The Current Status and Challenges of China Railway Express (CRE) as a Key Sustainability Policy Component of the Belt and Road Initiative

Abstract

1. Introduction

2. Literature Review

3. CRE-Related Policies and Operation Status

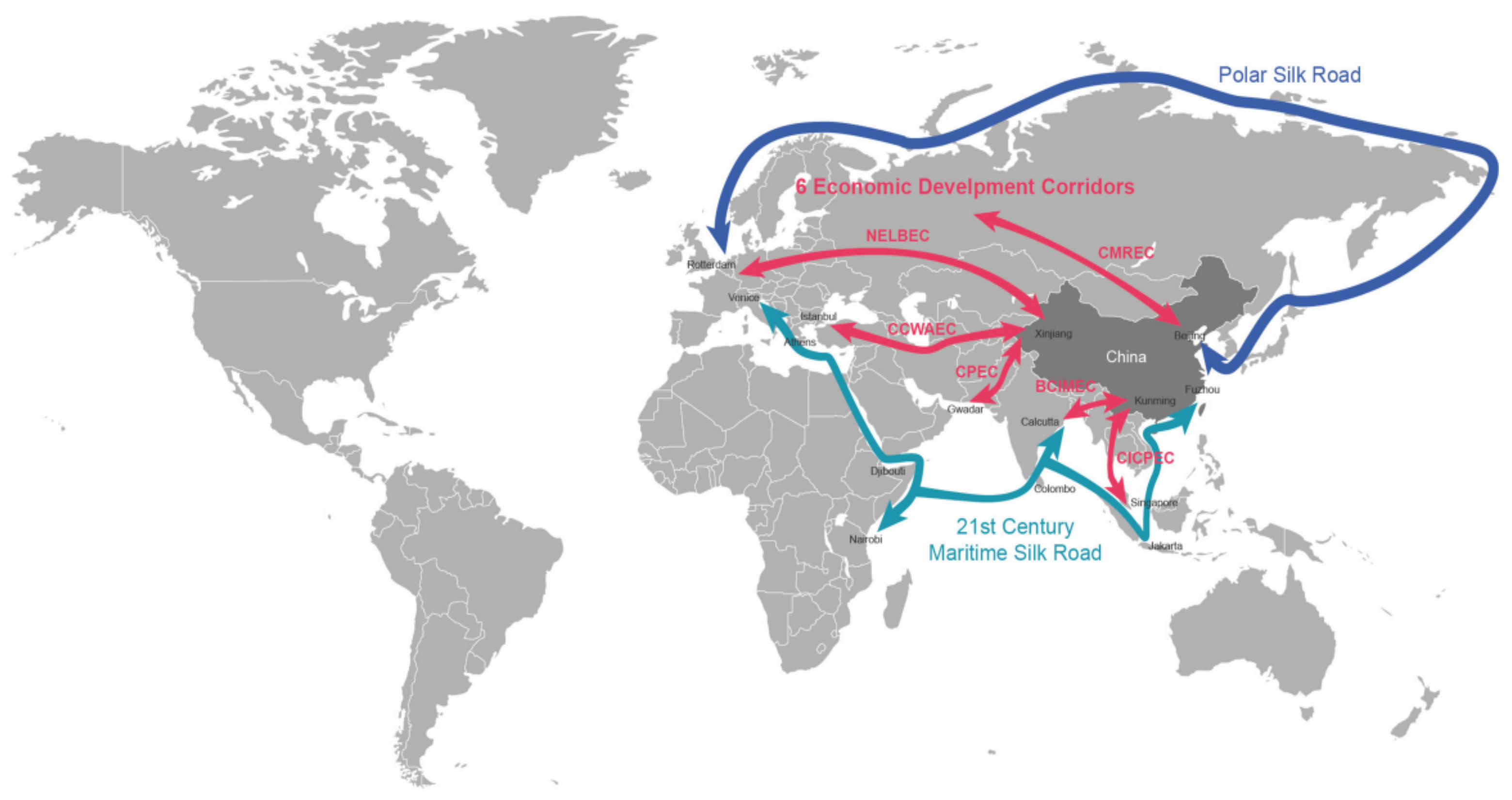

3.1. The Relationship between the BRI and China Railway

3.2. CRE Policies under the BRI

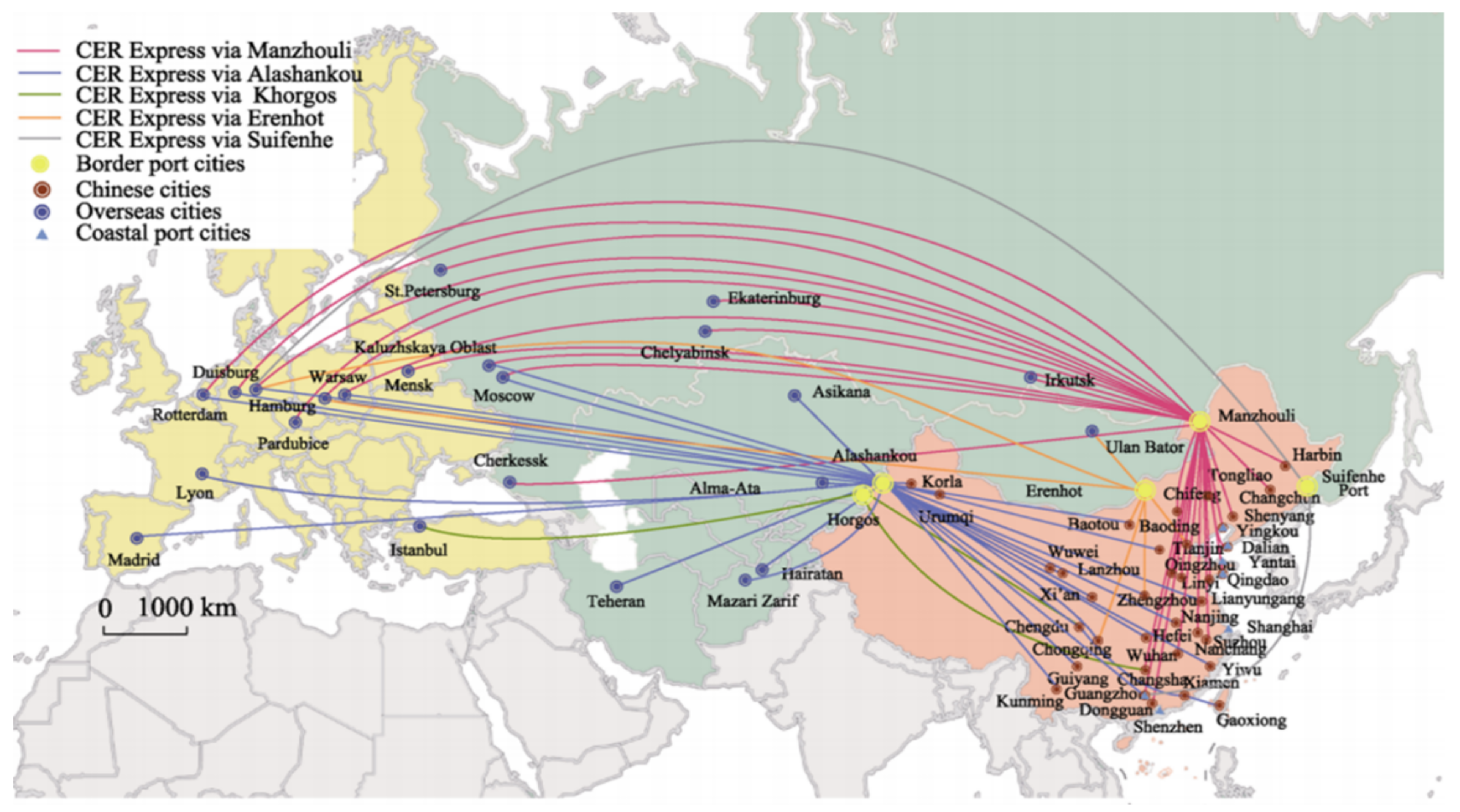

3.3. Operation Status of CRE Borders

3.4. The CRE Operation Status by Routes

4. Challenges for Sustainable CRE Development

4.1. Resolving Cargo Concentration and Bottlenecks at CRE Borders

4.2. Alleviating Competition and Subsidies between Local Governments

4.3. Expanding CRE Demand and Balancing Round-Trip CRE Cargoes

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, H.; Dong, H.; Wang, J. Research on Problems and Countermeasures of Promoting the High-quality Operation of China-Europe Railway. North Econ. Trade 2019, 8, 18–20. (In Chinese) [Google Scholar]

- China Railway. Available online: http://www.china-railway.com.cn/ (accessed on 17 August 2020). (In Chinese).

- Chen, L.; Zhai, H.; Zhang, Y.; Wang, J. The impact of China-Europe Express on China-Europe Trade-Based on the Trade Gravity Model and the Double Difference Model. J. Commer. Econ. 2020, 19, 139–142. (In Chinese) [Google Scholar]

- Lee, P.T.W.; Hu, Z.H.; Lee, S.J.; Choi, K.S.; Shin, S.H. Research trends and agenda on the Belt and Road (B&R) initiative with a focus on maritime transport. Marit. Policy Manag. 2018, 45, 282–300. [Google Scholar]

- Economic Daily. Available online: http://www.mofcom.gov.cn/article/i/jyjl/j/202012/20201203020660.shtml (accessed on 7 December 2020). (In Chinese)

- Wang, Y. Discussion on Construction and Development Planning of CHINA RAILWAY Express. Railw. Transp. Econ. 2017, 39, 41–45. (In Chinese) [Google Scholar]

- Monthly Maritime Korea. Available online: http://www.monthlymaritimekorea.com/news/articleView.html?idxno=24685 (accessed on 29 August 2020). (In Korean).

- The Korea Times. Available online: https://www.hankookilbo.com/News/Read/202004261635729859 (accessed on 27 April 2020). (In Korean).

- Zhao, Y.; Guo, M. Research on the Impact of China-Europe Railway Express on the Trade Potential of Asia and Europe. J. Humanit. 2017, 3, 29–36. (In Chinese) [Google Scholar]

- Yu, M.; Liu, Y. The Attraction and Prospect of China—EU Train and China—EU Trade: Based on Trade Gravity Model. Inq. Econ. Issues 2019, 10, 125–133. (In Chinese) [Google Scholar]

- Xu, Y. Development Status, Challenges and Suggestions of CR Express in the Context of High—Quality Development. Intertrade 2020, 5, 28–34. (In Chinese) [Google Scholar]

- Chen, Y. A Study on the Development of China Railway Express in Jiangsu Province. Railw. Freight Transp. 2020, 38, 44–48. (In Chinese) [Google Scholar]

- Fu, X.; Zhang, Y.; Wan, H. Study on Economy Optimization of China-Europe Block Train Corridor in Central West of China. Railw. Transp. Econ. 2017, 39, 26–30. (In Chinese) [Google Scholar]

- Li, J.; Min, Y.; Wang, X. Research on the Impact of the Opening of China-Europe Railway Express on Urban Innovation: Concurrently Discuss the Innovation Effect of China-Europe Railway Express under Policy Dilemma. World Econ. Stud. 2020, 136, 57–74. (In Chinese) [Google Scholar]

- Geng, J. Discussion on the Countermeasures for the Development of China-Europe Railway Express under the Belt and Road Initiative. Railw. Transp. Econ. 2020, 42, 69–73. (In Chinese) [Google Scholar]

- Ma, B. The development status, problems and countermeasures of China Railway Express. China Int. Stud. 2018, 6, 72–86. (In Chinese) [Google Scholar]

- Choi, K.S. A Study on China’s BRI Performance and the Connection Strategies of Eurasian Logistics Network. Korean-Chin. Soc. Sci. Stud. 2020, 18, 61–95. (In Korean) [Google Scholar] [CrossRef]

- Lee, P.T. Connecting Korea to Europe in the context of the Celt and Road Initiative. Int. J. Marit. Aff. Fish. 2018, 10, 43–54. [Google Scholar]

- Jiang, Y.; Sheu, J.B.; Peng, Z.; Yu, B. Hinterland patterns of China Railway (CR) express in China under the Belt and Road Initiative: A preliminary analysis. Transp. Res. Part E Logist. Transp. Rev. 2018, 119, 189–201. [Google Scholar] [CrossRef]

- Rodemann, H.; Templar, S. The enablers and inhibitors of intermodal rail freight between Asia and Europe. J. Rail Transp. Plan. Manag. 2014, 4, 70–86. [Google Scholar] [CrossRef]

- Besharati, B.; Gansakh, G.; Liu, F.; Zhang, X.; Xu, M. The ways to maintain sustainable China-Europe block train operation. Bus. Manag. Stud. 2017, 3, 25–33. [Google Scholar] [CrossRef]

- Li, S.; Lang, M.; Yu, X.; Zhang, M.; Jiang, M.; Tsai, S.; Bian, F. A sustainable transport competitiveness analysis of the China Railway Express in the context of the Belt and Road Initiative. Sustainability 2019, 11, 2896. [Google Scholar] [CrossRef]

- Zhao, L.; Zhao, Y.; Hu, Q.; Li, H.; Stoeter, J. Evaluation of consolidation center cargo capacity and locations for China railway express. Transp. Res. Part E Logist. Transp. Rev. 2018, 117, 58–81. [Google Scholar] [CrossRef]

- Wang, C.; Lim, M.K.; Zhang, X.; Zhao, L.; Lee, P.T.W. Railway and road infrastructure in the Belt and Road Initiative countries: Estimating the impact of transport infrastructure on economic growth. Transp. Res. Part A Policy Pract. 2020, 134, 288–307. [Google Scholar] [CrossRef]

- Yang, Z.; Sun, Y.; Lee, P.T.W. Impact of the development of the China-Europe Railway Express—A case on the Chongqing international logistics center. Transp. Res. Part A Policy Pract. 2020, 136, 244–261. [Google Scholar] [CrossRef]

- Yin, C.; Ke, Y.; Yan, Y.; Lu, Y.; Xu, X. Operation plan of China Railway Express at inland railway container center station. Int. J. Transp. Sci. Technol. 2020, 9, 249–262. [Google Scholar] [CrossRef]

- Cao, M.; Alon, I. Intellectual structure of the belt and road initiative research: A scientometric analysis and suggestions for a future research agenda. Sustainability 2020, 12, 6901. [Google Scholar] [CrossRef]

- Wang, X.; Wong, Y.D.; Li, K.X.; Yuen, K.F. Transport research under Belt and Road Initiative: Current trends and future research agenda. Transp. A Transp. Sci. 2020. [Google Scholar] [CrossRef]

- Hyun, K.; Kim, H. Analysis of the research trends of the Belt and Road Initiative in Korea: Based on co-ward network analysis. Int. Area Stud. Rev. 2019, 23, 25–43. (In Korean) [Google Scholar] [CrossRef]

- Huang, Y. Understanding China’s Belt & Road initiative: Motivation, framework and assessment. China Economic Review. 2016, 40, 314–321. [Google Scholar]

- Yan, S.; Liu, T. Discussion on the Space Framework in the Strategic Conception of the Belt and Road. J. Hum. Settl. West China 2016, 1, 37–40. (In Chinese) [Google Scholar]

- BRI. Belt and Road Initiative. Available online: https://www.beltroad-initiative.com/belt-and-road/ (accessed on 13 March 2021).

- Choi, K.S.; Chen, X.Q. Study on the mediating effects of changing logistics environment in Korea and China on attitude and choice intention of shippers on the train ferry. J. Korean Soc. Railw. 2018, 21, 118–129. (In Korean) [Google Scholar] [CrossRef]

- The People’s Republic of China. Mid and Long-Term Railway Network Planning. Available online: https://www.gov.cn/xinwen/2016-07/20/5093165/files/1ebe946db2aa47248b799a1deed88144.pdf (accessed on 23 August 2020). (In Chinese)

- The People’s Republic of China. Available online: http://www.gov.cn/ (accessed on 27 April 2020). (In Chinese)

- CNR. China CNR Corporation Limited. Available online: https://china.huanqiu.com/article/9CaKrnK29xY (accessed on 22 April 2020). (In Chinese).

- CRCT. China Railway Container Transport Corp., Ltd. Available online: http://www.crct.com/ (accessed on 3 September 2020). (In Chinese).

- Sirponeer. Available online: http://m.sohu.com/a/287359010_100166736 (accessed on 4 May 2020). (In Chinese).

- Wang, J.; Jiao, J.; Ma, L. An organizational model and border port hinterlands for the China-Europe Railway Express. J. Geogr. Sci. 2018, 28, 1275–1287. [Google Scholar] [CrossRef]

- Sun, H.; Jin, L. How does the development of China-Europe Railway Express affect my country’s coastal ports? New Silk Road Horiz. 2018, 7, 47–50. (In Chinese) [Google Scholar]

- Ministry of Commerce of the People’s Republic of China. Available online: http://www.mofcom.gov.cn/ (accessed on 30 March 2020). (In Chinese)

- Belt and Road Portal. Available online: https://www.yidaiyilu.gov.cn/ (accessed on 15 December 2020).

- Xi’an City. Available online: http://www.xatvs.com/ (accessed on 14 June 2020). (In Chinese).

- Zhao, H.; Yang, M. Research on the Mechanism of China-Europe Express Train to Promote the Development of Central and Western Regions. Mark. Mod. 2019, 9, 67–69. (In Chinese) [Google Scholar]

- Feng, F.; Fan, L. Risk Assessment for Clearance in Port Station of CR Express: Based on FTA-BN Model. Technol. Econ. 2020, 39, 54–62, 69. (In Chinese) [Google Scholar]

- China Business Journal. Available online: http://www.wuliujia2018.com/html/37743.html (accessed on 30 November 2020). (In Chinese).

- Xing, L.; Yin, Y.; Yan, H.; Xu, Q. Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies. Sustainability 2021, 13, 3182. [Google Scholar] [CrossRef]

- Ma, B. Four paths to promote the high-quality development of China Railway Express. New Silk Road Horiz. 2020, 4, 53–55. (In Chinese) [Google Scholar]

| Phase | Year | Date | Contents |

|---|---|---|---|

| Beginning (active exploration) | 2011 | 19 March | The CRE commences operation from Chongqing in China to Duisburg in Germany (16 days). |

| 2012 | 1 August | The “Yuxinou (Chongqing–Europe route)” seminar focuses on facilitating customs clearance, with the participation of eight countries. China, Russia and Germany reach consensus on further simplifying the customs clearance process and implementing the principle of mutual supervision. | |

| 24 October | The Wuhan–Czech corridor pilot operation. | ||

| Building and expansion | 2013 | 18 March | The first return test train of “Yuxinou” from Duisburg to Chongqing. |

| 2014 | 29 March | Chinese President Xi Jinping visits the port of Duisburg to observe the arrival of the Chongqing-Duisburg CREs. | |

| 14 August | The first CRE coordination meeting held in Chongqing, discussing how to unify brand logo, transport organization, wholesale pricing, service standard, management team, and coordination platform. Promulgated the “Interim Measures for CRE Organization Management”, and signed the “Establishing CRE Domestic Transportation Coordination Meeting Memo”. | ||

| 18 November | The first “Yixinou (Yiwu–Europe route)” departs from Yiwu to Madrid, Spain. | ||

| 2015 | 28 March | The Chinese government issues “Vision and Actions for Promoting the Joint Construction of the Silk Road Economic Belt and the 21st Century Maritime Silk Road” which calls for the establishment of a CRE railway transport corridors, port customs clearance coordination mechanism, and transportation channels that connect domestic and foreign countries. | |

| Active development | 2016 | 14 April | New route departs from Dongguan, passing through Manzhouli, Russia, Belarus, and Poland, and arriving in Duisburg, Germany (13,000 km, the longest CRE in China). |

| 15 April | CRE operating companies in Xinjiang, Chongqing, Zhengzhou and other cities established the China–Europe international freight transportation CRE alliance in Urumuchi. The “Xinjiang Declaration” unifies CRE operating mechanism and optimizes the transportation organization and spatial layout of the CRE. | ||

| 8 June | Unified CRE brand officially launched. President Xi Jinping and Polish President Duda attend the ceremony for the CRE’s first arrival in Poland. | ||

| 8 October | Release of “CRE Construction and Development Plan (2016–2020)” under the BRI. | ||

| 2017 | 20 April | Seven countries, including China, Belarus, Germany, Kazakhstan, Mongolia, Poland and Russia, sign the “Regarding deepening the CRE Cooperation Agreement”. | |

| 1 May | Transport document form unified with Germany, France, and other countries | ||

| 26 May | The CRE transport coordination committee established with seven CRE platform companies in Chongqing, Chengdu, Zhengzhou, Wuhan, and other regions. The international multimodal transport information platform and the CRE refrigerated container information-sharing platform are established. | ||

| 18 November | The total number of CRE operation exceeds 6000. | ||

| 20 December | CRE trial from Chengdu to Tilburg in the southern Netherlands via Urumuchi. | ||

| 2018 | 15–16 October | The NDRC holds the CRE meeting in Chongqing to make improvements in the CRE mechanism and enact new rules and laws. | |

| Stable improvement | 2019 | 22 April | “The Belt and Road Initiative: Progress, Contribution and Prospects” is announced, emphasizing the role of the CRE in promoting multi-country cooperation as an international train operation mechanism. By the end of 2018, CRE connects 108 cities in 16 countries on the Eurasian continent. The number of the CRE operation exceeds 13,000, transporting more than 1.1 million TEUs. Customs clearance time reduced by 50% as a result of customs clearance agreements with the BRI countries. |

| 2020 | 8 March | The NDRC announces round trip rate of over 90%. | |

| 3 April | The MOFCOM issues the “Notice on Further Utilizing the Role of the CRE to respond to the COVID-19 and Stabilizing Foreign Investment Promotion Fees”, proposing 11 specific measures and work requirements. | ||

| 14 April | CRE (Wuhan) X8015 arrives at the Duisburg in Germany under above measures. | ||

| 5 June | CHINA RAILWAY announces that in May this year, the number of the CRE operation have exceeded 1033, increasing 43% over the previous year. The transported cargoes reaches 93,000 TEUs, increasing 48% over the previous year. | ||

| 8 November | The X8020, jointly organized by CRE platform companies in Yiwu, Chongqing, Zhengzhou, Xi’an, and other cities, begins first cross-border e-commerce CRE from Yiwu to Brussels. |

| Routes | Corridors | Main Railway Border | Main Supply Regions |

|---|---|---|---|

| Eastern | Beijing–Harbin–Manzhouli–Russia–Belarus–Poland–other European countries | Manzhouli | East China, South China and North China |

| Central | Erenhot–Mongolia–Russia–Belarus–Poland–other European countries | Erenhot | Central China and North China |

| Western | Alashankou (Khorgos)–Kazakhstan–Russia–Belarus–Poland–other European countries | Alashankou Khorgos | Southwest, Northwest |

| Railway Border | 2018 (1–11) | Cumulative Total |

|---|---|---|

| Erenhot | 1000 | 1750 |

| Manzhouli | 1074 | 3000 |

| Alashankou | 2388 | 7123 |

| Year | Classification | Export and Import | Total | Year | Classification | Export and Import | Total |

|---|---|---|---|---|---|---|---|

| 2011 | # of operations | 17 outbound | 17 | 2016 | # of operations | 1130 out | 1702 |

| 0 inbound | 572 in | ||||||

| # of Containers | 0.14 out | 0.14 | # of Containers | 9.7 out | 14 | ||

| 0 in | 4.3 in | ||||||

| 2012 | # of operations | 42 out | 42 | 2017 | # of operations | 2399 out | 3673 |

| 0 in | 1274 in | ||||||

| # of Containers | 0.37 out | 0.37 | # of Containers | 21.2 out | 31.8 | ||

| 0 in | 10.6 in | ||||||

| 2013 | # of operations | 80 out | 80 | 2018 | # of operations | 3696 out | 6363 |

| 0 in | 2667 in | ||||||

| # of Containers | 0.70 out | 0.70 | # of Containers | 31.9 out | 54.2 | ||

| 0 in | 22.3 in | ||||||

| 2014 | # of operations | 280 out | 308 | 2019 | # of operations | 4525 out | 8225 |

| 28 in | 3700 in | ||||||

| # of Containers | 2.39 out | 2.62 | # of Containers | 40.2 out | 72.5 | ||

| 0.23 in | 32.3 in | ||||||

| 2015 | # of operations | 550 out | 815 | ||||

| 265 in | |||||||

| # of Containers | 4.7 out | 6.9 | |||||

| 2.2 in | |||||||

| CRE Name | Main Cargoes | Round Trip (Between China and Europe) | Corridors | Distance and Time | Departure Time | Cargo Collection |

|---|---|---|---|---|---|---|

| Xiangou (Changsha–Europe) | IT products, textiles, ceramics, tea, construction machinery, medical instruments | Outbound | Changsha–Erenhot–Warsaw–Hamburg | 11,808 km/13–15 days | Every Saturday | Cargo collection on average 3 days before round trip |

| Inbound | Hamburg–Warsaw–Alashankou–Hangsha | Every Saturday | ||||

| Zhengou (Zhengzhou–Europe) | IT products, clothing, auto accessories, construction machinery, medical instruments | Outbound | Zhengzhou–Alashankou– Kazakhstan–Russia–Belarus–Poland (Marasevic Station)–Hamburg | 10,461 km/13 days | Every Monday–Saturday | Cargo collection on average 3 days before round trip |

| Inbound | ① Hamburg–Marasevic–Alashankou–Zhengzhou | Every Monday, Tuesday, Thursday | ||||

| ② Hamburg–Marasevic–Erenhot–Zhengzhou | Every Wednesday, Friday, Saturday | |||||

| Yixinou (Yiwu–Europe) | Bags, stationery, art and crafts, daily necessities | Outbound | Yiwu–Alashankou–Marasevic–Duisburg–Madrid | 13,052 km/21 days | Every Wednesday | Cargo collection on average 2 days before round trip Transshipment at the French and Spanish border |

| Inbound | Madrid–Duisburg–Marasevic–Alashankou–Yiwu | Every Friday | ||||

| Hanou (Wuhan–Europe) | IT products, machinery, chemical products | Outbound | ① Wuhan–Arasankou–Marasevic–Duisburg | 10,880 km/15 days | Every Wednesday | Cargo collection on average 6 days before round trip |

| ② Wuhan–Alashankou–Marasevic–Hamburg | Every Friday | Cargo collection on average 4 days before round trip | ||||

| Outbound | Duisburg–Marasevic–Alashankou–Wuhan | Odd Week: Friday Even-numbered weeks: Friday, Saturday | Cargo collection on average 5 days before round trip | |||

| Rongou (Chengdu–Europe) | IT products, food, daily necessities, auto parts | Outbound | ① Chengdu–Alashankou–Lodz | 9826 km/14 days | Every Thursday and Saturday | Cargo collection on average 3 days before round trip |

| ② Chengdu–Alashankou–Lodz–Nürnberg | Every Wednesday | |||||

| ③ Chengdu–Alashankou–Lodz–Tillberg (Netherlands) | Every Wednesday | |||||

| Inbound | ① Tilberg–Lodz–Alashankou–Chengdu | Every Tuesday | ||||

| ② Nuremberg–Lodz–Alashankou–Chengdu | ||||||

| Every Friday | ||||||

| Yuxinou (Chongqing–Europe) | IT products, auto parts | Outbound | Chongqing–Alashankou–Marasevic–Duisburg | 11,000 km/14–15 days | Every Monday, Thursday, Saturday | Cargo collection on average 3 days before round trip |

| Inbound | ① Duisburg–Marasevic–Alashankou–Chongqing | Every Monday, Thursday, Saturday | ||||

| ② Duisburg–Marasevic–Erenhot–Chongqing | Every Friday |

| Major City (Node) | 2011–2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| Chongqing | 96 | 102 | 257 | 420 | 700 | 1442 |

| Chengdu | 32 | 45 | 103 | 453 | 777 | 1587 |

| Zhengzhou | 13 | 77 | 156 | 251 | 493 | 752 |

| Wuhan | 1 | 26 | 164 | 122 | 375 | 417 |

| Hefei | 0 | 13 | 28 | 54 | 70 | 182 |

| Wrumuqi | 0 | 0 | 0 | 135 | 710 | 1000 |

| Division | Yuxinou | Rongou | Zhengou | Hanou | Sumanou |

|---|---|---|---|---|---|

| Destination | Duisburg | Lodz | Hamburg | Pardubice | Warsaw |

| Total distance (Km) | 11,179 | 9826 | 10,214 | 10,100 | 11,200 |

| Chinese broad-gauge distance (Km) | 4137 | 3511 | 3422 | 2918 | 3256 |

| European broad-gauge distance (Km) | 5692 | 5692 | 5692 | 5692 | 7739 |

| European standard-gauge distance (Km) | 1350 | 623 | 1100 | 1490 | 205 |

| Period (days) | 12–14 | 12–14 | 11–12 | 14 | 14 |

| Frequency (trains/week) | 2–3 | 1 | 2–3 | 1–2 | 1 |

| Chinese freight cost, USD/FEU·km (standard gauge) | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 |

| Foreign freight cost, USD/FEU·km (broad-gauge) | 0.694 | 0.694 | 0.694 | 0.694 | 0.413 |

| Foreign freight cost, USD/FEU·km (standard gauge) | 0.704 | 2.73 | 0.864 | 1.713 | 3.415 |

| (un) Loading cost, (USD/FEU) | 1000 | 1000 | 1000 | 1000 | 1000 |

| Freight forwarding cost (USD/FEU) | 1800 | 1800 | 1500 | 1800 | 1500 |

| Subsidies a (USD/FEU) | 6400 | 7000 | 7400 | 5600 | 1000 |

| Freight costs (USD/FEU) | 10,182.85 | 10,557.64 | 9453.85 | 11,053.42 | 8349.88 |

| Freight costs (considering subsidies) (USD/FEU) | 3782.85 | 3557.64 | 2053.85 | 5453.42 | 7349.88 |

| Freight costs (balanced cargo flow), (USD/FEU) | 7721.9 | 7971.76 | 7135.9 | 8302.28 | 6399.92 |

| Freight costs (balanced cargo flow considering subsidies), (USD/FEU) | 1321.9 | 971.76 | 2135.9 | 2702.28 | 5399.92 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, K.-S. The Current Status and Challenges of China Railway Express (CRE) as a Key Sustainability Policy Component of the Belt and Road Initiative. Sustainability 2021, 13, 5017. https://doi.org/10.3390/su13095017

Choi K-S. The Current Status and Challenges of China Railway Express (CRE) as a Key Sustainability Policy Component of the Belt and Road Initiative. Sustainability. 2021; 13(9):5017. https://doi.org/10.3390/su13095017

Chicago/Turabian StyleChoi, Kyoung-Suk. 2021. "The Current Status and Challenges of China Railway Express (CRE) as a Key Sustainability Policy Component of the Belt and Road Initiative" Sustainability 13, no. 9: 5017. https://doi.org/10.3390/su13095017

APA StyleChoi, K.-S. (2021). The Current Status and Challenges of China Railway Express (CRE) as a Key Sustainability Policy Component of the Belt and Road Initiative. Sustainability, 13(9), 5017. https://doi.org/10.3390/su13095017