1. Introduction

In the last 20 years, the fresh agricultural produce supply chain has become a major field of study (see, for example, Clark and Hobbs, 2018 [

1]; Vernier et al., 2021 [

2]; Tian X et al., 2020 [

3]; Walker et al., 2016 [

4]). A broad range of subjects has been researched from the abstract, such as modeling (see Clark and Hobbs, 2018 [

1]; Magalhães et al., 2021 [

5]; Siddh et al., 2017 [

6]; Xiaofeng Xu et.al., 2021 [

7]), sustainability (Vernier et al., 2021 [

2]), propagation (Smith, 2011) [

8] and operation (Nosratabadi et al., 2020 [

9]), to physical systems such as retailer behavior (N. Xu et al., 2021 [

10]), pricing (C. Huang et al., 2021) [

11]; Gaggero et al., 2021 [

12]), risk (Walker et al., 2016 [

4]), and contract (Zheng et al., 2017 [

13]). In China, agricultural cooperatives have developed rapidly in recent years, and they cooperate with supermarkets to provide a sustainable and stable quality of agricultural products to consumers. This new fresh agricultural produce supply chain works well if and only if its operational steps are properly synchronized. It is a dual-channel supply chain that uses traditional and E-commerce channels. In the former, customers buy fresh agricultural produce from supermarkets, who buy it from agricultural cooperatives; in the latter, customers buy directly from agricultural cooperatives or supermarkets via the internet, which increases the convenience of their experience. After analyzing the literature, we found that these two channels often conflict with each other if the wholesale price is irrational (Siddh et al., 2017 [

6]; Liu et al., 2020 [

14]). Further, if the wholesale price is higher than a certain threshold, supermarkets will lose customers to E-commerce; if the wholesale price is lower, customers are more likely to buy from supermarkets, which could lead to a loss of profit for agricultural cooperatives. These channels are therefore linked by the behaviors of both suppliers and consumers. More importantly, the quantity and quality of fresh agricultural produce necessarily changes over time, which can produce considerable losses (Magalhães et al., 2021 [

5]; Siddh et al., 2017 [

6]; Smith 2011 [

8]) and result in a corresponding increase in price. Although this is a difficult problem to address, coordinating the supply chain is an important step in its solution.

Fresh agricultural produce is susceptible to dehydrolysis and rotting; the former causes a decrease in quantity and freshness, and the latter is detrimental to its quality (Siddh et al., 2017 [

6]). Both events therefore result in a loss of quality of the produce, which indirectly affects its saleable quantity (Magalhães et al., 2020 [

5]) and the topological structure of the customer base (Smith, 2011) [

8]. Further, bacterial and viral contamination of the fresh agricultural produce can occur, which not only leads to a sharp decline in the quality of fresh agricultural produce, but also harms human health and lives. Because this kind of contamination is often invisible and difficult to predict, it can make supply chain management more difficult (Ilkyeong Moon et al. 2018 [

15]; Mitchell et al., 2020 [

16]). Although block-chain technology can reduce this hazard by marking rotten food (Kramer et al., 2021 [

17]; Saurabh et al., 2020 [

18]), this identification process has inherent risks (Kamilaris et al., 2019 [

19];) that work against supply chain coordination. This highlights the need for an effective mechanism to be designed. Many scientists (Clark and Hobbs, 2018 [

1]; Magalhães et al., 2021 [

5]; Subrata Saha, 2014 [

20]; Subrata Saha and Izabela Nielsen, 2020 [

21]; Siddh et al., 2017 [

6]) have proven that written contracts are a feasible and reasonable coordination strategy for supply chains, as they specify price, quantity, quality, cost and risk as parameters to which all parties must adhere. Discounting prices is also an effective strategy with which to coordinate the supply chain, as proven by Gaggero et al. (2021 [

12])) and Xiaofeng Xu et.al. (2021) [

22]. The results of this previous research can help to coordinate a more efficient fresh agricultural produce supply chain. None of these results, however, are effective in all possible scenarios: i.e., they can only design an optimal discount strategy for a supply chain that satisfies certain conditions, and may need to be correct if these conditions shift to other new ones. Further, because the price of fresh agricultural produce reflects their freshness (determined by the time elapsed between picking and selling), a dynamic strategy with multiple discount stages should be designed; and because each category of food loses quantity and quality on a characteristic curve, a universal optimal price discount ratio is difficult to determine (Nosratabadi et al., 2020 [

9]; Xiaofeng Xu, et.al., 2020 [

23]).

This paper analyzes a supply chain consisting of agricultural cooperatives and supermarkets, and considers traditional and E-commerce channels simultaneously. On the one side, fresh food must be sold out before the deadline; on the other side, the price of the fresh food changes dynamically with time. Furthermore, there are many complex conflicts between the two channels. These two reasons make the coordination of this kind of supply chain more difficult. The purpose of this paper is to design a price discount strategy to both coordinate this fresh food dual-channel supply chain and make market clearing. To implement it, it also introduces the idea of a dual loss of quantity and quality in the distribution of fresh agricultural produce. First, a supply chain with quantity loss in mixed exponential and logistical distribution is examined. Then, an operating model with a single-stage discount is constructed, and the optimal discount ratios of supermarkets and agricultural cooperatives with decentralized and centralized decision-making processes are calculated, respectively. The same analytical method is then applied to find the optimal discount ratios for multi-stage discounts. Other scenarios of quantity loss are subsequently analyzed, and universal optimal ratios for multi-stage discounts are obtained by inductive reasoning. This can help ascertain different quantity loss scenarios and dual-channel supply chain coordination.

2. The Dual-Channel Fresh Agricultural Produce Supply Chain

As the previous analysis explains, a discount contract is an effective way to coordinate this supply chain. This paper will also consider the following questions: What properties should the optimal discount ratios of different enterprises contain? How many times should a discount be introduced in the supply chain’s operational process?

The specific properties of fresh agricultural produce mean that their quantity and quality change over time. Physical and biochemical causes make the quantity and quality of fresh food produce decrease. Physical changes (such as dehydration or damage in transit) trigger exponential decay. If

is the transitory quantity driven by physical change at time

t,

Biochemical change is considered logistic decay, because bacteria and viruses spread from infected to healthy fresh agricultural produce. If the corresponding quantity is

, then

The former is defined as the loss of food quantity, and the latter as the loss of food quality. The nature of logistic decay means that the quantity decreases dynamically, as in Equation (1). Further, physical changes, such as dehydration and impact damage, are inevitable, which decreases the quantity of fresh agricultural produce over time. In fact, the dual loss of quality and quantity happens synchronously, furthermore the quantity change that happens is produced by both physical and biochemical change, which are independent but parallel processes. This means that the quantity of a product at time

is:

So, the quality loss of fresh agricultural produce can be divided into two aspects. One is physical (exponential) decay, defined by Equation (1); the other is deterioration, rot and contamination as an inverted S-curve, which satisfies and is constrained to Equation (3), where, .

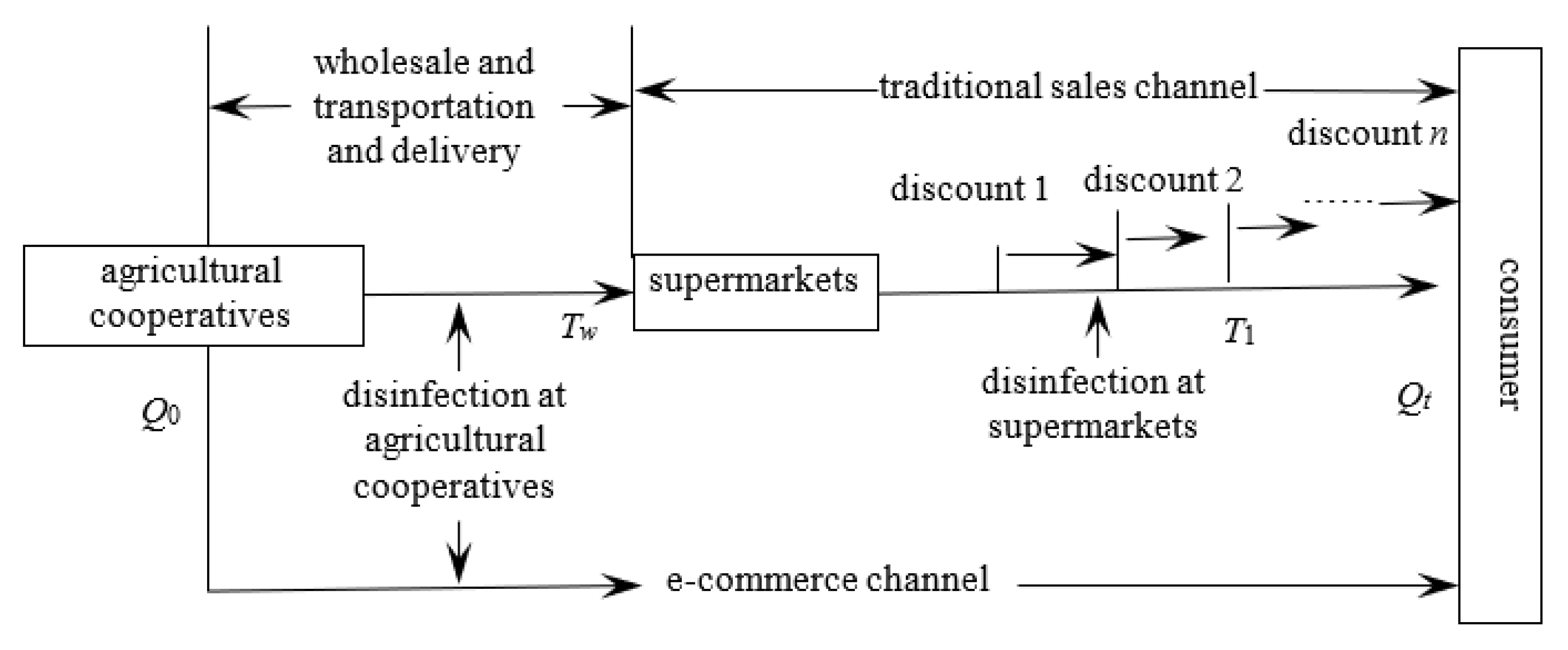

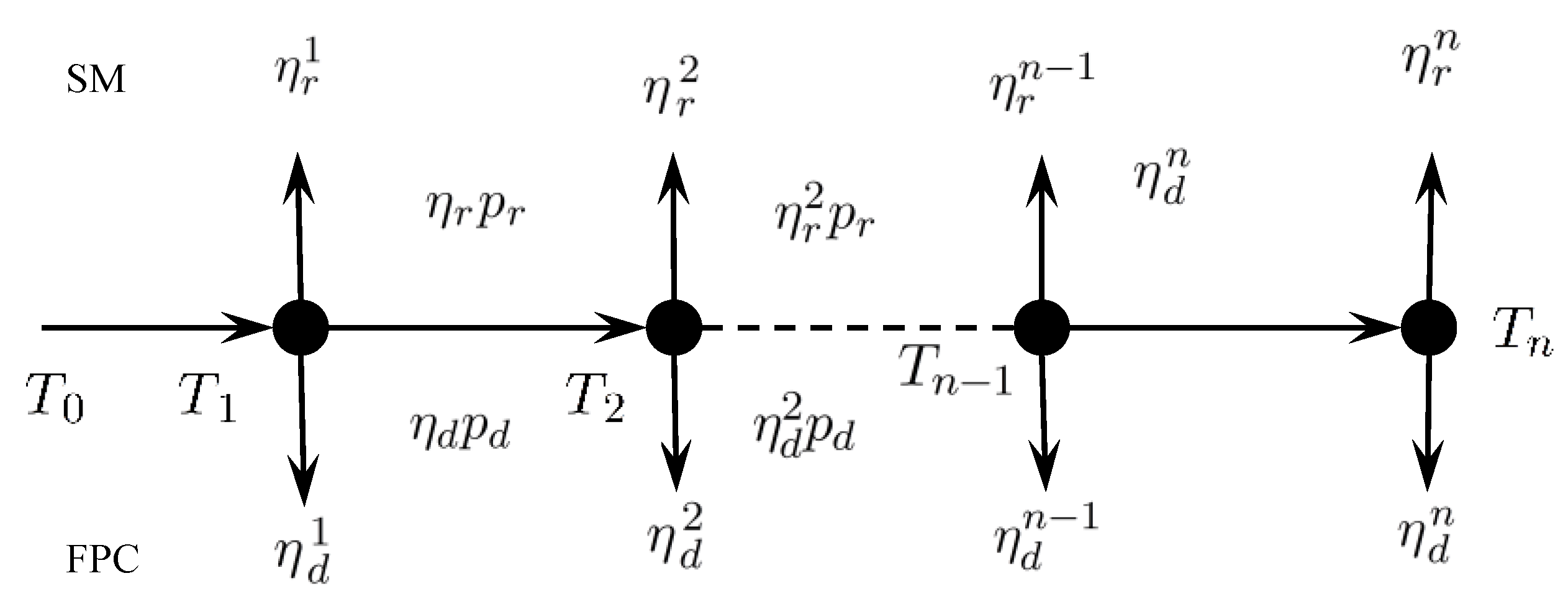

The supply chain operational system is shown in

Figure 1:

The notations in this paper are shown in

Table 1:

Figure 1 describes the operational process of the fresh agricultural produce supply chain. After the fresh agricultural produce is picked, agricultural cooperatives store it in a warehouse or transport it to a supermarket. At time

, the fresh products arrive at the supermarket, which then sells them to consumers. It may sell them at a discounted rate according to fresh agricultural produce characteristics or market demand. The supermarket decides when and how discounts should be applied. In the E-commerce channel, agricultural cooperatives may also apply discounts based on the same factors.

To analyze this problem, the operational process of the fresh agricultural produce supply chain should be identified (Ezzeddine et al., 2012 [

24]; Kollia et al., 2021 [

25]; Kurnia et al., 2016 [

26]). At the first step, because quantity

is dependent on the behavior of agricultural cooperatives but independent of supermarkets,

satisfies

However, at the second step, quantity

is dependent on both agricultural cooperatives and supermarkets, so

If the quantity of fresh agricultural produce at time is (5), it makes sense to apply a discount strategy to achieve market clearing. If a product falls below the acceptable sales quality, or if its supply far exceeds its demand, its value is 0; however, it still incurs disposal costs. If a discount strategy is applied in time, this can be avoided. In this sense, having an effective discount strategy in place is important for both agricultural cooperatives and supermarkets.

An effective discount strategy should achieve both market clearing and supply chain coordination; the latter’s primary objective is to obtain maximum profit based on the former. Second, agricultural cooperatives and supermarkets must balance their distribution with their discount strategy to ensure a reasonable profit. Third, the discount strategy should reduce the conflict between traditional and E-commerce channels to a negligible level (Tabrizi et al., 2018 [

27]).

The complexity of this problem is rooted mainly in the changeable properties of the quality and quantity of fresh agricultural produce, and the conflict within their supply chain. It is therefore necessary to clarify the operational process. In the traditional channel, agricultural cooperatives transport the fresh agricultural produce to supermarkets first in the time interval

, where

is the initial point in time, and

is the point in time at which the fresh agricultural produce reaches the supermarket’s warehouse. No discount is applicable at this step because the fresh agricultural produce is not yet being sold. In the second step,

, the fresh agricultural produce must be sold by the supermarket before it begins to rot at deadline

. The quantity and quality of fresh agricultural produce change dynamically with time, which causes the latter’s demand function to alter correspondingly, and enhances the difficulty of supply chain management. If supply and demand are equal, market clearing occurs; similarly, only if a scientific coordination mechanism is designed and implemented will the dual-channel fresh agricultural produce supply chain be coordinated. This is a necessary condition of a healthy supply chain (Gaggero et al., 2020 [

12]; Xu et al., 2019 [

28]; Zheng et al., 2017 [

13]). To focus on the first condition of equilibrium between the supply and demand of fresh agricultural produce, the demand function must first be identified. The characteristics of this supply chain give the corresponding demand function:

Equation (6) describes the demand for fresh agricultural produce in the traditional channel. In this process, customers buy the fresh agricultural produce from a supermarket, which causes a dynamic demand change as Equation (6). This demand function consists of four aspects: (a) the demand scale of the traditional channel, driven by the demand proportion of traditional commerce and market scale , i.e., the constant of the demand function of fresh agricultural produce; (b) sensitive demand , driven by retail price and a price-sensitive coefficient in the traditional channel , which is accompanied by a negative linear correlation between sensitive demand and retail price; (c) cross-elasticity demand from E-commerce trading, which is affected by demand in the E-commerce channel: if demand in E-commerce decreases in a negative linear correlation with the E-price , demand in the traditional channel will increase, and vice versa; and (d) the demand arising from quantity loss , which increases as quantity decreases. Here, the loss function has two parts: quantity loss in a certain time interval , denoted by , where ; and quantity loss from time to current time , denoted by , where , which are seen in the two fractions in square brackets in Equation (6). Because these two parts are sequential processes, the demand function could be described as . Furthermore, if time , , if , . In Equation (6), all parameters, such as , are the descriptive statistical analysis results of fresh food of the cases under certain conditions.

In the E-commerce channel, agricultural cooperatives sell fresh agricultural produce directly to their customers via the internet. The sales behavior, therefore, begins at the initial point in time

, which makes them independent of supermarkets. The corresponding demand function

is:

Similarly, the demand function of agricultural cooperatives has four aspects in the E-commerce channel: (a) the demand scale of the E-commerce channel; (b) the sensitivity demand αpd; (c) the cross-elasticity demand βpr in the traditional channel; and (d) demand arising from quantity loss γq0f’(t). In the E-commerce channel, fresh agricultural produce is sold directly to customers, so the time interval is [T0,t], which means that satisfies the form defined in the square brackets in Equation (7).

If the characteristics of the dual channel supply chain are reconsidered, two kinds of management must be considered: decentralized and centralized decision making (Zhai et al., 2021 [

29]; Zhu et al., 2018 [

30]). In the former, cooperatives and supermarkets make decisions independently, to maximize their own profits; in the latter, the two enterprises are regarded as a system, and make a decision by maximizing the profits of the system as a whole. In this case, a rational profit distribution mechanism must be designed to prevent conflict between the two sides. If both decision-making modes maximize their impact, a scientific coordination mechanism can be designed. In decentralized decision making, the supermarket’s profit can be represented as:

It relies on demand

in time interval

, the cost

, the loss arising from the quantity difference between supply and demand

, and the disposal cost

for unsaleable fresh agricultural produce. Similarly, the agricultural cooperative’s profit can be represented as:

The corresponding profit of the agricultural cooperative described in Equation (9) consists of the incomes from both the traditional channel and the E-commerce channel , and the cost of the loss arising from the quantity difference between supply and demand , and the disposal cost of unsaleable fresh agricultural produce .

To design a discount strategy that coordinates the supply chain, it is necessary to analyze the operational process and the corresponding profits of the supply chain as a whole. To do this, the supply chain should be regarded as a system that obtains the corresponding profit in the centralized decision-making mode. When the operational process is considered, the profit of supply chain

is:

If Equations (8)–(10) are combined, the differences in profit between decentralized and centralized decision-making modes in the supply chain are calculated in Equation (11). When the sum of the supermarket and agricultural cooperative’s profits are compared with those of the fresh agricultural produce supply chain,

Because there is no internal friction in the centralized decision-making mode, it is concluded that . This is an essential indicator that the supply chain can be coordinated.

4. The Single-Stage Discount Approach

In the supply chain operational process, there exists a discount point at which, because of conflict between demand and supply, the supply chain sells fresh agricultural produce at full price if , but a discount is required if .

If the single-stage discount strategy is used (in which the discount ratios of supermarkets and agricultural cooperatives are denoted as

and

, respectively), the corresponding prices should be

and

, respectively, after the discount. Because the discount strategy is implemented, the demand function changes accordingly. If

and no discount strategy is implemented, the demand function would not change; but if

, the agricultural cooperative and supermarkets change their prices from

and

to

and

, respectively, according to the theory of balance between supply and demand, the demand function must be changed. The properties of demand for fresh agricultural produce mean that the demand function can be regarded as a linear transformation of the original demand function. This means that in the traditional channel, if

,

The demand function consists of two parts: trend

and intercept

. The element

is defined in Equation (6). It is the adjustment effect for a change in market demand caused by the dynamic quantity of fresh agricultural produce in the traditional supply chain channel, and describes the decay properties of the initial quantity

over time

. The agricultural cooperative’s online price

also affects supermarket demand. Further, if

at the discount stage,

When

, the demand function shifts because the retail prices change from

and

to

and

, respectively. If prices

and

form a linear scale with prices

and

, respectively, then the demand function shifts accordingly, as seen in

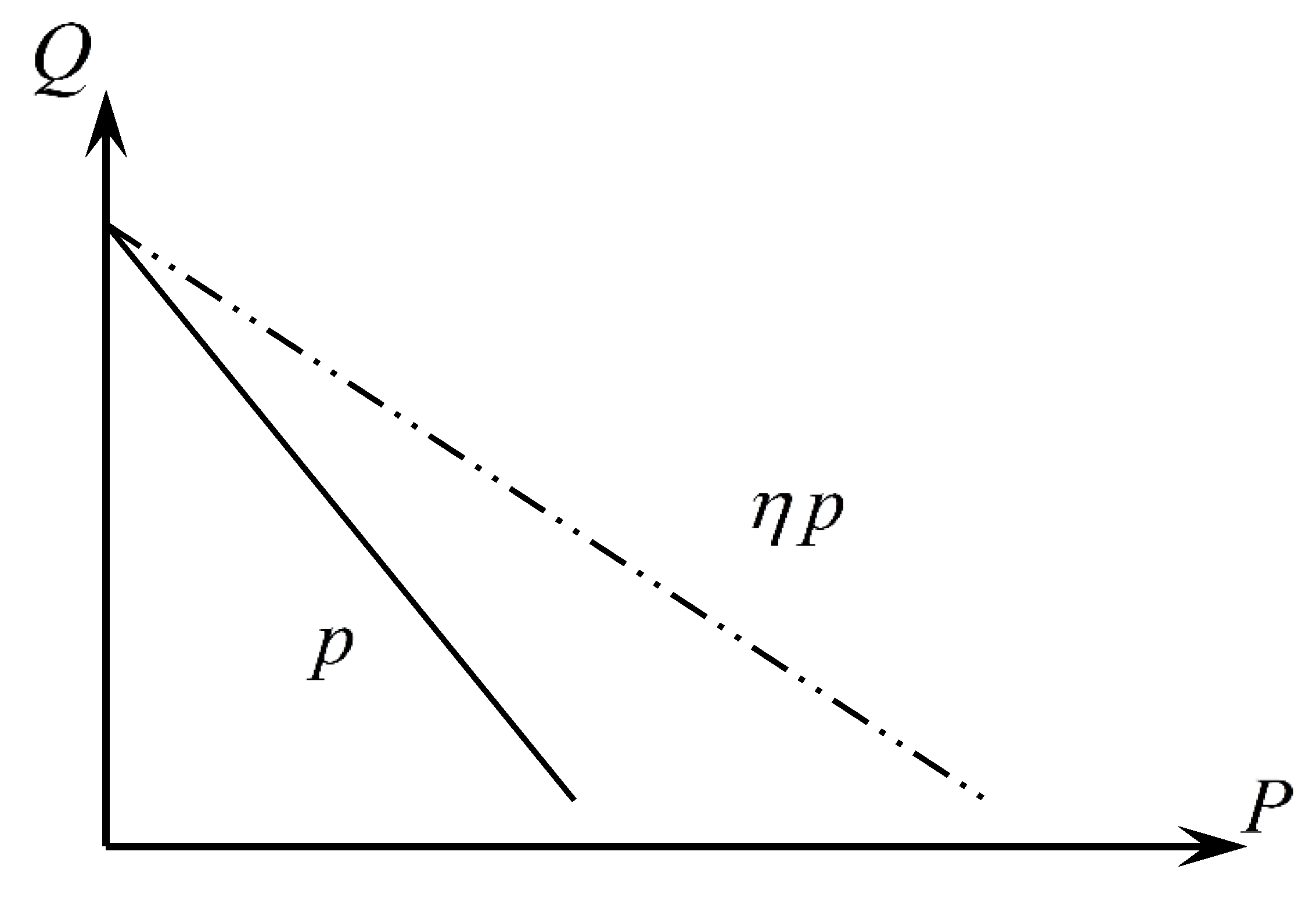

Figure 2.

Figure 2 shows the nature of the demand function’s change: i.e., there exists a discontinuous price point at which the demand function shifts from

to

. The latter consists of two parts: intercept

and trend

.

In the E-commerce channel, transport is not necessary: customers buy fresh produce directly from agricultural cooperatives, so quantity change can only occur when the fresh agricultural produce is picked. In this case, if

,

and if

,

In the traditional supply chain, the demand function is divided into two categories: Equation (26) describes the first step before the discount is applied; and Equation (27) maps the changes to supply price and demand quantity afterwards (Liu et al., 2020 [

14]; Zhang et al., 2017 [

32]). It is concluded that the common intercept

exists in both traditional and E-commerce channels, but the trend terms are different. The trend of the former channel is

, and that of the latter is

, where

is defined in Equation (7) as the adjustment effect of the dynamic supply quantity in the E-commerce channel of the supply chain.

4.1. Price Discounts in the Decentralized Decision-Making Mode

To coordinate discounts, the profits of the supply chain and its enterprises must be analyzed. Without loss of generality, set

, i.e., the fresh agricultural produce is distributed immediately after it is picked, and a price discount coordination process can be specified in the decentralized decision-making mode. First, the supermarket would determine the retail price of the fresh produce based on market demand after it is delivered from the agricultural cooperative. If the retail price, discount price, market demand, purchase price and quantity of the fresh produce are fixed, the corresponding profit of the supermarket

is

As shown in Equation (28), the supermarket’s profit

has two parts: one is independent of quantity change and the other is dependent on it. The former occurs in two steps (non-discount and discount), which are integral to profit density functions

on timescale

and

on timescale

, respectively. The latter is integral to the quantity decay function in these two sequential steps, i.e., the product of dynamic prices

driven by quantity loss from both physical change and decay; and the integral quantity decay function

of quantity change due to physical loss, and the operator

of quantity change due to quality loss. To simplify this, the profit coupled with quantity change is denoted as

, i.e.,

The properties of the discount process mean that the agricultural cooperative’s profit is

As with that of the supermarket, the profit of the agricultural cooperative consists of two sub-profits. The characteristics of the operation process mean that the wholesale process in time interval

and the corresponding profit driven by quantity loss index

should be considered, and can be described in terms of quantity loss caused by physical decay

and quality decay

, respectively. This means that

The optimal discount ratios of these two enterprises are important to coordinate the supply chain; they can be decided by taking the partial derivative of

to Equation (30).

where

describes the corresponding operator of the loss at the second step. If

and

, the physical properties of this supply chain operation mean that the discount ratio of the supermarket

satisfies

Similarly, the optimal discount ratio for agricultural cooperatives can be found by calculating the partial derivative of Equation (30) based on the condition of the second-order partial derivative of

. Further,

Here,

, and if

, the optimal discount ratio

is obtained, which satisfies

If (36) is substituted for (34),

Although there are differences between them, the optimal discount ratios

and

consist of two aspects: the trend term of the last part of Equations (36) and (37), and the constant term of the rest of these two equations. There is a decay effect in the trend term described by the integral demand function, which reflects the price and decay property coupled with dynamic quantity change. Further, the decay effects of discount ratios, which rely on the dynamic demand quantity of fresh agricultural produce, are determined by functions

and

, respectively. This shows that discount ratios depend on the operational process of the traditional supply chain channel. It can also be concluded that, if

, a minimum profit would be achieved, which is not desirable. If

, this is not an optimal solution;

is the basic condition for the supply chain to operate normally. With this in mind, the equilibrium condition of supply and demand in supermarkets is:

i.e., Equation (38) can be expanded to

and the constraint condition of equilibrium between supply and demand in the agricultural cooperative is

The balance of supply and demand equilibrates the dual channels of the fresh agricultural produce supply chain, and the scientific coordination mechanism defined by the discount ratios

and

ensures rational profit distribution based on maximizing market clearing and profit in the system as a whole. These two conditions ensure that discount ratios are always at an optimal trajectory, which stabilizes the supply chain, as shown in

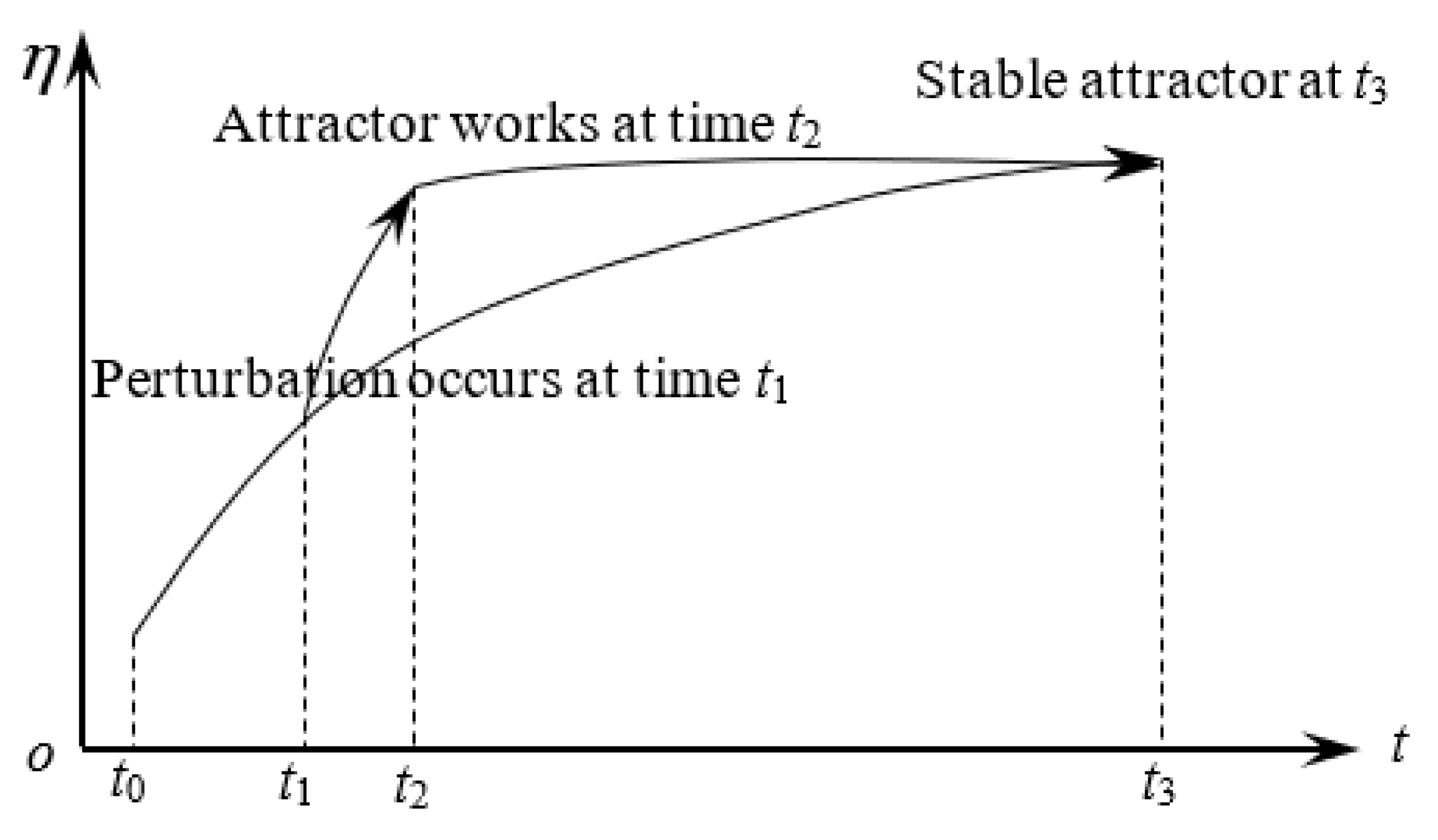

Figure 3.

If perturbation from the environment is added, the equilibrium between the supply and demand of fresh agricultural produce is broken, because the discount strategy can stimulate demand growth to fill it; there must be a “potential difference” attractor that pulls the deviation back to the optimal trajectory. Further, in decentralized decision making, because two enterprises make decisions independently, there are several non-synchronous behaviors that occur and entangle together in the operational process, which affects the efficiency of the supply chain.

4.2. Price Discount in the Centralized Decision-Making Mode

In centralized decision making, agricultural cooperatives and supermarkets are regarded as a whole, in which optimal prices are calculated by resolving a corresponding optimal model. Because of the relationship between market demand and system supply, and the operational properties of this supply chain, the supermarket’s retail price, the online price set by agricultural cooperatives, the supermarket’s discount ratio

, and the agricultural cooperative’s discount ratio

must be determined. The properties of the fresh agricultural produce supply chain mean that the profit

in the centralized decision-making mode is

Equation (42) shows that the supply chain profit has two parts: the drift term and the constant term. The constant term is , but the drift term is more complex. It relies on the behavior of agricultural cooperatives and supermarkets, which is determined by the price-sensitive coefficient of the channel; the price cross-elasticity coefficient of the between channels; the effective coefficient of food quality to demand; corresponding discount ratios; and the quantity loss index , where . To summarize: the profit coupled with centralized decision making is defined by the constant and drift terms, which are driven by their respective prices and discount ratios , coupled with the corresponding demand quantities in time intervals , and , respectively.

If the constraint of equilibrium conditions (38) and (40), or (39) and (41) are combined, the order quantity in the traditional channel

is

by taking partial derivative of

from Equation (42). Substitute (43) into supply chain profit Equation (42), and

and

, the optimal discount ratios for the agricultural cooperative and supermarket are

and

respectively. The optimal discount ratios of both

and

are determined by the point in time of the discount; prices

and

; the sensitive coefficient of the price of a channel

; the cross-elasticity coefficient of prices between channels

; and the effective coefficient of food quality to demand

.

A comparison of the optimal discount ratios in the centralized decision-making mode described in Equations (44) and (45) with those in the decentralized decision-making mode, described in Equations (37) and (36), shows that the latter is larger than or equal to the former. This is because there are much fewer internal conflicts in centralized decision making, which makes the supply chain more effective. Further, in the centralized decision-making mode, resources, such as information, inventory and equipment, can be shared in collaborative planning, forecasting and replenishment (CPFR), which greatly improves operational efficiency [

6,

9]. There are, however, gaps in profit between decentralized and centralized decision-making modes, and strategies should be introduced to improve the capability of the latter.

6. Discussion and Conclusions

6.1. Other Scenarios and Comparisons

Although there are several kinds of quantity loss, this paper examines the case of dual decay with quality and quantity loss. This hypothesis, however, is not strictly correct, because other scenarios can occur under certain conditions (Belkhatir et al., 2020 [

38]; Suhail et al., 2020 [

39]). For example, what strategy should be used if the quantity loss is not what Equation (3) defines, or if a demand disruption occurs, or if a series of substitutes for fresh agricultural products are considered synchronously? What we cared is not just the coordination strategy in the particular case defined in this paper, but a universal coordination strategy for all possible cases. All scenarios can be described by several specific parameters, and if they are taken as fixed constants, the scenario becomes deterministic (Inoue et al., 2020 [

40]; Tominac et al., 2020 [

41]). To draw a universal conclusion for discount coordination, other scenarios should be discussed. Because this is too complex to analyze in the scope of this paper, we examined a coordination strategy for the different kinds of quantity loss of fresh agricultural produce. A simple case of quantity loss that satisfies exponential distribution

is discussed in the following paragraph.

6.1.1. The Discount Strategy for Quantity Loss That Satisfies Exponential Distribution

This is a degenerate distribution of the model constructed in this paper that ignores quantity loss

arising from decay. Using the same analysis method and process, the optimal discount ratio of the agricultural cooperative in a single-stage discount strategy is considered. The optimal discount ratios of

and

in the decentralized decision-making mode would then be

and

respectively. Similarly, in the centralized decision-making mode, the optimal discount ratios of

and

would be

and

respectively. In the multi-stage discount strategy, the optimal discount ratios of

and

in decentralized decision making would be

and

respectively. In the centralized decision-making mode, the optimal discount ratios of

and

would be

and

respectively. In the optimal discount trajectory of agricultural cooperatives and supermarkets, similarities exist between single- and multi-stage discount scenarios with regard to the dual decay of quantity and quality and the single decay of quantity. This conclusion can be drawn by considering the quality loss of

.

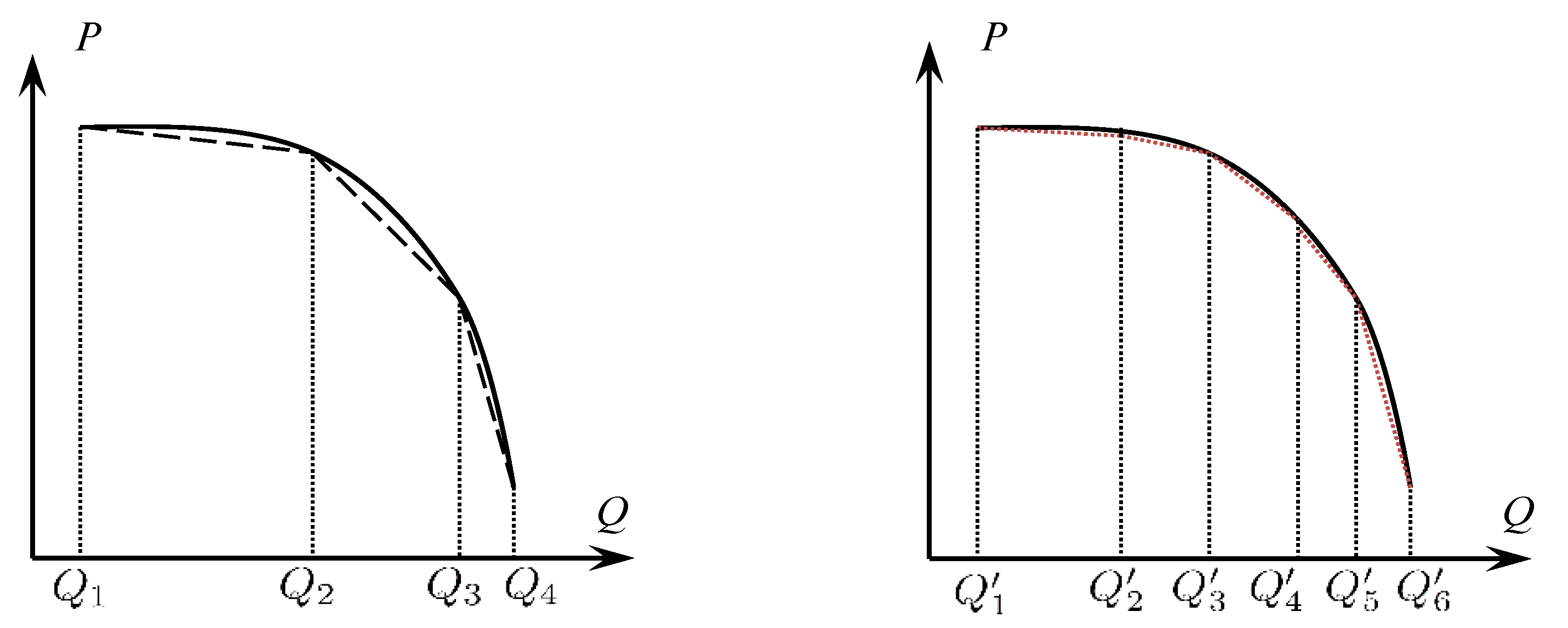

6.1.2. Comparing Quantity Loss Scenarios

Three scenarios of quantity loss can be considered: (1) where the logistical function arises from quality evolution and the exponential function arises from quantity evolution; (2) where the exponential function is driven by quantity evolution; and (3) where the logistical function is driven by quantity evolution or quality evolution. If these scenarios are compared, it is apparent that a discount contract is an effective way to ensure market clearance and supply chain coordination with maximal profit. The duration, size, and point in time of discounts are crucial in this strategy. In this paper, discount size has been discussed by considering the loss of both quality and quantity.

6.1.3. A Universal Coordination Strategy for Multi-Stage Discounts

By analyzing other quantity losses with diverse decay functions, and comparing the corresponding results of the transitory optimal discount ratios of supermarkets and agricultural cooperatives, a hypothesis can be proposed: There is a universal law that can coordinate supply chains in all scenarios. If this is true, all supply chains coupled with diverse scenarios could be coordinated in a discount strategy that uses certain discount ratios. The main idea of the coordination strategy would be the same in all scenarios, but the corresponding parameters of discount ratios and times would vary. The next subsection will attempt to find this universal law.

It can also be concluded that the discount size in the centralized decision-making mode relies on fixed and drift terms, regardless of which loss function arises from exponential, logistical, mixed, or other types of distribution. For a multi-stage discount strategy, the fixed term of the supermarket’s discount ratio

is

while the drift term relies on the distribution properties of quantity and quality loss. After generalizing the results of the corresponding distribution, the drift term of the supermarket’s discount ratio is:

Equations (74) and (75) show that for supermarkets, if centralized decision making is invoked, the fixed term is independent of the distribution of quantity decay, but the drift term is. Further, whatever the distribution of quantity decay, the discount ratio in the multi-stage discount strategy will be determined by this fixed term, even if no quantity loss occurs. The fixed term of this discount ratio is decided by the unit cost of fresh agricultural produce from the agricultural cooperative; the price set by the supermarket in the traditional channel; the potential market size; the price sensitive coefficient of the channel price cross-elasticity coefficient between channels; and the market share in the traditional channel, which is described in Equation (74). There are, however, distinctions between scenarios that are driven by the properties of quantity decay and supply chain operation. The former is decided by the characteristics of the fresh agricultural produce, and the latter is controlled by supermarket prices in the traditional channel; the price-sensitive coefficient of a channel price cross-elasticity coefficient between channels; and the time intervals in a particular discount strategy. These two fractions form the drift term, as shown in Equation (75).

In agricultural cooperatives, the discount ratio also has two parts. The fixed term can be generalized as

and the drift term as

If the decentralized decision-making mode is invoked, the discount ratio is similar to that of supermarkets. The fixed term is decided by the unit cost set by the agricultural cooperative; the price set by supermarkets in the traditional channel; the potential market size; the price-sensitive coefficient of the channel price cross-elasticity coefficient between channels; and the market share in the traditional channel, as described in Equation (76). The drift term is the same as that of the supermarket, which is affected by quantity decay and supply chain operation.

The universal law in the decentralized decision-making mode can be analyzed by using a similar method. In this case, the fixed term is the same as that of the centralized decision-making mode. The fixed term discount ratio for supermarkets and agricultural cooperatives would then be

and

respectively. Similarly, the drift term discount ratio for supermarkets and agricultural cooperatives would be

and

respectively. If the sizes of these two discount ratios and decision-making modes are compared, it can be seen that the discount ratios are larger in the centralized mode, which reflects its advantage.

It can be concluded that Equations (74)–(77), (80) and (81) are the universal analytical expression of discount size. The former four equations fit the coordination strategy of decentralized decision making, and Equations (74), (76), (80) and (81) fit the centralized mode. In most cases, the universal coordination mechanism of multi-stage discounts with reasonable ratios will greatly benefit the supply chain and its node enterprises (Zhang et al., 2021 [

42]).

Further, if

Q(

t) = 0, the optimal discount ratios would degenerate to the result proposed in [

6,

16,

43]; if

Q(

t) = exp(

a −

bt), the optimal discount ratios would degenerate to the result proposed in [

34]; if

Q(

t) is far larger than the normal quantity (i.e., it is a supernormal disruption, in which an extreme and sudden disruption occurs), the result calculated would match that shown in [

16]. This proves Theorem 2 is correct.

6.1.4. Coordination within Agricultural Cooperatives

Agricultural cooperatives are composed of several families who work together, in order to generate more profit than they would working alone. In this kind of enterprise, effective management (including planning, organization, control and coordination) increases its benefits.

A question then arises: How can all families obtain reasonable profits under the condition of maximized cooperative payment? This problem can be described as a dynamic stochastic cooperative game model, which is complex to resolve. A solution can be obtained without losing accuracy, by solving two sequential problems: first, a corresponding optimal model of profit under certain constraints should be constructed (this should be a multi-objective optimization model, but whatever category of model is used, a corresponding optimal solution should be obtained); second, a reasonable profit distribution mechanism should be designed, to make sure all families are compensated fairly.

Because the first question is an optimization problem, no matter how complicated it is, it can be solved by invoking a fitness algorithm. The objective function of an agricultural cooperative is multi-faceted: maximum profit, sustainable production, and a healthy relationship with other enterprises in the supply chain are all considerations. The objective of an agricultural family is, however, relatively simple: maximum payment. A rational payment distribution can be determined by constructing a dynamic Shapley distribution vector, if the optimal payment of the cooperative and all possible coalitions are calculated. Because this problem is relatively simple, it was omitted from this paper.

6.2. Conclusions

The structure of a fresh agricultural produce supply chain is extremely complex. Three kinds of coordination are involved in its operation: that between the agricultural cooperative and the supermarket; that between traditional and E-commerce channels; and that between families in a cooperative. The former two focus on the conflict between the supermarket and the agricultural cooperative in the two channels, and the latter involves conflict within the cooperative. To resolve these conflicts, coordination between enterprises is key. After analysis, it can be concluded that the application of discounts is an effective coordination strategy. Further, the coordination of discounts in the centralized decision-making mode is more effective than under the decentralized mode. The paper then studied a scientific discount parameter.

According to supply chain operation and coordination, the supermarket encourages demand through discounts, and the agricultural cooperative gives discounts to promote the E-commerce channel but surrenders part of its profits to the supermarket in the traditional channel. Because the quantity of fresh agricultural produce decreases with time, however, and because market demand is determined by supply, the price, including the corresponding discount ratio, is difficult to ascertain. This paper introduced a multi-stage discount strategy, and calculated each discount ratio coupled with its corresponding stage. If the quantity decays as in Equations (1) and (2), corresponds to the loss of quantity and quality, respectively, and if the decentralized decision-making mode is introduced, the optimal discount for the supermarket is described in Equation (71), and the discount for the agricultural cooperative in Equation (70). If centralized decision making is used but all other conditions remain the same, the optimal discounts for the supermarket and agricultural cooperative are decided by Equations (72) and (73), respectively. The centralized decision-making mode is superior to the decentralized mode in terms of coordination effect.

There are, however, other kinds of quantity loss in fresh agricultural produce that have diverse functions determined by the product’s physical properties and biochemical characteristics. This paper discussed the loss function of exponential and logistical decay, and found that whatever the nature of quantity loss, there is a universal function that describes the discount ratio. It then divided the discount behaviors into two aspects: fixed term (which is independent of changes to quantity and quality); and drift term (which is dependent on these changes). In the decentralized decision-making mode, the fixed term of supermarket discounts is given in Equation (78), and the drift term in Equation (80); and the fixed term of the agricultural cooperative discount is given in Equation (79), and the drift term in Equation (81). In the centralized decision-making mode, the fixed term of supermarket discounts is given in Equation (74), and the drift term in Equation (75); and the fixed term of agricultural cooperative discounts is given in Equation (76), and the drift term in Equation (77).

If this universal conclusion is analyzed, it is found that, regardless of what kind of quantity loss occurs, whether decentralized or centralized decision making is selected, or whether the supermarket’s or agricultural cooperative’s discount ratio is considered, the fixed term discount relies on the market share in the traditional channel; the potential market size; the retail price; the price sensitive coefficient of the channel; and the cross-elasticity coefficient of prices between channels. The drift term discount relies on the initial quantity of fresh agricultural produce in the supply chain; the retail price; the price-sensitive coefficient of the channel cross-elasticity coefficient of price between different channels, and property of quantity loss.

Another problem cannot be discussed: In the mapping between profit π and discount time n, it can be concluded from the demand Equations (46) and (47), and the profit Equations (60) and (65), that there is a positive correlation between π and n, such that the profit π is positively correlated with the discount time n. This is because long discount times decrease the difference between demand and supply, which in turn decreases the cost of disposing of a superfluous supply of fresh agricultural produce. Unfortunately, the discount cost cannot be analyzed using the demand Equations (46) and (47), or the profit Equations (60) and (65), which makes the positive correlation between n and π unacceptable. Each discount can produce some degree of cost or loss, and this should be added to the profit equations. The mapping between profit π and discount time n is therefore very complex, and probably a non-negative correlation. Further, if the discount times is too large, consumers could play a larger role in setting prices in the supply chain, and each further discount would increase the difficulty of management of the supply chain, thereby decreasing the profits of the supermarket and/or agricultural cooperative. For this reason, moderate discount times should be considered.

The dynamic discount ratio and at discount stage i are given as discussed, which raises another, more interesting, question: How long should discount stages be to yield maximum profit, supply chain coordination and market clearing? To ascertain this, the profits of the agricultural cooperative, supermarket and supply chain should be considered, and the relationship between profit π and discount time n should be analyzed. Discount time is therefore an important parameter in the discount coordination strategy, and it will be studied in the next paper.