The Effect of Air Quality and Weather on the Chinese Stock: Evidence from Shenzhen Stock Exchange

Abstract

1. Introduction

2. Literature Review

3. Overviews of Chinese Stock Markets

3.1. Overviews of Mainland and Hong Kong Stock Markets

3.2. Overview of Shenzhen Stock Markets

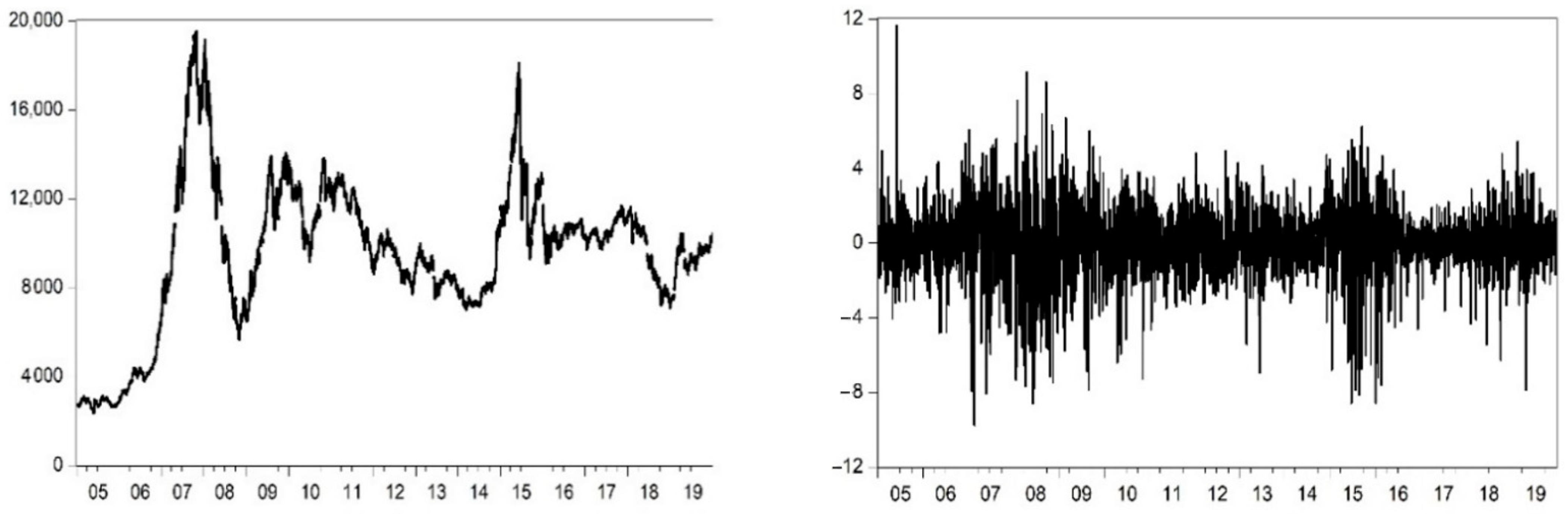

3.3. Summary Statistics of Sample Returns

4. Methodology

4.1. Weather Variables

4.2. Estimation Model

5. Empirical Results

5.1. Effects of Air Quality and Weather Conditions

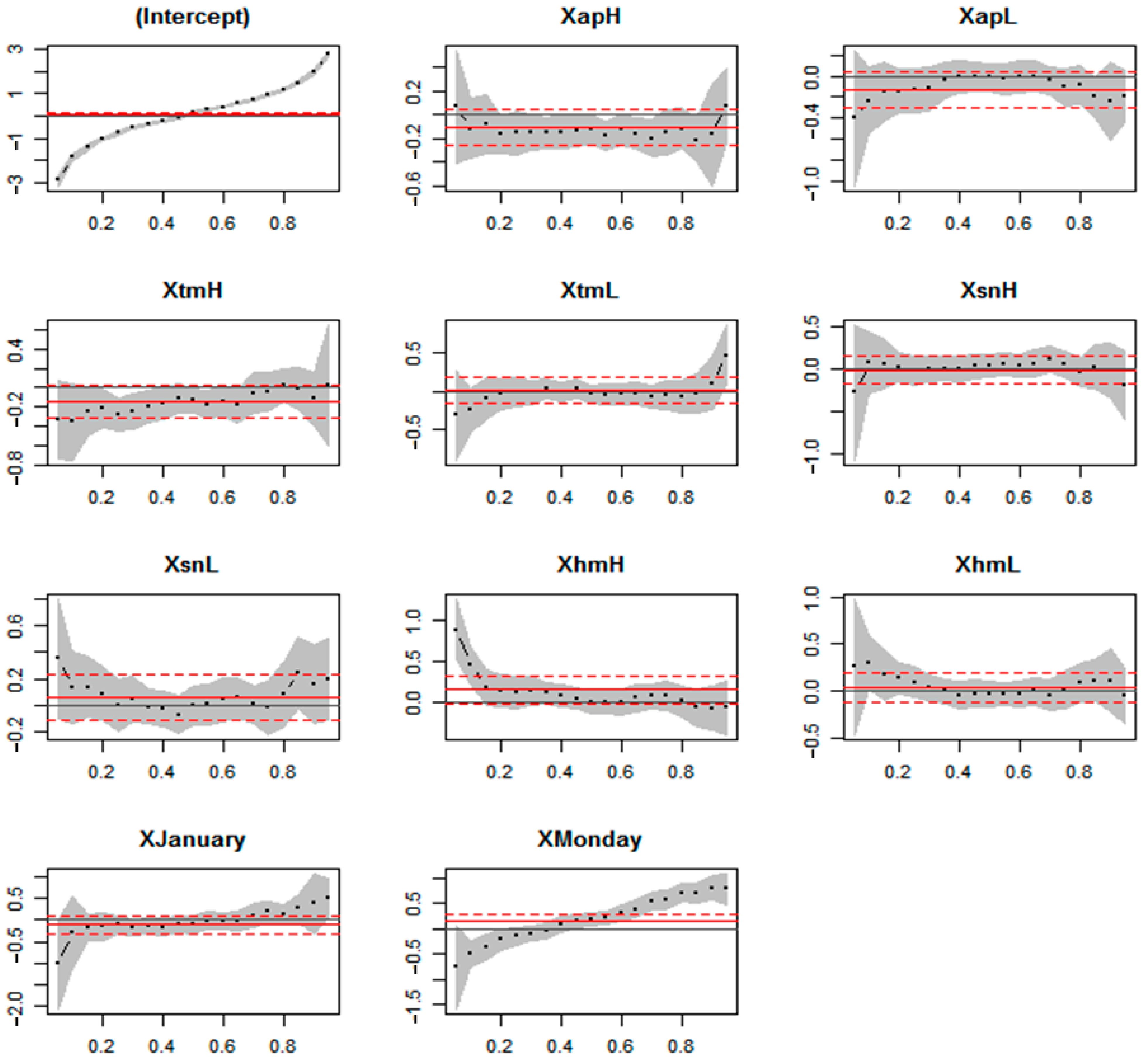

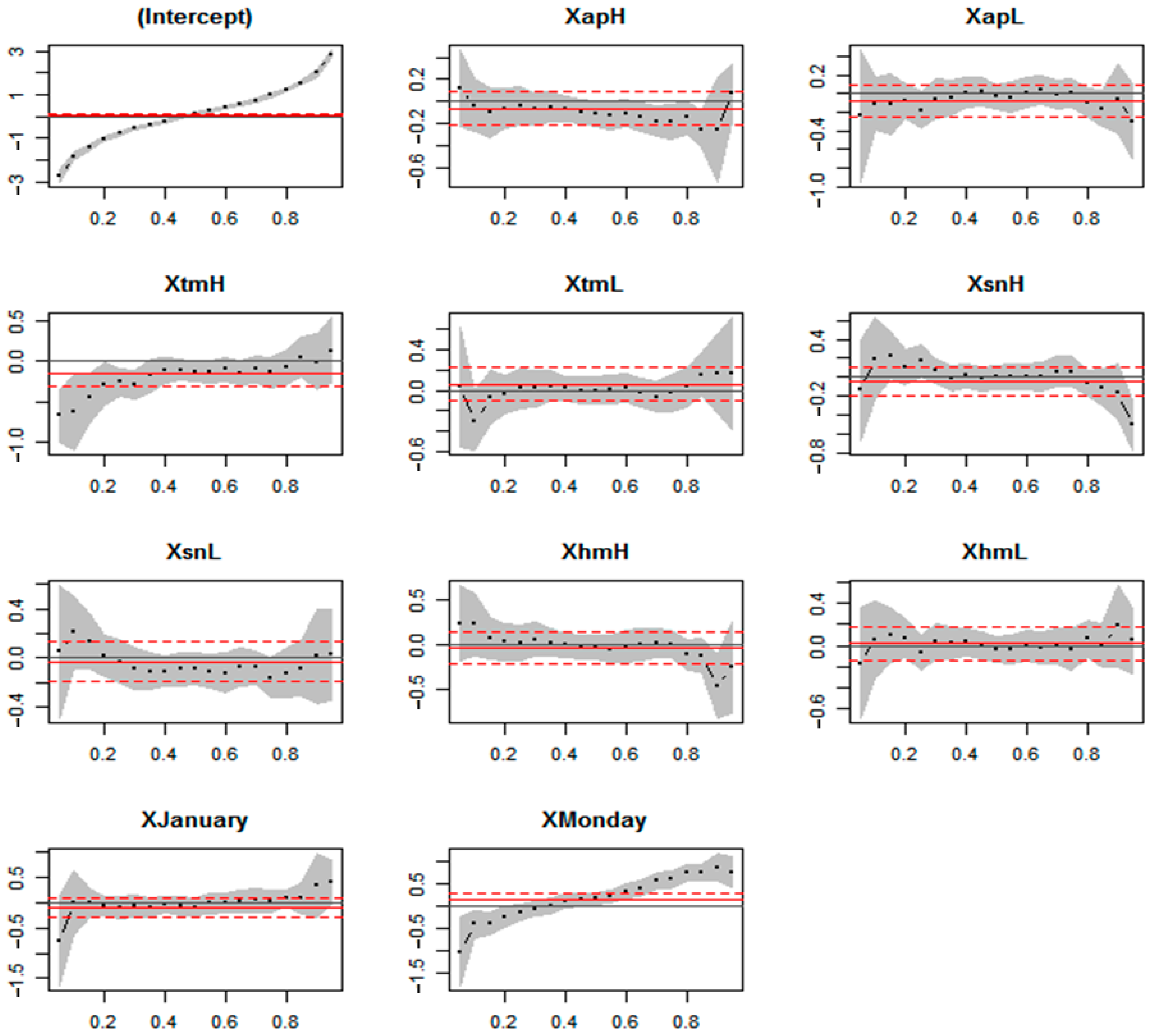

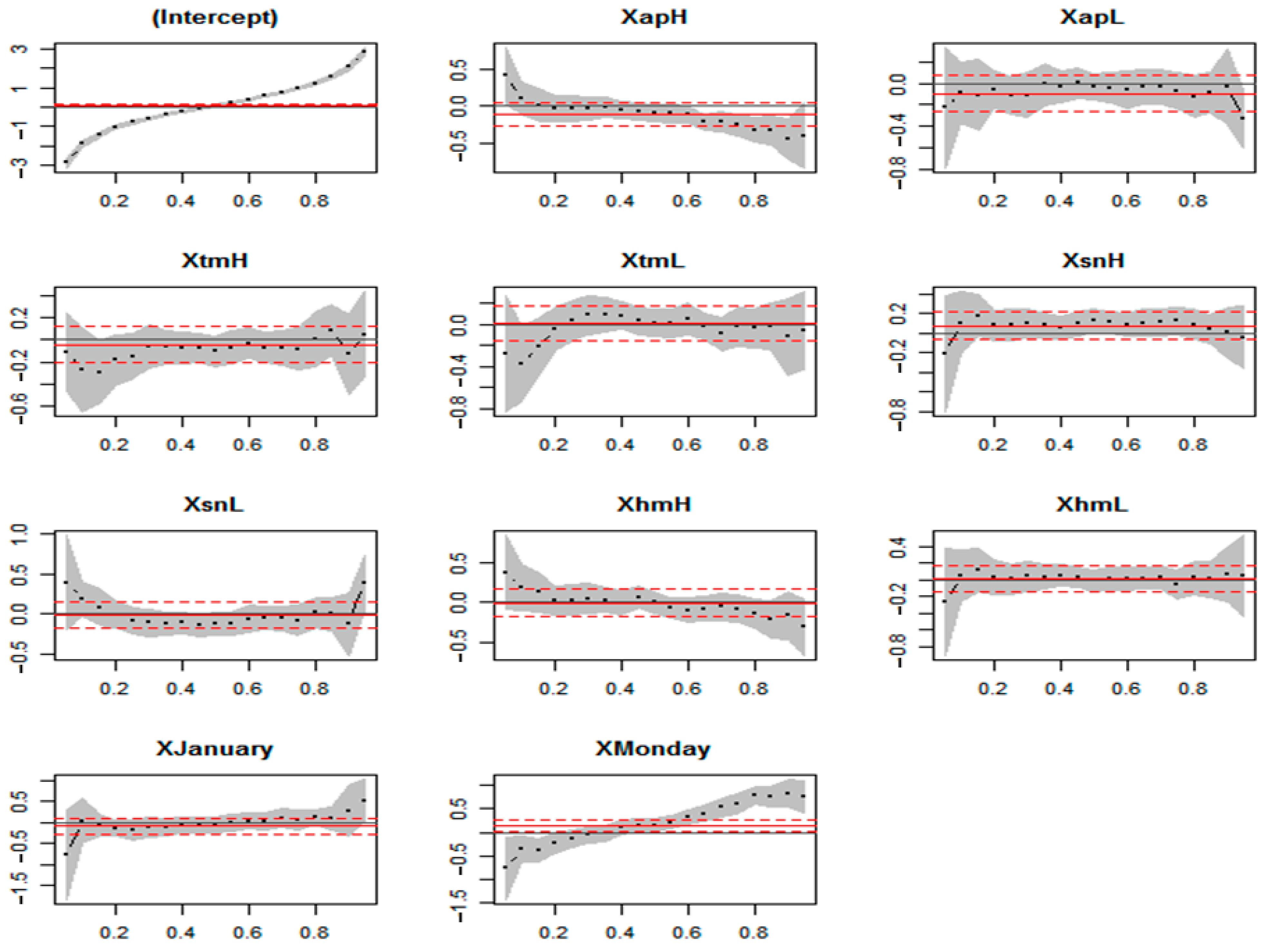

5.2. Effects of Air Quality and Weather on the Stock Returns Using Quantile Regression

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lepori, G.M. Environmental stressors, mood, and trading decisions: Evidence from ambient air pollution. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Saunders, E.M., Jr. Stock prices and the Wall Street weather. Am. Econ. Rev. 1993, 83, 1337–1345. [Google Scholar]

- Hirshleifer, D.; Shumway, T. Good day sunshine: Stock returns and the weather. J. Financ. 2003, 58, 1009–1032. [Google Scholar] [CrossRef]

- Chang, S.-C.; Chen, S.-S.; Chou, R.K.; Lin, Y.-H. Weather and intraday patterns in stock returns and trading activity. J. Bank. Financ. 2008, 32, 1754–1766. [Google Scholar] [CrossRef]

- Yoon, S.-M.; Kang, S.H. Weather effects on returns: Evidence from the Korean stock market. Physica A 2009, 388, 682–690. [Google Scholar] [CrossRef]

- Jiang, Z.; Kang, S.H.; Cheong, C.; Yoon, S.-M. The effects of extreme weather conditions on Hong Kong and Shenzhen stock market returns. Int. J. Financ. Stud. 2019, 7, 70. [Google Scholar] [CrossRef]

- Li, Q.; Peng, C.H. The stock market effect of air pollution: Evidence from China. Appl. Econ. 2016, 48, 3442–3461. [Google Scholar] [CrossRef]

- Yi, C.; Wang, J. Weather, seasonal mood disorder and stock returns. Stat. Decis. Mak. 2005, 18, 79–82. (In Chinese) [Google Scholar]

- Han, Z.-X. Study on weather effect of China’s stock index returns. J. Beijing Univ. Aeronaut. Astronaut. (Soc. Sci. Ed.) 2005, 18, 10–14. (In Chinese) [Google Scholar]

- Han, Z.-X. A study on sunshine effect of Chinese stock index returns. J. Harbin Inst. Technol. 2006, 38, 260–263. (In Chinese) [Google Scholar]

- Han, Z.-X.; Wang, Y.-S. A study for SAD effect on Chinese market indices return. J. Huazhong Univ. Sci. Technol. (Soc. Sci. Ed.) 2005, 19, 88–92. (In Chinese) [Google Scholar]

- Kang, S.H.; Jiang, Z.; Lee, Y.; Yoon, S.-M. Weather effects on the returns and volatility of the Shanghai stock market. Physica A 2010, 389, 91–99. [Google Scholar] [CrossRef]

- Levy, T.; Yagil, J. Air pollution and stock returns in the US. J. Econ. Psychol. 2011, 32, 374–383. [Google Scholar] [CrossRef]

- Levy, T.; Yagil, J. Air pollution and stock returns–Extensions and international perspective. Int. J. Eng. Bus. Enterp. Appl. 2013, 4, 1–14. [Google Scholar]

- Lepori, G.M. Air pollution and stock returns: Evidence from a natural experiment. J. Empir. Financ. 2016, 35, 25–42. [Google Scholar] [CrossRef]

- Guo, Y.J.; Zhang, Y.H. Can air quality affect the stock market? J. Financ. Res. 2016, 428, 71–85. (In Chinese) [Google Scholar]

- Wu, Q.; Hao, Y.; Lu, J. Air pollution, stock returns, and trading activities in China. Pac. Basin Financ. J. 2018, 51, 342–365. [Google Scholar] [CrossRef]

- Dong, R.; Fisman, R.; Wang, Y.; Xu, N. Air pollution, affect, and forecasting bias: Evidence from Chinese financial analysts. J. Financ. Econ. 2019, 139, 971–984. [Google Scholar] [CrossRef]

- Li, J.; Massa, M.; Zhang, H.; Zhang, J. Air pollution, behavioral bias, and the disposition effect in China. J. Financ. Econ. 2019, in press. [Google Scholar] [CrossRef]

- Ding, X.; Guo, M.; Yang, T. Air pollution, local bias, and stock returns. Financ. Res. Lett. 2020, 39, 101576. [Google Scholar] [CrossRef]

- Wu, Q.; Lu, J. Air pollution, individual investors, and stock pricing in China. Int. Rev. Econ. Financ. 2020, 67, 267–287. [Google Scholar] [CrossRef]

- Wu, Q.; Robin, K.; Lu, J. How does air pollution-induced fund-manager mood affect stock markets in China? J. Behav. Exp. Financ. 2020, 28, 100399. [Google Scholar] [CrossRef]

- He, X.; Liu, Y. The public environmental awareness and the air pollution effect In Chinese stock market. J. Clean. Prod. 2018, 185, 446–454. [Google Scholar] [CrossRef]

- Xu, M.; Wang, Y.; Tu, Y. Uncovering the invisible effect of air pollution on stock returns: A moderation and mediation analysis. Financ. Res. Lett. 2020, 39, 101646. [Google Scholar] [CrossRef]

- Shenzhen Stock Exchange. Shenzhen Market. Monthly Report; Shenzhen Stock Exchange: Shenzhen, China, 2019; Volume 12. [Google Scholar]

- Lin, J.Y. Demystifying the Chinese Economy; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- Shenzhen Stock Exchange. Shenzhen Stock Exchange Fact; Shenzhen Stock Exchange: Shenzhen, China, 2018. [Google Scholar]

- Teng, M.; He, X. Air quality levels, environmental awareness and investor trading behavior: Evidence from stock market in China. J. Clean. Prod. 2020, 244, 118663. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G., Jr. Regression quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Chuang, C.C.; Kuan, C.M.; Lin, H.Y. Causality in quantiles and dynamic stock return–volume relations. J. Bank. Financ. 2009, 33, 1351–1360. [Google Scholar] [CrossRef]

- Balcilar, M.; Gupta, R.; Nguyen, D.K.; Wohar, M.E. Causal effects of the United States and Japan on Pacific-Rim stock markets: Nonparametric quantile causality approach. Appl. Econ. 2018, 50, 5712–5727. [Google Scholar] [CrossRef]

| Hong Kong Exchange | Shanghai Stock Exchange | Shenzhen Stock Exchange | ||||

|---|---|---|---|---|---|---|

| Main Board | GEM | A-Share | B-Share | A-Share | B-Share | |

| No. of listed firms | 2071 | 378 | 1495 | 50 | 2195 | 47 |

| No. of listed H-shares | 262 | 22 | n.a. | n.a. | n.a. | n.a. |

| No. of listed red-chips stocks | 168 | 5 | n.a. | n.a. | n.a. | n.a. |

| No. of listed securities | 12,416 | 379 | n.a. | n.a. | n.a. | n.a. |

| Market capitalization (Billion) | HK$38,058 | HK$107 | RMB 34,609 | RMB 79 | RMB 23,689 | RMB 52.4 |

| Total negotiable capitalization (Billion) | n.a. | n.a. | RMB 29,918 | RMB 79 | RMB 18,169 | RMB 51.6 |

| Average P/E ratio (Times) | 13.28 | 22.04 | 14.28 | 9.03 | 26.25 | 10.17 |

| Total turnover (Million shares) | 80,247 | 351 | 21,609 | 21 | 28,248 | 18 |

| Total turnover (Million) | HK$48,434 | HK$86 | RMB 220,143 | RMB 137 | RMB 307,635 | RMB 66 |

| Stocks | No. of Listed Securities | Total Issued Capital (Shares) | Total Negotiable Capital (Shares) | Total Market Capitalization (RMB Yuan) | Negotiable Market Capitalization (RMB Yuan) |

|---|---|---|---|---|---|

| Main Board A shares | 461 | 797,185,123,699 | 696,114,461,407 | 7,686,204,108,110 | 6,779,766,998,846 |

| SME Board | 943 | 932,212,187,067 | 716,627,455,305 | 9,868,131,938,227 | 7,366,129,440,415 |

| ChiNext | 791 | 409,711,487,697 | 306,186,903,232 | 6,134,761,852,701 | 4,023,173,660,498 |

| Main Board B shares | 47 | 12,941,222,935 | 12,811,181,406 | 52,388,606,609 | 51,603,614,196 |

| No. of Individual Investors | No. of Institutional Investors | Total | |

|---|---|---|---|

| 2011 | 10,091.18 | 33.40 | 10,124.57 |

| 2012 | 10,537.82 | 35.48 | 10,573.30 |

| 2013 | 11,047.50 | 38.05 | 11,085.56 |

| 2014 | 11,995.29 | 41.58 | 12,036.87 |

| 2015 | 16,839.70 | 49.22 | 16,888.92 |

| 2016 | 20,841.00 | 56.12 | 20,897.13 |

| 2017 | 24,482.57 | 62.51 | 24,545.08 |

| 2018 | 27,621.26 | 64.06 | 27,685.32 |

| Area (Province) | Total Trading (RMB) | Weight (%) | Share Trading |

|---|---|---|---|

| Shanghai | 30,224 | 14.99 | 18,993 |

| Shenzhen | 23,309 | 11.56 | 13,332 |

| Zhejiang | 19,460 | 9.65 | 17,051 |

| Jiangsu | 16,865 | 8.36 | 12,692 |

| Beijing | 16,275 | 8.07 | 10,268 |

| Fujian | 9916 | 4.92 | 7037 |

| Guangdong | 9328 | 4.62 | 7450 |

| Guangzhou | 8111 | 4.02 | 5464 |

| Foreign | 4769 | 2.36 | 4769 |

| Obs. | Mean | Max. | Min. | Std. Dev. | Skew. | Kurt. | Jarque-Bera | ADF | PP |

|---|---|---|---|---|---|---|---|---|---|

| 3647 | 0.036 | 11.63 | −9.75 | 1.86 | −0.41 | 6.35 | 1817.8 *** | −55.47 *** | −55.68 *** |

| Variables. | Mean | Max. | Min. | Std. Dev. | Skew. | Kurt. | Jarque-Bera |

|---|---|---|---|---|---|---|---|

| AQI | 53.32 | 289.00 | 15.00 | 22.55 | 1.35 | 8.34 | 5040.5 *** |

| TEMP | 23.70 | 31.80 | 7.40 | 5.14 | −0.53 | 2.25 | 236.6 *** |

| HUMI | 78.49 | 99.00 | 29.00 | 10.23 | −1.00 | 4.90 | 1067.4 *** |

| SUNSH | 4.99 | 12.40 | 0.00 | 3.88 | 0.08 | 1.52 | 312.7 *** |

| Air Quality and Weather Condition Dummies | Description |

|---|---|

| Extremely high air pollution (low air quality) | |

| Extremely low air pollution (high air quality) | |

| Extremely high temperature | |

| Extremely low temperature | |

| Extremely long sunshine duration | |

| Extremely short sunshine duration | |

| Extremely high humidity | |

| Extremely low humidity |

| SZI | ||||||

|---|---|---|---|---|---|---|

| Whole Period (2005–2019) | Sub-Period I (2005–2012) | Sub-Period II (2014–2019) | ||||

| Coefficient | -Value | Coefficient | -Value | Coefficient | -Value | |

| 0.080 | 1.906 | 0.078 | 1.248 | 0.084 | 1.438 | |

| −0.174 | −2.223 ** | −0.322 | −2.686 *** | −0.072 | −0.659 | |

| −0.066 | −0.865 | −0.141 | −1.088 | −0.037 | −0.393 | |

| −0.113 | −1.414 | −0.219 | −1.785 | −0.013 | −0.120 | |

| 0.048 | 0.627 | 0.075 | 0.635 | 0.025 | 0.241 | |

| −0.019 | −0.255 | −0.001 | −0.009 | −0.055 | −0.534 | |

| 0.012 | 0.136 | −0.020 | −0.150 | 0.050 | 0.434 | |

| 0.008 | 0.092 | 0.207 | 1.630 | −0.156 | −1.330 | |

| −0.036 | −0.468 | 0.147 | 1.276 | −0.177 | −1.704 | |

| −0.078 | −0.947 | 0.009 | 0.077 | −0.221 | −1.767 | |

| 0.055 | 0.997 | 0.049 | 0.552 | 0.075 | 1.021 | |

| 0.028 | 6.43 *** | 0.067 | 4.85 *** | 0.016 | 4.22 *** | |

| 0.059 | 13.82 *** | 0.064 | 9.11 *** | 0.048 | 8.84 *** | |

| 0.934 | 212.37 *** | 0.920 | 106.46 *** | 0.946 | 183.90 *** | |

| −6525.760 | −3937.94 | −2572.62 | ||||

| 3.869 | 4.086 | 3.577 | ||||

| SZI | ||||||

|---|---|---|---|---|---|---|

| Whole Period (2005–2019) | Sub-Period I (2005–2012) | Sub-Period II (2014–2019) | ||||

| Coefficient | -Value | Coefficient | -Value | Coefficient | -Value | |

| 0.054 | 1.284 | 0.078 | 1.246 | 0.040 | 0.696 | |

| −0.074 | −0.964 | −0.182 | −1.617 | 0.011 | 0.103 | |

| −0.053 | −0.677 | 0.019 | 0.141 | −0.166 | −1.702 | |

| −0.163 | −2.055 *** | −0.164 | −1.449 | −0.163 | −1.402 | |

| 0.059 | 0.846 | 0.061 | 0.524 | 0.041 | 0.453 | |

| 0.072 | 1.004 | 0.038 | 0.344 | 0.100 | 1.036 | |

| −0.074 | −0.962 | −0.030 | −0.240 | −0.097 | −0.986 | |

| 0.052 | 0.625 | 0.003 | 0.026 | 0.090 | 0.792 | |

| −0.009 | −0.127 | 0.029 | 0.241 | −0.036 | −0.385 | |

| −0.022 | −0.269 | 0.040 | 0.335 | −0.099 | −0.873 | |

| 0.052 | 0.929 | 0.041 | 0.460 | 0.069 | 0.931 | |

| 0.025 | 6.33 *** | 0.064 | 4.66 *** | 0.015 | 4.56 *** | |

| 0.057 | 13.91 *** | 0.062 | 9.15 *** | 0.048 | 9.20 *** | |

| 0.937 | 223.35 *** | 0.922 | 108.97 *** | 0.946 | 196.41 *** | |

| −6521.030 | −3940.74 | −2570.57 | ||||

| 3.871 | 4.096 | 3.577 | ||||

| SZI | ||||||

|---|---|---|---|---|---|---|

| Whole Period (2005–2019) | Sub-Period I (2005–2012) | Sub-Period II (2014–2019) | ||||

| Coefficient | -Value | Coefficient | -Value | Coefficient | -Value | |

| 0.065 | 1.547 | 0.078 | 1.241 | 0.051 | 0.874 | |

| −0.104 | −1.364 | −0.226 | −1.975 ** | 0.005 | 0.045 | |

| −0.057 | −0.713 | 0.029 | 0.218 | −0.161 | −1.562 | |

| −0.103 | −1.347 | −0.094 | −0.832 | −0.110 | −1.013 | |

| −0.055 | −0.780 | −0.048 | −0.429 | −0.064 | −0.688 | |

| 0.048 | 0.690 | 0.038 | 0.371 | 0.062 | 0.630 | |

| −0.056 | −0.708 | −0.100 | −0.809 | −0.027 | −0.257 | |

| 0.062 | 0.720 | 0.067 | 0.502 | 0.063 | 0.551 | |

| 0.004 | 0.049 | 0.124 | 1.062 | −0.072 | −0.752 | |

| −0.020 | −0.224 | 0.063 | 0.471 | −0.091 | −0.791 | |

| 0.055 | 0.975 | 0.038 | 0.432 | 0.082 | 1.100 | |

| 0.022 | 5.87 *** | 0.054 | 4.26 *** | 0.016 | 4.44 *** | |

| 0.054 | 13.88 *** | 0.059 | 9.32 *** | 0.048 | 9.05 *** | |

| 0.941 | 235.83 *** | 0.928 | 117.57 *** | 0.946 | 189.58 *** | |

| −6513.630 | −3933.75 | −2571.64 | ||||

| 3.871 | 4.097 | 3.578 | ||||

| Dependent Variable: SZI Returns | |||

|---|---|---|---|

| Whole Period (2005–2019) | Sub-Period I (2005–2012) | Sub-Period II (2014–2019) | |

| 11-day MA-MSD | , (-) | , (-) | |

| 21-day MA-MSD | , (-) | ||

| 31-day MA-MSD | , (-) |

| Variables | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 |

|---|---|---|---|---|---|---|---|---|---|

| Intercept | −1.87 * | −1.03 * | −0.54 * | −0.20 * | 0.11 * | 0.39 * | 0.73 * | 1.17 * | 1.97 * |

| −0.12 | −0.17 | −0.15 | −0.14 | −0.12 | −0.13 | −0.20 * | −0.12 | −0.17 | |

| −0.23 | −0.14 | −0.12 | −0.01 | −0.01 | −0.01 | −0.04 | −0.08 | −0.23 | |

| −0.35 | −0.21 | −0.25 * | −0.16 | −0.13 | −0.14 | −0.05 | 0.02 | −0.12 | |

| −0.25 | −0.04 | −0.02 | −0.01 | −0.04 | −0.03 | −0.08 | −0.07 | 0.11 | |

| 0.08 | 0.02 | 0.01 | 0.00 | 0.05 | 0.04 | 0.12 | −0.02 | −0.01 | |

| 0.13 | 0.09 | 0.04 | −0.03 | 0.00 | 0.04 | 0.01 | 0.08 | 0.16 | |

| 0.45 | 0.14 | 0.14 | 0.08 | 0.00 | 0.01 | 0.07 | 0.02 | −0.08 | |

| 0.31 | 0.14 | 0.04 | −0.05 | −0.03 | −0.04 | −0.05 | 0.09 | 0.11 | |

| −0.28 | −0.14 | −0.17 | −0.16 | −0.11 | −0.02 | 0.10 | 0.14 | 0.38 | |

| −0.49 * | −0.22 | −0.10 | 0.10 | 0.18 * | 0.32 * | 0.56 * | 0.72 * | 0.81 * |

| Variables. | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 |

|---|---|---|---|---|---|---|---|---|---|

| Intercept | −1.84 * | −1.02 * | −0.55 * | −0.23 * | 0.12 * | 0.40 * | 0.75 * | 1.22 * | 2.02 * |

| −0.03 | −0.07 | −0.07 | −0.07 | −0.11 | −0.11 | −0.18 * | −0.15 | −0.25 | |

| −0.11 | −0.09 | −0.06 | 0.01 | −0.04 | 0.01 | −0.02 | −0.10 | −0.06 | |

| −0.63 * | −0.28 | −0.28 * | −0.11 | −0.13 | −0.10 | −0.10 | −0.07 | −0.00 | |

| −0.29 | −0.04 | 0.02 | 0.02 | 0.00 | 0.02 | −0.07 | 0.03 | 0.16 | |

| 0.20 | 0.11 | 0.07 | 0.02 | 0.00 | 0.00 | 0.07 | −0.06 | −0.16 | |

| 0.21 | 0.02 | −0.09 | −0.10 | −0.09 | −0.12 | −0.08 | −0.12 | 0.02 | |

| 0.23 | 0.03 | 0.07 | 0.00 | −0.03 | −0.01 | 0.03 | −0.11 | −0.45 * | |

| 0.06 | 0.07 | 0.04 | 0.04 | −0.03 | 0.00 | −0.01 | 0.06 | 0.18 | |

| 0.00 | −0.07 | −0.07 | −0.03 | −0.08 | 0.01 | 0.06 | 0.09 | 0.35 | |

| −0.41 * | −0.24 | −0.06 | 0.12 | 0.16 * | 0.32 * | 0.56 * | 0.77 * | 0.86 * |

| Variables | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 |

|---|---|---|---|---|---|---|---|---|---|

| Intercept | −1.91 * | −1.03 * | −0.59 * | −0.24 * | 0.09 * | 0.39 * | 0.76 * | 1.21 * | 2.06 * |

| 0.11 | −0.03 | −0.03 | −0.06 | −0.09 | −0.11 | −0.21 * | −0.32 * | −0.44 * | |

| −0.09 | −0.05 | −0.11 | −0.03 | −0.03 | −0.06 | −0.03 | −0.12 | −0.03 | |

| −0.27 | −0.18 | −0.06 | −0.08 | −0.11 | −0.03 | −0.07 | 0.01 | −0.13 | |

| −0.37 | −0.04 | 0.09 | 0.08 | 0.02 | 0.05 | −0.09 | −0.04 | −0.12 | |

| 0.11 | 0.08 | 0.10 | 0.06 | 0.14 | 0.09 | 0.11 | 0.09 | 0.01 | |

| 0.19 | −0.01 | −0.11 | −0.11 | −0.12 | −0.06 | −0.06 | 0.02 | −0.13 | |

| 0.18 | 0.03 | 0.05 | −0.01 | 0.00 | −0.09 | −0.05 | −0.14 | −0.16 | |

| 0.05 | 0.03 | 0.04 | 0.05 | −0.01 | 0.01 | 0.03 | 0.02 | 0.06 | |

| 0.04 | −0.13 | −0.11 | −0.07 | −0.06 | 0.04 | 0.10 | 0.14 | 0.27 | |

| −0.36 * | −0.23 | −0.04 | 0.11 | 0.15 | 0.32 * | 0.53 * | 0.80 * | 0.83 * |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Z.; Gupta, R.; Subramaniam, S.; Yoon, S.-M. The Effect of Air Quality and Weather on the Chinese Stock: Evidence from Shenzhen Stock Exchange. Sustainability 2021, 13, 2931. https://doi.org/10.3390/su13052931

Jiang Z, Gupta R, Subramaniam S, Yoon S-M. The Effect of Air Quality and Weather on the Chinese Stock: Evidence from Shenzhen Stock Exchange. Sustainability. 2021; 13(5):2931. https://doi.org/10.3390/su13052931

Chicago/Turabian StyleJiang, Zhuhua, Rangan Gupta, Sowmya Subramaniam, and Seong-Min Yoon. 2021. "The Effect of Air Quality and Weather on the Chinese Stock: Evidence from Shenzhen Stock Exchange" Sustainability 13, no. 5: 2931. https://doi.org/10.3390/su13052931

APA StyleJiang, Z., Gupta, R., Subramaniam, S., & Yoon, S.-M. (2021). The Effect of Air Quality and Weather on the Chinese Stock: Evidence from Shenzhen Stock Exchange. Sustainability, 13(5), 2931. https://doi.org/10.3390/su13052931