1. Introduction

Over the years, climate change has become a top concern globally, mainly due to human activities from the post-Industrial Revolution era. Humanity must reduce carbon emissions and carbon-intensive energy consumption to curb global warming and protect their homeland [

1]. To this end, a cooperative mechanism was signed, the United Nations Framework Convention on Climate Change (UNFCCC), in 1992, being the world’s first international convention to control greenhouse gas emissions [

2]. In 1997, the United Nations Climate Conference proposed the legally binding Kyoto Protocol. The Protocol implemented the objective of the UNFCCC to reduce the onset of global warming by reducing greenhouse gas concentrations in the atmosphere to “a level that would prevent dangerous anthropogenic interference with the climate system” [

3]. Accelerating global warming and severe weather phenomena are demanding stricter policies for countries to fulfill and strengthen their emission reduction obligations. Moreover, the relevant legal and supervision systems for the Carbon derivatives financial Market (Carbon Market) must be formulated as soon as possible [

4].

Kyoto Protocol clarifies the Carbon Peak and decomposition index of carbon emission reduction. It stipulates three market-based emission reduction mechanisms. They are Joint Implementation, stipulated in Article 6; Clean Development Mechanism (CDM), stipulated in Article 12; and International Emission Trading (IET) under Article 17 [

5]. These mechanisms determine the general idea of the Carbon Market.

At present, the Carbon Market and its carbon derivatives have become a research hotspot. Yang and Luo (2020) reviewed international carbon financial derivatives transactions. They sorted out the relevant research on the connotation, concept, and current situation of the Carbon Market. Subsequently, seven aspects were comparatively analyzed to reveal the development status of the global Carbon Market. Their findings provided policy suggestions and theoretical references for countries with insufficient carbon finance research. They analyzed the impact of the emission source and the financial market regulation by the transnational climate policies on the European Union’s (EU) participation in the Carbon Market [

6]. Yliheljo (2021) assessed the public–private nature of emission units and ownership. Ownership was understood as the legal status of emission unit holders, a collection of private law elements, climate law, and financial market regulation. As policy design choices and Carbon Market regulation evolve, a picture of legal status variables emerges across individual, temporal, and spatial dimensions. Ownership of emission units reflected an ongoing balance of different EU public policy objectives and differed from the economic theory underlying emissions trading. Regulatory intervention and risk had become inherent features of unit ownership due to the need for active management of programs. The impact of changes would vary across different market participants [

7]. However, the research on the supervision mechanism affecting the Carbon Market is not thorough enough. There is a need to analyze the influencing factors of carbon emissions from the perspective of the market economy and policy. At the same time, few scholars have analyzed the Carbon Market from the perspective of international supervision laws and regulations. Carbon trading and carbon finance involve a wide range and a large transaction scale, so they need to be regulated by a sound legal system. The formation and development of carbon trading and carbon finance are relatively short, and the related legal system is in the process of constant adjustment and improvement. How to quickly establish an efficient and perfect carbon financial regulatory legal system and form a complete and sound legal system is of great significance for ensuring the trading of carbon financial products and their derivatives and ultimately achieving green, low-carbon, and sustainable development.

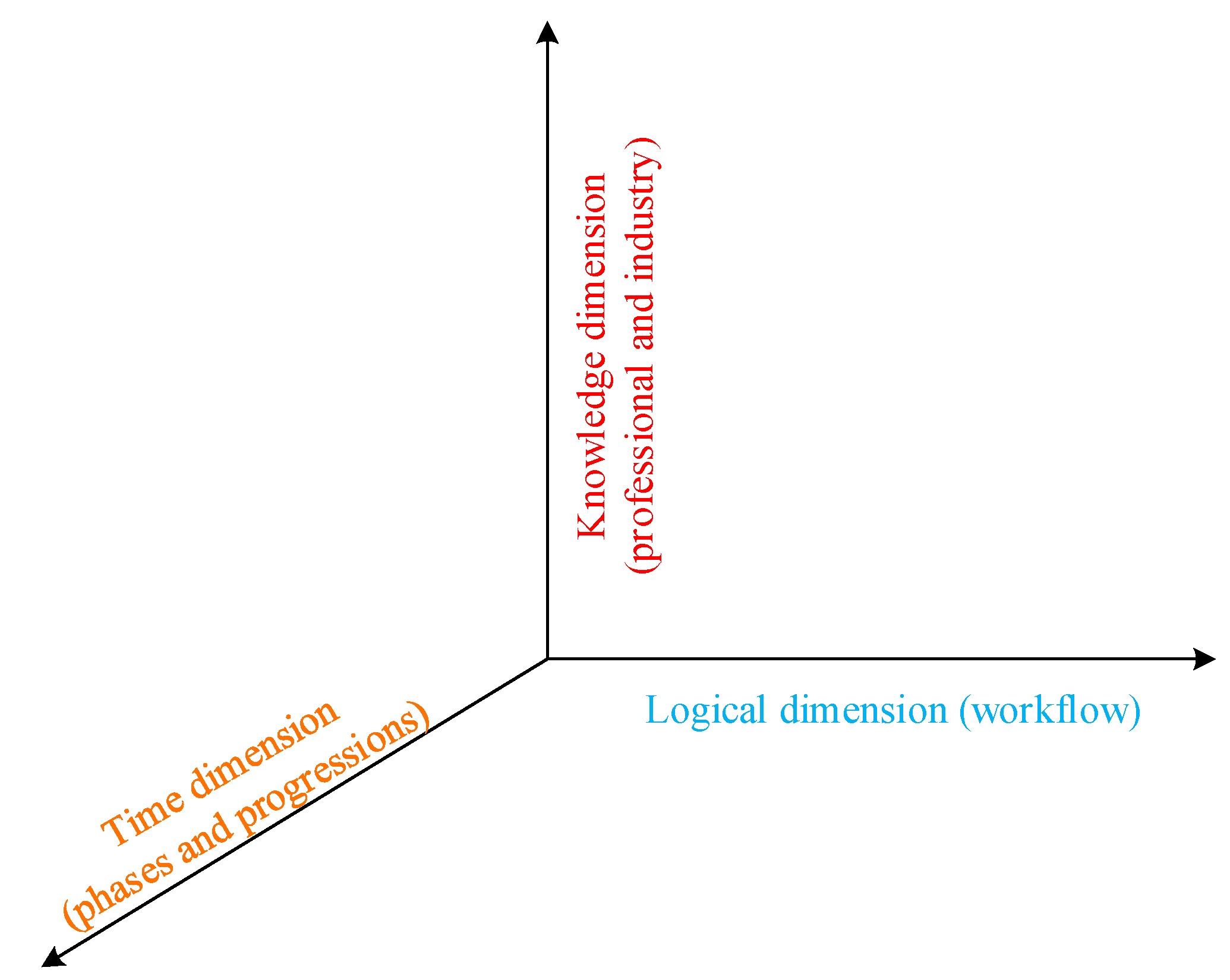

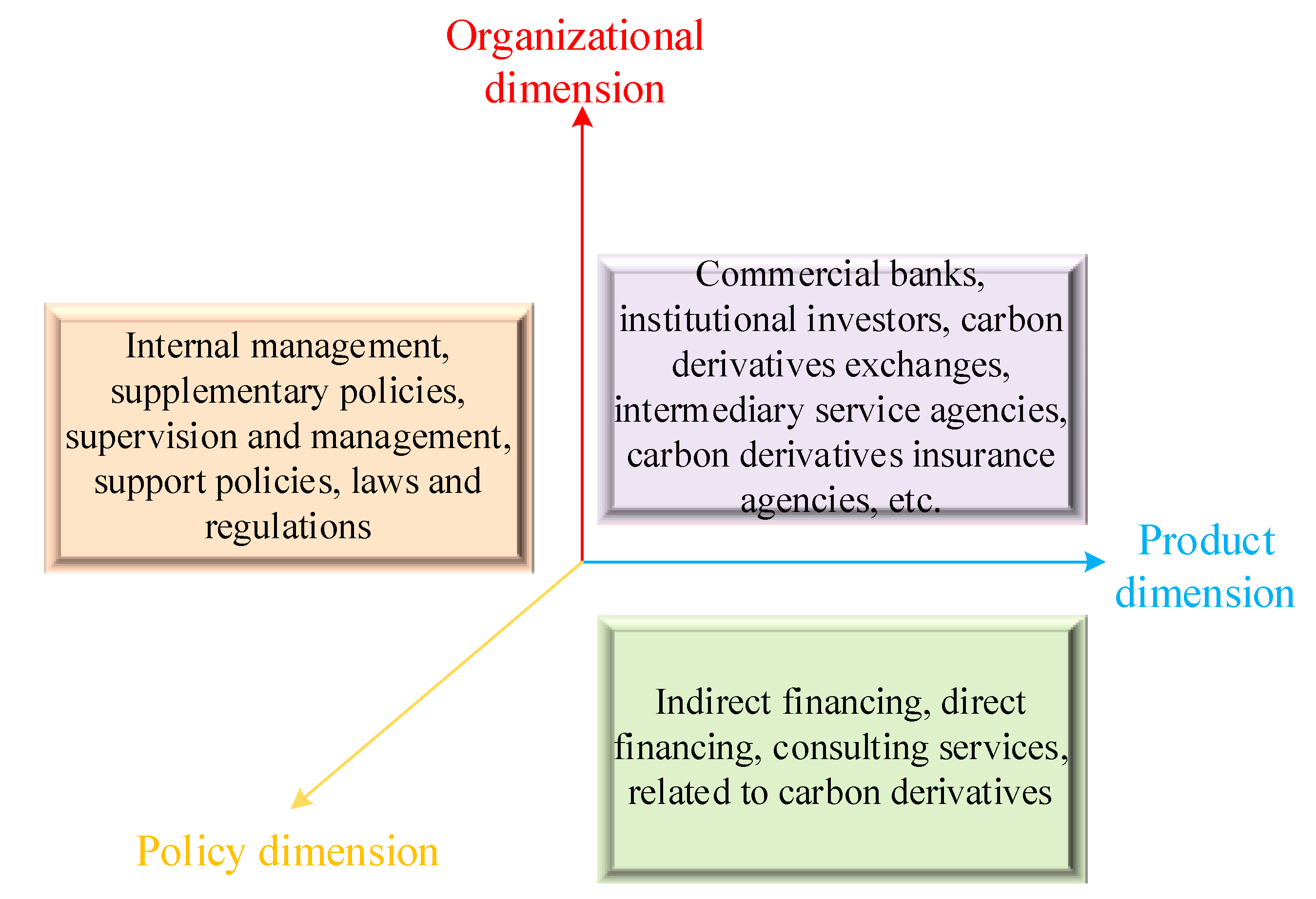

Thus, this work presents its innovation points. Firstly, it avoids the shortcomings of previous studies by more comprehensively understanding the Carbon Market as a complex system engineering. Secondly, a three-dimensional (3D) structure is introduced to model the Carbon Market from organizational, product, and policy dimensions. Finally, the supervision aspects of the policy dimension are presented in more detail. The results illustrate the necessity of market supervision and analyze the Carbon Market-oriented laws and regulations from three perspectives: supervisory entities, supervisory models, and international cooperation. Specifically, the Big Vector Autoregression (BigVAR) model is employed to study the relationship between Carbon Market, the energy market, and the financial market. The research finding ultimately has a reference role in improving the rights and obligations system of carbon emissions trading and the supervision of the Carbon Market.

3. Empirical Results and Analysis Based on the BigVAR Model

This section uses the VAR model for empirical analysis. The BigVAR model includes the VARX-L (Structured regulation for BigVAR with exogenous variables) model and the Hierarchical VAR (HVAR) model [

24].

The HVAR model structure is defined as:

In Equation (1),

demonstrates a

× 1-dimensional intercept vector.

stands for the

-dimensional time series as an endogenous variable, with lag order

p.

expresses the

×

coefficient matrix of the endogenous variable.

represents the m × 1-dimensional time series as the exogenous variable, with lag order

s.

denotes the

× m coefficient matrix of the exogenous variable.

means the selected sample time.

indicates the

× 1-dimensional white noise sequence, and

~N(0, ∑

). ∑

is the nonsingular diagonal matrices. When there is no limitation of exogenous variable

, or m = s = 0, the model is a VAR model. The parameters of the VARX model are optimized by using the least squares estimation:

In Equation (2),

represents Frobenius norm of matrix A.

, and

. The number of parameters to be estimated is

. In order to solve the problem of overparameterization in high-dimensional and multi-time delay, the VARX-L model introduces the concept of convex optimization based on the VARX model. Thereby, it reduces the parameter space with a structured sparse penalty function. The setting method is written in Equation (3):

In Equation (3),

refers to the penalty parameter estimated by cross-validation.

denotes the penalty function of the coefficient matrix of the endogenous variable.

signifies the penalty function of the coefficient matrix of the exogenous variable. In the empirical analysis, all indexes are treated as endogenous variables. Therefore, when there is no exogenous variable

or m = s = 0, VARX-L (with Lag-Group structure) model is defined as:

Then, the penalty function is set as Equation (5):

In terms of model testing, this section first uses Mean Square Forecast Error (MSFE) to measure the model performance under different settings. The smaller the MSFE is, the better the model performance is, and then the model form used to judge the relationship between variables can be selected. On this basis, the interaction between variables is classified and summarized according to the significance level and positive and negative values of parameter estimation. The specific expression of MSFE reads:

In Equation (6), is one third time point of the sampling period. stands for the two-third time point of the sampling period.

On the basis of Liu, Z et al. (2022) [

24], this empirical study expanded the sample data size to more than one year, which improved the accuracy of the analysis after the launch of the National Carbon Market. On 16 July 2021, China’s Carbon Market began to operate, which had a structural impact on China’s economy. Considering the trading date of China’s crude oil futures, the sampling duration is divided into two sections: before and after the operation of the National Carbon Market. The research data are sampled after the National Carbon Market operation (16 July 2021 to 31 August 2022). In the empirical process, there is a one-to-one correspondence between the order of variables and the sparse graph of the coefficient estimation matrix in the following text

Figure 9. In the empirical analysis after the operation of the National Carbon Market, the order of variables is Carbon Market volume weighted yield (turnover weighted yield), industry-weighted yield, CSI300, corporate debt index, steam coal continuous, crude oil recent, national debt index, asphalt recent, coke recent, fuel recent, dollar to RMB exchange rate by China Foreign Exchange Trade System (CFETS) and overnight Shanghai Interbank Offered Rate (SHIBOR). In addition, the penalty functions at Componentwise HVAR and Lag-Weighted Lasso are set according to Nicholson et al. (2017) [

25].

Then, it determines the lag order of the model according to Akaike Information Criterion (AIC) and Schwarz Criterion (SC).

Table 1 exhibits the model estimation effect of various penalty functions. After the release of the national carbon data, it is necessary to revise and demonstrate the results. From the above results, it can be seen that for the yields in both cases, Lag group performs relatively well, so the Lag group model is used to analyze the subsequent results.

As can be seen from the above six figures, in most cases, variables have a positive impact on the industry return rate, and each variable also influences each other. With the change of the model, the influence degree of each variable varies greatly. In the Lag-weighted Lasso model, most variables have a certain degree of mutual influence, but the influence of the variables is gradually weakened. In the volume-weighted results, each energy variable has a relatively obvious influence, while the enterprise debt index has a relatively strong influence on most variables, and the coke and the exchange rate of USD against RMB has a relatively significant influence. In the HVAR model, there are significant influences between asphalt and coke and most of the variables, and most of the influences are positive. From the above results, it can be seen that in most cases, HVAR has a better impact on the significance of various variables and has a better impact on the significance of various variables and is better reflected.

According to

Table 2, when the Carbon Market turnover-weighted yield and the National Carbon Market yield are introduced into the model simultaneously.

It can be seen from the above tables that, when carbon emission weighted yield rate and national carbon yield rate data are introduced at the same time, thermal coal continuous and asphalt recent months will have a positive impact on the result, which has a certain effect on volume weighting, and asphalt futures also have a positive impact on the national carbon yield rate. So, the energy market has an impact on both the industry and all carbon revenue data. Additionally, relatively speaking, most of the other energy sources will have a positive impact on either the volume-weighted yield or the turnover-weighted yield, as well as the national carbon data yield.

After the introduction of the national yield data, steam coal and asphalt futures will have a significant positive impact on the turnover weighted yield, coke will have a relatively strong negative impact. In the volume market, steam coal futures and crude oil futures have significant positive and negative influences on the distribution of results. The addition of USD to RMB in the carbon emission market has a significant positive impact, and the rest results are similar to the above results. In terms of carbon emission weight and national carbon yield data, the corporate debt index and coke futures all show negative intensity correlation, and the exchange rate between US dollar and RMB also shows corresponding positive correlation. It is similar in the carbon emission market, but the exchange rate variable of US dollar to RMB dollar has a significant impact the interaction between the energy and financial markets is complex, and the impact of steam coal futures and crude oil futures on SHIBOR overnight is negative. SHIBOR overnight has a negative impact on steam coal futures and coke futures and a positive impact on fuel futures and crude oil futures. The overall impact is asymmetric. In summary, after the introduction of the National Carbon Market, the correlation between the energy market and the financial market has become relatively complex but also presents a certain degree of asymmetry. Thus, the two hypotheses proposed above are verified.

4. Policy Recommendations

With the deepening of the reform of financial markets and the improvement of the degree of opening up, the linkage and risk contagion among financial markets will become more and more obvious [

26]. Therefore, the government should constantly improve the financial market in terms of institutional construction, ensure the healthy and rapid development of the stock market, focus on avoiding and preventing inter-regional financial risk contagion, and improve the ability to resist financial crises and financial risks. In particular, in the process of maintaining the stable and orderly operation of the financial market, financial regulatory authorities should pay attention to strengthening legal supervision and pay attention to the linkage between markets and information transmission characteristics so as to improve regulatory efficiency and reduce systemic risks. Moreover, coordination and cooperation should be strengthened to implement a more systematic and effective risk control system.

Specifically, the concept of “regulatory sandbox” should be applied to encourage innovation in policy and regulatory mechanisms while adhering to financial security and carbon trading standards. The idea of a regulatory sandbox originated in the UK. The principle is to define the scope, take inclusive and prudent regulatory measures for the enterprises within the scope, and not spread the problem beyond the prescribed scope [

27]. The regulatory sandbox can implement fault tolerance and error correction mechanisms within a controlled range. Regulators can supervise the entire operation process, effectively control risks and explore more quality and energy conservation supervision measures. The aim is to encourage safer innovation and find the best mix between protection and regulation. In the regulatory sandbox, attempts are made to improve the implementation of the responsibility system of relevant entities in the carbon financial market. At the same time, innovation in risk regulation should be carried out, including the establishment of a carbon finance risk prevention and disposal mechanism, mandatory information disclosure mechanism, credit punishment mechanism, green slanting mechanism, carbon finance crime prevention system, and judicial coordination communication mechanism.

Furthermore, in order to ensure the sound development of the carbon derivatives financial market, the legislative mechanism of each country should be unified, but there should also be regional differences. Subsequent international supervision should build a legislative path for an international unified carbon derivatives financial market system based on regional continuous pilot experience. However, it should also be encouraged and supplemented by local or regional special operational regulations.

5. Conclusions

In order to regulate the Carbon Market, such as carbon futures, options, and swap contracts, and to slow down climate change, it is necessary to construct and improve the supporting international supervisory laws and regulations. Following a review of the financial system theories and the Carbon Market’s characteristics, the 3D structural modeling technique in systems engineering was chosen to establish the Carbon Market framework. Next, the supervision and management aspects of the Carbon Market’s policy dimension were introduced. Then two hypotheses were proposed, and the BigVAR model was used for empirical analysis. The empirical results reveal that, after the introduction of the National Carbon Market, the steam coal, and asphalt futures have a significantly positive impact on the carbon-weighted price. However, the impact of the stock yield of the low-carbon transition industry on the weighted price of carbon emissions has regional and national differences, and the correlation between the financial market and the energy market has become relatively complex, showing a certain degree of asymmetry, which proves the correctness of the hypothesis. Finally, according to the idea of the regulatory sandbox, suggestions for improving the financial regulation of carbon derivatives are proposed. For example, to improve the responsibility system of relevant entities in the carbon financial market and innovation of risk supervision mechanisms. Countries differ in their development and should adapt their measures to local conditions. However, the analysis of the 3D structural model is not detailed enough. Future work will continue to focus on the operation mechanism of the Carbon Market and relevant international laws and regulations.