Abstract

The sound and sustainable development of the international monetary system is the cornerstone of the sound and stable development of the global economy. This paper takes digital currency in China as its research object and utilizes a regime-switching transition auto-regression (STAR) model and nonlinear time-varying parameter–stochastic volatility–vector auto regression (TVP-SV-VAR) model to empirically analyze the relationship between digital RMB, RMB internationalization, and the development of the international monetary system. The results show that the relationship between DC/EP and the internationalization of the RMB is time-varying, with the above relationship being significantly different in various economic situations. DC/EP can boost the internationalization of the RMB, and thereby contribute to the diversification of the international monetary system. The results have important policy implications for the sound and sustainable development of economic and financial markets.

1. Introduction

Finance is at the core of the modern economy, while, for finance, the currency is the core. In general, finance is considered to be the lifeblood of business, and the international monetary system (IMS) is also regarded as an integral and essential part of global finance [1,2,3,4]. Therefore, it is not difficult to understand that the sustainable and sound development of the IMS is a cornerstone of the global economy [5].

In the context of the deepening of economic globalization and financial market globalization, the unipolar international monetary system dominated by the U.S. dollar (for example, as a payment currency, the U.S. dollar accounted for 38.4% of the world total in February 2021; in global trade financing, the U.S. dollar accounted for 87.1%; as a reserve currency, in the foreign exchange reserves of countries around the world, the U.S. dollar accounted for 55.2% (data released for the fourth quarter of 2020)) will, in some cases, have a negative impact on global financial and economic stability [6]. After the outbreak of the subprime mortgage crisis in the United States in 2008, a multipolar international monetary system apart from the U.S.-dominated system has attracted much attention of many countries [7,8,9,10,11,12,13]. At present, the general consensus is that the RMB has become a “safe-haven” alternative to the dollar for many countries, and they have begun to carry out currency swaps with China and put forward their needs for trade and investment settlement [14,15,16,17,18,19]. Actually, the RMB has made positive contributions to the diversification, health, and sustainable development of the IMS, and has played an important and positive role in the stability of global finance and economy [19,20].

In recent years, the call for IMS reform has become stronger and stronger [21,22]. At the same time, with the rapid growth and development of IT and financial technology, digital currency is attracting a lot of attention around the world, and many countries have also launched various types of digital currency [23]. Digital currency has not only changed the form of money and payment systems, but also fundamentally brought profound changes to society, the economy, and information exchanges [24]. From the perspective of the inevitability of monetary development, the real economy is also undergoing rapid development (especially the global digital economy—in the United States, Germany, and the United Kingdom, the digital economy accounted for more than 60% of GDP in 2020, and the growth rate of China’s digital economy was 9.6%). The upgraded demands and advanced technology will inevitably promote the evolution of currency toward high efficiency and low cost, and gradually upgrade physical money into intangible credit money [25]. As a result, digital currency has emerged as a new form of currency. Digital currency is driven by underlying technologies such as distributed ledger technology (DLT) and encryption algorithms [26]. Its programmability, traceability, and (controllable) anonymity have catered well to transaction needs in the digital economy era, especially since 2020. To adapt to the new trend of economic digitization during the COVID-19 pandemic, and to cope with the competition from new digital currencies such as private digital currencies and stable coins, many central banks around the world have listed digital currencies guaranteed by national credit as a major issue in gaining a leading position in this field [27,28]. According to the survey report of the Bank for International Settlements in early 2021, about 86% of the central banks of 65 countries or economic entities have carried out digital currency research, 60% of the central banks have progressed to the testing stage of digital currencies, and 14% of the central banks are deploying pilot projects. In October 2020, the Working Group on Central Bank Digital Currencies established by the Bank for International Settlements and seven central banks published a report entitled, “Central bank digital currencies: foundational principles and core features.” This remarks that central bank digital currencies have received the official attention of international organizations and major central banks [29], and central bank digital currencies are entering into increasingly fierce competition on a global scale [30].

In recent years, the People’s Bank of China (PBC) has taken various measures to accelerate the research and development of legal digital currency for helping the development of its digital economy. As early as 2014, the PBC established the “Legal Digital Currency Research Group” and began to conduct a study; in 2016, the “Digital Currency Research Institute” was officially established by the PBC; in 2017, the PBC specified that the Chinese legal digital currency’s name would be Digital Currency/Electronic Payment (DC/EP); and at the end of 2019, China successively launched pilot tests of the DC/EP in Shenzhen, Suzhou, Xiongan New Area, Chengdu, and the 2022 Beijing Winter Olympics venues. The measures taken by the PBC to promote the development of the DC/EP show that the application scenarios of the DE/CP have been continuously expanded and improved, which will have significant and far-reaching impacts on the high-quality development of China’s digital economy and the promotion of RMB internationalization [31].

Since the PBC launched its pilot scheme for cross-border trade settlement for the RMB in 2009, the RMB has been developing toward an international currency, the cross-border use of the RMB has presented sustained, rapid growth, and its function as an international currency has been continuously enhanced. It has now become China’s second largest cross-border payment currency, the world’s fifth largest payment currency, and the fifth largest reserve currency. However, in 2020, China’s total economic output accounted for more than 17.4% of the world’s total (24.7% for the United States), but the RMB’s share in international payments and reserves was only 2.5% (in the first quarter of 2021, IMF) and 2.5% (June 2021, SWIFT), respectively. The Chinese RMB’s international currency status is extremely mismatched, with it being the world’s largest trading nation and second largest economy in the world. The RMB should take more responsibility for being an international currency in the diversification of international currencies [32,33]. However, in the traditional economy, the development of RMB internationalization is faced with many internal and external difficulties [26]. From the perspective of internal factors, China has not yet completed the market-oriented reform of interest rates and exchange rates, the RMB is not freely convertible under the capital account controls, and its export and return channels are not yet sound. At this stage, China does not have a financial system that matches international currency. From the external factors, there exists inertia in the use of a specific international currency. The U.S. dollar has absolute advantages in terms of scale and network externalities [34]. Other currencies face great obstacles to enhancing their statuses as international currencies and play a role in the construction of international currency diversification [35,36]. However, with the emergence of global central bank digital currencies, this situation is undergoing tremendous change, which brings huge opportunities for the construction of international currency diversification and the sustainable and sound development of the IMS [37,38,39,40].

The emergence of digital currency has brought many conveniences for people’s lives and work, especially by providing more diversified financial services for people living in areas with objectively inconvenient conditions [41]. The development of the DE/CP is not only conducive to China’s financial stability, but also beneficial for changing monetary policy to a certain extent (Huang Yiping, 2021). Specifically, the issuance of the DE/CP cannot only improve the partial convertibility of the RMB, but also break the limitations of time (7 × 24 h) and space (traveling anywhere, dual offline transactions), and greatly reduce transaction costs and time. This will change the development path of RMB internationalization.

Research studies have shown that China’s digital economy is currently in a period of rapid development, with an annual structural change of up to 0.3%. With the development of the DE/CP, it will inevitably play a considerable role in promoting the internationalization of the RMB. This is mainly reflected in the following aspects: (1) the DE/CP has further developed RMB cross-border payment and settlement businesses [42]; (2) the DE/CP has brought convenience to the RMB trading business (Feng Sixian and Yang Jing, 2020) [43]; (3) the promotion of the DE/CP will weaken the inertia of other international currencies; and (4) the DE/CP can alleviate the domestic and foreign difficulties faced by the internationalization of the RMB. The DE/CP issued by the PBC plays an important role in the process of RMB internationalization, but there are also many problems to be solved. The main difficulty is converting between digital RMB and foreign digital currencies. This is embodied in: (1) the systemic risks that may be brought about by complex overseas usage scenarios [42]—for example, the convenience of overseas conversion and the setting of the user’s ID account require endorsements and legal and financial agreements between China and foreign countries, which invisibly increase systemic risks [44]; (2) operational risks in the use of digital RMB overseas; (3) the risk of RMB outflow and money laundering, such as by moving money through a large amount of smaller purchases and forming an outflow of funds—the anonymity of the DE/CP and the convenience of cross-border payments can lead to money-laundering risks [45]; (4) private digital currencies eroding the status of legal digital currencies (for example, digital RMB). The large-scale issuance and use of private digital currencies will make users form habits or even a monopoly, thus threatening the dominant position of the RMB [46].

It is worth noting that although existing studies have investigated different dimensions of digital currency or internationalization of the RMB, there are still few studies focusing on the relationship between digital RMB and the internationalization of the RMB. In particular, there are no studies investigating the effect of digital currency on the internationalization of the RMB. Meanwhile, previous studies assume that the economic effects of digital currencies present linear characteristics; therefore, it is impossible to accurately evaluate the real effect of a digital currency without considering the data’s nonlinear characteristics. Besides, considering the complexity of the RMB internationalization mechanism and the inconsistent characteristics of system linkage under different environments and periods, it is particularly necessary to investigate the relationship between financial variables from a nonlinear perspective.

To fully describe the impact of digital RMB on RMB internationalization, this paper focuses on the time-varying impact of digital RMB on RMB internationalization from the perspective of regime-switching transition. Under different economic environments and heterogeneous timepoints, the impact of digital RMB on RMB internationalization is likely different because of the different economic scenarios, which create an asymmetric relationship between digital RMB on RMB internationalization. To this end, this paper first uses a nonlinear Fourier unit root test, which can capture structural and smooth breaks to explore the stationarity and convergence characteristics of the DE/CP and RMB internationalization. Second, based on the boundary cointegration approach, this paper characterizes the long-term equilibrium relationship between the DE/CP and RMB internationalization, and the results show that this is a significant one. Third, this paper explores the non-linear impact of the DE/CP on RMB internationalization from the perspective of regime switching by using a STAR model. Finally, to reveal the potential mechanism under the nonlinear impact of digital RMB on RMB internationalization, this paper further uses the TVP-SV-VAR model to deeply analyze the time-varying effect of digital RMB’s impact on RMB internationalization from different timepoints and periods, to provide theoretical references and suggestions for the monetary authorities to improve the DE/CP business and promote the internationalization of the RMB in an orderly manner.

Compared with the existing literature, the contributions of this study are threefold. First, based on my knowledge, this is the first study to directly examine the nonlinear relationship between digital currency and the internationalization of the RMB; the results show that the above relationship presents a regime switching and is obviously different in various economic environments and periods. The primary contribution of this study is filling the logical gaps of the missing link between the digital currency and the internationalization of the RMB in the current literature. Second, this paper utilizes the nonlinear unit root test to test the stationary process of variables that can capture both structural breaks and smooth breaks, and uses the regime-switching transition model (STAR) and TVP-SV-VAR model to investigate the relationship between digital currency and the internationalization of the RMB. It is worth noting that the time-varying parameters not only show the historical evolutionary characteristics of digital currency and the internationalization of the RMB, but also indirectly explain the nonlinear dynamic relationship. Third, this paper demonstrates that increased digital RMB development is helpful to the financial system, which is conducive to promoting the internationalization of the RMB to a great extent. Therefore, digital RMB development is an important link to improve the monetary system.

2. Variables, Model Setting and Data Sources

2.1. Variable Selection and Related Econometric Tests

Combined with the research focus of this paper and the existing literature, for digital currencies, the period of development for global central bank digital currencies, including the DE/CP, has been relatively short. Combined with the linkage between the DE/CP and basic currency, this paper selected the year-on-year growth rate of the base currency M0 issued by the PBC as a proxy variable for the DE/CP. On the one hand, the variation in the base currency M0 can reflect the monetary operations in the real economy and, on the other hand, also implies the conversion between different currencies. This is especially true because the M0 is highly correlated with the DE/CP, so the M0 growth rate has adopted that of the DE/CP, which can reflect the dynamic evolution of the DE/CP to a certain extent.

It should be pointed out that RMB internationalization is the result of a combination of multiple factors, and many scholars have constructed the RMB internationalization index from different perspectives. Considering comparability, operability, structural stability, and flexibility, this paper adopted the cross-border RMB index released by the People’s Bank of China.

To improve the effectiveness of parameter estimation and more effectively identify the impact of the DE/CP on RMB internationalization, this paper also drew on the research of Peng and Tan [47] and Si et al. [48] to select the difference between the RMB and the USD interest rates, between Chinese and U.S. inflation, and between Chinese and U.S. output, with the RMB exchange rate expectations serving as control variables to control the impact of other factors on RMB internationalization. In this way, the impact of the DE/CP on RMB internationalization can be more accurately portrayed. For interest rates, this paper used the Shanghai Interbank Offered Rate (Shibor) to represent the RMB interest rate, and the Fed Funds Rate to describe the U.S. dollar interest rate; for inflation in China and the U.S., this paper used the year-on-year growth rates of the CPI of the two countries as proxy variables for the inflation rates. For the output gap, this paper used the GDP growth rates as the proxy variables of output, and then used the Hodrick–Prescott (HP) filter to obtain the proxy variables for the output gap.

Based on the availability of data and timeliness of the research, the research samples in this paper are collected from the first quarter of 2012 to the fourth quarter of 2020, and all of the data came from the WIND database, the China National Bureau of Statistics, and the BIS database. It should be pointed out that, to eliminate seasonal effects, this paper performed an X-12 seasonal adjustment on all time-series data.

2.2. Stylized Facts

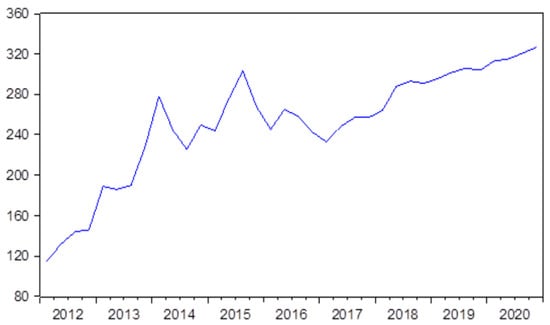

Figure 1 shows the dynamic evolutionary trend of RMB internationalization. It can be seen that, since 2012, the internationalization of the RMB has shown a rapid overall growth trend. In particular, during the periods of 2012–2014 and 2017–2020, the internationalization of the RMB showed a trend of rapid growth. In general, after the outbreak of the subprime mortgage crisis, the process of RMB internationalization showed rapid development, which can be further divided as follows: from 2012 to 2014, the process of RMB internationalization showed an accelerated upward trend; from 2014 to 2017, RMB internationalization fluctuated and slowed down; and since 2017, the internationalization of the RMB has resumed and steadily increased.

Figure 1.

Dynamic evolution of RMB internationalization.

Table 1 shows the summary statistical results of all variables in the paper. The results show that the standard deviation of the RMB internationalization index (RII) is relatively large among the key economic and financial variables in this paper, which implies that the fluctuation range of RMB internationalization is much larger. This is also in line with the reality of the development of RMB internationalization. In comparison, the standard deviation of the DC/EP growth rate (M0) is only 2.981, which is the smallest standard deviation among all the variables involved in this paper, indicating that the DC/EP presents a very stable and gradual change trend, which is consistent with the realistic characteristics of DC/EP development in China. It should be pointed out that since the standard deviations of the Sino–U.S. interest differential (ID) and exchange rate expectation (NDF) are close, this further reflects on the consistent interconnected trend between Sino–U.S. interest differential and exchange rate expectations, and also reflects on the fact that the Sino–U.S. interest differentials will have an obvious impact on expectations to a certain extent. For the inflation (CPI) and output (GDP) gaps, the standard deviations are 3.037 and 3.133, respectively. The volatility of the inflation and output gaps is very similar, and thus implies that China’s economic growth and price changes are in line with the evolutionary characteristics of the economic cycle as a whole. It is worth noting that, from the estimation results of skewness, it can be seen that since the skewness of the DC/EP, exchange rate expectations, and output gap are all bigger than 0, this indicates that the DC/EP, exchange rate expectations, and output gap are all subject to a right-skewed distribution. On the contrary, the skewness of the variables of RMB internationalization, Sino–U.S. interest differential, and inflationary gap are all less than 0, indicating that RMB internationalization, Sino–U.S. interest differential and inflation gap are all subject to a left-skewed distribution.

Table 1.

Summary of statistical results.

2.2.1. Stationarity Test

In econometrics, if the variables have the same time trend, even if there is no necessary economic correlation between them, there may be significant correlations in the regression statistical analysis. As a result, spurious regressions appear, resulting in the parameter results lacking validity, and leading to unreliability for the analysis results. At the same time, it should be noted that if the variables are not stationary, this will lead to potential endogeneity problems between the variables, which will further lead to the ineffectiveness of the results. In view of this, to avoid the false statistical results caused by nonstationary variables, this paper will test the stationarity of variables. The existing research mainly adopts unit root test methods such as ADF, PP, and KPSS; however, these tests do not account for the existing “breaks” in the variables. In other words, they cannot capture the structural breaks that are formed when the variable is subjected to external shocks, so it is very likely that the dynamic evolution characteristics of the variables cannot be accurately described. Therefore, to ensure the validity of the test results, this paper uses a combination of various measurement methods to test the stationary characteristics of all variables.

Table 2 shows the variable stability test results based on the traditional unit root test method. It is not difficult to find that when the original series of output gap (GDP), DC/EP (M0), exchange rate expectations (NDF), Sino–U.S. interest differential (ID), Sino–U.S. inflation differential (CPI) were tested by ADF and PP, the null hypothesis of the existence of a unit root was rejected at a certain level of significance, and these variables were considered to be stable; however, when tested by KPSS, the series-stationary hypothesis was accepted. At the same time, the test results also reached the same conclusion after the first-order difference, indicating that the above variables all follow the distribution of I(0). However, when the original sequence of the RMB internationalization index (RII) was tested by ADF, none of them rejected the null hypothesis of “nonstationary sequence” at the given significance level. At the same time, when using the KPSS test, the results show that the internationalization of the RMB has nonstationary characteristics, and the results were at the 1% significance level. It should be pointed out that the above results derived from the stationarity test in the case of the original value, and the ADF, PP, and KPSS tests were used again after taking the first-order differences for those variables, indicating that the first-order difference values of all variables are stationary; in other words, with the evolution of time, the above variables show convergence characteristics, indicating that the variables selected in this paper conform to the I(1) characteristics.

Table 2.

Traditional linear unit root test results (including intercept term).

As mentioned above, when there are sudden changes in policies, economic and financial variables may suddenly change and thus form structural breaks, facing unexpected shocks. However, traditional unit root test methods (including ADF, PP, and KPSS, etc.) cannot capture the structural breaks and the stationary test results may not accurately be described when ignoring the existence of the structural breaks. In view of this, this paper follows Si et al. [49], using a nonlinear Fourier unit root test that considers sharp breaks and smooth breaks in the data-generating process. The test results are shown in Table 3.

Table 3.

Unit root test results with structural breaks and smooth breaks.

From the unit root test results in Table 3, the DC/EP is shown to contain three structural breaks, the RMB internationalization and the Sino–U.S. inflationary gap both contain five structural breaks, and exchange rate expectations, Sino–U.S. interest differentials and output gap contain four structural breaks. From the results of the smooth breaks, the DC/EP contains one smooth break, the RMB internationalization and the Sino–U.S. inflationary gap contain five smooth breaks, the Sino–U.S. interest rate difference, the RMB exchange rate expectation, and the output gap difference contain two, three, and four smooth breaks, respectively.

It is worth noting that the time-series variables selected in this paper contain specific structural breaks, whether they are sharp breaks or smooth breaks. Therefore, it is more efficient to use the unit root method that can capture structural breaks to describe the stationary characteristics of variables. In addition, it can be seen that the statistics of the DC/EP growth rate, RMB internationalization, and RMB exchange rate expectations are all significant compared to the results of the Bartlett statistics, indicating that they contain a unit root; that is, these variables are nonstationary series. However, as for other variables, since the Bartlett statistic of the Sino–U.S. inflationary gap and output gap cannot pass the significance level test, this means that the Sino–U.S. inflationary gap and output gap are stationary. In other words, the Sino–U.S. inflationary gap and the output gap are stationary variables. In addition, that the F statistic can capture the nonlinear change invariables is statistically significant, implying that all the variables selected in this paper have nonlinear features. This also provides better empirical evidence for the use of nonlinear time-series methods in the following.

2.2.2. Granger Causality Test

After testing the stationarity of the variables, this paper further describes the causal relationship between variables. Based on the VAR model analysis framework, this paper first characterizes the optimal lag phase between the variables according to the SIC, and then characterizes the causal relationship between the DC/EP and the RMB internationalization based on the statistics under the minimum information criterion. It is worth noting that, considering the time limit of the research sample selected in this paper and after maximizing the sample size for this paper, following Toda and Phillips [50,51], the lag phase of the variable is set to the 1–4 phase, and the causal relationship was tested to obtain the minimum information criterion needed to optimize the model results. Table 4 shows the causal relationship between the DC/EP and RMB internationalization under different lag phases. From the corresponding statistics and their accompanying probabilities, it can be found that when the lag phase is 4, “DC/EP is not a Granger reason of RMB internationalization” is significantly rejected; in other words, when the lag phase is 4, the VAR system composed of the DC/EP, RMB internationalization, and its related variables confirms the conclusion that the “DC/EP is the Granger reason of RMB internationalization”.

Table 4.

Granger Causality Test.

2.2.3. Bounds Cointegration Test of DC/EP and RMB Internationalization

As mentioned above, some variables are stationary, that is, I(0), and other variables follow an integration of one order I(1). Therefore, whether there is an equilibrium relationship in the long term needs further confirmation. In particular, if the long-term relationship among different variables can be balanced at a certain level, the relationship between the core variables of the DC/EP and RMB internationalization, that is, the focus of this paper, is considered to be equal, with a cointegration relationship. At present, existing studies are mostly based on the VAR system to characterize the long-term equilibrium relationship among the variables. However, because the cointegration relationship of the VAR system requires the same-order single integration for the variables, this cannot be applied in the cointegration analysis of this paper. Under these circumstances, this paper follows Persaran et al. [52] and utilizes the ARDL model to describe the cointegration relationship between different single-integer variables. It should be noted that the ARDL bounds test is essentially different from the traditional cointegration relationship. In particular, the traditional method requires that the variables are all same-order integration, while the bounds test does not impose mandatory requirements for the stationarity of variables. It should also be pointed out that, from the perspective of China’s development reality, the research sample in this paper is not large because of the short development history and relatively short time of the DC/EP. To this end, this paper uses an error-corrected ARDL to characterize the long-term relationship between the DC/EP and RMB internationalization. The specific model setting is as follows:

In Equation (1), and are the lags in the dependent variable and independent variable, respectively, and and are the adjustment speeds of short-term imbalances; that is, this is a speed level from the short-term imbalance to the long-term equilibrium. Specifically, the null hypothesis of the coefficient is that:

If the joint test statistic exceeds the critical value of a certain significance level, this implies that there is a long-term equilibrium cointegration relationship between the key variables. On the contrary, if the joint test statistic is lower than the critical value corresponding to the significance level, this means that there is no long-term equilibrium cointegration relationship between the variables. Specifically, this paper uses the following Equation (2) to describe the long-term equilibrium relationship between the DC/EP and RMB internationalization.

Here, represents the differential value of RMB internationalization, represents the lag phase i after the RMB internationalization differential, represents the lag phase i after the DC/EP differential, represents the lag phase i after the interest differential, represents the lag phase i after the output gap differential, represents the lag phase i of the differential value of the exchange rate expectation, and is the error term. It should be noted that, when estimating Equation (2), this paper uses the traditional least-squares method to estimate the parameters, and further estimates the statistics of the bounds test based on the parameter estimation. At the same time, this paper also uses the bootstrap OLS method to simulate the upper and lower bounds of the bounds test statistics in the 95% confidence interval. The results are shown in Table 5.

Table 5.

Bounds Test Results.

From Table 5, it is not difficult to find that, after estimating the error correction ARDL, the optimal lag phase of all variables was 4, and its F-statistic was 18.44. According to the bootstrap self-sampling method, after simulating the upper and lower bounds of the 95% confidence interval, the upper bound of the bounds test F-statistic was 4.19 and the lower bound was 3.07. As the F-statistic is greater than the upper bound, this implies that there is a long-term equilibrium co-integration relationship between the core variables of the DC/EP, RMB internationalization, and its control variables in this paper. In other words, when subjected to external shocks, the DC/EP and the RMB internationalization, the Sino–U.S. interest differential, the Sino–U.S. inflationary gap, the output gap, and exchange rate expectation can automatically be restored to a stable equilibrium system and behave as a long-term equilibrium cointegration relationship.

2.2.4. Asymmetric Model Setting

It is important to note that, under different economic environments, the impact of the DC/EP on RMB internationalization may be significantly different. Its impact may depend on other economic variables and present an asymmetrical feature. In view of this, this paper further adopts the nonlinear smooth transition autoregression model (STAR) to characterize the relationship between the DC/EP and RMB internationalization. Specifically, we interpret the STAR as follows:

where denotes a sequence of independent identically distributed errors, and represents a continuous transition function, which is usually bounded between 0 and 1. Due to this reason, the model explains not only the two extreme states but also a continuum of states that lie between the two extremes. is a transition variable that is an element of , and is then assumed to be a lagged endogenous variable. is a slope parameter that measures the speed of the transition from one regime to another. x = (ID, CPI, GDP, NDF) is the vector including control variables. It should be noted that in the STAR model, due to the difference in the form of its transfer function, this paper further divides the STAR into logical type (LSTAR) and exponential type (ESTAR). Its forms are as follows:

With the LSTAR model, the two regimes are associated with small and large values of transition variables. This type of regime switching can be convenient for modeling, for example, business cycle asymmetry where the regimes of the LSTAR are related to expansions and recessions. Besides, in Equations (4) and (5), represents the exogenous disturbance shock, and its variance and covariance matrix can be further expressed as the following formula:

By further deforming Equation (6) and solving for , the above equation can be further expressed as:

Among them, is a low-dimensional triangular matrix and can be expressed as shown in Equation (8):

and is a diagonal matrix, as follows:

Therefore, we can reformulate Equation (9) as follows:

At the same time, we can superimpose all the coefficients in Equation (10) and re-express them in the form of a matrix, as follows:

Among them, and represent the Kronecker product. Next, this paper further set the changing rules of the parameters in the model, and are set to obey random walks, and is set as random fluctuations and obeys random walk characteristics. In addition, this paper assumes that the information () included in the model obeys the joint normal distribution, as follows:

At the same time, we can also express the joint distribution of its variance as follows:

When estimating the parameters of the above formula, this paper also uses the least squares method (OLS) to estimate the corresponding parameters. When solving the above equation, this paper can further express the parameter distribution as:

We obtain the parameters in a similar way, specifically:

As for , the prior distribution of the mean value is the standard deviation through OLS estimation, and then, when performing logarithmic processing, its variance-covariance matrix can be expressed as follows:

Finally, we construct the prior information of the hyperparameters as follows:

Following Cogley and Sargent [53], the eigenvectors are characterized in the form of the product of the constant and the corresponding variance of the OLS parameter estimate in this paper.

According to the above econometric model, this paper selects interest rate differential, inflation gap, output gap spread, and exchange rate expectation changes as transition variables in turn. When testing the form of the transition function, the specific regime system is determined by the concomitant probability corresponding to the transition interval in this paper. Specifically, when the smallest concomitant probability corresponds to the logistic smooth transition function, the nonlinear STAR form is set to the logistic. On the contrary, when the smallest concomitant probability corresponds to the exponential STAR, the model is set to the nonlinear exponential smoothing transition autoregressive model. From the results in Table 6, it can be found that, during the process of selecting transition variables such as interest differential, inflationary gap, output gap, and exchange rate expectation change, the transition function corresponding to the minimum concomitant probability is a logistic smooth transition function, and the optimal lag phase is 2, so the transition function is set as a logical smooth transition function, and the optimal lag phase is 2 in the smooth regime switching transition model.

Table 6.

Model selection results of the nonlinear effect of DC/EP on RMB internationalization.

To reduce the bias error of the parameter estimation in the results of the STAR model, this paper further adopted the nonlinear least squares method (NLLS) to estimate the parameters. Specifically, first, the preliminary parameters were estimated using the OLS method in this paper, and then the preliminary results were considered as the initial value, after which the Gauss–Newton iterative algorithm was used to identify the convergence of the parameters, the identified optimal parameters helped the model achieve optimal convergence, and the corresponding model had a higher explanatory power. In particular, this paper further utilized the Gauss–Newton iterative algorithm combined with the nonlinear least squares method to re-estimate the above parameters; the results are shown in Table 7.

Table 7.

Parameter estimation results of nonlinear STAR.

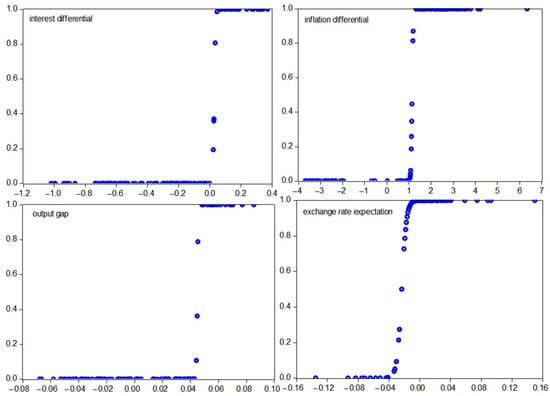

In the parameter estimation results in Table 7, the impact of the DC/EP on RMB internationalization is affected by the heterogeneity of the regime systems that are formed in particular, in the case of different transition variables, the impact of DC/EP on RMB internationalization is significant different, which reflects the significant asymmetric characteristics of the impact of DC/EP on RMB internationalization in a certain degree. It is worth noting that, the impact of core explanatory variable and control variables on RMB internationalization present significant nonlinear regime switching characteristics in the Figure 2, which demonstrates that the impact of DC/EP on RMB internationalization is significant regime heterogeneity once again, in other words, when Sino–U.S. interest differentials, inflationary gap, output gap, and exchange rate expectations are used as the transition variables. At the same time, Figure 2 shows that the impact of the DC/EP on RMB internationalization has a significant nonlinear regime heterogeneity. Specifically, first, when the interest differential is selected as the transition variable in a low-regime system, the impact of the DC/EP on RMB internationalization is 0.989, and the 1% significance level is significant, while, in a high-regime system, this impact is 0.018 (1.086–1.068), and is significantly positive at the 1% level. Therefore, combining the coefficients of the low-regime system and the high-regime system, the impact of the DC/EP on RMB internationalization was shown to be relatively large in the low-regime system (that is, the interest differential is less than 0.029), and, in both the low-regime system and the high-regime system, these coefficients are all significantly positive, indicating that when China’s monetary policy is tightened relative to the U.S. monetary policy, the DC/EP has a relatively small impact on the internationalization of the RMB. The potential economic implications of this result can be summarized as follows: when monetary policy shows a tightening trend, the central bank will tighten liquidity, the liquidity in the market will be reduced accordingly, and the breadth and depth of the use of the RMB will be reduced to a certain extent. In this context, the impact of digital currency on the internationalization of the RMB will be restrained. In addition, this tight monetary policy also leads to a short-term appreciation of the RMB exchange rate, which has an adverse impact on the export behavior of Chinese enterprises. At this time, the amount of money in current accounts will shrink, with a restraining effect on the internationalization of the RMB.

Figure 2.

Scatter plots of transfer functions under different regime systems.

Second, from the perspective of the results of the inflation gap as a transition variable, when the inflation gap is less than 1.145, that is, in a low-regime system of inflation, the DC/EP’s coefficient on the internationalization of the RMB is 0.981 (1.354–0.373), and is significantly positive at the 1% significance level, indicating that the development of the DC/EP tends to promote the internationalization of the RMB. It should be pointed out that in the low-regime system, the boosting effect of the DC/EP on RMB internationalization is relatively large in the short term (the coefficient is 1.354), but is not conducive to the promotion of RMB internationalization in the long term (−0.373). From the perspective of the high-regime system of inflation, the coefficient of the DC/EP is significantly negative (−0.047); this shows that when China is in a period of relatively high inflation, the increase in the DC/EP is not only adverse to the orderly progress of the RMB internationalization, but will also restrain the internationalization of the RMB. The underlying mechanism is that, when high inflation occurs, the central bank will adopt a tightening monetary policy to regulate the macro-economy. On the one hand, rising inflation will lead to a decline in money purchasing power, which will lead to capital outflow and have a restraining effect on the internationalization of the RMB. On the other hand, when the central bank adopts a tight monetary policy, this will lead to an increase in the financing costs of enterprises, which will have an adverse impact on their orderly operation, which is not conducive to the orderly promotion of RMB internationalization. It is worth noting that an increase in DECP will not only fail to promote the internationalization of the RMB, but will restrain it to a certain extent. In addition, since the impact of DC/EP on RMB internationalization is not consistent in the low-regime system and high-regime system, this reflects the significant asymmetry and regime heterogeneity of this impact.

Third, from the perspective of the regression results of the output gap as a transition variable, it can be seen that when the output gap is less than 0.045, that is, in the low-regime system of the output gap, the coefficient of the DC/EP on RMB internationalization is significantly positive, that is, 0.983 (1.321–0.038). As the coefficient is significantly positive, this indicates that, relative to the United States, when China’s economic growth is in a relatively stable state, the DC/EP can significantly promote the internationalization of the RMB. It should be noted that, in the low-regime system of output, the coefficient of the DC/EP on RMB internationalization is significantly positive (1.321), with one lag phase. However, when the lag phase is two, the coefficient is significantly negative (−0.038), which further reflects the output in the low-regime system; the impact of the DC/EP on RMB internationalization is mainly reflected in the short-term, while it tends to restrain RMB internationalization in the long term, but the restraint effect is less than the short-term promotion effect; thus, the DC/EP’s impact on RMB internationalization helps to promote the internationalization of the RMB in the low-regime system. At the same time, from the perspective of the high-regime system of output, the influence coefficient is significantly 0.164 (0.967–0.803), which implies that, in the high-regime system of output gap, the development of the DC/EP can significantly promote the process of RMB internationalization. The underlying reasons for the empirical results can be summarized as follows: as economic fundamentals are an important basic factor affecting the internationalization of the RMB, rapid economic growth will make RMB particularly attractive, and the exchange rate will also show an appreciation trend. On the one hand, this will attract investors’ attention regarding RMB assets. On the other hand, it will also increase the use of the RMB by dealers, which will improve the internationalization of the RMB to a certain extent. In other words, economic growth is an important factor determining the internationalization of the RMB. Furthermore, considering the changes in the low-regime system and the high-regime system, in the heterogeneous high-regime system of the output gap, the impact of DC/EP on RMB internationalization is relatively large in the low-regime system, and its effect is mainly felt in the short term. Therefore, in the heterogeneous environment of the output gap, the impact presents obvious term structure characteristics.

Finally, when the RMB exchange rate expectation is selected as the transition variable, the nonlinear regression results in Table 4 show that when the RMB exchange rate expectation is in a low-regime system (that is, the exchange rate expectation change is less than −0.023), the impact of the DC/EP on RMB internationalization is significantly 1.031 (1.183–0.152), indicating that, in the expected environment of RMB exchange rate appreciation (less than −0.023), this impact has a significant promoting effect. Moreover, when the exchange rate expectation is in the low-regime system, the impact is mainly reflected in the short-term (coefficient is 1.183), while, in the long-term, the impact coefficient is significantly negative (−0.152), implying that when the exchange rate expectation continues to appreciate, the DC/EP will have a significant restraining effect on the internationalization of the RMB. Further from the perspective of the high-regime system of exchange rate expectations, when there is a slight appreciation of the RMB exchange rate expectation (0~−0.027) and depreciation expectation (greater than 0), the short-term impact coefficient is 0.402, which is significant at the 1% level. However, when the DC/EP lag phase is two, the coefficient of the DC/EP on RMB internationalization is significantly negative (−0.489), implying that when there is a slight appreciation of the RMB exchange rate expectation and depreciation trends, the excessive development of the DC/EP may restrain the process of RMB internationalization to a certain extent. In particular, the RMB exchange rate expectation and RMB spot exchange rate have the characteristics of “mutual realization” and “mutual reinforcement”. When the expectation of RMB exchange rate depreciation appears, this leads to the depreciation of the RMB spot exchange rate, which not only leads to a large amount of capital outflow from the country, but also affects its main business due to the lack of sufficient capital within real enterprises, which is not conducive to the healthy growth of the real economy. This will undoubtedly have a negative impact on the internationalization of the RMB. In addition, considering the exchange rate expectations in different regime systems, the results also show that the impact of the DC/EP on RMB internationalization is significantly different, the promotion effect of the DC/EP on RMB internationalization is relatively obvious in the short term, and there is a relatively large effect in the low-regime system. This further reflects the significant heterogeneity in the impact of the DC/EP on RMB internationalization.

2.2.5. Time-Varying Relationship Test

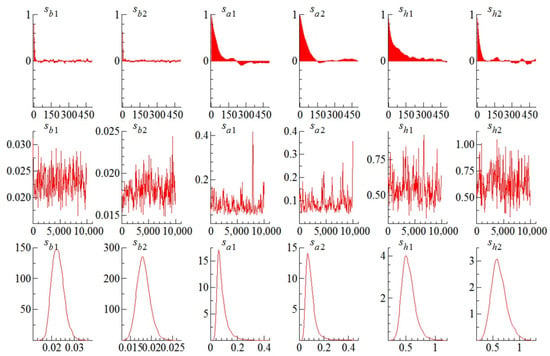

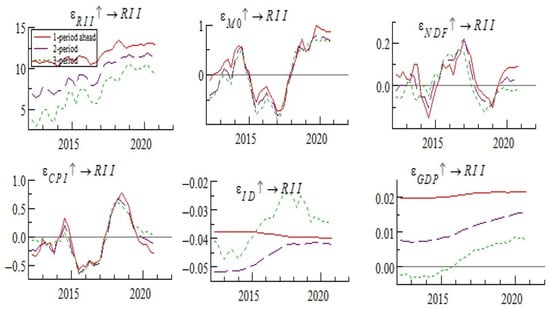

To examine the impact of the DE/CP on RMB internationalization from the perspective of dynamic evolution, this paper further adopts the TVP-SV-VAR model to capture the impact characteristics of the DE/CP on RMB internationalization at different timepoints and during different periods. In particular, since the TVP-SV-VAR model allows the volatility matrix to vary over time, it can present the dynamic effects exhibited by the relationships between variables. It should be pointed out that, in this paper, referring to the research of Si et al. [8], the Gibbs sampling method is used to conduct 11,000 samplings for parameter estimation. However, the estimated values of the first 1000 times were burn-in and discarded to avoid the influence of outliers on parameter estimation. Table 8 and Figure 3 show the parameter estimation results of the TVP-SV-VAR model. Figure 3 shows that the path to select sample values in this paper is relatively stable, and its autocorrelation is significantly decreased, indicating that the parameters of the sample selected in this paper are effective. The results in Table 8 show that, when estimating the samples, the CD test results in this paper show that all parameters are less than 1 and the invalid factor is greater than 1, which implies that the parameter estimation results in this paper are all valid, the system composed of the DE/CP, RMB internationalization, and its control variables is relatively stable; this further reflects the rationality and reliability of the parameter estimation results in this paper.

Table 8.

Parametric regression results of TVP-SV-VAR.

Figure 3.

TVP-SV-VAR parameter estimation results.

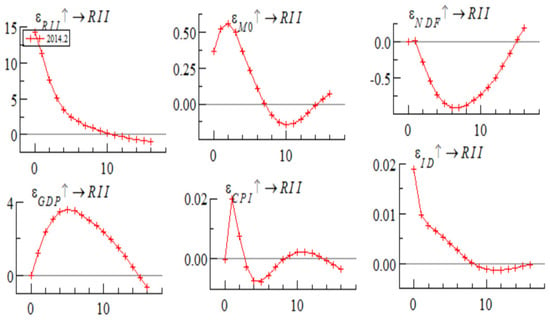

Figure 4 and Figure 5 show the results of impulse response at different timepoints and over different periods, respectively. The results of Figure 4 were obtained by empirical analysis in the second quarter of 2014, which is randomly selected in this paper. The timepoint diagram shows that for the DE/CP, when the DE/CP had a positive shock with one unit, its impact on the internationalization of the RMB was positive in the early stage, reached an extreme value in the second stage, and then began to decline. In the sixth stage, its value changed “from positive to negative”, implying that the impact of the DE/CP on RMB internationalization is positive in the short term, but also that the effect is not constant, and the DE/CP will have a negative impact on RMB internationalization as time passes. The result is consistent with the previous conclusion based on the STAR model. Therefore, from the time-varying results, the impact of the DE/CP on RMB internationalization is positive in the short term and negative in the long term. Moreover, the impact of the DE/CP on RMB internationalization is particularly obvious in the short term. On the one hand, digital currency can form a significant, short-term, basic support system for RMB internationalization. On the other, the rapid development of digital currency can form more stable conditions for promoting RMB internationalization. In addition, due to the short-term nature of impacts, the effect formed by one impact also has short-term characteristics.

Figure 4.

Impulse response at different timepoints.

Figure 5.

Impulse response at different times.

In addition, from the impact of the control variables on RMB internationalization, it can be seen that after the exchange rate expectations and inflation face positive shocks, the short-term response coefficient of RMB internationalization is negative, while the output gap and interest margin are positively affected, and the coefficient of the internationalization of the RMB is positive. The economic implications of the result can be summarized as follows. In the case of exchange rate depreciation and inflation, the process of RMB internationalization will be significantly inhibited. On the contrary, when China’s economy is in a growth trend and the RMB interest rate is higher than that of the US dollar, the internationalization of the RMB will be significantly promoted. The mechanism underlying the results is that, on the one hand, the increase in inflation and the depreciation of the exchange rate will lead to capital outflow, which will reduce the attractiveness of RMB assets, with a negative impact on the internationalization of the RMB. On the other hand, the central bank will also adopt a tightening monetary policy of raising interest rates and an intervention policy regarding the foreign exchange market to regulate inflation and the exchange rate, which will also affect the regulation of monetary policy, which is not conducive to the orderly promotion of RMB internationalization. Moreover, it should be pointed out that, with the gradual increase over time, the impact of all control variables on the internationalization of the RMB will change, which further implies that the impact of the control variables on RMB internationalization has the significant characteristic of maturity heterogeneity.

Based on the above estimation results, we also used the TVP-SV-VAR model to predict the coupling effect between the DE/CP, RMB internationalization, and control variables, and set the predictive time length as h = 1, 2, 3. Thus, the time-varying impulse response functions of the exogenous shocks are formed in the short term, medium term, and long term. Figure 5 shows that in the period of heterogeneity, the trends of impulse responses are similar, implying that the results obtained from the TVP-SV-VAR model are robust to a certain degree. Specifically, from the trend chart of the impact of the DE/CP on RMB internationalization, the coefficient was negative during 2012–2013 and 2015–2016, while, since 2016, the coefficient has been clearly positive and has the potential to increase. It should be pointed out that, from the perspective of the dynamic evolution, in different term structures, the impact of the DE/CP on RMB internationalization is relatively large in the short term, lesser in the medium term, and relatively small in the long term, which further confirms that the impact of the DE/CP on RMB internationalization has an obvious maturity heterogeneity, and the effect is much larger in the short term.

Furthermore, for the control variables, it can be seen that the impact of the exchange rate expectation and inflation gaps on RMB internationalization was positive during 2016–2018 and 2019–2020, the exchange appreciation of the RMB and lower inflation have a positive coefficient on RMB internationalization, and the RMB exchange rate expectation had a negative effect on RMB internationalization during 2015 and 2018–2019; the underlying reason for this is that the RMB exchange rate adopted the central parity rate over 2015, so the RMB had a relatively large depreciation trend over a certain period. Exchange rate depreciation not only affects international investors in RMB, but also aggravates the expectation of exchange rate depreciation, which further leads to international capital outflow, which undoubtedly has a significant adverse impact on the internationalization of the RMB. In addition, the sharp depreciation of the RMB may also generate a worsening circular effect between international capital outflows and the depreciation of the RMB. This is not conducive to orderly advancing the internationalization of the RMB.

From the impact of the output gap on RMB internationalization, we find that, in the short- and medium-term, the impact of output on RMB internationalization is positive, and the coefficient of output gap on RMB internationalization is relatively large in the short term, and, in recent years, there has been an obvious increasing trend, which further reflects that the economic fundamentals are important driving forces for RMB internationalization. It should be noted that, before 2015, the impact of the output gap on RMB internationalization in the long term was negative, which was in line with economic expectations. Since China’s economic growth entered a “new normal” in 2011, as the structural adjustment of the economy China’s economic growth has shown a significant downward trend. At this time, the internationalization of the RMB has been significantly inhibited. Therefore, in 2012–2015, there was a clear negative correlation between the output gap and RMB internationalization. The potential reasons for this result can be summarized as follows: on the one hand, the continuous decline in output will trigger the central bank to adopt an expansionary monetary policy, and the formation of an expansionary monetary policy will not only reduce the regulation effect of the policy, but will also easily lead to inflation, which will have an adverse impact on the internationalization of the RMB. On the other hand, the decline in output will lead to international capital outflow and the depreciation of the RMB exchange rate, which will reduce the attention of international investors to RMB assets, with a negative effect on the internationalization of the RMB. In addition, due to the different impacts of the output gap and interest spread on RMB internationalization in different periods, significant maturity heterogeneity is created with regard to its impact on RMB internationalization.

3. Conclusions

Can the DC/EP promote the internationalization of the RMB? This question will affect the sound and sustainable development of China’s financial system and the international monetary system. To accurately describe the impact of the DC/EP on RMB internationalization, this paper takes digital currency in China as its research object, focusing on the relationship between the digital currency and RMB internationalization. In particular, the paper utilizes a regime-switching transition auto regression (STAR) model and nonlinear time varying parameter–stochastic volatility–vector auto regression model (TVP-SV-VAR) to empirically analyze the relationship between digital RMB, RMB internationalization, and the development of the international monetary system. The results show that the relationship between the DC/EP and the internationalization of the RMB is time-varying, and the above relationship is significantly different in various economic situations, which shows that the effect of digital RMB on RMB internationalization is asymmetric. Furthermore, the DC/EP can boost the internationalization of the RMB and thereby contribute to the diversification of the international monetary system. The results have important policy implications for the sound and sustainable development of the economic and financial markets.

The central bank digital currency has the natural advantages of being an international currency (such as: extremely low production, issuance, and circulation management costs; breaking through time and space constraints; greatly reducing cross-border payment costs and shortening transaction times; national credit endorsement, noncompetitive legal tender, etc.). Driven by the rapid growth in the global digital economy, central banks of various countries have accelerated the development of their digital currencies. This will lead to the decomposition of the existing unipolar international monetary system and the reconstruction of the diversified international monetary system, gradually forming a diversified international monetary system that can ensure that economic development is sound and sustainable. This will further promote the stability of global finance and economy, optimize the allocation of global resources, greatly reduce transaction costs, improve global total factor productivity (TFP), and push global sustainable development.

Funding

This research was funded by the National Social Science Foundation of China, grant number 15ZDC020 and the APC was funded by the National Social Science Fund of China. At the same time, this research also received funding from the key projects of the National Bureau of Statistics of China, grant number 2020LZ24.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data can be accessed upon request by email to scm.2003@tsinghua.org.cn.

Acknowledgments

Constructive suggestions and comments on the manuscript from all the reviewers and editors are appreciated.

Conflicts of Interest

The author declares no conflict of interest.

References

- Duran, C. Voice and exit: How emerging powers are promoting institutional changes in the international monetary system. Rev. Direito Int. 2018, 15, 71–89. [Google Scholar] [CrossRef][Green Version]

- Farhi, E.; Maggiori, M. A model of the international monetary system. Q. J. Econ. 2017, 133, 295–355. [Google Scholar] [CrossRef]

- Ito, H.; McCauley, R.N. Currency composition of foreign exchange reserves. J. Int. Money Financ. 2020, 102, 102104. [Google Scholar] [CrossRef]

- Ponsot, J. The “four I’s” of the international monetary system and the international role of the euro. Res. Int. Bus. Financ. 2016, 37, 299–308. [Google Scholar] [CrossRef]

- Aizenman, J.; Cheung, Y.; Qian, X. The currency composition of international reserves, demand for international reserves, and global safe assets. J. Int. Money Financ. 2020, 102, 102120. [Google Scholar] [CrossRef]

- Susana, Á.; Alfaro-Cid, M.; Fernández-Blanco, O. Hedging foreign exchange rate risk: Multi-currency diversification. Eur. J. Manag. Bus. Econ. 2016, 25, 2–7. [Google Scholar]

- Miyajim, K.; Mohanty, M.; Chan, T. Emerging market local currency bonds: Diversification and stability. Emerg. Mark. Rev. 2015, 22, 126–139. [Google Scholar] [CrossRef]

- Asteriou, D.; Masatci, K.; Pílbeam, K. Exchange rate volatility and international trade: International evidence from the mint countries. Econ. Model. 2016, 58, 133–140. [Google Scholar] [CrossRef]

- Bollerslev, T.; Patton, A.J.; Quaedvlieg, R. Exploiting the errors: A simple approach for improved volatility forecasting. J. Econom. 2016, 192, 1–18. [Google Scholar] [CrossRef]

- Ding, S.; Zhang, Y.; Duygun, M. Modeling price volatility based on a genetic programming approach. Br. J. Manag. 2019, 30, 328–340. [Google Scholar] [CrossRef]

- Ho, K.-Y.; Shi, Y.; Zhang, Z. Does news matter in China’s foreign exchange market? Chinese RMB volatility and public information arrivals. Int. Rev. Econ. Financ. 2017, 52, 302–321. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Downside and upside risk spillovers between exchange rates and stock prices. J. Bank. Financ. 2016, 62, 76–96. [Google Scholar] [CrossRef]

- Ren, Y.; Chen, L.; Liu, Y. The onshore–offshore exchange rate differential, interest rate spreads, and internationalization: Evidence from the Hong Kong offshore renminbi market. Emerg. Mark. Financ. Trade 2018, 54, 3100–3116. [Google Scholar] [CrossRef]

- Wan, X.; Yan, Y.; Zeng, Z. Exchange rate regimes and market integration: Evidence from the dynamic relations between RenMinBi onshore and offshore markets. N. Am. J. Econ. Financ. 2020, 52, 101–173. [Google Scholar] [CrossRef]

- Cheung, Y.; Yiu, S. Offshore RenMinBi trading: Findings from the 2013 Triennial Central Bank Survey. Int. Econ. 2017, 152, 9–20. [Google Scholar] [CrossRef]

- Du, J.; Zhang, Y. Does one belt one road initiative promote Chinese overseas direct investment? China Econ. Rev. 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Qin, F.; Zhang, J.; Zhang, Z. RMB exchange rates and volatility spillover across financial markets in China and Japan. Risks 2018, 6, 120. [Google Scholar] [CrossRef]

- Ho, K.-Y.; Shi, Y.; Zhang, Z. Public information arrival, price discovery and dynamic correlations in the Chinese RenMinBi markets. N. Am. J. Econ. Financ. 2018, 46, 168–186. [Google Scholar] [CrossRef]

- Cheng, X.; Chen, H.; Zhou, Y. Is the RenMinBi a safe-haven currency? Evidence from conditional coskewness and cokurtosis. J. Int. Money Financ. 2021, 113, 102359. [Google Scholar] [CrossRef]

- Liu, T.; Wang, X.; Woo, W.T. The road to currency internationalization: Global perspectives and Chinese experience. Emerg. Mark. Rev. 2019, 38, 73–101. [Google Scholar] [CrossRef]

- Ding, S.; Cui, T.; Zhang, Y. Incorporating the RMB internationalization effect into its exchange rate volatility forecasting. N. Am. J. Econ. Financ. 2020, 54, 101–103. [Google Scholar] [CrossRef]

- Bénassy-Quéré, A.; Forouheshfar, Y. The impact of yuan internationalization on the stability of the international monetary system. J. Int. Money Financ. 2015, 57, 115–135. [Google Scholar] [CrossRef]

- Ammous, S. Can cryptocurrencies fulfil the functions of money? Q. Rev. Econ. Financ. 2018, 70, 38–51. [Google Scholar] [CrossRef]

- Marchiori, L. Monetary theory reversed: Virtual currency issuance and the inflation tax. J. Int. Money Financ. 2021, 117, 102441. [Google Scholar] [CrossRef]

- CastrénaIlj, O.; Kavonius, K.; Rancan, M. Digital currencies in financial networks. J. Financ. Stab. 2022, 60, 101000. [Google Scholar] [CrossRef]

- Balversa, R.; McDonald, B. Designing a global digital currency. J. Int. Money Financ. 2021, 111, 102317. [Google Scholar] [CrossRef]

- Glocker, C.; Piribauer, P. Digitalization, retail trade and monetary policy. J. Int. Money Financ. 2021, 112, 102340. [Google Scholar] [CrossRef]

- He, Q.; Korhonen, I.; Guo, J.; Liu, F. The geographic distribution of international currencies and RMB internationalization. Int. Rev. Econ. Financ. 2016, 42, 442–458. [Google Scholar] [CrossRef]

- Agur, I.; Ari, A.; Dell’Ariccia, G. Designing central bank digital currencies. J. Monet. Econ. 2022, 125, 62–79. [Google Scholar] [CrossRef]

- Han, D.; Yife, Z. Analysis on risks and Development Countermeasures of Central Bank digital RMB issue. In Proceedings of the 2021 International Conference on Public Management and Intelligent Society (PMIS), Shanghai, China, 26–28 February 2021. [Google Scholar]

- Chorzempa, M. China, the United States, and central bank digital currencies: How important is it to be first? China Econ. J. 2021, 14, 102–115. [Google Scholar] [CrossRef]

- Goodell, G.; Al-Nakib, H.D. The development of central bank digital currency in China: An analysis. arXiv 2021, arXiv:2108.05946v3. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. Fintech, Cryptocurrencies, and CBDC: Financial Structural Transformation in China. J. Int. Money Financ. 2022, 124, 102625. [Google Scholar] [CrossRef]

- Lu, X.; Tansuchat, R. The conflicting developments of RMB internationalization: Contagion effect and dynamic conditional correlation. Eng. Proc. 2021, 5, 54. [Google Scholar]

- Liang, Y. RMB internationalization and financing belt-road initiative: An MMT perspective. Chin. Econ. 2020, 53, 317–328. [Google Scholar] [CrossRef]

- Liu, L.-G.; Pauwels, L.L. Do external political pressures affect the renminbi exchange rate? J. Int. Money Financ. 2012, 31, 1800–1818. [Google Scholar] [CrossRef]

- Li, S.; Huang, Y. The genesis, design and implications of China’s central bank digital currency. China Econ. J. 2021, 14, 67–77. [Google Scholar] [CrossRef]

- Wang, C.; Wang, X. The macroeconomic effects of RMB internationalization: The perspective of overseas circulation. In Banking and Finance Issues in Emerging Markets; Emerald Publishing Limited: Bradford, UK, 2018; pp. 31–50. [Google Scholar]

- Chen, H.; Siklos, P. Central bank digital currency: A review and some macro-financial implications. J. Financ. Stab. 2022, 60, 100–985. [Google Scholar] [CrossRef]

- Ferrari, M.; Arnaud, M.; Straccaa, M. Central bank digital currency in an open economy. J. Monet. Econ. 2022, 127, 54–68. [Google Scholar] [CrossRef]

- Niu, M.; Qu, J.; Guang, X. The influence of the development of digital currency on the central bank and the corresponding countermeasures. Fortune Today 2021, 11, 22–24. [Google Scholar]

- Wu, Y. Central bank legal digital currency and RMB internationalization. Mod. Bus. 2021, 533, 121–123. [Google Scholar]

- Feng, S.; Yang, J. International Practice and Enlightenment of Central Bank Digital Currency. Reform 2020, 315, 68–79. [Google Scholar]

- Huo, Y. Opportunities and Path Choices of RMB Internationalization in the Digital Currency Era. China Econ. Trade Her. 2021, 13, 72–74. [Google Scholar]

- Cui, J. Research on risk prevention of the connection between RMB digital currency and overseas digital currency—From the perspective of RMB internationalization. Commun. Financ. Account. 2021, 18, 143–146. [Google Scholar]

- Qi, Y.; Li, H.; Xiao, X. The Reform of the International Monetary System and the Opportunity of RMB Internationalization Under the Trend of Digital Currency. Wuhan Univ. J. Philos. Soc. Sci. 2021, 74, 105–118. [Google Scholar]

- Peng, H.; Tan, X. RMB Internationalization: Degree Measurement and Determinants Analysis. Econ. Res. J. 2017, 52, 125–139. [Google Scholar]

- Si, D.; Li, X.; Jiang, C. Central Bank Intervention, Investor Sentiment and Exchange Rate Fluctuation. Stat. Res. 2018, 35, 58–70. [Google Scholar]

- Si, D.; Jiang, C.; Li, X. The Dynamic Determinations of Exchange Rate Expectation and Central Bank Intervention: Theory and Empirical Evidence. Stat. Res. 2016, 33, 13–21. [Google Scholar]

- Toda, H.Y.; Phillips, P. Vector autoregressions and causality. Econometrica 1993, 61, 1367–1393. [Google Scholar] [CrossRef]

- Toda, H.Y.; Phillips, P. Vector autoregression and causality: A theoretical overview and simulation study. Econom. Rev. 1994, 13, 259–285. [Google Scholar] [CrossRef]

- Pesaran, M.; Hashem, Y.S.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Cogley, T.; Sargent, T.J. Evolving Post World War II U.S. Inflation Dynamics. NBER Macroecon. Annu. 2001, 16, 331–373. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).