The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place

Abstract

1. Introduction

2. Literature Review

2.1. Impact of HSR on Economic Growth

2.2. Impact of HSR on Quality of Place

2.3. Impact of HSR on Urban Agglomeration

2.4. Impact of Quality of Place on Urban Agglomeration

3. High-Speed Railway Development for Economic Growth Model and Model Setting

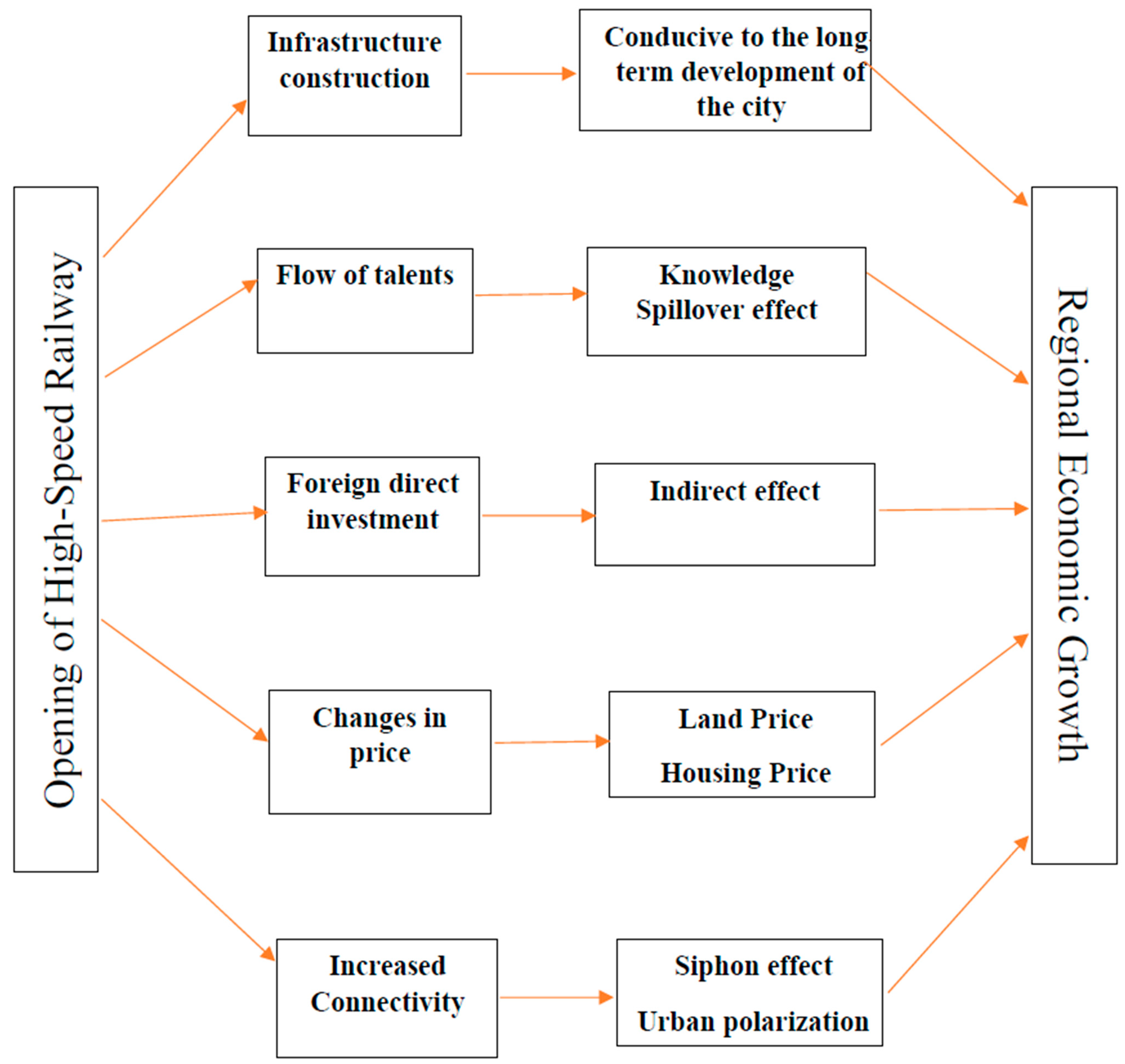

3.1. The Impact Path of High-Speed Railway on the Regional Economic Growth

3.1.1. Infrastructure Construction

3.1.2. The Flow of Talents

3.1.3. Foreign Direct Investment

3.1.4. Changes in Prices

3.1.5. Increased Connectivity

3.2. Theoretical Model

4. Variables, Data, and Methodology

4.1. Variables

- (a)

- DependentGross regional product (GRP) as the dependent variable that depicts China’s economic development. The values were measured per 100 million renminbi.

- (b)

- ControlPopulation (Pop) as the proxy for urban agglomeration. The values were measured per 10,000 persons.

- Employment (Emp): The values were measured per 10,000 persons.

- Investment in fixed assets (FA): The values were measured per 10,000 renminbi.

- Foreign direct investment (FDI): The values were measured per unit.

- Investment in the real estate (RE): The values were measured per 10,000 renminbi.

- Park and green areas (P&G): The values were measured by hectares.

- Theaters, music halls and cinemas (TM&C): The values were measured per unit.

- Hospital and health centers (HHC): The values were measured per unit.

- Average wages (AW): The values were measured per renminbi.

- Institute of higher education (IHE): The values were measured per unit.

4.2. Samples and Data

4.2.1. Sample Selection

4.2.2. Data Acquisition of Prefecture-Level High-Speed Railways

4.3. Methodology

5. Analysis of Empirical Results

5.1. Correlation Analysis

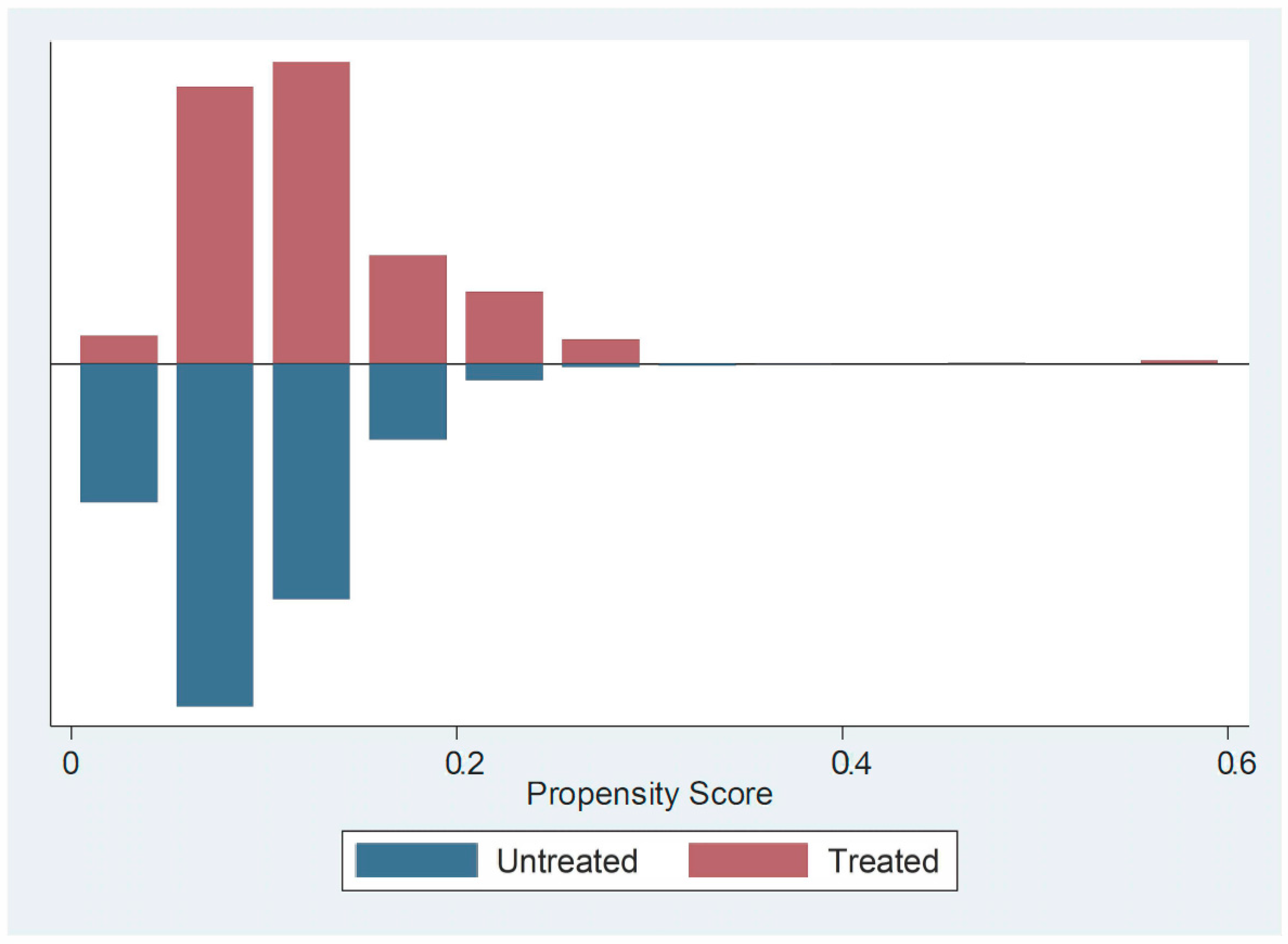

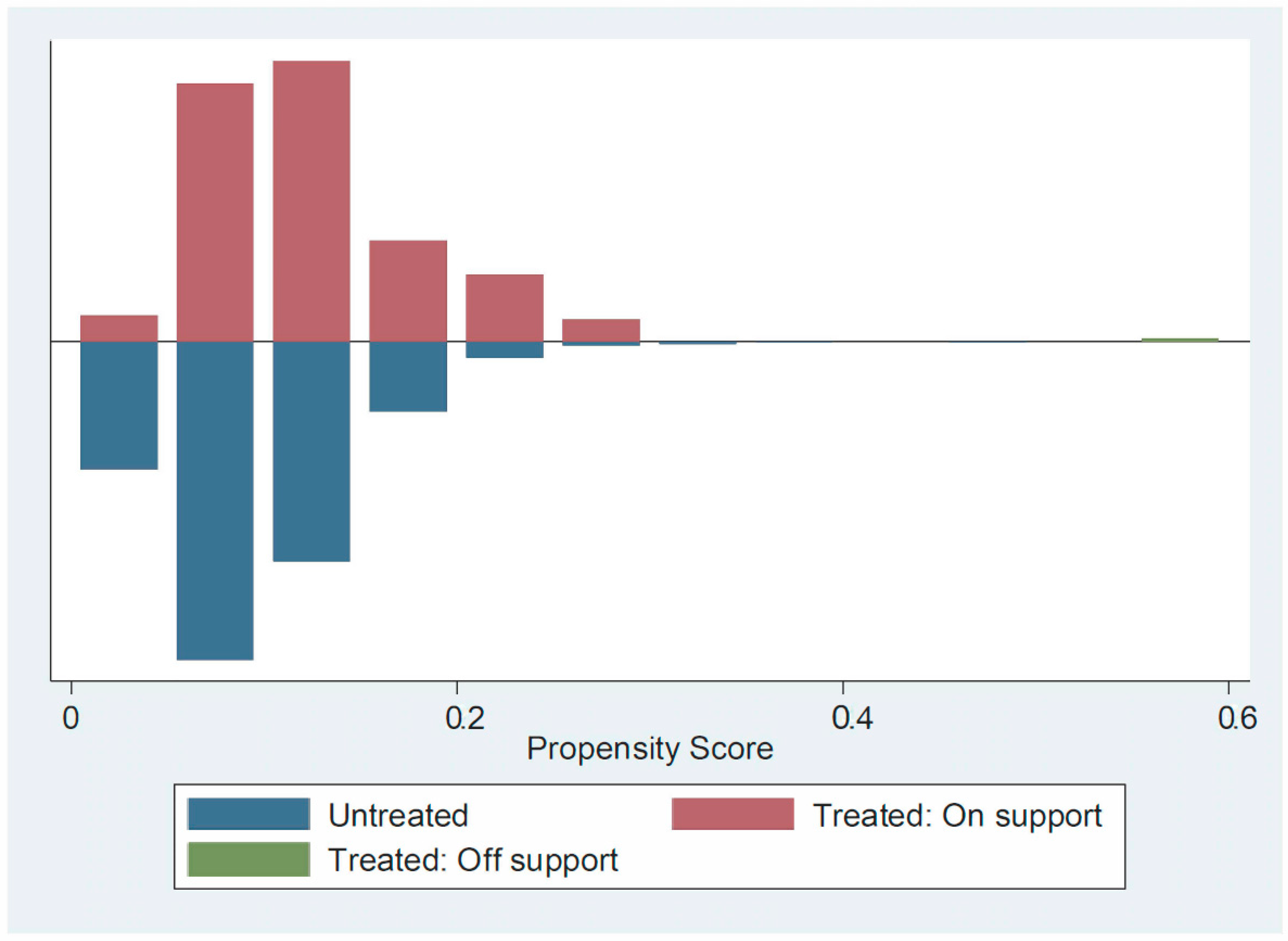

5.2. Propensity Score Matching (PSM)

5.3. PSM-DID and Robustness Model Testing

5.4. Parallel Line Testing

5.5. Heterogeneity Testing and Placebo Testing

5.6. Equilibrium Testing

5.7. Ordinary Least Square Regression (OLS)

5.8. Multicollinearity Testing

5.9. Heteroskedasticity Testing

5.10. Robust Regression Analysis

5.11. Discussion

5.11.1. HSR Has a Significant Influence on Regional Economic Growth

5.11.2. HSR Along with Quality of Place Improves Regional Economic Growth

5.11.3. HSR Along with Urban Agglomeration Improves the Regional Economic Growth of China

5.11.4. Urban Agglomeration has a Significant Influence on Economic Growth

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendation

- It is recommended that the government enhance the promotion of the human and natural resources and the capital and technology of HSR that would help accelerate the knowledge and information flow. The employment and wage rate must be improved for achieving more refined regional economic growth. It is also recommended to increase the economic growth by more investment in the fixed assets.

- The government of China can strengthen its policies related to the development of the infrastructure of HSR that can improve transportation services.

- It is recommended that China improve its real estate industry by reconstructing most of the urban station areas, which can increase the reliability of the high-speed railways and further boost China’s economic growth.

- It is further recommended to focus on the aspects of higher education institutions that would negatively impact the economic growth of the region.

- Further, it is recommended that more employment opportunities are implemented.

6.3. Future Implication of the Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bharule, S.; Kidokoro, T.; Seta, F. Evolution of High-Speed Rail and Its Development Effects: Stylized Facts and Review of Relationships; ADBI Working Paper 1040; Asian Development Bank Institute: Tokyo, Japan, 2019. [Google Scholar]

- Tierney, S. High-speed rail the knowledge economy and the next growth wave. J. Transp. Geogr. 2012, 22, 285–287. [Google Scholar] [CrossRef]

- Bonnafous, A. The Regional Impact of the TGV. Transportation 1987, 14, 127–137. [Google Scholar] [CrossRef]

- Givoni, M. Development and Impact of the Modern High-speed Train: A Review. J. Transp. Rev. 2006, 26, 593–611. [Google Scholar] [CrossRef]

- Cheng, Y.H. High-speed rail in Taiwan: New experience and issues for future development. Transp. Policy 2010, 17, 51–63. [Google Scholar] [CrossRef]

- Department for Communities and Local Government. Community, Opportunity, Prosperity; Annual Report; Communities and Local Government: London, UK, 2009. [Google Scholar]

- Raphael, D.; Renwick, R.; Brown, I.; Rootman, I. Quality of life indicators and health: Current status and emerging conceptions. Soc. Indic. Res. 1996, 39, 65–88. [Google Scholar] [CrossRef]

- Vaz, E.; Venter, C.J. The Effectiveness of Bus Rapid Transit as Part of a Poverty-Reduction Strategy: Some Early Impacts in Johannesburg. In Proceedings of the 31st Southern African Transport Conference, Pretoria, South Africa, 9–12 July 2012. [Google Scholar]

- Durmaz, S.B. Analyzing the Quality of Place: Creative Clusters in Soho and Beyoğlu. J. Urban Des. 2014, 20, 93–124. [Google Scholar] [CrossRef]

- Yin, M.; Bertolini, L.; Duan, J. The Effects of the High-Speed Railway on Urban Development: International Experience and Potential Implications for China. Prog. Plan. 2015, 98, 1–52. [Google Scholar] [CrossRef]

- Florida, R. The Rise of the Creative Class: And How It’s Transforming Work, Leisure, Community and Everyday Life; Basic Books: New York, NY, USA, 2002; 404p. [Google Scholar]

- Trip, J.J. What Makes a City: Urban Quality in Euralille, Amsterdam South Axis and Rotterdam Central; OTB Research Institute for Housing, Urban and Mobility Studies, Delft University of Technology: Delft, The Netherlands, 2008; pp. 79–99. [Google Scholar]

- Fang, C.; Zhou, C.; Gu, C.; Chen, L.; Li, S. A proposal for the theoretical analysis of the interactive coupled effects between urbanization and the eco-environment in mega-urban agglomerations. J. Geogr. Sci. 2017, 27, 1431–1449. [Google Scholar] [CrossRef]

- Wang, F.; Wei, X.; Liu, J.; He, L.; Gao, M. Impact of high-speed rail on population mobility and urbanization: A case study on Yangtze River Delta urban agglomeration, China. Transp. Res. Part A 2019, 127, 99–114. [Google Scholar]

- Aschauer, D.A. Is public expenditure productive? J. Monet. Econ. 1989, 23, 177–200. [Google Scholar] [CrossRef]

- Chandra, S.; Vadali, S. Evaluating accessibility impacts of the proposed America 2050 high-speed rail corridor for the Appalachian Region. J. Transp. Geogr. 2014, 37, 28–46. [Google Scholar] [CrossRef]

- Weber, A. Industrial Location Theory. 1997. Available online: economia.unam.mx/cedrus/descargas/Libro%20de%20Weber.pdf (accessed on 23 April 2021).

- Aldieri, L.; Vinci, C.P. Firm Size and Sustainable Innovation: A Theoretical and Empirical Analysis. Sustainability 2019, 11, 2775. [Google Scholar] [CrossRef]

- Yang, X.; Lin, S.; Li, Y.; He, M. Can high-speed rail reduce environmental pollution? Evidence from China. J. Clean. Prod. 2019, 239, 118135. [Google Scholar] [CrossRef]

- Li, X.; Wu, Z.; Zhao, X. Economic effect and its disparity of high-speed rail in China: A study of mechanism based on synthesis control method. Transp. Policy 2020, 99, 262–274. [Google Scholar] [CrossRef]

- Spiekermann, K.; Wegener, M. The shrinking continent: New time-space maps of Europe. Environ. Plan. B Plan. Des. 1994, 21, 653–673. [Google Scholar] [CrossRef]

- Zhang, X.L. Does China’s Transportation Infrastructure Promote Regional Economic Growth? Concurrently on the Spatial Spillover Effect of Transportation Infrastructure. Chin. Soc. Sci. 2012, 3, 60–77. [Google Scholar]

- Delaplace, M.; Pagliara, F.; Perrin, J.; Mermet, S. Can High Speed Rail foster the choice of destination for tourism purpose? Procedia Soc. Behav. Sci. 2014, 111, 166–175. [Google Scholar] [CrossRef]

- Trip, J.J. What Makes a City? Planning for Quality of Place. Sustainable Urban Areas Development; IOS Press: Amsterdam, The Netherlans, 2007. [Google Scholar]

- Andrews, C.J. Analyzing quality-of-place. Environ. Plan. B Plan. Des. 2001, 28, 201–217. [Google Scholar] [CrossRef]

- Shao, S.; Tian, Z.; Yang, L. High speed rail and urban service industry agglomeration: Evidence from China’s Yangtze River Delta Region. J. Transp. Geogr. 2017, 64, 174–183. [Google Scholar] [CrossRef]

- Shaw, S.L.; Fang, Z.; Lu, S.; Tao, R. Impacts of high-speed rail on railroad network accessibility in China. J. Transp. Geogr. 2014, 40, 112–122. [Google Scholar] [CrossRef]

- Zhu, Y.; Diao, M. The impacts of urban mass rapid transit lines on the density and mobility of high-income households: A case study of Singapore. Transp. Policy 2016, 51, 70–80. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of high-speed rail on regional economic disparity in China. J. Transp. Geogr. 2017, 65, 80–91. [Google Scholar] [CrossRef]

- Zheng, S.; Matthew, E. Kahn China’s bullet trains facilitate market integration and mitigate the cost of megacity growth. Proc. Natl. Acad. Sci. USA 2013, 110, E1248–E1253. [Google Scholar]

- Diao, X.; Harttgen, K.; McMillan, M. The Changing Structure of Africa’s Economies. World Bank Econ. Rev. 2017, 31, 412–433. [Google Scholar] [CrossRef]

- Vickerman, R. Location, accessibility, and regional development: The appraisal of trans-European networks. Transp. Policy 1995, 2, 225–234. [Google Scholar] [CrossRef]

- Li, H.; Liu, Y.; Peng, K. Characterizing the relationship between road infrastructure and local economy using structural equation modeling. Transp. Policy 2018, 61, 17–25. [Google Scholar] [CrossRef]

- Zhang, Q.; Nie, X. High-Speed Rail Construction and the Regional Economic Integration in China. Mod. Urban Res. 2010, 6, 7–10. [Google Scholar]

- Li, F.; Su, Y.; Xie, J.; Zhu, W.; Wang, Y. The Impact of High-Speed Rail Opening on City Economics along the Silk Road Economic Belt. Sustainability 2020, 12, 3176. [Google Scholar] [CrossRef]

- Chatman, D.G.; Noland, R.B. Do Public Transport Improvements Increase Agglomeration Economies? A Review of Literature and an Agenda for Research. Transp. Rev. 2011, 31, 725–742. [Google Scholar]

- Lakshmanan, T.R. The broader economic consequences of transport infrastructure investments. J. Transp. Geogr. 2011, 19, 1–12. [Google Scholar] [CrossRef]

- Zhang, P.; Zhao, Y.; Zhu, X.; Cai, Z.; Xu, J.; Shi, S. Spatial structure of urban agglomeration under the impact of high-speed railway construction: Based on the social network analysis. Sustain. Cities Soc. 2020, 62, 102404. [Google Scholar] [CrossRef]

- Khan, H.U.; Awan, M.A. Possible factors affecting internet addiction: A case study of higher education students of Qatar. Int. J. Bus. Inf. Syst. 2017, 26, 261–276. [Google Scholar]

- Royuela, V.; Moreno, R.; Vayá, E. Is the influence of quality of life on urban growth non-stationary in space? A case study of Barcelona. IREA Work. Pap. 2007, 3, 200703. [Google Scholar]

- Lee, J.C.; Won, Y.J.; Jei, S.Y. Study of the Relationship between Government Expenditures and Economic Growth for China and Korea. Sustainability 2019, 11, 6344. [Google Scholar] [CrossRef]

- Keynes, J.M. The General Theory of Money, Interest and Employment. In The CollectedWritings of John Maynard Keynes; Palgrave Macmillan: London, UK, 1936; p. 7. [Google Scholar]

- Harnessing High-Speed Rail: How California and Its Cities Can Use Rail to Reshape Their Growth; SPUR (San Francisco Bay Area Planning and Urban Research Association): San Francisco, CA, USA, 2017.

- Hutchison, T. Adam Smith and The Wealth of Nations. J. Law Econ. 1976, 19, 507–528. [Google Scholar] [CrossRef]

- Balasubramanyam, V.N.; Salisu, M.; Sapsford, D. Foreign Direct Investment and Growth in EP and IS Countries. Econ. J. 1996, 106, 92–105. [Google Scholar] [CrossRef]

- Borenztein, E.; De Gregorio, J.; Lee, J.W. How does foreign direct investment affect economic growth. J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Sothan, S. Causality between foreign direct investment and economic growth for Cambodia. Cogent Econ. Financ. 2017, 5, 1277860. [Google Scholar] [CrossRef]

- Islam, M.A.; Khan, M.A.; Popp, J.; Sroka, W.; Oláh, J. Financial Development and Foreign Direct Investment—The Moderating Role of Quality Institutions. Sustainability 2020, 12, 3556. [Google Scholar] [CrossRef]

- Zhou, Y.; Yang, J.; Huang, Y.; Geoffrey, J.D.H. Research on the impact of high-speed rail on urban land prices and its mechanism: Evidence from microscopic land transactions. China Ind. Econ. 2018, 5, 118–136. [Google Scholar]

- Wang, Y.; Liu, X.; Wang, F. Economic Impact of the High-Speed Railway on Housing Prices in China. Sustainability 2018, 10, 4799. [Google Scholar] [CrossRef]

- Rungskunroch, P.; Yang, Y.; Kaewunruen, S. Does High-Speed Rail Influence Urban Dynamics and Land Pricing? Sustainability 2020, 12, 3012. [Google Scholar] [CrossRef]

- Dong, Y.; Zhu, Y. Can high-speed rail construction reshape China’s economic, spatial layout based on the regional heterogeneity perspective of employment, wages, and economic growth? China Ind. Econ. 2016, 10, 92–108. [Google Scholar]

- Cobb, C.W.; Douglas, P.H. A Theory of Production (PDF). Am. Econ. Rev. 1928, 18, 139–165. [Google Scholar]

- Redding, S.J.; Weinstein, D.E. Measuring Aggregate Price Indexes with Taste Shocks: Theory and Evidence for CES Preferences; NBER: Cambridge, UK, 2016. [Google Scholar]

- Yao, S.; Zhang, F.; Wang, F.; Ou, J. Regional economic growth and the role of high-speed rail in China. Appl. Econ. 2019, 51, 3465–3479. [Google Scholar] [CrossRef]

- Giersch, H. Urban Agglomeration and Economic Growth; Springer: Berlin, Heidelberg, 1995. [Google Scholar]

- Tkachenko, I.; Destruel, C.; Strauss, O.; Puech, W. Sensitivity of different correlation measures to print-and-scan process. Electron. Imaging 2017, 7, 121–127. [Google Scholar] [CrossRef][Green Version]

- Silvestrini, R.T.; Burke, S.E. Linear Regression Analysis with JMP and R; Quality Press: Seattle, WA, USA, 2018. [Google Scholar]

- Moy, R.L.; Chen, L.S.; Kao, L.J. Study Guide for Statistics for Business and Financial Economics: A Supplement to the Textbook by Cheng-Few Lee, John C. Lee and Alice C. Lee; Springer: Berlin, Germany, 2014. [Google Scholar]

- Lee, C.F.; Chen, H.Y.; Lee, J. Financial Econometrics, Mathematics and Statistics; Springer: New York, NY, USA, 2019. [Google Scholar]

- Kleinbaum, D.G.; Kupper, L.L.; Nizam, A.; Rosenberg, E.S. Applied Regression Analysis and other Multivariable Methods; Nelson Education, Cengage Learning: Boston, MA, USA, 2013. [Google Scholar]

- Zou, W.; Chen, L.; Xiong, J. High-Speed Railway, Market Access, and Economic Growth; ADBI Working Paper 852; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar]

- Guo, B.; Ke, J. The Impacts of High-speed Rail on Sustainable Economic Development: Evidence from the Central Part of China. Sustainability 2020, 12, 2410. [Google Scholar] [CrossRef]

- Jayasooriya, S.P. Urban agglomeration and regional economic growth in China. Empir. Econ. Rev. 2019, 33, 281–295. [Google Scholar]

| Variable | Number of Samples | Average Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| Population | 2268 | 1074.412 | 621.9086 | 1 | 2163 |

| Employment | 2268 | 40.6391 | 40.6393 | 0 | 529.3 |

| Investment in Fixed Asset | 2268 | 1133.501 | 654.8572 | 1 | 2267 |

| Foreign Direct Investment | 2268 | 88.88757 | 263.0759 | 0 | 5096 |

| Investment in Real Estate | 2268 | 1132.359 | 654.6318 | 1 | 2264 |

| Park and Green Area | 2268 | 1073.5 | 1692.649 | 0 | 21165 |

| Theaters, Music Halls and Cinemas | 2268 | 12.59392 | 16.58828 | 0 | 201 |

| Hospital and Health Centers | 2268 | 186.6742 | 139.6449 | 1 | 468 |

| Average Wages | 2268 | 1116.421 | 653.7362 | 1 | 2249 |

| Gross Regional Product | 2268 | 1132.756 | 654.5287 | 1 | 2266 |

| Institute of Higher Education | 2268 | 6.835097 | 11.65741 | 0 | 80 |

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|

| Newly opened high-speed railway prefecture-level cities | 4 | 9 | 12 | 10 | 28 | 34 | 49 |

| Total number of prefecture-level cities | 4 | 13 | 25 | 35 | 63 | 97 | 146 |

| GRP | |

|---|---|

| Employment | −0.006 |

| Park and Green Area | 0.000 |

| Theaters, Music Halls and Cinemas | −0.013 |

| Foreign Direct Investment | 0.012 |

| Institute of Higher Education | −0.005 |

| Population | −0.020 |

| Investment in Fixed Assets | 0.062 * |

| Hospitals and Health Centers | −0.001 |

| Average Wages | −0.052 * |

| Investment in Real Estate | 0.138 * |

| Coef. | Std. | z | p > |z| | |

|---|---|---|---|---|

| LNPOP | −0.140 | 0.092 | −1.520 | 0.128 |

| Employment | 0.003 ** | 0.002 | 2.000 | 0.046 |

| LNIFA | 0.271 *** | 0.098 | 2.780 | 0.006 |

| LNIRE | −0.083 | 0.058 | −1.430 | 0.153 |

| LNPG | −0.054 | 0.062 | −0.870 | 0.386 |

| LNHHC | 0.076 | 0.080 | 0.950 | 0.344 |

| LNTCM | 0.040 | 0.051 | 0.790 | 0.430 |

| LNFDI | −0.047 | 0.033 | −1.410 | 0.159 |

| LNAW | 0.402 ** | 0.168 | 2.390 | 0.017 |

| Institute of Higher Education | −0.009 * | 0.005 | −1.810 | 0.070 |

| Constant | −7.763 *** | 1.399 | −5.550 | 0.000 |

| LR Chi-Square | 55.490 | Pseudo R-squared | 4.19% | |

| Prob of Chi-square | 0.000 |

| Variable | Sample | Treated | Controls | Difference | S.E. | T-Stat |

|---|---|---|---|---|---|---|

| LNGRP | Unmatched | 16.29 | 15.99 | 0.30 | 0.07 | 4.61 |

| ATT | 16.29 | 16.28 | 0.02 | 0.09 | 0.16 |

| Coef. | Std. Error | t | p > |t| | |

|---|---|---|---|---|

| LNPOP | 0.18 *** | 0.01 | 13.11 | 0.00 |

| Employment | 0.00 *** | 0.00 | 14.82 | 0.00 |

| LNIFA | 0.52 *** | 0.01 | 34.89 | 0.00 |

| LNIRE | 0.03 *** | 0.01 | 3.01 | 0.00 |

| LNPG | 0.14 *** | 0.01 | 14.49 | 0.00 |

| LNHHC | −0.04 *** | 0.01 | −3.19 | 0.00 |

| LNTCM | 0.06 *** | 0.01 | 7.94 | 0.00 |

| LNFDI | 0.04 *** | 0.00 | 8.79 | 0.00 |

| LNAW | 0.18 *** | 0.03 | 7.18 | 0.00 |

| Institute of Higher Education | −0.01 *** | 0.00 | −9.18 | 0.00 |

| Year*City | −0.01 | 0.04 | −0.35 | 0.73 |

| City | 0.00 | (omitted) | ||

| Year | 0.03 | 0.03 | 1.02 | 0.31 |

| Constant | 3.54 *** | 0.20 | 17.63 | 0.00 |

| F-statistics | 1809.47 | R-squared | 91.44% | |

| Probability of f | 0.000 | Adjusted R-squared | 91.39% |

| Coef. | Std. Error | t | p > |t| | |

|---|---|---|---|---|

| LNPOP | 0.18 *** | 0.02 | 9.09 | 0.00 |

| Employment | 0.00 *** | 0.00 | 6.59 | 0.00 |

| LNIFA | 0.52 *** | 0.02 | 26.48 | 0.00 |

| LNIRE | 0.03 * | 0.02 | 1.90 | 0.06 |

| LNPG | 0.14 *** | 0.02 | 7.63 | 0.00 |

| LNHHC | −0.04 *** | 0.01 | −3.11 | 0.00 |

| LNTCM | 0.06 *** | 0.01 | 7.41 | 0.00 |

| LNFDI | 0.04 *** | 0.01 | 7.33 | 0.00 |

| LNAW | 0.18 *** | 0.03 | 5.17 | 0.00 |

| Institute of Higher Education | −0.01 *** | 0.00 | −7.84 | 0.00 |

| Year*City | −0.01 | 0.03 | −0.37 | 0.71 |

| City | 0.00 | (omitted) | ||

| Year | 0.03 | 0.03 | 1.08 | 0.28 |

| Constant | 3.54 *** | 0.31 | 11.58 | 0.00 |

| F-statistics | 1687.83 | R-squared | 91.44% | |

| Probability of f | 0.000 |

| Coef. | Std. Error | t | p > |t| | |

|---|---|---|---|---|

| LNPOP | 0.28 *** | 0.09 | 3.29 | 0.00 |

| Employment | 0.01 *** | 0.00 | 3.53 | 0.00 |

| LNIFA | 0.43 *** | 0.07 | 6.26 | 0.00 |

| LNIRE | 0.11 * | 0.05 | 2.00 | 0.05 |

| LNPG | 0.04 | 0.04 | 1.07 | 0.29 |

| LNHHC | −0.01 | 0.06 | −0.12 | 0.90 |

| LNTCM | 0.01 | 0.04 | 0.36 | 0.72 |

| LNFDI | 0.05 * | 0.02 | 1.99 | 0.05 |

| LNAW | 0.55 *** | 0.19 | 2.95 | 0.00 |

| Institute of Higher Education | −0.01 *** | 0.00 | −4.06 | 0.00 |

| Constant | 0.11 | 1.40 | 0.08 | 0.94 |

| F-statistics | 206.84 | R-squared | 93.83% | |

| Probability of f | 0.000 |

| Coef. | Std. Error | t | p > |t| | |

|---|---|---|---|---|

| LNPOP | 0.18 *** | 0.02 | 8.79 | 0.00 |

| Employment | 0.00 *** | 0.00 | 6.53 | 0.00 |

| LNIFA | 0.52 *** | 0.02 | 26.39 | 0.00 |

| LNIRE | 0.03 * | 0.02 | 1.68 | 0.09 |

| LNPG | 0.14 *** | 0.02 | 7.81 | 0.00 |

| LNHHC | −0.04 *** | 0.01 | −3.20 | 0.00 |

| LNTCM | 0.06 *** | 0.01 | 7.53 | 0.00 |

| LNFDI | 0.04 *** | 0.01 | 7.10 | 0.00 |

| LNAW | 0.18 *** | 0.04 | 5.14 | 0.00 |

| Institute of Higher Education | −0.01 *** | 0.00 | −7.64 | 0.00 |

| Constant | 3.56 *** | 0.31 | 11.62 | 0.00 |

| F-statistics | 1900.39 | R-squared | 91.41% | |

| Probability of f | 0.000 |

| Outcome Var | LNGRP | Standard Error | t-Statistics | Probability | |

|---|---|---|---|---|---|

| Before | |||||

| Control | 3.538 | ||||

| Treated | 3.525 | ||||

| Diff (T-C) | −0.013 | 0.037 | −0.35 | 0.727 | |

| After | |||||

| Control | 3.565 | ||||

| Treated | 3.552 | ||||

| Diff (T-C) | −0.013 | 0.037 | 0.35 | 0.727 | |

| Diff-in-Diff | 0.00 | ||||

| R-square: | 91% |

| GRP | Coef. | Std. Err. | t | p > |t| |

|---|---|---|---|---|

| Employment | 0.162 | 0.633 | 0.260 | 0.798 |

| Park and Green Area | 0.004 | 0.014 | 0.280 | 0.783 |

| Theaters, Music Halls and Cinemas | −0.421 | 0.915 | −0.460 | 0.645 |

| Foreign Direct Investment | 0.042 | 0.068 | 0.620 | 0.538 |

| Institute of Higher Education | 0.150 | 1.776 | 0.080 | 0.933 |

| Population | −0.024 | 0.024 | −1.020 | 0.309 |

| Investment in Fixed Assets | 0.049 ** | 0.021 | 2.310 | 0.021 |

| Hospitals and Health Centers | −0.002 | 0.098 | −0.020 | 0.983 |

| Average Wages | −0.064 *** | 0.022 | −2.870 | 0.004 |

| Investment in Real Estate | 0.131 *** | 0.021 | 6.220 | 0.000 |

| Constant | 1016.535 | 51.580 | 19.710 | 0.000 |

| F (10,2257) | 5.85 | R-squared | 2.53% | |

| Probability of F | 0.000 |

| Variable | VIF | 1/VIF |

|---|---|---|

| Employment | 3.57 | 0.28 |

| Park and Green Area | 2.99 | 0.33 |

| Institute of Higher Education | 2.32 | 0.43 |

| Foreign Direct Investment | 1.71 | 0.58 |

| Theaters, Music Halls and Cinemas | 1.24 | 0.80 |

| Population | 1.17 | 0.86 |

| Average Wages | 1.15 | 0.87 |

| Investment in Fixed Assets | 1.05 | 0.96 |

| Investment in Real Estate | 1.03 | 0.98 |

| Hospital and Health Centers | 1.01 | 0.99 |

| Mean VIF | 1.72 | |

| Breusch–Pagan/Cook–Weisberg Test for Heteroskedasticity | |

|---|---|

| Chi-square | 73.83 |

| Probability Value | 0.00 |

| Variables | Coef. | Std. Error | T | p > |t| |

|---|---|---|---|---|

| Employment | 0.162 | 0.666 | 0.240 | 0.808 |

| Park and Green Area | 0.004 | 0.012 | 0.310 | 0.758 |

| Theaters, Music Halls and Cinemas | −0.421 | 0.825 | −0.510 | 0.610 |

| Foreign Direct Investment | 0.042 | 0.052 | 0.800 | 0.425 |

| Institute of Higher Education | 0.150 | 1.734 | 0.090 | 0.931 |

| Population | −0.024 | 0.024 | −1.010 | 0.312 |

| Investment in Fixed Assets | 0.049 ** | 0.022 | 2.180 | 0.029 |

| Hospitals and Health Centers | −0.002 | 0.096 | −0.020 | 0.983 |

| Average Wages | −0.064 *** | 0.022 | −2.900 | 0.004 |

| Investment in Real Estate | 0.131 *** | 0.023 | 5.660 | 0.000 |

| Constant | 1016.535 *** | 46.678 | 21.780 | 0.000 |

| F (10,2257) | 5.120 | R-squared | 2.53% | |

| Probability of F | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, S.; Dhakal, P.R.; Wu, Z. The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability 2021, 13, 4820. https://doi.org/10.3390/su13094820

Lin S, Dhakal PR, Wu Z. The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability. 2021; 13(9):4820. https://doi.org/10.3390/su13094820

Chicago/Turabian StyleLin, Shanlang, Prithvi Raj Dhakal, and Zhaowei Wu. 2021. "The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place" Sustainability 13, no. 9: 4820. https://doi.org/10.3390/su13094820

APA StyleLin, S., Dhakal, P. R., & Wu, Z. (2021). The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability, 13(9), 4820. https://doi.org/10.3390/su13094820