Abstract

Despite its short-term use, non-financial reporting is an important measure, as demonstrated by numerous theoretical studies and empirical research. However, the mandatory nature of non-financial reporting and public pressure have persuaded company management to address non-financial issues alongside financial ones. Companies from countries with a more prolonged culture and tradition have been more successful in this respect than the companies from “younger” transition countries. Overall, non-financial reporting has raised the level of social responsibility in companies. However, things are far from ideal. Many uncertain situations, e.g., environmental, health, energy, etc., bring new challenges. They require not only non-financial, but also sustainable solutions. Therefore, it is unsurprising that the disclosure of non-financial information has also been renamed sustainability reporting (regarding designation in legal acts). In the presented research, we analyze how Slovenian companies comply with the current legislation (NFRD) requirements and whether their non-financial reports are qualitatively and quantitatively adequate. We are interested in what changes the new legislative proposal (CSRD) requires from them. Are the efforts of the legislator going in the right direction? Will companies be better prepared for environmental and social risks, and therefore better manage for sustainability once the CSRD is in place? The results suggest that the qualitative part of the non-financial reporting is the weakest. This gap in the quality of (required) non-financial reporting is also the subject of the presented research, which shows the (non)quality of the present non-financial reporting and therefore justifies the development of further requirements. Thus, CSRD introduces mandatory and uniform reporting standards based on double materiality, unification of the system of sanctions, external audit, etc. Therefore, our expectations that the new directive will contribute to more sustainability-oriented corporate governance are legitimate and justified. Since the CSRD harmonized sustainability reporting in the EU, this applies to Slovenia and all member states.

1. Introduction

Every crisis brings an opportunity to change alongside all the difficulties (for the better). The quality of never giving up enables humans to evolve and survive continuously. Recently, the crises we have witnessed are primarily caused by man’s unstoppable desire to “have more”, hence the saying that man is becoming his own worst enemy.

Individuals, civil society, international organizations, and, more recently, the authorities have warned of the untenability of such practices. They tell us that our livelihoods are limited and that we must act in a way that will enable future generations to live. We must strive for sustainable development.

Sustainable development of the economy and the whole society cannot be imagined without sustainable corporate governance. Given corporations’ important role globally, they must consider stakeholders’ interests for the present and future generations while providing business activities [1]. In other words, corporations must act socially responsibly.

In this paper, we pursue two objectives: First, to discover Slovenian companies’ perception of corporate social responsibility (CSR). To achieve this objective, we include a CSR demonstration in the theoretical framework to identify companies’ activities as socially responsible. Secondly, we want to analyze the compliance of the non-financial reports of Slovenian companies with the legal requirements to see how they are prepared for the new challenges posed by the legislation change. To this end, we will look more closely at the current (de lege lata) and proposed new legislation (de lege ferenda). To better understand the current legislation, this paper will illustrate the development of the first EU legislation to promote corporate social responsibility (CSR), Directive 2014//95/EU (Non-financial Reporting Directive, NFRD), in response to the economic crisis of 2008. The NFRD built on the Directive 2006/46/ES on the annual and consolidated accounts and required large public interest corporations to disclose information on their non-financial performance requested by investors, non-governmental organizations, and trade unions [2]. Transparency of so-called ‘non-financial information’ could help companies better manage non-financial risks and opportunities, and thus improve their non-financial performance [3].

The climate and health crises further highlighted the additional risks to corporations. The EU has designed new legislation to manage such uncertain circumstances better and address the shortcomings shown by applying the NFRD in practice. Several stakeholders have further boosted the idea of a new standardization of non-financial reporting. This aims at providing more extensive guidelines to the companies to improve comparability of the reported information [4].

This paper exposed the proposal for a new directive (Corporate Sustainability Reporting Directive, CSRD) [5] that upgrades non-financial sustainability reporting. Regarding environmental, social, and governance (ESG) criteria of sustainable reporting, we engaged with the governance and social matters since the environmental dimension is too extensive that it could be included in the research. We gave particular importance to the announced legislative changes. Could we realize legislative measures to achieve sustainable corporate governance goals and see workers as one of the most essential and valuable stakeholders? The health crisis caused by the COVID-19 epidemic has not yet ended; and a new problem has emerged because of the war in Ukraine, which cannot be ignored.

While presenting the theoretical basis of CSR and the development of non-financial reporting as a legal institution, we used historical and teleological methods of interpretation.

In the empirical part of the paper, we analyzed the application of the NFRD in the practice of selected Slovenian corporations as the case study. We compared the NFRDs and diversity policy reports of 11 Slovenian companies, all listed on the Slovene stock exchange. Based on the results, we evaluated the current practice of NFRD reporting in Slovenia and identified its strengths and weaknesses using a comparative method. We also examined the challenges the new CSRD will bring to Slovenian companies, particularly the role of management and supervisory bodies in sustainability matters. The case study results of Slovenian corporations will also interest researchers on this type of issue in the other EU member states. Since the legislation regarding non-financial reporting is harmonized, it should not cause too much divergence in practice.

Considering the lack of scientific and research literature on the quality of non-financial reporting of Slovene companies, we designed our study and the presented contribution by answering the central research questions: How do Slovenian companies comply with the current legislation (NFRD) requirements, and are their non-financial reports qualitatively and quantitatively adequate? Indeed, how do they consider CSR? Besides, we are interested in what changes the new legislative proposal (CSRD) requires from them. Are the efforts of the legislator going in the right direction? Will companies be better prepared for environmental and social risks, and therefore better manage for sustainability once the CSRD is in place?

The structure of our paper is as follows: an introduction followed by a presentation of the theoretical background. First, the relation between non-financial reporting and CSR is outlined.

Section 2 introduces the development of the EU legislation on non-financial reporting with a detailed description of the legal requirements of the current NFRD. A brief description of the implementation of the NFRD in Slovenian law follows in Section 3. Section 4 discusses the new unified sustainability reporting system established by the Commission’s proposal on CSRD, focusing on social and governance matters. In Section 5, we made a short conclusion of the theoretical basis to justify the need for the study. Secondly, we described the methodology we used in our research. Thirdly, in the empirical part of the paper, one can observe the research results, which show that the companies surveyed have not qualitatively approached non-financial reporting yet but are still striving for “ticking the box” and ad hoc reporting. The existing NFRD requirements for reporting have not been entirely fulfilled and understood. This also means that the new CSRD with prescribed standards on non-financial information, which will come into force in 2023 fully, is needed and, for the quality of the companies’ non-financial reporting, of great importance.

The contribution of this article is to provide the first detailed analysis of Slovenian companies’ practice in non-financial reporting and to argue, through research, the need for new rules in this area.

2. Theoretical Basis

2.1. Non-Financial Reporting and Corporate Social Responsibility

Non-financial reporting is the first legal step toward enforcing socially responsible corporate governance. Corporate social responsibility is a global trend that began in the 1950s. However, Carroll noted that it is beneficial to start with some activities and practices originating in the Industrial Revolution in the mid-to-late 1800s (corporate philanthropy) as a useful starting point [6]. Murphy classified this period of CSR as philanthropic, marked by a concern for employees and charity [7]. The first work on corporate responsibility for businessmen is Frank Abrams’ article, “Management’s Responsibilities in [a] Complex World”, in the Harvard Business Review in 1951. He tried to influence colleague managers’ speculation about their status in society and their community responsibility, not only in the context of individual responsibility to shareholders, but also in the broadest sense of their responsibility to the public in general [8] (p. 354). CSR was understood as the idea of being responsible to the whole society [9].

In the 1970s, several efforts to define corporate social responsibility, including notions, e.g., the legal responsibility of a corporation, a corporation’s charitable action, being ethical, and ensuring legitimacy [10], began to emerge. Carroll proposed a model of four different categories of CSR: economic, legal, ethical, and philanthropic responsibility [11]. In the 1980s, the discussion of corporate social responsibility (CSR) tried to define the moral status of corporations. The 1990s brought specialization into business ethics theories and attention to global business ethics issues.

The 20th century has become much more fragmented and pluralistic, albeit arguably more equitable; Maignan and Ferrell [12] suggest that social obligation has become too broad to promote effective CSR management [13] (p.10). Instead, societal CSR has been aligner more towards stakeholder obligation. The first four categories of stakeholders (according to Maignan and Ferrell [9]: (a) organizational (to include employees, customers, shareholders, suppliers, and creditors); (b) community (e.g., residents and interest groups); (c) regulatory bodies; and (d) media stakeholders. Buchholz has argued for another category, the natural environment [14]. Through a content analysis of the 37 definitions of CSR, Dahlsrud identified five dimensions of CSR: the environmental, the social, the economic, the stakeholder, and the voluntariness dimensions [15].

After the Enron scandal, CSR became an instrument to benefit a corporation and transformed from CSR to strategic social responsibility (SCR). The new perspective sees CSR as a (strategic) response to changing circumstances and new corporate challenges. Organizations must rethink their position and act in terms of the complex social context they are a part of and how to engage with the stakeholders. [16] (p. 97). Since the interest and growth of CSR in the 2000s have been significant in the European Union and the Organization for Economic Co-operation and Development (OECD), the CSR movement has become a global phenomenon [6] (p. 41). The initial concept of social responsibility in the sense of “being good and charitable” significantly outgrew these outlines at the end of the 20th century and established itself as an international standard of social responsibility (ISO standard 26000) [17].

The more recent organizational theories promote sustainable corporate social responsibility, which places undertakings into a broader social and environmental context, encompassing the environmental, social and governance (ESG) criteria, thereby shifting the expansion of responsibilities of undertakings to the most advanced level. These three criteria are the key drivers of non-financial/sustainable reporting. A study investigating the effect of environmental, social, and governance (ESG) activities and their disclosure on firm value has revealed that ESG strengths increase firm value and weaknesses decrease it [18]. Sustainable development, specifically environmental performance, is also significantly influenced by human capital, among other things (institutions, politics, government effectiveness etc.) [19].

As we will explain later, the future sustainability reporting standards are divided into three groups (Standard E as environmental, Standard S as social, and Standard G as governance) to achieve the most important goals in the sustainability issues of corporate governance [20]. Although someone could treat the terms ESG and CSR interchangeably [21], we understand CSR as a concept governing corporations to be understood as a part of society. At the same time, ESG metrics show corporations’ non-financial performance and risk management. Uncertain global situations once again evidenced that firms have to seriously consider not just practicing CSR within their strategy, but also measuring it through an ESG analysis. With better ESG performance, they will be able to promptly identify future legislative initiatives and shape opinion processes [22].

The EU understands CSR as a process in which companies must identify, prevent, manage, and mitigate all negative impacts they may cause to society (including the effects on human rights, health, the environment, global supply chains, etc.). Responsible business conduct (RBC) established itself as a synonym [23].

As we will see below, today’s non-financial reporting considers the interests of all stakeholder categories based on the early 2000s. The NFRD introduced a requirement for companies to report how sustainability issues affect their performance, position, and development (the ‘outside-in’ perspective) and their impact on people and the environment (the ‘inside-out’ perspective). This requirement is often known as ‘double materiality’ and is also maintained in the new directive on corporate sustainability reporting (CSRD) proposal [5].

2.2. Development of the EU Legislation on the Non-Financial Reporting

2.2.1. Directive 2003/51/EU

The first step towards non-financial reporting was the ‘Directive’s 2003/51/EU recommendation that companies analyze environmental and social aspects (preciously employee matters) of business performance to clarify ‘companies’ development, implementation, and position in addition to financial information in annual and consolidated reports. Considering the evolving nature of this area of financial reporting and the potential burden placed on undertakings below specific sizes, Member States could choose to waive the obligation to provide non-financial information in the case of the annual report of such undertakings [24].

2.2.2. Directive 2006/46/ES

Another precursor to non-financial reporting, we can identify the requirements introduced by the EU through Directive 2006/46/ES on the annual and consolidated accounts. The Directive enacted measures to restore the confidence of the capital market and the public in annual accounts and reports of companies following severe economic shocks and scandals (Tico, Enron, Parmalat). Enhanced and consistent specific disclosures and publication of information about the performance should contribute to improved transparency of financial management of companies. Moreover, this directive sets out the liability of management bodies for drawing up and adopting annual reports, including their obligation to approve them with their signature. One of the essential requirements of the Directive was the corporate governance statement.

A corporate governance statement outlines the information on corporate governance in a company. These data are essential for stakeholders dealing with a company (suppliers, creditors, employees, government, banks, and investors), allowing them to find out how the company is managed even before cooperating. The key role of the corporate governance statement is to provide a transparent, efficient, and precise governance system inspiring the confidence of investors, employees, and the public in the corporate governance system. In this context, it is essential to recognize that the success of corporations is no longer measured solely based on their financial results, but also their responsibility toward society [25].

2.2.3. NFRD

Obligation on Non-Financial Information Disclosure

The NFRD introduced the non-financial reporting obligation for certain large undertakings and groups. The main objective of this Directive was to improve social responsibility. To this end, companies should also consider social and environmental issues in managing their business operations and adapting their strategy. The transparency of the so-called “non-financial information” may help the companies better manage their non-financial risks and opportunities, thus allowing them to improve their non-financial performance and providing an essential source of information for potential investors as well as for civil society when assessing the effects and risks related to the company’s performance [25].

According to the directive, non-financial reporting consists of two parts. The first one, the so-called “diversity policy”, was included within the corporate governance statement (established in 2006 with the Accounting Directive) [26]. At the same time, the other part contains the obligation for large public-interest entities to disclose non-financial information in the so-called non-financial statement. Both statements are parts of the company’s annual report, although the non-financial statement could be published separately as a single document.

Diversity Policy

The diversity policy refers to the representation of the company’s management or supervisory bodies in terms of gender, age, or education and includes an indication of the objectives, the manner of implementation, and the results achieved by the diversity policy during the reporting period.

The focus of different studies on diversity policy belongs to gender diversity.

Numerous political pressures and heated debates in the EU (despite a failed attempt to enforce the Women’s Quotas Directive ([27])) have led some countries to legislate on women’s quotas, following the example of Norway, which was the first country to adopt a law in 2003 on a 40% lower limit for representation of each gender on the boards of listed companies with more than 500 employees. Norway was followed by Spain, Sweden, France, and Italy, either in recommendations or statutory regulation [28].

According to the European Institute for Gender Diversity, women’s participation in the management and supervisory bodies of the largest publicly listed companies varies considerably across EU countries [29]. In 2020 the average percentage of women’s participation reached 29.5%. The highest was in France (45.1%), then followed by Belgium, Italy and Sweeden with approximately 38%. The results are not surprising as they result from the compulsory legal introduction of women’s quotas

In the EU and elsewhere in the world, there have been many studies and research on the impact of women in corporate governance structures. The main lines of enquiry are the impact of gender diversity on the governance body itself. The second line of enquiry focuses on the impact on the company’s external and internal stakeholders. Furthermore, women’s participation is examined from different perspectives, such as how the involvement of female directors affects the effectiveness of management, the independence of the management body, and the professionalism of decision-making.

Women have often been found to play an essential role in terms of exercising control over directors because they are more independent than their male counterparts, as they tend to come from outside and are not part of the permanent management team (“old ‘boys’ network”). Regarding resource dependency theory, women provide resources that men cannot, providing the authority with a ‘superior’ supply of resources [30]. From an information flow perspective, mixed bodies make better decisions because they consider different points of view, generate more ideas, and improve creativity, innovation, and adaptability, leading to better decisions. On the contrary, from a sociological point of view, mixed boards are more conflictual, have more communication problems, become more fictionalized, and are slower to make decisions. The latter can be complicated in cases requiring rapid decision-making.

The benefits of women’s participation in management and supervisory bodies include their high (university) education, the increasing number of women with successful careers in the private sector, and the loss of female talent in management and supervisory bodies.

The case against mandatory quotas for women is mainly based on the limitation of society’s autonomy in the composition of its organs by external authoritarian powers. When companies seek to improve governance, this type of rigid restriction can have the opposite effect and hurt the effectiveness of governance. The key question is whether selection processes are based on initial failures, incomplete information, or discriminatory preferences of new board members. Suppose the existing management set (old boys) wants to maintain positions of power or has only incomplete and outdated information on female candidates. In that case, mandatory quotas force a higher quality selection process [31].

Individual studies have also addressed women’s participation in strengthening corporate social responsibility, quickly becoming a subject of policy debate [32] or global discussion [28]. Most authors studying gender diversity have found apparent differences in values and thinking between men and women. Traits, such as assertiveness, aggressiveness, independence, self-confidence, and competitiveness, are generally present in men, while a sense of caring, shared interests, helpfulness, resignation, and receptivity predominate in women [33]. Women tend to occupy positions in softer management areas, such as human resources management, corporate social responsibility, and marketing [34].

However, the widespread political aspirations for a fair, balanced, and sustainable development of the global economy, which can be achieved through socially responsible governance, convincingly demonstrate that the political capital of women’s quotas cannot be doubted.

Non-Financial Statement

To enhance the consistency and comparability of non-financial information disclosed throughout the Union, a non-financial statement should contain at least environmental matters, social and employee-related issues, respect for human rights, anti-corruption, and bribery. Such a statement should include a description of the policies, outcomes, and risks related to those matters and should be contained in the management report of the undertaking concerned. The non-financial statement should also include information on the due diligence processes implemented by the undertaking, also regarding, where relevant and proportionate, its supply and subcontracting chains to identify, prevent, and mitigate existing and potential adverse impacts (NFRD; Section 1).

As regards social and employee-related matters, the information provided in the statement may concern the actions taken to ensure gender equality, implementation of fundamental conventions of the International Labour Organisation, working conditions, social dialogue, respect for the right of workers to be informed and consulted, respect for trade union rights, health and safety at work and the dialogue with local communities, and the actions taken to ensure the protection and the development of those communities. The Commission’s guidelines recommend disclosing information according to workers who participate in activities with a high risk of specific accidents or diseases; the number of occupational accidents, types of injury or occupational diseases; employee turnover, the ratio of employees working under temporary contracts, by gender; average hours of training per year per employee, by gender; employee consultation processes; the number of occupational accidents, types of injury or occupational diseases; employee turnover; the number of persons with disabilities employed [35].

The information listed above relates to the previous financial year. If the company does not apply any of the above policies, it shall provide a clear and reasoned explanation in the Statement of non-financial performance. The disclosure of non-financial information relies on the “comply or explain” principle, first introduced in the Cadbury Code [36]. Although the set of non-financial information is legally prescribed, using this “soft” approach allows companies a high level of discretion when deciding which information to disclose.

The NFRD has also determined the duty of management bodies concerning preparing and adopting annual reports, including the obligation to confirm them using their signatures. In contrast, the member states did not regulate the responsibility to prepare and publish financial and consolidated financial statements and annual reports.

Cosma et al. found that greater board member involvement in the non-financial reporting process is associated with a more substantial commitment toward sustainable development [37]. Specifically, participation in materiality assessment is positively associated with more proactive behaviors toward sustainability. Besides, the presence of women directors on the boards enhances ESG disclosure [38].

2.3. Implementation of the NFRD in Slovenia

Slovenia implemented the requirements of the NFRD through the Act Amending the Companies Act (ZGD-1J) in 2017. The Companies Act (ZGD-1) stipulates that only large companies that are public-interest entities and whose average number of employees exceeds 500 on the balance sheet cut-off date shall prepare a statement on non-financial performance (the first paragraph of Article 70c of the ZGD-1). Entities liable to organize information on non-financial operations include companies that are required to prepare a consolidated annual report and whose average number of employees exceeds 500 at the consolidated level (the twelfth paragraph of Article 56 of the ZGD-1). NFRD stipulates that small and medium-sized companies are exempt from this obligation, and the ZGD-1 follows the same line.

The statement on non-financial performance contains the information necessary to understand a company’s development, implementation, and position, as well as the effect of its activities. To meet these criteria, the statement must include at least information on environmental, social, and employee matters, respect for human rights, and anti-corruption and bribery matters. In addition to the above, the statement must also include a brief description of the business model, a description of the company’s policies regarding the issues mentioned above, including the performance of due diligence procedures, the results of those policies, the main risks regarding the points above in connection with the activities of the company, including its business relations, products, or services where appropriate and proportionate, when these risks could cause severe damage in these areas, and how the company manages these risks, as well as key non-financial performance indicators which are essential for specific activities (the first paragraph of Article 70c of the ZGD-1). This information relates to the past period of operation.

The statement is part of the management report, i.e., the annual report, whose drawing up and publication is the collective duty of the management and supervisory bodies as arises from the first paragraph of Article 60a of the ZGD-1. However, their responsibility is defined by the general provision under Article 263 of the ZGD-1, which defines the diligence, obligations, and liability of the management and supervisory bodies, as well as the responsibility for the drawing up and publication of the annual report with all its parts, including the statement of non-financial performance (the latter was additionally included under Article 60a as a result of implementing the NFRD). The specific emphasis on the statement in the text of the cited article and the further obligation imposed on the members of the management that the “annual report and its components shall be signed by all members of the company’s management” from the second paragraph of Article 60a of the ZGD-1 indicate the importance of the statement and that of the information contained in them.

If we compare the provisions of the ZGD-1 and the NFRD, we can conclude that Slovenia has implemented the latter in an exemplary manner. However, similarly to other transition countries (Czech Republic, Hungary, Estonia), non-financial reporting in Slovenia has sometimes been perceived as a communication activity rather than a strategic document that reflects a company’s approach to sustainable development (European Commission, 2020). We agree that the culture of non-financial reporting in Slovenia is not well developed, and only a small number of companies (around 50) are included in the scope of the NFRD [39]. This is one of the reasons why, in addition to the already mentioned challenges posed by the CSRD, a study of the current practice of non-financial reporting by Slovenian companies is essential.

2.4. Commission’s Proposal on New Legislation

Since its harmonization efforts do not cover integrated reporting and third-party assurance, the NFRD falls short in facilitating comparability, reliability, and thus reporting utility. The main weaknesses of the directive can be divided into two categories: (i) lack of harmonization regarding integrated reporting and assurance and (ii) an excess of possibilities for companies to deviate from reporting requirements [40].To prevent non-financial reporting from becoming a self-serving exercise, two elements are crucial: i) the assessment of materiality needs to follow a robust process, in which the methodology to define which non-financial information is material becomes critical; and ii) the disclosure of non-financial information should be perceived as beneficial by companies [41].

In addition, there is a growing demand for more comprehensive and more contextual information. Investors need to know what risks they can expect, in particular, because of the requirements of the new legislation, including the Regulation (EU) 2019/2088 (Sustainable Finance Disclosure Regulation) and the Regulation (EU) 2020/852 (Taxonomy Regulation).

The commission proposed a new legislative act, the Directive on Corporate sustainability reporting (CSRD), to safeguard these interests. The CSRD is changing the NFRD and the Accounting Directive 2013/34/EU and Directives 2004/109/EC and 2006/43/EC. The CSRD extends the scope to all large companies and companies listed on regulated markets (except listed micro-enterprises) established within the EU or outside the EU but with subsidiaries listed on an EU-regulated market. Since NFRD did not specify any standards on how information should be disclosed, the companies used different frameworks like GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board), IIRC (International Integrated Reporting Council), etc. The CSRD will stop this non-transparent and inconsistent practice by determining a uniform standard for information disclosure. Besides, the information must be announced in the annual report, in the same place as the financial information. The sustainability information should be cheque by external auditing. The commission shall adopt delegated acts to provide for sustainability reporting standards. Those sustainability reporting standards shall specify the information that undertakings are to report and determine the structure in which that information shall be notified. European Financial Reporting Advisory Group (EFRAG) is the technical advisor to the commission in developing the draft EU Sustainability Reporting Standards (ESRS).

The information that companies will have to disclose in the social policy context includes information about:

- (i)

- Equal opportunities for all, including gender equality and equal pay for similar work, training and skills development, and employment and inclusion of people with disabilities.

- (ii)

- Working conditions, including secure and adaptable employment, wages, social dialogue, collective bargaining and the involvement of workers, work–life balance, and a healthy, safe, and well-adapted work environment.

- (iii)

- Respect for the human rights, fundamental freedoms, democratic principles, and standards established in the International Bill of Human Rights and other core UN human rights conventions, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, and the ILO fundamental conventions and the Charter of Fundamental Rights of the European Union (19b/2/b article of the CSRD).

EFRAG has already drafted four standards in the context of social policy: S1 (Own workforce), S2 (Workers in the value chain), S3 (Affected communities), and S4 (Consumers and end-users).

Although the set of the information under the CSRD is far more widespread than the recommended information in the commission’s guidelines, the critical difference is that companies will now be required to disclose the above information, which was previously considered only as a recommendation. Companies have decided to reveal information on a comply or explain basis but will now be required to disclose unconditionally.

Regarding governance matters, the CSRD proposal stipulates that, in addition to the information already required, companies should be directed to disclose information about their business strategy and the resilience of their business model and approach to risks related to sustainability matters; any plans they may have to ensure that their business model and system are compatible with the transition to a sustainable and climate-neutral economy; any opportunities for the undertaking arising from sustainability matters; the role of the management and supervisory bodies concerning sustainability matters, etc. (for details, see the new Article 19. an entitled Sustainability Reporting).

Further, the commission’s binding sustainability reporting standards about governance factors shall include information about the following:

- The role of the undertaking’s administrative, management and supervisory bodies, including sustainability matters and their composition;

- Business ethics and corporate culture, including anti-corruption and anti-bribery;

- Political engagements of the undertaking, including its lobbying activities;

- The management and quality of relationships with business partners, including payment practices;

- The undertaking’s internal control and risk management systems, including the undertaking’s reporting process (the second paragraph of the new Article 19b of the CSRD proposal).

Compared to the requirements of the NFRD and the recommendations of the commission’s guidelines, the set of mandatory information in corporate matters has increased significantly. The current legislation in this area only required disclosure of the management of corruption and bribery risks, and similarly, the commission guidelines. On the contrary, the CSRD proposal makes significant inroads into other areas, as seen from the reporting standard about governance factors presented above. The stakeholders, i.e., investors etc., need information about governance factors (the role of companies’ administrative, management and supervisory bodies, including regarding sustainability matters and the composition of such bodies), corporate culture, business ethics (anti-corruption, anti-bribery, the political engagements, lobbying activities), and the quality of relationships with business partners (payment practices etc.) [5]. EFRAG has developed two standards regarding governance matters: G1 (Governance, risk management and internal control) and G2 (Business conduct).

The CSRD proposal introduces a unified sustainability reporting system, which consequently requires the unification of the sanctions system. That is why the minimum types of sanctions are now specified, which member states should provide for in the case of infringements of the national provisions transposing the sustainability reporting requirements of the accounting directive: a public statement indicating the natural person or the legal entity responsible and the nature of the infringement; an order requiring the natural person or the legal entity liable to cease the conduct constituting the infringement and to desist from any repetition of that conduct, and administrative monetary sanctions. Member states shall ensure that, when determining the type and level of penalties or measures, all relevant circumstances are considered, such as the gravity and duration of the breach, the degree of responsibility of the natural person or legal entity responsible, etc. (for details, see the third paragraph of the new Article 51 of the CSRD proposal).

Last but not least, in CSRD, the term “non-financial” (information, statement) changes to the term “sustainability”. Besides the opinion of many stakeholders who consider the term ‘non-financial’ inaccurate because it implies that the information in question has no financial relevance, which is not true [5], there is another reason. After the CSRD comes into force, companies will have to report qualitative and quantitative information, forward-looking and retrospective information, and information that covers short-, medium-, and long-term time horizons as appropriate (the second and the third paragraph of the new Article 19 as of the CSRD proposal), which demonstrates a change, e.g., disclosed information.

2.5. Conclusion of the Theoretical Basis

As demonstrated, CSR has evolved over the decades with economic and social conditions affecting the values entailed. In the context of sustainable development, CSR refers to the orientation and attitude of a company to voluntarily integrate social and environmental concerns into its strategy and, at the same time, ensure the company’s economic success [42]. We argue that non-financial reporting is one of the essential promoters of CSR. By publishing non-financial information, companies better manage their business risks and are thus more financially successful. Quality corporate governance positively impacts sustainable development [43], to which the EU’s legislative framework also contributes. As we have already highlighted, the fundamental act (NFRD) that has ‘committed’ companies to CSR is generously changing with CSRD with the requirements for companies and members of boards as outlined above.

We continue analyzing Slovenian companies’ non-financial reporting to achieve the research objectives outlined in Section 1.

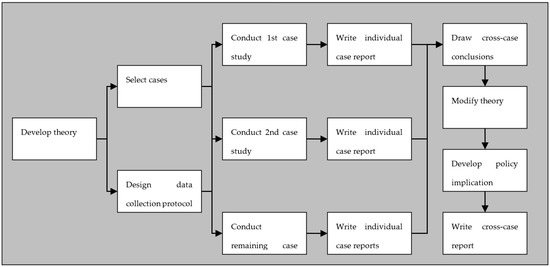

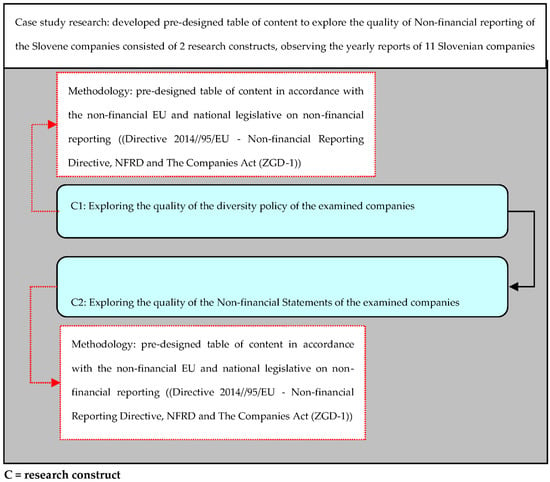

3. Research Methodology and Research Sample Used

For our research on non-financial reporting of Slovenian companies, we chose a multiple case study research methodology (as shown in Figure 1 and Figure 2). Bell [44] defines this methodology as an umbrella with typical characteristics of focusing research attention on specific examples or phenomena. Case study research is characterized by Yin [45] as empirical research regarding contemporary phenomena in the natural environment. The primary purpose of such a methodology is to obtain an idea of the real and reciprocal functioning of variables or events. As such, the case study research method enables the researcher to focus on certain specific phenomena in a quest to define the reciprocal processes that are fundamental in meaning for other research methods such as surveys, interviews, focus groups, experiments, analyses of archive data, etc. In our research, we examined the selected companies’ yearly reports. The observation was made on the predesigned table of content following the non-financial EU and national legislation on non-financial reporting (as shown in Table 1 below). The above-stated examination was carried out among 11 Slovenian companies listed on the Slovene Stock Exchange.

Figure 1.

Practical multiple case study design.

Figure 2.

Research framework: Methodologies and research constructs used in the empirical research.

Table 1.

Predesigned table of content to explore the quality of diversity policy reporting of the examined companies considering the Directive 2014//95/EU (Non-financial Reporting Directive, NFRD) and Slovene Companies Act (ZGD-1).

The primary data source for our study involved a predesigned methodology, which was applied during the examination of the annual reports of the 11 companies, all listed on the Slovenian stock exchange, where the stock listings are ordered in 6 groups: First listing (9 companies listed in total), standard listing (15 companies listed in whole), bonds (28 different bonds listed), treasury bills (11 different treasury bills listed), 2 various commercial records, and 7 other ETFs listed. As stated above, our research sample involved 11 Slovenian companies listed on the Slovene Stock Exchange out of (only) 24 companies listed on the Slovene Stock Exchange in total at the time of our research. Industries covered by our research sample were banking, insurance, oil, fuel distribution, telecommunication, logistics and postal industry, metallurgy, pharmaceutical, and retail industries. For our research on the quality of companies’ non-financial reporting, we examined 9 companies listed on the Slovene stock exchange as the first listing and 2 companies listed in a part of the standard listing. The main reason for the above-stated selection was our intention to observe the quality of non-financial reporting of all listed companies on the Slovene stock exchange, which will be achieved as the purpose of our ongoing research. The presented multiple case study research took place in March 2022, observing the annual reports of the examined 11 companies (as stated above) for 2020 in Slovenia. Unfortunately, at the time of carrying out the presented research, the annual reports for 2021 were not available yet.

In order to achieve our case study research goals, we designed the following research questions as stated below:

RQ1: Is the non-financial reporting of the Slovene companies in compliance with NFRD requirements?

RQ2: Are non-financial reports of the Slovene companies quantitatively as well as qualitatively adequate?

RQ3: Are the conceptual changes contained in CSRD as an addition to NFRD requirements necessary and justifiable (and therefore: Are the efforts of the legislator going in the right direction)?

In the first part of the presented research, we examined the quality of the diversity policy, following the legal frame and legal obligations of diversity policy reporting. After the diversity policy examination, all companies were discussed in the context of the non-financial statement. Again, our study followed a company’s non-financial statement’s legal reporting requirements.

As shown in Figure 2, our research framework consists of 2 research constructs: C1, exploring the quality of the diversity policy of the examined companies, and C2, exploring the quality of the non-financial statements of the examined companies. In the first research construct (as stated in Figure 2), we examined the quality of diversity policy reporting of 11 Slovene companies. The observation was made on the predesigned table of content under the Directive 2014//95/EU (Non-financial Reporting Directive, NFRD) and Slovene Companies Act (ZGD-1), as shown in Table 1.

In the second research construct of the presented research (as stated in Figure 2), we aimed to observe the quality of the non-financial statements of the 11 examined Slovene companies. The observation was made on the predesigned table of content under the Directive 2014//95/EU (Non-financial Reporting Directive, NFRD) and Slovene Companies Act (ZGD-1), as shown in Table 2.

Table 2.

Predesigned table of content to explore the quality of Non-financial Statements of the observed companies considering the Directive 2014//95/EU (Non-financial Reporting Directive, NFRD) and Slovene Companies Act (ZGD-1).

4. Research Results

In our multiple case study research, 11 companies were examined. The primary data source for our study involved a predesigned methodology, which was applied during the examination of the annual reports of the 11 companies, all listed on the Slovenian Stock Exchange. The presented case study took place in March 2022, observing the annual reports of the examined companies for 2020 in Slovenia.

For the purpose of answering to our research questions (RQ1: Is the non-financial reporting of the Slovene companies in compliance with NFRD requirements?; RQ2: Are non-financial reports of the Slovene companies quantitatively as well as qualitatively adequate?) in the first part of the presented research, we examined the diversity policy (research construct 1—C1 as showed in Figure 2), following the legal frame and legal obligations of diversity policy reporting. After the diversity policy examination, all companies were researched in the context of the non-financial statement. Again, our study followed a company’s non-financial statement’s legal reporting requirements. In Table A1 of the Appendix A, the research results (the content of examined companies’ reporting) on the diversity policy of the analyzed companies are presented.

Observing Table A1 of the Appendix A, we can state that all 11 observed companies dispose of the clearly defined diversity policy, where nine companies ensure such diversity in their management and supervisory bodies based upon gender and age, and all 11 companies provide diversity in their management supervisory bodies also upon the educational matter. However, the research showed that the two companies do not apply such diversity in their management and supervisory bodies upon gender or age.

Examining the consistency of the observed diversity policies with the required information (by the legislative), our research showed that out of 11 discussed companies, only five diversity policies of reviewed companies were consistent with the legislative requirements, whereas five diversity policies were partially consistent, and one policy inconsistent with the legislative conditions, where all 11 diversity policies as they were developed were also implemented in the observed companies.

In the presented research, the qualitative part of the reporting was also in focus. Research results show that nine out of 11 observed companies explain how they implement the diversity policy in detail. Further, we can observe that six companies observed reported on the results of the implemented diversity policy. However, only three companies focused strictly on reporting the results of the implemented diversity policy. Therefore, we can argue that the quality of the companies’ explanations and their awareness of the implemented diversity policy results are fragile.

Furthermore, in answering the above set research questions in Table A2 of the Appendix A, the research results on the non-financial Statement of the observed companies are presented (defined as research construct 2—C2 as showed in Figure 2). Observing Table A2 of the Appendix A, we can state that 10 included companies dispose of the non-financial statement, whereas one company does not follow the legislative requirements.

Observing the consistency of the examined non-financial statements with the required information (by the legislative), our research showed that out of 11 reviewed companies, nine non-financial reports of the investigated companies were consistent with the legislative requirements, where one non-financial statement was partially consistent and one non-financial statement inconsistent with the legislative requirements. Furthermore, our research showed that all 11 observed non-financial reports disclosed information on environmental, social, and human resource matters, where disclosure of information on respect for human rights only in 10 and disclosure of information on anti-corruption and anti-bribery issues only in nine observed non-financial statements is present.

Besides, eight observed non-financial statements include a brief description of the existing business model. All 11 observed non-financial statements include a description of the company’s environmental, social, human resources policies, etc. Furthermore, only one non-financial report does not include the description of implementing the company’s due diligence procedures concerning the above policies.

The results in Table 2 show that all 11 of the observed non-financial statements also include the effects of the abovementioned policies. Only nine statements define principal risks concerning those matters associated with the company’s activities. Furthermore, only seven non-financial statements include information on the company’s business relationships, products or services that could cause serious adverse effects in mentioned areas, and 10 observed statements include how the company manages such risks.

Furthermore, the research showed that nine of the observed non-financial statements also include key non-financial performance indicators relevant to specific companies’ activities, whereas six of the observed non-financial statements do not provide a clear and reasoned explanation when not applying the policies mentioned above. We can observe that only three observed non-financial statements refer to the accounting part of the company’s annual report.

Our research showed some discrepancies in the qualitative assessment of the non-financial statement. Considering the above, the presented research results showed that one company did not disclose information on respect for human rights, and two did not disclose information on anti-corruption and anti-bribery matters. However, in the part of the non-financial statement where these companies should explain the reason for lacking the description of policies on environmental, social, human resource matters, respect for human rights, and anti-corruption and bribery matters, they did not include such description or explanation. On the other side, the carried-out research showed that one company observed, reported, and described in a very detailed and narrow way its additional policies concerning non-financial reporting.

Therefore, we can argue that the quality of the companies’ explanation and the awareness of the importance of the policies’ missing description are fragile in part of the non-financial statement.

5. Conclusions and Further Discussion

The importance of corporate social responsibility, corporate transparency and integrity, business ethics, and credibility is of essential meaning for ensuring companies long term existence and success. It is also important for the well-being of society and the world, which is argued in this paper by showing the development of the EU as well as Slovenian legislation on the subject. The presented paper aimed to reveal and discuss the consequences of the newly adapted and implemented legislation on non-financial reporting of the Slovene companies. Therefore, the case study research was designed, and research questions developed as sated bellow:

RQ1: Is the non-financial reporting of the Slovene companies in compliance with NFRD requirements?

RQ2: Are non-financial reports of the Slovene companies quantitatively as well as qualitatively adequate?

RQ3: Are the conceptual changes contained in CSRD as an addition to NFRD requirements necessary and justifiable (and therefore: Are the efforts of the legislator going in the right direction?)?

In order to make some conclusions to the first research question (RQ1) we can argue that the state of examined companies in a frame of non-financial reporting is good in general. Especially, if we consider the important fact that the legislation, which makes the non-financial reporting obligatory, is new and very important step toward sustainable corporate governance as well as socially responsible corporates’ behavior. However, the research showed some deficiencies in the companies’ non-financial reporting, which, in an aim to achieve the higher level of corporate social responsibility, corporate transparency and integrity, must be improved. The presented case study research (especially in its aim to answer research questions 1 and 2) showed that in the context of diversity policy, we can observe some deficiencies in companies’ desire and preparedness to implement gender and age diversity. However, the research cognitions importantly showed that companies that do not ensure age and gender diversity do not explain the main reasons for such a condition, which clearly shows the lack of qualitative (conceptual) corporate reporting. Further, this also means that the reader of a company’s non-financial report cannot obtain the information concerning why the company does not comply with the above stated requirements on diversity policy, which is one of the important purposes of required non-financial reporting. As a result of neglecting the direction of explaining the nature of non-compliance with the legislation, such companies do not respect the important and mandatory principle “comply or explain” and therefore such reporting further results in a partially consistent or inconsistent diversity policies. We can argue that such reporting, therefore strongly confirms the companies’ principle of partly complying with the legislative requirements.

The presented research showed a similar condition in a frame of the non-financial statement of the examined companies set as second research construct (C2) of the presented research. The non-financial statement is mainly present and reported by all examined companies. However, the lack of substantive reporting to explain the reasons for the non-presence of a specific policy is worrying. Again, to apply the research cognitions to our research question (RQ2—Are non-financial reports of the Slovene companies quantitatively as well as qualitatively adequate?), we can argue the lack of qualitative and explained/revealed information on respect for human rights and anti-corruption and anti-bribery matters. Surprisingly, our study showed that some of the examined enterprises do not explain their risk policies and mainly the examined companies did not refer to their non-financial statements in the accounting part of their annual reports, which diminishes the transparency of the companies’ non-financial projects and activities, which again is one of the important aims of the non-financial reporting.

Therefore, in the context of the objectives of this paper (to discover Slovenian companies’ perception of CSR), and in conjunction with the stated research questions and presented research results, we can observe that the compliance and the quality of explanation of the examined companies in a frame of non-financial reporting show that the quality and usefulness of such reporting is lower due to the lack of substantive reporting as expected to be. It does not deliver holistic information of certain company’s non-financial functioning to all stakeholders in order to assess the real quality of the corporate governance in a particular company.

Referring to their various “non-financial” projects in their reports (as reported in Appendix A), our observations also showed that observed companies give some consideration to corporate social responsibility. However, debating the RQ3 (Are the conceptual changes contained in CSRD as an addition to NFRD requirements necessary and justifiable?), and considering the research cognitions, we must emphasize that companies have not qualitatively enough approached non-financial reporting yet but are still striving for “ticking the box” and ad hoc reporting. Consequently, this makes the new CSRD with prescribed standards on non-financial information necessary and even justified for European and Slovenian companies. Besides disclosing more valuable and more qualitative non-financial information for stakeholders, the CSRD will force the companies to disclose data to more and more challenging requirements established with other legal acts, e.g., Sustainable Finance Disclosure Regulation and Taxonomy Regulation. Such required reporting will result in the fact that companies will entirely comply with the legislation and explain in detail their functioning on specific “non-financial” policy.

Taking into account the ESG metrics, which are fundamental for the implementation of sustainable and responsible governance (as argued in Section 2.1. Non-financial reporting and corporate social responsibility) [18], the study showed a particular weakness in the disclosure of corporate governance information in Slovenian companies. Given that the new legislation will establish mandatory standards [20], which will require exactly what information must be explained by the companies, it is therefore reasonable to expect that companies will address all weaknesses of non-financial reporting based on NFRD and the weaknesses that also our research showed. As such, the CSRD will require from companies to report a broader range of information in the form of mandatory reporting standards that can be compared and assessed among each other and, importantly, a professional auditor will audit such new reports.

Our contribution as well as the presented research results are therefore useful as they detail the general shortcomings of the NFRD [40,41], which were highlighted and discussed in Section 2.4, the commission’s proposal on new legislation, taking into account the foundations of the substantive criteria for ESG reporting, which were already established in the 1980s, and then taken up by modern theories of CSR as their own [10,11]. It is true that the NFRD reporting is also based on the same criteria. However, as a serious weakness, it has not established a precise set of data (standardized or not to a sufficient extent), which would be uniform, binding, and in digital form [5,41], which would also ensure the inter-comparability of data and, consequently, the competitiveness of companies. This is precisely what is confirmed by the presented multiple case study (under the section Research results and Appendix A)), which demonstrates the lack of qualitative explanation and interpretation in the following areas: the bribery and anti-corruption, description of the existing business model, a description of implementing the company’s due diligence procedures, description of the results of the required policies, the principal risks about the matters associated with the company’s activities, the company’s business relationships, products or services that could cause serious adverse effects in those areas, and managing the included risks, the key non-financial performance indicators relevant to individual required activities, not providing a clear and reasoned explanation in the Company’s Statement of Non-Financial Performance, and referring to the accounting part of the annual report in its Statement on the Non-Financial Performance of Companies.

In order to conclude, on the basis of the above presented research cognitions we can argue that Slovenian companies do not consistently apply non-financial reporting in line with the requirements of the NFRD. As non-financial reporting requires disclosure of information on a company’s environmental, social and governance policies, the non-financial report can be used to determine whether a company is being run according to the principles of socially responsible management and corporate governance. A review of the non-financial reports suggests that corporate social responsibility is not sufficiently embedded in Slovenian corporations. Therefore, the adoption of new legislation (CSRD) is necessary. All changes made in non-financial reporting made by CSRD will also require companies’ directors to change their thinking in more responsible way of managing the companies, however the changes will also be made in corporate governance of those companies. These new CSRD legal obligations need further discussion on the Slovenian companies’ strategic treatment of their non-financial operations. Consequently, this will cause planning, organizing, managing, and controlling the “non-financial” activities and projects on the path to a socially responsible and sustainable company. We can understand this as another important step toward higher sustainable corporative governance and management of Slovenian and European companies. Nevertheless, considering all the above, it will be important research focus of the professionals in corporate governance transparency, social responsibility business ethics and credibility to examine the quality of non-financial reporting of the companies at the time of CSRD implementation with new and more demanding requirements, which in our research confirmed to be needed and justified.

Author Contributions

Conceptualization, A.P. and J.B.; methodology, A.P. and J.B.; resources, A.P. and J.B.; writing—original draft preparation, A.P. and J.B.; formal analysis, A.P. and J.B.; writing—review and editing, A.P. and J.B.; visualization, A.P. and J.B. All authors have read and agreed to the published version of the manuscript.

Funding

The research was funded by the Slovenian Research Agency (research core funding No. P5-0023 (A), Entrepreneurship for Innovative Society).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Diversity policy.

Table A1.

Diversity policy.

| 1. Does the company have a defined diversity policy? |

|---|

| YES: 11 NO: |

| 2. Does the company ensure diversity in its management and supervisory bodies: |

- Sex YES: 9 NO: 2 - Age YES: 9 NO: 2 - Education YES: 11 NO: |

| 3. In what way does the observed company implement a diversity policy? - Company 1: The annual report did not specify how diversity is implemented. However, considering the annual report, the diversity policy is implemented. - Company 2:/ - Company 3: The Diversity Policy is implemented through: Recruitment, selection of candidates and consent for members of the management bodies; In accordance with EU Regulation No. 575/2013 (CRR) and the provisions of the Banking Act; The Bank publicly discloses and, at least annually, reviews and updates information on the diversity policy for the selection of members of the management body; The Diversity Policy for the Management Body and Senior Management sets out the framework for diversity and gender representation in the management and supervisory bodies; The Diversity Policy for the Management Body and Senior Management sets out the framework for diversity and gender representation in the management and supervisory bodies; The management body is composed in such a way that it as a whole has the appropriate knowledge, skills and experience needed to have a thorough understanding of the bank’s strategy and challenges and the risks to which it is exposed; Recruitment, selection of candidates and proposal of candidates to the founder/community as members of the supervisory bodies; Selection of candidates and selection of appropriate members; Self-evaluation of the work of the Supervisory Board and its committees. - Company 4: The company’s corporate governance statement includes a commitment to non-discrimination, which states that Krka provides equal opportunities to its employees regardless of gender, race, colour, age, medical condition or disability, religious, political or other beliefs, trade union membership, national or social origin, marital status, property, sexual orientation or other personal circumstances. The company’s diversity policy respects the principle of inclusion and equal opportunities, including in the composition of supervisory and management bodies. Candidates for these positions are considered gender, age, education, professional experience and skills. They also consider professional diversity and international experience to ensure complementarity in the highest governance bodies for the continuous functioning of the Krka Group. - Company 5: The stakeholders commit to implementing the objectives of the Diversity Policy by taking into account the best practices of the Diversity Policy in the composition of these bodies, combined with the need to ensure continuity in their composition and the need to manage the areas and skills within their competence. All selected diversity aspects, as well as any other identifiable aspects, are taken into account when proposing and deciding on the appointment of candidates to the Management Board or the Supervisory Board, all to ensure the optimum structure of the Management Board or the Supervisory Board necessary for the successful operation of the Company, respectively, in combination with the requirements of Article 6. The diversity policy is implemented through an appropriate recruitment and selection process for candidates to the Supervisory Board and the Management Board. - Company 6: In its Corporate Governance Statement, the company states that it implements a diversity policy in the management and supervisory bodies, mainly through an appropriate recruitment and selection process, with the participation of the Human Resources or Nomination Committee. The company’s bodies implement it following the legislation in force, by the Labour Relations Act (ZDR-1), and by complying with the principles and provisions of the codes that set out the content and make recommendations in this area. The company does not specify the exact code(s) followed in its diversity policy (“...with due regard to the principles and provisions of the codes which state their content and make recommendations in this area”). As the company does not explicitly state which codes it follows, we cannot verify the ethical guidelines—or the principles and provisions of the regulations—that it claims to follow. - Company 7: The Diversity Policy is implemented in particular in the following activities: • Recruitment, selection of candidates and selection/approval of members of management bodies; • Recruitment, selection and proposal of candidates for members of supervisory bodies to the founder/group; • Recruitment, selection of candidates and selection of candidates in the succession procedure; • Conduct a self-assessment of the work of the Supervisory Board, which should include an assessment of the composition of the management and Supervisory Board in terms of ensuring diversity. - Company 8: It is implemented in a way that: respects the cultural, ethical, social, political and legal diversity of peoples and communities, taking into account the need for a business model that will be consistent with social, economic and environmental practices and that will serve to meet today’s needs while taking into account the provision of living and working space for future generations. It recognises its responsibility as a leading global telecommunications company, putting its technology, products and services to promote respect for human rights. - Company 9: They are committed to fairness, equal treatment and opportunity for individuals and business partners and tolerate and embrace diversity. The company respects the value of diversity. Employees, customers, business partners, suppliers and other members of external stakeholders are citizens of many different countries with a multitude of different nationalities, religions, beliefs, cultures and social characteristics. They foster cultural diversity and the creation of international teams and business communities. - Company 10: Through an appropriate search and selection process for management and Supervisory Board candidates. To this end, the Implementing Agents shall use one or more recruitment channels to apply a suitable number of competent candidates of different sexes and ages. - Company 11: For the members of the management body, the experience criterion, the personal reliability and reputation criterion and the governance criterion are defined, with emphasis on the management of conflicts of interest and independence, and the time availability criterion; the Fit & Proper Committee of the company is also defined as the evaluation body, and at least one member of the management board must be a female. |

| 4. Results of the diversity policy achieved for the reporting period: - Company 1: The Annual Report does not contain the information to answer this question. The Diversity Policy is implemented, but the results achieved are not presented. - Company 2: Company provides equal opportunities to its employees regardless of gender, race, colour, age, health or disability, religion, political or other beliefs, trade union membership, national or social origin, marital status, property, sexual orientation or other personal circumstances. Any form of discrimination against employees is not permitted. - Company 3: On behalf of the Governing Body’s assessment, the diversity screening exercise has been analysed according to the following criteria: gender, age, education, work experience (both in and outside the business) and banking knowledge. The 2019 analysis concluded that the company’s diversity policy was adequately reflected in the composition of the governing body. During the 2018 analysis, the company established an accompanying maturity model with target values for each substantive item. The target values were regularly monitored as part of the periodic assessments of the suitability and effectiveness of the body. This system should allow them to be assessed retrospectively in a comparable way and monitor progress and improvements regularly. The company does not have any results related to the Diversity Policy shown. Based on the diversity policy document, the governing body of Abanka d.d. notes that the diversity principle has not yet been fully implemented. However, the bank has made efforts to do so. They point out that effective management and control of business conduct is nevertheless ensured and that the governing body selected is appropriate. - Company 4: In 2019, the Management Board and Supervisory Board of the company did not adopt a specific document entitled Diversity Policy, but the company implements the principles of the Diversity Policy through other internal acts, policies and procedures, including the Code of Conduct, the Corporate Governance Policy, the Rules of Procedure of the Supervisory Board regarding the procedures for nominating Supervisory Board members, and the methods and commitments of the Human Resources Committee of the Supervisory Board and the Nomination Committee for the preparation of the election proposal for the members of the Supervisory Board. Diversity is ensured in practice in the nomination and nomination procedures for members of the management and supervisory bodies, as the company always strives to provide equal opportunities for candidates and prohibits any discrimination. - Company 5: Until October 2019, the composition of the Management Board and Supervisory Board remained unchanged in 2017. However, on 25 October 2019, the Chair of the Supervisory Board, Nada Drobne Popović, became interim Chair of the Management Board, following the early termination of the term of office of three members of the Management Board based on agreements. Therefore, the gender diversity of the two bodies changed significantly as of that date. As of 1 January 2020, the company’s Management Board will be headed by three women and the Supervisory Board by a man. There was considerable dynamism in the composition of the Management Board and the Supervisory Board throughout the year. The Management Board was composed of three women, then two women and two men, then three men and two women, and at the end of the year, when the Management Board was completed, one of the five members was a woman. At the end of the year, the Supervisory Board carried out a recruitment procedure to select candidates for the Supervisory Board. Still, it did not propose any women to the General Meeting held, which is not in line with the Diversity Policy of the Management Board and the Supervisory Board of the company, which also identifies gender diversity as one of the six essential aspects of diversity. In addition to the above, the Works Council did not appoint any female employee representatives to the Supervisory Board at the end of 2020, whose term of office will start in 2021. The Works Council also proposed to the Supervisory Board the appointment of a male as Works Director, whose term of office began on 11 December 2020. The energy business is otherwise characterised by low female gender representation in management positions. Based on a counter-proposal at the abovementioned General Meeting, it was voted that the Supervisory Board would be composed of eight males and one female member after 11 April 2021. In 2019, the Supervisory Board also signed up to the 40/30 2026 voluntary gender diversity target initiative of the Slovenian Supervisory Board Association, which was supported by, among others, Slovenian State Holding d.d. and the Ljubljana Stock Exchange d.d., and which pledges to voluntarily achieve the gender diversity target of 40 per cent for supervisory board members and 33 per cent in total for supervisory board members and management boards of the underrepresented gender in publicly traded and state-owned companies by the end of 2026. The initiative was also signed by the Supervisory Board of the Association of Supervisory Boards of Slovenia. Even though SDH, d.d. made a counter-proposal at the General Meeting, the fundamental commitments of that initiative were not respected, and only one female representative was proposed for appointment. Given that the members of the Supervisory Board were appointed for a four-year term and the members of the Management Board for five years in 2020, no significant changes in gender diversity are expected in the coming years. - Company 6: There is no record of the results achieved under the Diversity Policy for the reporting period (i.e., the 2019 performance and operational period). - Company 7: In the 2019 Annual Report, the company does not report on the results achieved under the Diversity Policy. - Company 8: In 2019, the company achieved another successful financial year, consolidating its leading position in all telecommunications market segments. In addition to the growth of all key financial indicators, last year was marked by a substantial investment cycle, as one of the country’s leading investors was positively influenced by the changes in the investment climate. With investments in the modernization of fixed and mobile networks, the focus remains on further growth in all business segments, developing innovative products, and raising the quality of service for all users. For years, the company has promoted sustainable development, set best practices in setting standards for superior communications, and taken a leading role in recognizing the importance of environmental protection. The company is an excellent company with a great team of employees. Over the last five years, the company has become one of the largest investors in the country and one of the most important employers contributing to the country’s overall development. - Company 9: For many years, the company has placed great emphasis on employee development, both in professional areas and in the development of individual competencies. Employee development and training are therefore planned according to the employee’s needs. In 2019, several individual and group training sessions were also organized. In 2019, within the framework of the company’s international project called XXX, in-depth training sessions for female and male employees at the points of sale were continued. - Company 10:/ - Company 11:/ |

| 8. Does the declaration on diversity policy contain all the required information (adequate, partially adequate, inadequate), describing it in words and illustrating it with concrete examples (see questions 2, 3, and 4 for details)? |

| (a) CONSISTENT: 5 (b) PARTIALLY CONSISTENT: 5 (c) INCONSISTENT: 1 |

| 9. Is the diversity policy implemented in the observed company? YES: 11 NO: |

| 10. Suppose the diversity policy is not implemented in the observed company. Is there an explanation of why the company is not implemented (describe in words and illustrate with a concrete example)? - Company 1: The company has a diversity policy but does not have a specific document for this due to the current situation in the company. This is made clear in the annual report. They also said that this report would be prepared when the time comes. - Company 2:/ - Company 3:/ - Company 4:/ - Company 5:/ - Company 6:/ - Company 7:/ - Company 8:/ - Company 9:/ - Company 10:/ - Company 11:/ |

Source: researchers’ source—carriers of the empirical research.

Table A2.

Non-financial Statement of observed companies.

Table A2.

Non-financial Statement of observed companies.

| 1. Does the Company’s Non-Financial Statement the observed company exist? |

|---|

| YES: 10 NO: 1 |

| 2. Does the company’s Statement of non-financial performance contain all the required information (see answers to questions 3 to 9)? |

| (a) CONSISTENT: 9 (b) PARTIALLY CONSISTENT: 1 (c) INCONSISTENT: 1 |

| 3. Does the company’s Statement of non-financial performance disclose information on the following: |