Corporate Governance vs. Financial Performance for Intensity of Innovation Investments

Abstract

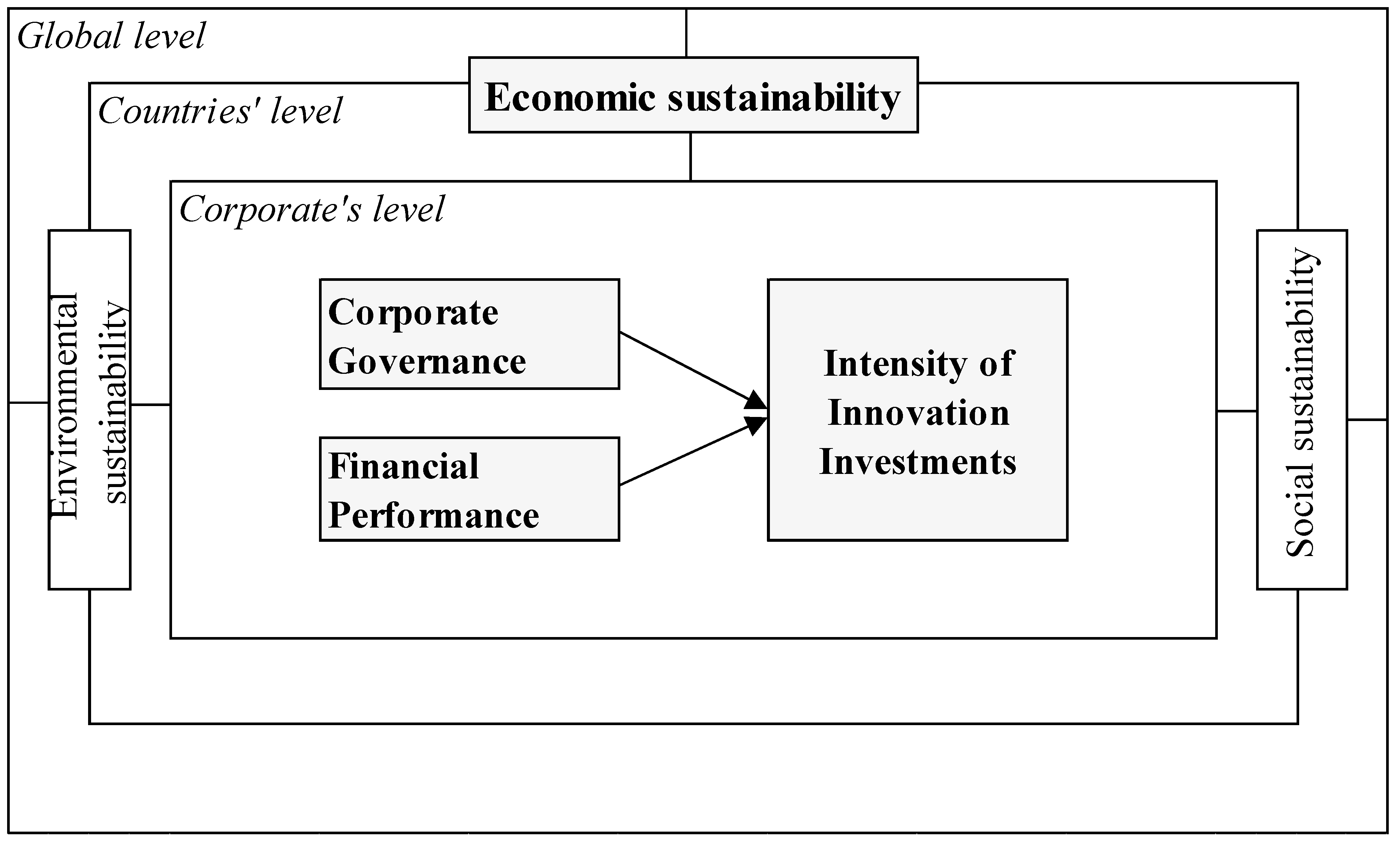

1. Introduction

2. Literature Background

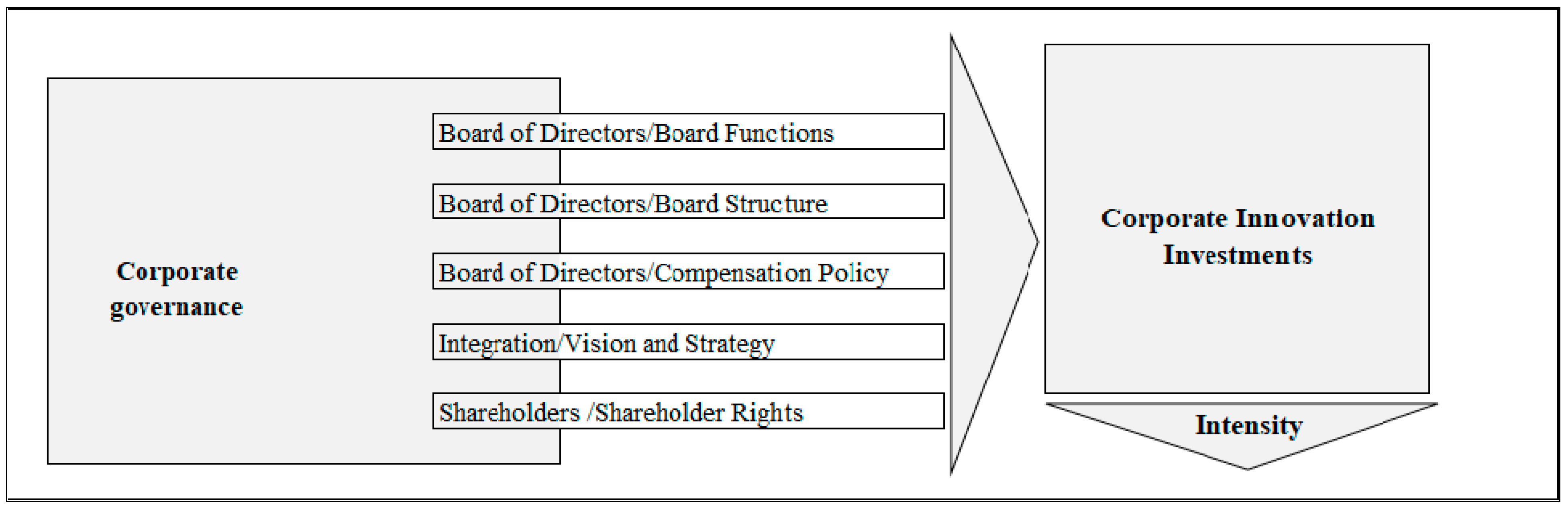

| Measurement Methodology of Corporate Governance | |

|---|---|

| Variables of Boards: | Evaluation’s Description |

| Functions | The clarity, validity, and consistency of the company’s management functions must be precisely defined and recorded to avoid unnecessary ambiguities. |

| Structure | The company’s management structure must be efficient, logical, and able to generate new ideas and implement those ideas by consensus on the company’s growth. |

| Compensation Policy | The company’s management compensation policy must be consistent and not contradict the management’s ambitions and the company’s growth aspirations. |

| Strategy and Vision | The company’s management strategy and vision must be based on innovations that create high added value, which would not contradict the general goal of the country—environmental protection and social responsibility. |

| Rights of Shareholders | Company shareholders should be given equal lefts based on the desire to increase their invested assets. |

3. The Research Hypotheses Based on the Literature

4. Research Methodology

5. Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- United Nations. About the Sustainable Development Goals; United Nations: New York, NY, USA, 2020. [Google Scholar]

- Khan, I.; Hou, F.; Zakari, A.; Tawiah, K.V. The dynamic links among energy transitions, energy consumption, and sustainable economic growth: A novel framework for IEA countries. Energy 2021, 222, 119935. [Google Scholar] [CrossRef]

- World Bank. Inclusive Green Growth Policies Tailored to Real-World Challenges; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Sulkowski, A.J.; Edwards, M.; Freeman, R.E. Shake Your Stakeholder: Firm Initiated Interactions to Create Shared Sustainable Value. Organ. Environ. 2018, 31, 3. [Google Scholar] [CrossRef]

- Drews, S.; Antal, M.; van den Bergh, J.C.J.M. Challenges in Assessing Public Opinion on Economic Growth Versus Environment: Considering European and U.S. Data. Ecol. Econ. 2018, 146, 265–272. [Google Scholar] [CrossRef]

- Kubiszewski, I.; Costanza, R.; Franco, C.; Lawn, P.; Talberth, J.; Jackson, T.; Aylmer, C. Beyond G.D.P.: Measuring and achieving genuine global pro-gress. Ecol. Econ. 2013, 93, 57–68. [Google Scholar] [CrossRef]

- Posner, S.M.; Costanza, R. Baltimore County, and the State of Maryland. A summary of ISEW and GPI studies at multiple scales and new estimates for Balti-more City, Baltimore County, and the State of Maryland. Ecol. Econ. 2011, 70, 1972–1980. [Google Scholar] [CrossRef]

- Schneider, F.; Kallis, G.; Martinez-Alier, J. Crisis or opportunity? Economic degrowth for social equity and ecological sustainability. Introduction to this special issue. J. Clean. Prod. 2010, 18, 511–518. [Google Scholar]

- Nogueira, C. Contradictions in the concept of sustainable development: An analysis in social, economic, and political contexts. Environ. Dev. 2019, 30, 129–135. [Google Scholar] [CrossRef]

- Phama, H.; Kim, S. The effects of sustainable practices and managers’ lead-ership competencies on the sustainability performance of construction corporate. Sustain. Prod. Consum. 2019, 20, 1–14. [Google Scholar] [CrossRef]

- Eva, C. Alfredsson and J. Mikael Malmaeus. Real capital investments and sustainability—The case of Sweden. Ecol. Econ. 2019, 161, 216–224. [Google Scholar]

- Heikkurinen, P.; Young, W.; Morgan, E. Business for sustainable change: Extending eco-efficiency and eco-sufficiency strategies to consumers. J. Clean. Prod. 2019, 218, 656–664. [Google Scholar] [CrossRef]

- Tumelero, C.; Sbragia, R.; Evans, S. Cooperation in R & D and eco-innovations: The role in companies’ socioeconomic performance. J. Clean. Prod. 2019, 207, 1138–1149. [Google Scholar]

- Hoepner, A.; Oikonomou, I.; Scholtens, B.; Schroder, A.M. The Effects of Corporate and Country Sustainability Characteristics on The Cost of Debt: An International Investigation. J. Bus. Financ. Account. 2016, 43, 158–190. [Google Scholar] [CrossRef]

- Tomaselli, M.F.; Sheppard, S.R.J.; Kozak, R.; Gifford, R. What do Canadians think about economic growth, prosperity, and the environment? Ecol. Econ. 2019, 161, 41–49. [Google Scholar] [CrossRef]

- The Organisation for Economic Cooperation and Development (OECD). OECD and the Sustainable Development Goals: Delivering on Universal Goals and Targets; OECD: Paris, France, 2020. [Google Scholar]

- Hu, S.; Liu, S.; Li, D.; Lin, Y. How Does Regional Innovation Ca-pacity Affect the Green Growth Performance? Empirical Evidence from China. Sustainability 2019, 11, 5084. [Google Scholar] [CrossRef]

- Bebchuk, L.; Cohen, A.; Ferrell, A. What Matters in Corporate Governance? Rev. Financ. Stud. 2009, 22, 783–827. [Google Scholar] [CrossRef]

- Chen, X.; Liu, Z.; Zhu, Q. Performance evaluation of China’s high-tech innovation process: Analysis based on the innovation value chain. Technovation 2018, 74–75, 42–53. [Google Scholar] [CrossRef]

- Sheikh, S. The impact of market competition on the relation between C.E.O. power and corporate innovation. J. Multinatl. Financ. Manag. 2018, 44, 36–50. [Google Scholar] [CrossRef]

- Balsmeier, B.; Fleming, L.; Manso, G. Independent boards and innova-tion. J. Financ. Econ. 2017, 123, 536–557. [Google Scholar] [CrossRef]

- Ye, Q.; Wang, D.; Guo, W. Inclusive leadership and team innova-tion: The role of team voice and performance pressure. Eur. Manag. J. 2019, 37, 468–480. [Google Scholar] [CrossRef]

- Choi, S.B.; Park, B.I.; Hong, P. Does Ownership Structure Matter for Corporate Technological Innovation Performance? The Case of Korean Corporate. Corp. Gov. Int. Rev. 2012, 20, 267–288. [Google Scholar] [CrossRef]

- Sariol, A.M.; Abebe, M.A. The influence of C.E.O. power on explorative and exploitative organizational innovation. J. Bus. Res. 2017, 73, 38–45. [Google Scholar] [CrossRef]

- Sunder, J.; Sunder, S.V.; Zhang, J. Pilot C.E.O.s and corporate in-novation. J. Financ. Econ. 2017, 123, 209–224. [Google Scholar] [CrossRef]

- Bernile, G.; Bhagwat, V.; Yonker, S. Board diversity, corporate risk, and corporate policies. J. Financ. Econ. 2018, 127, 588–612. [Google Scholar] [CrossRef]

- Custodio, C.; Metzger, D. Financial expert C.E.O.s: CEO׳s work experience and corporate׳s financial policies. J. Financ. Econ. 2014, 114, 125–154. [Google Scholar] [CrossRef]

- Makri, M.; Scandura, T.A. Exploring the effects of creative C.E.O. leadership on innovation in high-technology corporate. Leadersh. Q. 2010, 21, 75–88. [Google Scholar]

- O’Connor, M.; Rafferty, M. Corporate Governance and Innovation. J. Financ. Quant. Anal. 2012, 47, 397–413. [Google Scholar] [CrossRef]

- Becker-Blease, J. Governance and innovation. J. Corp. Financ. 2011, 17, 947–958. [Google Scholar] [CrossRef]

- Ullah, B. Corporate innovation in transition economies: The role of formal versus informal finance. J. Multinatl. Financ. Manag. 2019, 50, 58–75. [Google Scholar] [CrossRef]

- Lehn, K. Corporate governance and corporate agility. J. Corp. Financ. 2021, 66, 101929. [Google Scholar] [CrossRef]

- Shen, H.; Zheng, S.; Xiong, H.; Tang, W.; Dou, J.; Silverman, H. Stock market mispricing and firm innovation based on path analysis. Econ. Model. 2021, 95, 330–343. Available online: https://www.sciencedirect.com/science/article/abs/pii/S026499931932019X (accessed on 5 March 2020). [CrossRef]

- Aghion, P.; van Reenen, J.; Zingales, L. Innovation and Institutional Ownership. Am. Econ. Rev. 2013, 103, 277–304. [Google Scholar] [CrossRef]

- Cho, S.Y.; Kimb, S.K. Horizon problem and corporate innovation: The influence of C.E.O. career horizon, exploitation, and exploration on breakthrough in-novations. Res. Policy 2017, 46, 1801–1809. [Google Scholar] [CrossRef]

| Significant Variables | Reason of Significant Impact on Corporate Innovation Investment Intensity and Risk |

|---|---|

| Corporate governance | Board members (among whom various company directors) can make important effect on the whole value chain of innovation investments |

| Corporate size | Significant impact on the volume of innovation investments |

| Debt ratio | Important influence on external sources of financing for investments |

| Return on assets | Significant effect on corporate development and market prestige |

| Cash ratio | Significant impact on internal sources of financing for investments |

| Tobin’s q ratio | Important influence on corporate value. Corporate could increase the intensity of innovation investments, if asset’s market value is bigger than asset’s book value. |

| Region | Countries |

|---|---|

| Western Europe (17 countries) 34% | Austria (AUT), Belgium (B.E.L.), Switzerland (C.H.E.), Germany (D.E.U.), Denmark (D.N.K.), Spain (E.S.P.), Finland (FIN), France (F.R.A.), United Kingdom (G.B.R.), Greece (G.R.C.), Ireland (IRL), Italy (I.T.A.), Luxembourg (LUX), Netherlands (NLD), Norway (NOR), Portugal (P.R.T.) and Sweden (S.W.E.) |

| Eastern Europe (4 countries) 8% | Czech Republic (C.Z.E.), Hungary (H.U.N.), Poland (P.O.L.), and Russia (RUS) |

| North America (2 countries) 4% | United States of America (U.S.A.) and Canada (CAN) |

| Latin America (5 countries) 10% | Brazil (B.R.A.), Chile (C.H.L.), Colombia (C.O.L.), Mexico (MEX), and PER (Peru) |

| Asia (18 countries) 36% | United Arab Emirates (A.R.E.), China (C.H.N.), Hong Kong (H.K.G.), Indonesia (IDN), India (IND), Israel (I.S.R.), Japan (J.P.N.), North Korea (KOR), Kuwait (K.W.T.), Malaysia (M.Y.S.), Philippines (P.H.L.), Qatar (QAT), Saudi Arabia (S.A.U.), Jordan (JOR) Singapore (S.G.P.), Thailand (T.H.A.), Taiwan (T.W.N.) and Turkey (TUR) |

| Africa (2 countries) 4% | Egypt (E.G.Y.) and South Africa (Z.A.F.) |

| Oceania (2 countries) 4% | Australia (AUS) and New Zealand (N.Z.L.) |

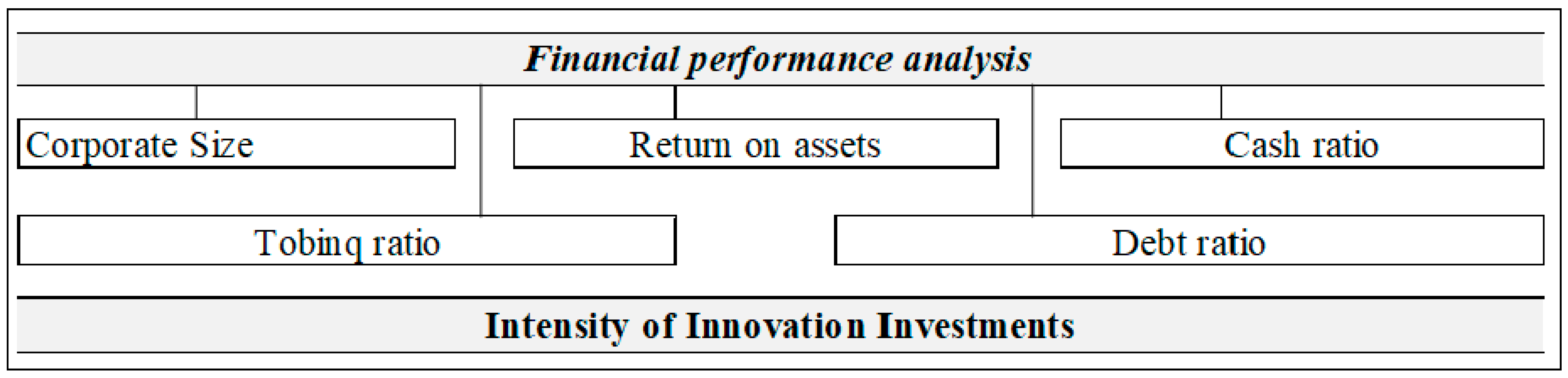

| Ratio | Name | Methodology (Measurement) |

|---|---|---|

| Intensity of innovation investments | INNOVATION_INVESTMENTS_INTENSITY | R&D EXPENDITURE/ASSETS (COEFF.) |

| Corporate governance | CG | AVERAGE OF 5 SUB-DIMENSIONS OF BOARD’S (functions; structure; compensation policy; vision and strategy; shareholder rights) (SCORE FROM 1 TILL 100) Board (COEFF) |

| Return on assets | ROA | NET INCOME/ASSETS (COEFF) |

| Debt ratio | DEBT RATIO | DEBT/ASSETS (COEFF) |

| Corporate size | CORPORATE SIZE | L.N. (ASSETS) (COEFF) |

| Cash ratio | CASH RATIO | CASH/ASSETS (COEFF) |

| Tobinq ratio | TOBINQ RATIO | (ASSETS + MCAPx1000-COMMON EQUITY)/ASSETS (COEFF) |

| Number of Obs = 42,160 | Prob > F = 0.0000 | |||||

|---|---|---|---|---|---|---|

| No. of Categories = 6033 | R-Squared = 0.9128 | |||||

| F(21, 6032) = 5.23 | Adj R-Squared = 0.8981 | |||||

| Root MSE = 0.0136 | ||||||

| INNOVATION_ INVESTMENTS_ INTENSITY | Coef. | Robust | t | P > t | [95% Conf.] | [Interval] |

| Std. Err. | ||||||

| CORPORATE_SIZE | −0.0040083 | 0.0008018 | −50.00 | 00.000 | −0.0055802 | −0.0024364 |

| DEBT_RATIO | −0.0069972 | 0.0024296 | −2.88 | 00.004 | −0.01176 | −0.0022343 |

| ROA | −0.0160227 | 0.0033633 | −4.76 | 00.000 | −0.022616 | −0.0094295 |

| CASH_RATIO | −0.0096931 | 0.0033123 | −2.93 | 00.003 | −0.0161865 | −0.0031997 |

| TOBINQ_ RATIO | 0.0012406 | 0.0004795 | 2.59 | 00.010 | 0.0003006 | 0.0021806 |

| 2003 | −0.0001045 | 0.0004124 | −0.25 | 0.800 | −0.000913 | 0.000704 |

| 2004 | −0.0011022 | 0.0007342 | −1.50 | 0.133 | −0.0025415 | 0.0003371 |

| 2005 | −0.0012909 | 0.0008681 | −1.49 | 0.137 | −0.0029927 | 0.000411 |

| 2006 | −0.0004248 | 0.0009834 | −0.43 | 0.666 | −0.0023526 | 0.0015031 |

| 2007 | 0.0005347 | 0.0010614 | 0.50 | 0.614 | −0.0015461 | 0.0026154 |

| 2008 | 0.0020361 | 0.001091 | 1.87 | 00.062 | −0.0001026 | 0.0041748 |

| 2009 | 0.0010794 | 0.0011594 | 0.93 | 0.352 | −0.0011934 | 0.0033522 |

| 2010 | 0.0003969 | 0.0012315 | 0.32 | 0.747 | −0.0020173 | 0.0028111 |

| 2011 | 0.0010641 | 0.0012792 | 0.83 | 0.406 | −0.0014436 | 0.0035719 |

| 2012 | 0.00153 | 0.0013164 | 1.16 | 0.245 | −0.0010505 | 0.0041105 |

| 2013 | 0.0012522 | 0.0012792 | 0.98 | 0.328 | −0.0012554 | 0.0037599 |

| 2014 | 0.001372 | 0.0012724 | 10.08 | 0.281 | −0.0011224 | 0.0038665 |

| 2015 | 0.0004368 | 0.001256 | 0.35 | 0.728 | −0.0020254 | 0.0028991 |

| 2016 | 0.0014684 | 0.0012788 | 1.15 | 0.251 | −0.0010385 | 0.0039753 |

| 2017 | 0.0013055 | 0.0012969 | 10.01 | 0.314 | −0.0012368 | 0.0038478 |

| 2018 | 0.0012531 | 0.0014233 | 0.88 | 0.379 | −0.001537 | 0.0040432 |

| _cons | 0.0797208 | 0.0115003 | 6.93 | 00.000 | 0.057176 | 0.1022656 |

| Number of obs = 42,160 | Prob > F = 00.0000 | |||||

|---|---|---|---|---|---|---|

| No. of Categories = 6033 | R-Squared = 0.9128 | |||||

| F(22, 6032) = 5.26 | Adj R-Squared = 0.8982 | |||||

| Root MSE = 00.0136 | ||||||

| INNOVATION_ INVESTMENTS_ INTENSITY | Coef. | Robust Std. Err. | t | P > t | [95% Conf.] | [Interval] |

| CORPORATE_SIZE | −0.0040943 | 0.0008023 | −5.10 | 00.000 | −0.005667 | −0.0025215 |

| DEBT_ RATIO | −0.0069896 | 0.0024302 | −2.88 | 00.004 | −0.0117537 | −0.0022254 |

| ROA | −0.0159845 | 0.0033622 | −4.75 | 00.000 | −0.0225756 | −0.0093934 |

| CASH_ RATIO | −0.0096373 | 0.0033123 | −2.91 | 00.004 | −0.0161306 | −0.0031441 |

| TOBINQ_RATIO | 0.0012453 | 0.0004796 | 2.60 | 00.009 | 0.0003051 | 0.0021855 |

| CG | 0.0024392 | 0.0009152 | 2.67 | 00.008 | 0.0006451 | 0.0042333 |

| 2003 | −0.0000851 | 0.0004129 | −0.21 | 0.837 | −0.0008946 | 0.0007244 |

| 2004 | −0.0013007 | 0.0007408 | −1.76 | 00.079 | −0.002753 | 0.0001515 |

| 2005 | −0.0015658 | 0.0008758 | −1.79 | 00.074 | −0.0032826 | 0.000151 |

| 2006 | −0.0006992 | 0.0009892 | −0.71 | 0.480 | −0.0026384 | 0.0012399 |

| 2007 | 0.0002449 | 0.0010625 | 0.23 | 0.818 | −0.0018379 | 0.0023277 |

| 2008 | 0.0017313 | 0.0010939 | 1.58 | 0.114 | −0.0004131 | 0.0038757 |

| 2009 | 0.0007517 | 0.0011629 | 0.65 | 0.518 | −0.001528 | 0.0030315 |

| 2010 | −0.00000882 | 0.0012342 | −00.01 | 0.994 | −0.0024282 | 0.0024106 |

| 2011 | 0.0006506 | 0.0012842 | 0.51 | 0.612 | −0.001867 | 0.0031681 |

| 2012 | 0.0011022 | 0.0013242 | 0.83 | 0.405 | −0.0014937 | 0.003698 |

| 2013 | 0.0008217 | 0.0012909 | 0.64 | 0.524 | −0.0017089 | 0.0033523 |

| 2014 | 0.0009118 | 0.0012842 | 0.71 | 0.478 | −0.0016056 | 0.0034293 |

| 2015 | −0.0000871 | 0.0012748 | −00.07 | 0.946 | −0.0025862 | 0.0024119 |

| 2016 | 0.0008755 | 0.0013011 | 0.67 | 0.501 | −0.0016752 | 0.0034261 |

| 2017 | 0.0006521 | 0.0013251 | 0.49 | 0.623 | −0.0019455 | 0.0032498 |

| 2018 | 0.0009113 | 0.0014239 | 0.64 | 0.522 | −0.00188 | 0.0037026 |

| _cons | 0.0801549 | 0.0114946 | 6.97 | 00.000 | 0.0576214 | 0.1026884 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Benetyte, R.; Gonenc, H.; Krusinskas, R. Corporate Governance vs. Financial Performance for Intensity of Innovation Investments. Sustainability 2021, 13, 5014. https://doi.org/10.3390/su13095014

Benetyte R, Gonenc H, Krusinskas R. Corporate Governance vs. Financial Performance for Intensity of Innovation Investments. Sustainability. 2021; 13(9):5014. https://doi.org/10.3390/su13095014

Chicago/Turabian StyleBenetyte, Raminta, Halit Gonenc, and Rytis Krusinskas. 2021. "Corporate Governance vs. Financial Performance for Intensity of Innovation Investments" Sustainability 13, no. 9: 5014. https://doi.org/10.3390/su13095014

APA StyleBenetyte, R., Gonenc, H., & Krusinskas, R. (2021). Corporate Governance vs. Financial Performance for Intensity of Innovation Investments. Sustainability, 13(9), 5014. https://doi.org/10.3390/su13095014