Determinants of Loan Acquisition and Utilization among Smallholder Rice Producers in Lagos State, Nigeria

Abstract

1. Introduction

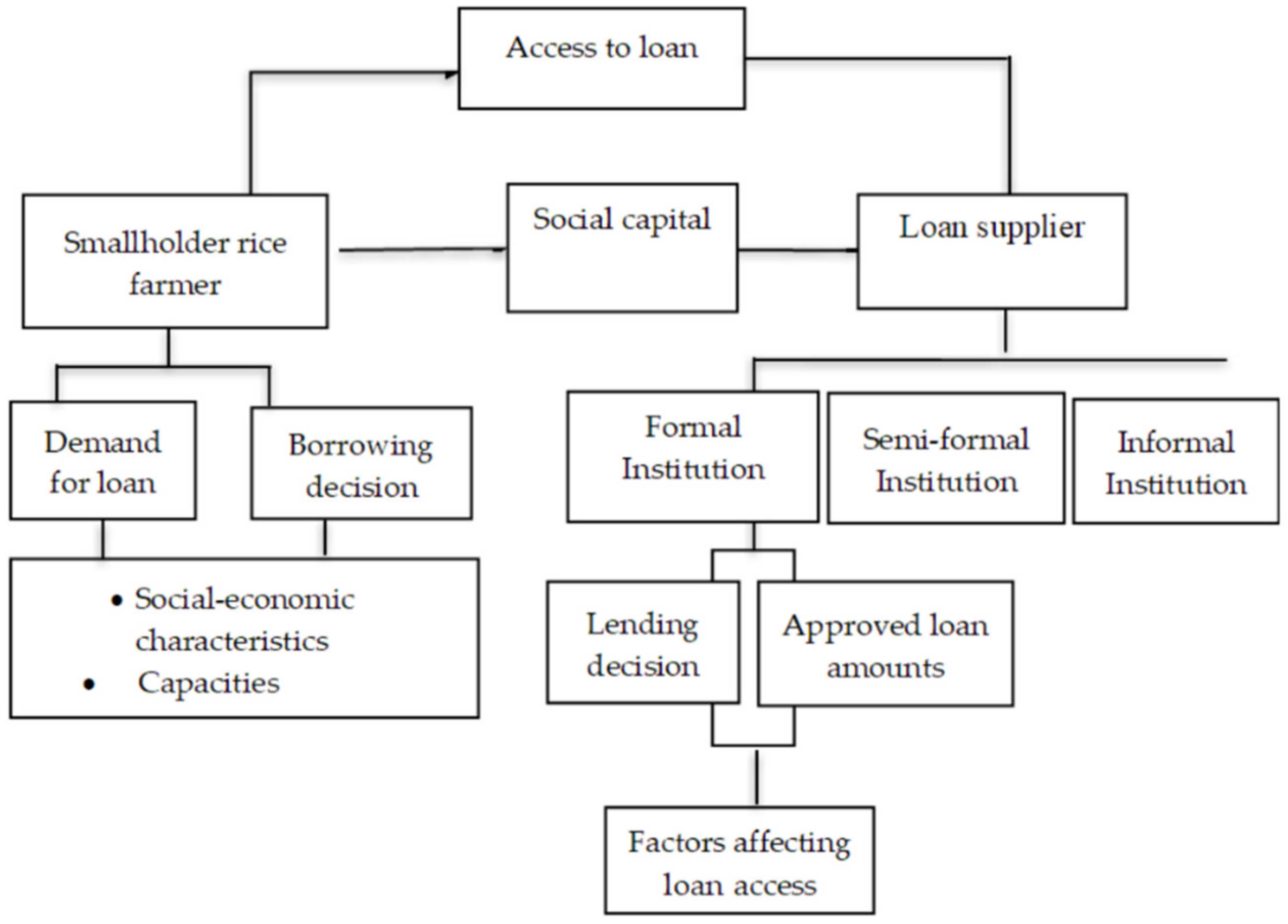

2. Conceptual Framework

2.1. Concept of Loan/Credit

2.2. Sources of Agriculture Loan Facilities in Nigeria

2.3. Determinants of Loan Access

3. Materials and Methods

3.1. Study Area

3.2. Empirical Model for the Determinants of Farmer’s Choice of Loan

3.3. Empirical Model for the Determinants of Loan Acquisition and Utilization

4. Results and Discussion

4.1. Descriptive Statistics Results

4.2. Descriptive Statistics of Farmers’ Sources of Loan

4.3. Econometric Results

4.4. Determinants of Rice Farmers’ Choice of Loan Sources from Financial Institutions

4.5. Determinants of Loan Access and Utilization

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Akinbode, S.O. Access to credit: Implication for sustainable rice production in Nigeria. J. Sustain. Dev. Afr. 2013, 15, 13–30. [Google Scholar]

- Attah, A.W. Food security in Nigeria: The Role of Peasant Farmers in Nigeria. Int. J. Ethiopia. 2012, 6, 173–190. [Google Scholar] [CrossRef]

- Nwagboso, I.C. Rural Development as Strategy for Food Security and Global Peace in the 21st Century Mediterranean. J. Soc. Sci. 2012, 3, 337–390. [Google Scholar]

- John, C.I.; Charles, K.O. Agricultural Credit sources and Determinants of Credit Acquisition by Farmers in Idemili Local Government Area of Anambra State, Nigeria. J. Agric. Sci. Technol. 2015, 5, 34–43. [Google Scholar]

- Oyiniran, T. Current State of Nigeria Agriculture and Agribusiness Sector. In African Continental Free Trade Area Workshop; Abuja, Nigeria, 2020; pp. 1–14. Available online: https://www.pwc.com/ng/en/assets/pdf/afcfta-agribusiness-current-state-nigeria-agriculture-sector.pdf (accessed on 16 March 2022).

- Ameh, M.; Iheanacho, A.C. Socio-economic Factors Influencing Agricultural Loan Acquisition among Small-Scale Rice Farmers in Benue State, Nigeria. Int. J. Innov. Agric. Biol. Res. 2017, 5, 8–17. Available online: www.seahipaj.org (accessed on 2 July 2020).

- Kuwornu, J.K.M.; Ohene-Ntow, I.D.; Asuming-Brempong, S. Agricultural Credit Allocation and Constraint Analysis of Selected Maize Farmers in Ghana. Br. J. Econs. Mgt. Trade 2012, 2, 353–374. [Google Scholar] [CrossRef]

- Isitor, S.U.; Babalola, D.A.; Obaniyi, K.S. An Analysis of Credit Utilization and Farm Income of Arable Crop Farmers in Kwara State, Nigeria. Glob. J. Sci. Front. Res. 2014, 14, 26–34. [Google Scholar]

- Christopher, S.; Mukata, W.; Chibamba, M. Determinants of Smallholder Farmers’ Access to Agricultural Finance in Zambia. J. Agric. Sci. 2014, 6, 63–73. [Google Scholar]

- Gideon, D.A.; Mensah, T.C.; Randy, A.A. Agricultural Credit Utilization among Farmers in Bole District of Northern Region, Ghana. Russ. J. Agric. Socio-Econ. Sci. 2016, 3, 70–80. [Google Scholar]

- Amanuel, A.; Degye, G. Determinants of Microfinance Loan Utilization by Smallholder Farmers: The Case of Omo Microfinance in Lemo District of Hadiya Zone, Southern Ethiopia. J. Dev. Agric. Econ. 2018, 10, 246–252. [Google Scholar] [CrossRef][Green Version]

- Shahab, E.S.; John, K.M.K.; Sanaullah, P.; Ubaid, A. Factor Determining Subsistence Farmers Access to Agricultural Credit in Flood-Prone Area of Pakistan. Kasetsart J. Soc. Sci. 2018, 39, 262–268. [Google Scholar]

- Liquiong, L.; Weizhuo, W.; Christopher, G.; David, A.C.; Quang, T.T.N. Rural Credit Constraint and Informal Rural Credit Accessibility in China. Sustainability 2019, 11, 1935. [Google Scholar] [CrossRef]

- Ettah, O.I.; Kuye, O.O. Socio-Economic Characteristics and Factors Affecting Credit Acquisition and Output of Rice Farmers in Yakurr Local Government Area of Cross River State, Nigeria. Int. J. Sci. Res. 2016, 5, 1–5. [Google Scholar]

- Adegeye, A.J.; Dittoh, J.S. Essentials of Agricultural Economics, 2nd ed.; Science and Education Nigeria Limited: Ibadan, Nigeria, 1985; pp. 164–177. [Google Scholar]

- Onu, J.O.; Nmadu, J.N.; Tanko, L. Determinants of Awareness of Credit Procurement Procedures and Farmers Income in Minna Metropolis, Nigeria. Niger. J. Agric. Econ. 2014, 4, 1–11. [Google Scholar] [CrossRef]

- Ammani, A.A. An Investigation into the Relationship between Agricultural Production and Formal Credit Supply in Nigeria. Int. J. Agric. For. 2012, 2, 46–52. [Google Scholar] [CrossRef]

- Silong, A.; Gadanakis, Y. Credit Sources, Access and Factors Influencing Credit Demand among Rural Livestock Farmers in Nigeria. Agric. Financ. Rev. 2020, 80, 68–90. Available online: http://centaur.reading.ac.uk/85405/ (accessed on 27 August 2021). [CrossRef]

- Ajah, E.A.; Igiri, J.A.; Ekpenyong, H.B. Determinants of Credit among Rice Farmers in Biase Local Government Area of Cross River State, Nigeria. Glo. J. Agric. Sci. 2017, 16, 43–51. [Google Scholar] [CrossRef]

- Ameh, M.; Iheanacho, A.C.; Ater, P.I. Effects of Loan Utilization on Rice Farmers Productivity in Benue State, Nigeria. J. Agric. Econ. Ext. Sci. 2018, 4, 45–54. [Google Scholar]

- Ekwere, G.E.; Edem, I.D. Evaluation of Agricultural Credit Facility in Agricultural Production and Rural Development. Glo. J. Hum. Soc. Sci. 2014, 14, 19–26. [Google Scholar]

- Gupta, V.; Gautam, T.K.; Bhandari, B.D. Choice of Agricultural Credit Sources by Nepalese Farmers; Department of Agricultural Economics and Agribusiness, LSU: Baton Rouge, LA, USA, 2014; p. 21. [Google Scholar]

- Fikadu, G.F. Determinants of Access to Credit and Credit Source Choice by Micro, Small and Medium Enterprises in Nekemte, Ethiopia. Int. J. Afri. Asian Stud. 2016, 28, 11–27. [Google Scholar]

- Greene, G.H. Econometric Analysis, 5th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2002. [Google Scholar]

- Finkelstein, E.A.; Trogdon, J.G.; Cohen, J.W.; Dietz, W. Annual medical spending attributable to obesity: Payer-and service-specific estimates. Health Aff. 2009, 28, 822–831. [Google Scholar] [CrossRef] [PubMed]

- Cawley, J.; Meyerhoefer, C. The medical care costs of obesity: An instrumental variables approach. J. Health Econ. 2012, 31, 219–230. [Google Scholar] [CrossRef] [PubMed]

- Le Cook, B.; McGuire, T.G.; Lock, K.; Zaslavsky, A.M. Comparing methods of racial and ethnic disparities measurement across different settings of mental health care. Health Serv. Res. 2010, 45, 825–847. [Google Scholar] [CrossRef] [PubMed]

- Mihaylova, B.; Briggs, A.; O’Hagan, A.; Thompson, S.G. Review of statistical methods for analysing healthcare resources and costs. Health Econ. 2011, 20, 897–916. [Google Scholar] [CrossRef] [PubMed]

- Maddala, G.S. Introduction to Econometrics, 3rd ed.; John Wiley: London, UK, 2001. [Google Scholar]

- Aladejebi, O.J.; Omolehin, R.A.; Ajiniran, M.E.; Ajakpovi, A.P. Determinants of credit acquisition and utilization among household farmers in the drive towards sustainable output in Ekiti state, Nigeria. Int. J. Sust. Dev. 2018, 11, 25–36. [Google Scholar]

- Ayat, U.; Nasir, M.; Alam, Z.; Harald, K. Factor Determining Farmers’ Access to and Sources of Credit: Evidence from the Rain-Fed Zone of Pakistan. Agriculture 2020, 10, 586. [Google Scholar] [CrossRef]

- Moahid, M.; Maharjan, K.L. Factors Affecting Farmers’ Access to Formal and Informal Credit: Evidence from Rural Afghanistan. Sustainability 2020, 12, 1268. [Google Scholar] [CrossRef]

- Olomola, A.S.; Gyimah-Brempong, K. Loan Demand and Rationing among Small Scale Farmers in Nigeria; Development Strategy and Governance Division, International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2014; p. 60. [Google Scholar]

- Awotide, B.A.; Abdoulaye, T.; Alere, A.; Manyong, V.M. Impact of Access to Credit on Agricultural Productivity: Evidence from Smallholder Cassava Farmers in Nigeria. In Proceedings of the International Conference of Agricultural Economists (ICAE), Milan, Italy, 9–14 August 2015. [Google Scholar]

- Asogwa, B.C.; Abu, O.; Ochoche, G.E. Analysis of Peasant Farmers’ Access to Agricultural Credit in Benue State, Nigeria. Br. J. Econ. Manag. Trade 2014, 4, 1525–1543. [Google Scholar] [CrossRef]

- Adekoya, O.A. The Patterns and Determinants of Agricultural Credit Use among farm Households in Oyo State, Nigeria. Asian Econ. Fin. Rev. 2014, 4, 1290–1297. [Google Scholar]

- Okeke, A.M. Effect of Anchor Borrowers’ Programme on the Income and Productive Assets Acquisition among Rice Farmers in Benue State, Nigeria. Int. J. Agric. Earth Sci. 2019, 5, 17. [Google Scholar]

| Variable | Description | Mean | SD |

|---|---|---|---|

| Dependent | |||

| Access to loan | 1 if farmer has access to loan and 0 otherwise | 0.88 | 0.32 |

| Amount of loan | The amount of loan obtained by farmers from the financial institutions (in NGN/USD) | 104,192.2 | 60,335.83 |

| Choice of loan sources | Category (1 if formal source, 2 if informal source and 3 if personal savings) | 1.37 | 0.68 |

| Explanatory | |||

| Age | Continuous variable indicating age of the farmers (years) | 38.37 | 10.47 |

| Sex | 1 if male and 0 otherwise | 0.65 | 0.477 |

| Marital status | 1 if single and 0 otherwise | 0.23 | 0.42 |

| Household size | Continuous variable indicating number of people on respondent | 3.62 | 2.31 |

| Education | Continuous variable indicating number of years spent in formal education (years) | 12.31 | 3.33 |

| Farming experience | Continuous variable indicating the period of time a farmer has been growing rice (years) | 4.87 | 1.73 |

| Farm size | Continuous variable indicating the total land area under rice production (hectares) | 1.57 | 0.49 |

| Membership in a cooperative | 1 if farmer is member of cooperative and 0 otherwise | 0.89 | 0.32 |

| Contact with extension agent | 1 if famer has access to extension service and 0 otherwise | 0.028 | 0.1666 |

| Interest rate | Interest rate as a percentage | 15.41 | 6.659 |

| Annual off-farm income | Continuous variable indicating the annual off-farm income of the respondent farmer (in NGN/USD) | 312,438.4 | 175,204.5 |

| Annual farm income | Continuous variable indicating the annual farm income of the respondent farmer (in NGN/USD). | 462,098.9 | 213,997.2 |

| Loan Sources | Frequency | Percentage (%) | Interest Rate (%) |

|---|---|---|---|

| Personal savings | 32 | 11.39 | - |

| Formal sources | 112 | 39.86 | 9–15 |

| Informal sources | 137 | 48.75 | 20–25 |

| Variable | VIF | Tolerance |

|---|---|---|

| Multicollinearity test | ||

| Farm size | 3.92 | 0.2549 |

| Household size | 3.54 | 0.2759 |

| Marital status | 2.92 | 0.3428 |

| Annual off farm income | 2.28 | 0.4394 |

| Membership | 2.27 | 0.4410 |

| Interestrate | 2.17 | 0.4614 |

| Age | 1.89 | 0.5282 |

| Farming exp | 1.47 | 0.6815 |

| Education | 1.20 | 0.8365 |

| Sex | 1.17 | 0.8521 |

| Extension agent | 1.16 | 0.8648 |

| Mean VIF | 2.30 | |

| Breusch–Pagan test for heteroscedasticity | ||

| Chi-square | 31.84 *** |

| Explanatory Variables | Formal Source | Informal Source | ||||

|---|---|---|---|---|---|---|

| Personal Savings (Base Outcome) | ||||||

| Coeff | SE | ME | Coeff | SE | ME | |

| Age | 0.067 | 0.060 | 0.0073 | 0.037 | 0.059 | −0.0070 |

| Sex | −0.30 | 0.89 | −0.015 | −0.24 | 0.88 | 0.014 |

| Marital status | 1.62 | 1.54 | −0.25 | 2.72 * | 1.51 | 0.26 |

| Household size | −0.028 | 0.26 | −0.044 | 0.15 | 0.25 | 0.045 |

| Education | 0.20 | 0.15 | 0.029 | 0.083 | 0.15 | −0.028 |

| Farming experience | −0.37 | 0.31 | −0.023 | −0.28 | 0.31 | 0.021 |

| Farm size | 4.30 ** | 1.76 | −0.018 | 4.42 ** | 1.76 | 0.043 |

| Engage in off farm | −0.84 | 1.80 | 0.025 | −0.95 | 1.78 | −0.029 |

| Annual off farm income | 1.12 × 10−6 | 3.92 × 10−6 | 0.219 × 10−6 | 0.240 × 10−6 | 3.92 × 10−6 | −0.215 × 10−6 |

| Interest rate | 0.40 *** | 0.081 | 0.00080 | 0.40 *** | 0.080 | 0.0015 |

| Constant | −11.45 *** | 4.13 | −9.88 *** | 4.07 | ||

| Observation | 281 | |||||

| LR chi2 (22) | 172.23 *** | |||||

| Prob > chi2 | 0.0000 | |||||

| Pseudo-R2 | 0.3178 | |||||

| Variables | First Part Model | Second Part Model | Marginal Effect |

|---|---|---|---|

| Age | 0.19 | −0.00089 | 23.81 |

| (0.20) | (0.0027) | ||

| Sex | −0.87 | −0.0028 | −829.96 |

| (1.81) | (0.046) | ||

| Marital status | 3.38 | 0.058 | 8134.39 |

| (3.94) | (0.085) | ||

| Household size | −0.82 | 0.017 | 1292.62 |

| (0.66) | (0.017) | ||

| Education | 0.15 | 0.026 *** | 2771.96 |

| (0.24) | (0.0067) | ||

| Farming experience | 0.64 | 0.028 ** | 3331.04 |

| (0.67) | (0.014) | ||

| Farm size | −1.74 | 0.45 *** | 45,395.16 |

| (4.71) | (0.067) | ||

| Annual off-farm income | −0.000012 | −2.76 × 10−7 ** | −0.04 |

| (9.21 × 10−6) | (1.18 × 10−7) | ||

| Annual farm income | 0.000055 ** | 6.62 × 10−7 *** | 0.10 |

| (0.000022) | (1.70 × 10−7) | ||

| Interest rate | 0.76 * | −0.0069 | −258.32 |

| (0.39) | (0.0049) | ||

| Constant | −23.01 * | 10.22 *** | |

| (13.56) | (0.19) | ||

| Observation | 281 | 248 | |

| LR Chi2(10)/F-value | 187.51 *** | 33.33 *** | |

| Prob > Chi2/Prob > F | 0.0000 | 0.0000 | |

| Peudo-R2/R-squared | 0.9222 | 0.5844 | |

| Adjusted R-squared | 0.5669 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ameh, M.; Lee, S.H. Determinants of Loan Acquisition and Utilization among Smallholder Rice Producers in Lagos State, Nigeria. Sustainability 2022, 14, 3900. https://doi.org/10.3390/su14073900

Ameh M, Lee SH. Determinants of Loan Acquisition and Utilization among Smallholder Rice Producers in Lagos State, Nigeria. Sustainability. 2022; 14(7):3900. https://doi.org/10.3390/su14073900

Chicago/Turabian StyleAmeh, Michael, and Sang Hyeon Lee. 2022. "Determinants of Loan Acquisition and Utilization among Smallholder Rice Producers in Lagos State, Nigeria" Sustainability 14, no. 7: 3900. https://doi.org/10.3390/su14073900

APA StyleAmeh, M., & Lee, S. H. (2022). Determinants of Loan Acquisition and Utilization among Smallholder Rice Producers in Lagos State, Nigeria. Sustainability, 14(7), 3900. https://doi.org/10.3390/su14073900