1. Introduction

Since the pioneering studies by [

1,

2], the importance of economies of scope has been widely argued, in particular in the context of the industrial organization literature on assessing the costs of specialization. Economies of scope exist if the cost of providing a diversified set of products is less than the cost of specialized production of these products. Much attention has been paid to economies of scope in multiproduct manufacturing firms, as these firms have considerable opportunities to increase their productivity by broadening their range of activities, enabling them to fully exploit underused resources such as employee expertise, information from various divisions, and production facilities. This results in joint production in which costs are shared by the various activities and overall organizational outcomes are jointly generated.

There is also potential for economies of scope in public sector activities. A notable example of economies of scope in the provision of public services involves the

colocation of organizations [

3,

4], which makes it possible to not only share facilities, thereby saving on overheads such as electricity, security, and cleaning, but also reduce users’ travel costs by providing one-stop access to a range of different services. In addition, different sections can approach the same users more easily at lower cost.

Moreover, the need for

professional staff who have expertise in various specific public services is related to the prevalence of economies of scope in the public sector. When economies of scope arise from intangible resources, such as managerial ability, dominant logic, routines and repertoires, and technologies, they can result in a sustainable competitive advantage [

5]. For example, third sector organizations operating residential care homes tend to be more diversified than private sector providers, providing both residential and other forms of care, and thus are able to benefit from economies of scope [

6]. Related to administrative expertise,

relationship-oriented activities are another source of economies of scope. Local governments have an advantage in this regard because they can access information about their residents and acquire more trust from their residents than other organizations.

Overall, there is considerable potential for economies of scope in local government activities because they provide a range of services. A strand of relevant literature has been accumulated. For example, in the case of local public transport, the long-term costs of urban transit companies in the US during the period from the late 1970s through the 1980s were investigated [

7,

8,

9]. There were potential economies of scope, dependent on the post-consolidation wage level [

7], whereas it was found that there was potential for cost complementarity depending on the combination of transit modes [

9]. The cost structure of Swiss urban transport was studied in [

10] and the study found evidence of economies of scope, supporting the view that multimode transportation companies may benefit in comparison to unbundled franchise monopolies. The cost structures of municipal solid waste (MSW) services have also been studied, albeit to a limited degree, given the rising levels of waste generation in society. The multiproduct nature of MSW services was modeled in [

11] and they found that offering joint disposal and recycling services reduced costs by approximately 5% as a result of economies of scope. Third sector organizations have drawn attention to the presence of economies of scope, as much of their work is undertaken by professionals and they have closer access to and more significant relationships with service users than other providers [

3]. It was found in [

3] that the benefits obtained by third sector organizations from economies of scale, for example through their consolidation, were overemphasized, while economies of scope and learning should be given more weight from a policy-making viewpoint. However, to date, little evidence of economies of scope in third sector organizations has been reported, while some studies of UK fundraising charities [

12] and US charities [

13] have found evidence of economies of scale.

Nevertheless, there is little evidence of either the existence or absence of economies of scope in public services provided by general-purpose local governments. A pioneering study on efficiency in the provision of local public services through economies of scope was conducted by [

14], which proposed a framework for modeling municipal costs as a means of measuring economies of scope. It was found that potential economies of scope exist in the provision of municipal services. An influential study involving cost function analysis of local government service provision was also conducted with a focus on firefighting services using data on municipal fire departments in New York [

15], and the study found evidence of economies of scale in the quality, economies of scope, and constant returns to population scale. It is suggested in [

16] that the finding that administrative overheads are higher for councils in the lower tier of their two-tier system indicates the presence of diseconomies of scope associated with administrative duplication in these units. Overall, it seems that economies of scope are present in the supply of local services provided by general local governments, as these local governments are naturally more multiproduct and multifunctional entities than specialized public service providers, and employ professional staff whose knowledge enables them to achieve greater efficacy across a range of services. In this vein, the assessment of economies of scale has been crucial in this field of study, although little evidence has been accumulated to date. Thus, the research question in this study involves accurately assessing the size of economies of scope in the activities of general local governments.

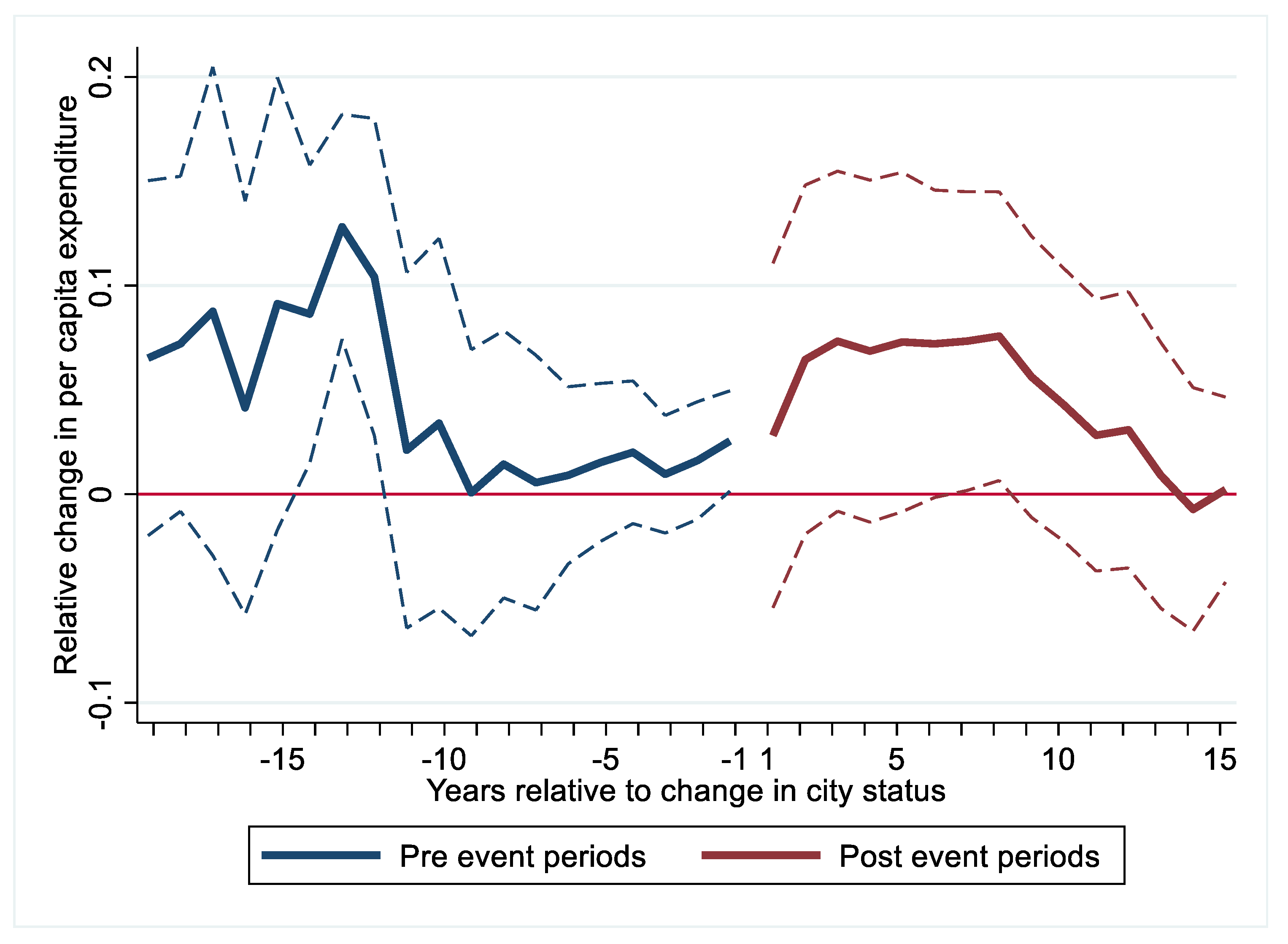

The objective of this study is to estimate the impact on expenditure of the designation of cities as either core cities or special case cities, thereby giving them the authority to undertake a wider range of activities. I use difference-in-differences (DID) analysis and the event study method to identify the magnitude of the economies of scope in local governments using panel data for Japanese municipalities during the period 1996–2015. As mentioned above, previous empirical studies on economies of scope in the provision of public services have measured the size of scope economies by estimating the cost function of the public organization concerned and calculating fitted values of the cost function in the case of specialized production by extrapolating the value zeros into the amounts of outcomes out of interest (e.g., [

10,

11]). However, previous studies have raised concerns about the validity of the extrapolations and the specifications regarding the cost functions (e.g., [

17]). The novel contribution of this study is the analysis of economies of scope by building on the program evaluation framework using the DID and event study approaches to avoid problems associated with the cost function approach. To the best of my knowledge, no previous empirical studies have used the program evaluation methodology to detect the presence of economies of scope in general public service provision.

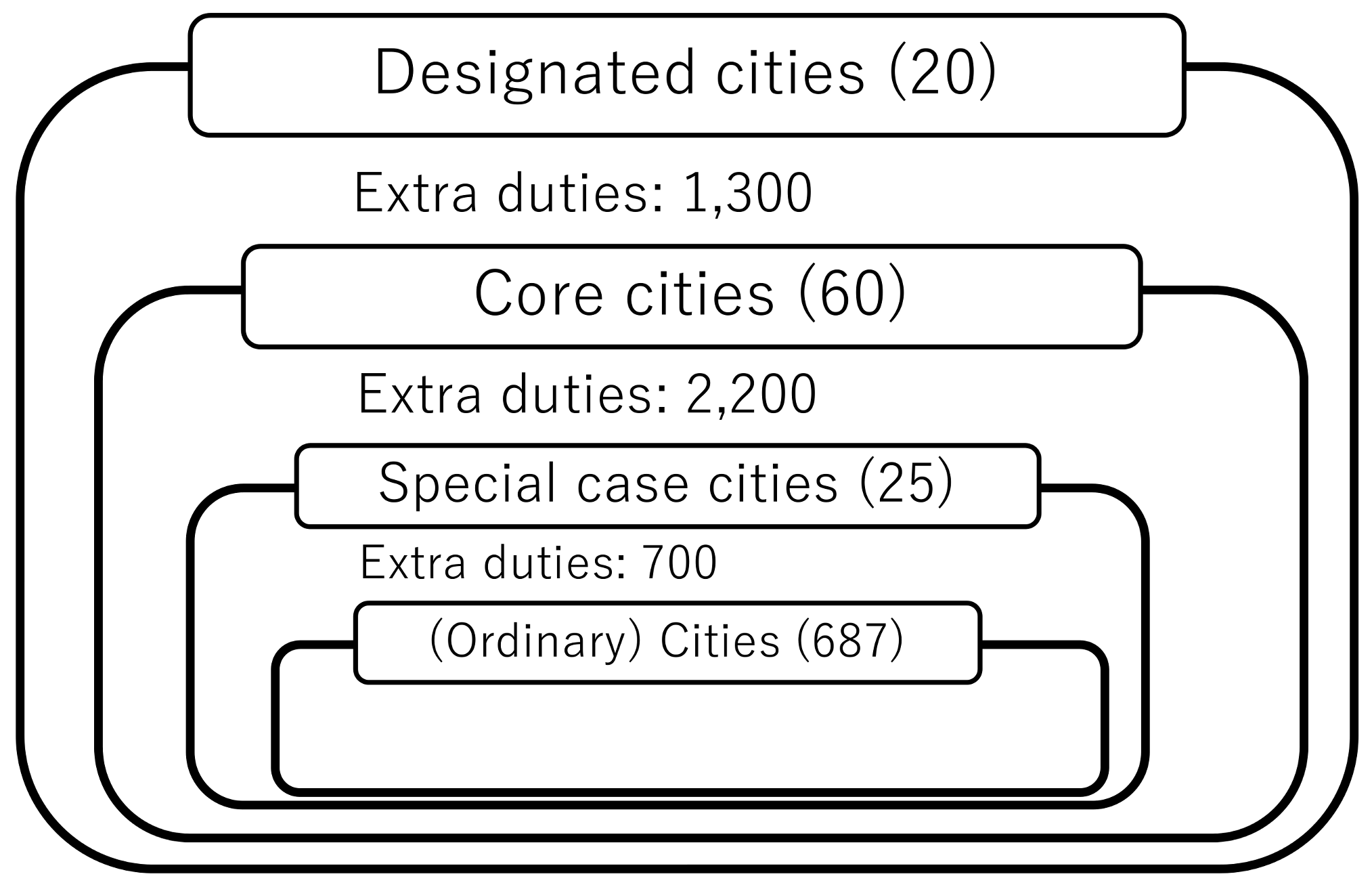

A key to the identification of the impact of designation is the system of specially authorized cities, that is, core cities and special case cities in Japan. The central government launched the core city designation in 1996 and the special case city designation in 2000 to delegate some of the activities the prefectures normally handled and give the designated cities the authority to handle a wider range of activities than ordinary cities. To ensure their fiscal capacity to handle a wider range of responsibilities, population requirements were set for both designations, and cities that met the population requirements were able to apply for specially authorized city status. As the population requirement was higher for core city status, a wider range of duties was delegated to core cities.

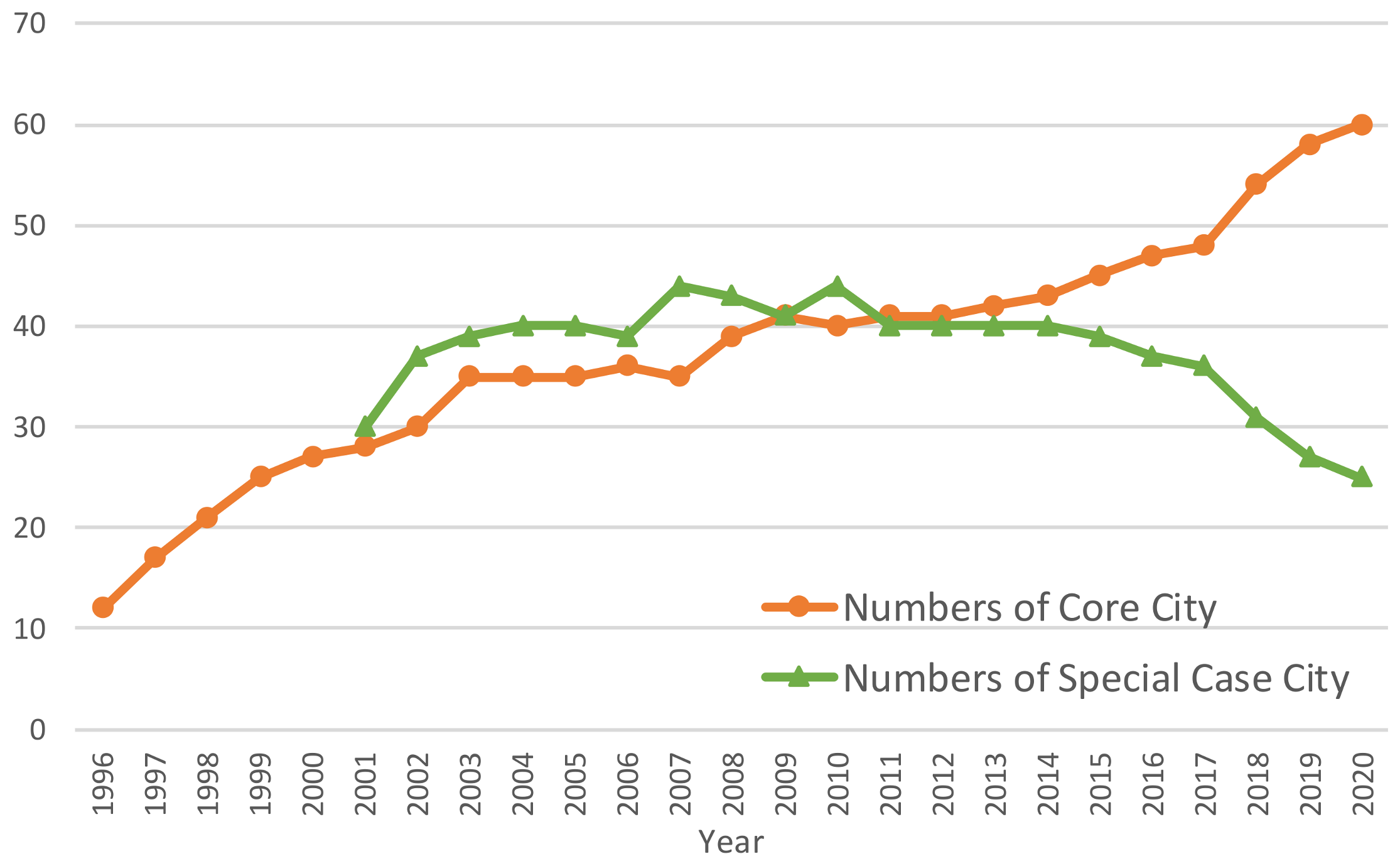

Figure 1 shows the numbers of core and special case cities that have been designated since 1996 and 2000, respectively. It can be seen that the number of core cities has steadily increased since the introduction of the core city designation, while the number of special case cities peaked in 2010, and has been falling since then. Additionally, the designation of cities as specially authorized cities has occurred every year since the scheme commenced. These authorized cities are used as the treatment group in this study, and the variations in the timing of designation are used to identify the impact on expenditure of changes in the scope of activities as a result of a transition to special city status, that is, the size of the economies of scope that were generated.

The remainder of this paper is organized as follows.

Section 2 presents the institutional background, specifically the Japanese local government system and the designations to core cities and special case cities.

Section 3 and

Section 4 discuss econometric specification and data, respectively. The main and extended results are presented and discussed in

Section 5.

Section 6 is the conclusion.

6. Conclusions

The aim of this study was to determine the existence/nonexistence of the economies of scope in general government expenditure using panel data for Japanese municipalities during the period 1996–2015. I used two-way fixed-effects regressions to estimate the DID treatment and trend impacts and event study effects on per capita expenditure of designation as a core city or special case city. Core and special case cities were authorized to undertake a broader range of activities than ordinary cities, and cities that met the population requirements were able to apply for designation at any time. Designations to these city statuses, which are labeled treatment events in this study, have occurred annually since their introduction, enabling a comparison of levels of expenditure between ordinary cities and these specially authorized cities.

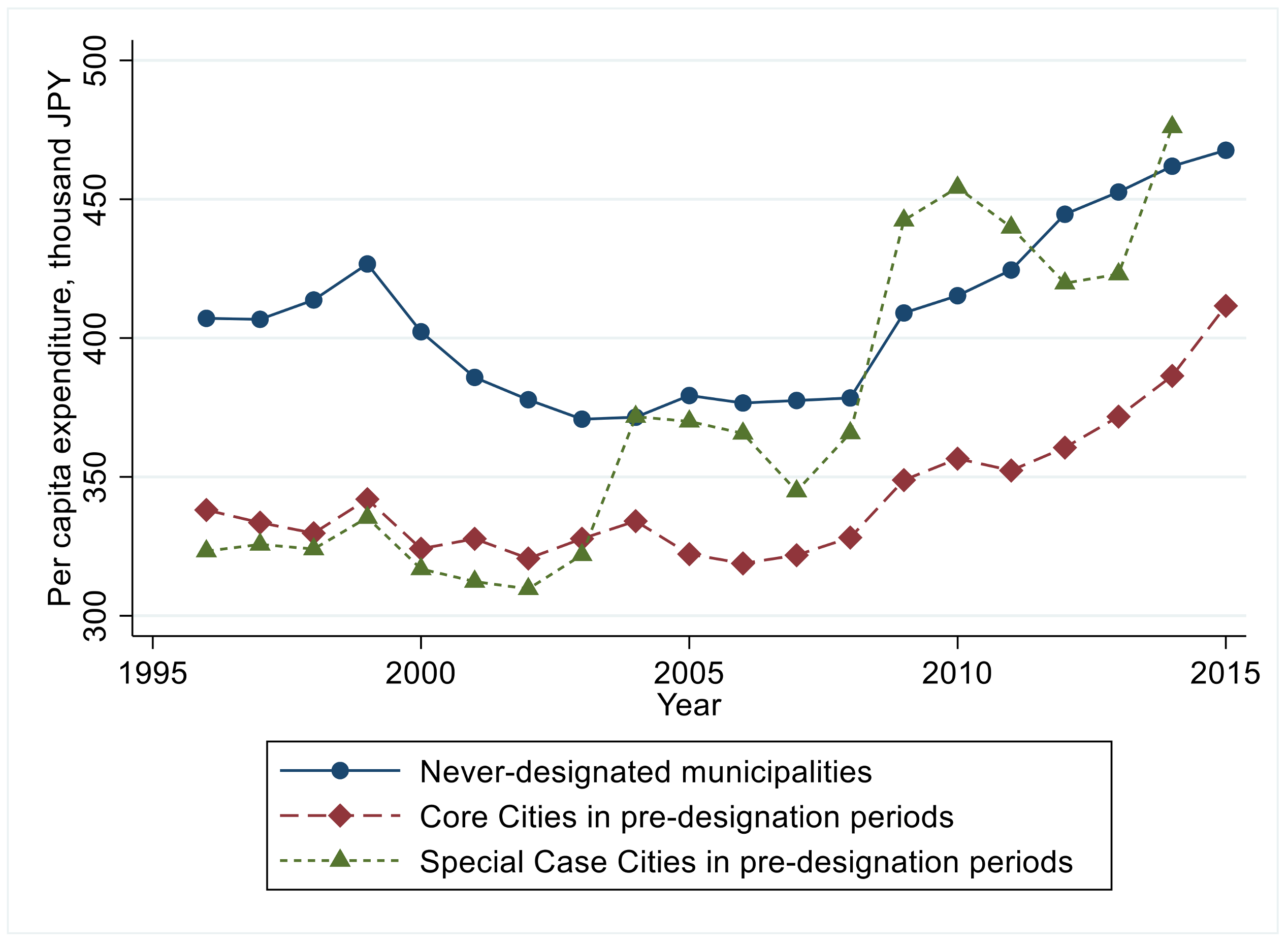

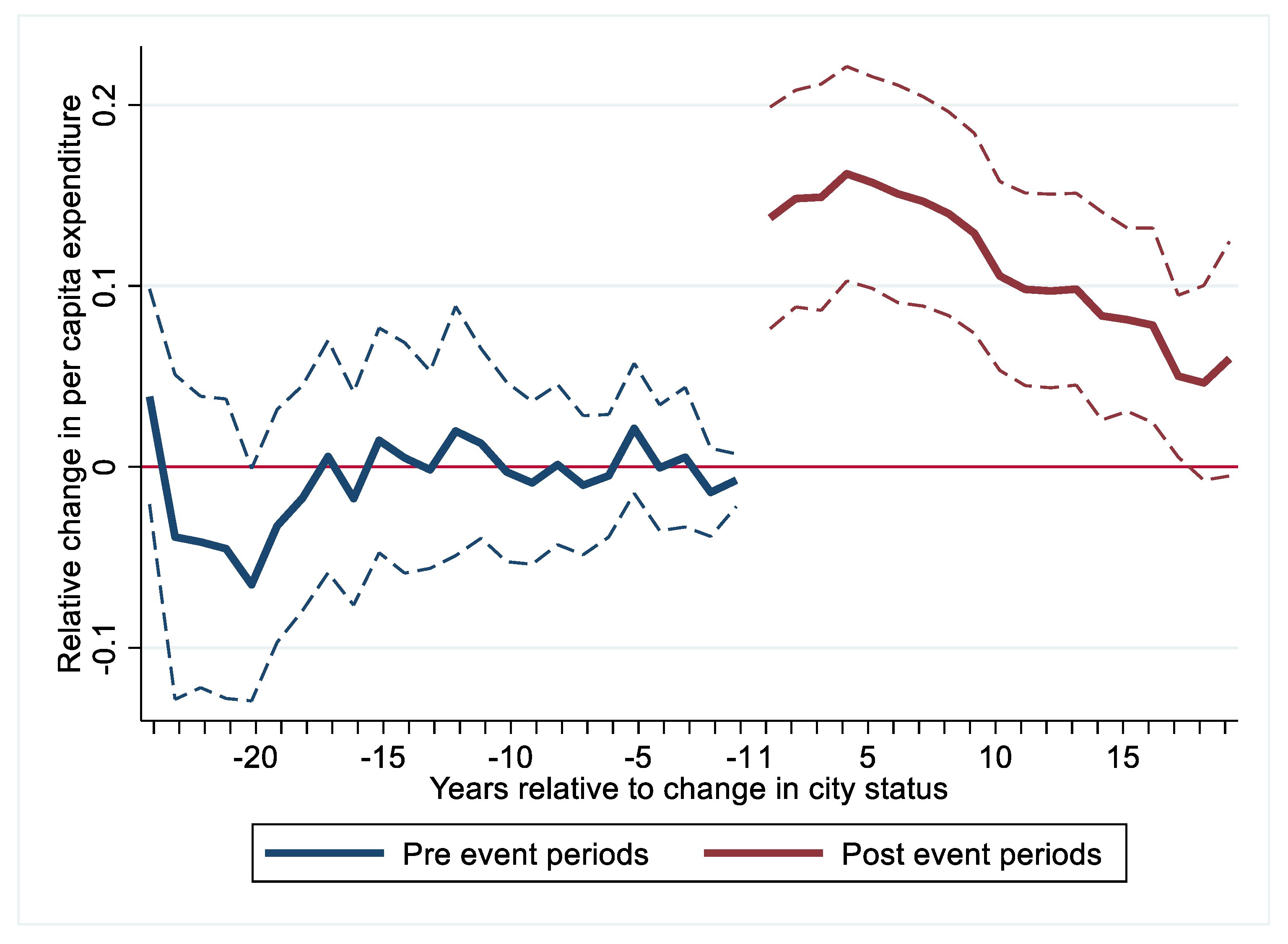

A key requirement for the identification of the DID treatment and event study impacts is the parallel trend assumption. In this framework, per capita expenditure in the “never designated” municipalities, which comprises municipalities that have never transitioned to core cities or special case cities, should have the same trend as the specially authorized cities in the predesignation period. Graphical illustrations and formal regression-based tests confirm that the parallel trend assumption holds for both core cities and special case cities. Two-way fixed-effects regressions were used to estimate the impact of designation as a core city or special case city on expenditure trends. The results show that first, in the provision of public services by general-local governments, economies of scope do not occur in the short term (2–3 years), but do appear in the mid to long term (more than 5 years for core city status). After the delegation of duties, per capita expenditure for core cities increases by 2.8% immediately after the designation, but then decreases by 0.6% annually. Special case cities see an immediate increase of 4.9% in expenditure per capita followed by a 0.45% decrease annually. The results show that for core cities, economies of scope appear 5 years after designation and reach a peak of 9.1% 20 years after the transition, while for special case cities economies of scope are first seen 11 years after designation and reach a peak of 4.1% 20 years after the transition. However, note that the results for special case cities are not robust to empirical specifications. Second, the wider the range of extra activities delegated, the greater the economies of scope. This is inferred from the first result, as a greater variety of activities is delegated to core cities than to special case cities. Thus, economies of scope are observed in public services provided by general local governments, and these findings are robust to changes in econometric specifications and the sample used. The empirical analysis undertaken in this study is limited to the Japanese case of the creation of specially authorized cities, but the results regarding long-term cost savings through economies of scale can contribute to policy debates over fiscal decentralization and local government autonomy in other countries.

These findings have several implications in terms of policy making. First, this study provides robust empirical evidence of potential economies of scale in public services provided by general local governments. It has been argued that the public sector, including general local governments, has a great opportunity to benefit from economies of scope in the provision of public services through organizational reforms such as colocation of various divisions, application of professional knowledge to services provided by other sectors, and utilization of their competitive advantage in terms of relationship-oriented activities [

3]. In practice, the public sector may be able to reduce its total and variable costs by colocating several divisions in the same building, facilitating interactions between skilled personnel in different sectors, such as primary and secondary school teachers, and sharing division-specific information such as that provided by the police department to enable search and rescue operations to be conducted in a timely manner. However, little evidence has been accumulated in previous studies, except for that of [

14], as to what potential economies of scale are available in the provision of municipal services. Empirical studies have focused on determining whether economies of scope exist in the provision of specific public services such as MSW services [

11], care services [

6], and public transportation [

7,

8,

9,

10]. In this study, I not only presented empirical evidence of economies of scale for general government activities, building on the program evaluation framework using DID and event study approaches, but also demonstrated how economies of scope in terms of government expenditure emerge over time. This provides practitioners and public administrators with useful information on practical ways to achieve cost reductions in the public sector.

Second, from a local government sustainability perspective, the findings of this study suggest potential new policy strategies aimed at reducing general-purpose local government expenditure. In many countries, particularly developed countries, both urban and rural governments are facing fiscal challenges related to aging and declining populations, placing pressure on social security budgets and leading to reductions in healthcare and other public services [

33] (p. 117). Given these pessimistic predictions regarding local government finances, cost savings are urgently required if local governments are to retain their fiscal autonomy [

34]. Borrowing to finance local public investment facilitates a better allocation of financial resources. However, in principle, local governments should finance current expenditure using tax revenues, and long-term debt financing should only be used for capital projects (e.g., [

35,

36,

37]). Thus, constituencies should keep a close eye on potentially excessive future debt service payments due to aging and declining population [

38,

39,

40,

41]. The findings of this study indicate that economies of scope, for example, through joint provision of multiple public services, can be a key driver of ongoing cost reductions in public service provision, resulting in improved sustainability of local governments.

Third, fiscal decentralization through the delegation of services that are currently provided by higher levels of government is clearly beneficial. Oates’s [

37] Decentralization Theorem states that in the absence of economies of scale in the provision of public goods and of interjurisdictional externalities, the level of welfare is higher under decentralization than under centralization [

42,

43]. By contrast, if economies of scale exist in public goods provision, spillovers are observed, and there is a low level of heterogeneity among jurisdictions in preferences for public goods, the level of welfare is likely to be higher under centralization than under decentralization (e.g., [

44,

45,

46]). In reality, given the potential economies of scale, municipal consolidation is favored by practitioners as a means of reducing administrative costs and increasing efficiency in the provision of public services [

47]. In many cases, economies of scope have not been considered in determining whether municipal consolidation is worthwhile (e.g., [

14]), but creation of a large-sized local government by a merger that can have fiscal capacity to operate a wider range of functions also could be an advantage of municipal consolidation. In this regard, this study makes a significant contribution to the fiscal federalism literature, with a focus on economies of scope in public services as a new channel for cost reduction, and to the policy debate regarding the validity of municipal consolidations from a cost-saving viewpoint.

There is, however, a caveat in this research. The economies of scope literature has built on the cost function analysis and a calculation of production costs predicted if each product were produced separately, to measure the degrees of scope economies. Yet, the present study employs the program evaluation framework, where the cost impacts of a wider range of responsibilities assigned to specially authorized cities are more directly assessed by comparing expenditure between the designated cities and nondesignated municipalities. Indeed, comparison between the sizes of scope economies estimated from the cost function approach and those from the program evaluation methodology may yield further insight into the literature. This issue is left for future research.