Abstract

The increase in studies on how digital transformation based on the application of digital technologies affects the sustainable development of various sectors of the economy has been observed. Although digital transformation is important for the financial sector sustainable development, the drivers and links between them are weakly addressed by researchers. The study is aimed at exploring how digital transformation due to the application of innovative technologies and solutions, especially digital payments, is leading to the financial sector sustainable development through financial inclusion and operational efficiency. The current research presents the study of the financial sector digital transformation and its sustainable development based on a systematic literature review, a secondary data analysis, and expert interviews to provide further research directions and draw practical suggestions for professionals on the financial sector digital transformation toward sustainable development in the future. A systematic literature analysis is performed based on text analytics, a bibliometric analysis, and network maps aimed at acknowledging the existing research outcomes and identifying the research gaps on the digital transformation agenda in the financial sector. The collected data on the digital payments’ dynamic in the EU were analyzed with the use of statistical methods, including a correlation and regression analysis. Structured expert interviews were used to validate research findings and to highlight key issues of the digital transformation in the financial sector of Baltic countries. The authors have paid special attention to the sustainable development of the financial sector’s economic dimension and its efficiency indicators, such as financial inclusion and digital payments’ intensity. A social dimension is limited toward financial inclusion based on digital payments’ offering. The research results indicated recent trends in digital transformation and types of usage of digital technologies in the EU and Baltic countries to ensure the sustainable development of financial institutions. Furthermore, the results revealed a significant increase in the digital payments’ intensity during the last years in the EU, as well as a close relationship between digital payments with financial inclusion and operational efficiency of financial institutions.

1. Introduction

The fourth industrial revolution led to a widespread use of digital technologies, the Internet, social networks, etc. Roblek et al. consider that the fourth industrial revolution is characterized as an era of digital transformation, which holds great potential for sustainability [1]. As a result, a greater diversity of new business models is emerging in the financial sector. A new emerging set of companies, known as FinTech companies, is taking advantage of this digitalization, such as digital platforms and advanced technologies, to provide financial products and services [2].

The rapid development of new technologies has had a significant effect on the financial sector. Digitalization is a management tool and digital transformation (DT) is the process of integrating digital technologies into the value chain of activities, in order to deliver added value to both customers and broader stakeholders, which leads to improving organizational performance. Moreover, digitalization is a helpful tool in contributing to sustainable development, thus emphasizing its strategic orientation for the benefits of stakeholders. Adaptation of new technologies in the financial sector leads to the development of new value in a form of offering, value proposition and business model innovation, transformation of value chains, ecosystems, development of new product delivery channels, changing the relationship between companies in the financial sector, etc., which increases the operational efficiency and effectiveness of financial institutions and enables a sustainable development path. Digital transformation enables social benefits by improving financial inclusion, which provides more personalized financial products and usable digital access channels.

Authors have observed that the amount of research on sustainable development of different economy sectors based on digital transformation as one of key drivers has increased. Digital transformation of the financial sector is important for sustainable development; however, academic studies on the topic are very limited.

The aim of the research is to determine the trends in digital transformation of the financial sector and to explore how digital transformation due to the application of innovative technologies and solutions, especially digital payments, is leading to the financial sector sustainable development through financial inclusion and operational efficiency. Researchers state that sustainable finance has emerged as an important concept at the intersection of finance and the sustainable development goals (SDG) and propose that sustainable finance should encompass all activities and factors that would make finance sustainable and contribute to sustainability [3].

This research contributes to the overall scientific discussion on digital transformation of the financial sector, digital technologies, and financial institutions’ sustainable development. The research results indicate two main directions: (1) Digital transformation trends and digital technology usage for sustainable development of financial institutions and (2) a digital payment intensity increase and its relationship with financial institutions’ operational efficiency and financial inclusion, as well as the differences between the digital transformation aims and progress of financial institutions in Baltic states compared to other European countries. At present, there is no common understanding among researchers of the digital transformation (DT) concept in the literature and its role in sustainable development since it is a rather complex issue. Both academic researchers and researchers from global consulting companies (MIT, Deloitte, etc.) emphasize that digital technology is only one element of the puzzle in organizations’ efforts to increase competitiveness in the digital world [4]. Accordingly, the process of selecting, developing or adapting technologies is complex, including a wide range of organizational processes, and permeates the structure of the whole organization. Digital transformation is a term that, in an academic and practical discourse, refers to the complex nature of digital technology adaptation, given that this process stems from the strategic choice of building, adapting, and transforming internal processes, customer relationships and customer experiences, value propositions and business models using a defined infrastructure, and resources to enable an organization to navigate effectively in digital ecosystems. Liu et al. describe the digital transformation as the integration of digital technologies into business processes [5]. Shim and Shin recognize that the rapid development of information and communications technology (ICT) is transforming the whole industry landscape, heralding a new era of convergence services [6]. From the authors’ point of view, DT is aimed at improving the overall performance of the organization, ensuring its sustainable development. In addition, it is a process, which requires a holistic, systemic, and systematic approach to create a favorable environment for its successful delivery.

Several studies reveal that it is possible to suggest a research framework that considers digital transformation as a driver and a predecessor of sustainability. To survive in the digital revolution, companies need to enhance their digital capabilities and balance their economic, environmental, and social impacts [7]. However, while sustainability is undisputedly one of the most growing phenomena, it is still an insufficiently discussed field of application for digital technology [8,9]. There are studies on how digital transformation in the financial sector affects sustainability while the financial inclusion is left outside the scope [10]. Flejterski defines that the key objectives in the financial sector and in the financial system will be sustainability, stability, and safety [11]. Schilirò emphasizes that sustainability requires efficiency [12].

Digitalization and financial sector transformation issues are topics that have already gained particular interest among researchers from Baltic countries. Therefore, there is extensive literature available on this topic, which were studied by Rupeiga-Apoga, Lace, Mavlutova, Andriuskevicius, Volkova, Arefjevs, Spilbergs, Natrins, etc. [13,14,15,16,17,18,19]. Other authors including Tambovceva, Uvarova, Romānova, Rupeika-Apoga, Atstaja, Brizga, and Titko have researched various aspects of sustainable development of Baltic countries [20,21,22,23].

The Baltic (defined as Estonia, Latvia, and Lithuania) marketplace is considered to be dominated by Nordic financial groups [24]. In recent years, there was an exit by Nordea and DNB banking groups, which sold their holdings to the Blackstone-led consortium [25]. The transaction has strengthened the United States domiciled ownership of Baltic financial groups to a certain extent. The overall trend of foreign ownership of the financial groups in the Baltics has not changed.

Banks are traditionally the biggest market players in the EU and in the Baltic countries, which form a backbone of the financial sector. According to the European Banking Federation, credit institutions’ assets vary from EUR 24 billion in Latvia to EUR 40 billion in Lithuania. Loan amounts are nearly balanced with deposits in Estonia (both stand at nearly EUR 26 billion) and Latvia (both figures are at EUR ~18 billion) while Lithuania stands out as a clear net lender with loans totaling to EUR 29 billion and deposits exceeding EUR 33 billion (European Banking Federation 2021). The statistics are available in Table 1, as presented below.

Table 1.

Key statistics of credit institutions in the Baltic countries.

The COVID-19 pandemic has affected the transformation of business and the financial sector toward sustainability, requiring not only environmental, but also financial and social sustainability priorities. Financial and social sustainability issues have increasingly become more important along with Russia’s invasion of Ukraine.

Financial inclusion has been identified as an enabler for nine of the seventeen UN sustainable development goals (SDG) aimed at building resilient infrastructure, promoting inclusive and sustainable industrialization, and fostering innovation, particularly to increase access to financial services and markets and to support domestic technology development and industrial diversification, as well as universal access to information and communications technologies [26]. The aim of the Recovery Plan for Europe (2021–2027) is to reduce the economic and social impact of the coronavirus pandemic and make the European economy and society more sustainable, resilient, and better prepared for the tasks and opportunities of not only green, but also digital transformation [27]. The importance of the digital transformation, which is addressed with The Digital Education Action Plan (2021–2027), is aimed at supporting the sustainable and effective adaptation of EU Member States’ education and training systems for the digital age [28].

The current study consists of the literature analysis and the quantitative research. The content analysis was performed by investigating academic publications of digital transformation, and the impact of digital technologies on the sustainable development of the financial sector. The quantitative research was based on the statistical data analysis of the financial sector and its development trends. Structured interviews were applied for an investigation of the financial sector’s current situation concerning technological changes and sustainability empowerment in the Baltic countries. The results of this study assist in understanding the financial sector’s contribution to sustainable development and in further developing new approaches for decision making toward meeting sustainability agenda goals in general, as well as sustainability of the financial sector in particular. Moreover, the findings are useful to academics for an investigation of recent trends on digital transformation and usage of digital technologies to ensure the sustainable development of financial institutions. Research limitations are the legal aspects of the digital transformation of financial institutions, as well as the environmental dimension of the financial sector sustainable development, all of which are outside the scope of the current research.

2. Literature Review

2.1. Digital Transformation of the Financial Sector and Development of Financial Technologies

Digital transformation of the financial sector is one of the most expeditiously researched topics across academic publications during the last decade [29,30]. From 2018 to 2022, the topic of digital transformation of the financial sector is rather recent. Based on the frequency of citations, the leading authors are Drasch, Szhwizer, Urbach, Basole, Patel, Forcadell, Aracil, Ubeda, Leitner-Hanetseder, Lehner, Al-Busaidi, Al-Muharrami, Agarwal, and Zhang [31,32,33,34,35]. Literature review was based on publications available from two databases, SCOPUS and Web of Science, using two sets of keywords (including similar meaning keywords)—financial institutions and sustainable development as well as financial institutions and digital transformation. More than 500 articles were identified while shortlisted articles were identified by reading publication abstracts. To identify the most recent publications related to the research topic, an additional review of publications in three journals for the time period from 2020 to 2022 was performed. Reviewed journals are Global Finance Journal, Pacific Basin Journal, and Journal of Corporate Finance.

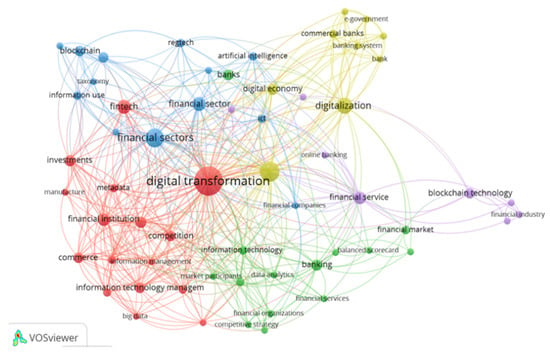

For the purpose of the bibliometric analysis, SCOPUS database and VOS-viewer software were used [36]. The bibliometric analysis and the network map based on the identified literature (see Figure 1), linking the digital transformation of the financial sector, assisted in dividing the research output into four research clusters: 1. Banking system, e-governance digitalization (yellow cluster); 2. Financial services and blockchain integrations (blue and pink clusters); 3. IT usage for advancements of internal efficiencies (green cluster); 4. Digital transformation as an enabler for competitive advantage (red cluster). The fourth research cluster focuses on topics, such as investments, metadata, competition, IT management, big data, and commerce.

Figure 1.

Network map of keywords related to financial sector ‘digital transformation’. Source: Keywords of articles from SCOPUS, created by authors using VOS-viewer [36].

The VOS-viewer software assists in creating network maps based on points of interest. Points of interest of this research are keywords of published articles in the SCOPUS database that match a specific set of search criteria. Authors of the software have explained the system of creating network maps in their research [36]. In this research, authors use the VOS-viewer to identify clusters of keywords that have been used in the published research to identify areas that are related to digital transformation and the financial sector in academic literature. Figure 1 contains the network map from identified articles in SCOPUS database using keywords “Financial Sector” and “Digital Transformation”, extracted on 15 August 2022.

At present, a growth can be observed in financial technologies development of the financial sector globally, for instance, machine learning, artificial intelligence (AI), blockchain, and robotic process automatization (RPA) are used to deliver innovations in the financial sector, including traditional banking, leasing, and insurance companies.

The overall progress in digitalization and digital transformation of the financial sector and financial institutions has been considerable [37]. According to the European Banking federation, changing consumers’ habits and a rise in financial technologies have fueled the financial sector and credit institutions’ digitalization in Lithuania, and the COVID-19 pandemic has further reignited the need for new digital solutions. In particular, 54% of card payments in Lithuania in 2020 were contactless (average for the EU—38%). The priority of banks has shifted even more toward facilitating a digital transition. During 2020, the volume of video consulting grew sharply, many clients took out mortgages without even leaving their homes, and new contactless payment methods were introduced, such as key chains, bracelets, shirt cufflink, as well as stickers.

Estonian banks, in turn, have issued 1.46 bank cards per inhabitant while 65% of retail payments initiated by bank cards and more than 99% of payment orders have been initiated electronically since 2009. Only 4% of the population receives income entirely or partially in cash according to the European Banking Federation [38].

Latvian banks demonstrated strong advancements, as well. Latvia was the first in the EU area to use SCT Inst payments—innovative, modern, lightning-fast bank transfers, which are available at any time of the day, including weekends and holidays. According to the European Banking Federation, instant payments have become available at around 90% of banks and have become a standard payment method for customers rather than an exclusive service. In addition, they make up 44.4% of all SEPA payments between banks who have implemented instant payments [38].

Authors have identified and compiled innovative digital technologies and their applications in financial institutions as show in Table 2.

Table 2.

Application of innovative digital technologies offered by financial institutions and FinTech companies.

Sahi et al. provided a comprehensive literature review on digital payments and highlighted that a single theory had failed to comprehensively explain the complex nature of the electronic payment adoption [43]. They found that the main limitation of existing theories is their inability to take into account the role of social and cultural aspects in the adoption of new technologies. This is one of the first systematic reviews of electronic payment adoption that structures existing knowledge and provides directions for future research.

Furthermore, in addition to the network map cluster analysis, an analysis of current directions and concepts in high-quote Elsevier publishing journal publications (including the Global Finance Journal, Pacific Basin Finance Journal, and Journal of Corporate Finance, from January 2020 to October 2022) on digitalization and digital transformation in the financial services sector, as well as topics of sustainable development and financial inclusion, was performed. By analyzing scientific literature, authors identified digital finances as an important parallel concept in the analysis of the effects of digitalization of the financial sector.

More recently, in addition to digitalization and digital transformation, many scholars used the term digital finance to describe digitalization-driven changes in the financial sector. Digital finance is a broader concept that covers both financial technology and all possible activities related to finance in the digital environment. Many authors studied and described digital finance in academic publications over the past 4 years, addressing the aspects which offer different opportunities, as it has been typical of financial markets in previous decades, linking it to the introduction of new technologies and innovative services by reducing risks and increasing efficiency [44]. Xia et al. argue that digital finance includes both Internet finance and FinTech [45], and, in turn, the development of digital finance is transforming financial services. Therefore, digital finance refers to a new financial model integrating financial activities with emerging technologies, such as artificial intelligence, blockchain technology, cloud computing, big data, and Internet technology. Fulop et al. indicate future-proofing or threats to the accounting profession [46].

Fu and Mishra believe that the spread of COVID-19 and the associated government lockdowns led to a significant increase in downloads of financial applications [47]. Akram et al. investigated the impact of digitalization on customers’ well-being in the pandemic period [48]. The authors investigated the factors that might have contributed to this impact on the demand side and better understood the “winners” from this digital acceleration on the supply side. The researchers’ overall results show that traditional incumbents experienced the greatest growth in digital offerings during the initial period of the COVID-19 pandemic; however, BigTech companies and emerging FinTech providers eventually surpassed them over time.

Digital payments are especially common in Baltic countries. In Estonia, around 98% of the population older than 15 years made digital payments in 2021. The same figures are 93% and 83% for Latvia and Lithuania, respectively. Detailed information on digital payments in Appendix A. Moreover, usage of debit or credit cards is popular. In Estonia, more than 93% of the population older than 15 years used a debit or a credit card in 2021, while the same indicator for Latvia was 83% and 65% for Lithuania [24]. However, Lithuania has a strong potential to use banking cards more extensively.

Based on the literature review, the following hypothesis was put forward:

H1.

In the financial sector of the EU countries significant progress in the intensity of digital payments is observed.

2.2. Financial Inclusion through Digital Transformation as a Driver of the Sustainable Development and Operational Efficiency of Financial Institutions

The research interest in the studies of the financial sector and sustainable development topics is growing. The rapid increase in the academic research can be observed starting from 2017 and onwards with leading authors based on citations from Tchamyou, Erreygers, Cassimon, Acheampong, Alonso-Almeida, Llach, Marimon, Richardson, Usman, Makhdum, Weber, Diaz, and Schwegler [49,50,51,52,53,54]. As widely known, a peculiarity of the management literature researchers is that leading organizations are increasingly using digital technologies to transform their business models with the purpose of better tackling societal challenges [55,56,57,58].

The meaning of sustainability is not commonly shared by researchers and practitioners. According to Jabareen, the term sustainability belongs originally to the field of ecology, referring to an ecosystem’s potential for subsisting over time, with almost no alteration [59]. When the idea of development was added, the concept would no longer be solely looked at from the point of view of the environment, but from that of society and the capital economy.

According to Sakalasooriya, sustainability implies maintaining the capacity of ecological systems, in order to support and enhance the quality of social system known as the three E’s model [60,61]. The sustainable development goes beyond corporate social responsibility and the environmental protection agenda. Elkington represents a popular approach, observing that sustainable development must consolidate social, environmental, and economic goals in the long term [62]. The authors of the current study emphasize the economic aspects of sustainability and examine this dimension through the concepts of financial inclusion and operational efficiency.

The efficient use of energy and of natural, material, and informational resources is vital for sustainability and sustainable development. Any strategy aimed at sustainability and resource efficiency must focus on innovation and technological progress. Therefore, innovation is essential to enable sustainability and improve efficiency [12]. Andriuškevičius et al. point out a need for a set of indicators that would serve as a monitoring tool and a benchmark for costs, such as assessing the energy consumption, the production paths, etc. [16].

The researchers point out that by acknowledging the existence of strengthening the relationship and increasing convergence between sustainability and digitalization, the professional environment has coined the term digital sustainability. In this regard, both practitioners and academics placed the emphasis on the achievement of sustainability development goals. In fact, for the Cybercom Group, digital sustainability is “the means by which digitalization, as a key part of the fourth industrial revolution, can deliver on the global sustainability goals” [63].

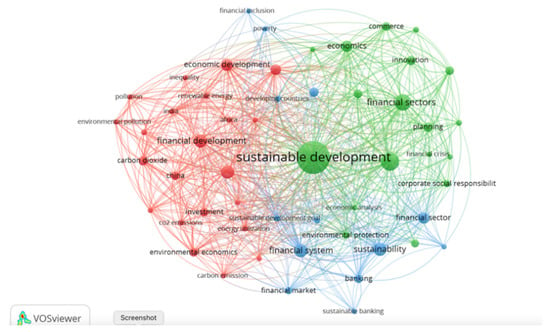

In the bibliometric analysis (see Figure 2) linking sustainable development with the financial sector, the research output has been divided into three research clusters: 1. Financial development and environment protection (red cluster); 2. Financial sector, corporate social responsibility, innovation, and economics (green cluster); and 3. Financial system and sustainability (blue cluster). The authors of this study pay attention to the economic aspect of sustainability since it is the least studied.

Figure 2.

Network map of keywords related to sustainable development. Source: Keywords of articles from SCOPUS, created by authors using VOS-viewer [36].

As shown in Figure 2, from the keyword network of sustainable development and economic dimension, the term financial inclusion is emphasized. According to the World Bank, the financial inclusion means “that individuals and businesses have access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit and insurance—delivered in a responsible and sustainable way”. Financial inclusion plays a greater role than availability in making use of financial transactions. It facilitates opportunities to invest in education, health, etc., and thus improves the overall well-being of individuals and families [64].

The United Nations (UN) emphasizes that financial inclusion means that everyone who can use financial services has access to a full range of quality financial services, thereby increasing financial opportunity [65]. The World Economic Forum emphasizes that “financial inclusion is not only a cornerstone of a fair, equal society, but also a thriving economy”. Promoting financial inclusion and access to finance can make a significant contribution to economic development, and new technologies can assist in improving access to financial products and services for a reasonable price [66].

While some progress has been made in financial inclusion over the last two decades, the world still faces challenges in achieving sustainable, affordable, and comprehensive financial inclusion. The achievement of financial inclusion and financial security is not a goal but rather a means for achieving a goal, in which both are widely recognized as critical to reducing poverty and achieving the inclusive economic growth. Research revealed that financial inclusion enables individuals to start and expand businesses, invest in education, better manage risks, and absorb financial shocks [67].

Danisman and Tarazi investigated how financial inclusion affects the stability of the European banking system [68]. Their findings indicate that advancements in financial inclusion through more intense account ownership and digital payments have a stabilizing effect on the banking industry. Along with its known benefits to society, financial inclusion has the additional benefit of improving the overall stability of the financial system. Sarma proposed a comprehensive vision of financial inclusion based on the dimensions of accessibility, availability, and use of the formal financial system by all agents within the economy [69]. Allen et al. found that greater financial inclusion is associated with lower account costs and increases in savings [70].

Arner et al. argue that financial technology is the key driver for financial inclusion, which, in turn, underlies the balanced sustainable development, as embodied in the UN SDGs [71]. Carranza et al. investigated the factors that influenced bank customers to adopt e-banking to facilitate their financial services, and found the presence of significant relationships among perceived ease-of-use, perceived usefulness, the attitude toward using e-banking, and the intention to use [72].

Gálvez-Sánchez et al. analyzed the research advances made in the field of financial inclusion and the main lines of investigation currently being addressed by means of a bibliometric analysis and found a growing interest in the academic community to create a more accessible financial system service, in particular, using digital money as a means for promoting financial inclusion [73].

Demir et al. investigated the interrelationship between financial inclusion and income inequality for a panel of 140 countries using the Global Findex waves of survey data for 2011, 2014, and 2017 [74]. The authors believe that FinTech directly and indirectly affects inequality through financial inclusion and reveals financial inclusion as the main channel through which FinTech reduces income inequality. These effects are mainly associated with higher income countries.

Kanga et al. found that FinTech diffusion and financial inclusion have long-run effects on GDP per capita over and above their short-run impact and effects on investment in fixed and human capital [75].

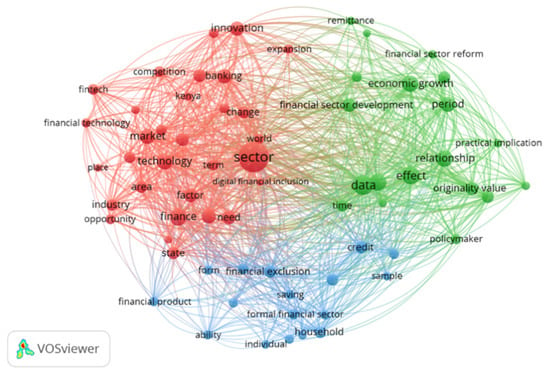

Figure 3 contains the network map from identified articles in the SCOPUS database using keywords “Financial Sector” and “Financial Inclusion”, extracted on 15 August 2022. It shows three main clusters in the identified academic literature: 1. Technological development and connections to the financial sector, and solutions for this sector (red cluster); 2. Technological development relations with changes in the sector and/or specific organizations; 3. Financial sector player product and service offering development evaluation in relation to financial inclusion.

Figure 3.

Network map of keywords related to financial sector financial inclusion. Source: Keywords of articles from SCOPUS, created by authors using VOS-viewer.

El Hilali, El Manouar, and Idrissi believe that the road to achieve sustainability in a digital era should focus on three main directions: Building data analytics capabilities and shifting innovation to the business model level, as well as enhancing the customer experience and adopting customer centricity [76]. Cella-de-Oliveira investigated indicators of organizational sustainability from organizational competences [77]. Al-Shaiba, Al-Ghamdi, and Koc provided a comparative review and an analysis of organizational efficiency indicators [78].

Based on the literature review, several directions are identified on how digital payments as the most important service of financial institutions can affect their efficiency. Operational efficiency plays the most important role in the operation of financial institutions; therefore, the authors study it along with cost efficiency. Allen et al. found that greater financial inclusion is associated with lower account costs [70]. Scott et al. investigated the SWIFT adoption impact on bank performance [79]. The authors found that the effect on profitability is large in the long-term and greater for small than large banks.

Son and Kim examined the mobile payment service demand growth and development [80]. The authors carried out the ordinary least squares regression analysis to study the effect on the active alliance with credit card companies on the firm value.

Ahamed and Mallick revealed that a higher level of financial inclusion contributes to greater bank stability [81]. The authors argue that a positive association is particularly pronounced with banks that have a higher customer deposit funding share and lower marginal costs of providing banking services and that operate in countries with stronger institutional quality. Parida et al. provided a comprehensive literature review on the impact of digitization on value creation [82]. Value delivery and value itself capture components of business model innovation and how the alignment of these components drives sustainable industry initiatives. Anderson suggests that automation and the digitalization of banks’ operations have played a key role in improving cost efficiency [83].

Based on the literature review, the following hypotheses were developed:

H2.

Positive relationship between the digital payments’ intensity and financial inclusion in the EU countries exists.

H3.

Positive relationship between the digital payments’ intensity and the operational efficiency of financial institutions in the EU countries exists.

3. Research Methodology and Results

To achieve the purpose of the study, the authors analyzed statistics on the digital transformation of the financial sector and chose digital payments as the most popular digital technology to identify the relationship between the intensity of financial inclusion and its dynamics across the Globe and in the European Union. For the empirical analysis, the authors collected data from two main sources: Global Financial Inclusion Database (WB 2022) for financial inclusion variables and European Central Bank Consolidated Banking Database (ECB 2022) for the bank expense variables. The data were collected from 26 European Union countries for the years 2014, 2017, and 2021. Luxemburg was excluded from the analysis since the data for 2021 were not available at the time of the study.

In the empirical study, the authors used two control variables:

- made a digital payment, % age 15+ (MDP);

- received digital payments, % age 15+ (RDP);

- and support variables:

- account, % age 15+ (ACC);

- made a deposit, % with a financial institution account, age 15+ (DEP);

- saved any money, % age 15+ (SAV);

- saved at a financial institution, % age 15+ (SAF);

- saved for old age, % age 15+ (SAO);

- borrowed any money, % age 15+ (BOR);

- total operating expenses, % of total assets (TOE);

- staff expenses, % of total assets (STE).

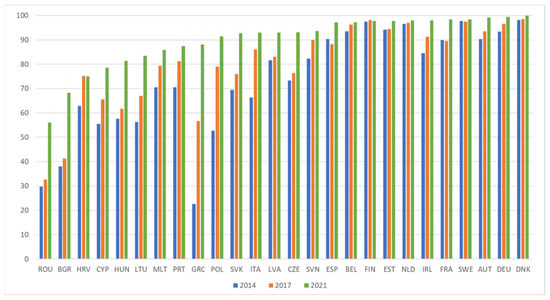

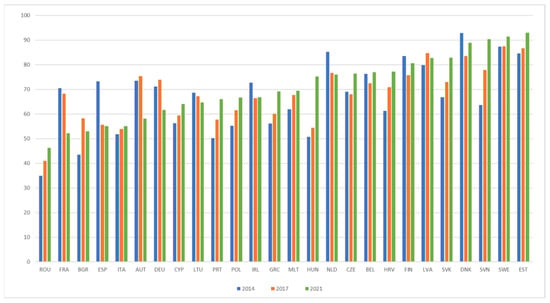

As shown in Figure 4, in 2021, the highest intensity of digital payments in the EU countries was in Denmark—99.9% of the population aged 15 and over made digital payments—followed by Germany (99.5%), Austria (99.2%), Sweden (98.4%), and France (98.4%). The indicators of Estonia (97.7%) and Latvia (93.0%) of the Baltic countries are also above average, while Lithuania (83.4%) is slightly lower.

Figure 4.

Intensity of digital payments made in the EU for the years 2014, 2017, and 2021, %. Source: Calculated by authors based on WB data.

The fastest growth of digital payments made in the last 8 years was in Greece (290.3%), Romania (88.8%), and Bulgaria (79.5%), which is largely explained by the low intensity of digital payments in 2014. Among the Baltic states, the fastest growth in 2021 compared to 2014 was in Lithuania (48.2%), compared with Latvia (14.0%) and Estonia (3.7%).

As shown in Figure 5, in 2021, Estonia (93.0%), followed by Sweden (91.4%), Slovenia (90.4%), Denmark (88.9%), Slovakia (82.9%), and Latvia (82.8%) were the leaders in the EU in terms of the intensity of digital payments received. The intensity of digital payments received in Lithuania was the lowest in the Baltics (64.7%). The fastest growth in digital payments received over the last 8 years was in Hungary (48.1%), Slovenia (42.0%), and Romania (32.1%), which is largely explained by the low intensity of received digital payments in 2014. Among the Baltic states, the fastest growth in 2021 compared to 2014 was in Estonia (9.8%) and Latvia (3.6%), while the decrease was seen in Lithuania (−5.7%).

Figure 5.

Intensity of digital payments received in the EU for the years 2014, 2017, and 2021, %. Source: Calculated by authors based on WB data.

To assess the dynamics of the intensity of digital payments, the authors use the chi-squared test and the statistic is calculated as follows:

where is the observed (2021) intensity of digital payments in i-th country and is the expected (2014 or 2017 accordingly) intensity of digital payments in i-th country.

The following table summarizes the results of chi-squared test.

As can be seen from the data in Table 3 on the digital payments made, the chi-square statistic is greater than the chi-square critical values (37.7); therefore, the authors can conclude that the increase in digital payments made, comparing the year 2021 with both 2014 and 2017, is statistically significant at a confidence level greater than 95%. A similar conclusion can be drawn about the increase in digital payments received in 2021 compared to 2014. However, compared to 2017, the increase in digital payments received is not statistically significant. Moreover, these conclusions are confirmed by the p-values summarized in Table 3. The results of the chi-square test allow for the confirmation of hypothesis H1.

Table 3.

Chi-square test statistics for the dynamics of the intensity of digital payments made and received.

In order to assess the relationship between the intensity of digital payments and the indicators of financial inclusion in the EU countries, the authors performed a Pearson correlation analysis, and the results obtained with the RStudio cor.test () function are summarized in Table 4.

Table 4.

Pearson correlation test statistics for the relationship between digital payments made and received with financial inclusion indicators in the EU countries.

As can be seen from the data in Table 4 for digital payments made, all Pearson correlation coefficients values are larger than 0.5, indicating a strong positive relationship with all analyzed financial inclusion indicators for the EU countries. A similar conclusion can be drawn in regard to the digital payments received. However, the relationship between digital payments received and borrowing is rather weak. These conclusions are confirmed by the p-values and Pearson correlation coefficients of 95% confidence intervals summarized in Table 4. The Pearson correlation analysis results allow for the confirmation of hypothesis H2.

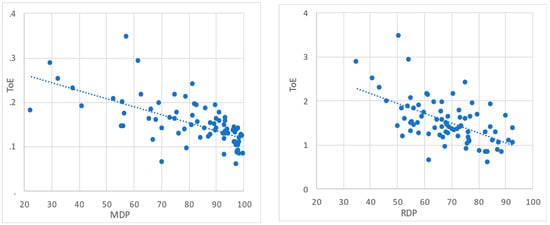

To evaluate the relationship between the intensity of digital payments and the operational efficiency of financial institutions in the EU countries, the authors provided regression analysis. A regression analysis has been widely used in similar studies, for example, by Allen et al., Demir et al., Son and Kim, that proved its ability to provide the necessary justifications for the validation of the proposed hypothesis [70,74,80]. To test the proposed hypothesis, the following four regression equations were developed:

where total costs (% of assets) depending on the intensity of digital payments made;

—total costs (% of assets) depending on the intensity of digital payments received;

—intercepts of respective regression model;

—regression coefficients of respective regression model;

—error terms of respective regression model.

Regression model’s calibration and evaluation results obtained with the RStudio are summarized in Table 5 and Table 6.

Table 5.

Regression model statistics for digital payments relationship between banks’ total and staff costs.

Table 6.

Regression coefficient statistics for digital payments relationship between banks’ total and staff costs.

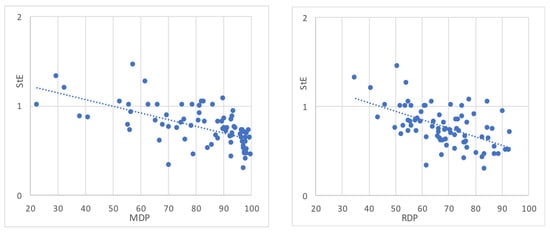

As shown in Table 6, all estimated regression model’s coefficients are statistically significant at level <1%. The results obtained allow for the conclusion that a positive relationship between digital payments’ intensity and the operational efficiency of financial institutions exists—when the intensity of digital payments increases, both banks’ total costs to assets and staff costs to assets decrease.

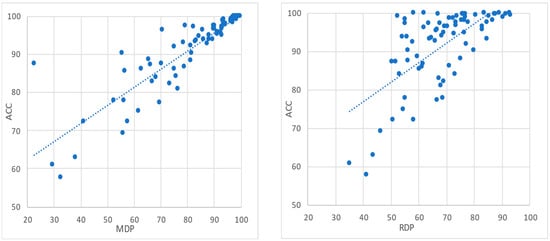

Since the tests of correlation coefficients substantiate the statistical significance of the relationship between the intensity of digital payments and financial inclusion identifiers, the authors conclude that with increased opportunities to make and receive digital payments, the proportion of account owners in the 15+ population group increases linearly (see Figure 6).

Figure 6.

The relationship between the intensity of digital payments made and received and the intensity of accounts. Source: Calculated by the authors based on WB data.

In addition, when the intensity of digital payments made increases by 1%, the intensity of accounts increases by 0.48%. Regarding digital payments received, the increase in accounts is slightly higher (0.51%).

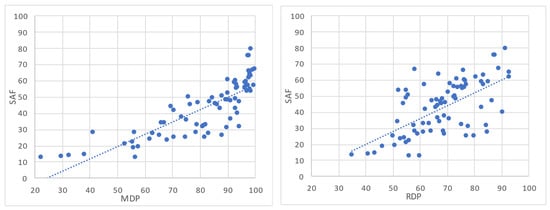

Regarding the relationship between digital payments and the intensity of savings at financial institutions, the results of the analysis allow for the conclusion that with increasing opportunities to make and receive digital payments, the intensity of savings at financial institutions in the 15+ population group increases linearly, as shown in Figure 7. In addition, as the intensity of digital payments increases by 1%, the intensity of savings increases by 0.75%. With regard to digital payments received, the growth of savings intensity is slightly higher (0.81%), which can be logically explained, since upon receiving a payment there is an additional opportunity to save money.

Figure 7.

The relationship between the intensity of digital payments made and received and the intensity of accounts with savings at financial institutions. Source: Calculated by the authors based on WB data.

Regarding the relationship between digital payments and the intensity of savings for old age customers, the results of the analysis allow for the conclusion that with increasing opportunities to make and receive digital payments, the intensity of savings for old age in the 15+ population group increases linearly, as shown in Figure 8. In addition, as the intensity of digital payments increases by 1%, the intensity of savings increases by 0.60%. Regarding received digital payments, the growth of savings intensity is similar (0.59%).

Figure 8.

The relationship between the intensity of digital payments made and received and the intensity of savings for old age. Source: Calculated by the authors based on WB data.

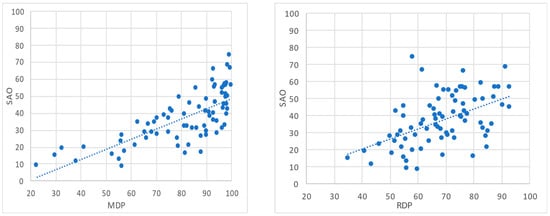

Since the tests of regression models and coefficients substantiate the statistical significance of the relationship between the intensity of digital payments and financial institutions operational efficiency, the authors concluded that with the increased intensity of digital payments, the total and staff costs to bank assets decrease, as shown in Figure 9 and Figure 10. In addition, as the intensity of digital payments made increases by 1%, the total costs to assets decrease by 0.018% on average. Regarding received digital payments, the decrease in total costs to assets is slightly higher (0.023%). Among the Baltic states, Latvia showed slightly lower total costs than the EU average—with the digital payments made factor as −0.49% and the digital payments received factor as −0.38%. On the other hand, Estonia’s result is +0.16% and +0.41%, and Lithuania is +0.07% and −0.05%, respectively.

Figure 9.

The relationship between the intensity of digital payments made and received and the banks’ total costs (% of assets). Source: Calculated by the authors based on WB and ECB data.

Figure 10.

The relationship between the intensity of digital payments made and received and the expenses of banks’ staff (% of assets). Source: Calculated by the authors based on WB and ECB data.

Regarding staff costs to assets, when the intensity of digital payments increases by 1%, the staff costs to assets decrease by 0.0074% on average. For digital payments received, the decrease in staff costs to assets is slightly higher (0.0096%). Among the Baltic states, Latvia showed slightly lower total costs than the EU average—with the digital payments made factor as −0.26% and digital payments received factor as −0.21%. On the other hand, Estonia’s result is +0.06% and +0.017%, and Lithuania is +0.07% and +0.02%, respectively.

All the results of the above analysis allow for the confirmation of hypothesis H3.

To conduct an in-depth study of the digital transformation and sustainable development of financial sector participants in Baltic countries, semi-structured expert interviews were used to validate research findings. In line with the research objectives, special attention has been paid to issues in relation to the cost efficiency of the sustainable development of the financial sector.

In total, nine top level experts participated in the interviews. The overall summary of the expert group is presented in the Table 7.

Table 7.

Characteristics of the interviewed financial sector participants from the Baltic countries.

The authors believe that the expert composition is representative to a sufficient extent since experts cover key industries and the area related to the financial sector, as well as possess local, regional, and global views on the studied topic. The interviews took place during the time period from September to October 2022.

As an opening question, the progress of digital transformation in a represented financial sector participant was described by experts mainly in the following way:

- A specific number of delivered solutions, technology projects, and improvement initiatives implemented per year in accordance with a technology strategy;

- Partnerships with service providers with strategic competence in the area;

- Implementation of machine learning techniques to shorten the process execution time and advance the quality of decision making.

Furthermore, in relation to sustainable development goals standing at the forefront of financial sector participant’s long-term development and related operational plans, experts mentioned:

- Setting strategic objectives for particular sustainability goals;

- Sustainability integrated in the application of business practices;

- Sustainability dimensions are included in the key strategic areas of the company (e.g., staff, risk management, partnerships).

The experts mentioned the following technological solutions for businesses that were most often considered for achieving sustainability goals:

- Artificial intelligence (incl. machine learning and processing big data);

- Digital payments, e-wallets, and remote customer onboarding;

- Cloud computing;

- Blockchain technology;

- Process automation.

According to the experts, technology plays a prominent role in balancing the relationship between the company’s sustainability and the sustainable development objectives. Technology can be considered as a foundation for further actions. However, it was also stressed that technology is merely a tool to achieve the goal. Practitioners, who work with technology, are the most important element of ensuring sustainability.

Experts cited digital payments as a key product or priority that tends to become more advanced. Traditionally, digital solutions including digital payments are heavily used for achieving cost efficiency objectives. In particular, experts emphasized that cost efficiency became the main goal to accelerate digitization at a time when the economy, and thus business activities, were slowing down. Nevertheless, the main goal of digitalization is manifested in the improvement in customer experience. Process automation deserves a special place in digitalization initiatives.

In terms of contribution of digital technology to sustainable development, digital technology enables the use of human capital in a smarter way (i.e., less manual work, more intellectual tasks). Moreover, it eliminates a wide range of risks, which can arise from human factors (varying from errors to conflict of interest) as well as save costs by not consuming excessive resources.

Currently, the following technological solutions that are most often in use as mentioned by the experts include data models and analytics, robotics, and basic artificial intelligence tools. Among the solutions that were mentioned in the pipeline are the introduction of various application programming interfaces (APIs), more advanced artificial intelligence tools, as well as various digital platforms.

Finally, with regard to the open-ended questions, the approach toward financial inclusion was described as:

- Special focus on underserved and potentially discriminated segments of customers (e.g., easing barriers for receiving financial services using digital technology);

- Indirectly by offering a regulatory sandbox and innovation hubs (by financial regulators).

During the interview, the experts were asked to answer specific questions by choosing the most appropriate score ranging from 1 (not important) to 5 (very important). The summary of the questionnaire with expert answers is provided in Table 8.

Table 8.

Summary of semi-structured interviews of financial sector institutions’ expert group from the Baltic countries.

As shown in Table 8, the digital transformation was assessed as a key method by experts for improving product development (4.8), developing financial sector participant customer base and customer relationships (4.8), as well as access to channel management (4.7). It is peculiar that experts do not consider digital transformation as the main method for optimizing internal processes and increasing the operative efficiency of financial institutions (4.3). In connection with the application of innovative digital technologies, expert evaluations show that the most important solutions are related to the development of digital payments (e.g., remote authentication tools (4.6), API platform technologies (4.4), process automation (4.3).

4. Discussion

In discussions, researchers from academia and practitioners from financial institutions and global consulting firms define digital transformation as a complex process of adapting digital technologies, which results from the strategic goal of creating, adapting, and transforming internal processes, customer relationships and customer experiences, value propositions and business models, with the aim of increasing the efficiency of financial institutions [4,5]. Liu et al. believe that the digital transformation is characterized by the integration of digital technologies into business processes. Shim and Shin recognize that the rapid development of ICT is transforming the landscape of the financial industry and starting a new era of convergence services [5,6]. Kotarba considers the digital transformation to be the modification of business models, which results from the dynamic of technological progress and innovation that triggers changes in consumer and social behaviors. Therefore, it is important to understand the role of digital transformation in bringing about beneficial changes in organizational strategies and behaviors [84]. All these considerations allow the authors to conclude that digital transformation is a driving force for the sustainable development of financial institutions, which coincides with the opinions of Flejterski, Schilirò, Yu et al. [10,11,12].

The results of both the recent academic and the current empirical research show that digital payments are the most affected area of digital transformation [43,47,49]. The current research reveals that the intensity and progress of digital payments made and received differ significantly between the EU countries; similar results have been shown by other research works (e.g., Mishra, Sarma, Allen, etc. [47,69,70]). Sarma proposes a comprehensive vision of the financial inclusion based on the dimensions of accessibility, availability, and use of the formal financial system by all agents within the economy, and explains the differences in the use of financial services with different income levels [69]. The results of our research do not provide a sufficient justification for this statement due to the gross national income per capita, which indicates a moderately strong correlation with the intensity of digital payments made in the EU countries in 2021 (coefficient of −0.649), while a correlation with the intensity of digital payments received in the EU countries in 2021 indicates a weak relationship (coefficient of −0.162). Allen et al. found that greater financial inclusion is associated with lower account costs and increases in savings. The authors explain the differences with greater proximity to financial intermediaries, stronger legal rights, and more politically stable environments. However, Sahi et al. explains the differences in cultural backgrounds [43,70]. The current study shows that the digital transformation in the financial sector significantly reduces the impact of income level on financial service penetration—the availability of digital payments is closely correlated with both account ownership and any savings intensity. Moreover, similar relationships are substantiated in the studies by Arner et al. 2020, Galvez-Sanchez et al. 2021 [71,73].

Digital transformation of the financial sector not only contributes to the increase in the intensity of financial services, but also provides an opportunity to reduce the costs of manual work and reduce operational risk losses. Moreover, the study by Ahamed and Mallick provides comprehensive empirical evidence that greater financial inclusion is positively associated with individual bank stability. Furthermore, the study substantiates that the channels through which financial inclusion impacts bank soundness and increases financial inclusion act as an instrument to reduce the marginal cost of outputs [81]. Similar conclusions can be derived from the research by Andersen on Norwegian banks’ online and mobile banking, payment apps, and other web-based services. The authors stated that these services led the bank customers to be more self-sufficient and reduced the need for bank personnel and bank offices. Therefore, automation and the digitalization of banks’ operations have played a key role in improving cost efficiency [83].

However, digital transformation in the financial sector of the Baltic states is insufficient compared to the EU as a whole. Of note, interviews with the expert group of financial sector institutions of the Baltic states revealed that experts do not consider digital transformation as the main method for optimizing internal processes and increasing the operational efficiency of financial institutions.

In general, the authors agree with the findings by Danisman and Tarazi, which suggest that advances in financial inclusion through increased account ownership and digital payments stabilize the banking industry in the EU [68].

5. Conclusions

The authors conclude that the digital transformation of the financial sector takes place under the influence of the fourth industrial revolution and is characterized by the integration of digital technologies into business processes, providing new innovative opportunities, thus directly affecting the operation of financial sector institutions. The rapid development of technologies changed the landscape of the financial sector. Therefore, development of technologies could be considered to be a driving force for the sustainable development of financial institutions.

There is no standardized solution for the digital transformation of financial institutions to promote sustainable development, as the sustainable development is a continuous process and requires contextualization.

The bibliometric analysis linking sustainable development and the financial sector, despite the growing interest of researchers, showed that the regularities of financial systems and sustainability were studied the least. The authors of the current study have paid attention to the economic aspect of sustainability since it was studied the least. In addition, by critically analyzing the latest research, they have concluded that the sustainability of a financial institution could be also characterized by the financial inclusion and operational efficiency aspects enabled by digital transformation.

The statistical analysis of the digital transformation of the financial sector was performed by the authors. Digital payments were selected as the most popular digital technology, in order to determine the relationship between the intensity of financial inclusion and its dynamics across the Globe and in the European Union. With three tested hypotheses, the authors concluded that in the financial sector of the EU countries significant progress in the intensity of digital payments was observed, and a positive relationship between the intensity of digital payments and financial inclusion was found. In addition, a positive relationship between the intensity of digital payments and the efficiency of financial institutions in the EU countries was proven.

Based on the analysis of semi-structured interviews of the expert group from the financial sector institutions of the Baltic countries to validate research findings, the authors believe that there is an evident basis for the conclusion that digital transformation is a key method for improving product development, developing a financial sector institution customer base, customer relationships, as well as access to channel management. Nevertheless, there is room for improvement in digital transformation solutions for optimizing internal processes and increasing the operational efficiency of financial institutions in the Baltic countries.

The authors conclude that digital transformation is beneficial for the clients of financial institutions and for the financial institutions themselves by ensuring the availability of financial services 24/7 even in conditions of a pandemic and similar restrictions, saving personal time for financial transactions and reducing logistics costs for financial institutions; cost savings by reducing manual operations, the need for offices and logistics; customer satisfaction, as the probability of errors in the execution of financial transactions decreases; reducing operational risk and its consequences (costs of operational risk insurance and the amount of capital required to cover operational risk are reduced); as well reducing the impact on the environment—the ecological footprint decreases by giving up material money carriers, diminishing the need for office space and logistics services.

For further research, it is suggested to study how financial inclusion interacts with different sustainability aspects while taking into account the hierarchy within the context of digital transformation of financial institutions, as well as the environment dimension of the sustainable development of the financial sector. Provided that digital transformation of financial institutions is possible only when appropriate legal framework is developed and adopted, regulatory aspects of digital transformation in the financial sector are important for further research, as well. In the context of the Baltic countries, in-depth research is needed to explain the differences between the dynamic of digital payments in all Baltic countries in general and the underlying reasons for a decrease in digital payments received in Lithuania in 2021 compared to 2014 in particular.

Author Contributions

Conceptualization, I.M. and A.S.; methodology, A.S. and A.N.; software, A.V.; validation, A.S.; formal analysis, A.V. and I.A.; investigation, A.S., I.M. and A.V.; resources, A.N. and I.A.; writing—original draft preparation, A.S., I.M., T.V., A.V. and I.A.; writing—review and editing, I.M.; visualization, A.V.; supervision, T.V.; project administration, I.M. and A.N.; funding acquisition, A.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Data can be requested via correspondence contacts.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

The digital payments’ intensity and growth (%) in the EU countries in 2014, 2017, and 2021.

Table A1.

The digital payments’ intensity and growth (%) in the EU countries in 2014, 2017, and 2021.

| Country | MDP 2021 | MDP 21 vs. 14 | MDP 21 vs. 17 | RDP 2021 | RDP 21 vs. 14 | RDP 21 vs. 17 |

|---|---|---|---|---|---|---|

| Austria | 99.2 | 6.1 | 9.9 | 58.2 | −22.7 | −20.9 |

| Belgium | 97.3 | 1.0 | 4.0 | 77.0 | 6.3 | 0.8 |

| Bulgaria | 68.3 | 65.7 | 79.5 | 53.0 | −9.1 | 21.7 |

| Croatia | 78.6 | 20.0 | 41.6 | 64.0 | 7.7 | 13.8 |

| Cyprus | 93.1 | 21.9 | 27.0 | 76.4 | 12.2 | 10.6 |

| Czech Rep. | 99.5 | 3.0 | 6.6 | 61.7 | −16.5 | −13.2 |

| Denmark | 99.9 | 1.5 | 1.8 | 88.9 | 6.4 | −4.2 |

| Estonia | 97.1 | 10.2 | 7.6 | 55.0 | −1.1 | −24.9 |

| Finland | 97.7 | 3.5 | 3.7 | 93.0 | 7.2 | 9.8 |

| France | 97.7 | −0.4 | 0.2 | 80.6 | 6.4 | −3.5 |

| Germany | 98.4 | 9.9 | 9.3 | 52.2 | −23.5 | −25.9 |

| Greece | 88.1 | 55.6 | 290.3 | 69.1 | 15.1 | 23.1 |

| Hungary | 75.0 | −0.2 | 19.2 | 77.3 | 9.0 | 26.1 |

| Ireland | 81.4 | 31.8 | 41.4 | 75.2 | 38.3 | 48.1 |

| Italy | 98.0 | 7.5 | 16.0 | 66.9 | 0.7 | −8.0 |

| Latvia | 93.0 | 7.9 | 40.4 | 55.1 | 2.1 | 6.3 |

| Lithuania | 83.4 | 24.5 | 48.2 | 64.7 | −3.8 | −5.7 |

| Malta | 93.0 | 11.9 | 14.0 | 82.8 | −2.3 | 3.6 |

| Netherlands | 85.8 | 8.1 | 21.6 | 69.4 | 2.4 | 11.9 |

| Poland | 98.0 | 1.1 | 1.5 | 76.1 | −0.9 | −10.8 |

| Portugal | 91.4 | 15.6 | 73.5 | 66.6 | 8.3 | 20.8 |

| Romania | 87.5 | 7.7 | 24.1 | 66.0 | 14.3 | 31.5 |

| Slovak Rep. | 56.1 | 71.5 | 88.8 | 46.2 | 12.6 | 32.1 |

| Slovenia | 92.7 | 22.1 | 33.4 | 82.9 | 13.5 | 24.1 |

| Spain | 93.6 | 4.1 | 13.8 | 90.4 | 16.1 | 42.0 |

| Sweden | 98.4 | 0.9 | 0.7 | 91.4 | 4.5 | 4.6 |

Source: Calculated by the authors based on WB data.

References

- Roblek, V.; Thorpe, O.; Bach, M.P.; Jerman, A.; Meško, M. The Fourth Industrial Revolution and the Sustainability Practices: A Comparative Automated Content Analysis Approach of Theory and Practice. Sustainability 2020, 12, 8497. [Google Scholar] [CrossRef]

- Wang, Y.; Xiuping, S.; Zhang, Q. Can fintech improve the efficiency of commercial banks?—An analysis based on big data. Res. Int. Bus. Financ. 2021, 16, 130–138. [Google Scholar] [CrossRef]

- Kumar, S.; Sharma, D.; Rao, S.; Lim, W.M.; Mangla, S.K. Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Ann. Oper. Res. 2022, 1–44. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. Manag. Digit. Transform. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Liu, D.Y.; Chen, S.W.; Chou, T.C. Resource fit in digital transformation: Lessons learned from the CBC Bank global e-banking project. Manag. Decis. 2011, 49, 1728–1742. [Google Scholar] [CrossRef]

- Shim, Y.; Shin, D.H. Analyzing China’s fintech industry from the perspective of actor–network theory. Telecommun. Policy 2016, 40, 168–181. [Google Scholar] [CrossRef]

- Gomez-Trujillo, A.M.; Gonzalez-Perez, M.A. Digital transformation as a strategy to reach sustainability. Smart Sustain. Built Environ. 2021, 11, 4. [Google Scholar] [CrossRef]

- George, G.; Merrill, R.K.; Schillebeeckx, S.J. Digital Sustainability and Entrepreneurship: How Digital Innovations Are Helping Tackle Climate Change and Sustainable Development. Entrep. Theory Pract. 2021, 45, 999–1027. [Google Scholar] [CrossRef]

- Merrill, R.K.; Schillebeeckx, S.J.D.; Blakstad, S. Sustainable digital finance in Asia: Creating environmental impact through bank transformation. SDFA DBS UN Environ. 2019. Available online: https://www.dbs.com/iwov-resources/images/sustainability/reports/Sustainable%20Digital%20Finance%20in%20Asia_FINAL_22.pdf (accessed on 25 August 2022).

- Yu, J.; Xu, Y.; Bai, K. Can Digital Finance Narrow the Household Consumption Gap of Residents on Either Side of the Hu Line? Sustainability 2022, 14, 9490. [Google Scholar] [CrossRef]

- Flejterski, S. Sustainable Financial Systems. Financ. Sustain. Dev. 2019, 269–297. [Google Scholar] [CrossRef]

- Schilirò, D. Sustainability, innovation, and efficiency: A key relationship. Financ. Sustain. Dev. 2019, 83–102. [Google Scholar]

- Rupeika-Apoga, R.; Wendt, S. FinTech in Latvia: Status Quo, Current Developments, and Challenges Ahead. Risks 2021, 9, 181. [Google Scholar] [CrossRef]

- Eremina, Y.; Lace, N.; Bistrova, J. Digital Maturity and Corporate Performance: The Case of the Baltic States. J. Open Innov. Technol. Mark. Complex. 2019, 5, 54. [Google Scholar] [CrossRef]

- Mavlutova, I.; Lesinskis, K.; Liogys, M.; Hermanis, J. Innovative Teaching Techniques for Entrepreneurship Education in the Era of Digitalisation. WSEAS Trans. Environ. Dev. 2020, 16, 725–733. [Google Scholar] [CrossRef]

- Andriuškevičius, K.; Štreimikienė, D.; Alebaitė, I. Convergence between Indicators for Measuring Sustainable Development and M&A Performance in the Energy Sector. Sustainability 2022, 14, 10360. [Google Scholar]

- Mavlutova, I.; Volkova, T.; Natrins, A.; Spilbergs, A.; Arefjevs, I.; Miahkykh, I. Financial Sector Transformation In The Era Of Digitalization. Estud. De Econ. Apl. 2021, 38, 4055. [Google Scholar] [CrossRef]

- Arefjevs, I.; Spilbergs, A.; Natrins, A.; Verdenhofs, A.; Mavlutova, I.; Volkova, T. Financial sector evolution and competencies development in the context of information and communication technologies. Res. Rural. Dev. 2020, 35, 260–267. [Google Scholar]

- Mavlutova, I.; Volkova, T.; Spilbergs, A.; Natrins, A.; Arefjevs, I.; Verdenhofs, A. The Role of Fintech Firms in Contemporary Financial Sector Development. WSEAS Trans. Bus. Econ. 2021, 18, 411–423. [Google Scholar] [CrossRef]

- Tambovceva, T.; Titko, J.; Svirina, A.; Atstaja, D.; Tereshina, M. Evaluation of the Consumer Perception of Sharing Economy: Cases of Latvia, Russia, Ukraine and Belarus. Sustainability 2021, 13, 13911. [Google Scholar] [CrossRef]

- Uvarova, I.; Mavlutova, I.; Atstaja, D. Development of the green entrepreneurial mindset through modern entrepreneurship education. IOP Conf. Series Earth Environ. Sci. 2021, 628. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Syeda, H.Z. The determinants of bank’s stability: Evidence from Latvia’s banking industry. New Challenges of Economic and Business Development-2018. Product. Econ. Growth 2018, 579–586. [Google Scholar] [CrossRef]

- Mavlutova, I.; Fomins, A.; Spilbergs, A.; Atstaja, D.; Brizga, J. Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia. Sustainability 2021, 14, 339. [Google Scholar] [CrossRef]

- Arefjevs, I. Efficiency assessment concept model for financial alliances: Baltic pension fund management. Eur. Integr. Stud. 2017, 11, 186–198. [Google Scholar] [CrossRef]

- Körnert, J.; Junghanns, T. The Potential for Sovereign Wealth Funds to Exert Influence Through Critical Banks in the Five Smallest EU Member States. Credit. Cap. Mark. 2020, 53, 187–220. [Google Scholar] [CrossRef]

- United Nations Development Programme. Goal 9: Industry, Innovation and Infrastructure. Available online: https://www.undp.org/tag/goal-09-industry-innovation-and-infrastructure (accessed on 25 August 2022).

- Recovery Plan for Europe (2021–2027). Available online: https://ec.europa.eu/info/strategy/recovery-plan-europe_en (accessed on 25 August 2022).

- The Digital Education Action Plan (2021–2027). Available online: https://education.ec.europa.eu/focus-topics/digital-education/action-plan (accessed on 25 August 2022).

- Barroso, M.; Laborda, J. Digital transformation and the emergence of the Fintech sector: Systematic literature review. Digit. Bus. 2022, 2, 100028. [Google Scholar] [CrossRef]

- Natrins, A.; Supe, L.; Mikelsone, E.; Sarnovics, A. Information Technology Competency Management in the Financial Sector in Latvia. Environ. Technol. Resour. 2019, 2, 98–103. [Google Scholar] [CrossRef]

- Drasch, B.J.; Schweizer, A.; Urbach, N. Integrating the ‘Troublemakers’: A taxonomy for cooperation between banks and fintechs. J. Econ. Bus. 2018, 100, 26–42. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E.; Ubeda, F. Using reputation for corporate sustainability to tackle banks digitalization challenges. Bus. Strat. Environ. 2020, 29, 2181–2193. [Google Scholar] [CrossRef]

- Leitner-Hanetseder, S.; Lehner, O.M.; Eisl, C.; Forstenlechner, C. A profession in transition: Actors, tasks and roles in AI-based accounting. J. Appl. Account. Res. 2021, 22, 539–556. [Google Scholar] [CrossRef]

- Al-Busaidi, K.A.; Al-Muharrami, S. Beyond profitability: ICT investments and financial institutions performance measures in developing economies. J. Enterp. Inf. Manag. 2020, 34, 900–920. [Google Scholar] [CrossRef]

- Agarwal, S.; Zhang, J. FinTech, lending and payment innovation: A review. Asia-Pac. J. Financ. Stud. 2020, 49, 353–367. [Google Scholar] [CrossRef]

- Van Eck, N.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Mavlutova, I.; Lesinskis, K.; Liogys, M.; Hermanis, J. The Role of Innovative Methods in Teaching Entrepreneurship in Higher Education: Multidisciplinary Approach. Int. Conf. Reliab. Stat. Transp. Commun. 2020, 684–693. [Google Scholar] [CrossRef]

- European Banking Federation. Banking in Europe: EBF Facts & Figures 2021. Available online: https://www.ebf.eu/wp-content/uploads/2022/01/FINAL-Banking-in-Europe-EBF-Facts-and-Figures-2021.-11-January-2022.pdf (accessed on 30 August 2022).

- Palmié, M.; Wincent, J.; Parida, V.; Caglar, U. The evolution of the financial technology ecosystem: An introduction and agenda for future research on disruptive innovations in ecosystems. Technol. Forecast. Soc. Chang. 2020, 151, 119779. [Google Scholar] [CrossRef]

- Azarenkova, G.; Shkodina, I.; Samorodov, B.; Babenko, M. The influence of financial technologies on the global financial system stability. Invest. Manag. Financial Innov. 2018, 15, 229. [Google Scholar] [CrossRef]

- Mihet, R. Who Benefits from Innovations in Financial Technology? 2019. Available online: https://news.unil.ch/document/1578925168744.D1578925289908 (accessed on 30 August 2022).

- Carmona, A.F.; Lombardo, A.G.Q.; Pastor, R.R.; Quirós, C.T.; García, J.V.; Muñoz, D.R.; Martin, L.C. Competition issues in the area of financial technology (Fintech). Policy Dep. Econ. Sci. Qual. Life Policies Eur. Parliam. 2018. Available online: https://www.startmag.it/wp-content/uploads/ipol_stu-1.pdf (accessed on 25 August 2022).

- Sahi, A.M.; Khalid, H.; Abbas, A.F.; Khatib, S.F. The Evolving Research of Customer Adoption of Digital Payment: Learning from Content and Statistical Analysis of the Literature. J. Open Innov. Technol. Mark. Complex. 2021, 7, 230. [Google Scholar] [CrossRef]

- Bollaert, H.; Lopez-de-Silanes, F.; Schwienbacher, A. Fintech and access to finance. J. Corp. Financ. 2021, 68. [Google Scholar] [CrossRef]

- Xia, Y.; Qiao, Z.; Xie, G. Corporate resilience to the COVID-19 pandemic: The role of digital finance. Pac. Basin Financ. J. 2022, 74, 101791. [Google Scholar] [CrossRef]

- Fülöp, M.T.; Topor, D.I.; Ionescu, C.A.; Căpușneanu, S.; Breaz, T.O.; Stanescu, S.G. Fintech accounting and Industry 4.0: Future-proofing or threats to the accounting profession? J. Bus. Econ. Manag. 2022, 23, 997–1015. [Google Scholar] [CrossRef]

- Fu, J.; Mishra, M. Fintech in the time of COVID−19. Technol. Adopt. Dur. Cris. 2022, 50, 100945. [Google Scholar]

- Akram, U.; Fülöp, M.T.; Tiron-Tudor, A.; Topor, D.I.; Căpușneanu, S. Impact of Digitalization on Customers’ Well-Being in the Pandemic Period: Challenges and Opportunities for the Retail Industry. Int. J. Environ. Res. Public Health 2021, 18, 7533. [Google Scholar] [CrossRef] [PubMed]

- Tchamyou, V.S.; Erreygers, G.; Cassimon, D. Inequality, ICT and financial access in Africa. Technol. Forecast. Soc. Change 2019, 139, 169–184. [Google Scholar] [CrossRef]

- Acheampong, A.O. Modelling for insight: Does financial development improve environmental quality? Energy Econ. 2019, 83, 156–179. [Google Scholar] [CrossRef]

- Del Mar Alonso-Almeida, M.; Llach, J.; Marimon, F. A Closer Look at the ‘Global Reporting Initiative’ Sustainability Reporting as a Tool to Implement Environmental and Social Policies: A Worldwide Sector Analysis. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 318–335. [Google Scholar] [CrossRef]

- Richardson, B.J. Keeping Ethical Investment Ethical: Regulatory Issues for Investing for Sustainability. J. Bus. Ethics 2009, 87, 555–572. [Google Scholar] [CrossRef]

- Usman, M.; Makhdum, M.S.A. What abates ecological footprint in BRICS-T region? Exploring the influence of renewable energy, non-renewable energy, agriculture, forest area and financial development. Renew. Energy 2021, 179, 12–28. [Google Scholar] [CrossRef]

- Weber, O.; Diaz, M.; Schwegler, R. Corporate social responsibility of the financial sector–strengths, weaknesses and the impact on sustainable development. Sustain. Dev. 2014, 22, 321–335. [Google Scholar] [CrossRef]

- Di Vaio, A.; Palladino, R.; Pezzi, A.; Kalisz, D.E. The role of digital innovation in knowledge management systems: A systematic literature review. J. Bus. Res. 2021, 123, 220–231. [Google Scholar] [CrossRef]

- Ferreira, J.J.; Fernandes, C.I.; Ferreira, F.A. To be or not to be digital, that is the question: Firm innovation and performance. J. Bus. Res. 2019, 101, 583–590. [Google Scholar] [CrossRef]

- Nill, J.; Kemp, R. Evolutionary approaches for sustainable innovation policies: From niche to paradigm? Res. Policy 2009, 38, 668–680. [Google Scholar] [CrossRef]

- Smith, T. Institutional and Social Investors Find Common Ground. J. Investig. 2005, 14, 57–65. [Google Scholar] [CrossRef]

- Jabareen, Y. A New Conceptual Framework for Sustainable Development. Environ. Dev. Sustain. 2008, 10, 179–192. [Google Scholar] [CrossRef]

- Sakalasooriya, N. Conceptual Analysis of Sustainability and Sustainable Development. Open J. Soc. Sci. 2021, 09, 396. [Google Scholar] [CrossRef]

- United Nations General Assembly. 2005 World Summit Outcome, Resolution A/60/1. Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_60_1.pdf (accessed on 25 August 2022).

- Elkington, J. Cannibals with forks: Triple bottom line of 21st century business. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- Guandalini, I. Sustainability through digital transformation: A systematic literature review for research guidance. J. Bus. Res. 2022, 148, 456–471. [Google Scholar] [CrossRef]

- World Bank. Available online: https://www.worldbank.org/en/topic/financialinclusion/overview#:~:text=Financial%20inclusion%20means%20that%20individuals,a%20responsible%20and%20sustainable%20way (accessed on 25 August 2022).

- UN Department of Economic and Social Affairs Poverty. Available online: https://www.un.org/development/desa/socialperspectiveondevelopment/issues/financial-inclusion.html (accessed on 30 August 2022).

- World Economic Forum. How New Technologies Create a Pathway to Financial Inclusion. Available online: https://www.weforum.org/agenda/2022/05/new-technologies-improve-financial-inclusion/ (accessed on 25 August 2022).

- Sun, T. Balancing Innovation and Risks in Digital Financial Inclusion—Experiences of Ant Financial Services Group. In Handbook of Blockchain, Digital Finance, and Inclusion; Academic Press: Cambridge, MA, USA, 2018; pp. 37–43. [Google Scholar] [CrossRef]

- Danisman, G.O.; Tarazi, A. Financial inclusion and bank stability: Evidence from Europe. Eur. J. Financ. 2020, 26, 1842–1855. [Google Scholar] [CrossRef]

- Sarma, M. Index of Financial Inclusion–A Measure of Financial Sector Inclusiveness 2012. Available online: https://finance-and-trade.htw-berlin.de/fileadmin/HTW/Forschung/Money_Finance_Trade_Development/working_paper_series/wp_07_2012_Sarma_Index-of-Financial-Inclusion.pdf (accessed on 25 August 2022).

- Allen, F.; Demirguc-Kunt, A.; Klapper, L.; Peria, M.S.M. The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financ. Intermed. 2016, 27, 1–30. [Google Scholar] [CrossRef]

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A.; Veidt, R. Sustainability, FinTech and financial inclusion. Eur. Bus. Or-Ganization Law Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Carranza, R.; Díaz, E.; Sánchez-Camacho, C.; Martín-Consuegra, D. e-Banking Adoption: An Opportunity for Customer Value Co-creation. Front. Psychol. 2021, 11, 621248. [Google Scholar] [CrossRef] [PubMed]

- Gálvez-Sánchez, F.J.; Lara-Rubio, J.; Verdú-Jóver, A.J.; Meseguer-Sánchez, V. Research advances on financial inclusion: A bibliometric analysis. Sustainability 2021, 13, 3156. [Google Scholar] [CrossRef]

- Demir, A.; Pesqué-Cela, V.; Altunbas, Y.; Murinde, V. Fintech, financial inclusion and income inequality: A quantile regression approach. Eur. J. Financ. 2020, 28, 86–107. [Google Scholar] [CrossRef]

- Kanga, D.; Oughton, C.; Harris, L.; Murinde, V. The diffusion of fintech, financial inclusion and income per capita. Eur. J. Financ. 2022, 28, 108–136. [Google Scholar] [CrossRef]

- El Hilali, W.; El Manouar, A.; Idrissi, M.A.J. Reaching sustainability during a digital transformation: A PLS approach. Int. J. Innov. Sci. 2020, 12, 52–79. [Google Scholar] [CrossRef]

- Cella-De-Oliveira, F.A. Indicators of organizational sustainability: A proposition from organizational competences. Int. Rev. Manag. Bus. Res. 2013, 2, 962. [Google Scholar]

- Al-Shaiba, A.S.; Al-Ghamdi, S.G.; Koc, M. Comparative Review and Analysis of Organizational (In)Efficiency Indicators in Qatar. Sustainability 2019, 11, 6566. [Google Scholar] [CrossRef]

- Scott, S.V.; Van Reenen, J.; Zachariadis, M. The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Res. Policy 2017, 46, 984–1004. [Google Scholar] [CrossRef]

- Son, I.; Kim, S. Mobile Payment Service and the Firm Value: Focusing on both Up- and Down-Stream Alliance. Sustainability 2018, 10, 2583. [Google Scholar] [CrossRef]