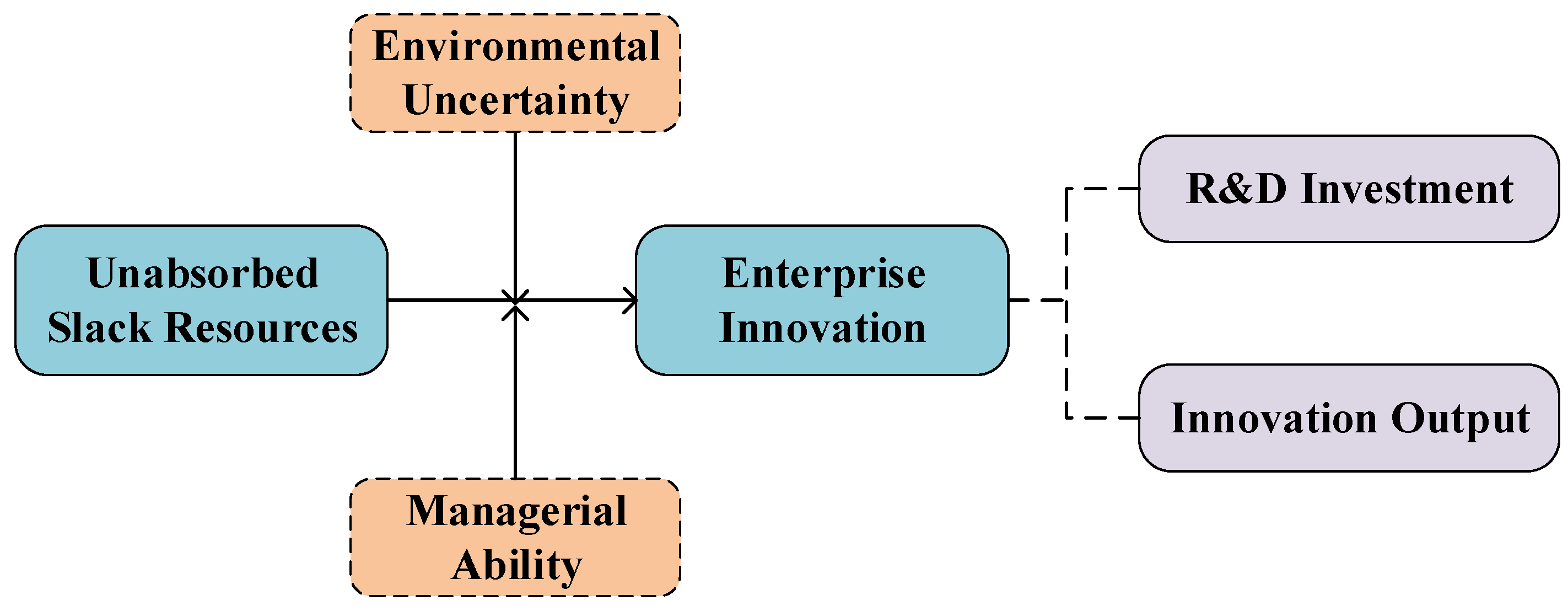

Unabsorbed Slack Resources and Enterprise Innovation: The Moderating Effect of Environmental Uncertainty and Managerial Ability

Abstract

:1. Introduction

2. Literature Review and Research Hypothesis

2.1. Unabsorbed Slack Resources and Enterprise Innovation

2.2. Unabsorbed Slack Resources, Environmental Uncertainty, and Enterprise Innovation

2.3. Unabsorbed Slack Resources, Managerial Ability, and Enterprise Innovation

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definitions

3.2.1. Explanatory Variable

3.2.2. Explained Variables

3.2.3. Moderating Variables

3.3. Empirical Methods

4. Empirical Research Results and Analysis

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis

4.3.1. Unabsorbed Slack Resources and Enterprise Innovation

4.3.2. Moderating Effect Test of Environmental Uncertainty

4.3.3. Moderating Effect Test of Managerial Ability

4.4. Robustness Tests

4.4.1. Replace Explained Variables

4.4.2. Replace Explanatory Variables

4.4.3. Transformation Estimation Method: Tobit Regression with Restricted Variables

5. Further Discussion: Mechanism Analysis

5.1. The Mediating Effect of Financing Constraints

5.2. The Mediating Effect of Large Shareholder Tunneling

6. Conclusions and Policy Implications

6.1. Theoretical Contributions

6.2. Managerial Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Type | Variable Name | Variable Symbol | Variable Definition |

|---|---|---|---|

| Explained variables | R&D investment | Rd_assets | R&D investment/Total assets at the end of the period |

| Innovation output | Patent | LN (Number of invention patents granted this year + 1) | |

| Explanatory variables | Unabsorbed slack resources | Slack | (Current assets inventory)/Current liabilities |

| Moderators | Environmental uncertainty | EU | Estimated by Model (1) and adjusted by industry |

| Managerial ability | MA_Score | Refer to Demerjian et al. (2012), using DEA phased calculations | |

| Control variables | Enterprise size | Size | The natural logarithm of the book value of total assets at the end of the year |

| Leverage Return on total assets | Lev ROA | Total liabilities/total assets Net profit/average balance of total assets | |

| Enterprise age | Age | LN (Current year minus listing year plus one) | |

| Independent director independence | Board | Number of independent directors/Total number of board of directors | |

| Book-to-market ratio | BM | Total assets/Total market value | |

| Equity concentration | Top1 | Number of shares held by the largest shareholder/Total share capital | |

| Enterprise growth | Grow | (Revenue of the current year minus revenue of the previous year)/Revenue of the previous year | |

| Industry | Ind | Dummy variable | |

| Year | Year | Dummy variable |

| Variables | Rd_Assets | Patent | Slack | EU | IC |

|---|---|---|---|---|---|

| Rd_assets | 1.000 | ||||

| Patent | 0.262 *** | 1.000 | |||

| Slack | 0.161 *** | −0.095 *** | 1.000 | ||

| EU | −0.125 *** | −0.069 *** | −0.006 | 1.000 | |

| IC | 0.070 *** | 0.065 *** | 0.072 *** | −0.116 *** | 1.000 |

Appendix B

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| RD | Patent_New | RD | Patent_New | RD | Patent_New | RD | Patent_New | |

| Slack | −0.1872 *** | −0.1326 *** | −0.2062 *** | −0.1164 *** | −0.1373 *** | −0.1087 *** | −0.1835 *** | −0.1337 *** |

| (−7.55) | (−6.27) | (−7.72) | (−4.71) | (−5.22) | (−4.88) | (−7.37) | (−6.32) | |

| Slack2 | 0.0071 *** | 0.0044 ** | 0.0096 *** | 0.0031 | 0.0083 *** | 0.0050 ** | 0.0069 *** | 0.0045 ** |

| (2.94) | (2.22) | (3.98) | (1.33) | (3.57) | (2.49) | (2.91) | (2.24) | |

| Slack × EU | −0.0481 *** | −0.0231 *** | ||||||

| (−7.16) | (−3.90) | |||||||

| Slack × MA_Score | 0.1879 *** | −0.0601 * | ||||||

| (3.97) | (−1.69) | |||||||

| _cons | 15.9326 *** | 0.5329 *** | 16.3858 *** | 0.6960 *** | 15.9308 *** | 0.5321 *** | 15.9259 *** | 0.5350 *** |

| (102.48) | (4.20) | (96.53) | (5.00) | (102.00) | (4.17) | (102.53) | (4.22) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 8236 | 8236 | 6094 | 6094 | 8236 | 8236 | 8236 | 8236 |

| adj. R2 | 0.165 | 0.140 | 0.159 | 0.141 | 0.171 | 0.142 | 0.167 | 0.141 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Rd_Assets | Patent | F.Rd_Assets | F.Patent | Rd_Assets | Patent | Rd_Assets | Patent | |

| Slacknew | 0.0153 *** | 0.9533 *** | 0.0137 *** | 0.9042 *** | 0.0157 *** | 0.9839 *** | 0.0160 *** | 1.0041 *** |

| (7.23) | (6.98) | (5.82) | (5.98) | (7.33) | (7.15) | (7.51) | (7.35) | |

| Slacknew2 | −0.0223 *** | −1.6824 *** | −0.0188 ** | −1.8182 *** | −0.0204 *** | −1.5248 *** | −0.0185 *** | −1.3995 *** |

| (−3.34) | (−3.25) | (−2.54) | (−3.17) | (−3.03) | (−2.92) | (−2.76) | (−2.68) | |

| Slacknew × EPU_Baker | −0.0001 ** | −0.0061*** | ||||||

| (−2.16) | (−3.29) | |||||||

| Slacknew × MA_Rank | −0.0002 *** | −0.0163 *** | ||||||

| (−3.84) | (−4.50) | |||||||

| _cons | 0.0180 ** | −11.9502 *** | 0.0199 ** | −12.3066 *** | 0.0189 ** | −11.8704 *** | 0.0185 ** | −11.9083 *** |

| (2.01) | (−19.22) | (2.00) | (−17.64) | (2.12) | (−19.10) | (2.07) | (−19.22) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 8236 | 8236 | 6094 | 6094 | 8236 | 8236 | 8236 | 8236 |

| adj. R2 | 0.298 | 0.295 | 0.294 | 0.298 | 0.300 | 0.297 | 0.302 | 0.299 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Rd_Assets | Patent | F.Rd_Assets | F.Patent | Rd_Assets | Patent | Rd_Assets | Patent | |

| Slack | 0.0012 *** | 0.0789 ** | 0.0010 ** | 0.1023 *** | 0.0013 *** | 0.0767 ** | 0.0020 *** | 0.1077 *** |

| (3.59) | (2.37) | (2.56) | (2.70) | (3.69) | (2.32) | (5.81) | (3.16) | |

| Slack2 | −0.0001 *** | −0.0124 *** | −0.0001 *** | −0.0147 *** | −0.0001 *** | −0.0120 *** | −0.0001 *** | −0.0119 *** |

| (−4.36) | (−4.41) | (−2.93) | (−4.66) | (−4.46) | (−4.29) | (−3.81) | (−4.22) | |

| Slack × EU | −0.0007 *** | −0.0261 *** | ||||||

| (−10.80) | (−3.86) | |||||||

| Slack × MA_Score | −0.0031 *** | −0.3120 *** | ||||||

| (−6.69) | (−6.94) | |||||||

| _cons | 0.0173 *** | −15.4150 *** | 0.0191 *** | −15.6130 *** | 0.0169 *** | −15.4205 *** | 0.0159 *** | −15.5347 *** |

| (3.79) | (−34.95) | (3.51) | (−30.25) | (3.73) | (−34.99) | (3.49) | (−35.31) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 8236 | 8236 | 6094 | 6094 | 8236 | 8236 | 8236 | 8236 |

Appendix C

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| SA | KZ | Rd_Assets | Patent | Rd_Assets | Patent | |

| Slack | −0.0048 *** | −0.1236 *** | −0.0002 | −0.0301 ** | −0.0002 | −0.0297 ** |

| (−3.42) | (−6.01) | (−0.71) | (−2.24) | (−0.94) | (−2.19) | |

| SA | −0.0019 | −0.6255 *** | ||||

| (−0.61) | (−2.62) | |||||

| KZ | −0.0005 ** | −0.0212 | ||||

| (−2.39) | (−1.56) | |||||

| _cons | 3.3918 *** | 4.7044 *** | 0.0259 * | −9.7960 *** | 0.0221 ** | −11.8177 *** |

| (35.12) | (8.48) | (1.80) | (−11.30) | (2.45) | (−18.40) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES | YES | YES |

| N | 8538 | 8538 | 8538 | 8538 | 8538 | 8538 |

| adj. R2 | 0.854 | 0.583 | 0.279 | 0.287 | 0.281 | 0.285 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Tun1 | Tun2 | Rd_Assets | Patent | Rd_Assets | Patent | |

| Slack | 0.0032 *** | 0.0010 *** | −0.0001 | −0.0250 * | −0.0001 | −0.0277 ** |

| (2.76) | (3.36) | (−0.28) | (−1.86) | (−0.53) | (−2.05) | |

| Tun1 | −0.0279 *** | −0.6386 *** | ||||

| (−8.60) | (−2.65) | |||||

| Tun2 | −0.0307 *** | 0.6324 | ||||

| (−2.71) | (0.72) | |||||

| _cons | 0.0821 *** | 0.0275 *** | 0.0219 ** | −11.8627 *** | 0.0204 ** | −11.9326 *** |

| (2.70) | (2.67) | (2.48) | (−18.71) | (2.29) | (−18.77) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES | YES | YES |

| N | 8533 | 8533 | 8533 | 8533 | 8533 | 8533 |

| adj. R2 | 0.108 | 0.122 | 0.289 | 0.285 | 0.280 | 0.285 |

Appendix D

| Mediating Path | The Indirect Effect | The Direct Effect | ||||

|---|---|---|---|---|---|---|

| Effect | 95% Confidence Interval | Effect | 95% Confidence Interval | |||

| BootLLCI | BootULCI | BootLLCI | BootULCI | |||

| Slack→SA→Rd_assets | 0.000000 | −0.000010 | 0.000030 | 0.000327 | 0.000038 | 0.000616 |

| Slack→SA→Patent | 0.002562 | 0.000763 | 0.004361 | −0.013846 | −0.029808 | 0.002117 |

| Slack→KZ→Rd_assets | 0.000042 | 0.000000 | 0.000080 | 0.000294 | 0.000000 | 0.000577 |

| Slack→KZ→Patent | 0.000274 | −0.001963 | 0.002511 | −0.011558 | −0.027616 | 0.004501 |

| Slack→Tun1→Rd_assets | −0.000101 | −0.000139 | −0.000063 | 0.000445 | 0.000154 | 0.000736 |

| Slack→Tun1→Patent | −0.004803 | −0.007092 | −0.002514 | −0.006155 | −0.022430 | 0.010119 |

| Slack→Tun2→Rd_assets | −0.000041 | −0.000064 | −0.000017 | 0.000385 | 0.000092 | 0.000678 |

| Slack→Tun2→Patent | −0.002105 | −0.003816 | −0.000395 | −0.008853 | −0.025666 | 0.007960 |

References

- Devece, C.; Peris-Ortiz, M.; Rueda-Armengot, C. Entrepreneurship during economic crisis: Success factors and paths to failure. J. Bus. Res. 2016, 69, 5366–5370. [Google Scholar] [CrossRef]

- Kahn, K.B. Understanding innovation. Bus. Horizons 2018, 61, 453–460. [Google Scholar] [CrossRef]

- Peters, M.; Schneider, M.; Griesshaber, T.; Hoffmann, V.H. The impact of technology-push and demand-pull policies on technical change—Does the locus of policies matter? Res. Policy 2012, 41, 1296–1308. [Google Scholar] [CrossRef]

- Cyert, R.; March, J.G. A Behavioral Theory of the Firm; Prentice-Hall: New York, NY, USA, 1963. [Google Scholar]

- Voss, G.B.; Sirdeshmukh, D.; Voss, Z.G. The effects of slack resources and environmental threat on product exploration and exploitation. Acad. Manag. J. 2008, 51, 147–164. [Google Scholar] [CrossRef] [Green Version]

- Suzuki, O. Enabling or constraining? Unraveling the influence of organizational slack on innovation. Ind. Corp. Change 2018, 27, 555–575. [Google Scholar] [CrossRef]

- Latham, S.F.; Braun, M.R. The Performance Implications of Financial Slack during Economic Recession and Recovery: Observations from the Software Industry (2001–2003). J. Manag. Issues 2008, 20, 30–50. [Google Scholar]

- Wei, Y.; Nan, H.X.; Wei, G.W. The impact of employee welfare on innovation performance: Evidence from China’s manufacturing corporations. Int. J. Prod. Econ. 2020, 228, 107753. [Google Scholar] [CrossRef]

- Camison, C.; Villar-Lopez, A. Organizational innovation as an enabler of technological innovation capabilities and firm performance. J. Bus. Res. 2014, 67, 2891–2902. [Google Scholar] [CrossRef]

- Natividad, G. Financial Slack, Strategy, and Competition in Movie Distribution. Organ. Sci. 2013, 24, 846–864. [Google Scholar] [CrossRef]

- Saehwa Hong, H.; Deok, S. Organizational slack and innovativeness: The moderating role of institutional transition in the Asian financial crisis. Asian Bus. Manag. 2019, 20, 370–389. [Google Scholar] [CrossRef]

- Hall, B.H.; Mairesse, J. Exploring the relationship between R&D and productivity in French manufacturing firms. J. Econom. 1995, 65, 263–293. [Google Scholar] [CrossRef]

- Du, J.; Zhang, J.; Li, X. What is the mechanism of resource dependence and high-quality economic development? an empirical test from china. Sustainability 2020, 12, 8144. [Google Scholar] [CrossRef]

- Guellec, D.; Van Pottelsberghe De La Potterie, B. The impact of public R&D expenditure on business R&D. Econ. Innov. New Technol. 2003, 12, 225–243. [Google Scholar] [CrossRef]

- Leung, T.Y.; Sharma, P. Differences in the impact of R&D intensity and R&D internationalization on firm performance–Mediating role of innovation performance. J. Bus. Res. 2021, 131, 81–91. [Google Scholar] [CrossRef]

- Gassmann, O.; Von Zedtwitz, M. New concepts and trends in international R&D organization. Res. Policy 1999, 28, 231–250. [Google Scholar] [CrossRef]

- Li, X.; Long, H. Research focus, frontier and knowledge base of green technology in china: Metrological research based on mapping knowledge domains. Pol. J. Environ. Stud. 2020, 29, 3003–3011. [Google Scholar] [CrossRef]

- Huang, J.; Xie, P.; Zeng, Y. The Effect of Corporate Social Responsibility on the Technology Innovation of High-Growth Business Organizations. Sustainability 2021, 13, 7286. [Google Scholar] [CrossRef]

- Sun, Y.; Du, S.; Ding, Y. The Relationship between Slack Resources, Resource Bricolage, and Entrepreneurial Opportunity Identification—Based on Resource Opportunity Perspective. Sustainability 2020, 12, 1199. [Google Scholar] [CrossRef] [Green Version]

- DanieleAmore, M.; Schneider, C.; Žaldokas, A. Credit supply and corporate innovation. J. Financ. Econ. 2013, 109, 835–855. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational Slack and Firm Performance during Economic Transitions: Two Studies from an Emerging Economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- March, J.; Shapira, Z. Managerial Perspective on Risk and Risk Taking. Manag. Sci. 1987, 33, 1404–1418. [Google Scholar] [CrossRef] [Green Version]

- Morrow, J.L.; Sirmon, D.G.; Hitt, M.A.; Holcomb, T.R. Creating value in the face of declining performance: Firm strategies and organizational recovery. Strateg. Manag. J. 2007, 28, 271–283. [Google Scholar] [CrossRef]

- De Vita, G.; Li, C.; Luo, Y. The inward FDI-Energy intensity nexus in OECD countries: A sectoral R&D threshold analysis. J. Environ. Manag. 2021, 287, 112290. [Google Scholar] [CrossRef]

- Wong, C.Y.; Boon-Itt, S.; Wong, C. The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J. Oper. Manag. 2011, 29, 604–615. [Google Scholar] [CrossRef]

- Chan, H.K.; Yee, R.W.; Dai, J.; Lim, M.K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Prasad, B.; Junni, P. Understanding top management team conflict, environmental uncertainty and firm innovativeness Empirical evidence from India. Int. J. Confl. Manag. 2017, 28, 122–143. [Google Scholar] [CrossRef]

- Safi, A.; Chen, Y.; Wahab, S.; Zheng, L.; Rjoub, H. Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J. Environ. Manag. 2021, 293, 112908. [Google Scholar] [CrossRef]

- Barker, V.L.; Mueller, G.C. CEO characteristics and firm R&D spending. Manag. Sci. 2002, 48, 782–801. [Google Scholar] [CrossRef]

- Giachetti, C.; Torrisi, S. Following or Running Away from the Market Leader? The Influences of Environmental Uncertainty and Market Leadership. Eur. Manag. Rev. 2017, 15, 445–463. [Google Scholar] [CrossRef] [Green Version]

- Demerjian, P.; Lev, B.; Mcvay, S. Quantifying Managerial Ability: A New Measure and Validity Tests. Manag. Sci. 2012, 58, 1229–1248. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.Y.; Podolski, E.J.; Veeraraghavan, M. Does managerial ability facilitate corporate innovative success? J. Empir. Financ. 2015, 34, 313–326. [Google Scholar] [CrossRef]

- Becker, W.; Dietz, J. R&D cooperation and innovation activities of firms—Evidence for the German manufacturing industry. Res. Policy 2004, 33, 209–223. [Google Scholar] [CrossRef] [Green Version]

- Zacher, H.; Rosing, K. Ambidextrous leadership and team innovation. Leadership Org. Dev. J. 2015, 36, 54–68. [Google Scholar] [CrossRef]

- Andreou, P.C.; Philip, D.; Robejsek, P. Bank Liquidity Creation and Risk-Taking: Does Managerial Ability Matter? J. Bus. Finance Acc. 2016, 43, 226–259. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.C.; Wang, C.W.; Chiu, W.C.; Tien, T.S. Managerial ability and corporate investment opportunity. Int. Rev. Financ. Anal. 2018, 57, 65–76. [Google Scholar] [CrossRef]

- Hirshleifer, D.; Low, A.; Teoh, S.H. Are Overconfident CEOs Better Innovators? J. Financ. 2012, 67, 1457–1498. [Google Scholar] [CrossRef] [Green Version]

- Narayanan, M.P. Managerial Incentives for Short-Term Results. J. Financ. 1985, 40, 1469–1484. [Google Scholar] [CrossRef]

- Love, E.G.; Nohria, N. Reducing slack: The performance consequences of downsizing by large industrial firms. Strateg. Manag. J. 2005, 26, 1087–1108. [Google Scholar] [CrossRef]

- Cheng, S. R&D Expenditures and CEO Compensation. Account. Rev. 2004, 79, 305–328. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Liu, J.; Zhang, L.W. Tunneling through allies: Affiliated shareholders, insider trading, and monitoring failure. Int. Rev. Econ. Financ. 2020, 67, 323–345. [Google Scholar] [CrossRef]

- Marlin, D.; Geiger, S.W. A Reexamination of the Organization Slack and Innovation Relationship. J. Bus. Res. 2015, 68, 2683–2690. [Google Scholar] [CrossRef]

- Tosi, H.; Aldag, R.; Storey, R. On the Measurement of the Environment: An Assessment of the Lawrence and Lorsch Environmental Uncertainty Subscale. Adm. Sci. Q. 1973, 18, 27–36. [Google Scholar] [CrossRef]

- Panousi, V.; Papanikolaou, D. Investment, Idiosyncratic Risk, and Ownership. J. Financ. 2012, 67, 1113–1148. [Google Scholar] [CrossRef] [Green Version]

- Jin, G.; Yu, B.; Shen, K. Domestic trade and energy productivity in China: An inverted U-shaped relationship. Energy Econ. 2021, 97, 105234. [Google Scholar] [CrossRef]

- Yang, D. Merger goodwill and corporate innovation capability. Sci. Res. Manag. 2021, 42, 1–11. [Google Scholar] [CrossRef]

- Lind, J.T.; Mehlum, H. With or Without U? The Appropriate Test for a U-Shaped Relationship. Oxf. Bull. Econ. Stat. 2010, 72, 109–118. [Google Scholar] [CrossRef] [Green Version]

- Eisenmann, T.R. The effects of CEO equity ownership and firm diversification on risk taking. Strateg. Manag. J. 2010, 23, 513–534. [Google Scholar] [CrossRef]

- Cleary, S. The Relationship between Firm Investment and Financial Status. J. Financ. 1999, 54, 673–692. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef] [Green Version]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Jiang, G.H.; Lee, C.M.C.; Yue, H. Tunneling through intercorporate loans: The China experience. J. Financ. Econ. 2010, 98, 1–20. [Google Scholar] [CrossRef]

- Salge, T.O.; Vera, A. Small Steps that Matter: Incremental Learning, Slack Resources and Organizational Performance. Brit. J. Manag. 2013, 24, 156–173. [Google Scholar] [CrossRef]

- Bowen, F.E. Organizational Slack and Corporate Greening: Broadening the Debate. Brit. J. Manag. 2002, 13, 305–316. [Google Scholar] [CrossRef]

| Variables | N | Mean | Sd | P25 | P50 | P75 | Min | Max |

|---|---|---|---|---|---|---|---|---|

| Rd_assets | 8236 | 0.0209 | 0.0174 | 0.0086 | 0.0177 | 0.0281 | 0.0001 | 0.0927 |

| Patent | 8236 | 1.4424 | 1.2501 | 0.0000 | 1.3863 | 2.1972 | 0.0000 | 5.1120 |

| Slack | 8236 | 1.7088 | 1.7336 | 0.7706 | 1.1806 | 1.9155 | 0.2214 | 12.3895 |

| EU | 8236 | 1.2500 | 1.0307 | 0.5871 | 0.9699 | 1.5356 | 0.1330 | 5.9394 |

| MA_Score | 8236 | −0.0267 | 0.1419 | −0.1261 | −0.0432 | 0.0557 | −0.3132 | 0.3731 |

| Size | 8236 | 22.3573 | 1.1924 | 21.5197 | 22.2044 | 23.0289 | 20.0580 | 26.0239 |

| Lev | 8236 | 0.4298 | 0.1958 | 0.2765 | 0.4234 | 0.5757 | 0.0552 | 0.8977 |

| Roa | 8236 | 0.0363 | 0.0610 | 0.0119 | 0.0334 | 0.0646 | −0.2315 | 0.2087 |

| Age | 8236 | 2.3674 | 0.5057 | 1.9459 | 2.3026 | 2.8332 | 1.0986 | 3.2189 |

| Board | 8236 | 2.1376 | 0.1947 | 1.9459 | 2.1972 | 2.1972 | 1.6094 | 2.7081 |

| Bm | 8236 | 0.5817 | 0.2461 | 0.3860 | 0.5678 | 0.7669 | 0.1197 | 1.1195 |

| Top1 | 8236 | 0.3298 | 0.1397 | 0.2217 | 0.3065 | 0.4214 | 0.0908 | 0.7210 |

| Grow | 8236 | 0.1712 | 0.3823 | −0.0190 | 0.1092 | 0.2648 | −0.4782 | 2.3539 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Rd_Assets | Rd_Assets | Patent | Patent | F.Rd_Assets | F.Rd_Assets | F.Rd_Assets | F.Patent | |

| Slack | 0.0053 *** | 0.0012 ** | −0.0458 ** | 0.0780 ** | 0.0052 *** | 0.0010 | −0.0300 | 0.0927 ** |

| (19.26) | (2.13) | (−2.29) | (2.13) | (16.47) | (1.60) | (−1.29) | (2.23) | |

| Slack2 | −0.0004 *** | −0.0001 *** | −0.0029 | −0.0100 *** | −0.0004 *** | −0.0001 * | −0.0044 * | −0.0116 *** |

| (−14.46) | (−2.74) | (−1.43) | (−3.62) | (−12.17) | (−1.95) | (−1.91) | (−3.68) | |

| Size | 0.0001 | 0.5570 *** | −0.0000 | 0.5798 *** | ||||

| (0.22) | (17.33) | (−0.06) | (15.87) | |||||

| Lev | 0.0021 | −0.2651 | 0.0026 | −0.1880 | ||||

| (0.80) | (−1.41) | (0.89) | (−0.88) | |||||

| Roa | 0.0364 *** | −0.2420 | 0.0480 *** | 0.3416 | ||||

| (6.85) | (−0.81) | (6.69) | (0.81) | |||||

| Age | −0.0015 ** | −0.0420 | −0.0012 | −0.0500 | ||||

| (−2.13) | (−0.88) | (−1.61) | (−0.94) | |||||

| Board | −0.0008 | 0.2585 ** | −0.0001 | 0.2842 ** | ||||

| (−0.43) | (2.16) | (−0.04) | (2.15) | |||||

| Bm | −0.0162 *** | −0.7885 *** | −0.0133 *** | −0.8897 *** | ||||

| (−7.52) | (−6.20) | (−5.44) | (−5.83) | |||||

| Top1 | −0.0028 | −0.0841 | −0.0030 | −0.0734 | ||||

| (−1.13) | (−0.47) | (−1.09) | (−0.37) | |||||

| Grow | −0.0013 *** | −0.0255 | −0.0007 | 0.0263 | ||||

| (−2.73) | (−0.72) | (−1.26) | (0.65) | |||||

| _cons | 0.0142 *** | 0.0173 * | 1.5375 *** | −11.9767 *** | 0.0145 *** | 0.0191 * | 1.6055 *** | −12.3838 *** |

| (37.84) | (1.88) | (55.97) | (-18.59) | (33.18) | (1.87) | (49.57) | (−17.18) | |

| Ind/Year | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 8236 | 8236 | 8236 | 8236 | 6094 | 6094 | 6094 | 6094 |

| adj. R2 | 0.050 | 0.280 | 0.010 | 0.282 | 0.051 | 0.280 | 0.010 | 0.287 |

| Enterprise Innovation | The Extreme Point of Unabsorbed Slack Resources (Slack) |

|---|---|

| Rd_assets | 4.9431 |

| F.Rd_assets | 5.3055 |

| Patent | 3.9013 |

| F.Patent | 3.9859 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Rd_Assets | Patent | F.Rd_Assets | F.Patent | |

| Slack | 0.0020 *** | 0.0981 *** | 0.0019 *** | 0.1166 *** |

| (3.20) | (2.60) | (2.69) | (2.75) | |

| Slack2 | −0.0001 ** | −0.0096 *** | −0.0001 | −0.0110 *** |

| (−2.37) | (−3.45) | (−1.56) | (−3.48) | |

| Slack × EU | −0.0007 *** | −0.0184 *** | −0.0008 *** | −0.0228 *** |

| (−5.52) | (−2.81) | (−6.20) | (−3.58) | |

| Size | 0.0001 | 0.5573 *** | 0.0000 | 0.5810 *** |

| (0.25) | (17.40) | (0.02) | (15.96) | |

| Lev | 0.0016 | −0.2754 | 0.0020 | −0.2043 |

| (0.65) | (−1.46) | (0.70) | (−0.95) | |

| Roa | 0.0320 *** | −0.3508 | 0.0432 *** | 0.2044 |

| (6.13) | (−1.17) | (6.16) | (0.48) | |

| Age | −0.0012 * | −0.0356 | −0.0010 | −0.0427 |

| (−1.77) | (−0.74) | (−1.29) | (−0.80) | |

| Board | −0.0009 | 0.2544 ** | −0.0003 | 0.2772 ** |

| (−0.52) | (2.13) | (−0.16) | (2.10) | |

| Bm | −0.0163 *** | −0.7895 *** | −0.0134 *** | −0.8926 *** |

| (−7.64) | (−6.23) | (−5.54) | (−5.88) | |

| Top1 | −0.0027 | −0.0820 | −0.0030 | −0.0728 |

| (−1.10) | (−0.45) | (−1.09) | (−0.37) | |

| Grow | 0.0003 | 0.0148 | 0.0012 ** | 0.0800* |

| (0.51) | (0.41) | (2.12) | (1.96) | |

| _cons | 0.0169 * | −11.9868 *** | 0.0183 * | −12.4081 *** |

| (1.86) | (−18.64) | (1.81) | (−17.25) | |

| Ind/Year | YES | YES | YES | YES |

| N | 8236 | 8236 | 6094 | 6094 |

| adj. R2 | 0.290 | 0.283 | 0.291 | 0.289 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Rd_Assets | Patent | F.Rd_Assets | F.Patent | |

| Slack | −0.0013 * | −0.0745 | −0.0013 * | −0.0290 |

| (−1.65) | (−1.56) | (−1.70) | (−0.50) | |

| Slack2 | −0.0001 ** | −0.0093 *** | −0.0001 | −0.0105 *** |

| (−2.33) | (−3.31) | (−1.53) | (−3.25) | |

| Slack × MA_Score | 0.0004 *** | 0.0239 *** | 0.0003 *** | 0.0185 *** |

| (4.33) | (4.96) | (4.16) | (2.98) | |

| Size | 0.0001 | 0.5639 *** | 0.0000 | 0.5847 *** |

| (0.25) | (17.86) | (0.00) | (16.33) | |

| Lev | 0.0016 | −0.2316 | 0.0016 | −0.1506 |

| (0.62) | (−1.25) | (0.55) | (−0.71) | |

| Roa | 0.0339 *** | −0.3140 | 0.0449 *** | 0.3389 |

| (6.33) | (−1.05) | (6.24) | (0.81) | |

| Age | −0.0013 * | −0.0295 | −0.0010 | −0.0368 |

| (−1.96) | (−0.63) | (−1.40) | (−0.71) | |

| Board | −0.0012 | 0.2281 * | −0.0005 | 0.2478 * |

| (−0.70) | (1.95) | (−0.26) | (1.90) | |

| Bm | −0.0162 *** | −0.8134 *** | −0.0135 *** | −0.8971 *** |

| (−7.64) | (−6.48) | (−5.64) | (−5.97) | |

| Top1 | −0.0030 | −0.1114 | −0.0031 | −0.1042 |

| (−1.21) | (−0.63) | (−1.15) | (−0.53) | |

| Grow | −0.0012 ** | −0.0176 | −0.0005 | 0.0358 |

| (−2.41) | (−0.50) | (−1.03) | (0.89) | |

| _cons | 0.0178 ** | −12.0811 *** | 0.0196 ** | −12.4589 *** |

| (1.99) | (−19.07) | (1.96) | (−17.64) | |

| Controls | YES | YES | YES | YES |

| Ind/Year | YES | YES | YES | YES |

| N | 8538 | 8538 | 6350 | 6350 |

| adj. R2 | 0.282 | 0.288 | 0.281 | 0.291 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Sun, Z.; Sun, M. Unabsorbed Slack Resources and Enterprise Innovation: The Moderating Effect of Environmental Uncertainty and Managerial Ability. Sustainability 2022, 14, 3782. https://doi.org/10.3390/su14073782

Zhang Y, Sun Z, Sun M. Unabsorbed Slack Resources and Enterprise Innovation: The Moderating Effect of Environmental Uncertainty and Managerial Ability. Sustainability. 2022; 14(7):3782. https://doi.org/10.3390/su14073782

Chicago/Turabian StyleZhang, Yan, Ziyuan Sun, and Mengxin Sun. 2022. "Unabsorbed Slack Resources and Enterprise Innovation: The Moderating Effect of Environmental Uncertainty and Managerial Ability" Sustainability 14, no. 7: 3782. https://doi.org/10.3390/su14073782

APA StyleZhang, Y., Sun, Z., & Sun, M. (2022). Unabsorbed Slack Resources and Enterprise Innovation: The Moderating Effect of Environmental Uncertainty and Managerial Ability. Sustainability, 14(7), 3782. https://doi.org/10.3390/su14073782