Abstract

This study investigates the relationship between corporate environmental, social and governance (ESG) performance disclosure and profitability, highlighting the significant differences between the financial and non-financial sectors. This study uses an extensive Australian sample during the 2007–2017 period from Bloomberg’s database. A panel regression model is used to evaluate the association between the corporate ESG performance disclosure and profitability to conduct an industry analysis. The robustness of the results is rigorously assessed using several robustness tests to evaluate the methodological, sample selection, endogeneity and causality issues associated with corporate ESG performance disclosure. This study finds that higher corporate ESG performance disclosure is associated with higher company profitability. However, the industry comparison analysis shows significant differences between financial and non-financial industries. This study finds that for companies operating in non-financial sectors, except for corporate governance, there is no significant association between corporate environmental and social elements and a company’s profitability. Therefore, this study has implications for regulators and corporations. The empirical results of this study show that improving corporate ESG performance disclosure is beneficial to shareholders and other stakeholders in the long run. However, the enforcement of environmentally and socially responsible conduct improves profitability only in the financial industry. This study recommends that the regulators create a conducive institutional environment to promote ESG performance in the financial industry. Therefore, it enhances ESG awareness for the borrowers as well as helps economic development.

1. Introduction

During the last decade and since the 2008–2009 period of financial turmoil, where the main driver of the financial crisis initiated from the irresponsible behaviour of the financial sector, the pursuit of environmental, social and governance (ESG) performance disclosure has increased globally [1,2]. The significance of responsible conduct for companies that operate in the financial industry is meaningful when considering the resource allocation role and its substantial impact on overall economic development [3,4]. Accordingly, the benefits of developing corporate ESG performance disclosure create a win-win situation for corporations, stakeholders and the overall economy [5]. However, previous studies on the association between corporate ESG performance disclosure and the company’s financial performance are inconclusive or present mixed results. For instance, a review study by Margolis and Walsh [6] reports some mixed results. Another study by Clacher and Hagendorff [7] provides evidence of a negative association between corporate ESG performance disclosure and financial performance. In contrast, a meta-analysis by Margolis et al. [8] reveals a positive association, later supported by other literature [8,9]. Some studies argue that the relationship is impacted by endogeneity issues caused by reverse causality [10,11] or industry characteristics [12]. The inconsistent results of previous studies on the relationship between corporate ESG performance disclosure and financial performance have left this line of investigation unresolved, therefore prompting new research questions [3,8].

The importance of having a healthy financial industry for economic development and sustained prosperity is uncontested [13]. However, few studies have investigated the implications of corporate ESG performance disclosure in the financial sector compared with other industries [4,14]. The business operations of a financial company depend on the confidence of its customers. Therefore, reputation and credibility are significant for financial companies [15,16]. In the aftermath of the 2008–2009 global financial crisis (GFC), the credibility and reputation of a financial company have become increasingly essential because the main reason for the GFC was the irresponsible conduct of financial companies [2,17,18]. Improving ESG performance in the financial industry plays a pivotal role in economic development and results in two positive spillovers [15,19]. First, it improves overall economic development due to its critical role in resource allocation. Second, it promotes ESG awareness among borrowers. Thus, the investigation of ESG performance in the financial industry is highly relevant and significant, given their important function as lenders and intermediaries in the economy.

Following the above discussion, this study aims to answer the following research questions:

Research question 1 (RQ1): how much is corporate ESG performance disclosure associated with financial performance?

Research question 2 (RQ2): are there any differences or similarities in the above relationship between financial and non-financial industries?

This study responds to the call for further investigation of the relationship using the sub-elements of corporate ESG performance disclosure by Brogi and Lagasio [4]. Investigating industry comparisons of corporate ESG performance disclosure across different industries may help managers and policymakers to incorporate best practices towards promoting sustainable businesses, thus contributing to economic development [14,15,19]. This study involves the use of several tests, including robustness and sensitivity analysis, to address concerns regarding differences in industry characteristics [12] or endogeneity issues [11]. Furthermore, this study performs panel regression analysis, including the year and industry fixed effects, to negate any concern about unobserved company-specific variables or missing elements.

This study has several implications for managers, market participants and other stakeholders as well as regulators. The most attractive implication for corporations is that improving their ESG performance can result in financial benefits in the long run. Therefore, corporate ESG performance disclosure is beneficial to shareholders and other stakeholders and creates a win-win situation. Managers should thus try to improve corporate ESG performance disclosure to foster sustainable profitability, and corporate governance should be integrated into long-term corporate strategies to sustain positive implications for financial performance. The results of this study help market participants and analysts better understand the economic implications of corporate ESG performance disclosure, particularly for financial companies. By promoting ESG performance, financial companies can capture new customers and increase deposit intake, which eventually impacts their financial performance. Regulators must create an institutional environment conducive to promoting ESG performance in the financial sector. This study recommends that regulators support the financial industry with active ESG performance and allocate resources to corporations with improved environmental and social performance.

The remainder of this paper is structured as follows. Section 2 discusses the theoretical framework, literature review and development of the hypotheses. Section 3 describes the data and methodology used for analysis. Section 4 reports the empirical findings. Section 5 discusses the robustness test results, and the conclusion is presented in Section 6.

2. Theoretical Framework

There are numerous theoretical and empirical studies on the association between corporate ESG performance disclosure and financial performance. Friedman, Mackey and Rodgers [20] propose a theoretical concept that better corporate ESG performance leads to lower financial performance. This is consistent with the neoclassical economic theory arguing that corporate commitment to ESG-related activities puts them at a competitive disadvantage and causes an unnecessary increase to the operation’s costs [21,22,23]. Addressing ESG-related issues is the responsibility of government and not-for-profit organisations [24]. Considering additional responsibilities other than wealth maximisation for companies complicates a company’s competition for sustainability [23].

The opposing theoretical prediction for the impact of corporate ESG performance disclosure on financial performance is justified by instrumental stakeholder theory [25], which predicts a positive association. Based on this theory, companies could enhance their profitability by satisfying their stakeholder’s expectations [26]. According to this theory, companies could improve their financial performance by maintaining good relationships with their key stakeholders [10]. Corporate ESG performance is an intangible asset that leads to more efficient use of corporate resources. Barnett and Salomon [27] argue that companies that manage their relationship with their stakeholders can create a valuable reputation that creates a competitive advantage and protects them during a crisis period. This cannot be achieved by companies with a lower level of ESG performance. Higher corporate ESG performance creates a moral reputation capital that connects ESG-related activities to stakeholders’ values [28,29].

In line with the instrumental viewpoint of stakeholder theory, managing the satisfaction of different stakeholder groups contributes to corporate financial performance [25,30]. Companies are thus encouraged to improve their ESG performance to enhance their reputation and maintain accountability [31], which leads to value generation for the company [15,32,33]. From this viewpoint [30,34], Crook, et al. [35] and, more recently, Fatemi, et al. [36], propose that the socially responsible performance disclosure of a company positively impacts a company’s financial and market value. A company’s commitment to socially responsible conduct, a higher standard of transparency and less engagement with bad news speculation are found to mitigate potential future damage to market value [37]. Fatemi, Fooladi and Tehranian [36] argue that corporate social performance disclosure improvements tend to ease the negative impacts of ESG concerns on corporate performance from the investor perspective. A more recent study by Rodriguez-Fernandez [38] reveals a positive association between corporate social engagement and financial performance.

Companies in the financial industry are increasingly motivated to move towards strategic choices regarding sustainability. The financial sector can be a major contributor to overall economic improvement if it can operate in a favourable political and economic environment [39,40]. Pursuing responsible conduct within the financial industry enhances corporate ESG awareness for borrowers and improves overall economic development. Financial companies are particularly interested in supporting the social and environmental requirements to build a strong image for sustainable operations [41]. Their compliance with ESG performance disclosure strongly signals that financial companies take a clear strategy to address ESG-related risks and increase stakeholders’ benefits [41]. Following the viewpoint of stakeholder theory that being socially and environmentally responsible leads to higher stakeholder support, Wu and Shen [42] and Maqbool and Zameer [43] find a positive relationship between corporate ESG performance disclosure and financial performance in the financial sector. These authors recommend investigating the association between different aspects of corporate ESG performance elements and financial performance by comparing financial and non-financial industries. This study argues that better ESG performance of companies that operate in the financial industry results in superior financial performance because of two mechanisms. First, a more efficient stakeholder relationship improves revenue/profit-generating potential. Second, it improves corporate transparency, thus reducing information asymmetry due to higher ESG performance disclosure. This argument is also motivated by the large number of studies that report the positive role of corporate ESG performance for value generation.

3. Literature Review and Hypotheses Development

Although the most prevalent viewpoint on the association between corporate ESG performance and financial performance is positive, some contrasting findings exist [44,45,46]. For instance, in a broad literature review by Brooks and Oikonomou [3], consistent with most studies, including a meta-analysis by Margolis, Elfenbein and Walsh [44], the association between corporate ESG performance disclosure and financial performance is found to be moderately positive. However, some studies find no significant relationship [21] nor a neutral relationship [47]. Nevertheless, the academic literature leans toward a modest positive association between corporate ESG performance disclosure and financial performance [44,45,48,49,50].

In line with the instrumental viewpoint of the stakeholder theory, in which intangible resources generate competitive advantages for the corporation, Russo and Fouts [51] and King and Lenox [52] find that environmental performance is positively related to return on assets (ROA). Their findings are consistent with some meta-analyses documenting a positive association between environmental practices and financial performance [53,54,55]. Kang and Shivdasani [56] examine the role of corporate governance among Japanese companies and provide evidence that corporate governance improvement impacts financial performance, which results in higher value for corporations. Corporate governance is the main driver of sustainable business, and ESG investment must lead by this element [57].

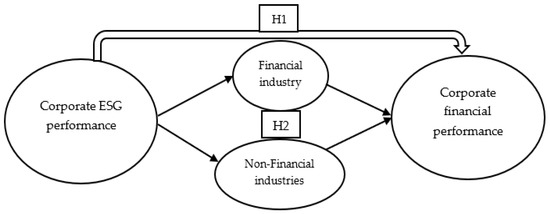

The current study explores the relationship between inclusive and exclusive aspects of corporate ESG performance disclosure and profitability. Therefore, the first hypothesis is postulated as follows:

Hypothesis 1 (H1).

There is a positive association between corporate ESG performance disclosure and a company’s profitability over time.

Prior to the current research, few studies have compared the financial industry with other industries in the context of sustainability and financial performance. Some studies provide evidence that good corporate ESG performance disclosure improves a company’s reputation and operational performance [15,58]. However, limited studies investigate the impact of ESG performance on profitability in the financial industry. Cornett, et al. [59] argue that, apart from the overall benefits of being socially responsible, larger financial corporations pursue sustainable business on a greater scale than smaller companies. Dell’Atti, et al. [60] provide evidence of a positive relationship between a company’s reputation and social performance in financial companies but a negative relationship for governance and environmental performance. This is due to the inadequate application of environmental watchfulness strategies within financial companies. Soana [39] constructs quantitative ethical metrics for corporate social performance disclosure for companies in the financial industry and investigates the association with financial performance using market and accounting measures, finding no statistically significant relationship between corporate social performance disclosure and financial performance in this sector. Platonova, et al. [61] develop an index as a proxy for the corporate social responsibility (CSR) performance disclosure of Islamic financial companies in the Gulf region. These proxies include ‘mission and vision statement’, ‘products’, ‘services’, ‘commitment towards employees’, ‘commitment towards debtors’ and ‘commitment towards society’. Platonova, Platonova, Asutay, Asutay, Dixon, Dixon, Mohammad and Mohammad [61] report a positive relationship between CSR disclosure and financial performance. However, there are no significant results for the exclusive elements of CSR disclosure except for the mission and vision statement element. Wu and Shen [42] argue that, across the three motives of strategic choice, altruism and greenwashing, only the strategic choice of engaging in ESG activities effectively improves financial performance in the financial sector.

Following the above discussion, the current study poses the below hypothesis:

Hypothesis 2 (H2).

The relationship between corporate ESG performance disclosure and profitability differs between financial and non-financial industries over time.

Figure A1 (Appendix C) presents the graph of the hypotheses of this study.

4. Data and Methodology

4.1. Environmental, Social and Governance (ESG)

The primary independent variable in this study is ‘corporate ESG performance disclosure (ESG)’. Beyond the compulsory requirement for basic disclosure, ESG disclosure is predominantly voluntary. The ESG disclosure score reflects a company’s level of non-financial performance disclosure.

Several databases have recently been developed for evaluating and scoring ESG performance disclosure. The provision of ESG information from data sets, such as Bloomberg, Asset4 and RepRisk, indicates the significance of stakeholder demand for ESG-related disclosure. However, a fair degree of inconsistency through awarding different scores has been found among these databases [62,63]. Bloomberg’s criteria for scoring corporate ESG performance disclosure are the most consistent measures among the databases [62]. Bloomberg’s score is based on 120 indicators covering three dimensions: environmental, social and governance activities. The disclosure ranges from a minimum of 0.1 to a maximum of 100. The elements of corporate ESG performance disclosure (environmental, social and governance) are evenly weighted for measurement in Bloomberg’s aggregated ESG disclosure score. Bloomberg has been used in several academic studies, such as Li et al. [64] and Baldini, et al. [65]. Following Di Giuli and Kostovetsky [66], this study standardises the ESG measures to obtain a notionally standard scale.

4.2. Sample and Data

This study first collected corporate ESG performance disclosure data and their elements, that is, environmental (ENV), social (SOC) and governance (GOV) for all publicly listed Australian companies, from the Bloomberg database from 2007–2017. Companies have mainly participated in ESG disclosure practices since 2007 due to the 2008–2009 GFC; thus, owing to data availability concerns and increased corporate ESG disclosure engagement, 2007 was chosen as the starting period in this study. This study excludes companies from the sample if they have not disclosed one of the ESG components. This study captures each company’s return on assets (ROA) as the main proxy for corporate financial performance. The ROA measure is also traditionally used for industry comparison between companies. This study also collects other financial data for each company, such as total assets (LNTA); property, plant and equipment (PPE); capital expenditure (Capex); total revenue (Growth); cash (Cash) and total liabilities (Leverage), as presented in Appendix A.

The primary sample included more than 127,000 observations of Australian-listed companies from 2007 to 2017. After collecting data on ROA and other financial characteristics, this study matched them with corporate ESG performance data. After considering the missing data, this study’s variables of interest were finalised with a total sample of 32,127 observations for 3422 publicly listed companies.

Table 1 shows the composition of the companies in the sample by year and industry specification.

Table 1.

Sample Composition by year and industry.

To answer the research questions, this study divides the final sample into two different subsamples under industry specifications: the financial industry and other non-financial industries. The industry classification is based on Bloomberg’s Industry Classification Systems (BICS), which classifies companies’ general business under a proprietary hierarchical category, as presented in Appendix B. As shown in the second section of Table 1, companies in the financial industry sample account for 575 (17%) observations across the different industry specifications. This represents the second-highest number of companies after those in the basic materials industry, with 754 (22%) observations.

4.3. Estimation Models

In order to evaluate the first hypothesis of this study and answer the research questions, this study performs a panel regression analysis on companies in the sample. This study proposes that the level of corporate ESG performance disclosure is positively related to a company’s profitability. This study uses the variable ROA to measure corporate profitability. The ROA measure is not a market-sensitive variable and is commonly used to compare profitability between different industries. The regression of ROA over the independent variable, namely, ‘corporate ESG performance disclosure (ESG)’ and its elements of ENV, SOC and GOV, leads to an understanding of the potential financial impacts of corporate ESG performance disclosure on a company’s profitability. The separation of the three ESG elements helps in understanding which of the three dimensions of ESG practice (ENV, SOC or GOV) has a significant association with corporate profitability:

Following the study by Aggarwal et al. [67], the current study includes other financial characteristics of companies that impact financial performance. In particular, a company’s size is measured by the natural log of total assets (LNTA); the ratio of property, plant and equipment to total revenue (PPE); total liabilities divided by total assets measured by debt ratio (Leverage); capital expenditure ratio (Capex) is measured by capital expenditure divided by total revenue; the revenue percentage change between periods measures revenue growth (Growth) and cash ratio (Cash) is measured by cash items divided by total assets. We ensure that the fixed effects are appropriate in this empirical framework.

To test this study’s second hypothesis, first, a new variable for industry specification is created and then a value of 1 to all companies in the financial industry and a value of 0 to others categorised in non-financial industries. This allows the investigation of differences in the association between corporate ESG performance disclosure, including its elements, and its financial performance between the financial and non-financial industries. This study utilises a panel regression analysis to examine the study’s second hypothesis and present the results in the following section.

5. Results

5.1. Descriptive Statistics

Table 2 presents descriptive statistics for the independent and dependent variables in this study. The variables are winsorised at the 1% and 99% levels to control for the impact of outliers. Based on the data provided in Table 2, the average ESG score is 2.92, with 2.54 at the 25th percentile and 3.18 at the 75th percentile, thus showing sufficient variation in the ESG disclosure score to examine the impact of corporate ESG performance on profitability. Table 2 also presents the summary descriptive statistics for companies in the financial industry and other non-financial industries.

Table 2.

Descriptive statistics—All industries.

5.2. Main Regression Results

5.2.1. Environmental, Social and Governance (ESG) Performance and Profitability

This study utilises the ROA ratio as the predictor variable and proxy for corporate profitability and tests the estimation models in this study. The results are reported in Table 3. The first column reports the results of the corporate ESG performance disclosure score as an explanatory variable. The estimated coefficient of corporate ESG performance of 0.2675 is statistically significant at the 1% level (t-statistic = 5.16 and standard error [SE] = 0.0518). Consistent with the first hypothesis, the results show that corporations with a higher ESG performance disclosure score achieve higher profitability. In other words, a one-standard-deviation increase in the corporate ESG performance disclosure score results in a 2.44% increase in a company’s ROA (0.0518 × 0.4711). Thus, this study concludes that companies with higher ESG performance disclosure perform better and are more profitable. This aligns with the findings in the recent literature [4,44,68,69]. Therefore, in line with the theoretical prediction of stakeholder theory, improving corporate ESG performance positively impacts financial performance, contributing to value creation for diverse groups of stakeholders.

Table 3.

Regression Analysis—All industries.

The results for other control variables are also consistent with the existing literature, with their coefficients following the same direction. Consistent with Aggarwal et al. [67], negative correlations are found between ROA and company size (LNTA) and the debt ratio (Leverage). Furthermore, consistent with Konijn et al. [70] and Sola et al. [71], a positive correlation is found between ROA and the liquidity ratio (Cash), representing the ratio of cash to total assets. In line with King and Santor’s [72] prediction, a positive correlation is found between ROA and revenue growth (Growth).

In Table 3, the second, third and fourth columns present the results of utilising the other three elements of corporate ESG performance disclosure: environmental (ENV), social (SOC) and governance (GOV), respectively. The coefficient for ENV is positively correlated with ROA and statistically significant at the 1% level (t-statistic = 2.82). This is consistent with prior literature, which documents a positive association and supports the resource-based view theory [51,52,53,54]. Similar to the ENV result, the coefficient for GOV shows a positive relationship with ROA at the same 1% level of statistical significance (t-statistic = 4.17). This is consistent with the prior literature and the view that considers corporate governance to be the primary driver of sustainable business [57,73]. Except for the social element, the overall association between corporate ESG and financial performance is strong and positive. Therefore, the first hypothesis of this study is supported.

5.2.2. Industry Analysis

Table 4 presents the results of industry comparison for companies in the financial industry (column a) and companies in non-financial industries (column b). Column (a) results show that, in the financial industry, companies with higher ESG performance disclosure achieve higher profitability. Column (b) shows the same results for non-financial industries. However, the association between corporate ESG performance disclosure (ESG) and profitability (ROA) is moderately stronger in the financial industry, with a statistical significance level of 5% compared with 10% for non-financial industries. In other words, one standard deviation increases in ESG performance disclosure (ESG) results in a 4% increase (0.0742 × 0.5258) in profitability (ROA) in the financial industry and a 3% increase (0.0665 × 0.4569) in profitability (ROA) of a company in non-financial industries. This is consistent with the theoretical discussion of this study that financial sectors particularly take a stronger strategy in promoting sustainable behaviour due to their important role in overall economic development and also to enhance their reputation and maintain their accountability. This results in a stronger stakeholder relationship, increased market opportunities and reduced transaction cost, which eventually improves financial performance.

Table 4.

Regression Analysis—Industry comparison.

The results for other elements of corporate ESG performance disclosure are presented in Table 4. They show a strong association between corporate environmental (ENV), social (SOC) and governance (GOV) elements and ROA in the financial industry (column a) at a significance level of 1%. However, except for the governance (GOV) element, running the same model for companies in the non-financial sector does not show a significant association.

Consistent with prior studies by Nizam et al. [74] and Brogi and Lagasio [4], these results support the viewpoint of a significant and positive relationship between corporate ENV, SOC and GOV performance and profitability (ROA) in the financial sector. However, for companies operating in the non-financial sector, the results are different. The latter results show that the governance (GOV) element is mainly responsible for the overall positive association between corporate ESG performance disclosure and companies’ profitability in the non-financial sector. The results show no significant association between social (SOC) and environmental (ENV) performance and companies’ profitability (ROA) in the non-financial sector. This is consistent with findings in prior studies by Dalton et al. [73] and later by Nollet et al. [57] that corporate governance is the main driver of corporate ESG performance disclosure that could also impact corporate financial performance.

For the other control variables, the company’s size (LNTA), with a strong negative coefficient, shows the same result for both the financial and non-financial industries. Revenue growth (Growth) and liquidity (Cash) are positively related to ROA in both the financial and non-financial industries. While the property, plant and equipment ratio (PPE) and capital expenditure ratio (Capex) for non-financial industries receive a negative and positive association, no significant association is witnessed in the financial industry. Furthermore, the debt ratio (Leverage) is negatively associated with profitability (ROA) at the level of 1% statistical significance for the financial industry. In contrast, the results for companies in non-financial industries are not significant. The results for all other control variables are consistent across both industry sectors.

The results show significant variances in the relationship between corporate ESG performance disclosure and its elements with financial performance between the financial and non-financial industries. Therefore, the study’s second hypothesis is supported.

5.2.3. Sensitivity Test

Following the previous study by Gupta [75], this study calculates alternative metrics for corporate ESG performance disclosure to perform a sensitivity analysis. This study benchmarks the individual corporate ESG performance disclosure score and its elements, ENV, SOC and GOV, relative to companies’ total sample and beyond their respective industry sectors. This method includes standardising the performance scores for each company (each industry) by subtracting the mean of measures for the total sample of companies (each industry), then dividing by the standard deviation of the total sample of companies (each industry). This approach addresses the concern that corporate ESG performance disclosure within these two industry sectors may not be comparable. Corporate ESG performance disclosure and additional sustainability engagement are more important in certain industry sectors such as mining, utilities or the chemical industry. Furthermore, traditional measures of financial performance have been criticised recently for inconsistency in evaluating corporate financial performance due to inability to include both economic capital and economic profit into the measurement [76,77,78,79]. Thus, this study utilises alternative metrics of corporate financial performance as economic value added (EVA). EVA has been recommended in prior studies as a true corporate financial measure which considers net profitability over the cost of capital invested [80].

This study performed sensitivity tests for all main models in this study. The results continue to mirror the main findings, including the findings for all variables of interest, but they are not presented in this paper for reasons of brevity. The findings indicate a robust positive association between the adjusted ESG, ENV and GOV performance scores and profitability (ROA and EVA). A significant positive association is shown between corporate ESG performance disclosure, with its elements, and ROA in the financial industry. However, except for the aggregated ESG and GOV scores, no significant association is found between corporate ENV with SOC performance and ROA for companies operating in non-financial industries. Overall, the results remain robust across all sensitivity analyses, indicating that the preliminary results of the study’s estimation models are supported.

6. Robustness Tests

This study ran several robustness tests to examine the authenticity of the main results in which the level of corporate ESG performance disclosure is positively associated with profitability.

We follow the existing empirical literature [64,81,82,83] in utilising an instrumental variable (IV) approach to re-examine the main estimation models and then report the results. This issue is addressed appropriately by including the year and industry fixed effect, thus considering time-invariant unobservable heterogeneity. In addition, this study performs extra endogeneity tests to negate these issues. Following prior studies by Cheng et al. [84] and Gupta [75], this study used the simultaneous equation system to find the appropriate instrument. This study uses the yearly company mean of corporate ESG performance disclosure as an instrument, consistent with previous studies by Cheng et al. [85]. For the sake of brevity, we do not report these results; however, these results are available from the authors upon request.

Consistent with the main findings, the robustness results show that the level of corporate ESG performance disclosure is positively correlated with profitability (ROA) (t-statistic = 5.02) at the significance level of 1%. This indicates that endogeneity does not steer the main results. The robustness analysis for the other three corporate ESG performance elements is also consistent with the main findings in the estimation models.

The results of the robustness analysis for the industry comparison are all consistent with the results presented in Table 4.

7. Conclusions, Policy Implications and Limitations

This study investigated whether corporate ESG performance disclosure is associated with financial performance and whether this relationship differs between the financial and non-financial industries. This study sheds new light on the significance of corporate ESG performance disclosure to improve sustainable development globally.

This study utilises the Bloomberg database and includes the corporate ESG performance disclosure of all Australian-listed companies from 2007–2017. The analyses include three corporate ESG performance elements (environmental, social and governance) to understand the association better. This study also performed panel regression analysis, including years and industry fixed effects, for the estimation models to address any concern about unobserved time-invariant or missing elements. Furthermore, it used alternative measures for corporate ESG performance disclosure and performs sensitivity analysis to address concerns regarding the comparability of performance disclosure across industry sectors. After conducting several robustness tests, the results remain consistent and are strongly confirmed using the IV approach and VIF analysis.

The results show that the overall association between corporate ESG performance disclosure and companies’ profitability is strong and positive across all industry sectors. However, the results of the industry comparison analyses show significant differences between financial and non-financial industries. All corporate ESG performance disclosure elements (ENV, SOC and GOV) are positively associated with corporate profitability for companies that operate in the financial industry. Remarkably, for companies operating in non-financial sectors, except for corporate governance, there is no significant association between corporate environmental and social elements and a company’s profitability. Thus, enforcement of environmentally and socially responsible conduct fosters corporate profitability only in the financial industry. This result is consistent with the findings of the prior studies by Dalton et al. [73] and later by Nollet et al. [57] that corporate governance is the main driver of corporate ESG performance disclosure.

The findings of this study have practical implications for corporations, managers, other stakeholders and regulators. Improvement in corporate ESG performance disclosure benefits a company’s financial performance and thus is also beneficial for shareholders and other stakeholders in the long run. Corporate managers should target improvements in ESG performance disclosure to improve business sustainability. In particular, integrating corporate governance into long-term corporate strategies benefits companies financially. Companies that place sustainability at the core of their business operations are attractive for investors as they are perceived as incipient market opportunities. Corporate managers can develop competitive advantages for their companies through ESG performance disclosure [74].

Regulators should continue to promote responsible conduct within the financial industry to enhance ESG awareness among borrowers and help economic development. Regulators should try to create an institutional environment conducive to promoting ESG performance in the financial industry. As Ng [85] points out, the financial industry could play an important role in overall economic improvement if it operates in an appropriate political and economic environment. This study recommends that regulators advocate for responsible conduct in the financial industry and allocate resources based on corporate environmental and social performance. Furthermore, regulators should support a company’s ESG performance disclosure by adopting requirements for corporate disclosure on socially and environmentally responsible behaviour and standards.

As one of the critical players in the economy, the financial industry has been adopting a more pragmatic approach to social and environmental stability. This indicates that the financial industry aims to control any potential risk of misconduct significantly, thus encouraging corporations to leave an ecological footprint and drive environmental awareness. Such effort could be extended by increasing investment in companies with higher ESG performance, sustainable activities, new product designs with ESG-related features and greater stakeholder interaction.

This study is not without limitations. This study includes financial characteristics such as LNTA, PPE, cash and leverage. However, moderating variables such as ownership structure, the existence of an ESG committee (or a corporate governance committee) and market competition could also influence corporate ESG performance. Additionally, the sample includes only publicly listed companies due to the data set’s limitations, which impedes the generalisability of the findings. Future studies could expand to non-listed companies or small and medium-sized companies with different reputational perspectives from those of large companies. Future studies could also investigate the different economic conditions under different financial industry structures, such as those in developed or developing economies. Cross-sectional analysis of the findings of this study between different countries with diverse economic contexts would be interesting. It is also valuable to develop and investigate similar studies using a developing disclosure index that focuses on particular aspects of the financial and non-financial sector and its ESG disclosure.

Author Contributions

Conceptualization, A.G. and J.S.; methodology, A.G. and H.U.R. software, A.G.; validation, A.G., J.S. and H.U.R.; formal analysis, A.G., J.S. and H.U.R.; investigation, A.G., J.S. and H.U.R.; resources, A.G. and J.S.; data curation, A.G.; writing—original draft preparation, A.G.; writing—review and editing, A.G. and H.U.R.; visualization, A.G., J.S. and H.U.R.; supervision, J.S.; project administration, A.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All relevant study data are contained within the article. Additional request for panel data source materials can be made directly to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Variable definitions, measurement and sources.

Table A1.

Variable definitions, measurement and sources.

| Category | Measure | Definition/Measurement |

|---|---|---|

| Environmental, social and governance disclosure | ESG | As measured based on a total of 120 indicators, covering three aspects: environmental, social and governance The aggregated ESG score ranges from 0.1 for the minimum ESG data disclosure to 100 maximum for those that disclose all data points |

| ENV | The environmental score includes energy, water, biodiversity, emissions, products and services and compliance | |

| SOC | The social score includes: labour practices and decent work, human rights, society and product responsibility | |

| GOV | The governance score includes over-boarding and executive compensation | |

| Operating profitability and financial performance | ROA | The indicator of a company’s profitability, as a percentage Return on assets is the ratio of earnings before interest and taxes (EBIT) to total assets (TA) |

| Company characteristics: | ||

| Company size | LNTA | The natural logarithm of total assets |

| Debt or leverage | Leverage | The leverage or total debt ratio measured as total debts divided by total assets |

| Property, plant and equipment | PPE | The ratio of property, plant and equipment to total sales |

| Capital expenditure | Capex | Capital expenditure divided by total sales |

| Sales growth | Growth | Percentage change in sales over the prior year |

| Cash | Cash | Cash divided by total assets |

Source: Bloomberg database.

Appendix B

Table A2.

Industry definition and source.

Table A2.

Industry definition and source.

| Category | Definition/Measurement |

|---|---|

| Communications | Telecommunication Services Media and entertainment |

| Consumer Cyclical (Discretionary) | Food and Staples Retailing Home and Office Products Leisure Products Recreation Facilities and Services Retail Discretionary Travel, Lodging and Dining Automotive Distributors |

| Consumer Non-Cyclical (Staples) | Retail Staples Health Care Equipment and Services Pharmaceuticals, Biotechnology and Life Sciences |

| Energy | Oil, Gas and Coal Renewable Energy |

| Financial | Asset Management Banking Institutional Financial Services Insurance Specialty Finance |

| Diversified (Health Care) | Biotech and Pharma Health Care Facilities and Services Medical Equipment Devices |

| Industrial | Aerospace and Defence Electrical Equipment Engineering and Construction Services Industrial Distribution Machinery Manufactured Goods Transportation and Logistics Waste and Environmental Service Equipment and Facilities |

| Basic Materials | Chemicals Construction Materials Containers and Packaging Metals and Mining Forest and Paper Products Iron and Steel |

| Technology | Technology Hardware adn Equipment Semiconductors and Semiconductor Equipment Software and Services |

| Utilities | Utilities |

Source: Bloomberg Industry Classification System (BICS).

Appendix C

Figure A1.

Conceptual framework (author’s own construction).

References

- Chae, B.; Park, E. Corporate Social Responsibility (CSR): A Survey of Topics and Trends Using Twitter Data and Topic Modeling. Sustainability 2018, 10, 2231. [Google Scholar] [CrossRef] [Green Version]

- Eberle, D.; Berens, G.; Li, T. The impact of interactive corporate social responsibility communication on corporate reputation. J. Bus. Ethics 2013, 118, 731–746. [Google Scholar] [CrossRef] [Green Version]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Brogi, M.; Lagasio, V. Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 576–587. [Google Scholar] [CrossRef]

- Heal, G. Corporate social responsibility: An economic and financial framework. Geneva Pap. Risk Insur. Issues Pract. 2005, 30, 387–409. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef] [Green Version]

- Clacher, I.; Hagendorff, J. Do announcements about corporate social responsibility create or destroy shareholder wealth? Evidence from the UK. J. Bus. Ethics 2012, 106, 253–266. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef] [Green Version]

- Harjoto, M.; Jo, H. Legal vs. normative CSR: Differential impact on analyst dispersion, stock return volatility, cost of capital, and firm value. J. Bus. Ethics 2015, 128, 1–20. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Nelling, E.; Webb, E. Corporate social responsibility and financial performance: The “virtuous circle” revisited. Rev. Quant. Financ. Account. 2009, 32, 197–209. [Google Scholar] [CrossRef]

- Amato, L.H.; Amato, C.H. Retail philanthropy: Firm size, industry, and business cycle. J. Bus. Ethics 2012, 107, 435–448. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and growth: Schumpeter might be right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- de la Cuesta-González, M.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Analysis of social performance in the Spanish financial industry through public data. A proposal. J. Bus. Ethics 2006, 69, 289–304. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. European banks’ reputation for corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 1–14. [Google Scholar] [CrossRef]

- Lorena, A. The relation between corporate social responsibility and bank reputation: A review and roadmap. Eur. J. Econ. Bus. Stud. 2018, 4, 7–19. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Gössling, T.; Vocht, C. Social role conceptions and CSR policy success. J. Bus. Ethics 2007, 74, 363–372. [Google Scholar] [CrossRef] [Green Version]

- Bencivenga, V.R.; Smith, B.D. Financial intermediation and endogenous growth. Rev. Econ. Stud. 1991, 58, 195–209. [Google Scholar] [CrossRef]

- Friedman, M.; Mackey, J.; Rodgers, T.J. Rethinking the social responsibility of business: A reason debate featuring Milton Friedman, Whole Foods’ John Mackey, and Cypress Semiconductor’s T.J. Rodgers Reason 2005, 37, 28–37. [Google Scholar]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- McWilliams, A.; Siegel, D. The role of money managers in assessing corporate social reponsibility research. J. Investig. 1997, 6, 98–107. [Google Scholar] [CrossRef]

- Jensen, M.C. Value maximisation, stakeholder theory, and the corporate objective function. Bus. Ethics Q. 2002, 7, 235–256. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A.; Vurro, C. Deconstructing the Relationship Between Corporate Social and Financial Performance. J. Bus. Ethics 2011, 102 (Suppl. 1), 59–76. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Barnett, M.L.; Salomon, R.M. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strateg. Manag. J. 2006, 27, 1101–1122. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Muller, A.; Kräussl, R. Doing good deeds in times of need: A strategic perspective on corporate disaster donations. Strateg. Manag. J. 2011, 32, 911–929. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar] [CrossRef]

- Said, R.; Zainuddin, Y.; Haron, H. The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Soc. Responsib. J. 2009, 5, 212–226. [Google Scholar] [CrossRef] [Green Version]

- Dellaportas, S.; Langton, J.; West, B. Governance and accountability in Australian charitable organisations: Perceptions from CFOs. Int. J. Account. Inf. Manag. 2012, 20, 238–254. [Google Scholar] [CrossRef]

- Deegan, C. Financial Accounting Theory, 4th ed.; McGraw-Hill Education: North Ryde, NSW, Australia, 2014. [Google Scholar]

- Gholami, A.; Sands, J.; Shams, S. Corporates’ sustainability disclosures impact on cost of capital and idiosyncratic risk. Meditari Account. Res. 2022; in press. [Google Scholar]

- Crook, T.R.; Ketchen, D.J.; Combs, J.G.; Todd, S.Y. Strategic resources and performance: A meta-analysis. Strateg. Manag. J. 2008, 29, 1141–1154. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.; Tehranian, H. Valuation effects of corporate social responsibility. J. Bank. Financ. 2015, 59, 182–192. [Google Scholar] [CrossRef]

- Kim, Y.; Li, H.; Li, S. Corporate social responsibility and stock price crash risk. J. Bank. Financ. 2014, 43, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Rodriguez-Fernandez, M. Social responsibility and financial performance: The role of good corporate governance. Bus. Res. Q. 2016, 19, 137–151. [Google Scholar] [CrossRef] [Green Version]

- Soana, M.-G. The relationship between corporate social performance and corporate financial performance in the banking sector. J. Bus. Ethics 2011, 104, 133–148. [Google Scholar] [CrossRef]

- Bae, S.M.; Masud, M.A.K.; Rashid, M.H.U.; Kim, J.D. Determinants of climate financing and the moderating effect of politics: Evidence from Bangladesh. Sustain. Account. Manag. Policy J. (Print) 2022, 13, 247–272. [Google Scholar] [CrossRef]

- Nobanee, H.; Ellili, N. Corporate sustainability disclosure in annual reports: Evidence from UAE banks: Islamic versus conventional. Renew. Sustain. Energy Rev. 2016, 55, 1336–1341. [Google Scholar] [CrossRef]

- Wu, M.-W.; Shen, C.-H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does It Pay to Be Good … and Does It Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance. SSRN 2009. [Google Scholar] [CrossRef]

- Revelli, C.; Viviani, J.L. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Bus. Ethics Eur. Rev. 2015, 24, 158–185. [Google Scholar] [CrossRef]

- Van Beurden, P.; Gössling, T. The worth of values—A literature review on the relation between corporate social and financial performance. J. Bus. Ethics 2008, 82, 407–424. [Google Scholar] [CrossRef] [Green Version]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Clark, G.L.; Viehs, M. The Implications of Corporate Social Responsibility for Investors: An Overview and Evaluation of the Existing CSR Literature. SSRN 2014. [Google Scholar] [CrossRef]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organisational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef] [Green Version]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- King, A.; Lenox, M. Exploring the locus of profitable pollution reduction. Manag. Sci. 2002, 48, 289–299. [Google Scholar] [CrossRef] [Green Version]

- Albertini, E. Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Ellstrand, A.E.; Johnson, J.L. The role of board environmental committees in corporate environmental performance. J. Bus. Ethics 2017, 140, 423–438. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Kang, J.-K.; Shivdasani, A. Firm performance, corporate governance, and top executive turnover in Japan. J. Financ. Econ. 1995, 38, 29–58. [Google Scholar] [CrossRef]

- Nollet, J.; Filis, G.; Mitrokostas, E. Corporate social responsibility and financial performance: A non-linear and disaggregated approach. Econ. Model. 2016, 52, 400–407. [Google Scholar] [CrossRef] [Green Version]

- Konar, S.; Cohen, M.A. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Cornett, M.M.; Erhemjamts, O.; Tehranian, H. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of US commercial banks around the financial crisis. J. Bank. Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Dell’Atti, S.; Trotta, A.; Iannuzzi, A.P.; Demaria, F. Corporate social responsibility engagement as a determinant of bank reputation: An empirical analysis. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 589–605. [Google Scholar] [CrossRef]

- Platonova, E.; Platonova, E.; Asutay, M.; Asutay, M.; Dixon, R.; Dixon, R.; Mohammad, S.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef] [Green Version]

- Halbritter, G.; Dorfleitner, G. The wages of social responsibility—Where are they? A critical review of ESG investing. Rev. Financ. Econ. 2015, 26, 25–35. [Google Scholar] [CrossRef]

- Semenova, N.; Hassel, L.G. On the validity of environmental performance metrics. J. Bus. Ethics 2015, 132, 249–258. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.-Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef] [Green Version]

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of country- and firm-level determinants in environmental, social, and governance disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Di Giuli, A.; Kostovetsky, L. Are red or blue companies more likely to go green? Politics and corporate social responsibility. J. Financ. Econ. 2014, 111, 158–180. [Google Scholar] [CrossRef]

- Aggarwal, R.; Erel, I.; Stulz, R.; Williamson, R. Differences in governance practices between US and foreign firms: Measurement, causes, and consequences. Rev. Financ. Stud. 2010, 23, 3131–3169. [Google Scholar] [CrossRef] [Green Version]

- Harjoto, M.; Laksmana, I. The impact of corporate social responsibility on risk taking and firm value. J. Bus. Ethics 2018, 151, 353–373. [Google Scholar] [CrossRef]

- Busch, T.; Friede, G. The robustness of the corporate social and financial performance relation: A second-order meta-analysis. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 583–608. [Google Scholar] [CrossRef] [Green Version]

- Konijn, S.J.; Kräussl, R.; Lucas, A. Blockholder dispersion and firm value. J. Corp. Financ. 2011, 17, 1330–1339. [Google Scholar] [CrossRef] [Green Version]

- Sola, C.M.; Teruel, P.J.G.; Solano, P.M. Corporate cash holding and firm value. Doc. Trab. FUNCAS 2013, 45, 161–170. [Google Scholar]

- King, M.R.; Santor, E. Family values: Ownership structure, performance and capital structure of Canadian firms. J. Bank. Financ. 2008, 32, 2423–2432. [Google Scholar] [CrossRef] [Green Version]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 1999, 42, 674–686. [Google Scholar]

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar] [CrossRef]

- Gupta, K. Environmental sustainability and implied cost of equity: International evidence. J. Bus. Ethics 2018, 147, 343–365. [Google Scholar] [CrossRef]

- Kumar, S.; Sharma, A.K. Association of EVA and accounting earnings with market value: Evidence from India. Asia-Pac. J. Bus. Adm. 2011, 3, 83–96. [Google Scholar] [CrossRef]

- Grant, J.L. Foundations of Economic Value Added; John Wiley & Sons: Hoboken, NJ, USA, 2003; Volume 99. [Google Scholar]

- Sloof, R.; van Praag, M. Testing for Distortions in Performance Measures: An Application to Residual Income Based Measures like Economic Value Added. J. Econ. Manag. Strategy 2015, 24, 74–91. [Google Scholar] [CrossRef] [Green Version]

- Murphy, K.J. Executive compensation: Where we are, and how we got there. In Handbook of the Economics of Finance; Elsevier: Amsterdam, The Netherlands, 2013; Volume 2, pp. 211–356. [Google Scholar]

- Stern, J.; Stewart, B.; Chew, D. The EVA financial management system. J. Appl. Corp. Financ. 1995, 8, 32–46. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate social responsibility and credit ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Ng, A.B.K. Banking for Sustainability: The Policy, Regulatory and Financial Case for Action; Asian Institute of Chartered Bankers: Kuala Lumpur, Malaysia, 2016. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).