1. Introduction

As governments around the world pay more attention to the issue of greenhouse gas emissions, and people continue to strengthen the concept of green consumption [

1], the traditional manufacturing industry is facing the huge challenge of green transformation and upgrading. “Made in China 2025” clearly proposes the building of an efficient, clean, low-carbon and circular green manufacturing system. Therefore, coordinating economic development and ecological environmental protection has become an urgent issue to be solved in the green transformation of manufacturing enterprises [

2]. Corporate green innovation can realize the harmonious development of the corporate economy and ecological environment [

3]. For example, Xie et al. [

4] used content analysis to collect data on 209 listed companies in heavily polluting manufacturing industries and found that green process innovation has a positive impact on green product innovation, and both green process innovation and green product innovation can improve the financial performance of enterprises. However, there are difficulties in the green innovation process of enterprises, such as the risk of innovation failure, high financing costs and insufficient supply of innovation funds. In order to promote the green innovation of enterprises and promote the green transformation of the manufacturing industry, the government has launched various policies such as tax relief and innovation subsidies to vigorously support the green innovation of enterprises, and also guide various financial institutions to provide financing services for the green innovation of enterprises [

5].

With the development of e-commerce, platform-based supply chains are increasingly emerging. Edwards et al. [

6] found that when consumers buy goods in brick-and-mortar stores rather than home delivery, carbon emissions in the transportation process are greater. Therefore, consumers with green preferences will also be more inclined to buy green products online. One of the more common types in the platform supply chain is that manufacturers sell products online through third-party e-commerce platforms (such as Tmall, JD.com) and pay a certain commission to the platform. E-commerce platforms also usually provide sellers with financing services based on the collected information and investment risks [

7]. In this process, whether manufacturers can obtain financing support from e-commerce platforms to implement green innovation, and what factors will affect the decision of e-commerce platforms to provide financial assistance to manufacturers are topics worthy of our attention.

To sum up, in view of the financing dilemma of green innovation of manufacturers in the e-commerce supply chain, we build a strategy evolution game model between manufacturers and e-commerce platforms and describe the dynamic evolution law of manufacturers choosing green innovation and platforms choosing green financing. Combined with numerical simulation, the factors affecting green innovation and green financing decisions are analyzed, and strategic suggestions are put forward. The main contributions of this paper are as follows. To the best of our knowledge, this paper is one of the few papers that studies green innovation and green financing in platform supply chains. We find that the behavioral decision-making of manufacturers and e-commerce platforms has a stable equilibrium strategy through dynamic evolution. The platform provides financing support to cooperate with manufacturers on green innovation, which is beneficial to both parties involved. The decision-making behavior of the participants is affected by factors such as commissions, additional benefits of green actions (green financing and green innovation), and financing amounts. This paper provides suggestions for green transformation cooperation between manufacturers and e-commerce platforms in the e-commerce supply chain.

The remainder of this paper is arranged as follows.

Section 2 reviews the relevant literature.

Section 3 describes the research question and makes relevant assumptions. In

Section 4, the evolutionary game model is constructed and the evolutionary equilibrium strategy is analyzed.

Section 5 simulates our proposed evolutionary game model and analyzes the key influencing factors. The conclusions of this paper are summarized in

Section 6.

2. Literature Review

The literature related to this study can be divided into three streams, including decision-making in the e-commerce supply chain, financial research on the e-commerce platform, and application of evolutionary games in the e-commerce supply chain.

2.1. Decision-Making in E-Commerce Supply Chain

The topic of decision-making in the e-commerce supply chain has been very rich in recent years. For example, Guo et al. [

8] studied a closed-loop dual-channel supply chain of a manufacturer producing green products by comparing multiple algorithms and analyzed how government subsidy is most effective. He et al. [

9] studied logistics service sharing (LSS) in a dual-channel e-commerce supply chain consisting of a manufacturer and retailer, where there is a competitive relationship between the two parties. The results showed that when the shared logistics service price is within a certain range, supply chain enterprises can obtain Pareto improvement through LSS. Zheng et al. [

10] investigated the optimal channel strategy for the supplier in a fresh produce supply chain, where the supplier can sell directly through an online channel or through a brick-and-mortar retailer. Xu et al. [

11] studied the impact of constructing an online platform on the pricing decisions of liner companies and freight forwarders in a sea-cargo supply chain. Mu et al. [

12] and Li et al. [

13] also studied an e-commerce supply chain in which the manufacturer possesses two-channel modes of online direct sales and offline retailer distribution, in which the manufacturer decides the level of green technology innovation and the retailer decides the level of green promotional service. In addition to the traditional perspective of an e-commerce supply chain composed of manufacturers and retailers, the platform’s e-commerce supply chain is also a research hotspot. He et al. [

14] considered an e-commerce platform service supply chain composed of a manufacturer, an e-commerce platform and a third-party logistics service provider, and decided on the manufacturer’s online channel encroachment strategy and the platform’s logistics service integration strategy. Wang et al. [

15] studied the decision-making and coordination between an e-commerce platform and a manufacturer with fairness concerns. On this basis, the authors further considered the manufacturer’s decision on the greenness of the product [

16]. Xue et al. [

17] investigated whether the implementation of green logistics practices and cause-related marketing by e-commerce platforms is beneficial to itself. Through the questionnaire survey and statistical analysis, it is proved that the benefit of the platform is positively promoted, which provides strong evidence for the green development of the e-commerce platform. This paper also incorporates the green factor into the operation of the e-commerce platform supply chain. Different from the above studies, we apply evolutionary game theory to explore the factors that affect manufacturers’ decisions on green innovation and e-commerce platforms’ decisions on green financing, as well as the interaction between the two parties in the dynamic game process.

2.2. Financial Research on E-Commerce Platform

The financing issue in the operation of the e-commerce supply chain is a certainly valuable research topic. Wang et al. [

18] studied various models in which a small and medium-sized e-commerce platform can alleviate financial constraints, including choosing loans, sharing service costs with the manufacturer, and both loaning and cost-sharing. It turns out that choosing a loan strategy is more effective than cost-sharing. Yu et al. [

19] investigated the application of IoT technology in e-commerce supply chain finance. By analyzing the value at risk and expected loss, it is found that the application of IoT technology can effectively reduce the risk of loss of platform financing. Xie et al. [

20] studied who among the seller, platform and consumers in the platform supply chain can benefit more from the e-commerce consumer credit, and it is the platform that provides the credit service. There is also a lot of literature that studies various financing strategies in the e-commerce supply chain, including bank credit and e-commerce platform financing. For example, Wang et al. [

21] studied the decision-making and coordination of online retailers’ financing through bank and e-commerce platforms, where the platform is divided into active and conservative forms. Cai and Yan [

22] studied the financial constraints and financing preferences of two competing online sellers. Yang et al. [

23] studied a three-echelon supply chain consisting of a bank, an e-commerce platform, and an online retailer, of which the bank is the leader. Qin et al. [

24] considered three financing modes of the manufacturer, including e-commerce platform financing, supplier credit and hybrid financing, and the manufacturer needs to make a decision on carbon emission reduction under cap-and-trade regulation. Wang et al. [

25] investigated the sales and financing modes of a capital-constrained manufacturer in a green platform supply chain, as well as carbon emission reduction decisions. It can be found that there are few studies on financing issues in the green platform supply chain. This paper considers the green financing strategy of an e-commerce platform, and judges under what conditions the financing is beneficial to the platform.

2.3. Application of Evolutionary Game in E-Commerce Supply Chain

The application of evolutionary game theory in the e-commerce supply chain usually focuses on the multi-party game when supervising the irregular behavior of an e-commerce enterprise. For example, Jiang et al. [

26] constructed an evolutionary game model among group-buying platforms, retailers and consumers, and proposed relevant regulatory strategies to better protect the interests of consumers. For the “deceptive pricing by acquaintances” behavior of e-commerce platforms, Wu et al. [

27] designed a tripartite evolutionary game model under the cooperative supervision of the government and consumers and analyzed the reasons for this behavior. Based on the big data discriminatory pricing (BDDP) behavior of the service platform, Liu et al. [

28] established a tripartite evolutionary game mechanism between the government, e-commerce platforms and consumers, and proposed effective control measures to prevent BDDP. Zhang et al. [

29] studied the dynamic evolutionary game between e-commerce companies and third-party logistics companies under public supervision, in which logistics companies can provide high or low-quality logistics services, and e-commerce companies may be actively regulated or passively regulated. There are also studies that explore the dynamic competition and cooperation between enterprises in the e-commerce supply chain. Zhao et al. [

30] used evolutionary game theory to study the cooperative or competitive relationship between commercial banks and big data-based e-commerce financial organizations in China and adopted the financing cases of Alibaba and JD.com to verify. Li and Cheng [

31] further studied the evolutionary game model between banks and e-commerce platforms under network effects to obtain supply chain financing cooperation strategies. This paper mainly focuses on the dynamic cooperative relationship between e-commerce platforms and manufacturers and uses evolutionary game theory to analyze the influencing factors of green financing and green innovation.

2.4. Research Gaps

According to the above literature, we summarize the research gaps in the relevant literature, as shown in

Table 1. It can be found that scholars have rich research on corporate green decision-making and financing strategy choices of e-commerce platforms. However, there are few studies on the financing difficulties of online green industries. Qin et al. [

24] and Wang et al. [

25] both studied the strategy choice of cooperative financing with multiple parties such as online retailers or platforms in the green decision-making process of capital-constrained manufacturers. However, this only reflects a static decision in a specific situation. In reality, decision-makers are not completely rational, and decisions are not static. To fill this gap, this paper further investigates the dynamic interaction mechanism during the strategy selection process of manufacturers and online platforms. The factors that affect manufacturers’ green innovation decisions and the conditions under which e-commerce platforms choose green financing are highlighted.

3. Problem Descriptions and Assumptions

This paper considers an online supply chain consisting of an e-commerce platform and a manufacturer, in which the e-commerce platform provides a space for the manufacturer to conduct commodity transactions by charging a certain commission. In addition, e-commerce platforms (such as JD.com and Tmall) generally provide financial services. Therefore, in the context of e-commerce platform-dominated and commission being an exogenous variable, the platform decides whether to provide green financing services to manufacturers based on the cognition level of the green product market. Then the manufacturer decides whether to accept the financing service of the platform to carry out green innovation on the product under the financial constraints and then sell it through the platform. The assumptions and parameter settings of the model are as follows:

Assumption 1: Assume that the probability of an e-commerce platform choosing a green financing strategy is, and the probability of choosing a non-green financing strategy is; the probability of a manufacturer choosing a green innovation strategy is, and the probability of choosing a non-green innovation strategy is.

Assumption 2: For the manufacturer, the basic benefit of not adopting green innovation is, and the basic cost is, thus. In the absence of green financing support from an e-commerce platform, the manufacturer cannot produce green products under financial constraints, but this move will still bring some additional image benefits [

32,

33]

. When the e-commerce platform provides green financing, the manufacturer’s additional benefit due to green innovation is [

34,

35]

, and the additional green innovation cost is , which satisfies .

Assumption 3: For an e-commerce platform, the basic benefit without green financing support is, whererepresents the commission rate that the platform charges the manufacturer, and the platform operating cost is, satisfying. The benefit of green financing is, and the amount of financing provided is. When the platform has green financing willingness and the manufacturer does not intend to carry out green innovation, the platform will also bring additional benefits, such as attracting other companies that want to finance to settle on the platform.

To sum up, the strategic space of the e-commerce platform is {green financing (GF), no-green financing (NGF)}, and the strategic space of the manufacturer is {green innovation (GI), no-green innovation (NGI)}. The payoff matrix of both parties is shown in

Table 2.

4. The Evolutionary Game Model

This paper studies the dynamic game process between green financing of e-commerce platforms and green product innovation of manufacturers. Without considering other factors, the interaction between the platform and the manufacturer follows the basic assumptions of evolutionary game theory such as bounded rationality and incomplete information, and both sides of the game adjust their strategies through continuous learning in the interaction.

4.1. Evolutionary Process

In evolutionary games, e-commerce platforms and manufacturers can randomly make decisions independently of the strategy space in each repeated game. Kim and Kim [

36] and Tong et al. [

37] verified that the probability of players choosing different behaviors can be evaluated by the proportion of e-commerce platforms choosing green financing and the proportion of manufacturers choosing green innovation.

Therefore, according to

Table 2, let

denote the expected benefit of an e-commerce platform choosing green financing;

denote the expected benefit of the platform choosing non-green financing;

denote the average expected benefit of the platform, then

let

denote the expected benefit of a manufacturer choosing green innovation;

denote the expected benefit of a manufacturer choosing non-green innovation;

denote the average expected benefit of the manufacturer, then

Replicated dynamic equations are often used to simulate the behavior of each player. The quantity growth rate of the GF strategy of the e-commerce platform is

, which is equal to the expected benefit

minus the average expected benefit

of choosing this strategy, and

represents time. Similarly, the quantitative growth rate

of a manufacturer’s GI strategy is equal to the expected benefit

of the chosen strategy minus the average expected benefit

. Based on the evolutionary game model, the replicated dynamic equation for e-commerce platforms to choose green financing strategies is obtained

Similarly, the replicated dynamic equation for manufacturers to choose green innovation is

Proposition 1. By replicated dynamic equations (7) and (8), the evolutionary equilibrium (EE) of the system can be obtained as, , and, where, and.

4.2. Evolutionary Equilibrium Stability Analysis

According to the method proposed by Friedman [

38], the Jacobian matrix can be applied to verify the local stable points of the system and obtain the evolutionarily stable strategy (ESS) of the system. When the determinant of the Jacobian matrix J of a certain equilibrium point is greater than 0 and its trace is less than 0, the point is a locally stable point, which is called the ESS of the system. The Jacobian matrix of the system is as follows

where

Note that since the trace of the Jacobian matrix of the equilibrium point is equal to 0, the ESS condition is not satisfied, and this point will not be discussed below.

Proposition 2. Judging by the determinant and trace of each evolutionary equilibrium point in Proposition 1, the stability of each equilibrium point is obtained as shown in Table 3. From Proposition 2, under the premise that the additional benefit earned by the manufacturer’s green innovation is greater than its investment capital or additional green innovation cost, that is, when

and

,

and

are saddle-points,

are unstable points, and only

has local stability, which means the system reaches a steady-state. Therefore, the evolutionary stability strategy of e-commerce platforms and manufacturers is {GF, GI}.

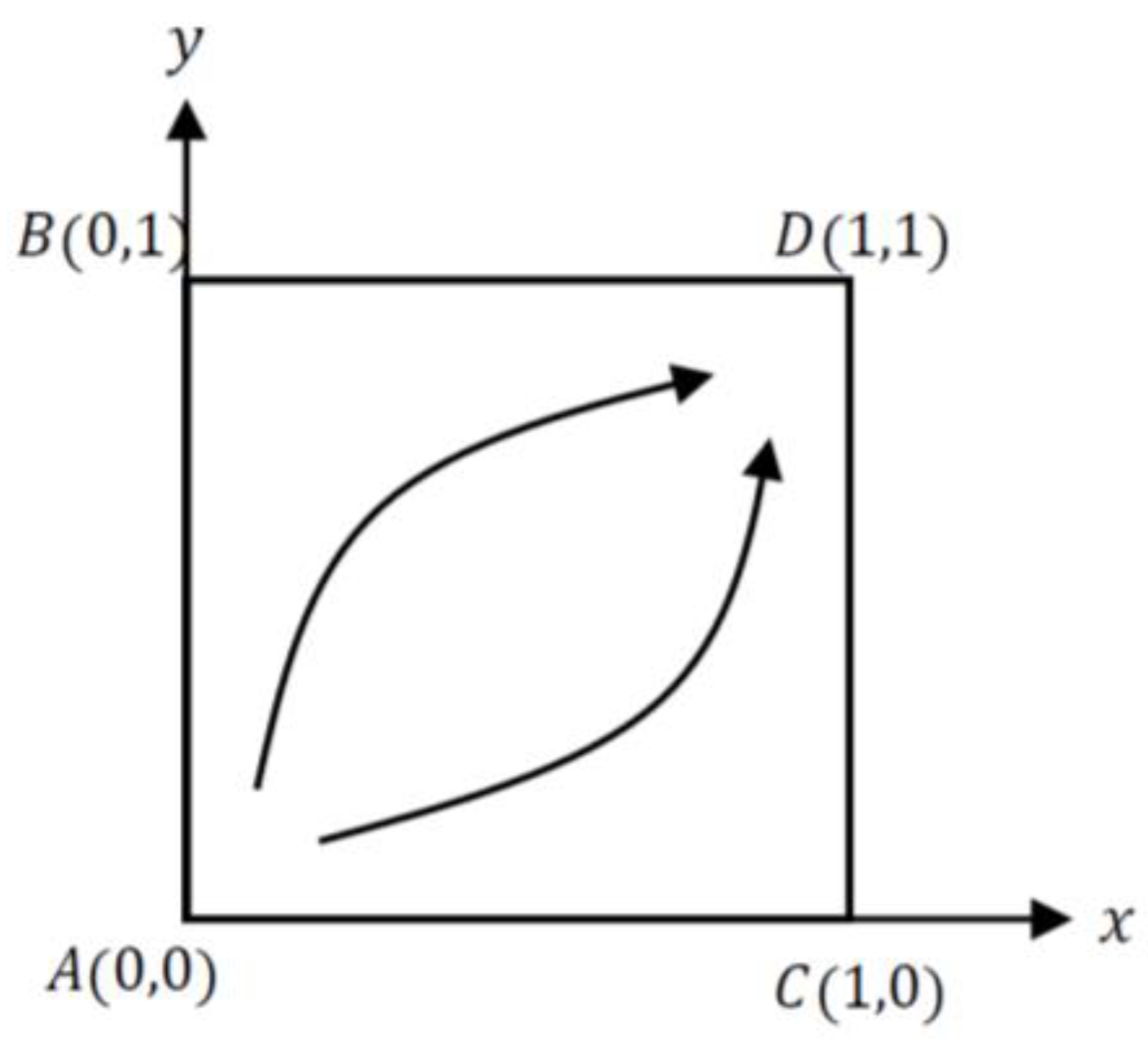

Figure 1 shows the phase diagram of the evolutionary game between e-commerce platforms and manufacturers.

As shown in

Figure 1, all points in the ABCD region of the system will converge to the equilibrium point (1, 1), that is, under the strategy {GF, GI}, the system will reach a stable state. Therefore, we can draw the following conclusions. The interaction between e-commerce platforms and manufacturers will force them to finally choose green financing and green innovation strategies. This is because both green financing and green innovation will create an environmentally friendly image for the company itself, and then occupy the market share of consumers with green preferences, which is certainly beneficial to e-commerce platforms and manufacturers. Furthermore, from the perspective of the government, it can vigorously publicize the economic benefits that green innovation and green financing can bring to enterprises, and encourage enterprises to spontaneously carry out green upgrades. From the perspective of enterprises, they should not only consider immediate economic benefits, but should actively undertake social and environmental responsibilities, improve their social image, and will gain substantial additional benefits in the long run.

5. Numerical Simulation

In this paper, numerical examples are used to verify the dynamic evolution process of manufacturers and e-commerce platforms and to further visualize the impact of various factors on enterprise decision-making. First, based on Weng et al. [

39], Cuerva et al. [

40] and Mu et al. [

12], we set initial values of parameters such as benefit and cost of corporate green innovation. Then, according to the data in Xue et al. [

17], Yu et al. [

19] and Xie et al. [

20], parameters such as the operating cost and financing amount of the e-commerce platform are set. At the same time, minor adjustments were made based on the official data disclosed by JD.com to make the simulation results closer to the facts. According to the latest tariff list announced by JD.com in 2022 [

41], the commission charged by the e-commerce platform to the merchant is generally less than 25%, so the initial commission in this article is assumed to be

. The other initial parameters are set to

,

,

,

,

,

,

,

. Referring to the evolutionary game models in Awaga et al. [

32], Chen et al. [

42] and Zhang and Kong [

43], the model simulation start time is assumed to be initial time = 0, the end time is FINAL TIME = 10, the unit is year, and the step size is time step = 0.1.

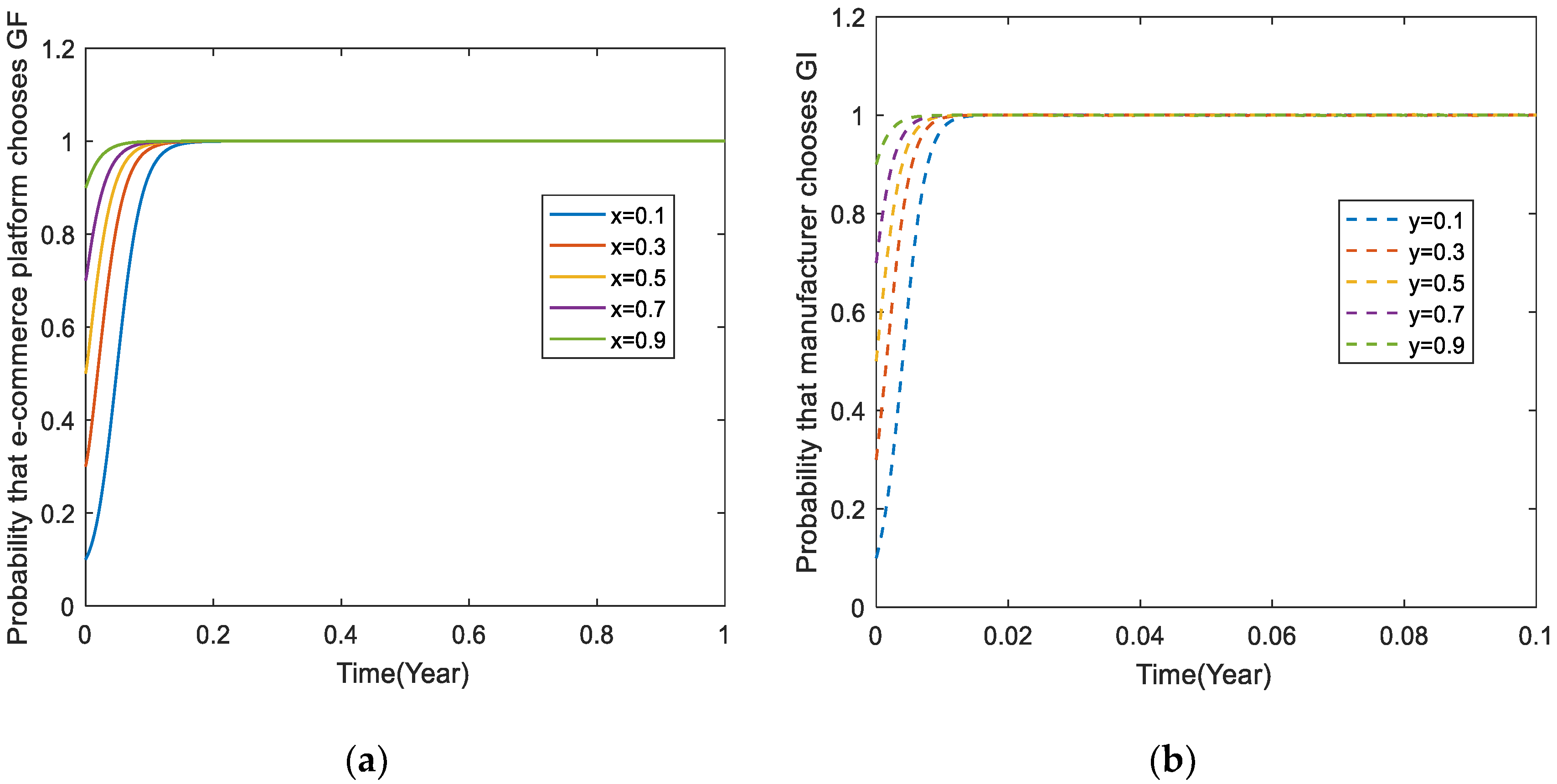

5.1. The Influence of Initial Probability on Enterprise Dynamic Behavior

Figure 2 shows the simulation results of the evolution behavior of e-commerce platforms and manufacturers over time under different initial probabilities. It can be found that no matter what the initial probability is that the e-commerce platform chooses the GF strategy and the manufacturer chooses the GI strategy, the system will eventually stabilize at the equilibrium point (1, 1), which verifies Proposition 2. As the initial probability continues to increase, the time required for the system to stabilize is shorter. This indicates that once there is a signal in the market that e-commerce platforms choose the GF strategy, other companies will also have a tendency to choose the GF strategy over time. Moreover, as more and more companies choose the GF strategy in the market, the steady-state where all companies finally choose the GF strategy will be reached sooner. The dynamic behavior of the manufacturer is similar. The final evolutionary stabilization strategy of the system is (GF, GT). Therefore, it is necessary for e-commerce platforms to seize the opportunity to implement a green financing strategy as soon as possible, and for a manufacturer to implement a green innovation strategy as soon as possible. When GF and GT strategies have appeared in the market, e-commerce platforms and manufacturers with NGF and NGT strategies should also make timely strategic adjustments to avoid being eliminated by the market. In order to promote the green upgrade of the manufacturing industry, the government can encourage e-commerce platforms to relax financing restrictions through subsidies and other means.

Section 5.2,

Section 5.3 and

Section 5.4 depict the impact of several key factors on the dynamic evolution of the supply chain system. According to the analysis in

Section 5.1, the ESS of the system is (1, 1). Therefore, in order to make the graph more intuitive and clearer, we assume that the initial probability that the e-commerce platform chooses the GF strategy and the manufacturer chooses the GI strategy is 0.1, that is,

and

.

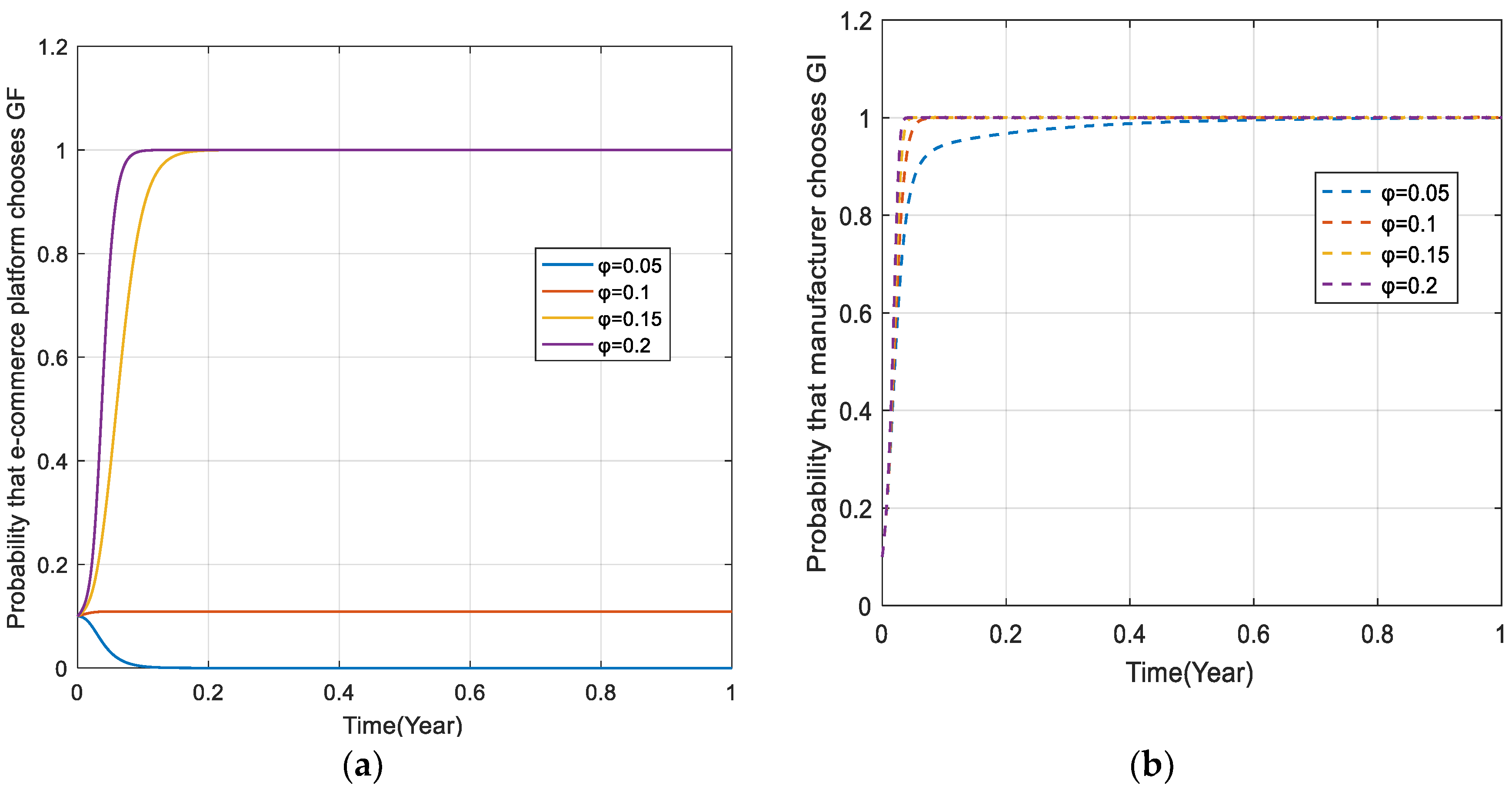

5.2. The Influence of Commission on Enterprise Dynamic Behavior

Figure 3 describes the dynamic evolution behavior of e-commerce platforms and manufacturers under the influence of commission. Interestingly, when the commission

, the probability that the e-commerce platform chooses the GF strategy eventually stabilizes at 0. Combining with

Figure 3b, it can be seen that the system cannot reach the evolutionary equilibrium state at this time. This means that lower commissions will prompt e-commerce platforms to reject green financing. When the commission

, the system eventually reaches ESS (1, 1) with the migration of time, and as the commission increases, the time required to reach the equilibrium state is shorter. It is understandable that higher commissions make platforms more willing to green finance. However, manufacturers also choose the GI strategy more quickly when the commission is higher, which can be explained as the higher commission prompts manufacturers to seek green innovation more actively to improve economic efficiency. Therefore, when e-commerce platforms and manufacturers reach a cooperation contract, they should attach great importance to the setting of commissions, and it is achievable to implement a win–win situation.

5.3. The Influence of Additional Benefit on Enterprise Dynamic Behavior

Figure 4 depicts the impact of the additional benefit

of the manufacturer choosing the GI strategy and the additional benefit

of the e-commerce platform choosing the GF strategy on the dynamic evolution behavior of the supply chain system. It can be seen that with the increase in additional benefits, the time required for the dynamic evolution of the supply chain system to reach ESS (1, 1) is shorter. Additionally, a reduction in the time for the system to reach a stable equilibrium state can be achieved, whether it is an increase in the additional benefit for the manufacturer or the platform. This reflects that the social value created by green financing and green innovation will further motivate enterprises to carry out green-related strategies. In addition, comparing

Figure 4a,b, it can be seen that the impact of additional benefits on manufacturers is more significant. With the same additional benefits, it takes less time for manufacturers to reach a GI strategy. Therefore, in the process of guiding the green development of enterprises, the government should vigorously publicize the additional economic benefits that green development can bring to enterprises. It can also popularize the benefits of green consumption to consumers, and promote manufacturers’ enthusiasm for green innovation by increasing the additional benefits brought by consumption.

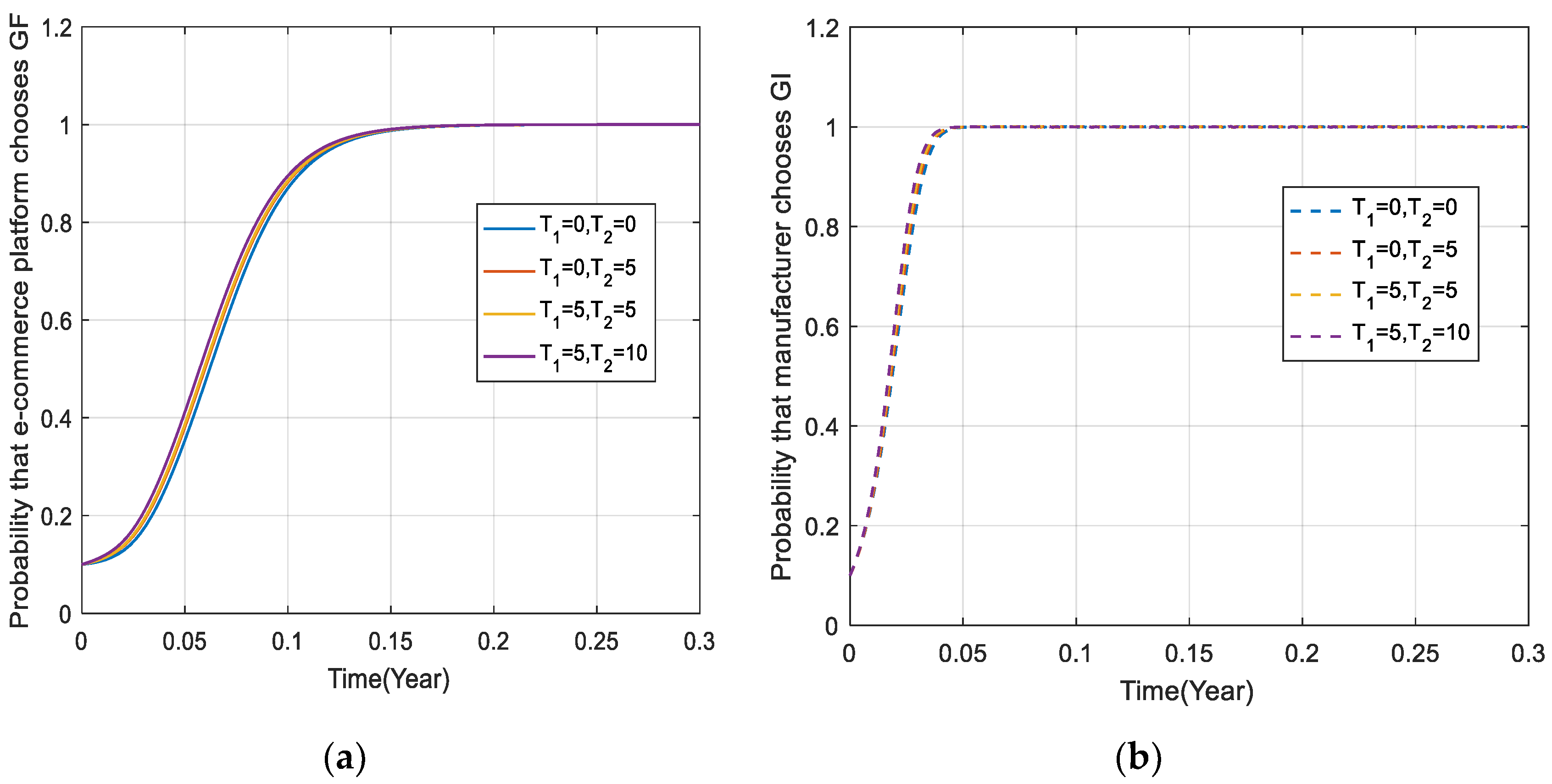

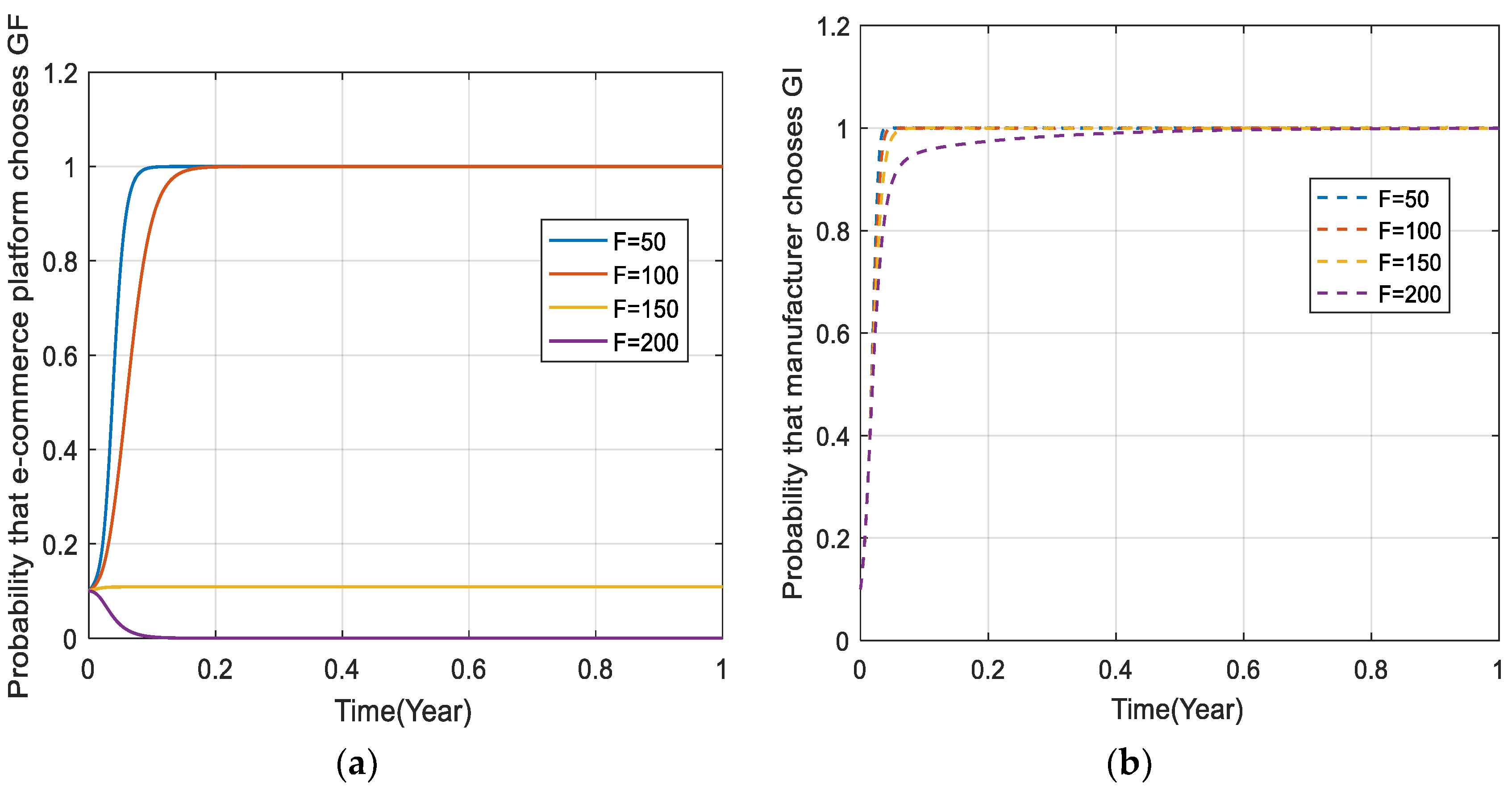

5.4. The Influence of Financing Amount on Enterprise Dynamic Behavior

Figure 5 shows the effect of financing amount

on the dynamic evolution behavior of e-commerce platforms and manufacturer strategies. It can be found that when the financing amount

, the probability that the e-commerce platform chooses the GF strategy will eventually stabilize at 0. Combining with

Figure 5b, it can be seen that the system cannot reach the evolutionary equilibrium state at this time. This means that when the amount of financing that the e-commerce platform needs to provide is too high, the platform will refuse green financing. When the financing amount

, the system eventually reaches ESS (1, 1) over time, and as the financing amount decreases, the time required to reach the equilibrium state is shorter. The less financing the e-commerce platform needs to spend, the more willing it is to choose the GF strategy, which is easy to understand. Manufacturers are more likely to choose the GI strategy when the financing amount is low, which can be explained as the lower financing amount means that it is relatively less difficult for manufacturers to carry out green innovation and it is easier to implement. In addition, from

Figure 5b, financing amounts are quite important for manufacturers to carry out green innovation. Therefore, manufacturers need to carefully consider the amount of financing before making green innovation decisions. On the one hand, it is to make the e-commerce platform more acceptable, and on the other hand, it is also to evaluate the difficulty of implementing green innovation. The government should also pay more attention to the green upgrade trend of the manufacturing industry, and actively understand the difficulties in this process, especially financing difficulties. For example, the government can advocate commercial banks to provide financial support for manufacturing enterprises.

6. Conclusions

This paper constructs an evolutionary game model between manufacturers and e-commerce platforms and describes the dynamic evolution behavior of manufacturers’ green innovation strategies and platform green financing strategies. Combined with numerical simulation, the key factors affecting green innovation and green financing decisions are analyzed. The following conclusions are drawn. First, there is a unique evolutionary equilibrium strategy for dynamic behavioral decision-making between manufacturers and e-commerce platforms. Second, green innovation and green financing are beneficial to both players of the game. Therefore, when manufacturers and e-commerce platforms make strategic adjustments, they need to seize opportunities and implement green decisions in a timely manner. The government can vigorously publicize the economic benefits that green innovation and green financing can bring to enterprises, and encourage enterprises to spontaneously carry out green upgrades. Finally, whether the platform provides green financing services for manufacturers is affected by factors such as commissions, additional benefits brought by green innovation or green financing, and financing amounts. It can be seen from the simulation results that when the commission charged by the platform is lower than 10%, both the manufacturer and the platform cannot achieve an equilibrium strategy. When the financing amount is higher than 150, the platform will also refuse to provide financing support. Therefore, in order to improve the possibility of financing assistance provided by e-commerce platforms, the commission that the manufacturer can accept cannot be too low, and the proposed financing amount cannot be too high. From the perspective of enterprises, they should not only consider immediate economic benefits, but should actively undertake social and environmental responsibilities, improve their social image, and will gain substantial additional benefits in the long run. This paper enriches the research on green strategies of the e-commerce supply chain and provides ideas for green development cooperation between e-commerce platforms and manufacturers.

There are also some limitations in this paper. For example, this paper explores that when the commission is only set in a certain range, it is beneficial to both the e-commerce platform and the manufacturer. How to determine this range needs further discussion. In addition, this paper only considers the evolutionary game between manufacturers and e-commerce platforms. The government also plays a crucial role in the green transformation of the manufacturing industry. In the future, the triparty evolutionary game between the government, e-commerce platforms and manufacturers should be explored.