Abstract

Financial inclusion has a wide range of positive effects on sustainable development, but studies indicate a lack of awareness about financial services in the large group of financially excluded individuals within the economy. This paper examines the mediating effects of financial literacy and the moderating role of social capital on the relationship between financial inclusion and sustainable development in Cameroon. A PLS-SEM model was used with 488 collected samples as empirical data from the residents of the Douala and Buea municipalities in Cameroon through a questionnaire survey. Financial inclusion was found to be positive and significantly related to financial literacy, and to have a positive and significant impact on sustainable development. Financial literacy and social capital positively and significantly affect sustainable development in Cameroon. However, financial literacy mediates, while social capital does not moderate the relationship between financial inclusion and sustainable development. The mediation is complementary because both the direct and indirect relationships are significant. The findings and contributions of this study provide useful insights and practical implications for financial institutions and governments, especially in developing countries. It provides empirical evidence and a better understanding of the link between financial inclusion and sustainable development, and the mediating effects and moderating role of financial literacy and social capital.

1. Introduction

The global financial crisis of 2009 and the subsequent recession in many parts of the world, coupled with the inability of many African countries including Cameroon to achieve the mandate of the millennium development goals (MDGs), exposed how backward these countries are. The presence of factors such as poverty, limited access to finance and education, and policies have hindered the sustainable development of Cameroon [1]. Cameroon experienced very slight economic growth in 2019, but it was not inclusive enough to contribute to human capital development meaningfully.

In terms of social indicators, the country has failed to achieve universal basic education [1]. According to the World Bank [2], the data for sustainable development goals (SDGs) concerning poverty show that Cameroon faces great socioeconomic inequality between rural areas (where the poverty level is close to 70%) and urban areas (where the poverty rate is around 5%). According to the World Bank’s CPIA macroeconomic score indicators, Cameroon lags behind the average for SDG compliance even though there have been considerable improvements in policies and institutions since 2016. Thus, to help improve the situation, the government and some other organizations, institutions, and agencies are trying to engage the private sector to promote economic growth and diversification. However, private sector organizations are concentrated on health and nutrition, and ignore other vital sectors such as education and financial inclusion.

The UN developed sustainable development goals (SDGs) to complement the leftover MDGs. Thus, many developing countries, particularly Cameroon, developed strategies to reduce poverty and other social vices among citizens to achieve economic growth and sustainable development. Among many areas identified by scholars are areas of financial inclusion, which dwarf the economy of many developing countries, including Cameroon. Hence, many researchers are focused on financial inclusion, financial literacy, and sustainable development issues. According to Alshebami and Aldhyani [3], financial literacy or awareness is necessary to achieve and maintain well-being among people in general, and young people in particular, in today’s economy.

Some studies in the literature have indicated that many developing countries in Africa face severe macroeconomic problems, ranging from uneven financial stability increasing income inequality to acute poverty and unemployment [4,5]. Researchers have suggested using financial inclusion (FI) to improve access to financial services for every segment of society [6,7,8]. The literature established that FI had been a subject of economic research in recent times [9,10,11]. Thus, FI attempts to encourage underprivileged individuals to enjoy financial services. Moreover, FI is now viewed as a policy tool for achieving diverse macroeconomic goals.

Furthermore, FI facilitates capital mobility, creates investment opportunities, promotes savings, improves financial stability, and drives economic progress to achieve sustainable development [12,13,14,15,16,17]. FI has a wide range of positive effects on economic development. It offers low-cost basic financial and banking services to struggling consumers and those who cannot access regular banking services, and it expands access to financial services for low-income individuals [18]. However, it may be hampered by a lack of financial literacy, preventing financial services from being capitalized to their full potential, thus diluting its impact on sustainable development [8,19,20]. Financial literacy is the ability of an individual to become familiar and/or knowledgeable with financial market products so that they can make informed decisions.

Scholars emphasize the significance of FI, highlighting its role in facilitating easy access to useful and affordable financial products and services. It has recently received much attention from policymakers and practitioners because of its proven effect on improving the wellbeing of poorer individuals. However, the world is still a long way from achieving the financial inclusion for all goal by 2030, with 1.7 billion adults unbanked as of 2017 [21]. One of the reasons for many unbanked adults and low levels of FI in many parts of the world is the reluctance of formal financial institutions to provide financial services to the poor because it is considered non-profiteering (Mia et al., 2019). A lack of financial literacy is also to blame [8].

Many established studies in the literature focused on FI and sustainable development. The outcome of the studies varies; some are supportive of the concept while others are not. However, the most significant issue is that FI is associated with economic growth and sustainability [22,23,24]. Investigations show that the dilemma of effective FI is linked to developing countries, while developed countries have functional access to financial services. According to Aguera [25], approximately 77% of people living on less than $2 per day do not have a bank account, hence do not have access to financial services.

Therefore, it is significant for developing countries, particularly Africa, to embark on policies that will promote access to financial services to boost their economic growth and achieve sustainability. Thus, research has revealed a plethora of benefits linked to FI for both individuals and businesses. For example, FI is crucial in alleviating poverty and economic disparities [13,26,27]. Furthermore, it encourages entrepreneurship and promotes productive investment and economic development. Access to and use of financial services boosts household welfare through higher consumption, increases investments, productivity, and entrepreneurship among women, and minimizes gender income inequality [28].

In Africa, the level of economic activities, growth, and development between countries determines FI. There is significant variation in FI between sub-Saharan African countries. Some regions are ahead of others with regards to FI, such as Southern Africa, West Africa, and Central Africa. In support of the preceding discussion, Demirgüç-Kunt et al. [29] opined that South Africa’s experience primarily drives the high level of financial inclusion in the Southern Africa region. In contrast, Kenya’s large mobile money system adoption is primarily driven by Eastern Africa. While in West Africa, it is driven by Nigeria’s economy, the largest in Africa. Compared to neighboring regions, financial inclusion in Central Africa remains relatively low, at least in terms of account penetration. According to Demirgüç-Kunt and Klapper [30], only 11% of adults in the Central African sub-region operate an account with financial institutions, lower than the average of 27% in sub-Saharan Africa.

However, information and communications technology (ICT) and the digital economy have a growing influence in accessing financial services across the continent, including Cameroon. For example, the Central African economic and monetary community (CEMAC) region has an estimated internet and mobile phone penetration rate of 80% [31]. In Cameroon, the value of mobile banking transactions as a proportion of GDP has risen from 0.08% in 2013 to 4.50% in 2016, and then to 30.24% in 2018. This demonstrates the significance of these phenomena and helps to explain the country’s growth rates [32]. Additionally, Cameroon saw a notable increase in terms of FI, whether in terms of deposits or borrowings in commercial banks, with a growth rate of 3.8% in 2018 [33]. Moreover, Cameroon benefits immensely from this scenario as research demonstrates that financial inclusion lowers information and transaction costs. This impacts savings rates, investment decisions, technological innovation, and sustainable development [18].

Therefore, having established the current trends from the literature between the two dimensions (FI and sustainable development), the current study introduced two intervening variables (financial literacy and social capital) as mediating and moderating variables. Although sustainable development appears to be macro, it can be captured at the micro-level, similar to the other constructs of financial inclusion, financial literacy, and social capital. This is because previous studies [24,34,35,36] have used them together across different domains. In addition, since the human development index has been used as a proxy for sustainable development, Castells-Quintana [37] and Sen [38] emphasized that it is the most accurate method of measuring development. It considers literacy rates and life expectancy, which affect productivity and may lead to inclusive economic growth. According to Jāhāna [39], the human development index creates more education, healthcare, employment, and environmental conservation opportunities. All these issues that define sustainable development could be measured using individual perceptions. With competing pressure worldwide regarding access to financial services, which some previous studies suggested are limited by financial literacy [8,20], the current study introduced the intervening variables to fill this gap in the literature. The two intervening variables have not been jointly tested previously in the relationship between FI and sustainable development. Therefore, this paper aims to examine the mediating effect of financial literacy and the moderating role of social capital on the relationship between financial inclusion and sustainable development. The paper would make significant theoretical and practical contributions in that two intervening variables were introduced. This paper is structured into six sections: introduction, literature review and concepts, theoretical underpinning and research model, research design and methods, data analysis and results, conclusions and limitations.

2. Literature Review and Concepts

This part presents the review of related literature, concepts, the theoretical background, and the proposed conceptual model for the study.

2.1. Financial Literacy

Financial literacy (FL) has become increasingly important in recent years, particularly since 2002, as financial markets have become more complex, and the average person finds it difficult to make informed decisions. FL is a critical tool for promoting FI and development, leading to financial stability. According to Alshebami and Al Marri [40], financial literacy enables entrepreneurs to understand the necessary financial sources for funding their businesses. Due to its significance in supporting investment decisions, enhancing personal financial management, and boosting financial wellness, financial literacy has drawn considerable attention from academics, policymakers, and other stakeholders [40]. According to studies, financial development is a critical driver of economic growth and sustainability [12]. Scholars have argued that a lack of FL is a significant impediment to service demand. Individuals will not demand products if they are not familiar with or comfortable with them [41].

Financial literacy is the ability to be familiar with and understand financial market products, particularly rewards and risks, to make informed decisions. Thus, it refers to making informed decisions about money management and effective financial decisions. Financial exclusion in developing countries is caused by a lack of FL regarding financial products and services [42]. Moreover, motivation for saving, borrowing, and using financial products and services influences FI in developing countries [43]. In recent years, FL has received a great deal of attention and growth in many countries. This expansion, however, is due to the difficulties that have arisen in the vibrant financial system, which requires financial customers to formulate financial alternatives and assessments more aggressively [44].

Many studies on FI and its relationship with economic development and sustainability support the significance of FL in the success of every country’s financial system. Specifically, FL is an essential tool of financial education concerning financial products, services, and activities [45,46]. It has been very helpful in aiding people to select appropriate financial products [47,48,49]. Thus, many scholars have argued that FL is inextricably linked to the sustainable development of every country’s financial system. As it has far-reaching implications for personal financial decisions [50,51,52,53,54], it enhances the level of economic development by promoting economic security through poverty reduction and unemployment [55,56,57].

There is a strong link between FI and FL, from demand and supply perspectives. FL increases demand by educating people about what they can and should demand. FI operates on the supply side, supplying what people need in the financial market [41].

2.2. Social Capital

Many studies in the literature have emphasized the significance of considering the social capital (SC) endowment of members of an organization or group [58,59,60]. Confidence and other elements incorporated into the concept of SC contribute to the development of FI processes that benefit residents and provide a sustainable population for financial institutions, resulting in economic growth and sustainability. Social capital refers to the informal relationships, associations, and networks that foster shared feelings of camaraderie and cooperation among actors through endearment and reciprocity [61]. Therefore, the strengths of a rural production organization’s social capital are based on complex interactions between social components of the internal network structure, connections and links with external actors, and a synergistic relationship between the institution and the state.

However, using firms’ perspectives, social capital represents the number of firm resources that are easily possessed and accessed because of its network of formal and informal relationships [62,63]. SC is improved through systematic coordination and mutual understanding between participants, and it is measured by the network’s level of trust, bonding, bridging, and collective action [61]. Trust is each party’s belief in the other party’s integrity, veracity, and ability to fulfill their obligations in the relationship [64]. Bonding refers to participants’ ability to use their collective strengths to reduce risks and distribute costs evenly [64]. Bridging entails the willingness of parties to maintain social interactions, mainly when any other party violates the social creed [65]. The ability of participants to take concurrent steps in the direction of a resolution or agreement is referred to as collective action, and it is enhanced by quality information sharing [66].

From the preceding discussion, the literature established that FI depends on social capital and can moderate the relationship between FI and sustainable development. Thus, positive SC endowment creates conditions for an inclusive financial process and strengthens the population’s capacity to engage in social learning [67], improve risk management, provide conventional contracts, work within collateral relationships, and serve as a reliable source of information [65].

2.3. Financial Inclusion

Researchers have made significant contributions in understanding the cause and implications of many people excluded from financial services, particularly in developing countries. Lyons and Kass-Hanna [68] discovered that economically vulnerable populations are significantly less likely to be included in financial systems. Literature on economics and finance has provided various definitions of FI. For example, Sarma [69] provided a comprehensive definition that addresses a large population’s critical issues, such as accessibility, availability, and utilization of financial services. FI, which entails individuals and businesses effectively accessing and utilizing available, affordable, convenient, high-quality, and long-term financial services from formal providers, can reduce poverty and achieve economic and sustainable development [70].

Improving enterprise performance is critical for developing countries worldwide and African countries in particular. Indeed, African countries are characterized by many enterprises that help them achieve their sustainable development by providing jobs, speeding-up industrialization to increase economic growth, and promoting the wellbeing of their people. Thus, such businesses are critical to the competitiveness of sub-Saharan African countries, such as Cameroon [71,72,73,74]. Therefore, lack of access to financial services can be a significant impediment on income opportunities and economic wellbeing of individuals, particularly the poor, women and youth, rural populations, migrants, and those involved in the informal economy and firms, particularly SMEs and micro-enterprises.

Studies also indicate that many scholars have identified FI as a significant component that assists enterprises to stay in business [75,76,77]. It enables businesses that find it challenging to obtain funding from traditional banking institutions to gain access to a wide range of financial products and services that are useful and tailored to their needs for sales, payment, savings, credit, and insurance at a lower cost. FI has primarily been measured through usage and access of formal financial services using supply-side aggregate data [69,78,79,80] and barriers on the other side.

2.4. Sustainable Development

The macroeconomic dimensions of a nation that the country builds for the current generation to achieve growth and development are the elements of sustainable development. Thus, every country attempts to accelerate these economic, social, and environmental variables to achieve sustainability, which should not affect the needs of the future generation. The literature described sustainable development as a broad agenda that aims to direct resources and policy toward meeting current needs while preserving the ability of future generations to meet their own [81,82]. Mbata [83] defines sustainable development as the holistic development of individuals. It is concerned with personal development and nation building, extending beyond the provision of bridges, roads, skyscrapers, and other social amenities. Therefore, sustainable development should be a continuous process that does not harm the environment, as supported by some scholars who argued that development is sustainable when it can be sustained and continued indefinitely [84,85,86].

Browning and Rigolon [87] opined that sustainable development, as a development model, calls for an increase in the standard of living without negatively impacting the environment or the earth’s ecosystems [87,88]. Sustainable development has three dimensions: social, economic, and environmental. According to Zhai and Change [89], sustainable development aims to achieve environmental balance, economic growth, and social progress. From the preceding discussion, the rural population has made significant contributions to the overall economic development and sustainability of the country through inclusive finance [90,91,92,93].

As previously mentioned, many studies supported the three dimensions of sustainable development (social, economic, and environmental). Thus, the UN agency indicates the social dimension of SD to gender equity, cultural diversity, human rights issues, intercultural understanding, and peace and human security issues [94]. The environmental variable is related to sustainable urbanization and natural resource protection, including air, soil, water, agriculture, and energy [94]. Others include minimizing environmental pollution (water, air, and soil), which encourages renewable energy such as wind energy and geothermal, to replace conventional sources such as petrol, gas, and coal. Preserving forests and expanding green areas reduces resource consumption and environmental pollution through waste recycling and halts all activities that accelerate global warming [95,96].

However, economic sustainability encompasses issues such as resource conservation, income and expense balance, the elimination of income distribution inequality, sustainable production and cost, creating an enabling environment for investment, investments in high-income sectors, investments in vital sectors, and R&D [96,97,98,99].

3. Theoretical Underpinning and Research Model

The current study is underpinned by a good public theory of FI, which is one of the FI beneficiaries’ theories. There are various arguments regarding who benefits from the outcomes of FI. Growing evidence shows poor people primarily benefit most from FI [100]. In contrast, the literature indicates that women are most likely to benefit from FI outcomes [101,102,103]. Furthermore, some studies believe the largest beneficiaries of FI are the economy and the financial system [103,104,105,106]. Aside from women and the poor, the literature has overlooked the young and the elderly. Others include institutionalized people expelled from the financial sector likely due to criminal offenses committed.

Formal financial services, according to the theory, are a public good that should be made available to everyone for everyone’s benefit. As a result, everyone should have unrestricted access to finance. According to the literature, as a public good, one person’s access to formal financial services does not limit its availability to others. Similarly, all elements of the population could be integrated into the formal financial sector for the benefit of all. According to this theory, all population members benefit from FI, and no one is excluded [107]. From the preceding discussion, the good public theory of FI can explain the theoretical model of the current study. The major objective of the study is to investigate the relationship between FI and SD in Cameroon.

Financial inclusion, as previously mentioned, focuses on providing formal, accessible financial services to all persons and enterprises, whereas sustainable development aims to meet the requirements of the present without jeopardizing the ability of future generations to do the same [108]. The economic, environmental, and social components of sustainable development are its three main pillars [109]. Financial inclusion meets sustainable development in its aspects of economic and social dimensions. The economic dimension of sustainable development relates to financial inclusion because financial institutions can reach out to the unbanked segments through account ownership schemes and affordable financial services to improve their economic conditions. This could improve the welfare of the people and increase the profitability of financial institutions which in turn contributes to job creation and higher economic growth, leading to sustainable development.

On the other hand, the social dimension of sustainable development relates to financial inclusion. This is because financial institutions must deal with financially included people with respect, care, and fairness through fair pricing of basic financial products and services. Thus, when financial inclusion policies are implemented by financial institutions that function within the existing economic and social systems that are crucial for sustainable development, there is a connection between financial inclusion and sustainable development.

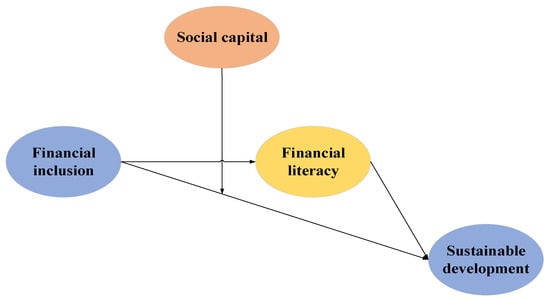

Recent literature implies that a sizable portion of Africa’s population is still financially excluded [110,111]. Thus, the theory entails how the poor, women, and others less privileged in society should have unrestricted access to financial services, leading to economic growth and sustainability. The best way to achieve this is through effective FL. Figure 1 shows the proposed conceptual model of the study. The model indicates the relationship between financial inclusion and sustainable development. Financial inclusion has three dimensions (access, usage, and barrier). In the same vein, sustainable development has three dimensions (social, economic, and environmental). The model also shows the two intervening variables, mediating effect of financial literacy and moderating role of social capital with four dimensions (collective action, bridging, bonding, and trust).

Figure 1.

A proposed conceptual model.

3.1. Hypotheses Development and Conceptual Model

3.1.1. Financial Inclusion and Sustainable Development Relationship

Many studies on economics and finance indicate a significant relationship between FI and SD [8,24]. Fine [112] considers economic development to increase or improve living standards, self-esteem needs, freedom from oppression, and increased choice. The study also emphasized that the human development index (HDI) is the most accurate method for measuring development. It considers literacy rates and life expectancy, which affect productivity and lead to inclusive economic growth. According to UNDP [40], the human development index creates more education, healthcare, employment, and environmental conservation opportunities. It simply means that everyone’s per capita income will rise. Thus, economic development can be more meaningful and sustainable if human development is prioritized in development plans. Thus, the literature supports financial inclusion to provide access to financial services to reduce poverty and improve the standard of living [10].

Dipasha [22] examines the relationship between the various dimensions of FI and the economic development of the emerging Indian economy. The findings of the empirical study show a positive relationship between economic development and various aspects of FI, specifically banking penetration, availability of banking services, and deposit usage. Babajide et al. [113] examined the impact of FI on economic growth in Nigeria. The study focused on the factors that influence FI and its impact on economic growth. Secondary data were obtained from world development indicators, and the data were analyzed using the ordinary least square regression model. The study results revealed that FI is a significant determinant of total production and capital per worker, which determines the final level of output in the economy.

Sarma and Pais [34] investigated the issue of FI concerning India’s development. The study focused on the relationship between FI and development across the country. According to their findings, the country’s levels of human development and FI are closely related, with a few exceptions. Income is positively associated with levels of FI among socioeconomic factors. However, the study of Adah and Abu [36] examined FI and SD in Nigeria. An empirical diagnosis presents a different outcome. Credit and capital market penetrations thus serve as proxies for FI, while the HDI serves as a proxy for long-term economic development. The results show significant probability values for the credit penetration variable at 0.05 significance levels, but the coefficient is negative. Despite its significant value, it has a negative impact on the economy during the study period.

On the other hand, the capital market has a positive beta coefficient despite not having a significant probability value at 0.05. This also implies that CMP appears to positively impact the economy, albeit with a low probability value. As a result, the null hypothesis of this study, that financial inclusion has had no significant impact on Nigeria’s sustainable economic development, is not rejected.

Furthermore, Khan et al. [8] examined the impact of FI on poverty, income inequality, and financial stability using panel data from 54 African countries. Thus, to accomplish this, the current study employed multiple regressions on an unbalanced panel dataset of 54 African countries based on the four-year mean value from 2001 to 2019. According to the findings, FI is an important indicator because it reduces poverty, income inequality and improves financial stability, leading to economic development. From the preceding discussion, the study suggests the following hypothesis:

H1.

Financial inclusion is significantly associated with sustainable development in Cameroon.

3.1.2. Financial Inclusion and Financial Literacy Relationship

As mentioned earlier, scholars are interested in issues concerning FI and its effect on the overall economy, which many studies indicated were limited by FL. Studies have examined the relationship between FI and FL, many of which present a significant association between the two dimensions. Thus, describing financial illiteracy as a significant impediment to the process of financial inclusion [68,114,115,116,117,118,119]. Hasan et al. [120] investigated how FL impacts inclusive finance. The study used three econometrics models: logistic regression, probit regression, and complementary log-log regression, to see if FL has a significant impact on removing barriers that prevent people from accessing and using financial services to better their lives. The empirical findings revealed that knowledge about various financial services significantly impacted obtaining financial access. Some variables, such as income level, profession, knowledge of depositing and withdrawing money, and knowledge of interest rates, significantly impacted overall access to finance.

According to Kou et al. [121], access to finance is a challenge; thus, various national and international organizations regarded FL as one of the influential FI components. Shen et al. [122] showed that, except for internet usage, there is a statistically significant relationship between digital financial product usage and FL. FI was not influenced solely by FL; however, combining FL and internet use may improve financial access [120]. Similarly, Hussain et al. [123] investigated the link between education level and business owners’ use of financial services. They discovered that FL influenced a firm’s access to finance and its growth.

Furthermore, due to the increased use of technology, Tryon [120] identified financial education as one of the twenty-first century’s most popular financial and economic terms. In this case, it was necessary to obtain technical education to discover new ways to operate new financial technologies. Based on the evidence above, the study suggests the following hypothesis:

H2.

Financial inclusion is significantly associated with financial literacy in Cameroon.

3.1.3. The Mediating Effect of Financial Literacy on Financial Inclusion and Sustainable Development

The preceding discussion presents enough evidence in the finance and economics literature that FI leads to sustainable economic development. There is also growing evidence that this link hinges upon effective FL. As a result, the UN agency proposed that targeted FI and financial education policies help bridge inclusion gaps by directing assistance where it is most needed, thereby contributing to inclusive growth and more sustainable societies worldwide. Furthermore, recent cross-country empirical evidence suggests that increased FL leads to increased FI at the national level. Improving FL would benefit all countries at different stages of economic and financial development [124]. FL regards the ability of individuals to process economic facts and figures to make informed decisions about financial planning, wealth accumulation, annuities, and debt management [52].

Scholars and experts believe that FL consists of financial attitude, financial knowledge, and financial behavior [42,125,126,127,128]. Thus, policymakers and stakeholders can achieve FI through effective FL to ensure sustainable economic growth and development [129]. Scholars have discovered that financial knowledge influences financial management performance and behavior and that consumers with more financial knowledge have better financial behavior [130,131,132]. Therefore, by understanding better financial behavior, excluded members of society can now have access to financial services, improve their standard of living, and achieve economic growth and sustainability.

Kaur and Bansal [133] investigated the role of financial products and services in mediating the relationship between financial access and MSME growth in India. The primary goal of the research is to determine what role financial goods and services play in mediating the link between financial access and the growth of micro, small, and medium-sized enterprises (MSMEs) in developing markets. The results confirmed the mediating effect though the finding could still be confirmed in other emerging economies. Using data from rural Uganda, Bongomin et al. [134] sought to establish the mediating role of financial intermediaries in the relationship between financial literacy and financial inclusion of the poor in developing countries. The study used the PLS-SEM model, and the findings reveal that financial intermediaries significantly mediate the relationship between FL and FI.

According to Huston [125], financial knowledge was specified as an input to model the need for financial education and explain variation in financial outcomes. According to Wang et al. [135], a lack of financial knowledge increases the likelihood of making unsecured P2P and personal loans. According to the literature, FL impedes financial inclusion and may stymie economic development [68,115,116,117,118,119,120,121,122,123,124,125,126,127,128,136]. Furthermore, financial literacy is strongly linked to developing every country’s financial system and economic development by accelerating economic security and lowering unemployment. As a result, it has far-reaching implications for personal financial decisions [50,52,53,54,56,57,131]. Therefore, FL can mediate the relationship between FI and SD. Based on the above evidence in the literature, the study suggests the next hypothesis:

H3.

Financial literacy significantly mediates the relationship between financial inclusion and sustainable development in Cameroon.

3.1.4. The Moderating Role of Social Capital on Financial Inclusion and Sustainable Development

Social capital could provide an important strength in ensuring FI and can lead to sustainable economic development. People who fall into rural organizations or production groups consider SC as immaterial assets. This creates a collective action capacity for them, allowing access to resources, identifying new ways of meeting needs, and responsible use of financial services [137]. Shim et al. [138] discovered that adolescent financial education is linked to financial behavior, attitudes, and learning, whether at school, home, or workplace.

Many studies have used SC as a moderating variable, some with similar independent variables similar to the current study, while others have different dimensions. Onodugo et al. [65] investigated the role of social capital in moderating the effect of financial behavior on FI. The study’s goal was to empirically test the moderating effects of collective action, bonding, trust, and bridging on the impact of financial behavior on FI. The findings indicate that financial behavior has a positive main effect on financial inclusion. Two of the four dimensions of social capital (collective action and bridging) had a significant moderating effect in the relationship, while bonding and trust were statistically insignificant. Rezazadeh et al. [139] investigated the moderating role of SC in developing tourism and urban sustainable development in Zahedan. According to the findings, SC had a moderating effect on the relationship between tourism development and sustainable urban development, to the extent that social capital explains 25% of the variation in the variable of interest.

Khaki and Sangmi [140] assess the impact of access to finance on the socio-political empowerment of Swarnjayanti Gram Swarozgar Yojana (SGSY) beneficiaries, now known as the National Rural Livelihood Mission (NRLM). According to the findings, access to finance positively impacts almost all socio-political indicators of empowerment, with the impact on FL and economic awareness being relatively lower. Moreover, Bongomin et al. [61] discovered that bonding acts as a mediator between FL and FI. As a result, bonding could increase the amount of financial information available to businesses, allowing them to execute financial strategies that allow them to access financial services continuously. Based on the above evidence, the study suggests the following hypothesis:

H4.

Social capital significantly moderates the relationship between financial inclusion and sustainable development in Cameroon.

4. Research Design and Methodology

4.1. Sample and Data Collection

A survey research design involving a questionnaire (see Appendix A) was used in this study to collect data that would be used for analysis with the aid of PLS-SEM. The study population consists of development experts from the National Institute of Statistics, Resource Centre for Environment and Sustainable Development (RCESD), a non-profit organization, and residents of the outskirts of the Douala and Buea municipality in Cameroon. Several customers from three deposit money banks were drawn for the study. The bank’s customers numbered 2350, while the local communities had a conservative estimate of 10,551. Thus, the entire population for the study is 12,901. The study used Krejcie and Morgan’s [141] scientific table to determine the sample size of 375.

The researchers added 30% to compensate for non-responses and missing values [142]. Thus, the study used a sample of 488 for data collection. Furthermore, a convenience sampling technique was used to collect data for the study. According to Sekaran and Bougie [143], convenience sampling is a data collection method that collects from a study population who are readily available and willing to provide it. We used the convenience sampling method because the bank customers were too numerous and using a probability sampling method such as the simple random method would be very difficult. Therefore, we considered it more appropriate to target customers as they came into the bank and to give them the questionnaires. The researchers used three assistants who distributed questionnaires for the data collection. The assistants were trained so that they would be able to guide the respondents while filling in the questionnaires. The study received 412 returned questionnaires; 381 were filled, representing 78% of the total distributed instruments. These 381 were used for further analysis.

4.2. Data Analysis Tools

The major statistical tool used to assess the hypothetical model in this study is structural equation modeling (SEM), which is considered a second-generation data analysis technique that is sophisticated and widely used to test complex models using data [144]. Since this study uses both mediator and moderator, it is appropriate to use PLS-SEM. The SEM technique allows researchers to model relationships between multiple independent and dependent variables simultaneously to answer certain research questions.

4.3. Measurement of Variables

The financial inclusion measures were adapted from the study of Cámara and Tuesta [145]; it consists of access (ACC), usage (USG) and barrier (BRR), represented by 5, 5, and 4 items each, respectively. The sustainable development construct consists of social (SCL), economic (ECO), and environmental (ENV), and was measured by 4, 4, and 4 items, respectively, adopted from Atmaca et al. [96] and Chow and Chen [146]. Financial literacy (one-dimension) is adapted from Rieger [147] and Vieira et al. [148], represented by 7 items. Finally, social capital consisted of collective action (CA), bridging (BRG), bonding (BND), and trust (TRS), and was measured by 3 items, each adapted from the study of Bongomin et al. [149] and Onodugo et al. [65]. A 5-point Likert scale was used to measure the items, ranging from strongly agree (1) to strongly disagree (5).

5. Data Analysis and Results

To test the study’s measurement model, the researcher looked at the reliability of the items, measuring each potential structure and the internal consistency reliability (discriminant validity, construct reliability, and convergence validity) [150]. Hair et al. [151] proposed an external load of between 0.40 and 0.70 as reliable and acceptable. They believe that an item should only be deleted when it will increase the reliability of constructs AVE or composite reliability.

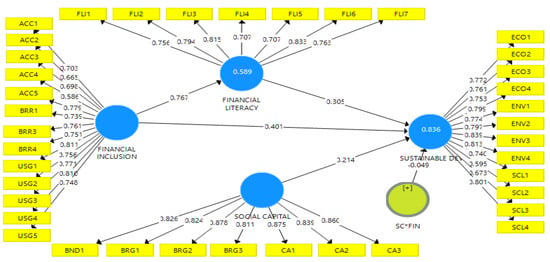

Figure 2 shows that the endogenous variable, FI, has 13 indicators (as BRR2 was deleted), while SD has 13 as none were removed from its indicators. The moderator, SC, has 7 indicators (as BND2, BND3, TRS1, TRS2, and TRS3 were deleted), while the mediating variable, FL, has 7 indicators. None had a loading below the threshold.

Figure 2.

Path coefficient. (Note: * Signifies multiplication).

As shown in Figure 2, the loading must be between 0.40 and 0.70 to retain a specific indicator; hence, the deletion is subject to the AVE and CR increment. As a result of Hair et al.’s [152] rule of thumb, only 6 items out of 45 measuring 4 constructs in this study were deleted, leaving the remaining 39 items for further analysis (see Figure 2). Table 1 shows the loading of the individual items.

Table 1.

Measurement model: reliability and convergent validity.

From Table 1, the indicators have loadings of 0.50 and higher. Although some of the items have loadings below 0.70, they were retained because they are above the critical level of 0.40. However, removing the items with lower loadings would have no significant impact on the AVE or CR. Based on the criterion established by [147], it is concluded that all the remaining items are reliable in measuring their respective reflective latent constructs.

5.1. Discriminant Validity of the Model

The extent to which a construct differs from one another empirically is referred to as discriminant validity. As a result, the study assesses discriminant validity using the heterotrait–monotrait (HTMT) ratio and the Fornell and Larcker correlation criterion. The study used only the HTMT.

The heterotrait–monotrait (HTMT) ratio of correlation was used to assess the discriminant validity further. Henseler et al. [153] emphasized the superior performance of the HTMT ratio (also see [154]) using the Monte Carlo simulation study. They discovered that HTMT achieves higher specificity and sensitivity rates (97% to 99%) when compared to the cross-loadings criterion (0.00%) and Fornell–Lacker (20.82%).

From Table 2, it can be seen that using the HTMT involves comparing it to a predetermined threshold. Thus, if the HTMT value is greater than the predefined threshold, it can be concluded that there is an absence of discriminant validity. Several authors propose a benchmark of 0.85 [155]. Furthermore, Gold et al. [156] proposed a value of 0.90 as the acceptable threshold. Based on this criterion, this study’s reflective latent constructs have achieved discriminant validity, as none exceed 0.90.

Table 2.

Discriminants validity: heterotrait-monotrait (HTMT) ratio criterion.

5.2. Structural Model Assessment: Direct Relationship

After all the requirements of the measurement model are satisfied, the structural model is then evaluated. Therefore, this section presents the results of the structural equation model. Both the direct and indirect relationships were analyzed using bootstrap analysis. Specifically, the standard bootstrapping procedure was employed for 381 cases to assess the significance of the path coefficients of both direct and indirect relationships [147], [150].

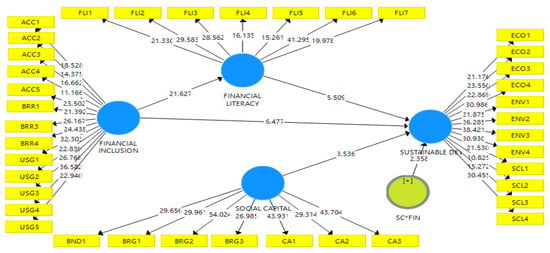

Considering the objective of this study, the researcher analyzed the data using structural equation modelling for both direct and indirect relationships (see [147,157,158]). The first evaluation was undertaken to assess the theoretical relationships. Specifically, standard bootstrap was adopted on a sample of 381 to evaluate the importance of path coefficients for the direct relationships [147,150,159]. The structural model was used to test the study’s hypotheses and assess the model’s coefficient of determination, effect size, and predictive relevance, as shown in Figure 3.

Figure 3.

PLS Bootstrapping result (structural model for direct and indirect relationships). (Note: * Signifies multiplication).

Table 3 presents the results of the test of hypotheses. The relationship between FI was found to be positive and significantly related to FL (β = 0.767 t−value = 21.627 and p value < 0.000). FI was also found to have a positive and significant relationship with SD (β = 0.401 t−value = 6.477 and p value < 0.000). FL was found to have a positive and significant effect on the SD of Cameroon (β = 0.305 t−value = 5.509 and p value < 0.000). The results further show that SC has a positive and significant effect on SD (β = −0.214 t−value = 3.536 and p value < 0.000). However, the results show that SC does not moderate the relationship between FI and SD (β = −0.049 t−value = 2.358 and p value < 0.000). The relationship between SC and SD was found to be positive and significant (β = 0.214 t−value = 3.536 and p value < 0.000). Finally, the results show that FL mediates the relationship between FI and SD (β = 0.233 t−value = 5.312 and p value < 0.000). The mediation is complimentary because both the direct relationship and the indirect relationship are significant.

Table 3.

Test of hypothesis path coefficient.

In summary, five alternate hypotheses out of six were supported empirically for all the direct and indirect relationships between the latent exogenous and endogenous constructs, while one hypothesis was not supported.

5.3. Coefficient of Determination for the Relationships

Apart from assessing the significance and relevance of the path model, another commonly used measure of evaluating the structural model relationships is assessing the level of R-square or the coefficient of determination [160]. The R-square (R²) measures the predictive power of a model; thus, it is computed as the squared correlation between the independent variable’s actual and predicted value [147].

Table 4 reports the R-square stood at 0.834, which implies that the exogenous variable of the study explains approximately 83.4% of the variation in the sustainable development of Cameroon. In comparison, the remaining 16.6% is explained by other factors not captured in this study. The Q² values appeared to be greater than zero, which implies that they have predictive relevance in the model. The results also show that financial inclusion has a large effect when it comes to contribution to sustainable development.

Table 4.

Coefficient of determination (R²), effect size (F2), and predictive relevance (Q²).

5.4. Discussion

The study attempts to answer the research question: what is the mediating effect of financial literacy and the moderating effect of social capital on the relationship between financial inclusion and sustainable development? The study was able to answer the question using empirical data, thereby revealing the effects of the two intervening variables. The results show that the relationship between FI and FL was found to be positive and significant. This finding is in line with the findings of previous studies [119,122], which found a positive and significant relationship between FI and FL. The findings also reveal that FI was found to have positively and significantly affected sustainable development. This corroborates the findings of some previous studies [104,113] conducted in other climes.

In addition, the results of this study further indicate that SC has a positive and significant effect on SD. This finding corroborates that of Bongomin et al. [61]. Furthermore, the results show that FL mediates the relationship between FI and SD. The finding is in line with previous studies [50,51,53,56]. Finally, the results reveal that SC does not moderate the relationship between FI and SD. This might be as a result of the fact that the direct relationship between social capital and sustainable development is positive and significant, as Soyemi, and Olowofela [161] confirmed. However, the finding is contrary to most previous studies, which found a positive and significant moderating effect of SC [65,114,139].

5.5. Implications

The findings imply that FL influences a firm’s access to finance and its growth. This means that the knowledge of firms and individuals about various financial products and services significantly impacts financial access, which promotes financial inclusion. Knowledge of other factors, such as income level, profession, deposits and withdrawals, and interest rates could improve access to finance. This suggests that when customers are aware that the financial institutions are located in convenient places, their loan processes are simplified, and that they can carry out so many banking transactions with ease, the level of financial inclusion will be higher. Thus, policymakers and stakeholders can achieve financial inclusion through adequate FL to ensure sustainable economic growth and development.

Moreover, the findings of this study suggest that the availability of affordable financial services that are easily accessible by the masses enables them to access education and health services that promote SD. In the same vein, the findings indicate that FI (in terms of access and usage) could help to reduce poverty levels and differences in income in Cameroon. This further suggests that FI reduces unemployment and facilitates investments in agriculture and livestock sectors, supporting sustainable development. Therefore, the more people that are financially included in Cameroon, the more social, economic, and environmental development goals can be achieved. Another implication of this finding is that some factors, such as income level, knowledge of depositing and withdrawing money, interest rate awareness, and occupation, significantly impacted overall access to finance, promoting SD. The study’s findings provide policymakers with helpful advice for improving financial inclusion in emerging countries.

The results of this study suggest that the value of trust, reciprocity, shared values, networking, and norms in connections between people in firms and between enterprises and other firms greatly impacts Cameroon’s sustainable development. Therefore, positive SC endowment creates conditions for an inclusive financial process and strengthens the population’s capacity to engage in social learning, improve risk management, and facilitate social and economic development.

Furthermore, another important implication of this study following the findings is that when people are familiar with and understand financial market products to make informed decisions, particularly rewards and risks, they would be more financially included, leading to sustainable development. This shows that financial inclusion in developing countries such as Cameroon is influenced by motivation for saving, borrowing, and using financial products and services, which eventually supports sustainable development. This further suggests that developing countries can use financial literacy as a conduit through which financial inclusion facilitates social, economic, and environmental development.

The testing of financial literacy and social capital as mediating and moderating variables in the relationship between financial inclusion and sustainable development has generated a new framework which extends the previous models in the field of sustainable development literature. Modelling the intervening variables in the said relationship has added novelty and new perspectives to the theories’ postulations using empirical evidence.

The study has identified factors that developing countries, especially Cameroon, could take advantage of to achieve sustainable development. The knowledge of those factors, such as income level, profession, deposits and withdrawals, and interest rates could lead to improved access to finance. This implies that when the government formulates policies to place financial institutions in convenient places and simplifies loan processes, the level of financial inclusion will be higher. Thus, policymakers and stakeholders can achieve financial inclusion through effective financial literacy to ensure sustainable economic growth and development.

Finally, the results of this study imply that social capital does not strengthen the relationship between FI and SD to promote FI. The lack of moderation by SC might not be unconnected with the positive and significant effect of the direct relationship (Baron and Kenny, 1986). The results imply that complex interactions between social components of the internal network structure, connections and links with external actors, and a synergistic relationship between the institution and the state did not strengthen the relationship between FI and SD.

6. Conclusions and Limitations

The study examined the mediating effect of financial literacy and the moderating effect of social capital on the relationship between financial inclusion and the sustainable development of Cameroon. It concludes that financial inclusion is an important predictor of sustainable development. Therefore, usage and access to finance could facilitate social, economic, and environmental development. The study also concludes that knowledge of various financial products and services by firms and individuals across Cameroon significantly influences financial access, promoting FI and facilitating socio-economic development. It is also concluded that FL, through the knowledge of factors such as income level, deposits and withdrawals, and interest rates, could lead to improved access to finance, which positively affects SD. FL, therefore, becomes an important conduit through which FI, by providing affordable financial products and services, can trigger the betterment of the wellbeing of citizens in Cameroon.

Furthermore, the study concludes that SC is an important predictor of SD, but does not strengthen the relationship between FI and SD. With this conclusion, the study has provided empirical and additional evidence to the literature regarding the mediating role of FL on the relationship between FI and SD. Thus, the study lends theoretical and empirical support to the good public theory of financial inclusion. The findings of this study have confirmed the postulations of the theory and the linkage between FI and SD. The findings and contributions of this study also provide useful insights and practical implications for financial institutions and governments, especially in developing countries.

The major limitation of this study was that it covered only Cameroon rather than many developing countries considering the variable of interest, SD. Sustainable development is an issue of concern to many African countries, and as a result, a cross-country investigation will be needed. The study was also cross-sectional in nature, and thus a longitudinal approach is required to ascertain the impacts of FI on SD over different periods. Another limitation for this study was the use of convenience sampling. This might have caused inaccurate representation and researcher bias. However, effort was made to ensure that such bias was eliminated by the researchers to ensure accurate data was collected. Future studies can use other sampling techniques not prone to those limitations mentioned. Finally, since social capital was found to have no moderating effect on the relationship between FI and SD, future studies can test its mediating effect on the same relationship.

Author Contributions

Conceptualization, C.B.L.; data curation, C.B.L.; methodology, C.B.L., B.Y. and Y.S.; supervision, B.Y. and Y.S.; writing—original draft, C.B.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by NSFC, Grant No.7217010477.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors acknowledge the support of NSFC. Similarly, the research assistants’ efforts during the field survey despite the enormous challenges amid COVID-19 restrictions. The authors also appreciate the reviewers’ and editor’s comments during the review process.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Variable items

Tick as appropriate as possible

1 = strongly disagree, 2 = disagree, 3 = neutral, 4 = agree, 5 = strongly agree.

Financial inclusion.

| Access (ACC) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | I have an active bank account with a credible financialinstitution. | |||||

| 2. | My bank is located at a convenient distance from my business. | |||||

| 3. | I regularly take loans from my financial sources with relativeease (borrowing). | |||||

| 4. | There were no hidden charges by the bank that affects thebusiness. | |||||

| 5. | Making remittances through a number of ways including the bank, mobile money transfers, and cash. |

| Usage (USG) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | The procedure for acquiring the loan was simple. | |||||

| 2. | I can do bank transactions through e.g., agency banking, e-banking, or mobile money transfer. | |||||

| 3. | I use my bank account regularly. | |||||

| 4. | I make more savings to qualify for bigger loans. | |||||

| 5. | I usually receive payment from customers through my bank. |

| Barrier (BRR) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | Trust: I do not have a bank account because I do not trust the financial system. | |||||

| 2. | Affordability: I do not have a bank account because I perceived it to be too expensive. | |||||

| 3. | Distance: I do not have bank account because the branches are too far away. | |||||

| 4. | Documents: I do not have a bank account because I do not have the necessary documents. |

Sustainable development.

| Social (SCL) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | We do have integrating and enhancing social services (such as nurseries, shelter homes, social assistance foundations, etc.). | |||||

| 2. | We have access to education and health services to all individuals in the society. | |||||

| 3. | Individuals are provided with environments where they feel safe while living. | |||||

| 4. | Society takes responsibility to keep the well-being of individuals and families above the minimum. |

| Economic (ECO) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | Our economic policies are aimed at reducing poverty and differences in income distribution. | |||||

| 2. | Our economic policies shaped sustainable production. | |||||

| 3. | Our economic development is planned to prevent unemployment. | |||||

| 4. | Our investments in agriculture and livestock sectors are supported for economic development. |

| Environmental (ENV) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | Green areas are dispensed with for urbanization and industrialization. | |||||

| 2. | Individual has responsibilities in the process of recycling waste so that the raw material resources can be used by future generations. | |||||

| 3. | Wastes are separated according to their characteristics and reused, so that raw material sources can be used by future generations. | |||||

| 4. | Global warming poses a serious threat to the future of our world if cautions are not taken. |

Financial literacy.

| Financial literacy Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | A high-return investment will also be high-risk. | |||||

| 2. | The cost of living rises as inflation rises. | |||||

| 3. | I save some part of the money I receive monthly for future needs. | |||||

| 4. | I regularly save money in order to achieve long-term financial goals, such as educating my children, purchasing a home, retiring. | |||||

| 5. | I find it more rewarding to spend money than to save for the future. | |||||

| 6. | I tend to live today and let tomorrow happen. | |||||

| 7. | I have been able to save money over the last year. |

Social capital.

| Collective action (CA) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | Business owners and managers are always willing to share information with other members of the business community. | |||||

| 2. | Business owners and managers allow access to financial services such as credit and are always willing to share information with other members of the business community. | |||||

| 3. | Business owners and managers maintain a collective culture regarding credit and spending; thus, they are more likely to save more and repay their loans than stand-alone firms. |

| Bridging (BRG) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | We always share our strategy with people outside our business community. | |||||

| 2. | A high level of bridging exposes business ideas such as producing cost-efficient products, accessing more markets, receiving external feedback, and forecasting market occurrences. | |||||

| 3. | Businesses with a high bridging ratio will exchange specific financial operating procedures and leverage each other’s capabilities to improve financial performance. |

| Bonding (BND) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | Business owners and managers are always truthful with one another. | |||||

| 2. | A high level of bonding between business owners and managers will improve the level of honesty in the exchange of information. | |||||

| 3. | Business owners and managers who maintain high bonding incidences will engender mutual respect, honor, and admiration with others. |

| Trust (TRS) Items | 1 | 2 | 3 | 4 | 5 | |

| 1. | In this business community, people generally trust one another when it comes to lending and borrowing money. | |||||

| 2. | High level of trust reduces incidences of financial contract default. | |||||

| 3. | Trust encourages involvement in financial activities. |

References

- Amoako, G.K.; Obuobisa-Darko, T.; Marfo, S.O. Stakeholder role in tourism sustainability: The case of Kwame Nkrumah Mausoleum and centre for art and culture in Ghana. Int. Hosp. Rev. 2021, 25–44. [Google Scholar] [CrossRef]

- Ollendorf, F.; Sieber, S.; Löhr, K. Societal dynamics of sustainability certification in Ghanaian cocoa producing communities: Assessing social cohesion effects and their implications for collective action. Agroecol. Sustain. Food Syst. 2022, 1–27. [Google Scholar] [CrossRef]

- Alshebami, A.S.; Aldhyani, T.H.H. The interplay of social influence, financial literacy, and saving behaviour among Saudi youth and the moderating effect of self-control. Sustainability 2022, 14, 8780. [Google Scholar] [CrossRef]

- Batuo, M.E.; Asongu, S.A. The impact of liberalisation policies on income inequality in African countries. J. Econ. Stud. 2015, 42, 68–100. [Google Scholar] [CrossRef]

- Neaime, S.; Gaysset, I. Sustainability of macroeconomic policies in selected MENA countries: Post financial and debt crises. Res. Int. Bus. Financ. 2017, 40, 129–140. [Google Scholar] [CrossRef]

- Maune, A.; Matanda, E.; Mundonde, J. Does financial inclusion cause economic growth in Zimbabwe? An empirical investigation. Acta Univ. Danubius. Oeconomica 2020, 16, 195–215. [Google Scholar]

- Sha’ban, M.; Girardone, C.; Sarkisyan, A. Cross-country variation in financial inclusion: A global perspective. Eur. J. Financ. 2020, 26, 319–340. [Google Scholar] [CrossRef]

- Khan, I.; Khan, I.; Sayal, A.U.; Khan, M.Z. Does financial inclusion induce poverty, income inequality, and financial stability: Empirical evidence from the 54 African countries? J. Econ. Stud. 2021, 49, 303–314. [Google Scholar] [CrossRef]

- Avom, D.; Bobbo, A. Réglementation de l’industrie bancaire et exclusion financière dans la communauté économique et monétaire de l’Afrique centrale. Afr. Contemp. 2018, 175–190. [Google Scholar] [CrossRef]

- UNCTAD. Access to Financial Services as a Driver for the Post-2015 Development Agenda; UNCTAD: Geneva, Switzerland, 2015. [Google Scholar]

- López, T.; Winkler, A. Does financial inclusion mitigate credit boom-bust cycles? J. Financ. Stab. 2019, 43, 116–129. [Google Scholar] [CrossRef]

- Levine, R. Finance and growth: Theory and evidence. Handb. Econ. Growth 2005, 1, 865–934. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A.; Levine, R. Finance, inequality and the poor. J. Econ. Growth 2007, 12, 27–49. [Google Scholar] [CrossRef]

- Morgan, P.; Pontines, V. Financial Stability and Financial Inclusion; ADBI: Tokyo, Japan, 2014. [Google Scholar]

- Cumming, D.; Johan, S.; Zhang, M. The economic impact of entrepreneurship: Comparing international datasets. Corp. Gov. Int. Rev. 2014, 22, 162–178. [Google Scholar] [CrossRef]

- Park, C.-Y.; Mercado, R.V. Financial inclusion: New measurement and cross-country impact assessment 1. In Financial Inclusion in Asia and Beyond; Routledge: London, UK, 2021; pp. 98–128. [Google Scholar]

- Klapper, L.; El-Zoghbi, M.; Hess, J. Achieving the Sustainable Development Goals. The Role of Financial Inclusion. 2016, 23. Available online: http//www.ccgap.org (accessed on 23 February 2022).

- Gautier, T.T.; Luc, N.N. Dynamic Analysis of Determinants of Financial Inclusion in Cameroon. Eur. Sci. J. 2020, 16, 106–121. [Google Scholar] [CrossRef]

- Chikalipah, S. What determines financial inclusion in Sub-Saharan Africa? Afr. J. Econ. Manag. Stud. 2017, 8, 8–18. [Google Scholar] [CrossRef]

- Nyarko, E.S. Financial Inclusion, Financial Literacy and Inclusive Growth in Africa; University of Ghana: Accra, Ghana, 2018. [Google Scholar]

- Bank, W. The Global Findex Database 2017. Washington, DC, USA. 2017. Available online: https://globalfindex.worldbank.org/ (accessed on 23 February 2022).

- Sharma, D. Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. J. Financ. Econ. Policy 2016, 8, 13–36. [Google Scholar] [CrossRef]

- Okoye, L.U.; Erin, O.; Modebe, N.J. Financial inclusion as a strategy for enhanced economic growth and development. J. Internet Bank. Commer. 2017, 22, 1–14. [Google Scholar]

- Adah, A.; Abu, A.S. Financial Inclusion and Sustainable Development in Nigeria: An Empirical Diagnosis. In Proceedings of the In Proceedings of the NOUN Conference on Nigerian Sustainable Economic Development, Abuja, Nigeria, 26–27 October 2019. [Google Scholar]

- Aguera, P. Inclusion financière, Croissance et Réduction de la Pauvreté. In Proceedings of the Conférence Régionale CEMAC, Brazzaville, Congo, 23 March 2015; pp. 1–19. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A. Access to finance: An unfinished agenda. World Bank Econ. Rev. 2008, 22, 383–396. [Google Scholar] [CrossRef]

- World Bank. Banking the Poor: Measuring Banking Access in 54 Economies; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Dupas, P.; Robinson, J. Savings constraints and microenterprise development: Evidence from a field experiment in Kenya. Am. Econ. J. Appl. Econ. 2013, 5, 163–192. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Klapper, L.F.; Singer, D.; Van Oudheusden, P. The Global Findex Database 2014: Measuring Financial Inclusion around the World; World Bank Policy Research Working Papers, No. 7255; The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- Demirgüç-Kunt, A.; Klapper, L. Financial Inclusion in Africa: An Overview; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Edjangue, J.-C. Afrique que fais-tu de ta jeunesse?: Les paradoxes d’un enjeu moteur du développement. In Afrique que fais-tu ta Jeunesse? Editions L’Harmattan: Paris, France, 2013; pp. 1–140. [Google Scholar]

- Espinosa-Vega, M.A.; Shirono, M.K.; Villanova, M.H.C.; Chhabra, M.; Das, M.B.; Fan, M.Y. Measuring Financial Access: 10 Years of the IMF Financial Access Survey; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Kraemer-Mbula, E. The African Development Bank. In Regional Development Banks in the World Economy; Oxford University Press: Oxford, UK, 2021; p. 55. [Google Scholar]

- Sarma, M.; Pais, J. Financial inclusion and development. J. Int. Dev. 2011, 23, 613–628. [Google Scholar] [CrossRef]

- Voica, M.C. Financial inclusion as a tool for sustainable development. Inst. Natl. Econ. 2017, 44, 121–129. [Google Scholar]

- Tampuri, M.Y., Jr.; Kong, Y.; Appiah, B.; Asare, I.; Baidoo, P. Enhancing Financial Capability for Quality Access and Usage of Financial Services; IJARIIE: Ahmedabad, India, 2021. [Google Scholar]

- Castells-Quintana, D.; Royuela, V.; Thiel, F. Inequality and sustainable development: Insights from an analysis of the human development index. Sustain. Dev. 2019, 27, 448–460. [Google Scholar] [CrossRef]

- Sen, A. Cultural Liberty and Human Development; UN Human Development Report; United Nations Development Programme: New York, NY, USA, 2004. [Google Scholar]

- Jāhāna, S. Human Development Report 2015: Work for Human Development; United Nations Development Programme: New York, NY, USA, 2015. [Google Scholar]

- Alshebami, A.S.; Al Marri, S.H. “The impact of financial literacy on entrepreneurial intention: The mediating role of saving behavior. Front. Psychol. 2022, 13, 911605. [Google Scholar] [CrossRef]

- Ramakrishnan, D. Financial Literacy—The Demand Side of Financial Inclusion. In Proceedings of the 26th SKOCH Summit 2011 Swabhiman-Inclusive Growth and Beyond, Mumbai, India, 2–3 June 2011. [Google Scholar]

- Atkinson, A.; Messy, F.-A. Measuring Financial Literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot Study; OECD: Paris, France, 2012. [Google Scholar]

- Holzmann, R. Bringing Financial Literacy and Education to Low and Middle Income Countries: The Need to Review, Adjust, and Extend Current Wisdom; IZA: Bonn, Germany, 2010. [Google Scholar]

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef]

- Fernandes, D.; Lynch, J.G., Jr.; Netemeyer, R.G. Financial literacy, financial education, and downstream financial behaviors. Manage. Sci. 2014, 60, 1861–1883. [Google Scholar] [CrossRef]

- Sun, H.; Yuen, D.C.Y.; Zhang, J.; Zhang, X. Is knowledge powerful? Evidence from financial education and earnings quality. Res. Int. Bus. Financ. 2020, 52, 101179. [Google Scholar] [CrossRef]

- Bianchi, M. Financial literacy and portfolio dynamics. J. Financ. 2018, 73, 831–859. [Google Scholar] [CrossRef]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef]

- Gaudecker, H.V.O.N. How does household portfolio diversification vary with financial literacy and financial advice? J. Financ. 2015, 70, 489–507. [Google Scholar] [CrossRef]

- Kezar, A.; Yang, H. The importance of financial literacy. About Campus 2010, 14, 15–21. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Paiella, M. Financial literacy and subjective expectations questions: A validation exercise. Res. Econ. 2016, 70, 360–374. [Google Scholar] [CrossRef]

- Maturana, G.; Nickerson, J. Teachers teaching teachers: The role of workplace peer effects in financial decisions. Rev. Financ. Stud. 2019, 32, 3920–3957. [Google Scholar] [CrossRef]

- Rashidin, M.S.; Javed, S.; Chen, L.; Jian, W. Assessing the competitiveness of Chinese multinational enterprises development: Evidence from electronics sector. SAGE Open 2020, 10, 2158244019898214. [Google Scholar] [CrossRef]

- Hogarth, J.M. The Federal Reserve System’s role in economic and financial literacy–rationale, activities, and impact. Und Wirtsch. Hum. Cap. Econ. Growth 2007, 145. [Google Scholar]

- Berry, J.; Karlan, D.; Pradhan, M. The impact of financial education for youth in Ghana. World Dev. 2018, 102, 71–89. [Google Scholar] [CrossRef]

- Pompei, F.; Selezneva, E. Unemployment and education mismatch in the EU before and after the financial crisis. J. Policy Model. 2021, 43, 448–473. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. The role of social capital in financial development. Am. Econ. Rev. 2004, 94, 526–556. [Google Scholar] [CrossRef]

- Arsel, M. Social Conflict, Economic Development and Extractive Industry: Evidence from South America; Taylor & Francis: Abingdon, UK, 2013. [Google Scholar]

- Olvera, S.G. Capital social, cultura organizacional, cultura innovadora y su incidencia en las Organizaciones Productivas Rurales Colaborativas. Econ. Soc. 2016, 20, 119–136. [Google Scholar]

- Bongomin, G.O.C.; Ntayi, J.M.; Munene, J.C.; Nabeta, I.N. Social capital: Mediator of financial literacy and financial inclusion in rural Uganda. Rev. Int. Bus. Strateg. 2016, 26, 291–312. [Google Scholar] [CrossRef]

- Woolcock, M.; Narayan, D. Social capital: Implications for development theory, research, and policy. World Bank Res. Obs. 2000, 15, 225–249. [Google Scholar] [CrossRef]

- Aldrich, D.P.; Meyer, M.A. Social capital and community resilience. Am. Behav. Sci. 2015, 59, 254–269. [Google Scholar] [CrossRef]

- Paul, C.J.; Weinthal, E.S.; Bellemare, M.F.; Jeuland, M.A. Social capital, trust, and adaptation to climate change: Evidence from rural Ethiopia. Glob. Environ. Chang. 2016, 36, 124–138. [Google Scholar] [CrossRef]

- Onodugo, C.; Onodugo, I.; Ogbo, A.; Okwo, H.; Ogbaekirigwe, C. Moderating role of social capital on the effect of financial behavior on financial inclusion. Probl. Perspect. Manag. 2021, 19, 502–512. [Google Scholar] [CrossRef]

- Adger, W.N. Social capital, collective action, and adaptation to climate change. In Der klimawandel; VS Verlag für Sozialwissenschaften: Wiesbaden, Germany, 2010; pp. 327–345. [Google Scholar]

- Bollier, D. El ascenso del paradigma de los bienes comunes. In Los Bienes Comunes del Conoc. la Teoría a la Práctica; Traficantes de sueños: Madrid, Spain, 2016; pp. 51–64. [Google Scholar]

- Lyons, A.C.; Kass-Hanna, J. Financial inclusion, financial literacy and economically vulnerable populations in the Middle East and North Africa. Emerg. Mark. Financ. Trade 2021, 57, 2699–2738. [Google Scholar] [CrossRef]

- Sarma, M. Index of Financial Inclusion—A Measure of Financial Sector Inclusiveness; The Centre for International Trade and Development (CITD) at the School of International Studies Work Paper; Jawaharlal Nehru University: Delhi, India, 2012. [Google Scholar]

- UNCDF. Finance inclusive: Améliorer l’accès aux Services Financiers; United Nations Capital Development Fund: New York, NY, USA, 2015. [Google Scholar]

- Kisaka, S.E.; Mwewa, N.M. Effects of micro-credit, micro-savings and training on the growth of small and medium enterprises in Machakos County in Kenya. Res. J. Financ. Account. 2014, 5, 43–49. [Google Scholar]

- Eniola, A.A.; Entebang, H. SME firm performance-financial innovation and challenges. Procedia-Soc. Behav. Sci. 2015, 195, 334–342. [Google Scholar] [CrossRef]

- Kimani, E.M. Effect of adoption of Financial Innovation on Performance of small and medium Enterprises in Kenya. 2016. Available online: http://repository.embuni.ac.ke/handle/123456789/1264 (accessed on 26 February 2022).

- Harelimana, J.B. Impact of mobile banking on financial performance of Unguka Microfinance Bank Ltd, Rwanda. Glob. J. Manag. Bus. Res. 2017, 17, 45–55. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Honohan, P. Access to financial services: Measurement, impact, and policies. World Bank Res. Obs. 2009, 24, 119–145. [Google Scholar] [CrossRef]

- Onaolapo, A.A.; Odetayo, T.A. Effect of accounting information system on organisational effectiveness: A case study of selected construction companies in Ibadan, Nigeria. Am. J. Bus. Manag. 2012, 1, 183–189. [Google Scholar] [CrossRef]

- Mago, S.; Chitokwindo, S. The impact of mobile banking on financial inclusion in Zimbabwe: A case for Masvingo Province. Mediterr. J. Soc. Sci. 2014, 5, 221. [Google Scholar]

- Sarma, M. Index of Financial Inclusion; Working Paper; Indian Council for Research on International Economic Relations (ICRIER): New Delhi, India, 2008. [Google Scholar]

- Chakravarty, S.R.; Pal, R. Financial inclusion in India: An axiomatic approach. J. Policy Model. 2013, 35, 813–837. [Google Scholar] [CrossRef]

- Amidžic, G.; Massara, M.A.; Mialou, A. Assessing Countries’ Financial Inclusion Standing—A New Composite Index; International Monetary Fund: Washington, DC, USA, 2014. [Google Scholar]

- UN. Report of the United Nations Conference on Sustainable Development, Rio de Janeiro, Brazil, 20–22 June; UN: New York, NY, USA, 2012. [Google Scholar]

- Wilkinson, A.; Mangalagiu, D. Learning with futures to realise progress towards sustainability: The WBCSD Vision 2050 Initiative. Futures 2012, 44, 372–384. [Google Scholar] [CrossRef]