Abstract

In the last few decades, Portugal has witnessed an extraordinary quantitative and qualitative transformation in housing provision. The pace of housing construction was so extensive that the contemporary real estate market is currently characterized by an excessive supply, vis-à-vis the resident population. In this study, we discuss the impact of the financial process on the housing sector in comparison with tenancy. We consider transaction prices of the housing assignments, either through acquisition or through tenancy. The recent shock resulting from the pandemic situation did not slow down house prices but caused a slight drop in rents. The model used proposes to analyze the fluctuations in prices and rents in the face of external shocks. In the residential market, the estimation is complex due to the many heterogeneous attributes of residential assets. Non-fluctuating variables, such as size, location, and external demand for homes, explain a large part of the variation in price levels included in the model.

1. Introduction and Literature Analysis

The cases studied here, individually, centered on a focus or, as in this case, on a country, form a research methodology and a didactic approach. It begins by discussing case research, follows the history of the case study research and defines several dimensions of the study in question. The explanation of the method used is based on data collection analysis and, finally, examines the future of the topic for researching other case studies [1]. The housing sector in Portugal presents a paradoxical situation. In average terms, on the one hand, we have a high number of vacant dwellings and, on the other hand, families find it difficult to access adequate housing for their financial means and the size of their households. The relative weight of the tax burden has not helped families. This dilemma brought with it the issue of maintaining the housing stock in terms of its degradation due to the drop in families’ purchasing power, whose weight of housing and comfort expenses are too high. Portugal had the tenth lowest mark from the European Commission (EC) in 2021 [2], but the weight has increased when compared to 2015, in a percentage equivalent to 0.3% of GDP. It was 2.5% higher when compared to 2011, a period that includes the time of the Troika and the “huge tax increase”, with which the country was forced to comply. In 2021, the EC (2021) estimated 34.7% of GDP in taxes and discounts, despite being below the EU average, which is misleading. When the Special Rehousing Program started, in 1993, several studies suggested the need to build around half a million houses, which was not unrelated to the existence of a huge amount of informal and precarious constructions [3,4,5,6,7]. In twenty years, the country has built one and a half million new homes, eliminating, in technical terms, the housing deficit. However, there are still problems related to house degradation and an increase in the construction of housing in urban centers and on the outskirts of cities, which imply mobility needs for families and housing costs, especially rent, which remain relatively high. According to the OECD (2020) [8], since 2010, Portuguese families have allocated the largest proportion of their income to housing costs, i.e., to expenses related to the comfort that comes from owning a home. The rigid supply of housing results from the scarcity of land and regulatory policies that make it more expensive and less available. Anticipation efforts are essential, given that dwellings have a long lifespan [9]. It is in this context that the expression “so many people without homes and so many homes without people” has taken on a recent dimension, as in Portugal, there is no longer a housing deficit, but rather adaptations and difficulties in accessing housing (Council of Ministers Resolution No. 48/2015, of 15 July) [10]. As with other social policies, housing policy reflects the ideological choices of those who govern the country (Guedes, 2012) [11]. Nesslein [12] wrote that “the optimal economic organization of the housing sector has long been a policy question generating extreme ideological controversy”. Silva [13] also states that “Left parties tend to emphasize social issues more, while parliamentary right parties focus more on the political dimension”. This desideratum is sublime, but who supports the financing and its maintenance in a country with an external debt at the limit and with an astronomical public debt compared to its size and annual wealth production? Taxes? In fact, when ideology overlaps with scarce reality, the result is state failures, which are followed by negative externalities. To ensure the right to housing, a public policy is required that takes into account its economic characteristics and local environment [14], capable of facilitating access to housing for all, whether through purchase, lease or even transmission. In this sense, it was important to consider and reflect on the advantages inherent to the behavior of purchase and sale and rental market prices, with and without public intervention in housing promotion, on its forms of action and on its results. In a broad sense, housing policy basically has two main areas of action: one relates with planning and land use and the other with the promotion and allocation of decent housing. From the first two decades of this century onwards, housing policy guidelines were joined by apprehensions of more social concern for the most unprotected groups of people, with rehousing programs being developed in urban areas, sponsoring rentals supported by different governments and encouraging the construction and rehabilitation of housing properties. We cannot forget that each political economy is a public policy, such as housing policy. Uncertainty and risk have strong potential policy implications. Many mistakes have been made because governments have based their political actions on inappropriate parameters (Perez et al., 2017) [15], based on estimates that did not adequately take into account risk and uncertainty ([16], p. 1661). Perhaps the first mistake is not understanding what housing is. The housing brand has to be well understood, in the right measure of its double characteristics, as an asset, consisting of the land and the building, and as a consumer good, in the form of services ([17], pp. 1–2).

Covering housing in the analyzed period of time reflects the understanding of the various economic moments as a result of the coexistence of historical failures in the housing system and the recent crises due to the real estate and tourism boom. On the other hand, a critical reflection on recent measures in terms of housing policy, especially those included in the New Generation of Housing Policies, aims to present concrete possibilities for reforming public action [18,19]. Decades of comparative studies on housing systems in Europe have shown that the national models that have come closest to guaranteeing universal access to housing are those where the State has been most active in terms of regulation, with effects on the forms of access to housing. This is what happens in northern European countries, which Alves ([20], p. 1175) called the ‘Scandinavian model’, a concept widely used in southern European countries. In southern European models, where states have not adopted comprehensive regulatory policies, permanent home ownership is dominant [21]. In the models of the Nordic countries, where practically the entire urban housing stock is under some form of price regulation and management model, renting is the major form of access to housing [22]. In other words, robust regulation makes renting a stable and secure option, allowing families not to have to expose themselves to indebtedness to have access to their own housing, as a result of assertive and scrutinized regulation. Notwithstanding, this suggestion of models of choice is a cultural genesis, which we can call “north-south housing”; it is, to some extent, in line with the statement that the “State production of housing is deeply interwoven into the national and cultural circumstances that have shaped our different housing stocks” ([23], p. 22). State intervention must be a balance between the control it exercises over public administration and the free market. Otherwise, it can become absolutist state control and manage the productive force, public spending and private property, or an absentee state, in which the market is governed by large monopolies.

In general, it is well known that economic law is a means of studying the intervention of the State in the economy and its main objective is to meet human needs. Other than that, there is an interdependence between law and economics, but for interference to be carried out in a controlled manner, it must be in accordance with legal norms. The State acts when it directly develops the economic activity of which it owns or intervenes in the private sector and also when it interferes indirectly in the economic activity of private property, in which housing policy is included. Thus, the term “State intervention” should be used when it regulates the housing market or other markets, without directly acting or participating in the economic activity of which it legally owns. That is why State intervention is necessary through the offer or creation of incentives to the offer of activities that constitute positive externalities, subsidizing research and development or offering public housing and through the inhibition or creation of incentives to the non-production of negative externalities, e.g., regulations of controlling affordability and dignity in housing, no matter the possession. In other words, Pareto improvement can be achieved with the intervention of public authorities [24].

2. Research Methodology and Framework

The study methodology is based on the model of Categorical Principal Component Analysis (CATPCA), which is a multivariate exploratory analysis technique that transforms a set of correlated variables into a smaller set of independent variables or linear combinations of the original variables. Thus, this method aims to reduce the complexity in the data. This way, from the available variables or from the inserted data, indicators are used that aggregate a large part of the information present in the original variables. These indicators, called principal components (dimensions), are the linear combination of all the variables studied. In this study, two components (two dimensions) were defined to simplify the analysis of the information of the variables under study. This process simultaneously quantifies categorical variables while constraining the dimensionality of the data. Reducing the dimensions makes it easier to interpret some uncorrelated components instead of a lot of more or less extensive variables unrelated in the original variables. Standard principal components analysis assumes linear relationships between numerical variables. Categorical variables are optimally quantified in accordance with the dimension assumed in the model analysis and non-linear relationships between variables can be modelled.

This methodology was selected due to the number of variables used in this study, not only to understand the correlation between variables (bi-variable correlation) but to understand the systemic result present when we study the relations among all the independent variables presented in this study.

Table 1 shows the acronyms of the variables considered in the model and the theoretical meaning of each of the thirteen variables considered.

Table 1.

Considered variables and their meanings.

A brief note to mention is that we did not consider the population because, between the 2011 and 2021 Census, there is a −2.1% variation, which means a certain stability of individuals for a decade (10,344,802 in 2021 compared to 10,562,178 in 2011), according to the Portuguese National Institute of Statistics. It was the first time since 1970 that the country lost population between censuses. The inland of the country decreased in the number of inhabitants when compared to 2011. In this decade, the positive migratory balance was not enough to compensate the negative natural balance (difference between births and deaths). In 2021, around 50% of the population was concentrated in 31 of the 308 municipalities, located mostly in the Metropolitan Areas of Lisbon and Porto. The questionnaire, translated into five languages ten years ago, was translated into 11 other languages in 2021. The Portuguese population today is strongly located on the coast, with the district of Algarve, Lisbon and Porto standing out, which together absorb around 55% of the total population. In fact, it is in these two cities and in this district that construction continues to increase. This paradox is due to foreign demand with high incomes, made up of the French, English, Brazilians, Germans and Chinese.

The summarized model is shown in Table 2. The analysis of the output shows that the first component (Dimension 1) has an eigenvalue of 7.594, which corresponds to 63.283% of the total variance. The second dimension (Dimension 2) has 2.236, which corresponds to 18.631%, in which both dimensions make up a total of 81.914% of the total variance.

Table 2.

Model summary of the two dimensions.

The variance accounted for the centroid coordinates and for the total coordinate vector shown in Table 3.

Table 3.

Variance accounted for centroid and total coordinates.

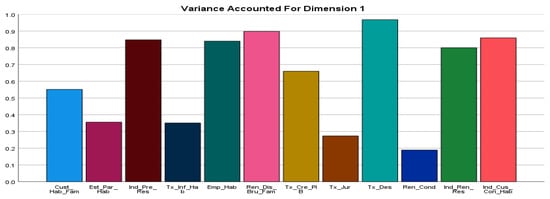

In the first dimension, the variables with the highest weight of variance are: unemployment rate (Tx. Des.), gross disposable income of households (Rend. Dis. Brut. Fam.), housing construction cost index (Ind_Cus_Con_Hab), home loans to individuals (Emp_Hab), residential price index (Ind_Pre_Res) and housing rent index (Ind_Ren_Res), as shown in Figure 1.

Figure 1.

Variance accounted for dimension 1. Source: own elaboration.

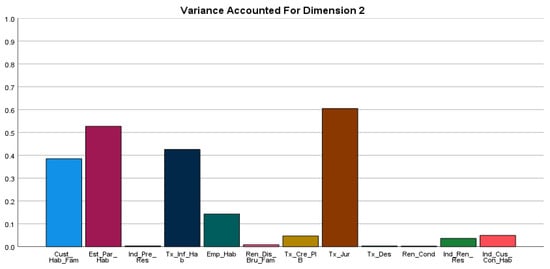

In the second dimension, the variables with the highest variance weight are: reference interest rate in the euro area (index) (Tx_Jur), housing stock estimates (Et_Par_Hab), inflation rate with housing (Tx_Inf_Hab) and housing costs per family (Cust_Hab_Fam.), as shown in Figure 2.

Figure 2.

Variance accounted for dimension 2. Source: own elaboration.

With the combination of the two dimensions, most variables have a statistically significant representation (higher than 70%), with the exception of the conditional housing rents (Ren Cond) variable, which has a weight of less than 20%.

3. Discussion of Results

Based on the existing data, an analysis of bivariate correlations was performed. Below are the tables that present the variables with the greatest correlation relevance, positive (1. Strongly Positive, 2. Positive) or negative (3. Strongly Negative, 4. Negative), present in Table 4 and also the correlations between all the original variables in this study, depicted in the variable principal normalization for the two dimensions as shown in Table 5. This Table shows correspondence between the realization of the objects—the years under study (2010, corresponding to Case Number 1, until 2019, corresponding to Case Number 10)—in the two defined dimensions (Dimension 1 and Dimension 2). This analysis allows for verifying the evolution of the objects (in this table, by years) in relation to each dimension. As an example, the year 2010 (Object Case Number 1) has a value of 0.277 in Dimension 1 and a value of −2.134 in Dimension 2.

Table 4.

Bi-variables with the highest correlation weight.

Table 5.

Variable principal normalization for the two dimensions.

A brief note on the interest rate implication is considered. According to several authors, the variable that most influences real estate promotion and credit for home purchase is the implicit interest rate on credit [38,39,40]. The opportunity cost is the lease through the market and the one that is supported by the public authorities. The interest rate on home loans reflects the relationship between the total interest due in the reference month and the principal outstanding at the beginning of that month (before repayment). The interest rate of month m, for characteristic k, with periodicity of p months, is given by the following calculation formula (INE; 2021 [41]):

The characters are: is the total amount of interest due in month m for characteristic k, with amortization of p in p months and is the total amount of outstanding credit, for characteristic k, whose reimbursement is paid from p to p months, at the time of collection of the previous repayment. This formula aimed to verify whether, in practice, the interest rate would have any relevant impact on the final results, as we will see later in the text. The present formula is used by the National Statistics Institute to determine the interest rate in studies on housing.

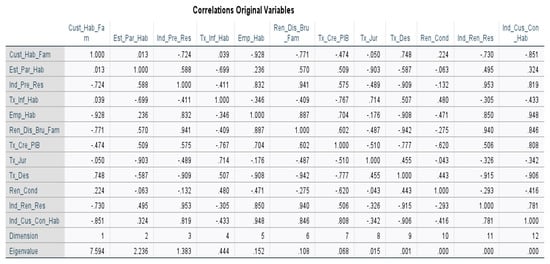

Figure 3 shows the correlations of the 14 original variables used in this research. It is noticed that the strongest relations are between Residential price index (Ind_Pre_Res) and Gross disposable income of households (Ren_Dis_Bru_Fam), Gross disposable income of households (Ren_Dis_Brut_Fam) and Residential rent index (Ind_Ren_Res), Residential rent index (Ind_Ren_Res) and Residential price index (Ind_Pre_Res), and Housing construction cost Index (Ind_Cust_Con_Hab) and Home loans to individuals (Emp_Hab).

Figure 3.

Correlations of the original variables. Source: own elaboration.

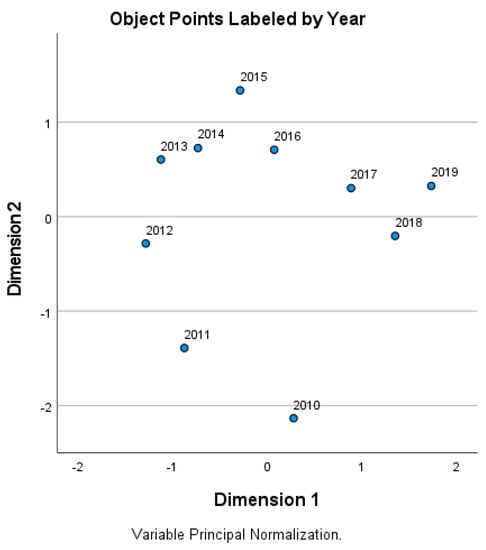

In Figure 4, we can see the behavior of the years in relation to the two dimensions in the analyzed timeline (2010–2019). In Dimension 1, there is a neutral alignment (close to zero) in the years 2010, 2015 and 2016, a negative weight in the period from 2011 to 2014 and a positive weight in the years 2017, 2018 and 2019. In Dimension 2, neutrality is obtained in the years 2012, 2017, 2018 and 2019, a negative relationship in 2010 and 2011 and a positive relationship in the period from 2013 to 2016. It is also possible to understand that there is no strong trend between the years analyzed because the dispersion of the values found in relation to the two dimensions is not concentrated.

Figure 4.

Behavior of years in relation to the two dimensions. Source: own elaboration.

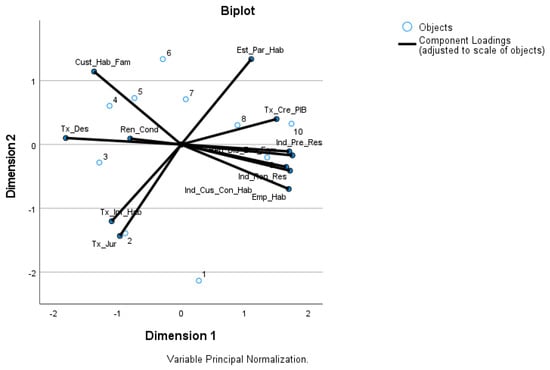

Table 6 shows the weights that the variables studied have in the two dimensions, which are later presented graphically in Figure 5. Based on the data presented, Dimension 1 includes the following as determining variables (Component Loading higher than the absolute value of 0.5) the variables Housing stock estimates (Est_Par_Hab), Residential price index (Ind_Pre_Res), Home loans to individuals (Emp_Hab), Gross disposable income of households (Ren_Dis_Bru_Fam), GDP growth rate (Tx_Cre_PIB), Residential rent index (Ind_Ren_Res) and Housing construction cost Index (Ind_Cus_Con_Hab). In Dimension 2, the variables are Housing costs per family (Cust_Hab_Fam) and Housing stock estimates (Est_Par_Hab). Interestingly, the variable Housing stock estimates (Est_Par_Hab) is defined as a determining variable in both dimensions.

Table 6.

Component loadings.

Figure 5.

Biplot. Source: own elaboration.

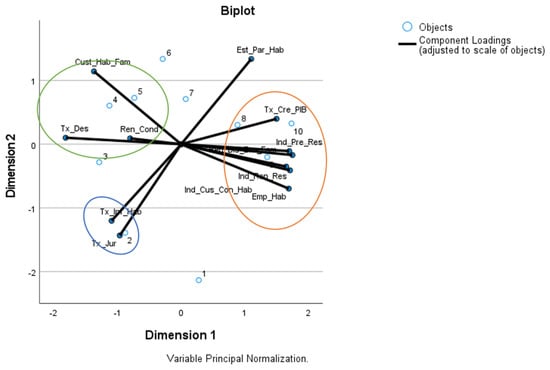

Establishing a relationship between the objects of study (years) and the defined variables, three groups were defined (blue, orange and green circles) that are presented in Figure 6. It is noted that, at the beginning of the analyzed period (blue circle), the Interest rate (Tx. Jur.) and Housing inflation rate (Tx. Inf. Hab.) had a negative preponderance in both dimensions. Subsequently (green circle), Housing cost per family (Cust. Hab. Fam.), Unemployment rate (Tx. Des.) and Conditional housing rents (Ren_Cond) are the most significant original variables, with a negative impact on Dimension 1 and positive impact on Dimension 2 and, at the end of the analyzed period (orange circle), the GDP growth rate (Tx. Cre. PIB.), the House price index (Ind. Pre. Res.), the Gross disposable income per household (Ren. Dis. Bru. Fam.), Residential rent index (Ind_Ren_Res), Housing construction cost index (Ind_Cus_Con_Hab) and the Home loans to individuals (Emp. Hab.) take on relief, mainly in Dimension 1.

Figure 6.

Biplot. Source: own elaboration.

4. Study Results and Data Collection

Taking into account the rule of eigenvalue greater than one, it can be said that the relational information between the variables studied in two orthogonal components significantly comprises the total variance in these variables, as it reaches a value of approximately 82%. In this study, the weights of the variables in the components, the percentage of explained variance and internal consistency were determined, as shown in Table 7. The eigenvalues greater than one rule [42] is implicitly linked to this model and states that the number of factors to be retained should correspond to the number of eigenvalues greater than one (i.e., deviating from the null expectation).

Table 7.

CATPCA analysis.

Thus, based on the data regarding the weights of each variable, the significant variables for Dimension 1 are: Gross disposable income of households (Ren_Dis_Bru_Fam) (0.948), Housing construction cost index (Ind_Cus_Con_Hab) (0.927), Residential rent index (Ind_Pre_Res) (0.921), Home loans to individuals (Emp_Hab) (0.916), Residential rent index (Ind_Ren_Res) (0.895), GDP growth rate (Tx_Cre_PIB) (0.812) and Housing stock estimates (Est_Par_Hab) (0.597). It should also be noted that in Dimension 1, the variables Unemployment rate (Tx_Des) (−0.984), Housing costs per family (Cust_Hab_Fam) (−0.743) and Reference interest rate in the euro area index (Tx_Jur) (−0.523) have an opposite weight to the other variables. As for Dimension 2, the variables Housing stock estimates (Est_Par_Hab) (0.726) and Housing cost per family (Cust_Hab_Fam) (0.621) are the ones that most represent it. The variables Reference interest rate in the euro area index (Tx_Jur) (−0.778) and Inflation rate with housing (Tx_Inf_Hab) (−0.652) represent the opposite. Dimension 1 has very high internal consistency (α = 0.947) and Dimension 2 also has high consistency (α = 0.603), though not as high as Dimension 1.

Through the CATPCA analysis and the representation on the two-dimensional map of the two dimensions, it is possible to state that, in the last years (2017–2019) of the study, Dimension 1 was influenced by Gross disposable income of households (Ren. Dis. Bru. Fam.), Housing construction cost index (Ind. Cus. Con. Hab.), Residential price index (Residential price index), Home loans to individuals (Emp. Hab.), Index of residential rent (Ind. Ren. Res.), GDP growth rate (Tx. Cre. PIB.), and Housing stock estimates (Est. Par. Hab.). The years 2011–2015 show a negative relationship with Dimension 1. Dimension 2, particularly in the years 2013 to 2016, is characterized positively by New housing construction cost index (Housing construction cost Index) and Housing stock estimates (Est. Par. Hab.) and, in the first two years of study, had a negative relationship.

5. Conclusions

The increasing attention that cities have given to housing since the 2011 financial crisis has made accessibility a relevant political issue for the governments of most European countries. Housing, though, cannot be viewed as an isolated matter. Portuguese governments have faced periods of stagnation in regard to housing allocation due to the country’s financial crisis. Even though there have been changes in economic policy, the rental market has not undergone much alteration in this period, even after an increase in construction. Despite legislation and housing regulation in Portugal, people systematically opt for homeownership, which has maintained and hindered the increase in the rental market, both private and public. We aimed to show and analyze these phenomena considering the regulation of housing by different public institutions and governments. Our conclusion is that only in the framework of cross-sectional investment will new and decent housing be made available, which will have an impact on housing prices and rents. The time interval under analysis corresponds to the period of the 2008/2009 financial crisis, with Portugal asking for international financial assistance. From this juncture, the crisis spread across Europe. Its beginning resulted, as in many other social areas, in political disorientation, with unpredictable and deep social effects. The housing sector did not escape this moment of financial crisis, which had harmful economic effects with substantial social consequences.

In an analysis of the respective time series, at the beginning of the period analyzed, the reference interest rate in the euro area index and the housing inflation rate had a negative preponderance in the two dimensions. Later, the housing cost per family, the unemployment rate, the inflation rate with housing and the conditional housing rents became the most significant original variables, with a negative impact on Dimension 1 and a positive impact on Dimension 2. Further, at the end of the period analyzed, the GDP growth rate, the house price index, the gross disposable gross income per family, the index of residential rent, housing construction cost index and the housing loan to individuals are mainly highlighted in Dimension 1.

Thus, a change is made evident in the use of housing in Portugal, based on the results obtained. It seems that, at the beginning of the period studied, housing had a strong relationship with interest rates and housing inflation rate, even both with low levels. Then, in the period after 2013, access to housing becomes linked to the unemployment rate, housing cost per family and conditional housing rents. At the end of the period studied, there is a stronger relationship with several variables, a conclusion being that the complexity of access to housing in Portugal depends on more factors, most of which are exogenous to Portuguese households. It is not statistically deducible evidence, but it is a theoretical inference given the various data and approaches carried out in this research.

The housing issue is not resolved in a governmental cycle. It needs a structural approach. The approaches have been mainly a short-run outlook and focused only on the most serious cases, which are those individuals who do not have a home. Households that, despite having a home, live in insufficient conditions do not see their situations being addressed. There is housing overcrowding, which refers to the proportion of the population living in housing with an insufficient number of rooms, taking into account the size and composition of a given household. On the other hand, the issue of housing costs is related to housing overcrowding. Overheads with housing expenses are one of the main housing shortages in Portugal. The country has a financial incapacity to keep the houses sufficiently warm in a relative value of about twenty percent of the population, which is relevant for a country with just over ten million inhabitants. This population group does not have the financial capacity to guarantee sufficient comfort for daily well-being. However, this fact has additional social costs for the population’s health status and quality of life, which is the target of any housing policy.

Author Contributions

Conceptualization, A.D.S. and H.C.; methodology, A.D.S.; software, H.C..; validation, A.D.S. and H.C.; formal analysis, A.D.S.; investigation, A.D.S.; resources, A.D.S.; data curation, A.D.S.; writing—original draft preparation, A.D.S.; writing—review and editing, A.D.S.; visualization, A.D.S.; supervision, A.D.S.; project administration, A.D.S.; funding acquisition, A.D.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Cooperativa de Ensino Universitário, C.R.L., Rua de Santa Marta, n° 56, 1150-297, Lisboa, Portugal.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Some or all data and models that support the findings of this study were available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- May, S. Case Studies. The International Encyclopedia of Organizational Communication; Scott, C., Lewis, L., Eds.; Wiley-Blackwell: Hoboken, NJ, USA, 2017; Volume 4. [Google Scholar] [CrossRef]

- European Comission. 2021 Annual Report of the European Fiscal Board. First Published on 10 November 2021. Available online: https://ec.europa.eu/info/files/2021-annual-report-european-fiscal-board_pt (accessed on 26 June 2022).

- Guerra, I. Diagnóstico sobre a Implementação do Programa PER nos Municípios das Áreas Metropolitanas de Lisboa e Porto; Instituto Nacional da Habitação: Lisboa, Portugal, 1999. [Google Scholar]

- Cachado, R. O Programa Especial de Realojamento: Ambiente histórico, político e social. Análise Soc. 2013, 206, 134–152. [Google Scholar]

- Alves, A.R. (Pre)textos e contextos: Media, Periferia e Racialização. Política Trab. 2016, 44, 91–107. [Google Scholar]

- Allegra, M.; Tulumello, S.; Falanga, R.; Cachado, R.; Ferreira, A.; Colombo, A.; Alves, S. Um Novo PER? Realojamento e Políticas da Habitação em Portugal, Policy Brief, Observa—Observatório de Ambiente e Sociedade, Instituto de Ciências Sociais, Universidade de Lisboa. 2017. Available online: https://www.academia.edu/35274424/Un_novo_PER_Realojamento_e_pol%C3%ADticas_de_habita%C3%A7%C3%A3o_em_Portugal (accessed on 26 June 2022).

- Farha, L. Special Rapporteur on Adequate Housing as a Component of the Right to an Adequate Standard of Living; United Nations Human Rights Council: Geneva, Switzerland, 2019. [Google Scholar]

- OECD. Social Housing: A Key Part of Past and Future Housing Policy, Employment, Labour and Social Affairs Policy Briefs; OECD: Paris, France, 2020; Available online: http://oe.cd/social-housing-2020 (accessed on 14 September 2022).

- OECD. Brick by Brick: Building Better Housing Policies; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- Presidência do Conselho de Ministros. Resolução do Conselho de Ministros n.º 48/2015, Diário da República, 1.ª série—N.º 136—15 de julho de 2015. 2015. Available online: https://dre.tretas.org/dre/984023/resolucao-do-conselho-de-ministros-48-2015-de-15-de-julho (accessed on 26 June 2022).

- Nuno Guedes, Convergência Ideológica? Uma Análise Comparada dos Programas Eleitorais do PS e do PSD (1991–2009), Sociologia, Problemas e Práticas [Online], 68|2012, Posto Online no dia 12 Novembro 2012, Consultado a 23 Outubro 2019. Abstract—Ideological Convergence? A Comparative Analysis of the Electoral Programmes of PS and PSD (1991–2009). Available online: http://journals.openedition.org/spp/711 (accessed on 26 June 2022).

- Nesslein, T.S. Alternative Decision—Making Models for Housing: The Question of Efficiency. Kyklos 1983, 36, 604–633. [Google Scholar] [CrossRef]

- Silva, I.S. A emigração e a Atividade Parlamentar: Uma Análise Longitudinal de 1985 a 2015. Master’s Thesis, University of Aveiro, Aveiro, Portugal, 2017. Available online: https://core.ac.uk/display/155248361?source=1&algorithmId=15&similarToDoc=223991893&similarToDocKey=CORE&recSetID=7ced9092-900a-4843-83fb-9cfefd99c6f0&position=5&recommendation_type=same_repo&otherRecs=227268248,328068685,231207415,223968242,155248361 (accessed on 26 June 2022).

- Harsman, B.; Quigley, J. Housing Markets and Housing Institutions: An International Comparison; Springer: Dordrecht, The Netherlands, 2012. [Google Scholar]

- Perez, S.A.; Matsaganis, M. The Political Economy of Austerity in Southern Europe. New Political Econ. 2018, 23, 192–207. Available online: https://www.tandfonline.com/doi/abs/10.1080/13563467.2017.1370445?journalCode=cnpe20 (accessed on 9 September 2022). [CrossRef]

- Chien, M.; Setyowati, N. The effects of uncertainty shocks on global housing markets. Int. J. Hous. Mark. Anal. 2020, 14, 218–242. Available online: http://www.emeraldinsight.com/doi/10.1108/IJHMA-03-2020-0020 (accessed on 26 June 2022). [CrossRef]

- Dias, D.L.; Duarte, J. Monetary Policy, Housing Rents, and Inflation Dynamics; International Finance Discussion Papers; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2019. [Google Scholar] [CrossRef]

- Instituto de Habitação e Reabilitação Urbana. Programa 1.º Direito: Programa de Apoio ao Acesso à Habitação, 1.º Relatório de Execução 2020. Available online: https://www.portaldahabitacao.pt/habitacao (accessed on 26 June 2022).

- Tulumello, S. O Estado e a Habitação, Cidades [Online], 38|2019, Posto Online no dia 29 Junho 2019, Consultado o 29 Agosto 2022. Available online: http://journals.openedition.org/cidades/1010 (accessed on 26 June 2022).

- Alves, S. Nuancing the international debate on social mix: Evidence from Copenhagen. Hous. Stud. 2022, 37, 1174–1197. Available online: https://eds.s.ebscohost.com/eds/detail/detail?vid=1&sid=a922d694-9e2e-4343-8211-0a9303752d51%40redis&bdata=JkF1dGhUeXBlPWlwLHVpZCZsYW5nPXB0LXB0JnNpdGU9ZWRzLWxpdmUmc2NvcGU9c2l0ZQ%3d%3d#db=bth&AN=158177568 (accessed on 26 June 2022). [CrossRef]

- Allen, J. Welfare Regimes, Welfare Systems and Housing in Southern Europe. Eur. J. Hous. Policy 2016, 6, 251–277. [Google Scholar] [CrossRef]

- Simmons, R.; Krokfors, K. Scandinavian Housing Design since the Mid 1990s: Selected Lessons from Practice. Built Environ. 2015, 41, 305–324. [Google Scholar] [CrossRef]

- Ramos, R.; Gonçalves, E.; Lameira, G.; Luciana, R. State-Subsidised Housing and Architecture in 20th-Century Portugal: A Critical Review Outlining Multidisciplinary Implications. Challenges 2021, 12, 7, Project Report. [Google Scholar] [CrossRef]

- Gong, Y.; Leung, C.K.Y. When education policy and housing policy interact: Can they correct for the externalities? J. Hous. Econ. 2021, 50, 101732. Available online: https://b-on.ual.pt:2479/eds/detail/detail?vid=6&sid=2341a78a-d3c1-4db4-bd01-cf02f5721273%40redis&bdata=JkF1dGhUeXBlPWlwLHVpZCZsYW5nPXB0LXB0JnNpdGU9ZWRzLWxpdmUmc2NvcGU9c2l0ZQ%3d%3d#AN=S1051137720300681&db=edselp (accessed on 10 September 2022). [CrossRef]

- Sterk, S. Incentivizing Fair Housing. Boston Univ. Law Rev. 2021, 101, 1607–1665. Available online: http://www.bu.edu/law (accessed on 9 September 2022).

- Halket, J.; Nesheim, L.; Oswald, F. The housing stock, housing prices, and user costs: The roles of location, structure, and unobserved quality. Int. Econ. Rev. 2020, 61, 1777–1814. [Google Scholar] [CrossRef]

- Waltl, S. A Hedonic House Price Index in Continuous Time; Graz Economics Papers, 2015-04; University of Graz: Graz, Austria, 2015; Available online: http://ideas.repec.org/s/grz/wpaper.html (accessed on 26 June 2022).

- Kirca, M.; Canbay, S. Determinants of housing inflation in Turkey: A conditional frequency domain causality. Int. J. Hous. Mark. Anal. 2021, 15, 478–499. Available online: http://www.emeraldinsight.com/doi/10.1108/IJHMA-02-2021-0013 (accessed on 26 June 2022). [CrossRef]

- Hoekstra, J.; Dol1, K. Attitudes towards housing equity release strategies among older home owners: A European comparison. J. Hous. Built Environ. 2020, 36, 1347–1366. [Google Scholar] [CrossRef]

- Antonin, C. The Links between Saving Rates, Income and Uncertainty: An Analysis based on the 2011 Household Budget Survey. Econ. Stat. 2019, 513, 47–68. [Google Scholar] [CrossRef][Green Version]

- Siliverstovs, B. Assessing nowcast accuracy of US GDP growth in real time: The role of booms and busts. Empir. Econ. 2020, 58, 7–27. [Google Scholar] [CrossRef]

- Horvath, R. Financial market fragmentation and monetary transmission in the euro area: What do we know? J. Econ. Policy Reform 2018, 21, 319–334. [Google Scholar] [CrossRef]

- Han, H.-S. Neighborhood characteristics and resistance to the impacts of housing abandonment. J. Urban Aff. 2017, 39, 833–856. [Google Scholar] [CrossRef]

- Lawson, J.; Berry, M.; Milligan, V.; Yates, J. Facilitating Investment in Affordable Housing—Towards an Australian Model. Hous. Financ. Int. 2009, 24, 18–26. [Google Scholar]

- MacAskill, S.; Stewart, R.; Roca, E.; Liua, B.; Sahin, O. Green building, split-incentives and affordable rental housing policy. Hous. Stud. 2021, 36, 23–45. [Google Scholar] [CrossRef]

- Weber, J.; Lee, G. A new measure of private rental market regulation index and its effects on housing rents: Cross-country evidence. Int. J. Hous. Mark. Anal. 2020, 13, 635–659. Available online: http://www.emeraldinsight.com/doi/10.1108/IJHMA-12-2019-0118 (accessed on 26 June 2022). [CrossRef]

- Murphy, P. How Taxes are Sending Housing Prices through the Roof. Quadrant 2021, 65, 28–33. [Google Scholar]

- Brett, D.; Schmitz, A. Real Estate Market Analysis: Methods and Case Studies, 2nd ed.; Chicago Urban Land Institute: Chicago, IL, USA, 2019. [Google Scholar]

- Fang, L. Mortgage Pricing Implications of Prepayment: Separating Pecuniary and Non-pecuniary Prepayment. J. Real Estate Financ. Econ. 2019, 60, 239–269. [Google Scholar] [CrossRef]

- Marfatia, H. Time-frequency linkages of international housing markets and macroeconomic drivers. Int. J. Hous. Mark. Anal. 2020, 14, 652–679. Available online: http://www.emeraldinsight.com/doi/10.1108/IJHMA-05-2020-0055 (accessed on 26 June 2022). [CrossRef]

- Instituto Nacional de Estatística. Taxas de juro Implícitas no Crédito à habitação, Agosto. 2021. Available online: https://www.ine.pt/xportal/xmain?xpgid=ine_main&xpid=INE (accessed on 26 June 2022).

- Kaiser, H.F. The application of electronic computers to factor analysis. Educ. Psychol. Meas. 1960, 20, 141–151. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).