3.2. The Base of a Carbon Tax Payment

In this paper, the primary energy sectors, the upstream production sectors, is set as the tax base, meaning the government levies a carton tax on primary energy input of various industries. The energy sectors listed in the 2012 IOA of China include coal mining and processing, crude oil and natural gas extraction, petroleum, coking, and nuclear fuel processing, the production and supply of electric power and other heat sources, as well as the production and supply of fuel gas. The first two are primary fossil energy sectors, and they are upstream sectors of the other energy sectors. The carbon content of the other energy and production sectors entirely comes from them, and therefore a carbon tax on the output of the primary energy sector can cover the carbon emissions of the whole economic system. If the output of all energy sectors or all production sectors is taxed, there would be double taxation.

3.3. Input–Output Price Model

A carbon tax imposed on energy sectors will inevitably increase input costs for other downstream enterprises, which will, in turn, lead to higher output prices in all sectors through industrial effects. Employing the method used by Metcalf [

5], we use the input–output price model to analyze the price interactions between sectors. Similarly to the horizontal equilibrium in quantity model, the vertical balance of the IOA can be achieved in the price model.

where

denotes the output value of sector

j,

is the price of product

i,

is the input amount of product

i to sector

j, and

is the added value of sector

j. Dividing two sides of the equation by

, the following equations can be obtained:

. Setting all

to be “1”, the equations can be expressed in the following matrixes:

Equation (3) can be denoted as

, where

is the transpose matrix of the direct consumption coefficient matrix

, and

is the value-added rate vector for each sector. We can solve the price vector as follows, and

P will be a vector of ones:

If a tax is imposed on the system, the elements of vector

P will be greater than 1, representing the ratio of the new price to the original one, and the greater-than-1 part is the price increase resulting from the tax. When setting

as the ad valorem tax levied on the intermediate products provided by sector

j during the production process, Equation (1) will be transformed into:

The set of equations can be manipulated, and then we obtain:

The element of B equals . Under the premise that the production technology of all sectors does not change and there is no short-term substitute for primary energy, the price model can be used to examine the impact of taxation on the prices of all sectors in an economy.

3.4. Regrouping the Input–Output Accounts

In the 2012 IOA of China, crude oil and natural gas were combined in one sector. In order to better examine the impact of price changes in various fossil energy sectors on the economy, this study separates the sector into crude oil and natural gas. For this purpose, we had to divide the sector into rows and columns. The most convenient method to divide the usage values in a row is to separate them by the ratio of usage values of two energies. We can achieve usage value by multiplying the energy usage quantity issued in 2012 EBA of China by the market prices of the energy.

Referring to the domestic and foreign market prices and the RMB exchange rate in 2012, the price of crude oil was set at 4949 RMB/ton, and the price of natural gas was 1.9 RMB/cubic meter. The crude oil usage value based on the EBA should be RMB 2,310,139 million, and that of natural gas should be RMB 277,970 million, totaling RMB 2,588,109 million. The domestic production of crude oil and natural gas sectors based on the EBA should be RMB 102,608 and 203,585 million, respectively, totaling RMB 1,230,396 million. Comparing the above total value of usage and domestic production with the corresponding value listed in the IOA (2,603,804 and 1,226,392 million RMB, respectively), it is found that the maximum error does not exceed 0.6%, so the price setting is reasonable to some extent.

However, it is crude to separate the row this way. This is because, by observing the major sectors of inputting crude oil and natural gas in 2012 ECA of China (

Table 1 and

Table 2), we found that the main sectors using the two energies are not in the same proportion. In fact, the usage structures of the two energies are quite different, and therefore the separation method based on the assumption of the same usage structure is not applicable.

Based on the ECA, EBA, and IOA, this study adopts the following separation method: First, to match the two accounts, the 2012 IOA of 139 sectors was condensed into 46 sectors according to the industry catalogue of the ECA. Second, for sectors that feature in both accounts, we multiplied the sectors’ energy usage quantities by setting prices and obtaining the two energies’ usage value ratio per sector. The usage value of “Crude oil and natural gas extraction” in the IOA was then divided by the ratio. There are some contradictory records between the IOA and ECA: Some sectors have no direct energy input in the IOA, but they have usage data in the ECA. Other sectors have energy input records in the IOA, but no data in the ECA. The former situation was ignored, because we want to keep the basic data and the balance of the IOA unchanged. In the latter case, the split had to be based on the ratio of the total usage value of the two energies.

For the vertical separation, since we lack information about the input structure of the two energy sectors via production processes, it can only be assumed that these structures are similar. The separation was based on the ratio of RMB 1,026,808 to 203,585 million, calculated by multiplying the domestic production quantity by the set price.

In this way, the IOA of 139 sectors was condensed to 47 sector accounts. We compared the calculated value based on the EBA, the ECA, and the setting price, with the corresponding value estimated or listed in the IOA after separation. The results are shown in the

Table 3 below.

3.5. The Carbon Tax Rate

From a collection convenience perspective, the carbon tax rate should be a specific duty rate. In international carbon tax practice, the specific duty is basically used. Denmark began to levy a carbon tax in 1992, and the tax rate is DKK 100 (Danish kroner)/ton of carbon dioxide (equivalent to USD 14.3/ton of carbon dioxide). In 1995, the Dutch tax rate on carbon dioxide was NLG 5.16 (Dutch guilders)/ton of carbon dioxide (equivalent to USD 2.5/ton of carbon dioxide). The tax rate in Sweden is USD 38.8/ton, and in Finland, it is USD 7/ton of carbon dioxide.

In domestic studies on the impact of a carbon tax in China, the tax rate structure is also designed based on a specific duty. For example, Su et al. [

31] proposed a carbon tax scheme of 10 to 40 RMB per ton of carbon dioxide. Wang et al. [

32] designed three specific duty schemes in the process of simulating the impact of a carbon tax by CGE. In addition, Fan and Zhang [

33] assumed a carbon tax rate of 200 RMB/ton of carbon dioxide in their study of the impact of a carbon tax on the income distribution of urban households in China.

The tax rate in our research is similar to the 75 RMB/ton of carbon dioxide referred to in Wang et al. [

32]. In fact, the tax rate has little effect on the conclusion of this study, as the tax rate only increases or reduces the absolute value of consumption expenditure after taxation—it has no essential effect on the trend of progressivity or regressivity.

However, the rate should be an ad valorem tax rate in Equation (5) so that we cannot achieve results based on the specific duty rate we adopt. To convert the specific duty rate into an ad valorem tax rate, we use the following formula:

where

is the ad valorem tax rate on sector

i,

is the specific duty rate on carbon dioxide emissions, and

denotes the carbon dioxide emissions of sector

i (these data can be obtained by multiplying the total consumption of the energy listed in the EBA by the carbon emission coefficient of the energy).

is the output value of the energy sector (for a more reasonable estimate of ad valorem tax rates, the output value is actually the total usage value of the energy sector, and equals the domestic production of the sector plus its net import value). Since the ad valorem tax rates of the same energy should be equal when they are applied to any downstream sector

j, we have

in Equation (5).

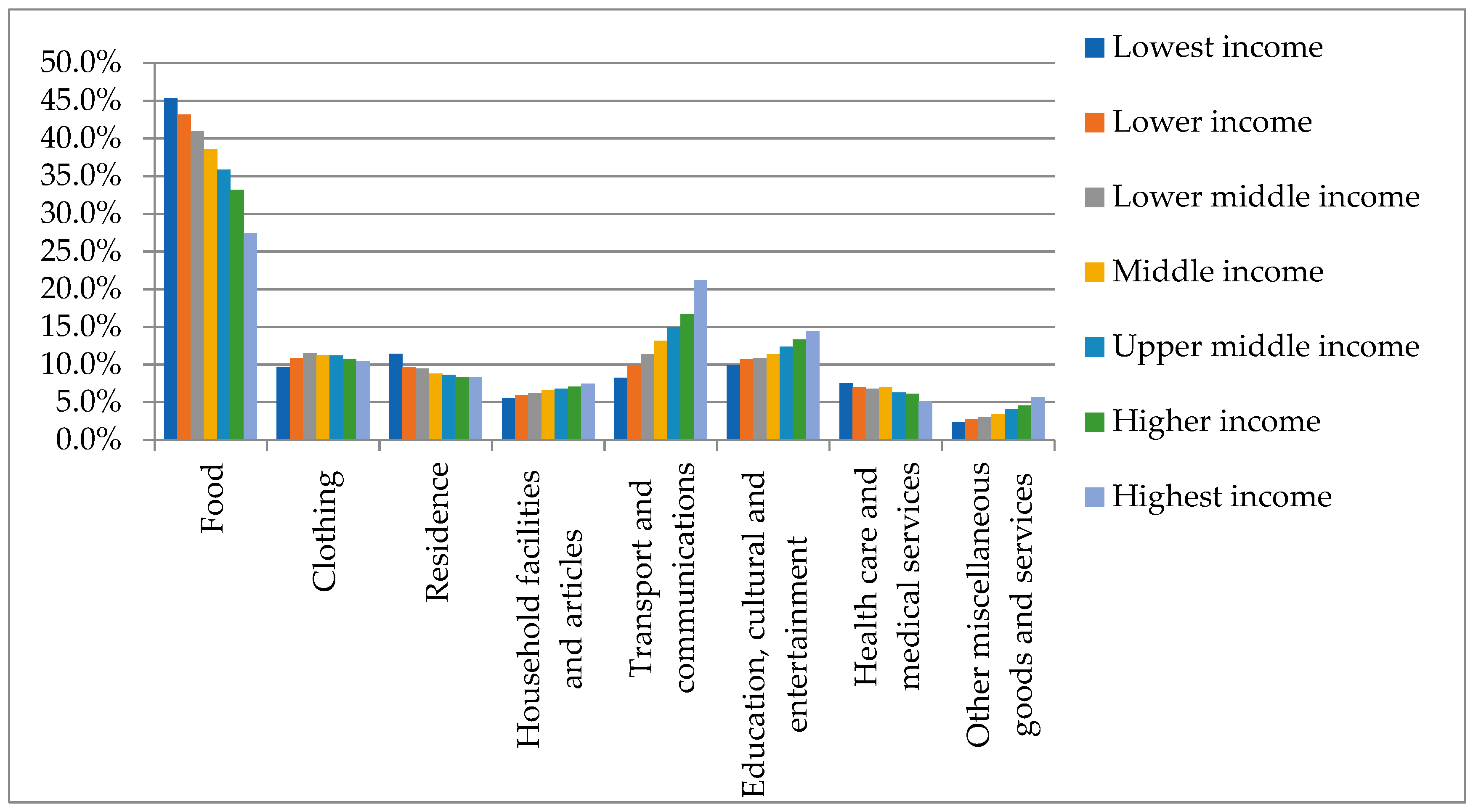

3.6. The Impacts on Consumption Expenditure

In the Consumption Expenditure Accounts (CEA) of urban and rural households with different income groups issued by the National Bureau of Statistics, consumer goods are classified into eight categories that do not match the IOA sector catalogue. The price changes of 47 sectors calculated by the input–output price model should therefore be converted into price changes of eight categories through a transformation matrix:

where

is the price vector of the eight categories of consumer goods after taxation,

denotes the transposed matrix of the price transformation matrix

, and

is the price vector of the 47 sectors after taxation. In

, the corresponding relationship of sectors between the IOA and CEA refers to the classification in Classification of Consumer Expenditure for Residents (2013), published by the National Bureau of Statistics and the relevant research of Fan and Zhang (2013) [

33]. The value

in

represents the proportion of the final household consumption of goods

i in the total consumption of goods category

j, and

.

Based on the price changes in eight categories of consumer goods, we can calculate the per capita consumption expenditure of different income groups after taxation by formula Equation (9):

where

is a vector that reflects the total expenditure per capita of different income groups after taxation and

n is the number of income groups. The National Bureau of Statistics divides urban households into seven income groups and rural households into five income groups.

is the per capita consumption composition matrix of urban and rural households of different income groups in 2012. Taking rural households as an example, the structure is shown as

Table 4:

3.7. The Impacts on Distribution Structure

The impact of a carbon tax on consumption expenditure cannot reflect its distribution effects. To examine the impact, the tax burden must be linked to income. The Suits index, proposed by Suits [

34], is widely used in the test of tax progressivity and regressivity. The progressive and regressive nature can tell us how a specific tax affects the distribution structure. If the tax is progressive, it will help to improve the distribution structure and narrow the gap between rich and poor. If the tax is regressive, it will lead to the deterioration of the distribution structure and will widen the gap between rich and poor. The Suits index can be illustrated by the concentration curve in

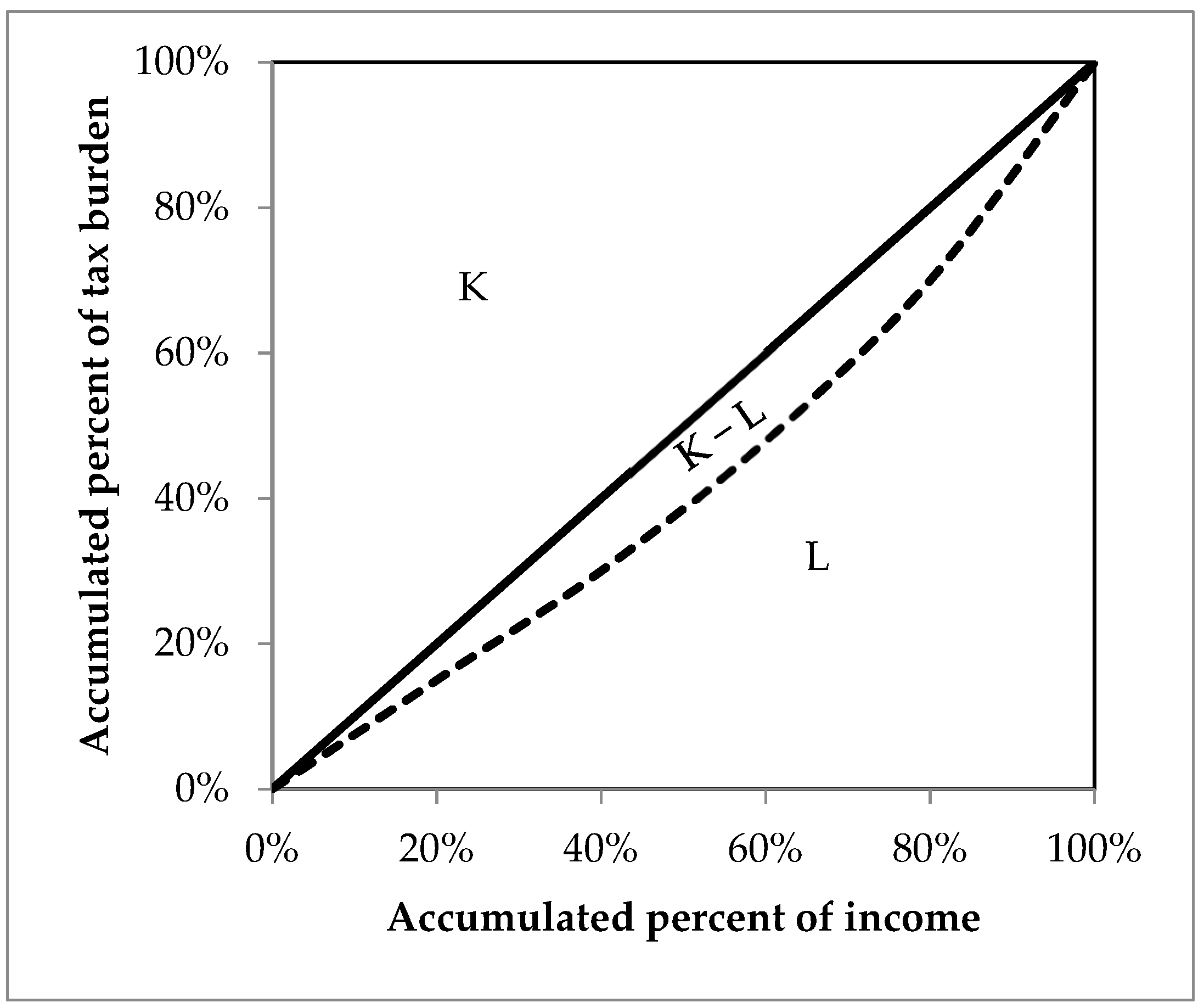

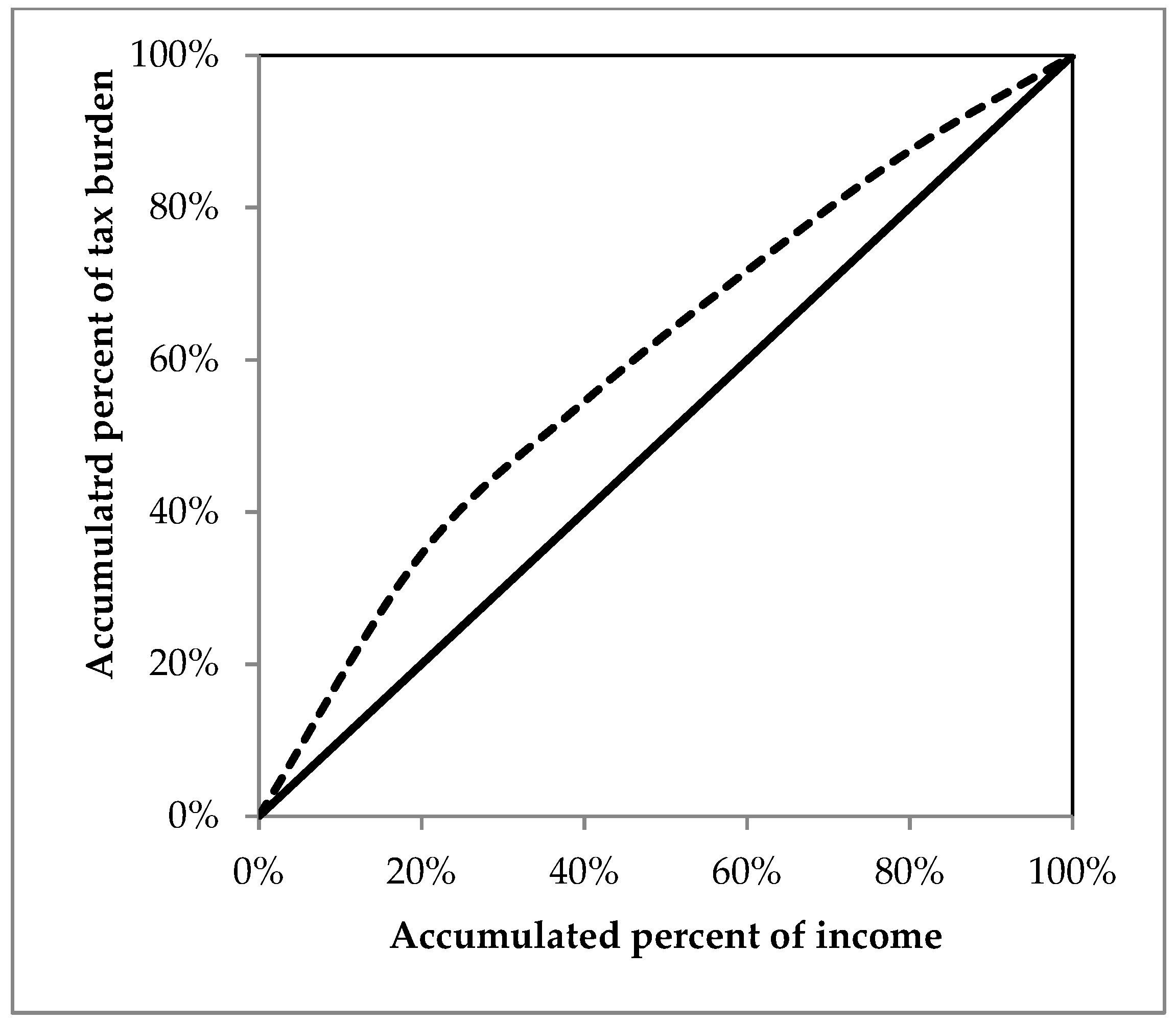

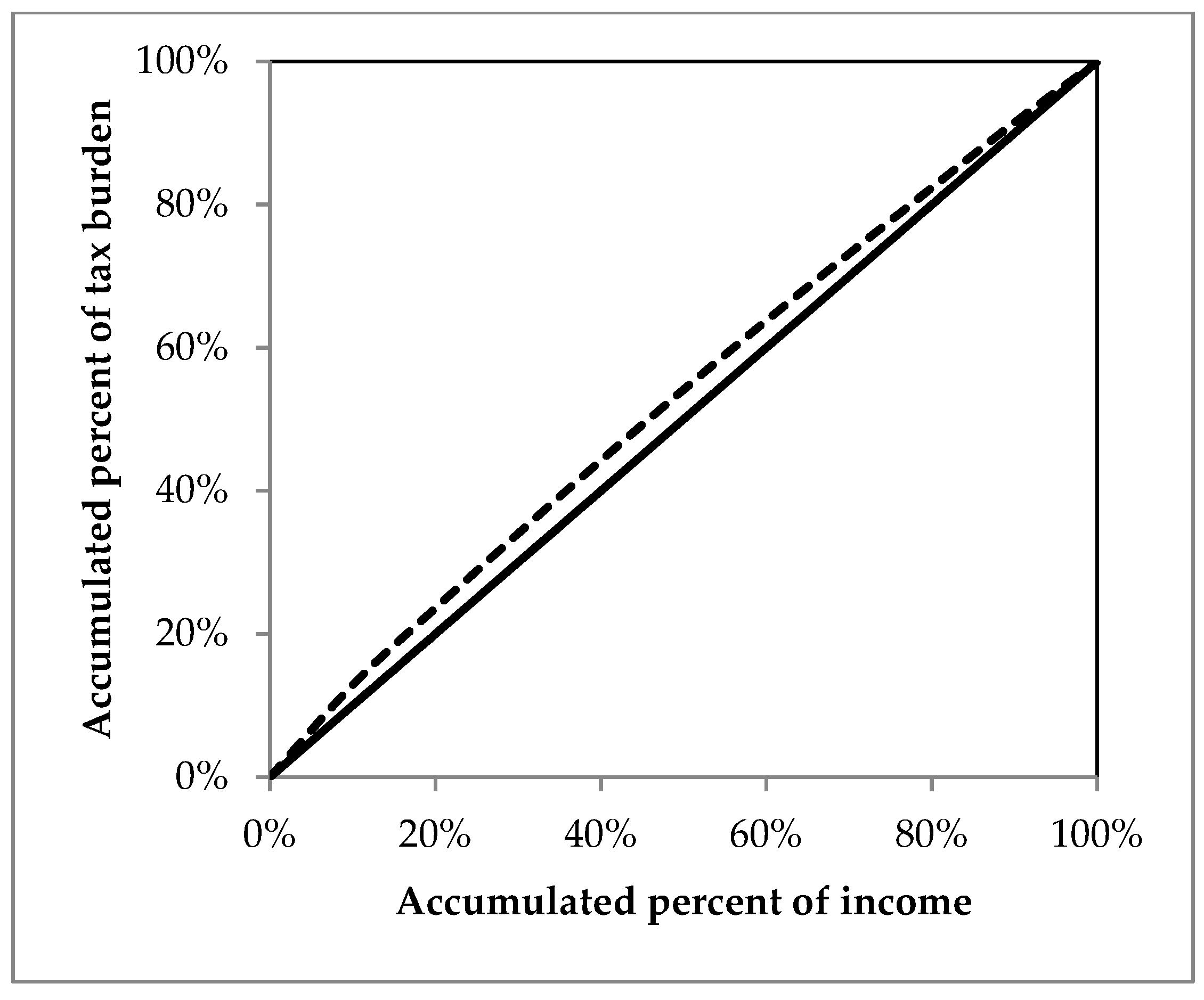

Figure 2. The horizontal axis is the cumulative proportion of income, and the accumulated percentage curve of the tax burden is plotted vertically, corresponding to the accumulated percentage of income on the horizontal axis. The Suits index equals ((K − L))/K, where K is the area of the triangle surrounded by the 45-degree line and the horizontal axis, and L is the area surrounded by the curve and the horizontal axis. When K is greater than L, the index is positive and the tax is progressive; when K is smaller than L, the index is negative and the tax is regressive.

The data obtained in most studies are discrete, so that the area cannot be calculated by integral. Suits (1977) [

27] proposed the following formula to approximate the Suits index:

where S denotes the Suits index,

is the cumulative percentage point of income,

is the cumulative percentage point of tax burden corresponding to the income, and n is the number of income groups.