Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective

Abstract

1. Introduction

1.1. Conceptual Background

1.2. Research Aims and Questions

1.3. Paper Layout

2. Methodology

2.1. Systematic Literature Review

2.2. Systematic Literature Review Conducting Procedure

3. Literature Collection, Evaluation and Data Extraction

3.1. Literature Review Search

3.2. Literature Evaluation

3.3. Data Extraction

4. Data Integration and Analysis

4.1. Conceptual Development Analysis

- SCF 1.0: Traditional ‘1 + N’ Mode

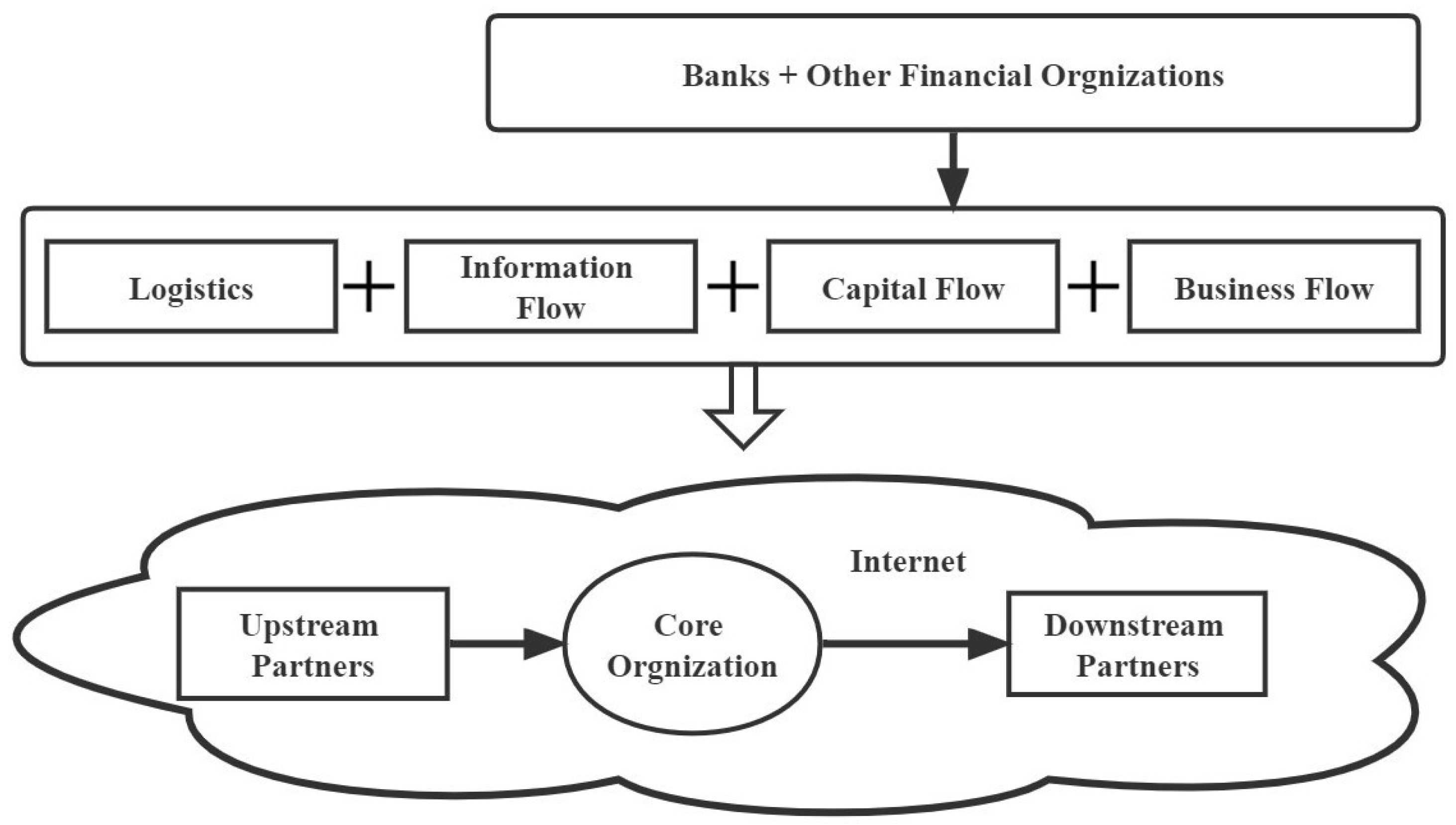

- SCF 2.0: 4 Flows Combination Mode

- SCF 3.0: Platform ‘N + N’ Mode

4.2. Content Analysis

- Financial ecological stakeholders (Supply Chain-oriented)

- (1)

- Financing Actor

- Financial ecological supply chain platform (Finance-oriented)

- (2)

- Financial Solution

- (3)

- Financial Instruments

- (4)

- Technology

- (5)

- Platform

- (6)

- Supply Chain Collaboration (SCC)

- Financial eco-environment

- (7)

- Regulations

- (8)

- Sustainable Supply Chain Finance (SSCF)

5. Discussion

5.1. Answering the Research Questions

5.2. Comparison with the Previous Literature

5.3. Differences Identified in the Research

- (1)

- The Physical Similarity of the Natural Ecosystem

- (2)

- SCF Environment Dynamicity

- (3)

- Supply Network Complexity

5.4. Research Contribution: Towards a Framework of Further SCF Ecosystem Understanding

6. Future Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shen, Y.; Chen, C.; Gu, J. Research on the Design of Supply Chain Financial Ecology Model and Risk Management. Ecology 2019, 28, 3653–3660. [Google Scholar]

- Budin, M.; Eapen, A.T. Cash generation in business operations: Some simulation models. J. Financ. 1970, 25, 1091–1107. [Google Scholar] [CrossRef]

- Haley, C.W.; Higgins, R.C. Inventory Policy and Trade Credit Financing. Manag. Sci. 1973, 20, 464–471. [Google Scholar] [CrossRef]

- Wood, J.H. Financial intermediaries and monetary control: An example. J. Monet. Econ. 1981, 8, 145–163. [Google Scholar] [CrossRef]

- Stemmler, L. The Role of Finance in Supply Chain Management. In Cost Management in Supply Chains; Springer: Berlin/Heidelberg, Germany, 2002; pp. 165–176. [Google Scholar]

- Hofmann, E. Supply chain finance: Some conceptual insights. In Beiträge Zu Beschaffung Und Logistik; Supply Chain Management (SCM); Springer: Berlin/Heidelberg, Germany, 2005; Volume 16, pp. 203–214. [Google Scholar]

- Sadlovska, V. The 2008 State of the Market in Supply Chain Finance; Aberdeen Group: Boston, MA, USA, 2008. [Google Scholar]

- Gong, Y.; Xie, S.; Arunachalam, D.; Duan, J.; Luo, J. Blockchain-based recycling and its impact on recycling performance: A network theory perspective. Bus. Strategy Environ. 2022. [Google Scholar] [CrossRef]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-commerce and blockchain-based supply chain finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Liang, X.; Zhao, X.; Wang, M.; Li, Z. Small and medium-sized enterprises sustainable supply chain financing decision based on triple bottom line theory. Sustainability 2018, 10, 4242. [Google Scholar] [CrossRef]

- Scfcommunity. Bridging Physical and Financial Chains. Available online: http://www.scfcommunity.org/ (accessed on 21 January 2022).

- Camerinelli, E. Supply chain finance. J. Paym. Strategy Syst. 2009, 3, 114–128. [Google Scholar]

- Omran, Y.; Henke, M.; Heines, R.; Hofmann, E. Blockchain-driven supply chain finance: Towards a conceptual framework from a buyer perspective. In Proceedings of the IPSERA 2017: 26th Annual Conference of the International Purchasing and Supply Education and Research Association, Budapest, Hungary, 9–12 April 2017; pp. 1–15. [Google Scholar]

- Pfohl, H.C.; Gomm, M. Supply chain finance: Optimizing financial flows in supply chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Petr, P.; Sirpal, R.; Hamdan, M. Post-crisis emerging role of the treasurer. Eur. J. Sci. Res. 2012, 86, 319–339. [Google Scholar]

- Walters, D. Effectiveness and efficiency: The role of demand chain management. Int. J. Logist. Manag. 2006, 17, 75–94. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Foerstl, K.; Henke, M. Managing the Innovation Adoption of Supply Chain Finance—Empirical Evidence From Six European Case Studies. J. Bus. Logist. 2013, 34, 148–166. [Google Scholar] [CrossRef]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Jia, F.; Brown, S.; Gong, Y.; Xu, Y. Supply chain finance: A systematic literature review and bibliometric analysis. Int. J. Prod. Econ. 2018, 204, 160–173. [Google Scholar] [CrossRef]

- Bals, C. Toward a supply chain finance (SCF) ecosystem—Proposing a framework and agenda for future research. J. Purch. Supply Manag. 2019, 25, 105–117. [Google Scholar] [CrossRef]

- Tansley, A.G. The Use and Abuse of Vegetational Concepts and Terms. Ecology 1935, 16, 284–307. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Wang, W.; Yang, Y. The Latest Literature Review of Financial Ecology at Home and Abroad. Acad. Res. 2006, 11, 69–74. [Google Scholar]

- Zhou, X. Further improve the financial ecological environment. Financ. Res. 2005, 2, 121–122. [Google Scholar]

- Xu, N. On the financial ecological environment in China. Financ. Res. 2005, 11, 31–37. [Google Scholar]

- Mizgier, K.J. Global sensitivity analysis and aggregation of risk in multi-product supply chain networks. Int. J. Prod. Res. 2017, 55, 130–144. [Google Scholar] [CrossRef]

- Wei, X. Construction of the Ecological Model for Supply Chain Finance Based on Ecosystem Theory. In Proceedings of the 2018 4th International Conference on Economics, Social Science, Arts, Education and Management Engineering (ESSAEME 2018), Huhhot, China, 28–29 July 2018; pp. 561–564. [Google Scholar]

- Pellegrino, R.; Costantino, N.; Tauro, D. Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. J. Purch. Supply Manag. 2019, 25, 118–133. [Google Scholar] [CrossRef]

- Scholtens, B. Why Finance Should Care about Ecology. Trends Ecol. Evol. 2017, 32, 500–505. [Google Scholar] [CrossRef]

- Ahmad, S.; Omar, R. Basic corporate governance models: A systematic review. Int. J. Law Manag. 2016, 58, 73–107. [Google Scholar] [CrossRef]

- Petticrew, M. Systematic reviews from astronomy to zoology: Myths and misconceptions. BMJ 2001, 322, 98. [Google Scholar] [CrossRef]

- Jesson, J.; Matheson, L.; Lacey, F.M. Doing Your Literature Review: Traditional and Systematic Techniques; Sage Publications: Thousand Oaks, CA, USA, 2011. [Google Scholar]

- Fink, A. Conducting Research Literature Reviews: From the Internet to Paper; Sage Publications: Thousand Oaks, CA, USA, 2019. [Google Scholar]

- Kitchenham, B. Procedures for Performing Systematic Reviews; 0400011T.1; Keele University: Keele, UK, 2004; pp. 1–27. [Google Scholar]

- Denyer, D.; Tranfield, D. Producing a systematic review. In The Sage Handbook of Organizational Research Methods; Buchanan, D.A., Bryman, A., Eds.; Sage Publications Ltd.: New York, NY, USA, 2009. [Google Scholar]

- Finfgeld-Connett, D. Use of content analysis to conduct knowledge-building and theory-generating qualitative systematic reviews. Qual. Res. 2013, 14, 341–352. [Google Scholar] [CrossRef]

- Nandy, B.R.; Sarvela, P. Content analysis reexamined: A relevant research method for health education. Am. J. Health Behav. 1997, 21, 222–234. [Google Scholar]

- Cavanagh, S. Content analysis: Concepts, methods and applications. Nurse Res. 1997, 4, 5–16. [Google Scholar] [CrossRef]

- Jia, F.; Blome, C.; Sun, H.; Yang, Y.; Zhi, B. Towards an integrated conceptual framework of supply chain finance: An information processing perspective. Int. J. Prod. Econ. 2020, 219, 18–30. [Google Scholar] [CrossRef]

- Donald, B.J.; David, C.J.; Bixby, C.M.; John, B.C. Supply Chain Logistics Management; International Edition; McGraw-Hill: New York, NY, USA, 2013. [Google Scholar]

- Guillén, G.; Badell, M.; Puigjaner, L. A holistic framework for short-term supply chain management integrating production and corporate financial planning. Int. J. Prod. Econ. 2007, 106, 288–306. [Google Scholar] [CrossRef]

- Lin, C.S.; Lin, C.Y. Constructing a network evaluation framework for improving the financial ecosystem in small-medium size firms. Technol. Econ. Dev. Econ. 2018, 24, 893–913. [Google Scholar] [CrossRef]

- Lin, C.Y. Optimal Core Operation in Supply Chain Finance Ecosystem by Integrating the Fuzzy Algorithm and Hierarchical Framework. Int. J. Comput. Intell. Syst. 2020, 13, 259–274. [Google Scholar] [CrossRef]

- Seifert, R.W.; Seifert, D. Financing the Chain. Int. Commer. Rev. 2011, 10, 32–44. [Google Scholar] [CrossRef]

- Lamoureux, J.F.; Evans, T.A. Supply Chain Finance: A New Means to Support the Competitiveness and Resilience of Global Value Chains. 2011. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2179944 (accessed on 21 January 2022).

- Popa, V. The financial supply chain management: A new solution for supply chain resilience. Amfiteatru Econ. J. 2013, 15, 140–153. [Google Scholar]

- Caniato, F.; Henke, M.; Zsidisin, G.A. Supply chain finance: Historical foundations, current research, future developments. J. Purch. Supply Manag. 2019, 25, 99–104. [Google Scholar] [CrossRef]

- Cronie, G.; Sales, H. ING Guide to Financial Supply Chain Optimisation; ING Wholesale Banking: Hong Kong, China, 2008; pp. 1–5. [Google Scholar]

- Kristofik, P.; Kok, J.; de Vries, S.; Hoff, J.V.S.-V.T. Financial supply chain management-challenges and obstacles. In Proceeding in Finance and Risk Perspectives ’12; ACRN Cambridge Publishing House: Enns, Austria, 2012; pp. 77–88. [Google Scholar]

- Chen, H. The Path Choice of Constructing Supply Chain Finance Cloud Ecosystem Based on Internet. World Econ. Res. 2017, 6, 71–77. [Google Scholar] [CrossRef]

- Chen, X.; Wang, C.; Li, S. The impact of supply chain finance on corporate social responsibility and creating shared value: A case from the emerging economy. Supply Chain Manag. Int. J. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Fellenz, M.R.; Augustenborg, C.; Brady, M.; Greene, J. Requirements for an evolving model of supply chain finance: A technology and service providers perspective. CIBIMA 2009, 10, 227–235. [Google Scholar]

- Song, H.; Chen, S. Development of Supply Chain Finance and Internet Supply Chain Finance: A Theoretical Framework. J. Renmin Univ. Chin. 2016, 30, 95–104. [Google Scholar]

- Gomm, M.L. Supply chain finance: Applying finance theory to supply chain management to enhance finance in supply chains. Int. J. Logist. Res. Appl. 2010, 13, 133–142. [Google Scholar] [CrossRef]

- Randall, W.S.; Theodore, F.M. Supply chain financing: Using cash-to-cash variables to strengthen the supply chain. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 669–689. [Google Scholar] [CrossRef]

- Hong, Y. Research on Energy Diffusion Modeling and Simulation Analysis of the Core Enterprise of Supply Chain Financial Ecosystem Based on Netlogo. Int. J. Simul. Syst. Sci. Technol. 2015, 16, 41–45. [Google Scholar] [CrossRef]

- Huang, C.; Chan, F.T.S.; Chung, S.H. Recent contributions to supply chain finance: Towards a theoretical and practical research agenda. Int. J. Prod. Res. 2022, 60, 493–516. [Google Scholar] [CrossRef]

- Li, S.; Chen, X. The role of supply chain finance in third-party logistics industry: A case study from China. Int. J. Logist. Res. Appl. 2019, 22, 154–171. [Google Scholar] [CrossRef]

- Chen, X.; Liu, C.; Li, S. The role of supply chain finance in improving the competitive advantage of online retailing enterprises. Electron. Commer. Res. Appl. 2019, 33, 100821. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Henke, M. Focusing the financial flow of supply chains: An empirical investigation of financial supply chain management. Int. J. Prod. Econ. 2013, 145, 773–789. [Google Scholar] [CrossRef]

- Chen, L.; Moretto, A.; Jia, F.; Caniato, F.; Xiong, Y. The role of digital transformation to empower supply chain finance: Current research status and future research directions (Guest editorial). Int. J. Oper. Prod. Manag. 2021, 41, 277–288. [Google Scholar] [CrossRef]

- Palia, D.; Sopranzetti, B.J. Securitizing Accounts Receivable. Rev. Quant. Financ. Account. 2004, 22, 29–38. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. A more complete conceptual framework for SME finance. J. Bank. Financ. 2006, 30, 2945–2966. [Google Scholar] [CrossRef]

- Sugirin, M. Financial supply chain management. J. Corp. Treas. Manag. 2009, 2, 237–240. [Google Scholar]

- Basu, P.; Nair, S.K. Supply Chain Finance enabled early pay: Unlocking trapped value in B2B logistics. Int. J. Logist. Syst. Manag. 2012, 12, 334–353. [Google Scholar] [CrossRef]

- More, D.; Basu, P. Challenges of supply chain finance. Bus. Process Manag. J. 2013, 19, 624–647. [Google Scholar] [CrossRef]

- Ji, G.; Gunasekaran, A. Evolution of innovation and its strategies: From ecological niche models of supply chain clusters. J. Oper. Res. Soc. 2014, 65, 888–903. [Google Scholar] [CrossRef]

- Ali, Z.; Gongbing, B.; Mehreen, A. Predicting supply chain effectiveness through supply chain finance. Int. J. Logist. Manag. 2019, 30, 488–505. [Google Scholar] [CrossRef]

- Chao, X.; Ran, Q.; Chen, J.; Li, T.; Qian, Q.; Ergu, D. Regulatory technology (Reg-Tech) in financial stability supervision: Taxonomy, key methods, applications and future directions. Int. Rev. Financ. Anal. 2022, 80, 102023. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Palmié, M.; Wincent, J.; Parida, V.; Caglar, U. The evolution of the financial technology ecosystem: An introduction and agenda for future research on disruptive innovations in ecosystems. Technol. Forecast. Soc. Change 2020, 151, 119779. [Google Scholar] [CrossRef]

- Liu, Z. Literature Review of Supply Chain Finance Based on Blockchain Perspective. OJBM 2020, 9, 419–429. [Google Scholar] [CrossRef]

- Cui, Y. Research on the Development of Supply Chain Finance Innovation Assisted by Fintech. In Proceedings of the 5th International Conference on Financial Innovation and Economic Development (ICFIED 2020), Sanya, China, 10–12 January 2020; pp. 189–193. [Google Scholar]

- Zhang, Z.Y.; Rohlfer, S.; Rajasekera, J. An Eco-Systematic View of Cross-Sector Fintech: The Case of Alibaba and Tencent. Sustainability 2020, 12, 8907. [Google Scholar] [CrossRef]

- Ning, L.; Yuan, Y. How blockchain impacts the supply chain finance platform business model reconfiguration. Int. J. Logist. Res. Appl. 2021. [Google Scholar] [CrossRef]

- De Reuver, M.; Sørensen, C.; Basole, R.C. The Digital Platform: A Research Agenda. J. Inf. Technol. 2018, 33, 124–135. [Google Scholar] [CrossRef]

- Du, M.; Chen, Q.; Xiao, J.; Yang, H.; Ma, H. Supply Chain Finance Innovation Using Blockchain. IEEE Trans. Eng. Manag. 2020, 67, 1045–1058. [Google Scholar] [CrossRef]

- Li, M.; Shao, S.; Ye, Q.; Xu, G.; Huang, G.Q. Blockchain-enabled logistics finance execution platform for capital-constrained E-commerce retail. Robot. Comput. Integr. Manuf. 2020, 65, 101962. [Google Scholar] [CrossRef]

- Wan, X.; Qie, X. Poverty alleviation ecosystem evolutionary game on smart supply chain platform under the government financial platform incentive mechanism. J. Comput. Appl. Math. 2020, 372, 112595. [Google Scholar] [CrossRef]

- Huang, Q.; Zhao, X.; Yeung, K.H.; Ma, L.; Yeung, J.H.Y. Effects of information-processing mechanisms on Internet-based purchase order financing. Transp. Res. E Logist. Transp. Rev. 2021, 146, 102222. [Google Scholar] [CrossRef]

- Camarinha-Matos, L.M.; Afsarmanesh, H. Collaborative networks: A new scientific discipline. J. Intell. Manuf. 2005, 16, 439–452. [Google Scholar] [CrossRef]

- Graça, P.; Camarinha-Matos, L.M. The Need of Performance Indicators for Collaborative Business Ecosystems. In Proceedings of the Technological Innovation for Cloud-Based Engineering Systems, Costa de Caparica, Portugal, 13–15 April 2015; Springer: Cham, Switzerland, 2015; pp. 22–30. [Google Scholar]

- Liu, X.; Zhou, L.; Wu, Y.-C.J. Supply Chain Finance in China: Business Innovation and Theory Development. Sustainability 2015, 7, 14689–14709. [Google Scholar] [CrossRef]

- Shi, W.; Mena, C. Supply Chain Resilience Assessment With Financial Considerations: A Bayesian Network-Based Method. IEEE Trans. Eng. Manag. 2021, 1–16. [Google Scholar] [CrossRef]

- Song, H.; Yang, X.; Yu, K. How do supply chain network and SMEs’ operational capabilities enhance working capital financing? An integrative signaling view. Int. J. Prod. Econ. 2020, 220, 107447. [Google Scholar] [CrossRef]

- Olan, F.; Arakpogun, E.O.; Jayawickrama, U.; Suklan, J.; Liu, S. Sustainable Supply Chain Finance and Supply Networks: The Role of Artificial Intelligence. IEEE Trans. Eng. Manag. 2022, 1–16. [Google Scholar] [CrossRef]

- Acharya, V.V. A theory of systemic risk and design of prudential bank regulation. J. Financ. Stab. 2009, 5, 224–255. [Google Scholar] [CrossRef]

- Milne, A. Distance to default and the financial crisis. J. Financ. Stab. 2014, 12, 26–36. [Google Scholar] [CrossRef]

- Kupiec, P.H. Will TLAC regulations fix the G-SIB too-big-to-fail problem? J. Financ. Stab. 2016, 24, 158–169. [Google Scholar] [CrossRef]

- Abedifar, P.; Giudici, P.; Hashem, S.Q. Heterogeneous market structure and systemic risk: Evidence from dual banking systems. J. Financ. Stab. 2017, 33, 96–119. [Google Scholar] [CrossRef]

- Zhang, H.; Shi, Y.; Yang, X.; Zhou, R. A firefly algorithm modified support vector machine for the credit risk assessment of supply chain finance. Res. Int. Bus. Financ. 2021, 58, 101482. [Google Scholar] [CrossRef]

- Wang, G.; Wang, L.; Mohammed, B.S.; Hamad, A.A. An investigation on the risk awareness model and the economic development of the financial sector. Ann. Oper. Res. 2022. [Google Scholar] [CrossRef]

- Li, X.; Zhou, P. Research on Risk Management of Digital Currency Based on Blockchain Technology in Mobile Commerce. In Proceedings of the Design, Operation and Evaluation of Mobile Communications, Virtual Event, 24–29 July 2021; Springer: Cham, Switzerland, 2021; pp. 45–67. [Google Scholar]

- Tseng, M.L.; Wu, K.J.; Hu, J.; Wang, C.H. Decision-making model for sustainable supply chain finance under uncertainties. Int. J. Prod. Econ. 2018, 205, 30–36. [Google Scholar] [CrossRef]

- Tseng, M.L.; Wu, K.J.; Lim, M.K.; Wong, W.P. Data-driven sustainable supply chain management performance: A hierarchical structure assessment under uncertainties. J. Clean. Prod. 2019, 227, 760–771. [Google Scholar] [CrossRef]

- Jia, F.; Zhang, T.; Chen, L. Sustainable supply chain Finance:Towards a research agenda. J. Clean. Prod. 2020, 243, 118680. [Google Scholar] [CrossRef]

- Kraljic, P. Purchasing must become supply management. Harv. Bus. Rev. 1983, 61, 109–117. [Google Scholar]

- Seifert, D.; Seifert, R.W.; Protopappa, S.M. A review of trade credit literature: Opportunities for research in operations. Eur. J. Oper. Res. 2013, 231, 245–256. [Google Scholar] [CrossRef]

- Viswanadham, N.; Samvedi, A. Multi tier supplier selection for a sustainable global supply chain. In Proceedings of the 2013 IEEE International Conference on Automation Science and Engineering (CASE), Madison, WI, USA, 17–20 August 2013; pp. 492–497. [Google Scholar]

- Liu, Q. China’s Internet financial ecosystem overview. In Proceedings of the 2015 International Conference on Logistics, Informatics and Service Sciences (LISS), Barcelona, Spain, 27–29 July 2015; pp. 1–4. [Google Scholar]

- Chen, F.; Drezner, Z.; Ryan, J.K.; Simchi-Levi, D. Quantifying the Bullwhip Effect in a Simple Supply Chain: The Impact of Forecasting, Lead Times, and Information. Manag. Sci. 2000, 46, 436–443. [Google Scholar] [CrossRef]

- Gligor, D.M.; Holcomb, M. The road to supply chain agility: An RBV perspective on the role of logistics capabilities. Int. J. Logist. Manag. 2014, 25, 160–179. [Google Scholar] [CrossRef]

- Bals, L.; Tate, W.; Gelsomino, L.; Bals, C. The Influence of Financial Flows on Sustainability. In Proceedings of the 28th Annual IPSERA Conference: Art and Science of Procurement, Milan, Italy, 14–17 April 2019; p. 53. [Google Scholar]

- Bascompte, J.; Jordano, P.; Olesen, J.M. Asymmetric Coevolutionary Networks Facilitate Biodiversity Maintenance. Science 2006, 312, 431–433. [Google Scholar] [CrossRef]

- Haldane, A.G.; May, R.M. Systemic risk in banking ecosystems. Nature 2011, 469, 351–355. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Finance Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

- Lund, S.; Manyika, J.; Woetzel, J.; Barriball, E.; Krishnan, M. Risk, Resilience, and Rebalancing in Global Value Chains; McKinsey Global Institute: Washington, DC, USA, 2020. [Google Scholar]

| Author, Yr. | Paper Title | Number of Quotes | Main Research Points |

|---|---|---|---|

| Camerinelli 2009 | Supply Chain Finance | 128 | Demonstrates the function of financial components as a ‘glue’ in the SC from the perspective of financial flow innovation by banks and financial institutions. |

| Pfohl and Gomm 2009 | Supply Chain Finance: Optimising Financial Flows in Supply Chains | 446 | Proposes an SCF mathematical model with three dimensions of the trigger, actor, and levers to detect the role of financial flows in SC and the effects SCM can have on optimizing such flows in terms of capital cost. |

| D. Seifert et al., 2013 | A Review of Trade Credit Literature: Opportunities for Research in Operations | 327 | Reviews SCF based on the literature of trade credit. |

| Gelsomino et al., 2016 | Supply Chain Finance: a Literature Review | 196 | Identifies the SCF business model from two perspectives: Financial-oriented and Supply Chain-oriented. |

| X. Xu et al., 2018 | Supply Chain Finance: a Systematic Literature Review and Bibliometric Analysis | 284 | Conducts SCF research from four clusters of ‘the deteriorating inventory model under trade credit policy’, ‘the inventory decisions made with trade credit policy’, ‘the interaction between replenishment decisions and delay payment strategies’ and ‘the roles of financing service in the supply chain’. |

| Jia et al., 2020b | Towards an Integrated Conceptual Framework of Supply Chain Finance: an Information Processing Perspective | 94 | Expands existing SCF business model into four types of ‘manufacturer-centred model’, ‘bank-centred model’, ‘3PL-centered model’ and ‘supply chain actor-centred model’. |

| Steps | Goal | Main Task |

|---|---|---|

| Step 1 | Make a research plan | Determine the research purpose, state the research questions, and introduce the research steps. |

| Step 2 | Search for literature review | Find the most valuable literature for the research problems, and edit the retrieval process into the document. The contents include the names of the databases used (two or more), the date of retrieval, the starting and ending years of literature, the terms or keywords used, the languages, and the number of articles retrieved. |

| Step 3 | Literature evaluation | The primary purpose of the retrieved literature quality evaluation is to set criteria to include or exclude the literature and ensure the validity and reliability of the data. |

| Step 4 | Data extraction | Various data extraction forms, such as ‘document basic information data extraction sheet’ and ‘literature connotation data extraction sheet’, are developed on Excel and other software to reduce human errors and biases. |

| Step 5 | Data integration and discussion | The differences and connections between the data are found according to the data extraction list, and appropriate analysis methods (e.g., description analysis, content analysis) are further used to explore the data’s knowledge and answer different research questions. |

| Step 6 | Summary of a write-up | Summarize a write-up, including an introduction, research background, study methodology, data extraction process, data integration results, discussion, and conclusion. |

| Source of Journal | AJG2018 | Number of Articles |

|---|---|---|

| International Journal of Production Economics | 3 | 10 |

| International Journal of Production Research | 3 | 8 |

| IEEE Transactions on Engineering Management | 3 | 7 |

| Industrial Management & Data Systems | 2 | 7 |

| Annals of Operations Research | 3 | 6 |

| International Journal of Operations and Production Management | 4 | 6 |

| Journal of Purchasing and Supply Management | 2 | 6 |

| Technological Forecasting and Social Change | 3 | 6 |

| International Journal of Logistics Research and Applications | 1 | 5 |

| Production and Operations Management | 4 | 4 |

| Business Strategy and the Environment | 3 | 3 |

| Industrial Marketing Management | 3 | 3 |

| Journal of Business and Industrial Marketing | 2 | 3 |

| Supply Chain Management: An International Journal | 3 | 3 |

| Computers & Industrial Engineering | 2 | 2 |

| Enterprise Information Systems | 2 | 2 |

| Expert Systems with Application | 3 | 2 |

| International Journal of Management | 3 | 2 |

| Journal of Business Research | 3 | 2 |

| Journal of Entrepreneurship | 1 | 2 |

| Journal of Theoretical and Applied Electronic Commerce Research | 1 | 2 |

| Management Science | 4* | 2 |

| Organization Science | 4* | 2 |

| The TQM Journal | 1 | 2 |

| Transportation Research Part E: Logistics and Transportation Review | 3 | 2 |

| Asia Pacific Business Review | 2 | 1 |

| Computational Economics | 1 | 1 |

| Economic Systems | 2 | 1 |

| Information & Management | 3 | 1 |

| Information Processing and Management | 2 | 1 |

| Information Resources Management Journal | 1 | 1 |

| Information Systems Management | 2 | 1 |

| Intelligent Systems in Accounting, Finance and Management | 1 | 1 |

| International Journal of Business and Systems Research | 1 | 1 |

| International Journal of Contemporary Hospitality Management | 3 | 1 |

| International Journal of Finance and Economics | 3 | 1 |

| International Journal of Forecasting | 3 | 1 |

| International Journal of Industrial Engineering & Production Research | 1 | 1 |

| International Journal of Innovation, Creativity and Change | 2 | 1 |

| International Journal of Services and Operations Management | 1 | 1 |

| International Journal of Technology Intelligence and Planning | 1 | 1 |

| International Review of Financial Analysis | 3 | 1 |

| International Transactions in Operational Research | 1 | 1 |

| Journal of Business Logistics | 2 | 1 |

| Journal of Development Studies | 3 | 1 |

| Journal of Industrial and Business Economics | 1 | 1 |

| Journal of Knowledge Management | 2 | 1 |

| Journal of Macromarketing | 2 | 1 |

| Journal of Organizational and End User Computing | 1 | 1 |

| Journal of Product Innovation Management | 4 | 1 |

| Journal of Rural Studies | 3 | 1 |

| Journal of Sustainable Finance & Investment | 1 | 1 |

| Journal of the Association for Information Systems | 2 | 1 |

| Electronic Commerce Research and Applications | 2 | 1 |

| Management Decision | 2 | 1 |

| Production Planning and Control | 3 | 1 |

| Research in International Business and Finance | 2 | 1 |

| Review of Finance | 4 | 1 |

| Methodology | Numbers | Percentage |

|---|---|---|

| Mixed | 14 | 10.61% |

| Case Study | 14 | 10.61% |

| Conceptual Framework | 6 | 4.55% |

| Model Simulation | 23 | 17.41% |

| Literature Review | 35 | 26.52% |

| Investigation research | 16 | 12.12% |

| Empirical Analysis | 24 | 18.18% |

| Sub-Areas of Financial Ecosystem | Key SCF Dimensions | Key Coding Terms | Article Counts | Selected Representative References | Proof Quotes (Exemplary) | |

|---|---|---|---|---|---|---|

| Financial ecological stakeholders | Supply Chain-oriented: | (1) Financing Actor | Core Organizations (COs); Upstream; Downstream; Financial Institutions; Banking Sectors; Customers; Third-Party Logistics Providers (3PLs); Small and Medium Enterprises (SMEs); Suppliers; Manufacturers; Wholesalers/Distributors; Retailers; Customer | 70 | Randall and Farris [55]; Hong [56]; C. Huang et al. [57]; C. Bals [20]; S. Li and Chen [58]; X. Chen et al. [59]; C.-Y. Lin [43]; Jia et al. [39] | “SCF actors include primary actors (buyers and suppliers) and supportive actors (banks, non-bank financial institutions, logistics service providers and platform providers” [57]. |

| Financial ecological supply chain platform | Finance-oriented: | (2) Financial Solution | Working Capital Optimization/Management; Financial Performance; Financial Product/Service/Solution; Financial Business Innovation | 69 | Hofmann [6]; Wuttke et al. [17,60]; Camerinelli [12]; Lamoureux and Evans [45]; Gelsomino et al. [18]; Caniato et al. [47]; S. Li and Chen [58]; L. Chen et al. [61] | “SCF optimizes financial flows at an inter-organizational level through solutions implemented by financial institutions or third-party technology and service providers with the ultimate goal of aligning financial flows with product and information flows within the supply chain” [58]. |

| (3) Financial Instruments | Trade Credit; Asset-based Financing; Pre-Shipment Financing; Purchasing Order Financing (Buyer-driven); in-Transit Financing; Inventory Pledge; Post-Shipment Financing; Reverse Factoring; Accounts Receivable; Accounts Payable; Dynamic Discounting | 35 | Palia and Sopranzetti [62]; Hofmann [6]; Berger and Udell [63]; Camerinelli [12]; Sugirin [64]; Gomm [54]; R. W. Seifert and D. Seifert [44]; Basu and Nair [65]; Popa [46]; More and Basu [66]; Wuttke, et al. [60]; Ji and Gunasekaran [67]; X. Xu et al. [19]; C. Bals [20]; Ali et al. [68]; L. Chen et al. [61]; X. Chen et al. [51]; C. Huang et al. [57] | “SCF arrangements are not limited to accounts receivable or accounts payable financing solutions but also include other forms of network financing, including factoring and reverse factoring, inventory and warehouse financing, dynamic discounting, leasing and other instruments” [69]. | ||

| (4) Technology | Digital Finance; Financial Technology (Fintech); Internet of Things (IoT); Blockchain; Big Data | 61 | Fellenz et al. [52]; Lamoureux and Evans [45]; Omran et al. [13]; Gomber et al. [70]; C. Bals [20]; Palmie et al. [71]; Z. Liu [72]; Cui [73]; Zhang-Zhang et al. [74]; Ning and Yuan [75]; L. Chen et al. [61] | “The digital technology (e.g., Blockchain) promotes the development of supply chain finance from three aspects: the realization of information symmetry among participating parties, the realization of core enterprise credit transfer, the realization of supply chain financial process visibility, risk controllability, and full-service coverage” [72]. | ||

| (5) Platform | Information Processing; Operational and Financial Decisions; Information Asymmetry; Credit Management; Risk management; Flows Integration | 62 | More and Basu [66]; Omran et al. [13]; Wei [27]; De Reuver et al. [76], Shen et al. [1]; Du et al. [77]; M. Li et al. [78]; Wan and Qie [79]; Jia et al. [39]; L. Chen et al. [61]; Ning and Yuan [75]; Q. Huang et al. [80]; | “An SCF platform has positive effects on optimizing the coordination of flows of funds, materials, and information and can promote all SCF actors’ ability of resource acquisition, sharing, and integration” [75]. | ||

| (6) Supply Chain Collaboration (SCC) | Dynamic Network; Collaborative Operation/Relationships | 26 | Camarinha-Matos and Afsarmanesh [81]; Graca and Camarinha-Matos [82]; X. Liu et al. [83]; C. Bals [20]; Shi and Mena [84]; H. Song et al. [85]; Olan et al. [86] | “SCF has the main characteristic of incorporating financing activities into the context of supply chain management, which emphasizes the intersection of logistics, supply chain collaboration, and finance” [85]. | ||

| Financial eco-environment | (7) Regulations | Laws; Financial Regulations; Financial Stability; Policy; Economic Development; Industrial Culture | 22 | Acharya [87]; Milne [88]; Kupiec [89]; Abedifar et al. [90]; H. Zhang et al. [91]; G. Wang et al. [92]; X. Li and Zhou [93]; Chao et al. [69] | “In financial regulation, by constructing financial networks, one can discover the structural nature of the network of financial institutions, impose balanced management, and intervene and block the network spread of risks” [57]. | |

| (8) Sustainable Supply Chain Finance (SSCF) | Life-Cycle; Value Innovation; Competitive Advantage; Social/Economic Aspects | 21 | Tseng et al. [94]; Tseng et al. [95]; C. Huang et al. [57]; Jia et al. [96]; X. Chen et al. [51]; Olan et al. [86] | “Both economic and social aspects are the two most crucial aspects within sustainable supply chain finance” [94]. | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Chen, M.; Lee, H. Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective. Sustainability 2022, 14, 14452. https://doi.org/10.3390/su142114452

Zhou L, Chen M, Lee H. Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective. Sustainability. 2022; 14(21):14452. https://doi.org/10.3390/su142114452

Chicago/Turabian StyleZhou, Lele, Maowei Chen, and Hyangsook Lee. 2022. "Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective" Sustainability 14, no. 21: 14452. https://doi.org/10.3390/su142114452

APA StyleZhou, L., Chen, M., & Lee, H. (2022). Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective. Sustainability, 14(21), 14452. https://doi.org/10.3390/su142114452