Construction Sector Contribution to Economic Stability: Malaysian GDP Distribution

Abstract

1. Introduction

- In which direction does the construction industry move to recover from external shocks and the time taken to regain its original position?

- What short- and long-term policies and decisions will affect the behavior of construction to achieve sustainability?

- What sustainable framework should be followed to achieve sustainability in the construction industry that has global application?

2. Literature Review

3. Methodology

3.1. Data Collection

3.2. Data Analysis

3.2.1. Initial Tests for Conducting Analysis

3.2.2. Cointegration Tests

3.2.3. Pairwise Granger Causality

3.2.4. Vector Error Correction Model (VECM)

3.2.5. Cumulative Sum (CUSUM) Tests

3.2.6. Impulse Response Functions (IRFs)

3.2.7. Forecasting

4. Results and Discussion

4.1. Relationship between Sectors and Stationarity Determination

4.2. Optimal Lag Length

4.3. Pairwise Granger Causality Analysis

4.4. Linkage Direction

4.5. Johansen–Jusilus Cointegration Examination

4.6. VECM for Construction Sector

4.7. Short- and Long-Run Causality Coefficients

4.8. Explanatory Power and Efficiency of Equation for CONST Model

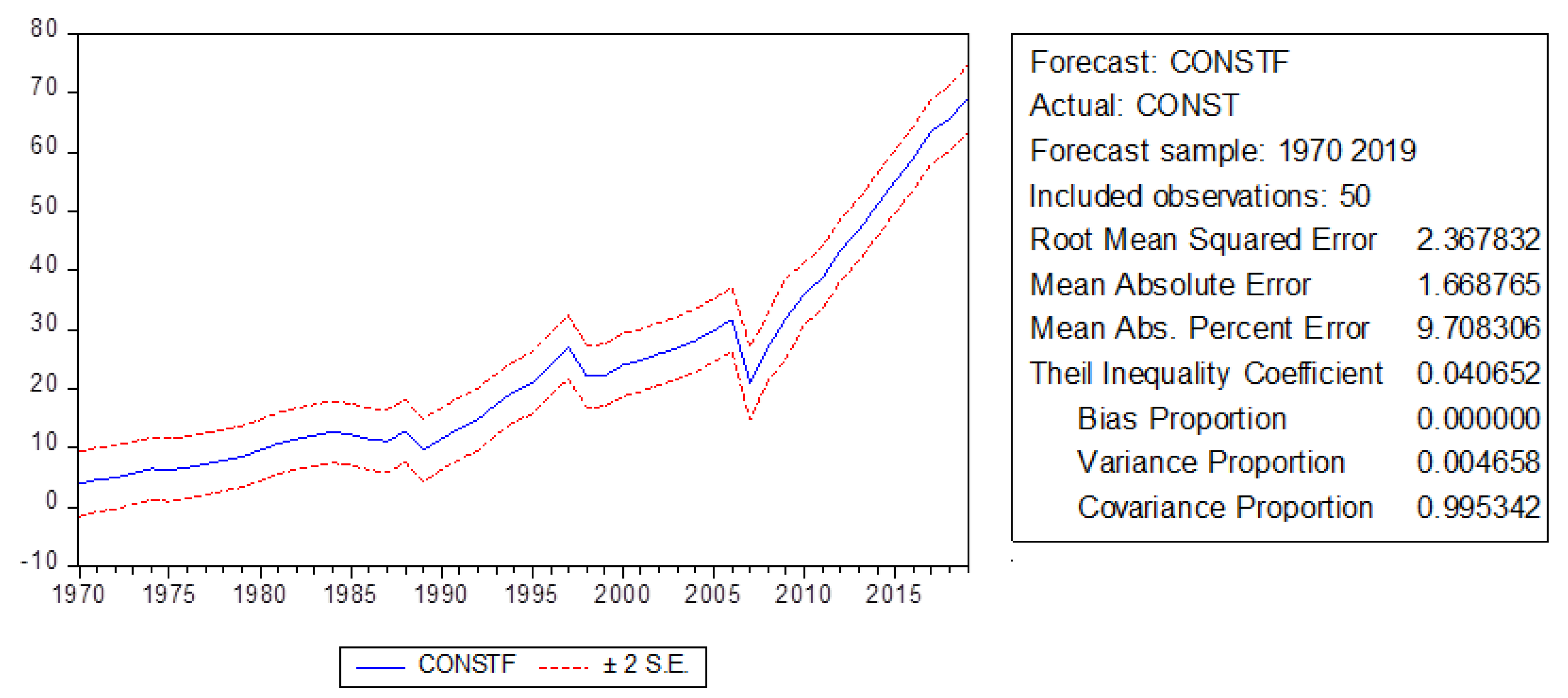

4.9. Validation of the Estimated Equation for CONST Model

4.9.1. Serial Correlation Test for Residual

4.9.2. Residual Heteroskedasticity Test

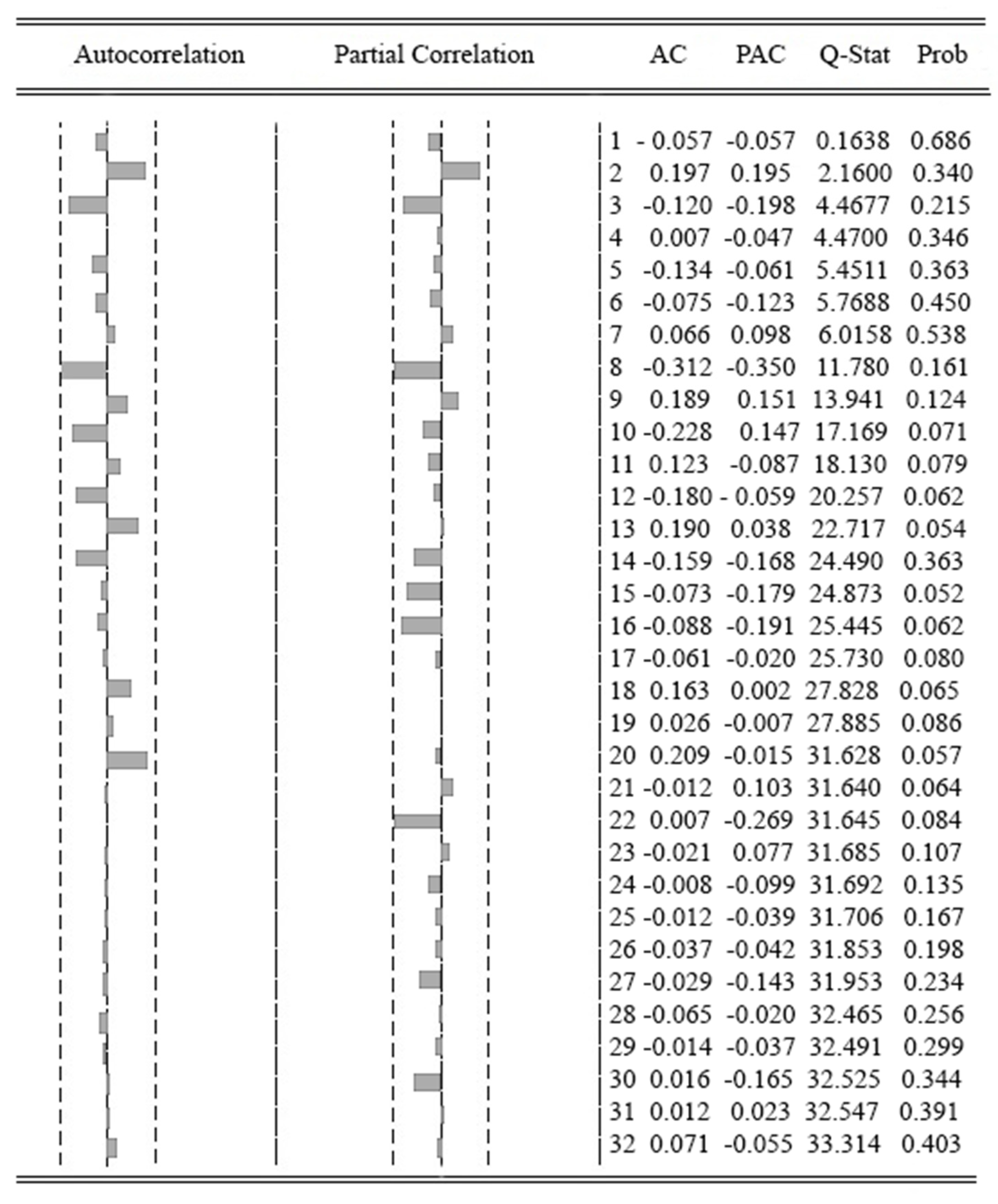

4.9.3. Residual Correlogram

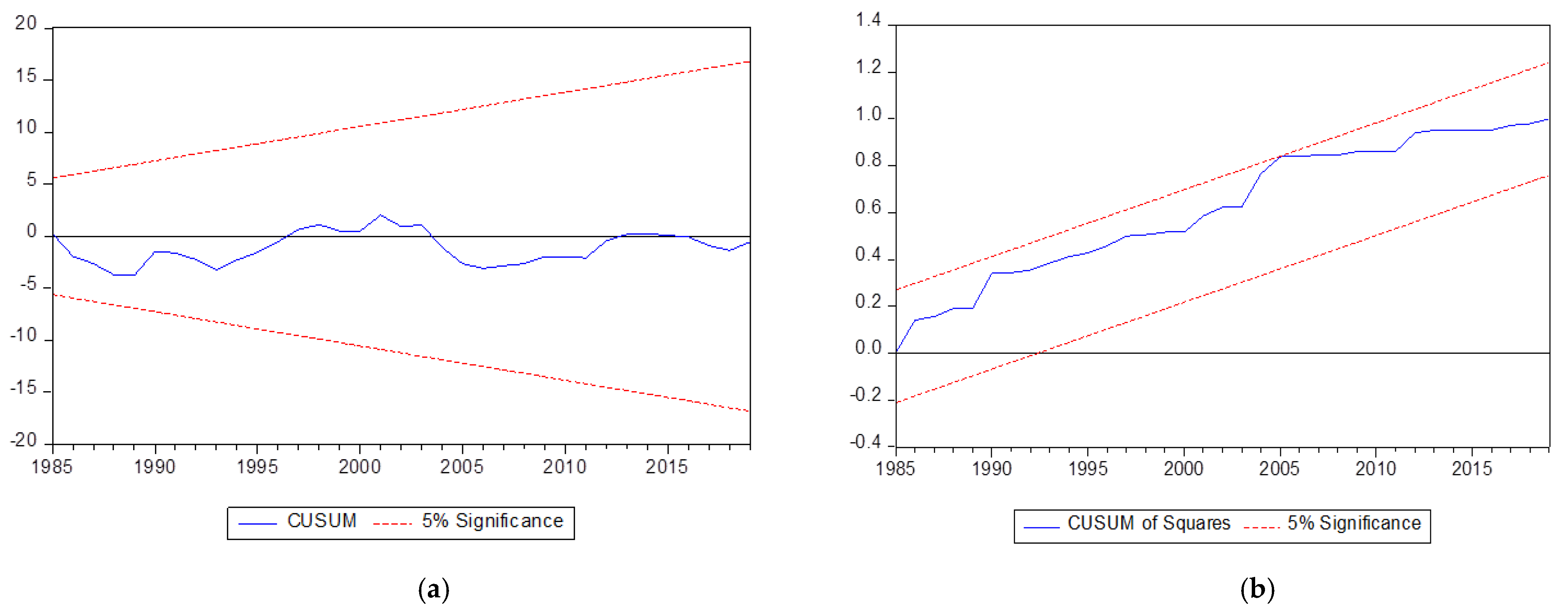

4.10. Structure Stability Test

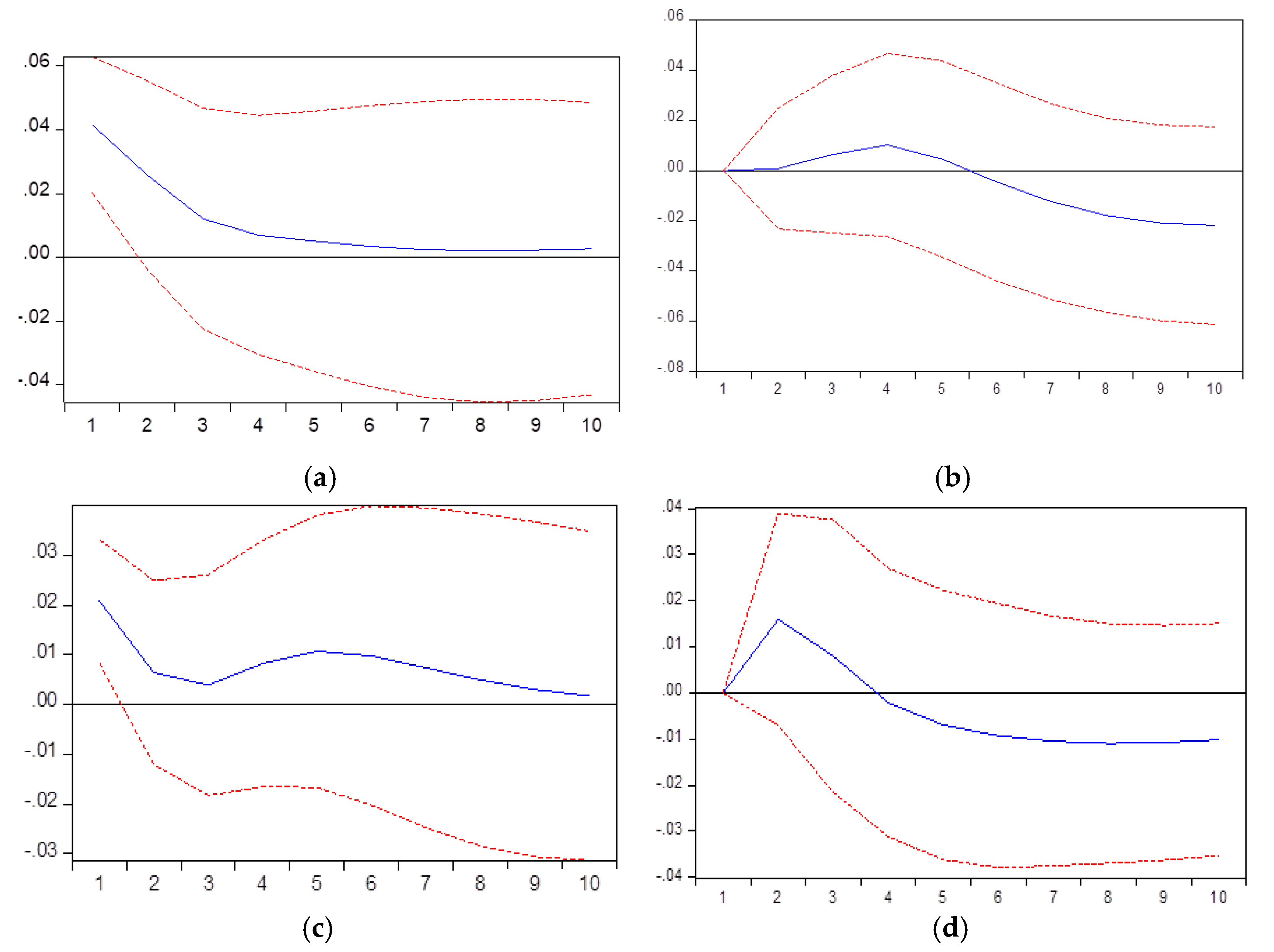

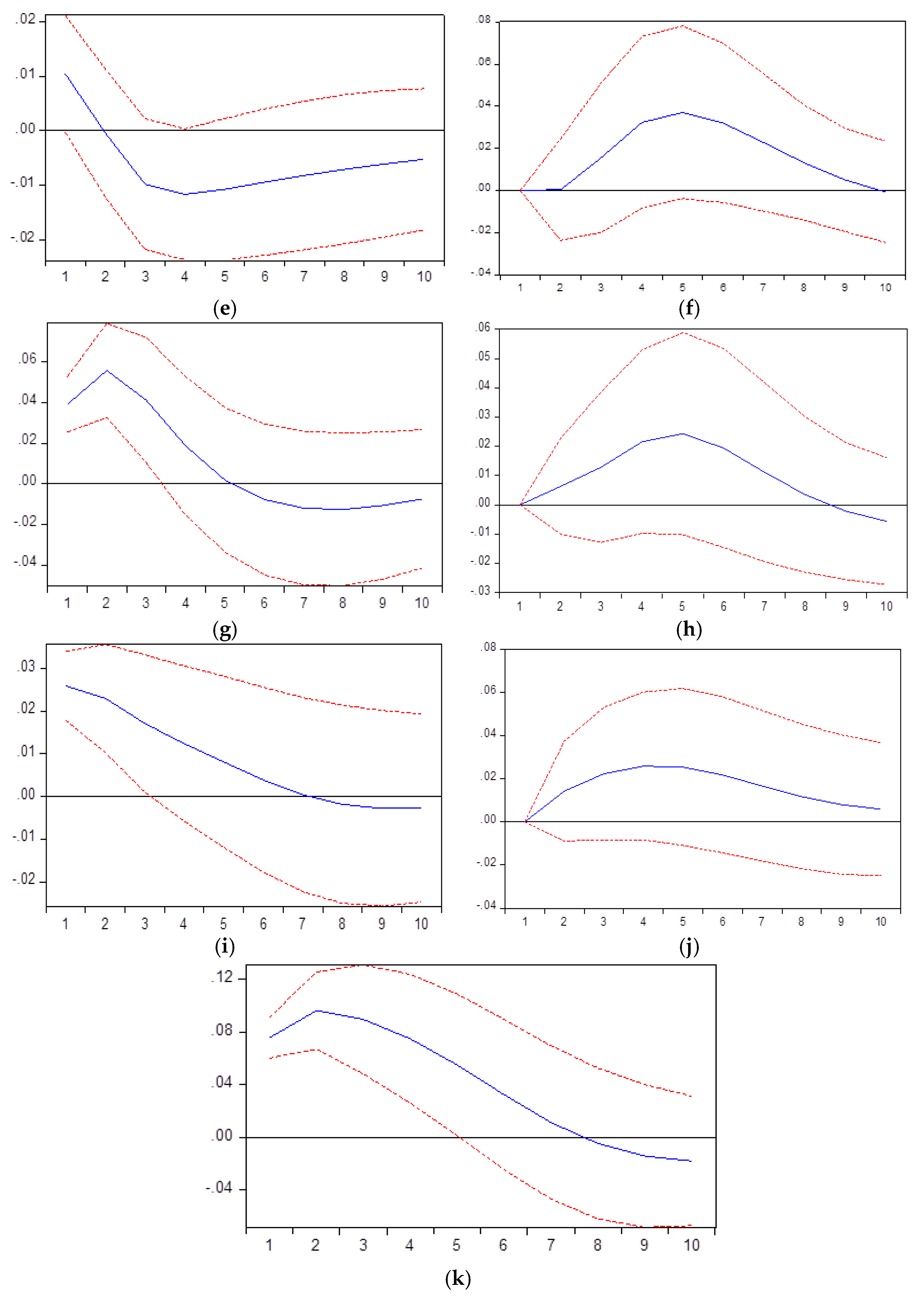

4.11. Impulse Response Functions (IRFs)

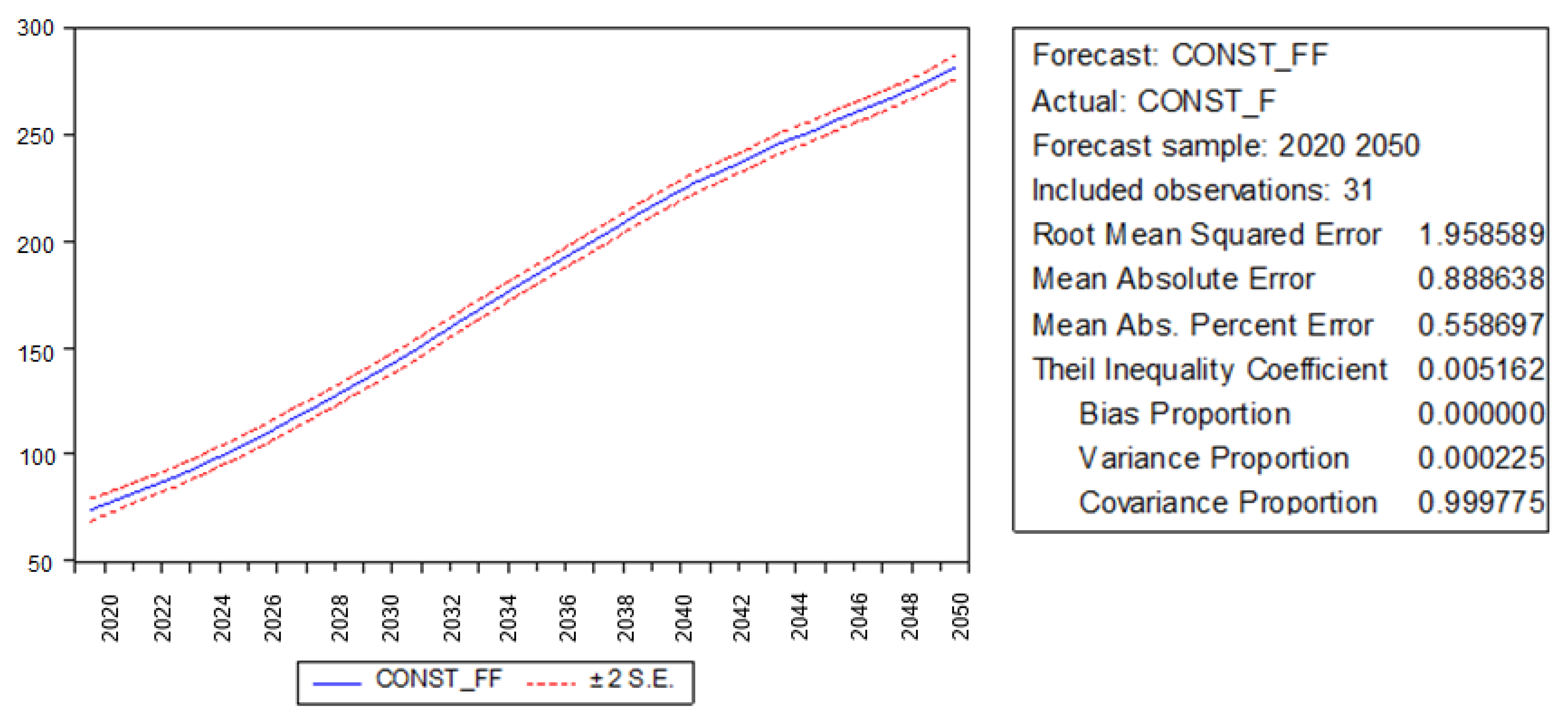

4.12. Forecasting and Validation

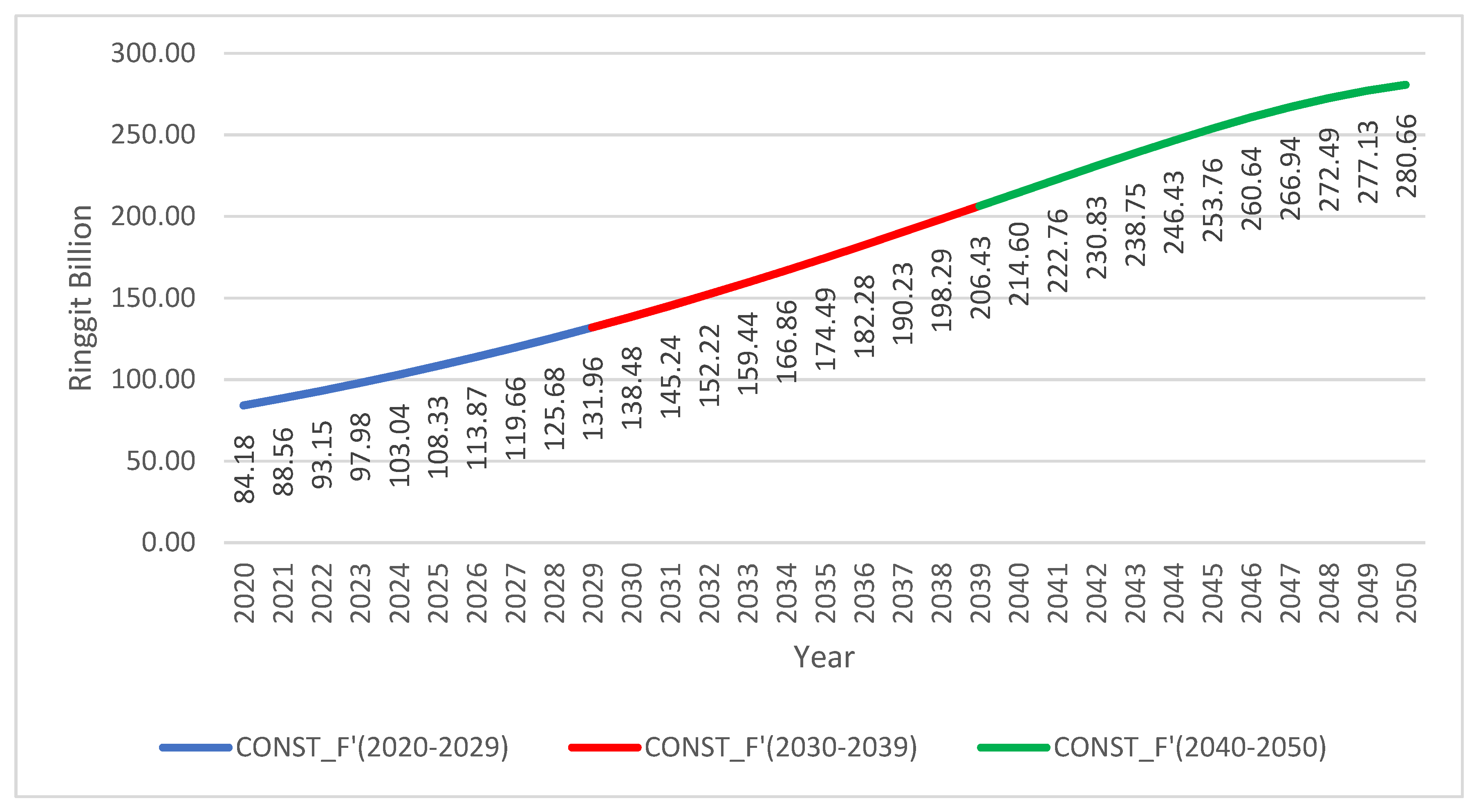

4.13. Predicted Contribution of the Construction Sector to GDP

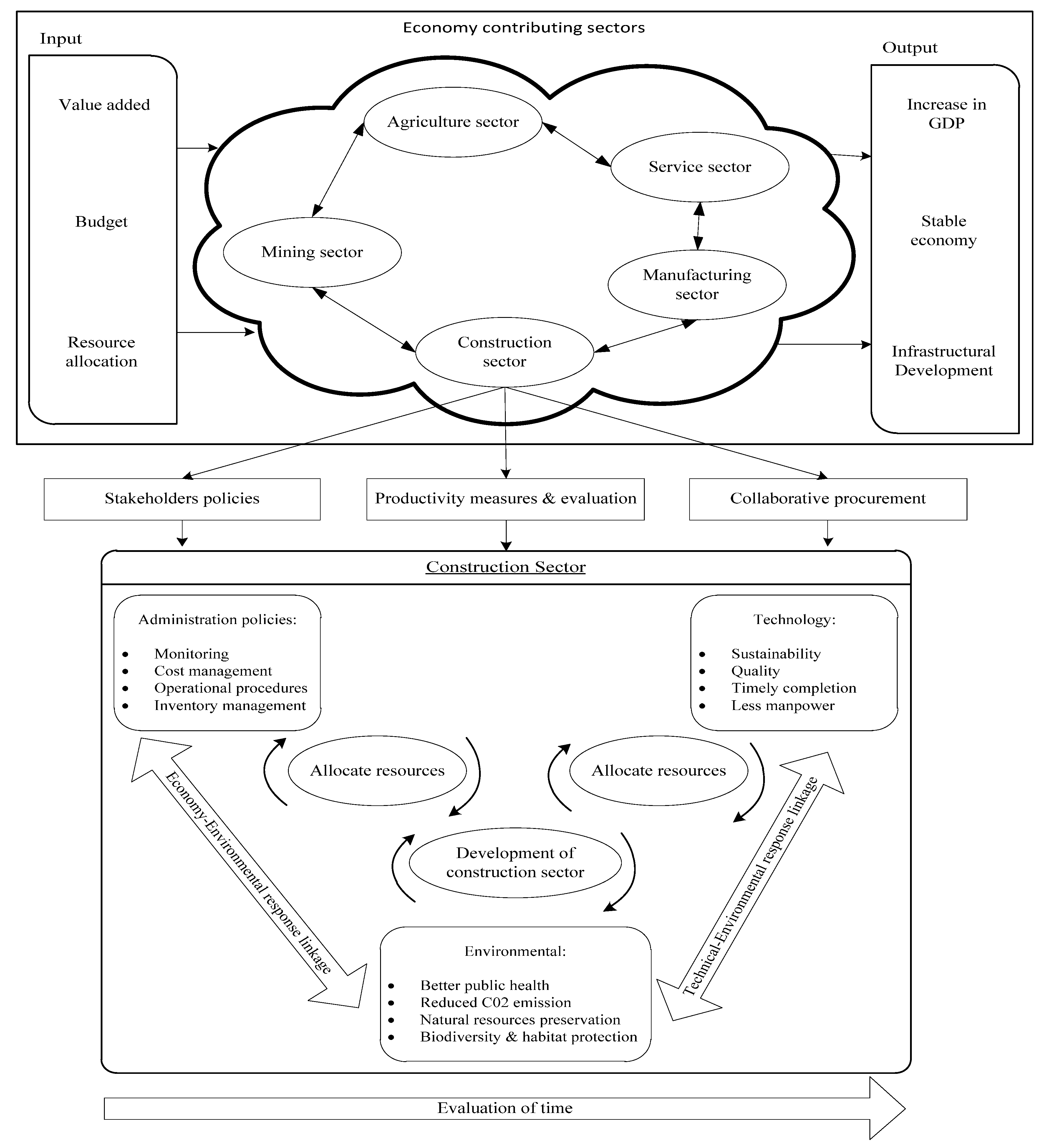

5. Conceptual Framework

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Year | CONST (RB) | MANU (RB) | AGRI (RB) | SERVC (RB) | MINING (RB) | GDP (RB) |

|---|---|---|---|---|---|---|

| 1970 | 3.079 | 7.346 | 27.112 | 9.668 | 30.434 | 73.752 |

| 1971 | 4.217 | 8.271 | 27.504 | 10.312 | 35.006 | 81.152 |

| 1972 | 4.451 | 9.113 | 29.601 | 12.525 | 37.712 | 88.771 |

| 1973 | 5.075 | 11.165 | 33.087 | 17.341 | 38.856 | 99.159 |

| 1974 | 5.683 | 12.322 | 35.373 | 22.863 | 38.500 | 107.407 |

| 1975 | 5.098 | 12.686 | 34.300 | 24.935 | 38.876 | 108.268 |

| 1976 | 5.558 | 15.034 | 38.498 | 24.512 | 46.435 | 120.787 |

| 1977 | 6.236 | 16.626 | 39.407 | 29.844 | 48.642 | 130.152 |

| 1978 | 7.164 | 18.168 | 40.056 | 32.155 | 53.135 | 138.812 |

| 1979 | 8.026 | 20.227 | 42.359 | 33.455 | 61.024 | 151.790 |

| 1980 | 9.416 | 22.092 | 42.902 | 41.322 | 62.383 | 163.086 |

| 1981 | 10.778 | 23.136 | 44.986 | 49.372 | 62.042 | 174.408 |

| 1982 | 11.840 | 24.433 | 47.896 | 51.197 | 66.220 | 184.773 |

| 1983 | 13.066 | 26.356 | 47.589 | 53.142 | 74.465 | 196.325 |

| 1984 | 13.618 | 29.596 | 48.940 | 56.010 | 84.204 | 211.564 |

| 1985 | 12.479 | 28.464 | 49.913 | 55.440 | 82.519 | 209.395 |

| 1986 | 10.728 | 30.607 | 51.993 | 51.292 | 88.158 | 211.993 |

| 1987 | 9.446 | 34.708 | 55.648 | 54.629 | 93.157 | 222.999 |

| 1988 | 9.721 | 40.605 | 57.157 | 61.984 | 103.179 | 245.160 |

| 1989 | 10.847 | 48.857 | 59.877 | 77.719 | 114.517 | 267.371 |

| 1990 | 12.860 | 56.327 | 58.842 | 92.127 | 122.379 | 291.457 |

| 1991 | 14.859 | 64.212 | 59.454 | 105.857 | 133.093 | 319.278 |

| 1992 | 16.457 | 68.708 | 63.532 | 119.495 | 141.521 | 347.646 |

| 1993 | 18.234 | 78.727 | 61.538 | 143.397 | 150.759 | 382.046 |

| 1994 | 20.995 | 87.682 | 60.372 | 162.454 | 164.675 | 417.240 |

| 1995 | 25.415 | 97.642 | 58.842 | 174.221 | 191.903 | 458.251 |

| 1996 | 29.527 | 115.394 | 61.510 | 190.431 | 213.159 | 504.088 |

| 1997 | 32.655 | 127.068 | 61.923 | 209.897 | 225.727 | 541.001 |

| 1998 | 24.832 | 110.018 | 60.211 | 196.350 | 210.295 | 501.187 |

| 1999 | 23.752 | 122.859 | 60.499 | 207.194 | 229.778 | 531.948 |

| 2000 | 23.882 | 145.358 | 64.165 | 222.718 | 254.844 | 579.072 |

| 2001 | 24.662 | 139.151 | 64.054 | 232.493 | 247.705 | 582.070 |

| 2002 | 25.234 | 144.885 | 65.890 | 249.865 | 258.539 | 613.449 |

| 2003 | 25.694 | 158.162 | 69.864 | 259.763 | 278.441 | 648.959 |

| 2004 | 25.475 | 173.279 | 73.130 | 278.332 | 298.934 | 692.981 |

| 2005 | 25.103 | 182.283 | 75.027 | 302.180 | 308.681 | 729.932 |

| 2006 | 24.970 | 195.825 | 79.405 | 323.017 | 321.966 | 770.697 |

| 2007 | 27.104 | 213.471 | 86.414 | 383.277 | 331.237 | 819.242 |

| 2008 | 28.288 | 211.961 | 83.438 | 416.388 | 330.964 | 858.826 |

| 2009 | 30.032 | 164.335 | 74.864 | 426.613 | 306.427 | 845.827 |

| 2010 | 33.444 | 207.244 | 85.641 | 449.182 | 330.023 | 908.628 |

| 2011 | 34.998 | 218.513 | 91.503 | 481.438 | 337.544 | 956.703 |

| 2012 | 41.347 | 228.161 | 92.382 | 513.389 | 349.987 | 1009.097 |

| 2013 | 45.745 | 235.946 | 94.216 | 544.324 | 360.138 | 1056.461 |

| 2014 | 51.109 | 250.346 | 96.146 | 581.164 | 378.810 | 1119.920 |

| 2015 | 55.382 | 262.379 | 97.539 | 612.173 | 397.148 | 1176.941 |

| 2016 | 59.508 | 273.899 | 93.977 | 647.149 | 412.679 | 1229.312 |

| 2017 | 63.522 | 290.463 | 99.381 | 688.267 | 430.651 | 1299.897 |

| 2018 | 66.218 | 304.847 | 99.470 | 735.834 | 444.009 | 1361.533 |

| 2019 | 71.850 | 316.355 | 101.287 | 781.024 | 453.070 | 1420.490 |

Appendix B

| Year | CONST_F (RB) |

|---|---|

| 2020 | 84.18 |

| 2021 | 88.56 |

| 2022 | 93.15 |

| 2023 | 97.98 |

| 2024 | 103.04 |

| 2025 | 108.33 |

| 2026 | 113.87 |

| 2027 | 119.66 |

| 2028 | 125.68 |

| 2029 | 131.96 |

| 2030 | 138.48 |

| 2031 | 145.24 |

| 2032 | 152.22 |

| 2033 | 159.44 |

| 2034 | 166.86 |

| 2035 | 174.49 |

| 2036 | 182.28 |

| 2037 | 190.23 |

| 2038 | 198.29 |

| 2039 | 206.43 |

| 2040 | 214.60 |

| 2041 | 222.76 |

| 2042 | 230.83 |

| 2043 | 238.75 |

| 2044 | 246.43 |

| 2045 | 253.76 |

| 2046 | 260.64 |

| 2047 | 266.94 |

| 2048 | 272.49 |

| 2049 | 277.13 |

| 2050 | 280.66 |

References

- Musarat, M.A.; Alaloul, W.S.; Liew, M. Impact of inflation rate on construction projects budget: A review. Ain Shams Eng. J. 2020, 12, 407–414. [Google Scholar] [CrossRef]

- Müller, R.; Veser, M. The current state of nonfinancial reporting in Switzerland and beyond. Die Unternehm. 2020, 74, 296–311. [Google Scholar] [CrossRef]

- Lean, C.S. Empirical tests to discern linkages between construction and other economic sectors in Singapore. Constr. Manag. Econ. 2001, 19, 355–363. [Google Scholar] [CrossRef]

- Alaloul, W.; Altaf, M.; Musarat, M.; Javed, M.F.; Mosavi, A. Systematic Review of Life Cycle Assessment and Life Cycle Cost Analysis for Pavement and a Case Study. Sustainability 2021, 13, 4377. [Google Scholar] [CrossRef]

- Hillebrandt, P.M. Economic Theory and the Construction Industry; Springer: Berlin/Heidelberg, Germany, 1985. [Google Scholar]

- Alaloul, W.S.; Musarat, M.A.; Liew, M.; Qureshi, A.H.; Maqsoom, A. Investigating the impact of inflation on labour wages in Construction Industry of Malaysia. Ain Shams Eng. J. 2021. [Google Scholar] [CrossRef]

- Pradip Ajugiya, J.J.B.; Pitroda, J. Comparison of Modern and Conventional Construction Techniques for Next Generation: A Review. In Proceedings of the 21st ISTE State Annual Faculty Convention and National Conference on “Emerging Trends in Engineering”, Tolani Foundation Gandhidham Polytechnic, Adipur, India, 27 December 2016. [Google Scholar]

- Rafiq, W.; Musarat, M.; Altaf, M.; Napiah, M.; Sutanto, M.; Alaloul, W.; Javed, M.; Mosavi, A. Life Cycle Cost Analysis Comparison of Hot Mix Asphalt and Reclaimed Asphalt Pavement: A Case Study. Sustainability 2021, 13, 4411. [Google Scholar] [CrossRef]

- Field, B.; Ofori, G. Construction and Economic Development: A Case Study. Third World Plan. Rev. 1988, 10, 41. [Google Scholar] [CrossRef]

- Gaal, O.H.; Afrah, N. Lack of Infrastructure: The Impact on Economic Development as a case of Benadir region and Hir-shabelle, Somalia. Dev. Ctry. Stud. 2017, 7, 212581063. [Google Scholar]

- Musarat, M.A.; Alaloul, W.S.; Liew, M.; Maqsoom, A.; Qureshi, A.H. Investigating the impact of inflation on building materials prices in construction industry. J. Build. Eng. 2020, 32, 101485. [Google Scholar] [CrossRef]

- Khan, R.A. Role of construction sector in economic growth: Empirical evidence from Pakistan economy. In Proceedings of the First International Conference on Construction in Developing Countries (ICCIDC), Karachi, Pakistan, 4–5 August 2008. [Google Scholar]

- Alaloul, S.W.; Musarat, M.A. Impact of Zero Energy Building: Sustainability Perspective. In Sustainable Sewage Sludge Management and Resource Efficiency; IntechOpen: London, UK, 2020. [Google Scholar]

- Kenny, C. Construction, Corruption, and Developing Countries; The World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Estache, A. PPI partnerships vs. PPI divorces in LDCs. Rev. Ind. Organ. 2006, 29, 3–26. [Google Scholar] [CrossRef]

- Lopes, J.P. Interdependence between the Construction Sector and the National Economy in Developing Countries: A Special Focus on Angola and Mozambique. Ph.D. Thesis, University of Salford, Salford, UK, 1997. [Google Scholar]

- Geadah, A.N.K. Financing of Construction Investment in Developing Countries Through Capital Markets. Master Thesis, Massachusetts Institute of Technology, Department of Civil and Environmental, Cambridge, MA, USA, 2003. [Google Scholar]

- Lopes, J. Investment in construction and economic growth. In Economics for the Modern Built Environment; Taylor & Francis: Oxford, UK, 2008; pp. 94–112. [Google Scholar]

- Rameezdeen, R. Study of Linkages between Construction Sector and Other Sectors of the Sri Lankan Economy. Sri Lanka. 2005. Available online: https://www.iioa.org/conferences/15th/pdf/rameezdeen.pdf (accessed on 2 January 2021).

- Ofori, G. Construction industry and economic growth in Singapore. Constr. Manag. Econ. 1988, 6, 57–70. [Google Scholar] [CrossRef]

- Khan, R.A.; Liew, M.S.; Bin Ghazali, Z. Malaysian Construction Sector and Malaysia Vision 2020: Developed Nation Status. Procedia Soc. Behav. Sci. 2014, 109, 507–513. [Google Scholar] [CrossRef]

- Yu-Chin, C.; Kenneth, R. Are the commodity currencies an exception to the rule? Glob. J. Econ. 2012, 1, 1250004. [Google Scholar] [CrossRef]

- Cashin, P.; Céspedes, L.F.; Sahay, R. Commodity currencies and the real exchange rate. J. Dev. Econ. 2004, 75, 239–268. [Google Scholar] [CrossRef]

- Olamade, O.O.; Oyebisi, T.O.; Olabode, S.O. Strategic ICT-use intensity of manufacturing companies in Nigeria. J. Asian Bus. Strategy 2014, 4, 1. [Google Scholar]

- Drewer, S. Construction and development: A new perspective. Habitat Int. 1980, 5, 395–428. [Google Scholar] [CrossRef]

- Ofori, G. Challenges of construction industries in developing countries: Lessons from various countries. In Proceedings of the 2nd International Conference on Construction in Developing Countries: Challenges Facing the Construction Industry in Developing Countries, Gaborone, Botswana, 15–17 November 2000. [Google Scholar]

- Latham, M. Constructing the Team: Final Report of the Government/Industry Review of Procurement and Contractual Arrangements in the UK Construction Industry; Hmso: London, UK, 1994. [Google Scholar]

- Oladinrin, T.; Ogunsemi, D.; Aje, I. Role of Construction Sector in Economic Growth: Empirical Evidence from Nigeria. Futy J. Environ. 2012, 7, 50–60. [Google Scholar] [CrossRef]

- Alfan, E.; Zakaria, Z. Review of financial performance and distress: A case of Malaysian construction companies. Br. J. Arts Soc. Sci. 2013, 12, 147. [Google Scholar]

- Kamar, A.M.; Hamid, Z.A.; Ghani, M.K.; Egbu, C.; Arif, M. Collaboration initiative on green construction and sustainability through Industrialized Buildings Systems (IBS) in the Malaysian construction industry. Int. J. Sustain. Constr. Eng. Technol. 2010, 1, 119–127. [Google Scholar]

- Hamid, Z.; Kamar, K. Modernising the Malaysian construction industry. In Proceedings of the W089-Special Track 18th CIB World Building Congress, Salford, UK, 10–13 May 2010. [Google Scholar]

- Malaysia, C. Construction Industry Master Plan Malaysia 2006–2015; Kuala Lumpur; Construction Industry Development Board: Negeri Sembilan, Malaysia, 2007. [Google Scholar]

- Bin Ibrahim, A.R.; Roy, M.H.; Ahmed, Z.; Imtiaz, G. An investigation of the status of the Malaysian construction industry. Benchmarking Int. J. 2010, 17, 294–308. [Google Scholar] [CrossRef]

- Kanan, P.D.P.; Bahaman, M.A.T.S. The Key Issues in the Malaysian Construction Industry: Public and Private Sector Engagement; Master Builders Association Malaysia: Kuala Lumpur, Malaysia, 2011. [Google Scholar]

- Munaaim, C.M.; Dauurl, M.M.; Abdul-Rahman, H. Is late or non-payment a significant problem to Malaysian contractors. J. Des. Built Environ. 2007, 3, 1. [Google Scholar]

- Department of Statistics Malaysia. Malaysia Economic Performance Fourth Quarter 2020. 2021. Available online: https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=100&bul_id=Y1MyV2tPOGNsVUtnRy9SZGdRQS84QT09&menu_id=TE5CRUZCblh4ZTZMODZIbmk2aWRRQT09 (accessed on 2 January 2021).

- Department of Statistics Malaysia. Malaysia Economic Performance Third Quarter 2020. 2020. Available online: https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=100&bul_id=ZlRNZVRDUmNzRFFQQ29lZXJoV0UxQT09&menu_id=TE5CRUZCblh4ZTZMODZIbmk2aWRRQT09 (accessed on 2 January 2021).

- Department of Statistics Malaysia. Malaysia Economic Performance Third Quarter 2019. 2020. Available online: https://www.dosm.gov.my/v1/index.php?r=column/pdfPrev&id=VDNYYXBkczhkUm9taU9pWUQvSEJBQT09 (accessed on 2 January 2021).

- Department of Statistics Malaysia. Malaysia Economic Performance Fourth Quarter 2019. 2020. Available online: https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=100&bul_id=WWk2MDA3R1k1SlVsTjlzU3FZcjVlUT09&menu_id=TE5CRUZCblh4ZTZMODZIbmk2aWRRQT09 (accessed on 2 January 2021).

- Hirschmann, R. Value of Construction Work in Malaysia from 2011 to 2019. 2020. Available online: https://www.statista.com/statistics/665028/value-of-construction-work-malaysia/#:~:text=Value%20of%20construction%20work%20in%20Malaysia%202011-2019&text=In%202019%2C%20the%20value%20of,a%20bid%20to%20decrease%20debt (accessed on 2 January 2021).

- Gamil, Y.; Alhagar, A. The Impact of Pandemic Crisis on the Survival of Construction Industry: A Case of COVID-19. Mediterr. J. Soc. Sci. 2020, 11, 122. [Google Scholar] [CrossRef]

- Wong, J.M.; Ng, S.T. Forecasting construction tender price index in Hong Kong using vector error correction model. Constr. Manag. Econ. 2010, 28, 1255–1268. [Google Scholar] [CrossRef]

- Fu, C.; Liu, C. An economic analysis of construction industries producer prices in Australia. Int. J. Econ. Financ. 2010, 2, 3–14. [Google Scholar]

- Jiang, H.; Xu, Y.; Liu, C. Construction price prediction using vector error correction models. J. Constr. Eng. Manag. 2013, 139, 04013022. [Google Scholar] [CrossRef]

- Jiang, H.; Liu, C. A panel vector error correction approach to forecasting demand in regional construction markets. Constr. Manag. Econ. 2014, 32, 1205–1221. [Google Scholar] [CrossRef]

- Shahandashti, S.M.; Ashuri, B. Highway Construction Cost Forecasting Using Vector Error Correction Models. J. Manag. Eng. 2016, 32, 04015040. [Google Scholar] [CrossRef]

- Faghih, S.A.M.; Kashani, H. Forecasting Construction Material Prices Using Vector Error Correction Model. J. Constr. Eng. Manag. 2018, 144, 04018075. [Google Scholar] [CrossRef]

- Wong, J.M.; Chan, A.P.; Chiang, Y. Forecasting construction manpower demand: A vector error correction model. Build. Environ. 2007, 42, 3030–3041. [Google Scholar] [CrossRef]

- Xu, J.-W.; Moon, S. Stochastic forecast of construction cost index using a cointegrated vector autoregression model. J. Manag. Eng. 2013, 29, 10–18. [Google Scholar] [CrossRef]

- Hyndman, J.R.; Athanasopoulos, G. Forecasting: Principles and Practice; OTexts: Melbourne, Australia, 2018. [Google Scholar]

- Mak, S.; Choy, L.; Ho, W. Region-specific estimates of the determinants of real estate investment in China. Urban Stud. 2012, 49, 741–755. [Google Scholar] [CrossRef]

- Hassani, M. Construction Equipment Fuel Consumption During Idling: Characterization Using Multivariate Data Analysis at Volvo CE; Digitala Vetenskapliga Arkivet: Vasteras, Sweden, 2020. [Google Scholar]

- Zhang, X.; Chen, Y.; Jiang, P.; Liu, L.; Xu, X.; Xu, Y. Sectoral peak CO2 emission measurements and a long-term alternative CO2 mitigation roadmap: A case study of Yunnan, China. J. Clean. Prod. 2020, 247, 119171. [Google Scholar] [CrossRef]

- Wang, Y.; Wen, Z.; Yao, J.; Dinga, C.D. Multi-objective optimization of synergic energy conservation and CO2 emission reduction in China’s iron and steel industry under uncertainty. Renew. Sustain. Energy Rev. 2020, 134, 110128. [Google Scholar] [CrossRef]

- Liu, Z.; Ciais, P.; Deng, Z.; Davis, S.J.; Zheng, B.; Wang, Y.; Cui, D.; Zhu, B.; Dou, X.; Ke, P.; et al. Carbon Monitor, a near-real-time daily dataset of global CO2 emission from fossil fuel and cement production. Sci. Data 2020, 7, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Momade, H.M.; Hainin, M.R. Review of sustainable construction practices in Malaysian construction industry. Int. J. Eng. Technol. 2018, 7, 5018–5021. [Google Scholar]

- Abidin, N.Z. Sustainable construction in Malaysia–Developers’ awareness. World Acad. Sci. Eng. Technol. 2009, 53, 807–814. [Google Scholar]

- Musarat, M.; Alaloul, W.; Liew, M.; Maqsoom, A.; Qureshi, A. The Effect of Inflation Rate on CO2 Emission: A Framework for Malaysian Construction Industry. Sustainability 2021, 13, 1562. [Google Scholar] [CrossRef]

- Hock, I.L.C. Malaysia Needs Sustainable Construction. Malaysia. 2015. Available online: https://www.malaysiakini.com/letters/315928 (accessed on 2 January 2021).

- Malaysia Department Of Statistics. Available online: https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=155&bul_id=aWJZRkJ4UEdKcUZpT2tVT090Snpydz09&menu_id=L0pheU43NWJwRWVSZklWdzQ4TlhUUT09 (accessed on 2 January 2021).

- Bank, W. Malaysia. 2020. Available online: https://data.worldbank.org/country/MY (accessed on 2 January 2021).

- Harris, R.I. Testing for unit roots using the augmented Dickey-Fuller test: Some issues relating to the size, power and the lag structure of the test. Econ. Lett. 1992, 38, 381–386. [Google Scholar] [CrossRef]

- Gujarati, D.N. Basic Econometrics; Tata McGraw-Hill Education: New York, NY, USA, 2009. [Google Scholar]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, J.S.; Juselius, K. Test. Struct. Hypothesis A Multivar. Cointegration Anal. PPP UIP UK J. Econom. 1992, 53, 1–244. [Google Scholar]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Koop, G.; Quinlivan, R. Analysis of Economic Data; Wiley: Chichester, UK, 2000; Volume 2. [Google Scholar]

- Gujarati, D.N. Basic Econometrics; MacGraw-Hill Inc.: New York, NY, USA, 1995; 838p. [Google Scholar]

- Granger, C. Some properties of time series data and their use in econometric model specification. J. Econ. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Suharsono, A.S. Forecasting Share Price Index In Indonesia and the World with the Univariate and Multivariate Time Series Model. J. Sains Dan Seni Pomits 2013, 2, 2. [Google Scholar]

- Suharsono, A.; Aziza, A.; Pramesti, W. Comparison of Vector Autoregressive (VAR) and Vector Error Correction Models (VECM) for Index of ASEAN Stock Price. In AIP Conference Proceedings; AIP Publishing LLC: New York, NY, USA, 2017. [Google Scholar]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

- Perron, P. The great crash, the oil price shock, and the unit root hypothesis. Econom. J. Econom. Soc. 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Lu, C.; Xin, Z. Impulse-Response Function Analysis: An Application to Macroeconomy Data of China. 2010. Available online: http://www.statistics.du.se/essays/D10_Xinzhou_lucao.pdf (accessed on 2 January 2021).

- Zikmund, G.W.; Carr, G. Business Research Methods, 7th ed.; Cengage Learning, Dryden: New York, NY, USA, 2000. [Google Scholar]

- James, H.A. Time Series Analysis; Princton University Press: Princton, NJ, USA; Oxford University: Oxford, UK, 1944. [Google Scholar]

- Bliemel, F. Theil’s Forecast Accuracy Coefficient: A Clarification; SAGE Publications: Los Angeles, CA, USA, 1973. [Google Scholar]

- Elengoe, A. COVID-19 outbreak in Malaysia. Osong Public Health Res. Perspect. 2020, 11, 93–100. [Google Scholar] [CrossRef]

- Government, Malaysia. Shared Prosperity Vision 2030; Percetakan Nasional Malaysia Berhad: Kuala Lumpur, Malaysia, 2019; pp. 1–30.

- Nielsen, C.; Aalbers, R. Optimal Discount Rates for Investments in Mitigation and Adaptation; CPB Discussion Paper 257; CPB Netherlands Bureau for Economic Policy Analysis: The Hague, The Netherlands, 2013.

| Sector | GDP in Q4’2019 | GDP in Q1’2020 | GDP in Q2’2020 | GDP in Q3’2020 |

|---|---|---|---|---|

| Construction | 1.0% | −7.9% | −44.5% | 12.4% |

| Services | 6.1% | 3.1% | −16.2% | −4.0% |

| Manufacturing | 3.0% | 1.5% | −18.3% | 3.3% |

| Agriculture | −5.7% | −8.7% | 1.0% | −0.7% |

| Mining | −2.5% | −2.0% | −20.0% | −6.8% |

| CONST | AGRI | GDP | MANU | MINING | SERVC | |

|---|---|---|---|---|---|---|

| CONST | 1 | - | - | - | - | - |

| AGRI | 0.957372 | 1 | - | - | - | - |

| GDP | 0.979313 | 0.978232 | 1 | - | - | - |

| MANU | 0.968410 | 0.971241 | 0.99501 | 1 | - | - |

| MINING | 0.967215 | 0.968167 | 0.994983 | 0.998431 | 1 | - |

| SERVC | 0.980794 | 0.980149 | 0.99728 | 0.993659 | 0.990488 | 1 |

| Variable | Lag Order | t* | ADF Results | Order of Integration | Decision at Significance Level |

|---|---|---|---|---|---|

| LAGRI | 4 | 2.922 | 6.40 | I (1) | non-stationary |

| LMINING | 4 | 2.923 | 6.22 | I (1) | non-stationary |

| LMANU | 4 | 2.923 | 6.95 | I (1) | non-stationary |

| LGDP | 4 | 2.923 | 5.76 | I (1) | non-stationary |

| LSERVC | 4 | 2.923 | 4.23 | I (1) | non-stationary |

| LCONST | 4 | 2.923 | 4.78 | I (1) | non-stationary |

| Lag | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|

| 0 | NA | 4.73 × 10−12 | −9.049402 | −8.815502 | −8.961011 |

| 1 | 648.5405 | 2.90 × 10−18 * | −23.36746 | −21.73016 * | −22.74872 * |

| 2 | 54.57443 * | 2.93 × 10−18 | −23.42673 * | −20.38603 | −22.27765 |

| Null Hypothesis | Lag | Alternate Hypothesis | F-Stat | p-Value | Null Hypo Result |

|---|---|---|---|---|---|

| AGRI does not Granger Cause CONST | 2 | AGRI Granger causes CONS | 4.775 | 0.013 | Reject |

| CONST does not Granger Cause AGRI | 2 | - | 0.610 | 0.547 | Accept |

| GDP does not Granger Cause CONST | 2 | - | 2.851 | 0.068 | Accept |

| CONST does not Granger Cause GDP | 2 | - | 1.853 | 0.169 | Accept |

| MANU does not Granger Cause CONS | 2 | - | 1.778 | 0.181 | Accept |

| CONST does not Granger Cause MANU | 2 | - | 0.474 | 0.625 | Accept |

| MINI does not Granger Cause CONS | 2 | - | 1.135 | 0.330 | Accept |

| CONST does not Granger Cause MINI | 2 | - | 0.859 | 0.430 | Accept |

| SERV does not Granger Cause CONS | 2 | SERVC Granger causes CONST | 4.159 | 0.022 | Reject |

| CONST does not Granger Cause SERV | 2 | - | 1.485 | 0.237 | Accept |

| Description | Direction of Linkages |

|---|---|

| Agriculture and Construction | Unidirectional (Agriculture to Construction) |

| GDP and Construction | Independent |

| Manufacturing and Construction | Independent |

| Mining and Construction | Independent |

| Services and Construction | Unidirectional (Services to Construction) |

| Hypothesized No. of Cointegrating Eqn(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | p-Value |

|---|---|---|---|---|

| None * | 0.730538 | 61.63243 | 40.07757 | 0.0001 |

| At most 1 * | 0.527047 | 35.19165 | 33.87687 | 0.0347 |

| At most 2 | 0.420552 | 25.64697 | 27.58434 | 0.0867 |

| At most 3 | 0.317081 | 17.92481 | 21.13162 | 0.1327 |

| Coefficient | Std. Error | t-Statistic | Prob. | |

|---|---|---|---|---|

| C(1) | −0.306733 | 0.101781 | −3.013650 | 0.0029 |

| C(2) | 0.011071 | 0.163561 | 0.067690 | 0.9461 |

| C(3) | 0.706349 | 0.362084 | 1.950790 | 0.0526 |

| C(4) | 0.244731 | 0.319261 | 0.766553 | 0.4443 |

| C(5) | 0.179515 | 0.220620 | 0.813686 | 0.4169 |

| C(6) | −0.137599 | 0.442141 | −0.311211 | 0.7560 |

| C(7) | −0.280829 | 0.425516 | −0.659974 | 0.5101 |

| C(8) | −1.390151 | 1.479392 | −0.939677 | 0.3486 |

| C(9) | −0.576630 | 1.530035 | −0.376873 | 0.7067 |

| C(10) | 1.823168 | 0.845907 | 2.155283 | 0.0324 |

| C(11) | 0.407999 | 0.937179 | 0.435347 | 0.6638 |

| C(12) | −0.526471 | 0.539764 | −0.975374 | 0.3306 |

| C(13) | −0.003194 | 0.486360 | −0.006567 | 0.9948 |

| C(14) | 0.771292 | 0.455573 | 1.693015 | 0.0921 |

| C(15) | 0.063258 | 0.430021 | 0.147105 | 0.8832 |

| C(16) | 0.006754 | 0.060987 | 0.110740 | 0.9119 |

| Parameters | Value |

|---|---|

| Coefficient of determination (R 2) | 0.527 |

| Adjusted R 2 | 0.456 |

| Probability of F-statistic | 0.000 |

| Durbin–Watson statistic | 2.053 |

| F-statistic | 0.661 | Prob. F (2, 39) | 0.5216 |

| Observed R-squared | 1.575 | Prob. chi-square (2) | 0.4549 |

| F-statistic | 1.947642 | Prob. F (7, 40) | 0.0872 |

| Observed R-squared | 12.20148 | Prob. chi-square (7) | 0.0941 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alaloul, W.S.; Musarat, M.A.; Rabbani, M.B.A.; Iqbal, Q.; Maqsoom, A.; Farooq, W. Construction Sector Contribution to Economic Stability: Malaysian GDP Distribution. Sustainability 2021, 13, 5012. https://doi.org/10.3390/su13095012

Alaloul WS, Musarat MA, Rabbani MBA, Iqbal Q, Maqsoom A, Farooq W. Construction Sector Contribution to Economic Stability: Malaysian GDP Distribution. Sustainability. 2021; 13(9):5012. https://doi.org/10.3390/su13095012

Chicago/Turabian StyleAlaloul, Wesam Salah, Muhammad Ali Musarat, Muhammad Babar Ali Rabbani, Qaiser Iqbal, Ahsen Maqsoom, and Waqas Farooq. 2021. "Construction Sector Contribution to Economic Stability: Malaysian GDP Distribution" Sustainability 13, no. 9: 5012. https://doi.org/10.3390/su13095012

APA StyleAlaloul, W. S., Musarat, M. A., Rabbani, M. B. A., Iqbal, Q., Maqsoom, A., & Farooq, W. (2021). Construction Sector Contribution to Economic Stability: Malaysian GDP Distribution. Sustainability, 13(9), 5012. https://doi.org/10.3390/su13095012