1. Introduction

Agricultural cooperatives play an indispensable role in the efficient and smooth governance of the global agri-food system [

1,

2]. Despite this substantial contribution, very little research has focused on the governance of agricultural cooperatives, particularly at the board level (e.g., [

3]). This might be partially explained by the until recently common, implicit scholarly assumption that the recommendations of corporate governance research on investor-oriented firms (IOFs) were also applicable to cooperatives (e.g., [

4,

5,

6]). However, recent empirical research on both sides of the Atlantic questions the relevance of IOF-derived recommendations for cooperative governance (e.g., [

3,

7,

8]).

The poverty of research on cooperative governance is more noticeable with respect to cooperatives in Eastern European countries where only a few studies have been published (e.g., [

9,

10]). However, even these studies focus solely on the overall governance mechanisms, including the definition and allocation of residual control rights among cooperative stakeholders. Yet, governance is not only about representation systems and implementation of cooperative principles, topics that seem to have dominated the extant literature on cooperative governance (e.g., [

1,

11,

12]). Board-level studies are rare or nonexistent, due to which we know very little about how agricultural cooperatives in these countries organize their governance structures and processes.

Similarly, to the best of our knowledge, little research has been conducted on how agricultural cooperatives in Eastern European countries measure their organizational health (e.g., [

10]). The latter concept has emerged in recent years as an alternative to simple financial performance measures that tend to ignore the non-negligible differences between cooperatives and IOFs and, as a result, present a non-realistic view of cooperative performance (e.g., [

13,

14]). Cooperative health is defined as a combination of (a) private goods (prices received or paid, services, feeling of community, social capital, and contributed collective good) received by the member-patron and (b) the perceived probability of cooperative survivability [

13]. Recent research also highlights the links between board governance and performance, even if measured solely with respect to financial efficiency (e.g., [

15,

16]).

Estonian agricultural cooperatives are worthy of scholarly inquiry due to a combination of characteristics that include: (1) their small but growing size and complexity, (2) the reported need to experiment with alternative organizational designs (e.g., [

10]), and (3) path dependencies due to the Soviet legacy of the country.

The paper addresses the above-described knowledge gaps by focusing on the governance of Estonian agricultural cooperatives. What makes Estonian agricultural cooperatives and their boards a fascinating research subject is their institutional context. Estonian cooperatives are regulated by the Commercial Associations Act, which states that the “provisions of the Commercial Code concerning private limited companies apply to associations, unless otherwise provided for in this Act” [

17]. Among other nuances, inner workings of the board of directors is also regulated by the Commercial Code that applies to all undertakings. Thus, agricultural cooperatives in Estonia are not regulated too heavily, or as one could argue, lack specific legislative focus when it comes to internal governance.

The research question motivating the study is threefold: (1) what are the board structures and processes adopted by Estonian agricultural cooperatives, (2) how do these cooperatives score in terms of organizational health, and (3) how do both compare to similar findings in other countries. Therefore, our objective is to identify board structures and processes adopted by Estonian agricultural cooperatives, measure the health of these organizations, and compare our findings to those of similar studies in selected other countries. We contribute to the scholarly literature on the governance of agricultural cooperatives by emphasizing sound governance structures and processes. To achieve the objective, we review the relevant literature in order to place our research in context, and derive concepts, constructs and measurable variables to use in our empirical investigation. Following that, we focus on structures and processes adopted by the boards of agricultural cooperatives in Estonia.

We collected data from 23 Estonian agricultural cooperatives through a purposefully designed survey of cooperative leaders. Our data enables us to identify key board structures and processes adopted by Estonian agricultural cooperatives and compare them to their counterparts in other countries in order to draw conclusions and make relevant recommendations. Our findings suggest that, at least within certain limits, neither the size of a cooperative organization nor whether or not it has instituted a board of directors affect its financial performance in a statistically significant manner.

Compared to their counterparts in European countries and the United States, Estonian agricultural cooperatives perform satisfactorily. However, we conclude that there exists considerable room for improvement in board processes through introduction of a more flexible legal framework and the adoption of professional board governance processes, introducing director orientation training, inclusion of additional financial expertise, and board evaluation routines. Our results also identify an emerging issue with member preference heterogeneity, which deserves attention from cooperative leaders in the short to medium run.

The paper is organized into six sections. Following this introduction, the second section sets the overall theoretical background of our research by reviewing the corporate governance literature on board structures and processes in both IOFs and cooperatives. We also focus on the governance of agricultural cooperatives and review relevant empirical research in order to inform our empirical research and place it in context. The third section presents the empirical methodology adopted and the sample selected, while the fourth section presents our findings. The fifth section discusses the results, while the last section concludes the paper by drawing implications, and proposing potentially fruitful avenues for future research.

5. Discussion

In terms of overall governance model, all responding cooperatives have adopted the traditional or extended traditional governance models identified in the literature (e.g., [

84]). Residual control rights are equally distributed among member-owners, as dictated by the Estonian cooperative law (one-member, one-vote). As with Spanish agricultural cooperatives [

89], we observe little variation in the governance models adopted by Estonian agricultural cooperatives. This lack of variation may be due to several reasons. First, the Estonian cooperative law is not flexible enough to permit the adaptation of governance models to the needs of each individual cooperative. Second, some cooperative leaders may not perceive a need to modify their governance model and lobby for amendments to the cooperative law that would enable such changes. Third, in most cases, there is simply no need to change anything; these cooperatives perform satisfactorily with their current governance model. Finally, as our results reveal, cooperative leaders do not seem to have access to inexpensive, top-quality expertise on cooperative organizational design. The latter may also explain that none of these cooperatives’ leaders has implemented tinkering actions to keep their dissatisfied members happy [

85].

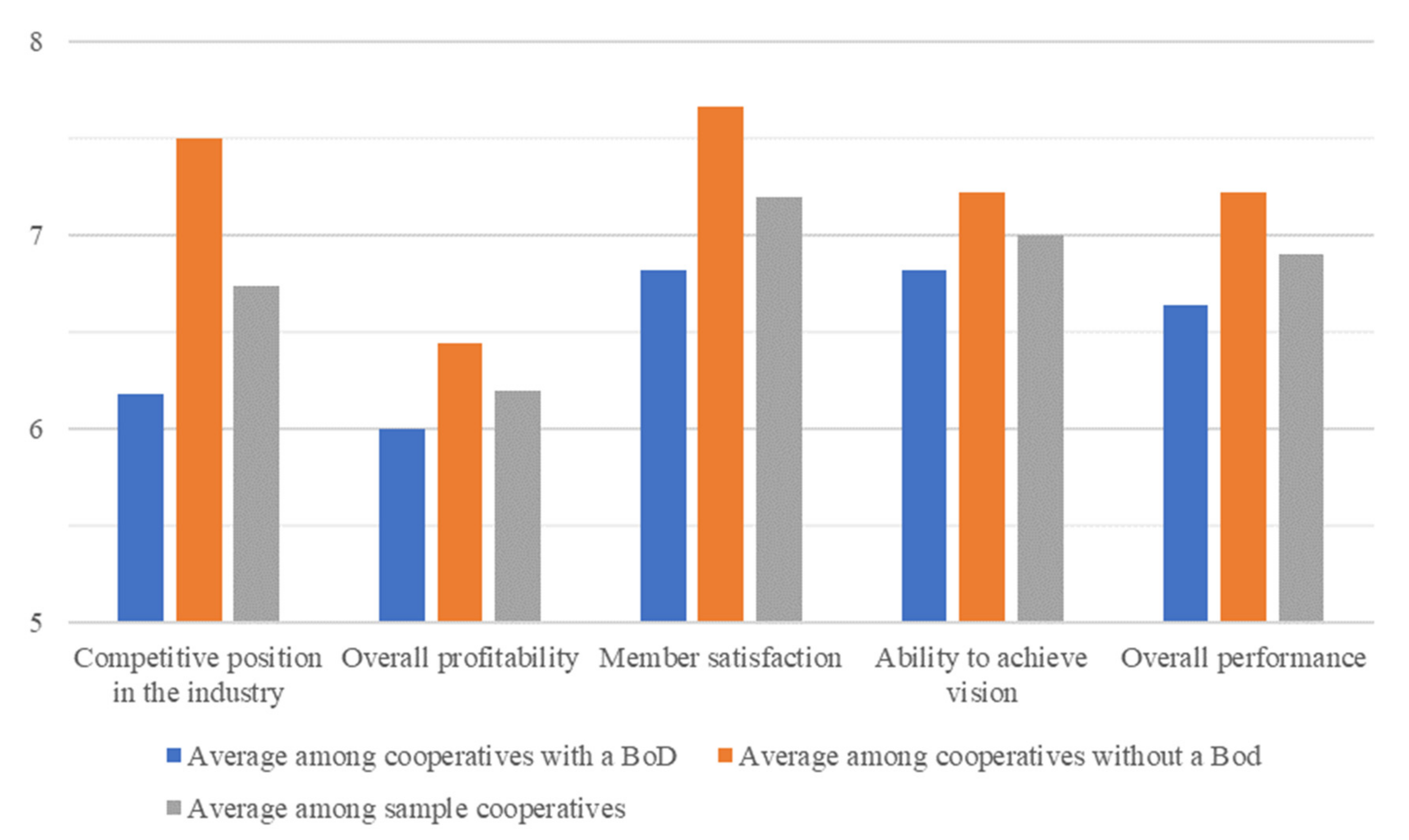

Having a board affects neither the financial results of sample cooperatives nor the satisfaction of members with the current performance of their cooperative. The small size of most organizations, particularly those without a board of directors, might reflect a preference for small organizations that score high on social capital and trust, despite their lack of professionalization and failure to capitalize on scale economies (e.g., [

103]).

Despite the differences in the organization of agricultural cooperatives in various countries and continents, the comparison of our findings to those of similar studies in other contexts generates useful insights. For example, in terms of board structure, responding cooperatives exhibit both similarities and differences when compared to agricultural cooperatives from other countries and Nordic IOFs. Board size is much smaller than that documented in all other studies, both for IOFs and agricultural cooperatives in Spain, Sweden, and the United States, which seems logical given the smaller size of responding Estonian agricultural cooperatives. No outside director serves on the boards of Estonian agricultural cooperatives, while in their United States’ counterparts, 2.20% have outside directors. The lack of financial expertise among board members is also evident in our sample, which, among other things, inhibits effective management monitoring.

On average, directors are slightly younger in responding cooperatives than directors serving in Nordic IOFs or agricultural cooperatives in Spain, Sweden, and the United States. In addition, because of the small size of responding cooperatives, current directors hold a considerably higher percentage of total cooperative equity when compared to their United States’ counterparts. This may provide them with additional incentives to monitor management more effectively and be more proactive in decision making, as suggested by agency theory (e.g., [

43]).

With respect to gender diversity, responding cooperatives have more women directors than all other organizations compared, both IOFs and cooperatives. Another interesting aspect, which might be related to stricter management monitoring, is that cooperatives with a board tend to change CEOs more often than those without one. This is probably due to more efficient management monitoring exercised by the board relative to the general assembly in cooperatives without a board. Furthermore, the small size of boards may facilitate closer CEO monitoring as suggested in the corporate governance literature (e.g., [

38,

39]). While a shorter CEO tenure may be associated with more board oversight, it may also stall more innovation and entrepreneurial development (e.g., [

56]).

In terms of board processes adopted, director tenure is similar to that in Nordic IOFs and Swedish cooperatives, but shorter than director tenure in United States’ cooperatives. However, board chair tenure is very close to that reported in all other studies used in the analysis.

Board meetings take place less than once a month, but the frequent interaction of the board chair with the CEO may compensate for this rather low engagement. Since similar metrics are not available for other organizations, we cannot infer how close or not to international standards Estonian agricultural cooperatives are. As suggested by corporate governance research, the low frequency of board meetings may be a harbinger of lower performance, loose CEO monitoring, and less adherence to farmer-patrons’ interests (e.g., [

63]).

A related issue is communication. Interactions between board members and management are rather infrequent, which raises the issue of communication effectiveness. However, as argued by Cook and Burress [

93], the monitoring role of the board might become more relevant than board-CEO interactions concerning day-to-day operations as cooperatives evolve.

Overall, board members seem to understand well the importance of establishing and maintaining smooth member relationships. They invest considerable time in doing so. However, adopting good governance practices seems to be constrained by their lack of full professionalization in several ways. This is evident in the fact that only about a half of these cooperatives have implemented a rudimentary training program for board members, let alone members at large, while only one organization has instituted orientation training for new board members. As a result, member relations consume a large part of top management’s working time, since these cooperatives do not have the size to justify the creation of a professional member relations department with communication experts.

Further, only two of the boards of directors have implemented a formal or informal process of board evaluation and just one conducts evaluations at the individual board of directors’ member level. Additionally, the fact that almost no outside directors or financial experts serve on the board may undermine these cooperatives’ governance capability, as only one sample board of directors declared that it had an outside member and another stated that one of its board of directors’ members was a financial expert. Lacking financial expertise at the board level raises the issues of effective management monitoring and ability to conduct due diligence.

Finally, no board of directors uses specialized member committees (e.g., finance, strategy, etc.) to support it in decision-making. Such committees would serve as training schools in governance and would thus facilitate the smooth succession of board members. Few exceptions to these observations exist of course, but overall, the ability of responding cooperatives to implement sound governance practices requires considerable improvement.

Many more United States’ cooperatives conduct full board training and devote much more time to director orientation than responding cooperatives. However, responding cooperatives that have instituted board training devote more hours to that training than their United States’ counterparts, but less than Swedish agricultural cooperatives. In addition, boards are substantially more active in United States’ cooperatives than in the responding ones.

Given the small size of the responding cooperatives, it is noteworthy how many of the respondents stated that disagreements among members or between members and the management are very common. According to recent research on the organization of Estonian agricultural cooperatives, the sources of such frictions vary from cooperative to cooperative and are [

10]:

Weak economic justification for the cooperative. If members do not feel a strong reason for being members of the cooperative, they have three options: exit, voice, or loyalty [

104]. Exit includes leaving the cooperative, but also free riding. Voice is another name for friction, if the cooperative does nothing to address members’ concerns.

Extremely high member preference heterogeneity that has not been addressed seriously by cooperative leaders. No or very little investment of resources in co-designing an organizational design in phase two of the cooperative’s lifecycle may have contributed considerably to high member preference heterogeneity and, consequently, to frictions among members [

13,

85,

105,

106].

A relatively high percentage of members have contributed more or less equity than their level of patronage demands. As a result, the latter group may press the management board and the board of directors to accelerate equity redemption or may vote down proposed investments in anticipation of higher equity redemption in the near future.

The involvement of board or general assembly members in pricing or cost allocation decisions creates potential for influence activities and frictions [

107].

The resource dependency approach to corporate governance highlights the need to achieve a delicate balance between homo- and heterogeneity. On the other hand, unlike stakeholder theory’s propositions, Estonian agricultural cooperatives tend to have small boards, which may enhance homogeneity.

The current research also focused on measuring the health of Estonian agricultural cooperatives and comparing it to the health of cooperatives in other countries. In terms of financial performance, ROE is very close to that of their United States’ counterparts [

3,

94]. With respect to self-reported cooperative health performance measures, responding cooperatives score slightly lower than the United States’ ones, although with a much lower variance. At the same time, the overall health of responding cooperatives, including measures of both financial and non-financial performance is not affected by whether they have instituted a board of directors or not. This result may be attributed to the small size of Estonian agricultural cooperatives, particularly those without a board, which turns the general assembly into a board of directors.

The current evolutionary phase of Estonian agricultural cooperatives justifies most of our findings and agrees with the overall results of the extant literature reviewed in

Section 2. The results of this research may inform policymakers and cooperative leaders in their quest to improve the governance of Estonian agricultural cooperatives. The ensuing recommendations are also applicable to other countries in the region and beyond where agricultural cooperatives are at a similar phase of their evolution.

As sample cooperatives grow, expand, and become more complex organizations, their governance needs to be adapted to new situations and will probably change even more in the near future. Well-educated directors, who exchange more information among them and with the CEO will become, more and more, of a necessity. Incorporating additional expertise in the board and experimenting with procedural governance innovations, such as those identified in the literature (e.g., [

1,

85,

108]), will probably become the norm in the years ahead. To this respect, the experience of agricultural cooperatives in other countries, and the establishment of a professional leadership program for cooperatives will prove extremely useful to Estonian cooperative leaders and their organizations.

As agriculture is an important sector of the Estonian economy [

109], the organization of sustainable cooperatives and other collective entrepreneurship schemes is a necessity for local farmers [

90]. The adoption of sound governance processes by Estonian agricultural cooperatives demands a well-designed mix of public policies and cooperative strategies. Top among the priorities of these public policies should be training and educating current and new generations of cooperative leaders, and increasing the professionalization of Estonian agricultural cooperatives through diverse initiatives and strategies.

For example, the establishment of a high quality, appropriately staffed, organized, and funded research and extension program for agricultural cooperatives, preferably placed within a local university, is a necessity that deserves the attention of policy makers. Similarly important is the establishment of undergraduate and graduate courses in business administration, economics, and law tailored to the needs of cooperatives, from which new generations of cooperative leaders will emerge. Legislation is another area of policy intervention. Amending current laws to enable agricultural cooperatives to adapt their organizational structures to the demands of the 21st century is recommended as a prerequisite for the adoption of sound governance practices.

Cooperative leaders may improve the governance of their organizations by designing and implementing board member orientation and development programs, board evaluation and self-evaluation procedures, and special task committees. An extensive training program for members is also necessary, which will help cooperatives in numerous ways, including, but not limited to, by enhancing member commitment, attracting new members, and ensuring a smooth board succession process.

The emerging issue of member preference heterogeneity and possible resulting frictions need to ring a bell for cooperative leaders, who should seriously consider taking action to address the root causes of such phenomena. Actions to consider might include, among others, the redrawing of cooperative boundaries (e.g., [

79]), the establishment of professional member relations programs, and the reinvention of their cooperatives [

13,

85].

6. Conclusions

The paper set out to identify board structures and processes adopted by Estonian agricultural cooperatives, measure the health of these organizations, and compare the findings to those of similar studies in other countries. Our research contributes to the emerging empirical literature on the governance of agricultural cooperatives. We have focused on Estonia, an Eastern European country that has escaped the attention of cooperative scholars so far.

We find that the Estonian cooperative law is not flexible enough and lacks a specific focus on governance to facilitate the adaptation of governance structures and processes to the needs of the 21st century. Policy makers should consider establishing research and extension programs tailored to the needs of agricultural cooperatives, focusing particularly on leadership governance and management aspects of the cooperative practice.

Our results also suggest that in cooperatives with a low number of members, there is probably no need to institute a board of directors, but this may change as cooperatives evolve and become larger and more complex organizations. Cooperative leaders need to think seriously of designing and implementing several universally accepted board processes in order to improve the governance of their businesses. These include board member orientation and development programs, board evaluation and self-evaluation procedures, the institution of special task committees, additional financial expertise at the board level, and training programs for members at large. In doing so, cooperative leaders need to take into account that corporate governance recommendations may not apply to their organizations and, thus, relevant adaptations might be in order. This implication of our findings is in line with the suggestions of agency and resource dependence theories.

The results reported above should be read with caution, due to the small size of our sample and the lack of panel data that would enable us to study the evolution of cooperative governance in Estonia. Further, due to the small sample, we were not able to perform multivariate analysis techniques, such as a principal component analysis, to calculate more realistic measures of cooperative health. Future research could ameliorate these constraints by targeting the population of cooperatives in the country and collecting panel data from both cooperatives and individual farmer-members. It also needs to focus on identifying the needs of member-patrons through detailed interviews and take them into account when proposing institutional changes to improve governance processes in Estonian agricultural cooperatives. Another research topic should be the emerging member preference heterogeneity issue, which might become even more relevant as Estonian cooperatives expand into other regions and accept members or merge with cooperatives from other countries. Unlike member diversity, which enhances the ability of cooperatives to make highly informed decisions, member preference heterogeneity increases relative maintenance organizational costs, which cooperatives incur throughout their lifecycle. Future research should focus on identifying selective incentive mechanisms to address such costs. Finally, future research should shed additional light on the cognitive conflict and trust dimensions of board processes, which have not been studied in the current research. Agricultural cooperatives and policy makers would highly benefit from in-depth research studies addressing the aforementioned issues.