Analysis of the Eurozone’s Resilience to Crises and Disturbances in the Context of EU Development Strategies—Contemporary Approach Using Anfis

Abstract

1. Introduction

- i.

- sensitivity of regional production and employment to exogenous shocks determines the demand for public policies;

- ii.

- recovery in terms of speed of rebound after a negative shock;

- iii.

- reorientation, which analyses the extent to which the region changes after the shock by changing, for example, the sectoral composition; and

- iv.

- recovery, which represents the ability of the regional economy to re-establish its growth path.

2. Data and Methodology

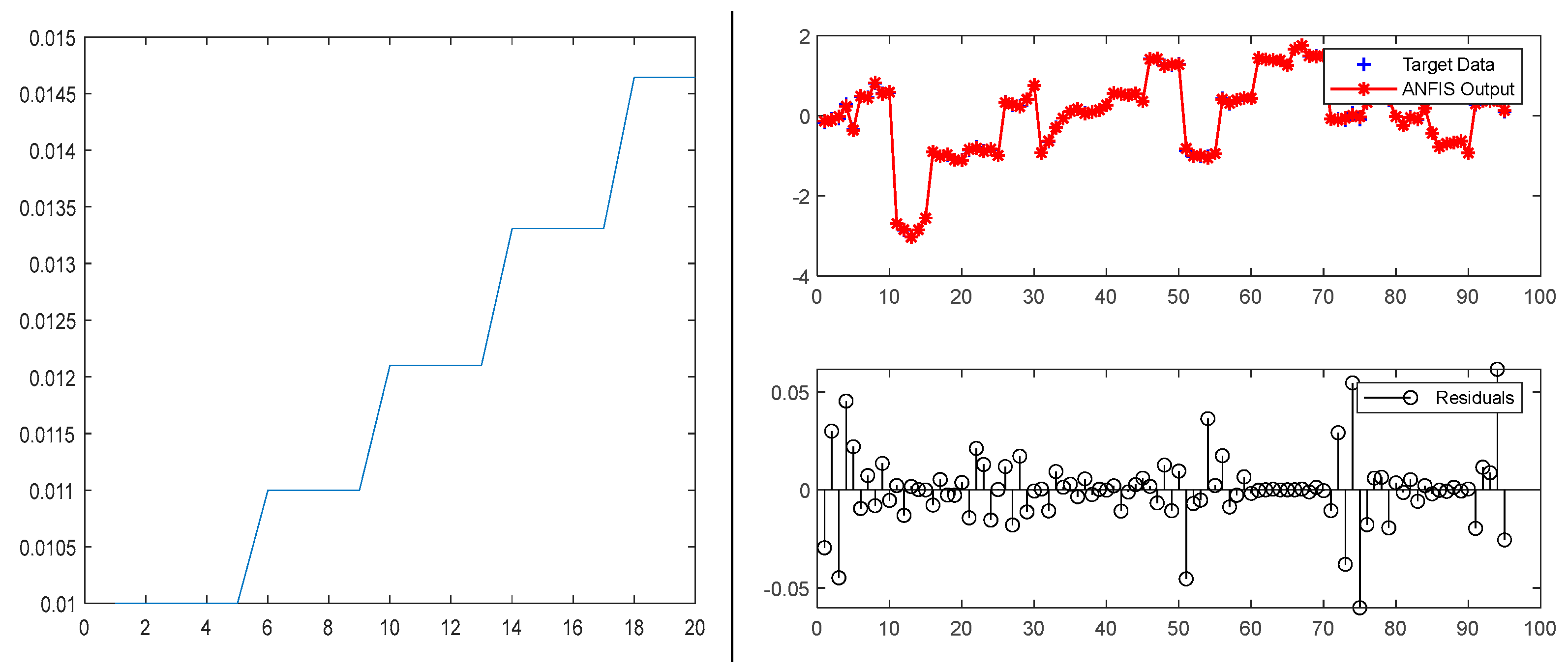

- Number of nodes: 193

- Number of linear parameters: 405

- Number of nonlinear parameters: 36

- Total number of parameters: 441

- Number of training data pairs: 95

- Number of checking data pairs: 0

- Number of fuzzy rules: 81

- Minimal training RMSE = 0.017338

- Number of nodes: 193

- Number of linear parameters: 405

- Number of nonlinear parameters: 36

- Total number of parameters: 441

- Number of training data pairs: 95

- Number of checking data pairs: 0

- Number of fuzzy rules: 81

- Minimal training RMSE = 0.00037804

- Number of nodes: 35

- Number of linear parameters: 27

- Number of nonlinear parameters: 18

- Total number of parameters: 45

- Number of training data pairs: 95

- Number of checking data pairs: 0

- Number of fuzzy rules: 9

- Minimal training RMSE = 0.752461

- Number of nodes: 193

- Number of linear parameters: 405

- Number of nonlinear parameters: 36

- Total number of parameters: 441

- Number of training data pairs: 95

- Number of checking data pairs: 0

- Number of fuzzy rules: 81

- Minimal training RMSE = 0.20408

- Number of nodes: 193

- Number of linear parameters: 405

- Number of nonlinear parameters: 36

- Total number of parameters: 441

- Number of training data pairs: 95

- Number of checking data pairs: 0

- Number of fuzzy rules: 81

- Minimal training RMSE = 0.0830715

3. Results and Discussion

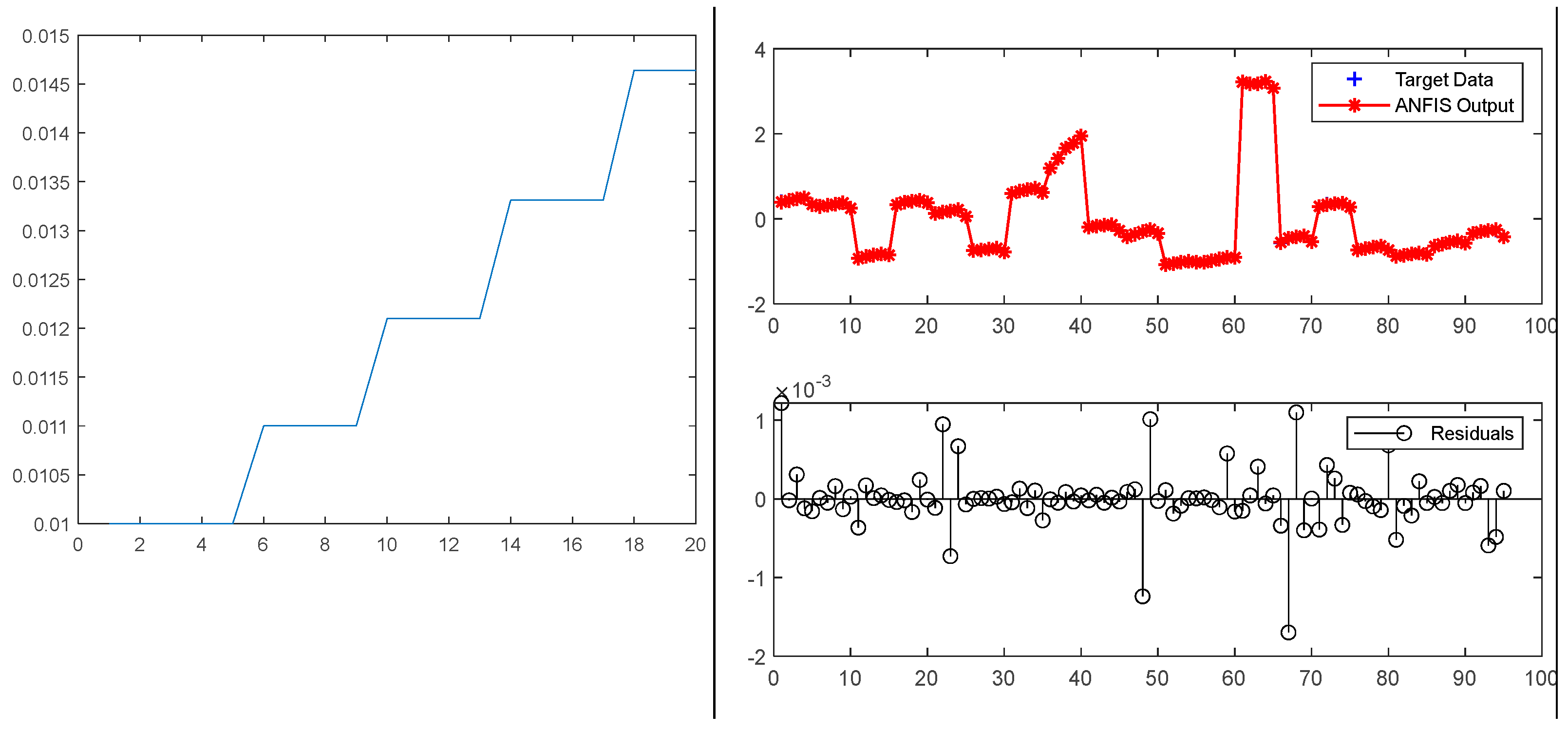

- Cluster 1 connects the parameters Exports of goods and services in % of GDP, Imports of goods and services in % of GDP, Energy imports dependency, Population by educational attainment level, and Share of fossil fuels in gross available energy. It is part of a large cluster together with cluster 2, and the indirect connection imposes the classification of the selected parameters in the same cluster. It points to the fact that in the observed period, the import and export of the Eurozone depends on energy issues, i.e., energy import and the share of fossil fuels in the total energy consumption, but also the level of education of the population, which contributes to the creation of various industrial policies, and the creation and use of innovative solutions in business and energy policy;

- Cluster 2 connects Real GDP per capita, Resource productivity and domestic material consumption, Digital inclusion—individuals, Enterprises that employ ICT specialists and Enterprises that provided training to develop/upgrade ICT skills of their personnel. This can also be characterised as the most important cluster, considering that in previous research, resilience to crises and disruptions was measured with the help of GDP per capita. Resilience to crises and disturbances in the Eurozone can therefore be directly linked to digitalisation and Resource productivity, and domestic material consumption;

- Cluster 3 connects Harmonised Indices of Consumer Prices (HICPs) all items—annual average indices, High-speed internet coverage and Share of trade with the EU27. It is also part of a large cluster together with clusters 1 and 2. It indicates the possibility of potential inflationary consequences that can be mitigated by digitisation and the degree of trade with the EU27;

- Cluster 4 is not directly but indirectly connected to the most significant cluster 2 and connects the parameters HRST by category, sex and age, Energy efficiency, Employment in technology and knowledge-intensive sectors, GERD by sector of performance, Gross domestic expenditure on R&D by sector and Early leavers from education and training by sex. In fact, it can be seen from the cluster analysis on the dendrogram that this cluster depends on a large cluster consisting of the already mentioned cluster 1, 2 and 3. Therefore, it was concluded that investment in research and development and energy efficiency play a significant role in resilience to crises and disruptions;

- The last cluster 5 is separate, but indirectly linked to the other clusters, and it consists of Unemployment rates, Self-reported unmet needs for medical examination; Arrears (mortgage or rent, utility bills or hire purchase), People at risk of poverty or social exclusion, Inability to face unexpected financial expenses and Trade volume indices, by reporting country. In accordance with the previous research that were highlighted in the introductory section, and with regard to the variables classified in this way, it is possible to conclude that unemployment, financial instability, and the occurrence of large healthcare costs can be directly protected by the volume of trade.

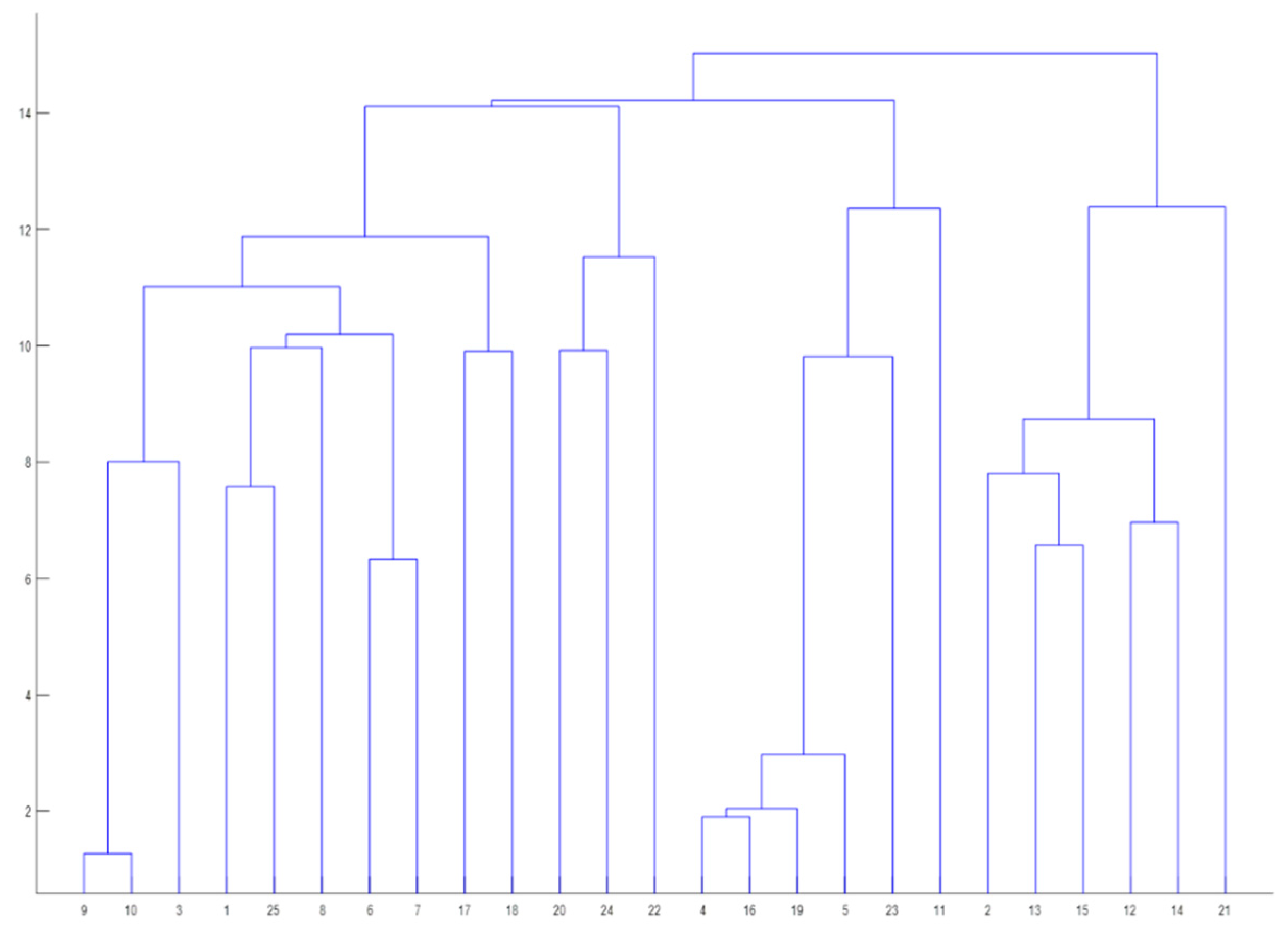

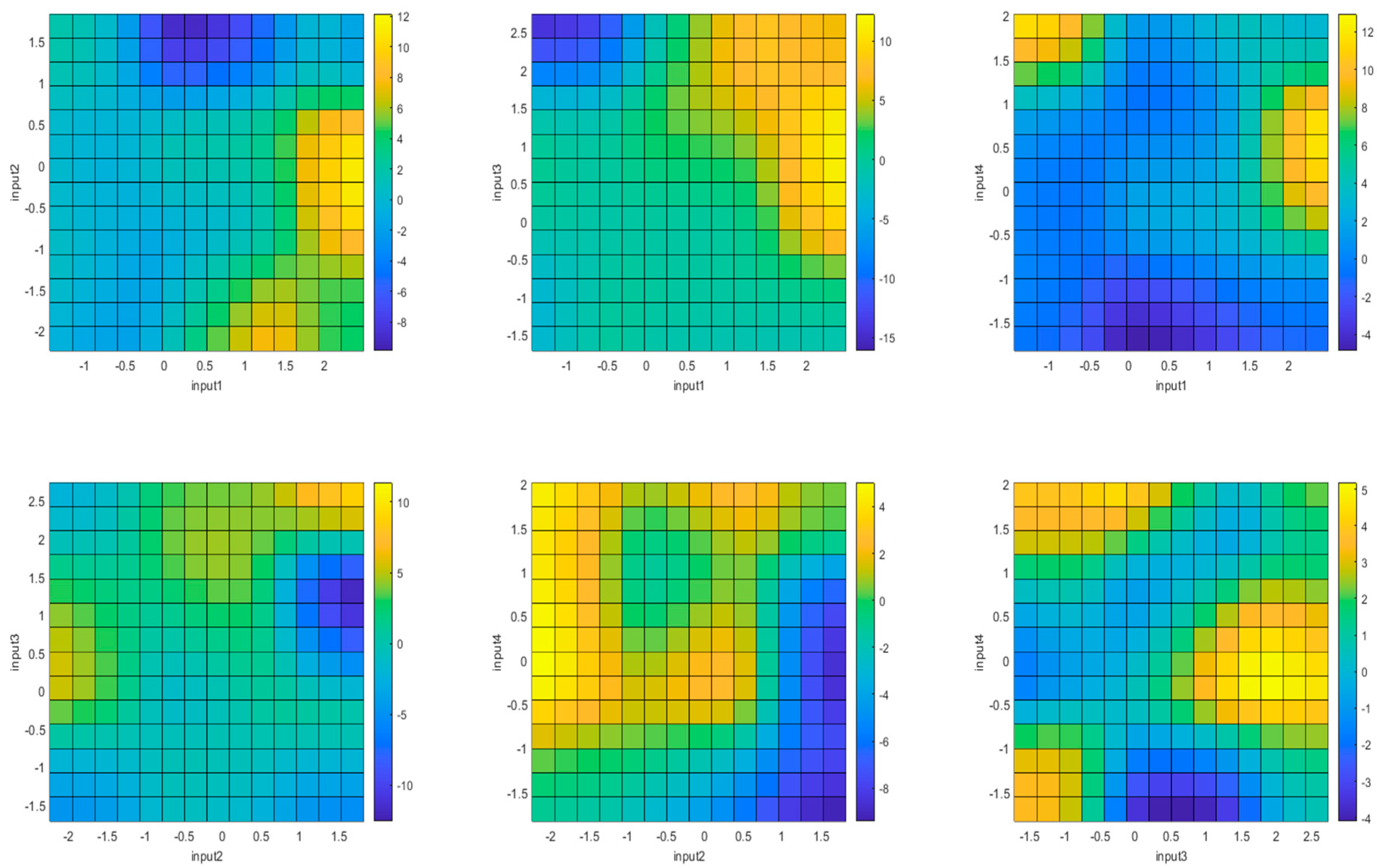

- medium values of Exports of goods and services in % of GDP with simultaneously very low values of Imports of goods and services in % of GDP;

- low values of Exports of goods and services in % of GDP with simultaneously high values of Imports of goods and services in % of GDP;

- medium values of Exports of goods and services in % of GDP with simultaneously high values of Population by educational attainment level;

- low values of Exports of goods and services in % of GDP with simultaneously low, but also high values of Share of fossil fuels in gross available energy;

- low values of Imports of goods and services in % of GDP with simultaneously low values of Population by educational attainment level;

- medium and high values of Imports of goods and services in % of GDP with simultaneously very high values of Population by educational attainment level;

- low values of Imports of goods and services in % of GDP with simultaneously medium to high values of Share of fossil fuels in gross available energy;

- low values of Population by educational attainment level with simultaneously very high values of Share of fossil fuels in gross available energy;

- very high values of Population by educational attainment level with simultaneously medium values of Share of fossil fuels in gross available energy.

- medium to high values of Exports of goods and services in % of GDP with simultaneously very high values of Imports of goods and services in % of GDP;

- very low values of Exports of goods and services in % of GDP with simultaneously very low values of Population by educational attainment level;

- very high values of Exports of goods and services in % of GDP with simultaneously very high values of Population by educational attainment level;

- medium values of Exports of goods and services in % of GDP with simultaneously low values of Share of fossil fuels in gross available energy;

- low values of Imports of goods and services in % of GDP with simultaneously very high values of Population by educational attainment level (high share of population with high educational attainment level);

- very high values of Imports of goods and services in % of GDP with medium levels of Population by educational attainment level (high share of population with high educational attainment level);

- medium values of Imports of goods and services in % of GDP with simultaneously low values of Share of fossil fuels in gross available energy;

- high values of Imports of goods and services in % of GDP with medium and high values of Share of fossil fuels in gross available energy;

- medium values of Population by educational attainment level with simultaneously low values of Share of fossil fuels in gross available energy (high share of population with high educational attainment level).

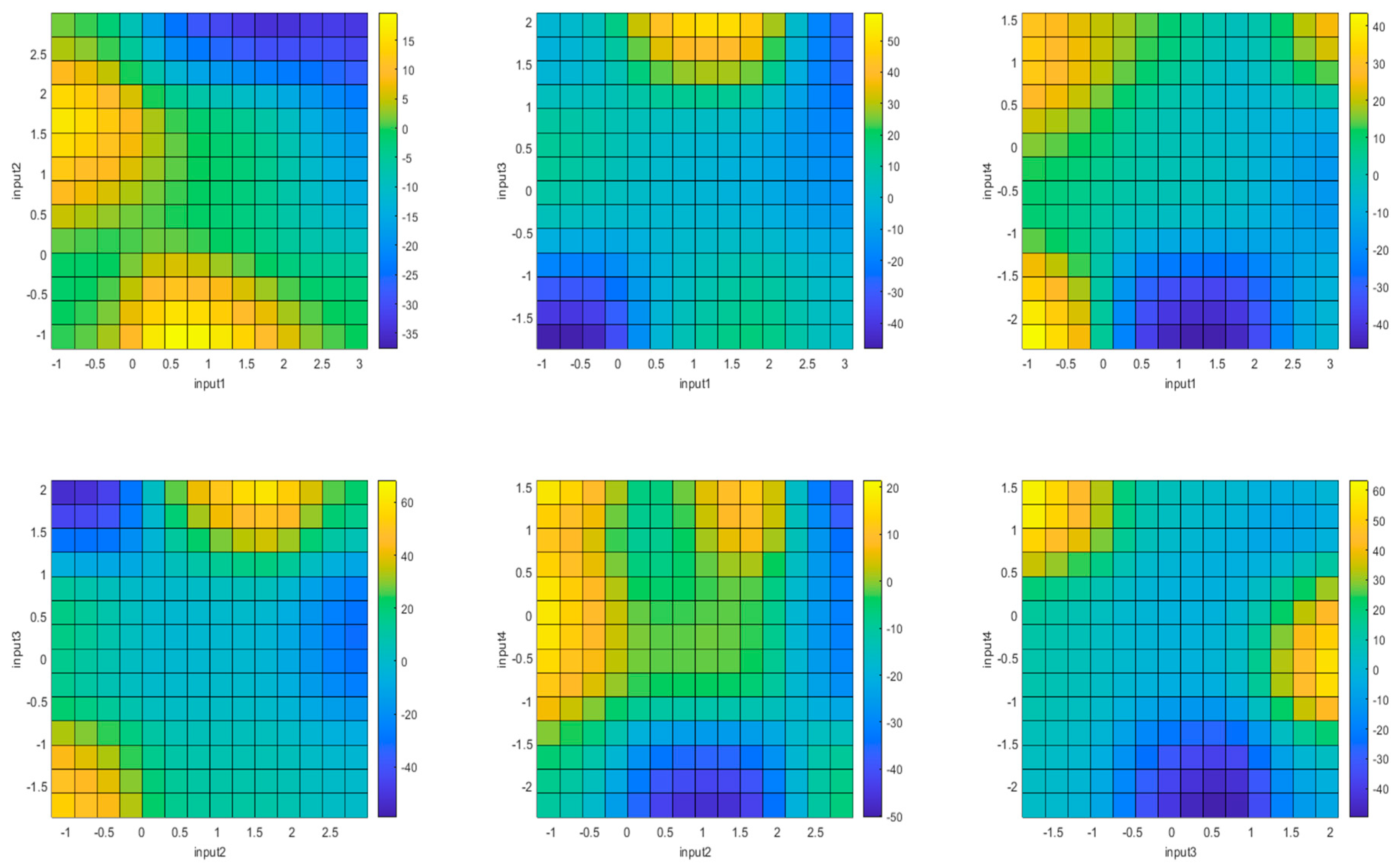

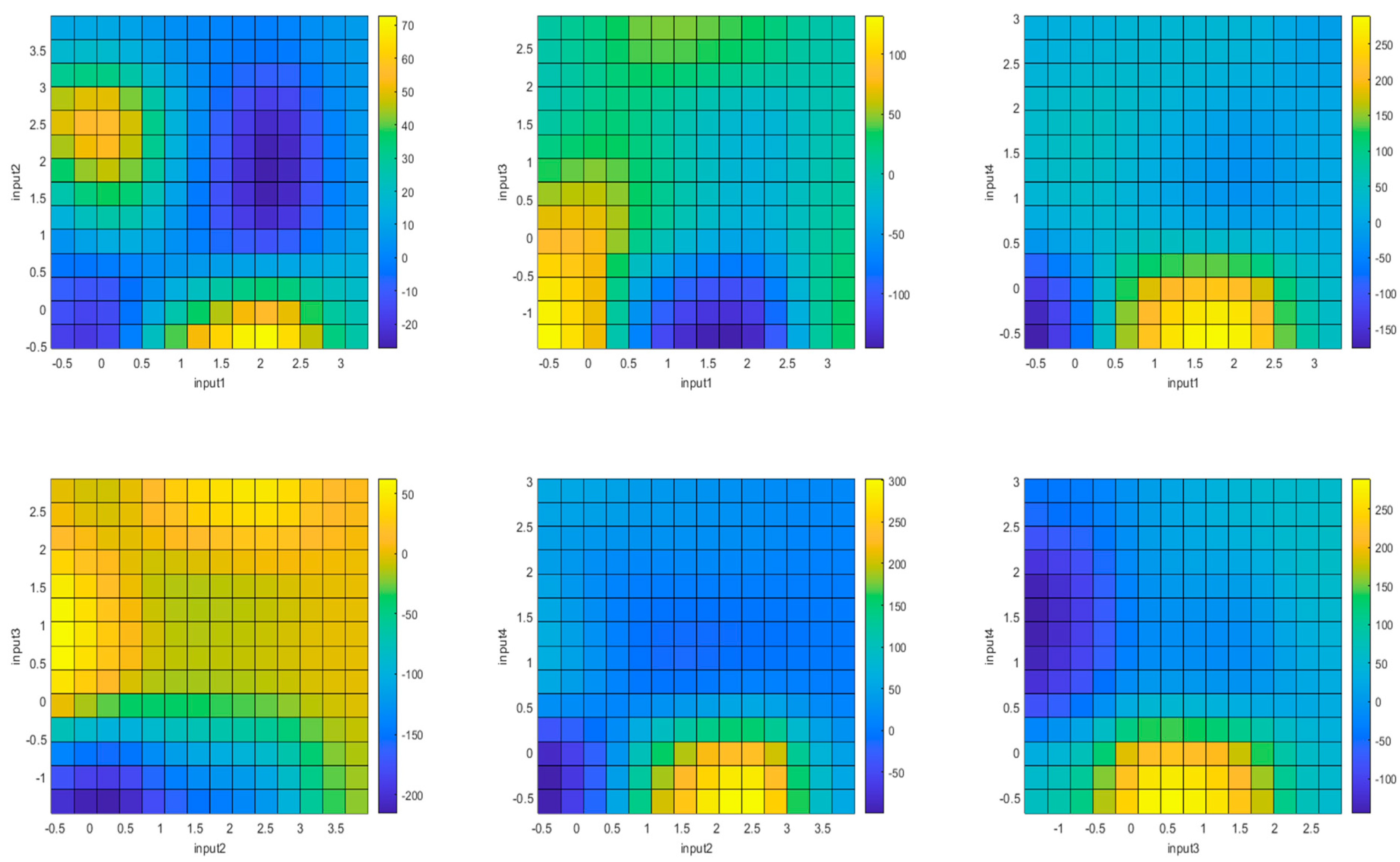

- very high values of Resource productivity and domestic material consumption with simultaneously medium values of Digital inclusion—individuals;

- very high values of Resource productivity and domestic material consumption with simultaneously medium to high values of Enterprises that employ ICT specialists;

- low values of Resource productivity and domestic material consumption with simultaneously very high values of Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- very high values of Resource productivity and domestic material consumption with simultaneously medium values of Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- very high values of Digital inclusion—individuals with simultaneously very high values of Enterprises that employ ICT specialists;

- low values of Digital inclusion—individuals with simultaneously medium to high values of Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- low values of Enterprises that employ ICT specialists with simultaneously low, but also high values of Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- high values of Enterprises that employ ICT specialists with simultaneously medium values of Enterprises that provided training to develop/upgrade ICT skills of their personnel.

- medium values of Resource productivity and domestic material consumption with simultaneously very high values of Digital inclusion—individuals;

- low values of Resource productivity and domestic material consumption with simultaneously very high values of Enterprises that employ ICT specialists;

- all values of Resource productivity and domestic material consumption with simultaneously medium values of Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- very high values of Digital inclusion—individuals with simultaneously high values of Enterprises that employ ICT specialists;

- very high values of Digital inclusion—individuals with simultaneously low to high values of (it does not apply only to very high values) Enterprises that provided training to develop/upgrade ICT skills of their personnel;

- medium values of Enterprises that employ ICT specialists with simultaneously very low values of Enterprises that provided training to develop/upgrade ICT skills of their personnel.

- medium to very high values of HRST by category with simultaneously low values of GERD by sector of performance;

- low values of HRST by category with simultaneously medium to high values of GERD by sector of performance;

- low values of HRST by category with simultaneously low values of Early leavers from education and training by sex;

- medium to high values of HRST by category with simultaneously low values of Energy efficiency;

- low values of GERD by sector of performance with simultaneously medium values of Early leavers from education;

- medium values of GERD by sector of performance with simultaneously low values of Energy efficiency;

- medium values of Early leavers from education and training with simultaneously low values of Energy efficiency.

- low values of HRST by category with simultaneously low values of GERD by sector of performance;

- high values of HRST by category with simultaneously medium values of GERD by sector of performance;

- medium values of HRST by category with simultaneously low values of Early leavers from education and training;

- low values of HRST by category with simultaneously low values of Energy efficiency;

- low values of GERD by sector of performance with simultaneously low values of Early leavers from education and training;

- low values of GERD by sector of performance with simultaneously low values of Energy efficiency;

- low values of Early leavers from education and training with simultaneously medium to high values of Energy efficiency.

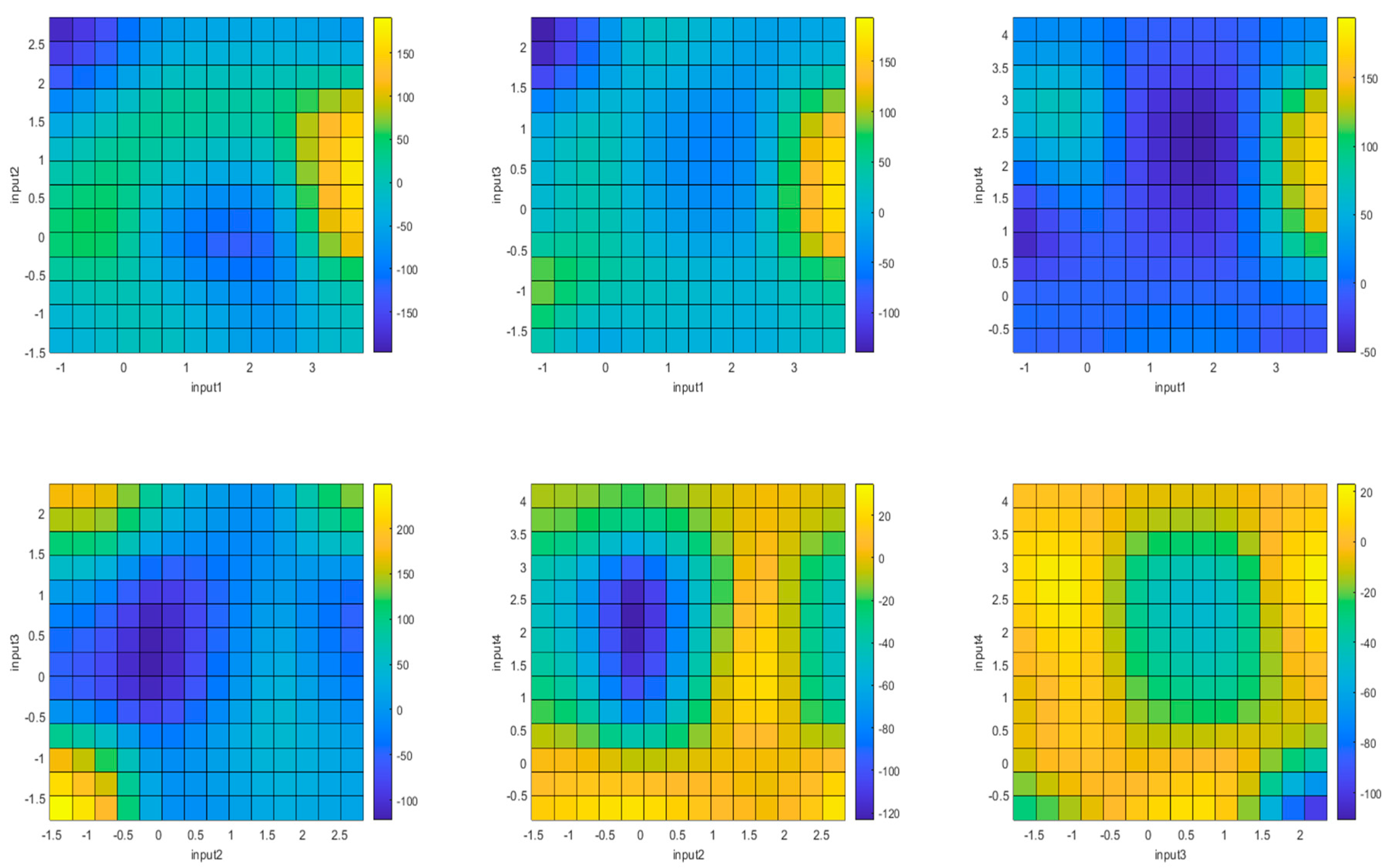

- high values of Unemployment rates with simultaneously medium values of People at risk of poverty or social exclusion;

- high values of Unemployment rates with simultaneously medium values of Inability to face unexpected financial expenses;

- high values of Unemployment rates with simultaneously medium values of Arrears;

- low values of People at risk of poverty or social exclusion with simultaneously low, but also very high values of Inability to face unexpected financial expenses;

- low values of People at risk of poverty or social exclusion with simultaneously low values of Arrears;

- low and very high values of Inability to face unexpected financial expenses with simultaneously high values of Arrears.

- low values of Unemployment rates with simultaneously very high values of People at risk of poverty or social exclusion;

- low values of Unemployment rates with simultaneously very high values of Inability to face unexpected financial expenses;

- very low and medium values of Unemployment rates with simultaneously occurrence of medium values of Arrears;

- medium values of People at risk of poverty or social exclusion with simultaneously medium values of Inability to face unexpected financial expenses;

- low values of People at risk of poverty or social exclusion with simultaneously medium values of Arrears;

- very high values of Inability to face unexpected financial expenses with simultaneously very low values of Arrears.

4. Conclusions

- import and exports of the Eurozone depend on energy issues, i.e., energy import and the share of fossil fuels in total energy consumption, but also the education attainment level of the population, which contributes to the creation of various industrial policies, and the creation and use of innovative solutions in business and energy policy;

- digitalisation is closely related to Resource productivity and domestic material consumption;

- inflationary consequences can be mitigated by digitisation (and preconditions for it, such as the availability of high-speed internet (5G and 6G)) and the share of trade with the EU27;

- investment in research and development and energy efficiency play a significant role in resilience to crises and disruptions;

- it can be directly protected from unemployment, financial instability, and the occurrence of large healthcare costs by using the volume of trade.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | 2 | 3 | 4 | 5 | |

| Real GDP per capita | Unemployment rates | Population by educational attainment level | HRST by category, sex and age | GERD by sector of performance | |

| Austria 2016 | 36,390 | 6.0 | 28.5 | 416.1 | 11,145.02 |

| 2017 | 36,980 | 5.5 | 28.4 | 390.9 | 11,289.78 |

| 2018 | 37,720 | 4.9 | 29.7 | 404.0 | 11,911.85 |

| 2019 | 38,110 | 4.5 | 30.5 | 410.7 | 12,441.23 |

| 2020 | 35,390 | 5.4 | 30.9 | 392.1 | 12,143.11 |

| Belgium 2016 | 34,620 | 7.8 | 29.5 | 443.6 | 10,852.674 |

| 2017 | 35,050 | 7.1 | 32.0 | 469.5 | 11,867.98 |

| 2018 | 35,520 | 6.0 | 32.8 | 488.4 | 13,158.25 |

| 2019 | 36,090 | 5.4 | 32.2 | 496.4 | 15,109.89 |

| 2020 | 33,880 | 5.6 | 33.7 | 509.8 | 15,887.07 |

| Estonia 2016 | 13,620 | 6.8 | 42.5 | 61.3 | 270.34 |

| 2017 | 14,410 | 5.8 | 40.1 | 61.5 | 304.32 |

| 2018 | 14,970 | 5.4 | 44.2 | 64.9 | 365.64 |

| 2019 | 15,510 | 4.4 | 46.5 | 69.4 | 452.97 |

| 2020 | 15,010 | 6.8 | 48.3 | 68.4 | 481 |

| Finland 2016 | 35,330 | 8.8 | 28.0 | 252.9 | 5926.10 |

| 2017 | 36,380 | 8.6 | 25.5 | 263.1 | 6173.20 |

| 2018 | 36,740 | 7.4 | 24.8 | 287.0 | 6437.70 |

| 2019 | 37,150 | 6.7 | 29.1 | 289.8 | 6715.10 |

| 2020 | 36,050 | 7.8 | 31.7 | 296.4 | 6932.60 |

| France 2016 | 31,770 | 10.1 | 28.9 | 2613.2 | 49,650.92 |

| 2017 | 32,360 | 9.4 | 29.1 | 2778.4 | 50,513.50 |

| 2018 | 32,820 | 9.0 | 30.3 | 2906.4 | 51,913.80 |

| 2019 | 33,320 | 8.4 | 31.2 | 3028.5 | 53,427.81 |

| 2020 | 30,610 | 8.0 | 33.5 | 3168.5 | 54,230.72 |

| Greece 2016 | 16,890 | 23.6 | 15.6 | 219.7 | 1754.18 |

| 2017 | 17,110 | 21.5 | 16.7 | 231.6 | 2038.43 |

| 2018 | 17,430 | 19.3 | 15.4 | 233.2 | 2179.31 |

| 2019 | 17,760 | 17.3 | 14.8 | 241.5 | 2337.66 |

| 2020 | 16,170 | 16.3 | 14.5 | 267.2 | 2473.45 |

| Netherlands 2016 | 39,810 | 6.0 | 26.8 | 745.7 | 15,235.00 |

| 2017 | 40,730 | 4.9 | 27.7 | 782.9 | 16,081.00 |

| 2018 | 41,450 | 3.8 | 27.4 | 802.3 | 16,554.00 |

| 2019 | 41,980 | 3.4 | 34.7 | 873.3 | 17,760.00 |

| 2020 | 40,160 | 3.8 | 37.4 | 901.0 | 18,356.00 |

| Ireland 2016 | 50,060 | 8.4 | 51.0 | 180.0 | 3175.10 |

| 2017 | 53,930 | 6.7 | 51.1 | 184.9 | 3727.60 |

| 2018 | 58,100 | 5.8 | 51.0 | 186.1 | 3812.43 |

| 2019 | 60,130 | 5.0 | 50.3 | 192.1 | 4370.61 |

| 2020 | 62,980 | 5.7 | 52.7 | 204.6 | 4594.97 |

| Italy 2016 | 26,240 | 11.7 | 11.7 | 989.7 | 23,171.61 |

| 2017 | 26,730 | 11.2 | 12.3 | 1096 | 23,793.65 |

| 2018 | 27,030 | 10.6 | 12.7 | 1190 | 25,232.24 |

| 2019 | 27,210 | 10.0 | 12.6 | 1250.1 | 26,259.66 |

| 2020 | 24,900 | 9.2 | 12.2 | 1282.4 | 25,364.33 |

| Cyprus 2016 | 22,310 | 13.0 | 33.2 | 30.7 | 98.82 |

| 2017 | 23,400 | 11.1 | 35.1 | 32.3 | 110.21 |

| 2018 | 24,430 | 8.4 | 38.6 | 32.0 | 133.09 |

| 2019 | 25,370 | 7.1 | 38.6 | 31.9 | 164.44 |

| 2020 | 23,770 | 7.6 | 36.7 | 33.8 | 177.20 |

| Latvia 2016 | 11,110 | 9.6 | 32.5 | 68.1 | 110.404 |

| 2017 | 11,590 | 8.7 | 32.7 | 68.7 | 137.90 |

| 2018 | 12,140 | 7.4 | 28.7 | 70.0 | 186.20 |

| 2019 | 12,530 | 6.3 | 31.1 | 74.1 | 195.20 |

| 2020 | 12,150 | 8.1 | 34.9 | 77.8 | 204.90 |

| Lithuania 2016 | 12,070 | 7.9 | 34.8 | 103.3 | 327.61 |

| 2017 | 12,760 | 7.1 | 35.9 | 105.0 | 378.91 |

| 2018 | 13,400 | 6.2 | 33.9 | 104.6 | 426.31 |

| 2019 | 14,050 | 6.3 | 35.8 | 109.1 | 485.99 |

| 2020 | 14,030 | 8.5 | 37.5 | 111.9 | 571.95 |

| Luxemburg | 84,750 | 6.3 | 47.1 | 17.6 | 712.10 |

| 2017 | 84,020 | 5.5 | 44.1 | 15.4 | 720.70 |

| 2018 | 84,040 | 5.6 | 48.3 | 21.1 | 704.50 |

| 2019 | 85,030 | 5.6 | 51.8 | 23.8 | 737.80 |

| 2020 | 82,250 | 6.8 | 50.6 | 23.1 | 724.80 |

| Malta 2016 | 20,080 | 4.7 | 27.5 | 15.5 | 58.70 |

| 2017 | 21,790 | 4.0 | 35.0 | 16.1 | 65.93 |

| 2018 | 22,320 | 3.7 | 39.6 | 16.1 | 74.63 |

| 2019 | 22,730 | 3.6 | 42.5 | 16.1 | 80.05 |

| 2020 | 20,410 | 4.4 | 41.3 | 16.8 | 85.59 |

| Germany 2016 | 34,610 | 4.1 | 22.3 | 3.40 | 92,173.56 |

| 2017 | 35,410 | 3.8 | 22.9 | 3.52 | 99,553.62 |

| 2018 | 35,690 | 3.4 | 23.2 | 3.66 | 104,669.05 |

| 2019 | 35,980 | 3.1 | 23.6 | 3.77 | 110,025.41 |

| 2020 | 34,310 | 3.8 | 25.2 | 3.96 | 105,596.20 |

| Portugal 2016 | 17,010 | 11.2 | 28.4 | 222.3 | 2388.47 |

| 2017 | 17,650 | 9.0 | 30.4 | 244.8 | 2585.10 |

| 2018 | 18,190 | 7.1 | 30.8 | 253.2 | 2769.07 |

| 2019 | 18,670 | 6.5 | 31.1 | 271.0 | 2991.864 |

| 2020 | 17,070 | 6.9 | 33.6 | 301.9 | 3202.86 |

| Slovakia 2016 | 14,550 | 9.7 | 24.3 | 135.3 | 640.84 |

| 2017 | 14,960 | 8.1 | 27.5 | 143.6 | 748.96 |

| 2018 | 15,510 | 6.5 | 30.8 | 147.0 | 750.95 |

| 2019 | 15,890 | 5.8 | 36.6 | 147.5 | 776.59 |

| 2020 | 15,180 | 6.7 | 36.8 | 142.8 | 838.93 |

| Slovenia 2016 | 18,550 | 8.0 | 13.7 | 56.1 | 811.95 |

| 2017 | 19,440 | 6.6 | 18.1 | 56.4 | 802.29 |

| 2018 | 20,240 | 5.1 | 16.4 | 59.9 | 892.72 |

| 2019 | 20,720 | 4.5 | 14.6 | 58.6 | 990.69 |

| 2020 | 19,720 | 5.0 | 17.3 | 62.8 | 1007.49 |

| Spain 2016 | 23,760 | 19.6 | 23.9 | 1,250.9 | 13,260.00 |

| 2017 | 24,430 | 17.2 | 24.4 | 1,299.5 | 14,063.00 |

| 2018 | 24,880 | 15.3 | 25.1 | 1,358.2 | 14,946.00 |

| 2019 | 25,200 | 14.1 | 26.9 | 1,447.2 | 15,572.00 |

| 2020 | 22,350 | 15.5 | 28.2 | 1,567.6 | 15,768.00 |

| 6 | 7 | 8 | 9 | 10 | |

| Enterprises that employ ICT specialists | Enterprises that provided training to develop/upgrade ICT skills of their personnel | Digital inclusion—individuals | Exports of goods and services in % of GDP | Imports of goods and services in % of GDP | |

| Austria 2016 | 25 | 13 | 82 | 52.4 | 48.6 |

| 2017 | 23 | 15 | 85 | 54.1 | 50.9 |

| 2018 | 20 | 10 | 85 | 55.4 | 52.4 |

| 2019 | 20 | 10 | 86 | 55.4 | 52.0 |

| 2020 | 20 | 11 | 86 | 51.4 | 48.6 |

| Belgium 2016 | 26 | 15 | 84 | 79.4 | 78.2 |

| 2017 | 29 | 17 | 86 | 83.2 | 82.1 |

| 2018 | 28 | 17 | 87 | 83.0 | 83.3 |

| 2019 | 28 | 18 | 89 | 82.2 | 81.5 |

| 2020 | 30 | 18 | 90 | 80.0 | 78.6 |

| Estonia 2016 | 15 | 7 | 85 | 77.0 | 73.4 |

| 2017 | 15 | 7 | 86 | 75.8 | 71.8 |

| 2018 | 13 | 7 | 87 | 74.5 | 71.9 |

| 2019 | 15 | 9 | 88 | 74.0 | 69.9 |

| 2020 | 17 | 10 | 88 | 71.2 | 70.7 |

| Finland 2016 | 24 | 15 | 91 | 34.8 | 36.1 |

| 2017 | 26 | 15 | 92 | 37.5 | 37.5 |

| 2018 | 26 | 15 | 93 | 38.5 | 39.7 |

| 2019 | 26 | 15 | 93 | 39.9 | 39.7 |

| 2020 | 28 | 15 | 95 | 36.2 | 35.9 |

| France 2016 | 16 | 9 | 82 | 30.2 | 30.9 |

| 2017 | 17 | 9 | 83 | 30.9 | 32.0 |

| 2018 | 17 | 9 | 85 | 31.7 | 32.7 |

| 2019 | 17 | 9 | 87 | 31.6 | 32.5 |

| 2020 | 18 | 8 | 87 | 27.9 | 29.9 |

| Greece 2016 | 30 | 10 | 66 | 31.3 | 32.7 |

| 2017 | 20 | 8 | 67 | 35.0 | 36.5 |

| 2018 | 22 | 9 | 70 | 39.0 | 41.2 |

| 2019 | 22 | 9 | 74 | 40.1 | 41.9 |

| 2020 | 19 | 8 | 77 | 32.0 | 39.6 |

| Netherlands 2016 | 26 | 14 | 92 | 79.5 | 69.3 |

| 2017 | 27 | 16 | 94 | 83.4 | 72.6 |

| 2018 | 27 | 17 | 94 | 84.7 | 74.1 |

| 2019 | 25 | 16 | 95 | 82.5 | 72.7 |

| 2020 | 24 | 15 | 93 | 77.9 | 67.4 |

| Ireland 2016 | 35 | 13 | 79 | 121.5 | 105.9 |

| 2017 | 33 | 14 | 79 | 121.1 | 99.0 |

| 2018 | 32 | 14 | 80 | 123.0 | 94.4 |

| 2019 | 32 | 14 | 88 | 127.9 | 124.4 |

| 2020 | 30 | 12 | 89 | 131.1 | 108.8 |

| Italy 2016 | 17 | 5 | 67 | 29.3 | 26.0 |

| 2017 | 16 | 6 | 69 | 30.7 | 27.9 |

| 2018 | 16 | 7 | 72 | 31.4 | 28.9 |

| 2019 | 16 | 8 | 74 | 31.6 | 28.3 |

| 2020 | 13 | 8 | 76 | 29.4 | 25.7 |

| Cyprus 2016 | 25 | 13 | 74 | 70.5 | 68.8 |

| 2017 | 25 | 12 | 79 | 73.9 | 74.4 |

| 2018 | 23 | 12 | 84 | 75.1 | 73.8 |

| 2019 | 23 | 12 | 85 | 75.6 | 75.4 |

| 2020 | 25 | 12 | 91 | 76.0 | 78.6 |

| Latvia 2016 | 17 | 5 | 77 | 59.6 | 59.3 |

| 2017 | 14 | 5 | 78 | 61.6 | 62.2 |

| 2018 | 15 | 5 | 81 | 61.5 | 62.2 |

| 2019 | 20 | 8 | 84 | 59.8 | 60.5 |

| 2020 | 20 | 7 | 87 | 60.3 | 59.2 |

| Lithuania 2016 | 15 | 6 | 72 | 67.6 | 66.9 |

| 2017 | 18 | 6 | 75 | 73.6 | 71.3 |

| 2018 | 17 | 5 | 78 | 75.2 | 73.4 |

| 2019 | 15 | 6 | 81 | 77.3 | 72.1 |

| 2020 | 16 | 7 | 82 | 73.5 | 64.2 |

| Luxemburg | 24 | 15 | 97 | 191.1 | 157.3 |

| 2017 | 24 | 16 | 96 | 192.7 | 161.0 |

| 2018 | 24 | 15 | 92 | 196.4 | 163.7 |

| 2019 | 25 | 16 | 93 | 205.5 | 174.6 |

| 2020 | 22 | 13 | 96 | 204.7 | 171.6 |

| Malta 2016 | 26 | 12 | 77 | 151.3 | 140.9 |

| 2017 | 24 | 13 | 80 | 150.4 | 132.7 |

| 2018 | 24 | 13 | 80 | 141.3 | 124.7 |

| 2019 | 27 | 14 | 85 | 140.6 | 124.6 |

| 2020 | 29 | 16 | 86 | 142.8 | 130.9 |

| Germany 2016 | 22 | 12 | 87 | 46.1 | 38.7 |

| 2017 | 19 | 12 | 87 | 47.2 | 40.1 |

| 2018 | 20 | 13 | 90 | 47.3 | 41.1 |

| 2019 | 19 | 13 | 91 | 46.6 | 41.0 |

| 2020 | 19 | 12 | 93 | 43.4 | 37.7 |

| Portugal 2016 | 19 | 10 | 68 | 40.2 | 39.1 |

| 2017 | 20 | 11 | 71 | 42.7 | 41.7 |

| 2018 | 19 | 9 | 71 | 43.4 | 43.0 |

| 2019 | 21 | 11 | 73 | 43.5 | 43.1 |

| 2020 | 20 | 10 | 76 | 37.0 | 39.1 |

| Slovakia 2016 | 20 | 11 | 78 | 93.8 | 90.8 |

| 2017 | 20 | 9 | 79 | 95.3 | 93.1 |

| 2018 | 18 | 9 | 78 | 96.3 | 94.4 |

| 2019 | 18 | 9 | 82 | 92.3 | 91.9 |

| 2020 | 17 | 9 | 88 | 85.4 | 84.5 |

| Slovenia 2016 | 20 | 13 | 73 | 77.6 | 69.1 |

| 2017 | 19 | 13 | 77 | 83.1 | 74.1 |

| 2018 | 20 | 13 | 79 | 84.8 | 76.4 |

| 2019 | 18 | 11 | 81 | 84.0 | 75.3 |

| 2020 | 17 | 11 | 85 | 77.9 | 68.7 |

| Spain 2016 | 25 | 13 | 76 | 33.9 | 29.9 |

| 2017 | 21 | 11 | 80 | 35.1 | 31.5 |

| 2018 | 18 | 10 | 83 | 35.2 | 32.4 |

| 2019 | 17 | 9 | 88 | 35.0 | 32.0 |

| 2020 | 17 | 9 | 91 | 30.6 | 29.1 |

| 12 | 13 | 14 | 15 | 16 | |

| People at risk of poverty or social exclusion | Self-reported unmet needs for medical examination | Inability to face unexpected financial expenses | Arrears (mortgage or rent, utility bills or hire purchase) | Energy efficiency | |

| Austria 2016 | 18.0 | 0.1 | 22.6 | 6.5 | 32.04 |

| 2017 | 18.1 | 0.2 | 20.6 | 5.9 | 32.82 |

| 2018 | 17.5 | 0.1 | 20.1 | 4.9 | 31.82 |

| 2019 | 16.9 | 0.2 | 18.5 | 4.3 | 32.27 |

| 2020 | 17.5 | 0.1 | 17.6 | 5.3 | 29.73 |

| Belgium 2016 | 20.9 | 2.5 | 26.0 | 7.0 | 48.45 |

| 2017 | 20.6 | 2.4 | 25.5 | 5.4 | 48.49 |

| 2018 | 20.0 | 2.0 | 24.5 | 6.1 | 46.47 |

| 2019 | 19.5 | 1.9 | 25.3 | 5.5 | 48.41 |

| 2020 | 18.9 | 1.6 | 23.3 | 5.6 | 43.88 |

| Estonia 2016 | 24.4 | 0.3 | 31.6 | 8.9 | 5.90 |

| 2017 | 23.4 | 0.7 | 36.3 | 7.3 | 5.65 |

| 2018 | 24.4 | 0.7 | 34.7 | 8.0 | 6.06 |

| 2019 | 24.3 | 0.5 | 31.4 | 8.5 | 4.71 |

| 2020 | 23.3 | 0.6 | 30.5 | 6.0 | 4.31 |

| Finland 2016 | 16.6 | 0 | 29.4 | 10.9 | 32.22 |

| 2017 | 15.7 | 0.0 | 28.5 | 10.8 | 32.09 |

| 2018 | 16.5 | 0.0 | 27.2 | 10.7 | 32.73 |

| 2019 | 15.6 | 0.1 | 26.4 | 10.5 | 32.01 |

| 2020 | 16.0 | 0.0 | 25.4 | 10.0 | 29.80 |

| France 2016 | 18.2 | 0.6 | 31.8 | 8.8 | 239.95 |

| 2017 | 17.0 | 0.9 | 29.6 | 9.1 | 239.19 |

| 2018 | 17.4 | 0.9 | 31.4 | 9.1 | 238.60 |

| 2019 | 17.9 | 0.9 | 30.6 | 8.4 | 235.16 |

| 2020 | 18.2 | 0.9 | 30.4 | 8.9 | 208.36 |

| Greece 2016 | 35.6 | 9.2 | 53.6 | 47.9 | 23.06 |

| 2017 | 34.8 | 6.2 | 52.7 | 44.9 | 23.24 |

| 2018 | 31.8 | 7.1 | 50.4 | 43.0 | 22.61 |

| 2019 | 30.0 | 5.9 | 47.8 | 41.4 | 22.26 |

| 2020 | 28.9 | 3.8 | 50.4 | 36.5 | 19.68 |

| Netherlands 2016 | 16.7 | 0 | 22.5 | 5.0 | 64.92 |

| 2017 | 17.0 | 0.0 | 20.7 | 4.6 | 64.87 |

| 2018 | 16.7 | 0.1 | 21.5 | 3.8 | 64.23 |

| 2019 | 16.5 | 0.1 | 21.9 | 4.0 | 63.46 |

| 2020 | 16.1 | 0.2 | 19.1 | 3.2 | 58.38 |

| Ireland 2016 | 24.4 | 1.7 | 45.2 | 15.4 | 14.70 |

| 2017 | 22.7 | 1.5 | 41.6 | 13.0 | 14.36 |

| 2018 | 21.1 | 1.0 | 37.3 | 11.2 | 14.62 |

| 2019 | 20.6 | 1.0 | 38.0 | 11.9 | 14.69 |

| 2020 | 20.9 | 0.8 | 35.6 | 15.1 | 13.43 |

| Italy 2016 | 30.0 | 3.2 | 40.4 | 10.7 | 147.97 |

| 2017 | 28.9 | 1.3 | 38.3 | 6.1 | 148.95 |

| 2018 | 27.3 | 1.6 | 35.1 | 6.0 | 147.24 |

| 2019 | 25.6 | 1.1 | 33.8 | 5.9 | 145.89 |

| 2020 | 26 | 1 | 34 | 6 | 132.32 |

| Cyprus 2016 | 27.7 | 0.6 | 56.6 | 26.6 | 2.42 |

| 2017 | 25.2 | 1.6 | 50.1 | 24.8 | 2.53 |

| 2018 | 23.9 | 1.5 | 49.5 | 21.6 | 2.55 |

| 2019 | 22.3 | 1.2 | 47.5 | 17.6 | 2.54 |

| 2020 | 21.3 | 0.4 | 44.6 | 14.7 | 2.20 |

| Latvia 2016 | 28.5 | 0.8 | 60.0 | 14.9 | 4.29 |

| 2017 | 28.2 | 4.1 | 59.9 | 14.0 | 4.47 |

| 2018 | 28.4 | 3.8 | 55.3 | 13.8 | 4.69 |

| 2019 | 27.3 | 2.6 | 49.8 | 9.9 | 4.56 |

| 2020 | 26.0 | 2.9 | 45.6 | 9.7 | 4.26 |

| Lithuania 2016 | 30.1 | 0.0 | 53.2 | 10.7 | 6.04 |

| 2017 | 29.6 | 0.3 | 50.6 | 8.7 | 6.16 |

| 2018 | 28.3 | 0.4 | 48.8 | 10.3 | 6.37 |

| 2019 | 26.3 | 0.2 | 46.8 | 8.2 | 6.28 |

| 2020 | 24.8 | 0.1 | 41.8 | 7.1 | 6.23 |

| Luxemburg | 19.1 | 0.4 | 21.9 | 6.6 | 4.15 |

| 2017 | 19.4 | 0.3 | 20.4 | 3.0 | 4.29 |

| 2018 | 20.7 | 0.3 | 19.7 | 4 | 4.46 |

| 2019 | 20.6 | 0.2 | 16.7 | 4 | 4.50 |

| 2020 | 20.9 | 0.1 | 22.5 | 4.9 | 3.94 |

| Malta 2016 | 20.3 | 0.7 | 20.8 | 10.4 | 0.71 |

| 2017 | 19.3 | 0.0 | 15.6 | 6.5 | 0.81 |

| 2018 | 19.0 | 0.0 | 13.9 | 8.1 | 0.82 |

| 2019 | 20.1 | 0.0 | 15.1 | 7.8 | 0.87 |

| 2020 | 19.0 | 0.0 | 16.3 | 7.0 | 0.74 |

| Germany 2016 | 19.7 | 0.2 | 30.0 | 4.2 | 297.63 |

| 2017 | 19.0 | 0.1 | 29.3 | 4.4 | 298.12 |

| 2018 | 18.7 | 0.1 | 28.1 | 4.6 | 291.95 |

| 2019 | 17.4 | 0.1 | 26.0 | 3.7 | 285.24 |

| 2020 | 24.0 | 0.1 | 37.9 | 5.1 | 262.49 |

| Portugal 2016 | 25.1 | 1.0 | 38.3 | 9.3 | 21.76 |

| 2017 | 23.3 | 1.8 | 36.9 | 7.7 | 22.81 |

| 2018 | 21.6 | 1.4 | 34.7 | 6.6 | 22.64 |

| 2019 | 21.6 | 1.2 | 33.0 | 5.8 | 22.05 |

| 2020 | 19.8 | 1.1 | 30.8 | 5.4 | 19.54 |

| Slovakia 2016 | 18.1 | 0.4 | 37.9 | 7.5 | 15.37 |

| 2017 | 16.3 | 0.7 | 34.6 | 7.4 | 16.15 |

| 2018 | 16.3 | 0.5 | 31.5 | 9.9 | 15.79 |

| 2019 | 16.4 | 0.5 | 30.0 | 10.2 | 15.98 |

| 2020 | 14.8 | 0.7 | 26.1 | 6.7 | 15.15 |

| Slovenia 2016 | 18.4 | 0 | 41.7 | 17.4 | 6.55 |

| 2017 | 17.1 | 0.2 | 37.1 | 15.2 | 6.73 |

| 2018 | 16.2 | 0.1 | 33.1 | 13.6 | 6.65 |

| 2019 | 14.4 | 0.0 | 33.0 | 12.2 | 6.52 |

| 2020 | 15.0 | 0.1 | 29.6 | 10.3 | 6.13 |

| Spain 2016 | 27.9 | 0.2 | 38.7 | 10.6 | 118.46 |

| 2017 | 26.6 | 0.1 | 36.6 | 9.3 | 124.94 |

| 2018 | 26.1 | 0.1 | 35.9 | 9.4 | 124.33 |

| 2019 | 25.3 | 0.0 | 33.9 | 8.1 | 120.66 |

| 2020 | 26.4 | 0.0 | 35.4 | 13.5 | 105.03 |

| 17 | 18 | 19 | 20 | 21 | |

| Energy imports dependency | Share of fossil fuels in gross available energy | Employment in technology and knowledge-intensive sectors | Harmonised Indices of Consumer Prices (HICPs) all items—annual average indices | Trade volume indices, by reporting country | |

| Austria 2016 | 62.09 | 67.96 | 182.5 | 100.97 | 98.6 |

| 2017 | 63.93 | 68.55 | 186.0 | 103.22 | 103.7 |

| 2018 | 64.23 | 68.31 | 179.1 | 105.41 | 106.1 |

| 2019 | 71.62 | 69.23 | 171.8 | 106.98 | 106.6 |

| 2020 | 58.32 | 66.83 | 175.0 | 108.47 | 98.7 |

| Belgium 2016 | 75.89 | 75.53 | 196.7 | 101.77 | 103.4 |

| 2017 | 75.26 | 76.04 | 211.3 | 104.03 | 104.1 |

| 2018 | 82.97 | 79.65 | 230.5 | 106.44 | 105.2 |

| 2019 | 77.59 | 76.47 | 245.1 | 107.77 | 105.4 |

| 2020 | 78.06 | 76.49 | 243.7 | 108.23 | 99.1 |

| Estonia 2016 | 8.11 | 86.83 | 34.8 | 100.80 | 103.4 |

| 2017 | 4.69 | 86.19 | 36.4 | 104.48 | 108.4 |

| 2018 | 1.01 | 84.69 | 36.4 | 108.05 | 116.7 |

| 2019 | 4.83 | 72.75 | 38.3 | 110.50 | 116.5 |

| 2020 | 11.05 | 66.14 | 38.0 | 109.80 | 117.6 |

| Finland 2016 | 46.19 | 47.21 | 138.1 | 100.39 | 100.2 |

| 2017 | 43.98 | 44.80 | 140.3 | 101.23 | 108.9 |

| 2018 | 44.86 | 44.97 | 146.3 | 102.42 | 111.2 |

| 2019 | 42.14 | 42.72 | 155.6 | 103.58 | 114.0 |

| 2020 | 42.02 | 41.42 | 167.8 | 103.98 | 106.2 |

| France 2016 | 47.40 | 50.30 | 1.0655 | 100.31 | 100.1 |

| 2017 | 48.80 | 50.91 | 1.0779 | 101.47 | 101.3 |

| 2018 | 46.85 | 49.22 | 1.1048 | 103.60 | 102.8 |

| 2019 | 47.56 | 49.63 | 1.1820 | 104.95 | 103.6 |

| 2020 | 44.47 | 47.94 | 1.2273 | 105.50 | 86.2 |

| Greece 2016 | 72.91 | 86.36 | 90.4 | 100.02 | 106.3 |

| 2017 | 71.28 | 86.99 | 93.8 | 101.15 | 109.6 |

| 2018 | 70.68 | 85.86 | 105.6 | 101.94 | 118.9 |

| 2019 | 74.19 | 84.54 | 116.0 | 102.46 | 121.9 |

| 2020 | 81.78 | 81.75 | 119.5 | 101.17 | 124.8 |

| Netherlands 2016 | 45.93 | 94.01 | 335.0 | 100.11 | 103.5 |

| 2017 | 51.85 | 93.93 | 326.8 | 101.40 | 110.4 |

| 2018 | 59.43 | 92.85 | 339.3 | 103.02 | 113.0 |

| 2019 | 64.29 | 92.35 | 368.9 | 105.78 | 114.9 |

| 2020 | 67.89 | 90.40 | 388.1 | 106.96 | 111.3 |

| Ireland 2016 | 69.08 | 92.90 | 179.8 | 99.8 | 107.1 |

| 2017 | 66.88 | 91.33 | 183.3 | 100.1 | 110.0 |

| 2018 | 67.56 | 90.24 | 181.3 | 100.8 | 127.7 |

| 2019 | 68.70 | 88.84 | 187.5 | 101.7 | 135.7 |

| 2020 | 71.30 | 87.36 | 210.1 | 101.2 | 143.4 |

| Italy 2016 | 77.65 | 81.34 | 779.5 | 99.9 | 101.5 |

| 2017 | 76.98 | 80.18 | 774.5 | 101.3 | 106.6 |

| 2018 | 76.34 | 79.30 | 812.7 | 102.5 | 106.4 |

| 2019 | 77.48 | 79.26 | 854.4 | 103.2 | 106.4 |

| 2020 | 73.45 | 77.70 | 879.9 | 103.0 | 95.9 |

| Cyprus 2016 | 95.84 | 94.10 | 10.7 | 98.78 | 106.6 |

| 2017 | 95.93 | 93.68 | 11.7 | 99.45 | 111.0 |

| 2018 | 92.49 | 91.79 | 12.8 | 100.23 | 153.1 |

| 2019 | 92.79 | 91.52 | 11.8 | 100.78 | 135.2 |

| 2020 | 93.08 | 89.04 | 13.4 | 99.67 | 136.2 |

| Latvia 2016 | 47.15 | 63.61 | 27.9 | 100.10 | 102.7 |

| 2017 | 44.05 | 59.89 | 31.8 | 103.00 | 111.2 |

| 2018 | 44.31 | 59.83 | 31.9 | 105.63 | 115.6 |

| 2019 | 43.91 | 61.20 | 29.8 | 108.53 | 118.2 |

| 2020 | 45.48 | 57.34 | 35.3 | 108.62 | 122.2 |

| Lithuania 2016 | 74.78 | 67.44 | 33.3 | 100.68 | 103.2 |

| 2017 | 71.96 | 66.40 | 33.4 | 104.42 | 113.8 |

| 2018 | 73.89 | 66.07 | 40.1 | 107.07 | 115.5 |

| 2019 | 75.20 | 66.31 | 44.1 | 109.47 | 120.7 |

| 2020 | 74.91 | 67.16 | 44.7 | 110.63 | 122.4 |

| Luxemburg | 96.29 | 81.79 | 9.3 | 100.04 | 96.2 |

| 2017 | 95.58 | 81.62 | 10.4 | 102.15 | 90.9 |

| 2018 | 95.18 | 81.70 | 11.9 | 104.21 | 88.5 |

| 2019 | 95.04 | 81.81 | 12.5 | 105.93 | 92.1 |

| 2020 | 92.46 | 78.62 | 12.4 | 105.93 | 77.2 |

| Malta 2016 | 101.08 | 93.69 | 12.7 | 100.90 | 126.6 |

| 2017 | 103.05 | 96.18 | 12.6 | 102.18 | 110.2 |

| 2018 | 97.53 | 96.77 | 12.9 | 103.95 | 111.9 |

| 2019 | 97.28 | 96.73 | 14.6 | 105.54 | 118.6 |

| 2020 | 97.56 | 96.85 | 15.5 | 106.37 | 97.5 |

| Germany 2016 | 63.75 | 82.26 | 1.6704 | 100.4 | 100.5 |

| 2017 | 63.96 | 82.22 | 1.7037 | 102.1 | 103.8 |

| 2018 | 63.48 | 81.40 | 1.7382 | 104.0 | 104.6 |

| 2019 | 67.06 | 80.02 | 1.7620 | 105.5 | 101.9 |

| 2020 | 63.67 | 78.38 | 2.2185 | 105.8 | 91.8 |

| Portugal 2016 | 72.24 | 76.15 | 125.2 | 100.64 | 102.0 |

| 2017 | 77.96 | 79.44 | 134.1 | 102.20 | 107.2 |

| 2018 | 75.65 | 76.32 | 143.2 | 103.40 | 109.2 |

| 2019 | 73.86 | 74.44 | 154.8 | 103.71 | 111.7 |

| 2020 | 65.26 | 70.58 | 173.0 | 103.58 | 102.2 |

| Slovakia 2016 | 60.55 | 65.12 | 103.3 | 99.52 | 100.9 |

| 2017 | 64.85 | 66.15 | 111.8 | 100.90 | 101.5 |

| 2018 | 63.68 | 66.80 | 110.6 | 103.46 | 105.0 |

| 2019 | 69.76 | 62.41 | 117.2 | 106.33 | 102.2 |

| 2020 | 56.22 | 62.08 | 133.9 | 108.47 | 95.8 |

| Slovenia 2016 | 49.02 | 64.65 | 50.3 | 99.85 | 104.9 |

| 2017 | 50.77 | 63.95 | 54.5 | 101.40 | 115.4 |

| 2018 | 51.21 | 65.00 | 53.7 | 103.36 | 123.3 |

| 2019 | 52.12 | 63.98 | 56.1 | 105.11 | 129.7 |

| 2020 | 45.80 | 61.16 | 68.0 | 104.82 | 126.8 |

| Spain 2016 | 71.47 | 74.56 | 656.6 | 99.66 | 103.8 |

| 2017 | 73.87 | 76.28 | 706.2 | 101.69 | 106.9 |

| 2018 | 73.59 | 75.51 | 699.0 | 103.46 | 107.8 |

| 2019 | 75.02 | 74.48 | 732.2 | 104.26 | 108.3 |

| 2020 | 67.89 | 70.76 | 746.5 | 103.91 | 97.3 |

| 22 | 23 | 24 | 25 | ||

| Share of trade with the EU27 | Gross domestic expenditure on R&D by sector | High-speed internet coverage | Resource productivity and domestic material consumption | ||

| Austria 2016 | 76.2 | 3.12 | 8.0 | 2.09 | |

| 2017 | 75.7 | 3.06 | 12.4 | 2.16 | |

| 2018 | 75.8 | 3.09 | 13.0 | 2.19 | |

| 2019 | 76.2 | 3.13 | 13.8 | 2.22 | |

| 2020 | 76.9 | 3.22 | 39.3 | 2.09 | |

| Belgium 2016 | 59.0 | 2.52 | 0.6 | 2.79 | |

| 2017 | 59.7 | 2.67 | 0.8 | 2.76 | |

| 2018 | 60.0 | 2.86 | 1.4 | 2.87 | |

| 2019 | 59.9 | 3.17 | 66.5 | 3.49 | |

| 2020 | 61.2 | 3.52 | 67.5 | 3.05 | |

| Estonia 2016 | 79.3 | 1.24 | 48.5 | 0.60 | |

| 2017 | 78.5 | 1.28 | 50.7 | 0.55 | |

| 2018 | 74.0 | 1.42 | 54.2 | 0.54 | |

| 2019 | 75.8 | 1.63 | 57.4 | 0.63 | |

| 2020 | 75.2 | 1.79 | 70.9 | 0.65 | |

| Finland 2016 | 69.9 | 2.72 | 31.6 | 1.25 | |

| 2017 | 68.9 | 2.73 | 31.7 | 1.23 | |

| 2018 | 67.6 | 2.76 | 31.4 | 1.19 | |

| 2019 | 68.9 | 2.8 | 61.8 | 1.31 | |

| 2020 | 71.6 | 2.94 | 66.7 | 1.29 | |

| France 2016 | 65.4 | 2.22 | 20.8 | 3.06 | |

| 2017 | 65.1 | 2.2 | 28.3 | 2.90 | |

| 2018 | 64.5 | 2.2 | 37.8 | 3.02 | |

| 2019 | 63.7 | 2.19 | 43.8 | 3.05 | |

| 2020 | 66.1 | 2.35 | 52.6 | 3.12 | |

| Greece 2016 | 54.2 | 1.01 | 0.4 | 1.40 | |

| 2017 | 52.8 | 1.15 | 0.4 | 1.47 | |

| 2018 | 50.1 | 1.21 | 0.4 | 1.51 | |

| 2019 | 51.3 | 1.27 | 7.1 | 1.68 | |

| 2020 | 57.1 | 1.49 | 10.2 | 1.77 | |

| Netherlands 2016 | 41.6 | 2.15 | 31.2 | 4.17 | |

| 2017 | 40.9 | 2.18 | 31.9 | 4.63 | |

| 2018 | 40.2 | 2.14 | 32.2 | 4.60 | |

| 2019 | 40.3 | 2.18 | 88.6 | 4.97 | |

| 2020 | 41.7 | 2.29 | 89.8 | 4.90 | |

| Ireland 2016 | 37.4 | 1.18 | 5.5 | 2.59 | |

| 2017 | 38.4 | 1.26 | 8.3 | 2.65 | |

| 2018 | 38.0 | 1.17 | 12.9 | 2.68 | |

| 2019 | 38.1 | 1.23 | 35.4 | 2.75 | |

| 2020 | 37.9 | 1.23 | 83.3 | 3.12 | |

| Italy 2016 | 57.7 | 1.37 | 18.8 | 3.46 | |

| 2017 | 57.3 | 1.37 | 21.7 | 3.53 | |

| 2018 | 56.2 | 1.42 | 23.9 | 3.52 | |

| 2019 | 57.0 | 1.47 | 30.0 | 3.56 | |

| 2020 | 58.3 | 1.54 | 33.7 | 3.54 | |

| Cyprus 2016 | 60.7 | 0.52 | 1 | 1.43 | |

| 2017 | 54.6 | 0.55 | 1 | 1.26 | |

| 2018 | 51.0 | 0.62 | 0.5 | 1.34 | |

| 2019 | 59.2 | 0.74 | 10.1 | 1.30 | |

| 2020 | 57.8 | 0.85 | 26.2 | 1.30 | |

| Latvia 2016 | 78.0 | 0.44 | 85.2 | 1.09 | |

| 2017 | 75.8 | 0.51 | 85.7 | 1.00 | |

| 2018 | 72.1 | 0.64 | 87.8 | 0.96 | |

| 2019 | 74.9 | 0.64 | 88.1 | 1.03 | |

| 2020 | 76.1 | 0.7 | 88.1 | 1.04 | |

| Lithuania 2016 | 68.3 | 0.84 | 50.1 | 0.85 | |

| 2017 | 67.4 | 0.9 | 54.4 | 0.79 | |

| 2018 | 66.1 | 0.94 | 60.6 | 0.83 | |

| 2019 | 66.4 | 1 | 61.0 | 0.81 | |

| 2020 | 70.7 | 1.17 | 67.1 | 0.82 | |

| Luxemburg | 76.3 | 1.3 | 51.5 | 3.95 | |

| 2017 | 81.8 | 1.27 | 57.2 | 3.80 | |

| 2018 | 86.6 | 1.17 | 63.4 | 4.12 | |

| 2019 | 83.5 | 1.16 | 92.0 | 4.10 | |

| 2020 | 89.0 | 1.13 | 95.1 | 4.47 | |

| Malta 2016 | 49.5 | 0.56 | 16.0 | 1.66 | |

| 2017 | 54.6 | 0.55 | 23.0 | 2.09 | |

| 2018 | 63.1 | 0.57 | 31.6 | 1.88 | |

| 2019 | 53.9 | 0.57 | 100.0 | 2.13 | |

| 2020 | 57.3 | 0.66 | 100.0 | 1.90 | |

| Germany 2016 | 62.2 | 2.94 | 7.1 | 2.53 | |

| 2017 | 62.2 | 3.05 | 7.3 | 2.52 | |

| 2018 | 62.7 | 3.11 | 8.5 | 2.68 | |

| 2019 | 63.1 | 3.17 | 32.7 | 2.80 | |

| 2020 | 63.1 | 3.14 | 55.9 | 2.75 | |

| Portugal 2016 | 74.9 | 1.28 | 49.6 | 1.19 | |

| 2017 | 73.7 | 1.32 | 63.6 | 1.12 | |

| 2018 | 73.4 | 1.35 | 70.2 | 1.16 | |

| 2019 | 73.8 | 1.4 | 83.0 | 1.16 | |

| 2020 | 74.7 | 1.58 | 86.6 | 1.09 | |

| Slovakia 2016 | 78.8 | 0.79 | 39.5 | 1.21 | |

| 2017 | 78.6 | 0.89 | 41.3 | 1.20 | |

| 2018 | 78.5 | 0.84 | 42.9 | 1.18 | |

| 2019 | 78.9 | 0.83 | 45.5 | 1.33 | |

| 2020 | 80.3 | 0.92 | 50.2 | 1.33 | |

| Slovenia 2016 | 69.6 | 2.01 | 50.4 | 1.51 | |

| 2017 | 68.2 | 1.87 | 52.2 | 1.55 | |

| 2018 | 66.0 | 1.95 | 61.1 | 1.46 | |

| 2019 | 62.2 | 2.05 | 63.8 | 1.60 | |

| 2020 | 58.7 | 2.15 | 65.6 | 1.53 | |

| Spain 2016 | 57.5 | 1.19 | 62.8 | 2.77 | |

| 2017 | 55.7 | 1.21 | 71.4 | 2.79 | |

| 2018 | 54.7 | 1.24 | 77.4 | 2.66 | |

| 2019 | 54.6 | 1.25 | 89.0 | 2.80 | |

| 2020 | 56.7 | 1.41 | 91.7 | 2.76 |

References

- Madni, A.M.; Jackson, S. Towards a Conceptual Framework for Resilience Engineering. IEEE Syst. J. 2009, 3, 181–191. Available online: https://www.researchgate.net/publication/224436791_Towards_a_Conceptual_Framework_for_Resilience_Engineering (accessed on 3 February 2022). [CrossRef]

- Gibson, C.A.; Tarrant, M. A ‘conceptual models’ approach to organizational resilience. Aust. J. Emerg. Manag. 2010, 25, 6–12. Available online: https://www.researchgate.net/publication/285685600_A_’conceptual_models’_approach_to_organisational_resilience_Gibson_and_tarrant_discuss_the_range_of_inter-dependant_factors_needed_to_manage_organisational_resilience (accessed on 3 February 2022).

- Rožman, M.; Peša, A.; Rajko, M.; Štrukelj, T. Building Organisational Sustainability during the COVID-19 Pandemic with an Inspiring Work Environment. Sustainability 2021, 13, 1747. Available online: https://www.researchgate.net/publication/355506833_Building_Organisational_Sustainability_during_the_COVID-19_Pandemic_with_an_Inspiring_Work_Environment (accessed on 20 February 2022). [CrossRef]

- Sensier, M.; Bristow, G.; Healy, A. Measuring Regional Economic Resilience across Europe: Operationalising a complex concept. Spat. Econ. Anal. 2016, 11, 128–151. [Google Scholar] [CrossRef]

- Sabatino, M. Competitiveness and Resilience of the Productive Districts in Sicily. The Behavior of the Sicilian Production Areas during the Economic Crisis. Contemp. Econ. 2016, 10, 233–248. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3170208 (accessed on 3 February 2022). [CrossRef][Green Version]

- Cruz-Castro, L.; Holl, A.; Rama, R.; Sanz-Menéndez, L. Economic crisis and company R&D in Spain: Do regional and policy factors matter? Ind. Innov. 2017, 25, 1–23. Available online: https://www.tandfonline.com/doi/full/10.1080/13662716.2017.1355231 (accessed on 4 February 2022). [CrossRef]

- ec.europa.eu. Available online: https://ec.europa.eu/info/sites/default/files/file_import/european-semester_thematic-factsheet_undeclared-work_en.pdf (accessed on 24 February 2022).

- Di Pietro, F.; Lecca, P.; Salotti, S. Regional Economic Resilience in the European Union: A Numerical General Equilibrium Analysis JRC Working Papers on Territorial Modelling and Analysis. 2020. Available online: https://joint-research-centre.ec.europa.eu/publications/regional-economic-resilience-european-union-numerical-general-equilibrium-analysis_en (accessed on 3 February 2022).

- Van Bergeijk, P.A.G.; Brakman, S.; van Marrewijk, C. Heterogeneous economic resilience and the great recession’s world trade collapse. Pap. Reg. Sci. 2017, 96, 3–12. [Google Scholar] [CrossRef]

- Rose, A. Defining and Measuring Economic Resilience to Disasters. Disaster Prev. Manag. 2004, 13, 307–314. Available online: https://www.researchgate.net/publication/242339162_Defining_and_Measuring_Economic_Resilience_to_Disasters (accessed on 5 February 2022). [CrossRef]

- Rose, A. Economic Resilience to Natural and Man-Made Disasters: Multidisciplinary Origins and Contextual Dimensions. Environ. Hazards 2007, 7, 383–398. Available online: https://www.researchgate.net/publication/223098001_Economic_Resilience_to_Natural_and_Man-Made_Disasters_Multidisciplinary_Origins_and_Contextual_Dimensions (accessed on 5 February 2022). [CrossRef]

- Angulo, A.; Mur, J.; Trivez, F.J. Measuring resilience to economic shocks: An application to Spain. Ann. Reg. Sci. 2018, 60, 349–373. Available online: https://www.researchgate.net/publication/313811375_Measuring_resilience_to_economic_shocks_an_application_to_Spain (accessed on 3 February 2022). [CrossRef]

- Duval, A.R.; Vogel, L. Economic Resilience to Shocks: The Role of Structural Policies. OECD J. Econ. Stud. 2008, 44, 1–38. Available online: https://www.researchgate.net/publication/227361361_Economic_Resilience_to_Shocks_The_Role_of_Structural_Policies (accessed on 18 February 2022). [CrossRef]

- Bristow, G.; Healy, A. Innovation and Regional Economic Resilience: An Exploratory Analysis. Ann. Reg. Sci. 2018, 60, 1–20. Available online: https://www.researchgate.net/publication/318715654_Innovation_and_regional_economic_resilience_an_exploratory_analysis (accessed on 5 February 2022). [CrossRef]

- Van den Berg, M.; Jaarsma, M. What drives heterogeneity in the resilience of trade: Firm-specific versus regional characteristics. Pap. Reg. Sci. 2016, 96, 13–32. [Google Scholar] [CrossRef]

- Pontarollo, N.; Serpieri, C. A composite policy tool to measure territorial resilience capacity. Socio-Econ. Plan. Sci. 2020, 70, 100669. [Google Scholar] [CrossRef]

- Davies, S. Regional Resilience in the 2008–2010 Downturn: Comparative Evidence from European Countries. Camb. J. Reg. Econ. Soc. 2011, 4, 369–382. [Google Scholar] [CrossRef]

- Fingleton, B.; Garretsen, H.; Martin, R. Recessionary Shocks and Regional Employment: Evidence on the Resilience of U.K. Regions. J. Reg. Sci. 2012, 52, 109–133. Available online: https://www.researchgate.net/publication/228288108_Recessionary_Shocks_and_Regional_Employment_Evidence_on_the_Resilience_of_UK_Regions (accessed on 15 February 2022). [CrossRef]

- Gardiner, B.; Martin, R.; Sunley, P.; Tyler, P. Spatially unbalanced growth in the British economy. J. Econ. Geogr. 2013, 13, 889–928. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Crisis Response, Choice and Resilience: Insights from Complexity Thinking. Camb. J. Reg. Econ. Soc. 2015, 8, 241–256. Available online: https://www.researchgate.net/publication/276924527_Crisis_response_choice_and_resilience_Insights_from_complexity_thinking (accessed on 4 February 2022). [CrossRef]

- Griffith-Jones, S.; Tanner, T. Financial Crises and Economic Resilience: Lessons for Disaster Risk Management and Resilience Dividends. In Realising the ‘Triple Dividend of Resilience’; Surminski, S., Tanner, T., Eds.; Springer International Publishing: New York, NY, USA, 2016; pp. 151–172. Available online: https://www.researchgate.net/publication/311169989_Financial_Crises_and_Economic_Resilience_Lessons_for_Disaster_Risk_Management_and_Resilience_Dividends#fullTextFileContent (accessed on 8 February 2022). [CrossRef]

- Doran, J.; Fingleton, B. Employment Resilience in Europe and the 2008 Economic Crisis: Insights from Micro-Level Data. Reg. Stud. 2016, 50, 644–656. [Google Scholar] [CrossRef]

- Dissart, J.C. Regional Economic Diversity and Regional Economic Stability: Research Results and Agenda. Int. Reg. Sci. Rev. 2003, 26, 423–446. Available online: https://www.researchgate.net/publication/249682405_Regional_Economic_Diversity_and_Regional_Economic_Stability_Research_Results_and_Agenda (accessed on 5 February 2022). [CrossRef]

- Christopherson, S.; Michie, J.; Tyler, P. Regional resilience: Theoretical and empirical perspectives. Camb. J. Reg. Econ. Soc. 2010, 3, 3–10. Available online: https://academic.oup.com/cjres/article/3/1/3/340777 (accessed on 5 February 2022). [CrossRef]

- Davies, A.; Tonts, M. Economic Diversity and Regional Socioeconomic Performance: An Empirical Analysis of the Western Australian Grain Belt. Geogr. Res. 2009, 48, 223–234. [Google Scholar] [CrossRef]

- Tsiapa, M.; Batsiolas, I. Firm resilience in regions of Eastern Europe during the period 2007–2011. Post-Communist Econ. 2019, 31, 19–35. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Economic crisis and regional resilience: Evidence from Greece. Pap. Reg. Sci. 2015, 96, 451–476. Available online: https://www.researchgate.net/publication/288073640_Economic_crisis_and_regional_resilience_Evidence_from_Greece (accessed on 5 February 2022). [CrossRef]

- Giannakis, E.; Bruggeman, A. Regional disparities in economic resilience in the European Union across the urban–rural divide. Reg. Stud. 2019, 54, 1200–1213. Available online: https://www.tandfonline.com/doi/full/10.1080/00343404.2019.1698720 (accessed on 5 February 2022). [CrossRef]

- Bertschek, I.; Polder, M.; Schulte, P. ICT and resilience in times of crisis: Evidence from cross-country micro moments data. Econ. Innov. New Technol. 2019, 28, 759–774. Available online: https://www.tandfonline.com/doi/full/10.1080/10438599.2018.1557417 (accessed on 8 February 2022). [CrossRef]

- Angulo, A.; Mur, J.; Trivez, J. Measure of the resilience to Spanish economic crisis: The role of specialization. Econ. Bus. Lett. 2014, 3, 263–275. Available online: https://reunido.uniovi.es/index.php/EBL/article/view/10419/10125 (accessed on 3 February 2022). [CrossRef]

- Đokić, I.; Fröhlich, Z.; Rašić Bakarić, I. The impact of the economic crisis on regional disparities in Croatia. Camb. J. Reg. Econ. Soc. 2016, 9, 179–195. Available online: https://www.econstor.eu/bitstream/10419/124317/1/ERSA2014_00455.pdf (accessed on 5 February 2022). [CrossRef]

- Cuadrado-Roura, J.R.; Maroto, A. Unbalanced regional resilience to the economic crisis in Spain: A tale of specialisation and productivity. Camb. J. Reg. Econ. Soc. 2016, 9, 153–178. Available online: https://www.researchgate.net/publication/299458006_Unbalanced_regional_resilience_to_the_economic_crisis_in_Spain_A_tale_of_specialisation_and_productivity (accessed on 5 February 2022). [CrossRef]

- Webber, D.J.; Healy, A.; Bristow, G. Regional Growth Paths and Resilience: A European Analysis. Econ. Geogr. 2018, 94, 355–375. Available online: https://eprints.whiterose.ac.uk/160635/8/G%20Bristow%20A%20Healy%20regional%20growth%20paths%20postprint.pdf (accessed on 8 February 2022). [CrossRef]

- Capello, R.; Caragliu, A.; Fratesi, U. Spatial heterogeneity in the costs of the economic crisis in Europe: Are cities sources of regional resilience? J. Econ. Geogr. 2015, 15, 951–972. [Google Scholar] [CrossRef]

- Dimian, G.; Apostu, S.A.; Vasilescu, D.; Aceleanu, M.I.; Jablonsky, J. Vulnerability and Resilience in Health Crises. Evidence from European Countries. Technol. Econ. Dev. Econ. 2021, 27, 783–810. Available online: https://journals.vilniustech.lt/index.php/TEDE/article/view/14753/10508 (accessed on 14 February 2022). [CrossRef]

- Ghosh, S.; Mastromarco, C. Exports, immigration and human capital in US states. Reg. Stud. 2018, 52, 840–852. Available online: https://www.tandfonline.com/doi/pdf/10.1080/00343404.2019.1698720 (accessed on 14 February 2022). [CrossRef]

- Petrakos, G.; Psycharis, Y. The spatial aspects of economic crisis in Greece. Camb. J. Reg. Econ. Soc. 2016, 9, 137–152. [Google Scholar] [CrossRef]

- Di Caro, P.; Fratesi, U. Regional determinants of economic resilience. Ann. Reg. Sci. 2018, 60, 235–240. Available online: https://link.springer.com/content/pdf/10.1007/s00168-017-0858-x.pdf (accessed on 14 February 2022). [CrossRef]

- Caldera Sánchez, A.; Rasmussen, M.; Röhn, O. Economic Resilience: What Role for Policies? J. Int. Commer. Econ. Policy 2016, 7, 1650009. [Google Scholar] [CrossRef]

- Mattas, K.; Tsakiridou, E. Shedding fresh light on food industry’s role: The recession’s aftermath. Trends Food Sci. Technol. 2010, 21, 212–216. Available online: https://www.academia.edu/26896285/Shedding_fresh_light_on_food_industrys_role_the_recessions_aftermath (accessed on 14 February 2022). [CrossRef]

- Williams, N.; Vorley, T.; Ketikidis, P.H. Economic resilience and entrepreneurship: A case study of the Thessaloniki City Region. Local Econ. 2013, 28, 399–415. [Google Scholar] [CrossRef]

- Jang, J.S.R. ANFIS Adaptive-Network-based Fuzzy Inference System. IEEE Trans. Syst. Man Cybern. 1993, 23, 665–685. Available online: https://www.researchgate.net/publication/3113825_ANFIS_Adaptive-Network-based_Fuzzy_Inference_System (accessed on 23 February 2022). [CrossRef]

- Sugeno, M. Industrial Applications of Fuzzy Control; Elsevier Science Ltd.: New York, NY, USA, 1985. [Google Scholar]

- Brlečić Valčić, S. Utilisation of ANFIS in analysing impact of cost structure on Croatian maritime companies development. Pomorstvo 2021, 35, 179–185. Available online: https://hrcak.srce.hr/file/377153 (accessed on 3 February 2022). [CrossRef]

- Brlečić Valčić, S.; Samodol, A.; Valčić, M. Using ANFIS in joint dynamics of monetization, financial development, public debt and unemployment analysis. Ekon. Vjesn. Rev. Contemp. Entrep. Bus. Econ. Issues 2021, 34, 23–40. Available online: https://hrcak.srce.hr/file/377941 (accessed on 3 February 2022). [CrossRef]

- Čiča, Đ.; Zeljković, M.; Tešić, S. Dynamical contact parameter identification of spindle-holder-tool assemblies using soft computing techniques. Facta Univ. Ser. Mech. Eng. 2020, 18, 565–577. Available online: http://casopisi.junis.ni.ac.rs/index.php/FUMechEng/article/view/5750 (accessed on 8 November 2022). [CrossRef]

- Abdulshahed, A.M.; Badi, I. Prediction and control of surface roughness for end milling process using ANFIS. Oper. Res. Eng. Sci. Theory Appl. 2018, 1, 1–12. Available online: https://www.researchgate.net/publication/329811425_PREDICTION_AND_CONTROL_OF_SURFACE_ROUGHNESS_FOR_END_MILLING_PROCESS_USING_ANFIS (accessed on 8 November 2022). [CrossRef]

| No. | Name of the Variable to be Analysed |

|---|---|

| 1 | Real GDP per capita |

| 2 | Unemployment rates |

| 3 | Population by educational attainment level |

| 4 | HRST by category, sex and age |

| 5 | GERD by sector of performance |

| 6 | Enterprises that employ ICT specialists |

| 7 | Enterprises that provided training to develop/upgrade ICT skills of their personnel |

| 8 | Digital inclusion—individuals |

| 9 | Exports of goods and services in % of GDP |

| 10 | Imports of goods and services in % of GDP |

| 11 | Early leavers from education and training by sex |

| 12 | People at risk of poverty or social exclusion |

| 13 | Self-reported unmet needs for medical examination |

| 14 | Inability to face unexpected financial expenses |

| 15 | Arrears (mortgage or rent, utility bills or hire purchase) |

| 16 | Energy efficiency |

| 17 | Energy imports dependency |

| 18 | Share of fossil fuels in gross available energy |

| 19 | Employment in technology and knowledge-intensive sectors |

| 20 | Harmonised Indices of Consumer Prices (HICPs)all items—annual average indices |

| 21 | Trade volume indices, by reporting country |

| 22 | Share of trade with the EU27 |

| 23 | Gross domestic expenditure on R&D by sector |

| 24 | High-speed internet coverage |

| 25 | Resource productivity and domestic material consumption |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brlečić Valčić, S.; Peša, A.; Čičin-Šain, D. Analysis of the Eurozone’s Resilience to Crises and Disturbances in the Context of EU Development Strategies—Contemporary Approach Using Anfis. Sustainability 2022, 14, 15594. https://doi.org/10.3390/su142315594

Brlečić Valčić S, Peša A, Čičin-Šain D. Analysis of the Eurozone’s Resilience to Crises and Disturbances in the Context of EU Development Strategies—Contemporary Approach Using Anfis. Sustainability. 2022; 14(23):15594. https://doi.org/10.3390/su142315594

Chicago/Turabian StyleBrlečić Valčić, Sonja, Anita Peša, and Dijana Čičin-Šain. 2022. "Analysis of the Eurozone’s Resilience to Crises and Disturbances in the Context of EU Development Strategies—Contemporary Approach Using Anfis" Sustainability 14, no. 23: 15594. https://doi.org/10.3390/su142315594

APA StyleBrlečić Valčić, S., Peša, A., & Čičin-Šain, D. (2022). Analysis of the Eurozone’s Resilience to Crises and Disturbances in the Context of EU Development Strategies—Contemporary Approach Using Anfis. Sustainability, 14(23), 15594. https://doi.org/10.3390/su142315594