Examining the Effect of Tax Reform Determinants, Firms’ Characteristics and Demographic Factors on the Financial Performance of Small and Micro Enterprises

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Tax Reform (Goods and Service Tax)

2.2. Characteristics of Firms

2.3. Demographic Variables

2.4. DuPont Analysis

2.5. Conceptual Model

3. Materials and Method Used

3.1. Sample

3.2. Survey Instrument and Data

3.3. Research Methodology

4. Results

4.1. EFA Results

4.2. CFA Results

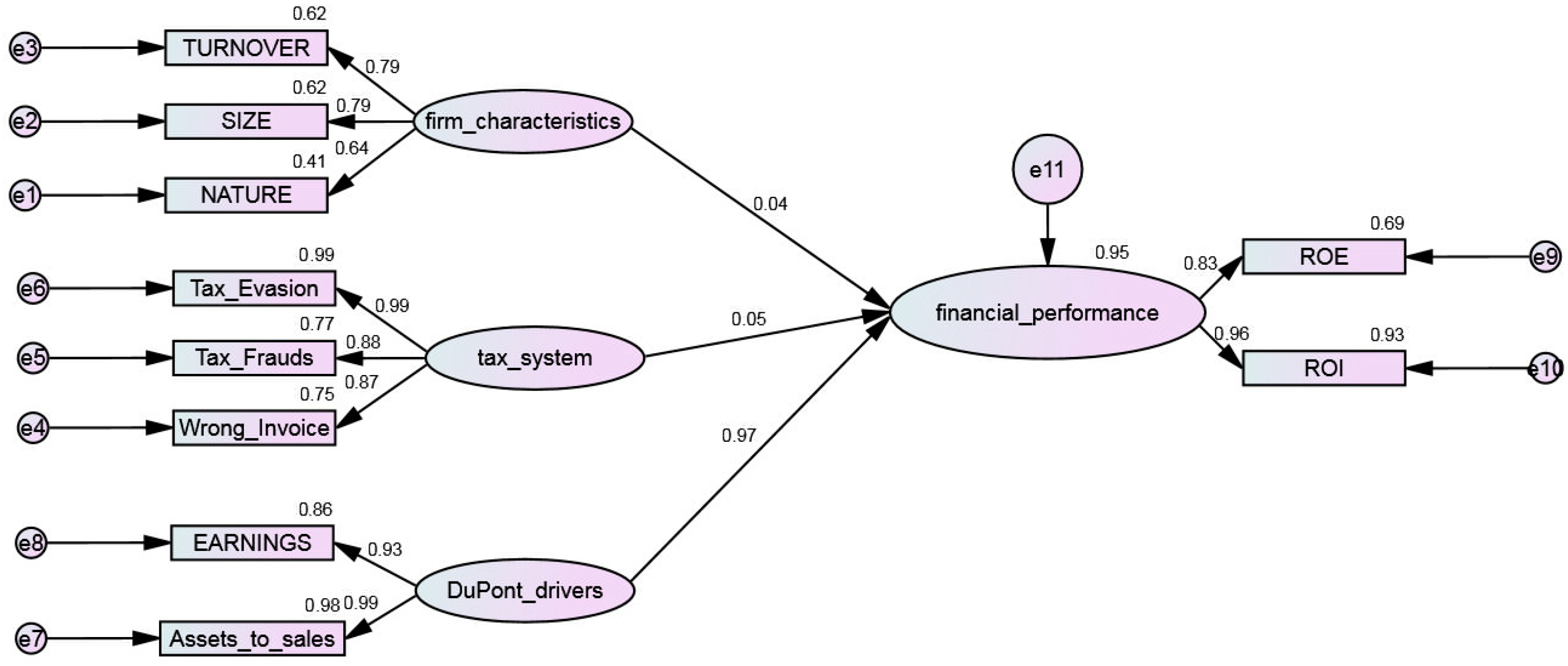

4.3. SEM Model and Regression Model Results

- (A)

- AMOS Model Results

- (B)

- Stepwise Regression Results

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Afuberoh, D.; Okoye, E. The impact of taxation on revenue generation in Nigeria: A study of federal capital territory and selected states. Int. J. Public Adm. Manag. Res. 2014, 2, 22–47. [Google Scholar]

- Egbunike, F.C.; Emudainohwo, O.B.; Gunardi, A. Tax revenue and economic growth: A study of Nigeria and Ghana. Signifikan. J. Ilmu Ekon. 2018, 7, 213–220. [Google Scholar] [CrossRef]

- Barro, R.J.; Furman, J. Macroeconomic Effects of the 2017 Tax Reform. Brook. Pap. Econ. Act. 2018, 1, 257–345. [Google Scholar] [CrossRef]

- ICC. 2018. Available online: https://cdn.iccwbo.org/content/uploads/sites/3/2018/02/icc-position-paper-on-tax-and-the-un-sdgs.pdf (accessed on 15 June 2018).

- De Paepe, G.; Dickinson, B. Tax Revenues as a Motor for Sustainable Development; Development Co-Operation Report; Organisation of Economic Co-Operation and Development: Colombo, Sri Lanka, 2014; pp. 91–97. [Google Scholar]

- Long, C.; Miller, M. Taxation and the Sustainable Development Goals. In Do Good Things Come to Those Who Tax More; Overseas Development Institute: London, UK, 2017; pp. 1–14. [Google Scholar]

- Juergensen, J.; Guimón, J.; Narula, R. European SMEs amidst the COVID-19 crisis: Assessing impact and policy responses. J. Ind. Bus. Econ. 2020, 47, 499–510. [Google Scholar] [CrossRef]

- Collett, N.; Pandit, N.R.; Saarikko, J. Success and failure in turnaround attempts: An analysis of SMEs within the Finnish Restructuring of Enterprises Act. Entrep. Reg. Dev. 2014, 26, 123–141. [Google Scholar] [CrossRef]

- Boateng, K.; Sodem, N.; Nagaraju, Y. The contribution of MSMEs to the growth of the Indian and global economy research review. Int. J. Multi-Discip. 2019, 4, 5–15. [Google Scholar]

- Gupta, J.; Barzotto, M.; Khorasgani, A. Does size matter in predicting SMEs failure? Int. J. Financ. Econ. 2018, 23, 571–605. [Google Scholar] [CrossRef]

- Mermelstein, B.; Nocke, V.; Satterthwaite, M.A.; Whinston, M.D. Internal versus external growth in industries with scale economies: A computational model of optimal merger policy. J. Political Econ. 2020, 128, 301–341. [Google Scholar] [CrossRef]

- Pati, R.K.; Nandakumar, M.K.; Ghobadian, A.; Ireland, R.D.; O’Regan, N. Business model design–performance relationship under external and internal contingencies: Evidence from SMEs in an emerging economy. Long Range Plan. 2018, 51, 750–769. [Google Scholar] [CrossRef]

- Dioha, C.; Mohammed, N.A.; Okpanachi, J. Effect of firm characteristics on profitability of listed consumer goods companies in Nigeria. J. Account. Financ. Audit. Stud. 2018, 4, 14–31. [Google Scholar]

- Luttmer, E.G. Models of growth and firm heterogeneity. Annu. Rev. Econ. 2010, 2, 547–576. [Google Scholar] [CrossRef]

- Watson, A.; Shrives, P.; Marston, C. Voluntary disclosure of accounting ratios in the UK. Br. Rev. 2002, 34, 289–313. [Google Scholar] [CrossRef]

- Chaniago, H. Demographic Characteristics and Small Business Success: Evidence from Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 399–409. [Google Scholar]

- Ahmed, Y.A.; Kar, B. Influence of demographic factors on business performance in Ethiopia. Int. J. Innov. Technol. Explor. Eng. 2019, 8, 2857–2862. [Google Scholar]

- Liem, V.T.; Hien, N.N. The impact of manager’s demographic characteristics on prospector strategy, use of management accounting systems and financial performance. J. Int. Stud. 2020, 13, 54–69. [Google Scholar] [CrossRef]

- Harpriya Sharma, R.K.; Sah, A.N. Impact of demographic factors on the financial performance of women-owned micro-enterprises in India. Int. J. Financ. Econ. 2022, 27, 6–17. [Google Scholar] [CrossRef]

- Ram, M.; Chouhan, R.K. DuPont analysis—A tool of financial performance analysis. Indian J. Bus. Adm. 2020, 13, 29–44. [Google Scholar]

- Eniola, A.A.; Entebang, H. Government policy and performance of small and medium business management. Int. J. Acad. Res. Bus. Soc. Sci. 2015, 5, 237. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G. Economic policy uncertainty: A literature review. J. Econ. Asymmetries 2019, 20, e00133. [Google Scholar] [CrossRef]

- Popescu, C.R.G. Sustainable and Responsible Entrepreneurship for Value-Based Cultures, Economies, and Societies: Increasing Performance through Intellectual Capital in Challenging Times. Sustain. Responsible Entrep. Key Driv. Perform. 2021, 2, 33–58. [Google Scholar]

- OECD. Investment Policy Reviews: Egypt 2020. Available online: https://www.oecd-ilibrary.org/sites/f7813858-en/index.html?itemId=/content/component/f7813858-en (accessed on 8 July 2020).

- Gersovitz, M.; Ahmad, E.; Stern, N. The Theory and Practice of Tax Reform in Developing Countries; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Slemrod, J.B.; Venkatesh, V. The income tax compliance cost of large and mid-size businesses. Ross Sch. Bus. Pap. 2002, 1–114. [Google Scholar] [CrossRef][Green Version]

- McMahon, G.; Berrios, M. Tax Reform and Macroeconomic Policy in Developing Countries; Oxford University Press: Oxford, UK, 1991. [Google Scholar]

- Mwanza, C.; Katoma, V. The Nexus of Tax Education and Compliance Among Small Business Enterprises: Otjiwarongo District, Namibia; GRIN Verlag: Munich, Germany, 2019. [Google Scholar]

- Fischer, C.M.; Wartick, M.; Mark, M. Detection probability and tax compliance: A review of the literature. J. Account. Lit. 1992, 11, 1–46. [Google Scholar]

- Abdel-Mowla, S.A.A. The Egyptian tax system reforms, investment and tax evasion (2004–2008). J. Econ. Adm. Sci. 2012, 28, 53–78. [Google Scholar]

- Narayanan, S. The impact of the goods and services tax (GST) in Malaysia: Lessons from experiences elsewhere (A note). Singap. Econ. Rev. 2014, 59, 1–15. [Google Scholar] [CrossRef]

- Sinha, Y.; Srivastava, V.K. Indirect Tax Reform in India: 1947 to GST and Beyond; SAGE Publishing: New Delhi, India, 2020. [Google Scholar]

- Singh, A.P. The Impact of GST and MSME Sector. GST Simplified Tax System: Challenges and Remedies; ICMAI: New Delhi, India, 2018; pp. 315–318. [Google Scholar]

- Vasanthagopal, S. GST in India: A Big Leap in the Indirect Taxation System. Int. J. Trade Econ. Financ. 2011, 2, 144–146. [Google Scholar] [CrossRef][Green Version]

- Bird, R.; Smart, M. Taxing consumption in Canada: Rates, revenues, and redistribution. Can. Tax J. 2016, 64, 417–430. [Google Scholar] [CrossRef][Green Version]

- Sarabu, V.K. GST in India—An Overview. Research Gate. 2018. Available online: https://www.researchgate.net/publication/316505697_GST_IN_INDIA_-_AN_OVER_VIEW?channel=doi&linkId=59016204aca2725bd71fb623&showFulltext=true (accessed on 2 July 2022).

- Bolton, T.; Dollery, B. An empirical note on the comparative macroeconomic effects of the GST in Australia, Canada and New Zealand. Econ. Pap. A J. Appl. Econ. Policy 2005, 24, 50–60. [Google Scholar] [CrossRef]

- Amentie, C.; Negash, E.; Kumera, L. The Effects of Firms Characteristics on the Growth of Medium and Small Business in Developing Country (Case Study Ethiopia). Glob. J. Manag. Bus. Res. 2016, 16, 34–42. [Google Scholar]

- Anderson, R.C.; Reeb, D.M. Founding-family ownership and firm performance: Evidence from the S&P 500. J. Financ. 2003, 58, 1301–1328. [Google Scholar]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Hillman, A.J.; Dalziel, T. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad. Manag. Rev. 2003, 28, 383–415. [Google Scholar] [CrossRef]

- Chen, M.J.; Hambrick, D.C. Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior. Acad. Manag. J. 1995, 38, 453–482. [Google Scholar] [CrossRef]

- Niresh, A.; Thirunavukkarasu, V. Firm size and profitability: A study of listed manufacturing firms in Sri Lanka. Int. J. Bus. Manag. 2014, 9, 57–64. [Google Scholar] [CrossRef]

- Lee, J. Does the size matter in firm performance? Evidence from US Public Firms. Int. J. Econ. Bus. 2009, 16, 189–203. [Google Scholar] [CrossRef]

- Darmawan, M.; Toro, J.S. The impact of intellectual capital on banks go public’s market value and financial performance listed in indonesia stock exchange (idx). Fokus Manajerial 2012, 10, 164–182. [Google Scholar]

- Ozgulbas, N.; Koyuncugil, A.S.; Yilmaz, F. Identifying the effect of firm size on financial performance of SMEs. Bus. Rev. Camb. 2006, 6, 162–167. [Google Scholar]

- Jónsson, B. Does the size matter? The relationship between size and porfitability of Icelandic firms. Bifröst J. Soc. Sci. 2007, 1, 43–55. [Google Scholar]

- Dwipayani, C.C.; Prastiwi, A. Pengaruh Intellectual Capital Terhadap Profitabilitas dan Kinerja Pasar (Studi Empiris pada Perusahaan Perdagangan dan Jasa). Ph.D. Thesis, Fakultas Ekonomika dan Bisnis, Jakarta, Indonesia, 2014. [Google Scholar]

- Becker-Blease, J.R.; Kaen, F.R.; Etebari, A.; Baumann, H. Employees, firm size and profitability of US manufacturing industries. Investig. Manag. Financ. Innov. 2010, 7, 7–23. [Google Scholar]

- Tanui, P.J.; Serebemuom, B.M. Corporate diversification and financial performance of listed firms in Kenya: Does firm size matter? J. Adv. Res. Econ. Adm. Sci. 2021, 2, 65–77. [Google Scholar] [CrossRef]

- Keen, M.; Lockwood, B. Is the VAT a money machine? Natl. Tax J. 2006, 59, 905–928. [Google Scholar] [CrossRef]

- Smart, M. The impact of sales tax reform on Ontario consumers: A first look at the evidence. SPP Res. Pap. 2011, 4, 11–13. [Google Scholar] [CrossRef][Green Version]

- Miki, B. The Effect of the VAT Rate Change on Aggregate Consumption and Economic Growth; WP. 297; Center of Japanese Economy and Business: New York, NY, USA, 2011. [Google Scholar]

- Mueller, D. The Persistence of Profits Above the Norm. Economica 1977, 44, 369–380. [Google Scholar] [CrossRef]

- Porter, M.E. Toward a new conception of the environment- competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Parida, V.; Patel, P.C.; Wincent, J.; Kohtamäki, M. Network partner diversity, network capability, and sales growth in small firms. J. Bus. Res. 2016, 69, 2113–2117. [Google Scholar] [CrossRef]

- Gaur, V.; Kesavan, S. The effects of firm size and sales growth rate on inventory turnover performance in the US retail sector. Int. Ser. Oper. Res. Manag. Sci. 2015, 2, 25–52. [Google Scholar]

- Kim, D.H.; Lin, S.C.; Chen, T.C. Financial structure, firm size and industry growth. Int. Rev. Econ. Financ. 2016, 41, 23–39. [Google Scholar] [CrossRef]

- Huria, N. Women empowerment through entrepreneurship: A way for economic development. Int. Glob. Res. Anal. 2013, 2, 2277–8160. [Google Scholar]

- Welsh, D.H.B.; Kaciak, E. Women’s entrepreneurship: A model of business-family interface and performance. Int. Entrep. Manag. J. 2018, 14, 627–637. [Google Scholar] [CrossRef]

- Parvin, L.; Jinrong, J.; Rahman, M.W. Women entrepreneurship development in Bangladesh: What are the challenges ahead? Afr. J. Bus. Manag. 2012, 6, 3862–3871. [Google Scholar]

- Bernard, M.C.; Victor, K.R. SWOT analysis of growth of women entrepreneurs in Dar Es Salaam. Acad. Res. Int. 2013, 4, 50–58. [Google Scholar]

- Evans, K.A.; Eriksson, R.H.; Urban, L.; Einar, H. Familial relationships and firm performance: The impact of entrepreneurial family relationships. Entrep. Reg. Dev. 2018, 31, 357–377. [Google Scholar]

- Child, J. Organizational structure, environment and performance: The role of strategic choice. Sociology 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Virtanen, A. Women on the boards of listed companies: Evidence from Finland. J. Manag. Gov. 2010, 16, 571–593. [Google Scholar] [CrossRef]

- Kim, K.-H.; Al-Shammari, H.A.; Kim, B.; Lee, S.-H. CEO duality leadership and corporate diversification behavior. J. Bus. Res. 2009, 62, 1173–1180. [Google Scholar] [CrossRef]

- Peni, E. CEO and Chairperson characteristics and firm performance. J. Manag. Gov. 2014, 18, 185–205. [Google Scholar] [CrossRef]

- Tarus, D.K.; Aime, F. Board demographic diversity, firm performance and strategic change: A test of moderation. Manag. Res. Rev. 2014, 37, 111–136. [Google Scholar]

- Zee, H.H. Personal income tax reform: Concepts, issues, and comparative country developments. IMF Work. Pap. 2005, 87, 1–59. [Google Scholar] [CrossRef][Green Version]

- Mertens, K.; Montiel Olea, J.L. Marginal tax rates and income: New time series evidence. Q. J. Econ. 2018, 133, 1803–1884. [Google Scholar] [CrossRef]

- Ljungqvist, A.; Smolyansky, M. To Cut or Not to Cut? On the Impact of Corporate Taxes on Employment and Income; (No. w20753); National Bureau of Economic Research: Cambridge, MA, USA, 2014. [Google Scholar]

- Van de Voorde, K.; Paauwe, J.; Van Veldhoven, M. Employee well-being and the HRMorganizational performance relationship: A review of quantitative studies. Int. J. Manag. Rev. 2012, 14, 391–407. [Google Scholar] [CrossRef]

- Judge, T.A.; Thorensen, C.J.; Bono, J.E.; Patton, G.K. The job satisfaction-job performance relationship: A qualitative and quantitative review. Psychol. Bull. 2001, 127, 376–407. [Google Scholar] [CrossRef]

- Locke, E.A.; Latham, G.P. Building a practically useful theory of goal setting and task motivation. Am. Psychol. 2002, 57, 705–717. [Google Scholar] [CrossRef] [PubMed]

- Dijkhuizen, J.; Gorgievski, M.; Van Veldhoven, M.; Schalk, R. Feeling successful as an entrepreneur: A job demands-resources approach. Int. Entrep. Manag. J. 2015, 12, 555–573. [Google Scholar] [CrossRef]

- Flesher, D.L.; Previts, G.J. Donaldson Brown (1885–1965): The power of an individual and his ideas over time. Account. Hist. J. 2013, 40, 79–101. [Google Scholar] [CrossRef]

- Vij, S.; Bedi, H.S. Are subjective business performance measures justified? Int. J. Product. Perform. Manag. 2016, 65, 603–621. [Google Scholar] [CrossRef]

- Wall, T.D.; Michie, J.; Patterson, M.; Wood, S.J.; Sheehan, M.; Clegg, C.H.; West, M. On the Validity of Subjective Measures of Company Performance. Pers. Psychol. 2004, 57, 95–118. [Google Scholar] [CrossRef]

- Masa’deh, R.; Tayeh, M.; Al-Jarrah, I.M.; Tarhini, A. Accounting vs. Market-based Measures of Firm Performance Related to Information Technology Investments. Int. Rev. Soc. Sci. Humanit. 2015, 9, 129–145. [Google Scholar]

- Runyan, R.; Droge, C.; Swinney, J. Entrepreneurial orientation versus small business orientation: What are their relationships to firm performance? J. Small Bus. Manag. 2008, 46, 567–588. [Google Scholar] [CrossRef]

- Haber, S.; Reichel, A. Identifying performance measures of small ventures—The case of the tourism industry. J. Small Bus. Manag. 2005, 43, 257–286. [Google Scholar] [CrossRef]

- Jacobson, R. The validity of ROI as a measure of business performance. Am. Econ. Rev. 1987, 77, 470–478. [Google Scholar]

- Sawarni, K.S.; Narayanasamy, S.; Ayyalusamy, K. Working capital management, firm performance and nature of business: An empirical evidence from India. Int. J. Product. Perform. Manag. 2020, 70, 179–200. [Google Scholar] [CrossRef]

- Deloof, M. Does working capital management affect profitability of Belgian firms? J. Bus. Financ. Account. 2003, 30, 573–588. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Chandak, A. Introduction of E-Way Bill: The Indian Logistics Sector and Supply Chain Industries Gearing Up for Huge Challenges. 2019. Available online: https://ssrn.com/abstract=3417555 (accessed on 10 July 2019).

- Rao, S.R. E-Way Bill—A bird’s-Eye view. Gavesana J. Manag. 2017, 9, 56–62. [Google Scholar]

- Silpa, P.; Mohan, S.; Murali, K.; Sreelakshmi, T.; Jayashankar, J. An introduction to e-way bill; A game changer of the Indian economic system. Int. J. Manag. IT Eng. 2018, 8, 72–86. [Google Scholar]

- Kadir, J.B.; Yusof, Z.B.; Hassan, M.A. Goods and services tax (GST) in Malaysia: Behind successful experiences. Int. J. Econ. Perspect. 2016, 10, 126–138. [Google Scholar]

- Schmidt, R.A.; Bennison, D.; Bainbridge, S.; Hallsworth, A. Legislation and SME retailers- compliance costs and consequences. Int. J. Retail. Distrib. Manag. 2007, 35, 256–270. [Google Scholar] [CrossRef]

- Sury, M.M. Goods and Services Tax (GST) in India: Background, Present Structure and Future Challenges: As Applicable from July 1, 2017; New Century Publications: New Delhi, India, 2019. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Muller, R.O. Basic Principles of Structural Equation Modeling: An Introduction to LISREL and EQS.; Springer: New York, NY, USA, 1996. [Google Scholar]

- Hu, L.; Bentler, P.M. Evaluating Model Fit. In Structural Equation Modeling: Concepts, Issues, and Applications; Hoyle, R.H., Ed.; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Kline, R.B. Software review: Software programs for structural equation modeling: Amos, EQS, and LISREL. J. Psychoeduc. Assess. 2008, 16, 343–364. [Google Scholar] [CrossRef]

- Marsh, H.W.; Barnes, J.; Hocevar, D. Self–other agreement on multidimensional self-concept ratings: Factor analysis and multitrait–multimethod analysis. J. Personal. Soc. Psychol. 1985, 49, 1360. [Google Scholar] [CrossRef]

- Arbuckle, J.L.; Wothke, W. AMOS 4.0 User’s Guide; Small Waters: Chicago, IL, USA, 2001. [Google Scholar]

- Hocking, R.R. Developments in linear regression methodology: 1959–l982. Technometrics 1983, 25, 219–230. [Google Scholar] [CrossRef]

- Craney, T.A.; Surles, J.G. Model-dependent variance inflation factor cutoff values. Qual. Eng. 2002, 14, 391–403. [Google Scholar] [CrossRef]

- Malhotra, N.; Dash, S. Marketing Research: An Applied Orientation, 5th ed.; Pearson Prentice Hall: New Delhi, India, 2009. [Google Scholar]

- Schmidt, M.J.; Hollensen, S. Marketing Research—An International Approach; Pearson Education: New Delhi, India, 2006. [Google Scholar]

- Hoseini, M.; Briand, O. Production efficiency and self-enforcement value added tax: Evidence from state-level reform in India. J. Dev. Econ. 2020, 144, 102462. [Google Scholar] [CrossRef]

- Jayalakshmi, M.; Venkateswarlu, G. Impact of GST on Micro, Small and Medium Enterprises (MSMEs). Int. J. Eng. Manag. Res. 2018, 8, 91–95. [Google Scholar]

| Factors | Definition | Cronbach’s Alpha |

|---|---|---|

| Financial Performance | The SMEs were often hesitant to publicly reveal their actual financial performance, leading to a poor or non-response. The subjective performance, that is, the perception of business performance on various dimensions rather than actual performance, has been widely collected in earlier studies [77,78]. Further, various studies found performance perception to be more valid and reliable than actual financial figures [79]. Another challenge with considering financial figures was their cross-validation due to privately held information [80,81]. The financial performance parameters used to study the impact were measured on the Likert scale 1–3 (1 = decrease, 2 = no change, and 3 = increase). The performance indicators used were Return on equity (ROE), Return on investment (ROI), and earnings of the firms [82,83,84] | 0.878 |

| Firms Characteristics |

| 0.727 |

| Demographic Variables | The demographic variables regarding the respondents were asked in relation to their age (25–35 years; 35–45, and above 45 years), gender (male or female) and annual income (Under INR 0.8 million 1; INR 0.8–1 million and above 1 million) [85,86,87] | 0.707 |

| GST Reform Determinants | This construct measured the respondents’ perception towards the impact of the new tax system (GST) on their business performance. The different factors of tax reform (GST) asked were detection of tax frauds, reduction in tax evasion, transparency, progressive system, input tax credit mechanism, uniform tax rates, and prevention of stock leakages [88,89,90,91]. A total of 19 statements were asked in the questionnaire (refer to Table 2 for details). The respondents were asked to rate their responses on a five-point Likert scaling (1 = strongly disagree, 5 = strongly agree). | 0.898 |

| Factors | Component | KMO | |||||

|---|---|---|---|---|---|---|---|

| Change in tax system | 1 | 2 | 3 | 4 | 5 | 6 | 0.791 *** |

| Tax_Evasion | 0.911 | ||||||

| Tax_Frauds | 0.892 | ||||||

| Wrong_Invoice | 0.851 | ||||||

| Tax_Credits | 0.585 | ||||||

| Smooth flow | 0.724 | ||||||

| E-way bills | 0.708 | ||||||

| Progressive tax | 0.633 | ||||||

| Liquidity | 0.618 | ||||||

| Unfair demands | 0.803 | ||||||

| No central jurisdiction | 0.729 | ||||||

| Tax structure simpler | 0.660 | ||||||

| Biggest reform | 0.537 | ||||||

| Efficiency | 0.891 | ||||||

| Transparency | 0.857 | ||||||

| Cascading effect | 0.600 | ||||||

| Insolvent trader | 0.850 | ||||||

| Illegal refunds | 0.710 | ||||||

| Expand tax base | 0.854 | ||||||

| Rational rates | 0.767 | ||||||

| Model | χ2 | Df | CMIN/DF | CFI | NFI | RMSEA | p-Value |

|---|---|---|---|---|---|---|---|

| CFA | 121.683 | 44 | 2.766 | 0.982 | 0.973 | 0.057 | 0.000 |

| Factors | Regression Weights Estimate | S.E. | C.R. | p-Value | Standardized Regression Weights | Squared Multiple Correlations |

|---|---|---|---|---|---|---|

| Financial performance ← firm characteristics | 0.049 | 0.023 | 2.089 | *** | 0.039 | 0.945 |

| financial_performance ← tax_system | 0.050 | 0.016 | 3.165 | *** | 0.053 | |

| financial_performance ← DuPont Analysis | 0.900 | 0.032 | 27.754 | *** | 0.970 | |

| NATURE ← firm_characteristics | 1.000 | *** | 0.638 | 0.407 | ||

| SIZE ← firm_characteristics | 0.762 | 0.059 | 12.821 | *** | 0.786 | 0.618 |

| TURNOVER ← firm_characteristics | 1.263 | 0.099 | 12.723 | *** | 0.787 | 0.620 |

| Wrong_Invoice ← tax_system | 1.000 | 0.869 | 0.754 | |||

| Tax_Frauds ← tax_system | 1.022 | 0.035 | 29.413 | *** | 0.878 | 0.771 |

| Tax_Evasion ← tax_system | 1.126 | 0.032 | 35.365 | *** | 0.994 | 0.988 |

| Earnings ← DuPont Drivers | 1.000 | 0.927 | 0.860 | |||

| Assets to sales← DuPont Drivers | 1.115 | 0.022 | 51.210 | *** | 0.990 | 0.981 |

| ROE ← financial_performance | 1.000 | 0.830 | 0.690 | |||

| ROI ← financial_performance | 1.155 | 0.037 | 31.301 | *** | 0.964 | 0.930 |

| Independent Factors | ROE | ROI | ||||||

|---|---|---|---|---|---|---|---|---|

| Coeff. | t-Stats | Collinearity Stats. | Coeff. | t-Stats | Collinearity Stats. | |||

| Tolerance | VIF | Tolerance | VIF | |||||

| Firms’ characteristics | ||||||||

| Size | 0.100 | 2.710 *** | 0.613 | 1.630 | -- | -- | -- | -- |

| Turnover | 0.080 | 3.460 *** | 0.584 | 1.713 | -- | -- | -- | -- |

| Demographic Variables | ||||||||

| Age | -- | -- | -- | -- | -- | -- | -- | -- |

| Income | -- | -- | -- | -- | -- | -- | -- | -- |

| Change in tax system | ||||||||

| Tax Fraud | 0.083 | 4.379 ** | 0.903 | 1.107 | 0.073 | 2.801 *** | 0.956 | 1.046 |

| Tax evasion | -- | -- | -- | -- | -- | -- | -- | -- |

| Wrong Invoice | -- | -- | -- | -- | -- | -- | -- | -- |

| DuPont Analysis Drivers | ||||||||

| Earnings | 0.734 | 22.328 *** | 0.293 | 3.413 | 0.466 | 10.235 *** | 0.302 | 3.310 |

| Sales to assets | 0.103 | 2.897 *** | 0.289 | 3.464 | 0.160 | 3.308 *** | 0.310 | 3.229 |

| Asset Turnover | −0.087 | −3.267 *** | 0.725 | 1.380 | -- | -- | -- | -- |

| Constant | 0.215 | 0.068 * | -- | -- | 0.434 | 4.138 *** | -- | -- |

| R | 0.905 | 0.724 | ||||||

| R-square | 0.818 | 0.525 | ||||||

| Adjusted R-square | 0.816 | 0.522 | ||||||

| Durbin Watson Ratio | 1.098 | 1.798 | ||||||

| F-value | 404.948 | 199.359 | ||||||

| p-value | 0.000 *** | 0.000 *** | ||||||

| ROI | Earnings | Asset Turnover | Sales to Assets | Wrong Invoice | Tax Evasion | Tax Fraud | Size | Turnover | Age | Income | |

| ROI | 1.000 | 0.714 | −0.405 | 0.643 | 0.133 | 0.187 | 0.210 | 0.009 | 0.118 | 0.005 | 0.128 |

| EARNINGS | 0.714 | 1.000 | −0.493 | 0.829 | 0.140 | 0.167 | 0.192 | 0.047 | 0.088 | 0.030 | 0.137 |

| ASSET TURNOVER | −0.405 | −0.493 | 1.000 | −0.495 | −0.131 | −0.136 | −0.168 | −0.021 | −0.057 | 0.031 | −0.039 |

| SALES TOASSET | 0.643 | 0.829 | −0.495 | 1.000 | 0.056 | 0.089 | 0.112 | 0.128 | 0.181 | 0.103 | 0.172 |

| Wrong_Invoice | 0.133 | 0.140 | −0.131 | 0.056 | 1.000 | 0.864 | 0.762 | 0.107 | 0.162 | 0.146 | 0.058 |

| Tax_Evasion | 0.187 | 0.167 | −0.136 | 0.089 | 0.864 | 1.000 | 0.873 | 0.122 | 0.179 | 0.179 | 0.075 |

| Tax_Frauds | 0.210 | 0.192 | −0.168 | 0.112 | 0.762 | 0.873 | 1.000 | 0.121 | 0.203 | 0.125 | 0.089 |

| SIZE | 0.009 | 0.047 | −0.021 | 0.128 | 0.107 | 0.122 | 0.121 | 1.000 | 0.620 | 0.163 | 0.503 |

| TURNOVER | 0.118 | 0.088 | −0.057 | 0.181 | 0.162 | −0.179 | −0.203 | 0.620 | 1.000 | 0.154 | 0.499 |

| AGE | 0.005 | 0.030 | 0.031 | 0.103 | 0.146 | 0.179 | 0.125 | 0.163 | 0.154 | 1.000 | 0.205 |

| INCOME | 0.128 | 0.137 | −0.039 | 0.172 | 0.058 | 0.075 | 0.089 | 0.503 | 0.499 | 0.205 | 1.000 |

| ROE | Earnings | Asset Turnover | Sales to Assets | Wrong Invoice | Tax Evasion | Tax Frauds | Size | Turnover | Age | Income | |

| ROE | 1.000 | 0.894 | −0.510 | 0.778 | 0.180 | 0.205 | 0.244 | 0.028 | 0.115 | 0.041 | 0.139 |

| EARNINGS | 0.894 | 1.000 | −0.493 | 0.829 | 0.140 | 0.167 | 0.192 | 0.047 | 0.088 | 0.030 | 0.137 |

| ASSET_TURNOVER | −0.510 | −0.493 | 1.000 | −0.495 | −0.131 | −0.136 | −0.168 | −0.021 | −0.057 | 0.031 | −0.039 |

| SALES toASSET | 0.778 | 0.829 | −0.495 | 1.000 | 0.056 | 0.089 | 0.112 | 0.128 | 0.181 | 0.103 | 0.172 |

| Wrong_Invoice | 0.180 | 0.140 | −0.131 | 0.056 | 1.000 | 0.864 | 0.762 | −0.107 | −0.162 | −0.146 | −0.058 |

| Tax_Evasion | 0.205 | 0.167 | −0.136 | 0.089 | 0.864 | 1.000 | 0.873 | −0.122 | −0.179 | −0.179 | −0.075 |

| Tax_Frauds | 0.244 | 0.192 | −0.168 | 0.112 | 0.762 | 0.873 | 1.000 | −0.121 | −0.203 | −0.125 | −0.089 |

| SIZE | 0.028 | 0.047 | −0.021 | 0.128 | −0.107 | −0.122 | −0.121 | 1.000 | 0.620 | 0.163 | 0.503 |

| TURNOVER | 0.115 | 0.088 | −0.057 | 0.181 | −0.162 | −0.179 | −0.203 | 0.620 | 1.000 | 0.154 | 0.499 |

| AGE | 0.041 | 0.030 | 0.031 | 0.103 | −0.146 | −0.179 | −0.125 | 0.163 | 0.154 | 1.000 | 0.205 |

| INCOME | 0.139 | 0.137 | −0.039 | 0.172 | −0.058 | −0.075 | −0.089 | 0.503 | 0.499 | 0.205 | 1.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bhalla, N.; Kaur, I.; Sharma, R.K. Examining the Effect of Tax Reform Determinants, Firms’ Characteristics and Demographic Factors on the Financial Performance of Small and Micro Enterprises. Sustainability 2022, 14, 8270. https://doi.org/10.3390/su14148270

Bhalla N, Kaur I, Sharma RK. Examining the Effect of Tax Reform Determinants, Firms’ Characteristics and Demographic Factors on the Financial Performance of Small and Micro Enterprises. Sustainability. 2022; 14(14):8270. https://doi.org/10.3390/su14148270

Chicago/Turabian StyleBhalla, Neba, Inderjit Kaur, and Rakesh Kumar Sharma. 2022. "Examining the Effect of Tax Reform Determinants, Firms’ Characteristics and Demographic Factors on the Financial Performance of Small and Micro Enterprises" Sustainability 14, no. 14: 8270. https://doi.org/10.3390/su14148270

APA StyleBhalla, N., Kaur, I., & Sharma, R. K. (2022). Examining the Effect of Tax Reform Determinants, Firms’ Characteristics and Demographic Factors on the Financial Performance of Small and Micro Enterprises. Sustainability, 14(14), 8270. https://doi.org/10.3390/su14148270