Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects

Abstract

1. Introduction

2. Literature Review

2.1. Risks Involved in PPP Projects

2.2. PPP Success Factors and Risk Allocation

3. Negotiations and CIRR

- n: Period (years) from the project’s launch to completion of construction prior to the launch of service

- N: Service period (years) after completion of construction

- CCi: Contracted annual expenses for completion of construction (excluding the amount of the government’s financial subsidy)

- ORi: Contracted annual operational revenue

- OCi: Contracted annual operational cost (excluding corporate tax)

- CIRR: Contracted (pre-tax real) rate of return of the project (CIRR)

4. Analysis of the Determinants of CIRR

4.1. Data

- Request for proposal notice or third-party proposal notice;

- Concession agreement;

- Construction;

- Operation.

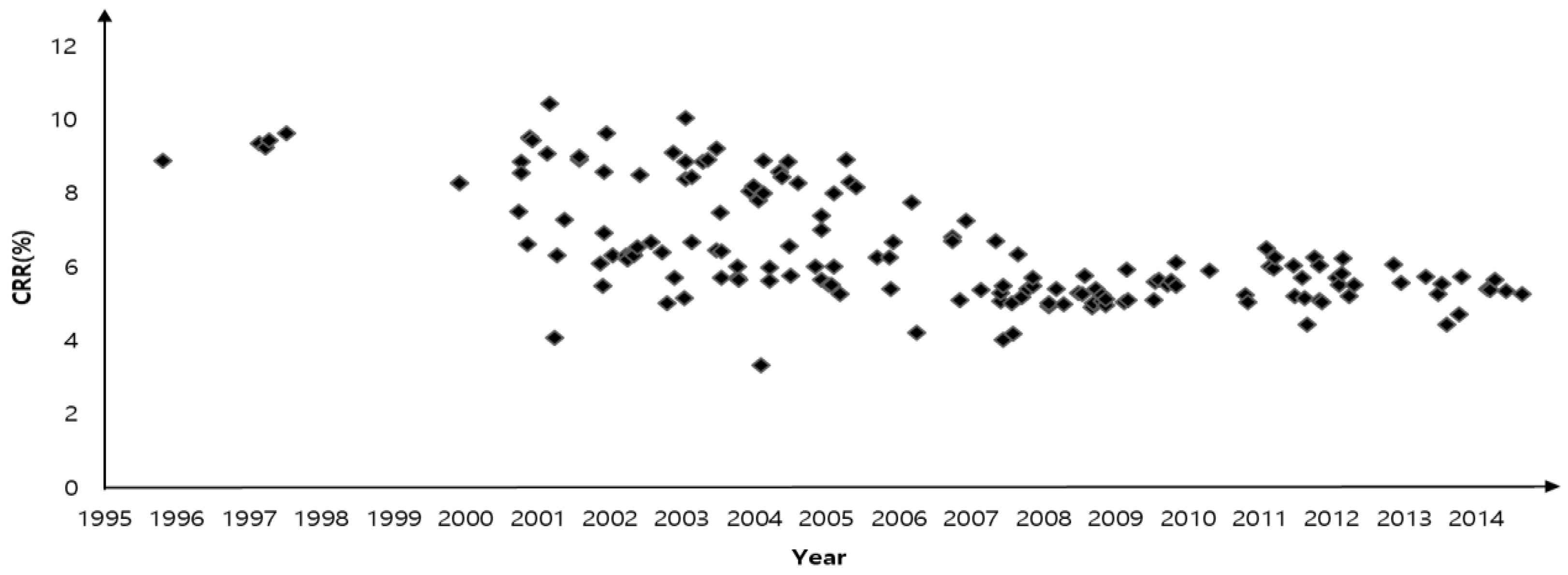

4.1.1. Dependent Variable: CIRR

4.1.2. Independent Variables

Financing Cost (Rf_5 years)

Facility Type

Service Area of the Project (Authority)

Operation Period (O_Period)

Project Size: Total Private Investment (Ln_P_Investment)

Solicited or Unsolicited Projects (Solicit)

Construction Subsidy: Ratio of Construction Subsidy (Sub)

Minimum Revenue Guarantee (MRG)

Project Preparation Period (Prepperiod) and Negotiation Period (Negoperiod)

Value for Money Assessment (VfM)

Negotiation Experience (Exp)

Competition Rate (Bid_compet)

Average CIRR of Recently Similar Projects (IRR_S_three)

4.2. Model Establishment

4.2.1. Model

4.2.2. Correlation Analysis

4.3. Results and Discussion

4.3.1. Cost Borne by the Private Partner

4.3.2. Project Characteristics and Government Support

4.3.3. Pre-Contract Process, Market Maturity, and Negotiation Behavior

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Brandao, L.E.T.; Saraiva, E. The option value of government guarantees in infrastructure projects. Constr. Manag. Econ. 2008, 26, 1171–1180. [Google Scholar] [CrossRef]

- O’Shea, C.; Palcic, D.; Reeves, E. Using PPP to Procure Social Infrastructure: Lessons from 20 Years of Experience in Ireland. Public Works Manag. Policy 2020, 25, 201–213. [Google Scholar] [CrossRef]

- Amovi´c, G. Eciency of ppp implementation in bosnia and herzegovina. Proc. Fac. Econ. East Sarajevo 2017, 15, 49–54. [Google Scholar]

- Martiniello, L.; Morea, D.; Paolone, F.; Tiscini, R. Energy Performance Contracting and Public-Private Partnership: How to Share Risks and Balance Benefits. Energies 2020, 13, 3625. [Google Scholar] [CrossRef]

- Guarini, M.R.; Battisti, F. Evaluation and Management of Land-Development Processes Based on the Public-Private Partnership. Adv. Mater. Res. 2013, 869–870, 154–161. [Google Scholar] [CrossRef]

- Guarini, M.R.; Battisti, F.; Buccarini, C. Rome: Re-Qualification Program for the Street Markets in Public-Private Partnership. A Further Proposal for the Flaminio II Street Market. Adv. Mater. Res. 2013, 838–841, 2928–2933. [Google Scholar] [CrossRef]

- Broadbent, J.; Laughlin, R. Public private partnerships: An introduction. Account. Audit. Account. J. 2003, 16, 332–341. [Google Scholar] [CrossRef]

- Gilmour, T.; Wiesel, I.; Pinnegar, S.; Loosemore, M. Social infrastructure partnerships: A firm rock in a storm? J. Financ. Manag. Prop. Constr. 2010, 15, 247–259. [Google Scholar] [CrossRef]

- Greve, C.; Hodg, G. Rethinking Public-Private Partnerships: Strategies for Turbulent Times; Routledge: Boca Raton, FL, USA, 2013. [Google Scholar]

- Vecchi, V.; Casalini, F. Is a social empowerment of ppp for infrastructure delivery possible? Lessons from social impact bonds. Ann. Public Coop. Econ. 2019, 90, 353–369. [Google Scholar] [CrossRef]

- Liu, J.; Love, P.E.D.; Smith, J.; Matthews, J.; Sing, C.-P. Praxis of Performance Measurement in Public-Private Partnerships: Moving beyond the Iron Triangle. J. Manag. Eng. 2016, 32, 4016004. [Google Scholar] [CrossRef]

- Yuan, J.; Zeng, A.Y.; Skibniewski, M.J.; Li, Q. Selection of performance objectives and key performance indicators in public–private partnership projects to achieve value for money. Constr. Manag. Econ. 2009, 27, 253–270. [Google Scholar] [CrossRef]

- Shenhar, A.J.; Dvir, D.; Levy, O.; Maltz, A.C. Project Success: A Multidimensional Strategic Concept. Long Range Plan. 2001, 34, 699–725. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A. Review of studies on the Critical Success Factors for Public–Private Partnership (PPP) projects from 1990 to 2013, 2015. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- Akintoye, A.; Taylor, C.; Fitzergald, E. Risk analysis and management of private finance initiative projects. Eng. Constr. Archit. Manag. 1998, 5, 9–21. [Google Scholar] [CrossRef]

- Shen, L.-Y.; Platten, A.; Deng, X. Role of public private partnerships to manage risks in public sector projects in Hong Kong. Int. J. Proj. Manag. 2006, 24, 587–594. [Google Scholar] [CrossRef]

- Abdul-Aziz, A.R. Unraveling of BOT scheme: Malaysia’s Indah water Consortium. J. Constr. Eng. Manag. 2001, 127, 457–460. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Chan, D.W.M.; Ho, K.S.K. An empirical study of the benefits of construction partnering in Hong Kong. Constr. Manag. Econ. 2003, 21, 523–533. [Google Scholar] [CrossRef]

- Smyth, H.; Edkins, A. Relationship management in the management of PFI/PPP projects in the UK. Int. J. Proj. Manag. 2007, 25, 232–240. [Google Scholar] [CrossRef]

- Bakatjan, S.; Arikan, M.; Tiong, R.L.K. Optimal Capital Structure Model for BOT Power Projects in Turkey. J. Constr. Eng. Manag. 2003, 129, 89–97. [Google Scholar] [CrossRef]

- Wibowo, A. Valuing guarantees in a BOT infrastructure project. Eng. Constr. Arch. Manag. 2004, 11, 395–403. [Google Scholar] [CrossRef]

- Ng, S.T.; Xie, J.; Cheung, Y.K.; Jefferies, M. A simulation model for optimizing the concession period of public–private partnerships schemes. Int. J. Proj. Manag. 2007, 25, 791–798. [Google Scholar] [CrossRef]

- Ye, S.; Tiong, R.L.K. The effect of concession period design on completion risk management of BOT projects. Constr. Manag. Econ. 2003, 21, 471–482. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.C.; Cheung, E. Research Trend of Public-Private Partnership in Construction Journals. J. Constr. Eng. Manag. 2009, 135, 1076–1086. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q.; Skitmore, M.; Cheng, E.W.L. Ranked Critical Factors in PPP Briefings. J. Manag. Eng. 2013, 29, 164–171. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Wu, X.; Li, J. Exploring the risk factors of infrastructure PPP projects for sustainable delivery: A social network perspective. Sustainability 2020, 12, 4152. [Google Scholar] [CrossRef]

- Burke, R.; Demirag, I. Risk transfer and stakeholder relationships in Public Private Partnerships. Account. Forum 2017, 41, 28–43. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.; Lam, P. Preferred risk allocation in China’s public–private partnership (PPP) projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Wang, H.; Liu, Y.; Xiong, W.; Song, J. The moderating role of governance environment on the relationship between risk allocation and private investment in PPP markets: Evidence from developing countries. Int. J. Proj. Manag. 2019, 37, 117–130. [Google Scholar] [CrossRef]

- Choi, J.; Park, D. A Study on the Reasonable Rate of Return for the Korean PPI Projects: An Investigation of Transportation Projects. Seoul Stud. 2013, 14, 203–222. [Google Scholar]

- Lee, K. Rate of Return of PPI Projects; Korea Research Institute for Human Settlements: Sejong, Korea, 2001. [Google Scholar]

- Shin, S. Study on the Fair Returns of Private Participants’ Investments on BTO PPI Projects. Korean J. Constr. Eng. Manag. 2009, 10, 121–131. [Google Scholar]

- Le, P.T.; Kirytopoulos, K.; Chileshe, N.; Rameezdeen, R. Taxonomy of risks in PPP transportation projects: A systematic literature review. Int. J. Constr. Manag. 2019, 1–16. [Google Scholar] [CrossRef]

- Bing, L.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Critical Success Factors for PPP/PFI Projects in the UK Construction Industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar]

- Bing, L.; Akintoye, A.; Edwards, P.; Hardcastle, C. The allocation of risk in PPP/PFI construction projects in the UK. Int. J. Proj. Manag. 2005, 23, 25–35. [Google Scholar] [CrossRef]

- Checherita, C.; Gifford, J. Risk Sharing in Public-Private Partnerships: General Considerations and an Evaluation of the U.S. In Proceedings of the Practice in Road Transportation, 48th Annual Transportation Research Forum, Boston, MS, USA, 15–17 March 2007. [Google Scholar]

- Department of Treasury and Finance, Australia. Partnerships Victoria: Public Sector Comparator: Technical Note; Department of Treasury and Finance: Melbourne, Australia, 2001.

- Hodges, J.T.; Dellacha, G. Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency; PPIAF: Washington, DC, USA, 2007. [Google Scholar]

- Lewis, M.K. Risk management in public private partnerships. CEGE Discuss. Pap. 2001, 12. [Google Scholar]

- World Bank. Understanding and Managing the Fiscal Risks of PPPs, Public-Private Partnership Conference; Wrold Bank: Washington, DC, USA, 2011. [Google Scholar]

- De Vries, P.; Yehoue, E.B. The Routledge Companion to Public-Private Partnerships; Routledge: Boca Raton, FL, USA, 2013. [Google Scholar]

- Pellegrino, R.; Vajdic, N.; Carbonara, N. Real option theory for risk mitigation in transport PPPs. Built Environ. Proj. Asset Manag. 2013, 3, 199–213. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q.; Cheng, E.W. A review of studies on Public–Private Partnership projects in the construction industry. Int. J. Proj. Manag. 2010, 28, 683–694. [Google Scholar] [CrossRef]

- Keers, B.B.; van Fenema, P.C. Managing risks in public-private partnership formation projects. Int. J. Proj. Manag. 2018, 36, 861–875. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Gunnigan, L.; Pellegrino, R. Risk Management in Motorway PPP Projects: Empirical-based Guidelines. Transp. Rev. 2015, 35, 162–182. [Google Scholar] [CrossRef]

- Ruster, J. A Retrospective on the Mexican Toll Road Program (1989–1994). Public Policy for the Private Sector; The World Bank Group: Washington, DC, USA, 1997. [Google Scholar]

- Babatunde, S.O.; Perera, S.; Adeniyi, O. Identification of critical risk factors in public-private partnership project phases in developing countries. Benchmarking Int. J. 2019, 26, 334–355. [Google Scholar] [CrossRef]

- Babatunde, S.O.; Perera, S. Analysis of traffic revenue risk factors in BOT road projects in developing countries. Transp. Policy 2017, 56, 41–49. [Google Scholar] [CrossRef]

- UNESCAP. Government Support for PPPs. Available online: https://www.unescap.org/ttdw/ppp/ppp_primer (accessed on 6 March 2021).

- Cheung, E.; Chan, A.P.; Kajewski, S.L. Factors contributing to successful public private partnership projects. J. Facil. Manag. 2012, 10, 45–58. [Google Scholar] [CrossRef]

- Liang, Y.; Wang, H. Sustainable Performance Measurements for Public–Private Partnership Projects: Empirical Evidence from China. Sustainability 2019, 11, 3653. [Google Scholar] [CrossRef]

- Liang, Y.; Jia, H. Key Success Indicators for PPP Projects: Evidence from Hong Kong. Adv. Manag. Civ. Eng. Proj. 2018, 2018. [Google Scholar] [CrossRef]

- Yuan, J.; Wang, C.; Skibniewski, M.J.; Li, Q. Developing Key Performance Indicators for Public-Private Partnership Projects: Questionnaire Survey and Analysis. J. Manag. Eng. 2012, 28, 252–264. [Google Scholar] [CrossRef]

- Mladenovic, G.; Vajdic, N.; Wundsch, B.; Temeljotov-Salaj, A. Use of key performance indicators for PPP transport projects to meet stakeholders’ performance objectives. Built Environ. Proj. Asset Manag. 2013, 3, 228–249. [Google Scholar] [CrossRef]

- Cong, X.; Ma, L. Performance Evaluation of Public-Private Partnership Projects from the Perspective of Efficiency, Economic, Effectiveness, and Equity: A Study of Residential Renovation Projects in China. Sustainability 2018, 10, 1951. [Google Scholar] [CrossRef]

- Villalba-Romero, F.; Liyanage, C. Evaluating success in PPP road projects in Europe: A comparison of performance measurement approaches. Transp. Res. Procedia 2016, 14, 372–381. [Google Scholar] [CrossRef]

- Collins, A.; Baccarini, D. Project success—A survey. J. Constr. Res. 2004, 5, 211–231. [Google Scholar] [CrossRef]

- Xiong, W.; Zhao, X.; Yuan, J.-F.; Luo, S. Ex Post Risk Management in Public-Private Partnership Infrastructure Projects. Proj. Manag. J. 2017, 48, 76–89. [Google Scholar] [CrossRef]

- Tiong, R.L.K.; Yeo, K.; McCarthy, S.C. Critical success factors in winning BOT projects. J. Constr. Eng. Manag. 1992, 18, 217–228. [Google Scholar] [CrossRef]

- Qiao, L.; Wang, S.Q.; Tiong, R.L.; Chan, T.-S. Framework for Critical Success Factors of BOT Projects in China. J. Struct. Financ. 2001, 7, 53–61. [Google Scholar] [CrossRef]

- Zhang, X. Critical Success Factors for Public–Private Partnerships in Infrastructure Development. J. Constr. Eng. Manag. 2005, 131, 3–14. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Perceptions of positive and negative factors influencing the attractiveness of PPP/PFI procurement for construction projects in the UK: Findings from a questionnaire survey. Eng. Constr. Archit. Manag. 2005, 12, 125–148. [Google Scholar] [CrossRef]

- Carbonara, N.; Pellegrino, R. Revenue guarantee in public–private partnerships: A win–win model. Constr. Manag. Econ. 2018, 36, 584–598. [Google Scholar] [CrossRef]

- Park, T.; Kim, B.; Kim, H. Real Option Approach to Sharing Privatization Risk in Underground Infrastructures. J. Constr. Eng. Manag. 2013, 139, 685–693. [Google Scholar] [CrossRef]

- Power, G.J.; Burris, M.; Vadali, S.; Vedenov, D. Valuation of strategic options in public–private partnerships. Transp. Res. Part A Policy Prac. 2016, 90, 50–68. [Google Scholar] [CrossRef]

- Kim, K.; Cho, H.; Yook, D. Financing for a Sustainable PPP Development: Valuation of the Contractual Rights under Exercise Conditions for an Urban Railway PPP Project in Korea. Sustain. J. Rec. 2019, 11, 1573. [Google Scholar] [CrossRef]

- Chen, Z.; Daito, N.; Gifford, J.L. Data Review of Transportation Infrastructure Public–Private Partnership: A Meta-Analysis. Transp. Rev. 2016, 36, 228–250. [Google Scholar] [CrossRef]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public–private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Neto, D.D.C.E.S.; Cruz, C.O.; Rodrigues, F.; Silva, P. Bibliometric Analysis of PPP and PFI Literature: Overview of 25 Years of Research. J. Constr. Eng. Manag. 2016, 142, 6016002. [Google Scholar] [CrossRef]

- Leigland, J. Public-Private Partnerships in Developing Countries: The Emerging Evidence-based Critique. World Bank Res. Obs. 2018, 33, 103–134. [Google Scholar] [CrossRef]

- Zhang, S.; Gao, Y.; Feng, Z.; Sun, W. PPP application in infrastructure development in China: Institutional analysis and implications. Int. J. Proj. Manag. 2015, 33, 497–509. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C.; Javed, A.; Ameyaw, E.E. Critical success criteria for public-private partnership projects: Interna-tional experts’ opinion. Int. J. Strateg. Prop. Manag. 2017, 21, 87–100. [Google Scholar] [CrossRef]

- Liu, J.; Love, P.E.D.; Smith, J.; Regan, M.W.; Davis, P.R. Life Cycle Critical Success Factors for Public-Private Partnership Infrastructure Projects. J. Manag. Eng. 2015, 31, 4014073. [Google Scholar] [CrossRef]

- Salman, A.F.M.; Skibniewski, M.J.; Basha, I. BOT Viability Model for Large-Scale Infrastructure Projects. J. Constr. Eng. Manag. 2007, 133, 50–63. [Google Scholar] [CrossRef]

- Yuan, J.; Li, W.; Guo, J.; Zhao, X.; Skibniewski, M.J. Social Risk Factors of Transportation PPP Projects in China: A Sustainable Development Perspective. Int. J. Environ. Res. Public Health 2018, 15, 1323. [Google Scholar] [CrossRef]

- Disley, E.; Giacomantonio, C.; Kruithof, K.; Sim, M. The Payment by Results Social Impact Bond Pilot at HMP Peterborough: Final Process Evaluation Report; Ministry of Justice Analytical Series; 2016; pp. 1–20. Available online: https://www.rand.org/pubs/research_reports/RR1212.html (accessed on 6 March 2021).

- Morano, P.; Tajani, F.; Anelli, D. A decisions support model for investment through the social impact bonds. The case of the city of Bari (Italy). Valori Valutazioni 2020, 24, 163–179. [Google Scholar]

- Zou, P.X.; Wang, S.; Fang, D. A life-cycle risk management framework for PPP infrastructure projects. J. Financ. Manag. Prop. Constr. 2008, 13, 123–142. [Google Scholar] [CrossRef]

- Ye, S.; Tiong, R.K.L. Government support and risk-return trade-off in China’s BOT power projects. Eng. Constr. Arch. Manag. 2000, 7, 412–422. [Google Scholar] [CrossRef]

- PIMAC. Infrainfo DB. Available online: http://infrainfo.kdi.re.kr (accessed on 23 April 2018).

- Clerck, D.D.; Demeulemeester, E. Creating a More Competitive PPP Procurement Market: Game Theoretical Analysis. J. Manag. Eng. 2016, 32, 4016015. [Google Scholar] [CrossRef]

| Process | Identified Risk | |

|---|---|---|

| Macro & political | ▪ Regulatory change ▪ Change in taxation ▪ Political will ▪ Unstable government ▪ Government intervention ▪ Expropriation of facility | ▪ Public sector budget deficit ▪ Strong political opposition ▪ Lack of PPP/toll experience ▪ Inflation risk ▪ Interest rate fluctuation ▪ Currency change |

| Force majeure | ▪ Natural disaster ▪ War | ▪ Vandalism |

| Approval | ▪ Delays in permits | ▪ Detailed design approval risk |

| Planning | ▪ Poor decision process risk ▪ Planning permit | ▪ Poor utilities access |

| Environmental assessment | ▪ NEPA (National Environment Policy Agent) approval | |

| Design | ▪ Design errors/deficiency | ▪ Unproven engineering techniques |

| Financing | ▪ Poor financial market ▪ Financial attraction to investors | ▪ Insufficient financing ability of partner ▪ Refinancing |

| Site preparation | ▪ Site acquisition ▪ Delays in right of way acquisition ▪ Geo-technical condition ▪ Archeological findings | ▪ Hazmat ▪ Availability/access of site ▪ Delays in cable and pipe relocation |

| Construction | ▪ Construction cost overrun ▪ Labor dispute ▪ Procurement (material availability) ▪ Subcontractor disputes ▪ Insurance coverage unavailable ▪ Construction security ▪ Insolvency of sub-contractors | ▪ Commissioning on time ▪ Change in scope/design ▪ Performance specification achievement ▪ Final acceptance ▪ Interface management ▪ Patent infringement ▪ Defects |

| Operation | ▪ Traffic demand ▪ Toll price change ▪ Competing facilities ▪ Withdrawal of supporting networks ▪ Maintenance cost overrun | ▪ Insurance coverage unavailable ▪ Security ▪ Service quality ▪ Early termination risk ▪ Traffic information system |

| Hand-over | ▪ Premature obsolete risk ▪ Needs for expansion | ▪ Residual transfer value risk |

| Others | ▪ Change in private partner share | ▪ Conflict between private partners |

| Min | Mean | Max | ||

|---|---|---|---|---|

| 1. Road projects (60) | Real | 4.21 | 6.76 | 10.03 |

| Current | 8.38 | 11.34 | 15.53 | |

| Premium | 2.50 | 5.77 | 10.50 | |

| 2. Rail projects (9) | Real | 5.03 | 7.83 | 10.43 |

| Current | 9.23 | 12.60 | 15.95 | |

| Premium | 4.65 | 7.86 | 10.49 | |

| 3. Port projects (18) | Real | 5.25 | 7.99 | 9.62 |

| Current | 8.41 | 12.73 | 15.10 | |

| Premium | 3.40 | 7.40 | 9.52 | |

| 4. Environmental projects (75) | Real | 3.33 | 5.72 | 8.44 |

| Current | 7.09 | 10.21 | 13.87 | |

| Premium | 1.84 | 5.37 | 9.00 | |

| Total (162) | Real | 3.33 | 6.47 | 10.43 |

| Current | 7.09 | 11.04 | 15.95 | |

| Premium | 1.84 | 5.40 | 10.50 | |

| Category | Explanatory Variable | Explanation | Statistics | |||

|---|---|---|---|---|---|---|

| Variable Name | Min | Mean | Max | Std. Dev | ||

| Financing cost | Risk free interest rate (Rf_5 years) | Market return of five-year treasury bond as of the date of agreement signing (%) | 2.39 | 5.16 | 12.20 | 1.76 |

| Project characteristics | Facility type | Road (Road), rail (Rail), port (Port), and environment (Environ) | - | - | - | - |

| Service area of the project (Authority) | Central government project, local government project, central government-managed local government project | - | - | - | - | |

| Operation period (O_Period) | Operation period as stated in the agreement (months) | 120.00 | 310.99 | 600.00 | 119.05 | |

| Project size: Total private investment (Ln_P_Investment) | Natural logarithm of total private investment (USD) | 13.19 | 18.07 | 21.87 | 1.80 | |

| Solicited/unsolicited (Solicit) | Solicited proposal and unsolicited proposal | - | - | - | - | |

| Government support | Ratio of construction subsidy (Sub) | Ratio of construction subsidy out of total project costs (%) | 0.00 | 38.36 | 94.48 | 24.69 |

| Minimum revenue guarantee (MRG) | Projects with or without MRG option | - | - | - | - | |

| Pre-contract process | Project preparation period (prepperiod) | Length from the date of receipt of project proposal to the date of designation of the preferred bidder (months) | 1.00 | 18.89 | 98.00 | 16.42 |

| Negotiation period (negoperiod) | Length from the date of designation of the preferred bidder to the date of agreement signing (months) | 1.00 | 19.15 | 84.00 | 16.10 | |

| Value for money assessment (vfm) | Whether value for money assessment was carried out or not | - | - | - | - | |

| Market maturity | Negotiation experience (Exp) | Negotiation experience of the authority | 1 | 25.23 | 75 | 19.42 |

| Competition rate (Bid_compet) | Number of bidders in the selection process of the preferred bidder | 1.00 | 1.62 | 5.00 | 0.86 | |

| Negotiation behavior | Average CIRR of similar recent projects (IRR_S_three) | Average CIRR of three recent PPP projects of the same type facility (%) | 4.40 | 6.60 | 10.43 | 1.51 |

| Time | Time | Year of the agreement signing | - | - | - | - |

| Category | Explanatory Variable (Variable Name) | Model 1 | Model 2 | ||

|---|---|---|---|---|---|

| coef. | std.errors | coef. | std.errors | ||

| Financing cost | Risk free interest rate (Rf_5 years) | 0.005 | 0.077 | 0.001 | 0.093 |

| Project characteristics | Rail | −0.012 | 0.362 | −0.648 | 0.437 |

| Port | 0.797 * | 0.345 | 0.534 | 0.353 | |

| Environment | −0.093 | 0.275 | 0.092 | 0.28 | |

| Service area of the project (Authority) | 0.186 | 0.201 | 0.132 | 0.205 | |

| Operation period (O_Period) | −0.001 | 0.001 | −0.001 | 0.001 | |

| Project size: Total private investment (Ln_P_Investment) | 0.086 | 0.062 | 0.041 | 0.066 | |

| Solicited/unsolicited (Solicit) | −0.157 | 0.177 | −0.101 | 0.184 | |

| Government support | Ratio of construction subsidy (Sub) | −0.008 * | 0.003 | −0.011 ** | 0.003 |

| Minimum revenue guarantee (MRG) | 0.605 ** | 0.212 | 0.543 * | 0.226 | |

| Pre-contract process | Project preparation period (prepperiod) | −0.001 | 0.004 | 0.005 | 0.005 |

| Negotiation period (negoperiod) | 0.005 | 0.005 | 0.009 | 0.005 | |

| Value for money assessment (vfm) | 0.006 | 0.223 | 0.196 | 0.233 | |

| Market maturity | Negotiation experience (Exp) | 0.013 | 0.007 | 0.010 | 0.007 |

| Competition rate (Bid_compet) | −0.257 ** | 0.08 | −0.255 ** | 0.08 | |

| Negotiation behavior | Average CIRR of similar recent projects (IRR_S) | 0.547 *** (IRR_S_three) | 0.082 | 0.616 *** (IRR_S_five) | 0.09 |

| Time | −0.089 * | 0.041 | −0.095 * | 0.044 | |

| Intercept | 181.378 * | 83.24 | 192.900 * | 89.15 | |

| Observations | 150 | 142 | |||

| Adjusted R-squared | 0.748 | 0.731 | |||

| IRR_S_3 | Rf_5 years | Exp | O_Period | Ln_P_Investment | Sub | Prep_Priod | Nego_Period | |

|---|---|---|---|---|---|---|---|---|

| IRR_S_3 | 1.00 | |||||||

| Rf_5 years | 0.37 | 1.00 | ||||||

| Exp | −0.51 | −0.46 | 1.00 | |||||

| O_period | 0.54 | 0.02 | −0.13 | 1.00 | ||||

| Ln_P_Investment | 0.33 | −0.07 | 0.15 | 0.54 | 1.00 | |||

| Sub | −0.21 | −0.08 | −0.27 | −0.36 | −0.54 | 1.00 | ||

| Prep_Period | −0.08 | −0.15 | 0.16 | 0.22 | 0.29 | −0.05 | 1.00 | 0 |

| Nego_period | 0.21 | 0.05 | 0.05 | 0.22 | 0.34 | −0.27 | 0.18 | 1.00 |

| Type | Average CIRR (%) | |

|---|---|---|

| Solicited project | Road | 8.101 |

| Rail | 8.469 | |

| Port | 8.313 | |

| Environment | 5.650 | |

| Total | 6.897 | |

| Unsolicited project | Road | 6.043 |

| Rail | 5.575 | |

| Port | 6.853 | |

| Environment | 5.816 | |

| Total | 5.983 | |

| Category | Explanatory Variable | Model 1 | |

| coef. | std.errors | ||

| Financing cost | Risk free interest rate (Rf_5 years) | −0.065 | 0.122 |

| Project characteristics | Service area of the project (Authority) | 0.688 * | 0.296 |

| Operation period (O_Period) | 0.002 | 0.003 | |

| Project size: Total private investment (Ln_P_Investment) | 0.148 | 0.13 | |

| Solicited/unsolicited (Solicit) | 0.008 | 0.313 | |

| Government support | Ratio of construction subsidy (Sub) | −0.006 | 0.006 |

| Minimum revenue guarantee (MRG) | 1.239 ** | 0.423 | |

| Pre-contract process | Project preparation period (prepperiod) | 0.005 | 0.009 |

| Negotiation period (negoperiod) | 0.006 | 0.006 | |

| Value for money assessment (vfm) | 0.236 | 0.358 | |

| Market maturity | Negotiation experience (Exp) | 0.042 * | 0.02 |

| Competition rate (Bid_compet) | −0.045 | 0.112 | |

| Negotiation behavior | Average CIRR of similar recent projects (IRR_S_three) | 0.386 * | 0.148 |

| Time | Time | −0.282 * | 0.105 |

| Intercept | 565.589 * | 211.763 | |

| Observations | 57 | ||

| Adjusted R-squared | 0.834 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, K.; Kim, J.; Yook, D. Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects. Sustainability 2021, 13, 3311. https://doi.org/10.3390/su13063311

Kim K, Kim J, Yook D. Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects. Sustainability. 2021; 13(6):3311. https://doi.org/10.3390/su13063311

Chicago/Turabian StyleKim, Kangsoo, Jinoh Kim, and Donghyung Yook. 2021. "Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects" Sustainability 13, no. 6: 3311. https://doi.org/10.3390/su13063311

APA StyleKim, K., Kim, J., & Yook, D. (2021). Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects. Sustainability, 13(6), 3311. https://doi.org/10.3390/su13063311