A Framework for the Analysis of the Sustainability of the Energy Retail Market

Abstract

1. Introduction

2. Materials and Methods

- Work available/accessible online;

- Work with a primary focus on the retail electricity market;

- Work that assessed the impact of regulatory reforms in the retail electricity market.

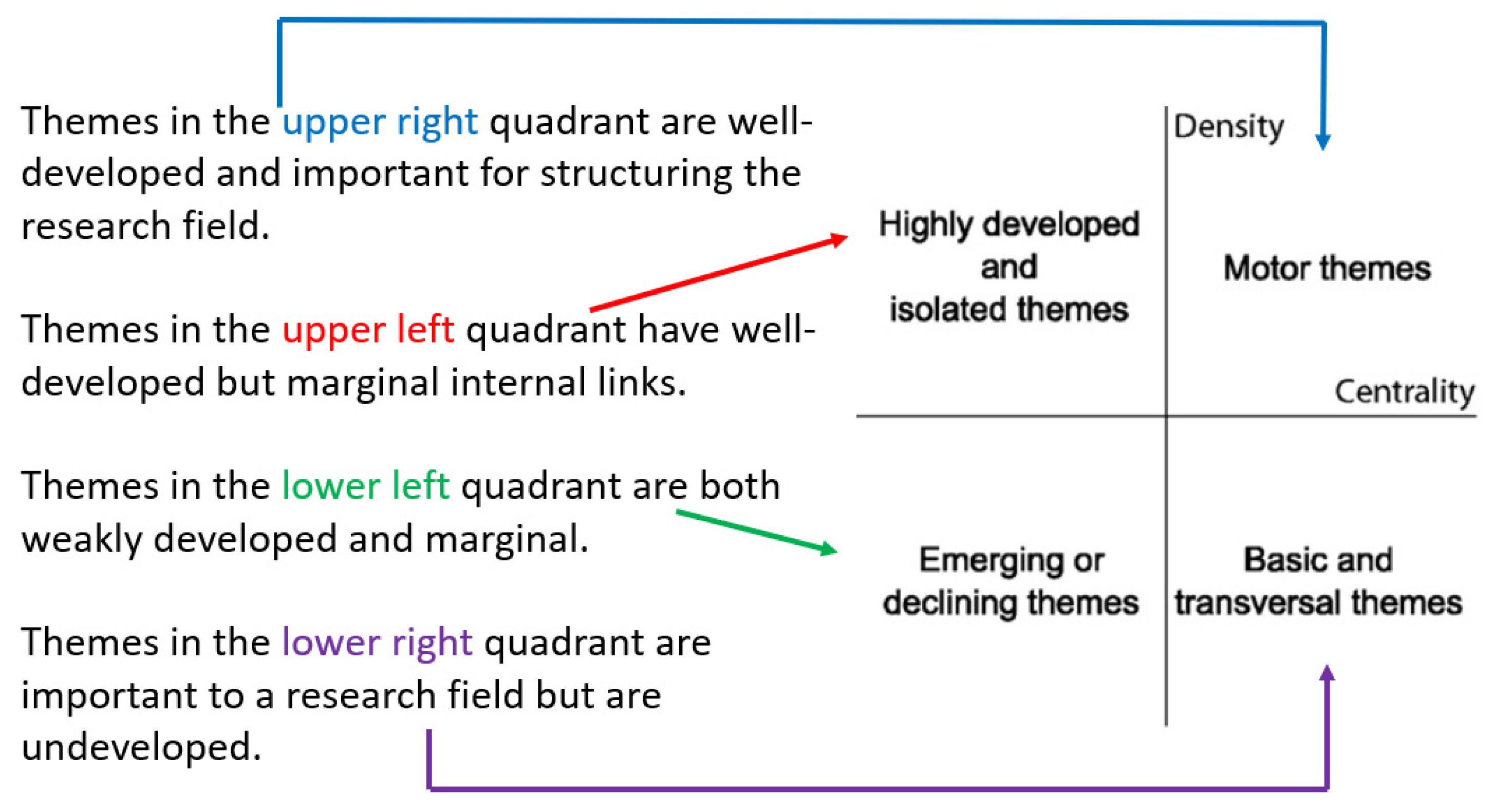

- Thematic Map, is a map based on co-word network analysis and clustering. The methodology used for the analysis is presented in [29]. The map starts with a network of co-occurrence keywords to plot in a two-dimensional chart the typological themes of a domain. The diagram in Figure 1 shows a summary of how to interpret the different areas of the map;

- The coupling map is a two-dimensional plot in which the x-axis represents cluster centrality index), while the y-axis depicts cluster effect (as measured by the Mean Normalized Local Citation Score, whose acronym is MNLCS);

- Most frequent abstract words, which is useful for understanding the main topics covered in the selected documents based on the frequency of words (in our case the bigrams, i.e., word pairs);

- Most referenced work in the literature, useful for determining the trend of the most studied topics and for providing a potential chronological interpretation.

- 44 articles because the focus of the work was not the energy retail market;

- 8 articles because the focus of the work was not the electricity market;

- 37 articles because the effects of liberalization or deregulation on the electricity retail market had not been analyzed;

- 8 articles after a critical discussion on the quality of the work and the methods adopted.

3. Results

3.1. Overview of the Analyzed Studies

3.2. Towards the Formulation of a Framework: The Elements Extrapolated from the Existing Literature

3.2.1. Effects on Market Structure and Operators

3.2.2. Effects on Consumers and Price

3.2.3. Effects on the Environment

4. Discussion

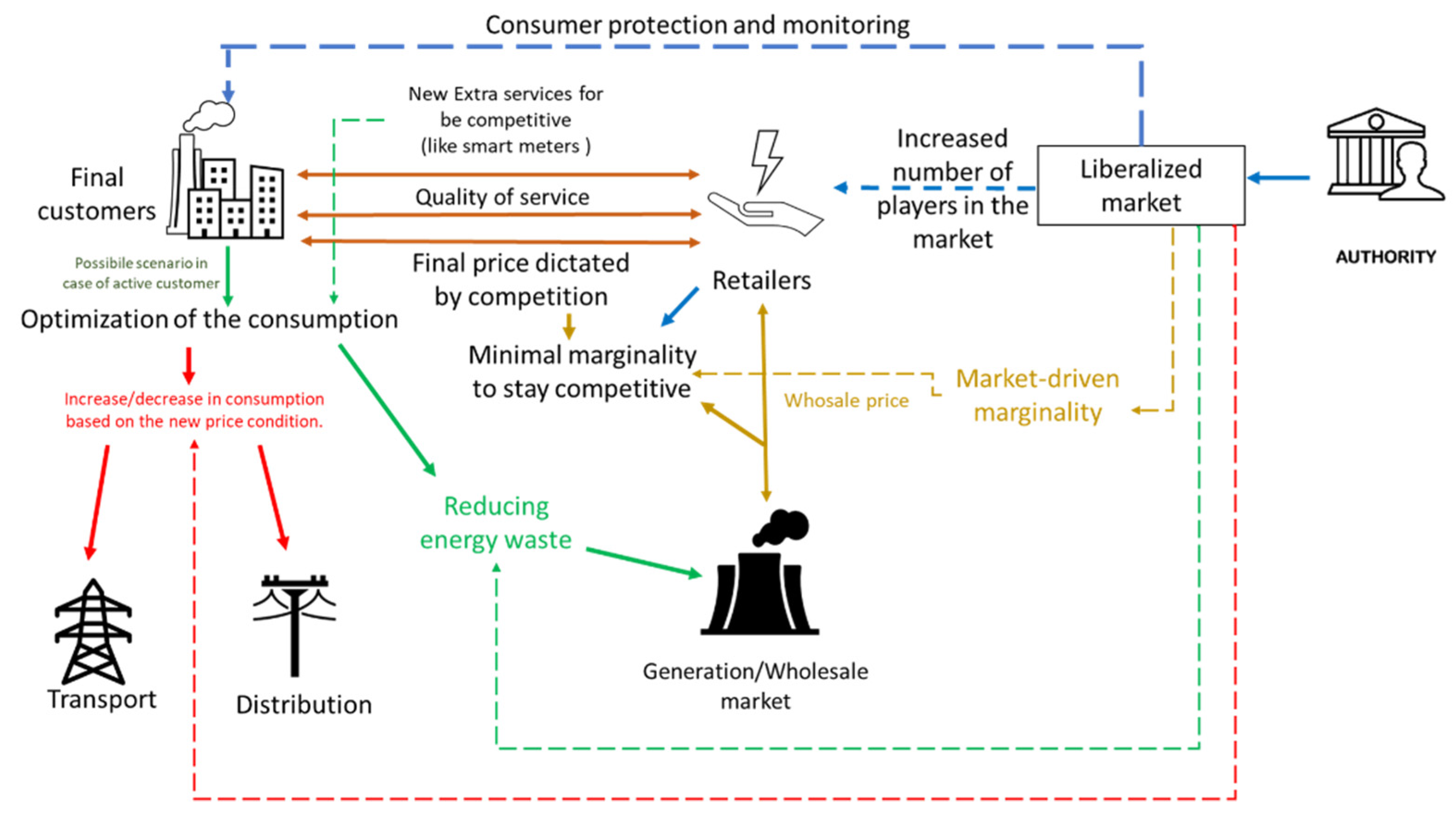

4.1. A Framework to Assess the Sustainability of Policy Decisions in Retail Energy Market

- Extra services refer to the dimension that identifies additional services such as smart meters or bundled sales of different services such as gas or district heating. This dimension relates to the innovation of market offers;

- Quality of service relates to the dimension comprising the quality of service to the consumer and the quality of information available to the consumer. This last dimension is very important to consider, otherwise, an asymmetry between the consumer and the retailer distorts consumer choice ([13,57,74]);

- Final price is a standard economic dimension. The impact on marginality is declined in the relationship between generation/wholesale with retailers. For this impact, the literature contains theoretical contributions that underline the importance of estimating margins for policy decisions and propose tools to support this estimate ([34]).

4.2. Implications and Further Extensions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Technical Details on the Systematic Review

| Query Scopus |

|---|

| (TITLE-ABS-KEY (energy OR electricity OR power) AND (TITLE-ABS-KEY (retailers OR retail)) |

| AND TITLE-ABS-KEY (liberalization OR deregulation OR “free market” OR competition OR restructured) |

| AND TITLE-ABS-KEY (impact OR evaluation OR status) |

| Query WOS |

|---|

| All Fields (energy OR electricity OR power) AND All Fields(retailers OR retail) |

| AND All Fields (liberalization OR deregulation OR “free market” OR competition OR restructured) |

| AND All Fields (impact OR evaluation OR status) |

| Query Scopus |

|---|

| TITLE-ABS-KEY (energy OR electricity OR power) TITLE-ABS-KEY (energy OR electricity OR power) AND TITLE-ABS-KEY (retailers OR retail)TITLE-ABS-KEY (energy OR electricity OR power) AND TITLE-ABS-KEY(retailers OR retail) |

| AND TITLE-ABS-KEY (liberalization OR deregulation OR “free market” OR competition OR restructured) |

| AND TITLE-ABS-KEY (impact OR evaluation OR status) |

| AND (LIMIT-TO (PUBYEAR, 2022) OR LIMIT-TO (PUBYEAR, english)) |

| Query WOS |

|---|

| ALL = (energy OR electricity OR power) AND ALL = (retailers OR retail) |

| AND ALL = (liberalization OR deregulation OR “free market” OR competition OR restructured) |

| AND ALL = (impact OR evaluation OR status) |

| AND Timespan: 2021-12-20 to 2022-04-04 (Publication Date) |

Appendix B. Summary of the Selected Papers

| Reference | Scopus Article Classification | Type of Market | Country Analyzed | Reference Year of the Study | Intervention |

|---|---|---|---|---|---|

| (Research Question) | |||||

| [30] | Article | Market in transition | Turkey | 2004 | Evaluation of Turkish electricity reform |

| [31] | Article | Theory market analysis | Japan | 2019 | Impact of deregulation/liberalization on the market (theoretical implication) |

| [32] | Conference Paper | Liberalized market | Europe (28 EU members) | 2008–2017 | Retail prices against the degree of penetration of renewable energy sources (RES) and market liberalization in each country. |

| [33] | Article | Mixed market | USA | 1972–2009 | Impact of Retail Competition on Prices |

| [34] | Article | Theory market analysis | Singapore | 2006–2016 | Impact of liberalization on forecasting prices (theoretical implication) |

| [35] | Article | Market in transition | Israel | 2007–2030 | Possible evolution of the market after the deregulation and privatization |

| [36] | Article | Market in transition | China | 2020 | Business risk on the reformed electricity retail market |

| [37] | Article | Mixed market | USA | 1993–2008 | estimates changes in price elasticity in the residential electricity market after market deregulation. |

| [38] | Article | Liberalized market | Spain | 2008–2009 | Unintended effects of retail market liberalization |

| [39] | Article | Liberalized market | United Kingdom | 2016–2019 | Communication-based interventions to encourage consumer switching |

| [40] | Article | Market in transition | Irland | 2015 | Impact of a fully integrated electricity market |

| [15] | Article | Market in transition | China | 2007 | impacts of deregulation of the electricity generation sector and retailing activities on other sectors, the macro-economy and electricity users |

| [41] | Article | Deregulated market | USA | 1998–2001 | how the process of retail deregulation affects the comparative efficiency of governance structures, which range on a continuum from fully vertically integrated structures to market transactions. |

| [42] | Review | Deregulated market | Ohio (USA) | 2004–2015 | price impacts of retail electric restructuring |

| [43] | Review | Market in transition | Japan | 2009–2014 | Impact of the Fukushima disaster and subsequent adjustment on Japanese energy market |

| [44] | Article | Mixed market | UK and Norway | UK 2003–2010, Norway 2003–2008 | Comparison between two liberalized markets but with profound differences related to vertical integration and market concentration and impact of multi-business structure |

| [45] | Article | Deregulated market | Finland | 1997–2006 | impact of the ownership structure on prices and the influence of low-cost electricity sources on retail prices |

| [46] | Article | Deregulated market | New Zeland and the Australian State of Queensland | 2000–2011 | Impact of deregulation and privatization on the electricity price |

| [47] | Article | Deregulated market | California (USA) | 2012 | California’s electricity market deregulation process from a subsidy viewpoint |

| [48] | Conference Paper | Deregulated market | Japan | 1978–2014 | electricity deregulation affects R&D input of the incumbent electric utilities |

| [49] | Article | Mixed market | USA | 1990–2011 | impact of retail competition on prices |

| [50] | Article | Deregulated market | California (USA) | 2001–2011 | Impact of electricity deregulation |

| [51] | Conference Paper | Deregulated market | California (USA) | 1990–2018 | Impact of Electric Deregulation on Renewable Investments |

| [52] | Article | Liberalized market | Denmark | 2004 | Impact of Liberalization on the Electricity Market |

| [53] | Article | Liberalized market | Japan | 2015–2016 | impact of liberalization on consumer satisfaction by enabling consumers to choose an electricity provider |

| [13] | Article | Liberalized market | Europe (25 EU members) | 2008–2014 | Impact of Liberalization on the Electricity Market |

| [54] | Conference Paper | Theory market analysis | Theory market analysis | 2019 | Theory market analysis |

| [55] | Article | Liberalized market | United Kingdom | 2013 | critical evaluations of the EU need an internal market for electricity and gas |

| [56] | Article | Theory market analysis | USA | 1998 | Regulation impact on restructuring (theoretical implication) |

| [57] | Article | Liberalized market | China | 2020 | Impact of retail competition mechanism on information disclosure |

| [58] | Article | Deregulated market | Pennsylvania (USA) | 2008–2010 | Analysis of what characteristics of the residential customer and community impacted the decision of whether or not to switch to an alternative electricity provider and when to make the switch |

| [59] | Conference Paper | Market transition | Japan | 2005–2006 | Liberalization in the early stages: impact on all actors (companies, consumers and regulators) |

| [60] | Article | Liberalized market | Theory market analysis | 2008 | Evaluation of retail competition in electricity market (theoretical implication) |

| [61] | Article | Deregulated market | Japan | 2004–2006 | impact of the reform on the retail power market in Japan |

| [62] | Review | Mixed market | Australia, USA, UK, Canada, Poland, Lithuania, Norway, New Zealand, France, Finland, Sweden, Germany | 1990–2012 | comparative assessment of electricity market models and evaluation of electricity market organization models based on sustainability criteria and proposal for evaluate the influence of electricity market models on sustainability |

| [63] | Article | Liberalized market | Italy | 2014 | local effects and market structure in determining the switching decision in retail electricity markets |

| [64] | Article | Liberalized market | United Kingdom | 2010–2020 | Impact of the new reform to inventive the presence of new retailers in UK |

| [65] | Article | Restructuring Market | Alberta (Canada) | 2006–2017 | Impacts of default regulated products and their design on the development of competitive retail markets and retailers’ pricing decisions. |

| [66] | Article | Deregulated market | USA | 1979–2015 | effect of financial leverage on the competitive level and analyzes the strategic behavior of firms under the higher competitive conditions resulting from the U.S. electricity deregulation in the 1990s |

| [67] | Article | Deregulated market | USA | 1990–2014 | Impact of market deregulation on price, intensity, and CO2 emissions (interrelationships between wholesale and retail electricity market reforms) |

| [68] | Article | Deregulated market | Australia | 2019–2020 | impacts of price regulation (cap) on price dispersion in Australia’s retail electricity markets |

| [69] | Article | Liberalized market | Russia | 2014 | Impact of market liberalization |

| [14] | Article | Liberalized market | Australia | 1986–1994–1998 | Electricity market reform impact |

| [70] | Article | Liberalized market | France | Post 2011 | NOME law impact |

| [71] | Article | Market in transition | Turkey | 2019 | Effects of various economic and psychological factors on the switching behavior of large scale electricity consumers. In addition, impact of possible future liberalization on consumers and retailers |

| [72] | Article | Restructuring Market | Delaware (USA) | 1995–2015 | Experience after restructuring |

| [73] | Article | Deregulated market | Texas (USA) | 1998–2008 | Impact of market reform on retail rates |

| [74] | Article | Liberalized market | Australia | March 2020 | Examine the relationship between vulnerable and low socioeconomic status customers and switching. |

References

- Littlechild, S.C. Competition and regulation in the UK electricity industry (with a brief look at California). J. Appl. Corp. Financ. 2001, 13, 21–38. [Google Scholar] [CrossRef]

- Littlechild, S. Promoting competition and protecting customers? Regulation of the GB retail energy market 2008–2016. J. Regul. Econ. 2019, 55, 107–139. [Google Scholar] [CrossRef]

- Kwoka, J. Restructuring the US electric power sector: A review of recent studies. Rev. Ind. Organ. 2008, 32, 165–196. [Google Scholar] [CrossRef]

- Markard, J.; Truffer, B. Innovation processes in large technical systems: Market liberalization as a driver for radical change? Res. Policy 2006, 35, 609–625. [Google Scholar] [CrossRef]

- Künneke, R.W. Electricity networks: How ‘natural’ is the monopoly? Util. Policy 1999, 8, 99–108. [Google Scholar] [CrossRef]

- Newbery, D.M. Problems of liberalising the electricity industry. Eur. Econ. Rev. 2002, 46, 919–927. [Google Scholar] [CrossRef]

- Necoechea-Porras, P.D.; López, A.; Salazar-Elena, J.C. Deregulation in the Energy Sector and Its Economic Effects on the Power Sector: A Literature Review. Sustainability 2021, 13, 3429. [Google Scholar] [CrossRef]

- Munro, F.R.; Cairney, P. A systematic review of energy systems: The role of policymaking in sustainable transitions. Renew. Sustain. Energy Rev. 2020, 119, 109598. [Google Scholar] [CrossRef]

- WCED. Report on the world conference on the environment and development. In Our Common Future; Oxford University Press: Oxford, MS, USA, 1987. [Google Scholar]

- Gunnarsdóttir, I.; Davidsdottir, B.; Worrell, E.; Sigurgeirsdóttir, S. Sustainable energy development: History of the concept and emerging themes. Renew. Sustain. Energy Rev. 2021, 141, 110770. [Google Scholar] [CrossRef]

- Pope, J.; Annandale, D.; Morrison-Saunders, A. Conceptualising sustainability assessment. Environ. Impact Assess. Rev. 2004, 24, 595–616. [Google Scholar] [CrossRef]

- Streimikiene, D.; Bruneckiene, J.; Cibinskiene, A. The review of electricity market liberalization impacts on electricity prices. Transform. Bus. Econ. 2013, 12, 40–60. [Google Scholar]

- Concettini, S.; Creti, A. Liberalization of electricity retailing in Europe: What to do next? Energy Stud. Rev. 2014, 21, 1–25. [Google Scholar] [CrossRef][Green Version]

- Sharma, D. The multidimensionality of electricity reform-an Australian perspective. Energy Policy 2003, 31, 1093–1102. [Google Scholar] [CrossRef]

- Chen, S.; He, L. Deregulation or Governmental Intervention? A counterfactual perspective on China′s electricity market reform. China World Econ. 2013, 21, 101–120. [Google Scholar] [CrossRef]

- Ness, B.; Urbel-Piirsalu, E.; Anderberg, S.; Olsson, L. Categorising tools for sustainability assessment. Ecol. Econ. 2007, 60, 498–508. [Google Scholar] [CrossRef]

- Veleva, V.; Ellenbecker, M. Indicators of sustainable production: Framework and methodology. J. Clean. Prod. 2001, 9, 519–549. [Google Scholar] [CrossRef]

- Waheed, B.; Khan, F.; Veitch, B. Linkage-based frameworks for sustainability assessment: Making a case for driving force-pressure-state-exposure-effect-action (DPSEEA) frameworks. Sustainability 2009, 1, 441–463. [Google Scholar] [CrossRef]

- La Rovere, E.L.; Soares, J.B.; Oliveira, L.B.; Lauria, T. Sustainable expansion of electricity sector: Sustainability indicators as an instrument to support decision making. Renew. Sustain. Energy Rev. 2010, 14, 422–429. [Google Scholar] [CrossRef]

- Nastasi, B.; Markovska, N.; Puksec, T.; Duić, N.; Foley, A. Renewable and sustainable energy challenges to face for the achievement of Sustainable Development Goals. Renew. Sustain. Energy Rev. 2022, 157, 112071. [Google Scholar] [CrossRef]

- Hottenroth, H.; Sutardhio, C.; Weidlich, A.; Tietze, I.; Simon, S.; Hauser, W.; Naegler, T.; Becker, L.; Buchgeister, J.; Junne, T.; et al. Beyond climate change. Multi-attribute decision making for a sustainability assessment of energy system transformation pathways. Renew. Sustain. Energy Rev. 2022, 156, 111996. [Google Scholar] [CrossRef]

- Khan, K.S.; Ter Riet, G.; Glanville, J.; Sowden, A.J.; Kleijnen, J. Undertaking Systematic Reviews of Research on Effectiveness: CRD’s Guidance for Carrying Out or Commissioning Reviews, No. 4 (2n); NHS Centre for Reviews and Dissemination: York, UK, 2001. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Petticrew, M.; Roberts, H. Systematic Reviews in the Social Sciences: A Practical Guide; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Prisma Group. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Richardson, W.S.; Wilson, M.C.; Nishikawa, J.; Hayward, R.S. The well-built clinical question: A key to evidence-based decisions. Acp. J. Club 1995, 123, A12–A13. [Google Scholar] [CrossRef] [PubMed]

- Reiswig, J. Mendeley. J. Med. Libr. Assoc. 2010, 98, 193. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Cobo, M.J.; Lopez-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the field of fuzzy sets theory. J. Informetr. 2011, 5, 146–166. [Google Scholar] [CrossRef]

- Camadan, E.; Kölmek, F. A Critical Evaluation of Turkish Electricity Reform. Electr. J. 2013, 26, 59–70. [Google Scholar] [CrossRef]

- Sekizaki, S.; Nishizaki, I.; Hayashida, T. A development of an equilibrium analysis model between electricity retailers under competitive environment. Electr. Eng. Jpn. 2019, 207, 24–35. (In English) [Google Scholar] [CrossRef]

- Ktena, A.; Panagakis, G.; Hivziefendic, J. A study of the retail electricity prices increasing trend in European retail electricity markets. In Proceedings of the 2019 IEEE 60th Annual International Scientific Conference on Power and Electrical Engineering of Riga Technical University, RTUCON 2019-Proceedings (Issue IEEE 60th International Scientific Conference on Power and Electrical Engineering of Riga-Technical-University (RTUCON)), Riga, Latvia, 7–9 October 2019. [Google Scholar] [CrossRef]

- Ros, A.J. An econometric assessment of electricity demand in the United States using utility-specific panel data and the impact of retail competition on prices. Energy J. 2017, 38, 73–99. [Google Scholar] [CrossRef]

- Loi, T.S.A.; Ng, J.L. Anticipating electricity prices for future needs–Implications for liberalised retail markets. Appl. Energy 2018, 212, 244–264. [Google Scholar] [CrossRef]

- Tishler, A.; Newman, J.; Spekterman, I.; Woo, C.K. Assessing the options for a competitive electricity market in Israel. Util. Policy 2008, 16, 21–29. [Google Scholar] [CrossRef]

- Guo, S.; Zhang, W.; Gao, X. Business risk evaluation of electricity retail company in China using a hybrid MCDM method. Sustainability 2020, 12, 2040. [Google Scholar] [CrossRef]

- Nakajima, T.; Hamori, S. Change in consumer sensitivity to electricity prices in response to retail deregulation: A panel empirical analysis of the residential demand for electricity in the United States. Energy Policy 2010, 38, 2470–2476. [Google Scholar] [CrossRef]

- Batalla-Bejerano, J.; Costa-Campi, M.T.; Trujillo-Baute, E. Collateral effects of liberalisation: Metering, losses, load profiles and cost settlement in Spain′s electricity system. Energy Policy 2016, 94, 421–431. [Google Scholar] [CrossRef]

- Yang, M.; Chi, Y.; Mamaril, K.; Berry, A.; Shi, X.; Zhu, L. Communication-based approach for promoting energy consumer switching: Some evidence from ofgem′s database trials in the United Kingdom. Energies 2020, 13, 5179. [Google Scholar] [CrossRef]

- Di Cosmo, V.; Lynch, M. Competition and the single electricity market: Which lessons for Ireland? Util. Policy 2016, 41, 40–47. [Google Scholar] [CrossRef]

- Delmas, M.; Tokat, Y. Deregulation, governance structures, and efficiency: The U.S. electric utility sector. Strateg. Manag. J. 2005, 26, 441–460. [Google Scholar] [CrossRef]

- Dormady, N.; Jiang, Z.; Hoyt, M. Do markets make good commissioners?: A quasi-experimental analysis of retail electric restructuring in Ohio. J. Public Policy 2019, 39, 483–515. [Google Scholar] [CrossRef]

- Goto, M.; Sueyoshi, T. Electricity market reform in Japan after Fukushima. Econ. Energy Environ. Policy 2016, 5, 15–30. [Google Scholar] [CrossRef]

- Boroumand, R.H. Electricity markets and oligopolistic behaviors: The impact of a multimarket structure. Res. Int. Bus. Financ. 2015, 33, 319–333. [Google Scholar] [CrossRef]

- Lehto, E. Electricity prices in the Finnish retail market. Energy Policy 2011, 39, 2179–2192. [Google Scholar] [CrossRef]

- Hooks, J.; Tooley, S. Electricity pricing in New Zealand and the Australian State of Queensland: Accounting for the impact of sector restructuring. Financ. Account. Manag. 2015, 31, 439–462. [Google Scholar] [CrossRef][Green Version]

- Ritschel, A.; Smestad, G.P. Energy subsidies in California’s electricity market deregulation. Energy Policy 2003, 31, 1379–1391. [Google Scholar] [CrossRef]

- Wang, N.; Mogi, G. From Regulation to Deregulation: An Empirical Study of Japanese Electric Utility R&D Investment Behavior under Transition. Energy Procedia 2017, 105, 3193–3200. [Google Scholar] [CrossRef]

- Su, X. Have customers benefited from electricity retail competition? J. Regul. Econ. 2015, 47, 146–182. [Google Scholar] [CrossRef]

- Razeghi, G.; Shaffer, B.; Samuelsen, S. Impact of electricity deregulation in the state of California. Energy Policy 2017, 103, 105–115. [Google Scholar] [CrossRef]

- Jang, P.Y.; Beruvides, M.G. Impact of the U.S. electric deregulation on California renewable investments. In Proceedings of the 2020 IISE Annual Conference, Online, 1–3 November 2020; pp. 109–114. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85105657936&partnerID=40&md5=182718364ce8224d73cb03f3ca737123 (accessed on 5 April 2022).

- Klinge Jacobsen, H.; Fristrup, P.; Munksgaard, J. Integrated energy markets and varying degrees of liberalization: Price links, bundled sales and CHP production exemplified by Northern European experiences. Energy Policy 2006, 34, 3527–3537. [Google Scholar] [CrossRef]

- Shin, K.J.; Managi, S. Liberalization of a retail electricity market: Consumer satisfaction and household switching behavior in Japan. Energy Policy 2017, 110, 675–685. [Google Scholar] [CrossRef]

- Zhao, C.; Zhang, S.; Wang, X.; Li, T. Modeling and Simulation of Electricity Retail Market with Oligopolistic Equilibrium Method. In Proceedings of the 8th Annual IEEE International Conference on Cyber Technology in Automation, Control and Intelligent Systems, CYBER 2018 2014 2019, 8th IEEE Annual International Conference on Cyber Technology in Automation, Control, and Intelligent Systems (IEEE-CYBER), Tianjin, China, 9–23 July 2018; pp. 1478–1483. [Google Scholar] [CrossRef]

- Thomas, S. Progress with energy markets in Europe. Econ. Policy Energy Environ. 2014, 1, 5–26. [Google Scholar] [CrossRef]

- Apprill, M. Regulations impact on restructuring. IEEE Potentials 1997, 16, 11–13. [Google Scholar] [CrossRef]

- Jin, L.; Chen, C.; Wang, X.; Yu, J.; Long, H. Research on information disclosure strategies of electricity retailers under new electricity reform in China. Sci. Total Environ. 2020, 710, 136382. [Google Scholar] [CrossRef] [PubMed]

- Kleit, A.N.; Shcherbakova, A.V.; Chen, X. Restructuring and the retail residential market for power in Pennsylvania. Energy Policy 2012, 46, 443–451. [Google Scholar] [CrossRef]

- Kurihara, I. Restructuring of the electric power industry and the current state of the power market in Japan. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, PES, Montreal, QC, Canada, 18–22 June 2006. [Google Scholar] [CrossRef]

- Defeuilley, C. Retail competition in electricity markets. Energy Policy 2009, 37, 377–386. [Google Scholar] [CrossRef]

- Hosoe, N.; Takagi, S. Retail power market competition with endogenous entry decision-An auction data analysis. J. Jpn. Int. Econ. 2012, 26, 351–368. [Google Scholar] [CrossRef]

- Streimikiene, D.; Siksnelyte, I. Sustainability assessment of electricity market models in selected developed world countries. Renew. Sustain. Energy Rev. 2016, 57, 72–82. [Google Scholar] [CrossRef]

- Fontana, M.; Iori, M.; Nava, C.R. Switching behavior in the Italian electricity retail market: Logistic and mixed effect Bayesian estimations of consumer choice. Energy Policy 2019, 129, 339–351. [Google Scholar] [CrossRef]

- Haar, L. The competitive disadvantages facing British assetless electricity retailers. Energy Policy 2021, 155, 112323. [Google Scholar] [CrossRef]

- Brown, D.P.; Eckert, A. The effect of default rates on retail competition and pricing decisions of competitive retailers: The case of Alberta. Energy Policy 2018, 118, 298–311. [Google Scholar] [CrossRef]

- Chen, A.S.; Ahn, P.T. The effect of deregulation on firm leverage and strategic behavior: Evidence from U.S. electricity industry. Finance a Uver-Czech. J. Econ. Financ. 2019, 69, 489–507. [Google Scholar]

- Wakiyama, T.; Zusman, E. The impact of electricity market reform and subnational climate policy on carbon dioxide emissions across the United States: A path analysis. Renew. Sustain. Energy Rev. 2021, 149, 111337. [Google Scholar] [CrossRef]

- Esplin, R.; Davis, B.; Rai, A.; Nelson, T. The impacts of price regulation on price dispersion in Australia’s retail electricity markets. Energy Policy 2020, 147, 111829. [Google Scholar] [CrossRef]

- Melnik, A.N.; Mustafina, O.N. The liberalization of electricity market in Russia. Asian Soc. Sci. 2014, 10, 280–286. [Google Scholar] [CrossRef][Green Version]

- Creti, A.; Pouyet, J.; Sanin, M.E. The NOME law: Implications for the French electricity market. J. Regul. Econ. 2013, 43, 196–213. [Google Scholar] [CrossRef]

- Erdogan, M.R.; Camgoz, S.M.; Karan, M.B.; Berument, M.H. The Switching Behavior of Large-scale Electricity Consumers in the Turkish Electricity Retail Market. Energy Policy 2022, 160, 112701. [Google Scholar] [CrossRef]

- Chen, W.M. The U.S. electricity market twenty years after restructuring: A review experience in the state of Delaware. Util. Policy 2019, 57, 24–32. [Google Scholar] [CrossRef]

- Woo, C.K.; Zarnikau, J. Will Electricity Market Reform Likely Reduce Retail Rates? Electr. J. 2009, 22, 40–45. [Google Scholar] [CrossRef]

- Esplin, R.; Best, R.; Scranton, J.; Chai, A. Who pays the loyalty tax? The relationship between socioeconomic status and switching in Australia’s retail electricity markets. Energy Policy 2022, 164, 112904. [Google Scholar] [CrossRef]

- Omine, E.; Hatta, H.; Ueno, T. A study of the economic feasibility of Smart Community—Calculation of the profit of Community Operator considering introduction of battery and cogeneration systems. In Proceedings of the 2016 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Minneapolis, MN, USA, 6–9 September 2016; pp. 1–5. [Google Scholar]

- Do Prado, J.C.; Qiao, W.; Qu, L.; Agüero, J.R. The next-generation retail electricity market in the context of distributed energy resources: Vision and integrating framework. Energies 2019, 12, 491. [Google Scholar] [CrossRef]

- Do Amaral, H.L.; De Souza, A.N.; Gastaldello, D.S.; Fernandes, F.; Vale, Z. Smart meters as a tool for energy efficiency. In Proceedings of the 2014 11th IEEE/IAS International Conference on Industry Applications, Juiz de Fora, Brazil, 7–10 December 2014; pp. 1–6. [Google Scholar]

- European Technology Platform. “SMART GRIDS”—Strategic Deployment Document for Europe’s Electricity Networks of the Future. 2008. Available online: http://www.smartgrid.eu/documents/smartgrids_SDD_Final_April2010.pdf (accessed on 6 June 2022).

- Vijayapriya, T.; Kothari, D.P. Smart grid: An overview. Smart Grid Renew. Energy 2011, 2, 305. [Google Scholar] [CrossRef]

- Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and The Committee of the Regions. REPowerEU: Joint European Action for more affordable, secure and sustainable energy, COM/2022/108. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en#documents (accessed on 6 June 2022).

- Ministero Dello Sviluppo Economico Decreto 6 Agosto 2020, Requisiti Tecnici per L’accesso Alle Detrazioni Fiscali per la Riqualificazione Energetica Degli Edifici—cd. Ecobonus. (20A05394). GU Serie Generale n.246 del 05-10-2020. Available online: https://www.gazzettaufficiale.it/atto/serie_generale/caricaDettaglioAtto/originario?atto.dataPubblicazioneGazzetta=2020-10-05&atto.codiceRedazionale=20A05394 (accessed on 6 June 2022).

- Caputo, F.; Buhnova, B.; Walletzký, L. Investigating the role of smartness for sustainability: Insights from the Smart Grid domain. Sustain. Sci. 2018, 13, 1299–1309. [Google Scholar] [CrossRef]

- Pepermans, G.; Driesen, J.; Haeseldonckx, D.; Belmans, R.; D′haeseleer, W. Distributed generation: Definition, benefits and issues. Energy Policy 2005, 33, 787–798. [Google Scholar] [CrossRef]

- Ketola, T. Genuine sustainability as virtuous sustainable development. In Handbook of Virtue Ethics in Business and Management; Springer: Dordrecht, The Netherlands, 2017. [Google Scholar]

- Gunnarsdóttir, I.; Davidsdottir, B.; Worrell, E.; Sigurgeirsdóttir, S. Review of indicators for sustainable energy development. Renew. Sustain. Energy Rev. 2020, 133, 110294. [Google Scholar] [CrossRef]

| Population | Intervention | Comparison | Outcome | |

|---|---|---|---|---|

| Key concepts | electricity retail market | Impact | Not applicable | Evaluation |

| Free text terms/natural language terms | Energy OR Electricity OR Power | Liberalization OR “free market” OR Competition | - | Impact OR Evaluation OR Status |

| Retailers OR retail | Deregulation OR restructured | - |

| Description | Results |

|---|---|

| Timespan | 1997–2022 |

| Sources (Journals, Books, etc) | 28 |

| Documents | 48 |

| Average years from publication | 7.33 |

| Average citations per document | 13.31 |

| Average citations per year per doc | 1.491 |

| References | 1806 |

| Scopus document type | |

| article | 40 |

| conference paper | 5 |

| review | 3 |

| Type of Market | Effect on Market Structure and Operators | References |

|---|---|---|

| Deregulated market | Diversification impact on efficiency | [41] |

| Financial issues for investor-owned utilities | [47] | |

| High negative impact on R&D expenditure | [48] | |

| Low Competition | [50] | |

| Ownership impact on efficiency | [45] | |

| Possible abuse of market power by retailers | [42] | |

| The RPS program was more influential than the electric prices | [51] | |

| Companies’ size impact on market strategies | [66] | |

| externalities for small firms | [66] | |

| utilities could not recover their energy procurement | [47] | |

| Withdrawal of the cheapest offers from the market in case of a price cap | [68] | |

| Not analyzed | [46,51,58,61,67,73] | |

| Liberalized market | competitive advantage for horizontally integrated retailers | [44,52,63] |

| Difficulties for incumbents | [38,60] | |

| Failure to prevent market concentration | [55] | |

| Competitive advantage for vertically integrated retailers | [13] | |

| Increased risk for small and non-integrated companies | [13] | |

| Increased service costs for independent retailers | [38] | |

| Negative correlation between price and market concentration of the largest retailer | [32] | |

| Negative impact on retailers only (externalities) | [64] | |

| Possible double margin for an incumbent | [70] | |

| Service quality impacts information transparency | [57] | |

| Supplier stimulated to be more efficient | [60] | |

| unstable dynamics of energy prices | [69] | |

| Not analyzed | [14,39,53,74] | |

| Market in transition | Higher power charges | [59] |

| Increase in operating costs | [35] | |

| Increase in the number of operators | [36] | |

| Increased business risk | [36] | |

| Low Competition | [30] | |

| New business opportunities | [43] | |

| Possible increase in total jobs but possible unemployment for pre-existing retailer workers | [15] | |

| Competitive advantage for vertically integrated retailers | [40] | |

| Reduced profit | [35] | |

| Advantages of incumbents and regional vendors | [71] | |

| Mixed market | Electricity suppliers are incentivized to vertical integration. | [44] |

| Income elasticity increased | [37] | |

| Possible higher sustainability after the retail creation | [62] | |

| Reduced Exit Barrier for Retailers | [49] | |

| suppliers transformed spot price rises and fall into profits | [44] | |

| Not analyzed | [33] | |

| Restructuring Market | Increase in the number of operators | [65] |

| Very high concentration in 3 major retailers | [65] | |

| No change | [72] | |

| Theory market analysis | Utilities will separate their services into the four components of distribution, transmission, generation, and customer services. | [56] |

| Not analyzed | [31,34,54] |

| Type of Market | Effect on Price and Customers | References |

|---|---|---|

| Deregulated market | The final regulated price leads to low consumer awareness by customers | [47] |

| In some cases, higher price | [42] | |

| Lower Prices | [67] | |

| Not lower prices | [42,59] | |

| Not optimal outcomes for consumers. | [46] | |

| Ownership impact on the price | [45,46,73] | |

| Possible future lower price | [61] | |

| Possible higher Base price | [68] | |

| Small discount for new (Active) customers | [68] | |

| Transitory price reduction | [58] | |

| Impact of utility dimension impact on the price | [66] | |

| Not analyzed | [41,48,51] | |

| Liberalized market | Impact of country heterogeneity impact on switching rate | [63] |

| Increased switching rate | [39] | |

| information asymmetry | [13,32,74] | |

| Limited benefit for household customers in case of market concentration | [63] | |

| Limited Benefits for Small and residential consumers | [13] | |

| Limited effect on residential prices | [14] | |

| Lower price for commercial and industrial sectors | [14] | |

| New choice opportunities | [53] | |

| New opportunities for active customers. | [60] | |

| No gain for passive customers | [60] | |

| welfare risks to vulnerable and low-income consumers | [55] | |

| Positive impacts on consumer engagement | [39] | |

| Possible higher price | [32] | |

| Possible increase in bundle gas + energy + district heating offers | [52] | |

| Possible optimization of consumption and costs with smart meters | [55] | |

| Scarce switching rate | [13] | |

| Crucial role of sales information in the market | [74] | |

| Not analyzed | [38,64,69,70] | |

| Market in transition | Higher price under competition scenario | [35] |

| Increase in eligible consumers with regulated price | [30] | |

| Low market opening ratio | [30] | |

| Lower prices | [59] | |

| Possible improve welfare | [15] | |

| The regulation of the price disincentivizes the switching rate | [30] | |

| information asymmetry | [71] | |

| Price restriction is a barrier to business innovation. | [71] | |

| Not analyzed | [36,40,43] | |

| Mixed market | competition has benefited consumers | [33] |

| Doubt about consumer benefits | [44] | |

| Lower price Residential customer transitory period | [49] | |

| lower prices | [33] | |

| Multimarket set to a collective market power at the expense of consumers | [44] | |

| Natural gas demand substitute for residential and commercial energy but complementary to industrial | [33] | |

| no benefit to commercial or industrial customers | [49] | |

| There are no significant differences in price elasticity between deregulated and not regulated countries | [37] | |

| Not Analyzed | [62] | |

| Restructuring Market | Limited benefit | [72] |

| Little influence of customers over electric rate | [72] | |

| No impact on prices | [72] | |

| Price restriction is a barrier to business innovation. | [65] | |

| Theory market analysis | The price regulation of RETAILCOs would be greatly reduced or eliminated. | [56] |

| Not analyzed | [31,34,54] |

| Type of Market | Environmental Effect | References |

|---|---|---|

| Deregulated market | Possible increase in CO2 emissions in the presence of retail market | [67] |

| renewable energy investments are affected by the state electric prices | [51] | |

| Liberalized market | CO2 emissions increased after electricity reforms | [14] |

| Possible optimization of consumption and costs with smart meters | [55] | |

| Market in transition | Possible stimulation in the establishment of smart communities and the proliferation of smart meters. | [43] |

| Mixed market | The opening of the retail market affects sustainability | [62] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Leo, S.; Chicca, M.; Daraio, C.; Guerrini, A.; Scarcella, S. A Framework for the Analysis of the Sustainability of the Energy Retail Market. Sustainability 2022, 14, 7320. https://doi.org/10.3390/su14127320

Di Leo S, Chicca M, Daraio C, Guerrini A, Scarcella S. A Framework for the Analysis of the Sustainability of the Energy Retail Market. Sustainability. 2022; 14(12):7320. https://doi.org/10.3390/su14127320

Chicago/Turabian StyleDi Leo, Simone, Marta Chicca, Cinzia Daraio, Andrea Guerrini, and Stefano Scarcella. 2022. "A Framework for the Analysis of the Sustainability of the Energy Retail Market" Sustainability 14, no. 12: 7320. https://doi.org/10.3390/su14127320

APA StyleDi Leo, S., Chicca, M., Daraio, C., Guerrini, A., & Scarcella, S. (2022). A Framework for the Analysis of the Sustainability of the Energy Retail Market. Sustainability, 14(12), 7320. https://doi.org/10.3390/su14127320