1. Introduction

According to the United Nations Buildings and Climate Change programs, buildings consume 30–40% of primary energy [

1] and even up to 48%, if one considers the construction industry’s energy and material needs [

2]. Construction can be seen as a system that goes through a cycle, and at each stage, a policy can address new practices to create a positive impact. Barriers and opportunities in real estate development will be identified as to why market-driven developers have notoriously put their individual and short-term profit goals ahead of the common good.

Real estate developers are currently relying on private businesses to find zero-carbon solutions for the built environment when it works against their financial interests. At the same time, these same developers are challenged by increasing government regulations for sustainable and affordable housing and creating green projects. However, it is not that simple to hand off responsibility to one stakeholder in the building community and assume that an entire industry will change. Cash is liquid, and if it is too challenging to build in one city, a developer will move to another city. With less development happening in a city, a secondary negative effect of scarcity in a city’s supply of housing and commercial space will develop, which will drive up building prices and lead to social and economic challenges that will add to the mounting climate challenges. Therefore, it is in a city’s best interest for real estate developers to identify the problems with adopting green projects and to identify solutions for those real estate developers to work WITH the community rather than only profit from them [

3]. This paper will, along with an empirical field study, apply academically accepted theories and practices to market-driven real estate developments.

Whereas there is no one clear definition of green projects or green project management in the literature, for the purposes outlined here, green projects, by definition, take into consideration life cycle modelling, recycled materials, lower waste and water management and effective resource management [

4,

5]. The literature highlights global resource depletion at an alarming rate based on human overexploitation [

6,

7,

8,

9]. The construction industry is a massive contributor to increasing the adverse effects of climate change based on buildings consuming large amounts of energy in their construction and management [

6,

10,

11,

12]. Green projects could be the construction industry’s response in enacting sustainable development and could be a part of the solution.

Alternatively, Choi et al. (2010) define a green project as “creating structures and using environmentally responsible and resource-efficient processes throughout a building’s life-cycle, from siting to design, construction, operation, maintenance, renovation, and deconstruction”. This definition is broader in its scope and involvement in the life cycle of buildings and introduces the notion of critical stakeholders in the question of how to address climate change through policy measures [

13]. In an article by Liu et al. (2015), which speaks of the “Green Deal”, green projects include a healthy, comfortable and efficient use of resources where buildings are evaluated along the whole life cycle [

14]. For this paper, we will focus on the role of private real estate developers that work with the construction industry to build sustainable, green projects that we hope can be scaled up in sustainable communities.

Suppose that real estate developers know what they need to do to lower our collective carbon footprint in the built environment. Why is the industry not adopting green construction or management practices? Social cognitive theory (SCT) is a behaviour theory to explain the decisions and motivations for investing in green projects [

15]. If it is less costly to invest in green projects, people will be motivated to do so. The challenge is finding financing solutions and business models for long payback periods, that are typical in building retrofit or high-efficiency new construction.

Therefore, what are the best options, and how can systemic change be driven across the market? Supposing that one is to drive systematic change in real estate development, individual buildings must then be seen as part of a city-wide system that creates the scale needed for meaningful change within a neighbourhood lens.

One of this study’s authors, being the president of a social impact real estate development company, has highlighted that business must change and adapt from being driven by purely capitalistic interests for the sake of a carbon emissions reduction for future generations. Real estate developers use collective resources for individual profit maximation and they benefit from global overharvesting and an ineffective use of resources that causes, in part, a large carbon footprint and pushes climate change at a rapid pace. As an alternative to the regular standard business practices of real estate developers, the B Corp’s business concept uses “business as a force of good” that modifies a private business’s requirement to operate on a triple bottom line where people, profit and the planet must be equal in importance as the drivers in company mandate missions and outcomes.

The B Corp community [

16] works toward a reduced inequality, lower levels of poverty, a healthier environment, stronger communities, and the creation of more high-quality jobs with dignity and purpose. The B Corp community involves 3720 certified companies across 150 industries in 74 countries, that all have one unifying goal of working collaboratively to demonstrate through action that a market-driven business can be the driving force of systemic change. If it can be widely accepted that the drive to individual profit maximation of the capitalist system has led in general to a massive negative impact on the planet, then the B Corp movement has chosen to address the positive attributes of market-driven business in a different way so that business can work towards the value creation of a collective good [

16].

In addition to the B Corp movement, additional social pressure on the real estate developer is the increase in popularity of the United Nations Sustainable Development Goals. The United Nations have played an active role in thought leadership on collective action. The United Nations Sustainable Development Goals (UNSDG) [

17] are managed through the United Nations Department of Economic and Social Affairs (UNDESA) to lead a policy framework to drive positive systemic impact. It investigates integrated policy responses in many priority areas such as sustainable development goals, technology facilitation, a green economy, sustainable transport, sustainable cities, oceans, climate change in sustainable development and the nexus among energy, food and water.

The UNSDG goal number 11 ([

18], p. 11) sets an essential framework for an urban policy as a context for real estate developers. Along with the B Corp [

16] business model, this helps to understand the role they can play in systematic climate mediation in the building community. The UNSDGs demonstrate a global commitment to work towards the 17 goals to change the world. Developers have a responsibility and an opportunity to make a real difference and undo the years of destruction that the industry has caused, but academic research is not enough to make developers understand their role in systematic solutions. Frameworks such as B Corp and the UNSDGs will serve as a way for businesses to develop a possible action plan and be part of the solution. The UNSDGs will also help provide government policymakers with a common language between stakeholders.

Before each stakeholder’s role can be listed, it is vital to recognise that the building industry is a system and not an isolated collection of buildings and contractors. This paper proposes that part of the solution to changing how real estate development is practiced is to create a new framework. To scale social change, all stakeholders have to come to the proverbial table, and all must create a new outlook that does not base itself on the few members of their group to rely on altruistic virtues to drive social change, as this is not enough to create real and long-lasting impact. The following section will be presented as a new typology of business applied to the real estate development industry. It aims to drive market returns by creating more substantial and socially integrated communities while minimizing damage to the environment and capitalizing on market returns, actively rebuilding our planet to allow buildings to be a part of the carbon solution rather than a significant player of negative impact.

This paper addresses vital stakeholders in real estate as agents of a possible change to positively impact development to shift from being a destructive environmental force to taking part in sustainable solutions. A SWOT identification will highlight the key stakeholders’ barriers and opportunities to climate change relating to real estate developers which can lead to policy recommendations that could be the solution to a win–win strategy for systems change and mitigate climate change’s adverse effects. Therefore, this paper is subdivided into four sections. The introduction is followed by a Materials and Methods section that discusses the literature review of significant problems focused on real estate development sustainable practice. The following section is a case study implemented to bring together the tools for a sustainable development project located in Lachine, QC. Finally, the conclusion section summarizes the findings throughout the study.

2. Materials and Methods

This paper’s methodology is based on a literature review of relevant articles and thought leaders in the sustainable development building industry to set the framework of thinking beyond the barriers and opportunities for real estate developers to adopt new practices as a baseline standard for development. Search keywords as shown in

Table 1 included “green buildings” + “barriers and incentives to implementation”, “green building methods”, barriers to green/carbon-neutral construction, the role of legislation or incentives as drivers to green development, green building funding and incentives, and the green performance of buildings, in real estate developments. The review was viewed through a market business lens to expand the research knowledge and overcome the barriers to adoption for real estate developers that are content with “business as usual”. The construction industry’s global impact is generally accepted as representing 40% of the carbon footprint responsible for climate change; therefore, the opportunity to mobilize change adoption in the real estate development world could lead to significant reductions in GHG.

In addition to this literature review, the novel part of this collaboration of authors is the addition of a private developer with over twenty-seven years of experience as a triple bottom line developer whose core values are to work based on care for the community and the environment while generating profit. The developer author offers her insight into over 1.5 million square feet of redeveloped industrial sites and heritage-protected properties in Montreal. She has vast experience engaging stakeholders and working collaboratively with cities regarding zoning regulations and uses innovative financing tools to create low-carbon developments. This paper benefits from an empirical field study approach that links together with the literature review results to create an innovative way to look at best practices, from academic research blended with practical market solutions.

The paper will address stakeholders as change agents in real estate development as a system of integrated parts through a SWOT identification of the key recurrent elements from the empirical field studies to complement the literature review findings. It uses one of the author’s experiences as a private developer to drive essential practices from academia to the developing world to adopt new practices and drive change at a scale needed to reach carbon reduction targets.

A case study eco-district in the borough Lachine-Est in Montreal, Canada, will be used to highlight the barriers and opportunities for cities to establish a collaboration with differentiated stakeholders, to drive policy change to engage rather than regulate an industry towards positive impact. One of the authors participated and was a key leader as a market developer for the Lachine-Est eco-district and worked with community groups, citizens, the mayor, bankers and other developers in the area. It was the first of its kind in Montreal, where this additional empirical field study was applied to the master planning of an area of Montreal where all the key stakeholders worked side by side. This paper will demonstrate that the suggestions that the authors make are based on an academic literature review as well as on empirical market studies that provide critical intersections of policy and incentives for cities to promote sustainable district development.

2.1. Green Project Cycle from a Real Estate Perspective

Greenhouse gas (GHG) emissions of over 40% are related to buildings. A study of 73 buildings showed that the operational stage contributes to 80–90% of GHG emissions [

19]; however, most real estate developers are not aware of what impact their choices have on carbon emissions. It is assumed that if the construction industry used fewer materials and also used locally produced materials, this would significantly affect carbon reductions. To take this thought one step further, one must look at the tendency that developers first demolish an older building to build a new one in its place. Real estate developers believe that they can, thus, have more control over the costs and reduce their exposure to financial risks and cost overruns; however, the actual cost savings should be evaluated including the demolition of the building instead of incorporating the existing building into the new development and the impact on carbon and energy reductions. Having an honest discussion on policy change can help bring stakeholders together to have a collective positive impact in the construction industry, but it must be pointed out that the development process itself is a cycle and must be evaluated accordingly, and not as an isolated building type or practice of development or redevelopment.

A life cycle analysis (LCA) of buildings is not considered by most developers when evaluating a new project. Designing and constructing new buildings usually does not include LCA in the early stages; however, a LCA perspective inclusion is crucial to achieving net-zero energy communities and buildings [

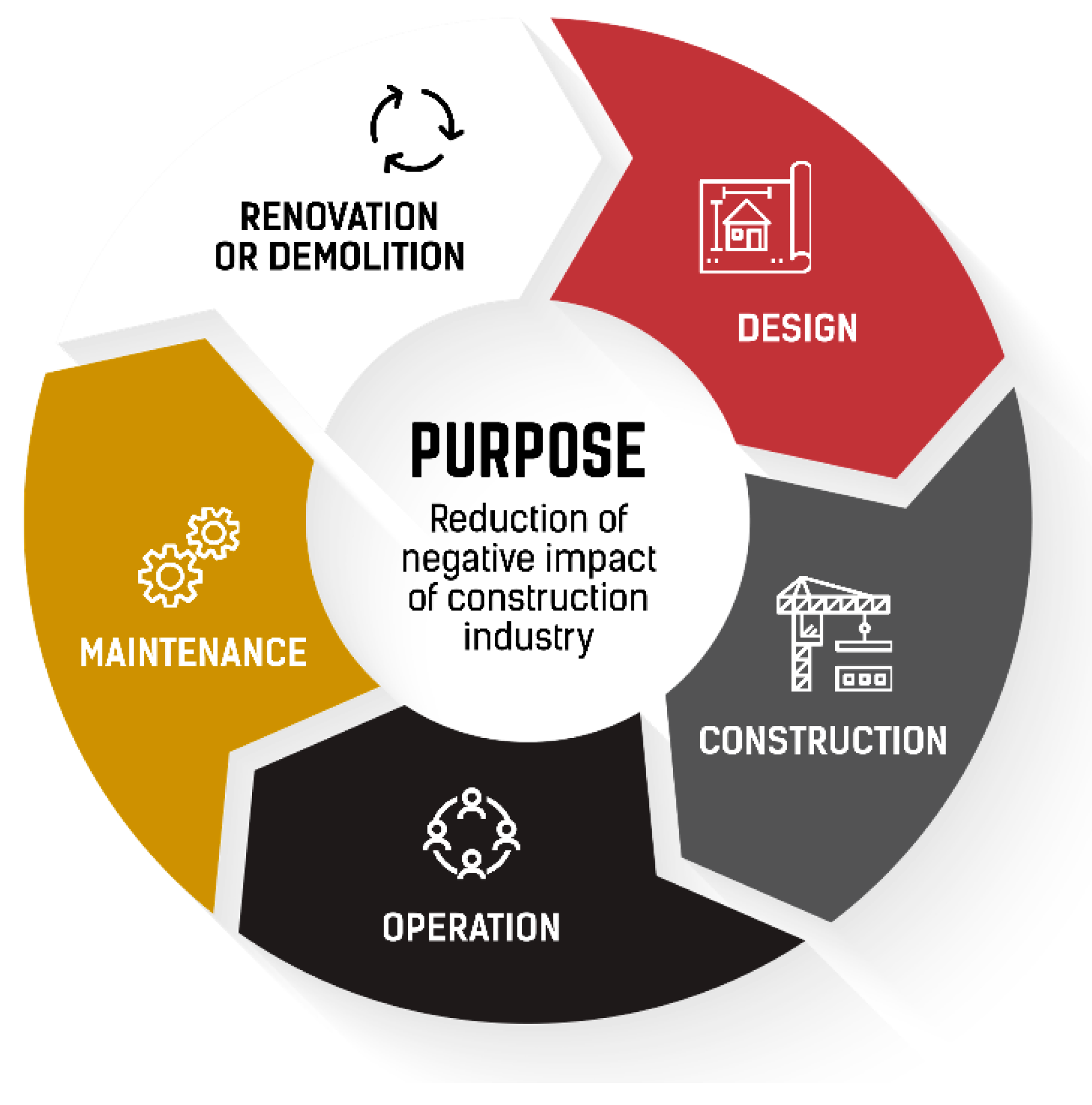

20]. Identifying that the construction process is a cycle helps set a deeper understanding of a developer’s actions and their possible impact. This cycle can be split into five stages: design, construction, operation, maintenance and management, and renovation/demolition [

13], as shown in

Figure 1.

For policymakers and real estate developers to truly see the most significant opportunities for change, all must start at the design stage. At this stage, the goals and objectives are set along with the guiding principles [

21]. All development team members from architects, urban planners, construction managers, development team members, and later, the leasing and sales directors, need to be on board with any theory of change that could lower the carbon footprint of their projects. In the construction stage, new integrated opportunities for green building techniques can be incorporated followed by green operations policies, where property holders can implement changes to end-user behaviour. The last stage links to the start of the cycle again when a strategic decision would be made if a building should be further renovated or demolished. If a building were to be demolished at this stage, sustainable waste strategies could be implemented to reduce the carbon footprint, and some materials could be salvaged to be reused.

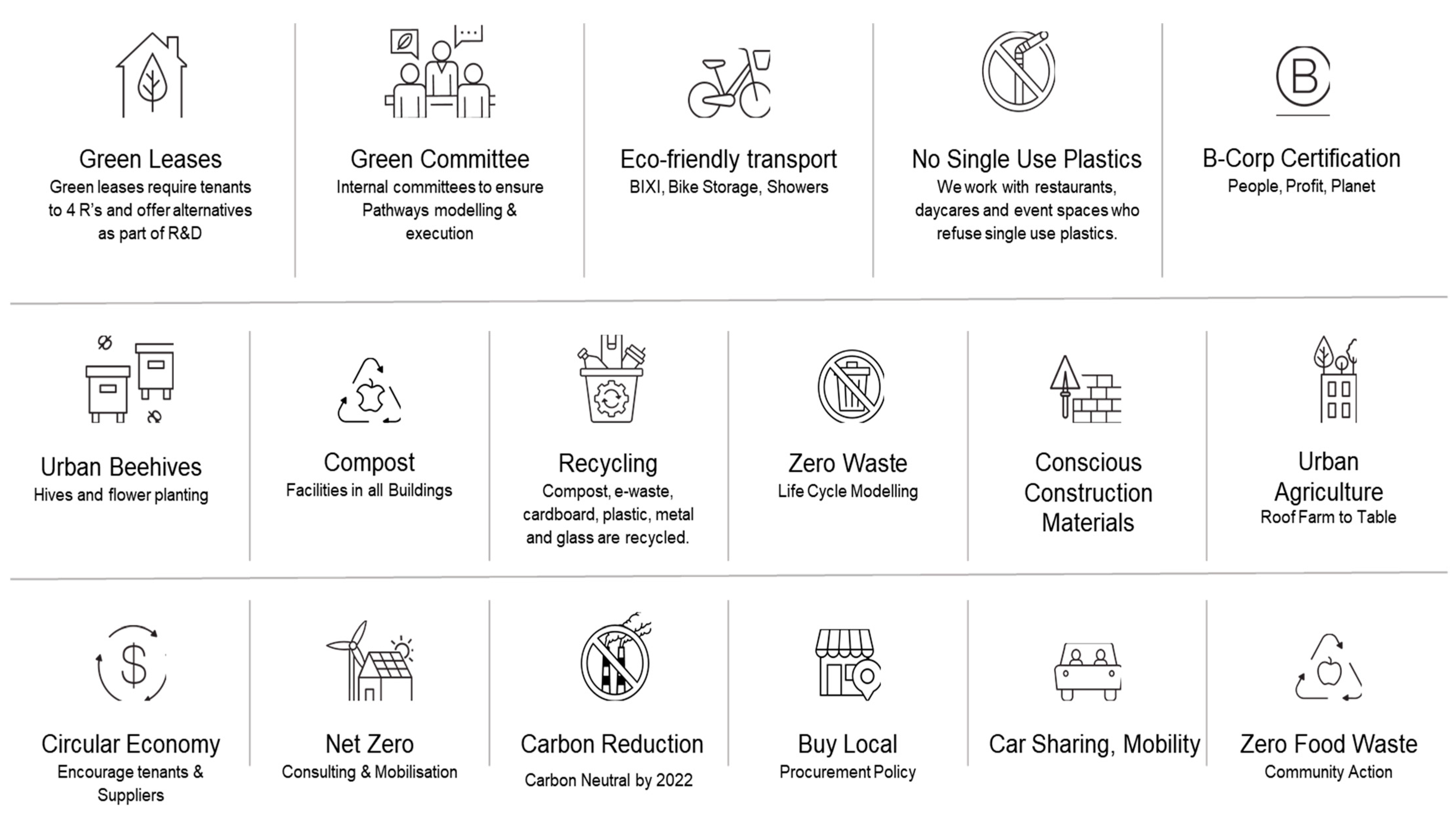

One area that is often overlooked is the real estate cycle’s operations. Building owners and managers could significantly reduce carbon in the building sector by instating policies that focus on green leases as part of the many sustainability practices shown in

Figure 2. These leases would disallow tenants to procure and store toxic materials, detail waste and water management strategies and affect the commercial sector tenants’ packaging policies by offering a mix of regulations and incentives within the lease itself. Recycling, reuse, composting, and zero waste goals could be incentive drivers in leases, with some landlords going so far as to create penalties for tenants that do not comply, with fines added to their monthly rent. These leases could only be included in commercial leases currently for Montreal city. The Regie du Logement requires landlords to use the standard government lease in the residential market with no room for innovations of environmental clauses that could go above and beyond the Quebec Civil Code. Why would landlords want to get involved in these measures where there is intense competition for rental space, such as in Montreal’s case study city? Gestion Immobilière Quo Vadis [

22], one of the authors, created a pilot project in all their buildings and saw rental and renewal rates increase after stricter environmental policies were instated, as the tenants had clear, value-driven guidelines in line with their values. These serious policies were transparently written in the leases, demonstrating the developer’s strong commitment to climate change, and setting her apart from the competition as her buildings filled faster and tenants stayed longer than her competition in the area with similar lease rates.

In addition to these green leases, as a manner for landlords to push for tenants as stakeholders to get involved in a positive impact to fight climate change, could be the creation of a sustainability-conscious committee of tenants. This committee would allow tenants to create ownership of these policies while also enabling discussions on how to roll out policies that would not negatively impact financial stability. Landlords could demonstrate that strong ESG (environmental, social and governance policies for businesses) policies increase employee productivity and engagement and foster a positive marketing impact for potential market-driven clients [

23]. Literature studies refer to the positive impact of tenant engagement and involvement. For example, UK regulations require tenants to direct housing organization boards by 50% [

24]. Landlords could offer services such as car-sharing and electric car chargers to add to their social responsibility offerings to drive climate change initiatives at a minimal cost with a strong positive response from their tenants. GI Quo Vadis [

22] has fostered urban beekeeping and this year is working on an urban farm on their roofs on a commercial building with the complete support of tenants, again with top rates of renewals for satisfied clients. These landlords’ policies could drive stakeholder engagement and have their buildings completely occupied, increasing their profit ratios and allowing for market returns WHILE taking active measures to drive a positive social and environmental impact.

2.2. Stakeholder Classification

The challenge is to figure out why “what is known in academia” is not translated into business models. This study aims to understand who the players are, those who make decisions, and those who are impacted. Once these stakeholders are mapped or listed, it would then be essential to figure out what each group is concerned about as barriers to change and what the opportunities are for actual, transparent collaboration to drive systemic change in the built environment along the lines of the UNSDGs and the B Corp business model. Each green project could be linked one at a time to build eco districts where fair, equitable, safe, and environmentally neutral (even harmful) communities can thrive. Simultaneously, real estate developers could make market returns, and cities could become attractive places for people to live, work, play and learn while harmonizing with nature.

If more green projects were built or reconverted, it is assumed that nearly 40% of the GHG would be reduced; therefore, how can one scale green projects into the cityscape? The different stakeholders need to be mapped and their motivations analyzed. It must then be established how to mobilize those stakeholders behaviours to drive the change towards becoming stewards of the environment beyond personal profit and short-term value goals. Assuming then that an increase in green buildings is the purpose we are driving towards, who are the stakeholders, and how do they inter-relate in the conversation about the impacts of the built environment?

Figure 3 displays the different stakeholders that are involved in the building industry. Building owners begin the cycle of stakeholders with their KPI being a minor exposure to risk, the quickest turnaround of their invested capital and the target rates of returns. According to practice, this group is resistant to change if it affects their significant motivators, but they are not against positive drivers to help reduce climate change, as long it is not their responsibility to accomplish it. The developers, mandated by the ownership group to carry out the owners’ goals and metrics, follow and are closely related. Should an enlightened developer have the skills and will to change the project goals to include climate mitigation, the positive outcome would depend on the building owners to decide to either increase their development risk or reduce their profit margins (or both). This is not often a likely scenario. The construction teams of engineers, architects, technocrats, and contractors are vital stakeholders that can make or break a green project development.

If the goal-setting were to come from the owners, down to the developers to the construction teams, then the likelihood that green project metrics be included in the actual construction would be high.

If the environmental change was not driven from the top-down, then enlightened construction teams such as LEED-certified architects or avant-garde builders could find ways to increase productivity with skills centred on the best practices of green project metrics to drive change up. Sometimes, however, these stakeholders have also been known (especially the contractors) to be resistant to change in contemporary construction methods to reduce their own risk with budgets or timelines.

There is a huge opportunity to train and support these stakeholders as they can influence the top up and push the end-users to do more for climate mitigation. One way to support these groups of stakeholders is through so-called green experts. These could be consultants, university researchers and product designers. This group of stakeholders could hold the key to de-risk green projects with their know-how and access to crucial resources. Green experts can mobilize end-users to see the value in green projects with lower operating costs and wellness metrics. Developers could hire these green experts, as non-profit, government and private philanthropy-sponsored citizen group mobilizers, or equally they could be hired by the city to support private developers and owners in their journey to modify building practices from contemporary to green practice models.

The prominent role of government zoning and planning officials will be discussed later; however, the opportunity to drive change through regulation and incentives is a much-underutilized resource. It can motivate private developers and drive developers to operate in another city if the mix of regulations and incentives is miscalculated in a very competitive market-driven development community. A government could also push for increased local green project supplies to be made more widely available if they invested heavily in the innovation of building materials made from waste, demolition harvests, or locally sourced materials. This could even be driven from all government levels as local employment and business development strategies are paired with a city’s sustainable urban strategies.

There is a growing pressure coming from community members, citizens, and end-users to drive developers to create better quality, low-carbon projects and adopt new policies. Consequently, adopting green management strategies allows people to embrace new behaviours for waste and water management and urban farming.

2.3. Variations That Affect Policy (Micro and Macro)

Developing a comprehensive, transparent policy driven by stakeholder interests requires each city to understand that each community and building has unique challenges and opportunities. A community’s level of education, the notion of the community, whether it has a strong leader, the community’s ability to communicate effectively and with transparency as well as to identify quantifiable sustainability targets, can all be barriers to systemic change for adopting green project practices or accelerating the change that is sought [

13].

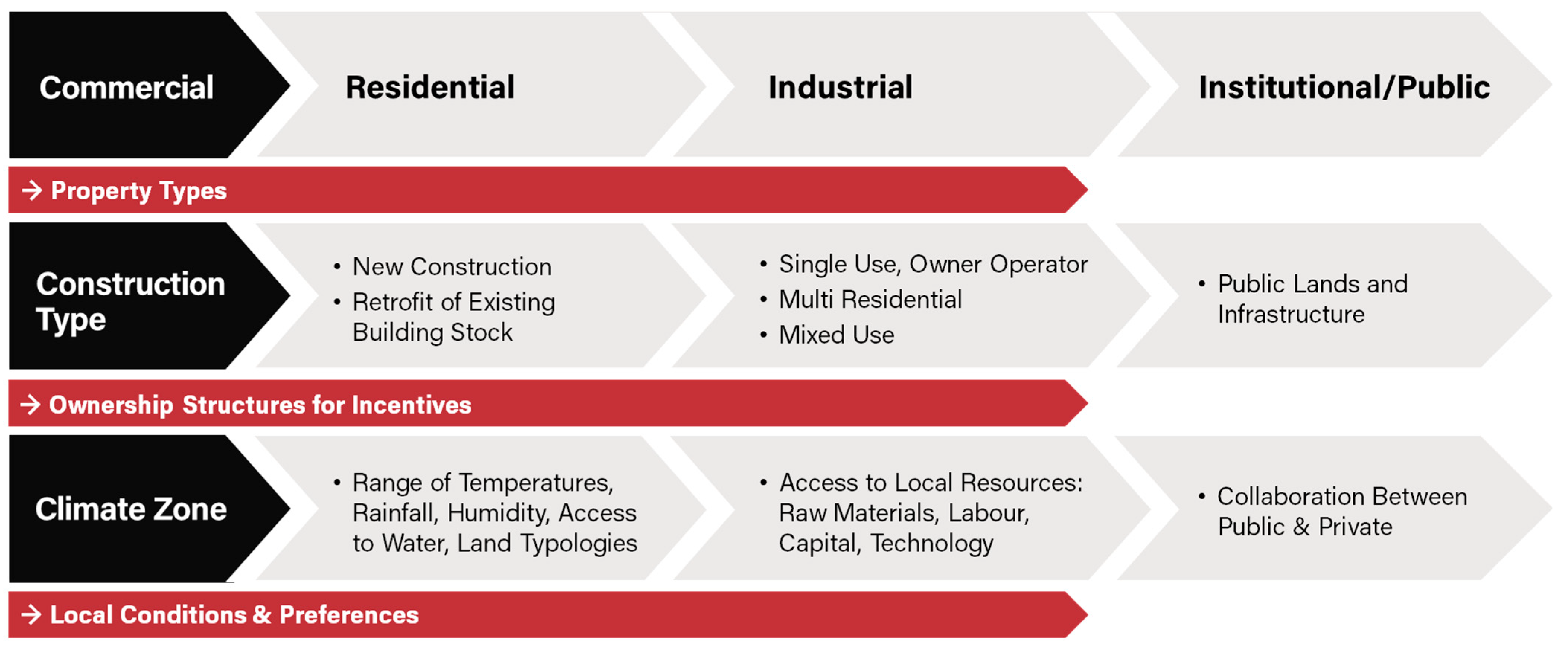

To provide complexity by creating a wide-reaching policy for social and environmental change in the building industry, there are different property types, all with their challenges and opportunities, as shown in

Figure 4. Commercial, residential, industrial, and institutional or public buildings have different purposes and funding structures with different ownership groups. Technically, they all fall under the category of “buildings” when carbon footprints are discussed. These “micro” variations of building definitions, and their purpose and ownership structures are added to the construction types.

New construction and retrofit projects can be seen in the developing world as being from another planet, figuratively speaking, for example, how and for what purpose these structures are owned and operated are different. Meanwhile, single owners, user-operators, and investor groups all have different interests. Public lands and infrastructure can also be seen as part of the construction industry even though they are not the traditional structures that we call buildings, but these assets do create a carbon footprint. The ownership structures of these assets are varied and would require different incentives to adapt to new construction methods and management of their built environments.

Where these assets are located changes how we build, heat, and cool them, for the climate zone of northern England is very different from Singapore and yet again different from Canada. In a country as large geographically as Canada, several climate zones exist. Local conditions and even population preferences play a significant role and are often a barrier to creating concise and comprehensive policies for the building industry to mitigate climate change, and they create immense challenges for implementing a general strategy [

14].

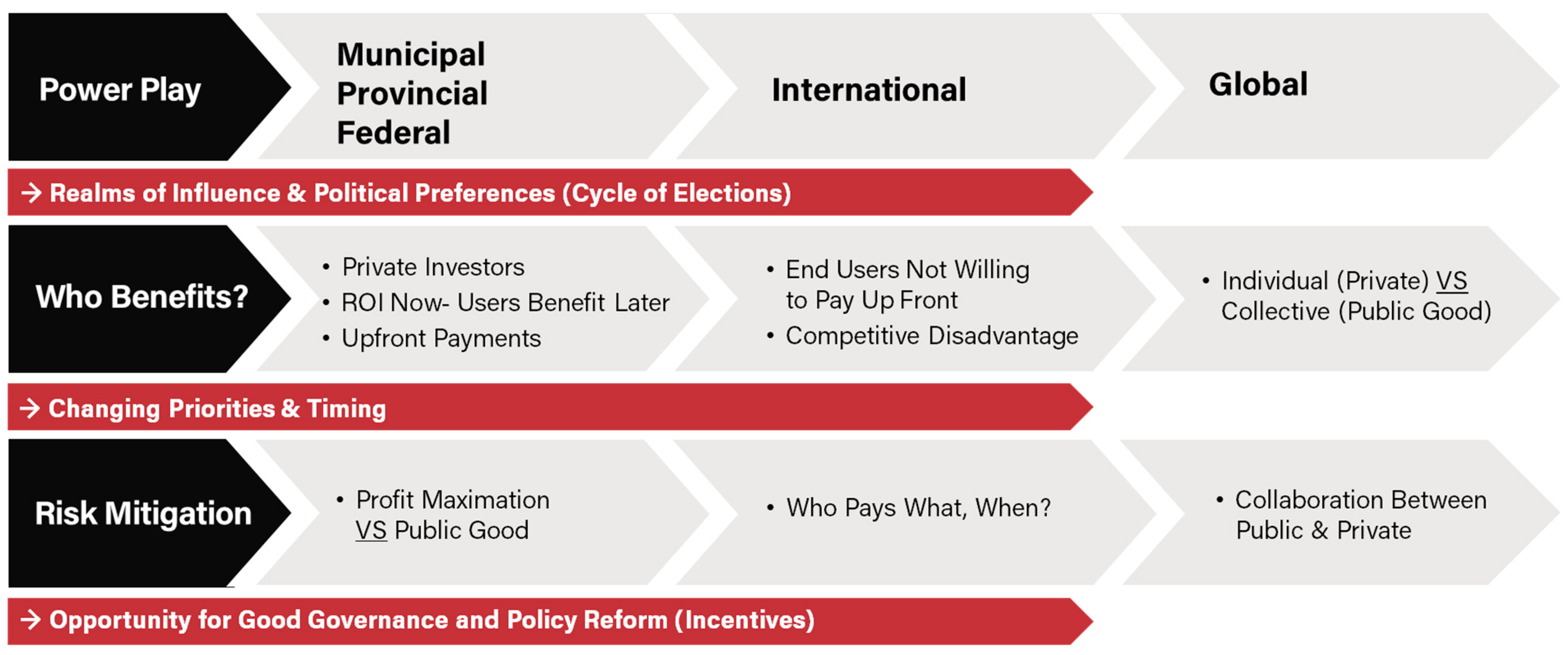

Power plays are in focus when considering the macro variations that can affect policy to drive system change in the construction and development industry (see

Figure 5). The realms of political influence and preferences can fall along country lines geographically and be based on who has the more significant influence in the division of power in a region. For instance, there is a clear division of power between the municipal, provincial and federal levels of government in Canada. Since Canada is such a large country, with two official languages, and is made up broadly of an international immigrant community, the “melting pot” often becomes a struggle of power that controls building codes or provides innovation funds, economic development, and climate mitigation strategies. If all these areas must work together, then it becomes even further complicated as legislation changes over time since the election cycle in Canada is every four years. One government may consider climate change a priority only to have some of their policies undone when the next election brings a new group into power that could, for example, switch to job creation in the industrial sector as a main priority. Climate change and policies associated with the built environment need to last for more than four years to effectively create the desired climate change mitigation.

Beyond “local” politics, international and global policies also affect cities beyond their borders. For instance, if the USA changes its funding to clean the Great Lakes, then the Canadian side of these lakes is also affected. The Paris Treaty at a global level can only be effective if the majority of the world’s countries are committed to the same goals, budget ratios and timelines.

Another extensive debate beyond this paper’s scope is the notion of the individual (private) versus the collective (public) good; however, it is worth noting it as a way to understand how a macro variation can affect the policy in how each community considers the role of capitalism and a free market-driven economy versus amore interventionist government that creates strategies, goals and regulations to follow the political and collective will of its citizens, with of course every shade of grey in between. The main point here is to ask, who benefits? In the sphere of the development industry, the need for the return of investment (ROI) metrics of the private developer, needing to mitigate their risk and receive immediate repayment of their investment at fixed returns, is pitted against the public good. Most developers do not favour increased government regulation that slows their development process and adds increased costs to their performance, including park fees, zoning delays, social and affordable housing, or even a required contribution towards investment into public transportation. If environmental mitigation targets were then added, many developers would claim they no longer had a minimum viable product and would not be able to develop. The main question can be turned on its head by asking, “who pays what and when?” Beyond all these barriers, there is a real opportunity to turn the tides on negative climate change by creating excellent and transparent participatory governance paired with policy reforms to create a clear and long-term collaboration between private developers and policymakers.

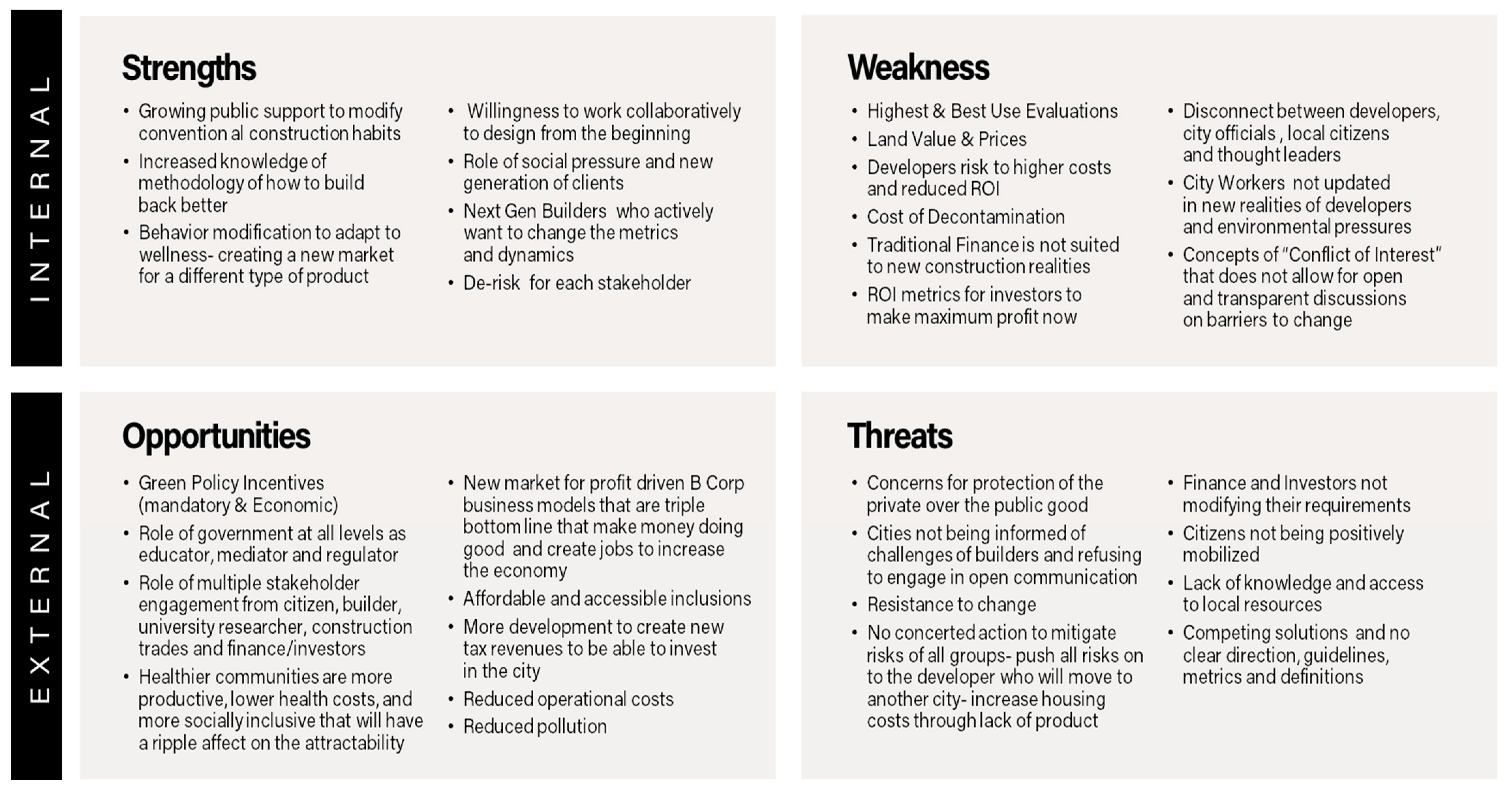

2.4. SWOT Analysis for Green Projects

A SWOT Analysis is implemented when someone innovates and wishes to start a new business, listing and identifying the strengths, weaknesses, opportunities and threats to the idea or business.

As this paper aims to highlight the barriers and opportunities for real estate developers to adopt green project methods and contribute to eco-districts, as well as to lower the negative impact of the industry’s carbon footprint overall, it is an exciting exercise to speak the language of business. The SWOT identification demonstrates the blending of interests and objectives of the key stakeholders, to highlight the recurring themes in the literature review and the empirical study, as a new way to look at the barriers and opportunities for green project development.

The literature review allowed us to identify recurrent themes. The SWOT is a graphic illustration of applying the author’s experience as a developer, as an empirical study applied to a business tool. The research question of the SWOT identification was based on what the key stakeholders may see as possible the intersections of barriers and opportunities in the form of strengths, weaknesses, opportunities and threats; however, the threat was based on what happens to communities if we as developers did not build green projects. This is meant to be seen as an illustration to highlight the links as a basis for possible behaviour modifications of private building companies. The SWOT is divided into four main sections, two positive and two negative, with the lenses of internal and external attributes (see

Figure 6).

The development industry in Quebec is relatively new to the consideration of sustainable practices; therefore, we can compare this to a “start-up” business type. Locally, public support in Montreal is building momentum for applying the Climate Action Plan, with growing pressure from investors and banking institutions.

Internationally, there is growing public support to change or modify the construction industry, as more citizens and governments are increasingly becoming aware of buildings’ negative impacts on cities carbon footprints [

13]. Consequently, there is the opportunity for local governments to create and commit to green policy incentives that could be both mandatory (through regulations) and incentivizing for private developers (through economic or financial rewards) to modify their business behaviour beyond their usual ROI and individualistic tendencies. As there is an increased knowledge base on

how to build back better, there is an opportunity for governments to play an increased role as educators, mediators and regulators of the “minimum viable product”. In this case, this could be seen as the minimum requirement of green project standards, incentivizing developers to go beyond the regulations and obtain higher rates of return, as more citizens drive the market to institute green construction methods both measurably and transparently. The private market can already be seen as shifting the industry to adapt its “behaviour” for to create a new type of product that is based on human wellness for the end-user, and not just the “wellness of the wallet” of the developer/investor. This expanded view of development allows for the opportunity to engage multiple stakeholders, including citizens, builders, university researchers, the construction trades, and the financers and lenders of a project.

A new willingness to work together and collaborate to design green projects from the very beginning was encouraged when developers started to understand that stakeholders mattered to real estate developers’ bottom-line. In addition, the increasing number of clients that are choosing B-Corp incorporated projects with triple bottom line metrics has motivated cities to add more regulations, as we have seen in the empirical study in Montreal for the last 27 years.

The market developers are now being driven to change their viewpoints on green projects as preference for them increases with their clients and investors. Clients require a developer to be financially stable (to have them last as a developer and to keep them accountable if something fails in the long-term with their developed projects). They also demand socially responsible acts and inclusive practices while having the minimum viable product ideal that a building at least “does no harm”. Currently, B Corp-type developers are no longer unheard of and they can create ways to de-risk an additional investment in the collective good, as cities want to work with them to achieve “good” while increasing the tax revenues for communities with new, accessible, and green developments, which could be a win–win–win scenario. In Montreal, there has been a tendency that municipal authorities did not want to engage in direct conversations and negotiations with developers based on the optics of partisanship. Increasingly, Montreal has evolved so that it now sees that the only way to create more low-carbon projects is to engage with developers and have them work with the city staff and local citizens in open discussions on what policies and processes are possible.

So why are not all real estate developers rushing to implement sustainable practices? What is harmful to this new “world order” for eco-districts? The behaviour change in the private development industry is attributed in Montreal to the market evaluation requirement of the “highest and best use”.

The significant challenge for real estate developers with more sustainable practices is the drawback of market evaluations that determine an optimal land use in high-end residential condos that produce the least risk to the developer and provide the highest and quickest yield. Consequently, some investors have demonstrated that if a development deviates from this course of best ROI, then it will go against the best interests of market returns. Consequently, if the development goes beyond the government regulation basic requirements, then it is acting against the investors interests and is “leaving money on the table”. One can consider a threat the continued protectionism of the private over the collective good, against the opportunities for green districts previously outlined. With an increasing cost in land and decontamination, developers are unwilling to take risks in climate action in an “unproved” market with innovated yet not-challenged low-carbon building materials that the local building codes may not approve. Even if they are accepted in other areas of the world, if the materials are not accepted where the project is set to occur, for instance, in Montreal, then a developer will not invest the time and money needed to clear a new material on their site when their builder guarantees are on the line.

There is a fundamental disconnect between the realities of each group of stakeholders, as often, each group will see the other as “the enemy” during their battle of who will win their way to reduced risk, namely, the developer seeking to maintain their business as usual against the city officials who have to answer to the citizens and interest groups to stop development at all costs. In Montreal, the city zoning process is tremendously malfunctioning in its design. The public consultations occur at the end of the process after considerable investments have already been made in master planning, while the developers often consider local citizens as being uninformed or even misinformed about what is possible to change or modify in a development. Some citizens ask for a developer’s concession that is not possible due to the land and decontamination costs. One option to improve communication and mitigate the development risks is to place the public consultations at the beginning of the zoning process, and this would allow for co-design and transparent discussions of each side’s questions and concerns, with an opportunity to work together rather than as adversaries. The main problem is that no one has the perfect answer for accurate concerted action plans to mitigate all stakeholder group risks. As a group, the private developers are not willing to take the time or to invest the resources in figuring out what a positive business plan could be achieve good market returns and build back better for the community and the environment [

25]. There is a lack of knowledge of each stakeholder and access to local resources for the “green experts”, as well as access to local low-carbon materials. This weakness could be an opportunity to build new local, green material businesses. Additionally, conflict of interest is often cited as a reason that stakeholders cannot work openly and transparently to co-design for possible rather than the probable.

Traditional finance plays a significant role as a weakness and a threat to private investment in creating sustainable cities. Lenders have basic underwriting completed to be able to fund a new development or to retrofit. If a project does not meet the guidelines, then the project cannot be funded; therefore, developers are encouraged to cut corners and build quicker with lower quality and cheaper materials that may oppose the concept of green projects. B Corp developers often have to use their cash to buy and build projects, and then when they are completed, the traditional banks will come to take out the developer; however, suppose that finance were not available to those triple bottom line developments overall. In that case, the ability to scale-up to have the impact needed to shift the construction industry would simply not be there.

Internally, it was presented in the empirical field study and the work with the Lachine-Est case study that there was more awareness and support for healthier and green buildings. Real estate developers were being pressured to do more for their clients, and their investors and bankers required this year, with the implementation of the Climate Plan in Montreal, that real estate developers with buildings of more than 100,000 square feet disclose their operational carbon emissions and present a transition plan to minimize them. Increasingly, more green transition consultants are present to guide this transition process. The main push for the strengths in the SWOT for real estate development is that there was a demonstration of an overall willingness to collaborate to figure out how to modify business plans, city zoning and the technical requirements to make sure these types of green projects come to completion [

26].

The internal weaknesses arise primarily over conflicts of interest, namely, who pays for what and who is responsible. Real estate developers are facing increasing pressure to pay more for scarcer land, the costs of decontamination are high, and the market evaluators that prepare bank documents require a “highest and best use” document that is often a description of a high-end condo project. If a real estate developer was to propose to the banks or their investors that they wished to build a community impact project, the real estate developer would be acting against their best interests, even if they were acting for carbon reductions or community engagement. Lastly, if the tendency were to start collaborating between and among stakeholders, the mechanisms for this collaboration are not yet in place, making the process laborious.

The external opportunities fall overwhelming on the side of the role of regulations and incentives. In Montreal, real estate developers are pressured by the city of Montreal’s goals and targets; however, the provincial and federal governments are leading the way in terms of incentives for early adopters. Green policies and long-term patient financing are becoming available for developers to adopt green metrics in their projects, as the Canadian Housing and Mortgage Corporation (CHMC) now offers 50-year amortization rates for affordable housing built in sustainability models. With the scaling of new innovative building modelling and control systems, it is becoming more accessible for real estate developers to access the technology and know-how to reduce their carbon footprints in their projects [

27].

The external threats are categorically associated with who should do what and who pays for what. Most real estate developers do not feel they alone should bear the brunt of paying the extra costs for green projects. Many in the empirical field study have expressed that they would be willing to “do their part”, but those additional incentives would go a long way in them making their decisions on how they can adapt their projects to satisfy their banks and investors while still creating a market opportunity to distinguish themselves as a green leader in the city. Many real estate developers in Montreal show a willingness to build greener but lack the knowledge or expertise on how they can do that while still making the returns needed for their banks and their investors.

The main problem is competing interests with no clear overall guidelines and action plans, as knowledge is often limited. There are no clear definitions or metrics to measure the impacts either. Moreover, there is an overwhelming feeling in real estate development that there is a resistance to change even though most people across all stakeholder categories would probably admit that the climate crisis is authentic and that buildings have a huge negative impact on global carbon levels. Time is running out for averting non-reversible and permanent damage to our planet, yet each group of stakeholders thinks that it is someone else’s problem to fix. Until all stakeholders can find a path to walk down together, there will be no systemic change; therefore, how can we de-risk this impasse? Maybe the answer is a cocktail of policies that forms the right combination of regulations and incentives based on all stakeholders sitting at the same table openly and transparently, with the city’s elected representatives and staff all working together.

The next section of this paper will deal with the policy opportunities and barriers and cites the case study of the eco-district of Lachine-Est in Montreal that the author worked on as a developer for the master planning of the area with key stakeholders.

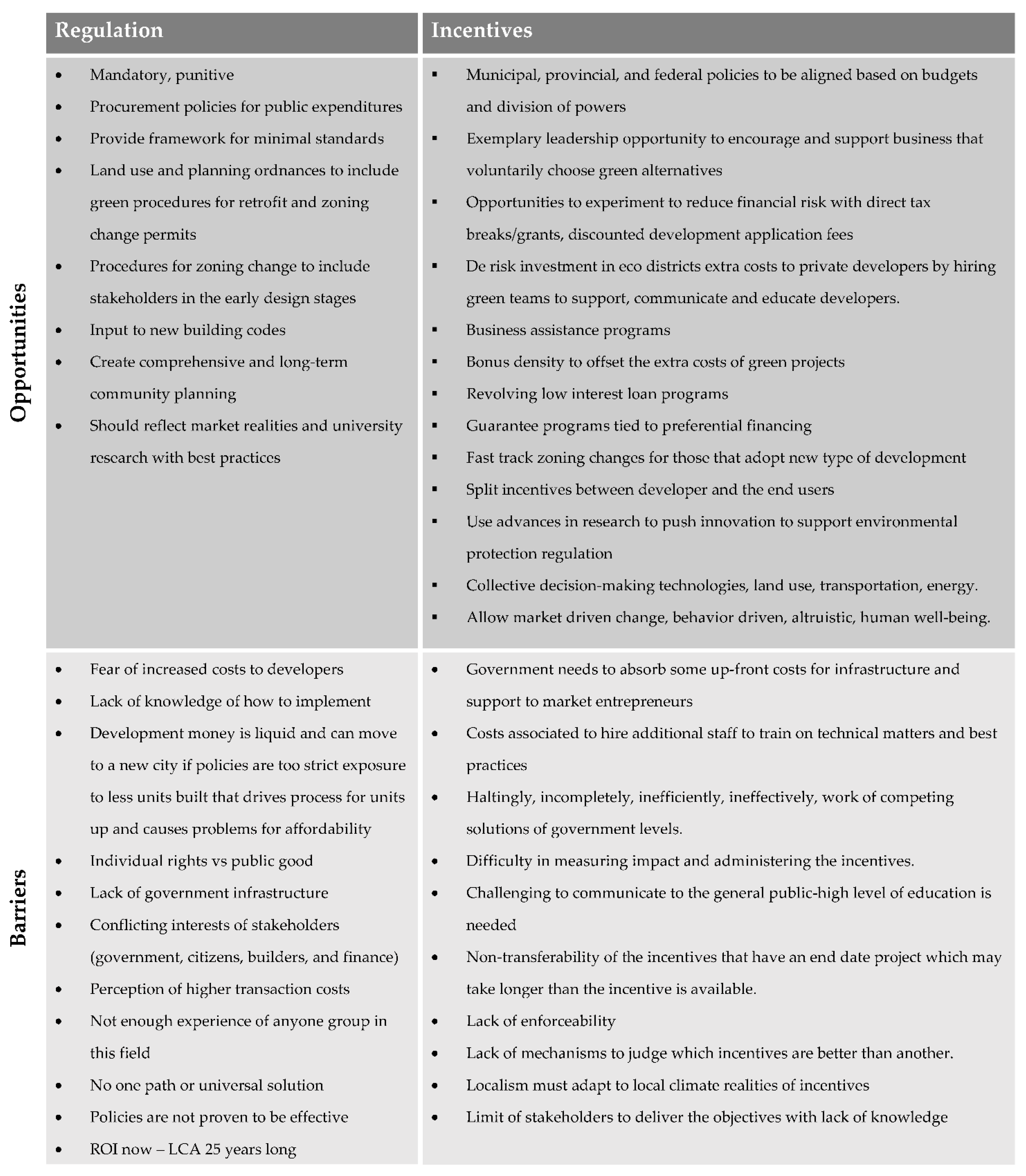

2.5. Policy Opportunities and Barriers

We have identified the key barriers to attracting a market industry of developers to build green projects. The following section of the paper will identify the key policies of cities that could positively affect behaviour modification so that more builders can see the benefits of building green projects. There is a long-standing debate on the efficiency of government regulation about incentives to drive change. What actions are more effective and cause a more positive impact? In what direction should policy go to modify the behaviour and best practices of the construction industry? Previous studies from the UK refer to various aspects that have drawn back private sector engagement for green project commitments [

28]. The causes include the industry structure, business culture [

29,

30,

31,

32,

33], technical drawbacks [

30,

31,

34], capital cost and finance [

34,

35,

36] and a lack of trust in the governmental sector [

37,

38]. According to the literature review, the opinions vary. The causal relationship between lowering the carbon footprint and the development industry concerning regulations and incentives is beyond this paper’s scope, but hopefully, it acquires more attention to justify the decisive actions and commitments that need to be taken to address climate change. For the current purpose, step one in the ongoing impact study would be to take an inventory of the different types of regulations and incentives proposed and to chart them as barriers and opportunities to change the industry to adapt its practices along the triple bottom line ideal laid out by the B Corp strategy [

3,

5,

13,

14,

15,

39] (see

Figure 7).

Regulation is often argued as the only effective tool to push developers to adapt their processes and products to have a low-carbon footprint, as they are mandatory and carry a punitive nature, and cities have direct control over their public expenditures by having green procurement policies and aggressive carbon emission goals.

Regulation can help shape the building codes, zoning changes, urban planning and renovation permits. Regulation also has the added luxury of time, allowing the opportunity to create long-term and comprehensive stakeholder-engaged planning practices; however, as previously discussed, real estate developers are often juggling many stakeholders simultaneously, where the prohibitive extra costs of green development are the deciding factor for whether they choose to build or not. Therefore, even if regulation effectively forces developments to be specific, private money is liquid And even the perceived additional cost to a real estate developer can cause them to divest from a city, which then has the circular effect of having less product on the market that causes scarcity and drives the prices of the available stock higher, causing damage to a city that is already struggling with affordability issues.

Should the regulations be considered too top-heavy by developers, who often lack the knowledge of building green, they may push back to prioritise their “individual rights” versus the collective good. They have claimed that there is not enough evidence that the regulations effectively achieve the desired result in climate mitigation and that there is no universal solution, thus, real estate developers may also push back, saying that the climate mitigation strategy does not reflect the current market conditions as the end-users are unwilling to pay extra for the “luxury of being green”.

Incentives can be described as motivators for private developers to align with public policy goals and drive stakeholders’ adoption of green project practices [

5]. In restrained markets where competition is high, incentives could help create a competitive advantage for a green real estate developer, enticing buyers and tenants with safer, more comfortable buildings and increasing occupant satisfaction [

13]. Incentives could increase the public perception and adherence to public policy, allowing developers to lead by example as governments create opportunities to push developers to adopt more green strategies in their developments. Choi et al. 2010 point out that there are three types of incentives: administrative (i.e., fast-track zoning), financial (i.e., tax credits, grants and rebates), and technical support (i.e., city staff as experts to help navigate new systems and technologies), and that some have proposed reduced property taxes for builders who invest in green projects to offset additional costs [

40].

Whereas incentives are not perfect, they do play a positive role in increasing long-term human well-being and increasing private and public engagement that play an active role in splitting the risk of climate mitigation [

5]. These authors split incentives into two categories, financial and non-financial, with the financial incentives including direct grants, tax inducements, rebates on permit or application fees, and development bonuses and grants. Meanwhile, their non-financial incentives were not direct costs to the city but rather, benefit the developers by offsetting their extra exposure to perceived risks and costs. These include increased density allotments (FAR—floor area ratio), technical and marketing assistance, regulatory relief, and guarantee programs. The authors also spoke of less tangible benefits to these incentives, including human well-being-related incentives, an increased market demand for better units, gratifying incentives of recognition, awards and certificates, and generous incentives based on the personal and moral norms of the stakeholders.

Some have suggested that the best long-term solutions for adopting new methodologies in a green project should be market-driven [

3], as regulations alone cannot bring about a “green revolution”.

However, the barriers to these incentives demonstrate that nothing is ideal. Local governments need to have large budgets to invest in their residents’ long-term well-being for things that are not immediately tangible (i.e., the problem with the 4 year election schedules discussed earlier) and to invest in more staff to administer, motivate and communicate these benefits. Due to a lack of enforceability, for a city to achieve behaviour modification, the private development community needs to have precise regulations and incentives to drive market change.

Due to this notion, there is no consensus on what should and could be done to motivate the real estate developers to change their behaviour to mitigate climate change. We need a multifaceted approach that should establish national base standards. These key metrics are measurable to be combined with local regulations and incentives to balance the playing field and lower the effective additional costs of investing in long-term sustainable building strategies to lower global warming costs [

39].

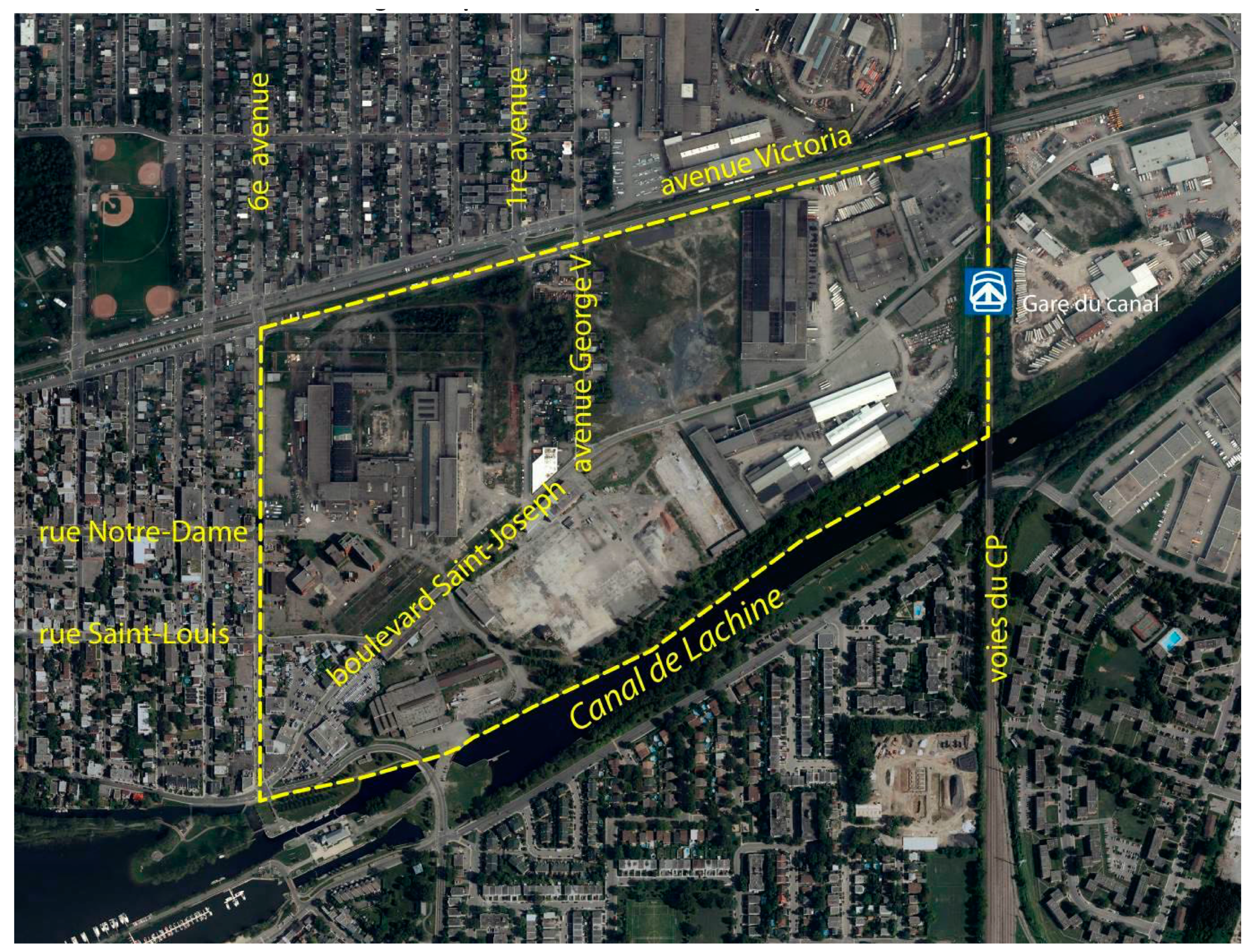

3. The Montreal Model—Lachine-Est Case study

This Lachine-Est case study [

41] is an area of Montreal that consists of 3.2 million square feet (297 thousand square meters) of centrally located, mostly abandoned heavy industrial and highly contaminated land that has been slated to be redeveloped into an eco-district, with the community as the leading impetus for the development (

Figure 8).

Several years ago, a few local non-profit and citizen advocacy groups [

42] decided to create a coalition to lobby the local administration to think of the older industrial area as an opportunity to drastically redevelop it into a multi-use, accessible and environmentally positive area. The so-called “Imagine Lachine Est” is a citizen lobby group that hosted several community sessions on what people wanted of this new site. The Climate Coalition of Montreal and GRAME [

43,

44] are climate advocacy groups that play the role of climate experts. The CDEC is a business development group, and the non-profit group called Revitalisation Saint-Pierre, a citizen group in a neighbouring community, was mandated to redevelop the area. One of the authors worked side-by-side with these stakeholders in the empirical study and witnessed firsthand what each side was putting forth as their critical objectives for the eco-district and why they could or could not support what the other stakeholders wished for their position.

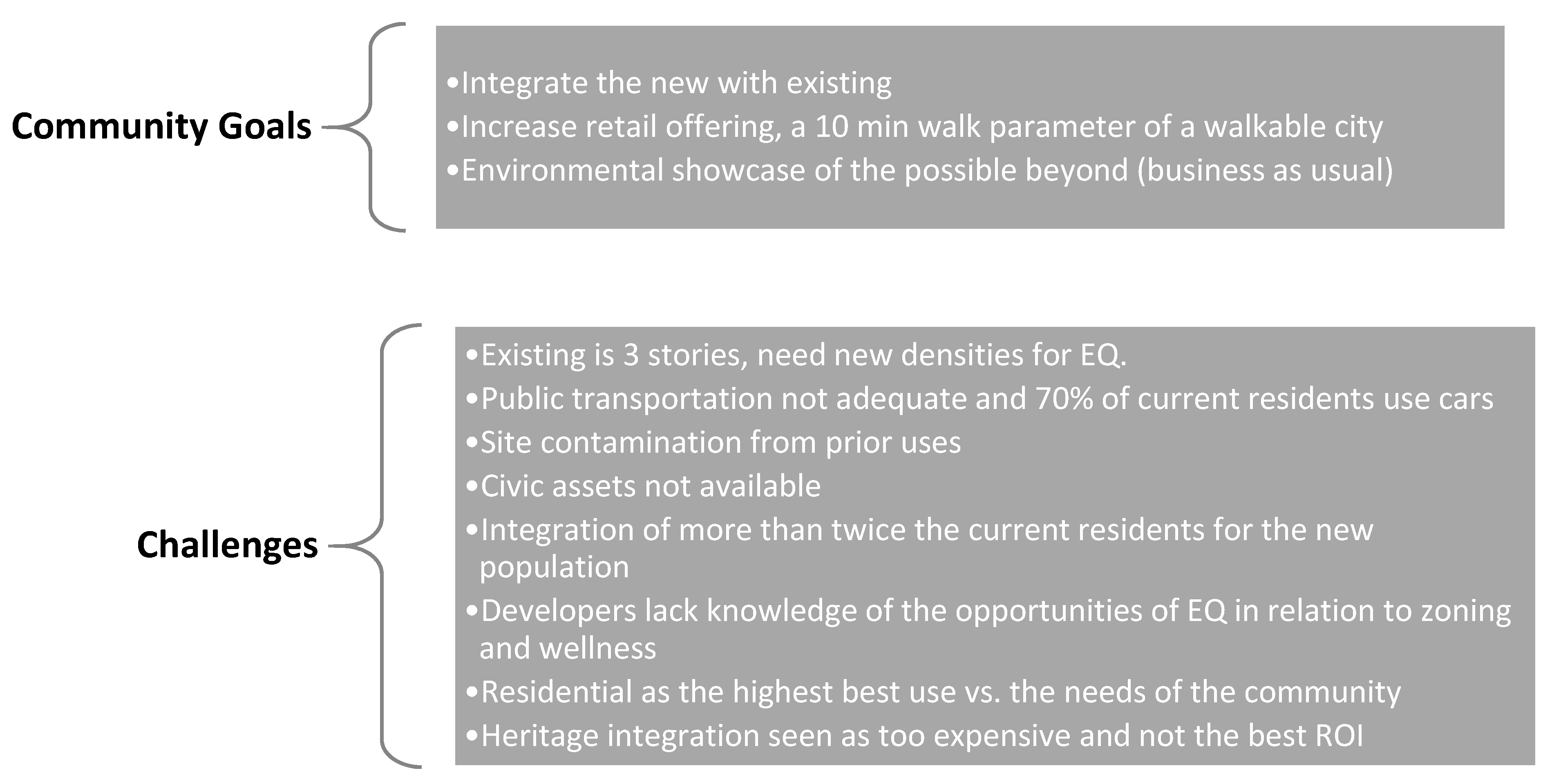

Together with the local administration and elected officials, the teams came together to find ways to integrate the area’s new development with the existing lower-income residents, to increase their service offering, and to increase the volume of affordable units while creating an exemplary eco-friendly project (

Figure 9). They dreamt of a 10 min neighbourhood, with a new city tram linking the area to Montreal’s downtown core so that cars would be replaced by bicycles, car sharing, and a walkable community; however, there were challenges. Who would pay for the development and infrastructure? How could the area remain accessible?

For Lachine-Est, the challenges for a developer were to build 20% social, 20% affordable units, and 20% family units, to save the heritage buildings, to build public roads that could not count for the buildable square footage, as well as grant the municipality a 10% land ratio for a public park, that all needed to be decontaminated at the expense of the developer. These were just the base requirements for the development (

Figure 10). With the additional requirements of an eco-district with better quality, energy-efficient buildings, large amounts of green infrastructure, bike and walking paths, waste and water remediation, and urban farming on roofs, the developers asked who would pay for the costs. Developers require specific rates of returns and for Montreal, the ROI is approximately 25%, which is demanded by the investors, the banks and financial institutions to obtain construction loans and long-term mortgages.

Consequently, this results in many people reducing the size of units, reducing the quality of construction and a solid need to sell units as quickly as possible to reduce the carrying costs borne by a development group. With the cost of land increasing in a steep curve, there is little space for experimentation, added to the cost of decontamination. Developers push back from the perceived higher costs of better-quality construction that is key for green projects but that add to the additional pressures and risks for the private developer. With little general knowledge of building green, the additional exposure to risk is too high for many to bear. The market bottom-line takes precedence over the opportunity to build better quality units that would increase the wellness of the people that live, work and play in these types of new buildings. The short-term returns of the developers do not allow for them to reap the benefits in cost savings of energy-efficient buildings, and often they will want to pass on these additional costs of building green to the end-user, who has many choices of what to buy, but who also are not yet ready to pay more for better-built buildings.

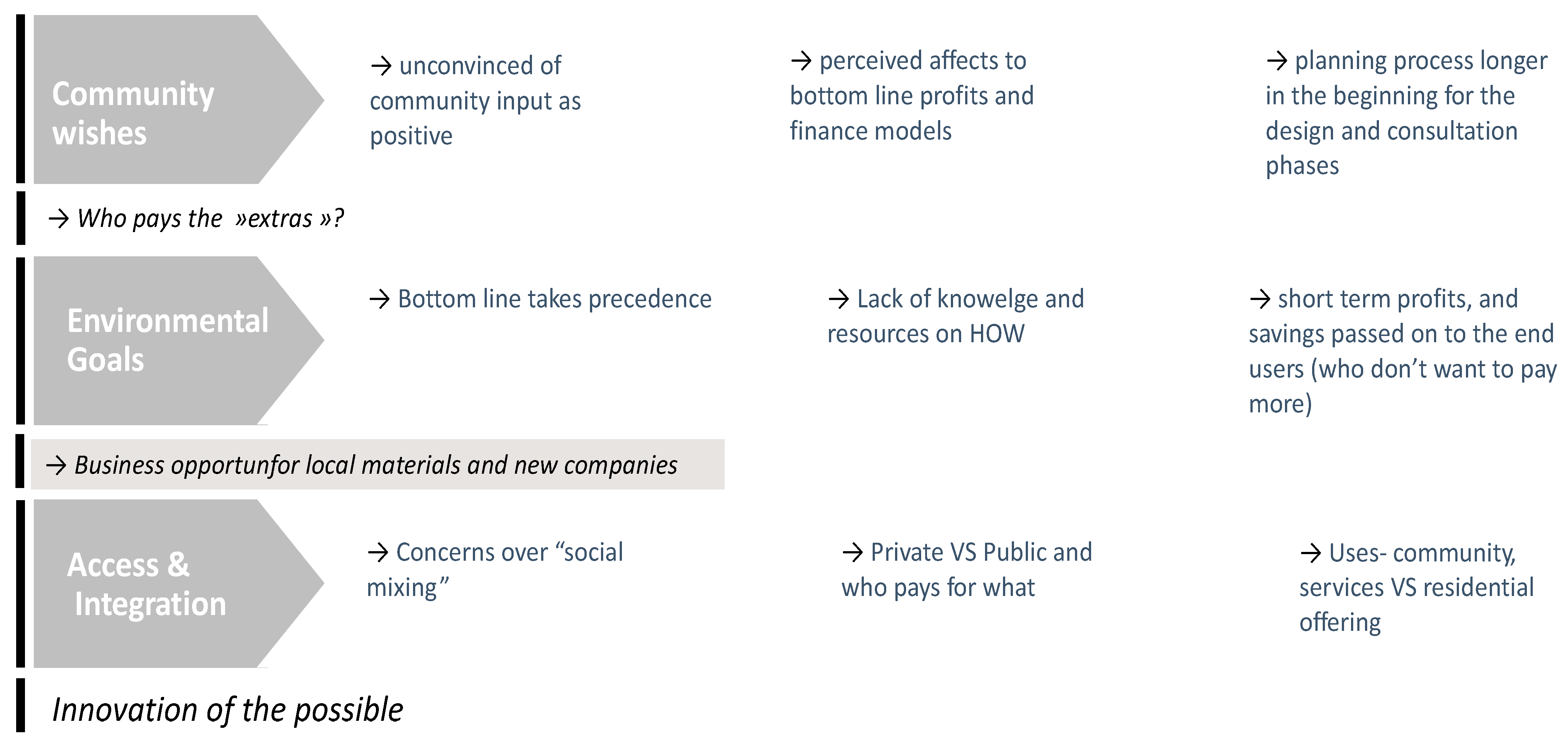

Lachine-Est’s opportunities go beyond the apparent barriers faced by the market-driven developers (see

Figure 11). The community engagement, the local mayor, and the city officials’ openness to “figure this out” provided a unique opportunity to collaborate openly and transparently and to analyze how eco-districts could be built technically yet make financial sense. The developers’ opportunity is to build what people want to buy and live in and to set their product apart from the other, mediocre products on the market. The quicker a developer can fill their projects, the less the carrying costs will be and the higher the revenues. Some of these additional revenues could be reinvested in higher-quality green projects.

Lachine-Est was an experiment to have the stakeholders work together to discuss the barriers and opportunities for each group and to collectively figure out a workable business model that would fall under the B Corp model’s lines. When a developer considers people, profit and the planet, and has the community’s ear and the resources of the city officials and green experts in the area, then ambitious projects can be realized. New definitions and blurred lines have started to emerge between the role of the public and private through a new transparent governance model for zoning modifications for the entire area slated for redevelopment, with four actual developers, non-profit groups, local citizens, municipal workers, the mayor, and the city central urban planners being involved. Through this new structure, the cross-pollination of ideas is encouraging. New local businesses for procurement and reinvestment in the retail arteries appear, creating new job opportunities while increasing tax revenues, and accessible and mixed-use developments are planned by and for the community with the developers at the table.

The master planning and governance processes are top-down and bottom-up processes for mobilizing all the key stakeholders identified earlier in this paper. Each group is being listened to and is open to working collaboratively to “figure it out”.

The policy options for the developers in Lachine-Est are based on a mix of regulations and incentives. The regulations are based on building standards with a low-carbon footprint and a restriction on fossil fuel heating. The minimum requirements for mixed and integrated units for social inclusion are regulated. The road and park areas are regulated. Incentives are related to bonus density depending on how far and above the developer is willing to go to build green and to positively impact a reduced carbon footprint. The zoning procedures involved the public at the beginning of the process, which allows for feedback loops and saves the developer a confrontation at the end of the process. The developers have already invested vast amounts of money in planning deliverables. Politicians can support the zoning changes and they have both the community buy-in and the private developers’ solid business models that can allow for fast-tracking the zoning modification that saves developer costs in carrying an empty asset. The city officials are offering the developers financial assistance for soil remediation. There are discussions regarding a tax freeze for five years for all new buildings in employment zones. The city is building a fast-track tram train direct to downtown Montreal, investing in new public infrastructure in its pipes and waste systems, and building a new elementary school and civic center. Lachine-Est is an inspiring project to watch to see if the social experiment of a transparent collaboration between the key stakeholders in the community will turn into a viable business model that reduces the risk and exposure for more private developers to build green communities.

4. Conclusions

Many cities worldwide have set ambitious climate carbon-reduction targets, Montreal included. When understanding that the building community has a substantial negative impact on carbon emissions, this paper addressed the competing interests between real estate developers and the public good. Real estate developers need short-term returns, can be agile where they choose to build, and often do not know how to build sustainably.

The role of government is best suited to several areas that include playing an educator, mentor and regulator. Ideally, through city policies and incentives, it would address the private developers’ risks while listing multiple critical stakeholders who could collaborate to create a melting pot of climate mitigation solutions while aligning the competing interests between public and private goals. Policies can be used as a motivator to push the industry further toward collective action rather than being left to the devices of a market-driven economy alone. Green projects and communities are not a natural product of the development community; therefore, builders need incentives blended with regulations, education, and tools to scale their behaviour modifications to change the construction and renovation industry.

Stakeholder identification allows the reader to identify the key players in the development cycle, including in the design, construction, operations, and renovation/demolition elements, and their motivations and interests. Shared and transparent information along with these motivations can be aligned by the role that government plays (municipal, provincial, federal), through a carrot and stick approach to create the urgent change needed to meet carbon reduction targets. Fast-track zoning, bonus density, expertise and supplier sharing, tax delays and mixed-use zoning are robust solutions that will allow city officials to become the leaders, motivators, and educators driving market change to regulate and incentivize developers to build green projects.

The case study of Lachine-Est in Montreal allowed the stakeholders to be identified, listed each of their barriers and opportunities for carbon reduction building, and cross-linked this to suggest the policies and regulation opportunities for building an eco-district. The “Atelier Lachine Est” group demonstrated for the first time in Montreal that the role of the City of Montreal was to bring all stakeholders to the table, to list their challenges, and to find collective solutions that were tailor-made to their area and population requirements. This included understanding the problems of why it is challenging to build or renovate in a carbon-neutral way through collective solutions, where each stakeholder has a role to play. Moreover, policies can provide the motivation for adopting those solutions to allow these projects to be built with aligned interests, budgets, targets, and with realistic solutions from real estate developers.

A limit of this study was that most real estate developers were reticent to speak to academics due to a lack of time or seeing a functional outcome of the time invested. Most real estate developers in Montreal, for the last 25 years at least, have seen green projects as a direct attack on their traditional business models and, therefore, their views are often not represented in literature reviews. We saw this limit of the study as an opportunity to blend academic reviews with the experience of a real estate developer who has taken it upon themselves to find ways to build sustainable projects and who has faced frustration in the industry as there has been a lack of know-how. In the world of academia, there could be a missing link in their work that will be tied and adopted by the market’s real estate developers.

As the market is changing rapidly, and as more real estate developers face social and environmental pressures from investors, clients, and cities for zoning and permit approvals, for the first time, we see that things are changing rapidly in Montreal. With the adoption of the Montreal Climate Plan and the Climate Partnership of Montreal where one of the study’s authors is on their advisory panel, we have seen the opportunity for this paper to address a wider audience of academics as well as real estate market developers, where each group can learn from the other to drive positive change in the green or sustainable development industry. For real change to happen, we need to understand the barriers and opportunities to change; therefore, a different area of study would need to work on an accelerator model, where representatives of the stakeholders could work hand-in-hand to modify traditional real estate projects into green ones. With the city working on policies and incentives that work, bankers creating alternative financing options to change the cash flow restrictions on developers, and consultant experts such as engineers and power utility leaders meeting at the same table with real estate developers, they can create the key performance indicators (KPIs) needed to chart what policies and incentives drive the most impactful change. The authors are currently working on this accelerator prototype to address the limitations of this paper and on collective work in our roadmap for changing the industry of real estate development.