Blood Diamonds and Ethical Consumerism: An Empirical Investigation

Abstract

1. Introduction

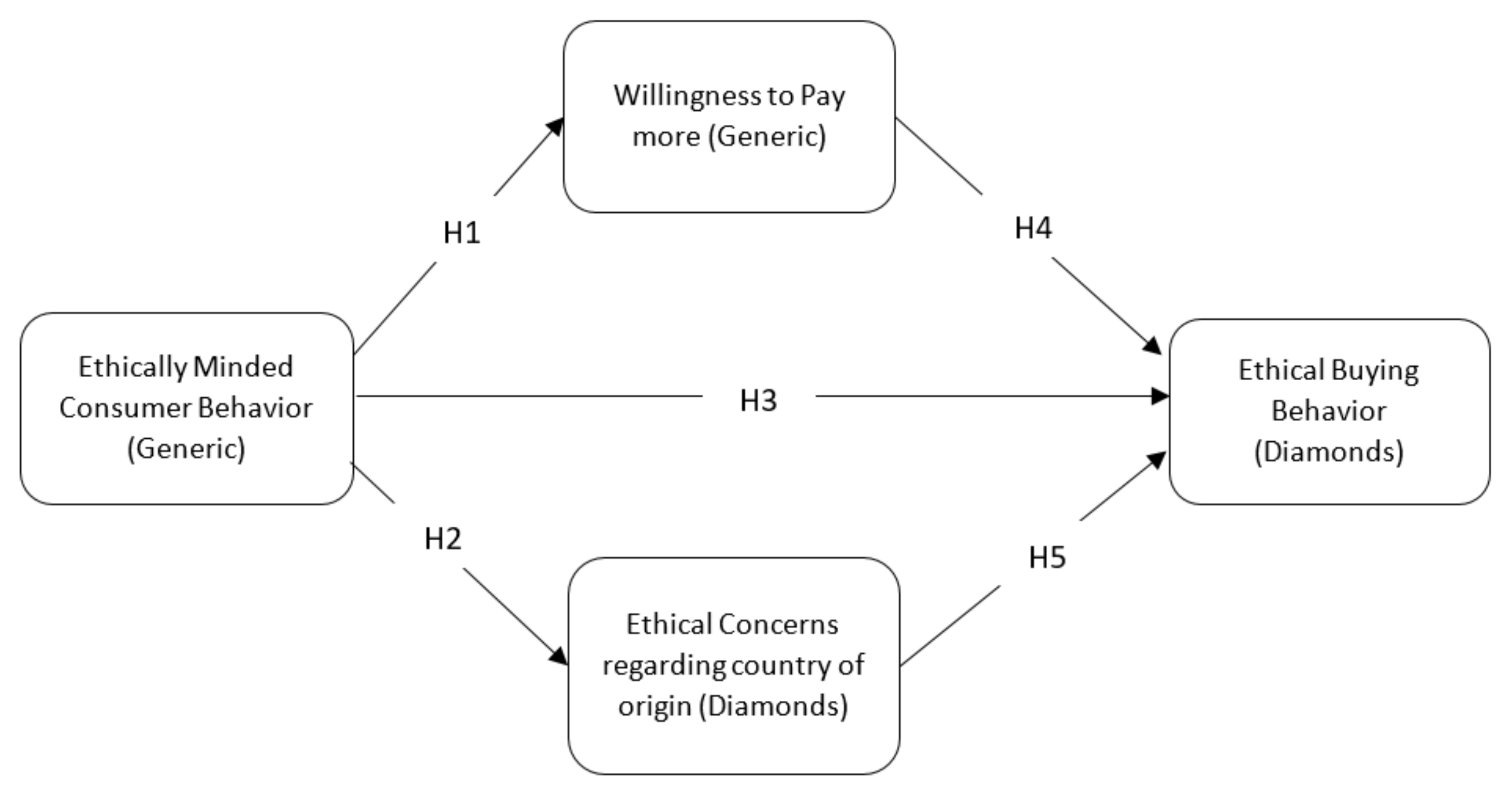

- Develop and validate a multi-dimensional framework to examine the ethical buying behavior of consumers in the diamond industry;

- Assess the relationships between constructs to capture how the consumers’ “generic” ethical attitude and buying behavior is translating into the ethical concerns regarding the country of origin of diamonds and their ethical buying behavior of diamonds; and

- Examine the moderating effects of consumer income level on the intricate relationships between the constructs.

2. Literature Review

2.1. Ethical Issues in the Diamond Industry

2.2. The Kimberley Process Certification Scheme (KPCS)

2.3. Ethical Consumerism in the Luxury and Diamond Industry

2.4. Willingness to Pay More for Ethical Luxury Goods and Diamonds

3. Conceptual Framework and Hypothesis Development

3.1. Ethically Minded Consumer Behavior (Generic) and Willingness to Pay More (Generic)

3.2. Ethically Minded Consumer Behavior (Generic) and Ethical Concerns Regarding Country of Origin (Diamonds)

3.3. Ethically Minded Consumer Behavior (Generic) and Ethical Buying Behavior (Diamonds)

3.4. Willingness to Pay More (Generic) and Ethical Buying Behavior (Diamonds)

3.5. Ethical Concerns Regarding Country of Origin (Diamonds) and Ethical Buying Behavior (Diamonds)

3.6. Moderating Effects of Buyers’ Income Level on the Relationships

4. Materials and Methods

5. Findings

5.1. Model Fit of the Structural Model

5.2. Relationships between Ethical Consumerism Constructs (H1–H5)

5.3. Moderating Effects of Income on the Relationships between Ethical Consumerism Constructs (H6a–H6e)

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Boehm, R.; Kitchel, H.; Ahmed, S.; Hall, A.; Orians, C.M.; Stepp, J.R.; Robbat, A., Jr.; Griffin, T.S.; Cash, S.B. Is Agricultural Emissions Mitigation on the Menu for Tea Drinkers? Sustainability 2019, 11, 4883. [Google Scholar] [CrossRef]

- Carrigan, M.; Attalla, A. The Myth of the Ethical Consumer—Do Ethics Matter in Purchase Behaviour? J. Consum. Mark. 2001, 18, 560–578. [Google Scholar] [CrossRef]

- Davies, I.A.; Lee, Z.; Ahonkhai, I. Do Consumers Care About Ethical-Luxury? J. Bus. Ethics 2012, 106, 37–51. [Google Scholar] [CrossRef]

- Bucic, T.; Harris, J.; Arli, D. Ethical Consumers Among the Millennials: A Cross-National Study. J. Bus. Ethics 2012, 110, 113–131. [Google Scholar] [CrossRef]

- Harrison, A.; Scorse, J. Multinationals and Anti-Sweatshop Activism. Am. Econ. Rev. 2010, 100, 247–273. [Google Scholar] [CrossRef]

- Khan, Z.R.; Rodrigues, G.; Balasubramanian, S. Ethical Consumerism and Apparel Industry-Towards a New Factor Model. World J. Soc Sci. 2017, 7, 89–104. [Google Scholar] [CrossRef]

- Shaw, D.; Riach, K. Embracing Ethical Fields: Constructing Consumption in the Margins. Eur. J. Mark. 2011, 45, 1051–1067. [Google Scholar] [CrossRef]

- Moraes, C.; Carrigan, M.; Bosangit, C.; Ferreira, C.; McGrath, M. Understanding Ethical Luxury Consumption Through Practice Theories: A Study of Fine Jewellery Purchases. J. Bus. Ethics 2017, 145, 525–543. [Google Scholar] [CrossRef]

- Koyame, M. United Nations Resolutions and the Struggle to Curb the Illicit Trade in Conflict Diamonds in Sub-Saharan Africa. Afr. J. Leg. Stud. 2005, 1, 80–101. [Google Scholar] [CrossRef]

- Fishman, J.L. Is Diamond Smuggling Forever—The Kimberley Process Certification Scheme: The First Step down the Long Road to Solving the Blood Diamond Trade Problem. Univ. Miami Bus. Law Rev. 2004, 13, 217. [Google Scholar]

- Schulte, M.; Paris, C.M. Blood Diamonds: An Analysis of the State of Affairs and the Effectiveness of the Kimberley Process. Int. J. Sustain. Soc. 2020, 12, 51–75. [Google Scholar] [CrossRef]

- Security Council Votes to Continue Ban on Rough Diamonds from Sierra Leone. Available online: https://news.un.org/en/story/2002/12/53322-security-council-votes-continue-ban-rough-diamonds-sierra-leone (accessed on 3 February 2021).

- The Truth about Diamonds. Available online: https://www.globalwitness.org/sites/default/files/import/the_truth_about_diamonds.pdf (accessed on 3 February 2021).

- Winetroub, A.H. A Diamond Scheme Is Forever Lost: The Kimberley Process’s Deteriorating Tripartite Structure and Its Consequences for the Scheme’s Survival. Indiana J. Glob. Leg. Stud. 2013, 20, 1425–1444. [Google Scholar] [CrossRef][Green Version]

- Howard, A. Blood Diamonds: The Successes and Failures of the Kimberley Process Certification Scheme in Agnola, Sierra Leone and Zimbabwe. Wash. Univ. Glob. Stud. Law Rev. 2016, 15, 137. [Google Scholar]

- Schulte, M.; Paris, C.M. Supply Chain Transparency, Ethical Sourcing, and Synthetic Diamond Alternatives: Exploring the Perspectives of Diamond Retailers. Int. J. Intell. Enterp. 2021. In press. [Google Scholar]

- Ward, D.; Chiari, C. Keeping Luxury Inaccessible. Available online: https://mpra.ub.uni-muenchen.de/11373/ (accessed on 3 February 2021).

- Hoekstra, Q. Conflict Diamonds and the Angolan Civil War (1992–2002). Third World Q. 2019, 40, 1322–1339. [Google Scholar] [CrossRef]

- Bruffaerts, L. A Diamantine Struggle: Redefining Conflict Diamonds in the Kimberley Process. Int. Aff. 2015, 91, 1085–1101. [Google Scholar] [CrossRef]

- Diamonds in the Rough. Available online: https://www.hrw.org/report/2009/06/26/diamonds-rough/human-rights-abuses-marange-diamond-fields-zimbabwe (accessed on 3 February 2021).

- Nichols, J.E. A Conflict of Diamonds: The Kimberley Process and Zimbabwe’s Marange Diamond Fields. Denv. J. Int. Law Policy 2011, 40, 648. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Marques, R. Diamantes de Sangue: Corrupção e Tortura Em Angola; Tinta da China: Lisboa, Portugal, 2011; ISBN 9789896710859. [Google Scholar]

- Hilson, G.; Clifford, M.J. A ‘Kimberley Protest’: Diamond Mining, Export Sanctions, and Poverty in Akwatia, Ghana. Afr. Aff. 2010, 109, 431–450. [Google Scholar] [CrossRef]

- Haufler, V. The Kimberley Process Certification Scheme: An Innovation in Global Governance and Conflict Prevention. J. Bus. Ethics 2009, 89, 403–416. [Google Scholar] [CrossRef]

- Rush, S.; Rozell, E. A Rough Diamond: The Perils of the Kimberley Process. Arch. Bus. Res. 2017. [Google Scholar] [CrossRef][Green Version]

- Kimberley Process. Available online: https://www.kimberleyprocess.com/en/about (accessed on 29 March 2021).

- Sadik-Zada, E.R. Natural Resources, Technological Progress, and Economic Modernization. Rev. Dev. Econ. 2021, 25, 381–404. [Google Scholar] [CrossRef]

- Hofmann, H.; Schleper, M.C.; Blome, C. Conflict Minerals and Supply Chain Due Diligence: An Exploratory Study of Multi-Tier Supply Chains. J. Bus. Ethics 2018, 147, 115–141. [Google Scholar] [CrossRef]

- Smillie, I. Blood Diamonds and Non-State Actors. Vand. J. Transnatl. Law 2013, 46, 1003. [Google Scholar]

- IPIS Insights: Kimberley Process: Observations from the Sidelines. Available online: https://ipisresearch.be/publication/ipis-insights-kimberley-process-observations-sidelines-part (accessed on 3 February 2021).

- Diamonds.Net—TRADE ALERT: Marange Diamonds. Available online: https://www.diamonds.net/MediaCenter/TradeAlert.aspx?ArticleID=32094 (accessed on 3 February 2021).

- Wexler, A. De Beers Diamonds Reflect a Changing Market. Wall Street J. 2019. [Google Scholar]

- George, J.; Whitten, G.D. Blockchain in the Role of Emancipatory Technology. AMCIS 2020 Proceedings 2020. Available online: https://aisel.aisnet.org/amcis2020/global_dev/global_dev/8/ (accessed on 3 February 2021).

- Van Bockstael, S. The Emergence of Conflict-Free, Ethical, and Fair Trade Mineral Supply Chain Certification Systems: A Brief Introduction. Extr. Ind. Soc. 2018, 5, 52–55. [Google Scholar] [CrossRef]

- The Gemfair Way: Reflecting on Gemfair’s Progress to Date. Available online: https://www.debeersgroup.com/views/2020/the-gemfair-way (accessed on 23 March 2021).

- De Beers Tracks Diamonds through Supply Chain Using Blockchain. Available online: https://www.reuters.com/article/us-anglo-debeers-blockchain/de-beers-tracks-diamonds-through-supply-chain-using-blockchain-idUKKBN1IB1CY (accessed on 23 March 2021).

- Husic, M.; Cicic, M. Luxury Consumption Factors. J. Fash. Mark. Manag. Int. J. 2009, 13, 231–245. [Google Scholar] [CrossRef]

- Achabou, M.A.; Dekhili, S. Luxury and Sustainable Development: Is There a Match? J. Bus. Res. 2013, 66, 1896–1903. [Google Scholar] [CrossRef]

- Gibson, P.; Seibold, S. Understanding and Influencing Eco-Luxury Consumers. Int. J. Soc. Econ. 2014, 41, 780–800. [Google Scholar] [CrossRef]

- Gucci and Prada Aim for Outrageousness, Instead They Get Outrage. Available online: https://www.cbsnews.com/news/gucci-blackface-luxury-fashion-designers-miss-mark-with-consumers-evoke-racist-imagery-in-designs/ (accessed on 3 February 2021).

- Kapferer, J.-N.; Michaut-Denizeau, A. Is Luxury Compatible with Sustainability? Luxury Consumers’ Viewpoint. In Advances in Luxury Brand Management; Kapferer, J.-N., Kernstock, J., Brexendorf, T.O., Powell, S.M., Eds.; Journal of Brand Management: Advanced Collections; Springer International Publishing: Cham, Switzerland, 2017; pp. 123–156. ISBN 9783319511276. [Google Scholar]

- Bray, J.; Johns, N.; Kilburn, D. An Exploratory Study into the Factors Impeding Ethical Consumption. J. Bus. Ethics 2011, 98, 597–608. [Google Scholar] [CrossRef]

- Carrigan, M.; McEachern, M.; Moraes, C.; Bosangit, C. The Fine Jewellery Industry: Corporate Responsibility Challenges and Institutional Forces Facing SMEs. J. Bus. Ethics 2017, 143, 681–699. [Google Scholar] [CrossRef]

- Hilson, G. ‘Fair Trade Gold’: Antecedents, Prospects and Challenges. Geoforum 2008, 39, 386–400. [Google Scholar] [CrossRef]

- Childs, J. Reforming Small-Scale Mining in Sub-Saharan Africa: Political and Ideological Challenges to a Fair Trade Gold Initiative. Resour. Policy 2008, 33, 203–209. [Google Scholar] [CrossRef]

- Hilson, G. ‘Constructing’ Ethical Mineral Supply Chains in Sub-Saharan Africa: The Case of Malawian Fair Trade Rubies. Dev. Chang. 2014, 45, 53–78. [Google Scholar] [CrossRef]

- Hainmueller, J.; Hiscox, M.J.; Sequeira, S. Consumer Demand for Fair Trade: Evidence from a Multistore Field Experiment. Rev. Econ. Stat. 2015, 97, 242–256. [Google Scholar] [CrossRef]

- Phau, I.; Teah, M.; Chuah, J. Consumer Attitudes towards Luxury Fashion Apparel Made in Sweatshops. J. Fash. Mark. Manag. 2015, 19, 169–187. [Google Scholar] [CrossRef]

- What Are Lab Created (Man-Made) Diamonds—A Complete Guide. Available online: https://www.diamonds.pro/education/lab-created-diamonds/ (accessed on 15 March 2020).

- Consumer-Goods’ Brands That Demonstrate Commitment to Sustainability Outperform Those That Don’t. Available online: https://www.nielsen.com/ae/en/press-releases/2015/consumer-goods-brands-that-demonstrate-commitment-to-sustainability-outperform (accessed on 3 February 2021).

- Uusitalo, O.; Oksanen, R. Ethical Consumerism: A View from Finland. Int. J. Consum. Stud. 2004, 28, 214–221. [Google Scholar] [CrossRef]

- The Global Diamond Report 2013: Journey through the Value Chain. Available online: https://www.bain.com/insights/global-diamond-report-2013/ (accessed on 3 February 2021).

- The Kimberley Process|Global Witness. Available online: https:///en/campaigns/conflict-diamonds/kimberley-process/ (accessed on 3 February 2021).

- Kwong, K.K.; Yau, O.H.M.; Lee, J.S.Y.; Sin, L.Y.M.; Tse, A.C.B. The Effects of Attitudinal and Demographic Factors on Intention to Buy Pirated CDs: The Case of Chinese Consumers. J. Bus. Ethics 2003, 47, 223–235. [Google Scholar] [CrossRef]

- Hoon Ang, S.; Sim Cheng, P.; Lim, E.A.C.; Kuan Tambyah, S. Spot the Difference: Consumer Responses towards Counterfeits. J. Consum. Mark. 2001, 18, 219–235. [Google Scholar] [CrossRef]

- Tan, B. Understanding Consumer Ethical Decision Making with Respect to Purchase of Pirated Software. J. Consum. Mark. 2002, 19, 96–111. [Google Scholar] [CrossRef]

- Alfadl, A.A.; Ibrahim, M.I.M.; Maraghi, F.A.; Mohammad, K.S. An Examination of Income Effect on Consumers’ Ethical Evaluation of Counterfeit Drugs Buying Behaviour: A Cross-Sectional Study in Qatar and Sudan. J. Clin. Diagn. Res. 2016, 10, IC01–IC04. [Google Scholar] [CrossRef] [PubMed]

- The Rise of Asia’s Middle-Class. Available online: https://glintpay.com/economics-en_us/rise-rise-asias-middle-class/ (accessed on 10 September 2019).

- Sudbury-Riley, L.; Kohlbacher, F. Ethically Minded Consumer Behavior: Scale Review, Development, and Validation. J. Bus. Res. 2016, 69, 2697–2710. [Google Scholar] [CrossRef]

- Marquart-Pyatt, S.T. Contextual Influences on Environmental Concerns Cross-Nationally: A Multilevel Investigation. Soc. Sci. Res. 2012, 41, 1085–1099. [Google Scholar] [CrossRef] [PubMed]

- Fauser, S.; Agola, D. The Influence of Regional Italian Images on Consumer Behaviour: A Study of Consumers in Germany. Ital. J. Mark. 2021. [Google Scholar] [CrossRef]

- Mettenheim, W.; Wiedmann, K. The Complex Triad of Congruence Issues in Influencer Marketing. J. Consum. Behav. 2021, cb.1935. [Google Scholar] [CrossRef]

- Baumgartner, H.; Homburg, C. Applications of Structural Equation Modeling in Marketing and Consumer Research: A Review. Int. J. Res. Mark. 1996, 13, 139–161. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 4th ed.; Methodology in the social sciences; The Guilford Press: New York, NY, USA, 2016; ISBN 9781462523351. [Google Scholar]

- Griffin, M.M.; Steinbrecher, T.D. Chapter Four—Large-Scale Datasets in Special Education Research. In International Review of Research in Developmental Disabilities. Using Secondary Datasets to Understand Persons with Developmental Disabilities and their Families; Urbano, R.C., Ed.; Academic Press: Cambridge, MA, USA, 2013; Volume 45, pp. 155–183. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory, 3rd ed.; McGraw-Hill Series in Psychology; Tata McGraw Hill Education Private Ltd.: New Delhi, India, 2010; ISBN 9780071070881. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the Evaluation of Structural Equation Models. JAMS 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Afthanorhan, A.; Nazim, A.; Ahmad, S. A Parametric Approach Using Z-Test for Comparing 2 Means to Multi-Group Analysis in Partial Least Square Structural Equation Modeling (PLS-SEM). BJAST 2015, 6, 194–201. [Google Scholar] [CrossRef]

- Afthanorhan, A.; Ahmad, S.; Safee, S. Moderated Mediation Using Covariance-Based Structural Equation Modeling with Amos Graphic: Volunteerism Program. Adv. Nat. Appl. Sci. 2014, 8, 108–116. [Google Scholar]

- StatWiki. Available online: http://statwiki.kolobkreations.com/index.php?title=Main_Page (accessed on 3 February 2021).

- Tröster, B Digital Solutions for Sustainable Commodity Value Chains. Available online: https://www.oefse.at/fileadmin/content/Downloads/Publikationen/Oepol/Artikel2020/OEPOL2020-Bernhard-Troester.pdf (accessed on 3 February 2021).

| Ethically-Minded Consumer Behavior (Generic) [EMCB] |

|---|

| When there is a choice, I always choose the product that contributes to the least amount of environmental or social damage (EMCB_1) |

| I have switched products for environmental or social reasons (EMCB_2) |

| If I understand the potential damage to the environment and communities that some products can cause, I do not purchase those products ((EMCB_3) |

| I do not buy household products that harm the environment or the communities where they were sourced from |

| Whenever possible, I buy products packaged in reusable or recyclable containers (EMCB_4) |

| Willingness to Pay more (Generic) [WPM] |

| I would be willing to pay much higher prices in order to protect the environment and social causes (WPM_1) |

| I would be willing to pay much higher taxes in order to protect the environment and social causes (WPM_2) |

| I do what is right for the environment and social issues whether it costs more money or takes more time (WPM_3) |

| Ethical Concerns regarding Country of Origin (Diamonds) [ECRCOO] |

| Corruption (ECRCOO_1) |

| Environmental Issues (ECRCOO_2) |

| Human Rights (ECRCOO_3) |

| Conflict (ECRCOO_4) |

| Modern Slavery (ECRCOO_5) |

| Child Labor (ECRCOO_6) |

| Ethical Buying Behavior (Diamonds) [EBB] |

| I would be loyal to a brand that sources their diamonds ethically (EBB_1) |

| Ethical sourcing is important when it comes down to buying diamond jewelry (EBB_2) |

| Responses | Percentage | |

|---|---|---|

| Gender | ||

| Male | 160 | 38.3% |

| Female | 258 | 61.7% |

| Total | 418 | 100% |

| Income Level | ||

| Low Income (<$20,000) | 170 | 40.7% |

| Middle Income ($20,001–$50,000) | 128 | 30.6% |

| High Income (>$50,000) | 120 | 28.7% |

| Total | 418 | 100% |

| Education Level | ||

| High School/Diploma | 74 | 17.7% |

| Bachelor’s Degree | 137 | 32.8% |

| Postgraduate Degree | 193 | 46.2% |

| PhD or Equivalent | 14 | 3.3% |

| Total | 418 | 100% |

| Age Group | ||

| 18–25 | 175 | 41.9% |

| 26–35 | 132 | 31.6% |

| 36–45 | 56 | 13.4% |

| 46–55 | 33 | 7.9% |

| >55 | 22 | 5.2% |

| Total | 383 | 100.0% |

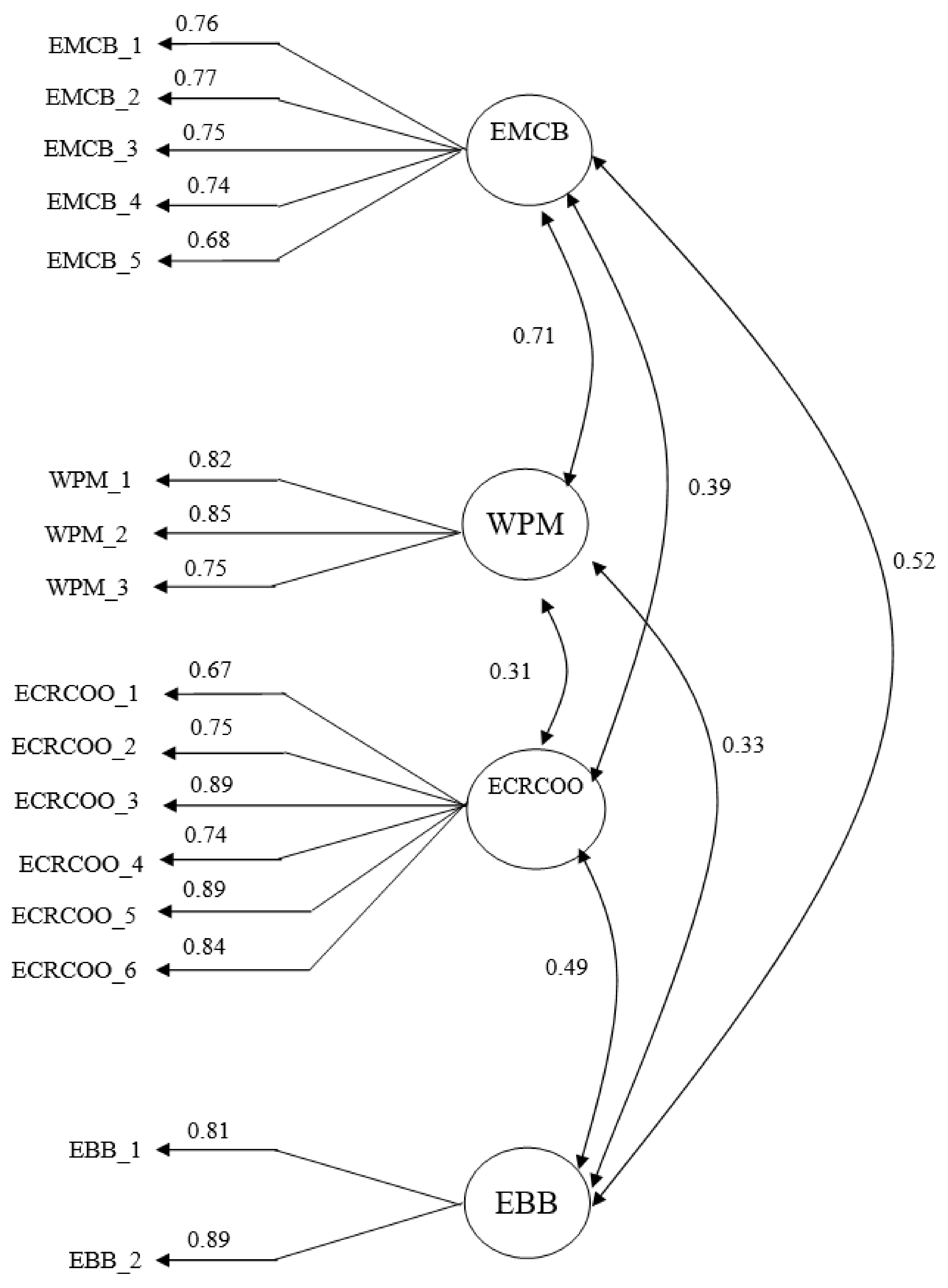

| Constructs | No. of Items | AVE | CR |

|---|---|---|---|

| Ethically Minded Consumer Behavior (Generic) | 5 | 0.55 | 0.856 |

| Willingness to Pay more (Generic) | 3 | 0.65 | 0.859 |

| Ethical Concerns regarding Country of Origin (Diamonds) | 6 | 0.64 | 0.912 |

| Ethical Buying Behavior (Diamonds) | 2 | 0.73 | 0.838 |

| Fit Index | Range | Result | Recommended Level |

|---|---|---|---|

| Chi-square/degrees of freedom (χ2/df) | 0 (ideal fit) to ∞ (low fit) | 1.724 | <2.00 |

| Confirmatory Fit Index (CFI) | 0 (no fit)–1 (perfect fit) | 0.983 | >0.90 |

| Goodness of Fit (GFI) | 0 (no fit)–1 (perfect fit) | 0.952 | >0.90 |

| Adjusted Goodness of Fit (AGFI) | 0 (no fit)–1 (perfect fit) | 0.926 | >0.90 |

| Normed Fit Index (NFI) | 0 (no fit)–1 (perfect fit) | 0.960 | >0.90 |

| Tucker-Lewis Index (TLI) | 0 (no fit)–1 (perfect fit) | 0.976 | >0.90 |

| Root Mean Square Error of Approximation (RMSEA) | 0 to 0.10 | 0.042 | <0.05 |

| Hypothesized Relationships | β | S.E | t-Value | Hypotheses Result | |||

|---|---|---|---|---|---|---|---|

| H1 | Ethically-Minded Consumer Behavior (Generic) | → | Willingness to Pay More (Generic) | 0.708 | 0.072 | 10.59 *** | Supported |

| H2 | Ethically-Minded Consumer Behavior (Generic) | → | Ethical Concerns regarding country of origin (Diamonds) | 0.396 | 0.075 | 7.029 *** | Supported |

| H3 | Ethically-Minded Consumer Behavior (Generic) | → | Ethical Buying Behavior (Diamonds) | 0.441 | 0.090 | 5.114 *** | Supported |

| H4 | Willingness to Pay more (Generic) | → | Ethical Buying Behavior (Diamonds) | −0.083 | 0.076 | −1.058 | Not Supported |

| H5 | Ethical Concerns regarding country of origin (Diamonds) | → | Ethical Buying Behavior (Diamonds) | 0.344 | 0.042 | 6.447 *** | Supported |

| Structural Relationships between Constructs | Group 1 Low Income (n = 170) | Group 2 Middle Income (n = 128) | Group 3 High Income (n = 44) | (1 and 2) | (2 and 3) | (1 and 3) | Hypothesis Test Results | |||

|---|---|---|---|---|---|---|---|---|---|---|

| Leads to | Estimate | Estimate | Estimate | z-Score | z-Score | z-Score | ||||

| H6a | Ethically-Minded Consumer Behavior (Generic) | → | Willingness to Pay More (Generic) | 0.742 *** | 0.685 *** | 0.686 *** | −1.798 * | 1.319 | −0.196 | Not Supported |

| H6b | Ethically-Minded Consumer Behavior (Generic) | → | Ethical Concerns regarding country of origin (Diamonds) | 0.463 *** | 0.470 *** | 0.226 * | 0.694 | −1.219 | −0.746 | Not Supported |

| H6c | Ethically-Minded Consumer Behavior (Generic) | → | Ethical Buying Behavior (Diamonds) | 0.392 *** | 0.091 | 0.738 *** | −1.88 * | 3.619 *** | 2.108 ** | Partially Supported |

| H6d | Willingness to Pay more (Generic) | → | Ethical Buying Behavior (Diamonds) | −0.088 | 0.355 * | −0.351 * | 2.363 ** | −3.433 *** | −1.570 | Partially Supported |

| H6e | Ethical Concerns regarding country of origin (Diamonds) | → | Ethical Buying Behavior (Diamonds) | 0.362 *** | 0.409 *** | 0.299 *** | −1.068 | 0.054 | −0.939 | Not Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schulte, M.; Balasubramanian, S.; Paris, C.M. Blood Diamonds and Ethical Consumerism: An Empirical Investigation. Sustainability 2021, 13, 4558. https://doi.org/10.3390/su13084558

Schulte M, Balasubramanian S, Paris CM. Blood Diamonds and Ethical Consumerism: An Empirical Investigation. Sustainability. 2021; 13(8):4558. https://doi.org/10.3390/su13084558

Chicago/Turabian StyleSchulte, Meike, Sreejith Balasubramanian, and Cody Morris Paris. 2021. "Blood Diamonds and Ethical Consumerism: An Empirical Investigation" Sustainability 13, no. 8: 4558. https://doi.org/10.3390/su13084558

APA StyleSchulte, M., Balasubramanian, S., & Paris, C. M. (2021). Blood Diamonds and Ethical Consumerism: An Empirical Investigation. Sustainability, 13(8), 4558. https://doi.org/10.3390/su13084558