1. Introduction

Cryptocurrencies have attracted much attention from investors, academics, regulators, and the financial media. Unlike fiat money, cryptocurrencies are independent of a central authority and use encryption methods to control the generation of currency and fund transfers. Their low correlation with conventional assets has been found to provide investors with significant diversification benefits [

1,

2,

3].

Despite their attractive features, several authors have recently voiced concerns regarding the sustainability of the massive consumption of energy and environmental costs resulting from the mining of cryptocurrencies [

4,

5,

6]. For example, [

7] estimate that a payment transaction on the Bitcoin platform uses around fifty-eight times more energy than that associated with a Visa credit transaction, which is equivalent to the amount of energy used by a typical American family for more than 62 days. Moreover, [

8] conclude that the Bitcoin network consumes as a whole as much energy as a country like Austria or Poland. The role of cryptocurrencies has also been found to be problematic for the United Nations Sustainable Development Goals [

6,

9]. Ref [

10] project that the carbon emissions from the continuous adoption of Bitcoin might increase global warming beyond two degrees Celsius within thirty years.

In response to these criticisms, a new family of cryptocurrencies—green cryptocurrencies—has been created recently to reduce energy consumption and environmental pollution by adopting alternative mining practices [

11,

12]. Today, green cryptocurrencies are one of the emerging assets in the development of sustainable finance, understood as the process of taking due account of the environmental, social, and governance impacts of investment decisions [

13].

It is plausible to admit that the ethical norms that guide investors in sustainable assets might create distinctive price patterns in comparison with conventional cryptocurrencies which are considered to be mainly speculative [

14,

15,

16]. However, little is known about the price behavior of eco-friendly cryptocurrencies. Econophysics measures were applied in [

17] to examine six green cryptocurrencies in the period of 2015–2019, concluding that those assets exhibited a distinct and more profound chaotic behavior than conventional cryptocurrencies. More recently, [

18] examined the price efficiency of one of the existing green cryptocurrencies (Bitcoin Green) in the period of 2018–2020. The authors concluded that Bitcoin Green became less efficient after the outbreak of the COVID-19 pandemic, displaying multifractal behavior. Moreover, they found no signs of herding behavior in the prices of the cryptocurrency.

In this paper, we conduct the first examination of the market-wide herding behavior of investors in green cryptocurrencies. We examined the herding toward the market consensus using the daily closing prices of a set of 26 green cryptocurrencies from January 2017 to June 2022.

The existing literature indicates that cryptocurrencies’ prices exhibit many of the patterns that have been observed in capital markets, including excessive volatility [

19], seasonal anomalies [

20], psychological barriers [

21], price clustering [

22], and short-term overreaction [

23]. Herding behavior among investors is one of the most important behavioral biases as it can hinder the price discovery process of the market mechanism and thus put into question the informational efficiency of financial markets [

24,

25]. Herding may be said to occur when investors disregard their private informational signals, choosing instead to align their decisions with the market consensus following interactive observation [

26,

27]. The phenomenon has been attributed to reputational concerns [

28,

29], informational inefficiencies [

30,

31], or informational cascades [

32,

33]. The presence of herding among investors has been documented to date, to varying degrees, in several asset classes, including stocks [

27,

34,

35], bonds [

36,

37], mutual funds [

38,

39], exchange rates [

40,

41], and derivatives [

42,

43]. However, there is no agreement regarding the prevalence of herding in the markets of conventional cryptocurrencies, with some authors finding strong evidence of that behavior [

44,

45,

46], other authors concluding that the phenomenon was not significant [

47,

48,

49], and a third group of authors reporting that investors exhibit anti-herding behaviors [

50,

51,

52].

In this study, we adopt two herding measures in the empirical analysis. The first measure is based on the cross-sectional standard deviation (CSSD) of returns relative to the market consensus which, according to [

26], is expected to decrease during periods of extreme market returns, signaling the presence of investors’ herding behavior. The second measure, developed by [

27], uses the cross-sectional absolute deviation (CSAD) of returns in relation to the market consensus to capture the occurrence of the phenomenon over the entire distribution of market returns.

Studying herding behavior in the market of green cryptocurrencies is of significant importance for several reasons. First, although eco-friendly cryptocurrencies have been receiving increasing attention from academicians and market practitioners, not much is known about the behavior of investors in that market. Second, herding has implications for market efficiency as it has been found in some studies to contribute to destabilizing financial markets and slowing the price adjustment process [

53,

54,

55]. To this extent, studies on this topic are of interest not only to academicians but also to policymakers and financial regulators that want to promote the transparency of the market. Finally, the study of the phenomenon may provide useful explanations of some of the features that have been observed in the evolution of the prices of cryptocurrencies, including price trends, bubbles and crashes, and periods of extremely high volatility [

56,

57,

58]. Thus, studies about herding in green cryptocurrencies are also of interest to market practitioners.

We report that herding behavior among investors in the green cryptocurrency market was absent in our full sample. However, the dynamics of herding seemed to have varied significantly throughout the sample period. Finally, the COVID-19 pandemic was found to significantly amplify the observed levels of herding behavior.

Our research contributes to the behavioral finance literature on cryptocurrencies in several ways. First, by covering a large sample of green cryptocurrencies, a subset of the cryptocurrencies that is still understudied, we provide new insights into the behavior of investors that operate in this market. Second, and unlike what happens in most studies about herding, we consider in our empirical analysis not one but two different measures of the phenomenon that capture the proximity of the assets’ returns to the market consensus. Moreover, given the possible time-varying nature of herding behavior as detected by [

47], we studied it in different subsamples and with rolling window regressions. Finally, this study explores not only the overall level of herding in green cryptocurrencies but also examines how that behavior responded to different market regimes (up and down markets) and to the occurrence of the COVID-19 pandemic.

The remainder of the paper is organized as follows.

Section 2 describes the data and methodology employed in the empirical study.

Section 3 discusses the results, and

Section 4 gives a summary of the discussion and concludes.

2. Data and Methodology

In order to examine market-wide herding through the study of the evolution of the cryptocurrency returns with respect to the market consensus, it was required to estimate the returns of the market portfolio. Following [

48,

51], we calculated the market returns employing an equally weighted market portfolio:

where

is the number of cryptocurrencies and

denotes each cryptocurrency’s daily return.

We used two models to examine herding toward market consensus. The first model was based on the cross-sectional standard deviation of returns (

) proposed by [

26] as a measure of return dispersion around the market portfolio return:

where

is the return of cryptocurrency

i in period

t and

is the number of cryptocurrencies in the portfolio in period

t.

According to this analysis, it is argued that investors are more likely to suppress their own beliefs and closely follow the market consensus during periods of extreme market movements. As a result, the value of

becomes low, which is understood as an indication of herding. The following regression captures the proximity of the return of a particular set of assets to the observed cryptocurrency market return:

where

if the market returns are at the upper tail of the distribution, and

otherwise; and

if the market returns are at the lower tail of the distribution, and

otherwise. The use of

and

allows the identification of differences in investor behavior under extreme market conditions (positive and negative). Therefore, if the dispersion of returns is lower in the presence of large market changes, that is, when the estimated

and

are significantly negative, the occurrence of herding behavior is assumed. However, if

and

are found to be significantly positive, that is an indication of anti-herding.

In our empirical estimation of Equation (3) we adopted the criteria of 1%, 2%, 5%, and 10% for the tails of the distribution of returns.

As argued by [

61,

62],

has some important shortcomings. The measure is sensitive to outliers and the herding is analysed under the condition of extreme market movements only, disregarding the herding behavior that might happen in other situations. Considering these criticisms, we also employed the measure proposed by [

27], which facilitated the detection of the effect over the entire distribution of market returns. These authors have suggested using the cross-sectional absolute deviation of returns (

), which assesses the relationship between the cross-sectional returns’ dispersion and absolute market returns.

may be defined as follows:

where

is the return of cryptocurrency

i in period

t and

is the number of assets.

It has been defended by [

27] that, in the absence of herding, market returns and

should display a positive and linear relationship as suggested by the capital asset pricing model (CAPM). However, in the presence of herding, this relation is expected to become non-linear. If, in that period, investors imitate each other,

decreases because the securities are expected to cluster around the market portfolio return. In these circumstances, the relation between

. and the square of market portfolio returns is expected to become negative as the cross-sectional dispersion of asset returns will decrease or increase to a lesser extent than the market return. This negative relation between

and the square of market returns is taken as an indication of herding behavior. Therefore, in the following regression equation,

is expected to have a significantly negative value if herding is present in the market. However, in the absence of herding, we expect to be positive and to be statistically no different than zero. If anti-herding exists, then should be positive.

Since [

26] argue that herding may display a time-varying dynamic, we estimated Equations (3) and (5) not only for the whole sample period but for the subperiods of January 2017–December 2018, January 2019–December 2020, and January 2021–June 2022 as well.

To further investigate the dynamic nature of the herding behavior in the market of green cryptocurrencies, we implemented a time-varying approach based on a rolling window of 250 observations and a step of one observation. The size of the window was the approximate number of trading days in a year and essentially covered the number of data points from January to August of 2017. Thus, we re-ran Equation (5) under rolling windows. In this case, if remained constant over a rolling window, this suggested stability in the relationship between the square term of the market portfolio return and CSAD; otherwise, our approach was able to capture the time-varying nature of herding.

It has been argued by [

63] that herding may exhibit an asymmetric behavior during days with a positive market return and days with a negative market return (up and down markets). According to [

61,

63], down markets may stimulate herding as investors tend to unload their positions in order to avoid suffering additional losses in case the downturn becomes prolonged. On the other hand, up markets can also lead to herding since they can motivate investors to ride what they believe to be an upward trend.

To assess whether herding varies during up and down markets, we followed [

44,

48], employing the following specification:

where

D = 1 on up-market days (

) and 0 otherwise. Significantly negative values of

(

) would signal that herding is significant on days of positive (negative) average cryptocurrency market performance. On the other hand, positive and significant values of

(

) would imply that anti-herding is significant on days of positive (negative) average returns.

Noise trading models suggest that these agents purchase assets in up markets and sell assets in down markets [

64]. In this context, risk-averse arbitrageurs would be reluctant to correct the mispricing because of the unpredictability of the timings of trend reversal. In consequence, prices will become more volatile, and the cross-sectional correlation of returns will tend to increase in a market with high levels of volatility [

65]. Because

may not properly capture the dynamics of nonlinearity, [

49,

66] suggest the introduction of

in Equation (5) to examine the asymmetry in herding behavior during up and down market regimes. Thus, we also estimated the following model:

A significantly negative (positive) value of indicates that herding tends to be stronger in an up (down) market.

Finally, we examined the impact of the COVID-19 pandemic on herding behavior. Given that the COVID-19 pandemic has provoked a massive spike in uncertainty and that herding may provide investors with a feeling of security in following the crowd [

67], we expected to find a positive impact of the pandemic on the intensity of that behavior. In order to assess the impact of the pandemic on herding behavior, we ran the following regression:

where

is a dummy variable that takes the value 1 on the trading days during the COVID-19 crisis period and 0 otherwise. A statistically significant and negative (positive)

meant that the dispersion of returns was lower during the pandemic, thus indicating that herding was stronger (weaker) during that period. There is no general agreement as to the exact timing of the COVID-19 crisis. However, as most countries worldwide began to take the new coronavirus seriously only after the World Health Organization (WHO) declared a global public health emergency on 30 January 2020, this is the date that we consider as the commencement of the COVID-19 crisis. Because the pandemic is ongoing, we consider that it may impact all the observations in our sample located after 30 January 2020.

Since [

27,

68] argue that the standard errors of the estimated regressions should be adjusted for heteroscedasticity and autocorrelation, we applied the estimator proposed by [

69] in all the models of the empirical analysis. To ensure that our results were not spurious, we tested the variables used in the empirical study for unit root using the ADF test and found that all the variables were stationary. The results of the ADF test are presented in

Table A2, provided in

Appendix B.

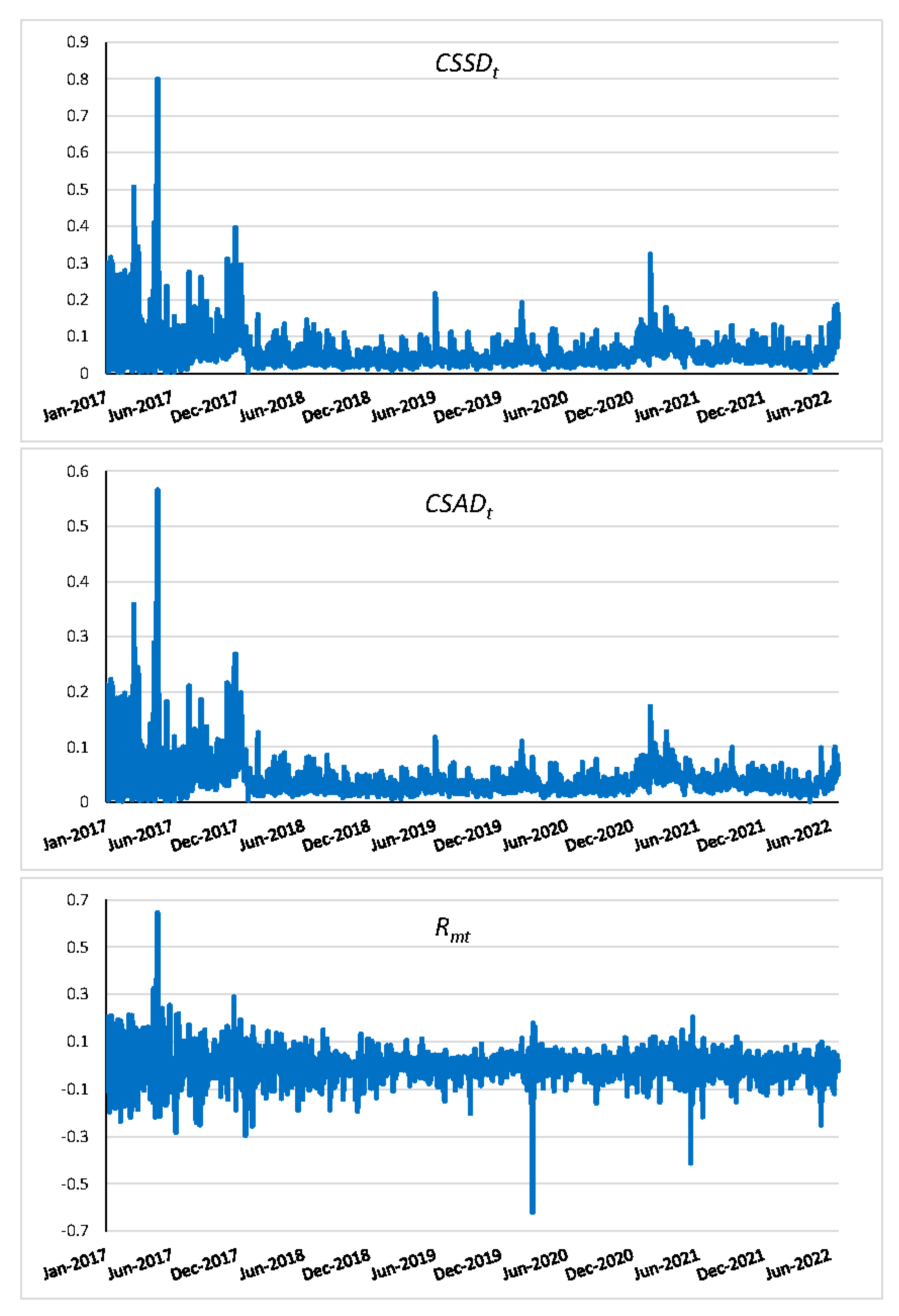

Table 1 shows the descriptive statistics for

,

, and market portfolio return (

) for the whole sample period, and

Figure 1 plots the three variables over the period of analysis. The market of green cryptocurrencies had a positive performance in the sample period, with a daily mean return of 0.18% and a very high standard deviation of 6.62%. The daily returns ranged from −62.05% to 64.35%.

and

exhibited a positive skewness which indicates a longer right tail. All series showed excessive kurtosis, which means that their distributions are leptokurtic.

Table 1 reports the descriptive statistics of the cross-sectional standard deviation (CSSD), the cross-sectional absolute deviations (CSAD), and the market portfolio return

) for green cryptocurrencies in the whole sample. ‘Std. Dv.’, ‘CV’, and ‘Obs’ denote the standard deviation, the coefficient of variation, and the number of observations, respectively.

4. Conclusions

This study conducted the first investigation of market-wide herding behavior among investors in the market for green cryptocurrencies. We analyzed the daily closing prices of 26 green cryptocurrencies for the period from January 2017 to June 2022 using the CSSD and CSAD approaches proposed by [

26,

27], respectively.

Our results can be summarized as follows. First, we detected no significant signs of herding in the market of green cryptocurrencies in our full sample period. Second, the dynamics of herding, captured by the subsample analysis and rolling window regression, seemed to have varied significantly throughout the sample period. Third, the investors’ behavior with respect to herding appears not to be sensitive to the performance of the market. Finally, the COVID-19 pandemic was found to amplify herding in the market for green cryptocurrencies.

The current research suffers from the limitations of the measures used to capture herding behavior. For example, the measure suggested by [

26] only assesses herding during extreme market movements. On the other hand, the measure of herding proposed by [

27] assumes that the return dispersion among individual assets exhibits a positive and linear correlation with the absolute variation of market returns [

61]. This presupposition, based on rational pricing models, was used in this paper to capture herding toward market consensus. In consequence, our results do not exclude the possibility that other types of herding might have occurred in the green cryptocurrency market.

As the cryptocurrency industry carries significant problems for environmental goals, the rise of sustainable alternative financial assets will likely attract more environmentally conscious investors in the future. It is plausible that the performance of the market of green cryptocurrencies will dictate how much belief policymakers, financial regulators, and investors will have in it and therefore whether it can continue to serve the purpose for which it was created. The prevalence of herding behavior in the more recent subperiod under analysis (January 2021–June 2022) suggests that opportunities for diversification for investors in the market of green cryptocurrencies may have become more limited lately. Thus, our evidence advises investors to hold a larger number of assets in order to achieve the desired reduction in idiosyncratic risk via diversification.

Studies about the market for green cryptocurrencies are still in their infancy. Further opportunities for research in this field may include studying the potential impact of herding in larger cryptocurrencies on the intensity of the phenomenon in smaller cryptocurrencies, examining the economic determinants of herding, and considering alternative estimating techniques (e.g., GARCH regressions, quantile regressions, etc.).

In recent years, financial regulators have been paying more and more attention to the cryptocurrency market. Several legislative initiatives are underway. For example, in the European Union, the Markets in Crypto Asset Regulation (MiCAR) is expected to come into force in 2022. In the US, a presidential executive order in May 2022 mandated several agencies to explore the implications of regulating the market and to report back at the end of 2022. In the face of the evidence presented in the current paper regarding the impact of the COVID-19 pandemic, regulators should continue to monitor the market of green cryptocurrencies if they want to promote the market’s efficiency necessary to attract additional investors.