Research on the Development and Influence on the Real Economy of Digital Finance: The Case of China

Abstract

:1. Introduction

2. Research Methods and Data Processing

2.1. Kernel Density Estimation

2.2. Panel Regression Models

2.3. Indicators Selection and Data Analysis

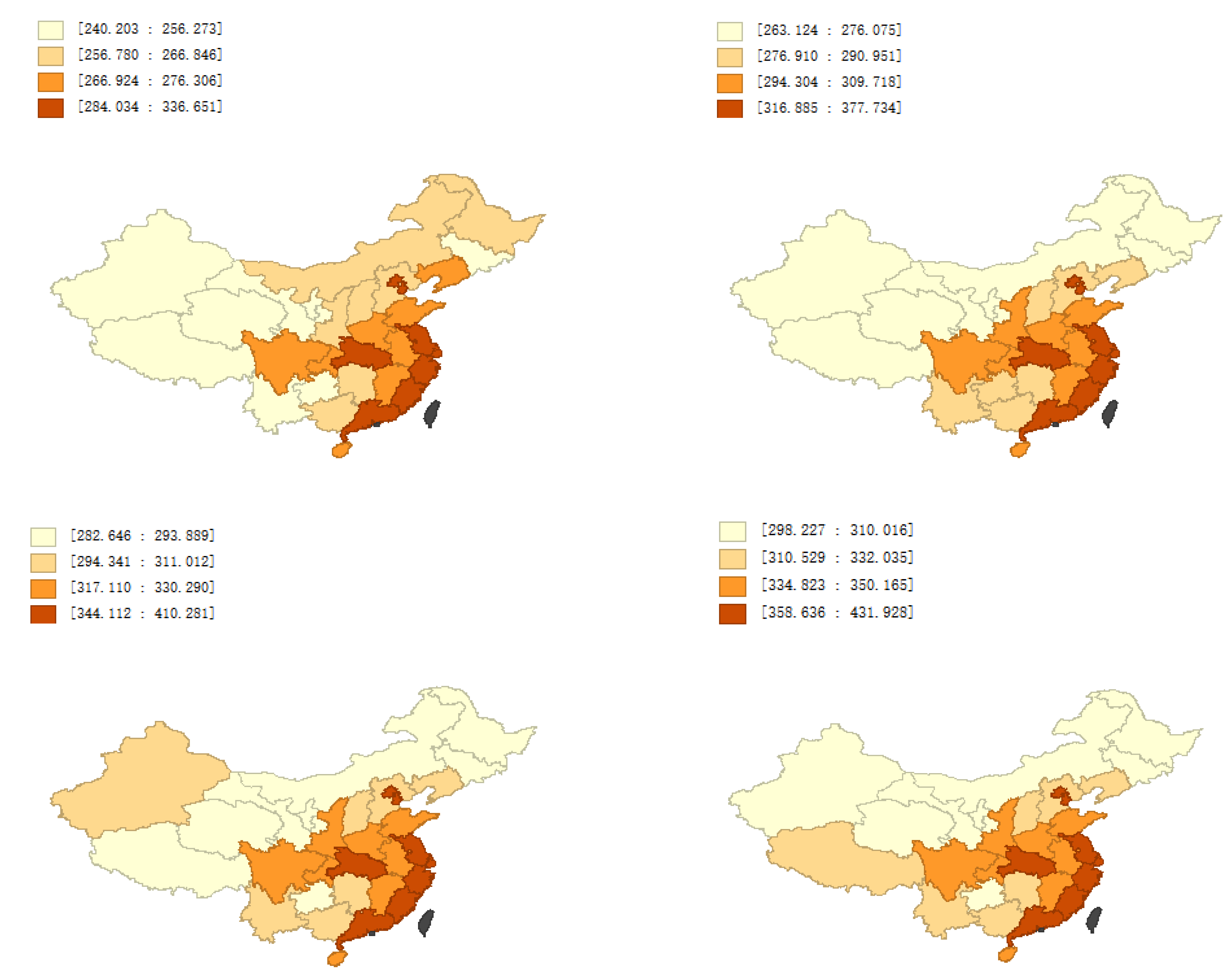

3. Analysis on the Development Characteristics and Distribution Dynamics of Digital Finance

3.1. Research on the Development Characteristics of Digital Finance

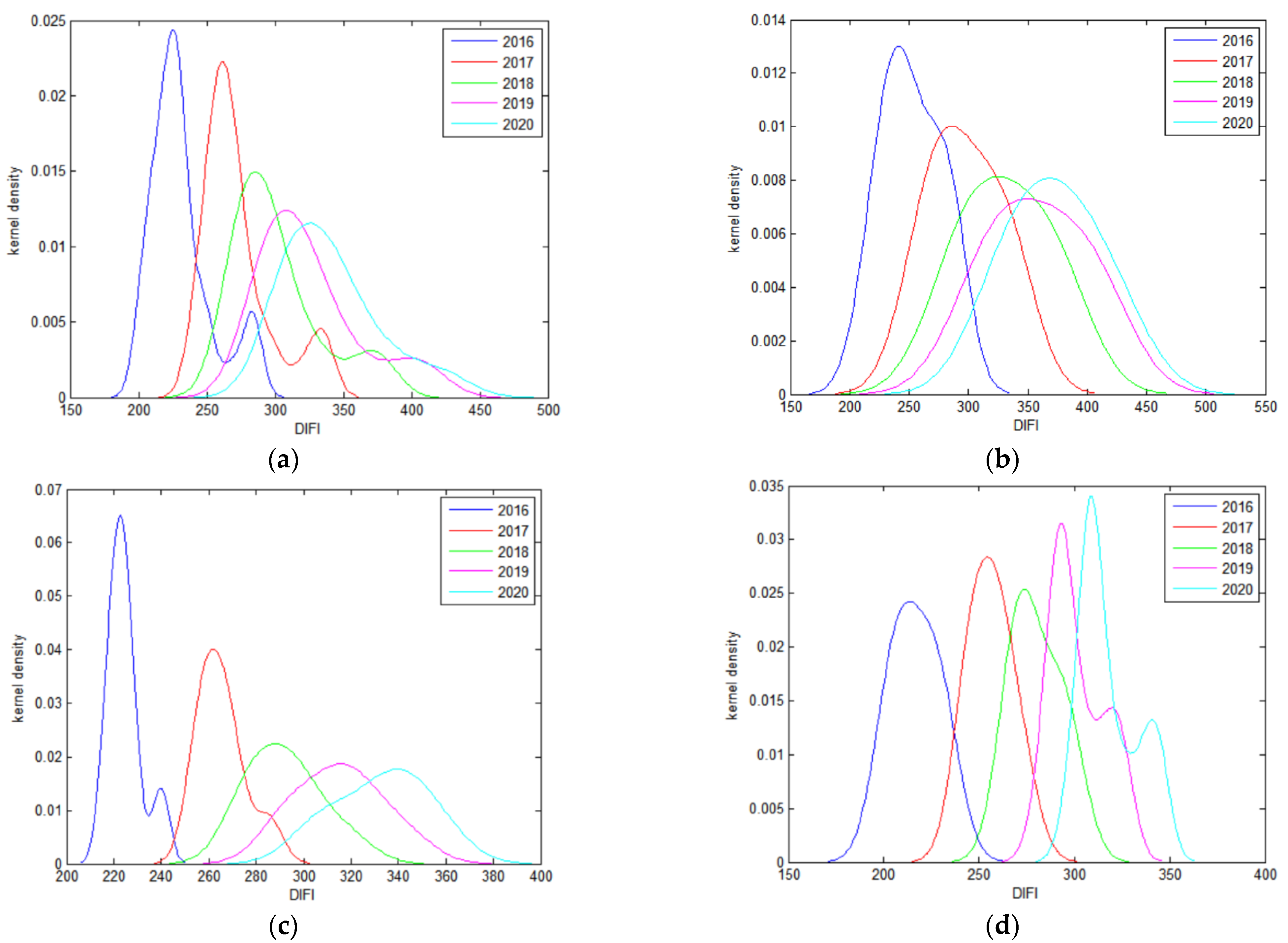

3.2. Distribution Dynamics of Digital Finance Development

3.2.1. The Development and Distribution of Digital Finance

3.2.2. Digital Finance Development and Distribution Dynamics in Three Regions

4. Analysis of the Effect of Digital Finance on the Real Economy

4.1. Panel Regression Analysis of Digital Finance on the Real Economy

4.1.1. The Development of Digital Finance and the Growth of the Real Economy

4.1.2. Secondary Indicators of Digital Finance and the Growth of the Real Economy

4.1.3. Regional Digital Finance Development and Real Economic Growth

4.2. Quantile Regression Analysis of Digital Finance and Real Economic Growth

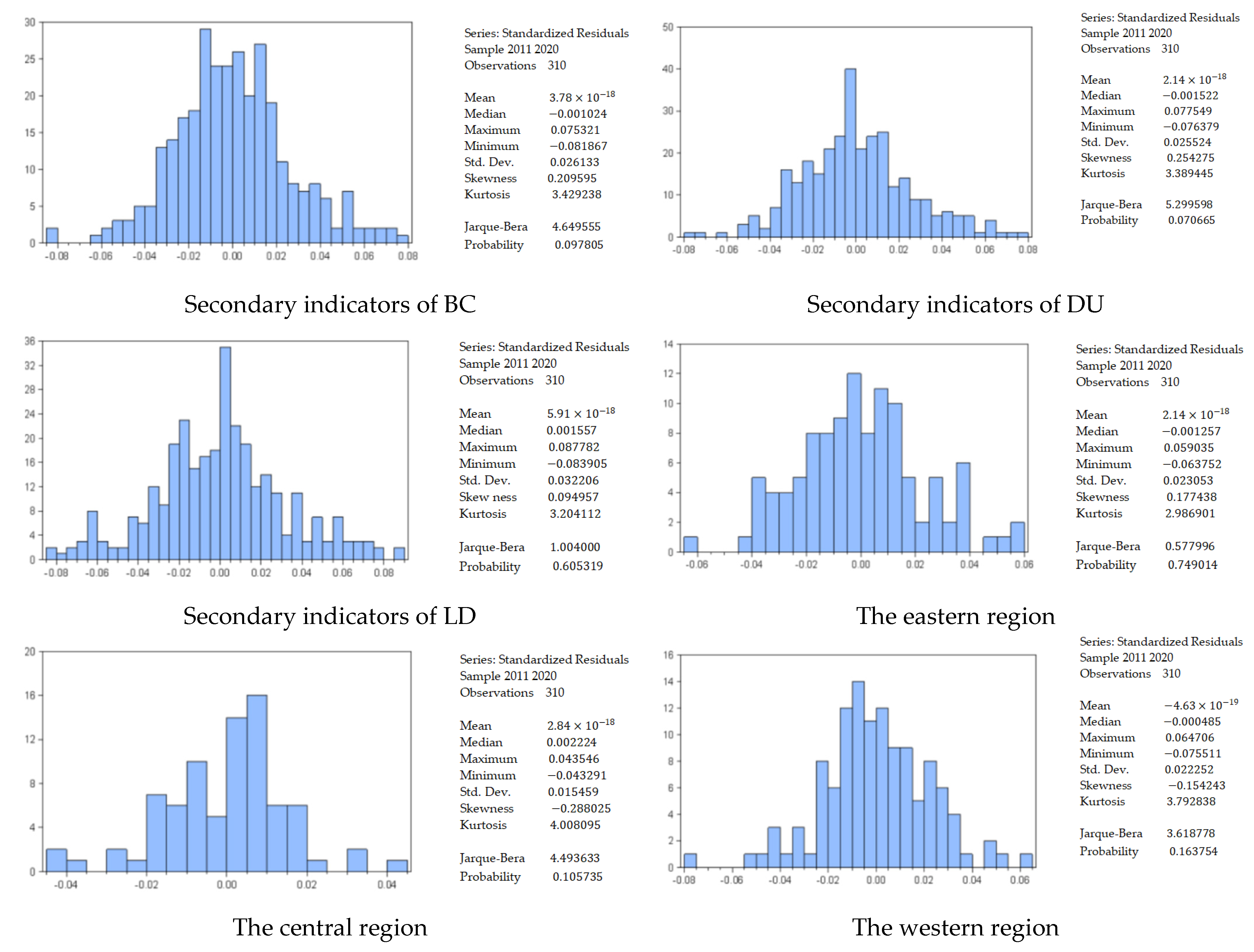

4.3. Model Test

4.3.1. Residual Normality Test

4.3.2. Robustness Test

- This paper takes the digital financial index as the core explanatory variable. The regression results are shown in column (I) in Table 9. The results show that digital finance still significantly promotes the growth of the real economy, and the parameter estimates and significance of explanatory variables have not changed significantly, indicating that the estimation results of this paper are robust.

- There are obvious regional differences in China’s economic development, which may act as an exogenous factor to affect the promotion of digital finance to the real economy. Therefore, this paper removes the top and bottom four provinces of the real economy in the past ten years—Guangdong, Jiangsu, Qinghai and Tibet—and returns the remaining panel data. The results are shown in column (II) in Table 9. It can be seen that after excluding samples from some regions, the parameter estimation and significance of the explanatory variables do not change significantly, which indicates that the estimated results in this paper are robust.

5. Conclusions and Suggestions

- (1)

- Promoting the simultaneous development of digital financial regions. The development of digital finance in China is uneven, and the status quo of the digital divide still needs to be resolved. Appropriate policy approaches should be developed according to regional characteristics. For the relatively underdeveloped regions, the government should focus on accelerating the construction of digital finance, improving financial resources, increasing the ownership rate of digital products, and supporting digital industries and digital talents so that both urban and rural areas can enjoy the financial services of digitalization. For the well-developed regions, the level of scientific and technological innovation should be further strengthened, digital information technology should be improved, digital finance should be developed in a healthy manner, and the efficiency of financial transaction services should be improved.

- (2)

- Improving the efficiency of digital finance in promoting the development of the real economy. Digital finance has promoted the growth of China’s real economy. It is necessary to continue to promote the healthy development of digital finance, improve the efficiency of promoting the growth of the real economy, and accelerate the flow of funds to the real economy. The government should coordinate the overall situation, formulate appropriate development strategies, and avoid the development of digital finance without a purpose. It must respect the laws of market development, ensure the simultaneous development of digital finance and the real economy, and promote the growth of the real economy with high efficiency. In addition, we can optimize the development of digital finance in many aspects, especially by strengthening the construction of digital finance, supporting the development of the real economy in a more comprehensive and convenient way, and guiding the development of the economy “from virtual to real”.

- (3)

- Advancing measures for the priority development of digital finance and improving the financial supervision system. The digital attributes and inclusiveness of digital finance have improved traditional finance, and the development of digital finance should be given priority. Digital finance is not limited by time and space, and is aimed at a wider group, which also creates new potential risks. Therefore, it is necessary to improve the financial supervision system, clarify the industry access threshold, and strictly control the financial credit system. Furthermore, the avoidance of potential risks in the field of digital finance should be strengthened, strict laws and regulations should be established, and the rights and interests of financial consumers in accordance with the law must be protected.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Arjunwadkar, P.Y. Fintech: The Technology Driving Disruption in the Financial Sevices Industry; Auerbach Publication: Boca Raton, FL, USA, 2018. [Google Scholar]

- Sarma, M. Financial inclusion and development: A cross country analysis. Indian Counc. Res. Int. Econ. Relat. 2008, 1, 1–28. [Google Scholar]

- Ambarkhane, D.; Singh, A.S.; Venkataramani, B. Measuring financial inclusion of Indian states. Int. J. Rural. Manag. 2016, 12, 72–100. [Google Scholar] [CrossRef]

- Ge, H.; Zhu, H. Research on provincial differences and influencing factors of digital inclusive finance in China. New Financ. 2018, 2, 47–53. [Google Scholar]

- Zhang, L.; Xing, Z. Research on distribution dynamics, regional differences and convergence of rural digital inclusive finance in China. J. Quant. Tech. Econ. 2021, 38, 23–42. [Google Scholar]

- Lu, L. Promoting SME finance in the context of the fintech revolution: A case study of the UK’s practice and regulation. Bank. Financ. Law Rev. 2018, 33, 317–343. [Google Scholar]

- Kodan, A.S.; Chhikara, K.S. A theoretical and quantitative analysis of financial inclusion and economic growth. Manag. Labour Stud. 2013, 38, 103–133. [Google Scholar]

- Sharma, D. Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. J. Financ. Econ. Policy 2016, 8, 13–36. [Google Scholar] [CrossRef]

- Kim, D.; Yu, J.; Hassan, M. Financial inclusion and economic growth in OIC countries. Res. Int. Bus. Financ. 2018, 43, 1–14. [Google Scholar] [CrossRef]

- Noppasit, C.; Paravee, M.; Somsak, C.; Songsak, S. Thailand in the era of digital economy: How does digital technology promote economic growth? Predict. Econom. Big Data 2018, 753, 350–362. [Google Scholar]

- Cheng, X.; Gong, Q. How does digital financial inclusion affect the development of real economy: Based on systematic GMM model and mediating effect test. J. Hunan Univ. 2020, 34, 59–67. [Google Scholar]

- Qian, H.; Tao, Y.; Cao, S.; Cao, Y. Theory and empirical research on the development and economic growth of China’s digital finance. Res. Quant. Econ. Tech. Econ. 2020, 37, 26–46. [Google Scholar]

- Zeng, M.; Reinartz, M. Beyond online search: The road to profitability. Calif. Manag. Rev. 2003, 45, 107–130. [Google Scholar] [CrossRef]

- Beck, T.; Demirgucu-Kunt, A.; Levine, R. Finance, inequality and the poor. J. Econ. Growth 2007, 12, 27–49. [Google Scholar] [CrossRef]

- Li, Y.; Ma, K. Research on the Path of Digital Inclusive Finance’s Influence on Industrial Structure Upgrade; Atlantis Press: Xiamen, China, 2021. [Google Scholar]

- Sun, Y.; Zhang, T.; Wang, X.; Li, D. The current situation, problems and prospects of China’s digital inclusive finance development. J. Quant. Tech. Econ. 2021, 38, 43–59. [Google Scholar]

- Wen, Y.; Liu, N. Research on the income increasing effect of rural inclusive finance development based on quantile regression: A case study of 40 counties in Guangxi province. Tech. Econ. 2021, 40, 94–100. [Google Scholar]

- Sarma, M.; Pais, J. Financial inclusion and development. J. Int. Dev. 2011, 23, 613–628. [Google Scholar] [CrossRef]

- He, J.; Wei, T.; Ni, C. How can digital finance alleviate the financing difficulties of SMEs? Wuhan Financ. 2021, 3, 29–36. [Google Scholar]

- Beck, T.; Pamuk, H.; Ramrattan, R.; Uras, B.R. Payment instruments, finance and development. J. Dev. Econ. 2018, 133, 162–186. [Google Scholar] [CrossRef]

- Zhang, L.; Wen, T. How the development of digital inclusive finance affects residents’ entrepreneurship. J. Zhongnan Univ. Econ. Law 2020, 4, 85–95. [Google Scholar]

- Zhang, L.; Ran, G.; Chen, Q. Regional financial strength, FDI spillover and real economic growth: A study based on panel threshold model. Econ. Sci. 2014, 6, 76–89. [Google Scholar]

- Li, Y.; Ren, H.; Zhu, D. Digital finance, equity pledge and enterprise innovation investment. Sci. Res. Manag. 2021, 42, 102–110. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Wang, M. The impact of digital inclusive finance on household consumption from the perspective of income stratification. Bus. Econ. Res. 2021, 7, 167–170. [Google Scholar]

| Variable | Sample Size | Mean | Std | Max | Min |

|---|---|---|---|---|---|

| 310 | 4.150 | 0.186 | 4.958 | 2.749 | |

| 310 | 2.265 | 0.086 | 2.635 | 1.210 | |

| BC | 310 | 2.197 | 0.134 | 2.599 | 0.292 |

| DU | 310 | 2.256 | 0.080 | 2.689 | 0.830 |

| LD | 310 | 2.393 | 0.092 | 2.665 | 0.880 |

| IS | 310 | 1.600 | 0.010 | 1.792 | 1.203 |

| FS | 310 | 1.430 | 0.059 | 2.306 | 1.078 |

| FI | 310 | 1.446 | 0.142 | 3.497 | 0.681 |

| UL | 310 | 1.752 | 0.010 | 1.952 | 1.358 |

| LI | 310 | 1.760 | 0.002 | 1.896 | 1.635 |

| Variable | IS | FS | FI | UL | LI | |

|---|---|---|---|---|---|---|

| 1.00 | ||||||

| IS | −0.40 | 1.00 | ||||

| FS | −0.10 | −0.21 | 1.00 | |||

| FI | 0.16 | −0.23 | −0.04 | 1.00 | ||

| UL | 0.48 | −0.27 | −0.32 | 0.17 | 1.00 | |

| LI | −0.02 | 0.27 | −0.01 | −0.06 | −0.30 | 1.00 |

| Variable | (I) | (II) | (III) | (IV) | (V) |

|---|---|---|---|---|---|

| GMM | Fixed-Effect | BC | DU | LD | |

| 0.776 *** (0.021) | |||||

| −0.002 (0.007) | 0.124 *** (0.015) | ||||

| CB | 0.073 *** (0.015) | ||||

| UD | 0.111 *** (0.022) | ||||

| DL | 0.097 *** (0.016) | ||||

| IS | −0.242 *** (0.026) | −0.206 (0.233) | −0.337 (0.242) | −0.252 (0.222) | −0.179 (0.216) |

| FS | −0.221 *** (0.04) | −0.308 * (0.148) | −0.291 (0.144) | −0.286 (0.143) | −0.328 * (0.155) |

| FI | 0.084 *** (0.007) | 0.061 * (0.024) | 0.054 * (0.025) | 0.049 * (0.023) | 0.068 ** (0.023) |

| UL | 0.061 (0.051) | 1.412 *** (0.223) | 1.557 *** (0.243) | 1.574 *** (0.206) | 1.688 *** (0.171) |

| LI | 0.456 *** (0.048) | 0.187 (0.178) | 0.248 (0.19) | 0.248 (0.186) | 0.174 (0.173) |

| Constant | 1.746 ** (0.608) | 1.697 * (0.68) | 1.445 * (0.605) | 1.31 * (0.567) | |

| The fixed effect | Yes | Yes | Yes | Yes | |

| AR(2) | 0.053 | ||||

| Sargan test | 0.305 | ||||

| 0.864 | 0.852 | 0.858 | 0.872 |

| Variable | (I) | (II) | (III) |

|---|---|---|---|

| Eastern Region | Central Region | Western Region | |

| 0.113 ** (0.035) | 0.069 ** (0.02) | 0.089 *** (0.016) | |

| IS | −0.804 * (0.319) | 0.235 (0.137) | 0.134 (0.251) |

| FS | −0.142 (0.268) | −0.535 *** (0.06) | −0.225 (0.192) |

| FI | 0.03 (0.033) | 0.056 (0.037) | 0.048 (0.025) |

| UL | 1.383 * (0.598) | 2.169 *** (0.216) | 1.799 *** (0.243) |

| LI | 0.322 (0.194) | −0.06 (0.096) | −0.192 (0.137) |

| Constant | 2.395 (1.646) | 0.586 (0.404) | 1.067 (0.867) |

| The fixed effect | Yes | Yes | Yes |

| 0.86 | 0.962 | 0.956 |

| 0.621 *** (0.119) | 0.5 *** (0.05) | 0.34 *** (0.053) | 0.355 *** (0.046) | 0.322 *** (0.012) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes |

| Observations | 310 | 310 | 310 | 310 | 310 |

| 0.494 * (0.211) | 0.756 *** (0.068) | 0.632 *** (0.103) | 0.524 *** (0.111) | 0.504 *** (0.088) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes |

| Observations | 110 | 110 | 110 | 110 | 110 |

| 0.5 *** (0.09) | 0.385 *** (0.063) | 0.327 *** (0.044) | 0.38 *** (0.055) | 0.287 *** (0.049) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes |

| Observations | 80 | 80 | 80 | 80 | 80 |

| 0.226 (0.153) | 0.151 (0.166) | 0.203 * (0.081) | 0.154 (0.08) | 0.174 * (0.087) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Individual fixation effect | Yes | Yes | Yes | Yes | Yes |

| Time fixed effect | Yes | Yes | Yes | Yes | Yes |

| Observations | 120 | 120 | 120 | 120 | 120 |

| (I) Substitution Variables | (II) Excluded Area Sample | |

|---|---|---|

| 0.092 *** (0.008) | 0.117 *** (0.021) | |

| Control variables | Yes | Yes |

| Individual fixation effect | Yes | Yes |

| Time fixed effect | Yes | Yes |

| Observations | 310 | 270 |

| 0.956 | 0.89 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Y.; Feng, Y. Research on the Development and Influence on the Real Economy of Digital Finance: The Case of China. Sustainability 2022, 14, 8227. https://doi.org/10.3390/su14148227

Zhao Y, Feng Y. Research on the Development and Influence on the Real Economy of Digital Finance: The Case of China. Sustainability. 2022; 14(14):8227. https://doi.org/10.3390/su14148227

Chicago/Turabian StyleZhao, Yuexu, and Yujing Feng. 2022. "Research on the Development and Influence on the Real Economy of Digital Finance: The Case of China" Sustainability 14, no. 14: 8227. https://doi.org/10.3390/su14148227

APA StyleZhao, Y., & Feng, Y. (2022). Research on the Development and Influence on the Real Economy of Digital Finance: The Case of China. Sustainability, 14(14), 8227. https://doi.org/10.3390/su14148227