Abstract

This paper investigates the reasons behind the surprising cost performance of road construction projects in Poland. In particular, in order to explain the phenomenon of cost underruns, the role of regulations related to the national and the European Union structural investment funding is verified. It is shown that in Poland there exist two different institutional frameworks related to infrastructure investment projects. However, in the case of road transport infrastructure investment, the public investor does not discriminate between the sources of funding and follows the optimal strategy for the EU co-funded projects. This, in turn, leads to the emergence of cost underruns.

1. Introduction

Since its accession in 2004, Poland has become the biggest beneficiary of European Union (EU) structural funding. According to the EU Commission, the amount of available financial support reached almost €13 billion between 2004 and 2006, over €67 billion between 2007 and 2013, and around €80 billion between 2014 and 2020. Structural funding significantly exceeded former transfers made within the framework of Pre-accession Funds (PHARE II, ISPA, SAPARD) or the earlier editions of different aid programmes (e.g., [1]). As a result, in the last two decades, Poland has experienced an unprecedented boom in public infrastructure investment that is expected to continue as a part of the policy response to the COVID-19 pandemic.

The majority of large public infrastructure projects implemented after 2004 belong to the transport sector; particular emphasis was placed on the development of the national high-speed road network (roads with maximum speeds between 120 km/h and 140 km/h). Following official sources, between 2007 and 2022 at least 125 major road transport infrastructure projects were completed in Poland. This, in turn, led to an increase in the overall length of the high-speed network from around 700 km in 2004 to over 4600 km in 2022. Furthermore, the Polish government is currently planning to implement another set of large infrastructure investment projects financed within the National Reconstruction Plan under the new EU Recovery and Resilience Facility. In accordance with the Council of Ministers’ decree of 2019 (Rozporządzenie Rady Ministrów z dnia 24 września 2019 r. zmieniające rozporządzenie w sprawie sieci autostrad i dróg ekspresowych), the target length of the high-speed road network in Poland is around 8000 km. This includes 2100 km of motorways.

There exist certain doubts concerning the economic impacts of major transport infrastructure projects (e.g., [2,3,4]). However, even more controversies arise due to their highly problematic performance record as far as the actual costs and benefits are concerned (e.g., [5]). In fact, cost overruns and delivery delays are among the main factors leading to inefficiency of public infrastructure investment (e.g., [6]). Following [7], cost overruns and delivery delays can have multiple negative consequences and may turn otherwise successful projects into failures. Moreover, while closely interrelated, their negative impact can go beyond a given project. For instance, delays in one large infrastructure project can lead to a lower number of infrastructure projects built in a given country in the future due to the financial holdbacks and constant re-estimation of the funds needed for project completion (e.g., [8]). Cost overruns are also considered to be a serious problem as they often lead to a Pareto inefficient resource allocation (e.g., [9]). As pointed out by [10], the latter may lead to economic inefficiency and a loss of social welfare.

Note that public infrastructure is not only believed to play a key role in enforcing economic growth through higher productivity, but also contributes to social sustainability (e.g., [11]). Nowadays, the global economic crisis caused by both COVID-19 and the Russian aggression in Ukraine has increased the importance of sustainable infrastructure that takes into account balanced economic, environmental and social outcomes over the entire project lifecycle (e.g., [12]). Given the above, it appears obvious that the problems related to cost overruns and delivery delays may seriously harm the achievement of sustainable development goals. In particular, their appearance may force investors to prioritize economic outcomes over environmental and social ones.

Many empirical papers provide evidence concerning the existence of cost overruns, delays, and benefit shortfalls all over the world (e.g., [6,13,14]). The notable exception is a recent study by [15] that reports the presence of cost underruns in the case of motorway construction projects in Slovakia. Still, despite the impressive amount of structural investment since 2004, there are hardly any empirical studies that focus on issues related to the implementation of major infrastructure projects in Poland. As a consequence, little can be said about the overall performance of such projects. Moreover, the are no papers that consider the institutional background related to the European structural funding as a possible factor determining cost performance of major public investment projects.

This paper aims to fill the existing gaps in the project management literature by focusing on major road infrastructure projects completed in Poland between 2007 and 2022. It analyses cost performance of both nationally funded and EU co-funded projects in order to see whether there exist any significant differences. Furthermore, it provides empirical evidence on the impact of different regulations, imposed by national and external funding institutions, on the performance of public infrastructure projects. The study aims to answer the following research questions:

- Is it possible for a large sample of transport investment projects accomplished over two decades to experience cost underruns?

- Is the cost performance of nationally funded and internationally funded road investment projects in Poland significantly different?

- What is the role of the institutional framework in explaining the cost performance of nationally and internationally funded public infrastructure projects in Poland?

It should be noted that economic theory underlines aspects related to contract design and award mechanisms as being among the main factors that may explain the poor performance of large infrastructure projects (e.g., [16,17]). At the same time, the project management literature concentrates on project complexity, application of non-standard technology, organisational weakness, and optimism bias or corruption (e.g., [18,19,20]). In order to explain the phenomenon of cost underruns, the present research concentrates on the regulative perspective of the institutional theory that refers to laws, regulations, contracts and their enforcement (e.g., [21,22,23]). In this paper, the source of funding is underlined as another, up to now overlooked, potential factor that may influence the performance of infrastructure investment projects. This is because different funding institutions may have different requirements concerning the funding procurement process or distinct financing standards that affect the complexity of projects, their organisational setup, or even their propensity to corruption. This, in turn, may significantly influence the behaviour of investors.

The remainder of the paper is organised as follows. Section 2 and Section 3 provide literature review and describe the policy background concerning the implementation of transport infrastructure projects in Poland in the last two decades, respectively. Section 4 presents the research methodology and a description of the data and results of the empirical study. Section 5 discusses the reasons behind the research findings, focusing in particular on institutional issues. Finally, Section 6 offers some concluding remarks.

2. Literature Review

The problem of cost overruns (The term “cost overruns” is commonly used in the project management literature to account for the difference between actual/final costs and estimated/forecasted investment costs (e.g., [24]). In the literature there exist, however, differences concerning the point of reference used for cost estimations (e.g., [14]) has been the subject of many analyses that discuss both possible causes and effects of cost underestimation. Most of the papers dealing with the cost performance of public infrastructure projects have an empirical character and focus on transport infrastructure. Early studies on particular countries can be found already in the second part of the 20th century (e.g., [25,26,27]). However, the real boom in the literature followed the paper by [28], who analysed 258 major transportation infrastructure projects completed worldwide and found cost overruns in the case of 9 out of 10 them.

Although there seems to be a consensus about the persistent existence of cost overruns (the notable exceptions are recent studies by [15] and [14] that report the existence of cost underruns in public transport investment projects in Slovakia and Hong Kong, respectively), there is no widespread agreement concerning their causes (e.g., [29]). For instance, many authors argue that cost overruns emerge as a consequence of deliberate underestimation of project costs for political reasons (e.g., [20,24,28,30,31,32,33,34]). Others show that cost overruns are more likely to occur in larger projects with longer construction phases (e.g., [35,36]). Many studies report a close relationship between cost overruns and delivery delays, especially in developing countries (e.g., [36,37,38,39]). Among factors, that are considered as potentially influencing cost performance, one can also find the type of project (e.g., [28,38]), geographical location (e.g., [8]), corruption (e.g., [40,41]), the lack of a clear definition of the scope of the project (e.g., [17]) or the bad quality of transport demand and cost forecasts ([42]).

Following [43], there is no universal theory that explains the existence of cost overruns. The project management literature seeks the main causes of cost overruns in either change in scope and definition of a given project (Evolution Theorists) or inadequate project planning and management, usually related to optimism bias and deception (Psycho Strategists). As a consequence, [29] argue that there is a need for a balanced approach combining different perspectives in order to reduce the incidence of cost overruns.

Not surprisingly, there exist hardly any studies that try to discuss factors related to the existence of cost underruns instead of cost overruns. Below, institutional theory is applied (e.g., [22]) to explain the behavior of policy makers or senior management that may lead to the emergence of the former. The institutional theory focuses on wider institutional framework and analyses how formal regulations or laws influence the structural evolution of organisations (e.g., [44]). As a result, it allows them to justify the role of regulations imposed by international funding organisations, such as the European Union, in shaping the cost performance of public investment projects. In this paper, it is argued that such regulations may significantly influence the incidence of cost overruns or even lead to cost underruns.

Note that the majority of papers analysing the cost performance of public investment projects focus either on well-developed economies (e.g., Australia, Western Europe or the United States) or developing countries from Africa or Asia. However, in the last two decades, an impressive increase in public infrastructure investment spending has been observed in the new member states of the EU. Poland, the biggest country in the aforementioned group, should be considered a particularly interesting case for research given the magnitude of transport investment. Here, the overall length of the high-speed network increased from around 700 km in 2004 to over 4600 km in 2022 (the above numbers include both motorways and express roads). As a result, many analyses have been carried out covering different aspects of the implementation of road transport investment projects in Poland since 2004 (e.g., [3,45]). Nevertheless, there are hardly any studies that analyse the cost performance of public transport investment projects both in Poland and other new member states of the EU. There exist several evaluation reports by [46,47,48]. Still, the above evaluations provide case studies of particular projects rather than analysing a wider dataset of completed investments. The only exception is a recent paper on motorway investment projects in Slovakia by [28]. As a consequence, little can be said about the overall performance of transport investment projects or factors that may influence their financial execution. In particular, there are no papers that consider the regulations related to structural funding, and European structural funding in particular, as a possible factor determining the cost performance of major public investment projects.

3. Policy Background

Prior to EU accession in 2004, transport infrastructure policy in Poland was characterised by limited funding and a lack of clearly defined development priorities. Investment in the high-speed road network began at the beginning of the 2000s, and was mainly due to the availability of pre-accession funding (e.g., Instrument for Structural Policy for Pre-Accession, ISPA). However, the first official list of planned expressways and motorways was only announced by the Polish Ministry of Transport in 2004. The aforementioned list was very extensive and did not rank particular sections in terms of their importance (e.g., [45]). The situation changed dramatically from May 1st 2004. First, because then Poland gained access to the European structural funds and the Cohesion Fund. Second, due to the fact that the European Commission required the preparation of detailed multiannual programmes related to the use of structural funding.

The spectacular increase in the amount of European funding available for transport infrastructure investment projects can be appreciated once particular financial frameworks are compared. During the years 2000–2003, the total budget for ISPA projects in Poland reached around €1.5 billion. Then, between 2004 and 2006 Poland received an allocation from the Cohesion Fund of €4 billion (for details see [49]). About 50% of financial support from the ISPA and Cohesion Fund was spent on public transport infrastructure. Additionally, over €1.1 billion was allocated from the European Regional Development Fund (ERDF) to the transport sector within the Sectoral Operational Programme Transport. A further increase in structural funding was observed within the 2007–2013 and 2014–2020 Financial Frameworks when major transport infrastructure projects were implemented within the Operational Programme Infrastructure and Environment. In both cases, the indicative allocation for transport-related projects topped around €19.5 billion. Furthermore, additional funds for transport infrastructure investment were allocated to the eastern Polish regions within the Development of Eastern Poland Operational Programme (around €0.7 billion between 2007 and 2013) and the Eastern Poland Operational Programme (around €1.3 billion between 2014 and 2020). It should be noted, however, that the EU co-funded programmes required a minimum share of national co-funding that, in the case of Poland, was set at 15%. Hence, the total amount of public funding available for transport infrastructure investment was significantly higher. Still, the allocation for road transport infrastructure projects constituted only a part of the total funds dedicated to transport infrastructure (the remaining funding was allocated for railways, airports and ports). As a result, the indicative allocation of public funding devoted to road transport infrastructure under the EU structural policy in Poland between 2004 and 2020 reached around €30 billion. A detailed breakdown is shown in Table 1 below.

Table 1.

Indicative allocation for road transport investment projects between 2004 and 2020 (current prices).

The National Development Plan 2004–2006, the first national strategy concerning the implementation of European structural policies in Poland, was adopted by the government in 2003. Its adoption followed the formal requirements of the European Commission, which approves such a strategy before the start of every programming period. The National Development Plan 2004–2006 defined the main development goals and the overall number of financial resources engaged in achieving them. It also specified the instruments that were applied in order to realise particular priorities. In terms of the development of the transport infrastructure, the strategy clearly defined the integration of Poland with the European transport networks as a top priority. As a result, the majority of investment was supposed to be directed towards the construction of new motorways and expressways. In accordance with this strategy, the overall length of motorways was to increase from 398 km in 2001 to 940 km at the end of 2006. At the same time, the length of the expressways network was to grow from 206 km to 399 km. The implementation of transport-related structural policies was further detailed in the implementation strategies for the sectoral Transport Operational Programme (OP) and the Cohesion Fund. The latter document included the Transport Development Strategy and outlined transport corridors that should be developed by 2013. It also specified particular road investment projects to be implemented within the 2004–2006 Financial Framework, and named the General Directorate for National Roads and Motorways (GDDKiA) as an investor in all projects related to the national high-speed road network.

For the 2007–2013 programming period, the investment priorities of the regional and sectoral programmes were set out in the National Strategic Reference Framework (NSRF). In terms of transport infrastructure, they followed the Transport Development Strategy from 2004. In accordance with the NSRF, the expected length of motorways in 2013 was set at 1754 km, as compared to 552 km in 2005. In the case of expressways, the goal for 2013 was established as 2555 km versus 258 km in 2005. Transport-related investment programmes were further specified in the Infrastructure and Environment OP and the Development of Eastern Poland programme. The former programme detailed the transport-related investment priorities at a national level while the latter focused on particular priorities for the least-developed Polish regions. As compared to the previous financial framework, the Infrastructure and Environment OP did not specify particular projects to be implemented between 2007 and 2013. Instead, an indicative list of major investment projects was provided. However, the decision on whether a given project would receive European co-funding was to be made by the implementing authority.

Finally, the national strategy for the 2014–2020 programming period was described in the Partnership Agreement. The priorities for the transport infrastructure investment were set up following the new Transport Development Strategy adopted in 2013 (for details see [50]). However, no particular goals were specified in terms of the length of the high-speed road network. Details concerning the planned infrastructure investment in the transport sector were outlined in the Infrastructure and Environment OP and the new Eastern Poland programme. In the case of the former, policy planners again provided an indicative list of major investment projects to be implemented between 2014 and 2020.

The completion of investment projects implemented after 2004 led to an increase in the overall length of high-speed network from around 700 km in 2004 to over 4600 km in 2022. Still, transport infrastructure investment in Poland within the 2004–2006 and 2007–2013 Financial Frameworks concentrated on the improvement of the main east-west and south-north corridors. The first long-term development strategy was adopted in 2013 and resulted in more spatially balanced investment during the 2013–2020 Financial Framework.

4. Cost Effectiveness of Major Transport Infrastructure Projects in Poland

4.1. Methodology

The main goal of the present study is to analyse the cost-related performance of major road projects in Poland accomplished between 2007 and 2022. Three different stages of cost-related project life cycle can be distinguished (e.g., [28]): formal decision to build, tendering and contracting, and project completion (see Figure 1 below). Following other studies, the focus is put on the difference between the estimated project cost at the stage of the formal decision to build (stage 1) and the overall cost at project completion (stage 3). Here, the majority of existing studies prove the existence of cost overruns ranging from 10% to over 100% (for details see [28]). The notable exception is a recent study by [28] that finds significant cost underruns in the case of motorway projects completed between 2008 and 2016 in Slovakia.

Figure 1.

Cost-related project life-cycle stages. Source: author’s preparation.

The deviation of final project costs from the initial estimates is calculated as follows:

Then, once the deviation given by (1) is calculated for all individual projects, an average is taken to assess the overall deviation of a given sample.

Additionally, it is also calculated the deviation related to the time elapsed to carry out individual projects. This is given by:

Again, an overall deviation of a given sample is calculated taking a simple average for individual projects.

4.2. Data

Many studies devoted to the issue of cost overruns in major infrastructure projects are criticised for the low quality of the data or their lack of representativeness. The best example may be the dataset used in a study by [28], consisting of 258 transport infrastructure projects. As [51] have claimed, the above sample is heterogeneous and far from being statistically representative, since it covers a diverse range of projects from different countries over a period of 70 years. The possible bias in the sample is, in fact, recognised in other papers (e.g., [8]) and usually due to limited data availability.

The data used in the present study consist of two unique datasets that cover almost all large road infrastructure investment projects carried out in Poland over the last two decades. The first dataset includes large public infrastructure investment projects implemented in Poland between 2007 and 2022 that were 100% nationally funded. The necessary data were gathered from different sources (GDDKiA, strategic documents, etc.) and include 44 observations. The second dataset comprises investment projects completed in Poland with EU financial support. The data were provided by the Polish Ministry of Development and cover projects undertaken within the 2007–2013 and 2014–2020 financial frameworks. The dataset consists of 81 large-scale infrastructure projects. The planned cost for each of the projects in both datasets is estimated to be over PLN 100 million, which roughly equals EUR 25 million (Note, that the latter value is lower than the minimum value of major projects considered by the European Commission, which is EUR 50 million. However, in the Polish case, many large projects are divided into smaller parts, which significantly decreases the number of projects above EUR 50 million. Furthermore, there are no significant statistical differences between the projects smaller than EUR 50 million and greater than EUR 50 million). For each project, the following information is available:

- Planned cost (at the time of the decision to build);

- Real cost (at the time of the official end of the investment);

- Month and year when the project started;

- Month and year when the project ended;

- Region of implementation at the NUTS2 level (voivodeship);

- Investing authority (either GDDKiA or local administration);

- Road type (motorway, expressway, national road, city road);

- Investment type (new construction or rebuilding of existing road);

- Length of road covered by the project.

Table 2 shows the main statistics concerning project costs in the database. It can be observed that nationally funded projects are on average smaller (mean value) and have a lower standard deviation. However, there are no significant differences in terms of the minimum and maximum size of the projects. Note that the mean value of real costs is lower for both the nationally funded and the EU co-funded projects. This may suggest the existence of cost underruns.

Table 2.

Summary statistics concerning planned and real costs in the database in PLN.

4.3. Empirical Findings

Cost overruns can be expressed either in absolute or relative terms. Here, the second approach is followed, and a cost overrun is expressed as a percentage difference between the planned and real cost of each investment project. The majority of existing studies also use relative terms, as they enable cost escalations to be compared across geographies and different time periods (e.g., [13,24,43]). Note that this analysis covers the project lifecycle, which either begins with the formal funding commitment (EU co-funded projects) or the award of the contract (nationally funded projects) (in fact, both approaches should be considered as very similar in terms of initial cost estimation. However, the data concerning the cost at the contract award stage in the case of EU co-funded projects are not available). In this sense, a common academic approach that can be found in most of the papers is followed (e.g., [43,52]). However, some authors claim that analysis of cost overruns should account for “realpolitik” and begin with the first public cost announcement (e.g., [34]). Most likely, the latter approach would result in higher cost overruns than the ones found in present paper.

Table 3 provides statistics concerning the cost performance of road investment projects in the database. It appears that out of the 125 projects only 10.4% suffered cost overruns, 19.2% were on budget and 70.4% experienced cost underruns. This is something hardly ever observed in other studies, with the exception of the aforementioned study by [28]. There exist minor differences in the cost performance of the nationally funded and the EU co-funded projects. In the case of the former, the share of projects on budget is higher (34% versus 11%). On the other hand, the latter more often experience cost underruns (75.3% versus 61.4%). In both cases, the share of projects that have been subject to cost overruns is very small (4.5% and 13.6%, respectively). It was also examined whether there could be observed significant differences in the performance of projects accomplished within different financial framework programmes (2007–2013 versus 2014–2020), prepared by different institutions (GDDKiA versus local authorities), consisting of different types of roadworks (new construction versus rebuilt), or comprising the construction of different road types (e.g., national road, expressway, motorway). However, no significant dissimilarities could be identified.

Table 3.

Cost performance of nationally funded and EU co-funded projects.

The relative magnitude of cost underruns can be observed in Table 4. As expected, the average deviation for all projects in the database is negative and indicates the existence of cost overruns of around 5% of initial cost estimates. Concerning the funding source, nationally funded projects experience on average lower cost underruns than the EU co-funded ones (−2.3% versus −6.5%). There exist significant differences between road types—while city roads may have average cost underruns as high as −20%, in the case of motorways the underruns reach only −2%. Smaller differences exist between project types; newly constructed roads face cost underruns of around −4.4% while in the case of rebuilt projects this indicator stands at −7.7%. Finally, major differences between investors are found. Here, projects accomplished by GDDKiA are on average much closer to the estimated budget (−3.5%). At the same time, projects implemented by local authorities experience cost underruns of over −19%. Note that the overall magnitude of cost underruns in Poland is much lower than the one reported by [28]; they found that in the case of Slovakia, initial cost estimates for 18 motorway construction projects were higher by around 27%. Still, the existence of cost underruns observed on a large sample of projects in Poland diverges significantly from findings concerning significant cost overruns reported in many international studies. Existing papers report cost overruns ranging from around 10% (e.g., [33,38]) to over 100% (e.g., [19]).

Table 4.

Relative cost performance as % deviation from the initial cost estimates.

Many studies report a close relationship between cost overruns and delivery delays, especially in developing countries (e.g., [36,37,38,39]). Hence, time performance of road investment projects was additionally analysed to verify whether cost underruns are related to a timely project execution. Nevertheless, this appears not to be the case; around 60% of projects experienced delivery delays, irrespective the source of funding (see Table 5 below). As a result, presented findings may indicate systematic overestimation of project costs at the planning stage. Possible reasons for such behaviour by investors are discussed in the next section.

Table 5.

Time performance of the nationally funded and the EU co-funded projects.

5. The Reasons behind Cost Underruns in Poland

In light of the existing empirical literature, the findings regarding the existence of cost underruns in the case of road transport projects (irrespective of the funding source) may seem surprising. In fact, previous case studies on EU co-funded large infrastructure projects show the existence of cost overruns. For instance, the ex-post evaluation of major projects accomplished within the 2000–2006 Cohesion Policy Programmes reports average cost overruns of around 21% (e.g., [53]). Furthermore, cost overruns in selected large transport infrastructure projects completed between 2000 and 2013 are found in a recent evaluation by [46] (In another report, [54] shows that in an analysis, 11 out of 20 major investment projects completed within the 2007–2013 programming period had experienced cost underruns. Still, the low number of projects analysed in the report does not allow any generalised conclusions to be drawn). The only exception is the abovementioned study on Slovakia [28], that reports cost underruns both for nationally funded and EU co-funded motorway construction projects.

The authors of the report by [28]) argue that the existence of cost underruns in Slovakia is due to the inadequate initial cost estimates. In particular, they claim that the unit prices applied on detailed estimates are excessively high due to a lack of historic unit price data. It does not seem, however, to be applicable to the Polish case. Several interviews were conducted with the staff responsible for the preparation of the budget for the EU co-funded projects in GDDKiA (note that GDDKiA acts as an official investor in the case of 113 out of the 125 projects in the database). However, they do not confirm the existence of problems related to inadequate unit prices. The methodology applied to estimate initial investment costs for the 2007–2013 and 2014–2020 periods is mainly based on experience gathered from previously completed projects. This includes technical documentation costs, costs related to archaeological works, costs related to land purchase and unit prices derived from recently signed contracts. For particular road sectors, construction costs are further adjusted to take into account the technical specification of the road, land characteristics or potential construction risks.

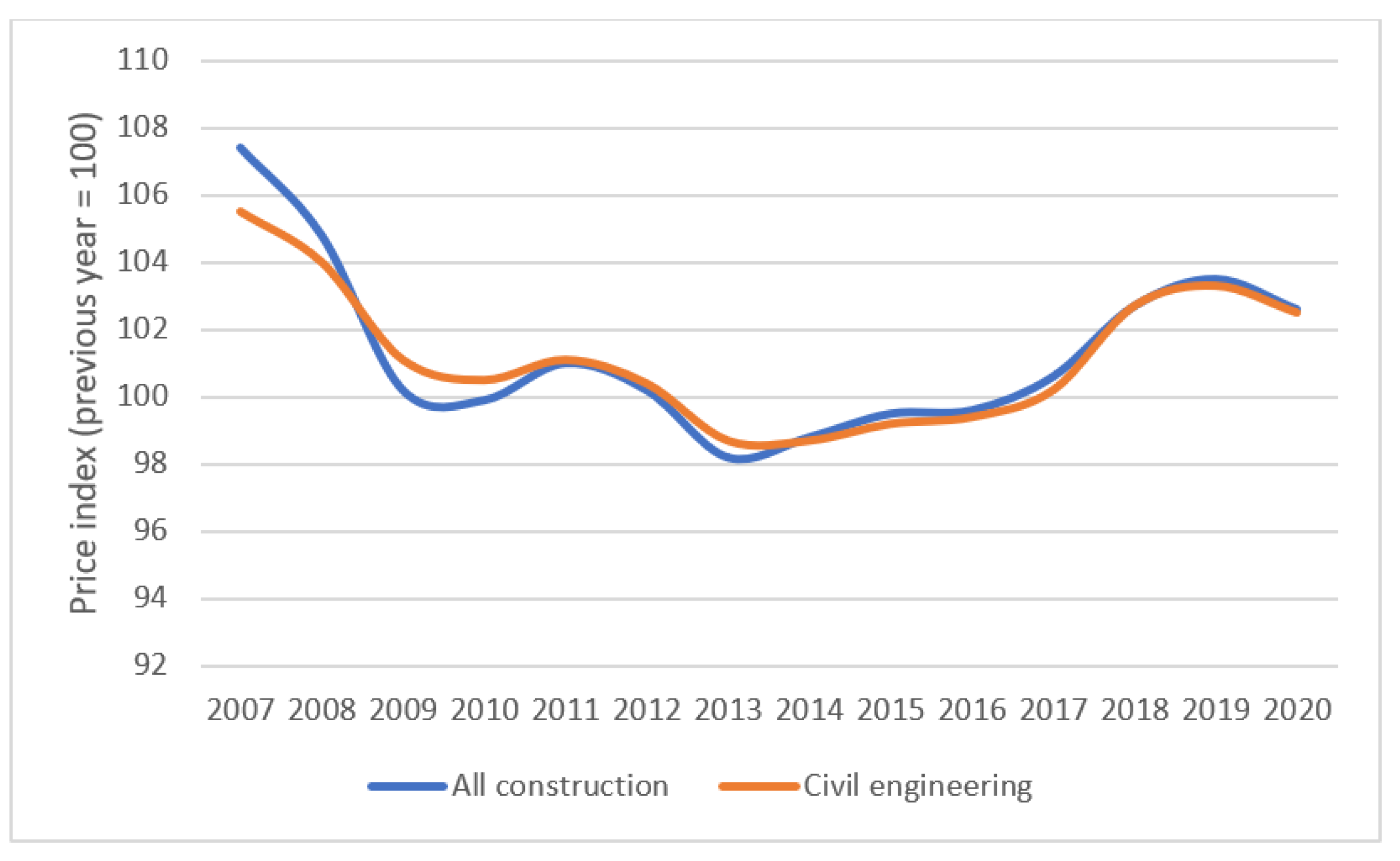

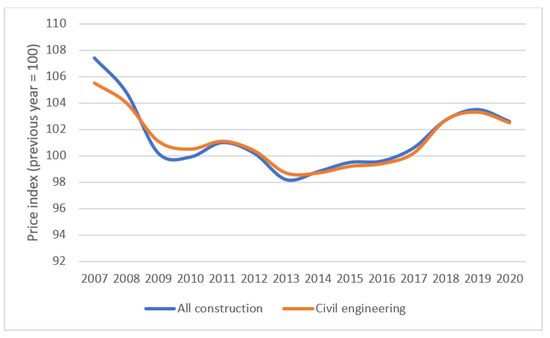

The presence of cost underruns could be also related to the overall macroeconomic situation during the period analysed. It should be noted that all the projects in the database were completed between 2007 and 2022. Yet, many of them were budgeted before the global financial crisis 2007–2009, when the construction bubble was at its peak. As a consequence, one could expect the crisis to cause a price decrease in the construction sector. However, as shown in Figure 2, the construction prices only fell during the 2013–2016 period. As a result, lower construction work prices cannot explain the cost performance for the majority of projects in the database.

Figure 2.

Evolution of price indices of construction and assembly production in Poland between 2007 and 2020. Source: author’s presentation based on data from Statistics Poland.

Furthermore, there is another reason to believe that inadequate initial estimates cannot explain the existence of cost underruns in Poland, at least once the EU co-funded projects are analysed. Here, in accordance with the conducted interviews, the usual strategy of GDDKiA is to apply for EU support once the construction contract is signed. Thus, even though the project budget may also include elements not directly related to the construction works, there is no possibility of erroneously overestimating the costs related to the latter.

Hence, a different, more plausible explanation is required. Here, the focus is put on the institutional background related to public infrastructure investment in Poland. Particular interest is taken in the differences that exist between the national and EU co-funded projects. Comparative institutional analysis is applied (e.g., [55]) to thoroughly review the regulatory framework related to the funding of large infrastructure projects in Poland. As a consequence, it is possible to contrast the regulations and institutions involved in the national funding of large infrastructure investment projects with the ones involved in the development and implementation of projects that rely on co-funding from the EU structural funds. This, in turn, allows us to assess whether fundamentally different regulatory frameworks may co-exist that trigger separate institutionalisation processes.

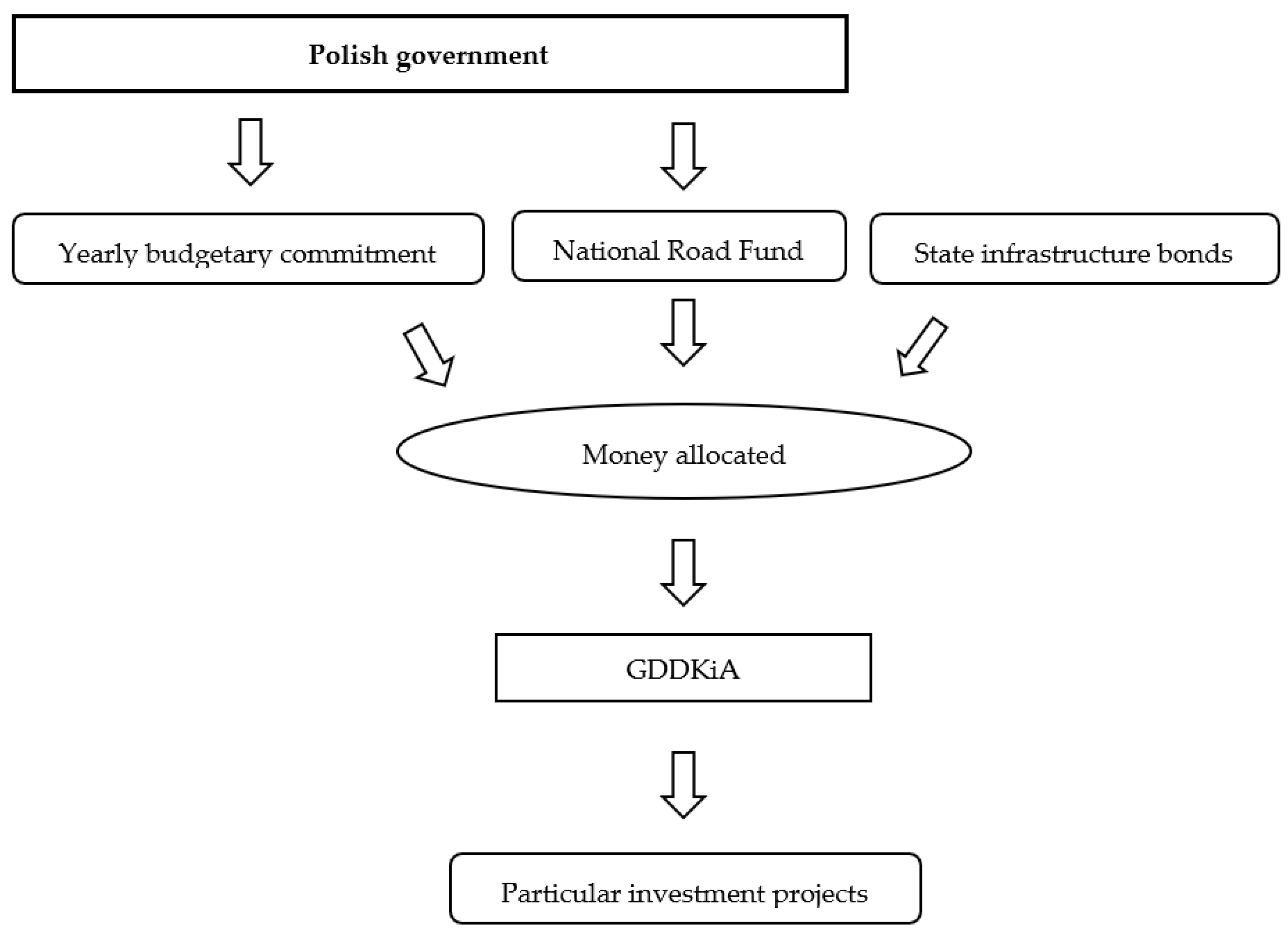

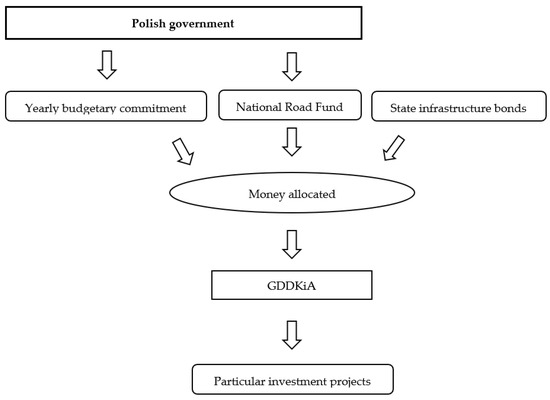

The institutional system related to the national financing of large infrastructure investment projects in Poland is similar to that of other European countries; the initial investment initiative may come from different interest groups (politicians, major public enterprises, local authorities), but it is the central government that decides whether or not to become involved in the project development process. The conventional approach to project development would be similar to the one presented by [30], and includes the identification of alternatives, a feasibility study, and an environmental impact study, etc. In the case of a positive decision, the government would have to secure the necessary funding either directly from the budget of a given ministry or from a specialised sectoral fund (e.g., National Fund for Environmental Protection and Water Management or National Road Fund). In recent years, there were also several cases where publicly controlled enterprises were forced to act as principal investors, principally in the case of energy sector investment projects. As an exception, an Act on financing of a particular investment could be passed through parliament—such a situation took place in 2005 when the Polish parliament passed the Act on the “Świnna Poręba water reservoir construction programme for the 2006–2013 period”. Figure 3 shows the public high-speed road network financing system in Poland. It can be observed that public funding comes from different sources—both budgetary (mainly through National Road Fund) and external (infrastructure bonds). All funding goes to GDDKiA, which acts as a general investor (investing authority) and is responsible for the entire investment process. Still, the initial decision on the implementation of particular investment projects is taken at the central government level within the multiannual national road construction program.

Figure 3.

Public investment financing system in Poland—high-speed road network case. Source: author’s preparation.

Following the game-theoretical approach of comparative institutional analysis, institutions can be seen as the rules of a particular game (e.g., [56]). As a result, the existing institutional framework may influence the behaviour of the different players participating in the investment process (e.g., [57]). In accordance with [55], institutionalisation consists in a process of feedback mechanisms from different players, where subjective expectations about the behaviour of other players coordinate the strategic choices of individual agents and serve as stable guides for strategy. In the Polish case, the institutional setup related to the national funding clearly seems to favour a strategy leading to the deliberate underestimation of large project costs. First, because the interest groups are perfectly aware of the fact that the higher the initial cost estimates, the lower the chance to obtain approval for a given project. Second, because, from the perspective of the policy makers, it is much easier to secure additional budgetary financing and to sell a prospect of a given project to the public when initial cost estimates appear to be reasonably low. This kind of behaviour may lead not only to cost overruns but may also cause a substantial loss of invested resources (The most recent example is the construction of the new coal power block in Ostrołęka that was stopped in 2020, after the public enterprises had invested around EUR 300 million). Nevertheless, such a common strategy of different players taking part in the investment process is also reported for other countries (e.g., [20,30,31,32,33,34]).

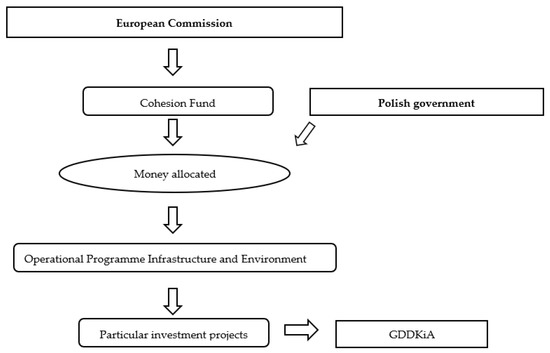

Since its accession to the EU in 2004, Poland has gained access to European structural funding. The institutional framework related to this alternative source of financing is completely different from the one that refers to national funding, first, because the project development process is longer, since the European Commission must give a green light to all investment projects previously accepted by national authorities, and second, because there exist fundamental differences in terms of funding eligibility. In fact, for both 2007–2013 and 2014–2020 programming periods, European structural funding was subject to several dimensions of eligibility such as:

- Geographical location;

- Scope of intervention (only certain types of activity can be financed);

- Cost categories (not all costs can be financed, e.g., debt interest);

- Time (e.g., investment projects had to be completed before a given deadline);

- Level or incidence of the expenditure (the expenditure should have taken place at the beneficiary level, e.g., the public or private entity carrying out the project).

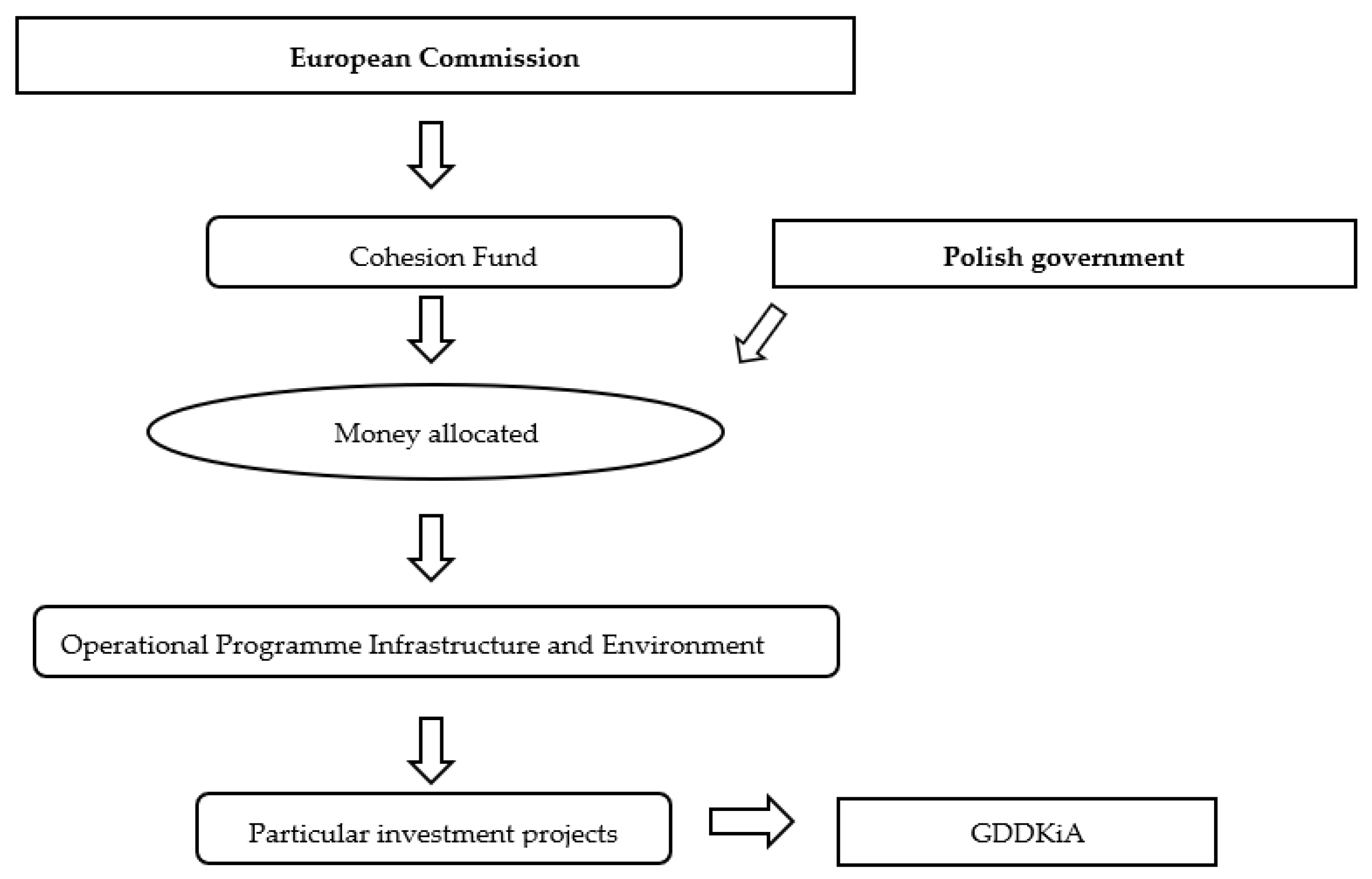

Furthermore, the European Commission set up a number of additional eligibility conditions that include compliance with other Community rules and policies, adequate publicity of the EU financing of projects, requirement to support the costs actually borne by the beneficiary by invoices or documents of equivalent probative value, obligation to keep the evidence of expenditure for a minimum period, and the necessity to keep the investment in operation for a minimum period. All the above seriously influence both the project development process and its construction phase. European Union structural project financing system is depicted in Figure 4.

Figure 4.

EU investment financing system in Poland—high-speed road network case. Source: author’s preparation.

Still, there exists a third fundamental difference between the national and EU funding; while the projects may be approved to receive structural funding, actual payments from European structural funds are provided after the successful completion of the entire investment process. This means that the EU Commission only pays out approved expenditure. Hence, investors must secure the funding necessary to complete the project before starting it. Finally, it should be underlined that all EU funding schemes require national co-funding. In the case of Poland, the maximum level of support from EU funds cannot exceed 85% of eligible costs. This means that all possible cost overruns must be covered by proper investors, as there is no possibility of asking for additional EU funding. In fact, this is probably one of the reasons why GDDKiA never renegotiates road construction contracts and includes very high contractual penalties. This reduces the probability of cost overruns due to a low-balling strategy by road construction firms, as reported by other studies (e.g., [58,59]). At the same time, however, it may lead to delivery delays, as some firms may decide to abandon the construction site. Such a situation took place around 2010, when several firms decided to leave different construction sites (e.g., Polish PBG and POLIMEX, Chinese COVEC, Austrian Alpine Bau or Irish SIAC). In some cases, the loss from Polish road contracts resulted in bankruptcy (Alpine Bau or SIAC) or a need for public aid (e.g., POLIMEX). Yet, it seemed to be repeated recently with the abandonment of construction sites by the Italian Impreza Pizzarotti or Salini in 2019.

In the majority of EU member states, European structural funding can probably be considered as an addition to the national financing sources. As a consequence, the impact of the European regulatory framework on institutions and players involved in the development of major infrastructure investment projects may be limited. At the same time, however, in the Polish case its significance is hard to overstate. Given its relatively low level of per capita income and large size, Poland became the biggest beneficiary of EU structural funding during the 2007–2013 and 2014–2020 periods. The majority of available EU funding was dedicated to financing infrastructure investment projects within the “Infrastructure and Environment” operational programme. This, in turn, resulted in a dramatic shift in the financing of large infrastructural projects. Since then, all eligible projects were directed towards EU funding schemes, while those remaining continued relying on national funding sources. As a result, it may be claimed that, in the last two decades, two different parallel institutional/regulatory frameworks have been used to finance structural investment projects in Poland.

Under the EU regulatory framework, both investors and the government face completely different rules of game, as compared to the national funding scheme. On the one hand, the preparation of a project proposal is more costly and time consuming. Usually, it requires investors to hire agencies specialising in attracting the EU funding. Furthermore, they have to apply for loans to secure the funding necessary for project completion. On the other hand, investors are aware that once the project is approved to receive European funding, there is no penalty if the project scope or its total value is limited during the construction phase (It would require, however, the signing of an annex to the grant contract with an implementing authority). They also know that there exists the possibility of receiving a higher than initially set co-funding rate (While the maximum level of co-funding from EU funds may be as much as 85%, usually it is much lower due to limited funding availability. However, it is a common strategy of implementing institutions to increase the co-funding rate during or after the project completion, once they realise that all the disposable allocation will not be spent). Finally, since the 2007–2013 period, large infrastructural projects are included on the individual project list and do not have to compete for European funding on the normal basis (projects outside the individual list should participate in regular calls for proposals where projects are selected on a competitive basis). Given all of the above, project planners have no reasons to deliberately underestimate project costs. On the contrary, a certain degree of cost overestimation could be welcome by the government. The latter used to be under constant pressure to assure the highest level of absorption of available EU funding. Underestimation of project costs and the subsequent failure of project delivery could seriously affect the absorption performance. As a result, unlike in the case of the nationally funded projects, the rational strategy of both investors and the government might have consisted in preparing and approving larger proposals with a certain degree of cost overestimation. The existing empirical literature does not report, however, this kind of systematic behaviour.

Given the above, one could expect to observe two different patterns; on the one hand, nationally funded projects should experience cost overruns as found in other empirical studies, but on the other hand, the optimal strategy in the case of EU co-funded projects would consist in deliberate overestimation of initial project costs. This kind of strategy might seem reasonable for several reasons. First, because major infrastructure projects came from the individual project list and were considered as a national investment priority. As a consequence, they did not have to participate in regular calls for projects (It has been analysed the list of projects that were proposed within the individual project list, but which did not qualify for EU funding. Only a few of the projects with a budget over PLN 100 million were completed with EU co-funding, following a competitive call for projects). Second, such investment projects could achieve a very high level of co-funding from EU funding; in accordance with the data, in some cases EU funding reached over 80% of total project costs. In such a situation, an initial cost overestimation could be preferable to cost underestimation, since it implies a lower final requirement for own funding. It also offers the investors a margin of manoeuvre, in case a part of the project spending is not recognised by the European Commission as an eligible cost and is not refunded from EU sources.

The cost performance of nationally funded and EU co-funded major infrastructure projects, not related to the transport sector (e.g., stadiums, museums, power plants, etc.), that were accomplished in recent years in Poland have been analysed. Indeed, it was found that the majority (28 out of 35) of nationally funded projects suffered significant cost overruns. At the same time, this share was much lower for those that were EU co-funded (15 out of 66). Nevertheless, empirical analysis provided in the previous section shows that road construction projects experience cost underruns irrespective their source of funding. The explanation of this phenomenon seems, however, to be rather straightforward. Remembering that all nationally funded projects and the vast majority of EU co-funded ones were carried out by GDDKiA, one can remember that the latter institution has no reason to discriminate between the source of funding. First, because not all of the projects included in the indicative list of major investment projects receive EU funding (the list is divided into main and reserve projects). Second, due to the fact that projects initially funded nationally may be included in the pool for EU co-funding once the allocation is not fully absorbed at the end of a given financial framework. As a consequence, GDDKiA most likely prepare initial cost estimations following an optimal strategy for the EU co-funded projects. Such behaviour of project planners may explain the similar cost performance of road infrastructure projects funded from different sources.

6. Conclusions

This study contributes to the analysis of cost performance in large-scale transport infrastructure projects, taking as an example major road investment projects completed in Poland between 2007 and 2022. The first contribution is to show that there can exist systematic cost underruns in a large, representative and homogenous sample of road investment projects. In particular, it is found that 88 out of the 125 road investment projects experience cost underruns. The average, negative deviation for all projects in the database is around 5% of initial cost estimates. The existence of cost underruns observed in a large sample of projects in Poland diverges significantly from findings concerning significant cost overruns reported in many international studies. It is also proven that the cost performance does not necessarily match the time performance. In fact, while the majority of analysed projects experience cost underruns, about 60% of projects suffer delivery delays. As a result, the positive correlation between cost overruns and delivery delays found in previous studies cannot be confirmed.

The results are particularly interesting in the case of the EU co-funded projects. In fact, this is the first paper to show that such projects have experienced significant cost underruns during the 2007–2013 and 2014–2020 programming periods. While a few papers compare public and private funding (e.g., [60]) or different sources of national public funding (e.g., [61]), there are no studies that simultaneously evaluate the execution of nationally funded projects, and those that rely on external funding. In the European context, this means that there are no papers systematically comparing projects funded nationally and those co-funded from EU sources. As a consequence, nothing can be said about the relative effectiveness of different sources of funding and the reasons behind possible dissimilarities in this matter. This seems to be extremely important given the policy challenges related to the COVID-19 pandemic (e.g., [62]).

The presence of cost underruns cannot be explained as a result of inadequate initial cost estimates and excessively high unit prices in particular. Neither can their roots be found in the overall macroeconomic situation. Hence, in order to explain the phenomenon of cost underruns, the focus is put on the institutional environment as a possible factor that leads to the unexpected cost performance observed in Poland. In particular, it is yet to be verified whether the existence of both national and external funding of structural investments may significantly influence the behaviour of project planners and investors. The comparative institutional analysis shows that in Poland there exist two different institutional frameworks related to major infrastructure investment projects. As a consequence, the behaviour of the main players involved in the investment process may differ in accordance with the source of funding they want to use. However, in the case of road transport infrastructure investment, the main investor (GDDKiA) has no reason to discriminate between the sources of funding and seems to follow the optimal strategy for the EU co-funded projects. This, in turn, leads to the emergence of cost underruns.

Note that the existence of cost underruns should not be considered a policy success by itself. In fact, the performed analysis clearly shows that over 60% of all infrastructure projects suffer delivery delays. Hence, one could claim that cost underruns may actually lead to delivery delays, confirming the existence of a causal relationship between both of them. Polish experience proves that the unwillingness to renegotiate the contract price on the part of the investor could force the contractor to abandon the construction site or even cause its bankruptcy. Thus, the question is whether the potential costs related to delivery delays do not exceed the benefits achieved due to strict financial execution of particular investment projects. Furthermore, systematic overestimation of initial project costs may potentially lead to inefficient allocation of public funding and postponement of some key investment projects. As a result, cost underruns are not necessarily any better than cost overruns. This, in turn, should be of particular interest to policy makers. In this sense, there seems to be a clear need for further investigation concerning the relationship between European funding and the cost/time performance of major infrastructure projects in other member states of the EU.

In light of the presented results, one could also wonder about the necessity of moving towards more modern procurement approaches, such as public–private partnerships (PPP). While their role seems to be slowly increasing globally, they are still practically inexistent in countries such as Poland. The main argument for an application of PPP procurement would be a potential gain in productive efficiency due to the involvement of the private sector. At the same time, however, there could arise problems related to the service quality (e.g., [60]) and possible difficulties concerning the design and monitoring of long-term contracts (e.g., [7]). In fact, existing empirical studies do not unequivocally confirm that PPP projects surpass traditional procurement methods in terms of cost and time performance (e.g., [7]). Moreover, some of them show that the transfer of risk from the public to the private sector is usually reflected in higher overall project price (e.g., [60,63,64]). As consequence, it is very unlikely that the PPP approach increases its popularity in the near future. In this sense, despite its deficiencies, the traditional procurement approach is expected to maintain its dominant role. Unless, as argued by [64], the efficiency gains from a PPP are clearly proven to be much higher than commonly expected. Still, one may expect the traditional procurement approach to include certain mechanisms that would lead towards sustainable infrastructure development more frequently. These include integrated contracts (e.g., [65]), effective Front-End Planning (e.g., [66]) or federated digital platforms (e.g., [67]).

Funding

This research was funded by the Polish National Science Centre under the grant UMO-2016/22/E/HS4/00464.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Some or all data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

B. Rokicki gratefully acknowledges financial support from the Polish National Science Centre under the grant UMO-2016/22/E/HS4/00464.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Churski, P. Structural Funds of the European Union in Poland—Experience of the First Period of Membership. Eur. Plan. Stud. 2008, 16, 579–607. [Google Scholar] [CrossRef]

- Bröcker, J.; Rietveld, P. Infrastructure and regional development. In Handbook of Regional Growth and Development Theories; Capello, R., Nijkamp, P., Eds.; Edward Elgar: Cheltenham, UK, 2009. [Google Scholar]

- Rokicki, B.; Stępniak, M. Major transport infrastructure investment and regional economic development—An accessibility-based approach. J. Transp. Geogr. 2018, 72, 36–49. [Google Scholar] [CrossRef]

- Nogués, S.; González González, E. Are current road investments exacerbating spatial inequalities inside European peripheral regions? Eur. Plan. Stud. 2022, 30, 1845–1871. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Mega Projects and Risk: An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Cavalieri, M.; Cristaudo, R.; Guccio, C. Tales on the dark side of the transport infrastructure provision: A systematic literature review of the determinants of cost overruns. Transp. Rev. 2019, 39, 774–794. [Google Scholar] [CrossRef]

- Välilä, T. An overview of economic theory and evidence of public-private partnerships in the procurement of (transport) infrastructure. Util. Policy 2020, 62, 1–11. [Google Scholar] [CrossRef]

- Cantarelli, C.; Molin, E.; van Wee, B.; Flyvbjerg, B. Characteristics of cost overruns for Dutch transport infrastructure projects and the importance of the decision to build and project phases. Transp. Policy 2012, 22, 49–56. [Google Scholar] [CrossRef]

- Flyvbjerg, B. Policy and Planning for Large-Infrastructure Projects: Problems, Causes, Cures. Environ. Plan. B Plan. Des. 2007, 34, 578–597. [Google Scholar] [CrossRef]

- Lewis, G.; Bajari, P. Procurement contracting with time incentives: Theory and evidence. Q. J. Econ. 2011, 126, 1173–1211. [Google Scholar] [CrossRef]

- Chan, M.; Jin, H.; van Kan, D.; Vrcelj, Z. Developing an innovative assessment framework for sustainable infrastructure development. J. Clean. Prod. 2022, 368, 133185. [Google Scholar] [CrossRef]

- United Nations Environment Programme. International Good Practice Principles for Sustainable Infrastructure; United Nations Environment Programme: Nairobi, Kenya, 2022. [Google Scholar]

- Flyvbjerg, B. What You Should Know About Megaprojects and Why: An Overview. Proj. Manag. J. 2014, 45, 6–19. [Google Scholar] [CrossRef]

- Love, P.; Sing, M.; Ika, L.; Newton, S. The cost performance of transportation projects: The fallacy of the Planning Fallacy account. Transp. Res. Part A Policy Pract. 2019, 122, 1–20. [Google Scholar] [CrossRef]

- ITF Motorway Cost Estimation Review: The Case of Slovakia. In International Transport Forum Policy Papers; OECD Publishing: Paris, France, 2018; p. 45.

- Bajari, P.; Houghton, S.; Tadelis, S. Bidding for incomplete contracts: An empirical analysis of adaptation costs. Am. Econ. Rev. 2014, 104, 1288–1319. [Google Scholar] [CrossRef]

- Thomas, L. Optimal Procurement Contract with Cost Overruns. Ann. Econ. Stat. 2019, 133, 109–126. [Google Scholar] [CrossRef]

- Cheng, Y.-M. An exploration into cost-influencing factors on construction projects. Int. J. Proj. Manag. 2014, 32, 850–860. [Google Scholar] [CrossRef]

- Locatelli, G.; Mariani, G.; Sainatia, T.; Greco, M. Corruption in public projects and megaprojects: There is an elephant in the room! Int. J. Proj. Manag. 2017, 35, 252–268. [Google Scholar] [CrossRef]

- Catalão, F.; Cruz, C.; Sarmento, J. The determinants of cost deviations and overruns in transport projects, an endogenous models approach. Transp. Policy 2019, 74, 224–238. [Google Scholar] [CrossRef]

- Henisz, W.; Levitt, R.; Scott, W. Toward a unified theory of project governance: Economic, sociological and psychological supports for relational contracting. Eng. Proj. Organ. J. 2012, 2, 37–55. [Google Scholar] [CrossRef]

- Scott, W. The institutional environment of global project organizations. Eng. Proj. Organ. J. 2012, 2, 27–35. [Google Scholar] [CrossRef]

- Müller, R.; Pemsel, S.; Shao, J. Organizational enablers for project governance and governmentality in project-based organizations. Int. J. Proj. Manag. 2015, 33, 839–851. [Google Scholar] [CrossRef]

- Cantarelli, C.; Flyvbjerg, B.; Molin, E.; van Wee, B. Cost Overruns in Large-Scale Transportation Infrastructure Projects: Explanations and Their Theoretical Embeddedness. Eur. J. Transp. Infrastruct. Res. 2010, 10, 5–18. [Google Scholar]

- Morris, S. Cost and time overruns in public sector projects. Econ. Political Wkly. 1990, 25, 154–168. [Google Scholar]

- Thurgood, G.; Walters, L.; Williams, G.; Wright, N. Changing environmental for highway construction: The Utah experience with construction cost overruns. Transp. Res. Rec. 1990, 1262, 121–130. [Google Scholar]

- Hinze, J.; Selstead, G.; Mahoney, J. Cost overruns on State of Washington construction contracts. Transp. Res. Rec. 1992, 1351, 87–93. [Google Scholar]

- Flyvbjerg, B.; Skamris Holm, M.; Buhl, S. Underestimating Costs in Public Works Projects: Error or Lie? J. Am. Plan. Assoc. 2002, 68, 279–295. [Google Scholar] [CrossRef]

- Love, P.; Simpson, I.; Olatunji, O.; Smith, J.; Regan, M. Understanding the landscape of overruns in transportation infrastructure projects. Environ. Plan. B Plan. Des. 2015, 42, 490–509. [Google Scholar] [CrossRef]

- Bruzelius, N.; Flyvbjerg, B.; Rothengatter, W. Big decision, big risks. Improving accountability in mega projects. Transp. Policy 2002, 9, 143–154. [Google Scholar] [CrossRef]

- Gamez, E.; Touran, A. A quantitative analysis of the performance of transportation projects in developing countries. Transp. Rev. 2010, 30, 361–387. [Google Scholar] [CrossRef]

- Makovšek, D. Systematic construction risk, cost estimation mechanism and unit price movements. Transp. Policy 2014, 35, 135–145. [Google Scholar] [CrossRef]

- Odeck, J. Do reforms reduce the magnitudes of cost overruns in road projects? Statistical evidence from Norway. Transp. Res. Part A Policy Pract. 2014, 65, 68–79. [Google Scholar] [CrossRef]

- Terrill, M.; Danks, L. Cost Overruns in Transport Infrastructure; Grattan Institute: Melbourne, Australia, 2016. [Google Scholar]

- Singh, R. Delays and Cost Overruns in Infrastructure Projects: Extent, Causes and Remedies. Econ. Political Wkly. 2010, 45, 43–54. [Google Scholar]

- Shrestha, P.; Burns, L.; Shields, D. Magnitude of Construction Cost and Schedule Overruns in Public Work Projects. J. Constr. Eng. 2013, 9, 1–9. [Google Scholar] [CrossRef]

- Aibinu, A.; Jagboro, G. The effects of construction delays on project delivery in Nigerian construction industry. Int. J. Proj. Manag. 2002, 20, 593–599. [Google Scholar] [CrossRef]

- Lee, J.-K. Cost overrun and cause in Korean social overhead capital projects: Roads, rails, airports, and ports. J. Urban Plan. Dev. 2008, 134, 59–62. [Google Scholar] [CrossRef]

- Mukuka, M.; Aigbavboa, C.; Thwala, W. Effects of construction projects schedule overruns: A case of the Gauteng Province, South Africa. Procedia Manuf. 2015, 3, 1690–1695. [Google Scholar] [CrossRef]

- Abbas Niazi, G.; Painting, N. Significant Factors Causing Cost Overruns in the Construction Industry in Afghanistan. Procedia Eng. 2017, 182, 510–517. [Google Scholar] [CrossRef]

- Fazekas, M.; Tóth, B. The extent and cost of corruption in transport infrastructure. New evidence from Europe. Transp. Res. Part A 2018, 113, 35–54. [Google Scholar] [CrossRef]

- van Wee, B. Large Infrastructure Projects: A Review of the Quality of Demand Forecasts and Cost Estimations. Environ. Plan. B Plan. Des. 2007, 34, 611–625. [Google Scholar] [CrossRef]

- Love, P.; Ahiaga-Dagbui, D.; Irani, Z. Cost overruns in transportation infrastructure projects: Sowing the seeds for a probabilistic theory of causation. Transp. Res. Part A Policy Pract. 2016, 92, 184–194. [Google Scholar] [CrossRef]

- Badewi, A.; Shehab, E. The impact of organizational project benefits management governance on ERP project success: Neo-institutional theory perspective. Int. J. Proj. Manag. 2016, 34, 412–428. [Google Scholar] [CrossRef]

- Rosik, P.; Stępniak, M.; Komornicki, T. The decade of the big push to roads in Poland: Impact on improvement in accessibility and territorial cohesion from a policy perspective. Transp. Policy 2015, 37, 134–146. [Google Scholar] [CrossRef]

- European Commission. Ex Post Evaluations of Major Projects in the Transport and Environmental Sectors Financed by the European Regional Development Fund and the Cohesion Fund between 2000 and 2013. 2020. Available online: https://ec.europa.eu/regional_policy/en/policy/evaluations/ec/transp2000-2013/ (accessed on 22 January 2020).

- European Court of Auditors. EU Transport Infrastructures: More Speed Needed in Megaproject Implementation to Deliver Network Effects on Time; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- European Investment Bank. Evaluation of Transport Projects in Central and Eastern Europe. 2003. Available online: https://www.eib.org/en/publications/evaluation-of-transport-projects-in-central-and-eastern-europe (accessed on 22 January 2020).

- RGL Forensics. Ex Post Evaluation of Cohesion Policy Interventions 2000–2006 Financed by the Cohesion Fund (Including Former ISPA). First interim report. 2011. Available online: https://ec.europa.eu/regional_policy/sources/docgener/evaluation/pdf/expost2006/wpa_1st_interim_report.pdf (accessed on 22 January 2020).

- TDS. Transport Development Strategy by 2020 (with Perspective by 2030); Ministry of Transport, Construction and Maritime Economy: Warsaw, Poland, 2013. [Google Scholar]

- Love, P.; Ahiaga-Dagbui, D. Debunking fake news in a post-truth era: The plausible untruths of cost underestimation in transport infrastructure projects. Transp. Res. Part A Policy Pract. 2018, 113, 357–368. [Google Scholar] [CrossRef]

- Siemiatycki, M. Academics and auditors: Comparing perspectives on transport project cost overruns. J. Plan. Educ. Res. 2009, 29, 142–156. [Google Scholar] [CrossRef]

- RGL Forensics. Faber Maunsell/Aecom, Frontier Economics Efficiency: Unit Costs of Major Projects. Final Report. 2009. Available online: https://ec.europa.eu/regional_policy/sources/docgener/evaluation/pdf/expost2006/wp10_final_report.pdf (accessed on 22 January 2020).

- European Commission. Ex Post Evaluation of Cohesion Policy Programmes 2007–2013, Focusing on the European Regional Development Fund (ERDF) and the Cohesion Fund (CF); Transport. Final Report; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Aoki, M. Toward a Comparative Institutional Analysis; MIT Press: Cambridge, UK; London, UK,, 2001. [Google Scholar]

- Jackson, G. Actors and institutions. In The Oxford Handbook of Comparative Institutional Analysis; Morgan, G., Campbell, J., Crouch, C., Pedersen, O., Whitley, R., Eds.; Oxford University Press: New York, NY, USA, 2010. [Google Scholar]

- North, D. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Guccio, C.; Pignataro, G.; Rizzo, I. Determinants of adaptation costs in procurement: An empirical estimation on Italian public works contracts. Appl. Econ. 2012, 44, 1891–1909. [Google Scholar] [CrossRef]

- Iimi, A. Testing Low-Balling Strategy in Rural Road Procurement. Rev. Ind. Organ. 2013, 43, 243–261. [Google Scholar] [CrossRef]

- Blanc-Brude, F.; Goldsmith, H.; Välilä, T. A comparison of construction contract prices for traditionally procured roads and public-private partnerships. Rev. Ind. Organ. 2009, 35, 19–40. [Google Scholar] [CrossRef]

- Marion, J. Are Bid Preferences Benign? The Effect of Small Business Subsidies in Highway Procurement Auctions. J. Public Econ. 2007, 91, 1591–1624. [Google Scholar] [CrossRef]

- Love, P.; Ika, L.; Matthews, J.; Fang, W. Shared leadership, value and risks in large scale transport projects: Re-calibrating procurement policy for post COVID-19. Res. Transp. Econ. 2020, 90, 100999. [Google Scholar]

- Fernandes, C.; Ferreira, M.; Moura, F. PPPs—True Financial Costs and Hidden Returns. Transp. Rev. 2016, 36, 207–227. [Google Scholar] [CrossRef]

- Makovšek, D.; Moszoro, M. Risk pricing inefficiency in public–private partnerships. Transp. Rev. 2018, 38, 298–321. [Google Scholar] [CrossRef]

- Lenferink, S.; Tillema, T.; Arts, J. Towards sustainable infrastructure development through integrated contracts: Experiences with inclusiveness in Dutch infrastructure projects. Int. J. Proj. Manag. 2013, 31, 615–627. [Google Scholar] [CrossRef]

- Rahat, R.; Ferrer, V.; Pradhananga, P.; ElZomor, M. Developing an effective front-end planning framework for sustainable infrastructure projects. Int. J. Constr. Manag. 2022. [Google Scholar] [CrossRef]

- Nübel, K.; Bühler, M.; Jelinek, T. Federated Digital Platforms: Value Chain Integration for Sustainable Infrastructure Planning and Delivery. Sustainability 2021, 13, 8996. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).