1. Introduction

The goal of local GDP growth is deemed as the primary target of local governments for performance evaluation due to the twin incentives of the current mixed economic system and economy and politics. As an instrument of local governments, land is of great practical significance to local governments in achieving industrial economic growth. Land distribution is governed by the local land transfer system and political promotion incentive mechanism. Under this circumstance, the local government creates behavioral reasoning for the benefit aimed at based on its own behavior motivation, during which the reasonable man concept underpins the administrative system of municipal governments. They directly regulate the land transaction price, quantity, and resource allocation of industrial land, as well as obtaining more land transaction fees, in order to achieve industrial structure adjustments and upgrades [

1], while also generating self-interest motives for personal political rights and reputation. For municipal governments seeking to attract investment and foster industrial growth, industrial property is a critical starting point. The State Council’s Circular on Issues Concerning Strengthening Land Regulation and Control, issued in 2006, declared unequivocally that industrial land must be awarded through “Tender, Auction, and Listing”. Industrial land has progressively becoming available on the market. Demand for industrial land rises as a result of local government officials’ promotion competition, and thus local governments frequently control the transaction prices of industrial property by returning land transaction fees and “point supply”. As a result, the phenomenon of selling industrial land at a low price still persists. The “National Minimum Price Standard for the Sale of Industrial Land” explicitly defines industrial land in China and splits it into 15 categories, with prices ranging from 840 CNY/m

2 (level 1) to 60 CNY/m

2 (level 15). Although more than half of China’s industrial land is Grade 5 or higher, the actual average transaction price of Grade 5 industrial land is 214 CNY/m

2, much lower than the low-price transfer criterion of 384 CNY/m

2 in the same grade. According to the report of the 19th CPC National Congress, realizing market-oriented factor allocation and speeding up market-oriented factor reform is a critical goal for economic system reform. Thus, how to improve industrial GTFP has become a key metric for assessing the quality of China’s industrial economic development.

The research into green total factor productivity at home and abroad mainly focuses on measurement methodologies, such as the SBM-ML model [

2], the trans-log production function [

3], the Divisia–Luenberger productivity Index [

4], the modified Malmquist–Luenberger index based on directional distance function [

5], the non-radial directional distance function [

6] and the Global Malmquist–Luenberger index [

7]. It also takes into account the interactions with affecting elements, such as intelligence [

8], emission trading [

9], land marketing [

10], outward foreign direct [

11], and market integration [

12]. Theoretical levels of land giving behavior and economic impact [

13,

14,

15], as well as the influence of land transfer marketization on land use efficiency and the environment [

16,

17], are among the existing areas of study on the impact of land granting on GTFP. As can be shown, in-depth theoretical research on the mechanism of land grants on economic growth is lacking. Few researchers have approached the influencing elements of green total factor productivity to construct a transmission path for the impact of land granting on green total factor productivity. The local government lowers the cost of land acquisition through low-price agreements, attracting more capital and businesses, and the growth of the local industrial sector fueled by the agglomeration of industrial firms. The transformation and upgrading of industrial industries, which involves technological innovation to deliver greater technological advancement, is at the heart of local industrial economic development. As a result, industrial agglomeration and technological innovation are chosen as the major variables to investigate the transmission mechanisms of the land transfer mode on green total factor production. Simultaneously, few academics take into account the spatial impacts of industrial GTFP. As a result, in this paper, taking China’s 30 provinces from 2007 to 2017 as examples, and the manufacturing agglomeration and technology innovation as intervening variables, we explore how the land granting strategy of local governments affects the transmission mechanism of industrial GTFP, in order to enrich the empirical and theoretical evidence on industrial GTFP and provide some policy implications for promoting regional GTFP.

2. Theoretical Analysis and Hypothesis

According to classical economic theory, businesses alter their development mode to maximize profits by regulating the marginal income and marginal cost. Likewise, the purchase cost of land, a significant facet in firm development, is directly affected by the transaction price. It is also a key determinant of how businesses develop and plays a crucial role in the manufacturing industry’s development. In this case, the cost of agglomeration economy is the transaction price of industrial land [

18]. Currently, the cost of acquiring industrial land is reduced through negotiation, which aids in attracting company investment and forming an agglomeration effect. Through knowledge spillover, labor force matching, and industrial association, industrial agglomeration can induce externalities that influence green total factor productivity. The “Tender, Auction, and Listing” grant mode raises the cost of industrial land and reduces the profit margins of businesses. High-productivity firms congregate in the local region as a result of externalities such as information transfer, labor force matching, and industrial association. In terms of local governments, they have strong incentives to attract investment, and the industry’s agglomeration effect contributes to regional competitive advantages, as well as the research, development, and implementation of new technologies for energy conservation and emission reduction, and technology upgrading. An insufficient market competition environment enables a large number of entrepreneurs to increase the input of production factors on a continuous basis, resulting in increased pollution while promoting the development of the industrial economy and expanding industrial scale. However, the scale effect and technological spillover can assist businesses in lowering production costs and pollution control costs.

Incomplete market competition motivates a large number of business leaders to spend on capital, labor, technology, and other elements on a constant basis, fostering manufacturing agglomeration. All input elements are generally concentrated in the early stages of manufacturing agglomeration, which promotes resource sharing and the division of labor in the region, improved resource usage efficiency, and lower industrial pollution emissions. Local governments tend to lower the acquisition cost of industrial land through agreement transfers, and aid local governments in meeting appraisal targets under the political performance appraisal system of “promotion championship”. As a result, local governments possess the behavioral logic necessary to encourage industrial agglomeration and capital investment. The local government provides support for manufacturing enterprises and key support projects, allowing first industry transit to second industry, boosting the development of local industry clusters [

19] and spatially orienting investments towards industries with high economic efficiency and tax revenues (e.g., manufacturing or construction). Simultaneously, the scale effect and technological spillover effect of industrial agglomeration can help firms cut production costs and pollution control costs, build a circular economy in industrial clusters, realize clean production, and effectively improve environmental quality. On the contrary, the industrial structure will be adjusted towards an industrial-oriented direction [

20], which, on the one hand, forms path dependence and reduces environmental access thresholds and regulations, ultimately leading to the “prisoner’s dilemma”, and on the other hand, is detrimental to improving industrial GTFP. At the same time, the spillover effect created by manufacturing agglomeration can help to preserve tertiary industries such as real estate, enhance municipal tax revenue, and relieve local financial stress. Although land negotiation is a basic process, it is prone to rent-seeking and corruption. The competitive pricing of industrial land through the “Tender, Auction, and Listing” procedure promotes the marketization of industrial land granting and land price reduction [

21], as well as the optimization of land factor allocation and productivity improvement [

14]. Local governments are more inclined to cut the price of industrial land negotiate transactions since the State Council proposed market-oriented rules for land granting, in order to attract more investment. However, participation in the grant of “Tender, Auction, and Listing” has an indirect effect on the proportion of industrial land negotiation transactions, which should be taken into account when providing industrial land. Rising industrial land demand aids the agglomeration and expansion of regional manufacturing firms. Due to the agglomeration effect, the inflow of capital and labor force encourages the research, development, and implementation of innovative energy-saving and emission-reduction technologies and industrial upgrading, which has a favorable effect on green industrial total factor productivity. Local governments, on the other hand, will change the industrial structure in order to increase the scale of investment attraction [

20], which makes it easy to build path dependence. Local governments may decrease the environmental entry threshold to encourage more heavy industry businesses to settle in, and environmental regulation may be relaxed, resulting in a “prisoner’s dilemma” that is not favorable to improving industrial green total factor productivity.

Lin argued that technological advancement has a significant impact on the organization of factor endowment [

22]. Technological innovation is the most direct form of clean technology research and development, as it aids in optimizing the degree of adaptation of industrial businesses to the needs of green clean production, and thus improves total factor productivity in the industry. The industrial sector, as the driving engine for industrial transformation and upgrading, is where technological innovation and environmental contamination occur most frequently [

23]. To provide more information and technical support for technological innovation, businesses require a significant amount of financial support and incentive for innovative behavior [

24,

25]. Technological innovation is the most direct kind of clean technology research and development, as it aids in the optimization of industrial businesses’ adaption to meet the demands of green and clean production. Institutional issues (such as property rights and patents), according to Acemoglu, will have an impact on technical progress [

26]. Local governments, as executors of land resource allocation, heavily rely on the development mode of land investment. This pattern lowers the legitimate price of industrial land, thus leading to price distortions. Under these circumstances, the excess demand for cheap land is stimulated, during which the crowding-out effect caused by R&D capital investment may weaken enterprises’ willingness to innovate technologically. The non-marketization of land has a negative impact on the equilibrium of the market system, as it quickly leads to resource misallocation, resulting in rent-seeking corruption [

27,

28] and a stifling effect on technical progress. Simultaneously, increased industrial land prices will have a crowding-out effect on company technology research and development [

29]. Enterprises will invest more money in land transaction fees due to the grant of “Tender, Auction, and Listing”, tightening financial support for technological activities. Technological innovation is the most direct form of clean technology research and development, as it aids in optimizing the degree of adaptation of industrial businesses to meet the needs of green clean production, and thus improves total factor productivity in the industry. The uncertainty of a long cycle and slow effect characterizes enterprise scientific and technological innovation activities, which is bound to affect enterprise scientific and technological research and development activities, causing a crowding effect on enterprise technological research and development and inhibiting enterprise technological upgrading. On the one hand, technical benefits can substitute for other elements, lower pollution emissions, accelerate the implementation of green environmental protection technologies in enterprise production processes, promote production procedure innovation and equipment improvement, enhance the output of unit energy consumption, and improve green production efficiency. The local government will spend a significant amount of money to build industrial infrastructure, improve the level of local supporting facilities, create a better investment environment for the development of local industrial enterprises, and reduce the flow cost of production factors in order to attract more capital inflow. Industrial businesses can share infrastructure and a mature labor market, lowering production costs while raising the costs of research and development and scientific and technological innovation, contributing to the enhancement of green total factor productivity in industry. If investment attraction fails, resources invested early on will be wasted, obstructing the transformation and upgrading of the local industry and yielding results that contradict the preceding analysis.

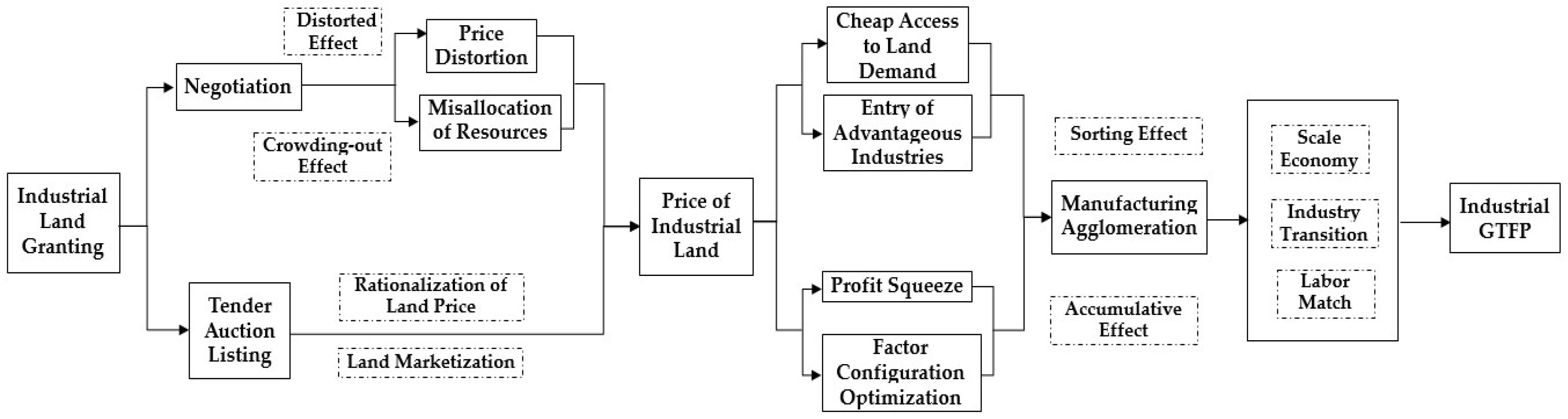

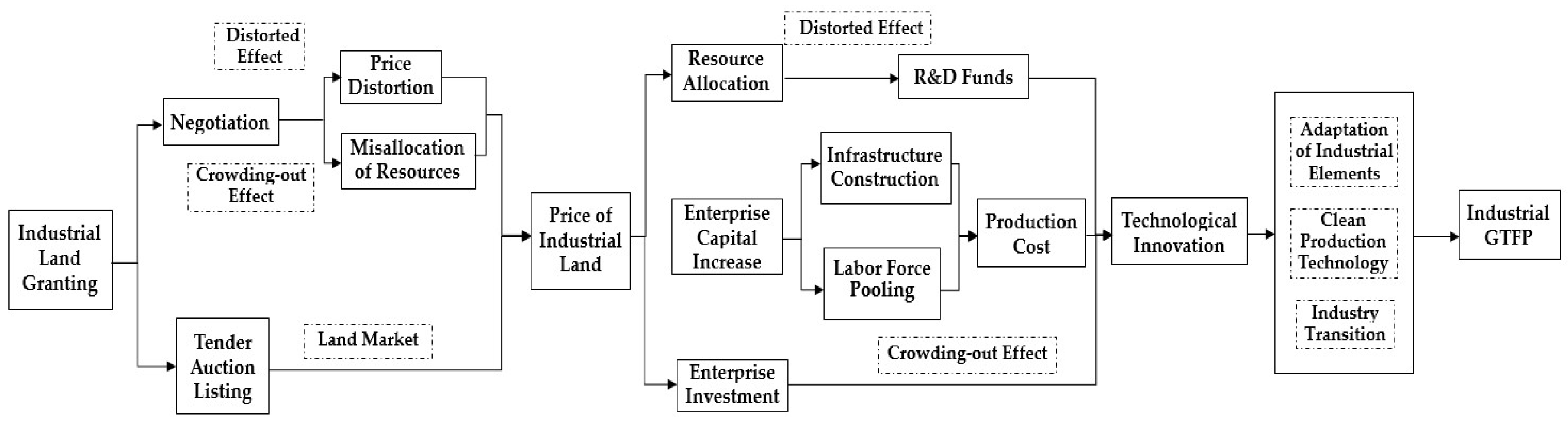

Figure 1 and

Figure 2 depict the specific theoretical analytical framework, and this study proposes the following hypotheses.

Hypothesis 1. The agglomeration effect of manufacturing will affect industrial GTFP, and will boost the impact of the negotiating transaction on industrial GTFP. On industrial GTFP, “Tender, Auction, and Listing” has no significant mediating effect.

Hypothesis 2. Through the crowding-out effect of technological innovation, negotiated transactions will obstruct the progress of industrial GTFP.

This study contributes to the existing studies in the following aspects. To begin with, it extends the scope of research on the impact of the land giving mode on industrial GTFP. The majority of studies focus on factors influencing industrial GTFP, while overlooking the transmission mechanism of the impact of land granting (negotiation and “Tender, Auction, and Listing”) on industrial GTFP. Second, the analysis framework is expanded to incorporate other transmission elements, and the impact of the land giving mode on industrial GTFP is exposed from a macro perspective. Third, the previous research has rarely mentioned the impacts of industrial agglomeration on GTFP due to the unequal geographical distribution. As a result, this research builds a dynamic spatial panel model with a lag term for industrial GTFP, and investigates the transmission mechanism of the effect of land granting modes on industrial land granting and industrial GTFP.

5. Empirical Results and Discussions

Table 1 and

Table 2 show the descriptive statistics of major variables and the Moran’s

I index of industrial GTFP for each year. The existence of a spatial correlation in China’s industrial GTFP indicates that spatial econometric models should be incorporated.

5.1. Results Analysis of Mediating Effect through the Procedure of Negotiation

As tabulated in

Table 3, the explained variable’s first-order lag coefficient passed the significance test at the 5% level, indicating that the industrial GTFP has a clear spatial effect, accompanied by a distinct tendency for inertia in the operation of China’s industrial green economy, in which the accumulation and path dependence of industrial GTFP are noticeable. At the same time, the Sargan test and the Arellano–Bond test prove the instrumental variables’ validity. In Equation (1), at the 1% level, the negotiate transaction is significantly negative, and every 1% increase in the negotiated transaction price of a unit of sold area reduces the industrial GTFP by 0.04%, implying that the negotiated transaction will obstruct the improvement in the industrial GTFP. The previous theoretical analysis supports this conclusion, and the mediation effect test can be continued. The influence coefficient of negotiate transaction on manufacturing agglomeration is significantly positive at 5%, and the overall fitting degree is good in Equation (2). The manufacturing agglomeration level rises by 0.04% for every 1% increase in the agreed sale price per unit selling area. Land will be sold by local governments under low-cost agreements, promoting the agglomeration of local manufacturing industries. Manufacturing agglomeration is negatively impacted by per capita income and infrastructure levels. The regression results here are in line with those from existing studies. The human capital regression coefficient fails to pass the significance test. Equation (3) shows that manufacturing agglomeration has a strong beneficial impact on industrial GTFP at a level of 5%. Industrial GTFP will grow by 0.02% when the manufacturing agglomeration level rises by 1%. The fourth hypothesis is correct. Manufacturing agglomeration has a positive mediating effect on the effect of negotiated transaction on industrial GTFP, meaning it promotes the effect of negotiated transaction on industrial GTFP. Equation (4) incorporates the quadratic term of manufacturing agglomeration on the basis of Equation (3) to further evaluate whether manufacturing agglomeration has a non-linear effect on industrial GTFP (3).

The results demonstrate that the manufacturing agglomeration quadratic coefficient is negative, even though it fails the significance test, indicating that the influence of manufacturing agglomeration on industrial GTFP has an inverted “U-shaped” nonlinear characteristic to some extent. Finally, Equation (4) has a lower estimated coefficient of negotiation than Equation (1), showing that manufacturing agglomeration is a mediating variable of the negotiation affecting industrial GTFP. The results of the intermediary effect tests support the “negotiation—manufacturing agglomeration—industrial GTFP” intermediary transmission path. The negotiated transaction will increase the mediation effect of local industrial GTFP through manufacturing agglomeration, relying on the cost advantages of labor-intensive and resource-intensive manufacturing enterprises, and will be more sensitive to price changes of input factors. The reduced industrial land price obtained through the negotiated deal will entice the manufacturing industry to congregate, and the increase in pollution emissions will reduce industrial GTFP. Industrial structure, government management, and infrastructure level show a significant positive correlation with industrial GTFP, while green transportation level and industrial GTFP have a significant negative correlation, indicating that the promotion of industrial structure, government intervention and support, and infrastructure improvement all help the growth of industrial GTFP. Furthermore, increasing transportation levels does not lead to an increase in industrial GTFP. Local governments should lay great emphasis on the long-term growth of the regional industrial economy, rather than attracting industrial firms by lowering land acquisition costs or enacting preferential land laws. To encourage the improvement of industrial GTFP, local governments must effectively regulate the price mechanism of industrial land, attract more knowledge-intensive high-end firms to enter, and raise the green innovation level of enterprises.

As shown in

Table 4, the coefficient of industrial GTFP lagging one stage is similarly notably negative at 5%, demonstrating the model selection’s rationality. The findings of Equations (1) and (5) regarding the negotiating transaction regression coefficient are nearly identical, which is consistent with the theoretical prediction. The technological innovation intermediation effect test can be continued. The influence of the negotiated transaction on technical innovation is highly beneficial in Equation (6), at a level of 5%. The internal R&D investment of industrial businesses increases by 0.08% when the negotiated transaction price of a unit of transferred area increases by 1%. Per capita income and infrastructure level have strong negative effects on technological innovation, with coefficients of −0.06 and −0.12, respectively. Negotiation and technological innovation both pass the 5% significance criteria for industrial GTFP in Equation (7). When industrial companies raise their internal R&D spending by 1%, the overall factor productivity of industrial green increases by 0.02%. The empirical results support the statements of hypothesis 5. Technological innovation promotes the effect of negotiation on industrial GTFP by acting as a positive mediating factor. Equation (8) is based on Equation (7), and the second component of technological innovation is included to further investigate the non-linear effects of technological innovation on industrial GTFP. The results reveal that at a level of 5%, the quadratic coefficient of technological innovation is highly positive, and the effect of technological innovation on industrial GTFP is not nonlinear. The coefficient of the negotiated transaction in Equation (8) is slightly lower than in Equation (5), indicating that technological innovation is an intermediary variable of negotiate transaction affecting industrial GTFP, and that an intermediary transmission path of “negotiation—technological innovation—industrial GTFP” has been established. Local governments attract investment and invest in the industrial infrastructure by lowering the industrial land price, improving the level of local infrastructure and the investment environment, lowering the flow cost of production factors, and increasing investment in green technology research and development, all of which contribute to the improvement of industrial GTFP. That is, via the intermediary influence of technological innovation, the negotiated sales will affect the improvement in local industry GTFP. The model’s stability is confirmed by the fact that the influence of industrial structure, government management, infrastructure level, and transportation level on industrial GTFP is relatively stable. According to the local factor resource endowment, the local government should carry out reasonable administrative interventions on low-production capacity departments, fully exploit the industry’s comparative advantage effect, realize manufacturing structure upgrading, and improve the industry’s competitiveness. Simultaneously, lowering polluting firms’ resource allocation will help to actualize green industries first, and increase the industry’s GTFP. The need for railway and highway transportation capacity and convenience is increasing as regional infrastructure improves. The elimination of transfer and communication between elements and adjacent areas is facilitated by improved transportation conditions, but high-load traffic operations will result in increased energy consumption and greenhouse gas emissions in the transportation process, impeding the improvement of industrial GTFP.

5.2. Results Analysis of Mediating Effect through the Procedure of “Tender, Auction, and Listing”

To begin, the LM test, Robust LM test, and Wald test are employed to assess the model’s fit. The spatial lag effect is large, as demonstrated in

Table 5. As a result, for analysis, a dynamic spatial lag model is created.

The spatial hysteresis of industrial green total factor productivity has been established; hence, it will not be discussed further here. The regression tests for the direct impact of “Tender, Auction, and Listing” selling on industrial GTFP and the mediating effect of manufacturing agglomeration on “Tender, Auction, and Listing” selling on industrial GTFP are carried out using Equations (13) and (14). The coefficient of “Tender, Auction, and Listing” shown in

Table 6 is 0.01, indicating that the land grant aids in the rationalization of the industrial land price. The enhancement of industrial GTFP is aided by optimizing land element allocation, which is compatible with the theoretical analysis above. However, it failed the significance test, demonstrating that granting industrial land through the “Tender, Auction, and Listing” system had no meaningful impact on improving industrial GTFP. In the examination of industrial land granting and industrial GTFP, the influence of industrial structure, transportation conditions, government intervention, and infrastructure building on industrial GTFP is essentially consistent with the direction of the coefficient.

The intermediation effect test could not be continued, since the impact of the “Tender, Auction, and Listing” of industrial land on the GTFP failed the significance test. The coefficient of industrial land “Tender, Auction, and Listing” selling fails the significance test in Equation (14), showing that “Tender, Auction, and Listing” selling has no direct impact on manufacturing agglomeration. This article attempts to investigate the influence of industrial land tenders, auctions, and listings on technical innovation. Similarly, the “Tender, Auction, and Listing” industrial land award has little impact on technical innovation. To summarize, the “’Tender, Auction, and Listing’—manufacturing agglomeration—industrial GTFP” and “’Tender, Auction, and Listing’ —technological innovation—industrial GTFP” intermediary transmission paths are invalid.

Land is one of the most essential components in the production and development of businesses, and land price is the most crucial factor in business development. Negotiation, as well as “Tender, Auction, and Listing”, are used in China’s industrial land distribution process. Negotiation and “Tender, Auction, and Listing” have a considerable impact on the improvement of GTFP in the above study on the impact of land granting procedures on GTFP. However, in this section’s research, the industrial land grant of negotiation hampered the improvement of industrial GTFP greatly, whereas the grant of “Tender, Auction, and Listing” had no effect. The reason for this could be that China’s present industrial development has long relied on cutting land costs through low-cost negotiated transactions, which helps businesses enhance their profit margins. According to the results of the preceding tests, the agglomeration of manufacturing industries can help increase industrial GTFP. This suggests that China’s manufacturing industry is still in the early stages of agglomeration, with highly concentrated input factors, innovative technologies, labor force distribution, and industrial association externalities all contributing to the enhancement of industrial GTFP. Moreover, the “Tender, Auction, and Listing” land grant is insufficient to meet the “promotion championship” performance assessment requirements. China has proposed applicable rules for the awarding of industrial land, requiring the grant of industrial land to gradually acquire marketization and requiring the grant of “Tender, Auction, and Listing” to enter and depart the land market. The technique of land granting will restrict the profit space of small start-up businesses and companies in the early stages of development, thereby limiting capital flow. To achieve the Pareto optimization of green output, an organization must improve the utilization efficiency of the input variables via external means, such as technical innovation. Under the dual restrictions of resources and the environment, businesses must not only maximize their profits, but also adhere to the notion of green development, which is extremely difficult for small businesses to achieve. The land price advantage gained through negotiating a deal cannot be realized through the “Tender, Auction, and Listing” process. Local governments are also unable to give industrial firms more project support and policy preferences. These conditions are not favorable to the geographical agglomeration of labor- and resource-intensive industrial firms that are sensitive to price changes in their inputs. Simultaneously, rising land prices will re-screen factors and resource allocation, preventing the scale effect of industrial agglomeration from being achieved, and lowering local competitiveness, which will stifle local industry investment. The improvement of a company’s technological innovation level is a long process that necessitates long-term financial support from the company. The increase in industrial land prices generated by “Tender, Auction, and Listing” will have a crowding-out effect on a company’s technical innovation. The undeniable fact in this case is that enterprises will face tremendous difficulties in upgrading their industrial manufacturing due to their insufficient innovation capacity, under which circumstance the industrial GTFP cannot achieve sustainable growth.

5.3. Robustness Test

This research adopts the approach of replacing the mediating variable index to carry out a robustness test in order to further evaluate the reliability and non-randomness of the preceding analysis results. An alternative variable of manufacturing agglomeration is the manufacturing agglomeration index, which is derived based on the number of law workers in the manufacturing industry. Government funds in the internal expenditure of industrial businesses’ R&D funds are chosen as an alternative variable of technological innovation, according to the research of Tao et al. [

34].

Table 7 shows the findings of the replacement mediation variables’ robustness assessment. The robustness test of the mediating impact, based on the substitution variable of manufacturing agglomeration, on the effect of negotiation on industrial GTFP, which omits the first stage, is shown in Equations (9) and (10). The influence of bargaining on manufacturing agglomeration is roughly consistent with the earlier study, as shown in Equation (9). The significance of the effect of the negotiated land transaction on the industrial GTFP vanishes after the substitution variable of manufacturing agglomeration is added to Equation (10), indicating that the land acquired through negotiation acts on the industrial GTFP through the path of manufacturing agglomeration, calculated based on manufacturing employees. As a result, the estimated results of the effect path of land negotiation transaction on industrial GTFP are rather robust, and the test results presented above are reliable. The test of the mediating influence of technical innovation substitution variables on the effect of negotiation on industrial GTFP is shown in Equations (11) and (12), which skip the first step. Equation (11), which essentially gives identical conclusions to prior research, states that property purchased through negotiation stimulates technical innovation. When the substitution variable of technical innovation is introduced to Equation (12), the impact of the land negotiate transaction on industrial GTFP remains strongly negative, indicating that the land negotiate transaction undertakes an intermediary transmission path through technological innovation. As a result, the estimated effect path of land grant on industrial GTFP is generally stable.

6. Conclusions

6.1. Key Findings

This paper integrates manufacturing agglomeration, technological innovation, and industrial GTFP into a unified theoretical framework based on the various land granting modes of local governments, and systematically analyzes the transmission mechanism of the effect of land granting modes on industrial GTFP. This paper produces dynamic panel data based on a binary space weight matrix of geographically adjacent land, and conducts empirical analysis on the transmission mechanism of the effects of different land granting modes on industrial GTFP, taking into account the spatial effect of industrial GTFP. The conclusions indicate that, the industrial green economy in China is characterized by clear path dependence, and the industrial GTFP has a significant geographical influence. Manufacturing agglomeration and industrial GTFP have a non-linear connection. Based on the empirical results, local governments gain a cost advantage depending on their low price competition, and the mediating effect of manufacturing agglomeration promotes the influence of land gained through negotiation on industrial GTFP. Between technological innovation and industrial GTFP, there is no non-linear relationship. By promoting industrial GTFP through the intermediary effect of technological progress, land ownership will be granted. There is no mediating transmission effect, based on manufacturing agglomeration and technical innovation as mediating variables, on the effect of “Tender, Auction, and Listing” on industrial GTFP, and there is no substantial effect of “Tender, Auction, and Listing” on industrial GTFP. The level of industrial structure, government management, and infrastructure considerably aided the improvement of industrial GTFP, whereas the level of transportation hampered it. Local governments integrate regional resource endowment, extensively exploit comparative industrial advantages, promote industrial structure upgrading and core competitiveness, and increase industrial GTFP through administrative interventions in low-production capacity departments. A high degree of transportation circumstances enhances the transportation operation’s energy consumption and greenhouse gas emissions, but we lack sufficient evidence to support the improvements of industrial GTFP.

The following are some of the paper’s flaws. To begin, the scope of this paper is confined to the province level, due to the influence of data collection, and further research should be refined to the city (county) level. Second, there are numerous elements that influence green total factor productivity, and it is impossible to control all of them for analysis purposes. As a result, the focus of this research is on a few key transmission parameters.

6.2. Policy Recommendation

In view of the results, the following recommendations are given.

With regard to the policy implications, local governments need to align the development paths of industrial enterprises, with the most imperative adjustment being the regulation of the industrial land transfer mode. Relevant regulatory departments should carry out the close inspection and the marketization of industrial land transactions. Furthermore, local governments should standardize legal and compliance procedures for industrial land use, put an end to land use methods that are detrimental to the development of the green economy, and collaborate in the formulation of relevant laws and regulations to restrict and regulate the granting of industrial land. According to the findings of the research, there is no conspicuous evidence that negotiating industrial land will contribute to industrial GTFP growth. Thus, local governments need to examine land granting modes, gradually eliminate all ways of suppressing industrial land prices through illegal means and attracting funds in exchange for high profits by lowering the environmental control threshold on the basis of formulating regulations to carry out judicial constraints. The marketization of land granting can only be made more effective in improving industrial GTFP if the inferior industrial land awarding conduct is eliminated at the source. At the same time, local governments must regulate the industrial land price mechanism and provide policy and financial support for emerging environmental protection industries in order to promote the adoption of technological advantages, as well as improve production processes to reduce pollution sources and achieve green and high-quality regional enterprise development.