1. Introduction

Taxes can be used to guide the economy to achieve specific social or economic goals. Therefore, an important problem is to determine the optimal amount of taxes and the structure of the tax system that will enable the creation of economic growth, stimulation of production, consumption and investment [

1]. The construction of an effective tax system is one of the basic tasks of fiscal policy. On the one hand, this system should provide the state with significant revenues necessary to cover budgetary expenses, and on the other hand, it should not act as a brake on economic growth. Today, the VAT tax is the one that provides the EU Member States’ budgets with the highest revenues [

2]. In its assumption, it is a very simple tax, but the multiplicity of rates, the often-ambiguous assignment of products to individual rates, as well as discrepancies in taxation between countries mean that it is often the subject of tax fraud. Individual countries are trying to seal the tax system as fully as possible, but there is still talk of a VAT gap [

3].

Value added tax system in the European Union, which is based on legislation adopted at the EU level and applied on a national level, has numerous shortcomings resulting in the fact that it is not fully efficient and compatible with the requirements of a real single market, and structural solutions integrated into the power of statutory provisions are vulnerable to fiscal abuse [

4]. The evidence of difficulties in the functioning of VAT in the EU was published in the Green Book in 2010 [

5] in which the European Commission emphasized the complexity of the VAT system and the susceptibility to tax fraud. It has been noted that the costs of VAT compliance represent a significant administrative burden for EU businesses, which makes the EU area less and less attractive to invest.

The essence of VAT, as a levy imposed on the generated added value, consists in paying a part of the tax at each stage of the sales chain, which decentralizes the risk of the seller evading payment. On the other hand, the number of transactions and entities to be controlled is increasing, making it difficult to supervise the tax authorities and increasing the costs of tax collection. The functioning of many tax rates exacerbates the problem [

6]. In all Member States, except Denmark, there are also one or two reduced rates in addition to the standard rate [

3]. The aim of these considerations is therefore to analyse the impact of the standard VAT rate and the number of rates on the efficiency of this tax collection. In the research, a comparison was made of the effective VAT rate in relation to the standard rate in individual European Union countries. The relationship between the value of the basic VAT rate along with the number of preferential rates and the scale of the tax gap was also examined. Data from 2011–2019 were analysed. It was a period of relatively good economic condition, during which state economies developed steadily. Therefore, an improvement in the efficiency of tax collection can be expected. For the purposes of the considerations, a research hypothesis were formulated:

Hypothesis 1. A tax system with a low standard VAT rate is the least susceptible to tax fraud.

Hypothesis 2. Countries with tax systems with a small number of reduced rates are characterized by greater collection efficiency, and thus a smaller VAT gap.

2. Review of the Literature

VAT (an indirect tax, levied at every stage of the sales of goods and services) is widely used in many countries of the world, due to the high fiscal performance [

6]. It was first introduced in France in 1954. Even at the end of the 1960s, VAT operated in less than 10 countries around the world, and now it (or ones of a similar nature—GST tax) is collected in more than 160 countries around the world. Currently, all members of the European Union are obliged to introduce VAT in the form of a value added tax [

7]. The value added tax is an important part of revenues of the European Union and its Member States [

8].

Mundell [

9,

10], McKinnon [

11] and Kennen [

12] may be mentioned as a few of the authors of the single optimum currency area, a concept based on the free movement of goods, people (labour) and capital under conditions of one currency. Nonetheless, this concept devotes little attention to taxes and their differentiation in the member states. Tax systems of individual Member States are significantly diversified, which results from historical, cultural or social factors, and thus determining the financial needs of the state. Taxes, even in the area of one country, are not neutral to economic processes, so such neutrality was hard to expect in case of integration of countries which in many respects are strongly diversified. When the Treaty of Rome was established (1957), it was recognized that in order to achieve a single internal market, indirect taxes should be harmonized, and customs barriers eliminated. It was then recognized that the impact of direct taxes (CIT and PIT) is not significant for the functioning of the single market [

13].

Initially, VAT was only imposed in France. Considering the conclusions of a special report published in 1963 by the so-called Neumark Committee, the Commission accepted and made a recommendation to introduce this tax in all countries of the European Community [

14]. Then, in 1967–1977, six directives were issued, which created the formal basis for the introduction of a uniform tax on goods and services. Among the six directives issued, the following had the greatest impact on the shape of VAT in the European Union [

15]:

First Council Directive 67/227/EEC of 11 April 1967 on the harmonization of the laws of the Member States relating to turnover taxes [

16];

Second Council Directive 67/228/EEC of 11 April 1967 on the harmonization of the laws of the Member States relating to turnover taxes—structure and rules for applying the common system of value added tax [

17];

Sixth Council Directive 77/338/EEC of 17 May 1977 on the harmonization of the laws of the Member States relating to turnover taxes—Common system of value added tax: unified tax base [

18]—the directive is referred to more than once as the “consignment” of European VAT.

Taxation of intra-community transactions is closely related to the establishment of the internal market on 1 January 1993 [

19]. One of its effects was the abolition of customs barriers between the member states, which in turn forced the abolition of the taxation scheme for deliveries and purchases in the European Community based on the procedure of goods export and import [

20,

21]. These terms have been replaced by the names of intra-community supply and intra-community acquisition [

22]. Due to the fact that transactions of this type concern the tax authorities of two Member States, it became necessary to introduce tax rules that would eliminate multiple taxation of the same turnover or, on the other hand, the lack of taxation of a specific transaction. This ‘fair’ taxation is possible through the application of either the principle of origin state or the principle of destination state. The intra-community supply of goods is taxed at 0% rate if the relevant requirements are met [

23]. This means that the invoices issued to buyers do not include the tax amount. The entity issuing the invoice may, however, deduct the amount of input tax.

Among the negative practices that use the structure of the EU value added tax, the VAT carousel should be distinguished [

24]. This term should be understood as a scheme of operation that assumes the execution of transactions (real or fictitious) in which the goods are sold and bought by several entities having their registered office in two or more Member States [

25]. The benefits of such frauds are greater in areas of economic activity where the value added tax system offers preferences, e.g., reduced rates or a 0% rate [

26]. Most often, these are the honest taxpayers, people who are inattentive or unaware of the consequences, in particular those encouraged by ‘easy profit’ or attractive transaction circumstances, that get mixed in the carousel [

27]. VAT carousel is based on the use of mechanism of ICS by entities that perform unauthorized deduction of VAT and the entities acting as missing trader, which after payment of the invoice (including VAT) cease business, not paying the due VAT to the tax authority. The largest of the broken VAT carousels in 2017 was made up of over 200 companies. The goods fictitiously circulated between eleven countries of the European Union [

7].

Each year these and other tax extortion operations or tax evasion lead to significant losses for the EU national budgets [

28,

29]. Tax fraud, along with the grey-economy, has the greatest impact on the VAT gap [

30], which is the result of escaping taxes. The Institute of Financial Policy of the Ministry of Finance in Slovakia defines this term as follows:

tax gap is the difference between the tax actually paid and the tax that should have been paid if all individuals and legal entities declared their activities and transactions in a proper manner, in accordance with the law and the intention of the legislator (the spirit of the law) [

31]. There is also a statement claiming that the tax gap is the sum of all frauds, extortions and unpaid taxes [

28] or, that it is an indicator of the effectiveness of tax enforcement and fulfilment of obligations. The VAT gap is also a tax efficiency indicator or a tax enforcement and an indicator of compliance efficiency. The general concept of estimating the VAT compliance gap is relatively simple. The VAT gap is the difference between potential and actually accumulated income. Formally, it is defined as follows [

32,

33]:

where

VTTLt—VAT total tax liability according to the law (potential VAT revenues) and

VATt—VAT revenues made (accrual approach, i.e., according to ESA). Similarly, the effectiveness of VAT was presented by Christie and Holzner [

34] comparing the actual VAT receipts and the estimated VAT receipts:

The sum of Equations (2) and (3) is 100%. The level of VAT gap according to Equation (2) in individual EU countries is presented in

Table 1. The highest level of the VAT gap is found in Romania, Greece, Italy and Slovakia. The European Commission claims that just in 2017 member states lost approximately €137 billion in VAT revenues [

35].

Among the disadvantages of value added taxes, many economists point to their regressive nature [

37]. These taxes burden the poorest households whose saving ability is usually lower to the greatest extent, and therefore all or most of their income is subject to consumption taxes [

38]. Consequently, the share of consumption taxes—i.e., primarily VAT and excise tax—in the income of people with low earnings is greater [

37]. According to Neumark [

39], taxes and the tax system, apart from internal cohesion, should distinguish the ethical aspect. Therefore, fairness is achieved through tax progression, and it is the state’s duty to build the tax system taking into account the redistributive properties of taxation [

40]. However, in their works Ramsey [

41] or Diamond and Mirrlees [

42] find no reasons for long-term differentiation of consumption tax rates. The preferences of a uniform VAT rate have also been expressed by contemporary economists, the authors of Tax by Design in the report

The Mirrlee’s Review [

43]. According to them, when a modern tax system is concerned, VAT is not an appropriate tool to achieve redistribution. A similar view was also shared by Braz and Cunha [

44], who analyzed the Portuguese VAT system. In the 2011 report, economists emphasized that the unification of VAT would allow for the reduction of the the complexity of the tax system and political lobbying (multiplicity of rates is the result of political assessments, which is typically applied under pressure) [

45]. Similar observations were presented by Böhringer et al., who assessed the effectiveness of VAT in Germany [

46].

The Mirrlees Review also recommended extending VAT practically on all goods and services at a single rate (mentioned here as an example of a uniform GST in New Zealand [

47], but this should be done comprehensively with appropriate legislation amending the package of tax of concerning the individuals and the benefit system [

48]. Analyzing the VAT system in France Kalyva et al. [

49], emphasized the economic arguments in favor of a simple VAT system with a limited use of reduced rates. Their work recommended compensation for the harmonization of VAT rates for the poorest social groups with introducing changes in income tax—as presented in

The Mirrlees Review. Some time ago, other economists: Agha and Haughton, in their work

Designing Vat Systems: Some Efficiency Considerations [

50], were also in favour of a uniform VAT rate. They also pointed to the positive relationship between the value of the basic VAT rate and the number of preferential rates and the scale of the tax gap—in countries with a higher basic rate VAT and a greater number of preferential rates the gap is often larger. The application of reduced VAT rates is also contrary to the principle of value added tax neutrality [

51].

It should be noted that the differentiation of VAT rates also significantly increases the cost of collecting it, therefore by reducing the transparency of the tax system, favours fraud and increases the possibility to legally reduce or even avoid tax [

52,

53]. According to Cammeraat and Crivelli, the reduced rates and exemptions contribute to the VAT gap in Italy [

54]. A similar position is taken by Bukowski et al. regarding the Polish VAT system [

52]. A different approach to this issue was demonstrated by Szczypińska [

55] while examining the relationship between the rates and the VAT gap in the European Union. More than once, the economists have indicated that the uniform VAT rate may also complement the regulatory changes aimed at sealing tax revenues by reducing the incentive to abuse in the system thanks to a significantly lower marginal tax rate in carousel transactions. It is worth noting that the uniform VAT rate is very popular in non-European countries, such as Australia, Canada, Singapore, South Africa and the aforementioned New Zealand [

53].

3. Materials and Methods

The efficiency of the tax system can be analysed in various ways. In addition to the abovementioned methods, there are also those indicated in

Table 2:

In the study, the determination of tax efficiency is understood as the relation of VAT revenues to consumer expenditures reduced by VAT:

As defined by Eurostat: final consumption expenditure is expenditure by resident institutional units—including households and enterprises whose main economic center of interest is in that economic territory—on goods or services that are used for the direct satisfaction of individual needs or wants or the collective needs of members of the community. Therefore, VAT is charged as a percentage of the price, that is:

The average tax paid in the economy will be the relation:

A similar position was presented in the work by Daniel et al. [

57]. Such a relation makes it possible to compare the effectiveness of VAT collection with the VAT rates in force in each country, which enables examination of the relationship between the results calculated using Equation (4) with the results of the compliance gap index presented in

Table 1.

Assuming the improvement in the effectiveness of VAT collection as the expected state, the above relation has been described on the timeline using a square function in its general form:

where

y’(

t)—the theoretical value of VAT efficiency and

t = 1, 2, …,

n the subsequent years of analysis.

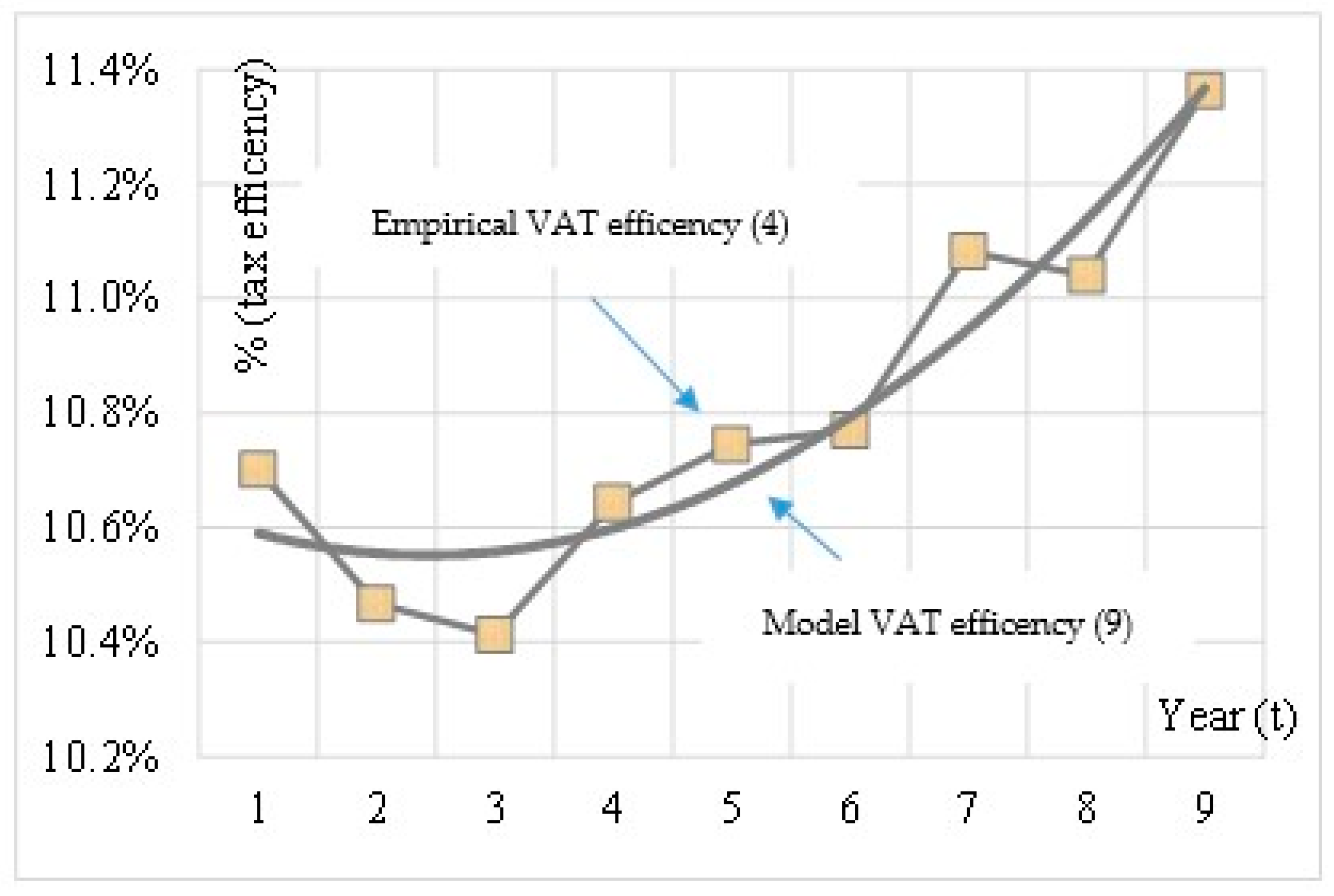

A situation in which the efficiency of VAT collection increases is expected (

Figure 1). The rate at which the efficiency level changes may vary. The quadratic model together with the parameter significance test allows you to easily capture the model behaviour of VAT efficiency. The significance of all model parameters was tested (9):

- (1)

H0: a = 0; against H1: a ≠ 0;

no grounds for rejecting the null hypothesis means that the VAT efficiency is linear, rejection of the null hypothesis means that the VAT efficiency changes according to the quadratic model;

- (2)

H0: b = 0; against H1: b ≠ 0;

no grounds for rejecting the null hypothesis (along with H0: a = 0) means that the VAT efficiency is constant over time, rejection of the null hypothesis means that the VAT efficiency significantly changes over time;

- (3)

H0: c = 0; against H1: c ≠ 0;

no grounds for rejecting the null hypothesis means zero VAT efficiency for t = 0 (possible to obtain only theoretically), rejection of the null hypothesis c ≠ 0 (with H0: a = 0 and H0: a = 0) means constant VAT efficiency.

The model (9) was estimated by the least squares method, and the significance of the model coefficients—by the Student’s t-test. The study presents the significance level of the test, the values of p < 0.05 were treated as evidence of the significance of the tested parameter (enabling the rejection of H0 and adoption of H1).

Such an approach can be treated as an extension of the approach to the description of effectiveness presented in in the work of Daniel and others. The approach based on estimating the quadratic function is justified in Janský [

59]. On the basis of the QUAIDS model, Janský assessed the reforms of VAT rates in the Czech Republic, i.e., the effects on consumption expenditure in selected product groups. The advantage of quadratic modelling is that it is very easy to determine the effectiveness of tax rate reform decisions

Due to the fact that the explanatory variable in the model (9) is time, it is quite an important limitation. The model has all the disadvantages of time-based models, i.e., it does not grant conclusions about the effectiveness of the reforms introduced in the analysed period of time and affect the tax system of other potentially significant fundamental factors, but merely shows the total effect of the changes. Therefore, general observations are far more important than individual description of each country. Taking into account the fact that the entire population of the European Union countries was studied, the general outcome concerning changes in the VAT efficiency, the link with the size of the basic rate and the link with the number of rates is justified. A model treating time as an independent variable can be considered as describing the studied phenomenon well if it is significant as a whole and not only in terms of individual structural factors. Therefore, the significance of the obtained models was determined using the F test.

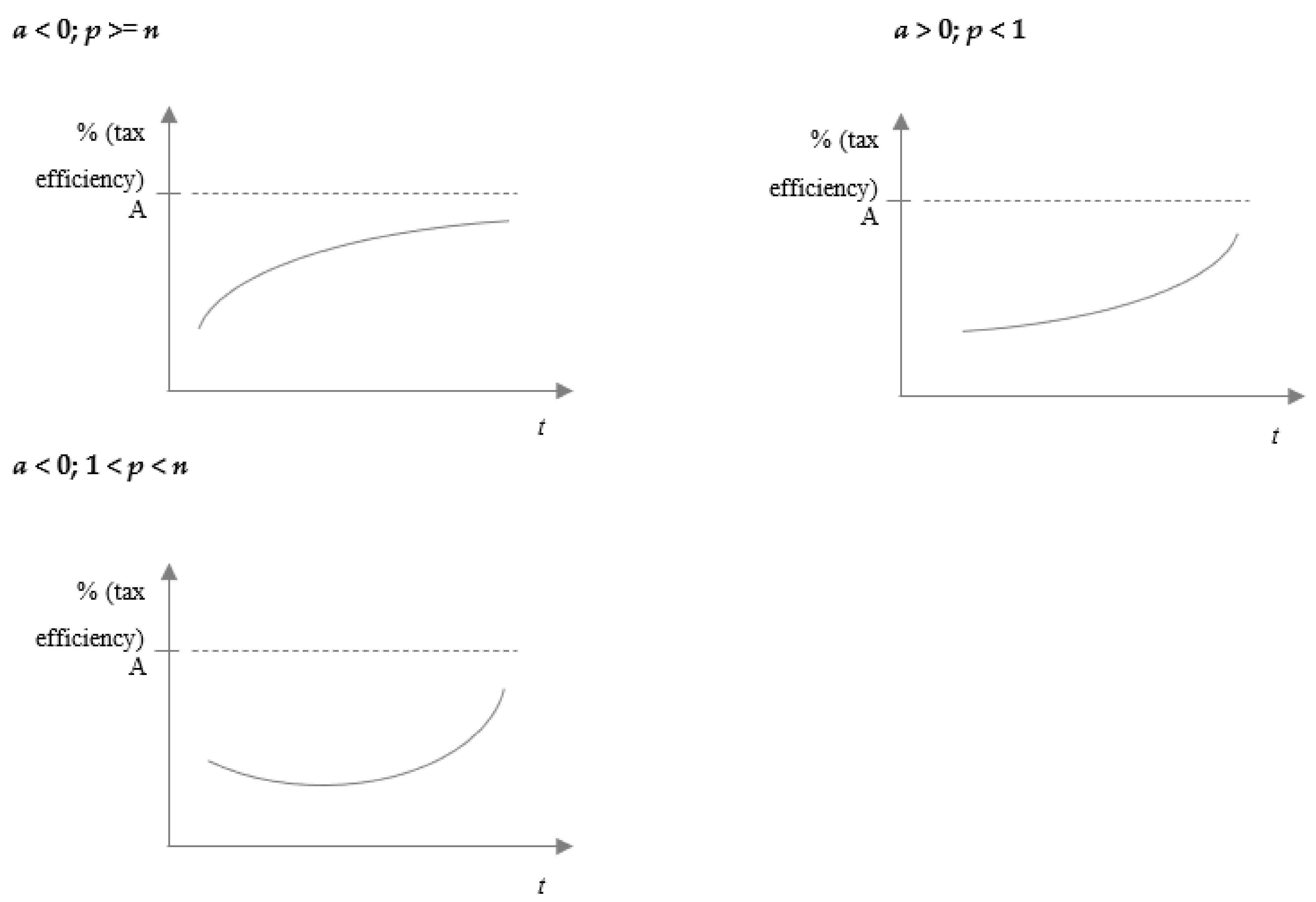

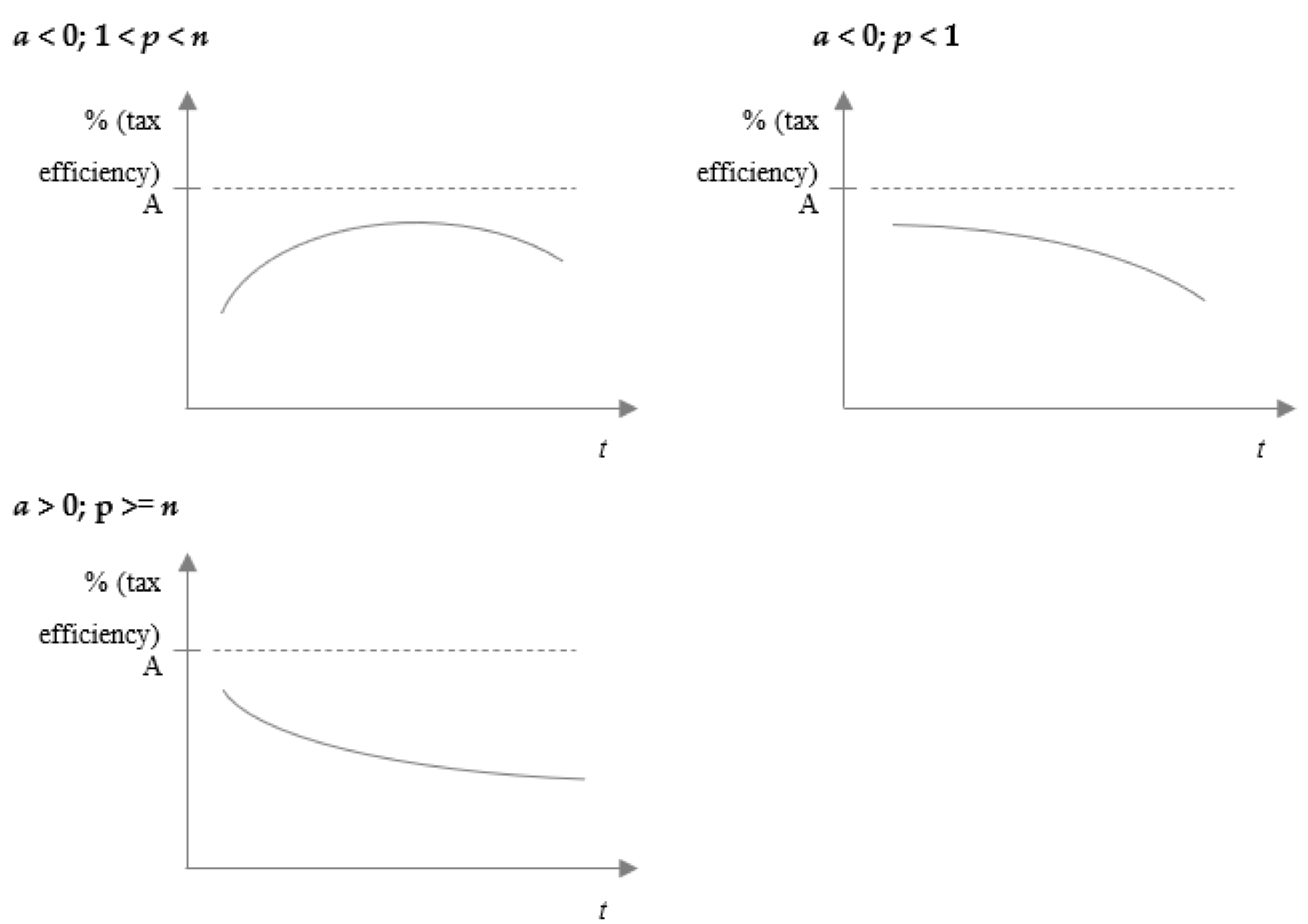

The features of the quadratic function described in

Figure 2 and

Figure 3, related to the location of the vertex, the direction and the shoulder width, allow to identify the turning point, the force and the direction in which the efficiency of tax collection is measured. The situations presented in

Figure 2 relate to the improvement of collection efficiency, and the situations presented in

Figure 3 relate to the deterioration of tax collection efficiency.

If we assume that there is only one basic rate of VAT in the economy—marked by A, without reduced rates as well as allowances and exemptions, the tax collection system would be fully effective if:

In reality, however, the presence of reduced rates, the system of reliefs and exemptions, as well as tax fraud cause that:

The problem is how does the ratio of value y’(t) to the basic rate of At changes in the time function. What is expected is the difference between y’(t) and the basic rate At to be reduced. This can be achieved, first and foremost, by reducing tax fraud, limiting the number of products eligible for reduced rates, and decreasing allowances and the number of exemptions. A stable tax system, however, is one in which the rates remain unchanged for a longer period of time, so the basis for improving the efficiency of VAT collection should be the reduction of tax fraud.

Depending on the obtained model parameters, six variants are possible. Considering the following situations, it is worth presenting the general model in a canonical form:

where (

p;

q) is the vertex of the quadratic function. There are relationships between the canonical form (12) and the general form (9):

Model (12) and model (9) are equivalent. But from the point of view of testing the significance of structural parameters, it is easier to use model (9), while the position of the truncated apex p is important from the point of view of VAT efficiency assessment, as discussed below.

In order to consider the tax system as effective or one in which its effectiveness has improved, the values of the model parameters should meet the following relationships (

Figure 2):

a < 0; p ≥ n—the arms of the parable are directed downwards (a < 0), but in the observed time period the apex of the parable (max) has not been reached yet (p ≥ n), it means that the efficiency is slowly improving (situation 1);

a > 0; p < 1—the arms of the parable are pointing upwards (a > 0), the apex of the parable (min) occurred before the first year of the analysis (p < 1), it means that the efficiency improves very quickly (situation 2);

a > 0; 1 < p < n—arms of the parable are pointing upwards (a > 0), the apex of the parable (min) occurred during the analysis period (1 < p < n), it means that the efficiency after deterioration in the first part of the analysis (before year t, for which y’(t) = q (point (p; q)); improves very quickly in the second part of the analysis period (situation 3);

On the other hand, the tax system can be considered ineffective or one in which its effectiveness deteriorates, if the values of the model parameters meet the dependencies (

Figure 3):

a < 0; 1 < p < n—the arms of the parable are directed downwards (a < 0), the apex of the parable (max) was reached in the observed time period (1< p < n), which means that despite the initial improvement in efficiency in the second part of the period it has worsened (situation 4); it may also be the result of a reduction in VAT rates;

a < 0; p < 1—the arms of the parable are directed downwards (a < 0), the apex of the parable (max) occurred before the first year of the analysis (p < 1), which means that the efficiency deteriorates very quickly (situation 5);

a > 0; p ≥ n—the arms of the parable are pointing upwards (a > 0), the apex of the parable (min) has not been reached yet (p ≥ n), which means that the efficiency is slowly deteriorating (situation 6).

The paper presents research carried out for 27 European Union countries for the periods 2011–2019. The efficiency of VAT collection was modelled using square function, determining the significance of the parameters of this function, as well as the value of abscissa, which made it possible to group the countries based on how they maintain the efficiency of VAT collection over the analysed period of time. The final part of the study focused on analysing the link between the efficiency of tax collection and the amount of the basic rate and the number of rates.

4. Results

The 2011–2019 period was one of relative peace in the economy, and therefore a time in which an improvement in the efficiency of tax collection would be expected. And so it was, as most countries recorded good results in terms of increasing VAT revenues. Detailed observations allow to conclude that almost all countries were included in the groups described by models in

Figure 2, and thus improving the efficiency of VAT collection (groups 1–3), and only a few in the groups described by models in

Figure 3, and thus deteriorating the efficiency of tax collection VAT (groups 4–6).

During this period, group 1 included: Bulgaria, Estonia, Ireland, Croatia, Latvia and Malta. Among these countries, Ireland and Croatia significantly improved collection efficiency by increasing VAT rates (significant parameter b). On the other hand, Bulgaria, Estonia, Latvia and Malta improved their collection efficiency without increasing rates, and Latvia even lowered it (from 22% to 21%), being the only country in this subgroup where there was a significant improvement in the collection efficiency (significant parameter b). On the border of the first group there are: Czechia, Spain, Hungary and Slovenia (negative a, and the cut off of the vertex p for the last year of the analysis). All these countries have increased their VAT rates which became the primary reason for improving the efficiency of tax collection.

The second group of countries includes Greece, Italy, Cyprus, Austria, Portugal and Slovakia. Among these countries, the VAT rates increased in Greece, Italy, Cyprus, which had a positive impact on the efficiency of collection, however these results are not significant (parameters a and b are statistically insignificant). On the other hand, even though Austria, Portugal and Slovakia did not raise VAT rates, they improved collection efficiency, which turned out to also be statistically insignificant (parameters a and b statistically insignificant).

The third group of countries includes Belgium, Denmark, Germany, France, Lithuania, Netherlands, Poland, Finland and Sweden. Only France, Netherlands and Sweden raised VAT rates. However, in Belgium, France, Lithuania, Netherlands and Poland the strength of changes in the efficiency of tax collection was different, as the coefficient of the model a turned out to be statistically significant. Therefore, it can be presumed that countries that did not increase VAT rates, but improved the efficiency of tax collection, have effectively limited tax fraud.

Years 2011–2019 did not bring an improvement in VAT collection in every country. There are no countries in the fourth and sixth group, with Luxembourg and Romania classified in the fifth group. Romania was placed there because the VAT rate was reduced (from 24% to 19%), whereas Luxembourg raised the VAT rate (from 15% to 17%), and yet it recorded a drop in the collection efficiency (

Table 3).

From the state budget’s point of view, the most important thing is to improve the efficiency of tax collection, and in most countries that is the case. It is worth noting, however, that it becomes possible due to both increasing and decreasing the base rates. Indirectly, it can be concluded that it is not the rate levels, but the fiscal control that may be essential.

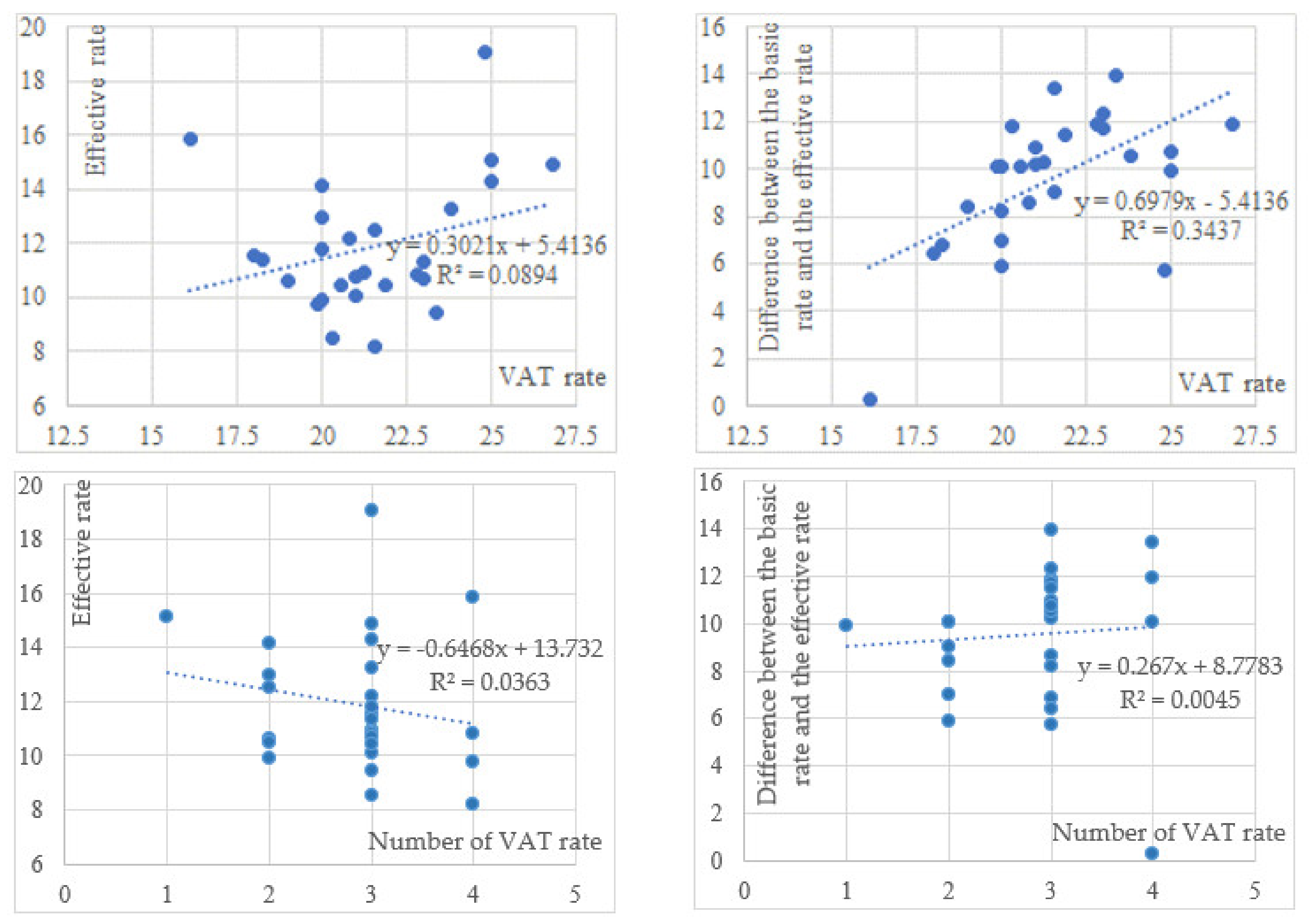

A common problem faced by decision makers is the level of VAT rates. Research for the selected period and group of countries allows for the conclusion that with the increase in VAT rates, the efficiency of collecting the tax increases (

Figure 4), which seems positive from the state budget’s point of view, but at the same time, the disproportion between the basic VAT rate and the effective rate increases, which may suggest an increase in fraud and tax evasion. Moreover, the latter phenomenon turns out to be clearly stronger than the first (coefficient of determination 0.3434 and 0.0894, respectively). On the other hand, the number of VAT rates has a negative impact on the level of the effective rate, but has no significance in shaping the difference between the basic rate and the effective rate.

Growing social expectations concerning public spending mean that policymakers often face a tax rate dilemma. During the analyzed period, some countries decided to increase tax rates. As a rule, such a step brings an absolute increase in tax revenues. However, in such situation, an increase in the phenomenon of the tax gap is noticeable, which results in a relative increase in tax revenues not being as strong as it might be expected. In the present study, it is visible as the disproportion between the basic and effective rate increases, proving that an increase in the standard VAT rate by 1 percentage point causes an increase in the difference between the basic and effective rate by 0.6979 percentage points. Probably as long as the value is lower than 1, the decision makers will see the sense of raising tax rates. In the present study, an increase in the standard VAT rate by 1 percentage point causes an increase in the effective rate by 0.3021 percentage points. However, taking into account the increasing difference between the basic rate and the effective rate, such an action can be regarded as damaging to the market.

In the vast majority of cases the obtained models, although based on a time variable and ignoring the influence of fundamental factors on tax efficiency, turn out to be statistically significant. Only for two countries (Luxembourg and Slovakia), the obtained models were not significant, but the model for Slovakia is on the border of statistical significance (p = 0.0549). So, the general inference made here is absolutely correct.

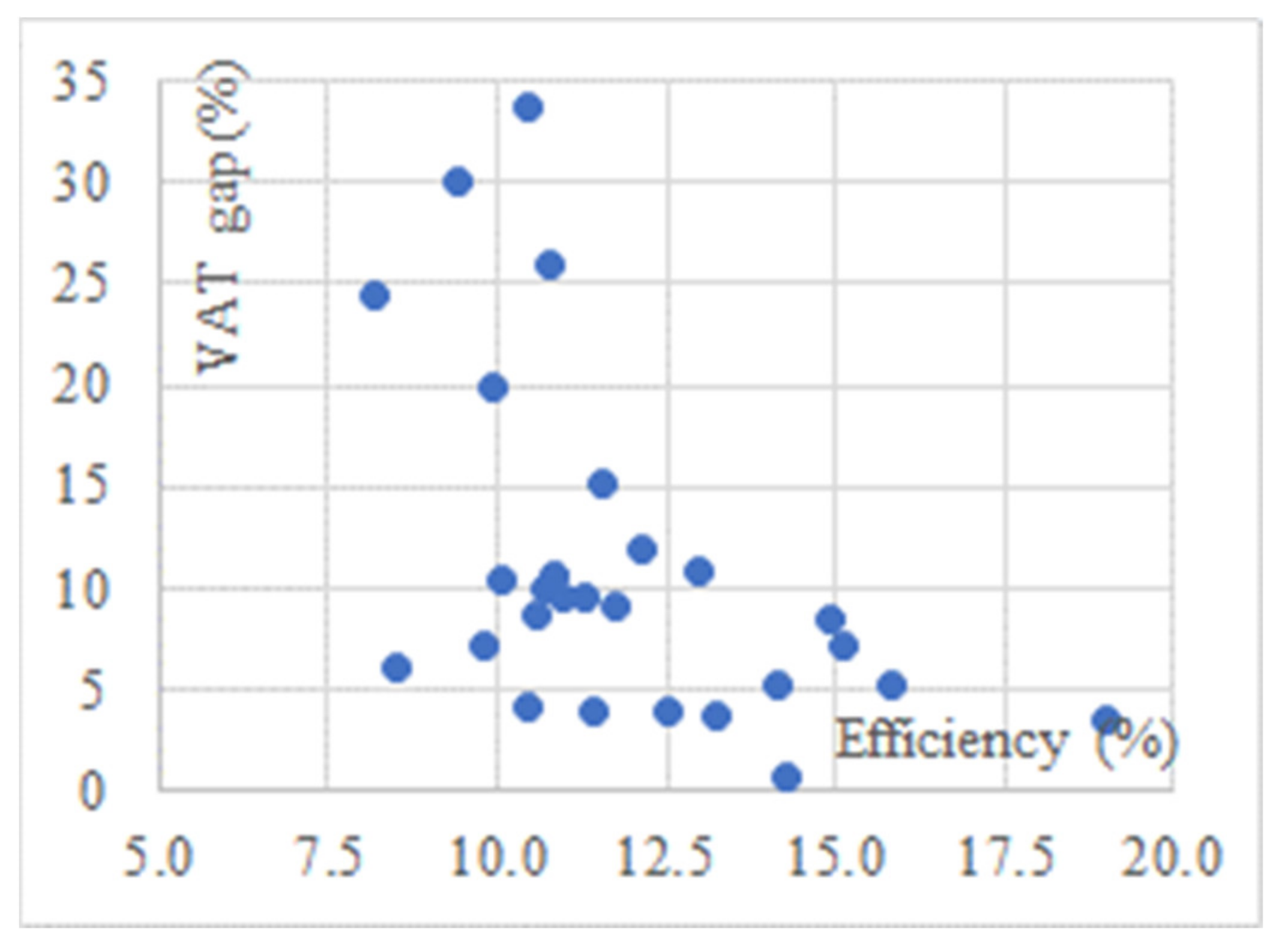

What is worth noting is the fact that the concept of VAT collection efficiency and the concept of the tax gap are closely related. The relationship between the efficiency of tax collection and the tax gap is negative (

Figure 5). The assessment uses the data on the VAT gap as %

VTTL presented in

Table 1 and the data on the efficiency of tax collection estimated according to formula 4. Greater efficiency of VAT collection corresponds to a smaller gap concerning the tax. Due to methodological issues in the assessment of effectiveness and the gaps, it is not a fully functional relationship. Therefore, when discussing the efficiency of tax collection and the tax gap, we refer to the same phenomenon, and the discrepancies in the assessment of the phenomena concern only the method of measurement.

As far as the tax gap (

Table 1) is concerned, five countries with the greatest problem with VAT collection can be identified. These are Greece, Italy, Lithuania, Romania and Slovakia. These countries are also characterized by relatively low efficiency, but apart from Romania, each of them improves this efficiency.

5. Conclusions

During the analysed period, VAT rates were increased in almost all European Union countries. This is the easiest way to increase budget revenues. This is an effective method because, as the situation of the surveyed countries shows, the effective rate increases along with the standard VAT rate. However, the increase in the effective rate is weaker than the increase in the base rate. The fact that the increase of the basic rate does not fully translate into the increase of the effective rate means that the grey tax zone is expanding. From the point of view of the state budget, revenues are growing, but it ‘spoils’ the economy by introducing unfair competition between companies paying VAT and the ones evading it.

When analysing VAT scheme, it is worth looking at the situation in countries that have lowered VAT rates, however improved the effective rate. Lithuania is such a country. In addition, there are countries where VAT rates have not changed and still there has been a marked improvement in the effective tax rate. Such countries (2000–2019) include Estonia, Lithuania, Malta, Poland, Portugal and Slovakia.

In assessing the improvement in the efficiency of VAT collection, an important issue is the difference between the effective rate and the basic rate. It can be presumed that countries with a greater difference face a greater problem of VAT fraud, but these countries should find it easier to improve the collection efficiency by taking anti-fraud measures. Of course, another reason for the significant difference between the effective rate and the basic rate may be the large difference between the basic rate and the reduced rates, as well as the large number of products taxed at the reduced rates. Among the countries with big initial difference between the basic rate and the effective rate there are Belgium, Ireland, Greece, Spain, France, Italy, Latvia, Lithuania, Hungary, Netherlands, Poland, Portugal, Romania, Slovakia, Finland, Sweden and Denmark. After a thorough study into the Czech tax system, it can be noticed that the reduction in the basic rate was accompanied by an increase in the reduced rates. Therefore, it might be assumed that the system with even rates is more effective. It is also worth looking at the situation of other countries not included in the above list. In particular Bulgaria, Germany, Estonia, Croatia, Cyprus and Luxembourg, where the basic VAT rate ranges from 17 to 20%, except for Croatia with the rate at the level of 25%. Apart from Croatia, these are the countries with the lowest VAT rates.

A greater number of VAT rates increases the complexity of the system and does not affect improving the efficiency of its collection [

49]. In the European Union, only Denmark applies a single VAT rate, but this is a high rate (25%) [

60], which makes the system vulnerable to fraud. Although Denmark has a high effective rate, a positive aspect from the state budget’s point of view. Nevertheless, the country found itself among the ones with the largest difference between the effective and the basic rate. Despite lower basic rates, countries such as Estonia and Luxembourg achieve collection efficiency similar to the Danes.

What is also an important issue is the stability of the entire system, which may be regarded as circumstances favourable for effective tax collection. However, in countries such as Belgium, Denmark, Austria and Sweden, VAT rates have not been changed for several years. Meanwhile, due to the different situation of those states with regard to changes in the effective tax rate, it cannot be argued that system’s stability has either favourable or negative effect on the collection efficiency. It can be argued that it is irrelevant.

What is also worth mentioning is the importance of certain additional political and economic conditions. According to Daniel et al. [

57] industrialized, more developed countries are characterized by a higher level of VAT collection efficiency than poor countries. In this study, limited to the countries of the European Union. There have been no specific differences between them in terms of the degree of development, their presence in the euro area or the period of their membership in the European Union. Countries from the “old 15”, countries with higher GDP or countries from the euro area may face problems related to VAT collection in a similar manner as the countries admitted to the European Union in the last twenty years, countries with lower GDP or countries outside the euro area.

All countries struggle with tax evaders [

55]. It does not depend on the well-established market system or the degree of economic development. The general conclusion that emerges from the research is that, a tax system with a small number of reduced rates, and preferably with one relatively low standard rate, is the system least susceptible to tax fraud. Such a system is easy to control, and at the same time the temptation to tax fraud is definitely lower than in systems with high basic rates numerous discounts and exemptions and a large difference between the basic rate and the reduced rates [

61].

This study will allow for further investigation into the strategy of determining the optimal VAT rate and research on the process of its unification. The proposed changes may contribute to increasing the efficiency of the VAT administration, reducing the shadow economy as well as tax fraud and positively influencing economic growth. In this way, there may be a reduction in discrepancies and even approximation of VAT rate structures across the EU not involving the EU harmonization process, however, by means of the process of natural convergence of national VAT policies. The authors recommend introducing a single VAT rate combined with a modification of the tax on natural persons or social transfers, so that the unification of the rate does not worsen the situation of the poorest social groups. However, such actions must be considered at national level and must be subject to detailed analysis.