Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

4. Results

5. Discussion

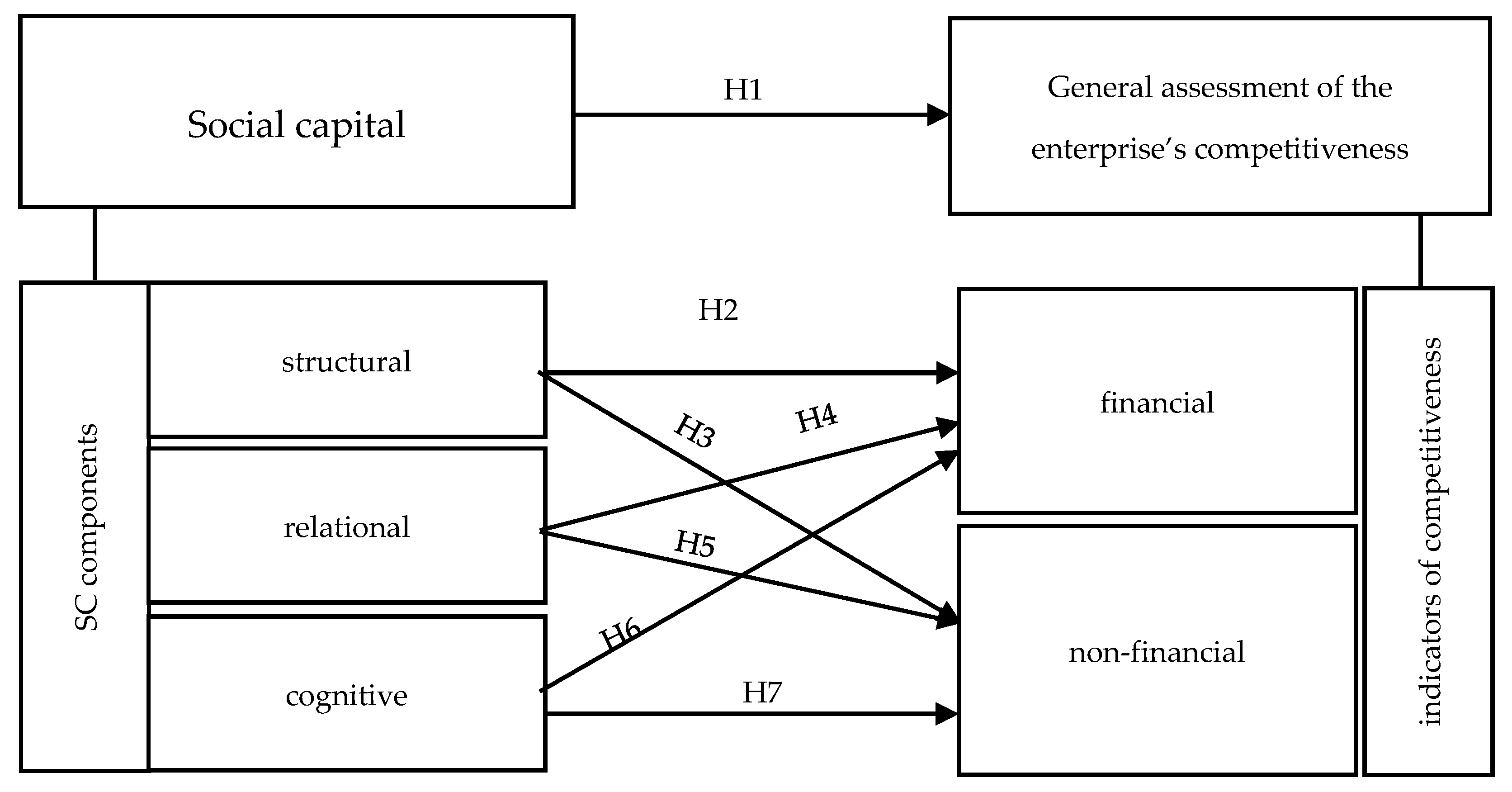

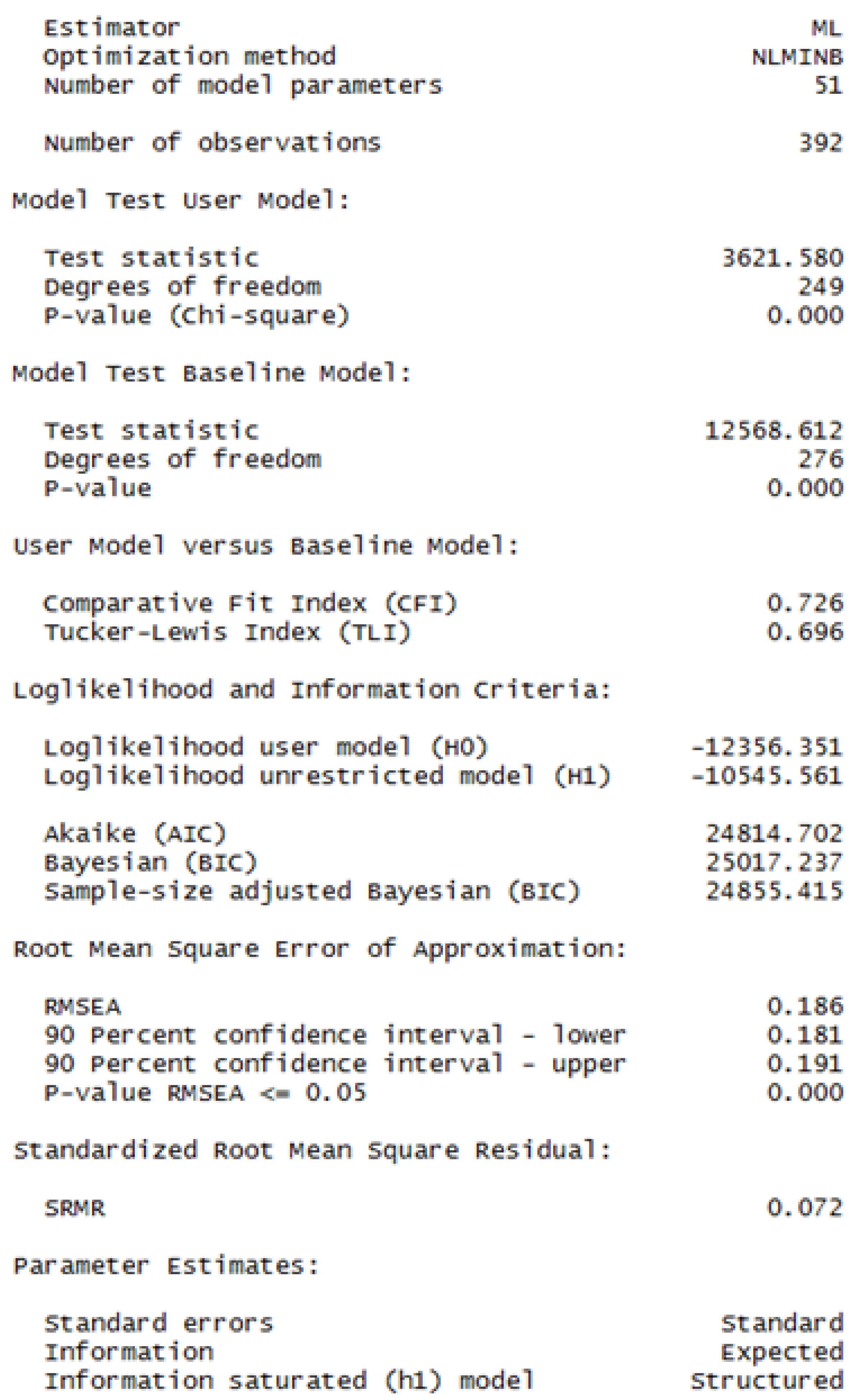

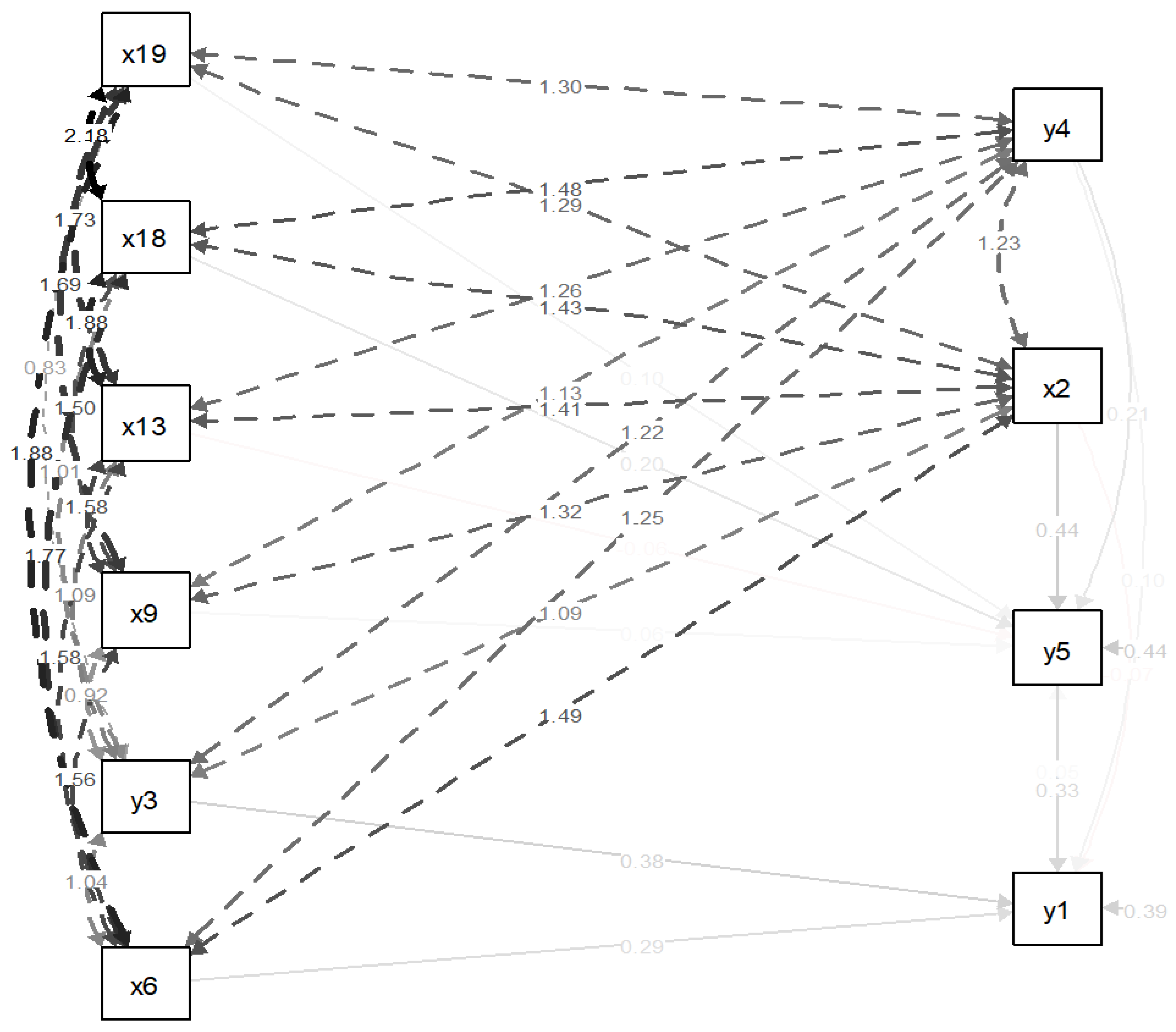

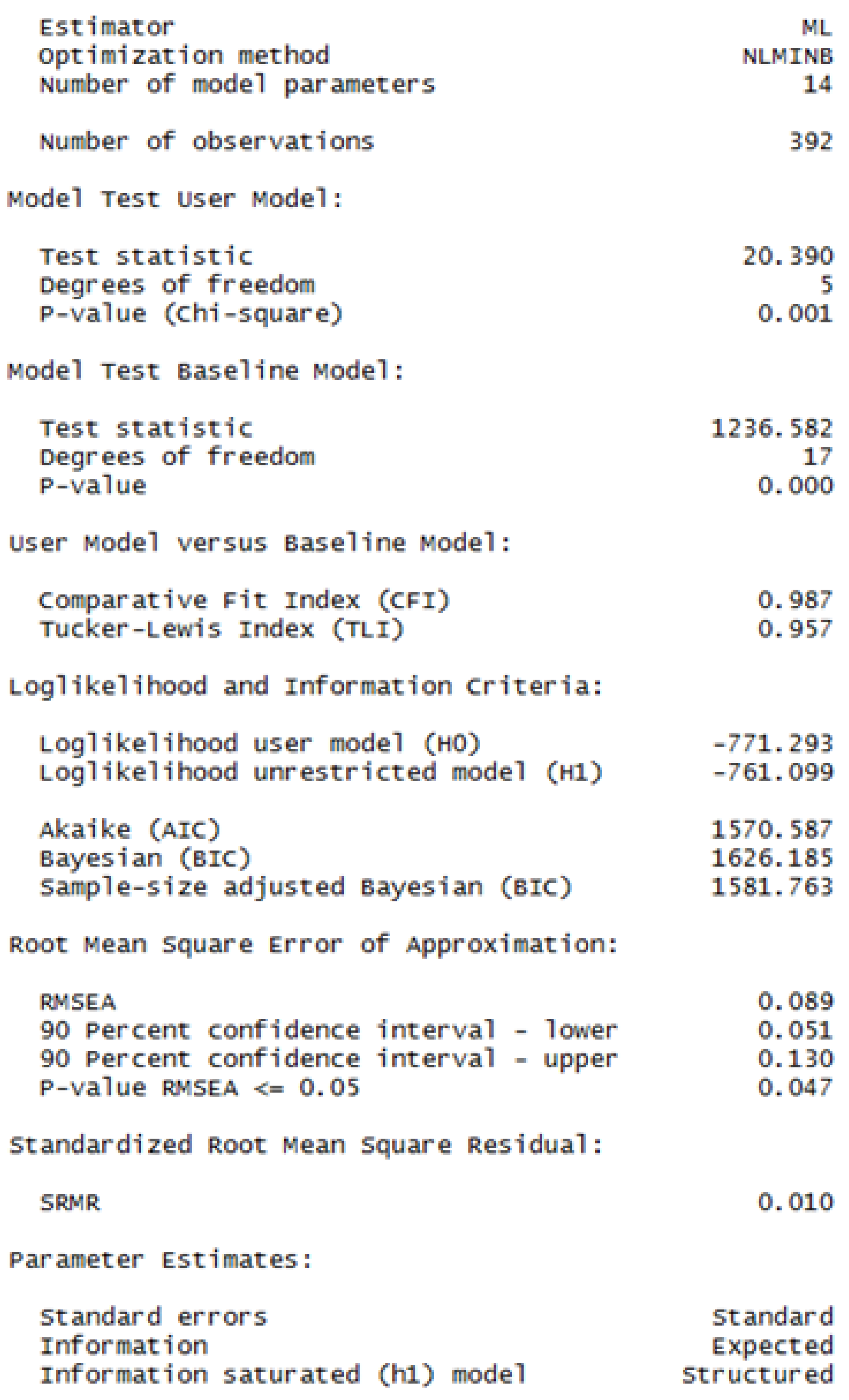

- The presence of dependence between the components of structural social capital, mostly strategic partnership with suppliers (х2), and financial indicators of competitiveness (according to estimates of the dynamics of the company’s financial success—growth in assets, income, profits). Thus, it can be stated that the hypothesis H2 is confirmed, but H3 is partially confirmed: from Figure 4 there is a connection (х2) with y3 and y4; with regard to y2, no connections were found in the simulative model (1) for the examined group of enterprises. This means that today changes in the structural SC do not have such a direct and rapid impact on the economic success of enterprises in terms of strengthening relations with staff and customers, as well as increasing the effectiveness of management in finding answers to market changes.

- The dependence between the components of relational social capital and indicators of competitiveness was established, namely the influence of factors (х6, х9) on (y3–y5) with the following pattern: financial indicators of competitiveness are determined to the greatest extent by the quality of horizontal relationships (х9), indirectly—through the influence of efforts in forming a positive image of the enterprise (х6), for non-financial indicators y3 and y4, non-financial indicators are formed under the influence of х6, х9 (determined from Figure 4). The non-financial indicator of competitiveness y2, as in the previous case, does not have a significant dependence on the system of relational capital factors, at least according to the approach to the selection of factors with correlations greater than 0.7. At the same time, y2 is only one in three non-financial indicators of competitiveness chosen; for the other two the connections in Figure 4 are defined. Thus, hypothesis H4 is fully confirmed, and H5 is partially confirmed, regarding the relationships of non-financial endogenous variables (for two out of three).

- Regarding the components of cognitive social capital, it was established that such indicators as satisfaction with the psychological climate at the enterprise (х13), as well as factors related to corporate culture, i.e., its development at the enterprise (х18) and support efforts (х19) have the most significant impact on the growth of financial indicators of enterprises, which in general means the correctness of hypothesis H6. Hypothesis H7 is partially confirmed—again no direct and very significant connection with the result y2 was found, but the other two indicators (y3 and y4) are influenced by the same components of social capital as the financial indicator y5.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Factors | Structural SC | Relational SC | Cognitive SC | Financial Indicators of Competitiveness | Non-Financial Indicators of Competitiveness | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| x1 | x2 | x3 | x4 | x5 | x6 | x7 | x8 | x9 | x10 | x11 | x12 | x13 | x14 | x15 | x16 | x17 | x18 | x19 | y1 | y2 | y3 | y4 | y5 | ||

| Reputation of the company’s products with consumer | x1 | 1.00 | |||||||||||||||||||||||

| Strategic partnership with suppliers | x2 | 0.71 | 1.00 | ||||||||||||||||||||||

| Quality of information flows in the cooperation of internal stakeholders | x3 | 0.72 | 0.72 | 1.00 | |||||||||||||||||||||

| Quality of cooperation with the local community | x4 | 0.51 | 0.65 | 0.49 | 1.00 | ||||||||||||||||||||

| The importance of the employer brand | x5 | 0.69 | 0.8 | 0.76 | 0.59 | 1.00 | |||||||||||||||||||

| Self-assessment of efforts in forming a positive image of the enterprise | x6 | 0.75 | 0.73 | 0.63 | 0.59 | 0.75 | 1.00 | ||||||||||||||||||

| Engaging personal contacts to achieve business goals | x7 | 0.54 | 0.67 | 0.57 | 0.52 | 0.69 | 0.71 | 1.00 | |||||||||||||||||

| Satisfaction with relationships with management. familiarity with the strategic plans of the enterprise | x8 | 0.55 | 0.58 | 0.68 | 0.46 | 0.72 | 0.71 | 0.68 | 1.00 | ||||||||||||||||

| Satisfaction with horizontal relationships | x9 | 0.61 | 0.72 | 0.61 | 0.49 | 0.70 | 0.75 | 0.66 | 0.7 | 1.00 | |||||||||||||||

| Trust of employees in the management | x10 | 0.70 | 0.75 | 0.65 | 0.53 | 0.77 | 0.75 | 0.61 | 0.53 | 0.69 | 1.00 | ||||||||||||||

| Management’s trust in employees | x11 | 0.67 | 0.71 | 0.57 | 0.61 | 0.77 | 0.75 | 0.66 | 0.53 | 0.68 | 0.91 | 1.00 | |||||||||||||

| Taking into account the needs of employees in the processes of HRM of an enterprise | x12 | 0.59 | 0.64 | 0.51 | 0.61 | 0.59 | 0.71 | 0.57 | 0.57 | 0.65 | 0.82 | 0.83 | 1.00 | ||||||||||||

| Satisfaction with the psychological climate at the enterprise | x13 | 0.61 | 0.72 | 0.56 | 0.70 | 0.70 | 0.70 | 0.62 | 0.66 | 0.78 | 0.69 | 0.77 | 0.76 | 1.00 | |||||||||||

| Self-assessment of own efforts in maintaining a comfortable working relationship | x14 | 0.63 | 0.65 | 0.57 | 0.58 | 0.61 | 0.83 | 0.60 | 0.64 | 0.77 | 0.63 | 0.69 | 0.66 | 0.74 | 1.00 | ||||||||||

| Level of compliance with internal business regulations and rules of conduct | x15 | 0.63 | 0.68 | 0.57 | 0.57 | 0.60 | 0.64 | 0.59 | 0.58 | 0.67 | 0.62 | 0.66 | 0.65 | 0.73 | 0.58 | 1.00 | |||||||||

| Availability of corporate values | x16 | 0.60 | 0.56 | 0.43 | 0.60 | 0.48 | 0.71 | 0.54 | 0.58 | 0.6 | 0.55 | 0.62 | 0.69 | 0.65 | 0.68 | 0.65 | 1.00 | ||||||||

| Level of development and perception of corporate values | x17 | 0.64 | 0.62 | 0.55 | 0.61 | 0.57 | 0.66 | 0.60 | 0.68 | 0.66 | 0.61 | 0.64 | 0.71 | 0.67 | 0.61 | 0.69 | 0.82 | 1.00 | |||||||

| Development of corporate culture | x18 | 0.63 | 0.64 | 0.55 | 0.69 | 0.59 | 0.70 | 0.59 | 0.63 | 0.66 | 0.65 | 0.72 | 0.81 | 0.76 | 0.73 | 0.77 | 0.84 | 0.81 | 1.00 | ||||||

| Self-assessment of own efforts to support and develop corporate culture | x19 | 0.61 | 0.61 | 0.45 | 0.64 | 0.61 | 0.79 | 0.61 | 0.62 | 0.78 | 0.67 | 0.74 | 0.76 | 0.75 | 0.81 | 0.62 | 0.81 | 0.80 | 0.83 | 1.00 | |||||

| Overall assessment of the company’s competitive position in the market (relative to the leader) | y1 | 0.66 | 0.73 | 0.52 | 0.55 | 0.60 | 0.75 | 0.62 | 0.46 | 0.64 | 0.62 | 0.69 | 0.52 | 0.63 | 0.67 | 0.64 | 0.65 | 0.62 | 0.64 | 0.65 | 1.00 | ||||

| Self-assessment of the impact of cooperation and interaction of staff on the economic success of the enterprise | y2 | 0.64 | 0.69 | 0.64 | 0.59 | 0.63 | 0.63 | 0.48 | 0.45 | 0.62 | 0.72 | 0.69 | 0.65 | 0.69 | 0.65 | 0.56 | 0.53 | 0.56 | 0.61 | 0.61 | 0.53 | 1.00 | |||

| The level of customer orientation of the enterprise | y3 | 0.65 | 0.65 | 0.52 | 0.48 | 0.57 | 0.55 | 0.47 | 0.37 | 0.54 | 0.67 | 0.68 | 0.48 | 0.59 | 0.47 | 0.57 | 0.42 | 0.49 | 0.48 | 0.42 | 0.75 | 0.63 | 1.00 | ||

| The effectiveness of responding to changes in market conditions | y4 | 0.68 | 0.67 | 0.56 | 0.6 | 0.59 | 0.60 | 0.50 | 0.44 | 0.60 | 0.63 | 0.64 | 0.59 | 0.62 | 0.50 | 0.62 | 0.64 | 0.63 | 0.65 | 0.60 | 0.74 | 0.59 | 0.71 | 1.00 | |

| Assessment of satisfaction with the dynamics of financial success of the enterprise (increase in assets. income. profits) | y5 | 0.65 | 0.80 | 0.58 | 0.59 | 0.64 | 0.69 | 0.59 | 0.49 | 0.71 | 0.69 | 0.69 | 0.68 | 0.70 | 0.68 | 0.64 | 0.64 | 0.69 | 0.75 | 0.72 | 0.80 | 0.62 | 0.60 | 0.73 | 1.00 |

References

- Bourdieu, P. The forms of capital. In The Handbook of Theory and Research for the Sociology of Education; Richardson, J., Ed.; Greenwood Press: New York, NY, USA, 1983; pp. 241–258. [Google Scholar]

- Coleman, J.S. Social capital in the creation of human capital. Am. J. Sociol. 1988, 94, 95–120. [Google Scholar] [CrossRef]

- Fukuyama, F. Social capital and the global economy. Foreign Aff. 1995, 74, 89. [Google Scholar] [CrossRef]

- Cismas, L.M.; Miculescu, A.; Negrut, L.; Negrut, V.; Otil, M.D.; Vadasan, I. Social capital, social responsibility, economic behavior and sustainable economic development—An analysis of Romania’s situation. Transform. Bus. Econ. 2019, 18, 605–627. [Google Scholar]

- Ievdokymov, V.; Lehenchuk, S.; Zakharov, D.; Andrusiv, U.; Usatenko, O.; Kovalenko, L. Social capital measurement based on “The value explorer” method. Manag. Sci. Lett. 2020, 10, 1161–1168. [Google Scholar] [CrossRef]

- Imran, A.; Mohammad, N.; Sulphey, M. Do trust and corporate social responsibility activities affect purchase intentions? An examination using structural equation modeling. Innov. Mark. 2020, 16, 62–73. [Google Scholar] [CrossRef]

- Prasetyo, P.E.; Setyadharma, A.; Kistanti, N.R. The role of social capital in new products development and business competitiveness enhancement. Int. J. Sci. Technol. Res. 2020, 9, 1838–1843. [Google Scholar]

- Zhang, Q.; Pan, J.; Jiang, Y.; Feng, T. The impact of green supplier integration on firm performance: The mediating role of social capital accumulation. J. Purch. Supply Manag. 2020, 26, 100579. [Google Scholar] [CrossRef]

- Vo, D.H.; Van, L.T.-H.; Dinh, L.T.-H.; Ho, C.M. Financial inclusion, corporate social responsibility and customer loyalty in the banking sector in Vietnam. J. Int. Stud. 2020, 13, 9–23. [Google Scholar] [CrossRef]

- United Nations. World Social Capital Monitor. 2019. Available online: https://sustainabledevelopment.un.org/content/documents/commitments/6686_11706_commitment_World%20Social%20Capital%20Monitor%202019.pdf (accessed on 10 August 2022).

- Solability. The Global Sustainable Competitiveness Index. 2021. Available online: https://solability.com/the-global-sustainable-competitiveness-index/the-index (accessed on 10 August 2022).

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital, and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Danilevičienė, I.; Lace, N. Assessment of the factors of sustainable competitiveness growth of the companies in Latvia and Lithuania. Int. J. Learn. Change 2021, 13, 510–526. [Google Scholar] [CrossRef]

- Karman, A.; Savanevičienė, A. Enhancing dynamic capabilities to improve sustainable competitiveness: Insights from research on organisations of the Baltic region. Balt. J. Manag. 2021, 16, 318–341. [Google Scholar] [CrossRef]

- Alam, S.M.; Islam, K.M. Examining the role of environmental corporate social responsibility in building green corporate image and green competitive advantage. Int. J. Corp. Soc. Responsib. 2021, 6, 8. [Google Scholar] [CrossRef]

- Farooq, K.; Yusliza, M.Y.; Wahyuningtyas, R.; Haque, A.U.; Muhammad, Z.; Saputra, J. Exploring challenges and solutions in performing employee ecological behaviour for a sustainable workplace. Sustainability 2021, 13, 9665. [Google Scholar] [CrossRef]

- Vrabcova, P.; Urbancova, H.; Hudakova, M. Strategic Trends of Organizations in the Context of New Perspectives of Sustainable Competitiveness. J. Compet. 2022, 14, 174–193. [Google Scholar] [CrossRef]

- Zhang, P.; London, K. Towards an internationalized sustainable industrial competitiveness model. Compet. Rev. Int. Bus. J. 2013, 23, 95–113. [Google Scholar] [CrossRef]

- Šnircová, J.; Fidlerová, H.; Božiková, L. Sustainable global competitiveness model as a new strategic opportunity for the companies in Slovakia. TEM J. 2016, 5, 241–247. [Google Scholar]

- Dey, P.K.; Malesios, C.; De, D.; Chowdhury, S.; Abdelaziz, F.B. The impact of lean management practices and sustainably-oriented innovation on sustainability performance of small and medium-sized enterprises: Empirical evidence from the UK. Br. J. Manag. 2019, 31, 141–161. [Google Scholar] [CrossRef]

- Hermundsdottir, F.; Aspelund, A. Sustainability innovations and firm competitiveness: A review. J. Clean. Prod. 2020, 280, 124715. [Google Scholar] [CrossRef]

- Balkyte, A.; Tvaronavičiene, M. Perception of competitiveness in the context of sustainable development: Facets of “sustainable competitiveness”. J. Bus. Econ. Manag. 2010, 11, 341–365. [Google Scholar] [CrossRef]

- Cheba, K.; Bąk, I.; Szopik-Depczyńska, K. Sustainable competitiveness as a new economic category—Definition and measurement assessment. Technol. Econ. Dev. Econ. 2020, 26, 1399–1421. [Google Scholar] [CrossRef]

- Herciu, M.; Ogrean, C. An overview on European Union sustainable competitiveness. Procedia Econ. Financ. 2014, 16, 651–656. [Google Scholar] [CrossRef]

- Belas, J.; Škare, M.; Gavurova, B.; Dvorsky, J.; Kotaskova, A. The impact of ethical and CSR factors on engineers’ attitudes towards SMEs sustainability. J. Bus. Res. 2022, 149, 589–598. [Google Scholar] [CrossRef]

- Činčalová, S. The impact of the level of corporate social responsibility on financial performance: Evidence from insurance firms in the Czech Republic. Insur. Mark. Co. 2021, 12, 64. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Lizcano-Álvarez, J.L. CSR-related competitiveness and legitimacy in MSMEs. Econ. Sociol. 2020, 13, 52–73. [Google Scholar] [CrossRef] [PubMed]

- Metzker, Z.; Zvarikova, K. The Perception of Company Employees by SMEs with CSR Concept Implementation. Int. J. Entrep. Knowl. 2021, 9, 81–96. [Google Scholar] [CrossRef]

- Oliinyk, O.O. Corporate social responsibility in the field of occupational safety and health. Nauk. Visnyk Natsionalnoho Hirnychoho Universytetu 2017, 17, 128–133. [Google Scholar]

- Almazroi, A.A.; Khedr, A.E.; Idrees, A.M. A proposed customer relationship framework based on information retrieval for effective Firms’ competitiveness. Expert Syst. Appl. 2021, 176, 114882. [Google Scholar]

- Khan, M.A.; Yasir, M.; Khan, M.A. Factors Affecting Customer Loyalty in the Services Sector. J. Tour. Serv. 2021, 12, 184–197. [Google Scholar] [CrossRef]

- Nikodemska-Wotowik, A.M.; Bednarz, J.; Wach, D.; Little, J.P.; Kubik, M.A. Building aware and unaware consumers’ trust towards family business: Evidence from Po-land. Entrep. Bus. Econ. Rev. 2020, 8, 135–154. [Google Scholar]

- Stocker, M.; Várkonyi, L. Impact of market orientation on competitiveness: Analysis of internationalized medium-sized and large enterprises. Entrep. Bus. Econ. Rev. 2022, 10, 81–95. [Google Scholar] [CrossRef]

- Benraiss-Noailles, L.; Viot, C. Employer brand equity effects on employees well-being and loyalty. J. Bus. Res. 2021, 126, 605–613. [Google Scholar] [CrossRef]

- Bite, P.; Konczos-Szombathelyi, M. Employer branding concept for small- and medium-sized family firms. J. Int. Stud. 2020, 13, 143–160. [Google Scholar] [CrossRef] [PubMed]

- Samoliuk, N.; Bilan, Y.; Mishchuk, H.; Mishchuk, V. Employer brand: Key values influencing the intention to join a company. Manag. Mark. Chall. Knowl. Soc. 2022, 17, 61–72. [Google Scholar] [CrossRef]

- Samoliuk, N.; Bilan, Y.; Mishchuk, H. Vocational training costs and economic benefits: Exploring the interactions. J. Bus. Econ. Manag. 2021, 22, 1476–1491. [Google Scholar] [CrossRef]

- Setini, M.; Yasa, N.N.K.; Gede Supartha, I.W.; Ketut Giantari, I.; Rajiani, I. The passway of women entrepreneurship: Starting from social capital with open innovation, through to knowledge sharing and innovative performance. J. Open Innov. Technol. Mark. Complex. 2020, 6, 25. [Google Scholar] [CrossRef]

- Yoo, S.; Lee, S.; Kim, S.; Jang, S.; Cho, D. Training and development investment and financial performance: The bidirectional relationship and the moderating effect of financial slack. Hum. Resour. Dev. Q. 2022, 33, 115–136. [Google Scholar] [CrossRef]

- Bilan, Y.; Mishchuk, H.; Pylypchuk, R. Towards sustainable economic development via social entrepreneurship. J. Secur. Sustain. Issues 2017, 6, 691–702. [Google Scholar] [CrossRef]

- Holoči, J.; Chromjaková, F. Process management of ergonomic workplace based on augmented reality principles. Hum. Technol. 2022, 18, 66–91. [Google Scholar] [CrossRef]

- Owusu, V.K.; Gregar, A.; Ntsiful, A. Organizational diversity and competency-based performance: The mediating role of employee commitment and job satisfac-tion. Manag. Mark.-Chall. Knowl. Soc. 2021, 16, 352–369. [Google Scholar] [CrossRef]

- Fan, Y.; Potočnik, K.; Chaudhry, S. A process-oriented, multilevel, multidimensional conceptual framework of work–life balance support: A multidisciplinary systematic literature review and future research agenda. Int. J. Manag. Rev. 2021, 23, 486–515. [Google Scholar] [CrossRef]

- Kryshtanovych, M.; Akimova, L.; Akimov, O.; Parkhomenko-Kutsevil, O.; Omarov, A. Features of creative burnout among educational workers in public administration system. Creat. Stud. 2022, 15, 116–129. [Google Scholar] [CrossRef]

- Guo, W.; Lu, W.; Gao, X.; Cai, F. How interpersonal ties affect interorganizational trust in construction projects: Role differences and cross-level effects. Constr. Manag. Econ. 2021, 39, 912–931. [Google Scholar] [CrossRef]

- Oláh, J.; Hidayat, Y.A.; Popp, J.; Lakner, Z.; Kovács, S. Integrative trust and innovation on financial performance in disruptive era. Econ. Sociol. 2021, 14, 111–136. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, L.T.; An, J.; Ngo, L.V. Transforming social capital into performance via entrepreneurial orientation. Australas. Mark. J. 2020, 28, 209–217. [Google Scholar] [CrossRef]

- Perez, C.; Sokolova, K.; Konate, M. Digital social capital and performance of initial coin offerings. Technol. Forecast. Soc. Change 2020, 152, 119888. [Google Scholar] [CrossRef]

- Akimova, L.; Akimov, O.; Maksymenko, T.; Hbur, Z.; Orlova, V. Adaptive management of entrepreneurship model as a component of enterprise resource planning. Acad. Entrep. J. 2020, 26, 1–8. [Google Scholar]

- Čepel, M. Social and Cultural Factors and Their Impact on the Quality of Business Environment in the SME Segment. Int. J. Entrep. Knowl. 2019, 7, 65–73. [Google Scholar] [CrossRef]

- Tarí, J.J.; Pereira-Moliner, J.; Molina-Azorín, J.F.; López-Gamero, M.D. A Taxonomy of Quality Standard Adoption: Its Relationship with Quality Management and Performance in Tourism Organizations in Spain. J. Tour. Serv. 2020, 11, 22–37. [Google Scholar] [CrossRef]

- Dai, Y.; Abdul-Samad, Z.; Chupradit, S.; Nassani, A.A.; Haffar, M.; Michel, M. Influence of CSR and leadership style on sustainable performance: Moderating impact of sustainable entrepreneurship and mediating role of organizational commitment. Econ. Res.-Ekon. Istraživanja 2021, 35, 3917–3939. [Google Scholar]

- AlKahtani, N.; Sulphey, M.; Delany, K.; Adow, A. Do psychological and sociological capitals predict employee engagement. Manag. Sci. Lett. 2021, 11, 823–832. [Google Scholar] [CrossRef]

- Luo, C.-Y.; Tsai, C.-H.; Chen, M.-H.; Gao, J.-L. The effects of psychological capital and internal social capital on frontline hotel employees’ adaptive performance. Sustainability 2021, 13, 5430. [Google Scholar] [CrossRef]

- Smolarek, M.; Sułkowski, Ł. Job satisfaction among SMEs employees in Fibres & Textiles of the CEE countries. Econ. Sociol. 2020, 13, 181–209. [Google Scholar] [CrossRef]

- Kokthi, E.; Guri, G.; Muco, E. Assessing the applicability of geographical indications from the social capital analysis perspective: Evidences from Albania. Econ. Sociol. 2021, 14, 32–53. [Google Scholar] [CrossRef] [PubMed]

- Setyaningsih, S.; Kelle, P. Comparison of Supply Chain Management (SCM) adoption at Small and Medium-Sized Enterprises (SMEs): A review from Hungary and Indonesia. J. Int. Stud. 2021, 14, 26–42. [Google Scholar] [CrossRef]

- Bari, M.W.; Mahmood, F.; Qurrah-tul-ain; Bashir, M.; Usman, M. The role of instrumental guanxi in the relation between entrepreneurs’ social competence and firms’ financial performance: A comparative study. Econ. Res.-Ekon. Istraživanja 2021, 34, 243–265. [Google Scholar] [CrossRef]

- Liu, F.; Fang, M.; Park, K.; Chen, X. Supply chain finance, performance and risk: How SMEs adjust their buyer-supplier relationship for competitiveness? J. Compet. 2021, 13, 78–95. [Google Scholar] [CrossRef]

- Belas, J.; Çera, G.; Dvorský, J.; Čepel, M. Corporate social responsibility and sustainability issues of small- and medium-sized enterprises. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 721–730. [Google Scholar] [CrossRef]

- Duc Tai, T. Impact of corporate social responsibility on social and economic sustainability. Ekon. Istraživanja/Econ. Res. 2022, 1–20. [Google Scholar] [CrossRef]

- Metzker, Z.; Streimikis, J. CSR activities in the Czech SME segment. Int. J. Entrep. Knowl. 2020, 8, 49–64. [Google Scholar] [CrossRef]

- Nogi, K.; Imamura, H.; Asakura, K.; Nishiwaki, Y. Association of Structural Social Capital and Self-Reported Well-Being among Japanese Community-Dwelling Adults: A Longitudinal Study. Int. J. Environ. Res. Public Health 2021, 18, 8284. [Google Scholar] [CrossRef]

- Pérez-Macías, N.; Fernández-Fernández, J.-L.; Rúa-Vieites, A. Entrepreneurial intention among online and face-to-face university students: The influence of structural and cognitive social capital dimensions. J. Int. Entrep. 2021, 19, 434–467. [Google Scholar] [CrossRef]

- Cai, W.; Polzin, F.; Stam, E. Crowdfunding and social capital: A systematic review using a dynamic perspective. Technol. Forecast. Soc. Chang. 2020, 162, 120412. [Google Scholar] [CrossRef]

- Akintimehin, O.O.; Eniola, A.A.; Alabi, O.J.; Eluyela, D.F.; Okere, W.; Ozordi, E. Social capital and its effect on business performance in the Nigeria informal sector. Heliyon 2019, 5, e02024. [Google Scholar] [CrossRef] [PubMed]

- Singh, S.K.; Mazzucchelli, A.; Vessal, S.R.; Solidoro, A. Knowledge-based HRM practices and innovation performance: Role of social capital and knowledge sharing. J. Int. Manag. 2021, 27, 100830. [Google Scholar] [CrossRef]

- Tajpour, M.; Salamzadeh, A.; Salamzadeh, Y.; Braga, V. Investigating social capital, trust and commitment in family business: Case of media firms. J. Fam. Bus. Manag. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Cochran, W.G. Sampling Techniques, 3rd ed.; John Wiley & Sons: New York, NY, USA, 1977. [Google Scholar]

- Hussin, F.; Ali, J.; Noor, M.S.Z. Kaedah Penyelidikan & Analisis Data SPSS; Universiti Utara Malaysia Press: Sintok, Malaysia, 2014. [Google Scholar]

- Bilan, Y.; Mishchuk, H.; Dzhyhar, T. Human capital factors and remuneration: Analysis of relations, modelling of influence. Bus. Theory Pract. 2014, 18, 208–214. [Google Scholar] [CrossRef]

- Drozdowski, G. The empirical analysis of human capital competences on the example of company executives. Ѐkon. i Prawo 2022, 21, 355–367. [Google Scholar] [CrossRef]

- Thite, M. Strategic positioning of HRM in knowledge-based organizations. Learn. Organ. 2004, 11, 28–44. [Google Scholar] [CrossRef]

- Taborsky, B.; Oliveira, R.F. Social competence: An evolutionary approach. Trends Ecol. Evol. 2012, 27, 679–688. [Google Scholar] [CrossRef]

- Tajpour, M.; Hosseini, E.; Mohammadi, M.; Bahman-Zangi, B. The Effect of Knowledge Management on the Sustainability of Technology-Driven Businesses in Emerging Markets: The Mediating Role of Social Media. Sustainability 2022, 14, 8602. [Google Scholar] [CrossRef]

- Oliinyk, O.; Bilan, Y.; Mishchuk, H. Knowledge Management and Economic Growth: The Assessment of Links and Determinants of Regulation. Central Eur. Manag. J. 2021, 29, 20–39. [Google Scholar] [CrossRef]

- Dana, L.-P.; Tajpour, M.; Salamzadeh, A.; Hosseini, E.; Zolfaghari, M. The Impact of Entrepreneurial Education on Technology-Based Enterprises Development: The Mediating Role of Motivation. Adm. Sci. 2021, 11, 105. [Google Scholar] [CrossRef]

| SC Components | Indicators | Content of the Component |

|---|---|---|

| structural SC (sSC) | x1 | reputation of the company’s products with consumer |

| x2 | strategic partnership with suppliers | |

| x3 | quality of information flows in the cooperation of internal stakeholders | |

| x4 | quality of cooperation with the local community | |

| x5 | the importance of the employer brand | |

| relational SC (rSC) | x6 | self-assessment of efforts in forming a positive image of the enterprise |

| x7 | engaging personal contacts to achieve business goals | |

| x8 | satisfaction with relationships with management, familiarity with the strategic plans of the enterprise | |

| x9 | satisfaction with horizontal relationships | |

| x10 | trust of employees in the management | |

| x11 | management’s trust in employees | |

| x12 | taking into account the needs of employees in the processes of HRM of an enterprise | |

| cognitive SC (cSC) | x13 | satisfaction with the psychological climate at the enterprise |

| x14 | self-assessment of own efforts in maintaining a comfortable working relationship | |

| x15 | level of compliance with internal business regulations and rules of conduct | |

| x16 | availability of corporate values | |

| x17 | level of development and perception of corporate values | |

| x18 | development of corporate culture | |

| x19 | self-assessment of own efforts to support and develop corporate culture |

| Ratings of the Respondents Offered in the Survey Questionnaire, % | Score Used to Analyze Results, Rank |

|---|---|

| 0 | 0 |

| 1–20 | 1 |

| 21–40 | 2 |

| 41–60 | 3 |

| 61–80 | 4 |

| 81–99 | 5 |

| 100 | 6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mishchuk, H.; Štofková, J.; Krol, V.; Joshi, O.; Vasa, L. Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises. Sustainability 2022, 14, 11905. https://doi.org/10.3390/su141911905

Mishchuk H, Štofková J, Krol V, Joshi O, Vasa L. Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises. Sustainability. 2022; 14(19):11905. https://doi.org/10.3390/su141911905

Chicago/Turabian StyleMishchuk, Halyna, Jana Štofková, Vita Krol, Olena Joshi, and László Vasa. 2022. "Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises" Sustainability 14, no. 19: 11905. https://doi.org/10.3390/su141911905

APA StyleMishchuk, H., Štofková, J., Krol, V., Joshi, O., & Vasa, L. (2022). Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises. Sustainability, 14(19), 11905. https://doi.org/10.3390/su141911905