A New Perspective on Interpreting the Accounting Information of Listed Companies: Research on the Asset Structure Difference and Earnings Value Based on a Sustainable Development Strategic Perspective

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Asset Structure Differences and Earnings Value Relevance

2.2. Asset Structure Differences and Value Relevance of Each Earnings Component

3. Research Design

3.1. Sample Selection and Data Source

3.2. Models and Variables

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Robustness Check

4.4.1. The Alternative Variable of the Dependent Variable

4.4.2. Regroup Samples

4.4.3. Change the Variable Type of Asset Structure Difference

4.4.4. Control Net Assets Per Share

4.4.5. Control Company Size

5. Conclusions and Contribution

5.1. Conclusions

- (1)

- Listed companies’ different asset structure affects the correlation of the earnings value. Overall, compared with the companies with a large proportion of investment assets, the companies with a large proportion of operating assets have a stronger earnings value relevance.

- (2)

- From the perspective of the main composition of profits, the value relevance of core profits is the strongest among the companies with a large proportion of operating assets, and the value relevance of investment income is the strongest among the companies with a large proportion of investment assets.

- (3)

- The listed company’s asset structure results from the corporate strategic development choice, which further shows that the corporate strategy affects the earnings value relevance.

5.2. Contribution

- (1)

- The research based on the perspective of corporate strategy has found new evidence for the influencing factors of earnings quality and further expands the literature on earnings quality. The previous research is basically “talking about numbers based on numbers”, which does not consider that the essence of corporate profits is the result of corporate strategic choice.

- (2)

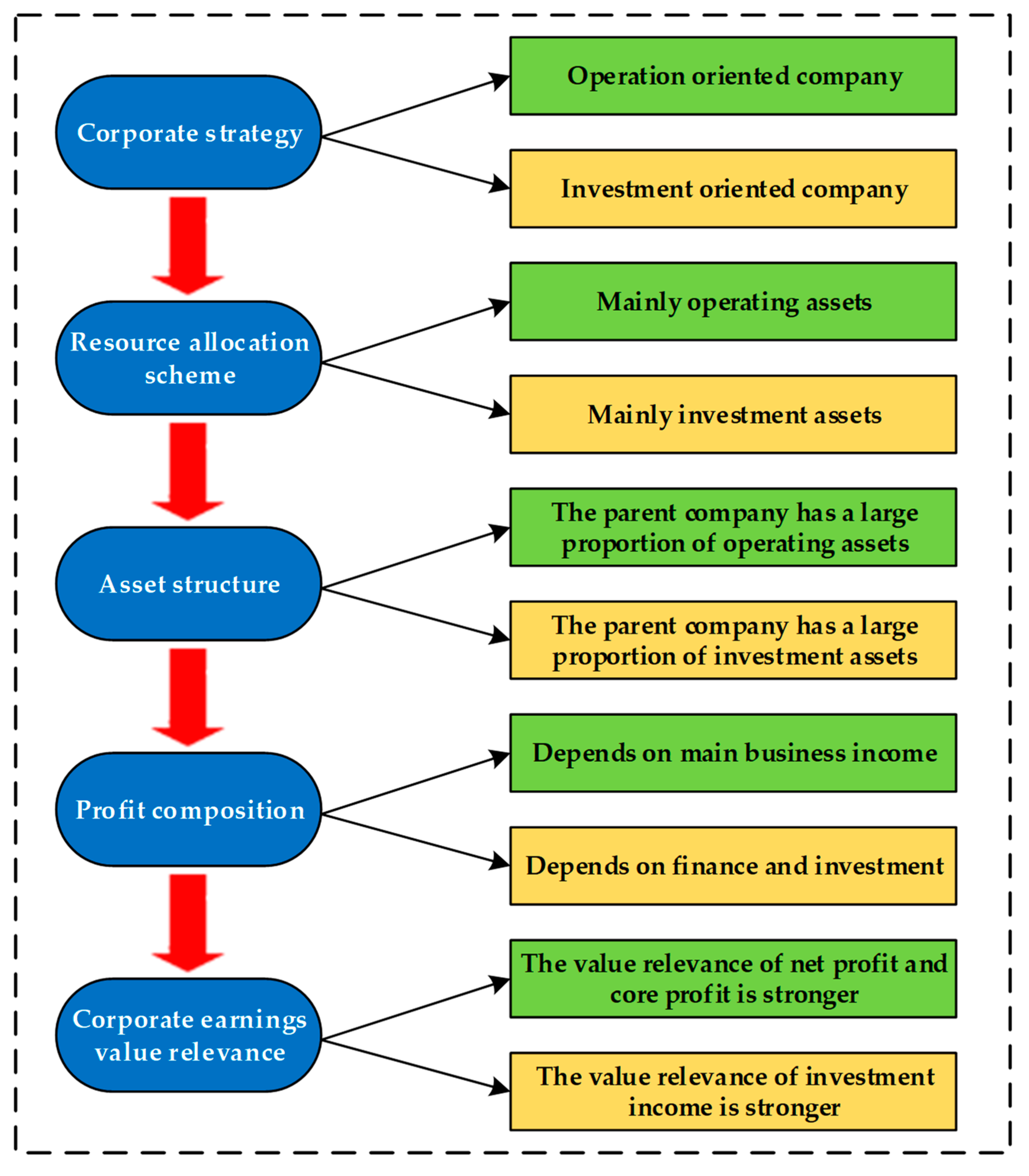

- It was found that the connotation behind earnings information is corporate strategy, and corporate strategy is the root of the differences affecting earnings quality. The research logic of this paper is: the corporate strategy determines the resource allocation scheme of the company, the resource allocation scheme determines the asset structure, and the asset structure determines the generation mode of profits. Therefore, there are different profit compositions, and the differences in profit compositions lead to differences in the corporate earnings value relevance.

- (3)

- It provides a new perspective for investors to more accurately interpret the earnings information of companies. We should understand the significance of current earnings and their components to the future development prospect and value of companies in combination with corporate strategy. It has a specific reference value for external investors and financial analysts to optimize investment choices because it can better explain the logic behind the corporate operation based on the strategic perspective, which will help the users of accounting information to understand and analyze the corporate financial statements more accurately and make reasonable investment decisions to promote the healthy development of the capital market. Not only do the general earnings have value relevance, but each specific item of earnings may also have value relevance. Investors pay attention to the surplus and spend more and more on the components. Investors also pay extra attention to each item of earnings. That is, the value relevance of each part of earnings is different.

- (4)

- It also has some enlightenment for the standard-setting department. Since the specific strategy of the company is an important factor affecting the characteristics of accounting information, the standard-setting department can encourage the company to disclose more and more comprehensive strategic information to help investors understand and analyze the corporate financial statements more accurately, conduct valuation analysis of the company more effectively, and make the correct decisions.

- (5)

- The research of this paper reflects the importance and necessity of the Treasury to vigorously promote the construction of a management accounting system [41]. Promoting the structure of a management accounting system and scientifically planning the development strategy of management accounting have become the new requirements of Chinese social and economic development for the guidance of accounting practice in the new era. To promote the construction of a management accounting system, the Treasury issued the “basic guidelines for management accounting” (CK (2016) No. 10) [42] in June 2016. Take strategic orientation as the first application principle of management accounting and emphasize that the application of management accounting is guided by strategic planning. To further promote the practice of management accounting, in September 2017, the Treasury issued 22 guidelines for the application of management accounting (CK (2017) No. 24) [43]. Among them, “management accounting application guide No. 100: strategic management” defines the concept, principles, application environment, application procedures, and strategic management tools to improve the Chinese management accounting system. Strategic management will play a more critical role in corporate strategic decision making, evaluation, and control as an essential management accounting function. The research in this paper is helpful to encourage the company to strengthen strategic management and the application of management accounting.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Huang, B.B.; Dai, D.M.; Ma, Y.J. Definition of profit concept. Mon. J. Financ. Account. 2022, 13, 82–85. [Google Scholar]

- Wei, X.D. Research on profit regulation and supervision of listed companies. Financ. Account. Commun. 2020, 24, 115–118. [Google Scholar]

- Ball, R.; Brown, P. An empirical evaluation of accounting income numbers. J. Account. Res. 1968, 6, 159–178. [Google Scholar] [CrossRef]

- Zhang, X.M.; Qian, A.M.; Chen, D.Q. Quality of financial situation of listed companies: Theoretical framework and evaluation system. Manag. World 2019, 35, 16. [Google Scholar]

- Cheng, X.K.; Gong, X.L. The value relevance of earnings structure under the new accounting standards for business corporations—Empirical Evidence from a shares in Shanghai stock market. J. Shanghai Lixin Account. Coll. 2008, 4, 36–46. [Google Scholar]

- Wu, S.P.; Xu, L.S. The effect of the implementation of new accounting standards—From the perspective of value relevance. Econ. Manag. Res. 2008, 6, 61–66. [Google Scholar]

- Zhao, Y.L. Accounting Earnings and Stock Price Behavior. PhD Dissertation, Shanghai University of Finance and Economics, Shanghai, China, 1999. [Google Scholar]

- Liang, X.T. Tax differences, audit supervision and earnings sustainability. Friends Account. 2022, 6, 90–95. [Google Scholar]

- Yuan, C.; Wang, P. Correlation between accounting earnings quality and value: Empirical Evidence from Shenzhen stock market. Econ. Theory Econ. Manag. 2005, 5, 36–39. [Google Scholar]

- Hitt, M.A.; Ireland, R.D.; Camp, S.M.; Sexton, D.L. Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strateg. Manag. J. 2001, 22, 479–491. [Google Scholar] [CrossRef]

- Zhang, R. Strategic Balanced Scorecard: A new index system to measure the strategic business performance of enterprises. Contemp. Financ. Econ. 2000, 10, 76–80. [Google Scholar]

- Datta, S.; Iskandar-Datta, M.; Raman, K. Value creation in corporate divestitures. Corp. Financ. Rev. 2003, 7, 25. [Google Scholar]

- Zhou, M.L. On the application of financial index analysis method in enterprise strategy. Contemp. Account. 2020, 2, 33–34. [Google Scholar]

- Zhang, X.M. Balance Sheet: From Elements to Strategy. Account. Res. 2014, 5, 19–28. [Google Scholar]

- Barth, M.E. The future of financial reporting: Insights from research. Abacus 2018, 54, 66–78. [Google Scholar] [CrossRef]

- Finkelstein, S.; Hambrick, D.C. Top-management-team tenure and organizational outcomes: The moderating role of managerial discretion. Adm. Sci. Q. 1990, 35, 484–503. [Google Scholar] [CrossRef]

- Tang, T.; Firth, M. Can book–tax differences capture earnings management and tax management? Empirical evidence from China. Int. J. Account. 2011, 46, 175–204. [Google Scholar] [CrossRef]

- Dichev, I.D.; Graham, J.R.; Harvey, C.R.; Rajgopal, S. Earnings quality: Evidence from the field. J. Account. Econ. 2013, 56, 1–33. [Google Scholar] [CrossRef]

- Ye, K.T.; Dong, X.Y.; Cui, Y.J. Enterprise strategic positioning and accounting earnings management behavior choice. Account. Res. 2015, 23–29. [Google Scholar]

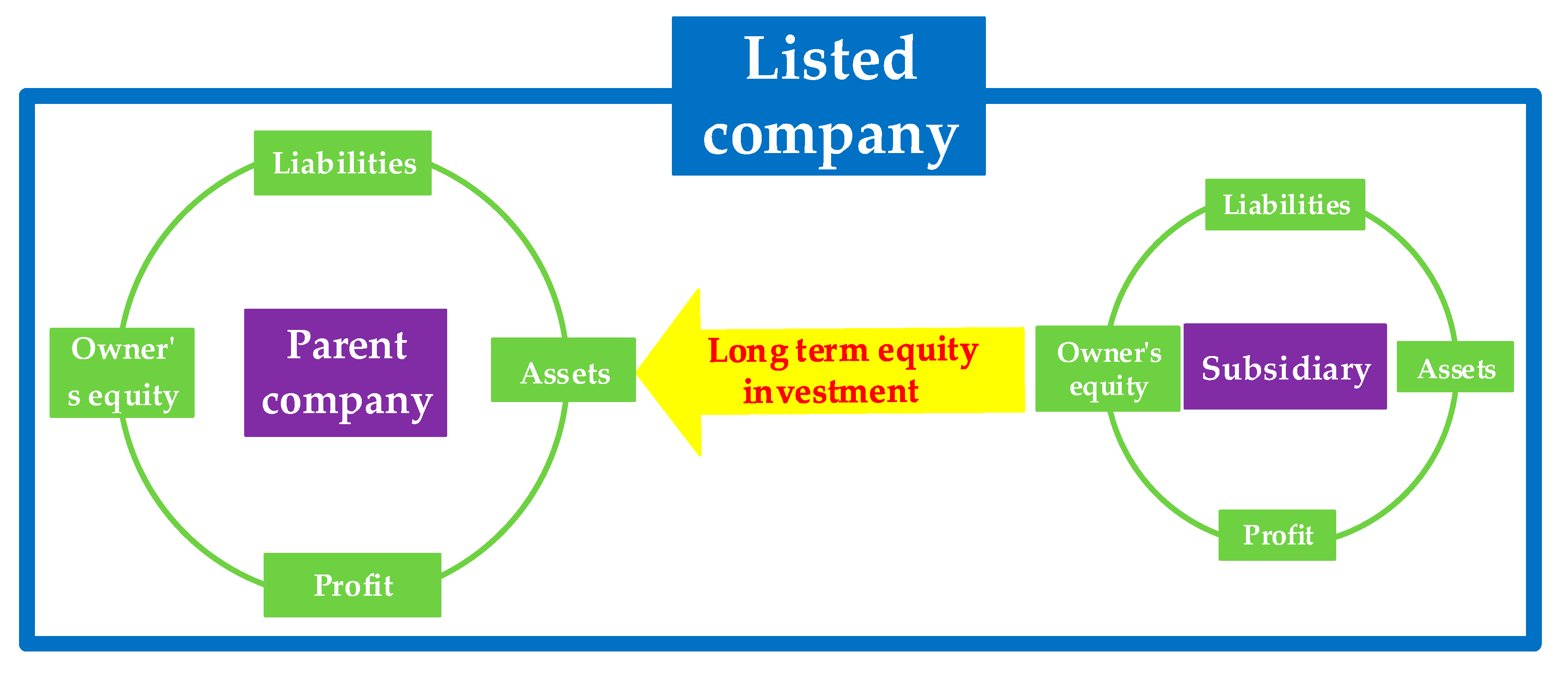

- Zhu, J.G.; Wang, J.; Zhang, X.M. Parent company’s business model, consolidation—Parent company’s earnings information and decision usefulness. Nankai Manag. Rev. 2014, 84–93. [Google Scholar]

- Sun, J.; Wang, B.Q.; Cao, F. Does corporate strategy affect earnings management? Manag. World 2016, 32, 160–169. [Google Scholar]

- Liu, X. Will the strategic type of an enterprise affect the earnings characteristics—An investigation from the perspective of accounting conservatism. Nankai Manag. Rev. 2016, 111–121. [Google Scholar]

- Zhou, B.; Huang, F.; Ren, Z.L. Enterprise competitive strategy and earnings sustainability. China Soft Sci. 2018, 141–152. [Google Scholar]

- Francis, B.B.; Hasan, I.; Hunter, D.M. Emerging market liberalization and the impact on uncovered interest rate parity. J. Int. Money Financ. 2002, 21, 931–956. [Google Scholar] [CrossRef][Green Version]

- Dechow, P.; Ge, W.; Schrand, C. Understanding earnings quality: A review of the proxies, their determinants and their consequences. J. Account. Econ. 2010, 50, 344–401. [Google Scholar] [CrossRef]

- Ramakrishnan, R.T.S.; Thomas, J.K. Valuation of permanent, transitory, and price-irrelevant components of reported earnings. J. Account. Audit. Financ. 1998, 13, 301–336. [Google Scholar] [CrossRef]

- Agnes, C.S.; Cheung, J.K.; Gopalakrishnan, V. On the usefulness of operating income, net income and comprehensive income in explaining security returns. Account. Bus. Res. 1993, 23, 195–203. [Google Scholar] [CrossRef]

- Swaminathan, S.; Weintrop, J. The information content of earnings, revenues, and expenses. J. Account. Res. 1991, 29, 418–427. [Google Scholar] [CrossRef]

- Jiang, Y.B.; Zhang, S. New accounting standards and accrual anomalies. Econ. Manag. 2010, 11, 115–123. [Google Scholar]

- Chen, D.Y. Empirical Research on the Correlation between Asset Impairment and Earning Management of Listed Company. J. Liaoning Shihua Univ. 2011, 31, 80. [Google Scholar]

- Zhang, G.Q.; Xia, L.J.; Fang, Y.Q. The Value Correlation of Accounting Earnings and Its Components: Empirical Evidence from Shanghai and Shenzhen Stock Markets. Res. Account. Financ. China. 2006, 3, 74–120. [Google Scholar]

- Lev, B. On The Usefulness of earning and Earning Research. J. Account. Res. 1989, 27, 153–192. [Google Scholar] [CrossRef]

- Varun, D. Earnings persistence and stock prices: Empirical evidence from an emerging market. J. Financ. Report. Account. 2014, 12, 117–134. [Google Scholar]

- Wang, P.; Chen, W.C. Research on value relevance of consolidated financial statements. Account. Res. 2009, 5, 46–52. [Google Scholar]

- Wang, X. Research on the value relevance of comprehensive income—Empirical Evidence Based on the implementation of new standards. Account. Res. 2013, 13, 20–27. [Google Scholar]

- Hayn, C. The information content of losses. J. Account. Econ. 1995, 20, 125–153. [Google Scholar] [CrossRef]

- Black, H.A.; Collins, M.C.; Robinson, B.L.; Schweitzer, R.L. Changes in Market Perception of Riskiness: The Case of Too-Big-To-Fail. J. Financ. Res. 1997, 20, 389–406. [Google Scholar] [CrossRef]

- Cai, C.; Tan, H.T.; Tang, G.Q. An empirical study on the scale, book value/market value of accounting earnings—Empirical data from Chinese Listed Companies. China Account. Rev. 2006, 4, 20. [Google Scholar]

- Li, M.; Xu, F.Y. Research on company size and earnings management before private placement. Account. Newsl. Next 2019, 3, 92–99. [Google Scholar]

- Wei, L.; Xiao, M.Y. The correlation test between the tone of the performance briefing and earnings value. Financ. Account. Mon. 2021, 22, 55–62. [Google Scholar]

- Gong, H.; Ning, X.D.; Cui, T. The board’s evaluation of the company’s strategic process: Logical structure and index system. Nankai Bus. Rev. 2007, 5, 26–30. [Google Scholar]

- Gu, S.S.; Liu, Y.H. Correlation between management power, high-quality audit and earnings value. Jiangxi Soc. Sci. 2014, 11, 209–213. [Google Scholar]

- Guo, C.Y. Corporate strategy: Basic connotation and evolution track. J. Xiamen Univ. Philos. Soc. Sci. Ed. 2005, 2, 34–41. [Google Scholar]

| Type | Symbol | Name | Definition |

|---|---|---|---|

| Dependent variable | P | Stock price | Closing price of the company’s shares at the end of the period |

| Independent variable | AS | Asset structure of parent company | The sample is grouped by the size of the parent company’s operating assets/(parent company’s operating assets + parent company’s investment assets) by year. Companies below the minimum 1/3 quantile and above the maximum 1/3 quantile are, respectively, defined as companies with a large proportion of investment assets of the parent company and companies with a large proportion of operating assets of the parent company. Companies with equal emphasis on both assets are in the middle 1/3 quantile (for the convenience of research, this sample was deleted). For companies with a large proportion of operating assets of the parent company, the value is 1. For companies with a large proportion of investment assets of the parent company, the value is 0. |

| Eps | Earnings per share | Net profit attributable to owners of the parent company/total equity | |

| Core | Core profit per share | Core profit/total equity. Core profit = operating revenue - operating costs - business taxes and surcharges - selling expenses - administrative expenses - financial expenses (applicable before 2018). Core profit = operating revenue - operating costs - business taxes and surcharges - sales expenses - management expenses - R&D expenses - interest expenses (applicable after 2018). | |

| Inv | Investment income per share | (Fair value gains and losses + investment income)/total equity | |

| Oth | Net non-operating income and expenditure per share | (Non-operating income–non-operating expenses)/total equity | |

| Control variable | Naps | Net assets per share | Net assets at the end of the period/total equity |

| Size | Company size | Natural logarithm of net assets at the end of the period |

| Variable | Unit | Observations | Average | Standard Deviation | 1/4 Quantile | Median | 3/4 Quantile |

|---|---|---|---|---|---|---|---|

| P | CNY | 20,234 | 17.81636 | 0.1205437 | 7.31 | 12.29 | 21.41 |

| AS | / | 20,234 | 0.499654 | 0.0035151 | 0 | 0 | 1 |

| Eps | CNY | 20,234 | 0.4756073 | 0.0034797 | 0.14 | 0.33 | 0.6329 |

| Core | CNY | 20,234 | 0.5080793 | 0.0041346 | 0.1321002 | 0.3537272 | 0.6979188 |

| Inv | CNY | 20,234 | 0.0681851 | 0.00109 | 0 | 0.0123846 | 0.0624958 |

| Oth | CNY | 20,234 | 0.036961 | 0.0005488 | −0.0003689 | 0.011074 | 0.0449691 |

| Naps | CNY | 20,234 | 4.866121 | 0.021508 | 2.770302 | 4.135953 | 6.111473 |

| Size | CNY | 20,234 | 21.47025 | 0.0082638 | 20.63665 | 21.34687 | 22.13074 |

| P | AS | Eps | Core | Inv | Oth | Naps | Size | |

|---|---|---|---|---|---|---|---|---|

| P | 1 | |||||||

| AS | 0.195 *** | 1 | ||||||

| Eps | 0.632 *** | 0.132 *** | 1 | |||||

| Core | 0.558 *** | 0.129 *** | 0.882 *** | 1 | ||||

| Inv | 0.012 * | −0.208 *** | 0.230 *** | −0.004 | 1 | |||

| Oth | 0.097 *** | −0.001 | 0.088 *** | −0.037 *** | −0.012 | 1 | ||

| Naps | 0.598 *** | 0.149 *** | 0.715 *** | 0.643 *** | 0.176 *** | 0.068 *** | 1 | |

| Size | −0.097 *** | −0.234 *** | 0.226 *** | 0.258 *** | 0.240 *** | 0.066 *** | 0.248 *** | 1 |

| Variable | Model (1) | Model (2) |

|---|---|---|

| AS | −1.400 *** (−4.40) | −0.441 (−1.35) |

| Eps | 13.64 *** (46.77) | |

| AS* Eps | 8.249 *** (21.76) | |

| Core | 9.860 *** (40.11) | |

| AS* Core | 8.166 *** (24.76) | |

| Inv | 7.418 *** (10.70) | |

| AS*Inv | −4.124 *** (−3.14) | |

| Oth | 16.91 *** (16.02) | |

| _cons | 18.30 *** (48.24) | 17.89 *** (45.41) |

| Id | Control | Control |

| Year | Control | Control |

| Obs | 20,234 | 20,234 |

| R−sq | 0.483 | 0.453 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| AS | −1.012 ** (−3.29) | −1.426 *** (−3.34) | −1.991 *** (−4.71) | −1.549 *** (−5.12) | −1.853 *** (−5.71) |

| Eps | 12.35 *** (43.83) | 13.23 *** (37.52) | 8.875 *** (21.83) | 8.731 *** (29.07) | 14.03 *** (47.33) |

| AS*Eps | 6.526 *** (17.81) | 10.06 *** (21.37) | 12.98 *** (23.76) | 6.994 *** (19.34) | 8.126 *** (21.44) |

| Naps | 1.764 *** (42.29) | ||||

| Size | −1.128 *** (−7.03) | ||||

| _cons | 13.03 *** (35.53) | 18.37 *** (38.76) | 18.62 *** (46.14) | 13.85 *** (36.86) | 41.49 *** (12.49) |

| Id | Control | Control | Control | Control | Control |

| Year | Control | Control | Control | Control | Control |

| Obs | 20,234 | 15,176 | 30,361 | 20,234 | 20,234 |

| R−sq | 0.411 | 0.484 | 0.478 | 0.533 | 0.485 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| AS | −0.344 (−1.09) | 0.130 (0.30) | −0.788 (−1.81) | −0.835 ** (−2.72) | −0.950 ** (−2.85) |

| Core | 9.014 *** (38.18) | 9.654 *** (31.58) | 5.030 *** (14.65) | 5.800 *** (23.61) | 10.24 *** (40.84) |

| AS * Core | 6.703 *** (21.16) | 9.331 *** (22.35) | 12.95 *** (27.46) | 6.559 *** (21.08) | 8.099 *** (24.59) |

| Inv | 6.052 *** (9.09) | 7.556 *** (9.43) | 10.82 *** (9.52) | 3.028 *** (4.61) | 7.664 *** (11.06) |

| AS * Inv | −2.068 (−1.64) | −6.346 *** (−3.62) | −5.816 ** (−3.20) | −3.153 * (−2.56) | −4.065 ** (−3.10) |

| Oth | 11.97 *** (11.81) | 15.81 *** (12.63) | 15.79 *** (19.42) | 10.30 *** (10.31) | 16.63 *** (15.78) |

| Naps | 1.982 *** (47.79) | ||||

| Size | −1.233 *** (−7.40) | ||||

| _cons | 12.86 *** (33.96) | 17.78 *** (36.00) | 17.85 *** (43.07) | 13.09 *** (34.16) | 43.23 *** (12.54) |

| Id | Control | Control | Control | Control | Control |

| Year | Control | Control | Control | Control | Control |

| Obs | 20,234 | 15,176 | 30,361 | 20,234 | 20,234 |

| R−sq | 0.384 | 0.449 | 0.449 | 0.518 | 0.454 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, F.; Ock, Y.-S.; Su, X. A New Perspective on Interpreting the Accounting Information of Listed Companies: Research on the Asset Structure Difference and Earnings Value Based on a Sustainable Development Strategic Perspective. Sustainability 2023, 15, 10. https://doi.org/10.3390/su15010010

Wu F, Ock Y-S, Su X. A New Perspective on Interpreting the Accounting Information of Listed Companies: Research on the Asset Structure Difference and Earnings Value Based on a Sustainable Development Strategic Perspective. Sustainability. 2023; 15(1):10. https://doi.org/10.3390/su15010010

Chicago/Turabian StyleWu, Fengpei, Young-Seok Ock, and Xiang Su. 2023. "A New Perspective on Interpreting the Accounting Information of Listed Companies: Research on the Asset Structure Difference and Earnings Value Based on a Sustainable Development Strategic Perspective" Sustainability 15, no. 1: 10. https://doi.org/10.3390/su15010010

APA StyleWu, F., Ock, Y.-S., & Su, X. (2023). A New Perspective on Interpreting the Accounting Information of Listed Companies: Research on the Asset Structure Difference and Earnings Value Based on a Sustainable Development Strategic Perspective. Sustainability, 15(1), 10. https://doi.org/10.3390/su15010010