Abstract

A Deviation from competitive neutrality is one of the main problems faced by Chinese state-owned enterprises. Based on the orientation of the classification reform of state-owned enterprises to all kinds of enterprises, we discuss the competitive neutrality of state-owned enterprises with special functions from the perspectives of enterprise policy burden and enterprise profits. The research herein shows that state-owned enterprises, as the main entities of policy burden, have undertaken social responsibilities such as helping the government to stabilize employment, which has caused problems such as creating redundant employees, reducing the efficiency of employees, and reducing the profits of enterprises. To make up for the loss of profits of enterprises that bear the policy burden, the government provides them with implicit guarantees, which makes it easier for them to obtain bank loans and other external factors, and the asset–liability ratio of enterprises increases, which comprises the problem concerning a deviation from competitive neutrality that the United States and other western countries have surmised. However, the empirical study found that the deviation from competitive neutrality in financing actually reduced the profits of enterprises, that is, the state-owned enterprises faced a certain competitive disadvantage. Based on the research conclusion herein, this paper puts forward some enlightening findings on state-owned enterprise reform.

1. Introduction

Competitive neutrality was first put forward by Australia, and after the development by OECD and the United States, it expanded from domestic regulation to international requirements [1,2,3,4]. Under the current background of the China–US competition, competitive neutrality is an important scenario variable of the reform and development of Chinese state-owned enterprises, which will have an external impact on state-owned enterprises [5] and is of great significant [6]. At present, there is no unified standard or definition of competitive neutrality [7], and it is mainly divided into three kinds of models: the OECD model, EU model, and US model. There are differences among them in the scope of their applications, implementation modes, specification strengths, etc. [8]. However, the common core idea of all kinds of competitive neutral models lies in the pursuit of fair competition among all the business entities in the market. For state-owned enterprises, competitive neutrality mainly means that they should follow the same market competition rules as private enterprises and not enjoy special advantages because of their special connection with the government [9]. This is the meaning of competitive neutrality that we will focus on.

In recent years, the increasing influence of China’s state-owned enterprises on the world economy has aroused the concern of western countries such as the United States and some European countries [10,11,12,13]. In the future, Chinese state-owned enterprises will face more problems concerning the violation of the principle of competitive neutrality, and competitive neutrality will become more and more important for China. Firstly, there are more and more foreign criticisms of deviation from neutral competition in China. For example, in 2018, the New York meeting of trade ministers of the United States, Japan, and the European Union issued a statement on industrial subsidies and state-owned enterprises. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) set up the clause of “state-owned enterprises and designated monopoly” to impose more binding rules on state-owned enterprises. In the future, the competitive neutrality of state-owned enterprises may be promoted globally by developed countries as one of the core issues of future trade rules. Chinese state-owned enterprises, especially state-owned enterprises with special functions, as the main entities for cooperation with government policies and measures and undertakers of policy burdens, will face more neutral competition regulations in the future, which will affect the sustainable development of state-owned enterprises. Secondly, the competitive neutrality principle is in line with the direction of the new round of state-owned enterprise classification reform in China [14]. In 2015, the Chinese government issued the ‘Guiding Opinions on Defining and Classifying the Functions of State-owned Enterprises’ to start the classification reform of state-owned enterprises. This document divided state-owned enterprises into two categories: commercial enterprises and public welfare enterprises. Public welfare state-owned enterprises aim at safeguarding people’s livelihood, serving society, and providing public goods and services. Commercial state-owned enterprises are divided into two categories: state-owned enterprises whose main businesses are fully competitive, and state-owned enterprises whose main businesses are in important industries and key areas related to national security and the lifeline of the national economy, and mainly undertake major special tasks. Among them, the latter are also called state-owned enterprises with special functions. The classification reform of Chinese state-owned enterprises requires that different types of enterprises should be given different reform paths, development ideas, supervision modes, responsibility requirements, and assessment standards based on classification, which coincides with the basic requirements and generating conditions of the principle of competitive neutrality [5]. The classification reform of state-owned enterprises is the basis and prerequisite for China to promote the principle of neutral competition [7,13,15,16]. However, after the classification reform, the state-owned enterprises with special functions have both commercial and public welfare goals, and the public welfare responsibility depends on the main commercial business of the enterprise, so it is difficult to completely separate the two. In the future, the state-owned enterprises with special functions will be the state-owned enterprises that face more challenges from competitive neutrality, and this is also one of the important problems to be solved in the classification reform of Chinese state-owned enterprises.

Based on this, in combination with the orientation of the classification reform of state-owned enterprises to all kinds of state-owned enterprises, we choose the state-owned enterprises with special functions that will face more competitive neutral challenges in the future as the samples, and study their policy burden, their deviation from competitive neutrality in financing, and their profits. The purpose of this paper is to study the competitive neutrality of state-owned enterprises comprehensively and dialectically in combination with the characteristics and economic development needs of developing countries such as China, and to provide references and suggestions for the future reform of state-owned enterprises in China according to the requirements of the competitive neutrality principle.

The limitations and future study directions of this paper include the following aspects: Firstly, the policy burden studied in this paper is mainly the general policy burden, that is the inefficiency of employees due to redundant employees, without considering the special policy burden borne by different industries. For example, the state-owned enterprises in the Chinese energy industry may bear the policy burden of ensuring national energy security. We can study SOEs in different industries, and further analyze their unique responsibilities according to the characteristics of different industries in the future. Secondly, in terms of the fact that Chinese financial market is still dominated by indirect financing such as bank loans, we analyze the deviation from competitive neutrality in bank loans of SOEs with special functions. In the future, we can analyze the deviation of this kind of SOE from competitive neutrality in other aspects.

2. Literature Review

The reform of Chinese state-owned enterprises has always been a hot topic. Scholars have formed different views such as “expanding SOEs and reducing private enterprises” based on Keynesianism and “expanding private enterprises and reducing SOEs” based on neoclassical economics [17]. The classified reform policy of state-owned enterprises helps to resolve the above sharp differences [18]. Early scholars focused on the classification of enterprises. Luo Xinyu [19] discussed the classification standards of state-owned enterprises. In 2015, the government’s document ‘Guiding Opinions on Defining and Classifying the Functions of State-owned Enterprises’ was published. After the classified reform policy of state-owned enterprises, the focus of scholars has shifted to the study of this policy’s effects [20,21].

The document concerning the classified reform of state-owned enterprises mandates the classified management of state-owned enterprises and the elimination of the policy functions of commercial state-owned enterprises to solve the problem of their deviation from competitive neutrality. Some scholars have studied the effect of the classified reform of state-owned enterprises with these kinds of state-owned enterprises as research samples, but scholars generally ignore the state-owned enterprises with special functions. Since state-owned enterprises with special functions both need to obtain profits and undertake the policy burden, they are special in the classification reform of state-owned enterprises. Due to the important position of state-owned enterprises with special functions in the national economy, the government still needs to maintain the controlling position of enterprises within the context of the classification reform, so such enterprises may still face more doubts about deviating from the competitive neutrality after the reform, which is one of the important problems to be solved in the process of deepening the reform of state-owned enterprises in China in the future.

Many countries face a problem wherein state-owned enterprises gain solely competitive advantages through a monopoly position, government subsidies, etc., and deviate from competitive neutrality. However, to deal with this problem, Australia, the European Union, and other developed countries and regions have established a competitive neutrality framework to identify and solve the potential solely competitive advantages of state-owned enterprises [22], and the problems of state-owned enterprises deviating from competitive neutrality and distorting the market have been alleviated. However, in developing countries, state-owned enterprises are an important force promoting economic growth and maintaining social stability, and bear part of the policy burden. The government provides them with preferential treatment to make up for the losses caused by the policy burden, forming an important position for state-owned enterprises in the national economy. At present, developing countries are the main entities facing the challenge of competition neutrality. Gaur, Seema [23] studied the competitive neutrality in India; Nawawi et al. [24] studied the management and competitive neutrality of state-owned enterprises in Malaysia; Alice, Pham [25] and Tang Van et al. [26] studied the state-owned enterprises and competitive neutrality in Vietnam; and Svetlicini [27] studied competitive neutrality in the Association of Southeast Asian Nations. Developing countries are generally faced with the challenge of competitive neutrality. Due to the relatively backward economic development of Vietnam and other countries, the deviation from competitive neutrality of their state-owned enterprises has little impact on the international market. The state-owned enterprises in Vietnam and other countries have also been exempted from relevant provisions in the CPTPP. However, with the rapid growth of the Chinese economy and the extensive participation of Chinese state-owned enterprises in the international market, it is of great significance for all countries in the world that Chinese state-owned enterprises follow the principle of competitive neutrality [28]. Further, the strategic competition between China and the United States makes the principle of competitive neutrality an urgent problem to be resolved within Chinese current reform [29], and promoting the implementation of competitive neutrality aids the course of Chinese economic development towards that end [30]. Many scholars at home and abroad choose the Chinese state-owned enterprises as their research samples to study competitive neutrality.

Combined with the requirements of the principle of competitive neutrality, some scholars focus on the discussion and analysis of various models of competitive neutrality [8], the connotation of competitive neutrality [31], the definition standard of competitive neutrality [32], the requirements and restrictions of competitive neutrality on state-owned enterprises, etc. [32,33]. Taking Chinese state-owned enterprises as samples, some scholars have studied whether state-owned enterprises deviate from competitive neutrality and form a solely competitive advantage. Mariko [34] identified the competitive neutrality of three Chinese electronic consumer industries. Mariko [35] believed that Chinese governments’ subsidies to state-owned enterprises in the steel industry distorted the competitive neutrality so that enterprises could gain price reductions and distort market competition. Garcia et al. [36] measured whether Chinese state-owned enterprises deviated from competitive neutrality from the perspective of debt and taxation, and they found that China completely lacks a competitive neutral environment.

Scholars’ research has focused on the role of neutral competition in the solely competitive advantage of state-owned enterprises but has paid less attention to the competitive disadvantages of state-owned enterprises. The OECD’s competitive neutrality states that any entity in the market is not restricted by inappropriate competitive advantages (disadvantages) and pays attention to the competitive disadvantages of state-owned enterprises. In addition, many scholars call for “ownership neutrality” and grasp the principle of “non-discrimination” to dialectically treat the competitive neutrality principle put forward by western countries such as the United States and those within Europe [37,38].

Based on this, we choose the state-owned enterprises with special functions as the main research sample, focus on the deviation of this kind of enterprise from competitive neutrality in financing, and study the reasons for the deviation from competitive neutrality in financing and its respective influence on enterprise profits. We further analyze its internal mechanism. A theoretical analysis and empirical research show that state-owned enterprises with special functions are the main entities that bear the policy burden, resulting in the loss of corporate profits. As one of the ways to make up for the loss of a policy burden, the financing conditions of special functional state-owned enterprises deviate from the principle of competitive neutrality, which in fact fails to make up for the loss of profits. State-owned enterprises with special functions may face competitive disadvantages under the constraint of the competitive neutrality principle put forward by western countries such as the United States and those within Europe. Therefore, we should provide the world with the Chinese model of the competitive neutrality principle in combination with the characteristics of state-owned enterprises with special functions in China.

The contributions of this paper are as follows: First, the state-owned enterprises with special functions are selected as the research sample, which makes up for the deficiency of the existing literature on state-owned enterprises; secondly, we not only pay attention to the competitive advantage formed by the special government–enterprise relationship of state-owned enterprises, but also pay attention to the competitive disadvantage caused by the policy burden of enterprises under the special government–enterprise relationship, which enriches the research scope of competitive neutrality; thirdly, we conduct an in-depth analysis of the deviation from competitive neutrality in the financing of state-owned enterprises with special functions, and find that it may not contribute to the profit advantage of enterprises, which is helpful for a more comprehensive understanding of the relationship between state-owned enterprises and competitive neutrality in China.

The rest of this paper is arranged as follows: the third part constructs the theoretical framework of competitive neutrality of state-owned enterprises with special functions and puts forward the research hypothesis, the fourth part comprises a data description and measurement model setting, the fifth part comprises the empirical research results and a robustness test, and the final part consists of the conclusions and suggestions.

3. Theoretical Analysis and Research Hypothesis

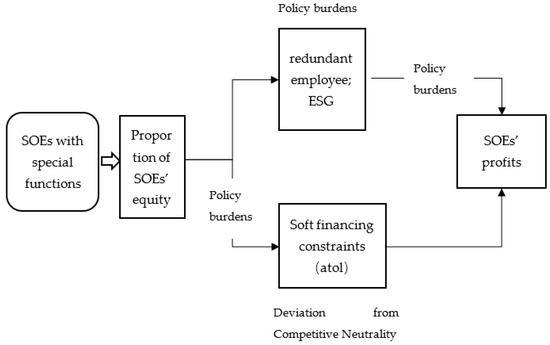

We take state-owned enterprises with special functions as the research samples, and study the enterprises’ policy burden, deviation from competitive neutrality, and profits. The research framework is as follows: First, as the main entities that cooperate with government policies and undertake policy burdens, we analyze this from the perspectives of redundant employees cooperating with government policies to stabilize employment and undertake social responsibilities and further study the impact of enterprises’ policy burdens on enterprises’ profits. Secondly, enterprises undertake the policy burden, which forms a special relationship between the government and enterprises. For example, the government may provide implicit guarantees for state-owned enterprises, making it easier for enterprises to obtain external financing such as bank loans. This will form a soft constraint on the enterprise budget, which means the enterprises deviate from competitive neutrality in financing, and this forms a higher asset–liability ratio for enterprises. However, the deviation from competitive neutrality in financing has not solely brought advantages to enterprises but has reduced their profits. The research framework of this paper is shown in the Figure 1.

Figure 1.

The research framework.

3.1. Policy Burdens and Profits of SOEs with Special Functions

The document “Guiding Opinions on Defining and Classifying the Functions of State-owned Enterprises” clearly states that state-owned enterprises with special functions should play a greater role in serving national macro policy, ensuring national security and national economic growth, and completing special tasks, that is, the orientation of state-owned enterprises with special functions in the classification reform requires them to undertake major national special tasks or cooperate with government policies in the course of their business activities, and occupy an important position in the national economy. The orientation of state-owned enterprises with special functions in the classification reform requires them to bear the policy burden.

From the perspective of the operation of state-owned enterprises with special functions, first, state-owned enterprises with special functions are in important industries and key fields related to national security and the lifeline of the national economy, and their production and operation are closely related to the national development strategy. On the one hand, enterprises’ investment and management decisions serve the national development strategy, for example, enterprises undertake or participate in major national strategies, and invest in key industries that are given priority by the government to play an industrial guiding role and promote the development of key industries [39,40]. On the other hand, in order to ensure that state-owned enterprises with special functions play a role in important industries and key fields, after the classification reform, the state-owned capital still holds a position in such enterprises. As the largest investor of enterprises, the government has a great influence on enterprises’ decision-making, which means that enterprises will have some public welfare goals [40,41,42,43,44,45].

Secondly, the state-owned enterprises with special functions include those in the energy, mineral, and other industries, with relatively large assets. The investment and operation behavior of these enterprises will have a significant impact on the national economy, which is an important supporting force of the Chinese economy. When China is faced with external shocks such as the international financial crisis, these enterprises cooperate with the government’s fiscal and monetary policies and play a role in stabilizing the macro-economy through counter-cyclical investment [46]. For example, in 2009, the fixed assets investment of state-owned enterprises in China increased by 20,987.61 billion yuan, while that of private enterprises increased by only 11,327.59 billion yuan. After the financial crisis, the investment of state-owned enterprises and private enterprises markedly diverged, and the counter-cyclical investment of state-owned enterprises played an important role in China’s economic stability.

Thirdly, undertaking people’s livelihood security is also one of the policy burdens undertaken by state-owned enterprises with special functions. Due to the social responsibility of maintaining employment and social stability, enterprises face more restrictions than non-state-owned enterprises in employee management such as dismissing employees and streamlining staff [47,48]. The problems of “being able to get in but not out” and “being able to get up but not down” in state-owned enterprises have not been completely solved, resulting in the problem of redundant staff in state-owned enterprises. When the COVID-19 epidemic in 2020 put downward pressure on the global economy, state-owned enterprises actively responded to the government’s call to increase the number of employees and played a stable role in employment. According to the abovementioned analysis of the reality of state-owned enterprises with special functions and their positioning in the classification reform of state-owned enterprises, Hypothesis 1 is put forward.

Hypothesis 1:

State-owned enterprises with special functions are the main entities that bear the policy burden.

State-owned enterprises with special functions are in key industries and bear the policy burden, but according to the classification and positioning of enterprises, they are essentially commercial state-owned enterprises, and obtaining economic benefits is also an important goal of enterprises. However, the decision of enterprises to bear the policy burden does not match their commercial activities, which will deviate from the goal of obtaining the maximum profit from commercial activities. Among all kinds of policy burdens, helping to alleviate the government’s employment pressure is a long-term problem faced by state-owned enterprises with special functions, which is also one of the reasons why many scholars believe that Chinese state-owned enterprises are inefficient [49,50]. After the classification reform, state-owned enterprises with special functions still must bear the policy burden of cooperating with the government to stabilize employment while participating in commercial activities. It is more difficult for enterprises to dismiss employees whose skills do not match their requirements, and the problem of redundant staff is difficult to solve in a short time, which reduces the efficiency of employees. In the business activities of enterprises, employee efficiency is an important factor affecting profits, and employee inefficiency will reduce the profits of enterprises [51]. Therefore, the redundant staff problem caused by state-owned enterprises cooperating with the government’s policy will reduce the efficiency of employees, and then lead to the loss of corporate profits. According to the above analysis, Hypothesis 2 is put forward.

Hypothesis 2:

The redundancy caused by the state-owned enterprises’ policy burden causes the loss of profits, and the efficiency of employees is an important channel for influencing the profits of enterprises.

3.2. Financing Deviation from Competitive Neutrality and Profit of SOEs with Special Functions

The policy burden reduces the efficiency of state-owned enterprises with special functions and causes the loss of profits. However, the important position of state-owned enterprises with special functions in the national economy and their connection with the government form a special relationship between enterprises and the government, which reduces the difficulty of financing. Factor acquisition, market access, operation, and so on are all important components of the competitive neutral framework, among which loan neutrality is one of the important principles towards achieving competitive neutrality in terms of factor acquisition [8]. Therefore, some scholars and non-state-owned enterprises think that these enterprises with lower financing difficulty have gained solely competitive advantages and deviated from the requirements of the competitive neutral principle.

Firstly, the government’s compensation for the losses caused by the policy burden of enterprises has formed a close relationship between the government and enterprises. State-owned enterprises with special functions belong to commercial state-owned enterprises. From a commercial point of view, the investment and management goal of enterprises is to maximize profits. However, enterprises bear the policy burden, which makes their investment and business activities deviate from the principle of profit maximization, resulting in the loss of corporate profits [49,50,52,53]. To reduce the negative impact of policy burdens on enterprises, the government provides compensation for enterprises in various ways, among which the implicit guarantee provided by the government is one of the main ways to reduce the financing difficulty of enterprises. However, the problem of the “soft budget constraint” of enterprises is thus formed, and some scholars believe that state-owned enterprises have gained solely competitive advantages. Secondly, the ownership structure of state-owned enterprises with special functions is the root of the special relationship between government and enterprises. The document “Guiding Opinions on Defining and Classifying the Functions of State-owned Enterprises” requires that in the ownership structure of state-owned enterprises with special functions, state-owned capital should maintain its controlling position. The government, as the owner of the enterprise, should share some enterprises’ risks, forming a special relationship between the government and enterprises. Thirdly, state-owned enterprises with special functions are in important industries related to national security and national economy. To maintain the ability of enterprises to play an important role in serving national macro-policy, thus ensuring national security and national economic operation, and completing special tasks, the government needs to keep enterprises running continuously. Therefore, when such enterprises are faced with difficulties, it is more likely that the government will provide them with assistance and share risks, thus forming a special relationship between enterprises and the government.

In the financial market, the special government–enterprise relationship means that the security of such enterprises is higher. When enterprises face the risk of default, the government, as the owner of enterprises, may bear certain responsibility for the repayment of corporate debts. Therefore, the risk of banks and other financial institutions providing external financing for enterprises is small. Financial institutions prefer to provide financing services for such enterprises, and even such enterprises can obtain external financing at a lower cost [54,55], which reduces the difficulty of the enterprises’ financing and provides a source of funds for enterprises to increase their liabilities and asset–liability ratio [56,57,58]. In addition, the “soft constraint of financing” may lead to a “moral hazard” of state-owned enterprises with special functions, blindly expanding and increasing liabilities, and increasing the asset–liability ratio of enterprises [59,60]. Therefore, the deviation of state-owned enterprises with special functions from competitive neutrality in financing will result in higher asset–liability ratios, which can be used as a measure of the deviation of enterprises from competitive neutrality in financing. According to the analysis of the relationship among state-owned enterprises with special functions, the government and the financial market, the higher the proportion of state-owned shares, the closer the relationship between enterprises and the government and the easier it is for enterprises to obtain financing advantages, thereby deviating from competitive neutrality and forming a higher asset–liability ratio. According to the above analysis, Hypothesis 3 is put forward.

Hypothesis 3:

The proportion of state-owned shares in state-owned enterprises with special functions is positively correlated with the deviation degree of competitive neutrality, and the policy burden is an important reason for the deviation from competitive neutrality in financing.

Compensating for the efficiency and profit loss of state-owned enterprises with special functions by the government provides sufficient financial support for enterprises. However, compared with private enterprises, state-owned enterprises experience lower efficiency and lower profitability in business operation and investment [61]. Due to the lack of pertinence of the government’s compensation for enterprises’ policy burden losses, the losses of enterprises’ commercial activities may also be compensated. Further, the ownership structure of state-owned enterprises with special functions and their important position in the national economy greatly increase the possibility of implicit guarantee and assistance provided by the government and reduce the default risk caused by the substantial increase in the liabilities of enterprises. Therefore, the financing advantages enjoyed by state-owned enterprises with special functions reduce the prudence of enterprise management and investment decisions, reducing the motivation of enterprises to improve efficiency and profitability, which has a negative impact on enterprise performance. The deviation of state-owned enterprises with special functions from competitive neutrality in financing did not improve their profitability and competitiveness but made their profitability lower than that of non-state-owned enterprises, that is, it did not constitute a solely competitive advantage for state-owned enterprises. Based on this, hypothesis 4 is put forward.

Hypothesis 4:

Deviating from the neutrality competition in financing reduces the profits of enterprises.

4. Empirical Model and Variable Specification

4.1. Data Sources and Data Processing

Combined with the relevant policies and the classification of enterprises in the research of Chen Xia et al. [62], Wei Minghai et al. [63], and Lv Chunyu [20], according to the industry names within the CSRC, this paper identifies the state-owned enterprises in mining, electricity, heat, gas and water production and supply, transportation, warehousing and postal services, scientific research and technical services, health and social work, information transmission, and software and information technology services as state-owned enterprises with special functions. This paper selects the state-owned enterprises with special functions listed before 2010. The sample range is from 2010 to 2020, and the data source is the wind database. The choice of listed companies is mainly due to the detailed and complete financial information published by them. To ensure data quality, this paper eliminated enterprises marked with ‘st’, enterprises with missing data, and enterprises with zero operating income, which finally left 333 state-owned enterprises as research samples after screening.

4.2. Variable Description

4.2.1. Dependent Variables

According to the main problems studied in this paper, the dependent variables include the asset–liability ratio (atol) and profit of enterprises (lnpro). A higher asset–liability ratio (atol) indicates that enterprises have a great debt burden. Fang Junxiong [64], Qian and Roland [60], Sheng Mingquan et al. [65], Ji Yang et al. [66], and Zeng Gang [67] all found that under the soft budget constraint, state-owned enterprises will expand the debt scale and form a higher asset–liability ratio. Therefore, this variable is used to measure the soft budget constraint in this paper, which is the degree of the deviation of state-owned enterprises from competitive neutrality. The profit of enterprises is used to study whether the deviation of state-owned enterprises from competitive neutrality can increase enterprise profits and be used to gain a competitive profit advantage.

4.2.2. Independent Variables

The main independent variables of this paper are the proportion of state-owned shares, which is used to study the relationship between state-owned shares of enterprises, the policy burden borne by enterprises, and the asset–liability ratio caused by the deviation of financing from competitive neutrality in special functional industries. When deeply analyzing the influence of policy burden on corporate profits and the reasons why enterprises deviate from competitive neutrality, this paper uses employee efficiency (prom_sta, rem_sta), corporate social responsibility (esg), and redundant employees (sta_re) as intermediary variables. In addition, the assets, liabilities, and profits of enterprises are also affected by the characteristics of enterprises. Therefore, this paper refers to the research of Lv Chunyu [20], Hao Yang, Gong Liutang [68], and Yi Yang [51], and adds variables such as enterprise scale, enterprise ownership concentration, the growth and solvency of enterprises, the proportion of independent directors, the proportion of main business, and the proportion of fixed assets as control variables. The introduction of each variable is shown in Table 1 and Table 2, which report the descriptive statistical results of each variable in the empirical study.

Table 1.

Variable Descriptions.

Table 2.

Descriptive statistics of variables.

4.3. Empirical Research Models

Firstly, this paper studies the relationship between the proportion of state-owned shares of enterprises in special functional industries and the policy burden of enterprises. We adopt the panel fixed effect model as shown in formula (1). In Formula (1), means the policy burden, which is referred to as corporates’ social responsibility (esg) and redundant employees (sta_re) in this paper. This paper mainly focuses on the symbol of coefficient , and the expected result is > 0, which indicates that the state-owned shares of enterprises cause enterprises to bear more policy burdens.

Secondly, this paper further studies the relationship between redundant employees and enterprise profits, as shown in formula (2). This paper mainly focuses on the symbol of coefficient , and the expected result is < 0, which indicates that redundant employees in enterprises have caused the loss of profits. Based on this, this paper uses the intermediary effect test (Equations (3)–(5)) to analyze the ways that redundant employees affect the profits of enterprises. Among them, represents the intermediary variables, which refer to employee efficiency indicators such as profit per employee (prom_sta) and operating income per employee (rem_sta). The research mainly focuses on the coefficients , , , and b. If , and b are all significantly different from 0, there is a significant intermediary effect, and if is significantly different from 0, there is a complete intermediary effect; otherwise, there is an incomplete intermediary effect. If at least one of these coefficients is not significantly different from 0, a further test, the Sobel test, is required.

Then, this paper analyzes the relationship between the proportion of state-owned shares of enterprises in special functional industries and the asset–liability ratio of enterprises. As shown in formula (6), it mainly focuses on the symbol of coefficient , and the expected result is > 0, which indicates that state-owned shares increase the asset–liability ratio of enterprises. Based on this, this paper uses the intermediary effect model similar to Formulas (3)–(5) to analyze the reasons why state-owned shares increase the debt burden of enterprises. Finally, in view of the fact that western countries such as the United States and countries within Europe think that the deviation of state-owned enterprises in China from competitive neutrality gives them additional competitive advantages, this paper further discusses the influence of deviation of financing from competitive neutrality on corporate profits, as shown in formula (7).

5. Empirical Research Results

5.1. The Policy Burden and Profit of SOEs with Special Functions

According to Formulas (1) and (2), Table 3 shows the relationship between Chinese state-owned shares in state-owned enterprises with special functions, the policy burden of enterprises, and the profits of enterprises. The results in column (1) of the table show that the higher the state-owned shares of enterprises with special functions, the more social responsibilities the enterprises undertake. The results in column (2) show that the higher the state-owned shares of enterprises with special functions, the more redundant employees, which means the greater the policy burden the enterprises must bear to maintain employment stability. The results in columns (1) and (2) verify Hypothesis 1.

Table 3.

Policy burdens and profits of SOEs with special functions.

The results in columns (3) and (4) show that the redundancy reduces the efficiency of employees. The results in columns (5) and (6) show that there is a positive relationship between employee efficiency and corporate profits, which means that the decrease of employee efficiency will have a negative impact on corporate profits. Based on the above results, Table 4 further show the results of the intermediary effect test, which studies the mediating effect of employees’ efficiency in the relationship between the redundancy and the enterprises’ profits. The results in columns (1) and (2) show that the heavier the policy burden of state-owned enterprises with special functions to maintain employment stability, the more redundant employees, and the lower the efficiency of employees, which in turn reduces the profits of enterprises, and the intermediary effect of employee efficiency is significant. The results in columns (3) and (4) in Table 3 and Table 4 verify Hypothesis 2.

Table 4.

Mediating effect test.

5.2. Financing Deviation from Competitive Neutrality and Profit of SOEs with Special Functions

Part A of Table 5 shows the relationship between Chinese state-owned shares in state-owned enterprises with special functions and the deviation from competitive neutrality in financing. Column (1) is the unitary regression of the asset–liability ratio and state-owned shares, column (2) includes control variables, and column (3) includes time control variables based on column (2). The results of the three columns all show that there is a positive relationship between state-owned shares and the asset–liability ratio, that is, state-owned shares account for a relatively high asset–liability ratio of SOEs. In addition, in columns (2) and (3), the coefficient of enterprises’ solvency is negative, which means that enterprises with higher solvency have better liquidity, and this will help to reduce the asset–liability ratio of enterprises. However, the coefficient of the cross term between the proportion of state-owned shares and solvency is positive, indicating that the proportion of state-owned shares has a significant moderating effect on the relationship between the solvency and asset–liability ratio, and the solvency of enterprises with higher state-owned shares has a lesser effect on the reduction of asset–liability ratios. The empirical results show that the greater the proportion of state-owned shares in state-owned enterprises with special functions, the more likely the enterprises are to deviate from competitive neutrality and form a higher asset–liability ratio.

Table 5.

Deviation from competitive neutrality in financing.

Based on the above results, this paper further studies the reasons why state-owned enterprises with special functions deviate from competitive neutrality in financing by using the intermediary effect model, and the results are shown in Table 6. The results in column (1) of the table show that the intermediary effect of corporate social responsibility is significant. Enterprises with higher state-owned shares bear more social responsibilities, which makes their financing deviate from competitive neutrality, which is an important reason for the formation of a higher asset–liability ratio. In addition to the general social responsibility, the duty of state-owned enterprises with special functions to ensure the stable economic growth makes them solve the problem of employment, resulting in the problem of redundant employees in enterprises. Column (2) of the table examines the intermediary effect of redundant employees in enterprises, and the results show that it is also an important reason for the high asset–liability ratio of state-owned enterprises with special functions. The results in part A of Table 5 and Table 6 verify Hypothesis 3.

Table 6.

The reason and way that SOEs deviate from competition neutral.

Finally, Part B of Table 5 shows the relationship between the deviation from competitive neutrality in the financing of state-owned enterprises with special functions and corporate profits. The results in the table show that the high asset–liability ratio caused by the deviation from competitive neutrality in financing reduces the profits of enterprises, regardless of whether the general control variables and time control variables are added. The empirical result verifies Hypothesis 4.

5.3. Robustness Test

In the empirical research, the profits of enterprises may also have an impact on their asset–liability ratio and employee efficiency, resulting in endogenous problems. To verify the robustness of the above results, this paper uses the dynamic panel regression model as the robustness test, and the results are shown in Table 7. Column (1) is listed as the dynamic panel regression of enterprises’ asset–liability ratio and enterprise profit. The results show that the asset–liability ratio is significantly negatively correlated with enterprise profit, which verifies that the deviation of enterprises’ financing from competitive neutrality has a negative impact on enterprises’ profit. Columns (2) and (3) in the table are listed as the dynamic panel regression of employee efficiency and enterprises’ profit. The results show that the efficiency of employees is significantly positively correlated with enterprises’ profit, which is the same as the previous empirical results.

Table 7.

Robustness Test.

6. Main Findings and Suggestions

Taking the listed state-owned enterprises with special functions from 2010 to 2020 as samples, we studied the relationship among enterprises’ policy burden, deviation from competitive neutrality in financing, and the profits of enterprises. We find the following conclusions: first, the state-owned enterprises with special functions are the main entities who cooperate with governments and bear the policy burden, resulting in the loss of corporate profits; secondly, part of the government’s methods to compensate for the loss of enterprise’s profits due to the policy burden may form a “soft budget constraint”, and deviate from the competitive neutrality in the financing. It further causes the loss of an enterprise’s profits.

The conclusions above show the dilemma faced by state-owned enterprises under the framework of competitive neutrality. For developing countries, state-owned enterprises are the main forces that promote economic growth and maintain social stability, and thus play an important role in developing countries. Moreover, the outbreak of the financial crisis in 2008 also led many developed countries to rediscover the important role of state-owned enterprises in the national economy and created some new state-owned enterprises. For example, the United States and Britain nationalized some large finance institutions, especially banks. Therefore, state-owned enterprises and the free-market economy can coexist. In the current competitive neutral framework, Chinese governments should deepen the reform of state-owned enterprises, so that they can fairly compete in the market economy and meet the requirements of competitive neutrality, instead of transforming state-owned enterprises into private enterprises. Therefore, we put forward the following policy recommendations for China to solve the problems whereby state-owned enterprises deviate from competitive neutrality:

Firstly, increasing the categories of enterprises that bear the policy burden. At present, the state-owned enterprises with special functions are the main entities to bear the policy burden and cooperate with the government’s policy objectives, thus forming the present situation that only such state-owned enterprises receive compensation from governments, which makes scholars think that such state-owned enterprises have gained special competitive advantages because of state-owned shares. If the scope of entities that the bear policy burden is enlarged, private and foreign enterprises can also choose to bear part of the policy burden, and governments can provide compensation to all enterprises that bear the policy burden. Thus, not only state-owned enterprises can receive compensations from governments, but also private and foreign enterprises, which can alleviate scholars’ doubts about the state-owned enterprises’ deviation from competitive neutrality.

Secondly, increasing the transparency of governments’ compensation to enterprises and improving the method of compensation. On the one hand, the governments should publish the measurement methods and results of the losses caused by the policy burden on enterprises, as well as the methods and the amount of compensation provided by the governments, and demonstrate with actual data that the compensation provided by the governments is equivalent to the losses borne by the enterprises with the policy burden, that is, demonstrate that the governments compensation does not make the enterprises deviate from competitive neutrality. On the other hand, the governments can use special subsidies or government procurement to provide more targeted compensation for enterprises and avoid the general compensations, such as soft financing constraints, to solve the “cross-subsidy problem” of enterprises. This can help prevent enterprises from deviating from competitive neutrality due to the amount of compensation exceeding the loss.

Thirdly, reforming the governance of state-owned enterprises. At present, the main reason why some scholars, foreign governments, and enterprises believe Chinese state-owned enterprises deviate from competitive neutrality is that the governance of Chinese state-owned enterprises has formed a close relationship between the government and enterprises. Therefore, China should learn from the reform methods of state-owned enterprises in other countries, such as the Temasek model in Singapore, to reform the governance of Chinese state-owned enterprises, and eliminate the doubts suggesting that state-owned enterprises deviate from competitive neutrality.

Author Contributions

Data curation, Y.D.; Formal analysis, Y.D. and Y.K.; Methodology, Y.D.; Writing—original draft, Y.D.; Writing—review & editing, Y.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data sources in this paper are Wind database (https://www.wind.com.cn/ accessed on 24 February 2022) and the National Bureau of Statistics of China (http://www.stats.gov.cn/ accessed on 24 February 2022).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shi, W. The Theory and Practice of Competitive Neutrality; Law Press: Beijing, China, 2017. [Google Scholar]

- Song, B. Sources, Policy Objectives and public Monopoly Reform of competitive neutrality. Res. Econ. Law 2017, 18, 179–199. [Google Scholar]

- Capobianco, A.; Christiansen, H. Competitive Neutrality and State-Owned Enterprises: Challenges and Policy Options; OECD Corporate Governance Working Papers; OECD Publishing: Paris, France, 2011. [Google Scholar] [CrossRef]

- Rennie, M.; Lindsay, F. Competitive Neutrality and State-Owned Enterprises in Australia: Review of Practices and Their Relevance for Other Countries; OECD Corporate Governance Working Papers; OECD Publishing: Paris, France, 2011. [Google Scholar] [CrossRef]

- Huang, S.; Xiao, H.; Wang, X. SOE Reform in the View of Competitive Neutrality. China Ind. Econ. 2019, 6, 22–40. [Google Scholar] [CrossRef]

- Peng, B.; Han, Y.; Lin, Z. The connotation, thought and game strategy of competitive neutrality under the background of trade friction. J. Int. Econ. Coop. 2020, 1, 66–77. [Google Scholar]

- He, J.; Zhang, Y. Classification reform of state-owned enterprises based on the principle of “neutral competition”. Soc. Sci. Guangdong 2020, 5, 22–31+254. [Google Scholar]

- Ba, S.; Chen, P. The Formation of Competitive Neutrality Principle and Its Implementation in China; Xiamen University Press: Xiamen, China, 2021. [Google Scholar]

- Healey, D. Competitive Neutrality: The Concept (1 January 2014). In Competitive Neutrality and its Application in Selected Developing Countries, Proceedings of the United Nations Conference on Trade and Development, New York, NY, USA, Geneva, Switzerland, 27 November 2014; UNCTAD Research Partnership Platform Publication Series; Healey, D.J., Ed.; United Nations: Geneva, Switzerland, 2014; Available online: https://ssrn.com/abstract=3705824 (accessed on 11 May 2022).

- Mair, S.; Strack, F.; Schaff, F. Partner and Systemic Competitor—How Do We Deal with China’s State-Controlled Economy? Federation of German Industries (BDI): Berlin, Germany, 2019; Available online: https://www.wita.org/wp-content/uploads/2019/01/201901_Policy_Paper_BDI_China.pdf (accessed on 11 May 2022).

- Grieger, G. EU Framework for FDI Screening. Briefing of April 2019. European Parliament Research Service (EPRS). Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2018/614667/EPRS_BRI(2018)614667_EN.pdf (accessed on 11 May 2022).

- Morrison, W.M. China-US Trade Issues. 2018. Available online: https://content.csbs.utah.edu/~mli/Econ%205420-6420-Fall%202018/Morrison-China%20US%20Trade%20Issues.pdf (accessed on 11 May 2022).

- Shen, W. SOEs’ Competition Neutrality Deviation and Neutralizing Routes in the Context of Principle of Competition Neutrality. Shanghai J. Econ. 2019, 5, 11–28. [Google Scholar] [CrossRef]

- Li, J. To Shape and Lead the Reform of State-Owned Enterprises with “Competitive Neutrality”. Economic Information Daily. 2018. Available online: http://www.jjckb.cn/2018-10/17/c_137537885.htm (accessed on 11 May 2022).

- Zhao, J. Research on the reform of state-owned enterprises from the perspective of neutral competition. Shanghai Bus. 2020, 4, 75–77. [Google Scholar]

- Yin, W. State-owned enterprise reform from the perspective of competition neutrality. Macroecon. Manag. 2019, 10, 8–12. [Google Scholar] [CrossRef]

- Yang, R. Evolutions and Reflections on the Logic and Practice of State-owned Enterprises Reform. J. Renmin Univ. China 2018, 32, 44–56. [Google Scholar]

- Yang, R. A brief discussion on the theoretical logic of state-owned enterprise classification reform. China Rev. Political Econ. 2015, 6, 38–41. [Google Scholar]

- Luo, X. Classification and Classification Supervision of State-Owned Enterprises; Shanghai Jiaotong University Press: Shanghai, China, 2014. [Google Scholar]

- Lv, C. Has the classification reform improved the performance of commercial SOEs? Spec. Zone Econ. 2021, 5, 115–120. [Google Scholar]

- Liu, H.; Qi, Y.; Xie, X. The Allocation logic of Equity Ownership and Control Rights from Equivalence to Non-equivalence: An Empirical Test of Listed Companies with Mixed-ownership under the Supervision of SASAC. Econ. Res. J. 2018, 53, 175–189. [Google Scholar]

- Kawashima, F. Competitive Neutrality Principles in Australia: Lessons for the TPP Negotiation on Disciplines over State-Owned Enterprises; Research Institute of Economy, Trade and Industry (RIETI): Tokyo, Japan, 2015. [Google Scholar]

- Gaur, S. Competitive Neutrality Issues in India; Unctad Research Partnership Platform: Geneva, Switzerland, 2014; p. 121. [Google Scholar]

- Nawawi, W.K.; Saovanee, C.S. SOE Regulation in Malaysia and the Competitive Neutrality Principle; Unctad Research Partnership Platform: Geneva, Switzerland, 2014; p. 190. [Google Scholar]

- Alice, P. State-owned Enterprises & Competitive Neutrality Principle in Vietnam. In Economic Competition Regime: Raising Issues and Lessons from Germany; Nomos Verlagsgesellschaft mbH & Co. KG: New York, NY, USA, 2014. [Google Scholar]

- Tang, V.N.; Nguyen, T.A.; Le, T.T.; Le, T.T. Competitive Neutrality: Challenges on the Application for Vietnam. SECO/WTI Academic Cooperation Project Working Paper Series 2016/19. December 2016. Available online: https://ssrn.com/abstract=2905632 (accessed on 11 May 2022).

- Svetlicinii, A. State Capitalism in ASEAN: The State-Owned Enterprises Under the ASEAN Regional Competition Policy. In Asian Yearbook of International Economic Law; Springer: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- World Bank. State Ownership and Competitive Neutrality; World Bank: Washington, DC, USA, 2020; pp. 59–77. [Google Scholar] [CrossRef]

- Wang, J.; Song, H. Sino-US trade war, the principle of competitive neutrality and the reform of China’s state-owned enterprise. Transnatl. Corp. Rev. 2019, 11, 298–309. [Google Scholar] [CrossRef]

- Huang, K.X.D.; Liu, Z.; Tian, G. Promote Competitive Neutrality to Facilitate China’s Economic Development: Outlook, Policy Simulations, and Reform Implementation—A Summary of the Annual SUFE Macroeconomic Report (2019–2020). Front. Econ. China 2020, 15, 1–24. [Google Scholar] [CrossRef]

- Tang, Y.; Yao, X. Competition neutrality: New rules for international markets. Intertrade 2013, 3, 54–59. [Google Scholar] [CrossRef]

- Tang, J. “Competition neutrality” rules: New Challenges for State-owned Enterprises. J. Int. Econ. Coop. 2014, 3, 46–51. [Google Scholar]

- Huang, Z. Competitive Neutrality rules in the Process of International Law making-Also on China’s countermeasures. Int. Bus. Res. 2013, 34, 54–63. [Google Scholar]

- Mariko, W. Identifying Competition Neutrality of SOEs in China; The Research Institute of Economy, Trade and Industry: Tokyo, Japan, 2015. Available online: https://www.rieti.go.jp/jp/publications/dp/15e134.pdf (accessed on 11 May 2022).

- Watanabe, M. Competitive Neutrality of State-Owned Enterprises in China’s Steel Industry: Causal Inference on the Impacts of Subsidies; Discussion Papers 20014; Research Institute of Economy, Trade and Industry (RIETI): Tokyo, Japan, 2020. [Google Scholar]

- Garcia-Herrero, A.; Ng, G. China’s State-Owned Enterprises and Competitive Neutrality (23 February 2021). Policy Contribution | Issue n˚05/21 | February 2021. Available online: https://ssrn.com/abstract=3793470 (accessed on 11 May 2022).

- Zhou, L. Promote the reform and development of Chinese enterprises through competitive neutrality. Economy 2018, 23, 82–83. [Google Scholar]

- Bai, M.; Shi, X. On competition neutrality policy and its influence on China. Intertrade 2015, 2, 22–24. [Google Scholar] [CrossRef]

- Daniel, Y.; Joseph, S. The Battle between Government and Market in the Modern World; Foreign Languages Press: Beijing, China, 2000. [Google Scholar]

- Lang, K.; Feng, J. A study on the dynamic relationship between State-owned enterprises and economic development: Empirical evidence from cross-country comparison. Contemp. Econ. Res. 2021, 5, 70–81. [Google Scholar]

- Bai, C.E.; Li, D.D.; Tao, Z.; Wang, Y. A multitask theory of state enterprise reform. J. Comp. Econ. 2000, 28, 716–738. [Google Scholar] [CrossRef] [Green Version]

- Zhang, H.; Cao, L. Does Redundancies Constraint Affect Investment Behaviors of SOEs. J. Beijing Technol. Bus. Univ. Soc. Sci. 2016, 31, 18–28. [Google Scholar]

- Liu, C.; Sun, L. Policy Burdens, Marketization Reform and SOEs’ Underperformance after Their Share Issue Privatization. J. Financ. Econ. 2013, 39, 71–81. [Google Scholar]

- Zhang, H.; Huang, H.; Yan, Q. Mixed Ownership Reform, Policy Burden and State-owned Enterprise Performance-Based on Industrial Enterprises Database from 1999–2007. Economist 2016, 9, 32–41. [Google Scholar]

- Zhao, Y.; Ao, X. The influences of SOEs Policy Burdens on Enterprise Financial Behavior. Econ. Probl. 2016, 11, 105–111. [Google Scholar] [CrossRef]

- Guo, J.; Ma, G. Maroeconomic Stability and State-Owned Economic Investment: Mechanism and Evidence. Manag. World 2019, 9, 49–64+199. [Google Scholar]

- Yu, K. Analysis of social burden of state-owned enterprises. Mod. SOE Res. 2016, 12, 7. [Google Scholar]

- Liao, G.; Shen, H. Policy Burdens of State-owned Enterprises: Reason, Consequence and Governance. China Ind. Economics. 2014, 6, 96–108. [Google Scholar]

- Lin, Y.; Liu, M.; Zhang, Q. On Cause of Soft Restraint of Enterprise’s Budget. Jianghai Acad. J. 2003, 5, 49–54+206. [Google Scholar]

- Lin, Y.; Li, Z. Policy Burden, Moral Hazard and Soft Budget Constraint. Econ. Res. J. 2004, 2, 17–27. [Google Scholar]

- Yi, Y.; Jiang, F.; Liu, Z.; Xin, Q. Decentralised Privatisaion, Mixed-Ownership Reform and Employee Efficiency in China. J. World Econ. 2021, 44, 130–153. [Google Scholar]

- Gong, Q.; Xu, Z. Policy Burdens and Long-run Soft Budget Constraint. Econ. Res. J. 2008, 2, 44–55. [Google Scholar]

- Ni, Z.; Gao, Z.; Zhang, K. Policy Burdens and the Leverage of State-owned Enterprises: The Mediate Effect of Soft Budget Constraint. Ind. Econ. Rev. 2019, 10, 102–114. [Google Scholar]

- Acharya, V.; Drechsler, I.; Schnabl, P. A pyrrhic victory? Bank bailouts and sovereign credit risk. J. Financ. 2014, 69, 2689–2739. [Google Scholar]

- Borisova, G.; Fotak, V.; Holland, K.; Megginson, W.L. Government ownership and the cost of debt: Evidence from government investments in publicly traded firms. J. Financ. Econ. 2015, 118, 168–191. [Google Scholar] [CrossRef] [Green Version]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Government ownership of banks. J. Financ. 2002, 57, 265–301. [Google Scholar] [CrossRef] [Green Version]

- Brandt, L.; Li, H. Bank discrimination in transition economies: Ideology, information, or incentives? J. Comp. Econ. 2003, 31, 387–413. [Google Scholar] [CrossRef] [Green Version]

- Ge, Y.; Qiu, J. Financial development, bank discrimination and trade credit. J. Bank. Financ. 2007, 31, 513–530. [Google Scholar] [CrossRef]

- Yang, J.; Luo, B. Industrial Policy, Regional Competition and Distortion of Resources Spatial Allocation. China Ind. Econ. 2018, 12, 5–22. [Google Scholar]

- Qian, Y.; Roland, G. The soft budget constraint in China. Jpn. World Econ. 1996, 8, 207–223. [Google Scholar] [CrossRef]

- Al-Janadi, Y.; Rahman, R.A.; Alazzani, A. Does government ownership affect corporate governance and corporate disclosure? Evidence from Saudi Arabia. Manag. Audit. J. 2016, 31, 871–890. [Google Scholar] [CrossRef]

- Chen, X.; Ma, L.; Ding, Z. Classified Governance of State-owned Enterprises, Government Control and the Executive Compensation Incentive-Empirical Research Based on Chinese Listed Companies. Manag. Rev. 2017, 29, 147–156. [Google Scholar]

- Wei, M.; Cai, G.; Liu, J. Research on classified Governance of listed Chinese State-owned Companies. J. Sun Yat-Sen Univ. Soc. Sci. Ed. 2017, 57, 175–192. [Google Scholar]

- Fang, J. Ownership, institutional environment and allocation of credit funds. Econ. Res. J. 2007, 12, 82–92. [Google Scholar]

- Sheng, M.; Zhang, M.; Ma, L.; Li, H. State-owned property rights, soft budget constraints and dynamic adjustment of capital structure. Manag. World 2012, 7, 151–157. [Google Scholar]

- Ji, Y.; Wang, X.; Tan, Y.; Huang, Y. Economic Policy Uncertainty, Implicit Guarantee and Divergence of Corporate Leverage Rate. China Econ. Q. 2018, 17, 449–470. [Google Scholar]

- Zeng, G. The root cause of the high debt of state-owned enterprises is the soft budget constraint. Enterp. Obs. 2018, 11, 86–87. [Google Scholar]

- Hao, Y.; Gong, L. State and Private Non-controlling Shareholders in SOEs and Private Firms, and Firm Performance. Econ. Res. J. 2017, 52, 122–135. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).