Abstract

State aid for airlines around the world has been a common practice during the COVID-19 pandemic, as the air transport was one of the sectors most heavily affected. This study analyzes 27 cases of state aid to EU airlines between 1 March 2020 and 30 September 2021 with a total amount of €31 billion. The information was obtained from the area of competition of the European Commission (EC), which is the entity responsible for final approval. Results indicate that the largest EU economies (Germany and France), as well as some Northern European countries, are supporting national airlines more extensively. Airlines with a weaker financial performance before the pandemic were more likely to receive state aid. Government involvement in the airline industry during the recent health crisis will have an important influence on the level playing field (LPF) for airlines. It is still unclear how this will evolve in the future, but it seems that some airlines now resemble the public flag companies of the past.

1. Introduction

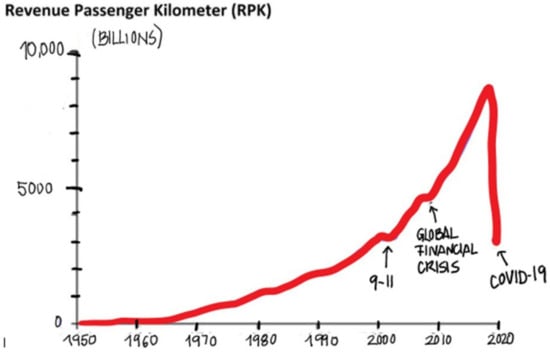

The COVID-19 pandemic caused a shock to the air travel industry that the International Air Transport Association (IATA) suggests can only be compared to the Second World War, having resulted in a 66 percent decrease in revenue passenger kilometers (RPK) and an estimated loss of €118 billion during 2020 [1]. The rise in the number of air passengers during the last 70 years is shown below in Figure 1, which shows the negative impacts of the terrorist attacks of 9–11 in 2001 and the global final crisis (GFC) of 2008. However, neither of these two 21st century events can compare with the effect of the COVID-19 pandemic in 2020.

Figure 1.

Worldwide air passenger numbers measured in revenue by passenger kilometer (RPK) from 1950–2020. Source: Authors adapted from [2].

Most airlines did not have internal financial resources to deal with this critical situation and had to rely on external financial sources, including different forms of state aid [2]. The support of airlines was carried out under three different schemes: (1) ad-hoc interventions targeting one airline perceived as being of ‘national interest’; (2) support of individual airlines in the broader context of overall corporate schemes; and (3) industry programs available to all companies within the air transport sector. Australia, the UK, and the USA are examples of some of the countries that have applied air transport sectoral schemes [3]. The US provided financial support to airlines through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) [4], and by December 2020, seven of the major US airlines had secured loans for around 20 billion USD [5].

The European Union (EU) is a special case, as the Treaty on the Functioning of the European Union (TFEU) does not allow any aid by member states that can distort competition [6]. Throughout the text, the two acronyms for both the EU (European Union) and the EC (European Commission) will be used. The EC is responsible for promoting the general interest of the EU by proposing and enforcing legislation, as well as by formulating policies and the EU budget. For example, article 107 (1) states: “Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favoring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market” [7].

However, there are certain exceptions that can be applied as the same article allows EU member states to provide aid to companies. Specifically, the exceptions applied to airlines during the COVID-19 pandemic were the following: (1) Article 107 (2)(b), aid to make good the damage caused by natural disasters or exceptional occurrences; (2) Article 107 (3)(b), aid to promote the execution of an important project of common European interest or to remedy a serious disturbance in the economy of a Member State; and (3) Article 107 (3)(c), aid to facilitate the development of certain economic activities or of certain economic areas, where such aid does not adversely affect trading conditions to an extent contrary to the common interest [7].

The COVID-19 outbreak has provoked a health emergency with a direct impact on the world’s economy, including the EU member states. Many economic sectors, such as aviation, tourism, meetings, conferences, exhibitions, bars and restaurants have been highly affected by the pandemic conditions and air transport has been restricted by many countries in order to control the spread of the virus. An unprecedented low in air traffic figures has been reported, such as on 29 April 2020, which saw the lowest point of aircraft traffic when Europe experienced 94% less traffic than on 1 January 2020 [8], or the air traffic levels during July 2020 which were still 57% less than that of July 2019 [9].

In response to the situation, on 19 March 2020, the EU issued a temporary framework for EU members state aid measures to support the economies during the COVID-19 outbreak [10]. Following its adoption, the framework was updated six times and was extended until 31 December 2021 [11]. The amendments were based on different issues and cycles, such as: (1) to give public support for research, testing and production of products required to fight the coronavirus outbreak, to protect jobs and to further support the economy; (2) to enable measures for recapitalization; (3) to support micro-, small and start-up companies and to incentivize private investment; (4) to prolong the temporary framework and to enable aid covering part of the uncovered fixed costs of companies affected by the crisis; (5) to expand the scope of the temporary framework by increasing the ceilings set out in it and by allowing the conversion of certain repayable instruments into direct grants until the end of the year; and (6) to prolong the state aid temporary framework and to introduce two new measures to create direct incentives for forward-looking private investment and solvency support measures for an additional limited period [10].

The type and amount of state aid provided to airlines could have a significant impact on the future financial performance of airlines and on the level playing field of the airline sector in the EU. This could potentially be a key factor determining whether airlines stay in business in the future. It is interesting to highlight that significant differences in the size of state aid to airlines have been reported in different regions of the world as a percentage of revenue generated in 2019 [12]. The US had the highest amount of aid (25%) in comparison with 15% in the EU, 10% in the Asia Pacific, and 1% in Africa. Thus, it would not be surprising to see the same differences also found within the EU.

These differences are not only seen at the regional level, but also at the country level. In the EU, although it has a harmonized state aid regulation, government support seems vastly different across countries [12] (e.g., Air France has received 36.1 percent of ticket revenues as state aid in 2019, in comparison with Lufthansa with only 19.5 percent). The level of government support or subsidies for their national airlines is difficult to quantify, even with access to datasets [3]. Abate et al. [13] made an initial assessment of government support for the air transport sector at the initial stages of the COVID-19 pandemic, concentrating on the factors motivating governments for the support as well as the implications of this aid in three dimensions relevant to air transport policy: competition and liberalization, airline ownership and control, and environmental sustainability.

Considering the differences observed in EU state aid to airlines under the umbrella of the EU state aid regulation and that the EU temporary framework for state aid has been functioning for about 18 months, this research aims: (1) to carry out a detailed assessment of state aid given to EU airlines; (2) to understand what the financial situation of those airlines was before the pandemic by analyzing if there is any correlation between airlines with a weaker financial performance in 2019 and those receiving state aid; and (3) to analyze whether the new level playing field could be reoriented in the future, as it seems that some airlines can be seen now as resembling the public flag airlines of the recent past.

The rest of the study is organized as follows. After this introduction, the main materials and methods related to COVID-19 state aid to EU airlines are presented, giving a special emphasis to the collection of the databases. Section 3 and Section 4 present the main results obtained in the study, and discuss them according mainly to the expected effects on the level playing field (LPF) in aviation. The last section concludes the study and presents new lines for future research.

2. Materials and Methods

2.1. Literature Review

Since the deregulation of the US airline industry in 1978, direct subsidies to airlines have been subject to controversy and debate in the field of industrial economics. Airline deregulation has been the main cause for airlines to operate at lower profit margins and capitalization rates of return than other industries [14]. In the EU, after its own airline deregulation process, state aid to airports and airlines has been brought into question with the aim of preventing overcapacity and market distortion [15]. However, opinion against these rigid policies have been common in the industry, claiming that more distortions were created in the level playing field for airlines in which important state aids were frequent in the Middle East and other regions of the world.

The LPF in international aviation has also given rise to much media, industry and academic attention in the EU, especially after the complaints raised by some EU legacy carriers about the unfair LPF that some airlines enjoyed by being state carriers, such as Emirates, Etihad Airways and Qatar Airways. Other issues that also affect the international aviation LPF are related to the foreign ownership clauses of airlines, which share characteristics with “flag of convenience” practices that are part of the shipping industry [16]. In maritime transport, “flag of convenience” has caused many labour contract breaches that have increased the stress and frustration of employees. Some scholars advocate a global solution that could establish fair working conditions providing an authentic LPF [17]. The authors contended that “this does not necessarily imply more legislation, but rather a more stringent monitoring, enforcement, and compliance of existing regulatory framework. Primarily, it is the flag states’ responsibility, supplemented by the authorities of port states, to identify deficiencies” (p. 7).

Gössling et al. [18] provided conceptual research on aviation subsidies by categorizing them according to type and source. The authors found that there are many different institutions at various levels that grant subsidies in the industry. Subsidies according to the OECD can be defined as “any measure that keeps prices for consumers below market levels, or for producers above market levels, or that reduces costs for consumers or producers” [19] (p. 114). There are five main types of subsidies: (1) direct cash transfers; (2) government loans; (3) government loan guarantees; (4) tax rates reductions or exemptions; and (5) beneficial depreciation rules. Regarding the nature of subsidies, these can be distinguished as ‘direct’ when the supply is used as the vehicle, i.e., the subsidies are directly applied to airlines, or ‘indirect’ when the demand takes this role, and passengers receive the benefits. In economics, it is well known that the impact of subsidies depends on the elasticity of both the demand and supply curves, and can only be justified by the correction of some market failure, such as the internalization of positive externalities, and not as rent extracting activities made by airlines. However, aviation subsidies have been supported by national governments for different reasons including guaranteeing an adequate air transport connectivity, controlling the CO2 emissions resulting from aviation, and public service obligations to remote areas justified by territorial cohesion policies [13].

Ryanair and other low-cost carriers have frequently been accused of this “rent seeking behavior”. There are many controversial cases related to the subsidies that the company received by increasing air traffic in secondary EU airports such as Charleroi in Belgium and Strasbourg in France. In some cases, some EU Administrative Courts have ruled out the subsidies received by the airline due to anti-competitive practices. Steinrücken and Jaenichen [20] discussed whether this ‘rent seeking behavior’ should be considered unfair and illegal in the light of EU competition laws, and concluded that the subsidies were not illegal as they were not selectively granted, but rather implied a form of optimum solution for the rate of return for access to regional airports. Therefore, it is the lack of transparency and not the subsidies themselves that should be corrected and better addressed by EU laws.

The world is facing unprecedented circumstances and the aviation LPF is changing accordingly. EU carriers are, unexpectedly, receiving government support that has affected the LPF in a manner that resembles that which existed previous to the EU air transport deregulation, which took place at the end of the 80s and the beginning of the 90s, in which government control of airlines was considered to be one of the main obstacles [21]. It is still unclear how this new LPF is going to distort competition and could jeopardize the benefits obtained by EU air transport liberalization [22]. It is expected that the direct participation of governments in the shares of airlines will affect the LPF in the years to come, so the end of air transport liberalization that was analyzed before the outbreak of the pandemic could be definitively installed [23]. State aid in the form of nationalization will have a more long-term effect than other measures [13].

2.2. COVID-19 State Aid to EU Airlines

The analysis is based on a case study method [24], as the method is a well-known mixed method that has been applied extensively in industrial organization and social science disciplines. The case study method is mainly based on a detailed investigation of one or more organizations, with a view to providing a depth analysis of the context and processes involved in the EU state aid to airlines. The study uses three different datasets: (1) state aid provided to European airlines due to the COVID-19 pandemic; (2) European airline data on passengers, revenue and net profit margin during the financial year 2019; and (3) population of EU countries.

The first dataset was obtained from the area of competition of the European Commission (EC) which is responsible for assessing cases of state aid by EU member states and provides a public search engine that enables the search for the evaluation of cases of competition that are directly related to air transport. A description of the case with the decision made is conveniently reported [25].

State aid to EU airlines, due to COVID-19, was determined by a four-step process. Firstly, 72 cases within the policy area of “state aid” and the economic sector of “Air Transport”, which were informed by the EC with a decision between 1 March 2020 and 30 September 2021 (18 months), were identified. Secondly, 51 cases referring to COVID-19 were filtered by including only those containing the word ‘COVID’ in the title. Thirdly, 27 cases which referred to other stakeholders other than airlines (e.g., airports) were discarded. Finally, three cases that combined more than one state aid instrument (SA.57153 of Lufthansa, SA.59158 of LOT and SA.62304 of TAP) were split into three different records for a better analysis. Thus, a total of 27 cases of EU state aid to airlines were identified and considered for the analysis (see Table A1 in Appendix A).

The amount of state aid is not provided by the EC’s search engine [25], and as this information was considered an important variable for the research, the authors needed to manually access each individual case to extract the amount of aid. Appendix A shows the amounts of state aid to each airline and includes a link to the decision of the EC for each case used by the authors to facilitate specific reference to further research on the topic.

The EU state aid framework includes the following options available for governments to support companies according to the temporary framework that allows state aid measures that support the economy under the current pandemic situation [10]: (1) Aid in the form of direct grants, repayable advances or tax advantages; (2) Aid in the form of guarantees on loans; (3) Aid in the form of subsidized interest rates for loans; (4) Aid in the form of guarantees and loans channeled through credit institutions or other financial institutions; and (5) Short-term export credit insurance. The categories are different from those used by [13]. The authors created seven different categories: (1) government-backed commercial loans and government guarantees; (2) recapitalization through state equity; (3) flight subsidies; (4) nationalization; (5) deferral and/or waiver of taxes and charges; (6) grants; and (7) private equity.

All aid options are based on clauses of article 107, (3)(b) and (3)(c), of the Treaty on the Functioning of the European Union [10]. Clause (3)(b) refers to the remedying of a serious disturbance in the economy of a member state, and clause (3)(c) stipulates that such aid must not adversely affect European trading conditions. The aid amounts have certain limitations, such as a maximum of €800,000 for direct grands, 25% of 2019 turnover for loans, or a maximum of six years for loan guarantees.

Each case of state aid requires a close monitoring and reporting by airlines and the member states affected. The latter needs to submit an annual report to the EC ensuring that detailed records are kept for 10 years. The EC in some cases even requires the appointment of a monitoring trustee to report whether commitments have been complied with [26]. In the case of the recapitalization of Air France and KLM, it was seen that the group had a significant market power at Paris-Orly airport (ORY), and the EC, supported by the monitoring trustee, was in charge to select the low-cost carrier (LCC) Vueling, part of the International Airlines Group (IAG), as the competing carrier to take 18 daily slots at ORY airport from November 2021 [27].

Other types of government support to airlines are more difficult to track as companies around the world in almost all sectors, including airlines, were forced to stop or reduce their activities during the COVID-19 pandemic and many of their employees switched to a leave of absence status—as furloughed employees. Governments, including those of the EU, applied different labour policy initiatives with the intention of providing flexibility to companies in order for them to continue operations while preventing the loss of jobs. For some European countries, namely Germany, France, Spain and Italy, between 70 to 80 percent of furloughed employee’s salaries were commonly subsidized, although social security was directly paid by airlines [28]. This type of state aid, although relevant, has not been included in the analysis as it is assumed that most of the EU airlines have benefited from this instrument.

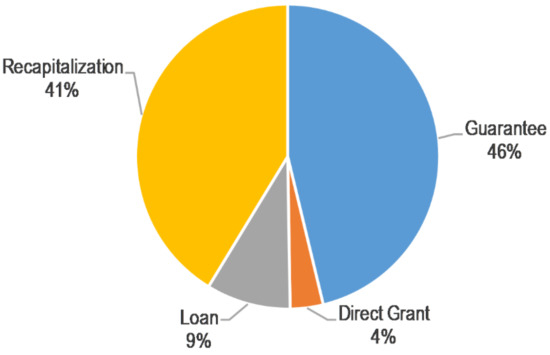

The types of state aid included in this research are based on the original list from the EU state aid framework: (a) direct grants; (b) loans; (c) guarantees; and (d) recapitalization. Direct grants refer to aid in the form of direct grants, repayable advances or tax advantages. Loans include only those provided directly from the EU member state to the airline. Guarantees include all other loans from public or private institutions with a public guarantee. Lastly, recapitalization refers to state aid in the form of capital injection into the airlines’ equity. Figure 2 shows the breakdown of state aid (total of €31 billion) for each category.

Figure 2.

COVID-19 state aid to EU airlines (€31 billion) by aid type. Generated by authors; Data source: [25].

This figure shows that the two most important categories are guarantee on loans (46%) and recapitalization (41%) that in total account for a large majority of state aid (87%). The remaining categories account for loans provided by governments (9%) and direct grants (4%). Interestingly, the recapitalization category is more important than that obtained in [13], as nationalization and state equity only accounts for a twelve percent share, so it would seem that state aid in the EU has followed a very different scheme from that employed in the rest of the world.

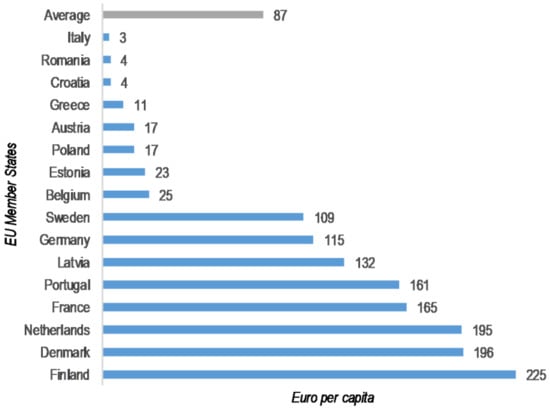

Due to the diversity of EU countries, a direct comparison of the aid of each member state to airlines is not possible. Thus, it was decided to follow a common approach in macroeconomics which overcomes the comparability problem by normalizing the amount of aid by the total population of the country [29]. Nevertheless, the authors are aware that the approach is not perfect, as some countries in the EU, such as the Netherlands and Belgium, will obtain better results as their importance in EU air transport is more significant than their relatively small populations would suggest.

In order to compare the results at airline level, a similar problem exists due to the uneven distribution of EU airline traffic. In this case, the approach used in the industry to overcome the comparability problem is to normalize the state aid received by each airline by the total revenue generated during 2019, before the pandemic crisis. This approach was also used by IATA in the analysis of COVID-19 state aid [12]. It is worth noting that the EU also uses the same ratio, as it limits the amount of loans states can provide to airlines to twenty-five percent of the company’s turnover in 2019.

With this aim, the total revenues and net profits generated in 2019 were collected for each of the airlines in the study. For most of the airlines, specially listed companies, the data were available in their annual reports. For the rest of the airlines, alternative sources such as Google, Wikipedia and Eurostat were used if the annual report for the airline was not publicly available. The searches were usually associated with some areas of the airline’s website that were used to find the needed data. Table 1 shows the EU airlines that have received state aid due to COVID-19 with information on 2019 revenues, the total amount of aid of the corresponding 27 cases included in the study, and the percentage of 2019 revenues given in aid.

Table 1.

Airline beneficiaries of COVID-19 state aid 1.

3. Results

The state aid provided to airlines varies significantly among EU countries. Figure 3 shows the state aid per capita at country level. It can be seen that the EU member states that provided more state aid than the average (i.e., more than €87 per capita) are countries that have decided to invest in the airlines as important shareholders. The group is mainly characterized by countries from northern Europe with higher incomes (e.g., Sweden, Germany, Netherlands, Denmark and Finland). The airlines are retreating from the privatization processes that had started in the past and now tend to have reverted to the status of ‘flag carriers’ which had a dominant position in their ‘fortress home hubs’ located in the respective countries (SAS for Sweden and Denmark, Lufthansa for Germany, Air Baltic for Latvia, TAP for Portugal, Air France–KLM for France and the Netherlands, and Finnair for Finland). The airline industry is therefore entering into a phase in which it is difficult to anticipate how the LPF is going to be affected.

Figure 3.

COVID-19 state aid to EU airlines in euros per capita at country level.

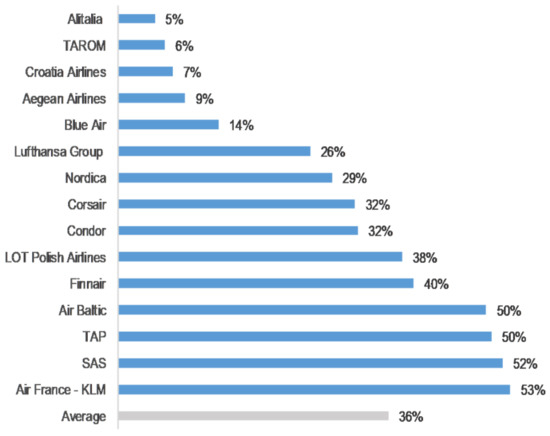

Figure 4 shows COVID-19 state aid as a percentage of the 2019 revenues of each airline. It can be seen that there are a select group of six airlines that have received more support in terms of the revenues obtained in 2019 than the average of 36% of revenues. The group consists of LOT Polish Airlines, Finnair, Air Baltic, TAP, SAS and Air France–KLM, which essentially overlaps with the above-mentioned group in which the state is now an important shareholder in the airline.

Figure 4.

COVID-19 state aid to EU airlines as a percentage of 2019 revenues.

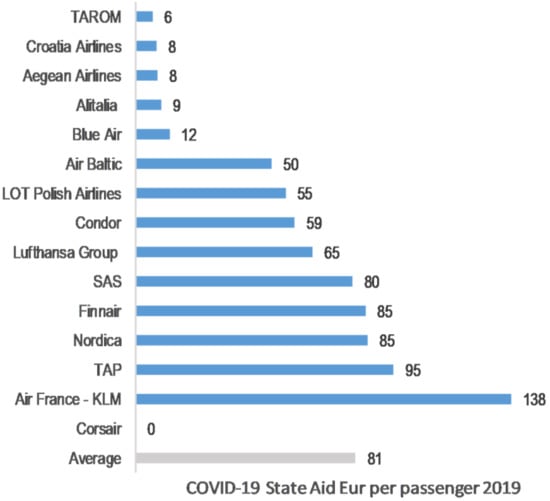

Figure 5 shows the COVID-19 state aid per airline normalized with the number of passengers transported in the year 2019. In principle, a better normalization could be obtained using passenger revenue kilometer (PRK); however, unfortunately, this metric was not available for all the airlines. Likewise, the total passengers for 2019 of Corsair could not be obtained even after contacting the airline directly. In this case, there are only four airlines that have received a higher ratio of aid per passenger than the average airline which received €81 per passenger. Finnair, Nordica, TAP and Air France–KLM are the airlines that constitute this group. It can be seen that the case of Air France–KLM presents a maximum ratio, with €138 per passenger. Air France was in a dramatic financial situation at the end of 2020 with a negative equity of €5.4 billion [25]. Despite the efforts Air France performed to mitigate the turbulent period at different levels, regarding operational, labour, and financial aspects, and without a clear parallel in the EU of Chapter 11 of the US Bankruptcy Law, it was evident that the airline needed some kind of support to navigate this difficult period.

Figure 5.

COVID-19 state aid to EU airlines in euros per 2019 passenger.

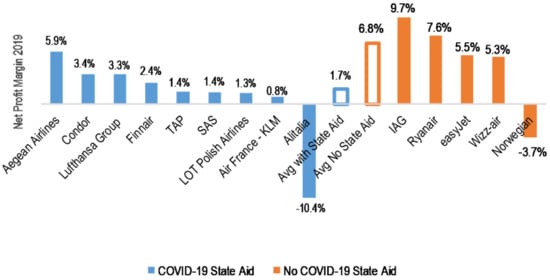

Figure 6 shows the airlines profit margins for the year 2019 of the group of medium and large European airlines, in which the airlines are distinguished by whether they have received COVID-19 state aid or not. It is worth noting first that it seems that airlines which have not received state aid on average enjoyed a higher profit margin than those which received them. All the airlines in the first group presented a positive profit margin, with the exception of Norwegian. It is also interesting to note that the first group is formed by IAG (a holding company formed by the network of carriers British Airways, Iberia and Air Lingus, and the low-cost carriers Vueling and Level), and the three most important EU low-cost carriers, namely Ryanair, easyJet and Wizzair. The situation of Iberia is clearly affected by the UK’s exit from the European Union as the holding company now shows a foreign ownership profile. Regarding the position of the low-cost carriers, it can be said that Ryanair CEO Michael O’Leary would have preferred a different approach to state aid, and cash refunds for flights cancelled due to lockdowns [30].

Figure 6.

Medium and large European airlines profit margins in 2019. Airlines which have received COVID-19 state aid vs. those which have not received it.

4. Discussion

Section 3 was based on four different figures that analyzed state aid to EU airlines under different normalizations or comparative groups, such as the state aid per capita at country level (€87 on average), state aid as a percentage of the 2019 revenues of each airline (36 percent on average), state aid per 2019 passengers (€81 on average), and a comparison of the marginal profits for the year 2019 was made differentiating the group of airlines that received state aid from those airlines that have not received any aid (the average figure for the first group was 1.7 percent vs. 6.8 percent for the latter group).

It was evident from the first two figures that state aid for EU airlines during COVID-19 was very unbalanced across different EU countries. The two largest economies in the EU (France and Germany), for which the air connectivity depends on two of the largest European airline groups (Air France–KLM and Lufthansa Group), have provided the most significant contributions to their former legacy carriers. Other airlines that received significant amounts of state aid were from the Northern countries (e.g., SAS and Finnair). The results confirmed those obtained in [13], in that the most important economies have been shown to be both more involved in supporting airlines and being more generous with the amount of aid. The lack of liquidity and capitalization of airlines were also positively associated with state aid. It is still unclear how this government involvement in going to affect the previous LPF for airlines.

The nationalization and recapitalization aid measures were aimed at restoring the balance sheet position and liquidity of the airlines after the exceptional situation that airlines were facing because of the COVID-19 outbreak, in which most of the EU airlines were obliged to stop operations during the first quarter of 2020. The airlines schedules were halted because national EU health authorities restricted air passenger mobility by closing the national borders to citizens of other countries that were badly affected by the pandemic. Borders were soon opened but with a number of conditions, such as a valid vaccination certificate or a negative COVID-19 test. The containment measures and travel restrictions caused airlines operations to be fraught with uncertainty, such as formal restrictions, travel conditions that included not only the negative COVID-19 tests already mentioned but also compulsory quarantine periods, and in all cases a myriad of different health formalities were imposed by most of the countries in the world. The positive prospects that existed in the EU during the summer season of 2020 with the recovery of air traffic have not yet materialized.

The close correlation that existed between the 2019 financial performance of airlines before the COVID-19 pandemic and those airlines receiving state aid demonstrated that, in most of the cases, the private sector seemed less willing to invest in airlines with weaker performance. Thus, for some airlines, the state was the only actor that could play a key role in their financial feasibility. Some EU governments were facing the trade-off of providing state aid to airlines or seeing the airline’s disappearance. In this respect, it is worth noting the difference in the approach of the Norwegian government with Norwegian Airlines, in comparison with that of Sweden and Denmark with SAS, and Finland with Finnair. While Norwegian was forced to apply a very tight restructuring process as a result of being very close to bankruptcy as the airline did not receive any support from the Norwegian government [31], SAS and Finnair received €2.3 and €1.2 billion, respectively, in different forms of state aid that have included recapitalization packages (see Table 1).

Arguments for a return to states being the major shareholder in airlines are nowadays becoming a trend. Interestingly, the state aid to Air France–KLM is paradigmatic because France explained that the Air France–KLM holding does not only play an essential role in the French economy but in the European economy as a whole. The essential role was mainly highlighted with the following key indicators: (1) the importance of the group in the economy and employment in various regions, especially in France and the Netherlands; (ii) the importance of the holding in providing air connectivity within France and Europe; (iii) the important role of the aircraft of the holding in transporting cargo, such as health supplies in the context of the COVID-19 crisis; and (iv) the decisive role that the holding group can have in the future for mitigating the economic crisis [32].

Data shows that the largest EU economies are willing to support their large airline groups. This fact has permitted airline companies to ride out this unexpected crisis in better condition than other companies that were obliged to restructure their activities to allow them to remain competitive and maintain better air connectivity around the globe. The EC rules regarding state aid have been relaxed due to these special circumstances, and the objections seen in [18] with respect to the cases that involved airBaltic, Air Malta and SAS seem to suggest issues from the near past when airlines were entirely or mostly funded by the state.

It is clear that all the state aid to airlines has not been distorting the market, as the market that existed before the pandemic no longer exists, and it is still uncertain when the industry will again be able to discuss issues such as economic efficiency or normal profits. In the past, the Chapter 11 bankruptcy clause has been criticized by non-American airlines for being a hidden subsidy [33] that distorts the LPF for airlines. Due to the current situation, it is nowadays admissible to discuss the mechanisms by which airline bankruptcies can be disregarded. Similarly, the same argument was already used to justify cases in which state aid was permissible, such as cases in which the recipient of the aid is facing financial difficulties due to ‘over-capacity’ [21]. It is still unclear whether pre-COVID-19 capacity could be regained in months or years. In the meantime, European airlines are obliged to respond with innovative strategies that allow them to stay in the market, but government involvement in providing liquidity will be a necessity for many EU airlines [34].

At the global level, COVID state aid has allowed certain governments to safeguard global airline groups, together with the ‘fortress’ airport hubs like Paris Charles de Gaul (CDG), Amsterdam Schiphol (AMS) and Frankfurt (FRA), from where they transport and connect passengers to different parts of the world, often in competition with airlines from other regions in North America, the Middle East and Asia. These direct nationalization and recapitalization grants could put recent accusations of Emirates, Etihad and Qatar airlines being airlines heavily subsidized by the state to rest. In this respect, the relationship between airports and airlines is usually a source of controversy. For instance, the Partnership for Open & Fair Skies [35] argued that Dubai and Doha airports were cross-subsidizing Emirates and Qatar Airways because the landing fees were too low to cover the long-term infrastructure costs.

Additionally, for the LPF, one important element alongside other issues related to state aid to airlines is the level of transparency. In particular, the Middle East has often appeared as not being transparent with regard to the state aid given to airlines, and government agreements have been reached in the past in that respect [36]. In fact, a fair aviation LPF assumes that all governments are subject to ensuring that all air value chain transactions with governments, independent of the assets’ ownership, should be transparent and conducted on commercial terms. Thus, unfair government subsidies could be disclosed. In this regard, the level of transparency in the allocation of state aid to EU airlines, including some market adjustments in certain cases like Air France–KLM in Orly, and Lufthansa in some German airports, needs to be further scrutinized. For example, Lufthansa Group has a dominant position in Frankfurt and Munich airports where it enjoys a significant share of the slots that exist in summer (40–50% of daily allocations on average) and a higher share is also common during peak times (75–85%). The dominant position is additionally reinforced because the second largest airline operates only 10 aircraft in comparison to between 200 and 300 aircraft for Lufthansa Group. For that reason, EC asked Germany to plan some adjustments that favor effective competition at Frankfurt and Munich airports. Finally, Germany decided that Lufthansa Group should withdraw from up to 24 slots per day at each of the airports [37].

5. Conclusions

Our study reaches three important conclusions that mainly respond to the three stated objectives: (1) the largest EU economies (Germany and France), as well as some Northern European countries, are supporting national airlines with COVID-19 state aid with more interest and intensity; (2) airlines with a weaker financial performance before COVID-19 were more likely to be COVID-19 state aid beneficiaries; (3) the government involvement in the airline industry during the recent health crisis will have an important influence on the LPF for airlines, and it is still unclear how the LPF for airlines will evolve in the years to come.

EU Government strategies regarding COVID-19 state aid to airlines have been very unbalanced, and it is especially relevant to the cases of Germany, France and the Netherlands where the complex relationship that usually exists between airports and airlines could artificially create vertically-integrated holdings between distinct aviation firms. Thus, it is unclear how Lufthansa, Air France–KLM, airports in Paris, Frankfurt and Munich, and the respective French and German Governments are going to agree a common vision for the future aviation market in the EU.

Nevertheless, a number of opportunities have been lost at the EU level regarding the harmonization and leadership of EU institutions that favor a more cohesive policy which would foster air transport recovery. In this respect, it would be interesting to study whether a shift in authority from the national governments to a more federalist EU leadership could improve the LPF for air transport. Other studies have analyzed this issue from the perspective of the healthcare system [38,39]. Thus, an interesting line for future research would be to analyze whether EU federalist COVID-19 aid to EU airlines could be more advantageous in comparison to the currently existing program.

After two years of pandemic crisis, travel restrictions persist in many countries, and air transport is facing a third year of uncertainty. It is not unlikely that airlines and airports in the EU will again present themselves as victims of the pandemic and demand more aids to survive. In this context, another open window for future research will be associated to link the new potential aids with innovative measures that control the spread of COVID-19, or the negative externalities produced by air transport, mainly emissions and noise. Thus, the state aids to airlines in the EU should include additional clauses in order to mitigate and control climate change or the spread of the virus. In this sense, different technologies based on contactless services such as robot use in the industry could be explored [40].

Author Contributions

L.M.-D.: Conceptualization, data curation, investigation, methodology, writing—original draft, writing—review and editing. J.C.M.: Conceptualization, data curation, investigation, methodology, writing—original draft, writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are publicly available. See Appendix A.

Acknowledgments

We wish to thank the Directorate-General for Competition of the European Commission for providing the raw data for the study. We also want to thank the editor and three anonymous reviewers for their constructive comments and suggestions on earlier drafts.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The appendix contains Table A1 which provides the detailed information of the dataset used in the study.

Table A1.

EU COVID-19 state aid 1 to airlines, with decisions taken between 1 March 2020–30 September 2021.

Table A1.

EU COVID-19 state aid 1 to airlines, with decisions taken between 1 March 2020–30 September 2021.

| ID | Case Code | Country | Airline | Aid € Million | Instrument | EC Decision | Date |

|---|---|---|---|---|---|---|---|

| 1 | SA.55373 | Croatia | Croatia Airlines | 17 | Direct Grant | No Objections | 30 November 2020 |

| 2 | SA.56795 | Denmark | SAS | 137 | Guarantee | No Objections | 15 April 2020 |

| 3 | SA.56809 | Finland | Finnair | 600 | Guarantee | No Objections + Corrigendum | 29 July 2020 |

| 4 | SA.56810 | Romania | TAROM | 19 | Guarantee | No Objections | 2 October 2020 |

| 5 | SA.56867 | Germany | Condor | 550 | Loan | No Objections | 26 July 2021 |

| 6 | SA.56943 | Latvia | Air Baltic | 250 | Recapitalization | No Objections | 3 July 2020 |

| 7 | SA.57026 | Romania | Blue Air | 62 | Guarantee | No Objections | 20 August 2020 |

| 8 | SA.57061 | Sweden | SAS | 137 | Guarantee | No Objections | 24 April 2020 |

| 9 | SA.57082 | France | Air France–KLM | 7000 | Guarantee | No Objections + Corrigendum | 26 July 2021 |

| 10 | SA.57116 | Netherlands | Air France–KLM | 3400 | Guarantee | No Objections | 16 July 2021 |

| 11 | SA.57153 | Germany | Lufthansa Group | 6000 | Recapitalization | No Objections | 5 November 2020 |

| 12 | SA.57153 | Germany | Lufthansa Group | 3000 | Guarantee | No Objections | 5 November 2020 |

| 13 | SA.57410 | Finland | Finnair | 286 | Recapitalization | No Objections | 9 June 2020 |

| 14 | SA.57539 | Austria | Lufthansa Group | 150 | Direct Grant | No Objections | 6 July 2020 |

| 15 | SA.57543 | Denmark | SAS | 1000 | Recapitalization | No Objections + Corrigendum | 23 February 2021 |

| 16 | SA.57544 | Belgium | Lufthansa Group | 290 | Loan | No Objections + Corrigendum | 30 September 2020 |

| 17 | SA.57586 | Estonia | Nordica | 30 | Recapitalization | No Objections | 11 August 2020 |

| 18 | SA.58114 | Italy | Alitalia | 200 | Direct grant | No Objections | 4 September 2020 |

| 19 | SA.58125 | France | Corsair | 140 | Direct grant | No Objections | 11 December 2020 |

| 20 | SA.58342 | Sweden | SAS | 1000 | Recapitalization | No Objections + Corrigendum | 23 February 2021 |

| 21 | SA.59158 | Poland | LOT Polish Airlines | 400 | Loan | No Objections | 22 December 2020 |

| 22 | SA.59158 | Poland | LOT Polish Airlines | 250 | Recapitalization | No Objections | 22 December 2020 |

| 23 | SA.59462 | Greece | Aegean Airlines | 120 | Direct Grant | No Objections | 23 December 2020 |

| 24 | SA.59913 | France | Air France–KLM | 4000 | Recapitalization | No Objections | 5 April 2021 |

| 25 | SA.60113 | Finland | Finnair | 350 | Loan | No Objections | 12 March 2021 |

| 26 | SA.62304 | Portugal | TAP | 462 | Direct Grant | No Objections | 23 April 2021 |

| 27 | SA.62304 | Portugal | TAP | 1200 | Loan | No Objections | 23 April 2021 |

References

- International Air Transport Association (IATA). Airline Investor Report. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/new-study-on-airline-investor-returns/ (accessed on 1 November 2021).

- International Air Transport Association (IATA). IATA’s Annual Review 2020. Available online: https://www.iata.org/en/publications/annual-review/ (accessed on 2 November 2021).

- Organisation for Economic Cooperation and Development (OECD). State Support to the Air Transport Sector: Monitoring Developments Related to the COVID-19 Crisis. Available online: https://www.oecd.org/corporate/State-Support-to-the-Air-Transport-Sector-Monitoring-Developments-Related-to-the-COVID-19-Crisis.pdf (accessed on 1 November 2021).

- US-Congress. Coronavirus Aid, Relief, and Economic Security Act—CARES Act (2019/2020) [Legislation]. Available online: https://www.congress.gov/bill/116th-congress/senate-bill/3548/text (accessed on 1 November 2021).

- GAO Financial Assistance: Lessons Learned from CARES Act Loan Program for Aviation and Other Eligible Businesses. Available online: https://www.gao.gov/products/gao-21-198 (accessed on 1 November 2021).

- EU European Union. Available online: https://europa.eu/european-union/about-eu/institutions-bodies/european-commission_en (accessed on 1 November 2021).

- EC Treaty on the Functioning of the European Union (TFEU)—Chapter 1: Rules on Competition—Section 2: Aids Granted by States—Article 107. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:12012E/TXT:en:PDF (accessed on 1 November 2021).

- International Air Transport Association (IATA). COVID 19 Impact on Global and Regional Flight Departures. Available online: https://www.iata.org/contentassets/91cf8136124a4bc3a62625539188b107/covid19-flight-impact_pax_060720.pdf (accessed on 2 November 2021).

- Eurocontrol COVID_7D_portal. Google Data Studio. Available online: http://datastudio.google.com/reporting/b2b43aeb-ce1d-4c7e-961a-8bb646368111/page/jwMJB?feature=opengraph (accessed on 1 November 2021).

- European Commission. Temporary Framework for State Aid Measures to Support the Economy in the Current COVID-19 Outbreak 2020/C 91 I/01. Available online: https://ec.europa.eu/competition-policy/state-aid/coronavirus/temporary-framework_en (accessed on 1 November 2021).

- European Commission. Amendments to the State Aid Temporary Framework. Available online: https://ec.europa.eu/competition-policy/state-aid/coronavirus/temporary-framework/amendments_en (accessed on 1 November 2021).

- International Air Transport Association (IATA). COVID-Government Aid. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/government-aid-and-airlines-debt/ (accessed on 2 November 2021).

- Abate, M.; Christidis, P.; Purwanto, A.J. Government support to airlines in the aftermath of the COVID-19 pandemic. J. Air Transp. Manag. 2020, 89, 101931. [Google Scholar] [CrossRef] [PubMed]

- Tretheway, M.W.; Markhvida, K. The aviation value chain: Economic returns and policy issues. J. Air Transp. Manag. 2014, 41, 3–16. [Google Scholar] [CrossRef]

- Halpern, N.; Graham, A. The Routledge Companion to Air Transport Management; Routledge: Abingdon, UK, 2018. [Google Scholar]

- Tretheway, M.; Andriulaitis, R. What do we mean by a level playing fi eld in international aviation ? Transp. Policy 2015, 43, 96–103. [Google Scholar] [CrossRef] [Green Version]

- Österman, C.; Boström, M. Workplace bullying and harassment at sea: A structured literature review. Mar. Policy 2022, 136, 104910. [Google Scholar] [CrossRef]

- Gössling, S.; Fichert, F.; Forsyth, P. Subsidies in Aviation. Sustainability 2017, 9, 1295. [Google Scholar] [CrossRef] [Green Version]

- Organisation for Economic Cooperation and Development (OECD). Environmentally Harmful Subsidies. Challenges for Reform; OECD: Paris, France, 2005. [Google Scholar]

- Steinrücken, T.; Jaenichen, S. Towards the conformity of infrastructure policy with European laws: The case of government aid for Ryanair. Intereconomics 2004, 39, 97–102. [Google Scholar] [CrossRef]

- Eaton, J. Flying the flag for subsidies-Prospects for Airline Deregulation in Europe. Intereconomics 1996, 31, 147–152. [Google Scholar] [CrossRef] [Green Version]

- Abate, M.; Christidis, P. Economics of Transportation The impact of air transport market liberalization: Evidence from EU’s external aviation policy. Econ. Transp. 2020, 22, 100164. [Google Scholar] [CrossRef]

- Budd, T. ‘The end of liberalization?’—Selected papers from the 4th European Aviation Conference (EAC), UK, 2015. J. Air Transp. Manag. 2019, 74, 20–21. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; SAGE Publications: London, UK, 1989. [Google Scholar]

- European Commission. Competition Policy—Search Competition Cases (All Policy Areas). Available online: https://ec.europa.eu/competition/elojade/isef/index.cfm?clear=1&policy_area_id=3 (accessed on 1 November 2021).

- Air France-KLM. Appointment Of The Monitoring Trustee In Case SA.59913–Recapitalization of Air France and the Air France-KLM Holding. Air France-KLM Publications. Available online: https://www.airfranceklm.com/en/system/files/appointment_of_the_monitoring_trustee.pdf (accessed on 2 November 2021).

- European Commission. State Aid: Award of Slots at Paris-Orly to Vueling. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_4805 (accessed on 2 November 2021).

- Laborda, J.; Rivera-Torres, P.; Salas-Fumas, V.; Suárez, C. Is there life beyond the Spanish government’s aid to furloughed employees by COVID-19? PLoS ONE 2021, 16, e0253331. [Google Scholar] [CrossRef] [PubMed]

- World Bank. Population, Total|Data. Available online: https://data.worldbank.org/indicator/SP.POP.TOTL?name_desc=false (accessed on 2 November 2021).

- Macilree, J.; Duval, D.T. Aeropolitics in a post-COVID-19 world. J. Air Transp. Manag. 2020, 88, 101864. [Google Scholar] [CrossRef] [PubMed]

- Raidió Teilifís Éireann (RTE). Norwegian Air to Furlough 1600 Staff after Government Said It Would Not Support Airline. Available online: https://www.rte.ie/news/business/2020/1109/1176863-norwegian-air-funding/ (accessed on 4 January 2022).

- European Commision. State Aid SA.59913—France COVID-19—Recapitalisation of Air France and the Air France—KLM Holding. 2021. Available online: https://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_59913 (accessed on 4 January 2022).

- Bock, S.; Forsyth, P.; Niemeier, H.M.; Mantin, B. Chapter 11 and the level playing field: Should chapter 11 be considered as a subsidy? J. Air Transp. Manag. 2019, 74, 39–46. [Google Scholar] [CrossRef]

- Albers, S.; Rundshagen, V. European airlines′ strategic responses to the COVID-19 pandemic (January–May, 2020). J. Air Transp. Manag. 2020, 87, 101863. [Google Scholar] [CrossRef] [PubMed]

- Partnership for Open & Fair Skies. Massive Subsidies Are Distorting the International Aviation Market. Available online: https://skift.com/wp-content/uploads/2015/03/White.Paper-2.pdf%0A (accessed on 2 January 2022).

- Shepardson, D.; Bayoumy, Y.U.S. and UAE Sign Pact to Resolve Airline Competition Claims. Available online: https://www.reuters.com/article/us-usa-airlines-emirates-idUSKBN1IC2BK (accessed on 2 January 2022).

- European Commission. Subject: State Aid SA. 57153 (2020/N)—Germany—COVID-19-Aid to Lufthansa Excellency, Following Pre-Notification Contacts, 1 by Electronic Notification of 12 June 2020, Germany Notified Aid in the Form of a Recapitalisation of Deutsche Luftha. Available online: https://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_57153 (accessed on 2 January 2022).

- Kovac, M.; Elkanawati, A.; Gjikolli, V.; Vandenberghe, A.-S. The COVID-19 Pandemic: Collective Action and European Public Policy under Stress. Cent. Eur. J. Public Policy. 2020, 14, 47–59. [Google Scholar] [CrossRef]

- Martín, J.C.; Román, C. The effects of COVID-19 on EU federalism. East. J. Eur. Stud. 2021, 12, 126–148. [Google Scholar] [CrossRef]

- Meidute-Kavaliauskiene, I.; Yıldız, B.; Çiğdem, Ş.; Činčikaitė, R. The effect of COVID-19 on airline transportation services: A study on service robot usage intention. Sustainability 2021, 13, 12571. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).