Analysis of the Paths Affecting Corporate Green Innovation in Resource-Based Cities: A Fuzzy-Set QCA Approach

Abstract

1. Introduction

2. Literature Review

2.1. Enterprise Green Innovation

2.2. Spatial Agglomeration

2.3. Digital Economy

2.4. Institutional Environment

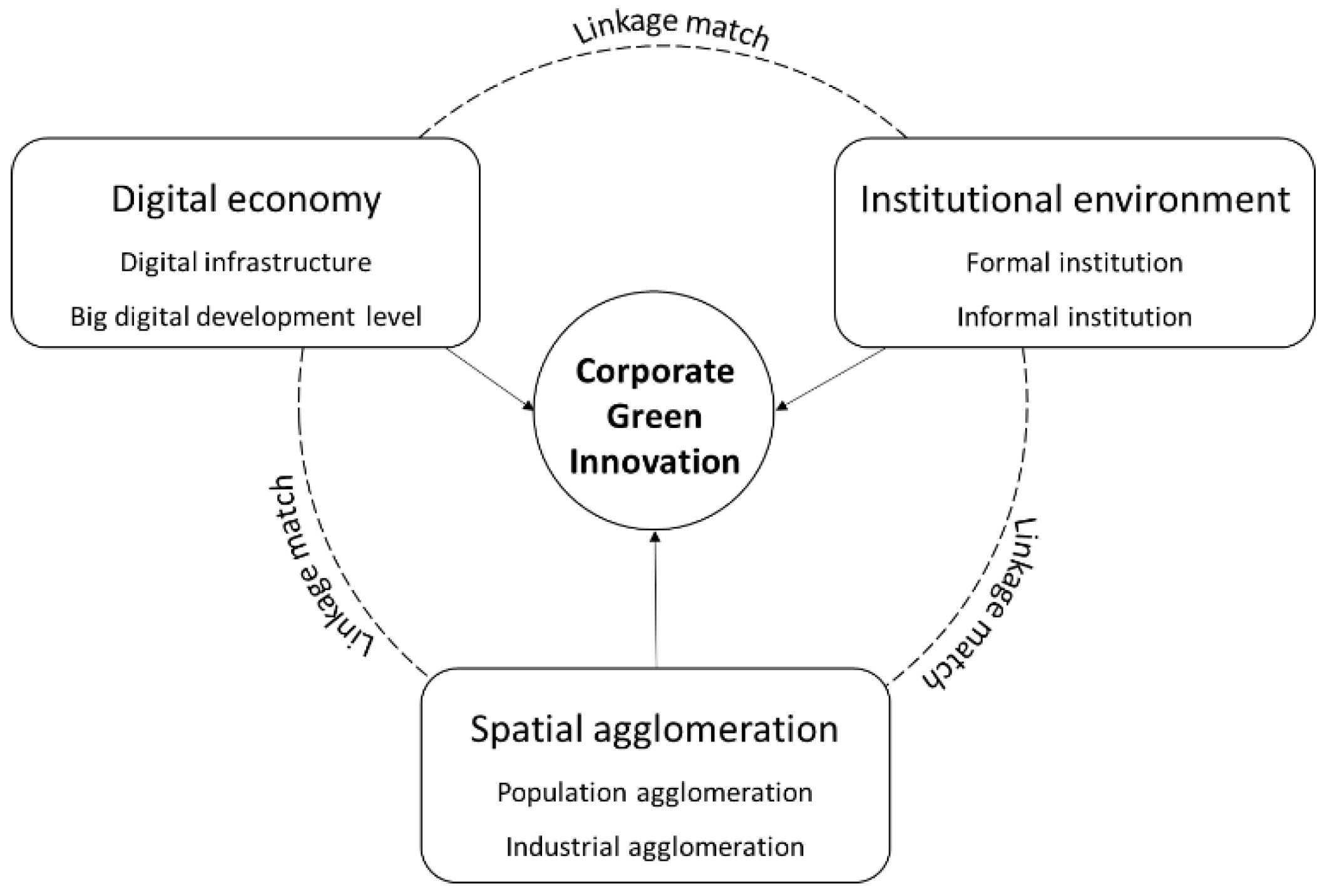

2.5. Configurational Framework

3. Materials and Methods

3.1. Fuzzy-Set Qualitative Comparative Analysis

3.2. Data Sources

3.3. Measures

3.3.1. Corporate Green Innovation

3.3.2. Spatial Agglomeration

3.3.3. Digital Economy

3.3.4. Institutional Environment

3.4. Calibration

4. Results

4.1. Necessity Conditions Analysis

4.2. Sufficient Solutions

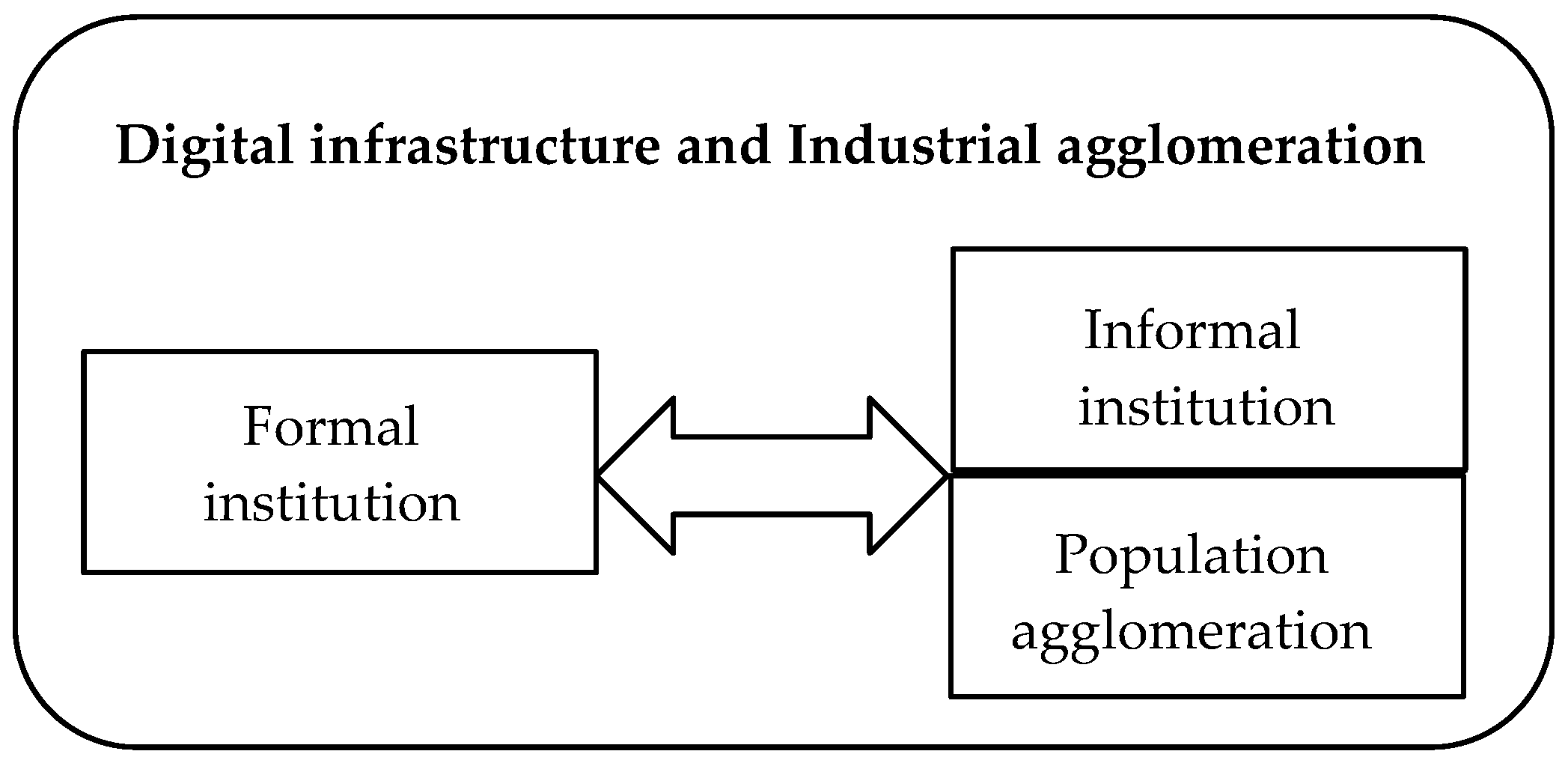

4.3. Horizontal Analysis of Antecedent Conditions

4.4. Robustness Analysis

5. Discussion and Implications

5.1. Research Conclusions

5.2. Theoretical Contributions

5.3. Practical Significance

5.4. Limitations and Future Prospects

6. Simple Summary

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, B.; Dewan, H. Efficiency Differences among China’s Resource-Based Cities and Their Determinants. Resour. Policy 2017, 51, 31–38. [Google Scholar] [CrossRef]

- Ge, X.; Xu, J.; Xie, Y.; Guo, X.; Yang, D. Evaluation and Dynamic Evolution of Eco-Efficiency of Resource-Based Cities—A Case Study of Typical Resource-Based Cities in China. Sustainability 2021, 13, 6802. [Google Scholar] [CrossRef]

- Sepehri, A.; Sarrafzadeh, M.-H. Effect of Nitrifiers Community on Fouling Mitigation and Nitrification Efficiency in a Membrane Bioreactor. Chem. Eng. Process. Process Intensif. 2018, 128, 10–18. [Google Scholar] [CrossRef]

- Sun, X.; Zhang, H.; Ahmad, M.; Xue, C. Analysis of Influencing Factors of Carbon Emissions in Resource-Based Cities in the Yellow River Basin under Carbon Neutrality Target. Environ. Sci. Pollut. Res. 2022, 29, 23847–23860. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Ma, X.; Chen, B.; Shang, Y.; Song, M. Challenges toward Carbon Neutrality in China: Strategies and Countermeasures. Resour. Conserv. Recycl. 2022, 176, 105959. [Google Scholar] [CrossRef]

- Wang, Z.; Zhu, Y. Do Energy Technology Innovations Contribute to CO2 Emissions Abatement? A Spatial Perspective. Sci. Total Environ. 2020, 726, 138574. [Google Scholar] [CrossRef]

- Chen, X.; Yi, N.; Zhang, L.; Li, D. Does Institutional Pressure Foster Corporate Green Innovation? Evidence from China’s Top 100 Companies. J. Clean. Prod. 2018, 188, 304–311. [Google Scholar] [CrossRef]

- Ishak, I.; Jamaludin, R.; Abu, N.H. Green Technology Concept and Implementation: A Brief Review of Current Development. Adv. Sci. Lett. 2017, 23, 8558–8561. [Google Scholar] [CrossRef]

- Guo, R.; Lv, S.; Liao, T.; Xi, F.; Zhang, J.; Zuo, X.; Cao, X.; Feng, Z.; Zhang, Y. Classifying Green Technologies for Sustainable Innovation and Investment. Resour. Conserv. Recycl. 2020, 153, 104580. [Google Scholar] [CrossRef]

- Castellacci, F.; Lie, C.M. A Taxonomy of Green Innovators: Empirical Evidence From South Korea. J. Clean. Prod. 2017, 143, 1036–1047. [Google Scholar] [CrossRef]

- Hashmi, R.; Alam, K. Dynamic Relationship among Environmental Regulation, Innovation, CO2 Emissions, Population, and Economic Growth in OECD Countries: A Panel Investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar] [CrossRef]

- Mensah, C.N.; Long, X.; Dauda, L.; Boamah, K.B.; Salman, M. Innovation and CO2 Emissions: The Complimentary Role of Eco-Patent and Trademark in the OECD Economies. Environ. Sci. Pollut. Res. 2019, 26, 22878–22891. [Google Scholar] [CrossRef] [PubMed]

- Faridian, P.H.; Neubaum, D.O. Ambidexterity in the Age of Asset Sharing: Development of Dynamic Capabilities in Open Source Ecosystems. Technovation 2021, 99, 102125. [Google Scholar] [CrossRef]

- Li, H.; Long, R.; Chen, H. Economic Transition Policies in Chinese Resource-Based Cities: An Overview of Government Efforts. Energy Policy 2013, 55, 251–260. [Google Scholar] [CrossRef]

- Tao, Y.; Li, F.; Crittenden, J.C.; Lu, Z.; Sun, X. Environmental Impacts of China’s Urbanization from 2000 to 2010 and Management Implications. Environ. Manag. 2016, 57, 498–507. [Google Scholar] [CrossRef]

- Xiong, L.; Ning, J.; Dong, Y. Pollution Reduction Effect of the Digital Transformation of Heavy Metal Enterprises under the Agglomeration Effect. J. Clean. Prod. 2022, 330, 129864. [Google Scholar] [CrossRef]

- van Hemert, P.; Nijkamp, P.; Masurel, E. From Innovation to Commercialization through Networks and Agglomerations: Analysis of Sources of Innovation, Innovation Capabilities and Performance of Dutch SMEs. Ann. Reg. Sci. 2013, 50, 425–452. [Google Scholar] [CrossRef]

- Jang, S.; Kim, J.; von Zedtwitz, M. The Importance of Spatial Agglomeration in Product Innovation: A Microgeography Perspective. J. Bus. Res. 2017, 78, 143–154. [Google Scholar] [CrossRef]

- Ghassim, B.; Foss, L. Understanding the Micro-Foundations of Internal Capabilities for Open Innovation in the Minerals Industry: A Holistic Sustainability Perspective. Resour. Policy 2021, 74, 101271. [Google Scholar] [CrossRef]

- Cui, V.; Yang, H.; Vertinsky, I. Attacking Your Partners: Strategic Alliances and Competition between Partners in Product Markets. Strateg. Manag. J. 2018, 39, 3116–3139. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as Structure: An Actionable Construct for Strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Bhawe, N.; Zahra, S.A. Inducing Heterogeneity in Local Entrepreneurial Ecosystems: The Role of MNEs. Small Bus. Econ. 2019, 52, 437–454. [Google Scholar] [CrossRef]

- Fisher, G. Online Communities and Firm Advantages. AMR 2019, 44, 279–298. [Google Scholar] [CrossRef]

- Chu, Z.; Xu, J.; Lai, F.; Collins, B.J. Institutional Theory and Environmental Pressures: The Moderating Effect of Market Uncertainty on Innovation and Firm Performance. IEEE Trans. Eng. Manag. 2018, 65, 392–403. [Google Scholar] [CrossRef]

- Khanagha, S.; Ansari, S.; Paroutis, S.; Oviedo, L. Mutualism and the Dynamics of New Platform Creation: A Study of Cisco and Fog Computing. Strateg. Manag. J. 2022, 43, 476–506. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Assessing the Impact of Big Data on Firm Innovation Performance: Big Data Is Not Always Better Data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Guziana, B. Is the Swedish Environmental Technology Sector ‘Green’? J. Clean. Prod. 2011, 19, 827–835. [Google Scholar] [CrossRef]

- Schumpeter, J. Theory of Economic Development; Routledge: New York, NY, USA, 1980. [Google Scholar] [CrossRef]

- de Marchi, V.; Grandinetti, R. Knowledge Strategies for Environmental Innovations: The Case of Italian Manufacturing Firms. J. Knowl. Manag. 2013, 17, 569–582. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who Is Financing Corporate Green Innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Autio, E.; Thomas, L.D. Innovation Ecosystems: Implications for innovation management? In The Oxford Handbook of Innovation Management; OUP Oxford: Oxford, UK, 2014; pp. 204–288. [Google Scholar]

- Kesidou, E.; Demirel, P. On the Drivers of Eco-Innovations: Empirical Evidence from the UK. Res. Policy 2012, 41, 862–870. [Google Scholar] [CrossRef]

- Vial, G. Understanding Digital Transformation: A Review and a Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A. Digital Transformation Strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Griffin-EL, E.W.; Olabisi, J. Breaking Boundaries: Exploring the Process of Intersective Market Activity of Immigrant Entrepreneurship in the Context of High Economic Inequality. J. Manag. Stud. 2018, 55, 457–485. [Google Scholar] [CrossRef]

- Gatignon, A.; Capron, L. The Firm as an Architect of Polycentric Governance: Building Open Institutional Infrastructure in Emerging Markets. Strateg. Manag. J. 2020, 44, 48–85. [Google Scholar] [CrossRef]

- Bosch-Sijtsema, P.; Bosch, J. User Involvement throughout the Innovation Process in High-Tech Industries. J. Prod. Innov. Manag. 2015, 32, 793–807. [Google Scholar] [CrossRef]

- Liu, Z.; Liu, J.; Osmani, M. Integration of Digital Economy and Circular Economy: Current Status and Future Directions. Sustainability 2021, 13, 7217. [Google Scholar] [CrossRef]

- De, S.; Zhang, J.; Luque, R.; Yan, N. Ni-Based Bimetallic Heterogeneous Catalysts for Energy and Environmental Applications. Energy Environ. Sci. 2016, 9, 3314–3347. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital Innovation Management: Reinventing Innovation Management Research in a Digital World. MISQ 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Chen, J.; Gao, M.; Mangla, S.K.; Song, M.; Wen, J. Effects of Technological Changes on China’s Carbon Emissions. Technol. Forecast. Soc. Chang. 2020, 153, 119938. [Google Scholar] [CrossRef]

- Zhou, X.; Wang, L.; Du, J. Institutional Environment and Green Economic Growth in China. Complexity 2021, 2021, e6646255. [Google Scholar] [CrossRef]

- North, D.C. Institutions and the Performance of Economies over Time. In Handbook of New Institutional Economics; Springer: Berlin/Heidelberg, Germany, 2008; pp. 21–30. [Google Scholar] [CrossRef]

- Chen, X.; Wan, P. Social Trust and Corporate Social Responsibility: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 485–500. [Google Scholar] [CrossRef]

- Meyskens, M.; Carsrud, A.L.; Cardozo, R.N. The Symbiosis of Entities in the Social Engagement Network: The Role of Social Ventures. Entrep. Reg. Dev. 2010, 22, 425–455. [Google Scholar] [CrossRef]

- Zhang, M.; Zhao, X.; Lyles, M. Effects of Absorptive Capacity, Trust and Information Systems on Product Innovation. Int. J. Oper. Prod. Manag. 2018, 38, 493–512. [Google Scholar] [CrossRef]

- Pan, J.; Lin, J. Construction of Network Entrepreneurial Platform Leadership Characteristics Model: Based on the Grounded Theory. J. Bus. Econ. Manag. 2019, 20, 958–978. [Google Scholar] [CrossRef]

- Fiss, P.C. Building Better Causal Theories: A Fuzzy Set Approach to Typologies in Organization Research. AMJ 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Ragin, C.C. Measurement Versus Calibration: A Set-Theoretic Approach. In The Oxford Handbook of Political Methodology; Box-Steffensmeier, J.M., Brady, H.E., Collier, D., Eds.; Oxford University Press: Oxford, UK, 2008; pp. 174–198. [Google Scholar] [CrossRef]

- Berg-Schlosser, D.; de Meur, G.; Rihoux, B.; Ragin, C.C. Qualitative Comparative Analysis (QCA) As an Approach. Config. Comp. Methods Qual. Comp. Anal. Relat. Tech. 2009, 1, 18. [Google Scholar]

- Ordanini, A.; Parasuraman, A.; Rubera, G. When the Recipe Is More Important Than the Ingredients: A Qualitative Comparative Analysis (QCA) of Service Innovation Configurations. J. Serv. Res. 2014, 17, 134–149. [Google Scholar] [CrossRef]

- Misangyi, V.F.; Greckhamer, T.; Furnari, S.; Fiss, P.C.; Crilly, D.; Aguilera, R. Embracing Causal Complexity: The Emergence of a Neo-Configurational Perspective. J. Manag. 2017, 43, 255–282. [Google Scholar] [CrossRef]

- Fan, F.; Zhang, X. Transformation Effect of Resource-Based Cities Based On PSM-DID Model: An Empirical Analysis from China. Environ. Impact Assess. Rev. 2021, 91, 106648. [Google Scholar] [CrossRef]

- Misangyi, V.F.; Acharya, A.G. Substitutes or Complements? A Configurational Examination of Corporate Governance Mechanisms. Acad. Manag. J. 2014, 57, 1681–1705. [Google Scholar] [CrossRef]

- Fan, G.; Wang, X.; Zhu, H. NERI Index of Marketization of China’s Provinces 2011 Report; Economic Science Press: Beijing, China, 2011. [Google Scholar]

- Lee, K.-H.; Min, B. Green R & D for Eco-Innovation and Its Impact on Carbon Emissions and Firm Performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the Mother of ‘Green’ Inventions: Institutional Pressures and Environmental Innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The Impact of Legitimacy Pressure and Corporate Profitability on Green Innovation: Evidence from China Top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Popp, D. International Innovation and Diffusion of Air Pollution Control Technologies: The Effects of NOX and SO2 Regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 2006, 51, 46–71. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do Carbon Emission Trading Schemes Stimulate Green Innovation in Enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, F. How Technological Innovation Impacts Urban Green Economy Efficiency in Emerging Economies: A Case Study of 278 Chinese Cities. Resour. Conserv. Recycl. 2021, 169, 105534. [Google Scholar] [CrossRef]

- Mitchell, S. London Calling? Agglomeration Economies in Literature since 1700. Urban Econ. 2019, 112, 16–32. [Google Scholar] [CrossRef]

- Doong, S.H.; Ho, S.-C. The Impact of ICT Development on the Global Digital Divide. Electron. Commer. Res. Appl. 2012, 11, 518–533. [Google Scholar] [CrossRef]

- Zhao, L.; Yang, C.; Su, B.; Zeng, S. Research on a Single Policy or Policy Mix in Carbon Emissions Reduction. J. Clean. Prod. 2020, 267, 122030. [Google Scholar] [CrossRef]

- de Crescenzo, V.; Ribeiro-Soriano, D.E.; Covin, J.G. Exploring the Viability of Equity Crowdfunding as a Fundraising Instrument: A Configurational Analysis of Contingency Factors That Lead to Crowdfunding Success and Failure. J. Bus. Res. 2020, 115, 348–356. [Google Scholar] [CrossRef]

- Ribeiro-Navarrete, S.; Botella-Carrubi, D.; Palacios-Marqués, D.; Orero-Blat, M. The Effect of Digitalization on Business Performance: An Applied Study of KIBS. J. Bus. Res. 2021, 126, 319–326. [Google Scholar] [CrossRef]

- Schneider, C.Q.; Wagemann, C. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis. Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Eren-Erdogmus, I.; Akgun, I.; Arda, E. Drivers of Successful Luxury Fashion Brand Extensions: Cases of Complement and Transfer Extensions. J. Fash. Mark. Manag. Int. J. 2018, 22, 476–493. [Google Scholar] [CrossRef]

- Jiang, C.; Fu, Q. A Win-Win Outcome between Corporate Environmental Performance and Corporate Value: From the Perspective of Stakeholders. Sustainability 2019, 11, 921. [Google Scholar] [CrossRef]

- Primc, K.; Slabe-Erker, R.; Majcen, B. Constructing Energy Poverty Profiles for an Effective Energy Policy. Energy Policy 2019, 128, 727–734. [Google Scholar] [CrossRef]

- Greckhamer, T.; Furnari, S.; Fiss, P.C.; Aguilera, R.V. Studying Configurations with Qualitative Comparative Analysis: Best Practices in Strategy and Organization Research. Strateg. Organ. 2018, 16, 482–495. [Google Scholar] [CrossRef]

- Gupta, K.; Crilly, D.; Greckhamer, T. Stakeholder Engagement Strategies, National Institutions, and Firm Performance: A Configurational Perspective. Strateg. Manag. J. 2020, 41, 1869–1900. [Google Scholar] [CrossRef]

- Bøllingtoft, A.; Ulhøi, J.P. The Networked Business Incubator-Leveraging Entrepreneurial Agency? J. Bus. Ventur. 2005, 2, 265–290. [Google Scholar] [CrossRef]

- Judge, W.Q.; Fainshmidt, S.; Brown, J.L. Institutional Systems for Equitable Wealth Creation: Replication and an Update of Judge et al. (2014). Manag. Organ. Rev. 2020, 16, 5–31. [Google Scholar] [CrossRef]

- Chen, M.-J.; Miller, D. Reconceptualizing Competitive Dynamics: A Multidimensional Framework. Strateg. Manag. J. 2015, 36, 758–775. [Google Scholar] [CrossRef]

- Cao, H.; Chen, Z. The Driving Effect of Internal and External Environment on Green Innovation Strategy-The Moderating Role of Top Management’s Environmental Awareness. Nankai Bus. Rev. Int. 2018, 10, 342–361. [Google Scholar] [CrossRef]

- Lin, W.L.; Yip, N.; Ho, J.A.; Sambasivan, M. The Adoption of Technological Innovations in a B2B Context and Its Impact on Firm Performance: An Ethical Leadership Perspective. Ind. Mark. Manag. 2020, 89, 61–71. [Google Scholar] [CrossRef]

- Zhengxia, H.; Wenqi, L.; Guihong, H.; Jianming, W. Factors Affecting Enterprise Level Green Innovation Efficiency in the Digital Economy Era—Evidence from Listed Paper Enterprises in China. BioResources 2021, 16, 7648–7670. [Google Scholar] [CrossRef]

| Condition | Calibration | |||

|---|---|---|---|---|

| Fully in | Crossover Point | Fully Out | ||

| Spatial agglomeration | Population agglomeration | 0.858 | 0.388 | 0.133 |

| Industrial agglomeration | 0.397 | 0.147 | 0.057 | |

| Digital economy | Digital infrastructure | 52.970 | 41.690 | 25.460 |

| Big data development | 0.763 | 0.293 | 0.170 | |

| Institutional environment | Formal institution | 10.960 | 7.620 | 4.880 |

| Informal institution | 74.665 | 70.340 | 65.536 | |

| Corporate Green Innovation | Corporate green patent | 0.878 | 0.500 | 0.111 |

| Condition | High Levels of Corporate Green Innovation | Not-High Levels of Corporate Green Innovation | ||

|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | |

| Population agglomeration | 0.583 | 0.648 | 0.581 | 0.630 |

| ~Population agglomeration | 0.667 | 0.620 | 0.676 | 0.613 |

| Industrial agglomeration | 0.574 | 0.681 | 0.557 | 0.645 |

| ~Industrial agglomeration | 0.701 | 0.619 | 0.725 | 0.624 |

| Digital infrastructure | 0.659 | 0.663 | 0.636 | 0.625 |

| ~Digital infrastructure | 0.627 | 0.639 | 0.657 | 0.653 |

| Big data development | 0.637 | 0.698 | 0.632 | 0.676 |

| ~Big data development | 0.705 | 0.663 | 0.718 | 0.658 |

| Formal institution | 0.654 | 0.670 | 0.650 | 0.649 |

| ~Formal institution | 0.658 | 0.658 | 0.670 | 0.654 |

| Informal institution | 0.615 | 0.639 | 0.615 | 0.623 |

| ~Informal institution | 0.637 | 0.629 | 0.644 | 0.620 |

| Antecedent Condition | 1a | 1b | 2 | 3a | 3b | |

|---|---|---|---|---|---|---|

| Spatial agglomeration | Population agglomeration | ⚫ | ⚫ | ⊗ | ⚫ | |

| Industrial agglomeration | ⚫ | ⚫ | ⚫ | ⚫ | ||

| Digital economy | Digital infrastructure | ● | ⚫ | ⚫ | ||

| Big data development | ● | ⚫ | ||||

| Institutional environment | Formal institution | ● | ● | |||

| Informal institution | ⚫ | ● | ||||

| Raw coverage | 0.285 | 0.269 | 0.367 | 0.227 | 0.251 | |

| Unique coverage | 0.043 | 0.009 | 0.167 | 0.002 | 0.018 | |

| Consistency | 0.807 | 0.869 | 0.758 | 0.862 | 0.855 | |

| Overall solution coverage | 0.562 | |||||

| Overall solution consistency | 0.729 | |||||

| Antecedent Condition | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| Spatial agglomeration | Population agglomeration | ⚫ | ⚫ | ⚫ | |

| Industrial agglomeration | ⚫ | ⚫ | ⚫ | ⚫ | |

| Digital economy | Digital infrastructure | ⚫ | ⚫ | ||

| Big data development | ● | ||||

| Institutional environment | Formal institution | ● | |||

| Informal institution | ● | ● | |||

| Raw coverage | 0.285 | 0.269 | 0.292 | 0.227 | |

| Unique coverage | 0.043 | 0.009 | 0.102 | 0.005 | |

| Consistency | 0.807 | 0.869 | 0.837 | 0.862 | |

| Overall solution coverage | 0.772 | ||||

| Overall solution consistency | 0.456 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Y.; Wu, X.; Zhang, J. Analysis of the Paths Affecting Corporate Green Innovation in Resource-Based Cities: A Fuzzy-Set QCA Approach. Sustainability 2023, 15, 337. https://doi.org/10.3390/su15010337

Zhao Y, Wu X, Zhang J. Analysis of the Paths Affecting Corporate Green Innovation in Resource-Based Cities: A Fuzzy-Set QCA Approach. Sustainability. 2023; 15(1):337. https://doi.org/10.3390/su15010337

Chicago/Turabian StyleZhao, Yunhui, Xinyue Wu, and Jian Zhang. 2023. "Analysis of the Paths Affecting Corporate Green Innovation in Resource-Based Cities: A Fuzzy-Set QCA Approach" Sustainability 15, no. 1: 337. https://doi.org/10.3390/su15010337

APA StyleZhao, Y., Wu, X., & Zhang, J. (2023). Analysis of the Paths Affecting Corporate Green Innovation in Resource-Based Cities: A Fuzzy-Set QCA Approach. Sustainability, 15(1), 337. https://doi.org/10.3390/su15010337