Abstract

The creative industries are recognized as one of the most perspective sectors of the economy with high potential to both contribute to local and regional prosperity and employment generation. Globally, the cultural and creative industries (CCIs, or culture and creative sector) became a large part of the economy in the first decade of the 21st century. They made a 3% contribution to the global economy. They generate US $2250 billion and create 29.5 million jobs worldwide. In parallel to economic benefits, the cultural and creative sectors also deliver benefits to people. They foster sustainable urban development, creativity, and culture. Furthermore, they support the implementation of the 2030 Agenda. Creativity and culture also have significant intangible value. They promote social inclusion and encourage dialogue and understanding between people. Culture is both a driver and an enabler of sustainable human development. It empowers people to take responsibility for their own development and boosts innovation and creativity, which can drive inclusive and sustainable development. The presence of CCI in a particular area is an important factor of competitiveness, image, and economic development. This paper presents the results of a study on the determinants of the development of creative industries in the Baltic Sea Region. The summary of the main results of the study focuses on the economic importance, innovation in creative enterprises, and the needs of organizations to grow. It shows that creative industries, which are characterized by rather small entities and elastic work organizations, acquire new ideas and approaches primarily through the mobility of independent employees. Since creative industries make a decisive contribution to the competitiveness of the national innovation system and enhance sustainable growth at the same time, it concludes with implications and challenges for regional innovation policies to improve the framework conditions for creative industries. This article presents the conclusions of research that was conducted in four countries of the Baltic Sea Region (Germany, Sweden, Lithuania, and Poland). The research was conducted by using a Computer Assisted Web Interview (CAWI) survey. A total of 682 correctly completed questionnaires were obtained. The results were subjected to statistical inference, in which the technique of detecting hidden interdependencies between the examined phenomena using the V-Cramer method was also applied. The main aim of this article is to verify the state of the creative industry in the Baltic Sea Region. And the research hypothesis is that the organizations of creative sectors are doing well in turbulent circumstances, and, by doing so, they continually enhance the realization of sustainability goals.

1. Introduction

Creative industries (CI) are becoming increasingly key sectors of the economy, especially now, when, apart from technological resources, imagination causes a difference between entrepreneurs [1] and the “new economy” has creativity at its center [2]. Since the emergence of the phenomenon of creative industries, several studies have focused on definition issues [3,4,5,6] as well as sector organization, spatial distribution, and cluster [7,8,9,10,11,12].

The Creative Sector has been recognized as a dynamic part of the economy by contributing to economic growth, job creation, revitalization, and internationalization [3,13], as well as being more resilient to economic recessions than other sectors [14,15]. However, it is only the beginning of researching how creative industries influence the innovation of the economy as a whole, building on the concept of the creative class [16]. The creative sector contribution to the development of the economy can be examined by offering creative products and services to customers [17] or indirectly influencing other non-creative industries through cross innovation, transfer of creative knowledge, and through processes of acquisition, acceptance, imitation, and collaboration between buyer and supplier [18]. This partly explains the difficulties in quantifying “creative innovation” [19], because while the innovation indicator for industrial enterprises is research & development (R&D) expenditure, this measure is not applicable to creative sectors. Companies in these sectors spend much less on R&D than industrial companies, which does not mean that they are not innovative at all [20]. Innovations in creative sectors are created as a result of individual and group creativity and are therefore more difficult to measure and often less spectacular than traditional innovations. Apart from the market value, the creative and culture sector also has social potential, contributing to social inclusion and shaping the attitude of responsibility for own growth. The creative sector also promotes innovation, which is crucial for sustainable development [21,22]. Therefore, although many researchers acknowledge that creativity fosters inclusive social development and sustainability, unfortunately there are no clear, direct empirical testable results. However, there is some important research on the creative economy and its relevance to sustainable development [23,24,25]. Sustainable economic development is closely associated with the creative and culture industries: for example, the demand for a green ecosystem requires creative and innovative solutions [26]. The creative economy engine runs on innovative ideas, but not on the use of limited conventional resources. Some authors claim that creative and cultural industries have a positive impact on sustainable economic development [27]. And as an argument they say that creativity promotes the development of urban economy. There is a growing demand for products and services that are more sustainable, reflecting a change in public sentiment, such as the “creative turn” and the “ecological turn” [26]. The most essential principles of culturally sustainable development can be summarized as follows: intergenerational equity—the development has to be long-term and must not endanger the ability of future generations to access cultural resources and meet their cultural needs; this requires special care to protect and enhance the nation’s tangible and intangible cultural capital.

In-generational equity: development must ensure equality of access to cultural production, participation, and enjoyment for all members of the community on a fair and non-discriminatory basis; special attention must be given to the poorest members of society to ensure that development is consistent with poverty alleviation objectives. Importance of diversity: the value of cultural and creative diversity for economic, social, and cultural development processes must also be taken into account. The above criteria are particularly relevant from a policy perspective in terms of focusing on cultural and creative industries—goods and services—that link culture and the economy in a way that recognizes both the economic importance of creative activities and the special cultural value inherent in and produced by those activities. There is therefore a strong link between the objectives of Article 13 and the role of cultural and creative industries in the development process. Assessing the strength of this link is an important issue in monitoring the implementation of the Convention. The creative and cultural sectors can take different forms of organization and thus be qualified as public, private, and social sector entities. Monitoring and maintaining the balance between the adopted forms of activity is crucial due to the realization of the principles of the concept of sustainable development: maintaining cultural diversity, accessibility to creative products and services, and maintaining cultural values for future generations. The creative and cultural sector, besides purely market aims like generating profit, has attributes which are social in nature, creating interpersonal bonds, building trust and social capital, reviving neglected places, stimulating pride in the place where one lives, and also creating new jobs—both in the sector and around the sector, which are also the basis of sustainable development.

Existing empirical studies emphasize both the direct and indirect contribution of creative industries to innovation, i.e., they have a high innovation potential [20,28] but also act as an important catalyst for innovation and knowledge-based growth in many other areas of the economy [8,29]. However, despite the growing interest in creative industries’ policies, the evidence based on innovation and creative sector development is particularly weak [30,31,32,33].

Creative and cultural industries are supported and dynamically developed in the world due to non-economic and economic impacts. Non-economic impacts are found in the areas of social cohesion and integration of marginalized groups; creation of a new value system, confirmation of creativity, talent, and excellence [34]; promotion of cultural diversity, national and local groups identity [34]; shaping the atmosphere for creativity and innovation [6,35]. These industries affect the growth rates of gross domestic product (GDP) or gross value added (GVA) as well as employment and can increase a country’s foreign trade position and competitiveness and support the regeneration and branding of creative cities and attract business and investment [36]. It is worth mentioning that many of the studies conducted so far have focused on the macro level of entities’ functioning, while the authors notice the need for a better understanding of the topic at the micro level, especially the analysis of factors differentiating the performance of CI companies. Research on creative industries has been carried out quite recently, but there has not yet been a single, universally valid definition. [37].

The creative sector includes:

- Major cultural (non-industrial) activities, production of unique goods and services, which are a source of inspiration for other areas of the sector.

- Activities aimed at producing cultural goods and services on a mass scale, such as audiovisual production, video games, television and radio, phonography, book and newspaper publishing.

- Activities in which culture is a “creative” contribution to the production of goods belonging to branches not directly related to culture. These are activities such as design (fashion design, interior design, industrial design), architecture, and advertising [38,39,40].

- With this in mind, it is extremely important to continually examine the state of the sector, especially in the risk situation we currently find ourselves in.

The main aim of this article is to verify the state of the creative industry in the Baltic Sea Region. And the research hypothesis is that the organizations of creative sectors are doing well in turbulent circumstances, and by doing so, they continually enhance the realization of sustainability goals.

The 2017 Regional Innovation Scoreboard (RIS) examines indicators from 220 regions in 22 EU countries, Norway, Serbia, and Switzerland. The 2017 RIS uses the refined analytical framework of the European Innovation Scoreboard where possible in terms of data availability at the European level. The results confirm that Europe’s most innovative regions are located in the most innovative countries. In addition, it introduces a more detailed breakdown of performance groups and offers a new set of tools with contextual data that can be used to analyze and compare structural differences between regions [36].

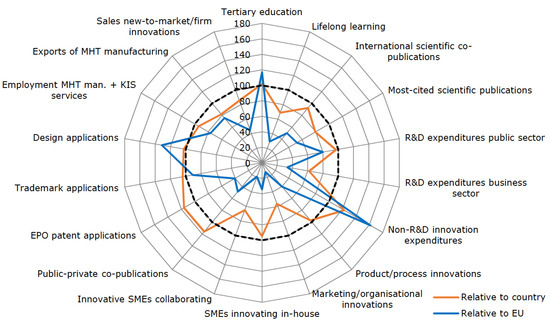

To give an idea of how innovative the regions are, the RIS surveys were selected to represent the regions with the most responses from the respondents to the survey. If we consider the regions from which subjects participated in the survey, then Western Pomerania in Poland is a Modest Innovator. The results have improved since the last survey. Strengths compared to Poland (red line) and EU (blue line), —e.g., mental health technician (MHT) manufacturing exports and weaknesses—e.g., sales of new innovations. The region has a lower population density and a higher employment rate in utilities, construction, and public administration. GDP per capita is also lower than the average [41,42,43,44,45] (Figure 1).

Figure 1.

The Regional Innovation Scoreboard (RIS) 2017 for West Pomerania. Source: https://ec.europa.eu/docsroom/documents/24181 (accessed on 14 December 2020).

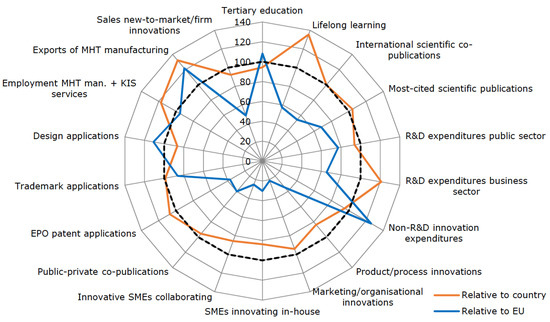

Pomerania (Pomorskie Poland) is a moderate innovator and the region’s performance on innovation has increased slightly over time. The radar chart shows the relative strengths compared to Poland (red line) and the EU (blue line). Similar strengths, as in West Pomerania, are MHT manufacturing exports, and weaknesses, such as sales of new innovations; Figure 2.

Figure 2.

The Regional Innovation Scoreboard (RIS) 2017 for Pomerania. Source: https://ec.europa.eu/docsroom/documents/24181 (accessed on 14 December 2020).

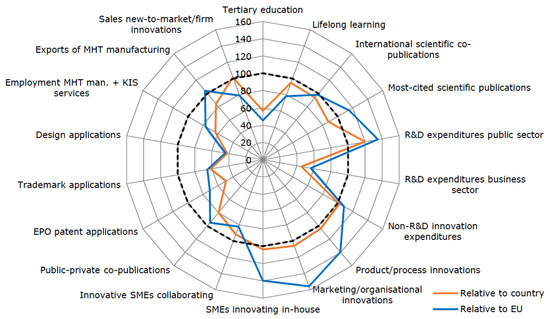

Mecklenburg-Vorpommern has been identified as a strong innovator and innovation scores have increased since the last survey. The radar chart shows relative strengths compared to Germany (red line) and the EU (blue line) Relative strengths are, e.g., marketing and organizational innovations and weaknesses are, e.g., higher education; Figure 3.

Figure 3.

The Regional Innovation Scoreboard (RIS) 2017 for Mecklenburg-Vorpommern. Source: https://ec.europa.eu/docsroom/documents/24173 (accessed on 20 December 2020).

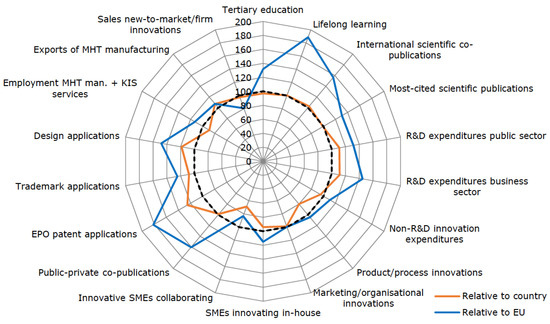

Sydsverige is an Innovation Leader, but the performance the region has achieved has deteriorated. The radar chart shows the relative strengths compared to Sweden with the red line and to the EU with the blue line. Strengths are, e.g., patent applications to the European Patent office (EPO)—patent applications, and weaknesses, e.g., cooperation of innovative small and medium enterprises (SMEs)—Figure 4.

Figure 4.

The Regional Innovation Scoreboard (RIS) 2017 for Sydsverige. Source: https://ec.europa.eu/docsroom/documents/24187. (accessed on 20 December 2020).

As can be seen, the regions covered in the study vary in their level of innovation, but they all diverge from the innovation of the countries in which they are located (this is particularly evident in Sweden and Germany and West Pomerania in Poland), which are much less innovative than the country as a whole. Further considerations carried out in this study were planned and arranged in such a way as to create one coherent logical structure, gradually introducing the reader to the problematic issues. In the second chapter, data sources and research methods were characterized. Thanks to this, in the third chapter, it was possible to characterize the “image of the respondent.” The fourth chapter is by far the most valuable from the substantive point of view, and the longest in the entire article. It contains a summary of the research results and conclusions that can be drawn on this basis. It is concluded with a synthetic summary that presents the most important observations and recommendations.

2. Materials and Methods

The data were collected in two-time stages in four EU countries: Poland, Sweden, Lithuania, and Germany. The first stage took place in May and June 2020. It was realized within the framework of the “Creative Cluster” project, which aims to improve and encourage cooperation between cultural and creative operators from the participating countries and further develop strategies and processes related to building their potential. The selection of countries was therefore closely related to the implementation of the project and included its participants, i.e., countries from the South Baltic region. In this paper, the study will be recorded as Stage A or Study A. Further data collection (Stage B or Survey B) takes place in the same countries and was initiated in September 2020 and is still ongoing. For the purpose of this article, the information that was collected by the end of November 2020 will be presented. The authors predict the end of Stage B at the end of January 2021. The second stage was not externally funded and is being carried out by the scientific team that includes the authors of this publication. Finally, 682 subjects were successfully examined in stages A and B. It is also planned to carry out the next (3rd stage) of research in the third or fourth quarter of 2021.

The undertaken activities are to lead to the solution of the research problem, outlined in the introduction and to the verification of the adopted research hypotheses. In general, they are to be an answer to the question about the financial and organizational condition, opinions, and expectations of CCI sector entities in the era of the COVID-19 pandemic.

Stage A was not an anonymous study, as it served the purpose of the implemented project, i.e., to maintain or establish new partnership relations between CCI sector entities. The basic role of Stage B is to collect data in order to analyze the occurring phenomena. Therefore, it was decided to keep the respondents anonymous. Moreover, the anonymity makes the entities to which the questionnaire is sent more willingly and in greater number participate in the research.

The choice of the research method was determined by several factors. The first of them was the subject of the study, which determined the aim of the study and the statistical community. Knowing the basic information about the target group and the aim of the study, the duration of the study was assumed. Then, the sample size was determined so that the study was representative and had the required accuracy. The resulting survey concept, after statistical consultation, proved unequivocally that the selection of a questionnaire survey—a relatively cheap, fast and reliable method that does not require the construction of extensive research teams—would be the most appropriate. Regulations and restrictions introduced in connection with the coronavirus pandemic and a relatively large area of research made the decision to use CAWI (Computer Assisted Web Interview). However, reality verified the initial assumptions, because (data at the end of November 2020) such a form of survey could be conducted in 97.5% of cases, and in 2% of cases it was necessary to use telephone interviews and send a printed questionnaire by mail in 0.5%. The questionnaire was carefully prepared by people with scientific experience and consulted by three independent professors from three separate research centers. Between stage A and B, it was also subject to minor technical changes, but not affecting data consistency and substantive unity.

During the analysis of the results, time comparisons between research A and B were abandoned (due to the use of many open-ended questions and different research attempts). An exception was made for the question directly related to COVID-19: What do you think your situation will be after the COVID-19 pandemic? The collected questionnaires were verified for technical correctness—incorrect or largely empty questionnaires were rejected. The answers were coded and subjected to further statistical analysis.

In the survey, open questions were used to a significant extent. In the case of a large sample, this is a certain discomfort especially when creating comparative analysis. However, the context of the respondents’ answers was in many cases similar, which prompted the researchers to develop an aggregating model. It was decided to create groups to which individual results were assigned. If the respondent’s statement was multi-faceted, it was possible to place them in more than one group. The groups were described with keywords of a general nature, so that they had a large substantive capacity. Their subject matter is related and results from the sense of thought provided by the respondents. In the end, 32 groups were formed:

- equipment,

- Internet and technology,

- finances,

- office/studio with big space,

- creativity and development,

- professional employees,

- promoting culture, nature, and history,

- customers,

- passion,

- knowledge and good ideas,

- experience

- market analysis,

- innovation and competitiveness,

- modern products and services,

- education,

- partnership,

- marketing,

- physical meetings,

- trends and impact from environment,

- paperwork,

- all,

- time,

- protection of intellectual property,

- foreign languages,

- strategy,

- regulations,

- COVID-19,

- economic stability,

- information society,

- ecology,

- other,

- no answer.

An additional selection was carried out for the individual questions: answers with indications below 10 were ignored, indications between 11 and 49 were considered insignificant and rejected, groups that scored between 50 and 99 were identified as significant, and those equal to and greater than 100 as very significant. No answer and other groups were also rejected, although the latter proved to be very numerous in several cases. The results were then compared with the countries from which the respondents came from, thus identifying leaders on the issue. It did not happen that the two countries achieved the same highest ex aequo score. The greatest individualism of attitudes and opinions was observed in the case of respondents from Germany. Such a lack of polarization of responses resulted in an increase in the size of the group “other”. It was decided to carry out statistical detection of regularities in the field of correlation of phenomena. The study of polytomic features is based on parameters related to statistics . On the basis of it, you can calculate the convergence coefficients such as: Txy Czuprowa, V-Cramer, C-Pearson, or Ø Yule. Due to positive experiences in other studies, the authors decided to use the V-Cramer method. It is quite similar to C-Pearson’s and Txy Czuprow’s method and can be used under similar circumstances (assumptions) and obtain similar results. An important difference is the independence of the V-Cramer method from the number of columns and rows in the association table. The V-Cramer allows to measure the relationship between variables whose values are expressed on nominal scales. The results it takes are in the range [0,1]. If the obtained result comes closer to unity, it means that there are very strong relations between qualitative variables. If it is zero or close to zero, it means independence of the analyzed characteristics.

The following assumptions were made: the significance level for the chi test was set at ≤ 0.05. For the V-Cramer coefficient, the following thresholds were adopted to determine the strength of the relation: ≤0.24999(...)—no significant relation; from 0.25 to 0.4999(...)—a relation of moderate strength; from 0.5 to 0.74999(...)—a relation of great strength; above 0.75—a relation of very great strength. The established thresholds are subjective and have been determined by the authors on the basis of comparisons of the obtained results with the assumed correlations resulting from substantive and logical analysis as well as research experience and general statistical knowledge.

3. Image of the Respondent

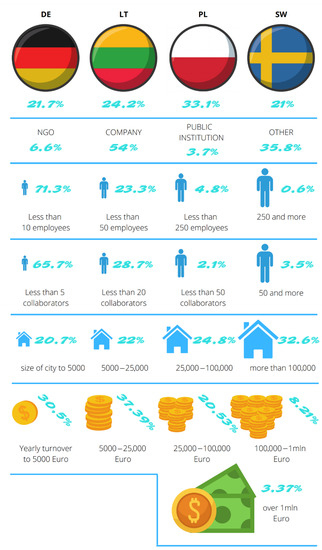

As already mentioned, the survey is being conducted in four countries: Germany, Lithuania, Poland, and Sweden. The ordered data about the respondents are presented in Figure 1. The highest number of responses was obtained from Polish institutions and companies (slightly over 33% of the total). It was possible to obtain quite a proportional distribution of the statistical community in the geographical sense, i.e., place of origin of the audited entity. The majority of respondents declared that they work in companies. This is confirmed by the tri-sectoral nature and various organizational forms of the creative sector, which includes state institutions, Non-governmental organizations (NGOs), and the private sector.

The CCI sector is formed by small entities, usually employing up to 10 employees (over 70% of indications). Larger organizations with less than 50 employees (slightly more than 23% of indications) are less common. The share of larger entities is rather marginal (over 50 employees—5.6% of responses). The survey shows a simple correlation trend between the number of employees and the number of collaborators and volunteers. The larger an organization is, the more people support it and function in its environment. This consistency is logical and is confirmed by general observations and research on the CCI sector.

Culture and creativity need direct access to the audience and creators. This determines the necessity of having a seat in a large agglomeration. This is how almost 33% of the surveyed companies and institutions function. However, this does not mean high affluence. The annual turnover was declared to be below 25,000 Euros per year in most cases, but this value may be significantly understated due to the current coronavirus pandemic.

In 2015, the total turnover of CCI entities in Poland fluctuated between 12,000 zloty (approximately €3000) and 640,000 zloty (approximately €156,000). Thus, significant differences and, by implication, different company sizes (further information follows on this aspect) can be noted between entity turnover, with some having a relatively small turnover through to those that have a larger turnover. Last year’s (2015) turnover by companies stood, on average, at around the 120,000 zloty, which is around €30,000.

Analyzing the results, the volume of turnover is related to the size of the company and the number of employees. Most of the organizations are micro-organizations up to 9 employees. And most of the respondents (71.3%) represented micro-organizations; 23.3% were organizations with up to 50 employees and only 0.6% had 250 employees. The CCI industry is extremely complex. It consists of organizations from various social, economic, cultural, and technical fields. This multidimensionality and diversity are confirmed by the results gathered in Table 1.

Table 1.

Main activity of respondents.

In summary and taking into account the observed trends, the average respondent can be described as a small company, without a significant number of co-workers and volunteers, located in a large city and with an annual turnover of less than 25,000 Euro (Figure 5).

Figure 5.

Image of the respondent. Source: own research.

4. Results and Discussion

In the South Baltic area, small and medium sized enterprises are the most common and are one of the key drivers of regional economies. In order to compete in the global market, the South Baltic needs to ensure skilled labor force and access to good and solid R&D activities in the region and to better utilize the knowledge and research industry in the South Baltic area.

Although the region has a fairly good network of vocational training institutions and universities that give access to education related to the humanities and sciences, it is an underutilized source of labor force and know-how. The situation is similar when we consider research centers and technology development centers. Access to these institutions is quite good, and this is not limited to the major urban areas in the region, but also applies to many smaller towns. Nevertheless, their research is not translated into the region.

Regarding the culture and creative sector in the South Baltic region, it is clear that it is quite a strong and fast-growing industry.

Table 2, with aggregated and grouped answers to the five issues, can be interpreted in many ways because it is multi-faceted in terms of the content. It turns out that for the respondents, most often material issues are important or very important. This is proved by the appearance of the following groups of answers: finances in 5/5 cases (and 3/5 among very important factors alone). This is consistent with the observation that CCI organizations are companies with business rights, so they have to take care of their profitability. The entities for which this aspect is most important (highest results) are those located in Poland. The second most frequent declaration was “equipment, Internet, and technology”—in 4/5 cases (and among very important factors 3/5). This is understandable given the fact that technology enables creation in many spaces and forms, while offering more effective tools that bring more effective results [5,46]. Another reason for such a large number of indications can be seen in the reduction of labor costs and in the possibility of reaching a larger number of recipients thanks to representation in virtual space, i.e., on the Internet [46]. The research was conducted during a pandemic, during which many institutions were forced to move away from classical solutions and turn to Internet communication Technology (ICT)-based work organization. This is a great challenge, which few have managed to meet with full success, and yet the success in this matter determines the possibility of further functioning or closure of the organization [47]. According to the results, equipment, Internet, and technology are of particular importance for the Lithuanian auditors. Respondents considered important or very important non-material factors like “passion, knowledge, and good ideas” and “creativity and development.” Both of these responses appeared in Table 2 three times, the first of them twice and the second only once among the “very important” group. (The answer “everything is important” is not included). Swedish companies and institutions gave the highest number of declarations, from which the significance of these factors was derived. Without passion, one cannot speak of creating a high level of culture, while creativity and development are one of the main assumptions and effects of the CCI sector.

Table 2.

Factors identified as important and very important in relation to countries.

The last position that deserves to be distinguished due to the frequent appearance among the qualified to significant responses were “professional employees.” Competent and professional employees are highly sought after in the CCI sector, which is based on the human factor and its ability to create [39]. This was the opinion of the German organizations.

The context of the COVID-19 pandemic appeared only in one group of answers to the question “What can change the rules of a company or institution in the CCI sector?” Due to the number of votes cast, the coronavirus pandemic was qualified as an important factor, in the opinion of entities most often coming from Germany [48].

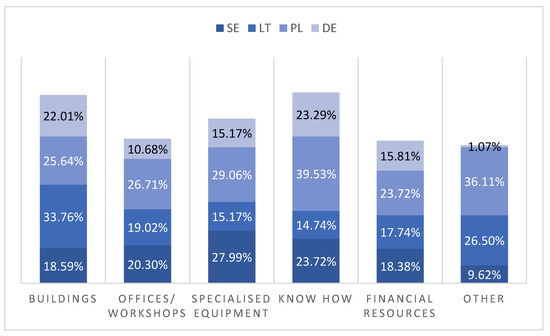

In order to operate correctly and fulfill their mission, both economic and socio-cultural institutions operating in the CCI sector must have constant access to resources. These resources can have both material and non-material dimensions. As shown in Figure 6, the resources that they most often possess are knowledge and real estate. Paradoxically, having a permanent location does not mean having a professional workshop and office. These are expensive and require a considerable financial outlay in order to obtain an appropriate presentation and functionality. And this is one of the resources that this organization lacks most.

Figure 6.

Material and nonmaterial values in possession organizations from CCI sector. Source: own research, multi answer possibility.

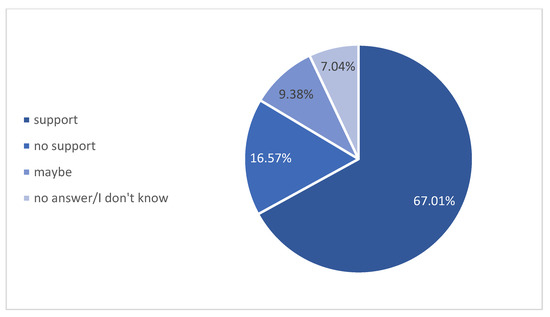

Regardless of the data presented in Figure 6, a very optimistic approach was observed among opinion leaders. More than 67% of them believe that over the next five years their governments or international institutions will provide support for their industry, thus enabling not only survival but further development and success (Figure 7).

Figure 7.

Will the economy support the CCI sector in the next 5 years? Source: own research.

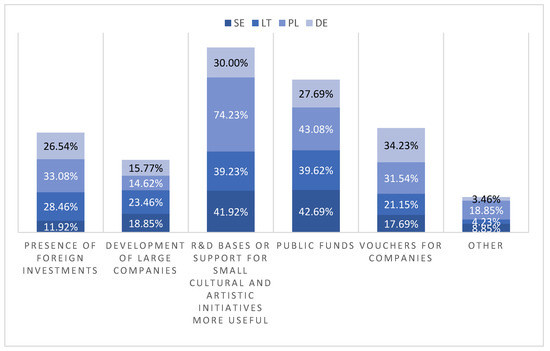

Looking through the prism of local communities, the respondents were asked to share their experiences and knowledge about their perceived problems and needs. In reference to the collected data (Figure 8), the issue of insufficient support for CCI entities, this time at the regional level, was once again revealed. Moreover, attention was drawn to unfortunate or missed objectives of local support strategies, which do not effectively address the most urgent needs. Incorrect allocation of funds causes that undertakings are implemented in accordance with the direction of support policy, not with the planned development and creative intentions of CCI sector organizations.

Figure 8.

Aspects with need supported in the region. Source: own research, multi answer possibility.

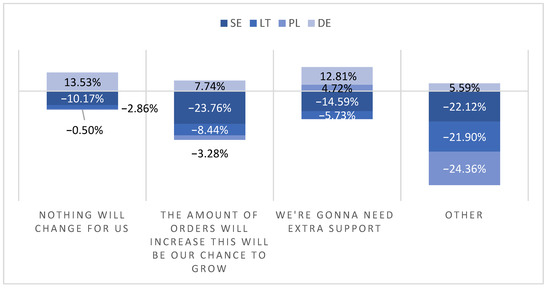

Study A was conducted at a time when the effects of the pandemic were relatively weak but with a sense of high uncertainty and fear (May/June 2020) and Study B was conducted under conditions of feeling relatively strong effects of the pandemic but in an atmosphere of daily life, routine, and acceptance. Study B was initiated in September 2020 and continues to the present. Respondents participating in it were already knowledgeable and familiar with mechanisms and techniques to protect themselves from the disease and were aware of advanced vaccine development. In addition, they had the opportunity to become beneficiaries of numerous government assistance programs. It is clear that COVID-19 has had and continues to have a tremendous impact on the opinions of the respondents. The changes in thinking and the evolution of the respondents’ views are presented in Figure 9, from which it can be concluded that:

Figure 9.

Situation forecast after COVID-19 pandemic based on study A and B. Source: own research, multi answer possibility.

- in almost all countries (except Germany) the number of entrepreneurs feeling discouraged and not believing that their situation will improve after the pandemic has ended has decreased,

- paradoxically, sub-entrepreneurs from Sweden, Lithuania, and Poland are not sure that after the end of the global crisis the number of orders will dramatically increase, which will be an opportunity for them to develop,

- in Poland and Germany, there has been an increase in the proportion of companies which believe that support is not only needed during the pandemic but will also be needed after it ends.

Further statistical analysis of the results, which uses the V-Cramer method, made it possible to detect relationships between the observed phenomena. The first one concerned the relationship between the respondent’s country of origin and the annual turnover of the institution associated with it. This is a relationship of moderate strength. The second one was discovered between the respondent’s country of origin and the size of the city where he or she operates. This time the relationship can be characterized as very strong.

These two statistically significant relationships are extremely difficult to interpret. However, the fact that they occur leads to conclusions, but only in the mode of conjecture and reference to the observation of the environment and the occurring causal associations and similarities.

The leader in terms of turnover volume are Swedish companies. They are highly commercialized. This may be related to the wealth of the society and the policy of stimulating cultural initiatives. The lowest turnover was recorded in Lithuania, and in Poland, the distribution seems to be the most proportional, which may account for the high differentiation and absorption of the market. In Germany, the value was dominated by turnover between 5000 and 25,000 Euros. It should be remembered that the sector in question is a specific one in which, contrary to the laws of economics, profit may be a secondary objective and many initiatives are pro bono.

Statistical relationship between the country of origin and location in terms of the size of the city where the company is located, the observed phenomena also look very interesting. In Poland, CCI sector entities are mainly concentrated in large agglomerations. In Sweden, these are mostly medium-sized cities. In Lithuania and Germany, very “proportional” distributions were observed.

Taking in the consideration that supporting innovation is also one of the sustainable agenda goals, it is worth putting together regional innovation and CCI conditions. Regional innovation performance shows that there are significant differences in the South Baltic area [34,40,41,42,43,44,45]. Most subregions perform below the national average. Lower development is also visible in the performance of knowledge-based sectors, business innovation, and creative and cultural sectors. Large areas of the region struggle with limited accessibility to the population. This is related to the distribution of settlements, significant distances from each other, as well as from metropolitan areas such as Copenhagen-Malmö. In addition, the transport system that connects different parts of the South Baltic requires significant improvement of air-rail and ferry connections in order to improve direct links for future passengers.

According to the study conducted by the team, the most successful CCI organizations are those that originate from Sweden. This also correlates with the innovation index, which indicates that the region is highly innovative. CCIs from Germany’s Meckelmburg region show high fragmentation and not very strong positions. This may be due to the peripheral location of the region itself, the generally low concentration of industry and historical conditions. However, the regional innovation index shows an increase since the last survey, which may also translate into an increase in the competitiveness and position of the creative and cultural sector in the region. Polish CCIs are equally dispersed and aspirational, which correlates with the regional creativity index. Large differences in the condition of the sector can also be seen between the Polish regions themselves. The level of support and recognition of CCI in Pomerania is much higher—the creative sector is inscribed as a smart specialization of the region. The authors did not reach the results of the innovation level in Lithuania.

5. Conclusions

In summary, the South Baltic area is diverse in terms of its social structure and its economies at regional and sub-regional levels. There are, however, contrasts in earnings and quality of life which normally sees a pattern of being higher in the West and decreasing the further East with the exceptions to this rule normally being the industrial/service sector and urban hotspots.

Respondents, while indicating the frequency of the implementation of the product development/design, stressed that what is very important in this process is to define clear design objectives (they do it nearly as a standard procedure),—project plan and key milestones (they do it frequently), define strategy for design (direction/idea creation, they do it frequently), hold review meetings on a regular basis (they do it frequently).

It is not that common to determine the skill requirements of the project team. Usually, companies that have been involved with product development/design operated on the market for more than a few years. Staff employed by creative industry companies is usually educated in other subjects other than design management. The knowledge about design management is not that common in Poland. This is a growing area of expertise. Companies in creative industries usually operate in services and employ service providers and manufacturers. Taking into account the aims of sustainable development strategy, one can undoubtedly notice the relation between creative sector organizations and realization of the aims of the strategy. Undoubtedly, further research is required to prove the direct influence of the creative sector on the realization of these goals. Nevertheless, the creative class created around the creative sector, with its responsible, less consumerist attitude to the market, with its desire to acquire experience and quality, contributes to the strengthening of the “creative turn” movement. The authors recommend deepening research on the condition and future of the creative sector as a sector that guarantees stable and sustainable jobs, whose fuel is human creativity.

Author Contributions

Conceptualization, M.K., E.G., L.G. and P.G.; formal analysis, M.K., E.G., L.G. and P.G.; methodology, M.K., E.G., L.G. and P.G.; writing and editing, M.K., E.G., L.G. and P.G.; visualization, M.K., E.G., L.G. and P.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Research results, data and drawings can be found at www address: https://drive.google.com/file/d/10JmD1x_dFZmql-dgn1GSQen-SdqSawU5/view (accessed on 14 December 2020).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hamel, G. Leading the Revolution; Harvard Business School Press: Boston, MA, USA, 2000. [Google Scholar]

- Townley, B.; Beech, N.; McKinlay, A. Managing in the creative industries: Managing the motley crew. Hum. Relat. 2009, 62, 939–962. [Google Scholar] [CrossRef]

- Towse, R. Ekonomia Kultury; Kompendium; Narodowe Centrum Kultury: Warszawa, Poland, 2011. [Google Scholar]

- Garnham, N. From cultural to creative industries. Int. J. Cult. Policy 2005, 11. [Google Scholar] [CrossRef]

- Galloway, S.; Stewart, D. A Critique of Definitions of the Cultural and Creative Industries in Public Policy. Int. J. Cult. Policy 2007, 13. [Google Scholar] [CrossRef]

- Bakhshi, S.; Shamma, D.A.; Gilbert, E. Faces Engage Us: Photos with Faces Attract More Likes an Comments on Instagram; One of CHInd (CHl): Toronto, ON, Canada, 2014. [Google Scholar] [CrossRef]

- Stryjakiewicz, T. Rozwój Sektora Kreatywnego w Regionach Metropolitarnych, Przekszatłcenia Struktur Regionalnych—Aspekty Społeczne, Ekonomiczne i Przyrodnicze; Instytut Geografii i Rozwoju Regionalnego: Poznań, Poland, 2010. [Google Scholar]

- Stryjakiewicz, T. Region Społeczno—Ekonomiczny i Rozwój Regionalny; Bogucki Wydawnictwo Naukowe: Poznań, Poland, 2012. [Google Scholar]

- Stryjakiewicz, T.; Męczyński, M.; Stachowiak, K. Sektor Kreatywnej Wiedzy w Poznaniu i Powicie Poznańskim w Świetle Wyników Międzynarodowego Projektu Badawczego; ACRE: Poznań, Poland, 2008. [Google Scholar]

- Suwala, L. The Geography of Creativity. Reg. Stud. 2012, 46, 1103–1105. [Google Scholar] [CrossRef]

- Lazzeretti, L. The Cultural Districtualisation Model; Cooke, P., Lazzeretti, L., Eds.; Edward Elgar Publishing: Northampton, MA, USA, 2008; pp. 93–121. [Google Scholar]

- Davis, C.; Creutzberg, T.; Arthurs, D. Applying an Innovation Cluster Framework to a Creative Industry: The Case of Screen-Based Media in Ontario. Innov. Manag. Policy Pract. 2009, 11, 201–214. [Google Scholar] [CrossRef]

- Europe 2020 Growth Strategy and Green Paper Zielona Księga w Sprawie Uwolnienia Potencjału Przedsiębiorstw z Branży Twórczej. p. 2. Available online: http://ec.europa.eu/culture/our-policy-development/doc/GreenPaper_creative_industries_pl.pdf (accessed on 14 December 2020).

- Henry, C.; de Bruin, A. Entrepreneurship and the creative economy. Process Pr. Policy 2011. [Google Scholar] [CrossRef]

- Nathan, M.; Lee, N. Does Cultural Diversity Help Innovation in Cities? Evidence from London’s Firms; SERC Working Paper 69; LSE: London, UK, 2015. [Google Scholar]

- Klein, M.; Spychalska Wojtkiewicz, M. Cross-Sector Partnerships for Innovation and Growth: Can Creative Industries Support Traditional Sector Innovations? Sustainability 2020, 12, 122. [Google Scholar] [CrossRef]

- Florida, R. Narodziny Klasy Kreatywnej; Narodowe Centrum Kultury: Warszawa, Poland, 2010. [Google Scholar]

- Pine, B.J.; Gilmore, J.H. The Experience Economy: Work Is Theatre and Every Business Is a Stage; Harvard Business School Press: Boston, MA, USA, 1999. [Google Scholar]

- McKinsey. 2018. Available online: https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/how-do-emerging-technologies-affect-the-creative-economy (accessed on 14 December 2020).

- Lisa, P. How are creative industries weathering the crisis? Camb. J. Reg. Econ. Soc. 2013, 6, 23–35. [Google Scholar] [CrossRef]

- Green, L.; Miles, I.; Rutter, J. Hidden Innovation in the Creative Industries; NESTA Working Paper; NESTA: London, UK, 2008. [Google Scholar]

- Brocchi, D. The Cultural Dimension of Sustainability. In Sustainability a New Frontier for the Arts and Culture; Kagan, S., Kirchang, V., Eds.; Verlag fur Akademische Schriften: Frankfurt am Main, Germany, 2008; pp. 25–58. [Google Scholar]

- Soini, V.; Dessein, J. Cultural Sustainability relation towards a conceptual framework. Sustainability 2016, 8, 167. [Google Scholar] [CrossRef]

- Hollands, R.G. Will the real smart city please stand up? Inteligent programme or entrepreneurial? City 2008, 12, 303–320. [Google Scholar] [CrossRef]

- Kirchberg, V.; Kogan, S. The Roles of Artists in the Emergence of Creative Sustainable Cities: Theoretical Clues and Empirical Ilussions, City, Culture and Society; University of Bristol: Bristol, UK, 2013. [Google Scholar]

- Rodrigues, M.; Franco, M. Measuring the urban sustainable development in cities through a composite index. The case of Portugal. Sustain. Dev. 2019, 1–14. [Google Scholar] [CrossRef]

- Martin-Brelot, H.; Grossetti, M.; Eckert, D.; Gritsai, O.; Kovacs, Z. The spatial mobility of creative class. A European perspetive. Int. J. Urban Reg. Res. 2010, 34, 854–870. [Google Scholar] [CrossRef]

- Howkins, J. The Creative Economy: How People Make More Money from Ideas; England Penguin: London, UK, 2001. [Google Scholar]

- Handke, C. Defining Creative Industries by Comparing the Creation of Novelty. Workshop Creative —A Measure for Urban Development? WIWIPOL: Vienna, Austria, 2004; pp. 64–81. [Google Scholar]

- Kimpeler, G. The Roles of Creative Industries in Regional Innovation and Knowledge Transfer—The Case of Austria in Measuring Creativity Measuring Creativity. Conference the Role of Creativity. Available online: https://www.researchgate.net/publication/41488292_The_roles_of_creative_industries_in_regional_innovation_and_knowledge_transfer_-_The_Case_of_Austria_in_Measuring_creativity (accessed on 20 December 2020).

- Bazalggete 2017. Available online: https://www.gov.uk/government/news/bazalgette-review-sets-recommendations-for-continued-growth-of-uks-creative-industries (accessed on 20 December 2020).

- Lee, N.; Drever, E. Do SMEs in deprived areas find it harder to access finance? Evidence from the UK Small Business Survey. Entrep. Reg. Dev. 2014, 26. [Google Scholar] [CrossRef]

- Jaaniste, L. Placing the creative sector within innovation: The full gamut. Innovation: Management. Policy Pract. 2009, 11, 215–229. [Google Scholar] [CrossRef]

- Lee, N.; Rodríguez-Pose, A. Entrepreneurial Potential in Less Innovative Regions: The Impact of Social and Cultural Environment. 2014. Available online: https://www.emerald.com/insight/content/doi/10.1108/EJMBE-07-2017-010/full/html (accessed on 27 December 2020).

- Lyck. Innovation and “Creative Economy”. 2011. Available online: https://openarchive.cbs.dk/handle/10398/8735 (accessed on 27 December 2020).

- Throsby D: Economics and Culture 2001. J. Cult. Econ. 2003, 27, 73–75. [CrossRef]

- Potts, J.; Cunningham, S. Four Models of the Creative Industries. Int. J. Cult. Policy 2008, 120, 163–180. [Google Scholar] [CrossRef]

- Mikić, H. Measuring Economic Contribution of Cultural Industries: Review and Assessment of Methodological Approaches; UNESCO Institute for Statistics: Montreal Canada, 2012; ISBN 978-92-9189-118-4. [Google Scholar]

- Mietzner, D.; Kamprath, M. A Competence Portfolio for Professionals in the Creative Industries. In Creativity and Innovation Management; John Wiley & Sons Ltd: Hoboken, NJ, USA, 2013; Volume 22, pp. 280–294. [Google Scholar]

- Koszarek, M. Diagnoza Sektora Branż Kreatywnych na Obszarze Metropolii Gdańskiej. Raport Końcowy. p. 11. Available online: http://www.creativecitiesproject.eu/en/output/doc-23-2011/SWOT_Gdansk_PL.pdf (accessed on 28 December 2020).

- The Regional Innovation Scoreboard (RIS) 2017. Available online: http://ec.europa.eu/growth/industry/innovation/facts-figures/regional_en (accessed on 27 December 2020).

- The Regional Innovation Scoreboard (RIS) 2017 for West Pomerania. Retrieved: 20.02.2019. Available online: https://ec.europa.eu/docsroom/documents/24181 (accessed on 14 December 2020).

- The Regional Innovation Scoreboard (RIS) 2017 for Pomerania. Available online: https://ec.europa.eu/docsroom/documents/24181 (accessed on 28 December 2020).

- The Regional Innovation Scoreboard (RIS) 2017 for Mecklenburg-Vorpommern. Available online: https://ec.europa.eu/docsroom/documents/24173 (accessed on 28 December 2020).

- The Regional Innovation Scoreboard (RIS) 2017 for Sydsverige. Available online: https://ec.europa.eu/docsroom/documents/2418745 (accessed on 28 December 2020).

- Materials Research and Innovation in the Creative Industries, Report on the Round Table Discussion, Brussels, Belgium 5 October 2012. EUR 25605 EN. Available online: https://op.europa.eu/en/publication-detail/-/publication/5e3c2ad2-e186-4793-b011-dc6f4a4860ab (accessed on 12 December 2020).

- Bhargava, J.; Klat, A. How the Internet is Fueling the Growth of Creative Economies; PWC report; PWC: Dubai, United Arab Emirates, 2016. [Google Scholar]

- COVID-19 Impact on the Cultural and Creative Industries in Germany. Economic Effects in a Scenario Analysis; Report Federal Ministry for Economic Affairs and Energy: Kompetenzzentrum Kultur- und Kreativwirtschaft des Bundes: Berlin, Germany, 2020.

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).