial and industrial levels for empirical research, while empirical evidence on the micro level is relatively lacking;

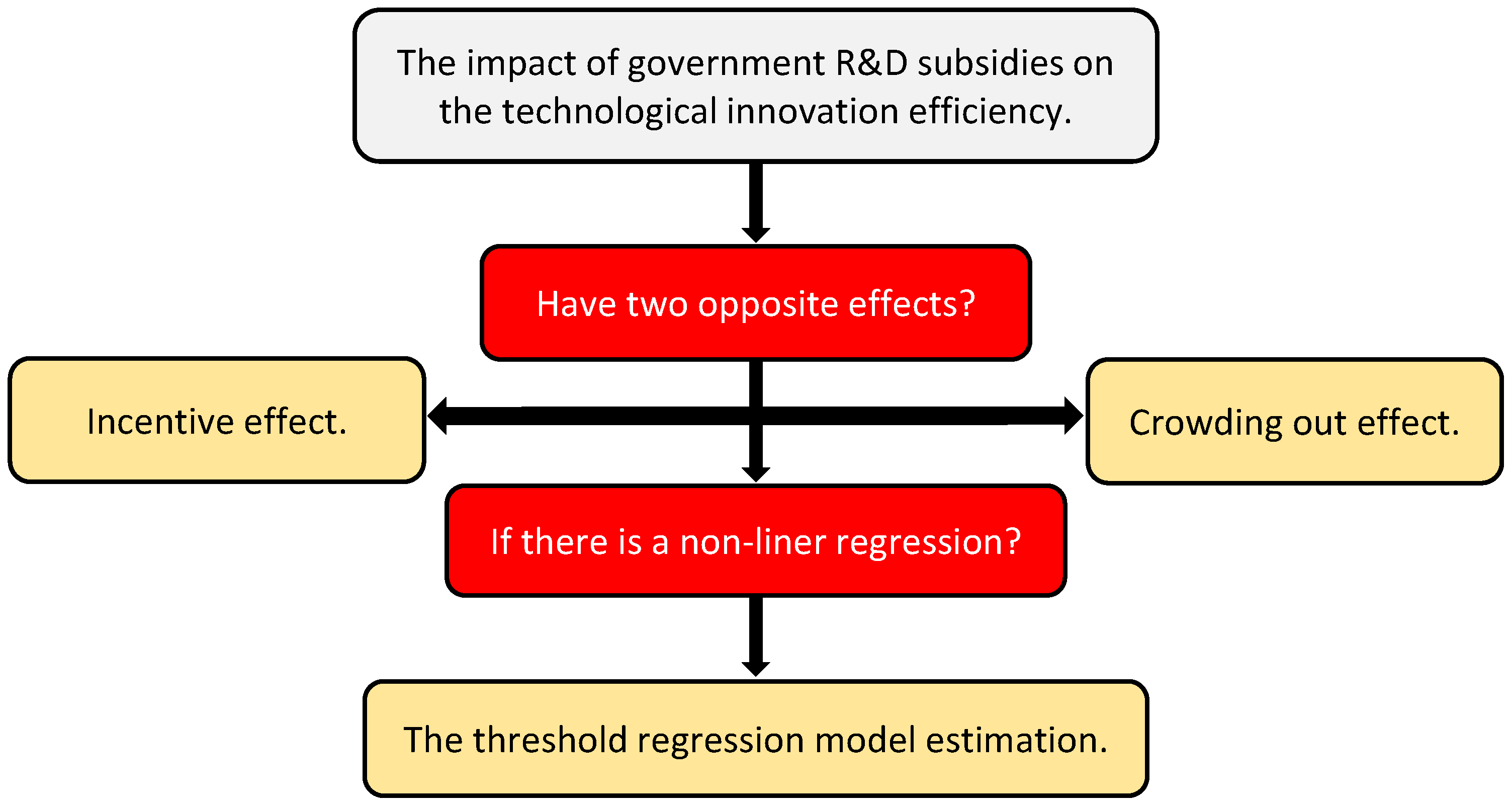

- The analysis of the impact of government subsidies on the innovation efficiency of enterprises is limited to being beneficial or unhelpful, without considering whether the difference in the effect of government subsidies originates from the threshold effect; The existing literature does not fully answer this question.

3. Theoretical Analysis and Hypothesis

3.1. The Relationship between Government Subsidies and Technological Innovation Efficiency

3.2. Heterogeneity Analysis of Government Subsidies and Technological Innovation Efficiency

3.2.1. Property Rights Heterogeneity

3.2.2. Regional Heterogeneity

3.3. Threshold Effect

4. Research Methodology

4.1. The Three Stage DEA Model

- Stage I

- Initial DEA efficiency evaluation.The efficiency evaluation at this stage uses the original input and output index data to measure the efficiency of the decision-making unit.where represents the input relaxation variable, and represents the i-th input of the n-th decision-making unit. represents the parameter to be estimated of the environmental variable. represents the influence of environmental variables on . and are the mixed error terms, indicating the interference of the error term on the innovation input and output of renewable energy enterprises. .

- Stage II

- Constructing SFA model.Because the input or output slack variables obtained in the initial efficiency evaluation stage will be affected by the external environment and random errors, the SFA model is built to measure the above two influencing factors in this stage, and then eliminate the influence of these two factors. The SFA model is as follows:where is the actual input value, and is the adjusted input value. The former part of formula (2) indicates that all DMUs are adjusted to the same external environment, and the latter part indicates that all DMUs are adjusted to the same random error. In this case, all DMUs have the same environment.

- Stage III

- DEA efficiency evaluation after adjustment.The initial input index shall be adjusted according to the regression results of the above stages. Compared with the first stage, the efficiency value obtained in this stage excludes the influence of external environmental factors and random errors, so it is a more accurate efficiency value.

4.2. Panel Benchmark Model

4.3. Threshold-Effect Model

- The original hypothesis (H0) is ; the threshold estimate is equal to its true value.

- The alternative hypothesis (H1) is ; the threshold estimate is not equal to its true value.

5. Data Source and Sampling

- (1)

- Delete the samples of ST and *ST renewable energy enterprises;

- (2)

- Delete samples with incomplete or missing information disclosure;

- (3)

- In order to eliminate the adverse effects of outliers, the sample data were reduced to 1%; in view of data availability and completeness, the time span of the sample is 2016 to 2020.

5.1. Variable Definition

5.2. Descriptive Statistics on Samples

- The maximum value of technological innovation efficiency (CRSTE) of renewable energy enterprises reaches 1, while the minimum value is 0.001 and the average value is 0.149. It shows that there are obvious differences in the level of technological innovation efficiency among different sample enterprises;

- The average value of government subsidy intensity (GOV) is 0.013, and the maximum and minimum values are 0.083 and 0.0003, respectively. This obviously implies that the subsidies obtained by different sample enterprises are very different.

6. Empirical Estimation Results and Discussions

6.1. Multiple Regression of Governmental Subsidies on the Technological Innovation Efficiency

6.1.1. Basic Regression Analysis

6.1.2. The Property Rights Heterogeneity—Linear Regression Test

6.1.3. The Regional Heterogeneity—Linear Regression Test

6.2. The Threshold Effect Test of Governmental Subsidies on the Technological Innovation Efficiency

6.2.1. Threshold Effect Test

6.2.2. Estimation of Threshold Effect

6.2.3. The Property Rights Heterogeneity—Threshold Effect Test

6.2.4. The Regional Heterogeneity—Threshold Effect Test

7. Robustness Test

8. Conclusions and Policy Recommendation

8.1. Key Findings

8.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Miremadi, I.; Saboohi, Y.; Arasti, M. The influence of public R&D and knowledge spillovers on the development of renewable energy sources: The case of the Nordic countries. Technol. Forecast. Soc. Chang. 2019, 146, 450–463. [Google Scholar]

- Wu, T.; Yang, S.; Tan, J. Impacts of government R&D subsidies on venture capital and renewable energy investment–an empirical study in China. Resour. Policy 2020, 68, 101715. [Google Scholar]

- Zeeshan, M.; Rehman, A.; Ullah, I.; Hussain, A.; Afridi, F.E.A. Exploring symmetric and asymmetric nexus between corruption, political instability, natural resources and economic growth in the context of Pakistan. Resour. Policy 2022, 78, 102785. [Google Scholar] [CrossRef]

- Zeeshan, M.; Han, J.; Rehman, A.; Ullah, I.; Afridi, F.E.A.; Fareed, Z. Comparative Analysis of Trade Liberalization, CO2 Emissions, Energy Consumption and Economic Growth in Southeast Asian and Latin American Regions: A Structural Equation Modeling Approach. Front. Environ. Sci. 2022, 10, 854590. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Zhang, D.; Wang, J.; Lin, Y.; Si, Y.; Huang, C.; Yang, J.; Huang, B.; Li, W. Present situation and future prospect of renewable energy in China. Renew. Sustain. Energy Rev. 2017, 76, 865–871. [Google Scholar] [CrossRef]

- Olabi, A.G. Developments in Sustainable Energy and Environmental Protection. Energy 2012, 39, 2–5. [Google Scholar] [CrossRef]

- Chen, H.; Zhong, T.; Lee, J.Y. Capacity reduction pressure, financing constraints, and enterprise sustainable innovation investment: Evidence from Chinese manufacturing companies. Sustainability 2020, 12, 10472. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Liu, D.; Chen, T.; Liu, X.; Yu, Y. Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Econ. Model. 2019, 80, 441–452. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Sung, B. Do government subsidies promote firm-level innovation? Evidence from the Korean renewable energy technology industry. Energy Policy 2019, 132, 1333–1344. [Google Scholar] [CrossRef]

- Basit, S.A.; Kuhn, T.; Ahmed, M. The effect of government subsidy on non-technological innovation and firm performance in the service sector: Evidence from Germany. Bus. Syst. Res. Int. J. Soc. Adv. Innov. Res. Econ. 2018, 9, 118–137. [Google Scholar] [CrossRef]

- Zhao, S.; Xu, B.; Zhang, W. Government R&D subsidy policy in China: An empirical examination of effect, priority, and specifics. Technol. Forecast. Soc. Chang. 2018, 135, 75–82. [Google Scholar]

- Wang, S.X.; Lu, W.M.; Hung, S.W. Improving innovation efficiency of emerging economies: The role of manufacturing. Manag. Decis. Econ. 2020, 41, 503–519. [Google Scholar] [CrossRef]

- Zuo, Z.; Guo, H.; Li, Y.; Cheng, J. A two-stage DEA evaluation of Chinese mining industry technological innovation efficiency and eco-efficiency. Environ. Impact Assess. Rev. 2022, 94, 106762. [Google Scholar] [CrossRef]

- Campos, M.S.; Costa, M.A.; Gontijo, T.S.; Lopes-Ahn, A.L. Robust stochastic frontier analysis applied to the Brazilian electricity distribution benchmarking method. Decis. Anal. J. 2022, 3, 100051. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, P. Applying the three-stage SBM-DEA model to evaluate energy efficiency and impact factors in RCEP countries. Energy 2022, 241, 122917. [Google Scholar] [CrossRef]

- Choi, S.B.; Lee, S.H.; Williams, C. Ownership and firm innovation in a transition economy: Evidence from China. Res. Policy 2011, 40, 441–452. [Google Scholar] [CrossRef]

- Luo, G.; Liu, Y.; Zhang, L.; Xu, X.; Guo, Y. Do governmental subsidies improve the financial performance of China’s new energy power generation enterprises? Energy 2021, 227, 120432. [Google Scholar] [CrossRef]

- Lin, B.; Luan, R. Are government subsidies effective in improving innovation efficiency? Based on the research of China’s wind power industry. Sci. Total Environ. 2020, 710, 136339. [Google Scholar] [CrossRef] [PubMed]

- Wu, A. The signal effect of government R&D subsidies in China: Does ownership matter? Technol. Forecast. Soc. Chang. 2017, 117, 339–345. [Google Scholar]

- Li, H.; Zhou, L.A. Political turnover and economic performance: The incentive role of personnel control in China. J. Public Econ. 2005, 89, 1743–1762. [Google Scholar] [CrossRef]

- Luan, R.; Lin, B. Positive or negative? Study on the impact of government subsidy on the business performance of China’s solar photovoltaic industry. Renew. Energy 2022, 189, 1145–1153. [Google Scholar] [CrossRef]

- Ma, C.; Yang, H.; Zhang, W.; Huang, S. Low-carbon consumption with government subsidy under asymmetric carbon emission information. J. Clean. Prod. 2021, 318, 128423. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, M.; Wang, Y. Impacts of government subsidies and environmental regulations on green process innovation: A nonlinear approach. Technol. Soc. 2020, 63, 101417. [Google Scholar] [CrossRef]

- Li, Q.; Wang, M.; Xiangli, L. Do government subsidies promote new-energy firms’ innovation? Evidence from dynamic and threshold models. J. Clean. Prod. 2021, 286, 124992. [Google Scholar] [CrossRef]

- Hidalgo, J.; Lee, J.; Seo, M.H. Robust inference for threshold regression models. J. Econom. 2019, 210, 291–309. [Google Scholar] [CrossRef]

- Liu, Z.; Huang, Y.; Huang, Y.; Song, Y.A.; Kumar, A. How does one-sided versus two-sided customer orientation affect B2B platform’s innovation: Differential effects with top management team status. J. Bus. Res. 2022, 141, 619–632. [Google Scholar] [CrossRef]

- Sunder, J.; Sunder, S.V.; Zhang, J. Pilot CEOs and corporate innovation. J. Financ. Econ. 2017, 123, 209–224. [Google Scholar] [CrossRef]

- Yang, B.; Gan, L. Contingent capital, Tobin’sq and corporate capital structure. N. Am. J. Econ. Financ. 2021, 55, 101305. [Google Scholar] [CrossRef]

| Category | Definition | Calculation/Valuation Method | Abbreviation |

|---|---|---|---|

| Explained variables | Technological innovation efficiency | Calculated by Three-stage DEA method | CRSTE |

| Explanatory variables | Government subsidies | Government subsidies/operating income | GOV |

| Control variables | Ownership concentration | Shareholding ratio of the top five shareholders | HERF |

| Enterprise size | Natural logarithm of ending assets | SIZE | |

| Enterprise property right | According to the property right nature of the largest shareholder, listed companies are divided into state-owned and non-state-owned enterprises | PROP | |

| Market competition level | Percentage of main business income of each market competitor in the industry | MARKET | |

| Executive academic experience | Number of senior management with academic experience/total number of senior management team | ACAD | |

| Employee salary level | Per capita wage level | HUM | |

| Enterprise value index | Tobin Q | GROW | |

| Cash asset ratio | Cash assets/current assets | CASH |

| Variable | N | Mean | Variance | Minimum | Maximum |

|---|---|---|---|---|---|

| CRSTE | 1575 | 0.149 | 0.193 | 0.003 | 1 |

| GOV | 1575 | 0.0134 | 0.0145 | 0.000269 | 0.0827 |

| TOP | 1575 | 0.495 | 0.144 | 0.179 | 0.846 |

| SIZE | 1575 | 22.72 | 1.181 | 20.41 | 26.44 |

| SOE | 1575 | 0.314 | 0.464 | 0 | 1 |

| MARKET | 1575 | 0.00157 | 0.00304 | 2.56 × 10 | 0.0165 |

| EDU | 1575 | 0.0857 | 0.124 | 0 | 0.5 |

| SALARY | 1575 | 9.62 | 0.791 | 6.984 | 11.65 |

| TOBINQ | 1575 | 1.733 | 0.862 | 0.833 | 5.837 |

| CASH | 1575 | 0.119 | 0.0811 | 0.0112 | 0.422 |

| Variable | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| Crste | |||

| Gov | 0.744 * | 1.711 *** | 1.763 *** |

| [1.808] | [5.209] | [5.661] | |

| Top | 0.071 ** | 0.062 ** | |

| [2.561] | [2.245] | ||

| Size | 0.080 *** | 0.089 *** | |

| [15.880] | [17.526] | ||

| Market | 15.659 *** | 13.602 *** | |

| [7.323] | [6.447] | ||

| Edu | −0.004 | ||

| [−0.141] | |||

| Salary | 0.018 *** | ||

| [3.683] | |||

| Tobinq | 0.010 *** | ||

| [2.694] | |||

| Cash | 0.073 * | ||

| [1.798] | |||

| _cons | 0.148 *** | −1.803 *** | −1.857 *** |

| [5.301] | [−15.539] | [−13.512] | |

| F | 11.562 | 33.037 | 34.299 |

| p | 0 | 0 | 0 |

| N | 1575 | 1575 | 1575 |

| Variable | State-Owned Enterprises | Non-State-Owned Enterprises | Eastern Region | Central Region | Western Region |

|---|---|---|---|---|---|

| Crste | |||||

| Gov | 1.347 * | 1.961 *** | 1.763 *** | 1.847 *** | 1.829 ** |

| [1.962] | [5.343] | [4.563] | [3.123] | [2.426] | |

| Top | −0.091 | 0.074 ** | 0.045 | −0.053 | 0.280 ** |

| [−1.391] | [2.384] | [1.505] | [−0.655] | [2.327] | |

| Size | 0.110 *** | 0.077 *** | 0.073 *** | 0.159 *** | 0.134 *** |

| [8.549] | [14.736] | [13.219] | [9.068] | [6.014] | |

| Market | 18.143 *** | 13.092 *** | 20.475 *** | 4.927 | 3.724 |

| [3.512] | [4.480] | [8.060] | [0.290] | [0.401] | |

| Edu | 0.062 | −0.034 | −0.025 | −0.013 | −0.009 |

| [0.821] | [−1.319] | [−0.901] | [−0.124] | [−0.064] | |

| Salary | 0.022 * | 0.018 *** | 0.016 *** | −0.019 | 0.02 |

| [1.918] | [3.362] | [2.777] | [−1.553] | [1.200] | |

| Tobinq | 0.017 | 0.006 | 0.006 | −0.005 | 0.047 ** |

| [1.549] | [1.630] | [1.452] | [−0.383] | [2.162] | |

| Cash | 0.085 | 0.017 | 0.028 | 0.273 *** | −0.510 *** |

| [0.847] | [0.409] | [0.609] | [2.815] | [−2.953] | |

| _cons | −2.259 *** | −1.635 *** | −1.523 *** | −2.997 *** | −2.989 *** |

| [−6.833] | [−10.626] | [−9.346] | [−7.104] | [−4.679] | |

| F | 18.603 | 26.954 | 40.454 | 10.407 | 21.148 |

| p | 0 | 0 | 0 | 0 | 0 |

| N | 495 | 1080 | 1205 | 235 | 135 |

| SAMPLE | The Whole Sample | Non-State-Owned | State-Owned | Eastern Region | Central Region | Western Region | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Threshold Numbers | F Value | p Value | F Value | p Value | F Value | p Value | F Value | p Value | F Value | p Value | F Value | p Value |

| Single threshold | 14.65 | 0.04 | 9.7 | 0.21 | 15.14 | 0.035 | 13.37 | 0.06 | 5.33 | 0.59 | 5.01 | 0.66 |

| Double threshold | 14.39 | 0.01 | 15.28 | 0.005 | 21.11 | 0.005 | −0.29 | 0.9991 | 6.13 | 0.39 | 7.73 | 0.27 |

| Triple threshold | 1.66 | 0.965 | 10.79 | 0.14 | 1.93 | 0.96 | 2.64 | 0.925 | 4.43 | 0.79 | 4.28 | 0.635 |

| SAMPLE | The Whole Sample | Non-State-Owned | State-Owned | Eastern Region | ||||

|---|---|---|---|---|---|---|---|---|

| Threshold Numbers | Threshold Estimate | Confidence Interval | Threshold Estimate | Confidence Interval | Threshold Estimate | Confidence Interval | Threshold Estimate | Confidence Interval |

| Single threshold | 0.0025 | [0.0023,0.0025] | 0.0031 | [0.003,0.0031] | 0.0018 | [0.0017,0.0018] | 0.0034 | [0.0031,0.0034] |

| Double threshold | 0.0037 | [0.0037,0.0038] | 0.0083 | [0.0083,0.0083] | 0.0037 | [0.0037,0.0038] | ||

| SAMPLE | The Whole Sample | Non-State-Owned | State-Owned | Eastern Region | ||||

|---|---|---|---|---|---|---|---|---|

| Variable | Coefficient | T Value | Coefficient | T Value | Coefficient | T Value | Coefficient | T Value |

| Top | 0.157 *** | [2.871] | 0.208 *** | [3.465] | 0.063 | [0.521] | 0.164 ** | [2.523] |

| Size | 0.086 *** | [7.685] | 0.084 *** | [7.509] | 0.097 *** | [3.046] | 0.070 *** | [5.809] |

| Market | 19.726 *** | [5.043] | 16.796 *** | [3.618] | 24.368 *** | [3.315] | 20.948 *** | [5.033] |

| Edu | −0.025 | [−0.644] | −0.004 | [−0.097] | −0.05 | [−0.577] | −0.026 | [−0.631] |

| Salary | 0.004 | [0.467] | 0.007 | [0.746] | −0.003 | [−0.169] | 0.003 | [0.346] |

| Tobinq | −0.007 | [−1.505] | −0.005 | [−1.117] | −0.01 | [−0.702] | −0.006 | [−1.258] |

| Cash | −0.062 | [−1.137] | −0.107 ** | [−1.983] | 0.04 | [0.281] | −0.069 | [−1.173] |

| th 1 | −8.522 ** | [−2.360] | −0.547 | [−0.381] | −15.020 ** | [−2.046] | −13.551 *** | [−3.169] |

| < th ≤ | 46.237 *** | [3.236] | 22.470 *** | [3.439] | 78.147 *** | [3.188] | 0.103 | [0.283] |

| th > 1 | 0.383 | [1.204] | 0.791** | [2.253] | −0.295 | [−0.449] | ||

| _cons | −1.975 *** | [−7.554] | −1.987 *** | [−7.383] | −1.985 *** | [−2.910] | −1.599 *** | [−5.453] |

| F | 20.383 | 15.967 | 6.684 | 14.123 | ||||

| N | 1575 | 1080 | 495 | 1205 | ||||

| Variable | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| Crste | |||

| lGov | 0.943 ** | 1.882 *** | 1.828 *** |

| [2.129] | [5.497] | [5.431] | |

| Top | 0.065 ** | 0.056 * | |

| [2.039] | [1.741] | ||

| Size | 0.083 *** | 0.085 *** | |

| [14.893] | [15.200] | ||

| Soe | 0.019 ** | 0.018 * | |

| [1.974] | [1.959] | ||

| Market | 14.407 *** | 13.377 *** | |

| [6.268] | [5.900] | ||

| Edu | 0.005 | ||

| [0.167] | |||

| Salary | 0.020 *** | ||

| [3.624] | |||

| Tobinq | 0.010 ** | ||

| [2.412] | |||

| Cash | 0.175 *** | ||

| [3.761] | |||

| _cons | 0.155 *** | −1.885 *** | -2.171 *** |

| [5.036] | [−14.747] | [−15.552] | |

| F | 14.403 | 33.42 | 34.287 |

| p | 0.0000 | 0.0000 | 0.0000 |

| N | 1260 | 1260 | 1260 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, L.; Chen, Y.; Fan, T. The Influence of Government Subsidies on the Efficiency of Technological Innovation: A Panel Threshold Regression Approach. Sustainability 2023, 15, 534. https://doi.org/10.3390/su15010534

Hu L, Chen Y, Fan T. The Influence of Government Subsidies on the Efficiency of Technological Innovation: A Panel Threshold Regression Approach. Sustainability. 2023; 15(1):534. https://doi.org/10.3390/su15010534

Chicago/Turabian StyleHu, Lihua, Yuanyuan Chen, and Tao Fan. 2023. "The Influence of Government Subsidies on the Efficiency of Technological Innovation: A Panel Threshold Regression Approach" Sustainability 15, no. 1: 534. https://doi.org/10.3390/su15010534

APA StyleHu, L., Chen, Y., & Fan, T. (2023). The Influence of Government Subsidies on the Efficiency of Technological Innovation: A Panel Threshold Regression Approach. Sustainability, 15(1), 534. https://doi.org/10.3390/su15010534