Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies

Abstract

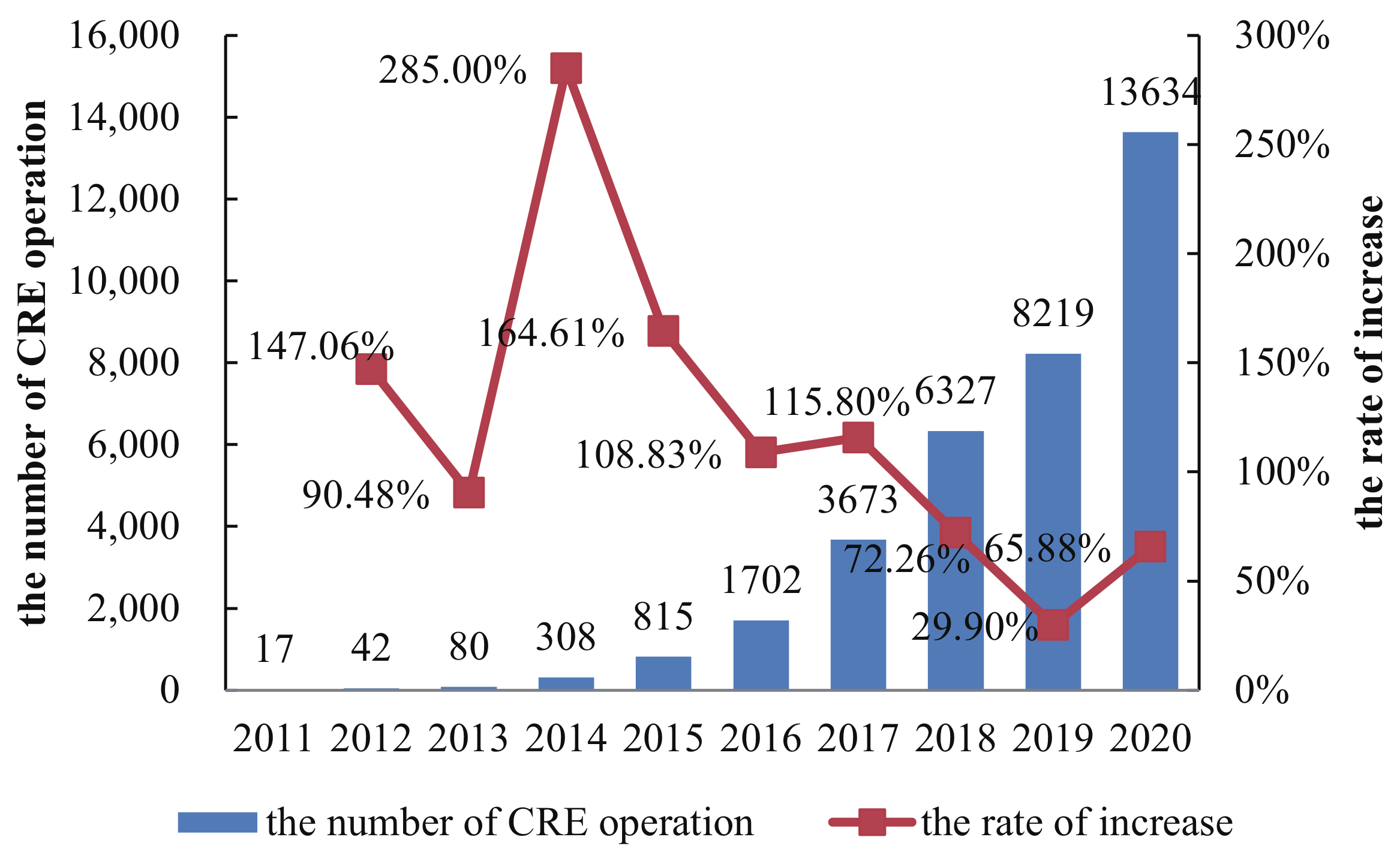

1. Introduction

2. Literature Review

3. Problem Description

4. Mathematical Model

4.1. Assumptions

- The empty container demand of customer must be met in each period;

- All of containers are the same type;

- Container handling time is negligible.

- The operation route of the CRE is known, and transportation time and unit transportation cost between the cities are known;

- The routes of liner companies between ports are known and can cover all ports.

4.2. Symbol Description

4.3. Mathematical Model

4.3.1. The Empty Container Repositioning Optimization Model of CRE

4.3.2. The Empty Container Repositioning Optimization Model of the International Liner Company

4.3.3. The Empty Container Repositioning Optimization Model of the Cooperation between CRE and the International Liner Company

5. Numberial Experiment

5.1. Experiment Description

5.2. Experimental Results

5.3. Sensitively Analysis

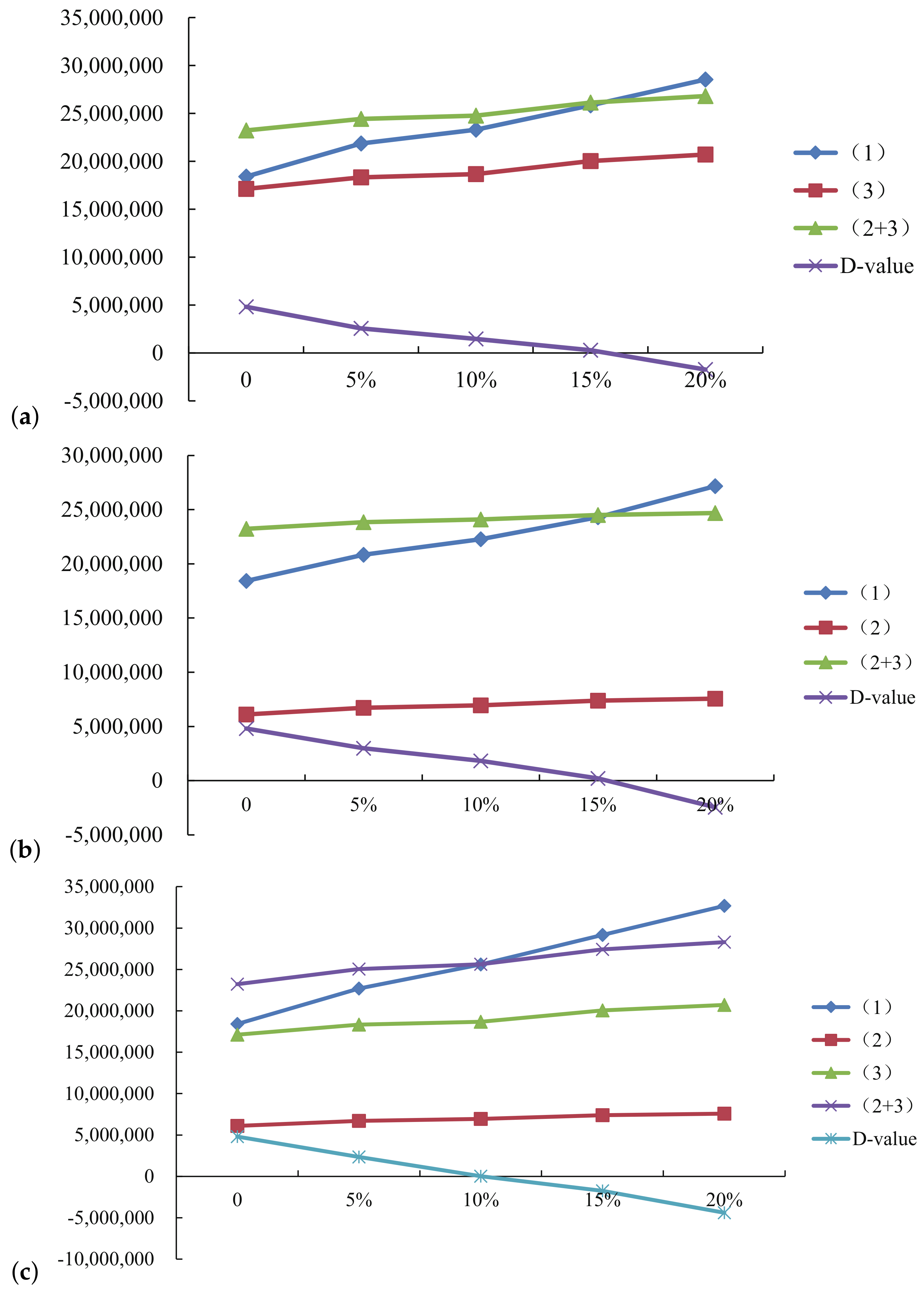

5.3.1. Sensitively Analysis with Unit Storage Cost

5.3.2. Sensitively Analysis with Unit Repositioning Cost

5.3.3. Sensitively Analysis with

5.3.4. Sensitively Analysis with Demand Fluctuation

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Shi, X.; Voß, S. Container terminal operations under the influence of shipping alliances. In Risk Management in Port Operations, Logistics and Supply Chain Security; Bichou, K., Bell, M.G.H., Evans, A., Eds.; Informa: London, UK, 2007; pp. 135–167. [Google Scholar]

- Shi, X.; Vanelslander, T. Design and evaluation of transportation networks: Constructing transportation networks from perspectives of service integration, infrastructure investment and information system implementation. Netnomics 2010, 11, 1–4. [Google Scholar] [CrossRef][Green Version]

- Li, F.; Shi, X.; Hu, H. Location selection of dry port based on AP clustering—The case of Southwest China, in conference proceedings of LISS. Proc. Int. Conf. Logist. Inform. Serv. Sci. 2011, 2, 255–260. [Google Scholar]

- Braekers, K.; Janssens, G.K.; Caris, A. Challenges in managing empty container movement at multiple planning levels. Transp. Rev. 2011, 31, 681–708. [Google Scholar] [CrossRef]

- Dang, Q.V.; Yun, W.Y.; Kim, H.W. Positioning empty containers under dependent demand process. Comput. Ind. Eng. 2012, 62, 708–715. [Google Scholar] [CrossRef]

- Guo, Z.; Wang, W.; Tang, G. A recursive model for static empty container allocation. Front. Comput. Sci. China 2011, 5, 486–495. [Google Scholar] [CrossRef]

- Chou, C.C.; Gou, R.H.; Tsai, C.L.; Tsou, M.C.; Wong, C.P.; Yu, H.L. Application of a mixed fuzzy decision making and optimization programming model to the empty container allocation. Appl. Soft Comput. 2010, 10, 1071–1079. [Google Scholar] [CrossRef]

- Song, D.P.; Dong, J.X. Cargo routing and empty container repositioning in multiple shipping service routes. Transp. Res. Part B Methodol. 2012, 46, 1556–1575. [Google Scholar] [CrossRef]

- Song, D.P.; Dong, J.X. Effectiveness of an empty container repositioning policy with flexible destination ports. Transp. Policy 2011, 18, 92–101. [Google Scholar] [CrossRef]

- Khakbaz, H.; Bhattacharjya, J. Maritime empty container repositioning: A problem Review. Int. J. Strateg. Decis. Sci. 2014, 5, 1–23. [Google Scholar] [CrossRef]

- Zheng, J.F.; Sun, Z.; Gao, Z.Y. Empty container exchange among line carriers. Transp. Res. Part E 2015, 83, 158–169. [Google Scholar] [CrossRef]

- Kuzmicz, K.A.; Pesch, E. Approaches to empty container repositioning problems in the context of Eurasian intermodal transportation. Omega 2019, 85, 194–213. [Google Scholar] [CrossRef]

- Peng, Z.; Wang, H.; Wang, W.; Jiang, Y. Intermodal transportation of full and empty containers in harbor-inland regions based on revenue management. Eur. Transp. Res. Rev. 2019, 11, 1–18. [Google Scholar] [CrossRef]

- Olivo, A.; Zuddas, P.; Francesco, M.D.; Manca, A. An operational model for empty container management. Marit. Econ. Logist. 2005, 7, 199–222. [Google Scholar] [CrossRef]

- Sun, H. Research on multimodal repositioning of empty containers around seaborne and land carriage. J. Wuhan Univ. Technol. 2010, 34, 533–536. [Google Scholar]

- Li, Y.M.; Guo, X.Y.; Yang, L. Route optimization of China-EU container multimodal transport considering various factors. J. Railw. Sci. Eng. 2017, 14, 2239–2248. [Google Scholar]

- Xie, Y.; Laing, X.; Ma, L.; Yan, H. Empty container management and coordination in intermodal transport. Eur. J. Oper. Res. 2016, 257, 223–232. [Google Scholar] [CrossRef]

- Zhang, H.; Lu, L.; Wang, X. Tactical and Operational Cooperative Empty Container Repositioning Optimization Model Based on Business Flow and Initial Solutions Generation Rules. Symmetry 2019, 11, 300. [Google Scholar] [CrossRef]

- Liang, Y.; Liao, B.; Xu, C. Single period transportation of port empty containers based on carbon trading in uncertain environment. Navig. China 2016, 39, 133–139. [Google Scholar]

- Wang, C.; Chen, F. Optimal empty container reposition with collaboration among shipping companies based on multiple ports. J. Syst. Manag. 2016, 25, 539–545. [Google Scholar]

- Jiang, Y.; Han, X. Fuzzy Optimization Model of Maritime Empty Container Repositioning under the Cooperation of Shipping Companies. Packag. Eng. 2018, 39, 151–156. [Google Scholar]

- Xing, Y.; Yang, H.; Chu, F. Empty container transportation of liner alliance based on mutual leasing strategy. J. Dalian Marit. Univ. 2016, 42, 101–106. [Google Scholar]

- Song, D.P.; Dong, J. Empty container repositioning. In Handbook of Ocean Container Transport Logistics—Making Global Supply Chain Effective; Springer: New York, NY, USA, 2015; pp. 163–208. [Google Scholar]

- Lee, C.Y.; Song, D.P. Ocean container transport in global supply chains: Overview and research opportunities. Transp. Res. Part B 2017, 95, 442–474. [Google Scholar] [CrossRef]

- Song, D.P.; Carter, J. Empty container repositioning in liner shipping. Marit. Policy Manag. 2009, 36, 291–307. [Google Scholar] [CrossRef]

| Region | Cities | Ports |

|---|---|---|

| China | Chengdu (1), Wuhan, Tianjin (3), Qingdao (4), | Dalian port (1), Tianjin port (2), |

| region | Rizhao (5), Shanghai (6), Ningbo (7), | Qingdao port (3), Shanghai Port (4), |

| Xiamen (8), Shenzhen (9), Guangzhou (10) | Xiamen port (5), Shenzhen port (6), | |

| Qianzhou (11) Nanning (12), Kunming (13) | Ningbo port (7) | |

| Europe | Hamburg (14), Duisburg (15), Lodz (16), | Hamburg Port (8), Rotterdam Port (9), |

| region | lyon (17), London (18), Tilburg (19), | Piraeus Port (10), Port of Gdynia (11), |

| Nuremberg (20), Poznan (21), Rotterdam (22) | Barcelona (12) |

| Parameters | Quantity |

|---|---|

| T | 12 |

| The length of each time period (days) | 25 |

| unit storage cost in city/port (yuan/day · TEU) | 20/15 |

| unit rental cost in city/port (yuan/TEU) | 5000/5000 |

| unit transportation cost between cities or between cities and ports | 0.5/0.8 |

| in China/Europe (yuan/km · TEU) | |

| unit transportation cost by CRE lines (yuan/km · TEU) | 0.6 |

| unit transportation cost between ports (yuan/km · TEU) | 0.25 |

| m1/m2 (yuan/TEU) | 2500/2000 |

| The maximum booking capacity (TEU) | 400 |

| The maximum storage capacity in city for CRE company (TEU) | 1000 |

| The maximum storage capacity in city or port for | 500/1500 |

| international liner company (TEU) | |

| The empty container demand/supply of CRE company | [30,60]/[20,40] |

| in cities of china (TEU) | |

| The empty container demand/supply of CRE company | [25,40]/[40,60] |

| in cities of Europe (TEU) | |

| The empty container demand/supply of international | [30,50]/[20,40] |

| liner company of cities (TEU) | |

| The empty container demand/supply of international | [400,800]/[350,750] |

| liner company in ports of China (TEU) | |

| The empty container demand/supply of international | [400,800]/[450,850] |

| liner company in ports of China (TEU) | |

| The initial storage volume in cities for CRE | [5,15]/[5,15] |

| company/ international liner company (TEU) | |

| The initial storage volume in ports for international liner company (TEU) | [50,80] |

| CRE Company | International Liner Company | |||||

|---|---|---|---|---|---|---|

| Non- | In- | D- | Non- | In- | D- | |

| Cooperation (1) | Cooperation (2) | Value (1–2) | Cooperation (1) | Cooperation (2) | Value (1–2) | |

| rental cost | 1.27 | 1.08 | 0.19 | 0.95 | 0.89 | 0.05 |

| storage cost | 0.23 | 0.17 | 0.07 | 5.44 | 4.83 | 0.62 |

| repositoining | 4.59 | 4.43 | 0.16 | 10.74 | 7.02 | 3.73 |

| cost | ||||||

| Total cost | 6.10 | 5.68 | 0.42 | 17.13 | 12.73 | 4.40 |

| Change of Unit | In-Cooperation | Non-Cooperation | D-Value | ||

|---|---|---|---|---|---|

| Storage Cost | The Total Cost (1) | The Total Cost | The Total Cost of | The Total Cost | (2 + 3 − 1) |

| of CRE | of International | (2 + 3) | |||

| Company (2) | Liner Company (3) | ||||

| 0 | 18.41 | 6.10 | 17.13 | 23.23 | 4.82 |

| +5 | 18.81 | 6.35 | 17.32 | 23.67 | 4.86 |

| +10 | 19.20 | 6.61 | 17.51 | 24.12 | 4.91 |

| +15 | 19.60 | 6.86 | 17.70 | 24.56 | 4.96 |

| +20 | 19.99 | 7.12 | 17.88 | 25.00 | 5.01 |

| Change of Unit | In-Cooperation | Non-Cooperation | D-Value | ||

|---|---|---|---|---|---|

| Repositioning | The Total Cost (1) | The Total Cost | The Total Cost of | The Total Cost | (2 + 3 − 1) |

| Cost | of CRE | of International | (2 + 3) | ||

| Company (2) | Liner Company (3) | ||||

| 0 | 18.41 | 6.10 | 17.13 | 23.23 | 4.82 |

| +20% | 20.70 | 7.02 | 19.28 | 26.30 | 5.59 |

| +40% | 22.99 | 7.94 | 21.43 | 29.36 | 6.37 |

| +60% | 25.28 | 8.86 | 23.57 | 32.43 | 7.15 |

| +80% | 27.57 | 97.75 | 25.72 | 35.50 | 7.92 |

| Change of | In-Cooperation | Non-Cooperation | D-Value | ||

|---|---|---|---|---|---|

| Parameter | The Total Cost (1) | The Total Cost | The Total Cost of | The Total Cost | (2 + 3 − 1) |

| of CRE | of International | (2 + 3) | |||

| Company (2) | Liner Company (3) | ||||

| 0 | 18.41 | 6.10 | 17.13 | 23.23 | 4.82 |

| +500 | 20.44 | 6.10 | 17.13 | 23.23 | 2.79 |

| +1000 | 20.81 | 6.10 | 17.13 | 23.23 | 2.42 |

| +1500 | 22.10 | 6.10 | 17.13 | 23.23 | 1.13 |

| +2000 | 23.02 | 6.10 | 17.13 | 23.23 | 0.21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, L.; Yan, H.; Yin, Y.; Xu, Q. Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies. Sustainability 2021, 13, 3182. https://doi.org/10.3390/su13063182

Xing L, Yan H, Yin Y, Xu Q. Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies. Sustainability. 2021; 13(6):3182. https://doi.org/10.3390/su13063182

Chicago/Turabian StyleXing, Lei, Hong Yan, Yandong Yin, and Qi Xu. 2021. "Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies" Sustainability 13, no. 6: 3182. https://doi.org/10.3390/su13063182

APA StyleXing, L., Yan, H., Yin, Y., & Xu, Q. (2021). Research on the Optimization of Empty Container Repositioning of China Railway Express in Cooperation with International Liner Companies. Sustainability, 13(6), 3182. https://doi.org/10.3390/su13063182