Analysis of the Relationship between Corporate CSR Investment and Business Performance Using ESG Index—The Use-Case of Korean Companies

Abstract

:1. Introduction

2. Theorical Background

2.1. Non-Financial ESG

2.2. Financial Perspective ESG

3. Research Methods and Design

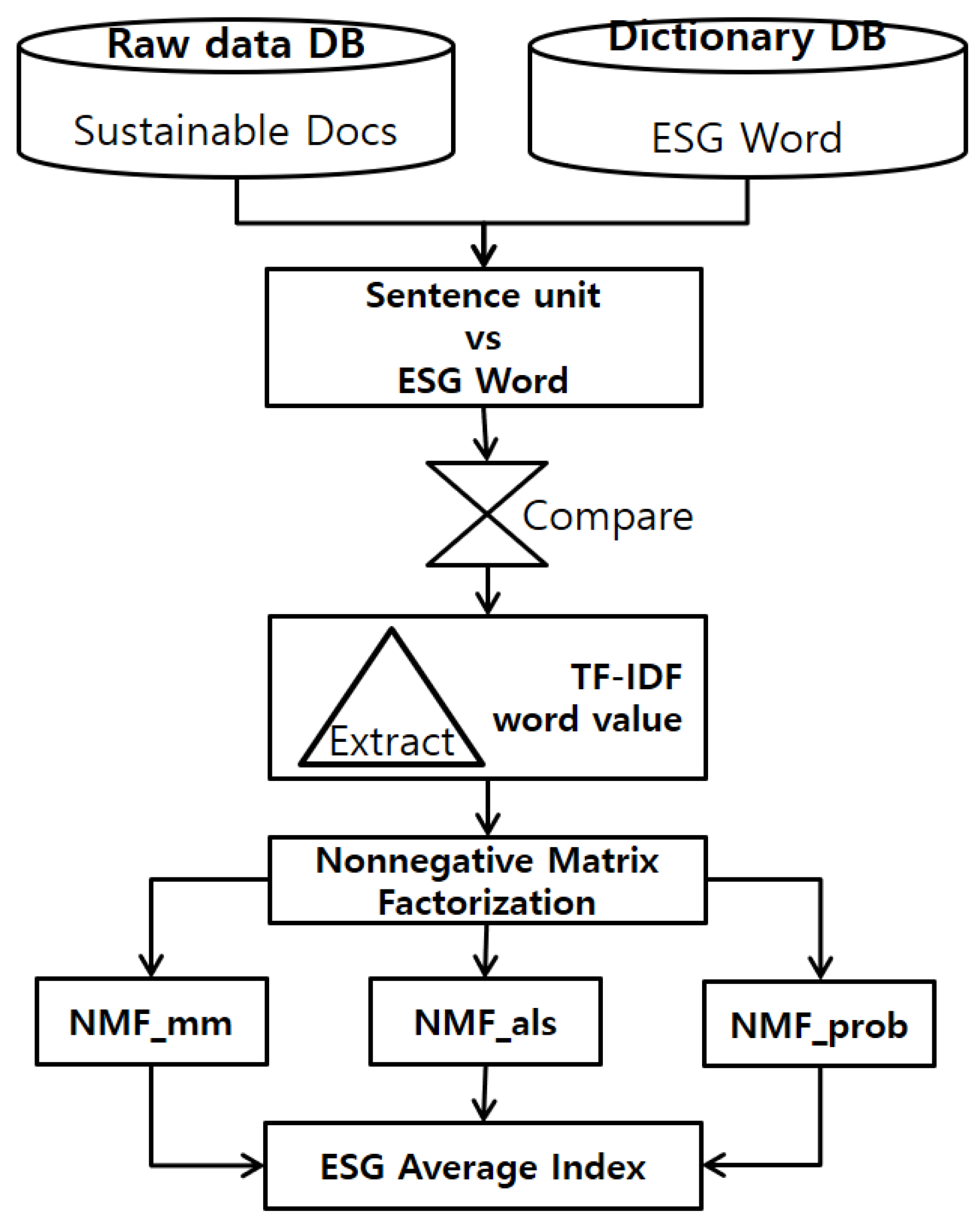

3.1. ESG Index Development

- (1)

- NMF_mm multiplicative update method

- (2)

- NMF_als—alternating least-squares method

- (3)

- NMF_prob—multinomial method

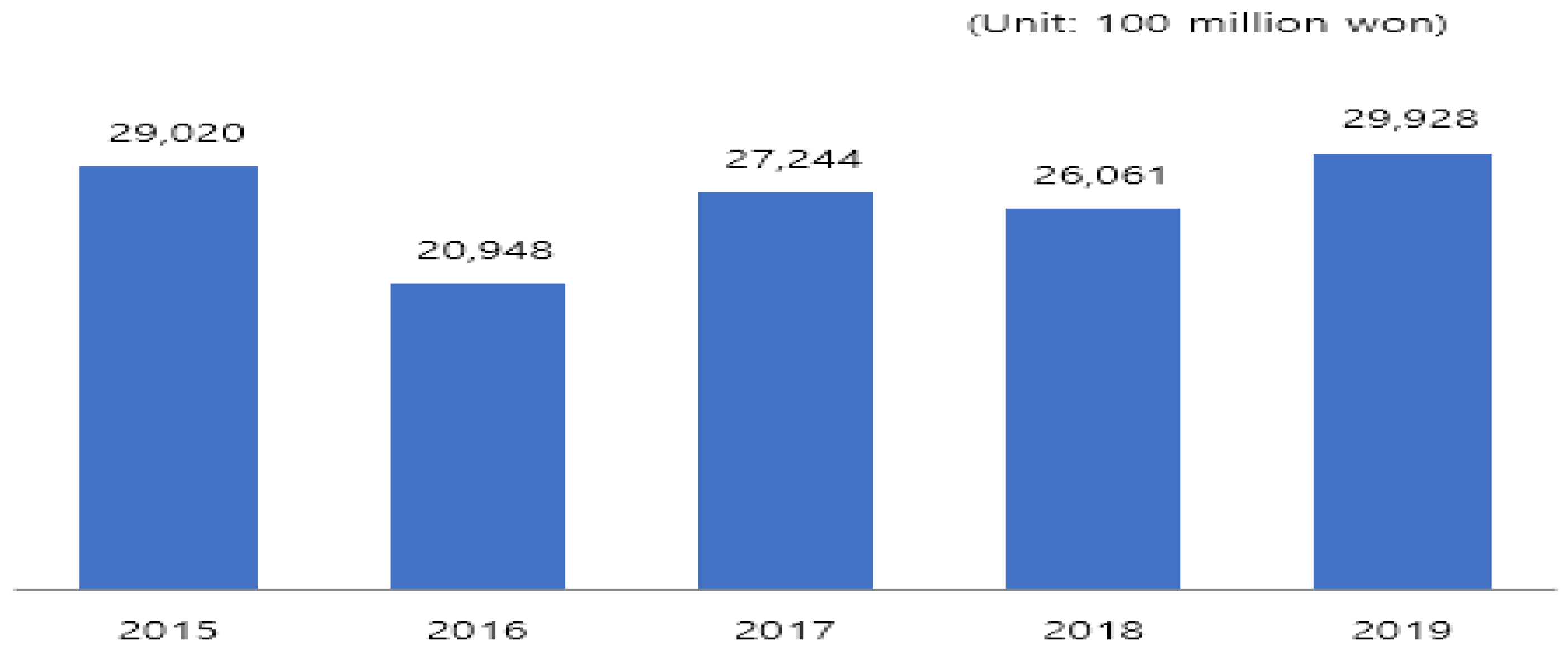

3.2. CSR Investment and Business Performance

4. Research Results

5. Discussion and Future Research

5.1. Conclusions

5.2. Discussion of Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hermundsdottir, F.; Aspelund, A. Sustainability Innovations and Firm Competitiveness: A Review. J. Clean. Prod. 2021, 280, 124715. [Google Scholar] [CrossRef]

- Byen, S.H.; Kim, K.H. Challenges and Tasks for Establishing a Korean Model of ESG Management; Korea CEO Academy: Seoul, Korea, 2021; pp. 85–89. [Google Scholar]

- Jang, Y.J. Status and Problems of Korean ESG Rating Agencies and Regulatory Direction. Commercial Cases Rev. 2021, 34, 423–471. [Google Scholar] [CrossRef]

- Amazon, Complete the ESG Management Model as a Global E-Commerce Leader, ESG Tomorrow. 2021. Available online: http://www.esgtomorrow.co.kr/news/newsView.asp?aidx=24 (accessed on 9 November 2021).

- Korea’s First Steel Industry to Declare Carbon Neutrality ‘Corporate Citizenship’ ESG Management, ESG Tomorrow. 2021. Available online: http://www.esgtomorrow.co.kr/news/newsView.asp?aidx=50 (accessed on 10 November 2021).

- Lee, S.K.; Park, M.S. ESG Management Era, Talking about Social Contribution, Daily Impact New. 2021. Available online: http://www.dailyimpact.co.kr/news/articleView.html?idxno=66725 (accessed on 20 November 2021).

- Park, Y.J. 2020 Social Value Report of Major Companies, FKI Report. 2020. Available online: http://www.fki.or.kr/publication/report/View.aspx?content_id=3d1003e9-348c-42c8-b093-a8cd6d3d8172&cPage=1&search_type=0&search_keyword= (accessed on 10 December 2021).

- Jain, T.; Jamali, D. Strategic approaches to corporate social responsibility: A comparative study of India and the Arab world. In Development-Oriented Corporate Social Responsibility; Routledge: Abingdon-on-Thames, London, UK, 2017; Volume 2, pp. 71–90. [Google Scholar]

- Jung, J.S.; Niu, S.J. The Fourth Industrial Revolution and ESG Management: Based on the Comparison between Korea and China Cases in the Distribution Industry. Korean Manag. Consult. Rev. 2021, 21, 351–366. [Google Scholar]

- Lee, J.J. The Rise of ESG Management and the Field of Convergence; Korean Association of Converging Business: Seoul, Korea, 2021; pp. 18–28. [Google Scholar]

- Yun, J.H.; Lee, J.H. A Study on Generalization of Corporate CSR Keywords Using Text Mining. J. Internet Electron. Commer. Res. 2021, 21, 31–48. [Google Scholar] [CrossRef]

- Kim, H.J.; Lee, J.S. A study on the gap between ESG implementation and evaluation: Focusing on the ESG performance indicators. Public Policy Rev. 2021, 35, 199–225. [Google Scholar] [CrossRef]

- The Federation of Korean Industries. Domestic and Overseas ESG Evaluation Trends and Implications. ESG MEMO; The Federation of Korean Industries: Seoul, Korea; Volume 2, pp. 1–3. Available online: http://www.esgtomorrow.co.kr/news/newsView.asp?aidx=16 (accessed on 10 December 2021).

- Morea, D.; Mango, F.; Cardi, M.; Paccione, C.; Bittucci, L. Circular Economy Impact Analysis on Stock Performances: An Empirical Comparison with the Euro Stoxx 50® ESG Index. Sustainability 2022, 14, 843. [Google Scholar] [CrossRef]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Hamann, R. Mining Companies Role in Sustainable Development: The ‘Why’ and ‘How’ of Corporate Social Responsibility from a Business Perspective. Dev. South. Afr. 2003, 20, 237–254. [Google Scholar] [CrossRef]

- Do, E.J. Strategies for creating social activities. POSRI Bus. Rev. 2005, 5, 203–229. [Google Scholar]

- Choi, W.W.; Bae, J.H.; Kim, S.I. The Effect of Charitable Contributions on the Firm Value: From the Perspective of Corporate Ownership. Korean Acad. Soc. Bus. Adm. 2009, 38, 1415–1443. [Google Scholar]

- Fry, L.W.; Keim, G.D.; Meiners, R.E. Corporate Contributions: Altruistic or For-Profit? Acad. Manag. J. 1982, 25, 94–106. [Google Scholar] [CrossRef]

- Wokutch, R.E.; Barbara, A. Spencer: Corporate Saints and Sinners: The Effects of Philanthropic and Illegal Activity on Organizational Performance. Calif. Manag. Rev. 1987, 29, 62–77. [Google Scholar] [CrossRef]

- La Torre, M.; Mango, F.; Cafaro, A.; Leo, S. Does the ESG Index Affect Stock Return? Evidence from the Eurostoxx50. Sustainability 2020, 12, 6387. [Google Scholar] [CrossRef]

- Kovacova, M.; Lăzăroiu, G. Sustainable Organizational Performance, Cyber-Physical Production Networks, and Deep Learning-assisted Smart Process Planning in Industry 4.0-based Manufacturing Systems. Econ. Manag. Financ. Mark. 2021, 16, 41–54. [Google Scholar] [CrossRef]

- Dawson, A. Robotic Wireless Sensor Networks, Big Data-driven Decision-Making Processes, and Cyber-Physical System-based Real-Time Monitoring in Sustainable Product Lifecycle Management. Econ. Manag. Financ. Mark. 2021, 16, 95–105. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Kliestik, T.; Novak, A. Internet of Things Smart Devices, Industrial Artificial Intelligence, and Real-Time Sensor Networks in Sustainable Cyber-Physical Production Systems. J. Self Gov. Manag. Econ. 2021, 9, 20–30. [Google Scholar] [CrossRef]

- Lee, J.K.; Rhee, J.H. Current Status and Future Directions of Research on Sustainable Management: Focusing on the ESG Measurement Index. J. Strateg. Manag. 2020, 23, 65–92. [Google Scholar] [CrossRef]

- Cha, J.I.; Yoon, H.K.; Kim, M.S. Qualitative Analysis of ESG Factors Using Sustainability Report. J. KIISE Softw. Appl. 2021, 2021, 1753–1755. Available online: http://www.kiise.or.kr (accessed on 23 December 2021).

- Christian, H.; Agus, M.P.; Suhartono, D. Single document automatic text summarization using term frequency-inverse document frequency (TF-IDF). ComTech Comput. Math. Eng. Appl. 2016, 7, 285–294. [Google Scholar] [CrossRef]

- Lee, D.D.; Seung, H.S. Learning the parts of objects by non-negative matrix factorization. Nature 1999, 401, 788–791. [Google Scholar] [CrossRef] [PubMed]

- Cho, Y.S. The Relationship between Social Responsibility and Management Performance by Firm Size; Korean management Consulting Review: Incheon Metropolitan City, Korea, 2020; Volume 20, pp. 61–71. [Google Scholar]

| Company Name | Adjustment Level * | Rating Gap | |||||

|---|---|---|---|---|---|---|---|

| MSCI (Level 7) | Refinitiv (Out of 100 Points) | KCGS (Level 7) | M-R ** | M-K ** | R-K ** | Average Gap | |

| Hyundai Steel | CCC | AA (77) | BBB (B+) | 5 | 3 | 2 | 2.2 |

| Kia Motors | CCC | A (62) | A (A) | 4 | 4 | 0 | |

| Hyundai Motor | B | AA (74) | A (A) | 4 | 3 | 1 | |

| Samsung Heavy Industries | CCC | A (64) | BBB (B+) | 4 | 3 | 1 | |

| Korea Electric Power Corporation Co., Ltd. | BB | AA (73) | A (A) | 3 | 2 | 1 | |

| Korea Gas Corporation Co., Ltd. | BB | AA (73) | A (A) | 3 | 2 | 1 | |

| Hyundai Glovis Co., Ltd. | BB | AA (77) | A (A) | 3 | 2 | 1 | |

| Hyundai Engineering & Construction Co., Ltd. | BB | AA (81) | A (A) | 3 | 2 | 1 | |

| Doosan Heavy Industries & Construction Co., Ltd. | BB | AA (74) | A (A) | 3 | 2 | 1 | |

| S-Oil Co., Ltd. | BB | AA (82) | AA (A+) | 3 | 3 | 0 | |

| Hyundai Mobis Co., Ltd. | B | BBB (51) | A (A) | 2 | 3 | 1 | |

| Lotte Shopping Co., Ltd. | B | BBB (49) | A (A) | 2 | 3 | 1 | |

| E-Mart | B | BB (36) | A (A) | 1 | 3 | 2 | |

| Kumho Petrochemical Co., Ltd. | B | B (27) | A (A) | 0 | 3 | 3 | |

| BGF Retail | BB | CCC (12) | A (A) | 2 | 2 | 4 | |

| S1 Corporation | BB | CCC (9) | BBB (B+) | 2 | 1 | 3 | |

| CJ Logistics Co., Ltd. | BB | B (20) | A (A) | 1 | 2 | 3 | |

| The Shilla Hotels & Resorts | BB | B (21) | A (A) | 1 | 2 | 3 | |

| Korea Aerospace Industries Co., Ltd. | BB | B (22) | A (A) | 1 | 2 | 3 | |

| Ottogi Corporation Co., Ltd. | B | CCC (8) | BBB (B+) | 1 | 2 | 3 | |

| Samsung Electronics Co., Ltd. | A | AAA (91) | BBB (B+) | 2 | 1 | 3 | |

| LG Electronics Co., Ltd. | A | AAA (90) | BBB (B+) | 2 | 1 | 3 | |

| Mean | S.D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Scale | 30.737 | 1.350 | 1 | ||||||||||

| 2. Chaebol | 0.550 | 0.500 | 0.052 | 1 | |||||||||

| 3. Ownership | 1.860 | 0.348 | −0.197 * | 0.039 | 1 | ||||||||

| 4. Advertising ratio | 0.577 | 0.012 | −0.074 | −0.115 | 0.026 | 1 | |||||||

| 5. CSR investment | 0.105 | 0.132 | −0.307 ** | −0.146 | 0.151 | 0.226 * | 1 | ||||||

| 6. ROA (year t) | 2.735 | 4.774 | 0.147 | 0.351 ** | 0.285 ** | 0.302 ** | 0.069 | 1 | |||||

| 7. ROE (year t) | 5.513 | 14.504 | −0.030 | 0.300 ** | 0.258 ** | 0.096 | 0.030 | 0.857 ** | 1 | ||||

| 8. ROS (year t) | 6.718 | 6.884 | −0.030 | −0.099 | 0.047 | −0.037 | 0.042 | 0.126 | 0.095 | 1 | |||

| 9. ROA (year t + 1) | 2.578 | 4.816 | 0.123 | 0.357 ** | 0.305 ** | 0.215 * | 0.051 | 0.568 ** | 0.497 ** | 0.125 | 1 | ||

| 10. ROE (year t + 1) | 5.203 | 15.410 | −0.049 | 0.286 ** | 0.270 ** | 0.058 | 0.032 | 0.323 ** | 0.384 ** | 0.137 | 0.872 ** | 1 | |

| 11. ROS (year t + 1) | 7.819 | 7.457 | −0.054 | −0.109 | 0.045 | −0.023 | −0.044 | 0.077 | 0.080 | −0.010 | 0.138 | 0.099 | 1 |

| Mean | S.D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Scale | 29.830 | 1.156 | 1 | ||||||||||

| 2. Chaebol | 0.720 | 0.453 | 0.075 | 1 | |||||||||

| 3. Ownership | 1.810 | 0.391 | −0.125 | 0.424 ** | 1 | ||||||||

| 4. Advertising ratio | 0.012 | 0.017 | −0.137 | 0.087 | 0.229 * | 1 | |||||||

| 5. CSR investment | 0.151 | 0.197 | −0.194 | −0.048 | −0.309 ** | 0.306 ** | 1 | ||||||

| 6. ROA(year t) | 4.186 | 5.880 | −0.044 | 0.191 | 0.150 | 0.405 ** | 0.430 ** | 1 | |||||

| 7. ROE(year t) | 6.903 | 11.787 | −0.124 | 0.195 * | 0.094 | 0.371 ** | 0.332 ** | 0.900 ** | 1 | ||||

| 8. ROS(year t) | 5.590 | 9.143 | 0.011 | 0.147 | 0.168 | 0.192 | 0.267 ** | 0.845 ** | 0.763 ** | 1 | |||

| 9. ROA (year t + 1) | 4.423 | 6.012 | −0.081 | 0.189 | 0.131 | 0.418 ** | 0.406 ** | 0.647 ** | 0.509 ** | 0.497 ** | 1 | ||

| 10. ROE (year t + 1) | 7.358 | 11.912 | −0.144 | 0.161 | 0.058 | 0.363 ** | 0.326 ** | 0.423 ** | 0.327 ** | 0.308 ** | 0.896 ** | 1 | |

| 11. ROS (year t + 1) | 5.968 | 9.474 | −0.031 | 0.143 | 0.154 | 0.185 | 0.319 ** | 0.531 ** | 0.418 ** | 0.442 ** | 0.833 ** | 0.754 ** | 1 |

| Division | Dependent Variable: Year t | Dependent Variable: Year t + 1 | |||||

|---|---|---|---|---|---|---|---|

| ROA | ROE | ROS | ROA | ROE | ROS | ||

| Control variable | Company size | 0.234 ** | 0.016 | −0.012 | 0.217 * | 0.009 | −0.068 |

| Chaebol presence | 0.377 *** | 0.306 ** | −0.103 | 0.377 *** | 0.288 ** | −0.126 | |

| Type of possession | 0.296 *** | 0.244 ** | 0.040 | 0.318 ** | 0.254 * | 0.050 | |

| Ad rate | 0.338 *** | 0.122 | −0.058 | 0.244 ** | 0.078 | −0.022 | |

| Independent variable | CSR Investment | 0.075 | 0.015 | 0.030 | 0.079 | 0.030 | −0.088 |

| F value | 4.347 ** | 0.346 | 8.458 *** | 3.410 ** | 0.454 | ||

| R2 | 0.166 | 0.016 | 0.315 | 0.156 | 0.024 | ||

| Modified R2 | 0.128 | −0.030 | 0.278 | 0.111 | −0.029 | ||

| Division | Dependent Variable: Year t | Dependent Variable: Year t + 1 | |||||

|---|---|---|---|---|---|---|---|

| ROA | ROE | ROS | ROA | ROE | ROS | ||

| Control variable | Company size | 0.092 | −0.045 | 0.118 | 0.039 | −0.074 | 0.084 |

| Chaebol presence | 0.099 | 0.173 | 0.037 | 0.116 | 0.153 | 0.039 | |

| Type of possession | 0.206 | 0.037 | 0.273 * | 0.167 | 0.008 | 0.306 * | |

| Ad rate | 0.225 * | 0.260 * | 0.030 | 0.259 * | 0.266 * | −0.003 | |

| Independent variable | CSR Investment | 0.447 *** | 0.264 * | 0.367 ** | 0.408 *** | 0.253 * | 0.444 *** |

| F value | 5.638 *** | 3.560 ** | 7.529 *** | 4.486 ** | 3.879 ** | ||

| R2 | 0.227 | 0.156 | 0.315 | 0.215 | 0.191 | ||

| Modified R2 | 0.187 | 0.112 | 0.273 | 0.167 | 0.142 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yun, J.; Lee, J. Analysis of the Relationship between Corporate CSR Investment and Business Performance Using ESG Index—The Use-Case of Korean Companies. Sustainability 2022, 14, 2911. https://doi.org/10.3390/su14052911

Yun J, Lee J. Analysis of the Relationship between Corporate CSR Investment and Business Performance Using ESG Index—The Use-Case of Korean Companies. Sustainability. 2022; 14(5):2911. https://doi.org/10.3390/su14052911

Chicago/Turabian StyleYun, Jihye, and Jonghwa Lee. 2022. "Analysis of the Relationship between Corporate CSR Investment and Business Performance Using ESG Index—The Use-Case of Korean Companies" Sustainability 14, no. 5: 2911. https://doi.org/10.3390/su14052911

APA StyleYun, J., & Lee, J. (2022). Analysis of the Relationship between Corporate CSR Investment and Business Performance Using ESG Index—The Use-Case of Korean Companies. Sustainability, 14(5), 2911. https://doi.org/10.3390/su14052911