What Is the Policy Effect of Coupling the Green Hydrogen Market, National Carbon Trading Market and Electricity Market?

Abstract

:1. Introduction

2. Literature Review

2.1. Coupling of Green Hydrogen Market and Electricity Market

2.2. Coupling of Carbon Trading Market and Electricity Market

2.3. Research Methods of Market Coupling Mechanism

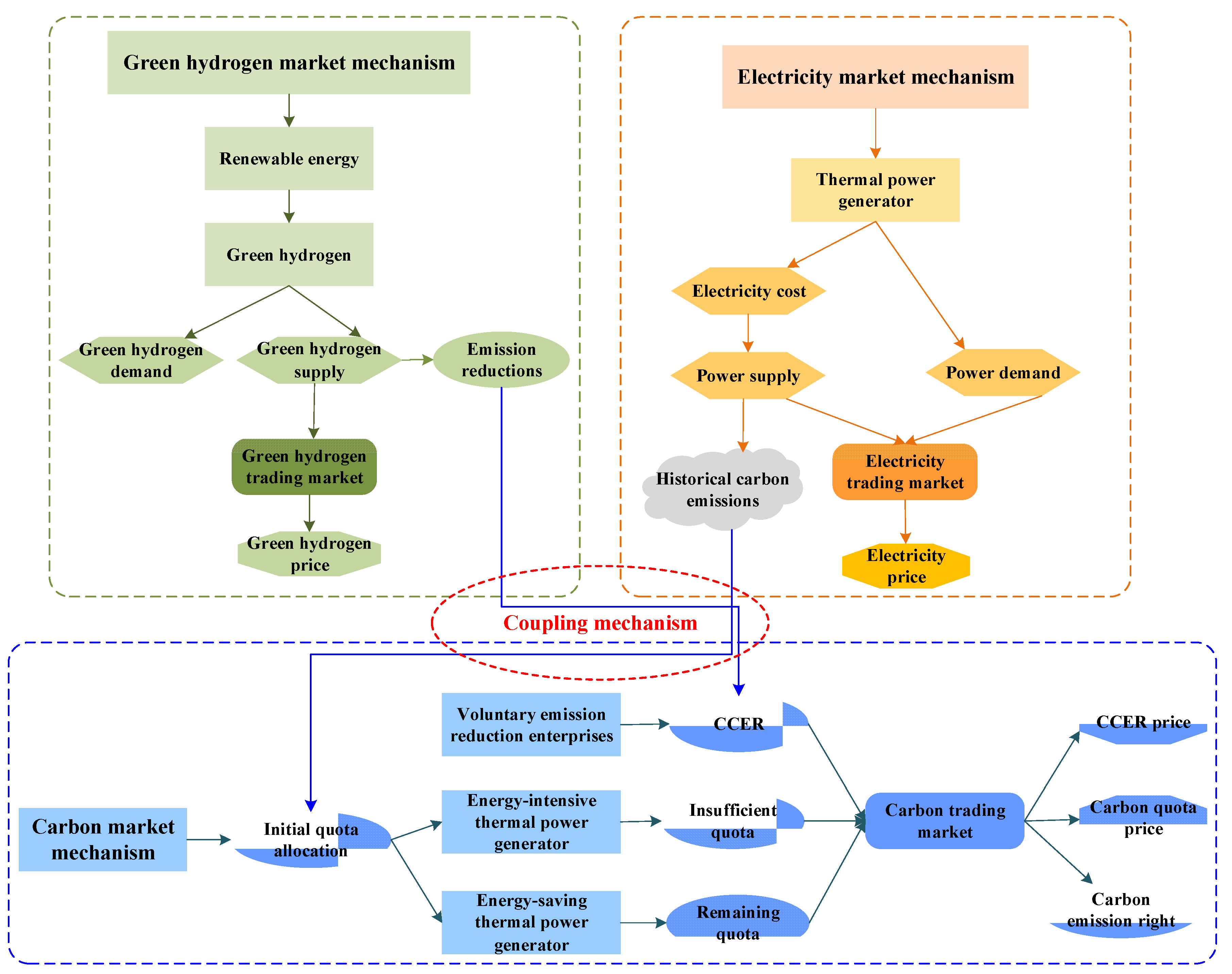

3. Design of “Green Hydrogen Market–National Carbon Trading Market–Electricity Market” Coupling Mechanism

4. Model Construction

4.1. Boundary and Model Assumptions

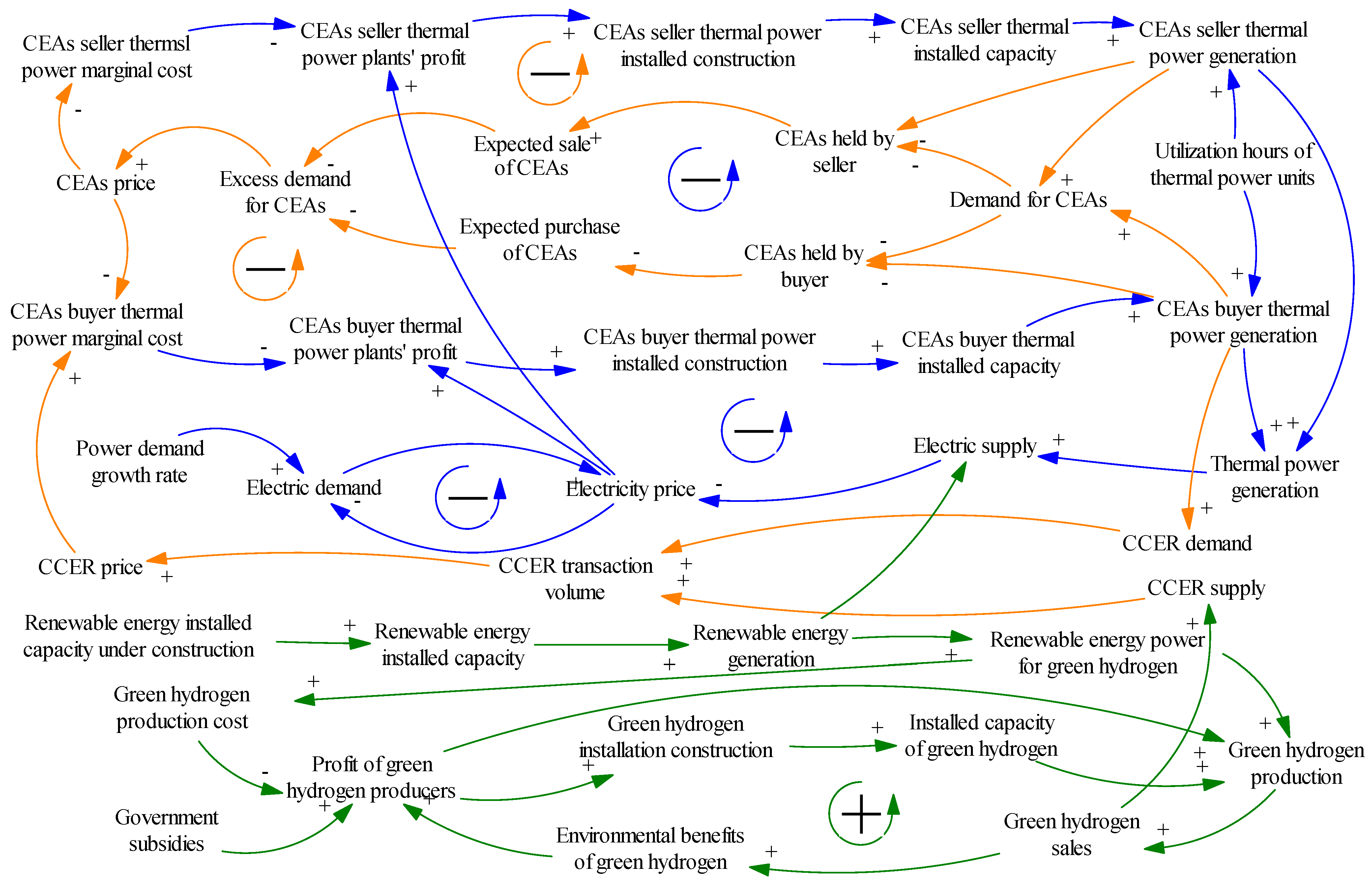

4.2. Causality Analysis

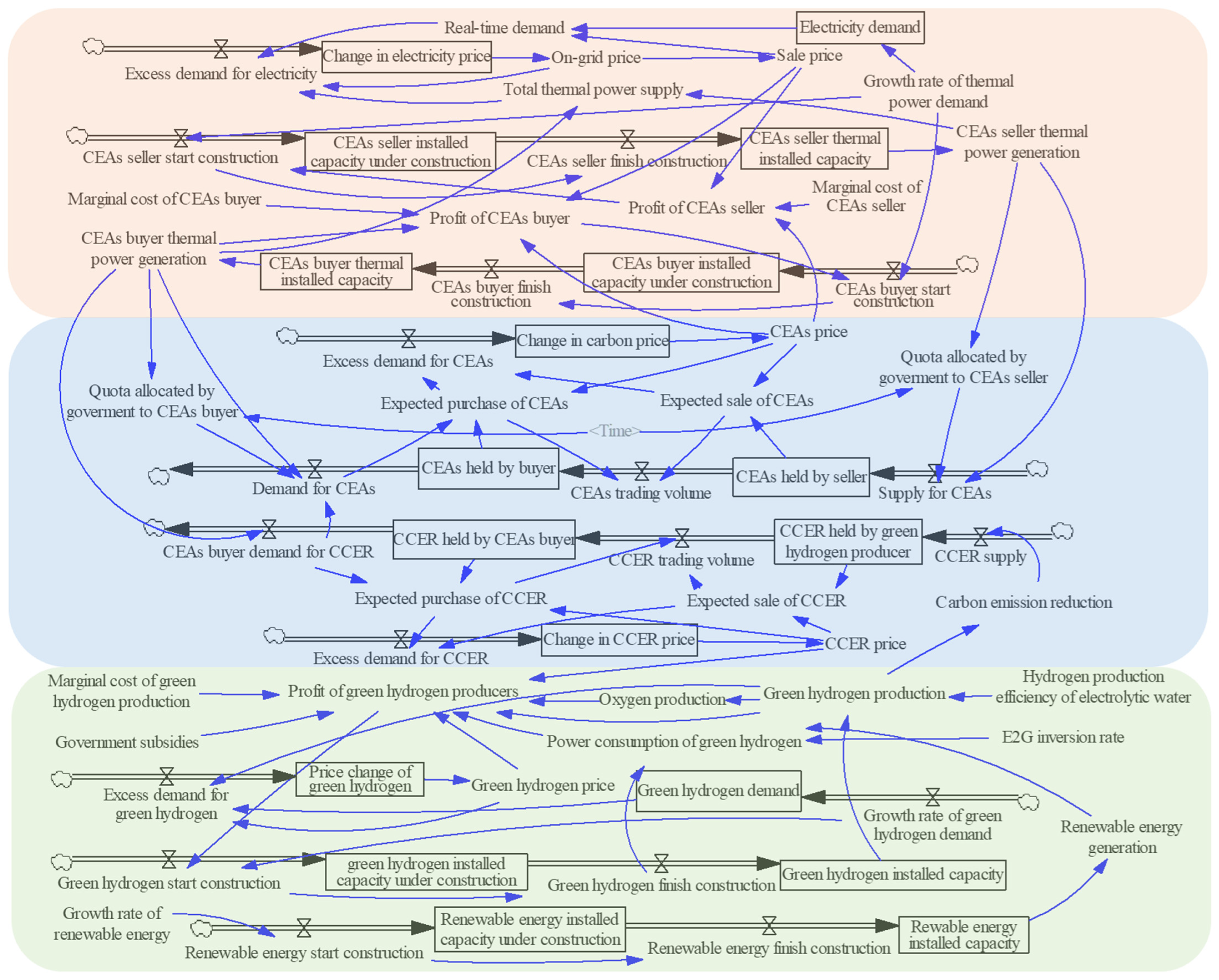

4.3. System Dynamics Model Construction

4.4. Data Sources and Related Parameter Settings

4.5. Model Scenario Setting

5. Results and Discussion

5.1. Simulation Results

- (1)

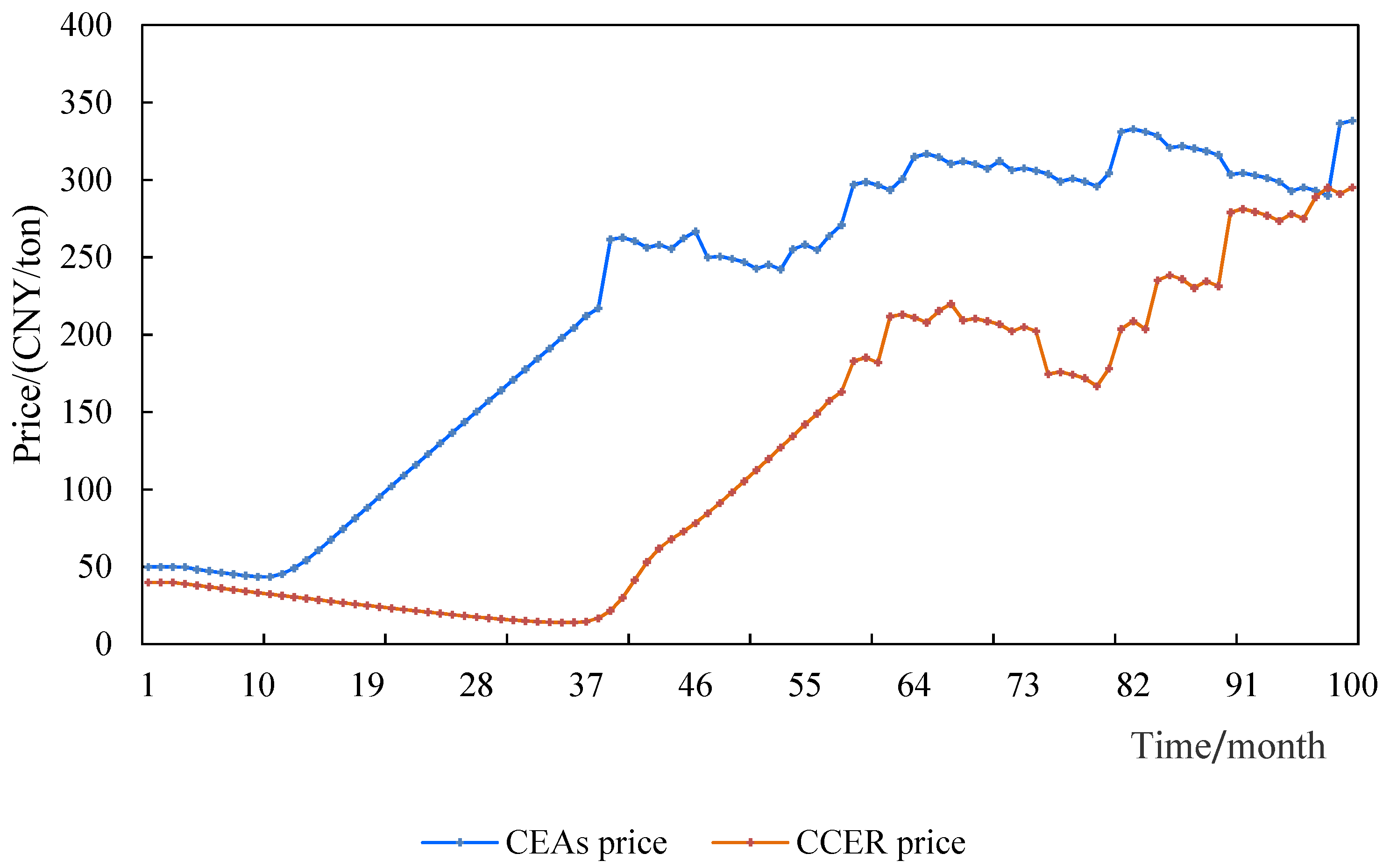

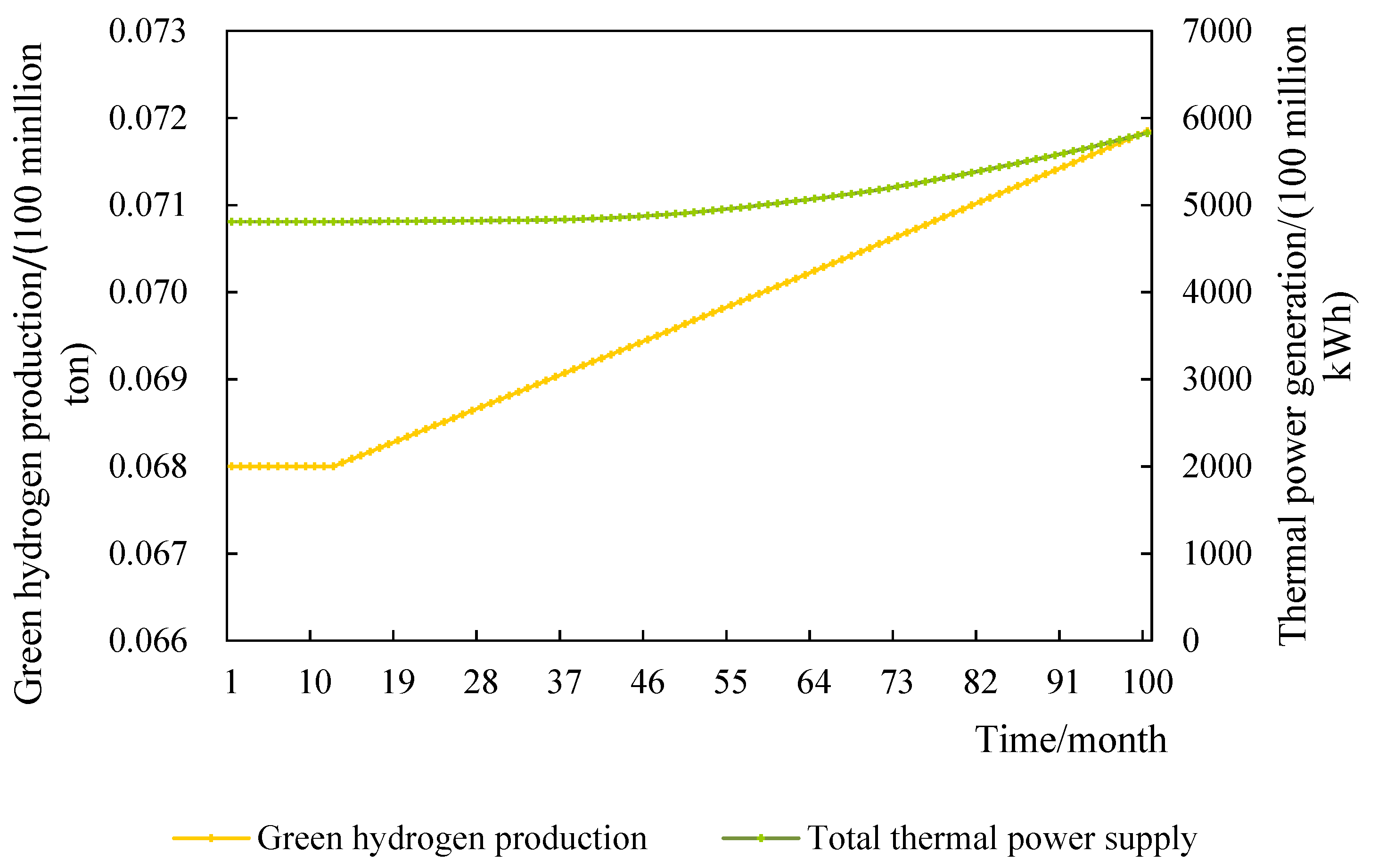

- Simulation analysis of the baseline scenario

- (2)

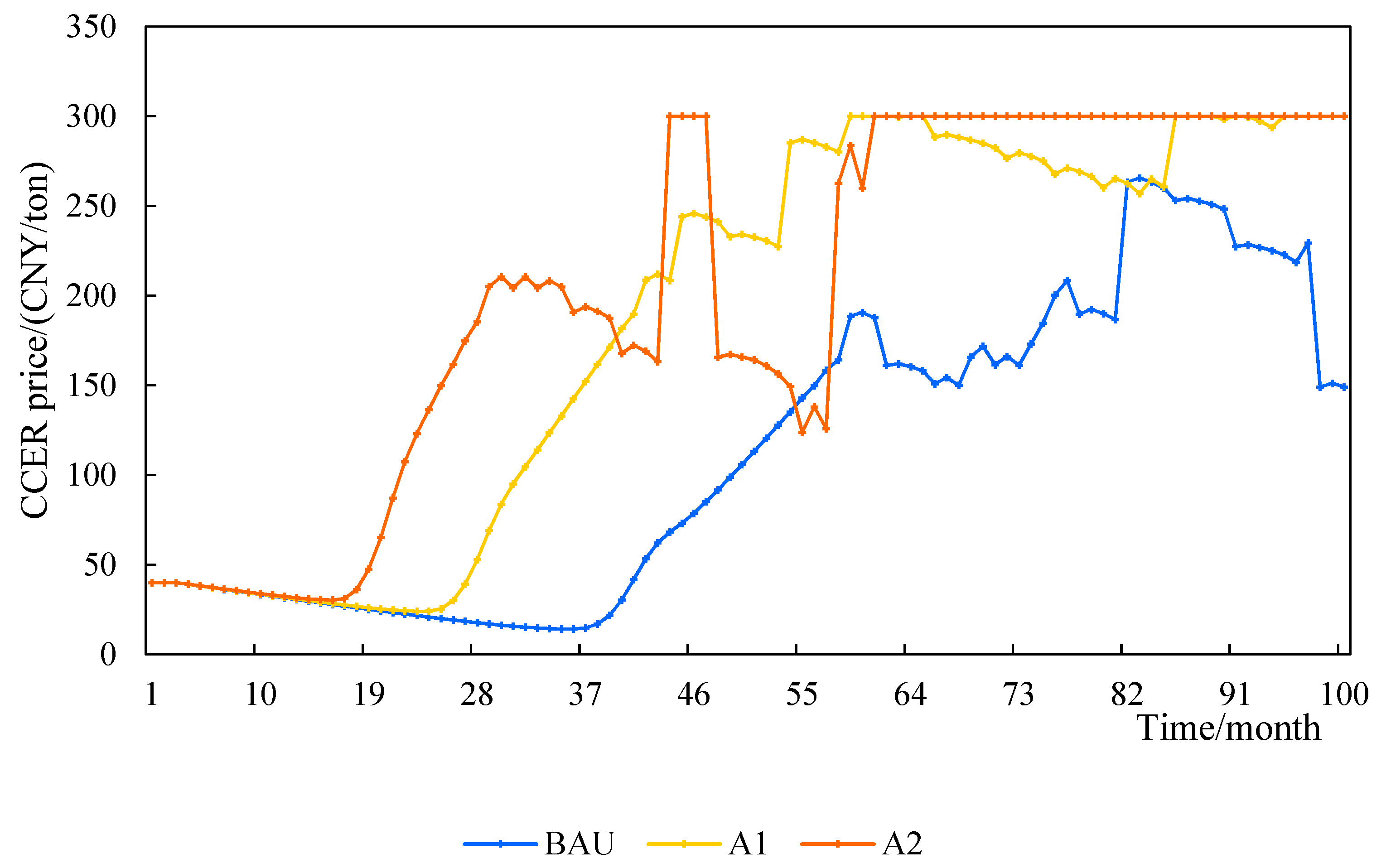

- Simulation analysis of different CCER offset ratios

- (3)

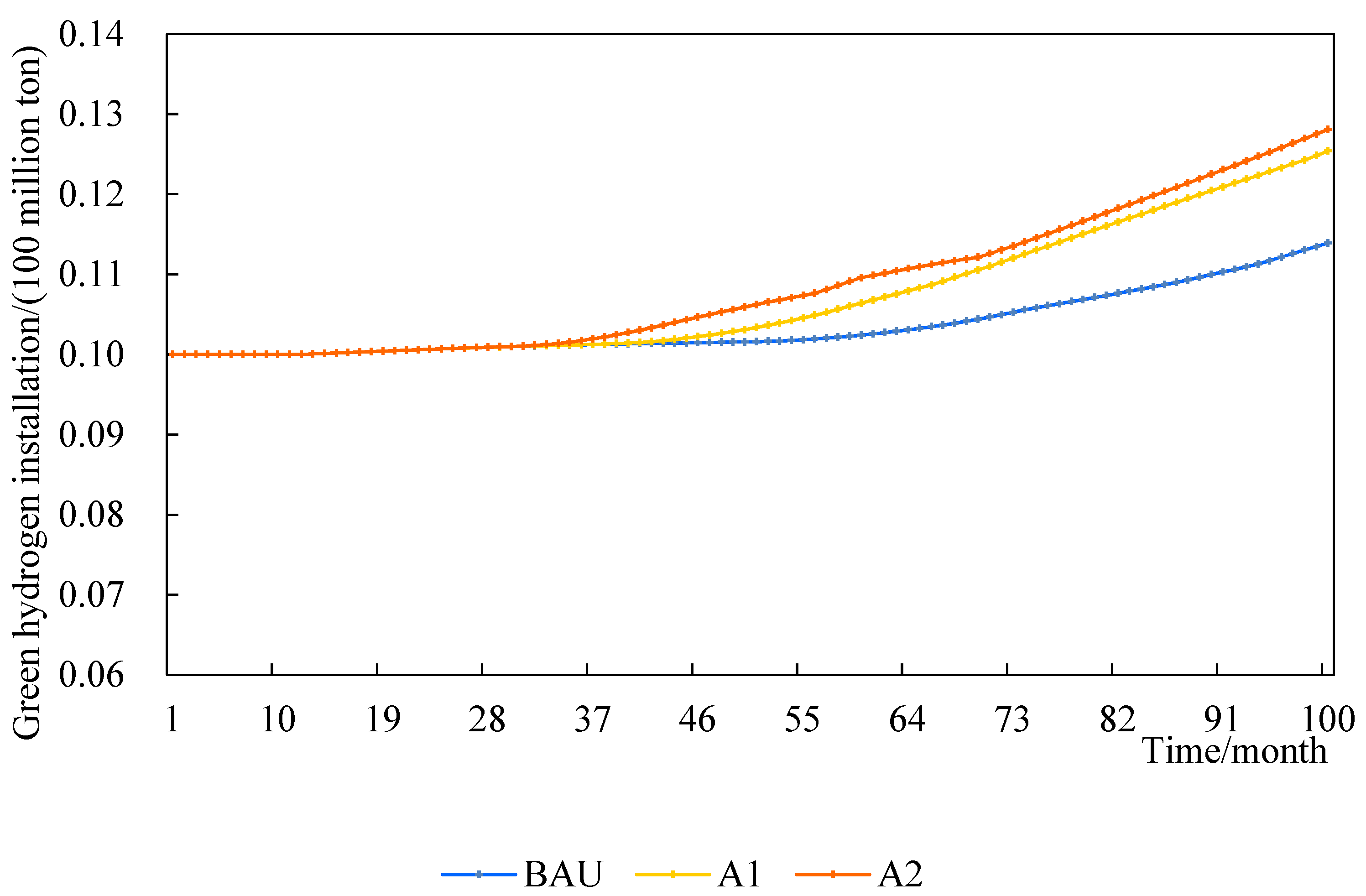

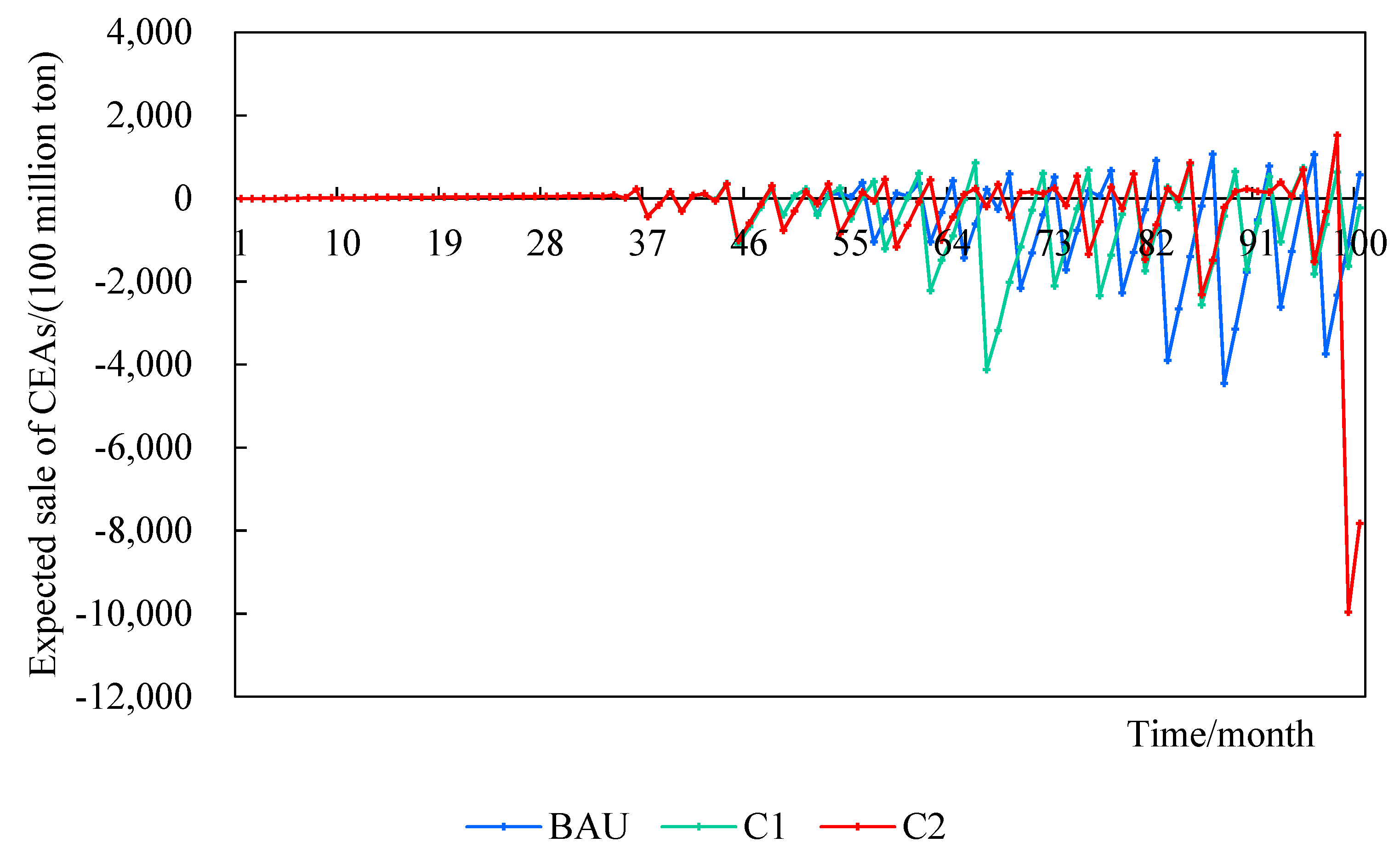

- Simulation analysis of different green hydrogen certification ratios

- (4)

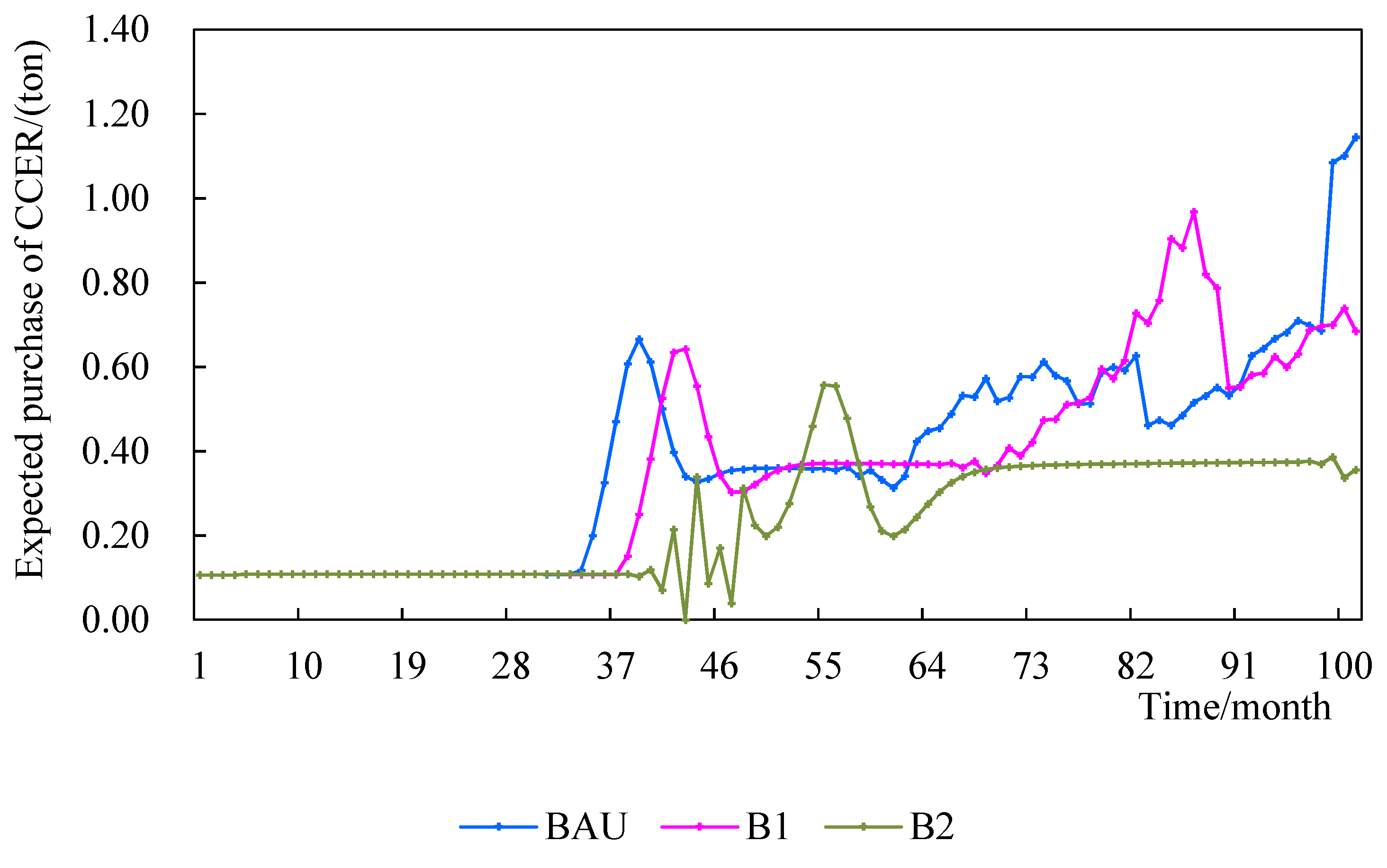

- Simulation analysis of different backward unit elimination rates

- (5)

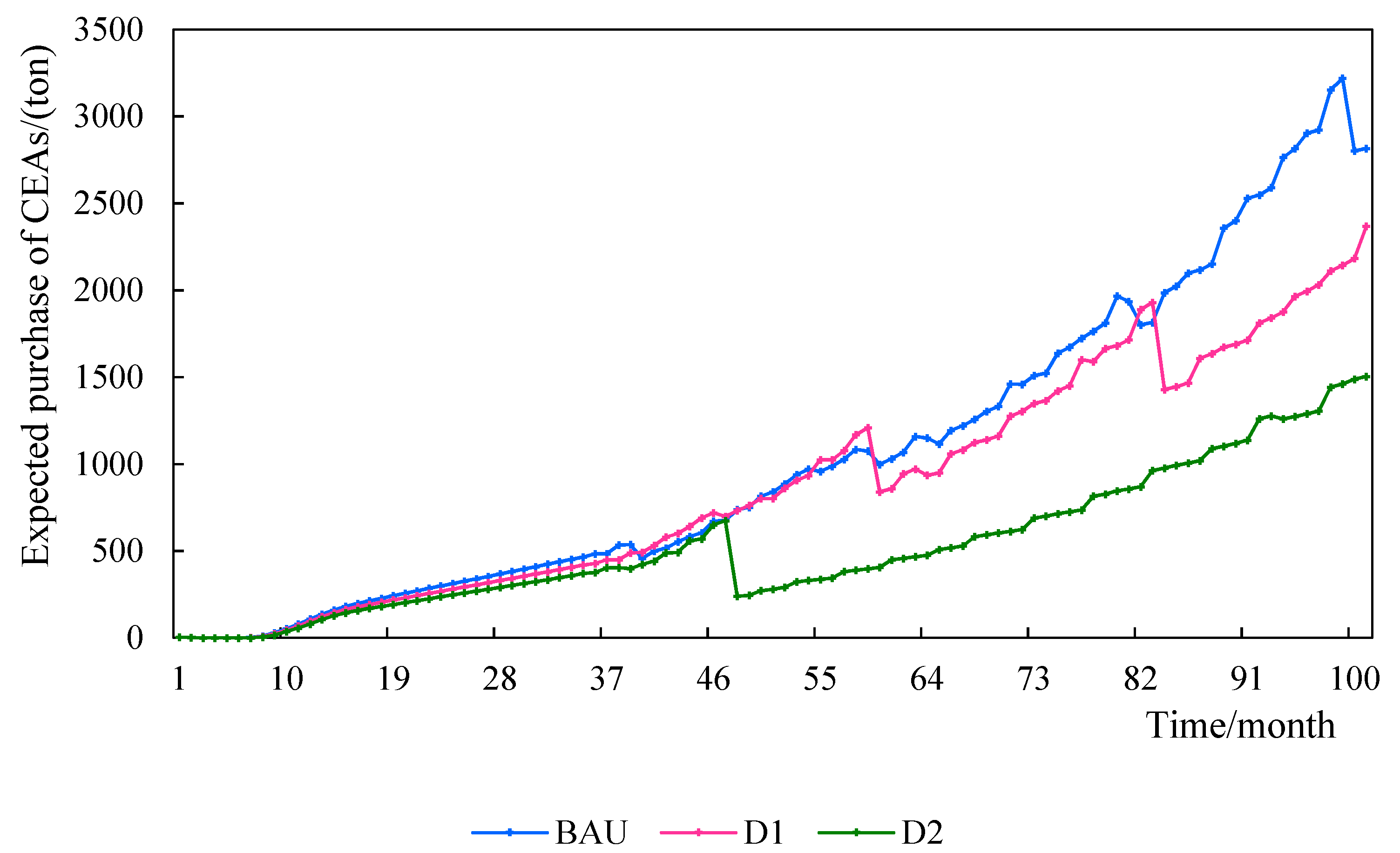

- Simulation analysis of different auction ratios

- (6)

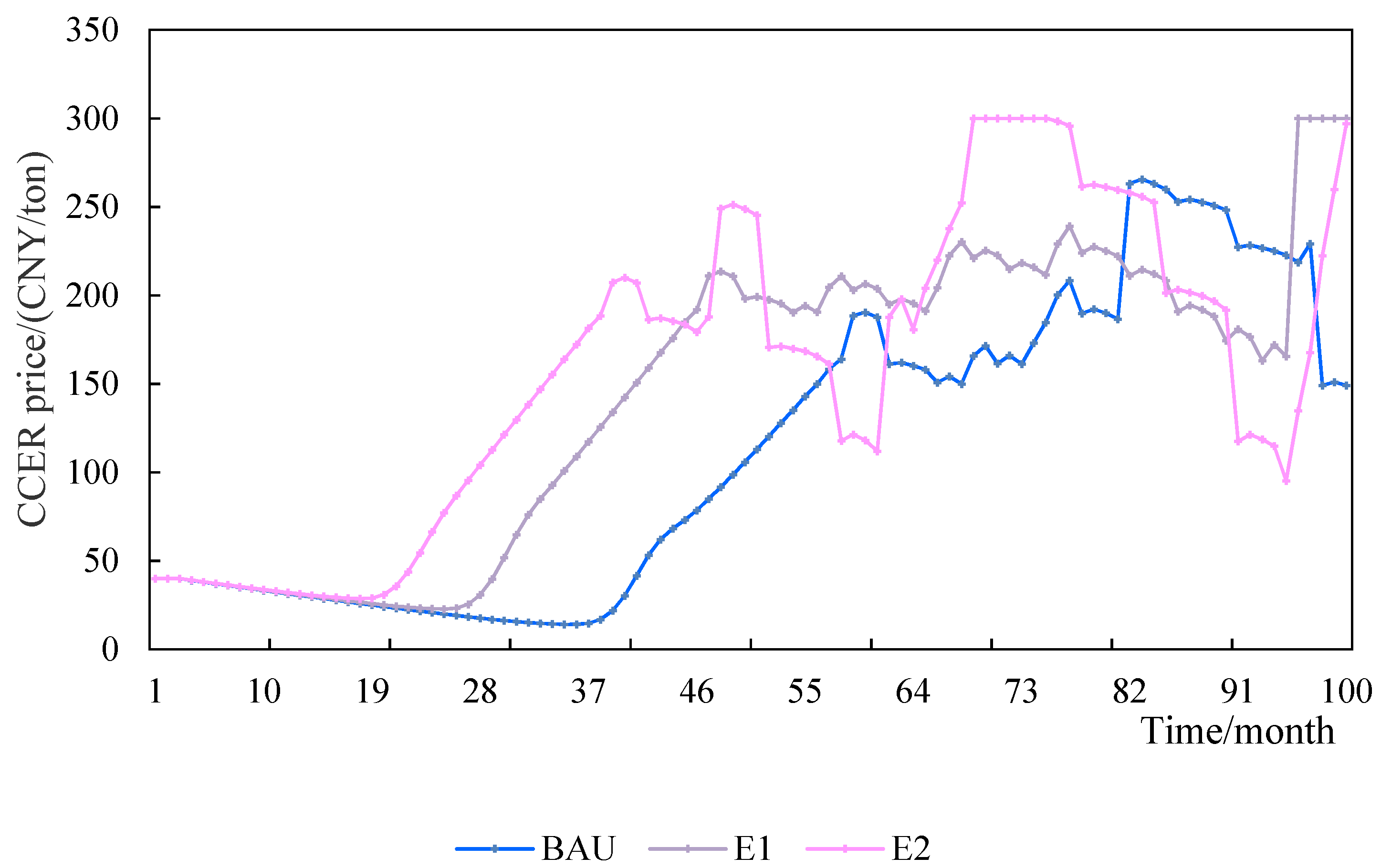

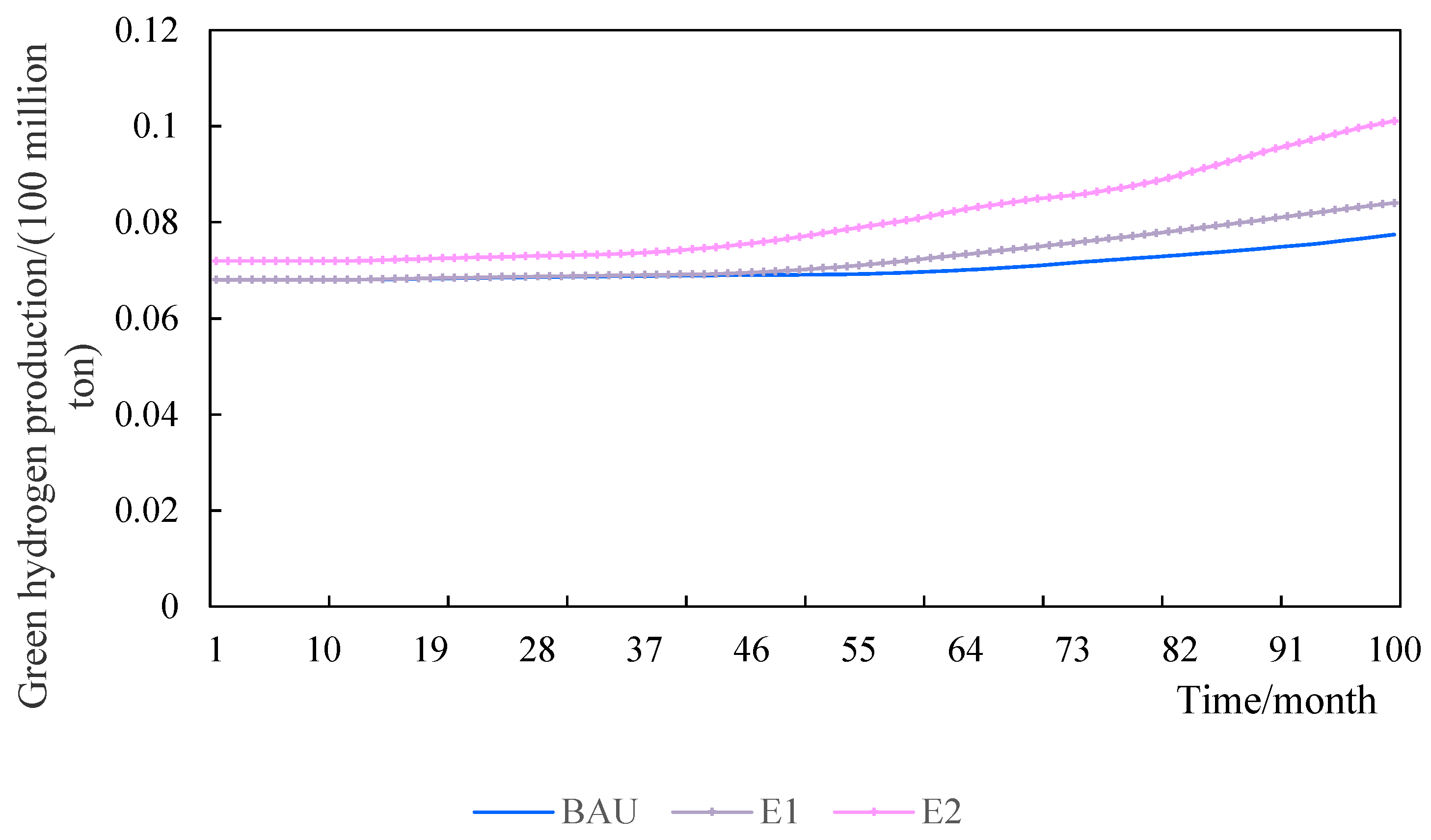

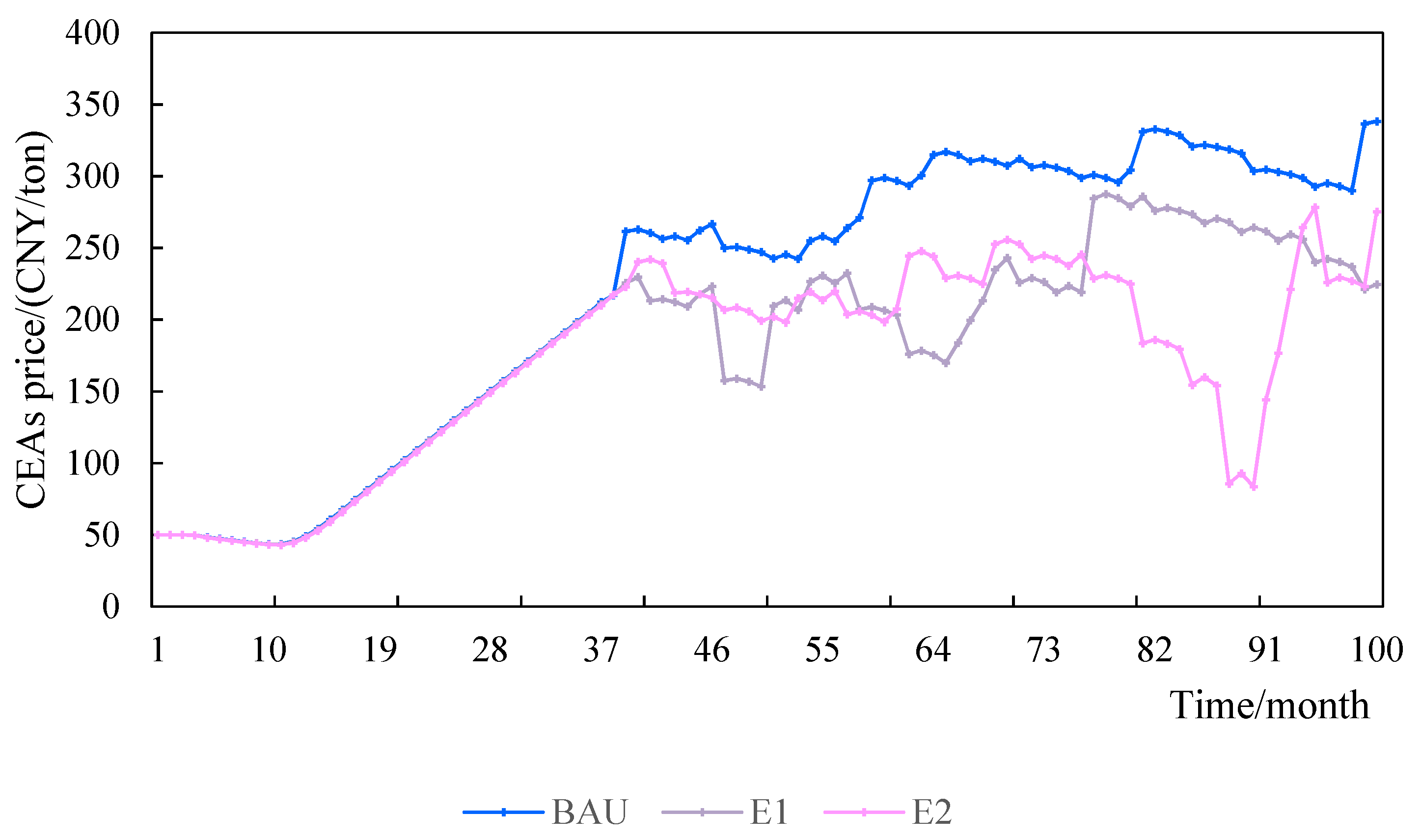

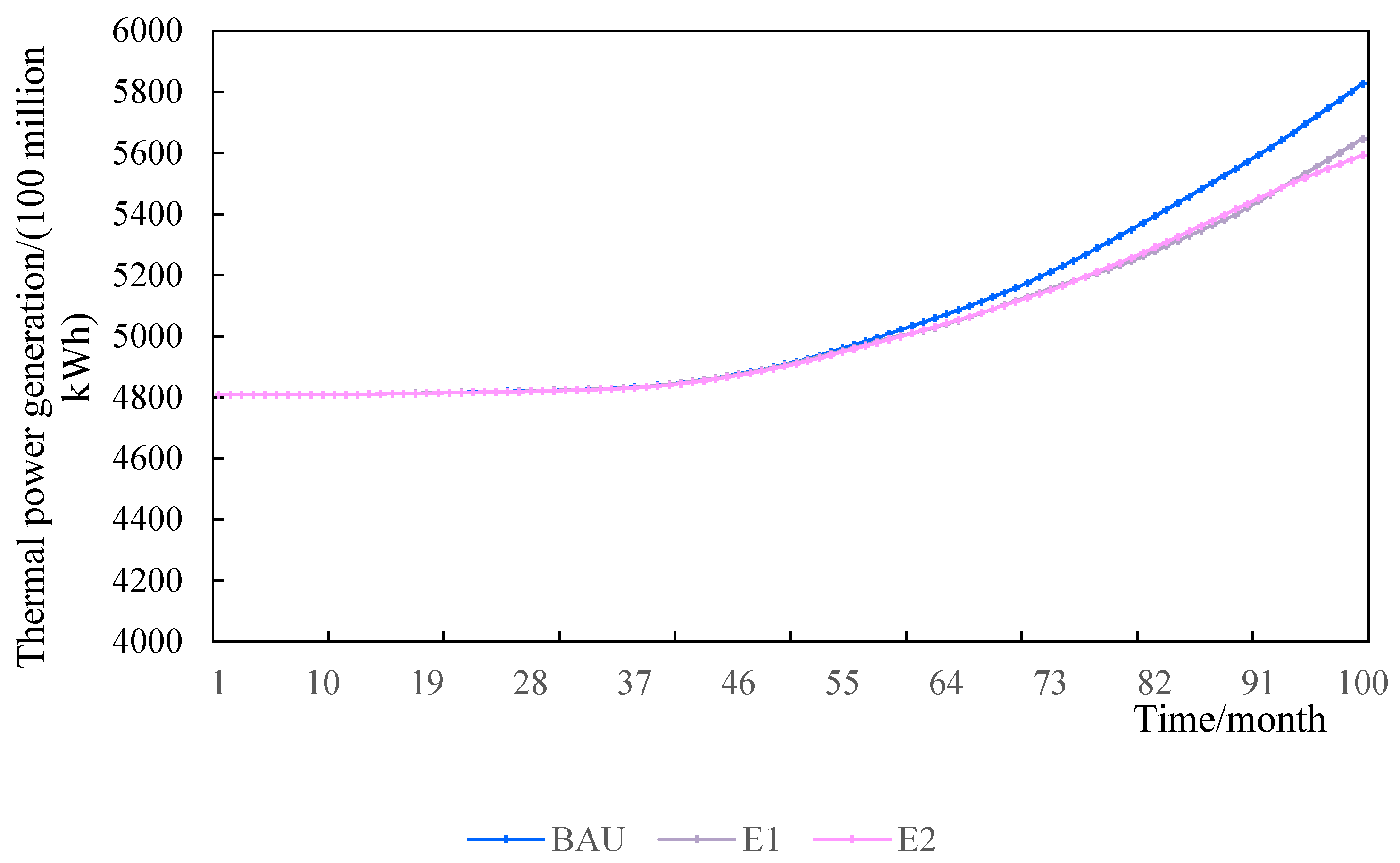

- Comprehensive scenario-simulation analysis

5.2. Discussion

6. Main Conclusions and Policy Recommendations

6.1. Main Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Nomenclature

| ETS | Emissions trading system | |

| CCER | Chinese Certified Emission Reduction | |

| SD | System dynamics | |

| CEAs | Chinese emission allowances | |

| DYNAMO | Dynamic model | |

| UN COP26 | The United Nations Conference of the Parties 26 | |

| electricity–carbon | Electricity market and carbon market | |

| CO2 | Carbon dioxide | |

| CEC | China Electricity Council | |

| EU | European Union | |

| US | United States | |

| Double carbon | Carbon emission peak, carbon neutrality | |

References

- Energy & Climate. Net Zero Emissions Race [EB/OL]. 2022. Available online: https://eciu.net/netzerotracker (accessed on 1 January 2022).

- Xi, J.P. Building on the Past to Start a New Journey in the Global Response to Climate Change—Speech at the Climate Ambition Summit. China Environment Supervision. 2020. Available online: http://www.gov.cn/gongbao/content/2020/content_5570055.htm (accessed on 12 December 2020).

- PRC National Development and Reform Commission. Medium and Long-Term Planning of Hydrogen Energy Industry Development(021-2035) [EB/OL]. 2022. Available online: http://www.nea.gov.cn/2022-03/23/c_1310525755.htm (accessed on 23 March 2022).

- Li, W.; Wan, Y.M.; Xiong, Y.L.; Gao, P.B. Green hydrogen standard in China: Standard and evaluation of low-carbon hydrogen, clean hydrogen, and renewable hydrogen. Int. J. Hydrog. Energy 2022, 47, 24584–24591. [Google Scholar] [CrossRef]

- Dabar, O.A.; Awaleh, M.O.; Waberi, M.M.; Adan, A.I. Wind resource assessment and techno-economic analysis of wind energy and green hydrogen production in the Republic of Djibouti. Energy Rep. 2022, 8, 8996–9016. [Google Scholar] [CrossRef]

- Nogrady, B. China launches world’s largest carbon market: But is it ambitious enough? Nature 2021, 595, 637. [Google Scholar] [CrossRef]

- Wang, Y.Z.; Ou, X.M.; Zhou, S.H. Future cost trend of hydrogen production in China based on learning curve. Adv. Clim. Chang. Res. 2022, 18, 283–293. [Google Scholar]

- Liu, W.; Wan, Y.M.; Xiong, Y.L.; Tao, Z.J.; Zhu, Y.B. Key Technology of Water Electrolysis and Levelized Cost of Hydrogen Analysis under Carbon Neutral Vision. Trans. China Electrotech. Soc. 2022, 37, 2888–2896. [Google Scholar]

- Xu, C.B.; Zhao, Y.H.; Wang, X.C.; Ke, Y.M. Optimal Configuration of Hydrogen Energy Storage for Wind and Solar Power Stations Considering Electricity-Hydrogen Coupling Under Carbon Neutrality Vision. Electr. Power Constr. 2022, 43, 10–18. [Google Scholar]

- Yang, J.G.; Liu, W.M.; Li, S.X.; Deng, T.H.; Shi, Z.P.; Hu, Z.C. Optimal Operation Scheme and Benefit Analysis of Wind-Hydrogen Power Systems. Electr. Power Constr. 2017, 38, 106–115. [Google Scholar]

- Dai, H.C.; Dai, H.M. Green hydrogen production based on the co-combustion of wood biomass and porous media. Appl. Energy 2022, 324, 119779. [Google Scholar] [CrossRef]

- Ling, W.; Li, Q.; Zhang, K. Development Strategy of Hydrogen Energy Industry in China. Chin. J. Eng. Sci. 2022, 24, 80–88. [Google Scholar] [CrossRef]

- Cao, F.; Guo, T.; Chen, K.; Jin, X.L.; Zhang, L.; Yang, J.H.; Yin, A.M. Progress and development prospect of coupled wind and hydrogen systems. In Proceedings of the CSEE 2021, Lisbon, Portugal, 21–23 June 2021; Volume 41, pp. 2187–2200. [Google Scholar]

- Schrotenboer, A.H.; Veenstra, A.A.; uit het Broek, M.A.; Ursavas, E. A Green Hydrogen Energy System: Optimal control strategies for integrated hydrogen storage and power generation with wind energy. Renew. Sustain. Energy Rev. 2022, 168, 112744. [Google Scholar] [CrossRef]

- Ji, B.; Sun, H.; Liang, X.; Liu, Y.; Li, F. Discussion on convergent trading of the carbon and electricity market on the path to carbon peak and carbon neutrality. Huadian Technol. 2021, 43, 33–40. [Google Scholar]

- Shuai, Y.F.; Zhou, C.L.; Li, M.; Hu, J.F.; Wang, P. Coupling mechanism of U.S. carbon market and electricity market: A case study of regional greenhouse gas initiative. Electr. Power Constr. 2018, 39, 41–47. [Google Scholar]

- Zhao, C.; Zhang, M.; Wu, J.; Yuan, J. The Coupling Study on Carbon Market and Power Market. Chin. J. Environ. Manag. 2019, 11, 105–112. [Google Scholar]

- Feng, C.S.; Xie, F.R.; Wen, F.S.; Zhang, Y.B.; Hu, J.H. Design and Implementation of Joint Trading Market for Green Power Certificate and Carbon Based on Smart Contract. Autom. Electr. Power Syst. 2021, 45, 1–11. [Google Scholar]

- Feng, T.T.; Li, R.; Zhang, H.M.; Gong, X.L.; Yang, Y.S. Induction mechanism and optimization of tradable green certificates and carbon emission trading acting on electricity market in China. Resour. Conserv. Recycl. 2021, 169, 105487. [Google Scholar] [CrossRef]

- Wang, B.C.; Liu, Y.; Cui, X. Research on compensation mechanism of thermal power enterprises based on electricity-carbon linkage. Electr. Meas. Instrum. 2019, 56, 65–70. [Google Scholar]

- Liu, Y.; Cui, X.; Xie, X.; Gao, J.; Zou, C. Research on the trading of clean energy power generation right with the best social benefit under the electric-carbon linkage environment. Electr. Meas. Instrum. 2020, 57, 112–117. [Google Scholar]

- Liang, Z.Y.; Bao, M.L.; Ding, Y.; Song, Y.H.; Hou, Y.Q.; Feng, H. Clearing model of electricity-gas joint market considering the complementary elasticity of multi-energy loads. In Proceedings of the CSEE 2022, Montreal, QC, Canada, 14–19 August 2022; pp. 1–16. [Google Scholar]

- Song, X.H.; Han, J.J.; Zhang, L.; Zhao, C.P.; Wang, P.; Liu, X.Y.; Li, Q.C. Impacts of renewable portfolio standards on multi-market coupling trading of renewable energy in China: A scenario-based system dynamics model. Energy Policy 2021, 159, 112647. [Google Scholar] [CrossRef]

- Zhang, H.; Han, D.; Liu, T.; Huang, Y. Analysis of market coupling mechanism between distributed photovoltaic penetration and electricity market under the background of carbon neutrality. J. Shanghai Jiaotong Univ. 2022, 1–9. [Google Scholar] [CrossRef]

- Wang, L.; Jiao, S.; Xie, Y.; Xia, S.; Zhang, D.; Zhang, Y.; Li, M. Two-way dynamic pricing mechanism of hydrogen filling stations in electric-hydrogen coupling system enhanced by blockchain. Energy 2022, 239, 122194. [Google Scholar] [CrossRef]

- China Hydrogen Alliance. White Paper on Hydrogen Energy and Fuel Cell Industry in China. [EB/OL]. 2020. Available online: http://www.h2cn.org.cn/publication.html (accessed on 29 June 2020).

- Peng, G.B.; Xiang, Y. CO2 emission coupled power generation mix evolution: A system dynamics approach. Energy Rep. 2022, 8, 597–604. [Google Scholar] [CrossRef]

- Ding, Y.; Chen, S.; Zheng, Y.; Chai, S.; Nie, R. Resilience assessment of China’s natural gas system under supply shortages: A system dynamics approach. Energy 2022, 247, 123518. [Google Scholar] [CrossRef]

- Cao, X.L.; Cheng, Y.M.; Wu, W.G. Study on the Priorities for the Development of CCER Forestry Carbon Sink Projects under the Context of Carbon Neutrality Goals. J. Stat. Inf. 2022, 37, 52–63. [Google Scholar]

- Wu, Q.Y. Price and scale effects of China’s carbon emission trading system pilots on emission reduction. J. Environ. Manag. 2022, 314, 115054. [Google Scholar] [CrossRef] [PubMed]

- Qi, S.; Cheng, S.; Tan, X.; Feng, S.; Zhou, Q. Predicting China’s carbon price based on a multi-scale integrated model. Appl. Energy 2022, 324, 119784. [Google Scholar] [CrossRef]

- Wang, M.G.; Zhu, M.R.; Tian, L.X. A novel framework for carbon price forecasting with uncertainties. Energy Econ. 2022, 112, 106162. [Google Scholar] [CrossRef]

- Pan, G.S.; Gu, W.; Zhang, H.Y.; Que, Y. Electricity and Hydrogen Energy System Towards Accommodation of High Proportion of Renewable Energy. Autom. Electr. Power Syst. 2020, 44, 1–10. [Google Scholar]

- Shuang, L.I.; Yixiang, S.H.I.; Ningsheng, C.A.I. Progress in hydrogen production from fossil fuels and renewable energy sources for the green energy revolution. J. Tsinghua Univ. (Sci. Technol.) 2022, 62, 655–662. [Google Scholar]

- Yue, B.X.; Xiong, H.B.; Guo, Y.Z.; Guo, C.X. Carbon transaction mechanism promotes low-carbon transformation of power industry. Electr. Autom. 2022, 44, 1–3. [Google Scholar]

- Wang, W.; Zhao, X.; Zhang, Q.; Fu, C.; Xie, P. Auction mechanism design of the Chines national carbon market for carbon neutralization. Chin. J. Popul. Resour. Environ. 2022, 20, 115–124. [Google Scholar] [CrossRef]

- Experience and Lessons Learned from the Power Sector’s Participation in the EU Carbon Emissions Trading System. Available online: http://www.edf.org (accessed on 1 May 2020).

- Yan, J. The impact of climate policy on fossil fuel consumption: Evidence from the Regional Greenhouse Gas Initiative (RGGI). Energy Econ. 2021, 100, 105333. [Google Scholar] [CrossRef]

| Influencing Factors | Scenario | Parameter Setting | |||

|---|---|---|---|---|---|

| CCER Offset Ratio (%) | Proportion of Green Hydrogen Certification (%) | Elimination Rate of Backward Units (%) | Quota Auction Proportion (%) | ||

| Basic scenario | BAU | 5 | 2.5 | 0 | 0 |

| CCER offset ratio | A1 | 7 | 2.5 | 0 | 0 |

| A2 | 10 | 2.5 | 0 | 0 | |

| Proportion of green hydrogen certification | B1 | 5 | 3 | 0 | 0 |

| B2 | 5 | 4 | 0 | 0 | |

| Elimination rate of backward units | C1 | 5 | 2.5 | 5 | 0 |

| C2 | 5 | 2.5 | 20 | 0 | |

| Quota auction proportion | D1 | 5 | 2.5 | 0 | 10 |

| D2 | 5 | 2.5 | 0 | 20 | |

| Comprehensive scenario | E1 | 7 | 3 | 5 | 10 |

| E2 | 10 | 4 | 20 | 20 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.-R.; Feng, T.-T.; Li, Y.; Zhang, H.-M.; Kong, J.-J. What Is the Policy Effect of Coupling the Green Hydrogen Market, National Carbon Trading Market and Electricity Market? Sustainability 2022, 14, 13948. https://doi.org/10.3390/su142113948

Wang H-R, Feng T-T, Li Y, Zhang H-M, Kong J-J. What Is the Policy Effect of Coupling the Green Hydrogen Market, National Carbon Trading Market and Electricity Market? Sustainability. 2022; 14(21):13948. https://doi.org/10.3390/su142113948

Chicago/Turabian StyleWang, Hao-Ran, Tian-Tian Feng, Yan Li, Hui-Min Zhang, and Jia-Jie Kong. 2022. "What Is the Policy Effect of Coupling the Green Hydrogen Market, National Carbon Trading Market and Electricity Market?" Sustainability 14, no. 21: 13948. https://doi.org/10.3390/su142113948

APA StyleWang, H.-R., Feng, T.-T., Li, Y., Zhang, H.-M., & Kong, J.-J. (2022). What Is the Policy Effect of Coupling the Green Hydrogen Market, National Carbon Trading Market and Electricity Market? Sustainability, 14(21), 13948. https://doi.org/10.3390/su142113948