The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China

Abstract

1. Introduction

2. Literature Review

2.1. Carbon Emission Trading Policy

2.2. Enterprises’ Green Technology Innovation

2.3. Enterprises’ Environmental Strategies

3. Theoretical Basis

3.1. Resource Scarcity Theory

3.2. Porter’s Hypothesis

3.3. Green Technology Innovation Theory

4. Research Hypothesis

4.1. Carbon Emission Trading Policies and Enterprises’ Green Technology Innovation

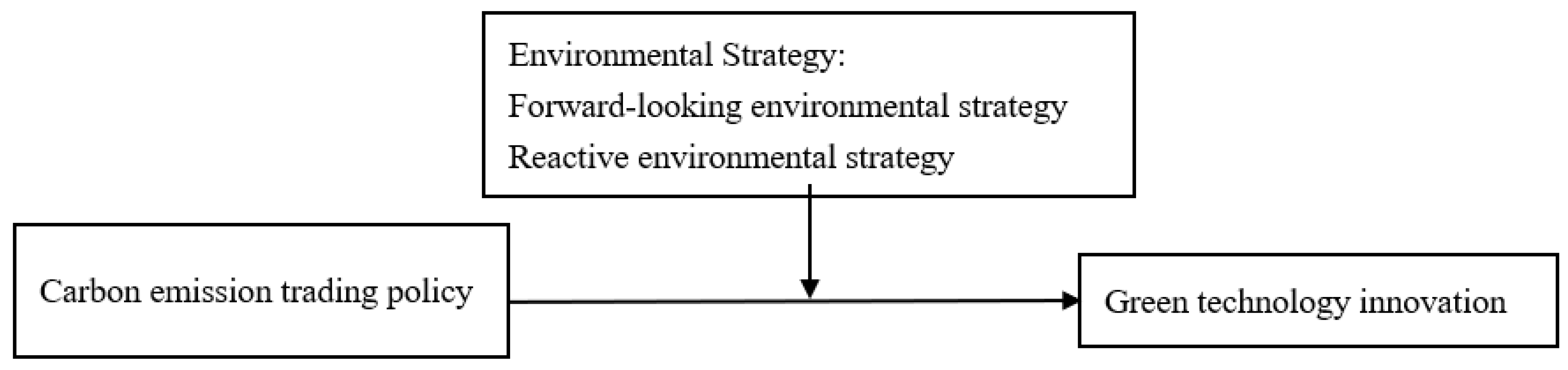

4.2. Regulatory Effects of Environmental Strategies

5. Research Methodology

5.1. Research Methods

5.2. Variable Description and Descriptive Statistics

5.3. Data Analysis Results

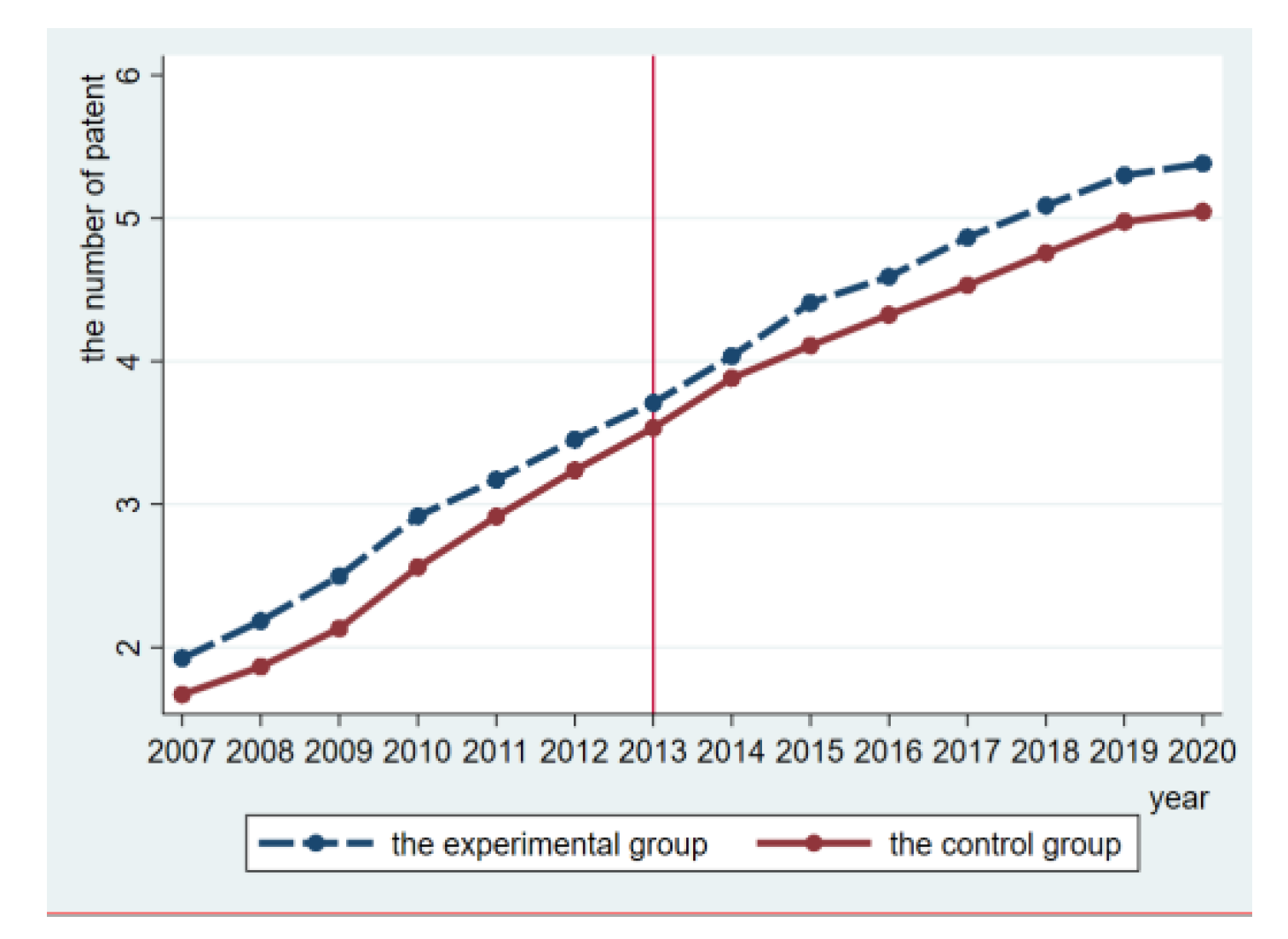

5.3.1. Parallel Trend Test

5.3.2. Correlation Test

5.3.3. Robustness Test

6. Conclusions and Discussion

6.1. Research Conclusions

- First, carbon emission trading policies have a significant positive impact on enterprises’ green technology innovation based on the consideration of the enterprise size, maturity, profit margins, and debt-paying ability ratio. The carbon emission trading policies restrain carbon emissions in the production and operation processes of enterprises, promote enterprises to carry out green technology innovation activities, and reduce the carbon emission per unit product. These policies have a significant effect on innovation promotion.

- Second, according to the information disclosure of environmental performance and energy consumption, different environmental strategies were divided into forward-looking strategies and reactive strategies. We classified the sample enterprises into different strategic types and found that environmental regulation has a significant positive impact on the green technology innovation of the two strategic types of enterprises and that the carbon emission trading policies have a greater promotion effect on the green technology innovation of enterprises with forward-looking strategies than those with reactive strategies.

6.2. Research Significance

6.2.1. Theoretical Significance

6.2.2. Practical Significance

6.3. Research Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aldy, J.E. Pricing climate risk mitigation. Nat. Clim. Chang. 2015, 5, 396–398. [Google Scholar] [CrossRef]

- Edenhofer, O.; Kowarsch, M. Cartography of pathways: A new model for environmental policy assessments. Environ. Sci. Policy 2015, 51, 56–64. [Google Scholar] [CrossRef]

- Keohane, N.; Petsonk, A.; Hanafi, A. Toward a club of carbon markets. Clim. Chang. 2017, 144, 81–95. [Google Scholar] [CrossRef]

- Convery, F.J.; Redmond, L. The European Union Emissions Trading Scheme: Issues in allowance price support and linkage. Annu. Rev. Resour. Econ. 2013, 5, 301–324. [Google Scholar] [CrossRef][Green Version]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Chau, C.K.; Leung, T.M.; Ng, W.Y. A review on life cycle assessment, life cycle energy assessment and life cycle carbon emissions assessment on buildings. Appl. Energy 2015, 143, 395–413. [Google Scholar] [CrossRef]

- Zailani, S.; Iranmanesh, M.; Nikbin, D.; Jumadi, H.B. Determinants and environmental outcome of green technology innovation adoption in the transportation industry in Malaysia. Asian J. Technol. Innov. 2014, 22, 286–301. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Porter, M.E. Towards a dynamic theory of strategy. Strateg. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Stavins, R.N. Dynamic incentives of environmental regulations: The effects of alternative policy instruments on technology diffusion. J. Environ. Econ. Manag. 1995, 29, S43–S63. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Calel, R.; Dechezleprêtre, A. Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef]

- Wagner, M. On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 2007, 36, 1587–1602. [Google Scholar] [CrossRef]

- Chintrakarn, P. Environmental regulation and US states’ technical inefficiency. Econ. Lett. 2008, 100, 363–365. [Google Scholar] [CrossRef]

- Filatova, T. Market-based instruments for flood risk management: A review of theory, practice and perspectives for climate adaptation policy. Environ. Sci. Policy 2014, 37, 227–242. [Google Scholar] [CrossRef]

- Luo, Y.; Salman, M.; Lu, Z. Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef] [PubMed]

- Zhang, K.; Liu, X.; Hong, M. Discretionary effort on green technology innovation: How Chinese enterprises act when facing financing constraints. PLoS ONE 2021, 16, e0261589. [Google Scholar] [CrossRef] [PubMed]

- Memari, A.; Ahmad, R.; Rahim, A.; Rahman, A.; Akbari Jokar, M.R. An optimization study of a palm oil-based regional bio-energy supply chain under carbon pricing and trading policies. Clean Technol. Environ. Policy 2018, 20, 113–125. [Google Scholar] [CrossRef]

| Variable | Indicator | Mean | Sd | Min | Max |

|---|---|---|---|---|---|

| lnpatent | The logarithm of patents | 3.789 | 1.875 | 0 | 11.143 |

| lrl | The profit margin | 8.006 | 14.861 | −92.655 | 74.266 |

| czl | Solvency ratio | 53.403 | 18.756 | −9.744 | 98.694 |

| age | Enterprise maturity | 21.602 | 5.344 | 5 | 62 |

| scale | The enterprise scale | 8.148 | 1.258 | 4.331 | 12.859 |

| lncapital | The logarithm of the total assets of a business | 20.982 | 1.392 | 17.402 | 26.539 |

| (1) | |

|---|---|

| lnpatent | |

| did | 1.116 *** |

| (27.36) | |

| cons | 3.570 *** |

| (197.18) | |

| N | 12,609 |

| Source | SS | Df | MS | Number of Obs | 12,593 |

|---|---|---|---|---|---|

| F(612,586) | 451.5 | ||||

| Model | 7839.49125 | 6 | 1306.58187 | Prob > F | 0 |

| Residual | 36,422.5574 | 12,586 | 2.8938946 | R-squared | 0.1771 |

| Adj R-squared | 0.1767 | ||||

| Total | 44,262.0486 | 12,592 | 3.51509281 | Root MSE | 1.7011 |

| Lnpatent | Coef. | Std. Err. | T | [95% Conf. Interval] | |

|---|---|---|---|---|---|

| did | 1.099 *** | 0.0383453 | 28.66 | 1.02367 | 1.173995 |

| lrl | −0.007 *** | 0.0011047 | −5.91 | −0.0086979 | −0.0043672 |

| lncapital | 0.032 | 0.0215339 | 1.49 | −0.0100346 | 0.0743847 |

| czl | 0.003 ** | 0.0010062 | 3.02 | 0.0010661 | 0.0050107 |

| scale | 0.500 *** | 0.0217822 | 22.95 | 0.4570962 | 0.542489 |

| age | −0.001 | 0.0028759 | −0.26 | −0.0063748 | 0.0048996 |

| _cons | −1.267 *** | 0.3533195 | −3.59 | −1.959487 | −0.5743671 |

| Strategy | Forward | React |

|---|---|---|

| lnpatent | lnpatent | |

| did | 1.196 *** | 0.975 *** |

| (16.73) | (20.17) | |

| _cons | 3.957 *** | 3.377 *** |

| (114.06) | (166.29) | |

| N | 4401 | 8208 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, H.; Lin, J.; Jiang, C. The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China. Sustainability 2022, 14, 7207. https://doi.org/10.3390/su14127207

Tian H, Lin J, Jiang C. The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China. Sustainability. 2022; 14(12):7207. https://doi.org/10.3390/su14127207

Chicago/Turabian StyleTian, Hong, Jiaen Lin, and Chunyuan Jiang. 2022. "The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China" Sustainability 14, no. 12: 7207. https://doi.org/10.3390/su14127207

APA StyleTian, H., Lin, J., & Jiang, C. (2022). The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China. Sustainability, 14(12), 7207. https://doi.org/10.3390/su14127207