Developing a Green Governance Framework for the Performance Enhancement of the Oil and Gas Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Green Governance

2.1.1. Enterprise Risk Management

2.1.2. Sustainability Practices

2.1.3. Green Board Committees

2.2. Conceptualisation of Firm Performance

2.3. Theoretical Framework

Green Governance and Firm Performance: Signaling Theory and Stakeholder Theory

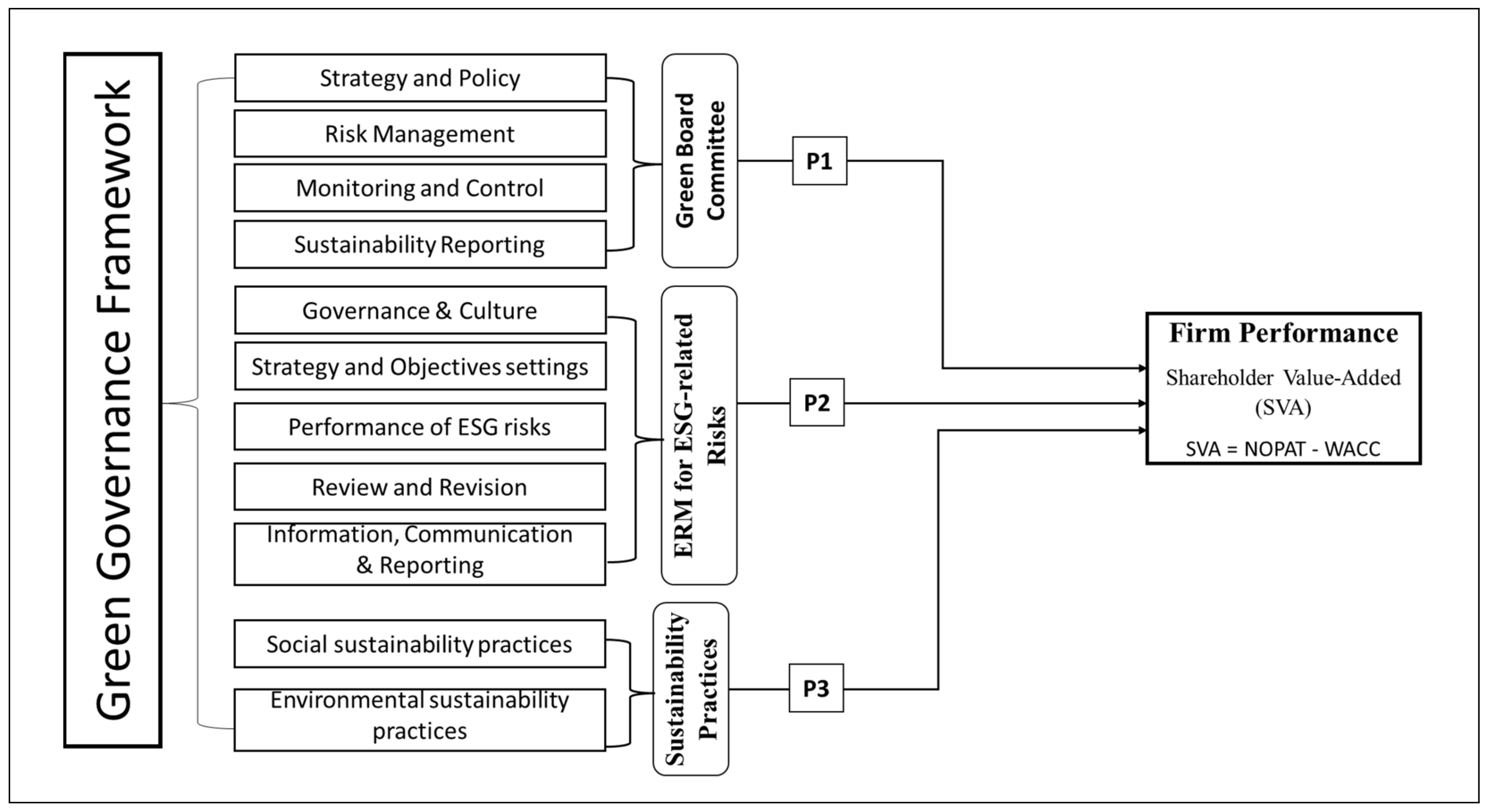

2.4. Conceptual Framework

2.5. Development of Propositions

2.5.1. Green Board Committees and Firm Performance

2.5.2. Enterprise Risk Management and Firm Performance

2.5.3. Social and Environmental Sustainability Practices and Firm Performance

3. Methodology

3.1. Sampling and Proposed Estimating Models

3.2. Measurement of Variables

4. Discussion

4.1. Theoretical Implication

4.2. Practical Implication

4.3. Policy Implications

5. Conclusions

Limitations and Future Directions

Authors Contribution

Funding

Conflicts of Interest

Appendix A

| Dimensions (D) | S. no | Proxy Elements |

| Governance and Culture for ESG-Related Risks (D1) | 1 | A charter of the board for ESG-related risks |

| 2 | Board’s approval on integrating ESG risks into the organization’s mission and vision | |

| 3 | Board’s training and educational programs on ESG-related risks | |

| 4 | Formation of board committee for ESG related risks | |

| 5 | Communication of board committees on ESG-related risks | |

| 6 | Knowledge and awareness sessions to management on ESG risks | |

| 7 | Board’s report on ESG-related risks | |

| Strategy and Objective-Setting for ESG-Related Risks (D2) | 8 | The business model for ESG-related risks |

| 9 | SWOT analysis of ESG-related risks | |

| 10 | Mitigation plan for ESG-related risks | |

| 11 | Organization’s risk appetite for ESG-related risks | |

| 12 | Linking ESG-related risks to shareholder value creation | |

| Performance for ESG-Related Risks (D3) | ||

| Event identification | 13 | Identification of CO2 emissions risk |

| 14 | Identification of product carbon footprint risk | |

| 15 | Identification of biodiversity risk | |

| 16 | Identification of water risk | |

| 17 | Identification of toxic emissions and waste | |

| 18 | Identification of health and safety risks | |

| 19 | Identification of reputational risk | |

| 20 | Identification of product quality risk | |

| 21 | Identification of fraudulent governance risk | |

| 22 | Identification of compliance risk | |

| 23 | Identification of litigation risk | |

| 24 | Identification of credit risk | |

| 25 | Identification of liquidity risk | |

| 26 | Identification of market risk | |

| 27 | Identification of operational risk | |

| 28 | Identification of data security risks | |

| 29 | Identification of IT risks | |

| Assessing risk | 30 | Appropriate assessment of CO2 emissions risk |

| 31 | Appropriate assessment of product carbon footprint risk | |

| 32 | Appropriate assessment of biodiversity risk | |

| 33 | Appropriate assessment of water risk | |

| 34 | Appropriate assessment of toxic emissions and waste | |

| 35 | Appropriate assessment of health and safety risk | |

| 36 | Appropriate assessment of reputational risk | |

| 37 | Appropriate assessment of product quality risk | |

| 38 | Appropriate assessment of fraudulent governance risk | |

| 39 | Appropriate assessment of compliance risk | |

| 40 | Appropriate assessment of litigation risk | |

| 41 | Appropriate assessment of credit risk | |

| 42 | Appropriate assessment of liquidity risk | |

| 43 | Appropriate assessment of market risk | |

| 44 | Appropriate assessment of operational risk | |

| 45 | Appropriate assessment of data security risks | |

| 46 | Appropriate assessment of IT risks | |

| Implement Risk Responses | 47 | Actions to mitigate CO2 emissions risk |

| 48 | Actions to mitigate product carbon footprint risk | |

| 49 | Actions to mitigate biodiversity risk | |

| 50 | Actions to mitigate water risk | |

| 51 | Actions to mitigate toxic emissions and waste | |

| 52 | Actions to mitigate health and safety risk | |

| 53 | Actions to mitigate reputational risk | |

| 54 | Actions to mitigate product quality risk | |

| 55 | Actions to mitigate governance fraudulent risk | |

| 56 | Actions to mitigate compliance risk | |

| 57 | Actions to mitigate litigation risk | |

| 58 | Actions to mitigate credit risk | |

| 59 | Actions to mitigate liquidity risk | |

| 60 | Actions to mitigate market risk | |

| 61 | Actions to mitigate operational risk | |

| 62 | Actions to mitigate data security risks | |

| 63 | Actions to mitigate IT risks | |

| Review and Revision for ESG-Related Risks (D4) | 64 | Monitoring changes to the internal and external environment affecting organization’s risk profile |

| 65 | Revision of strategies related to ESG risks | |

| 66 | Due diligence of ESG-related risk management process | |

| 67 | Revision of ERM processes and capabilities to enhance the management of ESG-related risks | |

| Information, Communication, and Reporting for ESG-Related Risks (D5) | 68 | Reporting information on ESG risk to board of directors and management |

| 69 | Communicating ESG risks to shareholders in annual general meeting | |

| 70 | Disclosure of ESG-related risks to all stakeholder groups | |

| 71 | Board’s approval in annual reports on data of ESG-related risks. | |

References

- Ozkan, N.; Cakan, S.; Kayacan, M. Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanb. Rev. 2017, 17, 190–198. [Google Scholar] [CrossRef] [Green Version]

- Shah, S.A.A.; Shah, S.Q.A.; Tahir, M. Determinants of CO2 emissions: Exploring the unexplored in low-income countries. Environ. Sci. Pollut. Res. 2022, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Rane, S.B.; Potdar, P.R.; Rane, S. Development of Project Risk Management framework based on Industry 4.0 technologies. Benchmarking Int. J. 2021, 28, 1451–1481. [Google Scholar] [CrossRef]

- Elsayed, N.; Ammar, S. Sustainability governance and legitimization processes: Gulf of Mexico oil spill. Sustain. Account. Manag. Policy J. 2020, 11, 253–278. [Google Scholar]

- Jan, A.A.; Lai, F.-W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean. Prod. 2021, 315, 128099. [Google Scholar] [CrossRef]

- Khan, P.A.; Johl, S.K.; Akhtar, S. Vinculum of Sustainable Development Goal Practices and Firms’ Financial Performance: A Moderation Role of Green Innovation. J. Risk Financ. Manag. 2022, 15, 96. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.-W.; Draz, M.U.; Tahir, M.; Ali, S.E.A.; Zahid, M.; Shad, M.K. Integrating sustainability practices into islamic corporate governance for sustainable firm performance: From the lens of agency and stakeholder theories. Qual. Quant. 2021, 1–24. [Google Scholar] [CrossRef]

- Abdul Manab, N.; Abdul Aziz, N.A.; Othman, S.N. The effect of corporate governance compliance and sustainability risk management (SRM) success factors on firm survival. Int. J. Dev. Sustain. 2017, 6, 1559–1575. [Google Scholar]

- COSO; WBCSD. Enterprise Risk Management: Applying Enterprise Risk Management to Environmental, Social and Governance-Related Risks. 2018. Available online: https://www.coso.org/Documents/COSO-WBCSD-ESGERM-Guidance-Full.pdf (accessed on 21 July 2021).

- Fletcher, L. Beyond the Cycle: What’s on the Horizon for Oil and Gas Majors? 2019. Available online: https://www.cdp.net/en/articles/investor/beyond-the-cycle-whats-on-the-horizon-for-oil-and-gas-majors (accessed on 15 September 2021).

- Kaur, G.; Say, T.L. Petronas’ Foiled Canadian Dream. The Star. Available online: https://www.thestar.com.my/business/business-news/2017/07/29/why-the-pullback-in-canada (accessed on 15 September 2021).

- Khan, I. HASCOL Petroleum Corruption: Senate Panel Summons SECP, FIA, SBP. The News. Available online: https://www.thenews.com.pk/print/869379-hascol-petroleum-corruption-senate-panel-summons-secp-fia-sbp (accessed on 15 September 2021).

- Post, C.; Rahman, N.; Rubow, E. Green Governance: Boards of Directors’ Composition and Environmental Corporate Social Responsibility. Bus. Soc. 2011, 50, 189–223. [Google Scholar] [CrossRef]

- Khan, P.A.; Johl, S.K. Does adoption of ISO 56002-2019 and green innovation reporting enhance the firm sustainable development goal performance? An emerging paradigm. Bus. Strategy Environ. 2021, 30, 2922–2936. [Google Scholar] [CrossRef]

- Khan, P.A.; Johl, S.K. Nexus of Comprehensive Green Innovation, Environmental Management System-14001-2015 and Firm Performance. Cogent Bus. Manag. 2019, 6, 1691833. [Google Scholar] [CrossRef]

- Toha, M.A.; Johl, S.K.; Khan, P.A. Firm’s Sustainability and Societal Development from the Lens of Fishbone Eco-Innovation: A Moderating Role of ISO 14001-2015 Environmental Management System. Processes 2020, 8, 1152. [Google Scholar] [CrossRef]

- Shah, S.Q.A.; Lai, F.-W.; Shad, M.K.; Konečná, Z.; Goni, F.A.; Chofreh, A.G.; Klemeš, J.J. The Inclusion of Intellectual Capital into the Green Board Committee to Enhance Firm Performance. Sustainability 2021, 13, 10849. [Google Scholar] [CrossRef]

- Mahmood, M.; Orazalin, N. Green governance and sustainability reporting in Kazakhstan’s oil, gas, and mining sector: Evidence from a former USSR emerging economy. J. Clean. Prod. 2017, 164, 389–397. [Google Scholar] [CrossRef]

- Li, W.; Xu, J.; Zheng, M. Green Governance: New Perspective from Open Innovation. Sustainability 2018, 10, 3845. [Google Scholar] [CrossRef] [Green Version]

- Lin, R.; Gui, Y.; Xie, Z.; Liu, L. Green Governance and International Business Strategies of Emerging Economies’ Multinational Enterprises: A Multiple-Case Study of Chinese Firms in Pollution-Intensive Industries. Sustainability 2019, 11, 1013. [Google Scholar] [CrossRef] [Green Version]

- Li, W.; Zheng, M.; Zhang, Y.; Cui, G. Green governance structure, ownership characteristics, and corporate financing constraints. J. Clean. Prod. 2020, 260, 121008. [Google Scholar] [CrossRef]

- Li, X.; Li, W.; Zhang, Y. Family Control, Political Connection, and Corporate Green Governance. Sustainability 2020, 12, 7068. [Google Scholar] [CrossRef]

- MCCG. Malaysian Code on Corporate Governance; Securities Commission Malaysia: Kuala Lumpur, Malaysia, 2021. [Google Scholar]

- Dieng, B.; Pesqueux, Y. On ‘green governance’. Int. J. Sustain. Dev. 2017, 20, 111–123. [Google Scholar] [CrossRef]

- Kuo, L.; Yu, H.-C.; Chang, B.-G. The signals of green governance on mitigation of climate change—Evidence from Chinese firms. Int. J. Clim. Chang. Strat. Manag. 2015, 7, 154–171. [Google Scholar] [CrossRef]

- Kantabutra, S.; Ketprapakorn, N. Toward a theory of corporate sustainability: A theoretical integration and exploration. J. Clean. Prod. 2020, 270, 122292. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.-W.; Shamim, A.; McShane, M. The efficacy of sustainability reporting towards cost of debt and equity reduction. Environ. Sci. Pollut. Res. 2020, 27, 22511–22522. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.-W.; Fatt, C.L.; Klemeš, J.J.; Bokhari, A. Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. J. Clean. Prod. 2019, 208, 415–425. [Google Scholar] [CrossRef]

- Shahbaz, M.; Karaman, A.S.; Kilic, M.; Uyar, A. Board attributes, CSR engagement, and corporate performance: What is the nexus in the energy sector? Energy Policy 2020, 143, 111582. [Google Scholar] [CrossRef]

- Ahmad, N.N.; Abdullah, W.M.T.W. i-Green Governance Accountability System [i-GASS]. Glob. Bus. Manag. Res. 2018, 10, 1128–1132. [Google Scholar]

- Ali, S.E.A.; Lai, F.-W.; Dominic, P.D.D.; Brown, N.J.; Lowry, P.B.B.; Ali, R.F. Stock market reactions to favorable and unfavorable information security events: A systematic literature review. Comput. Secur. 2021, 110, 102451. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.-W.; Shamim, A.; McShane, M.; Zahid, S.M. The relationship between enterprise risk management and cost of capital. Asian Acad. Manag. J. 2022. Available online: https://ejournal.usm.my/aamj/article/view/170 (accessed on 6 February 2022).

- Ali, S.E.A.; Lai, F.-W.; Hassan, R.; Shad, M.K. The Long-Run Impact of Information Security Breach Announcements on Investors’ Confidence: The Context of Efficient Market Hypothesis. Sustainability 2021, 13, 1066. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.-W. Enterprise risk management implementation and firm performance: Evidence from the Malaysian oil and gas industry. Int. J. Bus. Manag. 2019, 14, 47–53. [Google Scholar] [CrossRef] [Green Version]

- Shad, M.K.; Lai, F.W. A Conceptual Framework for Enterprise Risk Management performance measure through Economic Value Added. Glob. Bus. Manag. Res. 2015, 7, 1–11. [Google Scholar]

- Shad, M.K.; Lai, F.W. Enterprise Risk Management and Firm Performance Validated Through Economic Value Added Factors. Int. J. Econ. Stat. 2015, 3, 148–154. [Google Scholar]

- Tiganoaia, B.; Niculescu, A.; Negoita, O.; Popescu, M. A New Sustainable Model for Risk Management—RiMM. Sustainability 2019, 11, 1178. [Google Scholar] [CrossRef] [Green Version]

- Jagoda, K.; Wojcik, P. Implementation of risk management and corporate sustainability in the Canadian oil and gas industry. Account. Res. J. 2019, 32, 381–398. [Google Scholar]

- Zou, X.; Isa, C.R.; Rahman, M. Valuation of enterprise risk management in the manufacturing industry. Total Qual. Manag. Bus. Excel. 2019, 30, 1389–1410. [Google Scholar] [CrossRef]

- COSO. Enterprise Risk Management: Integrating with Strategy and Performance. 2017. Available online: https://www.coso.org/documents/2017-coso-erm-integrating-with-strategy-and-performance-executive-summary.pdf (accessed on 11 October 2020).

- Bouslah, K.; Kryzanowski, L.; M’Zali, B. Social Performance and Firm Risk: Impact of the Financial Crisis. J. Bus. Ethics 2018, 149, 643–669. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Maletic, M.; Maletic, D.; Dahlgaard, J.; Dahlgaard-Park, S.M.; Gomišcek, B. Do corporate sustainability practices enhance organizational economic performance? Int. J. Qual. Serv. Sci. 2015, 7, 184–200. [Google Scholar]

- Hamad, S.; Draz, M.U.; Lai, F.-W. The Impact of Corporate Governance and Sustainability Reporting on Integrated Reporting: A Conceptual Framework. SAGE Open 2020, 10. [Google Scholar] [CrossRef]

- Aras, G.; Tezcan, N.; Furtuna, O.K. Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector. J. Clean. Prod. 2018, 185, 600–609. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and social disclosures: Link with corporate financial performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef] [Green Version]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Burke, J.J.; Hoitash, R.; Hoitash, U. The Heterogeneity of Board-Level Sustainability Committees and Corporate Social Performance. J. Bus. Ethics 2019, 154, 1161–1186. [Google Scholar] [CrossRef]

- Klettner, A.; Clarke, T.; Boersma, M. The Governance of Corporate Sustainability: Empirical Insights into the Development, Leadership and Implementation of Responsible Business Strategy. J. Bus. Ethics 2014, 122, 145–165. [Google Scholar] [CrossRef]

- Gennari, F.; Salvioni, D.M. CSR committees on boards: The impact of the external country level factors. J. Manag. Gov. 2019, 23, 759–785. [Google Scholar] [CrossRef]

- Birindelli, G.; Dell’Atti, S.; Iannuzzi, A.P.; Savioli, M. Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System. Sustainability 2018, 10, 4699. [Google Scholar] [CrossRef]

- Biswas, P.K.; Mansi, M.; Pandey, R. Board composition, sustainability committee and corporate social and environmental performance in Australia. Pac. Account. Rev. 2018, 30, 517–540. [Google Scholar] [CrossRef]

- Rodrigue, M.; Magnan, M.; Cho, C.H. Is Environmental Governance Substantive or Symbolic? An Empirical Investigation. J. Bus. Ethics 2013, 114, 107–129. [Google Scholar] [CrossRef]

- Shaukat, A.; Qiu, Y.; Trojanowski, G. Board Attributes, Corporate Social Responsibility Strategy, and Corporate Environmental and Social Performance. J. Bus. Ethics 2016, 135, 569–585. [Google Scholar] [CrossRef] [Green Version]

- Wach, D.; Stephan, U.; Gorgievski, M. More than money: Developing an integrative multi-factorial measure of entrepreneurial success. Int. Small Bus. J. Res. Entrep. 2015, 34, 1098–1121. [Google Scholar] [CrossRef] [Green Version]

- Ali, S.E.A.; Rizvi, S.S.H.; Lai, F.-W.; Ali, R.F.; Jan, A.A. Predicting Delinquency on Mortgage Loans: An Exhaustive Parametric Comparison of Machine Learning Techniques. Int. J. Ind. Eng. Manag. 2021, 12, 1–13. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Translating Strategy into Action; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Largani, M.S.; Kaviani, M.; Abdollahpour, A. A review of the application of the concept of Shareholder Value Added (SVA) in financial decisions. Procedia Soc. Behav. Sci. 2012, 40, 490–497. [Google Scholar] [CrossRef] [Green Version]

- Fernández, P. A Definition of Shareholder Value Creation; IESE Research Papers D/448; IESE Business School: Barcelona, Spain, 2002. [Google Scholar]

- Rappaport, A. Creating Shareholder Value: The New Standard for Business Performance; Free Press: New York, NY, USA, 1986. [Google Scholar]

- Spence, M. Job Market Signaling*. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Ardianto, D.; Rivandi, M. Pengaruh Enterprise Risk Management Disclosure, Intellectual Capital Disclosure Dan Struktur Pengelolaan Terhadap Nilai Perusahaan. J. Profita Komun. Ilm. Perpajak. 2018, 11, 284–305. [Google Scholar] [CrossRef]

- Pratama, B.C.; Sasongko, K.M.; Innayah, M.N. Sharia Firm Value: The Role of Enterprise Risk Management Disclosure, Intellectual Capital Disclosure, and Intellectual Capital. Shirkah J. Econ. Bus. 2020, 5, 101–124. [Google Scholar] [CrossRef]

- Haninun, H.; Lindrianasari, L.; Denziana, A. The effect of environmental performance and disclosure on financial performance. Int. J. Trade Glob. Mark. 2018, 11, 138–148. [Google Scholar] [CrossRef]

- Santis, P.; Albuquerque, A.; Lizarelli, F. Do sustainable companies have a better financial performance? A study on Brazilian public companies. J. Clean. Prod. 2016, 133, 735–745. [Google Scholar] [CrossRef]

- Lai, F.-W.; Shad, M.K.; Shah, S.Q.A. Conceptualizing Corporate Sustainability Reporting and Risk Management Towards Green Growth in the Malaysian Oil and Gas Industry. SHS Web Conf. 2021, 124, 04001. [Google Scholar] [CrossRef]

- Cancela, B.L.; Neves, M.E.D.; Rodrigues, L.L.; Dias, A.C.G. The influence of corporate governance on corporate sustainability: New evidence using panel data in the Iberian macroeconomic environment. Int. J. Account. Inf. Manag. 2020, 28, 785–806. [Google Scholar] [CrossRef]

- Spitzeck, H. The development of governance structures for corporate responsibility. Corp. Gov. Int. J. Bus. Soc. 2009, 9, 495–505. [Google Scholar] [CrossRef]

- Chen, F.; Ngniatedema, T.; Li, S. A cross-country comparison of green initiatives, green performance and financial performance. Manag. Decis. 2018, 56, 1008–1032. [Google Scholar] [CrossRef]

- Noja, G.; Cristea, M.; Jurcut, C.; Buglea, A.; Popa, I.L. Management Financial Incentives and Firm Performance in a Sustainable Development Framework: Empirical Evidence from European Companies. Sustainability 2020, 12, 7247. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strat. Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Baalouch, F.; Ayadi, S.D.; Hussainey, K. A study of the determinants of environmental disclosure quality: Evidence from French listed companies. J. Manag. Gov. 2019, 23, 939–971. [Google Scholar] [CrossRef] [Green Version]

- Baxter, R.; Bedard, J.C.; Hoitash, R.; Yezegel, A. Enterprise Risk Management Program Quality: Determinants, Value Relevance, and the Financial Crisis. Contemp. Account. Res. 2013, 30, 1264–1295. [Google Scholar] [CrossRef]

- Ping, T.A.; Muthuveloo, R. The Impact of Enterprise Risk Management on Firm Performance: Evidence from Malaysia. Asian Soc. Sci. 2015, 11, 149–159. [Google Scholar] [CrossRef] [Green Version]

- Froot, K.A.; Scharfstein, D.S.; Stein, J.C. Risk Management: Coordinating Corporate Investment and Financing Policies. J. Financ. 1993, 48, 1629–1658. [Google Scholar] [CrossRef] [Green Version]

- Modigliani, F.; Miller, M.H. Corporate Income Taxes and the Cost of Capital: A Correction. Am. Econ. Rev. 1963, 53, 433–443. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- González, L.O.; Santomil, P.D.; Herrera, A.T. The effect of Enterprise Risk Management on the risk and the performance of Spanish listed companies. Eur. Res. Manag. Bus. Econ. 2020, 26, 111–120. [Google Scholar] [CrossRef]

- Saeidi, P.; Saeidi, S.P.; Gutierrez, L.; Streimikiene, D.; Alrasheedi, M.; Saeidi, S.P.; Mardani, A. The influence of enterprise risk management on firm performance with the moderating effect of intellectual capital dimensions. Econ. Res./Ekon. Istraživanja 2021, 34, 122–151. [Google Scholar] [CrossRef]

- Lai, F.-W.; Shad, M.K. Economic Value-Added Analysis for Enterprise Risk Management. Glob. Bus. Manag. Res. 2017, 9, 338–347. [Google Scholar]

- Lai, F.W.; Azizan, N.A.; Samad, M.F.A. A strategic framework for value-enhancing enterprise risk management. J. Glob. Bus. Econ. 2011, 2, 23–47. [Google Scholar]

- Faisal, F.; Situmorang, L.S.; Achmad, T.; Prastiwi, A. The Role of Government Regulations in Enhancing Corporate Social Responsibility Disclosure and Firm Value. J. Asian Financ. Econ. Bus. 2020, 7, 509–518. [Google Scholar] [CrossRef]

- Orazalin, N.; Mahmood, M.; Narbaev, T. The impact of sustainability performance indicators on financial stability: Evidence from the Russian oil and gas industry. Environ. Sci. Pollut. Res. 2019, 26, 8157–8168. [Google Scholar] [CrossRef] [PubMed]

- Zahid, M.; Ghazali, Z. Corporate Sustainability Practices and Firm’s Financial Performance: The Driving Force of Integrated Management System. Glob. Bus. Manag. Res. 2017, 9, 479–491. [Google Scholar]

- Jan, A.A.; Tahir, M.; Lai, F.-W.; Jan, A.; Mehreen, M.; Hamad, S. Bankruptcy Profile of the Islamic Banking Industry: Evidence from Pakistan. Bus. Manag. Strat. 2019, 10, 265. [Google Scholar] [CrossRef] [Green Version]

- Murray, A.; Sinclair, D.; Power, D.; Gray, R. Do financial markets care about social and environmental disclosure? Account. Audit. Account. J. 2006, 19, 228–255. [Google Scholar] [CrossRef]

- Benlemlih, M.; Shaukat, A.; Qiu, Y.; Trojanowski, G. Environmental and Social Disclosures and Firm Risk. J. Bus. Ethics 2018, 152, 613–626. [Google Scholar] [CrossRef]

- Breuer, W.; Müller, T.; Rosenbach, D.; Salzmann, A. Corporate social responsibility, investor protection, and cost of equity: A cross-country comparison. J. Bank. Financ. 2018, 96, 34–55. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

- Shah, S.Q.A.; Khan, I.; Tahir, M. Factors Affecting Liquidity of Banks: Empirical Evidence from the Banking Sector of Pakistan. Colombo Bus. J. 2018, 9, 1–18. [Google Scholar] [CrossRef]

- Tahir, M.; Shah, S.Q.A.; Khan, M.M.; Afridi, M.A. Intellectual Capital and Financial Performance of Banks in Pakistan. Dialogue 2018, 13, 105–117. [Google Scholar]

- Tahir, M.; Jan, A.A.; Shah, S.Q.A.; Alam, A.; Afridi, M.A.; Tariq, Y.B.; Bashir, M.F. Foreign inflows and economic growth in Pakistan: Some new insights. J. Chin. Econ. Foreign Trade Stud. 2020, 13, 97–113. [Google Scholar] [CrossRef]

- Bursa Malaysia. Sustainability Reporting Guide, 2nd ed.; Bursa Malaysia: Kuala Lumpur, Malaysia, 2018; pp. 1–102. [Google Scholar]

- Lai, F.W. Shareholders value creation through enterprise risk management. Int. J. Bus. Res. 2010, 10, 44–57. [Google Scholar]

- Liu, W.; Shao, X.; De Sisto, M.; Li, W.H. A new approach for addressing endogeneity issues in the relationship between corporate social responsibility and corporate financial performance. Financ. Res. Lett. 2021, 39, 101623. [Google Scholar] [CrossRef]

| Reference | Explanatory Variables | Dependent Variable | Methodology | Theory | Country/Region |

|---|---|---|---|---|---|

| Shah et al. [17] | Green board committees | Shareholder value-added | Content analysis | Agency and stakeholder theory | Malaysia |

| Li et al. [21] | Green governance structure, ownership characteristics | Financial constraints | Content analysis | Signaling theory | China |

| Li et al. [22] | Family ownership | Green governance | Content analysis | Theory of social-emotional wealth | China |

| Shad et al. [27] | Sustainability practices | Cost of capital | Content analysis | Signaling theory | Malaysia |

| Abdul Manab et al. [8] | Corporate governance compliance, sustainable risk management | Firm survival | Questionnaire survey-structural equation model | Risk management and compliance theory | Malaysia |

| Shad et al. [28] | Enterprise risk management, sustainability practices | Economic value added | Content analysis | Modern portfolio and stakeholder theory | Malaysia |

| Lin et al. [20] | Environmental regulations, foreign direct investment policies | Business strategies | Content analysis | Resource-based view theory | China |

| Mahmood and Orazalin [18] | Board independence, the board size, board committees, board diversity | Sustainability reporting | Content analysis | Stakeholder and resource dependency theory | Kazakhstan |

| Shahbaz et al. [29] | Board independence, CSR committee, gender diversity, board diligence | CSR Performance, Tobin’s Q, Return of assets | Content and ratio analysis | Agency and stakeholder theory | Global energy sector |

| Li et al. [19] | Open innovation | Sustainability performance | Qualitative techniques | Innovation, governance, and resource scarcity theory. | China |

| Ahmad and Abdullah [30] | A green governance accountability system | Sustainability performance | Qualitative techniques | Accountability theory | Malaysia |

| Kuo et al. [25] | Environmental management, green innovation, greenhouse, and carbon emission | Climate change | Coding and content analysis | Signaling and stakeholder theory | China |

| Khan et al. [14] | ISO 56002-2019, green innovation | Sustainable development | Content analysis | Disclosure, legitimacy, institutional and stakeholder theory | Malaysia |

| Toha et al. [16] | Eco-innovation | Social performance | Content analysis | Resource-based view theory | Malaysia |

| S. No | Enterprise Risk Management Frameworks | Sustainability Frameworks |

|---|---|---|

| 1 | ISO31000: 2009–2018 Risk Management-Principles and Guidelines on Implementation of Enterprise Risk Management | Global Reporting Initiative (GRI) |

| 2 | Federation of European Risk Management Associations (FERMA). A Risk Management Standard | Task Force on Climate-related Financial Disclosures (TCFD) |

| 3 | COSO 2004: Enterprise Risk Management Integrated Framework | Sustainability Accounting Standards Board (SASB) |

| 4 | COSO 2018: Enterprise Risk Management for Environmental-, Social-, and Governance-related Risks. | Global Real Estate Sustainability Benchmark (GRESB) |

| 5 | RMM—Risk Maturity Model | Dow Jones Sustainability Indexes (DJSI) |

| 6 | AS/NZS 4360 (2009) | The Framework for Policy Coherence for Sustainable Development (OECD-PCSD) |

| 7 | ISO 31000: 2018 | ISO 26000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shah, S.Q.A.; Lai, F.-W.; Shad, M.K.; Jan, A.A. Developing a Green Governance Framework for the Performance Enhancement of the Oil and Gas Industry. Sustainability 2022, 14, 3735. https://doi.org/10.3390/su14073735

Shah SQA, Lai F-W, Shad MK, Jan AA. Developing a Green Governance Framework for the Performance Enhancement of the Oil and Gas Industry. Sustainability. 2022; 14(7):3735. https://doi.org/10.3390/su14073735

Chicago/Turabian StyleShah, Syed Quaid Ali, Fong-Woon Lai, Muhammad Kashif Shad, and Ahmad Ali Jan. 2022. "Developing a Green Governance Framework for the Performance Enhancement of the Oil and Gas Industry" Sustainability 14, no. 7: 3735. https://doi.org/10.3390/su14073735

APA StyleShah, S. Q. A., Lai, F.-W., Shad, M. K., & Jan, A. A. (2022). Developing a Green Governance Framework for the Performance Enhancement of the Oil and Gas Industry. Sustainability, 14(7), 3735. https://doi.org/10.3390/su14073735