Young Consumers’ Perceptions of Family Firms and Their Purchase Intentions—The Polish Experience

Abstract

1. Introduction

2. The Essence and Factors Shaping Purchase Intentions

2.1. New Trends in Young Consumers’ Purchasing Behavior

- selection of a given product category, e.g., energy-saving light bulbs, ecological cleaning agents, food from local farms [63];

- evaluation of the activities of specific enterprises and selection of ethical, socially responsible and environmentally friendly companies, while avoiding those violating social or environmental standards [66];

2.2. Perceptions of Family Businesses

3. Dataset and Methods

3.1. Sampling and Inclusion Criteria

3.2. Analytical Procedures

4. Measurement

4.1. Objective Knowledge

4.2. Consumers’ Convictions about Family Businesses

4.3. Orientation towards Products ‘Made by’ Family Companies

5. Results

6. Discussion

7. Conclusions

8. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ogonowska-Rejer, A. Firmy Rodzinne to Rodzaj Specyficznego Biznesu, Rzeczpospolita E-Wydanie. 2020. Available online: https://www.rp.pl/wydarzenia-gospodarcze/art8925071-firmy-rodzinne-to-rodzaj-specyficznego-biznesu (accessed on 29 May 2020).

- Armstrong, J.S.; Morwitz, V.G.; Kumar, V. Sales Forecasts for Existing Consumer Products and Services: Do Purchase Intentions Contribute to Accuracy? Int. J. Forecast. 2000, 16, 383–397. [Google Scholar] [CrossRef]

- Ba, S.; Kumar-Tiwari, M.; Chan, F.T.S. Predicting the consumer purchase intention of durable goods. An attribute-level analysis. J. Bus. Res. 2019, 94, 408–419. [Google Scholar] [CrossRef]

- Abraham, V.; Reitman, A. Conspicuous consumption in the context of consumer animosity. Int. Mark. Rev. 2018, 35, 412–428. [Google Scholar] [CrossRef]

- Firat, A.F.; Dholakia, N. From consumer to construer: Travels in human subjectivity. J. Consum. Cult. 2017, 17, 504–522. [Google Scholar] [CrossRef]

- Kumar, P.; Ghodeswar, B.M. Factors affecting consumers’ green product purchase decisions. Mark. Intell. Plan. 2015, 33, 330–347. [Google Scholar] [CrossRef]

- Peña-García, N.; Gil-Saura, I.; Rodríguez-Orejuela, A.; Siqueira-Junior, R. Purchase intention and purchase behavior online: A cross-cultural approach. Heliyon 2020, 6, e04284. [Google Scholar] [CrossRef]

- Uwemi, K.H.U.; Fournier-Bonilla, S.D. Challenges of E-commerce in developing countries: Nigeria as case study. Northeast. Decis. Sci. Inst. Conf. 2016, 31. [Google Scholar]

- Rauschendorfer, N.; Prügl, R.; Lude, M. Love is in the air. Consumers’ perception of products from firms signaling their family nature. Psychol. Mark. 2022, 39, 239–249. [Google Scholar]

- Wekeza, S.; Sibanda, M. Factors Influencing Consumer Purchase Intentions of Organically Grown Products in Shelly Centre, Port Shepstone, South Africa. Int. J. Environ. Res. Public Health 2019, 16, 956. [Google Scholar] [CrossRef]

- Kim, E.; Ham, S.; Sun Yang, I.S.; Choi, J.G. The roles of attitude, subjective norm, and perceived behavioral control in the formation of consumers’ behavioral intentions to read menu labels in the restaurant industry. Int. J. Hosp. Manag. 2013, 35, 203–213. [Google Scholar] [CrossRef]

- Li, J.; Guo, F.; Xu, J.; Yu, Z. What Influences Consumers’ Intention to Purchase Innovative Products: Evidence from China. Front. Psychol. 2022, 13, 838244. [Google Scholar] [CrossRef] [PubMed]

- Kayid, W.A.; Jin, Z.; Priporas, C.V.; Ramakrishnan, S. Defining family business efficacy: An exploratory study. J. Bus. Res. 2022, 141, 713–725. [Google Scholar] [CrossRef]

- Zulfiqar, M.; Zhang, R.; Khan, N.; Chen, S. Behavior Towards R&D Investment of Family Firms CEOs: The Role of Psychological Attribute. Psychol. Res. Behav. Manag. 2021, 14, 595–620. [Google Scholar] [CrossRef] [PubMed]

- Chrisman, J.J.; Chua, J.H.; Steier, L.P. An introduction to theories of family business. J. Bus. Ventur. 2003, 18, 441–448. [Google Scholar] [CrossRef]

- Elsbach, K.D.; Pieper, T.M. How psychological needs motivate family firm identifications and identifiers: A framework and future research agenda. J. Fam. Bus. Strategy 2019, 10, 100289. [Google Scholar] [CrossRef]

- Ustawa z dnia 23 kwietnia 1964 roku Kodeks cywilny (t.j. Dz.U. 2020 r. poz. 1740). 1740.

- Peráček, T. E-commerce and its limits in the context of consumer protection: The case of the Slovak Republic. Jurid. Trib. 2022, 12, 35–50. [Google Scholar] [CrossRef]

- Morwitz, V. Consumer’s Purchase Intentions and their Behavior. Found. Trends Mark. 2014, 7, 181–230. [Google Scholar] [CrossRef]

- Lesko, N. Act Your Age! A Cultural Construction of Adolescence; Routledge Falme: New York, NY, USA, 2001. [Google Scholar]

- Włodarczyk, K. Trends of Evolution in Consumer Behavior in the Contemporary World. Manag. Issues 2021, 19, 40–51. [Google Scholar] [CrossRef]

- Westbrook, G.; Angus, A. Top 10 Global Consumer Trends 2021. Euromonitor International. 2021. Available online: https://go.euromonitor.com/white-paper-EC-2021-Top-10-Global-Consumer-Trends.html (accessed on 15 July 2022).

- Tan, W.L.; Goh, Y.N. The role of psychological factors in influencing consumer purchase intention towards green residential building. Int. J. Hous. Mark. Anal. 2018, 11, 788–807. [Google Scholar] [CrossRef]

- Zhang, S.; Zhou, C.; Liu, Y. Consumer Purchasing Intentions and Marketing Segmentation of Remanufactured New-Energy Auto Parts in China, Hindawi Mathematical Problems in Engineering. Math. Probl. Eng. 2020, 2020, 5647383. [Google Scholar] [CrossRef]

- Islam, T.; Hussain, M. How consumer uncertainty intervene country of origin image and consumer purchase intention? The moderating role of brand image. Int. J. Emerg. Mark. 2022, 17. [Google Scholar] [CrossRef]

- Safeer, A.A.; Abrar, M.; Liu, H.; He, Y. Effects of perceived brand localness and perceived brand globalness on consumer behavioral intentions in emerging markets. Manag. Decis. 2022, 60. [Google Scholar] [CrossRef]

- Willis Lee, E.; Reynolds, K.J.; Klik, K.A. The theory of planned behavior and the social identity approach: A new look at group processes and social norms in the context of student binge drinking. Eur. J. Psychol. 2020, 16, 357–383. [Google Scholar] [CrossRef] [PubMed]

- Bosnjak, M.; Ajzen, I.; Schmidt, P. The Theory of Planned Behavior: Selected Recent Advances and Applications. Eur. J. Psychol. 2020, 16, 352–356. [Google Scholar] [CrossRef]

- Manalu, V.G.; Adzimatinur, F. The Effect of Consumer Ethnocentrism on Purchasing Batik Products: Application of the Extended Theory of Planned Behaviour (TPB) and Price Sensitivity. Bp. Int. Res. Crit. Inst. J. 2020, 3, 3137–3146. [Google Scholar] [CrossRef]

- Si, H.; Shi, J.; Tang, D.; Wen, S.; Miao, W.; Duan, K. Application of the Theory of Planned Behavior in Environmental Science: A Comprehensive Bibliometric Analysis. Int. J. Environ. Res. Public Health 2019, 16, 2788. [Google Scholar] [CrossRef]

- Chan, R.K.; Wong, Y.H.; Leung, T.K.P. Applying ethical concepts to the study of “Green” consumer behavior: An analysis of Chinese Consumers’ intentions to bring their own shopping bags. J. Bus. Ethics 2007, 79, 469–481. [Google Scholar] [CrossRef]

- Agag, G.; El-Masry, A.A. Understanding the determinants of hotel booking intentions and moderating role of habit. Int. J. Hosp. Manag. 2016, 54, 52–67. [Google Scholar] [CrossRef]

- Arifani, V.; Haryanto, H. Purchase intention: Implementation theory of planned behavior (Study on reusable shopping bags in Solo City, Indonesia). IOP Conf. Ser. Earth Environ. Sci. 2019, 200, 012019. [Google Scholar] [CrossRef]

- Conner, S.L.; Reardon, J.; Miller, C.; Salciuviene, L.; Auruskeviciene, V. Cultural antecedents to the normative, affective, and cognitive effects of domestic versus foreign purchase behavior. J. Bus. Econ. Manag. 2017, 18, 100–115. [Google Scholar] [CrossRef]

- Jiménez, N.H.; San Martín, S. The role of country-of-origin, ethnocentrism and animosity in promoting consumer trust. The moderating role of familiarity. Int. Bus. Rev. 2010, 19, 34–45. [Google Scholar] [CrossRef]

- Warren, C.; Mohr, G.S. Ironic consumption. J. Consum. Res. 2019, 46, 246–266. [Google Scholar] [CrossRef]

- O’Brien, E.; Smith, R.W. Unconventional consumption methods and enjoying things consumed: Recapturing the “first-time” experience. Personal. Soc. Psychol. Bull. 2018, 45, 67–80. [Google Scholar] [CrossRef] [PubMed]

- Martensen, A.; Grønholdt, L. The Effect of Word-Of-Mouth on Consumer Emotions and Choice: Findings From a Service Industry. Int. J. Qual. Serv. Sci. 2016, 8, 298–314. [Google Scholar] [CrossRef][Green Version]

- Ham, C.D.; Lee, J.; Lee, H. Understanding consumers’ creating behaviour in social media: An application of uses and gratifications and the theory of reasoned action. Int. J. Internet Mark. Advert. 2014, 8, 241–265. [Google Scholar] [CrossRef]

- Zhang, N.; Liu, R.; Zhang, X.; Zhi-Liang, P. The impact of consumer perceived value on repeat purchase intention based on online reviews: By the method of text mining. Data Sci. Manag. 2021, 3, 22–32. [Google Scholar] [CrossRef]

- Levrini, G.R.D.; Dos Santos, M.J. The Influence of Price on Purchase Intentions: Comparative Study between Cognitive, Sensory, and Neurophysiological Experiments. Behav. Sci. 2021, 11, 16. [Google Scholar] [CrossRef]

- Garrido-Morgado, Á.; González-Benito, Ó.; Martos-Partal, M. Influence of Customer Quality Perception on the Effectiveness of Commercial Stimuli for Electronic Products. Front. Psychol. 2016, 7, 336. [Google Scholar] [CrossRef]

- Mughal, H.A.; Faisal, F.; Khokhar, M.N. Exploring consumer’s perception and preferences towards purchase of non-certified organic food: A qualitative perspective. Cogent Bus. Manag. 2021, 8, 158–169. [Google Scholar] [CrossRef]

- Su, J.; Chang, A. Factors affecting college students’ brand loyalty toward fast fashion. Int. J. Retail. Distrib. Manag. 2018, 1, 90–107. [Google Scholar] [CrossRef]

- Woźny, D. Analiza kategorii młodych konsumentów z uwzględnieniem różnych kryteriów jej wyodrębniania. Zesz. Nauk. Wyższej Szkoły Zarządzania Bank. Krakowie 2013, 30, 15–26. [Google Scholar]

- Czerniawska, D.; Czerniawska, M.; Szydło, J. Between Collectivism and Individualism—Analysis of Changes in Value Systems of Students in the Period of 15 Years. Psychol. Res. Behav. Manag. 2021, 8, 2015–2033. [Google Scholar] [CrossRef] [PubMed]

- Handriana, T.; Yulianti, P.; Kurniawati, M.; Arina, N.A.; Aisyah, R.; Ayu Aryani, M.G.; Wandira, R.K. Purchase behavior of millennial female generation on Halal cosmetic products. J. Islam. Mark. 2021, 12, 1295–1315. [Google Scholar] [CrossRef]

- Chaturvedi, P.; Kulshreshtha, K.; Tripathi, V. Investigating the determinants of behavioral intentions of generation Z for recycled clothing: An evidence from a developing economy. Young Consum. 2020, 21, 403–417. [Google Scholar] [CrossRef]

- Adnan, A.; Khan, M. Examining the role of consumer lifestyles on ecological behavior among young Indian consumers. Young Consum. 2017, 18, 348–377. [Google Scholar] [CrossRef]

- Lendel, V.; Siantová, E.; Závodská, A.; Šramová, V. Generation Y. Marketing—The Path to Achievement of Successful Marketing Results Among the Young Generation. In Strategic Innovative Marketing; Kavoura, A., Sakas, D., Tomaras, P., Eds.; Springer Proceedings in Business and Economics: Mycanos, Greece, 2017. [Google Scholar] [CrossRef]

- Djafarova, E.; Bowes, T. ‘Instagram made Me buy it’: Generation Z impulse purchases in fashion industry. J. Retail. Consum. Serv. 2021, 59, 102345. [Google Scholar] [CrossRef]

- Amayah, A.T.; Gedro, J. Understanding generational diversity: Strategic human resource management and development across the generational “divide”. New Horiz. Adult Educ. Hum. Resour. Dev. 2014, 26, 36–48. [Google Scholar] [CrossRef]

- Sasmita, J.; Mohd Suki, N. Young consumers’ insights on brand equity: Effects of brand association, brand loyalty, brand awareness, and brand image. Int. J. Retail. Distrib. Manag. 2015, 43, 276–292. [Google Scholar] [CrossRef]

- Martin, D.; Schouten, J. Sustainable Marketing; Prentice Hall: Boston, MA, USA, 2012. [Google Scholar]

- Priporas, V.; Stylos, N.; Fotiadis, A. Generation Z consumers’ expectations of interactions in smart retailing: A future agenda. Comput. Hum. Behav. 2017, 77, 374–381. [Google Scholar] [CrossRef]

- McGregor, S.L.T. Sustainable life path concept: Journeying toward sustainable consumption. J. Res. Consum. 2013, 24, 33–56. Available online: http://www.jrconsumers.com/Consumer_Articles/issue_24 (accessed on 15 July 2022).

- Aday, M.S.; Yener, U. Understanding the buying behaviour of young consumers regarding packaging attributes and labels. Int. J. Consum. Stud. 2014, 38, 385–393. [Google Scholar] [CrossRef]

- Kamenidou, I.C.; Mamalis, S.; Pavlidis, S.; Bara, E.Z.G. Segmenting the generation Z cohort university students based on sustainable food consumption behavior: A preliminary study. Sustainability 2019, 11, 837. [Google Scholar] [CrossRef]

- Dahlstrom, R. Green Marketing Management; South-Western Cengage Learning: Mason, IA, USA, 2011. [Google Scholar]

- Robichaud, Z.; Yu, H. Do young consumers care about ethical consumption? Modelling Gen Z’s purchase intention towards fair trade coffee. Br. Food J. 2021, 124, 2740–2760. [Google Scholar] [CrossRef]

- Joshi, Y.; Rahman, Z. Predictors of young consumer’s green purchase behavior. Manag. Environ. Qual. 2016, 27, 452–472. [Google Scholar] [CrossRef]

- Lorek, S.; Spangenberg, J.H. Sustainable consumption within a sustainable economy—Beyond green growth and green economies. J. Clean. Prod. 2014, 63, 33–44. [Google Scholar] [CrossRef]

- Ketelsen, M.; Janssen, M.; Hamm, U. Consumers’ response to environmentally-friendly food packaging—A systematic review. J. Clean. Prod. 2020, 254, 120123. [Google Scholar] [CrossRef]

- Hoffmann, S.; Mai, R.; Smirnova, M. Development and validation of a cross-nationally stable scale of consumer animosity. J. Mark. Theory Pract. 2011, 19, 235–252. [Google Scholar] [CrossRef]

- Noh, M.; Runyan, R.; Mosier, J. Young consumers’ innovativeness and hedonic/utilitarian cool attitudes. Int. J. Retail. Distrib. Manag. 2014, 42, 267–280. [Google Scholar] [CrossRef]

- Leong, S.M.; Cote, J.A.; Ang, S.H.; Tan, S.J.; Jung, K.; Kau, A.K.; Pornpitakpan, C. Understanding consumer animosity in an international crisis: Nature, antecedents, and consequences. J. Int. Bus. Stud. 2008, 39, 996–1009. [Google Scholar] [CrossRef]

- Ziesemer, F.; Hüttel, A.; Balderjahn, I. Young People as Drivers or Inhibitors of the Sustainability Movement: The Case of Anti-Consumption. J. Consum. Policy 2021, 44, 427–453. [Google Scholar] [CrossRef]

- Seegebarth, B.; Peyer, M.; Balderjahn, I.; Wiedmann, K.P. The Sustainability Roots of Anti-Consumption Lifestyles and Initial Insights Regarding Their Effects on Consumers’ Well-Being. J. Consum. Aff. 2016, 50, 68–99. [Google Scholar] [CrossRef]

- Ahmed, N.; Li, C.; Khan, A.; Ali Qualati, S.; Naz, S.; Rana, F. Purchase intention toward organic food among young consumers using theory of planned behavior: Role of environmental concerns and environmental awareness. J. Environ. Plan. Manag. 2020, 64, 796–822. [Google Scholar] [CrossRef]

- Naz, F.; Oláh, J.; Vasile, D.; Magda, R. Green Purchase Behavior of University Students in Hungary: An Empirical Study. Sustainability 2020, 12, 10077. [Google Scholar] [CrossRef]

- Young, L.J.; Halter, H.; Johnson, K.P.; Ju, H. Investigating fashion disposition with young consumers. Young Consum. 2013, 14, 67–78. [Google Scholar] [CrossRef]

- Chen, Y.; Burman, R.; Hongshan, Z. Second-hand clothing consumption: A cross-cultural comparison between American and Chinese young consumers. Int. J. Consum. Stud. 2014, 38, 670–677. [Google Scholar] [CrossRef]

- Chen, J.; Lobo, A. Organic food products in China: Determinants of consumers’ purchase intentions. Int. Rev. Retail. Distrib. Consum. Res. 2012, 22, 293–314. [Google Scholar] [CrossRef]

- Pham, T.H.; Nguyen, T.N.; Phan, T.T.H. Evaluating the purchase behavior of organic food by young consumers in an emerging market economy. J. Strateg. Mark. 2019, 27, 540–556. [Google Scholar] [CrossRef]

- Jaciow, M.; Wolny, R. New Technologies in the Ecological Behavior of Generation Z. Procedia Comput. Sci. 2021, 192, 4780–4789. [Google Scholar] [CrossRef]

- Misra, P.; Mukherjee, A. YouTuber icons: An analysis of the impact on buying behavior of young consumers. Int. J. Bus. Compet. Growth 2019, 6, 330–345. [Google Scholar] [CrossRef]

- Kim, S.; Park, H. Effects of various characteristics of social commerce (s-commerce) on consumers’ trust and trust performance. Int. J. Inf. Manag. 2012, 33, 318–332. [Google Scholar] [CrossRef]

- D’Angelo, A.; Majocchi, A.; Buck, T. External managers, family ownership and the scope of SME internationalization. J. World Bus. 2016, 51, 534–547. [Google Scholar] [CrossRef]

- Minola, T.; Kammerlander, N.; Kellermanns, F.W.; Hoy, F. Corporate entrepreneurship and family business: Learning across domains. J. Manag. Stud. 2021, 58, 1–26. [Google Scholar] [CrossRef]

- Moss, T.W.; Payne, G.T.; Moore, C.B. Strategic Consistency of Exploration and Exploitation in Family Businesses. Fam. Bus. Rev. 2016, 27, 51–71. [Google Scholar] [CrossRef]

- Sharma, P.; Chrisman, J.J.; Gersick, K.E. 25 Years of Family Business Review: Reflections on the Past and Perspectives for the Future. Fam. Bus. Rev. 2012, 25, 5–15. [Google Scholar] [CrossRef]

- Gedajlovi, E.; Carney, M.; Chrisman, J.J.; Kellermanns, F.W. The Adolescence of Family Firm Research: Taking Stock and Planning for the Future. J. Manag. 2012, 38, 1010–1037. [Google Scholar] [CrossRef]

- Xi, M.; Kraus, S.; Filser, M.; Kellermanns, F.W. Mapping the Field of Family Business Research: Past Trends and Future Directions. Int. Entrep. Manag. J. 2015, 11, 113–132. [Google Scholar] [CrossRef]

- Rovelli, P.; Ferasso, M.; De Massis, A.; Kraus, S. Thirty years of research in family business journals: Status quo and future directions. J. Fam. Bus. Strategy 2021, 13, 100422. [Google Scholar] [CrossRef]

- Aparicio, G.; Ramos, E.; Casillas, J.C.; Iturralde, T. Family Business Research in the Last Decade. A Bibliometric Review. Eur. J. Fam. Bus. 2021, 11, 33–44. [Google Scholar] [CrossRef]

- Debicki, B.J.; Matherne III, C.F.; Kellermanns, F.W.; Chrisman, J.J. Family Business Research in the New Millennium. Fam. Bus. Rev. 2009, 22, 151–166. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Lester, R.H.; Cannella, A.A. Are family firms really superior performers? J. Corp. Financ. 2007, 13, 829–858. [Google Scholar] [CrossRef]

- Andreini, D.; Bettinelli, C.; Pedeliento, G.; Apa, R. How Do Consumers See Firms’ Family Nature? A Review of the Literature. Fam. Bus. Rev. 2020, 33, 18–37. [Google Scholar] [CrossRef]

- Chen, S.; Wu, B.; Liao, Z.; Chen, L. Does familial decision control affect the entrepreneurial orientation of family firms? The moderating role of family relationships. J. Bus. Res. 2022, 152, 60–69. [Google Scholar] [CrossRef]

- Tien, N.H. Vietnamese family business in Vietnam and in Poland: Comparative analysis of trends and characteristics. Int. J. Entrep. Small Bus. 2021, 42, 282–299. [Google Scholar] [CrossRef]

- Kovacs, B.; Carroll, G.R.; Lehman, D.W. Authenticity and consumer value ratings: Empirical tests from the restaurant domain. Organ. Sci. 2013, 25, 458–478. [Google Scholar] [CrossRef]

- Lude, M.; Prügl, R. Why the family business brand matters: Brand authenticity and the family firm trust inference. J. Bus. Res. 2018, 89, 121–134. [Google Scholar] [CrossRef]

- Dam, S.M.; Dam, T.C. Relationships between Service Quality, Brand Image, Customer Satisfaction, and Customer Loyalty. J. Asian Financ. Econ. Bus. 2021, 8, 585–593. [Google Scholar] [CrossRef]

- Botero, I.C.; Astrachan, C.B.; Calabro, A. A receiver’s approach to family business brands: Exploring individual associations with the term “family firm”. J. Fam. Bus. Manag. 2018, 8, 94–112. [Google Scholar] [CrossRef]

- Botero, I.C.; Spitzley, D.; Lude, M.; Prügl, R. Exploring the Role of Family Firm Identity and Market Focus on the Heterogeneity of Family Business Branding Strategies. In The Palgrave Handbook of Heterogeneity among Family Firms; Memili, E., Dibrell, C., Eds.; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 909–932. [Google Scholar] [CrossRef]

- Carrigan, M.; Buckley, J. What’s so special about family business? An exploratory study of UK and Irish consumer experiences of family businesses. Int. J. Consum. Stud. 2008, 32, 656–666. [Google Scholar] [CrossRef]

- Adamczyk, G. Wybrane aspekty zachowań młodych konsumentów w nowych realiach rynkowych. Handel Wewnętrzny 2015, 354, 5–16. [Google Scholar]

- Gracz, L.; Ostrowska, I. Młodzi Nabywcy E-Zakupach; Wydawnictwo Placet: Warszawa, Poland, 2014. [Google Scholar]

- Szul, E. Prosumpcja młodych konsumentów—Korzyści i wyzwania dla firm. Stud. Proc. Pol. Assoc. Knowl. Manag. 2018, 88, 63–74. [Google Scholar]

- Wałęga, A.; Kwapniewski, W. Czynniki determinujące lojalność młodych konsumentów na rynku dóbr konsumpcyjnych. Mark. Rynek 2021, 7, 10–19. [Google Scholar] [CrossRef]

- Sears, D.O. College sophomores in the laboratory: Influences of a narrow data base on social psychology’s view of human nature. J. Personal. Soc. Psychol. 1986, 51, 515–530. [Google Scholar] [CrossRef]

- Henry, P.J. Student Sampling as a Theoretical Problem. Psychol. Inq. 2008, 19, 114–126. [Google Scholar] [CrossRef]

- Salant, P.; Dillman, D.A. How to Conduct Your Own Survey; John Wiley and Sons: New York, NY, USA, 1994. [Google Scholar]

- Forero, C.G.; Maydeu-Olivares, A. Estimation of IRT graded response models: Limited versus full information methods. Psychol. Methods 2009, 14, 275–299. [Google Scholar] [CrossRef]

- Lynch, A.M. The Application of Item Response Theory to Employee Attitude Survey Data Using Samejima’s Graded Response Model. 1997. Available online: https://www.proquest.com/docview/304342072 (accessed on 17 October 2022).

- Beck, S.; Prügl, R. Family Firm Reputation and Humanization: Consumers and the Trust Advantage of Family Firms Under Different Conditions of Brand Familiarity. Fam. Bus. Rev. 2018, 31, 460–482. [Google Scholar] [CrossRef]

- Fernández-Aráoz, C.; Iqbal, S.; Ritter, J.; Sadowski, R. Traits of Strong Family Businesses. Harv. Bus. Rev. 2019, 6, 123–128. [Google Scholar]

- Ciaburro, G. Regression Analysis with R: Design and Develop Statistical Nodes to Identify Unique Relationships within Data at Scale; Packt Publishing Ltd.: Birmingham, UK, 2018. [Google Scholar]

- Lee, J.M. An Efficient kNN Algorithm. KIPS Trans. Part B 2004, 11B, 849–854. [Google Scholar] [CrossRef]

- Tu, J.-C.; Hsu, C.-F.; Creativani, K. A Study on the Effects of Consumers’ Perception and Purchasing Behavior for Second-Hand Luxury Goods by Perceived Value. Sustainability 2022, 14, 10397. [Google Scholar] [CrossRef]

| Range of Activity | Number of Family Companies Listed | Total | ||||||

|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | ||

| None | 743 | 0 | 0 | 0 | 0 | 0 | 0 | 743 (70.8%) |

| Local | 10 | 76 | 11 | 3 | 0 | 0 | 0 | 100 (9.5%) |

| Mixed | 0 | 0 | 12 | 7 | 7 | 2 | 0 | 28 (2.7%) |

| International | 0 | 86 | 42 | 32 | 12 | 6 | 1 | 179 (17%) |

| Total | 753 (71.7%) | 162 (15.4%) | 65 (6.2%) | 42 (4%) | 19 (1.8%) | 8 (0.8%) | 1 (0.1%) | 1050 (100%) |

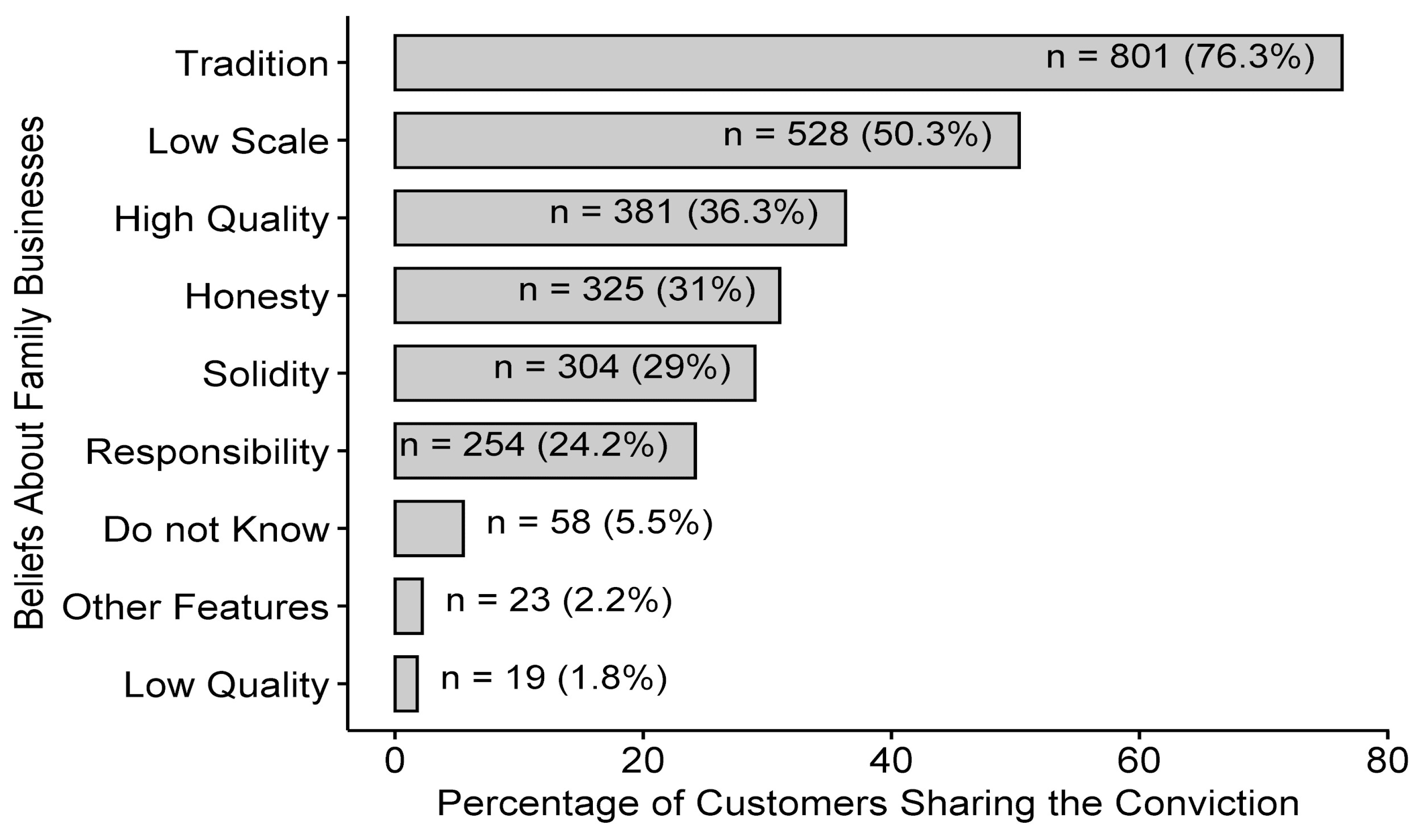

| Convictions about Family Brands | Frequency of the Conviction Being Shared | Test of Whether 50% of Consumers Share the Conviction | |||

|---|---|---|---|---|---|

| N | % | Z | p | ε2 | |

| Tradition | 801 | 76.3 | −20.041 | <0.001 | −0.618 |

| Low Scale | 528 | 50.3 | −0.194 | 0.846 | −0.006 |

| High Quality | 381 | 36.3 | 9.232 | <0.001 | 0.285 |

| Honesty | 325 | 31.0 | 13.312 | <0.001 | 0.411 |

| Solidity | 304 | 29.0 | 14.996 | <0.001 | 0.463 |

| Responsibility | 254 | 24.2 | 19.520 | <0.001 | 0.602 |

| Do Not Know | 58 | 5.5 | 63.250 | <0.001 | 1.952 |

| Other Features | 23 | 2.2 | 105.595 | <0.001 | 3.259 |

| Low Quality | 19 | 1.8 | 117.476 | <0.001 | 3.625 |

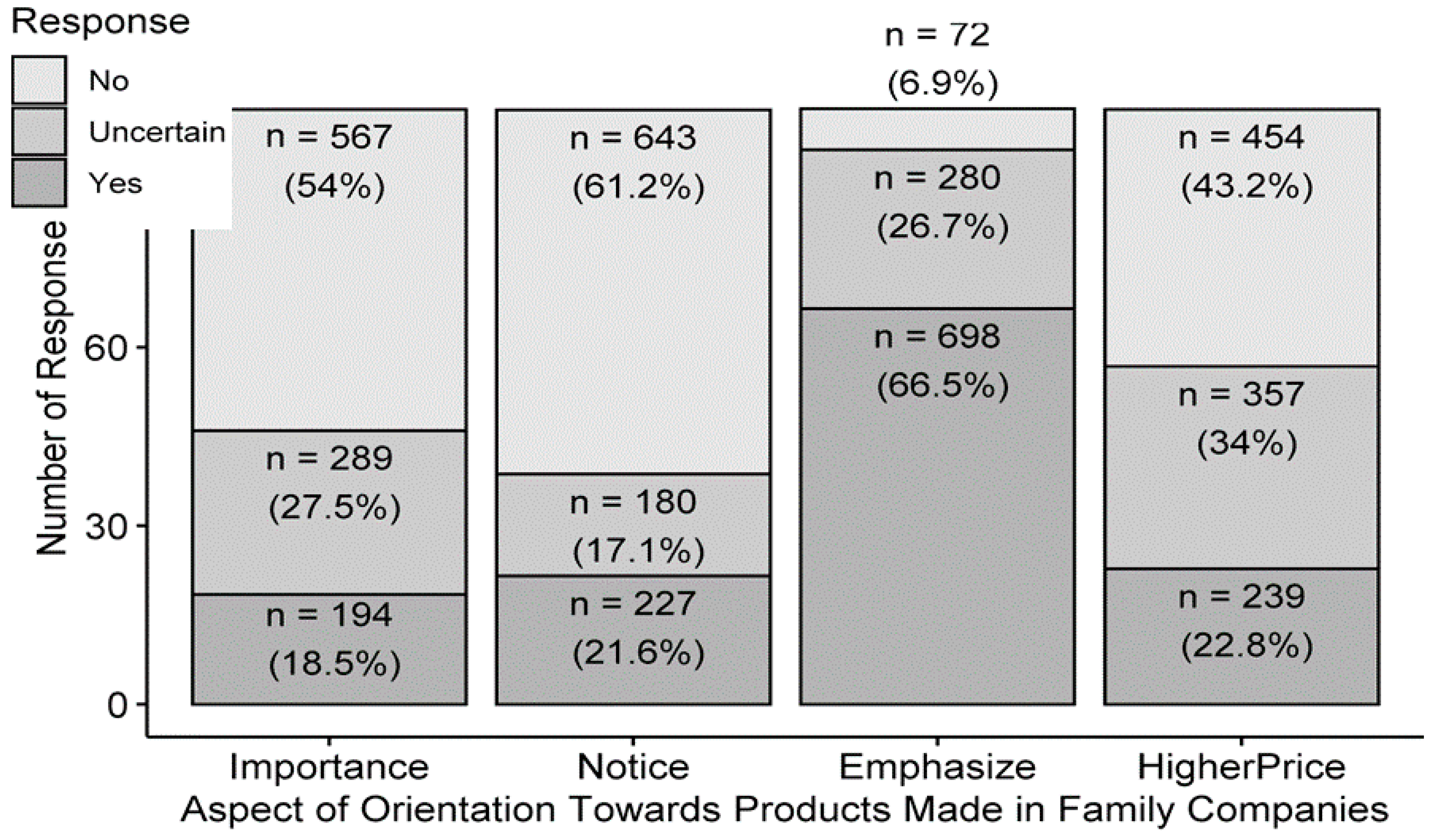

| Aspect | No | Uncertain |

|---|---|---|

| Information that a product has been made by a family company is of importance for me. | 567 (54.0%) | 289 (27.5%) |

| I notice family company brand labels/tags in branded graphics of products. | 643 (61.2%) | 180 (17.1%) |

| I am convinced that family company brand labels/tags emphasize product traits | 352 (25.1%) | 698 (49.8%) |

| I am willing to pay a higher price for a product made by a family company | 454 (43.2%) | 357 (34.0%) |

| Model | Fit Indices | Marginal Reliability | Empirical Reliability | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| M2 | df | RMSEA | SRMSR | TLI | CFI | AIC | BIC | HQ | logLik | Estimate | Lower | Upper | Estimate | Lower | Upper | |

| GRM | 16.033 | 2 | 0.082 | 0.034 | 0.935 | 0.978 | 7461.5 | 7520.9 | 7484.0 | −3718.7 | 0.693 | 0.666 | 0.719 | 0.698 | 0.671 | 0.723 |

| GPCM | 13.453 | 2 | 0.074 | 0.033 | 0.947 | 0.982 | 7441.7 | 7501.1 | 7464.2 | −3708.8 | 0.684 | 0.656 | 0.710 | 0.692 | 0.665 | 0.718 |

| Item | Discrimination | Easiness | Loadings | ||

|---|---|---|---|---|---|

| d− | d₌ | λ | η2 | ||

| Graded Response Model | SS = 1.873, H2 = 0.468 | ||||

| Importance of communicating the information that a product has been made by a family company | 2.139 | −0.275 | −2.47 | 0.783 | 0.612 |

| Noticing family business branded graphics | 0.771 | −0.516 | −1.442 | 0.413 | 0.170 |

| Conviction that family company brand labeling/tagging emphasizes product traits | 1.547 | 3.523 | 0.994 | 0.673 | 0.452 |

| Willingness to pay higher prices for products made by family companies | 2.261 | 0.481 | −2.126 | 0.799 | 0.638 |

| Graded Partial Credit Model | SS = 1.460, H2 = 0.365 | ||||

| Importance of communicating the information that a product has been made by a family company | 1.703 | −0.525 | −2.181 | 0.707 | 0.500 |

| Noticing family business branded graphics | 0.485 | −1.253 | −1.206 | 0.274 | 0.075 |

| Conviction that family company brand labeling/tagging emphasizes product traits | 1.297 | 2.591 | 3.641 | 0.606 | 0.367 |

| Willingness to pay higher prices for products made by family companies | 1.763 | 0.171 | −1.311 | 0.720 | 0.518 |

| Data | R2 | 95% Confidence | Test of Significance | |||

|---|---|---|---|---|---|---|

| Lower Bound | Upper Bound | F | df | p | ||

| Training data | 0.032 | 0.012 | 0.062 | 2.044 | 12, 742 | 0.019 |

| Test data | 0.049 | 0.013 | 0.104 | 1.750 | 12, 302 | 0.056 |

| Characteristic | Overall |

|---|---|

| Number of company names listed | 100.00 |

| Level of knowledge | 65.59 |

| Range of company activity | 58.63 |

| Gender | 44.51 |

| Age | 34.62 |

| Size of the place of consumer’s residence | 10.22 |

| Education | 0.00 |

| Data | R2 | 95% Confidence | Test of Significance | |||

|---|---|---|---|---|---|---|

| Lower Bound | Upper Bound | F | df | p | ||

| Training data | 0.255 | 0.2021 | 0.311 | 11.389 | 22, 732 | <0.001 |

| Test Data | 0.160 | 0.0915 | 0.239 | 2.528 | 22, 292 | <0.001 |

| Predictor | Overall Significance |

|---|---|

| High quality | 100.00 |

| Solidity | 43.73 |

| Honesty | 30.58 |

| Small scale | 20.58 |

| Uncertain | 20.35 |

| Responsibility | 12.01 |

| Other | 9.50 |

| Number of family company names listed | 8.69 |

| Level of knowledge of family company brands | 5.70 |

| Range of activity of family companies listed | 5.09 |

| Low quality of products | 4.15 |

| Gender | 3.87 |

| Age | 3.01 |

| Size of the consumer’s place of residence | 0.89 |

| Traditional production | 0.47 |

| Education | 0.00 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bitkowska, A.; Moczydłowska, J.; Leszczewska, K.; Karasiewicz, K.; Sadkowska, J.; Żelazko, B. Young Consumers’ Perceptions of Family Firms and Their Purchase Intentions—The Polish Experience. Sustainability 2022, 14, 13879. https://doi.org/10.3390/su142113879

Bitkowska A, Moczydłowska J, Leszczewska K, Karasiewicz K, Sadkowska J, Żelazko B. Young Consumers’ Perceptions of Family Firms and Their Purchase Intentions—The Polish Experience. Sustainability. 2022; 14(21):13879. https://doi.org/10.3390/su142113879

Chicago/Turabian StyleBitkowska, Agnieszka, Joanna Moczydłowska, Krystyna Leszczewska, Karol Karasiewicz, Joanna Sadkowska, and Beata Żelazko. 2022. "Young Consumers’ Perceptions of Family Firms and Their Purchase Intentions—The Polish Experience" Sustainability 14, no. 21: 13879. https://doi.org/10.3390/su142113879

APA StyleBitkowska, A., Moczydłowska, J., Leszczewska, K., Karasiewicz, K., Sadkowska, J., & Żelazko, B. (2022). Young Consumers’ Perceptions of Family Firms and Their Purchase Intentions—The Polish Experience. Sustainability, 14(21), 13879. https://doi.org/10.3390/su142113879