Profiling (Non-)Nascent Entrepreneurs in Hungary Based on Machine Learning Approaches

Abstract

1. Introduction

2. Nascent Entrepreneurs

3. Methodology

4. Data and Hypotheses

5. Analysis of Nascent Entrepreneurs in Hungary

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

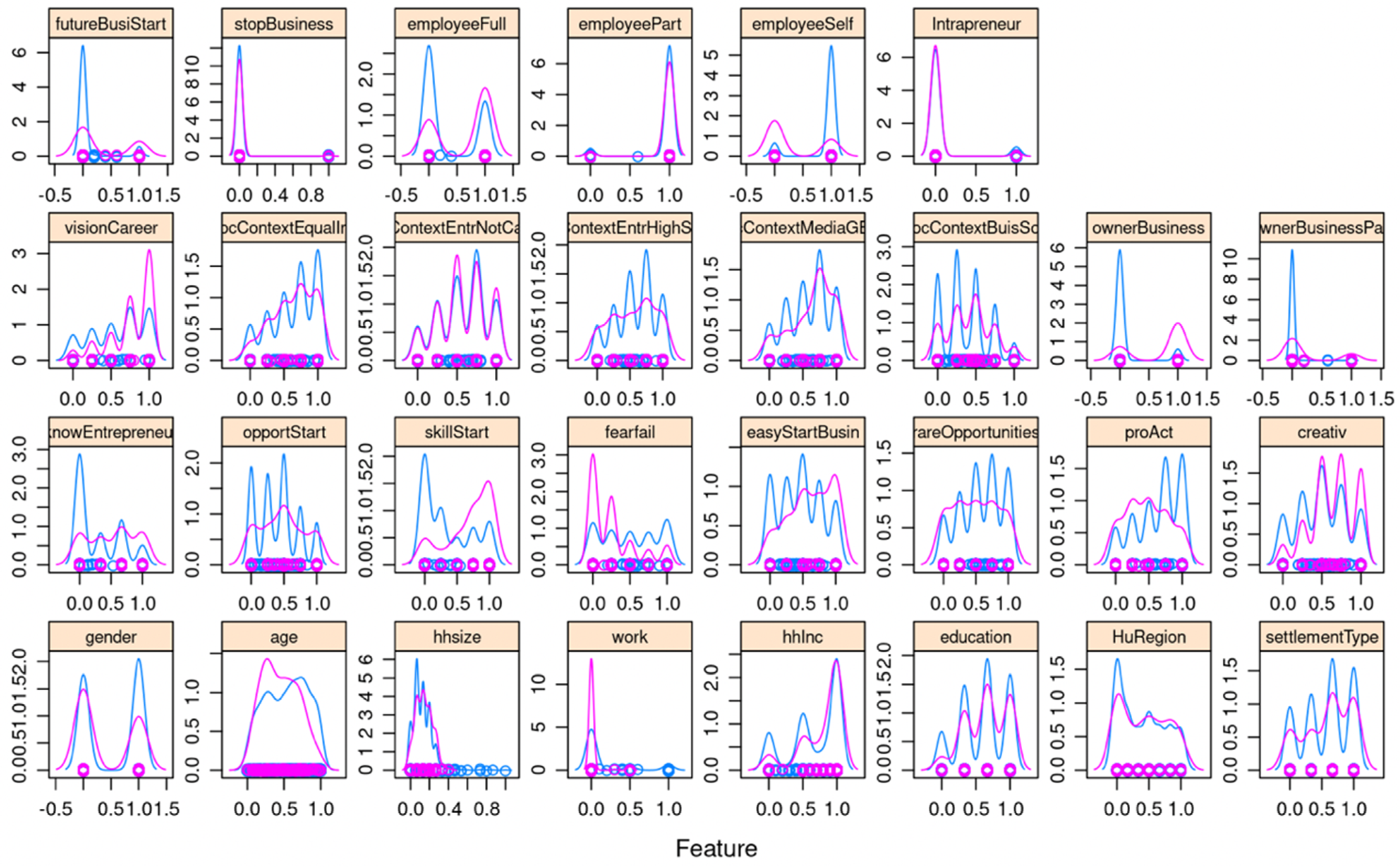

| Context | Variable Code | GEM Question | ||

|---|---|---|---|---|

| Predictive (input) variables | Aggregate Conditions | HuRegion | Survey vendor to provide the region in which the respondent lives | |

| settlementType | Settlement type of respondent | |||

| Demographic and Economic Factors | Age | What is your current age (in years)? | ||

| Gender | What is your gender? | |||

| education | What is the highest level of education you have completed? | |||

| hhsize | How many members make up your permanent household, including you? | |||

| work | Harmonized work status | |||

| hhInc | Which ranges describes the total annual income of all the members of your household? | |||

| employeeFull | Employed by others in full-time work | |||

| employeePart | Employed by others in part-time work | |||

| employeeSelf | Self-employed | |||

| Intrapreneur | Active as intrapreneur in past three years | |||

| ownerBusiness | Are you, alone or with others, currently the owner of a business you help manage, self-employed, or selling any goods or services to others? | |||

| ownerBusinessPart | Are you, alone or with others, currently the owner of a business you help manage for your employer as part of your main employment? | |||

| stopBusiness | Have you, in the past 12 months, sold, shut down, discontinued or quit a business you owned and managed? | |||

| Perceptual Variables | Social | socContextEqualInc | In my country, most people would prefer that everyone had a similar standard of living. | |

| socContextEntrNotCareer | In my country, most people consider starting a new business a desirable career choice. | |||

| socContextEntrHighStatus | In my country, those successful at starting a new business have a high level of status and respect. | |||

| socContextMediaGEntr | In my country, you will often see stories in the public media and/or internet about successful new businesses. | |||

| socContextBuisSoc | In my country, you will often see businesses that primarily aim to solve social problems. | |||

| Individual | futureBusiStart | Are you, alone or with others, expecting to start a new business, including any type of self-employment, within the next three years? | ||

| knowEntrepreneur | Do you know someone personally who started a business in the past two years? | |||

| opportStart | In the next six months, will there be good opportunity for starting a business in the area where you live? | |||

| skillStart | Do you have the knowledge, skill, and experience required to start a new business? | |||

| fearfail | Would fear of failure prevent you from starting a business? | |||

| easyStartBusin | In your country, it is easy to start a business. | |||

| rareOpportunities | You rarely see business opportunities, even if you are very knowledgeable in the area. | |||

| proAct | When you spot a profitable opportunity, you act on it. | |||

| creativ | Other people think you are highly innovative | |||

| visionCareer | Every decision you make is part of your long-term career plan. | |||

| Output variable | nascent | Category YES—nascent entrepreneur Category NO—represents all other respondents | ||

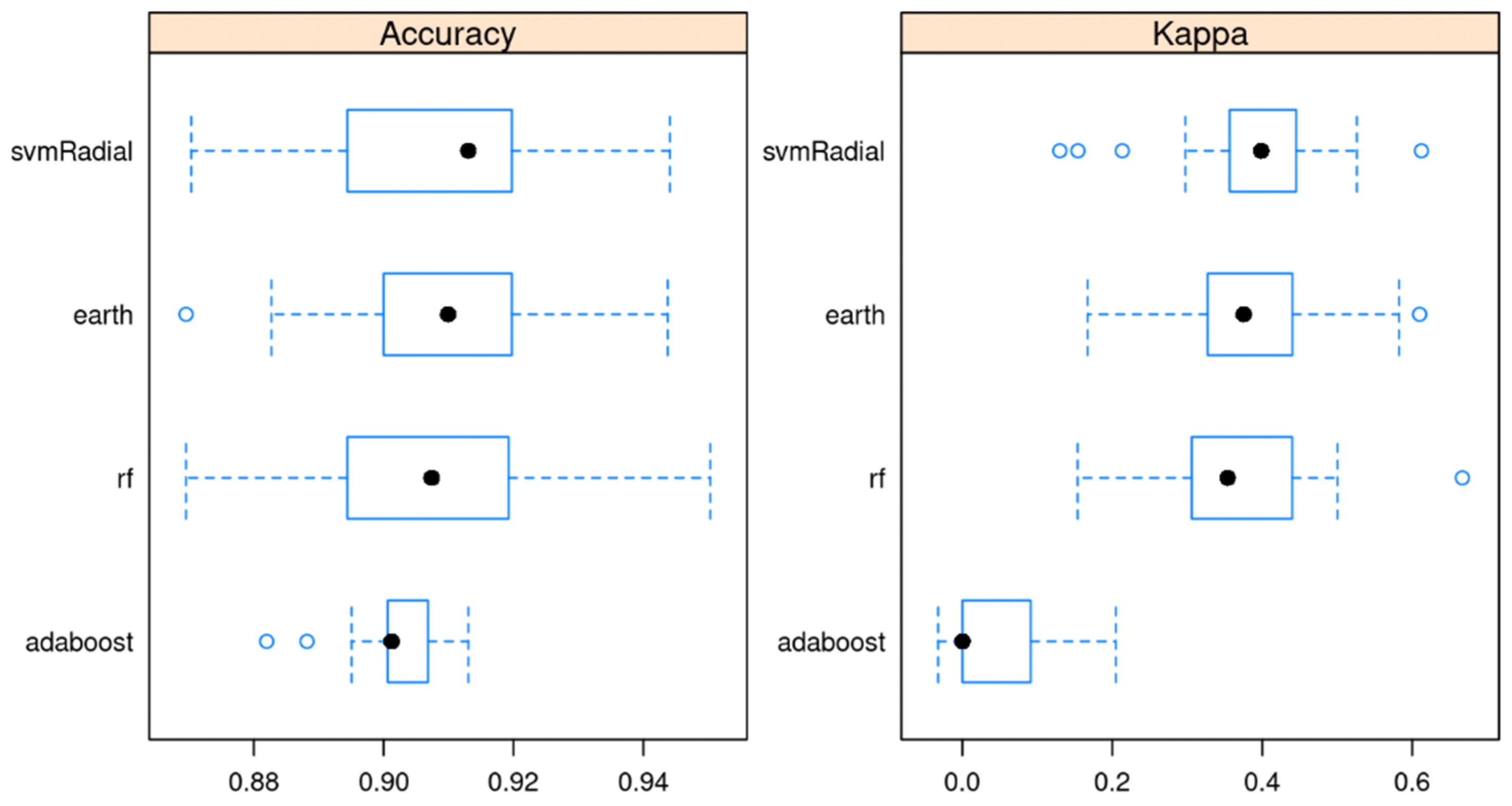

| MARS | AdaBoost | Random Forest | svmRadial | |

|---|---|---|---|---|

| Accuracy | 0.9104 | 0.9104 | 0.9159 | 0.9174 |

| 95% CI | (0.8782, 0.9365) | (0.8782, 0.9365) | (0.8866, 0.9428) | (0.8838, 0.9407) |

| No Information Rate | 0.903 | 0.903 | 0.903 | 0.903 |

| p-Value (Acc > NIR) | 0.0503 | 0.13544 | 0.1777165 | 0.227 |

| Kappa | 0.38531 | 0.00461 | 0.3833 | 0.3917 |

| Mcnemar’s Test p-Value | 0.04675 | 0.004607 | 0.0004985 | 1.807e-05 |

| Pos Pred Value | 0.55556 | 0.57143 | 0.66667 | 0.69231 |

| Neg Pred Value | 0.93600 | 0.92913 | 0.92969 | 0.92288 |

| Precision | 0.55556 | 0.57143 | 0.66667 | 0.69231 |

| Recall | 0.38462 | 0.30769 | 0.30769 | 0.23077 |

| F1 | 0.45455 | 0.40000 | 0.42105 | 0.34615 |

| Prevalence | 0.09701 | 0.09701 | 0.09701 | 0.09701 |

| Detection Rate | 0.03731 | 0.02985 | 0.02985 | 0.02239 |

| Detection Prevalence | 0.06716 | 0.05224 | 0.04478 | 0.03234 |

| Balanced Accuracy | 0.67578 | 0.64145 | 0.64558 | 0.60987 |

| “Positive” Class | Yes | Yes | Yes | Yes |

References

- Van Stel, A.; Wennekers, S.; Thurik, R.; Reynolds, P.; De Wit, G. Explaining Nascent Entrepreneurship Across Countries; Working Paper No. 200301; EIM Business and Policy Research: Zoetermeer, The Netherlands, 2003. [Google Scholar]

- Bruyat, C.; Julien, P.A. Defining the field of research in entrepreneurship. J. Bus. Ventur. 2001, 16, 165–180. [Google Scholar] [CrossRef]

- Dorado, S.; Ventresca, M.J. Crescive entrepreneurship in complex social problems: Institutional conditions for entrepreneurial engagement. J. Bus. Ventur. 2013, 28, 69–82. [Google Scholar] [CrossRef]

- Stathopoulou, S.; Psaltopoulos, D.; Skuras, D. Rural entrepreneurship in Europe. Int. J. Entrep. Behav. Res. 2004, 10, 404–425. [Google Scholar] [CrossRef]

- Anderson, A.R.; Dodd, S.D.; Jack, S.L. Entrepreneurship as connecting: Some implications for theorising and practice. Manag. Decis. 2012, 50, 958–971. [Google Scholar] [CrossRef]

- Nijkamp, P.; Poot, J.; Vindigni, G. Spatial dynamics and government policy: An artificial intelligence approach to comparing complex systems. In Knowledge, Complexity and Innovation Systems; Fischer, M.M., Frolich, J., Eds.; Springer: Boston, MA, USA, 2001; pp. 369–401. [Google Scholar]

- Varian, H.R. Big data: New tricks for econometrics. J. Econ. Perspect. 2014, 28, 3–28. [Google Scholar] [CrossRef]

- Carree, M.A.; Thurik, A.R. The impact of entrepreneurship on economic growth. In Handbook of Entrepreneurship Research; Acs, Z.J., Audretsch, D., Eds.; Springer: New York, NY, USA, 2003; pp. 557–594. [Google Scholar] [CrossRef]

- Neumark, D.; Wall, B.; Zhang, J. Do Small Businesses Create More Jobs? New Evidence for the United States from the National Establishment Time Series. Rev. Econ. Stat. 2008, 93, 16–29. [Google Scholar] [CrossRef]

- Haltiwanger, J.C.; Jarmin, R.S.; Miranda, J. Who Creates Jobs? Small vs. Large vs. Young; Working Paper No. 16300; National Bureau of Economic Research: Cambridge, UK, 2010. [Google Scholar] [CrossRef][Green Version]

- Lueckgen, I.; Oberschachtsiek, D.; Sternberg, R.; Wagner, J. Nascent Entrepreneurs in German Regions: Evidence from the Regional Entrepreneurship Monitor (REM); Working Paper No. 1394; Institute for the Study of Labor: Bonn, Germany, 2004. [Google Scholar] [CrossRef]

- Wagner, J. Nascent entrepreneurs. In The Life Cycle of Entrepreneurial Ventures; Parker, S., Ed.; Springer: Boston, IL, USA, 2006; pp. 15–37. [Google Scholar] [CrossRef]

- Kessler, A.; Hermann, F. Nascent Entrepreneurship in a Longitudinal Perspective: The Impact of Person, Environment, Resources and the Founding Process on the Decision to Start Business Activities. Int. Small Bus. J. 2009, 27, 720–742. [Google Scholar] [CrossRef]

- Krueger, N. The Impact of Prior Entrepreneurial Exposure on Perceptions of New Venture Feasibility and Desirability. Entrepreneurship. Theory Pract. 1993, 18, 5–21. [Google Scholar] [CrossRef]

- Krueger, N.F.; Reilly, M.D.; Carsrud, A.L. Competing Models of Entrepreneurial Intentions. J. Bus. Ventur. 2000, 15, 411–432. [Google Scholar] [CrossRef]

- Reynolds, P.D. New Firm Creation in the United States A PSED I Overview. Found. Trends Entrep. 2007, 3, 1–150. [Google Scholar] [CrossRef]

- Reynolds, P.D. Who Starts New Firms—Preliminary Explorations of Firm-in-Gestation. Small Bus. Econ. 1997, 9, 449–462. [Google Scholar] [CrossRef]

- Rotefoss, B.; Kolvereid, L. Aspiring, Nascent and Fledgling Entrepreneurs: An Investigation of the Business Start-up Process. Entrep. Reg. Dev. 2005, 17, 109–127. [Google Scholar] [CrossRef]

- Delmar, F.; Davidsson, P. Where do they come from? Prevalence and characteristics of nascent entrepreneurs. Entrep. Reg. Dev. 2000, 12, 1–23. [Google Scholar] [CrossRef]

- Kolvereid, L.; Isaksen, E. New business startup and subsequent entry into self-employment. J. Bus. Ventur. 2006, 21, 566–885. [Google Scholar] [CrossRef]

- Minniti, M. Entrepreneurship and Network Externalities. J. Econ. Behav. Organ. 2005, 57, 1–27. [Google Scholar] [CrossRef]

- Capelleras, J.L.; Ignacio, C.P.; Martin-Sanchez, V.; Larraza-Kintana, M. The Influence of Individual Perceptions and the Urban/Rural Environment on Nascent Entrepreneurship. Investig. Regiionales—J. Reg. Res. 2013, 26, 97–113. [Google Scholar]

- Mueller, P. Entrepreneurship in the Region: Breeding Ground for Nascent Entrepreneurs? Small Bus. Econ. 2006, 27, 41–58. [Google Scholar] [CrossRef]

- Kim, P.; Howard, A.; Lisa, K. Access (Not) Denied: The Impact of Financial, Human, and Cultural Capital on Entrepreneurial Entryin the United States. Small Bus. Econ. 2006, 27, 5–22. [Google Scholar] [CrossRef]

- Arenius, P.; Minniti, M. Perceptual variables and nascent entrepreneurship. Small Bus. Econ. 2005, 24, 233–247. [Google Scholar] [CrossRef]

- Hindle, K.; Klyver, K. Exploring the relationship between media coverage and Participation in entrepreneurship: Initial global evidence and research implications. Int. Entrep. Manag. J. 2007, 3, 217–242. [Google Scholar] [CrossRef]

- Tiwari, P.; Anil, K.B.; Jyoti, T.; Kaustav, S. Exploring the factors responsible in predicting entrepreneurial intention among nascent entrepreneurs: A field research. South Asian J. Bus. Stud. 2019, 9, 1–18. [Google Scholar] [CrossRef]

- Krieger, A.; Joern, B.; Stuetzer, M. Skill Variety in Entrepreneurship: A Literature Review. Res. Dir. 2018, 16, 29–62. [Google Scholar]

- Nagy, Á.; Pete, S.; Gyorfy, L.Z.; Petru, T.P.; Benyovszki, A. Entrepreneurial Perceptions and Activity–Differences and Similarities in Four Eastern European Countries. Theor. Appl. Econ. 2010, 8, 1728. [Google Scholar]

- Alomani, A.; Baptista, R.; Athreye, S.S. The Interplay between Human, Social and Cognitive Resources of Nascent Entrepreneurs. Small Bus. Econ. 2022, 22, 322–342. [Google Scholar] [CrossRef]

- Cai, W.; Gu, J.; Wu, J. How Entrepreneurship Education and Social Capital Promote Nascent Entrepreneurial Behaviours: The Mediating Roles of Entrepreneurial Passion and Self-Efficacy. Sustainability 2021, 13, 11158. [Google Scholar] [CrossRef]

- Amit, Y.; Geman, D. Shape Quantization and Recognition with Randomized Trees. Neural Comput. 1997, 9, 1545–1588. [Google Scholar] [CrossRef]

- Mueller, P.; Van Stel, A.; Storey, D.J. The Effects of New Firm Formation on Regional Development over Time: The Case of Great Britain. Small Bus. Econ. 2008, 30, 59–71. [Google Scholar] [CrossRef]

- Ozmen, A.; Weber, G.W. RMARS: Robustification of multivariate adaptive regression spline under polyhedral uncertainty. J. Comput. Appl. Math. 2014, 259, 914–924. [Google Scholar] [CrossRef]

- Hamilton, B.H. Does Entrepreneurship Pay? An Empirical Analysis of the Returns to Self-Employment. J. Political Econ. 2000, 108, 604–631. [Google Scholar] [CrossRef]

- Moskowitz, T.J.; Vissing-Jørgensen, A. The Returns to Entrepreneurial Investment: A Private Equity Premium Puzzle? Am. Econ. Rev. 2002, 92, 745–778. [Google Scholar] [CrossRef]

- Parker, S.C. The Economics of Self-Employment and Entrepreneurship; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar] [CrossRef]

- Kirzner, I.M. Competition and Entrepreneurship; University of Chicago Press: Chicago, IL, USA, 1978. [Google Scholar] [CrossRef]

- Kirzner, I.M. Perception, Opportunity, and Profit: Studies in the Theory of Entrepreneurship; University of Chicago Press: Chicago, IL, USA, 1979. [Google Scholar]

- Baciu, E.-L.; Vîrgă, D.; Lazăr, T.-A.; Gligor, D.; Jurcuț, C.-N. The Association between Entrepreneurial Perceived Behavioral Control, Personality, Empathy, and Assertiveness in a Romanian Sample of Nascent Entrepreneurs. Sustainability 2020, 12, 10490. [Google Scholar] [CrossRef]

- Wyrwich, M.; Stuetzer, M.; Sternberg, R. Entrepreneurial role models, fear of failure, and institutional approval of entrepreneurship: A tale of two regions. Small Bus. Econ. 2016, 46, 467–492. [Google Scholar] [CrossRef]

- Linan, F. Skill and value perceptions: How do they affect entrepreneurial intentions? Int. Entrep. Manag. J. 2008, 4, 257–272. [Google Scholar] [CrossRef]

- Wagner, J.; Sternberg, R. Start-up Activities, Individual Characteristics, and the Regional Milieu: Lessons for Entrepreneurship Support Policies from German Micro Data. Ann. Reg. Sci. 2004, 38, 219–240. [Google Scholar] [CrossRef]

- Bosma, N.; Hessels, J.; Schutjens, V.; Van Praag, M.; Verheul, I. Entrepreneurship and role models. J. Econ. Psychol. 2012, 33, 410–424. [Google Scholar] [CrossRef]

- Carr, J.C.; Sequeira, J.M. Prior Family Business Exposure as Intergenerational Influence and Entrepreneurial Intent: A Theory of Planned Behavior Approach. J. Bus. Res. 2007, 60, 1090–1098. [Google Scholar] [CrossRef]

- Nguyen, P.A.; Doan, D.R. Giving in Vietnam: A nascent third sector with potential for growth. In The Palgrave Handbook of Global Philanthropy; Palgrave Macmillan: London, UK, 2015; pp. 473–487. [Google Scholar]

- Portugal, I.; Alencar, P.; Cowan, D. The use of machine learning algorithms in Recommender systems: A systematic review. Expert Syst. Appl. 2018, 97, 205–227. [Google Scholar] [CrossRef]

- Juric, P.M.; Adela, H.; Tihana, K. Profiling Nascent Entrepreneurs in Croatia—Neural Network Approach. Ekon. Vjesn. 2019, 32, 335–346. [Google Scholar]

- Nguyen, X.T. Factors Affecting Entrepreneurial Decision of Nascent Entrepreneurs Belonging Generation Y in Vietnam. J. Asian Financ. Econ. Bus. 2010, 7, 407–417. [Google Scholar] [CrossRef]

- Shapero, A.; Sokol, L. The Social Dimensions of Entrepreneurship. In Encyclopedia of Entrepreneurship; Kent, C.A., Sexton, D.L., Vesper, K.H., Eds.; Prentice-Hall: Englewood Cliffs, NJ, USA, 1982; pp. 72–90. [Google Scholar]

- Ajzen, I. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes. Theor. Cogn. Self-Regul. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Fitriani, W.; Siahaan, A.P.U. Comparison Between WEKA and Salford System in Data Mining Software. Int. J. Mob. Comput. Appl. 2016, 3, 1–4. [Google Scholar]

- Maimon, O.; Last, M. Knowledge Discovery and Data Mining. Info-Fuzzy Netw. (IFN) Methodol. 2001, 2, 23–44. [Google Scholar]

- Marlina, L.; Muslim, A.; Siahaan, P.U. Data Mining Classification Comparison (Naive Bayes and C4.5 Algorithms). Int. J. Eng. Trends Technol. 2016, 38, 380–383. [Google Scholar] [CrossRef][Green Version]

- Rahim, R.; Mesran, A.; Putera, U.; Siahaan, S.; Aryza, S. Composite performance index for student admission. Int. J. Res. Sci. Eng. 2017, 3, 68–74. [Google Scholar]

- Siahaan, M.D.L.; Elviwani, A.; Surbakti, B.; Lubis, A.H.; Siahaan, A.P.U. Implementation of Simple Additive Weighting Algorithm in Particular Instance. Int. J. Sci. Res. Sci. Technol. 2017, 3, 442–447. [Google Scholar]

- Turban, E.; Aronson, J.E.; Liang, T. Decision Support Sistems and Intelligent Systems; ICA: Yogyakarta, India, 2005.

- Dunham, M.H. Data Mining Introductory and Advanced Topics; Prentice Hall: Englewood Cliffs, NJ, USA, 2003. [Google Scholar]

- Lee, H. Role of artificial intelligence and enterprise risk management to promote corporate entrepreneurship and business performance: Evidence from Korean banking sector. J. Intell. Fuzzy Syst. 2020, 39, 5369–5386. [Google Scholar] [CrossRef]

- Nasution, M.D.T.P.; Rossanty, Y. Country of Origin as a Moderator of Halal Label and Purchase Behavior. J. Bus. Retail. Manag. Res. 2018, 12, 194–201. [Google Scholar] [CrossRef]

- Zhang, D.; Tsai, J.J.P. Advances in Machine Learning Applications in Software Engineering; Idea Group Pub: Hershey, PA, USA, 2007. [Google Scholar]

- Boutell, M.R.; Luo, J.; Shen, X.; Brown, C.M. Learning multi-label scene classification. Pattern Recognit. 2004, 37, 1757–1771. [Google Scholar] [CrossRef]

- Kotsiantis, S.B. Supervised machine learning: A review of classification techniques. Inform.-Ljubl. 2007, 31 Pt 3, 249–268. [Google Scholar]

- Mitchell, T.M. Machine Learning; McGraw-Hill: New York, NY, USA, 1997. [Google Scholar] [CrossRef]

- Pedregosa, F.; Varoquaux, G.; Gramfort, A.; Michel, V.; Thirion, B.; Grisel, O.; Duchesnay, E. Scikit-learn: Machine Learning in Python. J. Mach. Learn. Res. 2011, 12, 2825–2830. [Google Scholar]

- Cameron, A.C.; Trivedi, P.K. Microeconometrics: Methods and Applications; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar] [CrossRef]

- Montebruno, P.; Bennett, R.J.; van Lieshout, C.; Smith, H. A tale of two tails: Do Power Law and Lognormal models fit firmsize distributions in the mid-Victorian era? Phys. A Stat. Mech. Its Appl. 2019, 573, 858–875. [Google Scholar] [CrossRef]

- James, G.; Witten, D.; Hastie, T.; Tibshirani, R. An Introduction to Statistical Learning; Springer: New York, NY, USA, 2013. [Google Scholar] [CrossRef]

- Mokhtia, M.; Eftekhari, M.; Saberi-Movahed, F. Dual-manifold regularized regression models for feature selection based on hesitant fuzzy correlation. Knowl.-Based Syst. 2021, 229, 107308. [Google Scholar] [CrossRef]

- Najafzadeh, M.; Etemad-Shahidi, A.; Lim, S.Y. Scour prediction in long contractions using ANFIS and SVM. Ocean Eng. 2016, 111, 128–135. [Google Scholar] [CrossRef]

- Najafzadeh, M.; Homaei, F.; Mohamadi, S. Reliability evaluation of groundwater quality index using data-driven models. Environ. Sci. Pollut. Res. 2022, 29, 8174–8190. [Google Scholar] [CrossRef] [PubMed]

- Saberi-Movahed, F.; Najafzadeh, M.; Mehrpooya, A. Receiving more accurate predictions for longitudinal dispersion coefficients in water pipelines: Training group method of data handling using extreme learning machine conceptions. Water Resour. Manag. 2020, 34, 529–561. [Google Scholar] [CrossRef]

- Sadeghi, G.; Najafzadeh, M.; Ameri, M. Thermal characteristics of evacuated tube solar collectors with coil inside: An experimental study and evolutionary algorithms. Renew. Energy 2020, 151, 575–588. [Google Scholar] [CrossRef]

- Celbis, M.G. A machine learning approach to rural entrepreneurship. Pap. Reg. Sci. 2021, 100, 1079–1104. [Google Scholar] [CrossRef]

- Oztekin, A.; Delen, D.; Turkyilmaz, A.; Zaim, S. A machine learning-based usability evaluation method for eLearning systems. Decis. Support Syst. 2013, 56, 63–73. [Google Scholar] [CrossRef]

- Qing, Y.; Zejun, W. Research on the impact of entrepreneurship policy on employment based on improved machine learning algorithms. J. Intell. Fuzzy Syst. 2021, 40, 6517–6528. [Google Scholar] [CrossRef]

- Friedman, J. Multivariate Adaptive Regression Splines. Ann. Stat. 1991, 19, 1–67. [Google Scholar] [CrossRef]

- Hastie, T.; Tibshirani, R.; Friedman, J. The Elements of Statistical Learning: Data Mining, Inference and Prediction, 2nd ed.; Springer: Boston, MA, USA, 2008. [Google Scholar]

- Borodin, V.; Bourtembourg, J.; Hnaien, F.; Labadie, N. Predictive modelling with panel data and multivariate adaptive regression splines: Case of farmers crop delivery for a harvest season ahead. Stoch. Environ. Res. Risk Assess. 2015, 3, 309–325. [Google Scholar] [CrossRef]

- Barron, A.R.; Xiao, X. Discussion: Multivariate adaptive regression splines. Annu. Stat. 1991, 19, 67–82. [Google Scholar] [CrossRef]

- Dietterich, T. An Experimental Comparison of Three Methods for Constructing Ensembles of Decision Trees: Bagging, Boosting, and Randomization. Mach. Learn. 2000, 40, 139–158. [Google Scholar] [CrossRef]

- Golub, G.; Heath, M.; Wahba, G. Generalized Cross–Validation as a Method for Choosing a Good Ridge Parameter. Technometrics 1979, 21, 215–223. [Google Scholar] [CrossRef]

- Kuhn, M.; Johnson, K. Applied Predictive Modeling; Springer: New York, NY, USA, 2013. [Google Scholar] [CrossRef]

- Huberty, C.J. Problems with stepwise methods—better alternatives. Adv. Soc. Sci. Methodol. 1989, 1, 43–70. [Google Scholar]

- Chen, H.-L.; Yang, B.; Liu, J.; Liu, D.-Y. A support vector machine classifier with rough set-based feature selection for breast cancer diagnosis. Expert Syst. Appl. 2011, 38, 9014–9022. [Google Scholar] [CrossRef]

- Freund, Y.; Schapire, R. Experiments with a New Boosting Algorithm. Mach. Learn. Proc. Thirteen. Int. Conf. 1996, 23, 148–156. [Google Scholar]

- Thapa, A. Determinants of microenterprise performance in Nepal. Small Bus. Econ. 2015, 45, 581–594. [Google Scholar] [CrossRef]

- Yao, X.; Wu, X.; Long, D. University students’ entrepreneurial tendency in China effect of students’ perceived entrepreneurial environment. J. Entrepren. Emerg. Econ. 2016, 8, 60–81. [Google Scholar] [CrossRef]

- Hsu, C.; Lin, C. A Comparison of Methods for Multiclass Support Vector Machines. IEEE Trans. Neural Netw. 2002, 13, 415–425. [Google Scholar] [PubMed]

- Platt, J. Probabilistic Outputs for Support Vector Machines and Comparison to Regularized Likelihood Methods. In Advances in Kernel Methods Support Vector Learning; Bartlett, B., Schölkopf, B., Schuurmans, D., Smola, A., Eds.; MIT Press: Cambridge, MA, USA, 2000; pp. 61–74. [Google Scholar]

- Boser, B.; Guyon, I.; Vapnik, V.A. Training Algorithm for Optimal Margin Classifiers. In Proceedings of the Fifth Annual Workshop on Computational Learning Theory, Pittsburgh, PA, USA, 27–29 July 1992; Volume 12, pp. 144–152. [Google Scholar] [CrossRef]

- Duan, K.; Keerthi, S. Which is the Best Multiclass SVM Method? An Empirical Study. Mult. Classif. Syst. 2005, 12, 278–285. [Google Scholar]

- Scholkopf, B.; Smola, A.J. Support Vector Machines, Data Mining Knowledge. Discovery 2003, 1, 283–289. [Google Scholar] [CrossRef]

- Blumer, A.; Ehrenfeucht, D.; Haussler, M.; Warmuth, K. Learnability and the Vapnik-Chervonenkis dimension. J. ACM 1989, 36, 929–965. [Google Scholar] [CrossRef]

- Vapnik, V. The Nature of Statistical Learning Theory; Springer: New York, NY, USA, 2010. [Google Scholar] [CrossRef]

- Cortes, C.; Vapnik, V. Support–Vector Networks. Mach. Learn. 1995, 20, 273–297. [Google Scholar] [CrossRef]

- Huang, C.; Davis, L.S.; Townshend, J.R.G. An assessment of support vector machines for land cover classification. Int. J. Remote Sens. 2002, 23, 725–749. [Google Scholar] [CrossRef]

- Huang, Z.; Chen, H.; Hsu, C.J.; Chen, W.H.; Wu, S. Credit rating analysis with support vector machines and neural net- works: A market comparative study. Decis. Support Syst. 2004, 37, 543–558. [Google Scholar] [CrossRef]

- Shen, L.; Chen, H.; Yu, Z. Evolving support vector machines using fruit fly optimization for medical data classification. Knowl.-Based Syst. 2016, 96, 61–75. [Google Scholar] [CrossRef]

- Nasution, M.D.T.P.; Siahaan, A.P.U.; Rossanty, Y.; Aryza, S. Entrepreneurship intention prediction using decision tree and support vector machine. In International Conference on Advance & Scientific Innovation; EUDL: Medan, Indonesia, 2018. [Google Scholar]

- Marijana, Z.S.; Sanja, P.; Ivana, D. Classification of entrepreneurial intentions by neural networks, decision trees and support vector machines. Croat. Oper. Res. Rev. 2010, 1, 62–71. [Google Scholar] [CrossRef]

- Iskender, E.; Bati, G.B. Comparing Turkish universities entrepreneurship and innovativeness index’s rankings with sentiment analysis results on social media. Procedia—Soc. Behav. Sci. 2015, 195, 1543–1552. [Google Scholar] [CrossRef][Green Version]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Efron, B.; Tibshirani, R.J. An Introduction to the Bootstrap; CRC Press Book: Boca Raton, FL, USA, 1994. [Google Scholar] [CrossRef]

- Breiman, L.; Friedman, J.H.; Olshen, R.A.; Stone, C.J. Classification and Regression Trees; Routledge: New York, NY, USA, 1984. [Google Scholar]

- Breiman, L. Randomizing Outputs to Increase Prediction Accuracy. Mach. Learn. 2000, 40, 229–242. [Google Scholar] [CrossRef]

- Ho, T. The Random Subspace Method for Constructing Decision Forests. IEEE Trans. Pattern Anal. Mach. Intell. 1998, 13, 340–354. [Google Scholar]

- Wang, X.; Wang, Z.; Weng, J.; Wen, C.; Chen, H.; Wang, X. A New Effective Machine Learning Framework for Sepsis Diagnosis. IEEE Access 2018, 6, 48300–48310. [Google Scholar] [CrossRef]

- Xu, B.; Yang, J.; Sun, B. A nonparametric decision approach for entrepreneurship. Int. Entrep. Manag. J. 2018, 14, 5–14. [Google Scholar] [CrossRef]

- Carter, M.R.; Tjernstro€m, E.; Toledo, P. Heterogeneous impact dynamics of a rural business development program in Nicaragua. J. Dev. Econ. 2019, 138, 77–98. [Google Scholar] [CrossRef]

- Kearns, M.; Valiant, L. Cryptographic Limitations on Learning Boolean Formulae and Finite Automata. In Proceedings of the Twenty-First Annual ACM Symposium on Theory of Computing, Seattle, WA, USA, 14–17 May 1989; ASSE: Cardif, UK. [Google Scholar]

- Valiant, L. A Theory of the Learnable. Commun. ACM 1984, 27, 1134–1142. [Google Scholar] [CrossRef]

- Schapire, R. The Strength of Weak Learnability. Mach. Learn. 1990, 45, 197–227. [Google Scholar] [CrossRef]

- Schapire, Y.F.R. Adaptive Game Playing Using Multiplicative Weights. Games Econ. Behav. 1999, 29, 79–103. [Google Scholar]

- Dudoit, S.; Fridlyand, J.; Speed, T. Comparison of Discrimination Methods for the Classification of Tumors Using Gene Expression Data. J. Am. Stat. Assoc. 2002, 97, 77–87. [Google Scholar] [CrossRef]

- Ben-Dor, A.; Bruhn, L.; Friedman, N.; Nachman, I.; Schummer, M.; Yakhini, Z. Tissue, Classification with Gene Expression Profiles. J. Comput. Biol. 2000, 7, 559–583. [Google Scholar] [CrossRef]

- Varmuza, K.; He, P.; Fang, K. Boosting Applied to Classification of Mass Spectral Data. J. Data Sci. 2003, 1, 391–404. [Google Scholar] [CrossRef]

- Bergstra, J.; Casagrande, N.; Erhan, D.; Eck, D.; Kegl, B. Aggregate Features and AdaBoost for Music Classification. Mach. Learn. 2006, 65, 473–484. [Google Scholar] [CrossRef]

- Cohen, J. A Coefficient of Agreement for Nominal Data. Educ. Psychol. Meas. 1960, 20, 37–46. [Google Scholar] [CrossRef]

- Cohen, P.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, 2nd ed.; Psychology Press: New York, NY, USA, 2014. [Google Scholar]

- Altman, D.; Bland, J. Diagnostic Tests 3: Receiver Operating Characteristic Plots. Br. Med. J. 1994, 309, 188. [Google Scholar] [CrossRef] [PubMed]

- Brown, C.; Davis, H. Receiver Operating Characteristics Curves and Related Decision Measures: A Tutorial. Chemom. Intell. Lab. Syst. 2006, 80, 24–38. [Google Scholar] [CrossRef]

- Fawcett, T. An Introduction to ROC Analysis. Pattern Recognit. Lett. 2006, 27, 861–874. [Google Scholar] [CrossRef]

- GEM Global Report. GEM Global Report 2021/2022. Available online: https://gemconsortium.org/file/open?fileId=50900 (accessed on 10 March 2022).

| MARS | Reference | AdaBoost | Reference | |||

| No | Yes | No | Yes | |||

| Prediction | No | 351 | 24 | No | 354 | 27 |

| Yes | 12 | 15 | Yes | 9 | 12 | |

| Random Forest | Reference | svmRadial | Reference | |||

| No | Yes | No | Yes | |||

| Prediction | No | 357 | 27 | No | 359 | 30 |

| Yes | 6 | 12 | Yes | 4 | 9 | |

| Average of ROC | StdDev of ROC | Average of Sens | StdDev of Sens | Average of Spec | StdDev of Spec | |

|---|---|---|---|---|---|---|

| AdaBoost | 0.948 | 0.001 | 0.959 | 0.005 | 0.437 | 0.036 |

| MARS | 0.956 | 0.003 | 0.973 | 0.005 | 0.427 | 0.056 |

| Random Forest | 0.953 | 0.002 | 0.965 | 0.017 | 0.415 | 0.169 |

| svmRadial | 0.941 | 0.010 | 0.967 | 0.002 | 0.413 | 0.088 |

| Total | 0.949 | 0.010 | 0.968 | 0.008 | 0.420 | 0.087 |

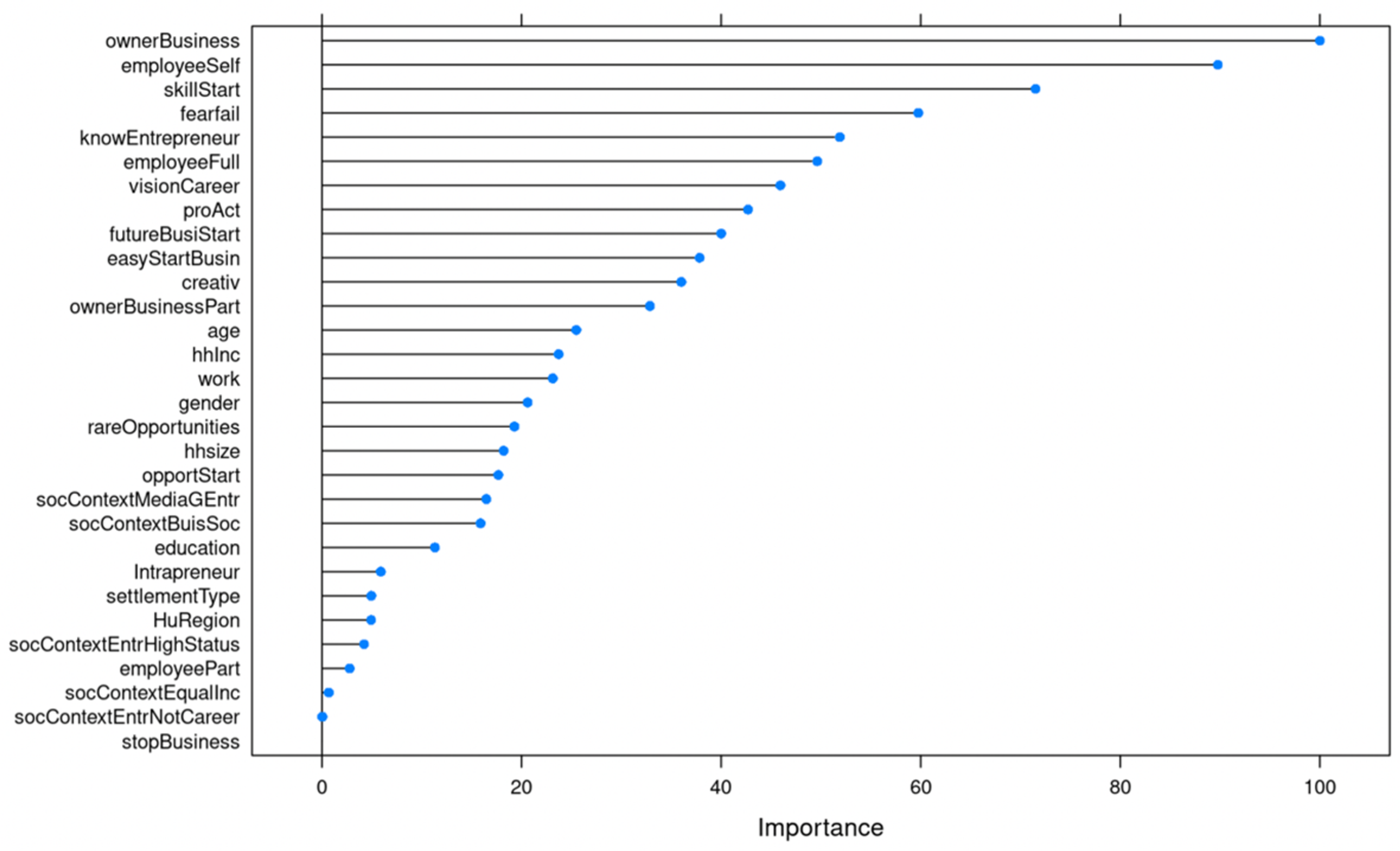

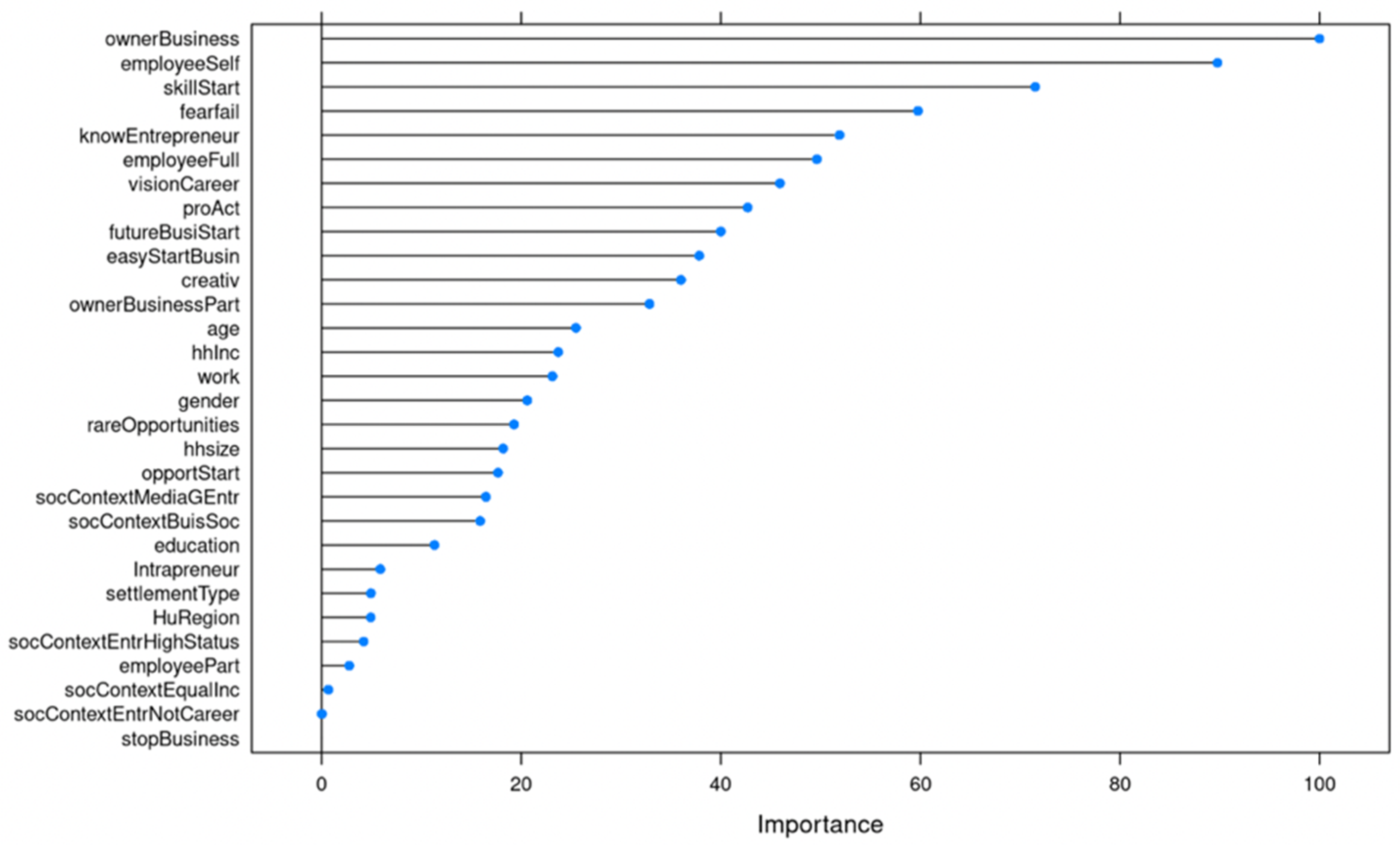

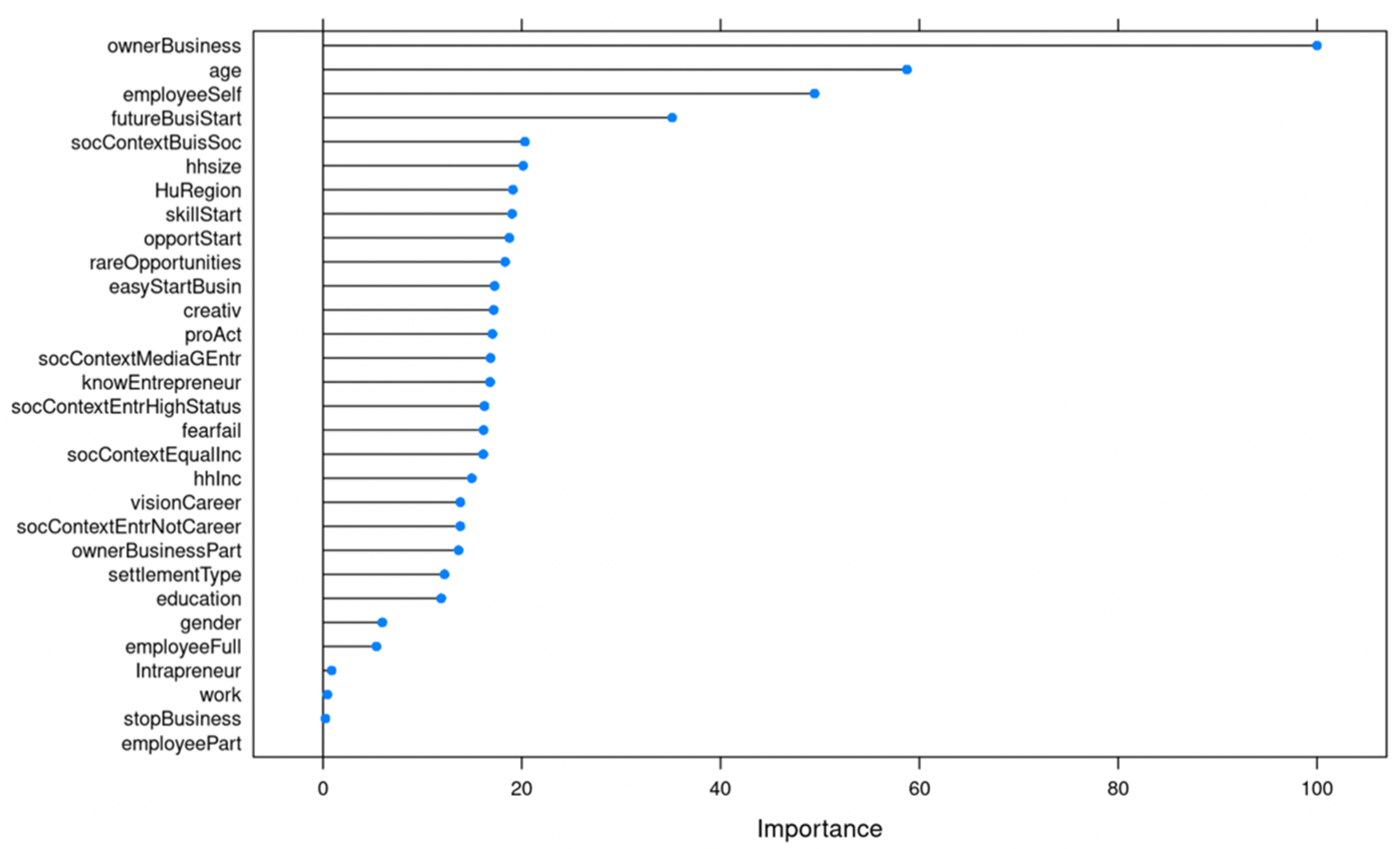

| Context | Variable Code | MARS | svmRadial | AdaBoost | RandomForest | |

|---|---|---|---|---|---|---|

| Aggregate Conditions | HuRegion | X | ||||

| settlementType | ||||||

| Demographic and Economic Factors | Age | X | X | |||

| Gender | ||||||

| education | ||||||

| hhsize | X | X | ||||

| work | ||||||

| hhInc | ||||||

| employeeFull | X | X | ||||

| employeePart | ||||||

| employeeSelf | X | X | X | X | ||

| Intrapreneur | ||||||

| ownerBusiness | X | X | X | X | ||

| ownerBusinessPart | ||||||

| stopBusiness | X | |||||

| Perceptual Variables | Social | socContextEqualInc | ||||

| socContextEntrNotCareer | ||||||

| socContextEntrHighStatus | ||||||

| socContextMediaGEntr | ||||||

| socContextBuisSoc | X | |||||

| Individual | futureBusiStart | X | X | X | X | |

| knowEntrepreneur | X | X | X | |||

| opportStart | X | |||||

| skillStart | X | X | X | |||

| fearfail | X | X | ||||

| easyStartBusin | X | X | ||||

| rareOpportunities | X | |||||

| proAct | X | X | X | |||

| creativ | ||||||

| visionCareer | X | X | ||||

| MARS | svmRadial | AdaBoost | RandomForest | |

|---|---|---|---|---|

| Demographic and Economic Factors | 1 | 1 | 1 | 1 |

| Perceptual Variables—Individual | 2 | 2 | 2 | 2 |

| Perceptual Variables—Social | 0 | 3 | 3 | 3 |

| Aggregate Conditions | 0 | 4 | 4 | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gosztonyi, M.; Judit, C.F. Profiling (Non-)Nascent Entrepreneurs in Hungary Based on Machine Learning Approaches. Sustainability 2022, 14, 3571. https://doi.org/10.3390/su14063571

Gosztonyi M, Judit CF. Profiling (Non-)Nascent Entrepreneurs in Hungary Based on Machine Learning Approaches. Sustainability. 2022; 14(6):3571. https://doi.org/10.3390/su14063571

Chicago/Turabian StyleGosztonyi, Márton, and Csákné Filep Judit. 2022. "Profiling (Non-)Nascent Entrepreneurs in Hungary Based on Machine Learning Approaches" Sustainability 14, no. 6: 3571. https://doi.org/10.3390/su14063571

APA StyleGosztonyi, M., & Judit, C. F. (2022). Profiling (Non-)Nascent Entrepreneurs in Hungary Based on Machine Learning Approaches. Sustainability, 14(6), 3571. https://doi.org/10.3390/su14063571