1. Introduction

Since the early 2010s, EU nations such as Germany, the UK, France, etc. and Japan have implemented policies to shift fossil fuel energy-based energy systems to renewable energy-based energy systems to cope with climate change. In the past few decades, only a few countries have pushed for a national energy transition, which has been slow. Recently, however, the energy transition policy has expanded to many countries and is progressing rapidly [

1]. According to IRENA’s Transforming Energy Scenario with Deep Decarbonization Perspective, energy transition realizes a sustainable low-carbon society, increases employment, further promotes economic growth and cleanses living conditions [

2].

The Korean government confirmed the energy transition policy as a national task, and established the Energy Conversion Roadmap, Renewable Energy 3020, the eighth Electricity Supply–Demand Basic Plan in 2017 (hereafter the eighth basic plan), and the third Energy Basic Plan in 2019. In December 2020, the government announced its 2050 Carbon Neutral Vision. Korea’s energy transition is to transform itself into a safe and clean future energy system centered on renewable energy and energy efficiency in response to climate change, fine dust reduction, and the safety of nuclear power [

3].

The Korean government implements energy transition policies that tend to phase out nuclear power and coal power [

4,

5,

6]. The Renewable Energy 3020 plan has been established to increase the share of renewable generation to 20% by 2030. The eighth basic plan includes an environmentally friendly generation mix [

5]. In the third Energy Basic Plan, the mid- to long-term policy direction of energy transition has been established and the renewable energy share target by 2040 was expanded to be around 30 to 35% [

7]. As renewable energy sources become more competitive both technologically and economically, renewable energy is increasing its share not only in Korea but also in many other countries. By 2040, the renewable energy share in OECD countries will increase to 42% [

6,

7].

As the energy transition policy changes the generation mix, the required inputs will also be changed. Additionally, the inputs are different for each generation source in each step of construction and operation. The change in the inputs required affects the production activities of the industrial sectors, industrial structure, product composition, and employment level of the country. The structural impact of energy transition and the impact on the labor market will vary depending on the region, industry and working contract type [

2].

According to the analysis results of the Mitsubishi Research Institute (MRI) [

8], in the case of photovoltaic (hereafter PV) power and wind power, the construction stage has a ripple effect that is greater than the operation stage, regardless of scale. In the view of PV power by scale, during the construction phase of the facility, the effect of mega PV is greater than that of single-house PV. This is because mega PV includes land groundwork [

8]. Matsumoto and Hondo [

9] described that in the case of single-house PV-generation, the production of facilities manufacturing, operation, and maintenance is large, but the employment coefficient is small, so the effect of job creation is not significant. Matsumoto and Hondo [

9] estimated that the production and employment of wind power operations and repairs are greater than in other forms of renewable energy.

According to the International Renewable Energy Agency (IRENA)’s research on estimating the employment effect of renewable energy, induced employment increased in China, Brazil, the US, India, Japan, and Germany [

10]. Using Input–Output analysis, Baba [

11] analyzed that the induced employment effect of solar and wind power is greater than conventional power generation (thermal, nuclear, hydro) in both generation (people/Million kWh) and capacity (people/thousand kW) [

11]. Mah and Cheung [

12] presented Seoul’s urban PV power along with London and New York as examples of continuous lower costs of PV facilities and greater success for policymakers in finding more cost-effective energy policies.

Each country’s socioeconomic situation varies depending on domestic natural resources such as fossil fuels and other primary products, industrial productivity, technology options, and the depth and diversity of the domestic supply chain. It has a positive effect when policy customized to a specific country is implemented. This is also the same in energy transition policy.

Generation mix will be changed when a country places importance on the environmental friendliness and safety of the generation source in energy policy unlike before and implements energy transition policy. This changes goods and services in the national economy, production activities and labor demand of each industrial sector. Nuclear power and coal power, which Korea has mainly used in generation, had a large capacity and generation, large-scale construction and facility costs, and operation costs corresponding to its generation. Renewable energy sources, which are increasing in the energy transition policy, have small capacity and generation. These power sources consist of different facilities. As the power sources with different characteristics increase, Korea’s economic structure changes accordingly. Even if the energy sources increasing in the energy transition policy have an environmental advantage, they may not induce production in other industries. Therefore, this study estimates the induced effects of environmentally friendly power sources in the energy transition policy and measures the effect of these power sources on the national economy.

This study assumes the representative capacity and generation of power sources that will continue to increase in Korea, which promotes energy transition policy. This study also estimates the induced effect of these generation sources on the Korean economy when they are manufactured, constructed, installed, operated and maintained. The analysis covers five capacities of three generation sources. Those are LNG thermal power, 900 MW; small photovoltaic power (hereafter small PV), 3 kW; mega photovoltaic power (hereafter Mega PV), 100 kW; onshore wind power, 10 MW; and offshore wind power, 120 MW. The phase of manufacturing power facilities, building power plants, and installing facilities in the plant is called manufacture, construction and installation (hereafter MCI). The phase of operating a power plant and performing various maintenance is called operation and maintenance (hereafter O&M). The analysis method is the Input–Output model (hereafter the IO model), and the induced production effect, the induced value-added effect, and the induced employment effect are estimated.

Accordingly, the analysis reflects Korea’s economic, production and consumption structure using Korea’s 2015 Input–Output Statistics (benchmark) published in 2019 [

13] (statistics such as sales, generation, facility capacity, capacity factor, employee, performance by power company, electricity transaction amounts in the electricity industry sector use the values of 2015). The Input–Output table (hereafter the IO table) for this analysis is made by separating LNG thermal power, small PV power, mega PV power, onshore wind power, and offshore wind power in the 2015 Input–Output Statistics. The MCI and O&M of each generation source are separately reflected. The MCI cost and O&M cost required to include the generation sources to 2015 Input–Output Statistics are cited in the eighth basic plan (the electricity supply–demand basic plan is established every two years pursuant to Article 25 of the Electricity Business Act and Article 15 of the Enforcement Decree in order to forecast mid- to long-term electricity demand and to expand electricity facilities accordingly. Korea has established the electricity supply–demand basic plan since 2002. The eighth electricity supply–demand basic plan, published in 2017, covers 2017~2031. The ninth electricity supply–demand basic plan has yet to be announced, and it went through the process of a public hearing at the end of 2019. Therefore, the latest official electricity supply–demand basic plan is the 8th basic plan). The estimated cost of KEEI [

14] is also applied to the MCI cost and O&M cost of PV power and wind power. The share for the allocation of the IO table by industry sector is referred to in the related literature.

This paper consists of the following:

Section 2 describes the IO model and the Input–Output matrix balance method. The matrix balance method is applied when expanding the IO table for the analysis and balancing matrix.

Section 3 prepares an IO table for empirical analysis by separating the MCI and O&M of LNG thermal power, mega PV power, small PV power, onshore wind power and offshore wind power. Furthermore, the input and distribution structure of each power source are investigated.

Section 4 presents the empirical analysis results of the induced production effects, induced value-added effects, and induced employment effects of LNG thermal power, mega PV power, small PV power, onshore wind power and offshore wind power.

Section 5 is the discussion. The empirical results are compared with the results of previous studies. The parts that were not considered in this analysis are also mentioned.

Section 6 is the conclusion.

3. Statistics for the Input–Output Table with Analysis Target Generation Sources

3.1. The Input and Output Structure of LNG Thermal, Photovoltaic and Wind Power

The construction cost of LNG thermal power is referred to in the total cost of the eighth basic plan. The construction cost consists of the direct cost, indirect cost, and construction interest, while the indirect costs consist of design service costs, land costs, owner’s cost, foreign capital manufacture cost, and reserve funds. According to the eighth basic plan, the construction cost of 900 MW LNG power is 851,000 won/kW, and the net construction cost excluding construction interest is 814,000 won/kW. The standard construction period for LNG power (450 MW and 900 MW) is 28 months.

The intermediate input share (53.08%) and the value-added share (46.92%) of the power plant (No.5133) in the base classification of the 2015 Input–Output Statistics are applied to the construction cost of LNG power plants. The intermediate input amount is allocated using the classification and cost share of LNG combined thermal power generation project in the KEPCO Management Research Institute [

18]. The value-added amount is allocated using the sectoral share of the power plant (No.5133).

According to the eighth basic plan, the O&M cost of 900MW LNG power is 2.77 won/kW/month. The O&M costs consist of labor costs (38.1%), repair maintenance costs (21.2%), expenses (19.8%), general management costs (16.2%), and others (4.7%). The O&M cost of the eighth basic plan is considered as a ceiling value when allocating the O&M costs by component. The input and output structures for the O&M of LNG thermal power cannot be obtained from the 2015 Input–Output Statistics. No.4502 thermal power of the basic-sized classification of the 2015 Input–Output Statistics is a sum of coal power, LNG power, and other thermal power, with one input structure and one distribution structure. LNG power is separated from the thermal power in the 2015 Input–Output Statistics to obtain the input structure. The composition of the input factors are adjusted. Since electricity produced from each generation source is not distributed separately, the distribution structure of LNG power follows the distribution structure of No. 45 electricity and the renewable energy sector of the medium-sized classification of 2015 Input–Output Statistics.

The construction costs and O&M costs of PV power and wind power are referred to by the KEEI [

14]. As shown in

Table 1, these data consist of the Capital Expenses (hereafter CAPEX), O&M, insurance, and corporate taxes. The sector shares of CAPEX and O&M for PV power and wind power are required to link them to the classification in the IO table. The sector shares are referred to by Mitsubishi Research Institute (MRI) [

19,

20], Nakamura, Ishikawa and Matsumoto [

21], Science and Technology Foresight Center National Institute of Science and Technology Policy (NISTEP) Ministry of Education, Culture, Sports, Science and Technology Japan (MEXT) [

22].

In Japan, the share of intermediate inputs and value-added for house PV generation is 74.6% and 25.3%, respectively, in construction and 7.2% and 92.8%, respectively, in operation [

19]. The share of intermediate inputs and value-added for non-house PV generation is 75.9% and 24.1%, respectively, in construction and 10.2% and 89.8%, respectively, in operation. The ratio of intermediate inputs and value-added for mega PV generation is 73.5% and 26.5%, respectively, in construction and 4.6% and 95.4%, respectively, in operation [

19]. PV generation, regardless of its size, has a large intermediate input and a small value-added in construction, and a very small intermediate input and a very large value-added in operation. The shares of non-house PV and mega PV are used to allocate the MCI cost and O&M cost.

The cost of PV power depends on various factors such as technology, installation characteristics, system size, and supplier’s price spread [

23]. In PV power systems, the module’s cost accounts for half of the installation cost, including mounting equipment, the power inverter, the electrical wing, connection equipment, location selection and permission, design, and installation services cost. According to the system cost of PV power, the largest one in capital cost (382.6 thousand yen/kW) is the installation cost (76.9%), followed by the construction cost (19.5%). In addition, there are access cost (2.0%), land construction costs (1.2%) and design costs (0.4%) [

19]. The sum of installation costs and construction costs is more than 95% of the total capital costs. In the O&M cost by size, the labor cost excluding land rents is the largest and 2100 yen/kW/year in 10~50 kW. The next largest cost is the repair costs [

19]. For 10~50 kW, labor costs and repair costs account for 55% of the total O&M costs [

19].

In Japan, the share of intermediate inputs and value-added of wind power is 78.1% and 21.9%, respectively, in construction and 15.7% and 84.3%, respectively, in operation [

19]. These shares are kept regardless of type and size. In the case of construction, the intermediate inputs are large and the value-added is small. The construction cost breakdown of onshore and offshore wind power is as shown in

Table 2 [

22]. In the case of the O&M, the intermediate inputs are small and the value-added is large.

The operating costs of wind power consist of a depreciation of 40%, fixed asset tax and corporate tax of 15%, maintenance cost of 10%, insurance and financial cost of 10%, land rent of 1%, repair cost and general management cost of 5% and profit of 19% [

22]. This, in turn, leads to capital depreciation, indirect taxes (excluding tariffs), construction maintenance, finance and insurance, real estate service and lease, employee’s compensation and operating surplus of the IO table. The more recent the operation year, the smaller the operating cost [

22]. The share of repair costs for those that started operating during 2001~2005 is 57%. The repair costs of wind power operated after the year 2006 decrease, with a share of 46%.

Table 3 summarizes the facility capacity, capacity factor, generation, MCI cost, and the O&M cost of the target generation sources. The MCI cost considers the facility capacity of each power sources. The O&M cost considers the generation and capacity factor of each power source.

3.2. Generation and Sales

Facility capacity, generation and sales by generation source are referred in the 2015 Input–Output Statistics [

13], 2015 Yearbook of Energy Statistics [

25], and Statistics of Electric Power in Korea 2015 [

26].

Table 4 shows the capacity and generation by source as of 2015 [

25].

Table 5 shows the power trading and power turnover by energy source as of 2015 [

25].

The induced-effect analysis uses these statistics compared to the statistics by power sources in the 2015 Input–Output Statistics. The total input in the electricity and renewable energy sector (No.45 in medium-sized classification) of the 2015 Input–Output Statistics is 59,575 billion won. Hydro (No.4501) is 89.1 billion won, thermal (No.4502) is 40,530 billion won, nuclear (No.4503) is 13,293 billion won, self-generation (No.4504) is 225.9 billion won, and renewable energy (No.4505) is 260.3 billion won (the number in parenthesis is the sector No. of base–sized classification of 2015 Input–Output Statistics). Since this study uses the 2015 Input–Output Statistics in the analysis, the total input of the 2015 Input–Output Statistics is the control total (hereafter CT) and is distributed with the share of generation by the source above.

3.3. Employment

The operational employee by power source is referred to in the 2015 Input–Output Statistics [

13], 2015 Yearbook of Energy Statistics [

25], Survey on the Status of Nuclear Industries in 2015 [

27], and International Renewable Energy Agency (IRENA) [

28]. According to the 2015 Input–Output Statistics, the number of people employed in electricity and renewable energy (No.45 in medium-sized classification) is 58,528 and the number of employees is 57,274 [

13]. According to the Survey on the Status of Nuclear Industries in 2015, the number of nuclear power workers is 10,745 and the remaining 47,783 are employed by other generation sources [

27]. The allocation of 47,783 workers using the proportion of facility capacity in the 2015 Yearbook of Energy Statistics was 12,854 for coal, 14,139 for gas, 3163 for hydro, 1443 for oil, 2618 for district energy and 2762 for alternative energy. The number of employed in the O&M of LNG thermal is 0.48 people/MW.

The average employment of the OECD’s manufacture, construction and installation (MCI) is 17.9 people/MW in PV power, 8.6 people/MW in onshore wind power, and 18.1 people/MW in offshore wind power [

28]. The average employment of the OECD’s O&M is 0.3 people/MW people in PV power, and 0.2 people/MW in onshore and offshore wind power [

28]. These OECD averaged are used as Korea’s employment number in renewable energy.

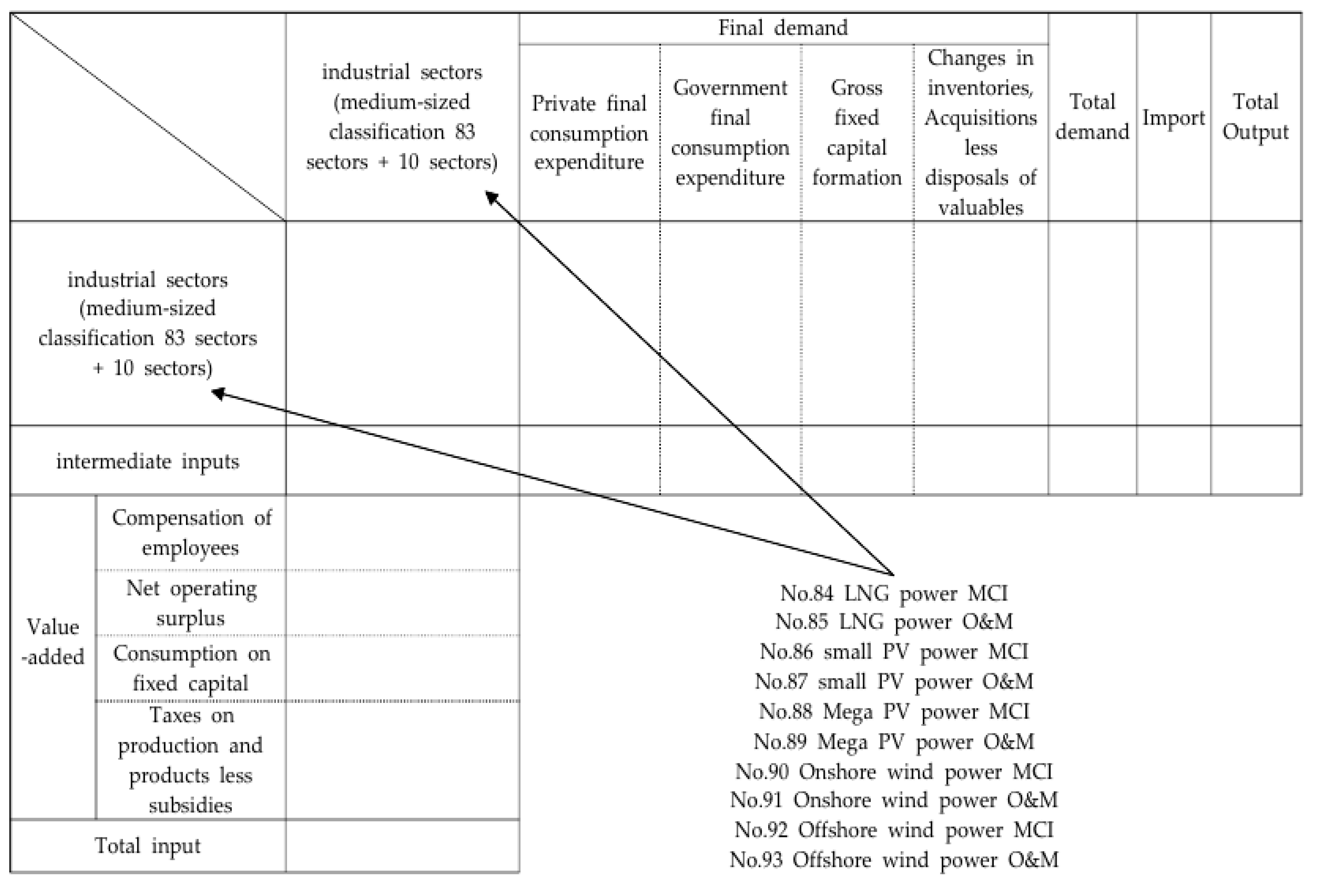

3.4. Composition of Input–Output Table with Analysis Target Generation Sources

In the induced-effect analysis, the 2015 Input–Output Statistics (benchmark, producer’s price) published in 2019 by the Bank of Korea was used [

13]. To ensure that transactions among industries are explicitly revealed, the classification is maintained at medium size (83 sectors). The MCI sector and O&M sector of LNG power (900 MW), small PV power (3 kW), mega PV power (100 kW), onshore wind power (10 MW), and offshore wind power (120 MW) are added to the 2015 Input–Output Statistics. These are the No.84 LNG power MCI, No.85 LNG power O&M, No.86 small PV power MCI, No.87 small PV power O&M, No.88 Mega PV power MCI, No.89 Mega PV power O&M, No.90 Onshore wind power MCI, No.91 onshore wind power O&M, No.92 offshore wind power MCI, and No.93 offshore wind power O&M. The total number of expanded classifications is 93. The structure of the IO table with analysis target generation sources is shown in

Figure 1.

The MCI period and O&M period are one year each in the analysis. The construction of the MCI takes longer than a year and the construction cost expenses are not equal in each year. However, the analysis period is assumed to be one year because the IO table contains economic activity in a year. In addition, the induced-effect analysis uses the total cost of each project and the induced amount of this to derive the inducement coefficient. The induced-effect coefficient shows the direct and indirect effects induced by one unit of final demand for the power source, and thus excludes the influence of the amount of cost.

The outputs of the MCI are the power plant and facilities, and the output of the O&M is electricity. The former is allocated to the fixed capital formation in the final demand and the latter is allocated according to the distribution share of the electricity and renewable energy sector (No.45 of basic-sized classification) from the 2015 Input–Output Statistics.

5. Discussion

According to the estimation results, the induced-effect coefficients of the MCI is larger than those of the O&M in all the power sources mentioned. This result is the same as the result of the Mitsubishi Research Institute (MRI) [

8]. In this study, the largest induced production coefficient is the MCI of mega PV power. This is also shown in the O&M. As the PV power and the wind power have different characteristics, the former has a larger induced coefficient than the latter. In the MCI, PV power is composed of more parts assembly than civil engineering, and wind power accounts for more civil engineering than parts assembly. In the O&M, PV power is associated with many industries by managing a number of panels, but wind power only manages large-scale blades and towers, so there is little connection between industries.

Although it is the same PV generation, both in the MCI and in O&M, mega PV power has a greater induced production effect coefficient than that of small PV power. This is because the mega PV power and small PV power have different connections with the other industries. The mega PV power, unlike small PV, requires land construction, larger detection and control facilities and many other equipment. More inputs are needed for management, maintenance, and repair. Offshore wind power is more difficult in civil engineering than onshore wind power. Therefore, more inputs of goods and services, and high technology are needed in the MCI of offshore wind.

The induced employment coefficient is greater in the MCI than O&M in all generation sources. LNG thermal has a large coefficient in the MCI and O&M. The MCI of LNG thermal requires the construction of the power plant itself, so the contents of construction are different. The induced employment coefficient of PV power is greater in mega PV power. The induced employment increases along with the scale in PV power. The mega PV power consists of many small PVs, unlike wind power. The induced employment coefficient of wind power is greater on onshore than offshore. This means that the induced employment at a small scale is greater than at a large scale because a certain level of economic efficiency is being realized in wind power.

According to Matsumoto and Hondo [

9], in the case of single-house PV power, the productions of facilities manufacturing, operation and repair are large, but the employment coefficient is small. The production of operation and repair, and employment of wind power are greater than in other renewable energy sources. In the case of Korea, estimation results of the induced production and value-added effects of small PV are not large, and the induced employment effect of small PV is neither small or nor significant compared with other sources. Small PV in Korea has many connections with other industries and labor markets. The induced coefficient of mega PV is similar to or slightly larger than that of small PV. Even large-scale PV power, intermediate inputs and labor inputs are similar to small-scale PV power, and do not decrease significantly. This means that even as PV power grows in size, it does not show much of an efficiency at this moment. Renewable energy is realizing the economic efficiency by expanding like the generation sources with a long history. PV power still has an opportunity to achieve efficiency.

Each country has its own industrial structure. Therefore, just because a certain policy has worked in other countries does not necessarily mean it can be implemented successfully in other countries. For effective policies implemented by one country to be applied in other countries, policies must be customized for each country. The results of this study are applied when predicting the results of implementing policies to expand certain renewable energy sources or LNG power, if a country has an industrial structure and energy facility export and import structure similar to Korea. When countries apply the analysis structure of this study to their own Input–Output table, they can produce results that fit their own conditions. The result of this study will be referred to as a case study in the analysis of other countries.

This analysis does not reflect the supply chain of PV power and wind power in Korea but reflects the statistics of international organizations in 2015 Input–Output statistics of Korea because of data availability. The survey for supply chain information of PV and wind power in Korea will help to estimate the induced effects in Korea more practically.

6. Conclusions

The world had a highly dependent energy supply–demand structure on fossil fuels. But gradually, many countries, including Korea, are implementing energy transition policies and declaring carbon neutrality. In Korea’s third Energy Basic Plan, Renewable Energy 2030, and the eighth basic plan, the proportions of coal power and nuclear power among the generation mix are decreasing and the proportions of renewable energy and LNG power are increasing. This change in policy direction and generation mix means that future economic activities will take a different appearance than before. This will have a different impact on the economy than before.

Therefore, this study estimated the induced effect of LNG thermal, PV and wind power, which are used as major power sources under Korea’s energy transition policy. The MCI and O&M of each power source would have different effects, so in the analysis the MCI and O&M of each power source were distinguished. In addition, the 2015 Input–Output Statistics were used to reflect Korea’s economic structure.

PV power has a greater coefficient in induced production and induced value-added than wind power because the MCI of PV power has a greater share in component assembly than civil engineering and the MCI of wind power is the opposite. In the O&M, PV power needs to manage a number of panels, requiring more inputs to manage and repair, which is more relevant between industries and requires more operation personnel. Offshore wind power has a greater induced production effect than onshore wind and PV power due to the large difficulty of civil engineering in the sea. However, O&M of wind power show less of an inter-industry relationship and less efficiency as scale grows, as the number of blades does not grow proportionally and only a small number of large blades are managed. The MCI of LNG thermal power is different from the MCI of PV power and wind power because the power plant itself must be built. In addition, the induced effect in the MCI and O&M is small due to the high maturity of the LNG power industry as the generation with a long history. However, the induced employment effect in the MCI of LNG power plant is greater than renewable energy because of the construction of power plants.

The carbon neutrality and energy transition policies implemented by Korea have a certain level of inducement effect and offset the burden of transition costs even if existing power sources are replaced with environmentally friendly power sources. The efficiency of existing power generation sources, such as LNG power, is appearing on wind power and is gradually implemented in PV power. This increases the likelihood of achieving two simultaneous objectives of continuing production activities on the economic side while responding to climate change on the environmental side.