Long-Term Dynamic Behaviour of Human Resource Needs in Ghana’s Oil Sector: System Dynamics Approach

Abstract

1. Introduction

- What is the projected oil industry workforce needs in the next 50 years?

- What are the policy options to develop local human resource needs for the industry?

- To develop a causal loop diagram (CLD) based on a cause–effect diagram for human resource development (HRD) with the explicit purpose to illustrate the various factors influencing HRD and, in turn, depict the causal relationship in the CLD. The CLD has the advantage of aiding the research participants in understanding the root causes of an issue and its interrelationships. Therefore, the participants will be able to proffer better policy. This forms the first stage of the study covered by Obiri et al. [13] and summarised in Section 3.1.

- Based on the validated causal loop diagram in point 1, the system dynamics concept will transform the CLD into a stock and flow diagram for stimulation. This section constitutes the second stage of the study, which begins from Section 3.2 onwards.

2. Literature Review

3. Methodology

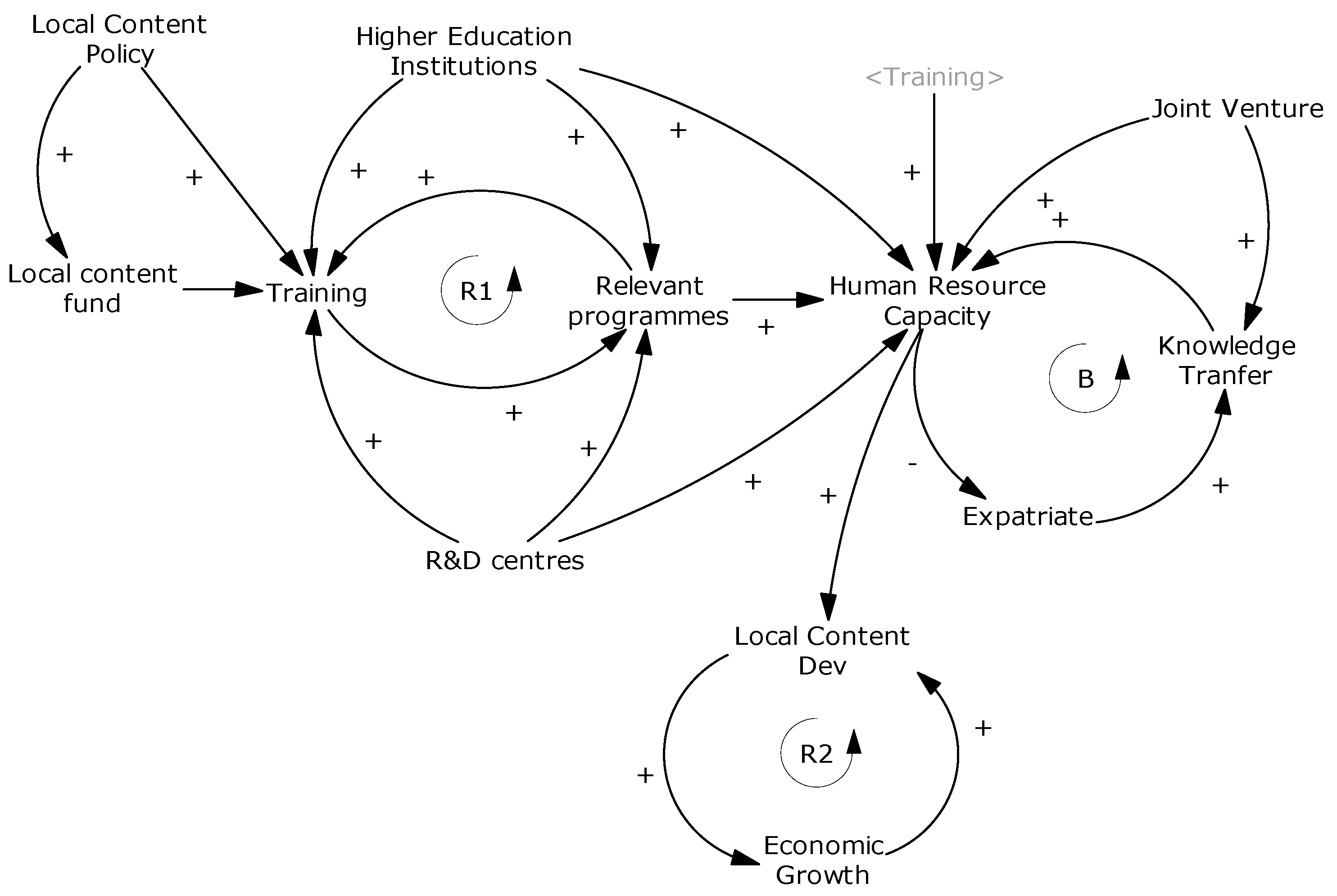

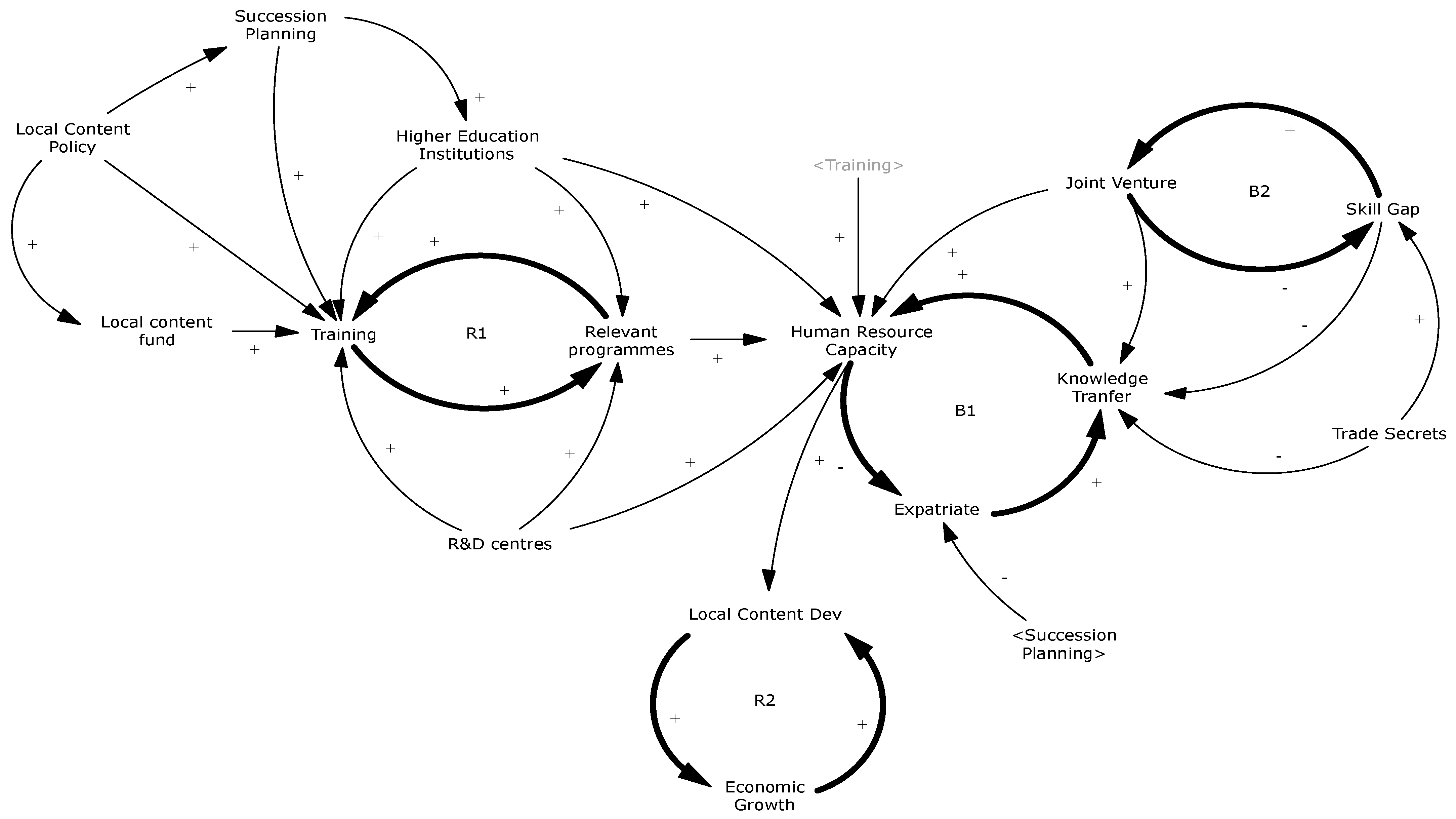

3.1. The Causal Loop Diagram

- How do you effectively deal with the loops in Figure 1?

- What are the policy options for this scenario in the diagram?

3.2. Validation of the Causal Loop Diagram

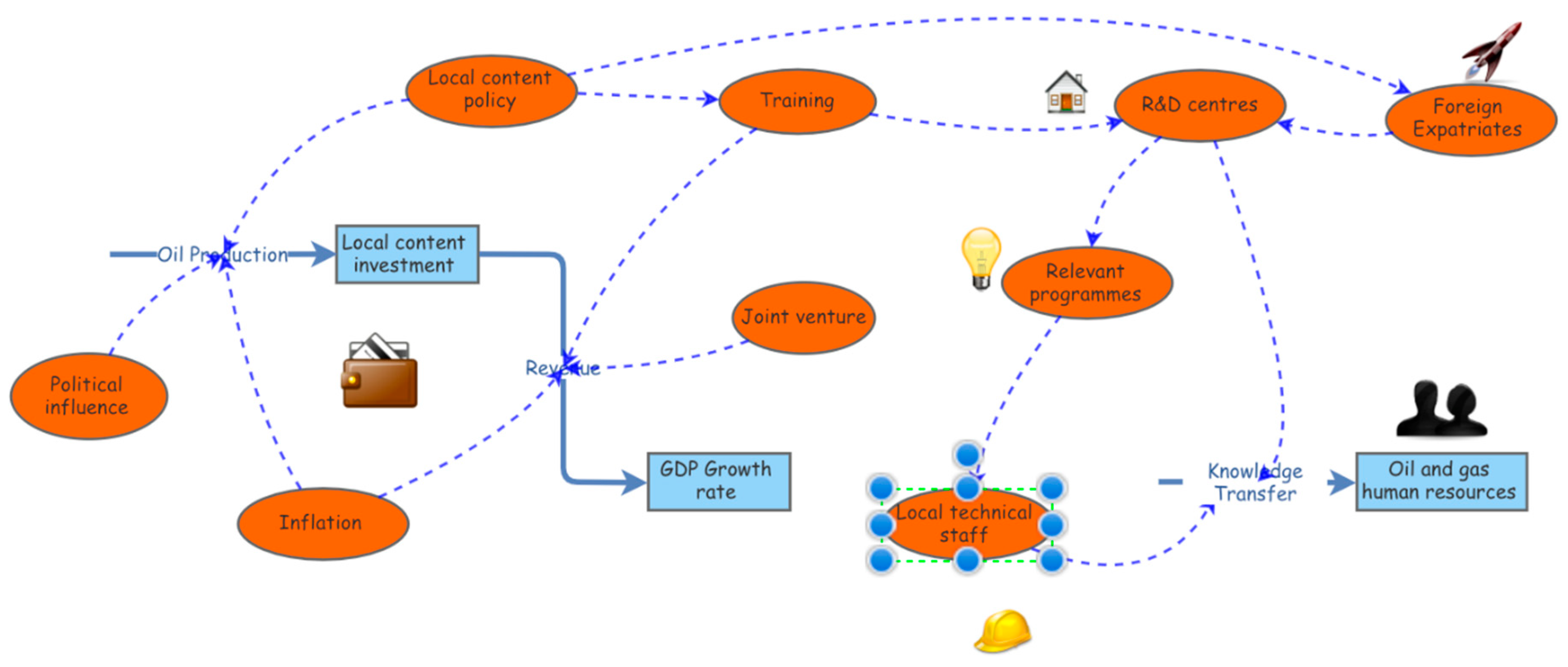

3.3. The Stock Flow Diagram

3.4. Sensitivity Analysis

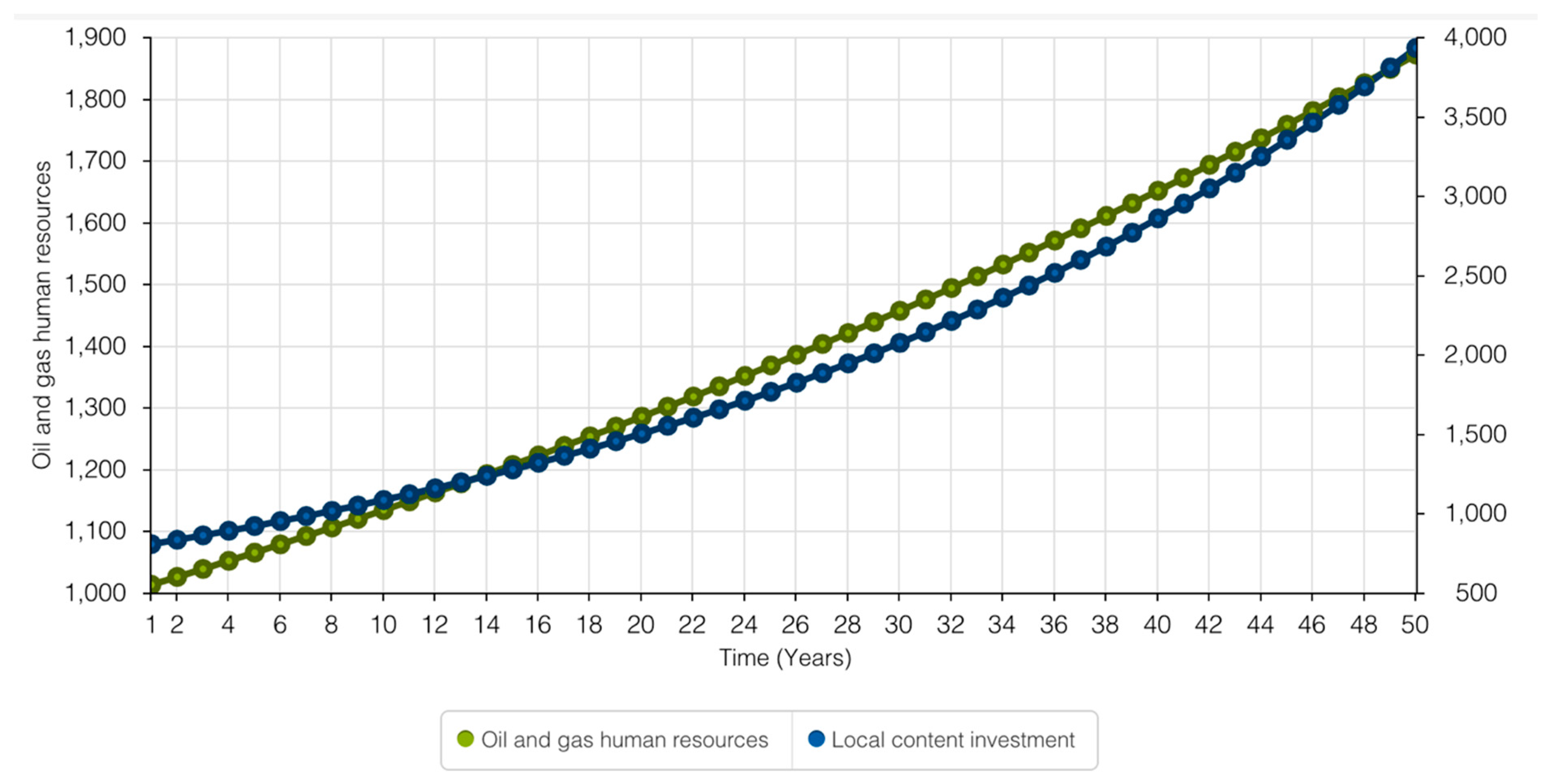

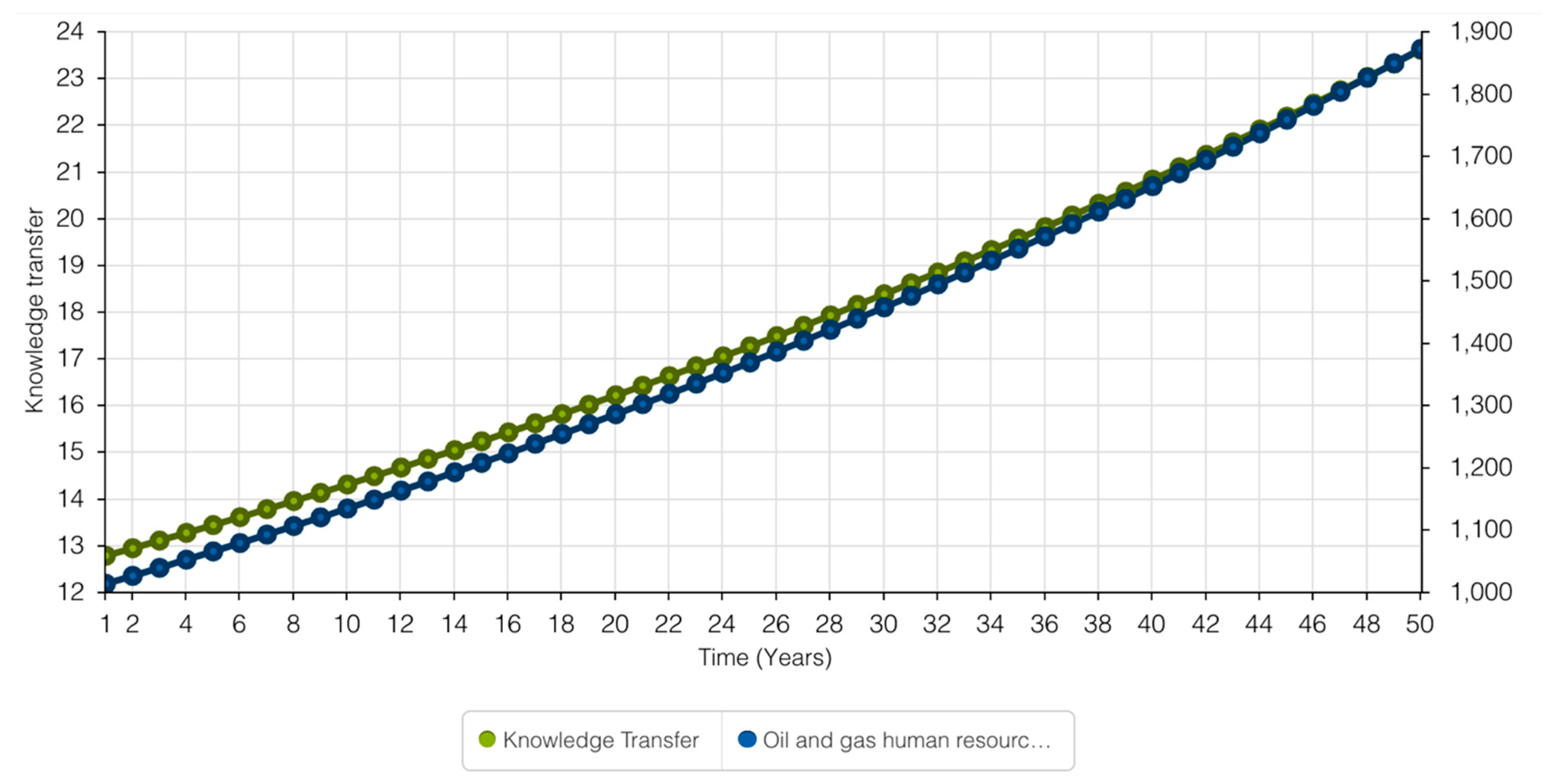

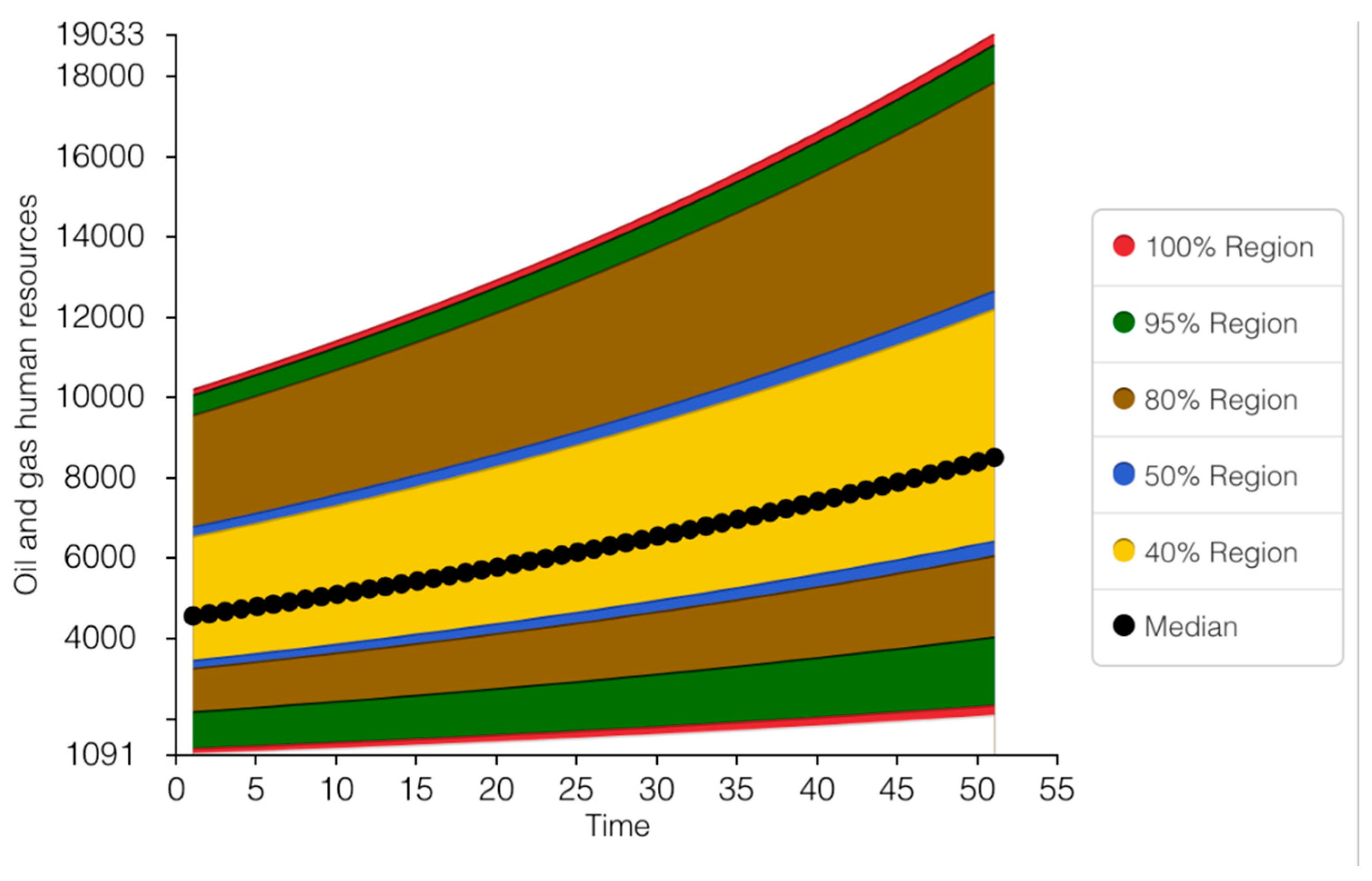

3.4.1. Oil and Gas Human Resources

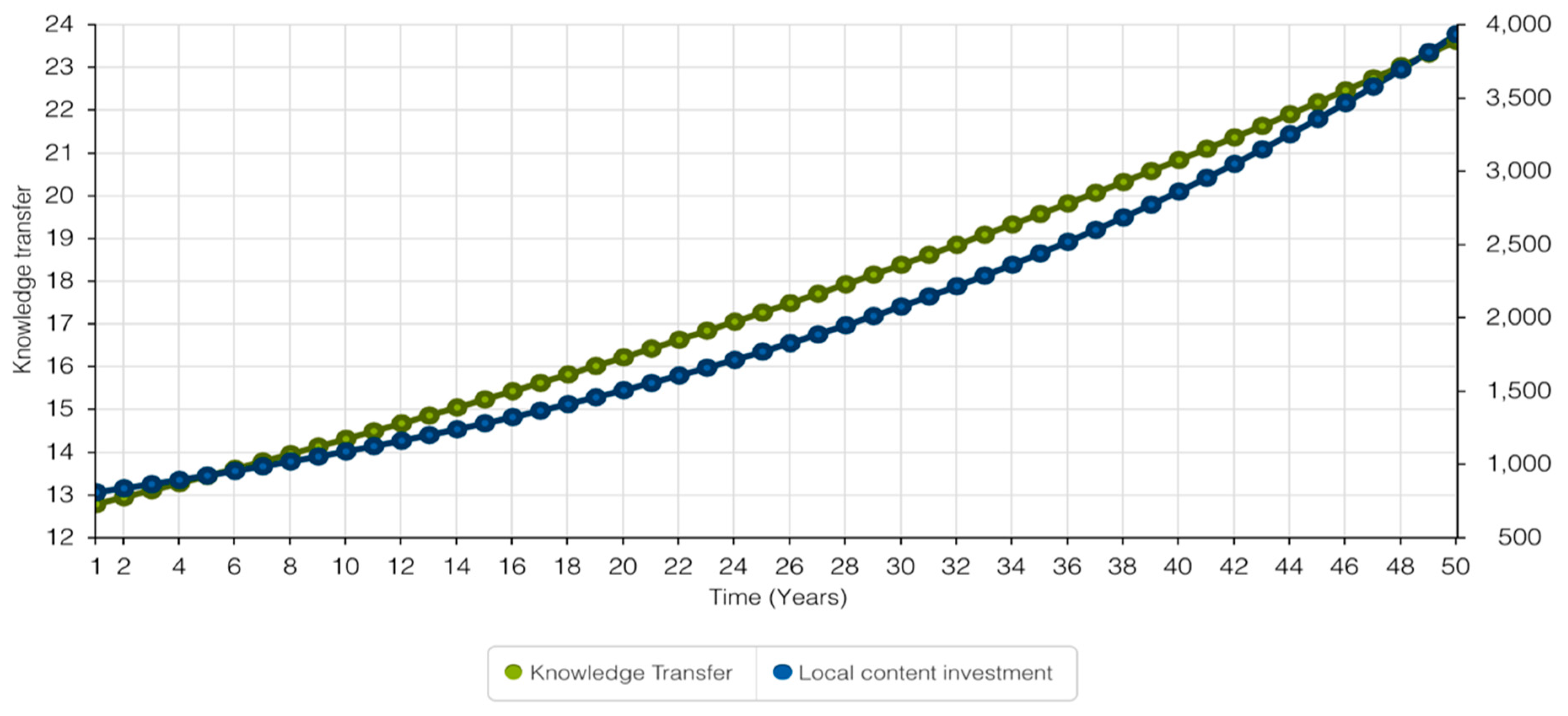

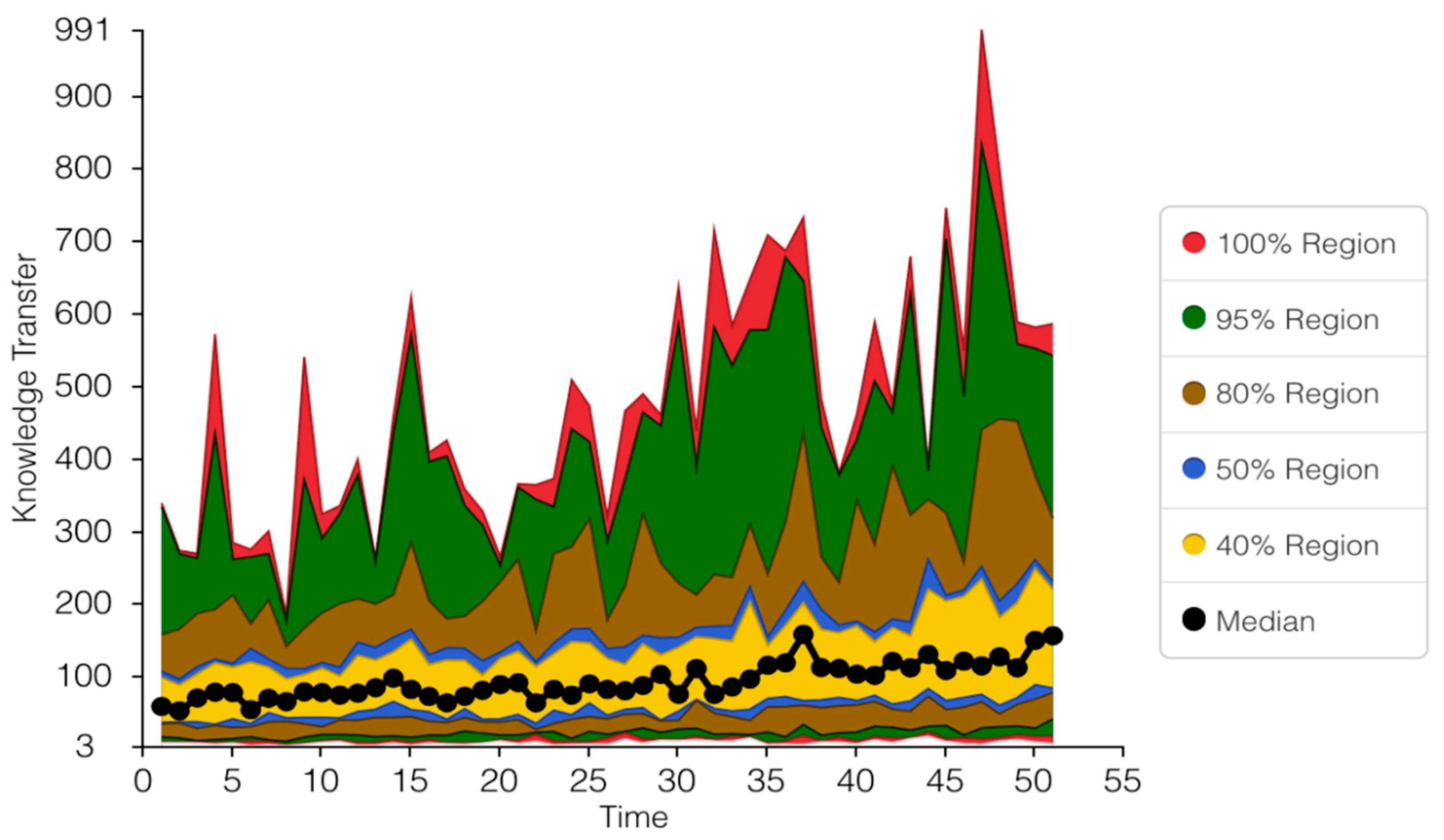

3.4.2. Knowledge Transfer

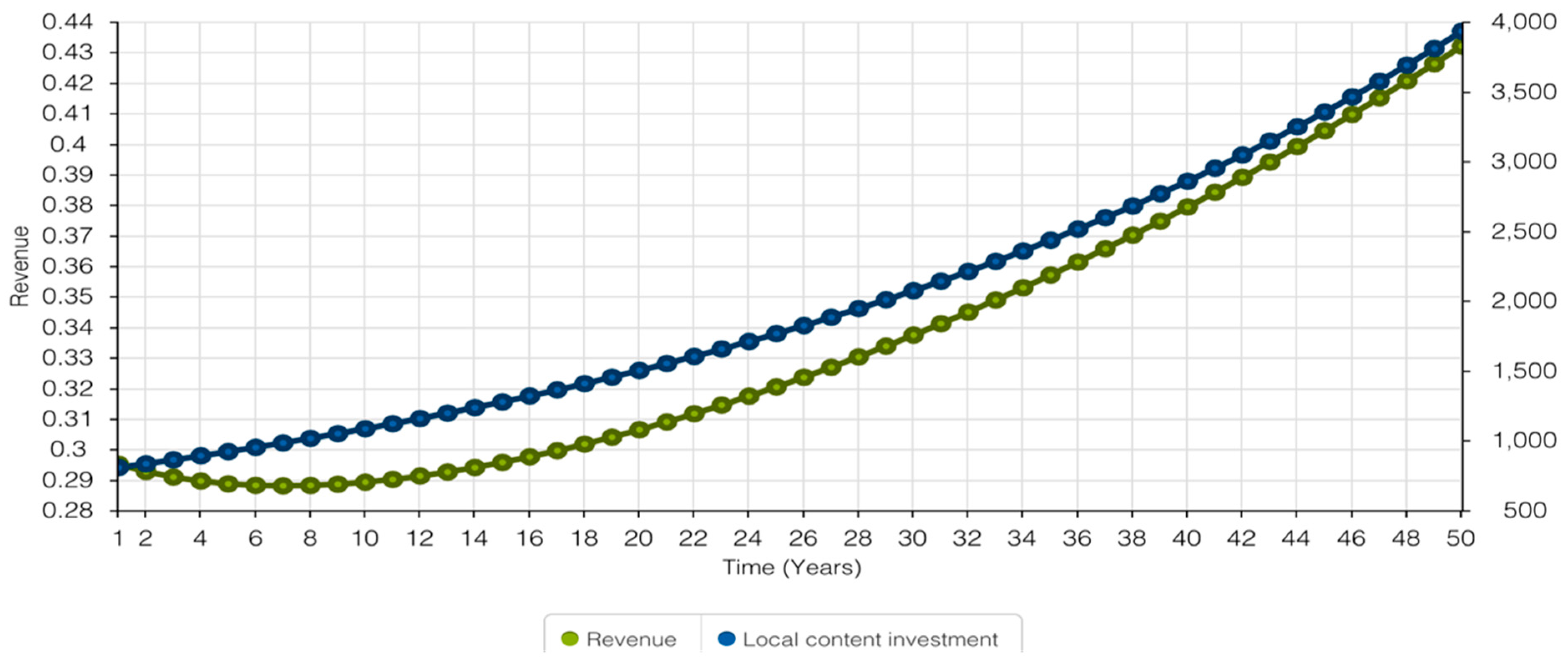

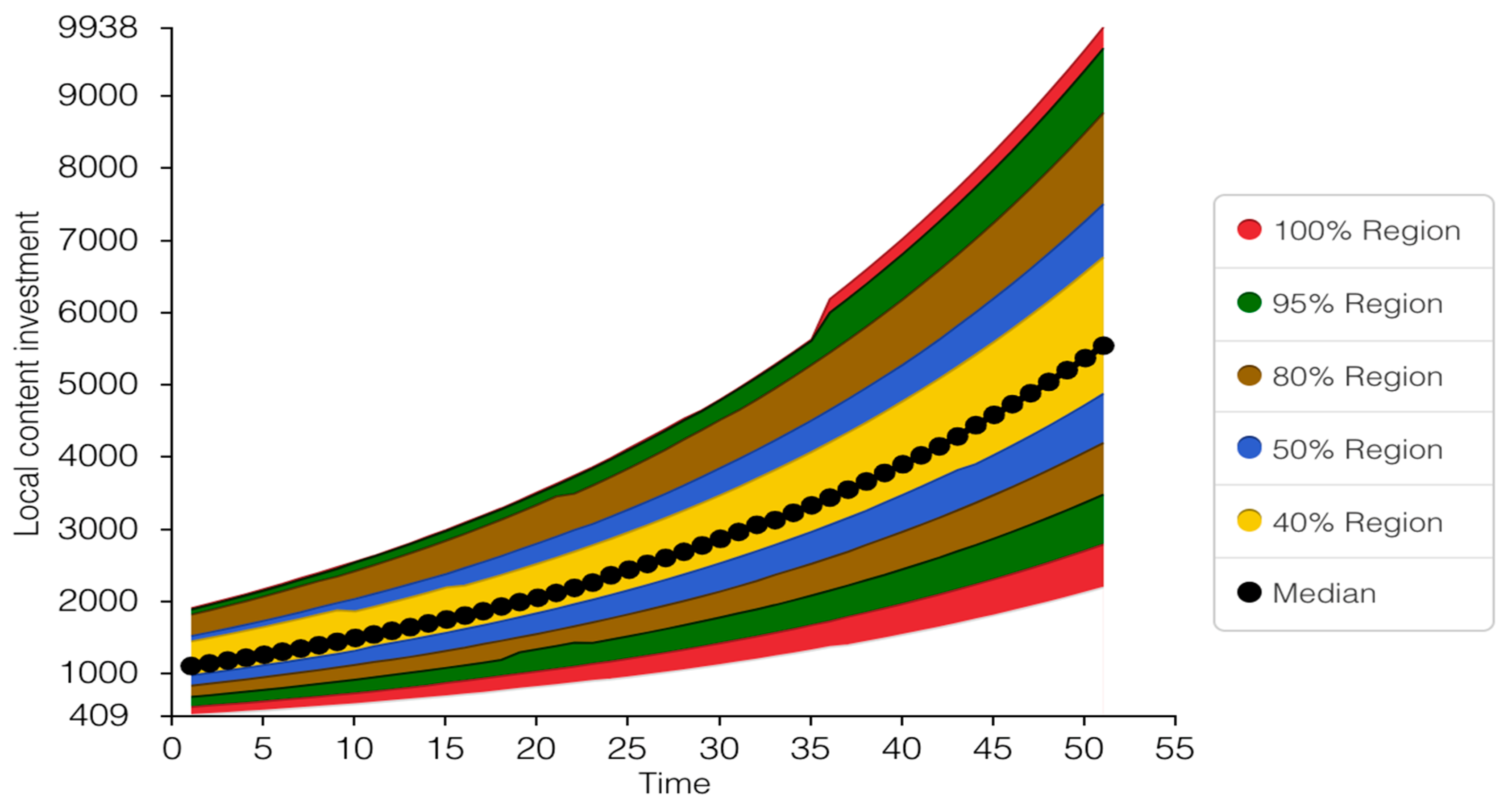

3.4.3. Local Content Investment

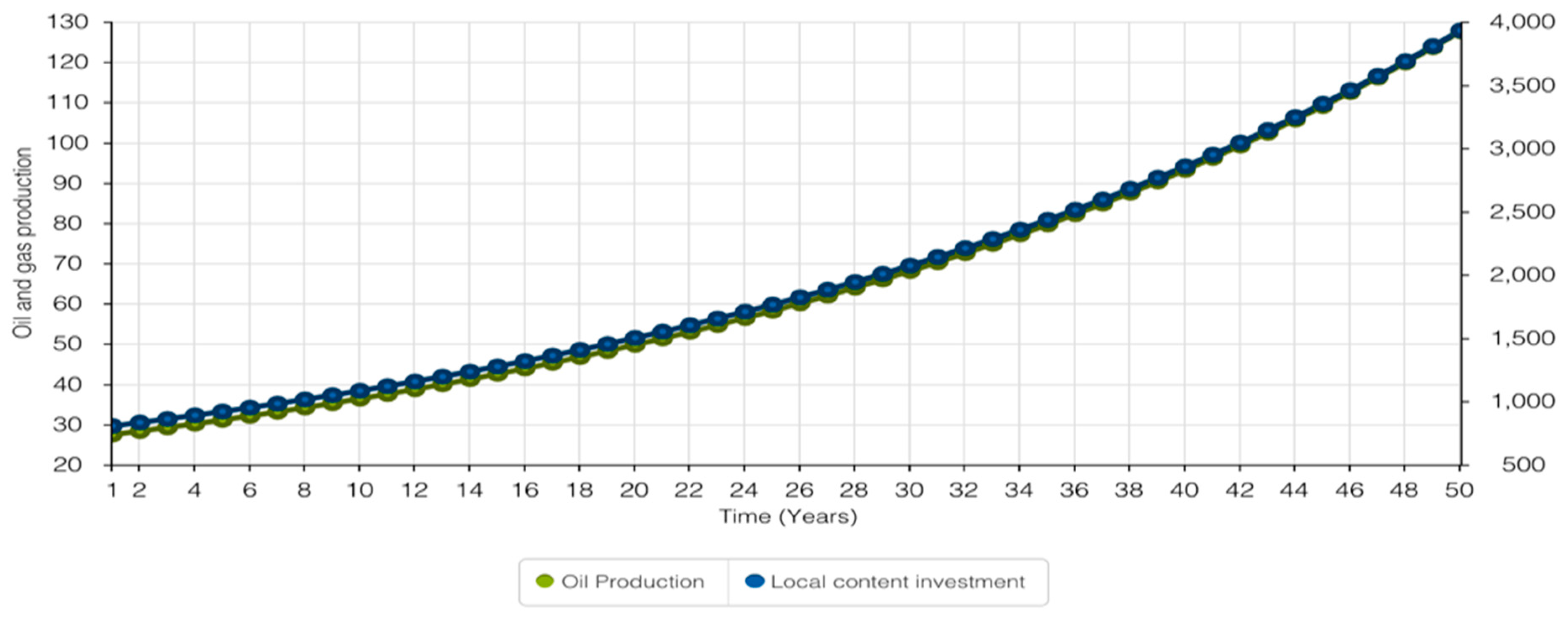

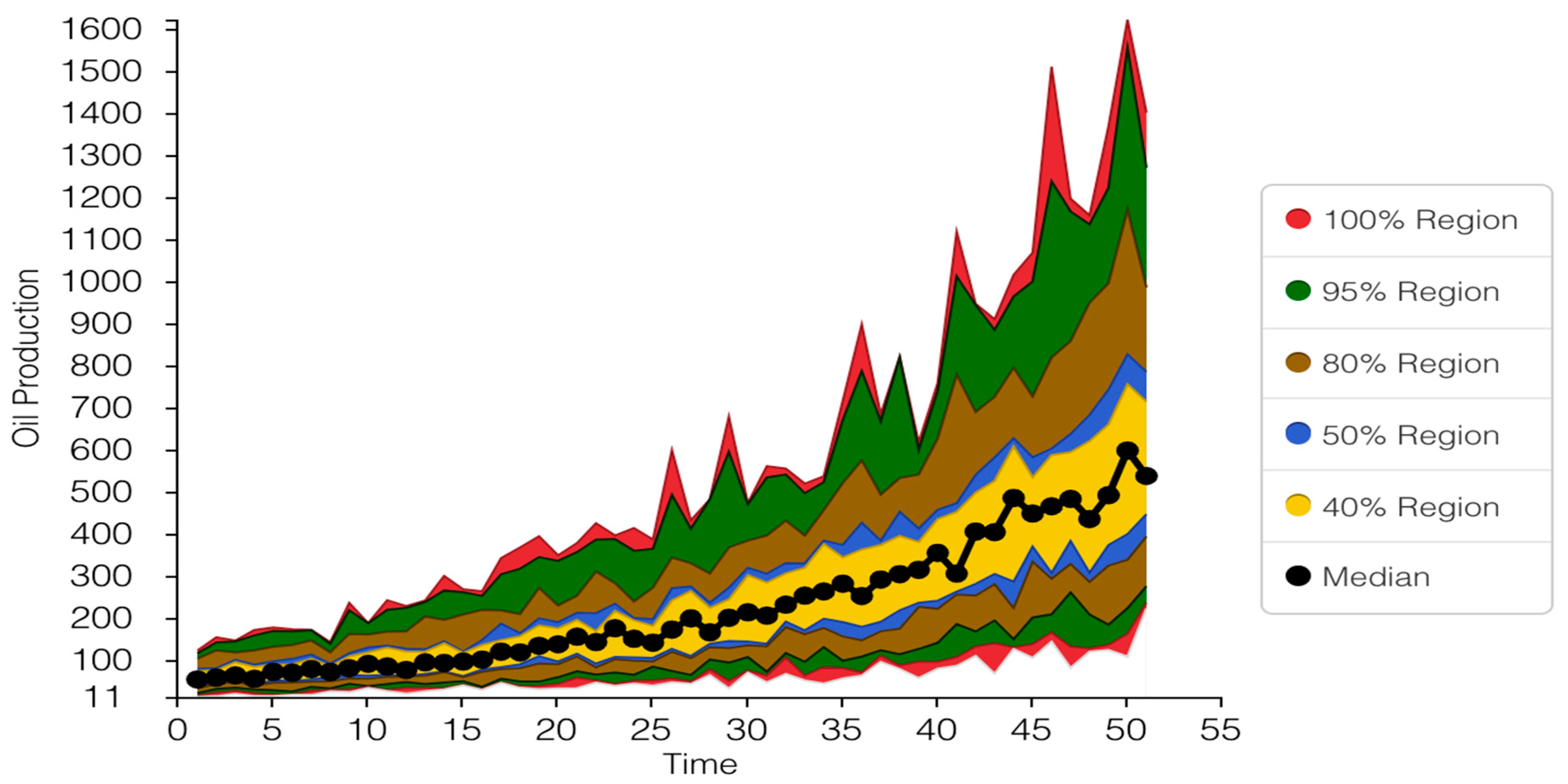

3.4.4. Oil Production

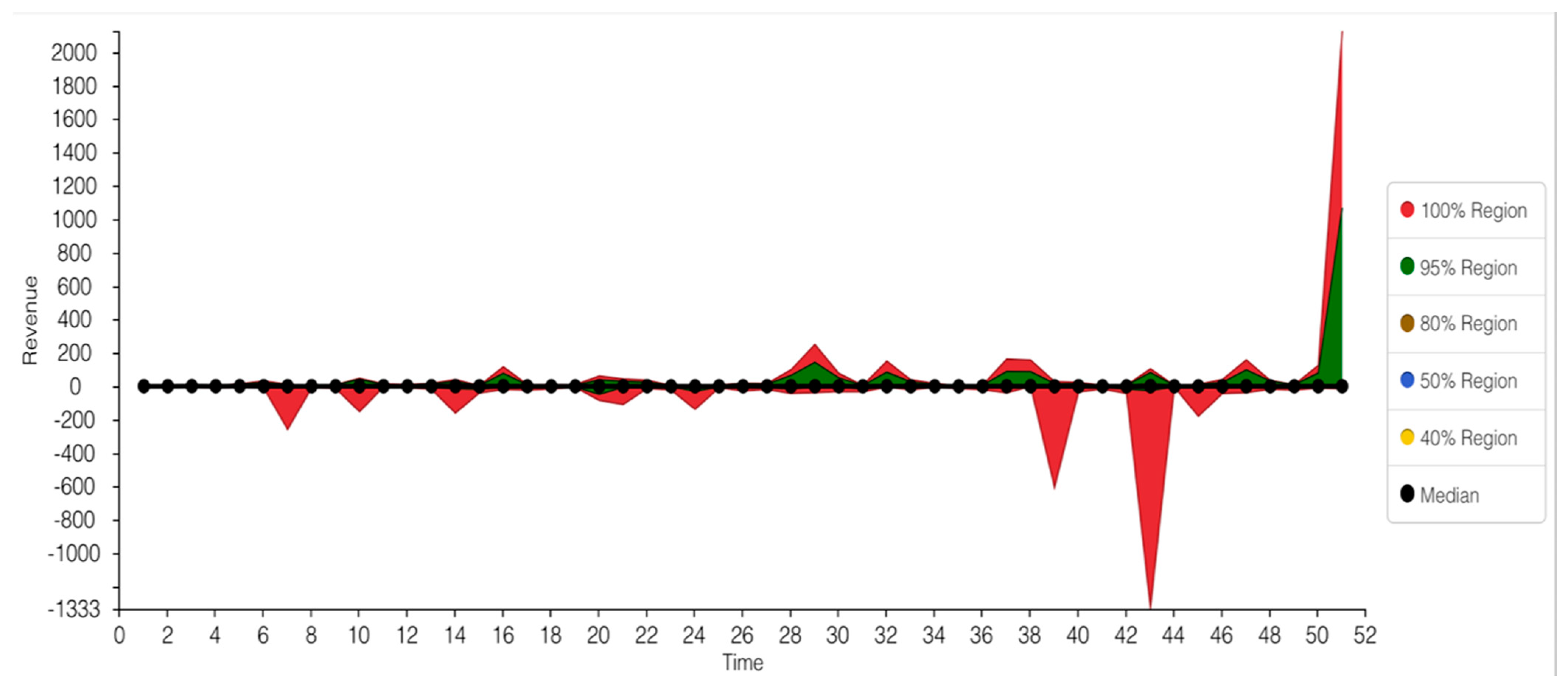

3.4.5. Revenue from Oil and Gas Production

4. Discussion of Findings

“Many people point their fingers at the PC … PC is just one institution. Indeed, we are the ones to enforce the law … implementation is not PC but three-fold. You have industry, PC and the academia or civil society … so it is a three-fold activity, and all of them must be seen to play their role.”

“… government has several credit facilities … the challenge is that these are not well coordinated and often politicized …”

5. Conclusion and Limitations of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Parameters | Type | Unit | Value | Equation |

|---|---|---|---|---|

| Local content investment | Stock | $ | 779 m | Value |

| GDP growth rate | Stock | % | 6.7 | Value |

| Oil and gas human resources | Stock | People | 1000 | Value |

| Local content policy | Auxiliary | % | 51 | Value |

| Training | Auxiliary | Unitless | 10 | [Local content policy]/10 |

| Inflation rate | Auxiliary | % | 7.8 | Value |

| Joint venture | Auxiliary | Unitless | 50 | Value |

| Knowledge transfer | Flow | Unitless | Nil | [Oil and gas human resources]/[R&D centres] |

| Oil production | Flow | Bpd | Nil | ([Local content investment] + [Local content policy])/([Inflation]*[Political influence]) |

| R&D centres | Auxiliary | Unitless | 13 | [Training]*[Foreign Expatriates] + 13 |

| Relevant programmes | Auxiliary | Unitless | Nil | [R&D centres]/13 |

| Foreign expatriates | Flow | Unitless | Nil | IfThenElse ([Local content policy], 13, 12) |

| Political influence | Auxiliary | Years | 4 | Value |

| Local technical staff | Auxiliary | People | 5590 | 5590/[Relevant programmes] |

| Years | Knowledge Transfer | Local Content Investment ($m) | Oil and Gas Human Resources | Oil Production | Revenue |

|---|---|---|---|---|---|

| 1 | 12.61034048 | 779 | 1000 | 26.6025641 | 0.298124761 |

| 2 | 12.76936117 | 805.3044393 | 1012.61034 | 27.44565511 | 0.295062356 |

| 3 | 12.93038716 | 832.4550321 | 1025.379702 | 28.31586641 | 0.292670413 |

| 4 | 13.09344374 | 860.4782281 | 1038.310089 | 29.21404577 | 0.290851024 |

| 5 | 13.25855653 | 889.4014228 | 1051.403533 | 30.14107124 | 0.289526577 |

| 6 | 13.42575144 | 919.2529675 | 1064.662089 | 31.09785152 | 0.288634708 |

| 7 | 13.59505474 | 950.0621843 | 1078.087841 | 32.08532642 | 0.288124706 |

| 8 | 13.766493 | 981.859386 | 1091.682895 | 33.1044675 | 0.287954906 |

| 9 | 13.94009317 | 1014.675899 | 1105.449388 | 34.1562788 | 0.288090758 |

| 10 | 14.11588249 | 1048.544087 | 1119.389481 | 35.24179765 | 0.288503378 |

| 11 | 14.29388857 | 1083.497381 | 1133.505364 | 36.36209554 | 0.289168442 |

| 12 | 14.47413938 | 1119.570308 | 1147.799252 | 37.5182791 | 0.290065336 |

| 13 | 14.6566632 | 1156.798522 | 1162.273392 | 38.71149108 | 0.291176488 |

| 14 | 14.84148871 | 1195.218836 | 1176.930055 | 39.94291142 | 0.292486847 |

| 15 | 15.02864494 | 1234.869261 | 1191.771544 | 41.21375837 | 0.293983461 |

| 16 | 15.21816127 | 1275.789036 | 1206.800189 | 42.52528961 | 0.295655146 |

| 17 | 15.41006747 | 1318.01867 | 1222.01835 | 43.87880354 | 0.297492206 |

| 18 | 15.60439366 | 1361.599982 | 1237.428417 | 45.27564044 | 0.299486218 |

| 19 | 15.80117038 | 1406.576136 | 1253.032811 | 46.71718384 | 0.301629846 |

| 20 | 16.00042852 | 1452.99169 | 1268.833981 | 48.20486186 | 0.303916687 |

| 21 | 16.20219937 | 1500.892635 | 1284.83441 | 49.74014856 | 0.306341151 |

| 22 | 16.40651462 | 1550.326442 | 1301.036609 | 51.32456546 | 0.30889835 |

| 23 | 16.61340636 | 1601.34211 | 1317.443124 | 52.959683 | 0.31158401 |

| 24 | 16.82290707 | 1653.990209 | 1334.05653 | 54.64712207 | 0.314394399 |

| 25 | 17.03504965 | 1708.322936 | 1350.879437 | 56.38855565 | 0.317326257 |

| 26 | 17.24986743 | 1764.394166 | 1367.914487 | 58.18571044 | 0.320376747 |

| 27 | 17.46739413 | 1822.259499 | 1385.164355 | 60.04036857 | 0.323543407 |

| 28 | 17.68766392 | 1881.976325 | 1402.631749 | 61.95436938 | 0.326824105 |

| 29 | 17.91071138 | 1943.60387 | 1420.319413 | 63.92961121 | 0.330217009 |

| 30 | 18.13657155 | 2007.203264 | 1438.230124 | 65.96805333 | 0.333720557 |

| 31 | 18.36527989 | 2072.837597 | 1456.366695 | 68.07171784 | 0.337333426 |

| 32 | 18.59687233 | 2140.571981 | 1474.731975 | 70.2426917 | 0.341054513 |

| 33 | 18.83138522 | 2210.473618 | 1493.328848 | 72.48312879 | 0.344882915 |

| 34 | 19.0688554 | 2282.611864 | 1512.160233 | 74.79525206 | 0.348817907 |

| 35 | 19.30932016 | 2357.058298 | 1531.229088 | 77.18135572 | 0.352858933 |

| 36 | 19.55281726 | 2433.886795 | 1550.538408 | 79.64380754 | 0.357005586 |

| 37 | 19.79938494 | 2513.173597 | 1570.091226 | 82.18505119 | 0.3612576 |

| 38 | 20.04906193 | 2594.997391 | 1589.890611 | 84.80760868 | 0.365614837 |

| 39 | 20.30188742 | 2679.439385 | 1609.939673 | 87.51408284 | 0.370077281 |

| 40 | 20.55790114 | 2766.58339 | 1630.24156 | 90.30715994 | 0.374645022 |

| 41 | 20.81714327 | 2856.515905 | 1650.799461 | 93.18961234 | 0.379318259 |

| 42 | 21.07965453 | 2949.326199 | 1671.616604 | 96.16430125 | 0.384097284 |

| 43 | 21.34547615 | 3045.106403 | 1692.696259 | 99.23417959 | 0.388982481 |

| 44 | 21.61464988 | 3143.9516 | 1714.041735 | 102.4022949 | 0.393974318 |

| 45 | 21.88721797 | 3245.959921 | 1735.656385 | 105.6717923 | 0.399073345 |

| 46 | 22.16322324 | 3351.23264 | 1757.543603 | 109.0459179 | 0.404280187 |

| 47 | 22.44270903 | 3459.874278 | 1779.706826 | 112.5280217 | 0.409595542 |

| 48 | 22.72571923 | 3571.992704 | 1802.149535 | 116.121561 | 0.415020177 |

| 49 | 23.01229829 | 3687.699245 | 1824.875254 | 119.830104 | 0.420554923 |

| 50 | 23.30249121 | 3807.108794 | 1847.887553 | 123.6573331 | 0.426200677 |

References

- NEPAP. Available online: http://www.nepad.org/nepad/news/1429/africa-richer-you-think-says-exciting-new-african-wealth-cheque-report (accessed on 14 July 2020).

- Bakwena, M.; Bodman, P.; Le, T.; Tang, K.K. Avoiding the Resource Curse: The Role of Institutions. Available online: https://www.researchgate.net/profile/Thanh-Le-33/publication/47332076_Avoiding.the_Resource_Curse_The_Role_of_Institutions/links/0046351d25fa86ed6b000000/Avoiding-the-Resource-Curse-The-Role-of-Institutions.pdf (accessed on 22 March 2021).

- Natural Resource Governance Institute (NRGI). Available online: https://resourcegovernance.org/about-us/what-we-do/strategy (accessed on 15 July 2020).

- Sigam, C.; Garcia, L. Extractives Industries: Optimising Value Retention in Host Countries; UNCTAD: Geneva, Switzerland, 2012. [Google Scholar]

- Omenikolo, I.A.; Amadi, R.O. Challenges Facing Nigerian Local Content in Oil and Gas Industry. 2010. Available online: http://academia.edu/660216/CHALLENGES_FACING_NIGERIAN_LOCAL_CONTENT_IN_AND_GAS_INDUSTRY (accessed on 16 March 2021).

- Ibilol, A. Implementation of Local Content in Nigeria; Briefing Note on the Nigerian Natureal Resource Charter. 2013. Available online: http://nigerianrc.org/sites/default/files/Briefing%20Note%20on%20Local%20Content.pdf> (accessed on 14 March 2021).

- African Development Bank. Flagship Report Paper Series. Paper 6: Creating Local Content for Human Development in Africa’s New Natural Resource-Rich Countries. Available online: http://www.opml.co.uk/files/Publications/8517-harnessing-natural-resources/paper-1.pdf?noredirect=1 (accessed on 1 July 2019).

- Ovadia, J.S. Local content and natural resource governance: The cases of Angola and Nigeria. Extr. Ind. Soc. 2014, 1, 137–146. [Google Scholar] [CrossRef]

- Ovadia, J.S. Local content policies and petro-development in sub-Saharan Africa: A comparative analysis. Resour. Policy 2016, 49, 20–30. [Google Scholar] [CrossRef]

- Stevens, P.; Lahn, G.; Kooroshy, J. The resource curse revisited. Research paper. In Energy, Environment and Resources; Chatham House: London, UK, 2015. [Google Scholar]

- Amoako-Tuffour, J.; Augynn, T.; Atta-Quayson, A. Local Content and Value Addition in Ghana’s Mineral, Oil, and Gas Sectors: Is Ghana Getting It Right? African Centre for Economic Transformation: Washington, DC, USA, 2015. [Google Scholar]

- Tordo, S.; Warner, M.; Manzano, O.; Anouti, Y. Local Content Policies in the Oil and Gas Sector. 2013. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-0-8213-9931-6 (accessed on 22 March 2021).

- Obiri, K.A.; Bjeirmi, B.; Boateng, P. A System Thinking Approach to Human Resource Development in the Oil Industry. J. Energy Res. Rev. 2020, 4, 39–49. [Google Scholar] [CrossRef]

- Obiri, K.A.; Bjeirmi, B. A Comparative analysis of local content policies in the North Sea and the Gulf of Guinea regions. J. Sci. Res. Rep. 2019, 25, 1–13. [Google Scholar] [CrossRef]

- Peek, P.; Gantès, P. Skills Shortages and Local Content in the Sub-Saharan African oil and Gas Industry; Centre de Recherches Enterprises et Societies: Geneva, Switzerland, 2008. [Google Scholar]

- MoE (Ministry of Energy). Available online: http://www.gnpcghana.com/_upload/general/Meet_the_press_sept_2012.pdf (accessed on 18 April 2020).

- Darkwah, A. Keeping hope alive: An analysis of training opportunities for Ghanaian youth in the emerging oil and gas industry. Int. Dev. Plan. Rev. 2013, 35, 119–134. [Google Scholar] [CrossRef]

- Yamoah, E.E. The link between human resource capacity building and job performance. Int. J. Hum. Resour. Stud. 2014, 4, 122–139. [Google Scholar] [CrossRef]

- Groot, R.; Molen, P. Workshop on Capacity Building in Land Administration for Developing Countries: Held at ITC Enschede, The Netherland, 12–15 November 2000; International Institute for Geo-Information Science and Earth Observation: Enschede, The Netherland, 2000. [Google Scholar]

- Aneke, P. The role of major operators in the development of local content in the Nigerian oil and gas industry. In A Paper Delivered during a National Seminar on the Dynamics of Equipment Leasing and Contract Financing for Local Contractors in the Oil and Gas Sector; Port Harcourt, Nigeria, 2002; Unpublished. [Google Scholar]

- Ariweriokuma, S. The Political Economy of Oil and Gas in Africa: The Case of Nigeria; Routledge: New York, NY, USA, 2009. [Google Scholar]

- Onuoha, N.I.; Onyihe, I.J.; Iledare, O. Economic Implications of Oil and Gas Supply Infrastructure Disruption in Nigeria. Available online: http://www.iaee.org/iaee2017/submissions/OnlineProceedings/ONUOHA%20NNACHI%20ONLINE%20PROCEEDINGS%20PAPER.pdf (accessed on 4 April 2020).

- Ramdoo, I. Local Content Policies in Mineral-Rich Countries. An Overview. Available online: https://ecdpm.org/wp-content/uploads/ECDPM-Discussion-Paper-193-Local-Content-Policies-Mineral-Rich-Countries-2016.pdf (accessed on 22 March 2021).

- Cosar, A.K. Human capital, technology adoption and development. BE J. Macroecon. 2011, 11, 130–141. [Google Scholar] [CrossRef][Green Version]

- Youndt, M.A.; Subramaniam, M.; Snell, S.A. Intellectual Capital Profiles: An Examination of Investments and Returns. J. Manag. Stud. 2004, 41, 335–361. [Google Scholar] [CrossRef]

- Marimuthu, M.; Arokiasamy, L.; Ismail, M. Human Capital Development and Its Impact on Firm Performance: Evidence from Developmental Economics. J. Int. Soc. Res. 2009, 2, 265–272. [Google Scholar]

- Delaney, J.T.; Huselid, M.A. The Impact of Human Resource Management Practices on Perceptions of Organizational Performance. Acad. Manag. J. 1996, 39, 949–969. [Google Scholar]

- Sterman, J. Business Dynamics: Systems Thinking and Modelling for a Complex World. Available online: https://dspace.mit.edu/handle/1721.1/102741 (accessed on 22 March 2021).

- Alasad, R.; Motawa, I.; Ougunlana, S. A system dynamics-based model for demand forecasting in PPP infrastructure projects–A case of toll roads. Organ. Technol. Manag. Constr. Int. J. 2013, 5, 1–12. [Google Scholar] [CrossRef]

- Richmond, B. Systems dynamics/systems thinking: Let’s just get on with it. In Proceedings of the International Systems Dynamics Conference, Sterling, UK, 11–15 July 1994. [Google Scholar]

- Behl, D.V.; Ferreira, S. Systems thinking: An analysis of key factors and relationships. Procedia Comput. Sci. 2014, 36, 104–109. [Google Scholar] [CrossRef]

- Omotayo, T.; Olanipekun, A.; Obi, L.; Boateng, P. A systems thinking approach for incremental reduction of non-physical waste. Built Environ. Proj. Asset Manag. 2020, 10, 509–528. [Google Scholar] [CrossRef]

- Kim, D.H. Introduction to Systems Thinking; Pegasus Communications: Waltham, MA, USA, 1999; p. 16. [Google Scholar]

- Dettmer, H.W. Goldratt’s Theory of Constraints: A Systems Approach to Continuous Improvement; ASQ Quality Press: Milwaukee, WI, USA, 1999. [Google Scholar]

- Xu, Y.; Sun, C.; Skibniewski, M.J.; Chan, A.P.; Yeung, J.F.; Cheng, H. System Dynamics (SD)-based concession pricing model for PPP highway projects. Int. J. Proj. Manag. 2012, 30, 240–251. [Google Scholar] [CrossRef]

- Maryani, A.; Wignjosoebroto, S.; Partiwi, S.G. A System Dynamics Approach for Modeling Construction Accidents. Procedia Manuf. 2015, 4, 392–401. [Google Scholar] [CrossRef]

- Boateng, P.; Chen, Z.; Ogunlana, S. A dynamic framework for managing the complexities of risks in megaprojects. Int. J. Technol. Manag. Res. 2016, 1, 1–13. [Google Scholar] [CrossRef]

- Bank of Ghana. Available online: https://www.bog.gov.gh/monetary_policy_rpts/inflation-outlook-and-analysis-report-september-2020/ (accessed on 23 July 2020).

- Ackah Mohammed. Available online: https://www.wider.unu.edu/sites/default/files/Publications/Working-paper/PDF/wp2018-152.pdf (accessed on 23 July 2020).

- Ministry of Finance. Available online: https://www.mofep.gov.gh/press-release/2019-02-14/ghana%27s-oil-production-estimated-to-go-up-to-500%2C000-Barrels-per-day-by-2024#:~:text=%E2%80%9COverall%2C%20crude%20oil%20production%20is,and%20first%20quarter%20of%202021 (accessed on 23 July 2020).

- Kazzazi, A.; Nouri, B. A conceptual model for local content development in the petroleum industry. Manag. Sci. Lett. 2012, 2, 2165–2174. [Google Scholar] [CrossRef]

- Marcel, V.; Tissot, R.; Paul, A.; Omonbude, E. A Local Content Decision Tree for Emerging Producers; The Royal Institute of Internationa Affairs: London, UK, 2016. [Google Scholar]

- Ablo, A.D. Scale, local content and the challenges of Ghanaians employment in the oil and gas industry. Geoforum 2018, 96, 181–189. [Google Scholar] [CrossRef]

- Azevedo Filho, E.T.; Palma, M.A.M.; Perestrelo, M.; da Hora, H.R.M.; Lira, R.A. The pre-salt layer and challenges to competitiveness in Brazil: Critical reflections on the local content policy in the oil and gas Sector. Extr. Ind. Soc. 2019, 6, 1168–1173. [Google Scholar] [CrossRef]

| Challenge Code | Challenge Type |

|---|---|

| Human Resource Capacity (HRC) | Type 1: Endogenous Variables |

| HRC1 | Human resource capacity |

| HRC2 | Relevant programmes |

| HRC3 | Local content development |

| HRC4 | Expatriates |

| HRC5 | Knowledge transfer |

| HRC6 | Local content fund |

| HRC7 | Economic growth |

| HRC8 | Training |

| HRC9 | R&D Centres |

| Types 2: Exogenous Variables | |

| HRC10 | Joint Venture |

| HRC11 | Higher education institutions |

| HRC12 | Local content policy |

| HRC13 | Business development infrastructure |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Obiri, K.A.; Omotayo, T.S.; Bjeirmi, B.; Boateng, P. Long-Term Dynamic Behaviour of Human Resource Needs in Ghana’s Oil Sector: System Dynamics Approach. Sustainability 2021, 13, 3546. https://doi.org/10.3390/su13063546

Obiri KA, Omotayo TS, Bjeirmi B, Boateng P. Long-Term Dynamic Behaviour of Human Resource Needs in Ghana’s Oil Sector: System Dynamics Approach. Sustainability. 2021; 13(6):3546. https://doi.org/10.3390/su13063546

Chicago/Turabian StyleObiri, Kwadwo Ayeh, Temitope S. Omotayo, Bassam Bjeirmi, and Prince Boateng. 2021. "Long-Term Dynamic Behaviour of Human Resource Needs in Ghana’s Oil Sector: System Dynamics Approach" Sustainability 13, no. 6: 3546. https://doi.org/10.3390/su13063546

APA StyleObiri, K. A., Omotayo, T. S., Bjeirmi, B., & Boateng, P. (2021). Long-Term Dynamic Behaviour of Human Resource Needs in Ghana’s Oil Sector: System Dynamics Approach. Sustainability, 13(6), 3546. https://doi.org/10.3390/su13063546