Identifying the Spatiotemporal Differences and Driving Forces of Residents’ Consumption at the Provincial Level in the Context of the Digital Economy

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.3. Research Methods and Paper Organization

2. Study Area and Data Source

2.1. Study Area

2.2. Data Sources

2.3. Residents’ Consumption Distribution

3. Model Setting

3.1. Variable Selection

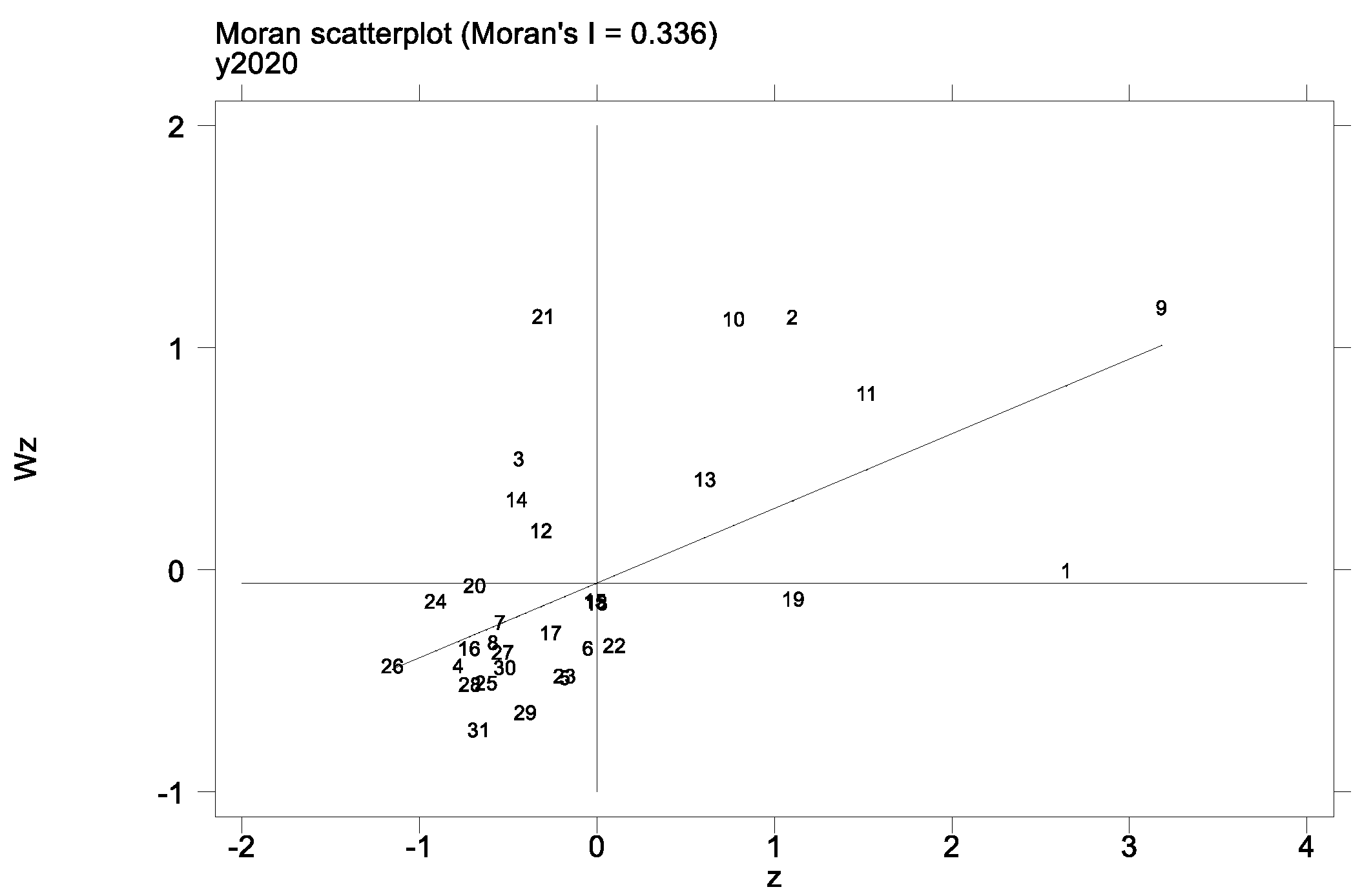

3.2. Global Spatial Autocorrelation Model

3.3. Local Spatial Autocorrelation Model

3.4. Geodetector

3.4.1. Factor Detector

3.4.2. Ecological Detector

3.4.3. Interaction Detection

- (1)

- If , the interaction of and decreases nonlinearly;

- (2)

- If , is single-factor nonlinear weakening;

- (3)

- If , and are bi-factor enhancement;

- (4)

- If , are independent of each other;

- (5)

- If , the interaction of and is enhanced nonlinearly.

4. Residents’ Consumption Spatial Difference

4.1. Global Spatial Autocorrelation Analysis

4.2. Local Spatial Autocorrelation Analysis

5. Driving Factors of Residents’ Consumption Spatial Differences

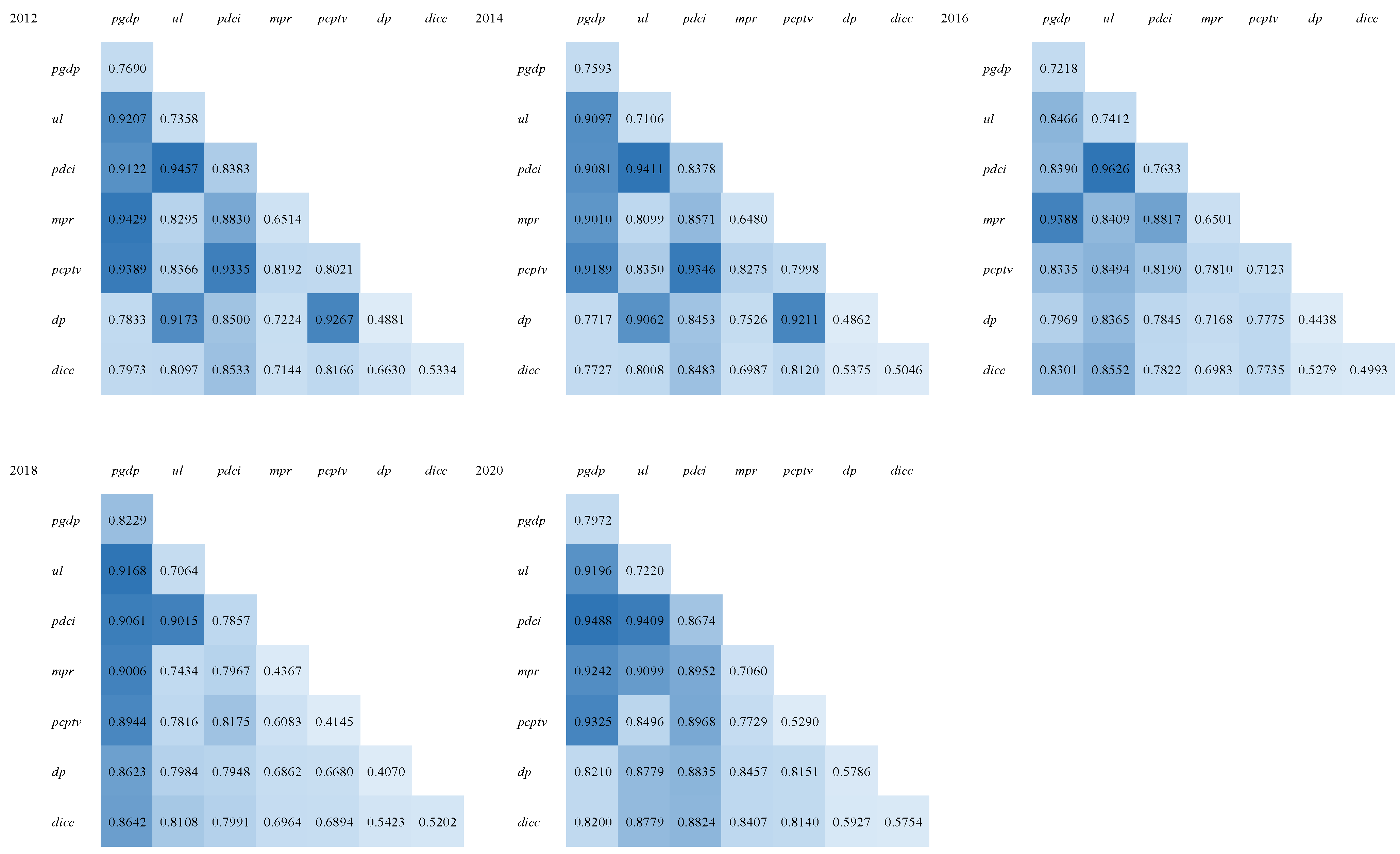

5.1. Factor Detection Analysis

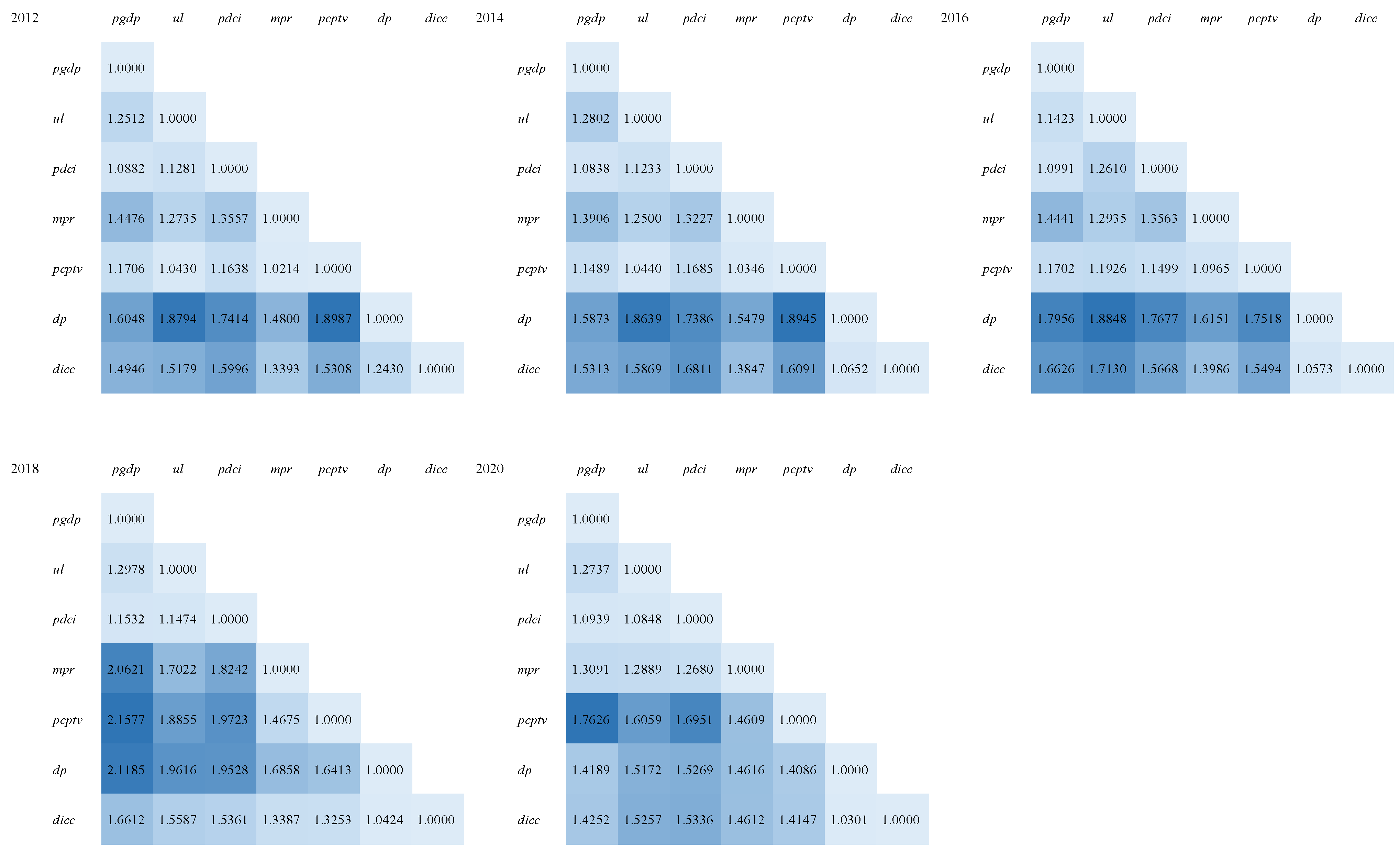

5.2. Ecological Detection Results and Analysis

5.3. Interaction Detection and Analysis

5.4. Comprehensive Analysis of Driving Force Factors

6. Conclusions and Recommendations

6.1. Conclusions

- (1)

- Residents’ consumption expenditure at the provincial level in China has a positive spatial correlation, showing a spatial pattern of “high in the east and low in the middle and west”; the inter-annual variation in the inter-provincial differences in residents’ consumption expenditure is small, and the spatial dependence is mainly L–L agglomeration.

- (2)

- From the average value of the overall stage, the single-factor driving force of the four factors representing the digital economy on the spatial differences in residents’ consumption expenditure is lower than the digital economic factors, indicating that in terms of a single factor, the digital economic factors are beneficial to reducing the regional differences in residents’ consumption; in other words, they are good for the balance of residents’ consumption among all provinces because they can break through regional limitations.

- (3)

- All of the factor pairs are bi-factor-enhanced. In terms of the average value of the overall stage, the interaction values of non-digital economic factors are larger, indicating that non-digital economic factors greatly increase the spatial differences in residents’ consumption and enlarge the regional imbalance in residents’ consumption after interacting with other factors, while the four factors representing the digital economy improve residents’ consumption expenditure after interacting with other factors.

6.2. Policy Recommendations

6.3. Limitations and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Keynes, J.M. The General Theory of Employment, Interest, and Money; John Maynard Keynes: Cambridge, UK, 1936. [Google Scholar]

- Modigliani, F.; Brumberg, R. Utility Analysis and the Consumption Function: An Interpretation of Cross-Section Data. In Post Keynesian Economics; Kurihara, K., Ed.; Rutgers University Press: New Brunswick, NJ, USA, 1954; pp. 388–436. [Google Scholar]

- Su, Z.; Li, W.; Sun, Y.; Guo, P. A Time Prediction Model for Residents’ Consumption Level Based on ARIMA and PCA. MATEC Web Conf. 2020, 309, 05009. [Google Scholar] [CrossRef][Green Version]

- Liu, D.; Zhang, S. Digital economy empowers household consumption: Theoretical mechanism and micro evidence. Consum. Econ. 2022, 38, 72–82. [Google Scholar]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence, 156–168; McGraw-Hill Companies: New York, NY, USA, 1995. [Google Scholar]

- Lane, N. Advancing the Digital Economy into the 21st Century. Inf. Syst. Front. 1999, 1, 317–320. [Google Scholar] [CrossRef]

- Teo, T.S.H. Understanding the Digital Economy: Data, Tools, and Research. Asia Pac. J. Manag. 2001, 18, 553–555. [Google Scholar] [CrossRef]

- Cheon, B.Y.; Kim, H.W. Digital Economy and Job Creation; Korea Labor Institute: Yeongi-gun, Korea, 2003; pp. 1–222. [Google Scholar]

- OUP. Digital Economy, Oxford Dictionary; Oxford University Press: Oxford, UK, 2017; Available online: https://en.oxforddictionaries.com/definition/digital_economy (accessed on 21 May 2022).

- Turcan, V.; Gribincea, A.; Birca, I. Digital Economy-A Premise for Economic Development in the 20th Century. Econ. Sociol. Theor. Sci. J. 2014, 2, 109–115. [Google Scholar]

- Chen, Y.; Wang, L. Commentary: Marketing and the Sharing Economy: Digital Economy and Emerging Market Challenges. J. Mark. 2019, 83, 28–31. [Google Scholar] [CrossRef]

- Miao, Z. Digital economy value chain: Concept, model structure, and mechanism. Appl. Econ. 2021, 53, 4342–4357. [Google Scholar] [CrossRef]

- OECD. A Roadmap toward A Common Framework for Measuring the Digital Economy; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Ren, B. Logic, mechanism and path of the digital economy leading high-quality development. J. Xi Univ. Financ. Econ. 2020, 2, 5–9. [Google Scholar]

- China Year Book. 2020. Available online: https://www.stats.gov.cn/tjsj/ndsj/2020/indexch.htm (accessed on 21 May 2002).

- Tang, L.; Lu, B.; Tian, T. Spatial Correlation Network and Regional Differences for the Development of Digital Economy in China. Entropy 2021, 23, 1575. [Google Scholar] [CrossRef]

- Wu, X.; Zhang, Y. An analysis of the status quo and international competitiveness of China’s digital economy. Sci. Res. Manag. 2021, 41, 250–258. [Google Scholar]

- Du, D. Research on the dynamic mechanism of Internet promoting consumption upgrading. Economist 2017, 3, 48–54. [Google Scholar]

- Li, X.; Li, T.; Zou, W. Does the Internet promote residents’ consumption upgrading?—A Research based on micro survey data in China. J. China Univ. Geosci. 2019, 4, 145–160. [Google Scholar]

- Ma, X. Research on the Realization Mechanism of Chinese Residents’ Consumption under the Network Economy Environment; Northwest University: Xi’an, China, 2021. [Google Scholar]

- Zhu, Z. Will Internet skills bring consumption upgrading to rural residents?—Empirical analysis based on CSS2015 data. Stat. Res. 2020, 9, 68–81. [Google Scholar]

- Yi, E.; Ma, J.; Chen, X. Research on the relationship between digital financial support, e-commerce embedment and consumer consumption upgrading. J. Commer. Econ. 2021, 4, 94–97. [Google Scholar]

- Chen, B. Reflection and reconstruction of consumer protection in the context of artificial intelligence. J. Shanghai Univ. Financ. Econ. 2019, 4, 140–152. [Google Scholar]

- Ma, X. Final consumption reform in the era of the digital economy: Trends, characteristics, mechanisms, and models. Sci. Financ. Econ. 2020, 1, 120–132. [Google Scholar]

- Zhang, F.; Liu, L. Dialectical Thinking on digital consumption in the era of digital Economy. Econ. Rev. 2020, 2, 45–54. [Google Scholar]

- Chen, X.; Wang, W.; Zhang, S. Can Internet development effectively narrow the cultural consumption gap between urban and rural residents? Rural. Econ. 2020, 12, 87–93. [Google Scholar]

- Liu, S. Targeted paths and policy supply for high-quality development of China’s digital economy. Economist 2019, 6, 52–61. [Google Scholar]

- Zhang, X. Research on the evolution of innovation mode under the condition of the digital economy. Economist 2019, 7, 32–39. [Google Scholar]

- Li, J.; Yin, Y. The basic characteristics of the new economy and the dual dimensions of its impact on residents’ consumption. Reform Strategy 2020, 2, 9–17. [Google Scholar]

- Lin, C.; Chen, X.; Chen, W.; Chen, Y. Artificial intelligence, economic growth, and residents’ consumption improvement: A perspective of capital structure optimization. China Indus. Econ. 2020, 2, 61–83. [Google Scholar]

- He, D. Theoretical analysis of internal circulation strategy under digital economy. Soc. Sci. Front. 2020, 12, 36–47. [Google Scholar]

- Ma, Y. The impact of the digital economy on consumer market: Mechanism, performance, problems, and countermeasures. J. Macroecon. Res. 2021, 5, 81–91. [Google Scholar]

- Li, S.; Tan, M.I.; Di, Z. Institutional Economics analysis of Final consumption upgrading in China under the new Double-cycle Pattern. Chongqing Soc. Sci. 2020, 12, 75–87. [Google Scholar]

- Lan, Q.; Zhao, Y. The development of the digital economy under the new development pattern of double circulation. J. Theor. Sci. 2021, 1, 24–31. [Google Scholar]

- Zhao, C.; Ban, Y.; Li, H. The mechanism, path, and countermeasures of the digital economy boost the new development pattern of the double cycle. Int. Trade 2021, 2, 54. [Google Scholar]

- Niu, L. Retail business model innovation under the promotion of new business model in the digital economy: Based on the perspective of organizational resilience. J. Bus. Econ. 2021, 4, 31–34. [Google Scholar]

- Chen, B. The key path of expanding consumer Demand under the new development pattern of orderly upgrading consumer rights and Interests protection system. People Forum 2021, 4, 42–45. [Google Scholar]

- Meng, Q. Digital economy and high-quality employment: Theory and Evidence. Soc. Sci. 2021, 2, 47–58. [Google Scholar]

- Ren, B.; Miao, X. The path and policy orientation of expanding new consumer demand under the background of the new economy. Reform 2021, 3, 14–25. [Google Scholar]

- Gao, Z.; Zhao, J.; Zhang, J.; Li, X. The mechanism and path selection of enabling consumption upgrading in the digital economy. Southwest Financ. 2021, 10, 44–54. [Google Scholar]

- Zhou, M. The Change of Social Structure and the Enhancement of Consumer Power—Consumer empowerment in the era of mobile Internet. J. Zhejiang Soci. Sci. 2021, 3, 87–93. [Google Scholar]

- Lin, T.; Zhang, S. Research on the evolution law of urban residents’ household consumption behavior preference under the perspective of Internet. Price Theory Pract. 2017, 8, 156–159. [Google Scholar]

- Zhao, M. Research on the change of residents’ consumption behavior and its influencing factors based on the behavior of micro subjects. Bus. Econ. Res. 2018, 9, 46–48. [Google Scholar]

- Jiao, S.; Sun, Q. Mechanism and empirical research on the linkage between digital economy development and consumption upgrading. Ind. Technol. Econ. 2021, 40, 84–93. [Google Scholar]

- Zhou, N. Research on characteristics and influencing factors of residents’ consumption behavior in the context of Internet. Bus. Econ. Res. 2018, 24, 65–68. [Google Scholar]

- Bai, S.; Yang, Y.; Shi, K. Analysis on characteristics of online consumption behavior of Chengdu residents—Based on the comparative perspective of e-commerce. World Geogr. Res. 2018, 27, 71–81. [Google Scholar]

- Xu, L. The cracking effect and action path of digital economic development on consumption inequality. Bus. Econ. Res. 2021, 15, 61–64. [Google Scholar]

- Zhong, R.; Zeng, J. Research on the impact of the digital economy on household consumption—Empirical analysis based on spatial Durbin model. Explor. Econ. Issues 2022, 3, 31–43. [Google Scholar]

- Zou, X.; Wang, W. Spatial-temporal evolution and interaction of digital finance and technological innovation in China. J. Guangdong Univ. Financ. Econ. 2021, 36, 4–17. [Google Scholar]

- Mao, Z.; Wu, Y.; Xie, C. Spatial pattern of consumption level and its influence mechanism of urban agglomeration in the Yangtze River Delta. Econ. Geogr. 2020, 40, 56–62. [Google Scholar] [CrossRef]

- Wei, Y.; Yang, G.; Yang, M. The Characteristics and Motivations of urban residents’ consumption Upgrading: An empirical study from the perspective of spatial spillover. Explor. Econ. Issues 2017, 1, 51–63. [Google Scholar]

- Huang, C.; Zhang, X. Innovation drive, spatial spillover and consumer demand. Explor. Econ. Issues 2020, 2, 11–20. [Google Scholar]

- Zhang, L.; Tu, B. An empirical study on the influence of internet financial information advantage on interbank market interest rate—Based on the analysis of commercial banks’ operation decisions. Bus. Rev. 2018, 2, 47–57. [Google Scholar] [CrossRef]

- Tan, H.; Li, X.; Zhu, X. Internet penetration and consumption differences in The era of digital economy: An empirical study based on CFPS data from 2010 to 2018. Macroecon. Res. 2022, 2, 83–106. [Google Scholar] [CrossRef]

- Wang, X. Local effect and spatial spillover effect of the digital economy leading consumption upgrading. Res. Bus. Econ. 2022, 2, 68–71. [Google Scholar]

- Wei, Q.; Wang, C.; Yao, C.; Shi, F.; Cao, H.; Wang, D.; Sun, Z.; Tan, X. Research on the Spatial Spillover Effect of Provincial Final Consumption Level in China Based on the Complex Network. Sustainability 2022, 14, 648. [Google Scholar] [CrossRef]

- Shen, Z. The impact of “Internet + retail” on consumption upgrading—An empirical study based on the perspective of regional differences in the Yangtze river delta. Bus. Econ. Res. 2020, 22, 39–42. [Google Scholar]

- Li, H.; Huang, F. Can the digital economy promote service consumption? Discuss. Mod. Econ. 2022, 3, 14–25, 123. [Google Scholar] [CrossRef]

- Hu, Y. Can Mobile Payment Increase the Consumption Expenditure of Chinese Residents? Shaanxi Normal University: Xi’an, China, 2020. [Google Scholar]

- Ma, D.; Han, X.; Zhao, X. Research on the promotion effect of Internet Consumer Finance on the consumption behavior of Chinese urban residents. Mod. Financ. Econ. 2017, 37, 19–27. [Google Scholar]

- Zhang, T.; Cai, K. Has digital inclusive finance narrowed the consumption gap between urban and rural residents?–Based on the experience of the Chinese provincial panel data test. J. Econ. Issues 2021, 9, 31–39. [Google Scholar] [CrossRef]

- Wang, J.; Li, X.; Christakos, G.; Liao, Y.; Zhang, T.; Gu, X.; Zheng, X. Geographical detectors-based health risk assessment and its application in the neural tube defects study of the Heshun Region, China. Int. J. Geo. Infor. Sci. 2010, 24, 107–127. [Google Scholar] [CrossRef]

- Ji, Y.; Ning, L. Research on the impact of the income gap on consumption under the relative income hypothesis. Quant. Econ. Technol. Econ. Res. 2018, 35, 97–114. [Google Scholar]

- Pan, L. Research on the relationship between urbanization development level and consumption of urban and rural residents. Financ. Econ. 2013, 18, 34–36. [Google Scholar]

- Jiang, L.; Gao, W. Urbanization and rural residents’ consumption—An empirical study based on the dynamic panel data model of 31 provinces (regions) in China. Invest. Res. 2013, 32, 141–149. [Google Scholar]

- Pan, M.; Gao, W. Testing and analysis of the Impact of Urbanization on residents’ consumption in China. J. Macroecon. Res. 2014, 1, 118–125. [Google Scholar]

- Li, F.; Ouyang, D. Dynamic research on the impact of urbanization development on residents’ consumption growth in Gansu Province. Bus. Era 2014, 23, 11–12. [Google Scholar]

- Ai, T.; Zhang, H. Statistical Evaluation On The Consumption Upgrading Model of Chinese Provincial Residents. Stat. Decis. 2019, 35, 93–96. [Google Scholar]

- Li, H. Empirical analysis on the relationship between urbanization level, consumption structure, and residents’ consumption upgrading. J. Bus. Econ. 2018, 11, 40–43. [Google Scholar]

- Zhao, B.; Gai, N. The impact of Internet consumer finance on the consumption structure of domestic residents—An empirical study based on VAR model. J. Cent. Univ. Financ. Econ. 2020, 3, 33–43. [Google Scholar] [CrossRef]

- Jiao, Y. Regional differences and dynamic evolution of high-quality development of China’s digital economy. Econ. Syst. Reform 2021, 6, 34–40. [Google Scholar]

- Liu, H.; Zhang, J. Is the Internet a new engine for expanding residents’ consumption? Consum. Econ. 2016, 2, 17–22. [Google Scholar]

- Kuang, X. Research on the heterogeneity of the change of urban and rural consumption structure of digital empowerment. Bus. Econ. Res. 2021, 22, 50–53. [Google Scholar]

- Qin, Y. Discussion on the consumption upgrading effect of the integrated development of Internet and circulation industry under the digital economy. Bus. Econ. Res. 2021, 12, 22–25. [Google Scholar]

- Yun, S.; Cheng, Y. Analysis of the causes of College Students’ online loan and its risk aversion path—An empirical study based on the survey of college students’ consumption behavior in Shanghai. Ideol. Theor. Educ. 2017, 2, 107–111. [Google Scholar] [CrossRef]

- Shao, T.; Lv, X. The performance, role and prospects of China’s Internet consumer finance under the new normal. West. Forum 2017, 27, 95–106. [Google Scholar]

- Dong, Z.; Guan, D. Research on the development strategy of digital Inclusive Finance for rural residents’ consumption upgrading. Agric. Econ. 2021, 3, 143–144. [Google Scholar]

- He, Z.; Song, X. How the development of digital finance affects residents’ consumption. Financ. Trade Econ. 2020, 41, 65–79. [Google Scholar]

- Tian, C.; Liu, R. Theoretical and empirical analysis of consumer finance promoting consumption upgrading. Consum. Econ. 2013, 6, 18–21. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the development of digital inclusive finance in China: Index compilation and spatial characteristics. Econ. Q. 2020, 4, 1401–1418. [Google Scholar]

- Anselin, L. Local indicators of spatial association LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar] [CrossRef]

- Wang, J.; Xu, C. Geodetector’s: Principles and Prospects. Acta Geogr. Sin. 2017, 1, 116–134. [Google Scholar]

- Wang, J.F.; Hu, Y. Environmental health risk detection with GeogDetector. Env. Model. Softw. 2012, 33, 114–115. [Google Scholar] [CrossRef]

- Cao, F.; Ge, Y.; Wang, J.F. Optimal discretization for geographical detectors-based risk assessment. GISci. Remote Sens. 2013, 50, 78–92. [Google Scholar] [CrossRef]

- Ou, X.; Gu, C. Quantitative analysis of regional economic polarization and its dynamic mechanism in Jiangsu Province. Acta Geogr. Sin. 2004, 5, 791–799. [Google Scholar]

| Variable Type | Variable Name | Description | Computation |

|---|---|---|---|

| Dependent Variable | Y | residents’ consumption expenditure | per capita residents’ consumption of each province in China |

| Independent Variable | pgdp | per capita GDP | regional GDP/total population at the end of the year |

| ul | urbanization level | the proportion of the urban population at year end = urban population at year end/total population at year end | |

| pdci | per capita disposable income | -- | |

| mpr | mobile phone penetration rate | -- | |

| pcptv | post and telecommunications services per capita | total post and telecommunications services/regional population at year end | |

| dp | digital payment level | using the payment subindex of the Peking University Digital Financial Inclusion Index [80] | |

| dicc | digital finance individual consumption credit level | using the credit sub-index of the Peking University Digital Financial Inclusion Index [80] |

| Year | Moran’s I | Z-Value | p-Value |

|---|---|---|---|

| 2012 | 0.321 | 3.159 | 0.001 |

| 2014 | 0.311 | 3.066 | 0.001 |

| 2016 | 0.297 | 2.927 | 0.002 |

| 2018 | 0.315 | 3.117 | 0.001 |

| 2020 | 0.326 | 3.178 | 0.001 |

| Year | Quadrant I High–High (H–H) | Quadrant II Low–High (L–H) | Quadrant III Low–Low (L–L) | Quadrant IV High–Low (H–L) |

|---|---|---|---|---|

| 2012 | 6 | 6 | 16 | 3 |

| 2014 | 6 | 6 | 16 | 3 |

| 2016 | 6 | 5 | 17 | 3 |

| 2018 | 6 | 5 | 18 | 2 |

| 2020 | 6 | 4 | 19 | 2 |

| NO. | Description | Variable | 2012 | 2014 | 2016 | 2018 | 2020 | Avg. | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Per capita GDP | pgdp | q | 0.7690 | 0.7593 | 0.7218 | 0.8229 | 0.7972 | 0.7722 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| 2 | Urbanization level | ul | q | 0.7358 | 0.7106 | 0.7412 | 0.7064 | 0.7220 | 0.7296 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| 3 | Per capita disposable income | pdci | q | 0.8383 | 0.8378 | 0.7633 | 0.7857 | 0.8674 | 0.8322 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| 4 | Mobile phone penetration rate | mpr | q | 0.6514 | 0.6480 | 0.6501 | 0.4367 | 0.7060 | 0.6132 |

| p | 0.000 | 0.000 | 0.000 | 0.0359 | 0.0039 | ||||

| 5 | Per capita post and telecommunications business volume | pcptv | q | 0.8021 | 0.7998 | 0.7123 | 0.4145 | 0.5290 | 0.6562 |

| p | 0.000 | 0.000 | 0.000 | 0.0450 | 0.0173 | ||||

| 6 | Digital payment level | dp | q | 0.4881 | 0.4862 | 0.4438 | 0.4070 | 0.5786 | 0.4807 |

| p | 0.0116 | 0.0114 | 0.0077 | 0.0126 | 0.000 | ||||

| 7 | Personal digital credit level | dicc | q | 0.5334 | 0.5046 | 0.4993 | 0.5202 | 0.5754 | 0.5237 |

| p | 0.0034 | 0.0070 | 0.0077 | 0.0030 | 0.000 |

| Year | Ranking Order | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 | pdci | > | pcptv | > | pgdp | > | ul | > | mpr | > | dicc | > | dp |

| 2014 | pdci | > | pcptv | > | pgdp | > | ul | > | mpr | > | dicc | > | dp |

| 2016 | pdci | > | ul | > | pgdp | > | pcptv | > | mpr | > | dicc | > | dp |

| 2018 | pgdp | > | pdci | > | ul | > | dicc | > | mpr | > | pcptv | > | dp |

| 2020 | pdci | > | pgdp | > | ul | > | mpr | > | dp | > | dicc | > | pcptv |

| Avg. | pdci | > | pgdp | > | ul | > | pcptv | > | mpr | > | dicc | > | dp |

| 2012 | pgdp | ul | pdci | mpr | pcptv | dp | dicc |

|---|---|---|---|---|---|---|---|

| pgdp | |||||||

| ul | N | ||||||

| pdci | N | Y | |||||

| mpr | N | N | N | ||||

| pcptv | N | N | N | Y | |||

| dp | N | N | N | N | N | ||

| dicc | N | N | N | N | N | N |

| 2014 | pgdp | ul | pdci | mpr | pcptv | dp | dicc |

|---|---|---|---|---|---|---|---|

| pgdp | |||||||

| ul | N | ||||||

| pdci | N | Y | |||||

| mpr | N | N | N | ||||

| pcptv | N | N | N | Y | |||

| dp | N | N | N | N | N | ||

| dicc | N | N | N | N | N | N |

| 2016 | pgdp | ul | pdci | mpr | pcptv | dp | dicc |

|---|---|---|---|---|---|---|---|

| pgdp | |||||||

| ul | N | ||||||

| pdci | N | N | |||||

| mpr | N | N | N | ||||

| pcptv | N | N | N | N | |||

| dp | N | N | N | N | N | ||

| dicc | N | N | N | N | N | N |

| 2018 | pgdp | ul | pdci | mpr | pcptv | dp | dicc |

|---|---|---|---|---|---|---|---|

| pgdp | |||||||

| ul | N | ||||||

| pdci | N | N | |||||

| mpr | N | N | N | ||||

| pcptv | N | N | N | N | |||

| dp | N | N | N | N | N | ||

| dicc | N | N | N | N | N | N |

| 2020 | pgdp | ul | pdci | mpr | pcptv | dp | dicc |

|---|---|---|---|---|---|---|---|

| pgdp | |||||||

| ul | N | ||||||

| pdci | N | Y | |||||

| mpr | N | N | N | ||||

| pcptv | N | N | N | N | |||

| dp | N | N | N | N | N | ||

| dicc | N | N | N | N | N | N |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, Q.; Wang, C.; Yao, C.; Wang, D.; Sun, Z. Identifying the Spatiotemporal Differences and Driving Forces of Residents’ Consumption at the Provincial Level in the Context of the Digital Economy. Sustainability 2022, 14, 14227. https://doi.org/10.3390/su142114227

Wei Q, Wang C, Yao C, Wang D, Sun Z. Identifying the Spatiotemporal Differences and Driving Forces of Residents’ Consumption at the Provincial Level in the Context of the Digital Economy. Sustainability. 2022; 14(21):14227. https://doi.org/10.3390/su142114227

Chicago/Turabian StyleWei, Qing, Chuansheng Wang, Cuiyou Yao, Dong Wang, and Zhihua Sun. 2022. "Identifying the Spatiotemporal Differences and Driving Forces of Residents’ Consumption at the Provincial Level in the Context of the Digital Economy" Sustainability 14, no. 21: 14227. https://doi.org/10.3390/su142114227

APA StyleWei, Q., Wang, C., Yao, C., Wang, D., & Sun, Z. (2022). Identifying the Spatiotemporal Differences and Driving Forces of Residents’ Consumption at the Provincial Level in the Context of the Digital Economy. Sustainability, 14(21), 14227. https://doi.org/10.3390/su142114227